Chinese buyers pullback dramatically in buying U.S. real estate: foreign purchases drop by 36% and the results will be magnified in prime areas of California.

Apparently there is a limit to how many houses Chinese investors can purchase in the U.S. Foreign real estate purchases largely driven by Chinese investors plunged by 36% as internal controls in China made it harder to move money out of the country and trade war talks are having an impact in this sector. While some might say this is small relative to the overall U.S. real estate market you need to realize that money from China was hyper focused on certain areas. At one point there were new developments in Irvine that were seeing 80% purchases from Chinese investors. This has a lot of potential to hit markets where volume and inventory is low and prices are valued at ridiculous levels inflated by outlier buyers. There are many areas in California like that. This also applies to areas like New York, Boston, San Francisco, and Seattle to name a few. So what does this mean for these inflated markets?

Looking at the numbers

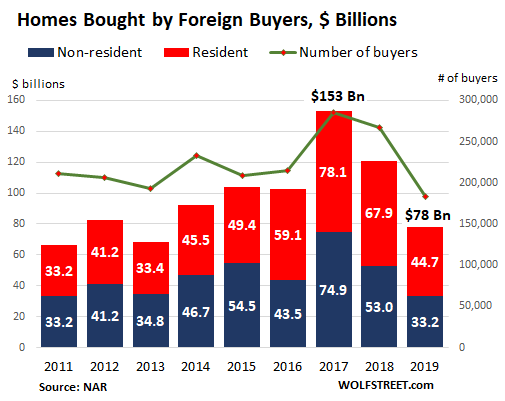

This is a clear pullback in foreign purchases in the U.S. real estate market. The value of homes bought by foreign investors is at multi-year lows but more telling is the actual number of buyers is at a decade low:

This is significant and we’ve seen a drop across all areas. No surprise that the largest buyer in dollar amount is China. This is the group that has pulled back the most significantly and when it comes to prime California areas will likely have an impact. This issue has many layers but many of these prime areas have top schools within their area and this is valued by many investors who utilize homes as investment properties after their kids go to school in these areas (e.g., NY, Boston, San Francisco, SoCal, etc.).

The CEO of Juwai even points to this:

“(CNBC) The Chinese were the leading buyers for the seventh consecutive year, purchasing an estimated $13.4 billion worth of residential property. Yet that was a 56% decline from the previous 12 months and comparatively the biggest percentage drop of all foreign buyers. Chinese economic growth slowed to 6.3% in 2019 compared with 6.9% in 2017, when the previous buyer survey began. The Chinese government also tightened its grip on the outflow of cash to purchase foreign property.

The Chinese may also be souring on U.S. real estate due to the current political climate. Anecdotally, real estate agents in California have seen a pullback in Chinese buyer demand. Southern California had been particularly popular with Chinese parents hoping to send their children to American colleges.â€

And word is only starting to spread faster. Tougher visa policies and tighter internal controls will likely make this an ongoing issue unless policies turn in another direction. And this makes total sense in inflated markets where there is scant inventory and a few buyers can set the price. Even a few years ago the thought of Chinese money pulling back even a little in California was unimaginable for a few cheerleaders of the housing industry. All they could see was how their glorious little crap shack was “worth†$1 million even though it was built a few years after World War II and the only updating they have done is slapping granite countertops in the kitchen, added a few stainless steel appliances, made the home Alexa “friendlyâ€, and made the bathroom look like a toilet in Caesars Palace.

No surprise here that tougher policies on foreigners is making things tougher on foreigners. But it isn’t all the doing from one side since internal controls are also getting more stringent within China.

