Cultural Spending Neurosis: How a Nation Went From Prudence to Financial Decadence.

I was having a conversation with someone last week regarding his home equity line being shut down. He was rather distraught and frustrated by the sudden move of the lender to close off his line due to market conditions here in California. “How can they do that? They have no right to take away my hard earned money!” Aside from restraining myself from smacking him upside his head I did ask him how he earned that money that was now gone. “My home equity was my money. The bank has no right in closing access to my money.” Welcome to the new mentality of wealth in our nation.

This simple conversation is the tip of the iceberg of the challenge that is now confronting our nation. In the past few decades, Americans have arrived to the current distorted point in reality where alternate universes collide and somehow debt is now the equivalent to wealth. I should actually clarify that last statement in light of the above conversation about home equity lines being shut down:

“Wealth in the last decade isn’t how much you save or your net worth. Wealth is determined by your ability to have access to large amounts of easy debt via credit lines and maximum leverage.”

That is a very important point and once you grasp this knowledge, you can understand why we are in the predicament we are in. Today, retail sales numbers perked up and the market initially came out of the gate with guns-a-blazing. That is until folks stopped for two seconds and did the current economic math:

A: If all recent data is showing us that consumers are tapped out.

B: Home prices are still declining and foreclosures are rising.

C: Consumer inflation is hitting on every front.

D: Then how can Americans still be spending?

Let me show you how:

“American credit card debt is growing at the fastest rate in years, a fact that may signal coming trouble for the banks that issue them.

The Federal Reserve reported this week that the amount outstanding of revolving consumer credit hit $937.5 billion in November, on a seasonally adjusted basis, up 7.4 percent from a year earlier.

The annual growth rate has now been above 7 percent for three months running, the first such stretch since 2001, when a recession was driving up borrowing by hard-pressed consumers.

The surge in credit card borrowing comes as credit card default rates are gradually rising, albeit from low levels, and may reflect the fact that it has gotten harder for consumers to borrow against the value of their homes, both because home values have fallen in many markets and because mortgage lending standards have tightened.”

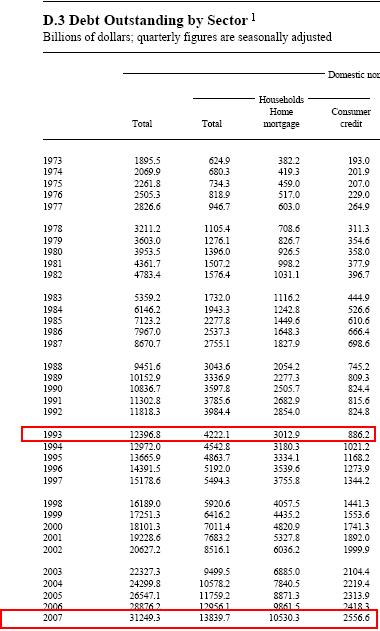

Now the above article was posted in January but now we are close to $1 trillion in revolving consumer debt out there. And the more ominous problem is that defaults are rising in this area. So what has occurred in the above equation is due to the lack of wage growth, people were using leverage via mortgages and consumer debt to bridge the Joneses gap. Take a look at the massive explosion in mortgage and consumer debt over the past 20 years:

Source: Fed Flow of Funds Report, June 2008

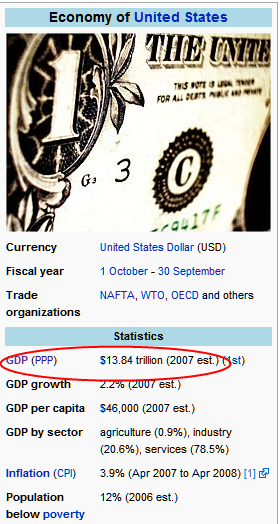

It is rather shocking that American households have approximately $13.84 trillion in debt obligations. In 1993, this number was at $4.2 trillion so we’ve nearly triple our national household debt in the matter of 15 years. That $13.84 trillion is a very large number and to put that into context, the estimate GDP for the entire United States for 2007 was $13.84 trillion:

Source: Wikipedia

We spend every last penny! Is it any wonder why Americans have a negative personal savings rate? You really have to wonder how people can spend more than they earn but that is essentially the way we as a nation have been living for the past decade. This housing bubble fueled by the debt bubble was only a logical extension of the cultural financial neurosis. The great majority of the public started associating the ability to access credit with true financial prosperity. Well as we all now know, anyone with a pulse and one tooth was able to get a large mortgage in California by simply making things up. Need we remind you about the farmer making $14,000 a year with access to a $720,000 loan? Or what about the hundreds of credit card offers Americans receive each year in the mail? When debt is no longer seen as a necessary evil and a sign of wealth, new definitions take hold of mass psychology.

