Digging into Countrywide: When Half Your Loans are in California and Florida.

A bicoastal strategy is not an effective way to balance out a company. Countrywide has been at the center of the mortgage market meltdown. It is important to understand the five main segments of the company:

1. Mortgage Banking: this segment originates, purchases, and services non-commercial loans primarily linked to residential real estate.

2. Banking: takes deposits and invests in mortgage loans and home equity lines of credit.

3. Capital Markets: this segment primarily specialize in underwriting mortgage-backed securities.

4. Insurance: offers property, casualty, life and disability insurance as an underwriter.

5. Global Operations: licenses technology to mortgage lenders in the UK.

It is important to note that in 2006, Mortgage banking accounted for 48% of the company’s pre-tax earnings. The company has been declining steeply even after the announcement that Bank of America would be purchasing the company. Even during the credit crunch, BofA infused a large sum of money into Countrywide that has now evaporated. Their move continues to baffle the market. Last week as reported on Minyanville we get the following:

“In Countrywide’s 10K, filed last Friday, the company detailed the abysmal performance of option adjustable-rate mortgages, or Option ARMs. Option ARMs allow borrowers to choose between monthly payment options, the lowest of which result in principal being added to the balance of the loan, known as negative amortization (see number five).

Option ARMs more than 90 days delinquent increased to 5.4%, up 900% from a year ago. In Countrywide’s $28 billion Option ARM portfolio, 71% of borrowers are only making the minimum payment and 80% of the loans did not require borrowers to verify their income.

$87 billion of the company’s entire mortgage portfolio is backed by loans in either California or Florida.”

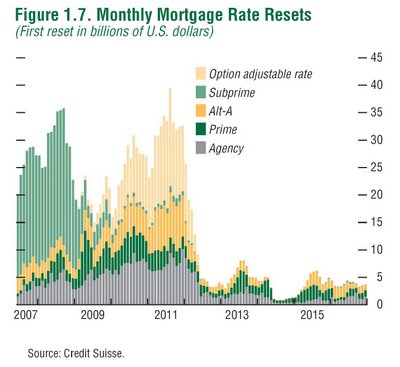

I’ve highlighted a couple of key points which shouldn’t come as a surprise to many of you. First, option ARM delinquencies are now rising. The problem with this is that many of these aren’t set to recast until 2010 or 2011 and we are already seeing problems hitting this segment of the market. Let us revisit the now infamous reset chart:

This chart represents an aggregate overview of the entire market. Clearly 2008 will see another large percentage of subprime mortgages resetting while late 2009 and early 2010 will see many option ARM mortgages begin to recast. Why is the 900% yearly jump in delinquencies problematic? Well option ARM mortgages give borrowers typically 3 pay options. First, a buyer can pay the principal and the interest. Not much different from a conventional mortgage. The second option usually allows for a borrower to pay only the interest component of the note. The third option allows for the absolute minimum payment which usually results in negative amortization and an increase in the original mortgage balance. The frightening thing out of the 10-K report last week is that 71% of the borrowers are only making the minimum payment, meaning that the large majority of these people potentially have increased their mortgage balances while holding onto depreciating assets. And here is the kicker. 80% of these loans did not require borrowers to verify their income! So the massive early jump in delinquencies is now telling us that these borrowers are going to have just as many or even more problems than the subprime loan explosion we are still working through.

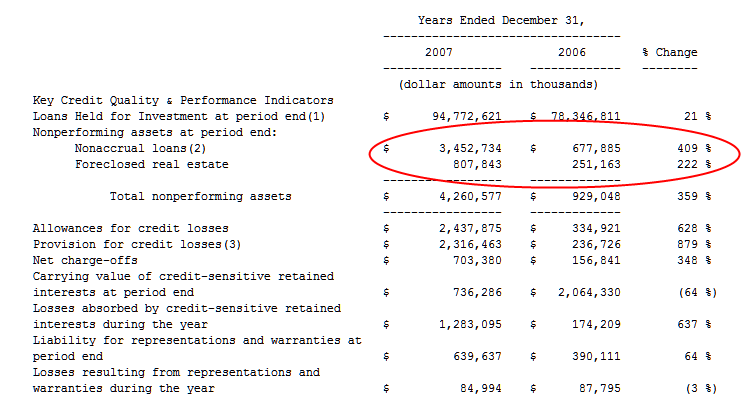

If you really want to see how quickly the market is deteriorating, simply take a look at their 10-K filed last week:

*Click for clearer picture

A nonaccrual loan is typically a loan that is no longer performing under the contractual rate due to borrower difficulties. Normally this is assigned to loans that are behind on principal and interest for 90 days. The speed in which these loans are going into delinquency is simply startling. So if we dig even further, we are told that half of Countrywide’s mortgage holdings are in either Florida or California. Let us now look at what is occurring in California.

California Cliff Diving

Let us show how quickly things have changed by highlighting the median home price for California:

January 2007 Median: $551,220

January 2008 Median: $430,370

*Source: California Association of Realtors

A 21.9% decline in one year for the most populace state in the nation. What makes this even worse is the mounting inventory and lack of sales:

January 2007 Unsold Inventory Index (months): 7.6

January 2008 Unsold Inventory Index (months): 16.8

So you couple the fact that California is rapidly declining and Countrywide has a large amount of their loans here and it isn’t hard to see why we will continue to see problems for the foreseeable future. Let us run a scenario to demonstrate how absurd an option ARM mortgage is. First, we’ll assume that you bought a Real Home of Genius at the height of the bubble for $400,000 and went zero down. I remember an option ARM with the following terms from another mortgage lender that is no longer with us:

Minimum payment rate: 1.25% (fixed 1-yr)

Fully Indexed Rate: 6.826%

* Minimum Payment: $1,333.01 ( Deferred Interest: $942.33 )

* Interest Only Payment: $2,275.33

* Fully Amortizing 30-Year Payment: $2,614.63

* Fully Amortizing 15-Year Payment: $3,556.51

The amazing thing of how these products were marketed is that they put you even further into financial peril. They would say, “income tight? Lost a job? Then an option ARM is for you!” giving the impression that you had built in insurance should job troubles arise or some other loss of income. Income by the way that would pay for the mortgage in the first place but since 80 percent didn’t verify their income, who really cares I suppose. Initially, the lenders gave the impression that the majority of these loans were being given out to sophisticated investors who couldn’t document their $500,000 income and had better places to put their money to work. Clearly this wasn’t the case as we are seeing that 71% of the people are electing for the lowest of the low payments. Of course when the market in California was ripping it up by seeing 20%+ appreciation each year, making the minimum payment made sense because you were going to sell in 1 to 2 years and pocket the change. Heck, it was cheaper than renting! Of course, just look at the above breakdown. The minimum payment under prices the true fully amortized monthly nut by nearly 50 percent. Now that we know that 80 percent didn’t verify their incomes, do we assume that these were sophisticated investors who will ride the market out or folks who bought because of: naiveté about the markets or amateur speculating? Either way, both do not warrant bailouts. Also, this is similar to a Ponzi Scheme where the only way to keep the game going is by continually bringing in more people into the game.

I’m still looking for a solid answer as to why BofA decided to pursue Countrywide. Even the talk of the right-offs doesn’t make sense given the above data and the years of potential problems facing them down the road. There was also talk about taking a bigger share of the mortgage pie but why not wait to go after prime customers when the dust settles and only strong banks can offer loans? BofA had a great no-fee mortgage loan that basically covered all your closing costs which I’m sure brought in a larger market share. I guess we’ll have to wait to see how things turn out but now that the curtain has been removed, we realize that things are as bad as we once predicted.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “Digging into Countrywide: When Half Your Loans are in California and Florida.”

As an x-mortgage broker during the boom I never sold a single Option ARM for the simple fact that I never ran into a client that it benefited. However, I lost a lot of business to competing loan officers who sold these option arms to homeowners who simply did not understand the program.

Many of those homeowners are now hurting big time because they did not want to listen and the other loan officer said whatever they needed to to get that big paycheck.

It’s good that the Option ARMs are defaulting well ahead of their reset dates. It means we can clear the market of most mickey mouse loans in one shot over the next year or so. A big crash rather than a drawn-out, tortuous process will be good for the economy in moving forward. Us renters have a stake in this as well. I don’t like seeing my 401K balance in the gutter.

