Don’t Catch a Falling Guillotine: Housing Free Falling in Southern California. A Deep Look at the Numbers.

The DataQuick numbers for Southern California were released today and the numbers were astounding. Yes, I’m sure that you’ve heard that line probably a thousand times in the last year but in reality, each month gives more and more insight into the absolute corruption and malfeasance that propelled this housing bubble to its current levels. In this article we are going to examine in detail, the overall housing numbers for the region and dig deeper into Los Angeles County to find out what really is going on. Los Angeles County with its 88 cities and 10,000,000 residents is a solid indicator of how bad things may get for supposedly economically diverse areas with high priced housing. In addition, the retail sales numbers came out today and once again show cracks in the overall consumer economy. Bottom line? All stars are aligning to a severe market correction. Let us take a look at some of the highlights in the DataQuick report:

“Of the homes that resold in February, about one-third, 33.5 percent, had been foreclosed on at some point since January 2007. A year earlier the figure was 3.5 percent. At the county level, the percent of homes resold in February that had been foreclosed on since January 2007 ranged from 25.3 percent in Orange County to 48.1 percent in Riverside County.”

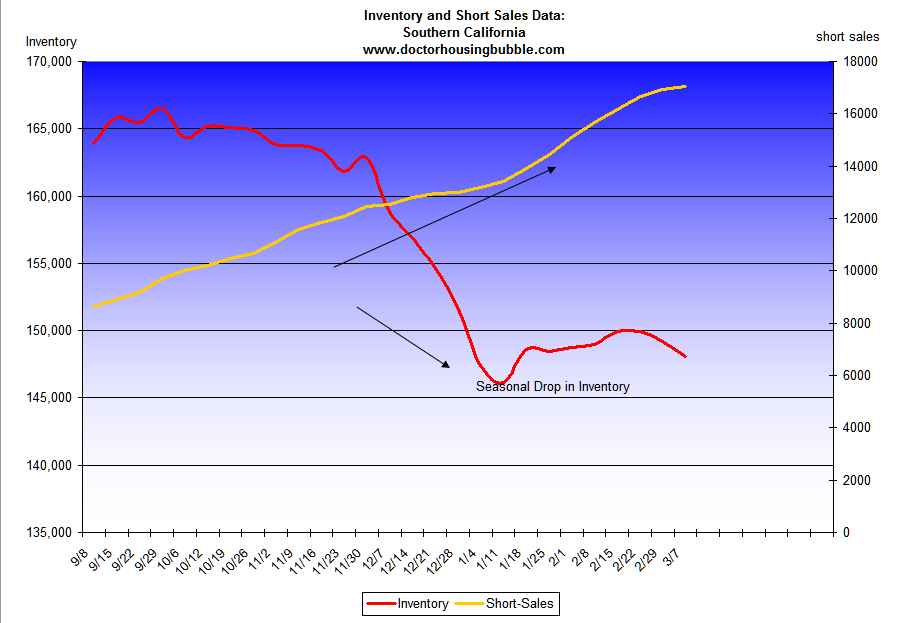

In only one year, distressed sales jumped from 3.5 percent of sales to an incredible 33.5 percent of all sales. Again, this is why looking at the amount of short sales on the market is so important in determining how the market is going to trend in the future. Let us take a look at the current short sale numbers for the Southern California region:

*Click to enlarge.

We may be swimming in muddy waters regarding the credit bubble, CDOs, CRE, MBS, and the entire alphabet soup of credit problems but nothing can be clearer than the above chart. What we see in the above chart which is a tiny snapshot of the market, is that short sales jumped 92 percent since September of 2007. The rapidity of the market deterioration is astounding. Short sales now make up 11.51 percent of the entire Southern California home inventory. The trajectory of this is only increasing and until short sales start decreasing, not much is going to change. According to the DataQuick report for last month, only 10,777 homes sold. There are currently 148,103 homes for sale in the Southern California market. At the current sales rate, that means we have 13.7 months of inventory! No where are we remotely close to a bottom. Let us take a look at another section of the report:

“The median price paid for a Southland home was $408,000 last month, the lowest since $402,500 in October 2004. Last month’s median was down 1.7 percent from January’s $415,000, and down a record 17.6 percent from $495,000 in February 2007.