Take a look at this ad during the heyday of the housing bubble:

“Chances are, you’ll sell your home before we sell your mortgage.” Is this some sort of race? The underlying implication of course is you’ll make so much equity in a few short years that you’ll be selling your current McMansion for a double whopper McMansion so why worry yourself with whether they sell your mortgage off to some foreign investor. These ads only spoke to the distorted psychology of consumers who thought access to a $500,000 mortgage meant that they had access to a $500,000 net worth.

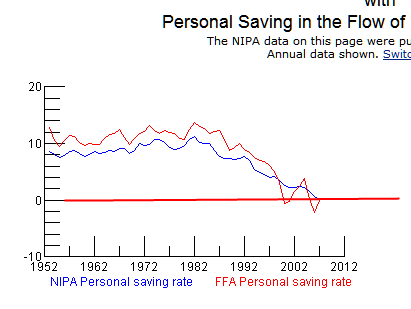

In a way, it allowed consumers to put on the bourgeois costume for a few years and feel like a million bucks even though they were drowning internally by suffocating debt. Think this isn’t the case? Take a look at the below chart:

That is why at the height of pseudo prosperity and the pinnacle of the housing bubble, Americans had for the first time crossed the negative savings barrier. This is the perfect example of watering down the definition of wealth in our country; collectively as a society people started having an aversion to saving money and a liking to debt. This of course is a major problem and no country can survive in the long run with crushing amounts of debt. I don’t care what kind of math political parties want to sell you but there is no way a country can be prosperous in the long run by running larger and larger deficits.

This implosion of the credit (debt) markets is simply a decade long debt ponzi scheme that can go on no longer. Consumer psychology still can’t understand why fuel is rising or why everything from education to groceries are costing much more. The perfect scheme was to con people into believing that going into debt, meaning you were spending tomorrow’s dollars today, was somehow a prudent way toward wealth. And the entire idea of savings lost its allure. In fact, society punished savers implicitly. For much of the past, if you bought a home folks knew that you had the diligence and restraint to hunker down for 2 or 3 years and put off conspicuous consumption for a larger goal such as a home. That entire romanticism of saving went out the window when anyone and everyone was getting BMWs and McMansions with zero down.

In fact, if you were renting and saving and trying to be frugal, you were seen as an outcast and a bum because you just missed out in a home that just went up $50,000 in one years simply because everyone was smoking the housing peyote. I wonder how many people had a kitchen conversation like this circa 2003:

Spouse A: “We should buy a home. The Perma Bulls down the street bought a home last year and they now have $50,000 in equity.”

Spouse B: “But it doesn’t make sense. How can a home be worth $50,000 more if they didn’t do anything?”

Spouse A: “Well here we are saving and all we’ve been able to save in our 2% savings account is $15,000. What if homes go up $50,000 again next year?”

Spouse B: “That can’t be because that makes no economic sense. Prices go up and correspond to some fundamental reason.”

Spouse A: “I heard that they got a home equity line and took a trip to Europe. Isn’t that great and fantastic? We actually make a bit more than they do but why do we live and feel poorer?”

Spouse B: “I don’t know. It just doesn’t make sense. I feel uncomfortable going into that large of debt. Why is that?”

Spouse A: “Because you’re stupid?”

Spouse B: “No. You are stupid you moron and don’t understand the difference between net worth and being in debt.”

Spouse A: “Isn’t wealth about what you can buy? We don’t take fancy trips or even have our own home! You are the true idiot you financial midget with no home.”

Spouse B: “I hate you.”

Spouse A: “I’m leaving you.”

Spouse B: “Go ahead and take the dog while you’re at it. I always hated how he looked at me anyways.”