What are banks going to do with all the empty houses? Is there any sign of them moving into the landlord business and renting them out?

My understanding it that the neg-am option allows you to add to the balance up until a certain amount (for example, 15% higher than the original mortgage) at which point the rules change and and larger payments become due. In a sense, this results in an earlier “re-set” than what would be predicted in the graphs (i.e. two years). Is it this early re-set that is causing the defaults to start ahead of schedule?

FED

Creativity needed to limit foreclosures: Bernanke

By Greg Robb, MarketWatch

March 4, 2008

WASHINGTON (MarketWatch) — The mortgage and financial-services industry will have to use fresh thinking to reduce preventable foreclosures, said Federal Reserve Board Chairman Ben Bernanke on Tuesday.

“Efforts by both government and private-sector entities to reduce unnecessary foreclosures are helping but more can, and should, be done,” Bernanke said in a speech to community bankers in Orlando Florida. Bernanke urged the banking industry to consider new approaches, including making loan principle smaller for strapped homeowners.

A willingness to consider new ideas has been a hallmark of the Bernanke Fed in the months since the financial market turmoil began last summer. For instance, the central bank has begun novel auctions of liquidity to get around the unwillingness of banks to borrow at the Fed’s discount window.

Ultimately, Bernanke said, real relief for the mortgage market requires stabilization and recovery in the nation’s housing sector.

Economists estimated on Monday that house prices will continue to fall and that perhaps only half of the decline has been realized. See full story.

Bernanke agreed that home prices had further to fall, although he did not quantify by how much.

Bernanke also said delinquencies and foreclosures will continue to rise for a while longer. This will likely add to the inventory of vacant unsold homes — already at more than 2 million units at the end of 2007, he said. More coverage of the U.S. economy

“This situation calls for a vigorous response,” Bernanke said.

“Measures to reduce preventable foreclosures could help not only stressed borrowers but also their communities and, indeed, the broader economy,” he added.

One of the difficulties in working out problem loans is a thicket of complications arising from the fact that the loans were bundled together, then securitized into complex derivative products and sold.

These packages differ in the type and scope of workouts permitted by loan servicers.

Bernanke said that holders of the securitized mortgages should permit servicers to write down the mortgage liabilities of borrowers.

He said financial firms should consider reducing the principal of the trouble loans and not only the knee-jerk action of lowering the interest rate of the loans.

“In this environment, principal reductions that restore some equity for the homeowner may be a relatively more effective means of avoiding delinquency and foreclosure,” Bernanke said.

Permitting the Federal Housing Administration greater latitude to set underwriting standards and risk-based premiums for mortgage refinancing would help more troubled borrowers, he said.

Greg Robb is a senior reporter for MarketWatch in Washington.

I talked to BoA about their “no fee” mortgage and even though they advertised “no closing costs” they wanted me to pay some closing costs (about $5k worth).

THERE WILL BE BLOOD.

http://seekingalpha.com/article/66034-evidence-of-walking-away-in-wamu-mortgage-pool

Here’s an interesting article on Washington Mutual showing that:”Foreclosures increased a whopping 4.92%, yet in December, 2007 the 90 days delinquent bucket was only 3.79% (If every 90 day delinquent loan went to foreclosure, the jump would only have been 3.79%) How could this happen? The evidence suggests that people are walking away 30 days or 60 days delinquent without even waiting for foreclosure….”

Why would Bank America want CFC? Well they did give themselves a way to back out of the deal and they have until the third quarter to ‘fish or cut bait’. Yet they did send a team of examiners to go over CFC’s books before announcing the putative ‘deal’. Presumably, these experienced accountanting people would have seen the Option ARM trouble coming. Then again BofA had put $2 billion into CFC already and to turn their noses up after this ‘exploratory’ look at CFC might have pulled the rug out from Countrywide. MIght have been an attempt to ‘buy time’, to see what Washington would offer in the way of a bailout or perhaps a ‘request’ from the Treasury Secretary. As the head of Suntrust put it when asked if his bank would participate in the Super SIV then being floated, “A

request from the Secretary of the Treasury is not something a US bank can ignore!”