Last month’s median fell 19.2 percent shy of the $505,000 peak reached last spring and summer. The sharp decline in the median reflects two things: depreciation, especially in areas rife with foreclosures, and a substantial shift in the types of homes selling. Most notable in recent months is the big dropoff in sales of more expensive homes financed with “jumbo” mortgages.”

I love how DataQuick frames certain aspects of the market. First of all, prices are depreciating but not only in areas that are “rife” with foreclosures. Let us take a look at the actual numbers:

| County | Median price Feb 2007 | Median Price Feb 2008 | Yearly Decline |

| Los Angeles | $528,000 | $460,000 | -12.9% |

| Orange | $620,000 | $520,000 | -16.1% |

| Riverside | $410,000 | $325,000 | -20.7% |

| San Bernardino | $368,750 | $290,000 | -21.4% |

| San Diego | $480,000 | $415,000 | -13.5% |

| Ventura | $584,000 | $445,000 | -23.8% |

| Southern California | $495,000 | $408,000 | -17.6% |

First, every single county is down in the double-digits. The sales numbers are even worse with the entire county seeing a yearly drop of 39 percent. Then we get DataQuick’s second reason for market deterioration blaming jumbo mortgages. Every county aside from Orange County, with the above median numbers, a person can get a conventional (the old school conventional) mortgage of $417,000 with 10 percent down – so there isn’t any need for jumbo mortgages with the new $729,500 cap. It is misleading really to say that the reason prices are dropping is because of the “dropoff” in jumbo mortgages. If you want to buy a house in practically every county above and have a measly 10 percent down, you’ll be able to get a conforming loan with historically low interest rates. No need for jumbo.

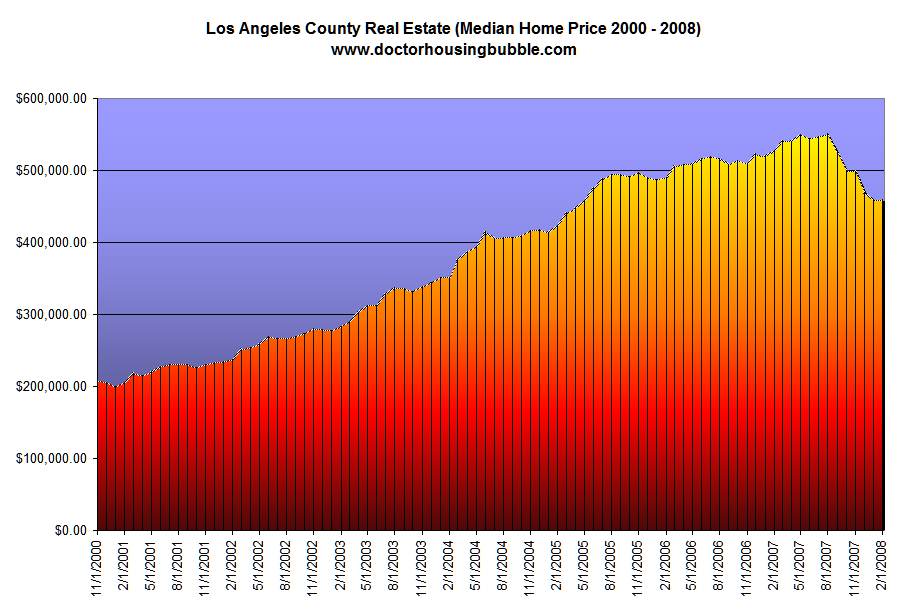

I’ll give you my two reasons for why the market is tanking and I’ll let this chart of Los Angeles County wet your appetite:

The first reason, as you can see from the above is the median priced home in Los Angeles County went from $200,000 in January of 2001 to a peak in August of 2007 of $550,000. As of 2004, the median income for a Los Angeles County household is $43,518. At its peak, the median priced home in the area was 12.6 times the local median household income. See, in 2001 the ratio was approximately 4.5 times the local median household income. Of course the current median priced home is now $460,000 but we have a long way to go before affordability ratios make any sense, even after a 16 percent drop in 7 short months. I understand that DataQuick reports aren’t intended as commentaries on the overall economic situation but you can see how quickly people can miss the forest for the trees. There is such a major disconnect from market fundamentals that we are now witnessing a fierce correction now that the bubble has popped. When mainstream articles start looking in depth at local area incomes in relation to housing, then we can start seriously having a debate of substance. Right now they keep reverting to a philosophy that is rooted in the belief that current prices are somehow justified and are being harmed simply because of lack of credit. What about lack of income? NINJA loans anyone?