What a lovely and heart warming story don’t you think? As you can see from the above sign, many people did have a conversation like this except in our story above, the couple split ways because of diverging financial goals and with that lawn sign, we can see that some folks unfortunately realized that selling a home in a busted bubble is no easy task.

This is the real deal here folks. We are shifting back whether we want to or not. The real psychological shift that is unfolding is the ability to break down wants and needs. A big gas guzzling car is a want and many folks are painfully realizing this. A large crushing mortgage for a McMansion is a want. Food and education are needs. Time to get these equations recalibrated before the market recalibrates them for you.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

36 Responses to “Cultural Spending Neurosis: How a Nation Went From Prudence to Financial Decadence.”

Not a very pretty picture is it?

It’s too bad you are so right.

I just hope we can get this mess cleaned up without people getting violent.

I had to get my name on my parents checking account last week, their health is declining (hell mine is too), so if they can’t write a check to pay a bill I can do it. The B of A employee had the screen so I could see it. I saw my moms checking account balance and I jokingly said “I came all the way down here for that” (low balance). The lady points to a spot on the screen and says “More importantly look at this” It was some credit line that had a high amount. I thought “Who cares”

Debt = usury

Wake up America.

how do we get out of this ??? its very desperating to read all this

Amen!

Haha your sample dialogue was hilarious. Gee I wonder which one is supposed to be the husband?

But Suzanne researched it!!!

You’re right on about credit cards. More and more people are using them to live. These people are not living paycheck to paycheck, but day to day. I know several at my job that are in this situation and it’s scary just hearing about it.

This morning I open the paper and the local school district is going to increase the price of school lunches from $1.75 to $2.15. Nickel and dime stuff but you have to shell it out everyday. The electric utility wants an 18% rate hike or $16.50

per month more for every 1000 kwh. I see the price of a rotisserie chicken in my supermarket last night was $6.39. It was $5.99 last week.$4.99 a few months ago. My propane for the BBQ grill is twice what is was last summer. I finally noticed too, that the half gallon of ice cream I bought is now but 1.75 quarts. Same price though. Keep this in mind when you hear tales of how consumer spending is ‘resilient’. Sure it is but it is buying less for more.

You totally misunderstand the ad stating “Chances are, you’ll sell your home before we sell your mortgage.†I remember this ad. The point is not that you will sell your home quickly! The point is that this particular company won’t “flip” your mortgage to another company.

Also the fact that the GDP equals our total debt obligations does not in any way mean that “we spend every last penny.” This is nonsense.

And your understanding of the effect of debt is simplistic. Debt is the TRANSFER of wealth from one person or group to another. If I borrow $100 from you and in a year pay back $110, I am $10 poorer, but you are $10 richer.

You are correct that we have become a nation of foolish borrowers, but the real problem is the foolishness of our lenders. And it is the lenders who should have to pay for their foolishness. Government intrusion in the process to try to bail these financial institutions out is leading to ugly inflation and other long term problems.

WEALTH DESTRUCTION IS EVERYWHERE TODAY AND NO WHERE IS THERE A PLACE TO HIDE FROM IT………….

One aspect that is missed in this synopsis is how the FRB caused this mentality to sink in. What are savers to do when you lose money by holding it in a money market fund? Rates were 1% and inflation 3 to 5% for years. Now rates are 2% and inflation 4+%. The government will do anything to try to keep the inflation tax alive. In a way, they encouraged this mentality. In a way, it is smart to take on debt when inflation is rampant. The problem is, nobody knows for sure when the music will stop playing and the house of card collapses. I think we are in the beginning stages of this happening. Personally, I never bought into the bubble psychology. But I am pretty pissed off about the risk free return on my savings right now. It is a rate that is fixed by a government backed cartel. I say do away with the FRB and let the market set short term rates. That will pretty much solve the whole problem.

A most interesting discussion. One item never mentioned however is the effect of massive money infusion (fed policy) on long term savers. A portion of my long term retirement savings (started in 1946) have been eroded by a falling dollar value to greatly reduce my purchasing ability. Is it any wonder that savings rates are low or negative.

One of the reasons I am splitting up. Thank God for the housing market crash! Now I only have to buy her psycho spending arse out for 12K!