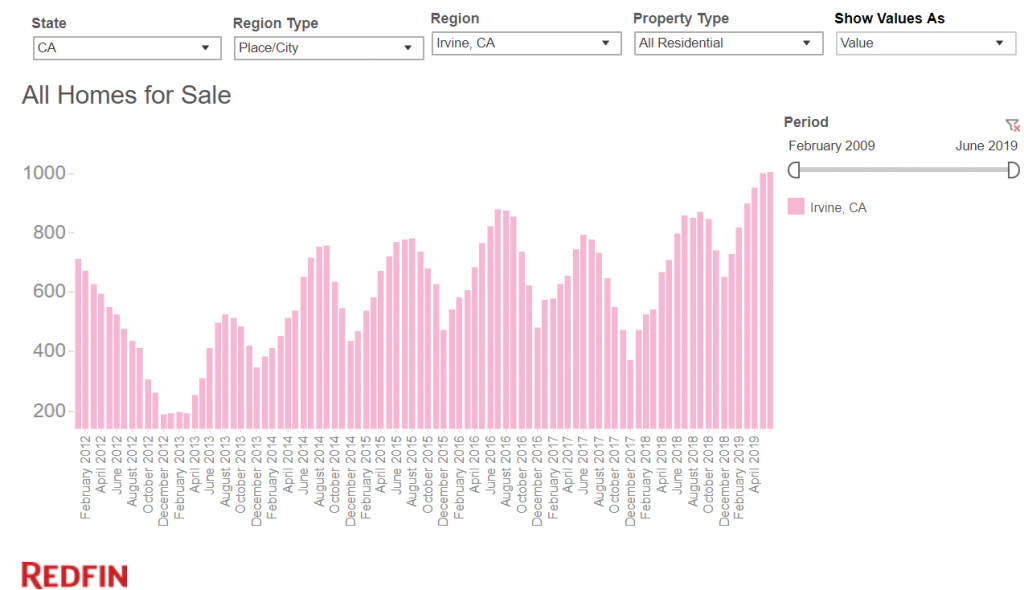

So to bring this back to an example, the number of homes for sale in Irvine is now at a decade plus high:

Not a surprise and expect this trend to continue unless we reverse course on policies.  Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

439 Responses to “Chinese buyers pullback dramatically in buying U.S. real estate: foreign purchases drop by 36% and the results will be magnified in prime areas of California.”

This is off topic but connected to the theme of the website:

My friend works in London in the financial sector. I was talking to him a couple of weeks about my concerns over the UK debt and deficit. He told me that it didn’t matter how much debt we had as long as we can make the monthly payments(He didn’t use the word monthly payments). I found that very interesting.

RE shills don’t do rent vs buy calc. and if they do they don’t including repairs/maintenance, PMI, transaction costs, HOA’s and opportunity costs. The math on a RE shills spreadsheet will always point to BUY NOW OR BE PRICED OUT FOREVER. And if you don’t buy now you will rent forever. They never learned to buy low and sell high. They only learned “buy now†which leads to financial destruction. They never consider any macro economic trends. As soon as you qualify you buy. This old thinking worked 60 years ago but with the recurring ten year boom and bust cycles we have nowadays it’s just financial stupidity to buy at the peak. Which is good for people that save during good times and buy RE during the downturn.

You posted this same thing, word for word, on the previous thread.

And now you post it again, out of context of anything said here.

Knowing your fondness for repetition, I suppose you’ll repost this several more times on this thread alone.

Did you run a rent vs buy calc on your wife?

Knowing how stubborn RE shills are, you need to re-post good stuff like my post above a few times.

Milli is posting the same negative garbage under different handles on zerohedge as well as marketwatch and other sites. I think he is trying to spread misinformation for political reasons.

I tend to hit the nail on the head. RE shills and cheerleaders can’t take it so they respond with anger. I am not political at all. I report the RE developments. Everything is pointing towards a crash. RE shills are in full denial. Probably because they are heavily invested in RE. Denial won’t help, the market is going downhill fast and this trend cannot be stopped. Don’t fight the cycle. Get out before you lose your shirt.

Makes perfect sense that Millie is a troll on Zero(brians)Hedge.

RE Shills and RE permabears will both suffer the same fate – not taking cyclic markets into account.

No one here says ‘buy now or be priced out forever’ except in Millie Vanillie’s lip-synced mind.

I often quote good articles from zero hedge. Why not? It’s accurate data and not manipulated like the stuff from the NAR. If you want to read manipulated data you just fool yourself. I haven’t posted on zerohedge, simply because there are no RE shills and RE cheerleaders. Where is the fun in posting on a website that has already people who know and accept the crash is coming? Here, you still have a few perma bulls that are in full denial and keep saying if you don’t buy now you will rent forever. They never understood that you can rent during a bubble and wait until the crash to buy at the bottom. It’s so simple but for some reason they can’t grasp that concept. It’s sad and it’s going to hurt a lot of these RE shills.