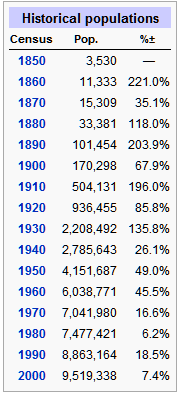

The next argument I’ll make for Los Angeles County is the growth of the County has slowed down to historical proportions:

*Source: Wikipedia

Currently there is only a 4.2% growth rate for the decade and we are now in 2008; it is the slowest population growth rate since records started being kept in 1850. As we all know, another argument being made about sky high prices is how we have a growing population. There have been many reports showing a net migration out of the county from middle to upper class families being replaced by immigrant families. Now tell me, are these the people that are going to be looking for jumbo mortgages? What we have is a lack of affordable housing. Los Angeles County and pretty much all of Southern California is failing in this regard.

The second reason prices are falling, is the crushing debt burden many people are now facing. There is a reason why people in record numbers are now raiding their 401k plans and maxing out their credit cards. They are using the money to hold themselves over. It isn’t being used on consumption given today’s retail numbers. It would be one thing if they were taking out the money as a short term loan but they are actually full out taking the money out of 401ks, tax consequences and all, because they need the cash for various reasons including paying the mortgage. It is a very sad commentary given that we keep hearing how poorly people are doing in saving for retirement. In fact, prices will need to fall overall in Southern California by 40 to 50 percent to even be back in line with economic fundamentals. This branded many as doom and gloomers a few years ago but now it is the party line of such places like Goldman Sachs who are predicting 30 percent drops.

Many cities are now becoming Real Cities of Genius. It looks like more and more people are now saying don’t catch a falling knife, or in the case of Southern California, a phrase I’ve seen used which is more apropos, don’t catch a falling guillotine.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

21 Responses to “Don’t Catch a Falling Guillotine: Housing Free Falling in Southern California. A Deep Look at the Numbers.”

I’m not so sure Data Quick is an ‘honest broker’ anymore. Its sales and price figures maybe accurate but this is how Data Quick spun in for the SF Chronicle.”The lending system has been in lockdown mode the last half year, especially when it comes to so-called jumbo mortgages which have traditionally been the majority of Bay Area loans,” said Marshall Prentice, DataQuick president, in a statement. “We can only conclude that a lot of activity is just on hold, hence the spectacularly low sales count.”With the Federal Reserve trying to pour Drano into the lending system, it will be interesting to see how things play out if jumbo financing does come back online,” Prentice said. “Theoretically, there could be enough pent-up demand, enough catch-up activity at the high end, to result in a statistically bizarre record median home price.” Well yeah that’s theoretically possible if you could find enough qualified borrowers and banks with the money to lend. Do they exist however especially as the banks swallow Bernanke’s Drano and the public shops with Bernanke’s incredible shrinking dollars. I read in BusinessWeek this morning some interesting factoids in regards to the banks situation. I did not realize that banks were counting every penny of deferred interest payments on an Option Arm mortgage as current income because the deferred interest would be paid sooner or later right? That all the future fees to be derived from those MBS they sold on were

similiarly counted as current income. That all the loans that could not be sold after the meltdown in the market for MBS were simply ‘reclassified’ as ‘loans held for investment’ and not put on the books at a heavy discount to their face value but carried at full or near to full face value. So the bank’s have some heavy restatement of earnings to do, increasing their loan loss reserves and hoping that their depositors don’t pull their deposits in reaction to Bernanke’s negative real interest rates or in fear of the Drano Bernanke is pouring into the US monetary system. Mr. Prentice might want to consider the ‘theoretical’ possibility that WAMU is bankrupt as is CountryWide as is Wachovia etc. and that getting a jumbo or any mortgage in such a financial crisis would be about as easy as Eliot Spitzer found getting a hooker without paying ‘Tameka’ first.

Dr.:

Do the invetory numbers in Dataquick’s report include the REO’s (are we seeing the entire picture here)?