Jason

Still not enough pain has been experienced to force people to change. Credit cards will carry the day for many, many months for lots of people. By then, they will owe more than can ever be re-paid. It is a very sad situation.

This will truly be a painful 5 years? But, unfortunately, we need this ass kicking. It’s going to take that to get a change in our collective behavior to sink in.

The question is, when will credit card companies start cutting people off like the banks already have for HELOC customers. Your credit line is reduced effective immediately to your current balance…

Why were the bankruptcy laws changed?

You think someone saw this comeing? Now it’s time to pay the piper, does he take VISA? LOL

Greenspan speaks of higher rates:

http://news.yahoo.com/s/nm/20080613/bs_nm/usa_economy_greenspan_dc;_ylt=Am0EpqTYnzQBSBqLyNG.s4.yBhIF

That should be…..well who knows these days?

Here in Mexico the wealthy man is the man who pays in “cash”.

But even here you are beginning to see credit lines and credit cards. Following the gabacho way!

there have been several generations that believe they are entitled. This may actually create a generation that must live within it’s means.

Tough lesson ahead.

Just got word that my credit limit went up another 3000 bucks. Thanks BofA!

Dr HB…

I think that it may be time to do another RHOG thread. Have you checked out the listings for Compton & Watts lately? Houses that sold for 435k in 2006 are now down as low as 135k.

There are some real “crack house beauties” out there now!

Mass therapy!

Ready…

Everyone please take out your wallet

remove all of your credit cards.

Find a pair of scissors.

Cut each card into many small pieces.

Repeat!

repeat!

repeat!

repeat!

repeat!

repeat!

repeat!

repeat!

The only cards left should be your DL/library card.

Q. how do we get out of this ??? its very desperating to read all this

A. How do we get out of this housing crash? Well, when prices get cheap, eventually people will buy. At that point the people who would be buying could be investors looking to rent. Regular people may be too scared by that point.

Personally I do not think that this is the end of the world. Housing has encountered a bubble in CA, FL, NV, and AZ. Many places in the USA did not experience a bubble, and are not experiencing a correction or crash.

Other areas will feel some of the effects of this. Lending has tightened up, even here, but that is a good thing. Inflation is up. I look at this as a good smack in the face that the USA needs.

In the movie Sicko, there was a very smart man (i think he was British) that pointed out that the best way to keep a population under control was to keep them AFRAID and IN DEBT. I think the bush administration has scored home runs on both counts.

Escalating credit card debt? Out of control banks. Someone said in here “Debt = Usury”.

Anyone else thinking maybe the movie “Fightclub” might be an instruction manual?

What is going to drive the American economy? The good paying middle class jobs have been sent to other nations due to the GATT, and NAFTA, treaties. Exxon has just announced that it is going to sell off its retail market because there is not enough profit in it. Heavy industry is gone, textiles are gone. Well maybe we can buy coal from ourselves.

“Global Sustainability requires the deliberate quest of poverty,

reduced resource consumption and set levels of mortality control.”

– Professor Maurice King

“The only hope for the world is to make sure there is not another

United States. We can’t let other countries have the same

number of cars, the amount of industrialization, we have in the US.

We have to stop these Third World countries right where they are.”

– Michael Oppenheimer,

Environmental Defense Fund

“A massive campaign must be launched to de-develop the

United States. De-development means bringing our

economic system into line with the realities of

ecology and the world resource situation.”

– Paul Ehrlich,

Professor of Population Studies

“Isn’t the only hope for the planet that the

industrialized civilizations collapse?

Isn’t it our responsiblity to bring that about?”

– Maurice Strong,

founder of the UN Environment Programme

“We must make this an insecure and inhospitable place

for capitalists and their projects. We must reclaim the roads and

plowed land, halt dam construction, tear down existing dams,

free shackled rivers and return to wilderness

millions of acres of presently settled land.”

– David Foreman,

co-founder of Earth First!

“Current lifestyles and consumption patterns of the

affluent middle class – involving high meat intake,

use of fossil fuels, appliances, air-conditioning,

and suburban housing – are not sustainable.”