Milli: Here, you still have a few perma bulls that are in full denial and keep saying if you don’t buy now you will rent forever.

No one has said you must “buy now or rent forever.”

What some have said is that if you wait for a 50-70% crash on coastal California, then you will rent forever.

Son of a landlord,

Not only did they say “if you don’t buy now you will rent forever†they also said:

“This will be the year when millennials buy in drovesâ€

“Buy now before the Chinese buy all the housesâ€

“Interest rates are low, it’s a great time to buyâ€

“This might be your last chance, if you don’t buy soon, you will never buyâ€

“This next spring selling season will be epicâ€

“There is no inventoryâ€

“Incomes don’t matterâ€

The list goes on and on. There is no end to the lies of RE cheerleader/RE shill.

Zerohedge has a habit of spinning anything into a gloom and doom article. They cut and paste what makes the prognosis sound bad. LOL There are several time I read one of ZH articles and then went to the original source which actually was a very bullish. I think 95% of ZH articles are manipulated because Doom and Gloom sells.

Using ZH as a source for any investing will resort in a failure. IMHO

Seen It All Before, And It Ends Badly.

It reminds me of the mid to late 80s when the Japanese were buying everything in sight and were going to take over the world. And then it all fell apart.

History repeats.

Just a thought.

VicB

A Chinese buyer just purchased a newly constructed Bel Air mansion for $75 million: https://www.dailymail.co.uk/news/article-7267933/Los-Angeles-megamansion-sold-Chinese-buyer-75-MILLION.html

A megamansion in Los Angeles has been sold to a Chinese national for $75 million, marking one of the biggest residential real estate deals in the city’s history.

The 25,000 square foot home was originally listed last November for $88 million, before the seller slashed the asking price.

Located in the swanky neighborhood of Bel-Air, the property had only just been completed by Ardie Tavangarian, a high-powered owner of construction firm Arya Group. …

The seller did lower the asking price from $88 million to $75 million.

Still, it’s hard to extrapolate meaningful data from megamansion sales. Does this sale have any relevancy for homes in the $500k to $2 million range?

Exactly.

This is a good development for the average worker in CA.

In another social democrat paradise (Chicago), the communists (liberals) decided to nationalize the houses faster and faster at the same time collapsing the value of all real estate:

https://www.illinoispolicy.org/illinois-home-values-down-21-property-taxes-up-9-since-2007/

When you elect communists (liberals) in power every election cycle, there are consequences – they run out of other people’s money. There are limits in how much they can steal. Any way, the voters did not learn anything because their IQ is too low – they repeat the same voting expecting different results – definition of insanity. Well, that is what our public indoctrination centers are able to produce with the money (taxes) they steal from producers.

this would make perfect sense if…….you actually believe in voting, as if we have a choice, we dont. Voting is just an illusion to let people think they have a voice. They dont. If we take a look at history, we can see that basically the same thing is happening, we have rulers/owners. Control tactics of the population are religion (dont beleive me, check your histroy books about the romans its well documented), but that was the romans, they wouldnt do that to us! why not? cause they arent supposed to….ahh ok gotchya. The other control tactic of the people, is to keep us busy fighting with each other rather than joining forces to fight them, white vs black, dem vs rep, left vs right, us vs mexico which sturs up racial tension with the whole wall bullshit that aint happening. We have no vote, no voice, nothing. Entire world is corrupt………..also worth mentioning and I would like to see if others have heard of this……..apparently they are trying to make home purchasing online, just as easy as buying stocks…….so homes will basically be stocks, therefore all the rich will buy up all the properties, and barely anyone in the US will be a homeowner anymore, US will be a renting majority nation, all owned by the rich, for future generations, home ownership will be a thing of the past…….this could just be their way to get out of debt!

“I don’t care who does the electing, so long as I get to do the nominating.”

-William M. Tweed

Great post!

During the campaign runup to the last presidential election, two polls asked voters about which candidate they wanted. Both Pew and Gallup came up with the same results. Less than 30% of voters wanted either Trump or Clinton. That means over 70% didn’t want either. However, they way democracy works means the country gets a president that very people originally wanted.