Whatever was/is behind BorA’s dealings with CFC may have been, it would seem events have moved on and deteriorated beyond the point where saving a middling bank in trouble will have any effect on the broader banking problems. It maybe that rescuing Citi and other big banks is the issue at hand.

About BofA purchase of Countrywide:

Let’s say ALL of the loans default. CFC is left “holding the bag”… Hang on… Let’s open that bag & look in… Well there are REAL homes in that bag… Well GOLLY,,,, a REAL asset to back it (not like the ENRON shell company game)….

Unless we see another great depression, those homes will be worth more than 25% of the note value and maybe as much as 50% of the note value. So let’s assume the home will sell at 40cents on the dollar.

– Per the Jan.31-2008 year end, you will find they have over $11B worth of mortgage loans on the books. At 40cents on the dollar you quickly see that this company can “close its doors” and still be worth over $4B dollars….

Well, what did BofA offer??? $4.1B…

Why there isn’t a bidding ware for CFC is beyond me… BofA is getting the bargain of the century.

I would like to see in 2009 how reluctant banks will be to lower their prices when they have 3 years worth of inventory on the market. Were almost halfway there and yet you still see 2005-2006 prices out there. Something has to give and I have a feeling one of the major banks (WAMU or CITI) will go under before it’s all over. Goodbye Free Checking.

Bank of America didn’t buy anything… They announced that they would buy it in the future….

If 10 million American’s announced they were buying homes in the next year, would the market turn around?

I fully expect BofA to walk away from CW in the next 6-12 months.

If the market had a miracle and turned around, BofA would have got a great deal, but it hasn’t, it won’t, and BofA won’t ever close the deal.

but how much debt has CFC issued that must be paid back?

Pat: Welcome to the next great depression. That is why BofA will not be getting the bargain of the century.

I suspect BoA is willing to place the CFC albatross around its neck because they sense there’s a bailout coming. If middle class taxpayers are going to be bled white to bail out the rogues and fools who created this mess, taking on more worthless debt provides a double benefit – first, it can make BoA too big to fail and put it at the front of the line of bailees, second; that bad debt will be redeemed by you, me, our children and grandchildren.

I have no inside info, just healthy senses of skepticism and cynicism. Plus I watched as BoA was the first big financial institution to send a specific bailout proposal to our revered leaders.

I do think there are some parallels to the great depression. But I will reserve that observation when we officially enter a recession first and unemployment rises above 10 percent.

@dutchtrader

Who was it that said that line about “lies, damn lies, and statistics?” Unemployment figures, like inflation numbers, are cooked. They specifically exclude under-employed and those who no longer qualify for UI. Just like the inflation figures exclude “volatile energy and food”. Both sets come from the same state as the Tooth Fairy, Easter Bunny, and Santa Claus.

No less than Warren Buffett opined that he believes the US is in recession. He didn’t get to be the now official according to Forbes “richest man alive” by not being able to read and forecast. Whether you like or dislike him, what he says carries weight on Wall Street and beyond.

IMO, BofA likely paid money to/for CFC at the behest of Paulson and others in government, who believe Mozilo that CFC is ‘too big to fail’. I concur with CathyG that there’s a bailout in there somewhere.

Doc

Great stuff. BAC grabbing Countrywide makes no sense unless the FED is pulling the thread behind the scenes. I don’t see how we afford a bailout so I expect a combo of Wall St. taking big hits and a partial bailout.

What a mess. Credit markets are a mess. 200 point spread on the 10 year vs the 30 yar mortgage which is the biggest spread in history. I don’t see how we are going to dig out of this.

Here’s an interesting report. UBS is reported to have conducted a firesale to get rid of $24 BILLION in Alt-A mortgages they hold. Surprisingly Pimco is reported to have bought them… at 70 cents on the dollar. Don’t know if the 24 billion is the face value or the amount realized from the sale but either way UBS is going to have to own up to another huge write off.

This just in CNBC reporting that Thornburg Mortgage has gone belly up. They were mentioned as another big holder of Alt-A mortgages.

Leave a Reply