– Maurice Strong,

Rio Earth Summit

“All these dangers are caused by human intervention

and it is only through changed attitudes and

behaviour that they can be overcome.

The real enemy, then, is humanity itself.”

– Club of Rome,

The First Global Revolution

———————————————-

green-agenda.com

Death to America! I mean, uh, death to uh, well, actually

I believe in peace, but my imam told me to say that.

I don’t really believe that but there is a lot of pressure to

be a muslim, let me tell you. With all the chanting, and

the beheadings, it gets so old! I just want to play xbox.

Really!

The banks must love this. A friend told me today that B of A is charging her 33% interest on her $4,000 credit card balance. (I’m going to pay it off for her.) And there are those TV ads with Gary Coleman (diminutive star in the ’70’s TV show “Diff’rent Strokes”) extolling the virtues of borrowing money from “Cash Call” while the screen says 99.25% interest. “Payday loan” storefronts popping up like mushrooms. We’ve become a country of loan sharks.

NAFTA and GATT didn’t send the jobs overseas, it just institutionalized off-shoring.

These trade agreements should enforce minimum labor standards. Workers should get living wages and be able to form trade unions. Eventually their wages will approach ours and their currency rise and the cycle will move on

This peak oil period is an excellent opportunity for educated, high tech nations push the limits of energy conservation and alternate sources like wind and solar.

Reply to AA – I think spouse B was the husband [B said, “But it doesn’t make sense. How can a home be worth $50,000 more if they didn’t do anything?â€]. I say so because I find husbands’ positions getting weaker all around.

The tide is such that anyone who does not want to dodge the issues and avoids sugarcoating will become unpopular, or will be hated as the conversation mentioned!!

God grant wisdom to America so that she could ask for real, solid blessings!!

You are so right and yet so wrong. Yes Americans have come to see debt as wealth and many have access to easy credit lines and easy debt. They are living it up for a while and maybe they have the right idea? I mean is anyone in debtors prison that you know. More likely, they file bankruptcy or get some agency to reduce their debt or get govt. assistance and life goes on. In the meantine, I have worked hard and saved for many years and have accumulated some money which loses value with each passing day. In a few years my savings will be worth half its current value and so forth and so forth. I beginning to wonder who are the real morons here. It seems that in America there is always a scheme to bail out people and institutions for bad decisions and the honest, right minded, responsible people pay one way or another.

TheLargerPicture gets it. You’re witnessing in real-time the subsuming of the industrial West into a dependent, dumbed-down and subservient bloc under control of the old banking families. None of this is a secret. The people with all the guns and the people with all the money will soon be the same people.

Unless you fight. Let gold, silver, food and ammo be your IRA. Get the hell out of Dodge (the town AND the car company). Keep your cash out of the banks except $100 to keep your account open. A Wal-Mart safe can be your bank; you don’t own it if you can’t hold it in your hand. And yes, for the love of God, CUT UP those cards. The borrower is slave to the lender.

History can not be repealed by an act of Congress. Congress, however, can be repealed by an act of History … unless you Yanks WAKE UP!

Ron,

If your savings are in paper assets you will be robbed by inflation. You must shift your paper assets into hard assets (precious metals, farmland, food, maybe even an underground fuel tank) and the shares of the companies who will benefit from food/fuel inflation. Inflation is ongoing and continuous so shifting your assets NOW will mean they will appreciate in fiat terms. Waiting is costing you money.

The US has a 10 trillion dollar debt. The Fed Funds Rate is not going to go to

OH my goodness!!!!!

My husband old me I had to read this…It is almost the same conversation word for word we had a few years ago (except for the leaving part).

I wanted to by a house so bad. Everyone had big cars and nice large homes and all this “stuff”. My family thought it was horrid that we were renting and driving a used car, oh the shame of it all!

The hubby had done some simple research and reading and said “In three years it will all be over.” He would not get a loan or credit card or anything of the sort.

Now I feel fortunate and “rich” to a certain extent. A car that is paid for, small home, small utility bills, no credit cards. Gee I love that man!

I agree with Ron, i think the smart ones are in massive debt and then just walk away! how do you think they are paying for $4 gas, with cash? lol

Woow.. you americans are in a deep deep shit…

Leave a Reply to fi trader