We have unfortunately gone too. While widespread “homeowner” bankruptcy and bank failures won’t lead to the End of the World, they are unpalatable. We know that prices should fall fifty percent and most major banks and hedge funds should go under, but from should to will is a political gap that no one wants to leap.

If forty million households lost everything (they probably have nothing to lose, in reality, so the argument is potentially semantical) and the banks failed, the world economy would go into a depression. Would we have widespread famine, disease, and war? That is a political, not economic or social question. In reality, there would no need for any of that. The world would merely take a breather and re-assess priorities, perhaps even learning from past mistakes. Painful, annoying, depresssing, but not the end of the world.

If the big banks and funds fail, what then? Who cares? A whole bunch of rich people become less rich. Two million people lose their jobs for a while. But does that mean we will never have banks again? Of course not. Other, solvent banks will step in and buy up the hard assets (offices, branches, desks, computers) and take over the business. Simple as that. You will cancel your Citibank account and open an HSBC account. A bit of turmoil during the transitional phase, but not the end of the world.

The entire effort of the Fed and the Treasury to prop up housing and Wall Street is merely an effort to protect politicians and Wall Street from the consequences of their greed and arrogance.

This may be somewhat off-topic, but I was wondering what people think this is going to do for rents in SoCal? Do they go *up* or *down* in a crazy market like this?

Got to go up. And it is I hear.

At least my SoCal brethren are seeing some relief. Up here in the Citadel of SF the barbarians are at the gate but people keep getting into bidding wars over dilapidated properties. Last week I talked a friend of mine out of buying a $850,000 2 bed 1 ba condo (with 500k down!) as an investment property. He actually had no idea that the seller pays a 5-6% sales commission on a real estate sale…

The current credit crunch won’t stop (financially) stupid rich people, which we have a lot of around here. Even though my friend backed out of the contract he’s pretty certain that he missed a big opportunity. Real estate only goes up…

Expat,

great points. Just heard that Bear Stearns had to get an emergency loan….after claiming for weeks that all was fine.

Doc Stu…you are a good friend. ‘Financially stupid rich people’ don’t stay rich for long though.

I’ve been wondering about the effect of all of this would be on rents too. I’d expect a surge in demand from people losing their homes, but then there seems to be some extra supply as condos become rentals or would be flippers become landlords. I’m guessing a short term spike in rents as too many people will have no choice but to rent until credit is cleaned up and down payment accumulated. That should be followed by downward pressure on rents as housing prices become affordable, offset by the many people out there that will be very hesitant to buy after getting burned by the bubble.

This article highlights the most important problem which is the lack of financing available to buy homes. There is a lack of actual income (see current income averages versus home prices) and now there is a lack of financing options (see ING Stated going away and others). The market has many reasons why values are down, but that has to be the #1 reason. The positive note? Once the market resets itself, more home buyers will be able to afford homes again. That might not be for awhile, but the day will come.

Graeme

in the future, people will be unable to purchase homes until they can afford to put “some skin in the game” and that will not occur until the population gets out of debt and the savings rate in this country increases.

If you look at craigslist, you’ll see that rents are already dropping rapidly. I’ve seen houses and apartments that have been listed for two months or more and still aren’t occupied even though the rents have dropped by $500. And this is in Silverlake, Echo Park, Downtown–pretty desirable areas.

Please tell me, are the rental apartment complexes going to allow people to take a unit after they find out that the people that are applying are not credit worthy? Or are they going to chaarge such high monthly fees to offset the finantial risk they’ll be undertaking, such that the renter won’t have enough money for daily living expenses.

“the median priced home in Los Angeles County went from $200,000 in January of 2001 to a peak in August of 2007 of $550,000. As of 2004, the median income for a Los Angeles County household is $43,518. At its peak, the median priced home in the area was 12.6 times the local median household income. See, in 2001 the ratio was approximately 4.5 times the local median household income”

Wow. That says a whole lot right there. I make more than that median income in MN, and we struggle just to have the basics. And our house might be appraised at 130,000 on a really good day. So our payment is a lot lower than even those folks with the “median” house at 200,000. And it is a very well-known fact, even to people like me, with no CA ties, that the cost of living in general in CA is much higher than it is in MN.

My mind just boggles at whoever was thinking that these people could afford these houses. Whether it was the banks, lenders, or the borrowers themselves, someone was mighty deluded. It’s really no wonder things are crashing like they are. Greed will get you every time.

Rents in San Diego are down a bit. I’m in the market and I’m seeing prices for 3 BR/2BA homes in decent areas for a bit less than they were last year.

It seems puzzling–you’d expect rents to rise as people who’ve been foreclosed on move out of their houses, but I think they probably can’t afford to rent, or at least not rent anything comparable to what they’ve lost. What I mean is that they don’t have enough up-front cash on hand to rent–Landlords want first months rent and a deposit typically equal to the rent, and maybe a pet deposit, which adds up to at least $3K here in SD. I also suspect that the foreclosures are weeding out the people who bought houses intending to make money as landlords—during 05 and 06, it was really hard to find a 3 Br 2 BA rental house in a decent neighborhood for less than $2300. Since the banks are not renting out these houses, most of the landlords out there now are, I suspect, the ones who’ve been doing in longer and are more in tune with realistic rental rates.

I concur with Li.

When I looked for a new place last Sep, there are few places for rent in the desirable neighborhoods, but (rent) prices were good.

Then when the show started in Oct, I see quite a few places keep on putting for lease signs, but craiglist prices went nuts, FBs were trying to rent 2 b\b for $3000+ around my zip. I was really worried.

This month it is sharply reversed. Prices are pretty close (but still higher) than last Sep, and the for rent signs are still around. Guess those FBs are either put out of their misery or rented their place out. My guess? Hehe.

Again this might also have something to do with school registration.

Thanks for the responses re rents: I am in San Diego and just read today in the paper that rents have actually been going up more than usual and are expected to continue on that trend…I had actually predicted they’d go down – but maybe this is the “spike” before later downward pressure on rents? I check Craigslist a lot to see what’s out there in the rental market and it does seem that there are a lot more single-family detached homes for rent than there were this time last year. That’s obviously far from scientific.

I rent and was saving to buy but now…I plan to rent for the foreseeable future. Only problem is that I would like to rent a better place, and I don’t know if I should do it now or wait. And honestly, sometimes I just wonder if the whole economy is going to implode in which case I should consider moving to Europe!

My guess is that landlords are going to ask for bigger deposits for renters with poor credit, but the flood of unsold houses and condos on the market is going to keep rents low,

Rents typically fall in times of contraction. I expect to renegotiate for lower rent sometime by the end of the year. Or just move somewhere better for less…

FWIW, most of the listings I see on craigslist are overpriced compared with the listings I see on westsiderentals.com.

Rents-I think people who tried to flip could not sell. Now they have decided to rent out their “flips gone bad”. “I’ll rent it out till it goes up again” theory is not working (how long can you cover that monthly negative?) . Their not paying the mortgage and still collecting rents. Now they’re bank owned and banks are not in the business of renting out houses.

Those who have just been foreclosed on will not be able to afford $2000+ unless they did not even try to fight and just walk away. If they do their life has turned upside down, and I kind of doubt they are ready to spend much with their savings gone and their CC loaded.

Also if I were a landlord I would be stupid not to demand a lot of deposit from these people, I think many of them on the higher end simply avoid FBs. So many stories of FBs just walk away or rip everything out of the house or fight silly battles with lenders, several thousand dollars are not going to cover the very likely hazzle.

Rents? Vacancies are increasing, asking/effective rents are down in many areas.

The consumer’s hanging on by a thread: high energy/food costs, overwhelming debt, declining wages, rising unemployment, etc. Add a recession and you’ve reached the tipping point (already starting to see the effects of the implosion from the FIRE sector alone).

Although the multifamily market isn’t overbuilt like the late 80s boom, a lot of units were taken offline for condo conversions, shadow inventory from SFR/condos, and at the end of the day the “it’s cheaper than buying” argument held up. Rents basically moved in lockstep with home prices.

In tough times people move back home, get roommates, etc.

In some cities rent/purchase costs have almost reached parity.

It’s funny to look at deals from a year ago: $1.5k actual rents, $1.8k proforma, today they’re sitting empty @ $1.2k

The same I/O and/or high LTV was done on the commercial side — virtually every property that changed hands in the past couple years. Pure speculative purchases producing little/no income, lots of people will go belly up.

Leave a Reply