Your comment regarding the stupidity of voters is so incredible true!

Bob, I responded to late to you on the previous thread. Any way, here are the indisputable facts which you disingenuously ignore and pretend you are not aware of:

1. CA has a supermajority of Democrats where they have 100% control and are responsible 100% of what is happening there

2. CA has the biggest wealth inequality in the nation

3. CA has the largest percent poverty in the nation (worse than Kansas, Alabama or Mississipi)

4. CA has the largest amount of unfunded liabilities at the same time with the highest level of taxation

5. CA has more ocean opening than any state while Kansas is a landlocked state where it is hard to do business

6. CA along the coast has the best weather (attracting people with money) while Kansas has a miserable weather year round which does not attract or keep people with money.

Sure, in your mind you blame a political party for things beyond their control while comparing apples with oranges in order to get to a stupid conclusion which you know very well that it doesn’t hold any water. The conclusions you reach are an insult to level of intelligence of the other bloggers who read it. You know it very well but prefer to embarrass yourself with the level of comparison you make.

Flyover, Thanks for carrying this forward.

Here are my unbiased responses.

1. CA has a supermajority of Democrats where they have 100% control and are responsible 100% of what is happening there.

Yes! I agree. CA is extremely successful(more than any other state) with the Democrats in charge. Unlike the Great Republican experiment disaster in Kansas.

2. CA has the biggest wealth inequality in the nation

You are saying CA under Democrat leadership has created more wealthy people than ANY other state in the US? Please explain why that is bad? The Republican Kansas experiment created more wealth equality because everyone ended up poor. After that, who would ever vote Republican?

3. CA has the largest percent poverty in the nation (worse than Kansas, Alabama or Mississippi)

Yes, it also imports many illegals and poor people for low wage Ag jobs. CA is the biggest agricultural state in the US under Democrat leadership. It supplies the food for much of the US. I agree with you, paying the Ag workers low wages is not fair. We need a higher minimum wage.

4. CA has the largest amount of unfunded liabilities at the same time with the highest level of taxation.

As far as taxation, you get what you pay for. In CA, there is cleaner air, cleaner beaches, more bike paths, parks than any other state. Most people prefer not to live in a Republican slum state while being poisoned daily.

.

5. CA has more ocean opening than any state while Kansas is a landlocked state where it is hard to do business

That is true. People in CA like their ocean and appreciate the government not to pave over the beaches or have massive oil spills (They don’t like the Republican oil states along the Gulf due to the Republican oil spill pollution). That is why TX, AL, GA, MS don’t have nice beaches. I wouldn’t move there. My friend worked in the Coast Guard on the Gulf Coast after working in CA. He said that in TX, they don’t clean up oil spills, they just bury them. That is why I will never live there. Cancer rates are MUCH higher along the oil coast of TX. I want to live a healthy life.

6. CA along the coast has the best weather (attracting people with money) while Kansas has a miserable weather year round which does not attract or keep people with money.

CA does have the best weather. I can’t credit either party for that. People who appreciate quality of life, tend to move to the Democrat CA, rather than the Republican slum states.

So, when Bob is confronted about CA, he deflects to TX. Ok; that means you admitted that what I said are facts.

You can’t hide the largest poor population behind billionaires. In feudalism you also had lots of equivalent billionaires today, but that was not progress – it was a sick society. CA looks more and more like a feudalist society of few super rich and all equally poor. If you praise the CA politicians for that, then you admit how sick are the liberals who campaign on redistribution.

You also praise the liberal politicians for environment and the air is full of smog (yellowish greyish color) the streets of the big cities full of homeless and feces (thousand and hundred of thousands) with all the health consequences of such a “clean” environment.

You blame poverty on illegals but the CA social democrats support and invite them in their sanctuary state and cities. Trump offered them help via ICE and walls but democrats refuse that. They like to see that mass poverty because it reminds them of the good old days of feudalism where they are noble and the rest are servants.

As far as taxation, you get what you pay for. In CA, there is cleaner air, cleaner beaches, more bike paths …

I’d happily pay more taxers for fewer bike paths.

40 Million People for 6th largest economy in the WORLD. You can cut and dice and divide that number any way you want and every old poor neglected Californian looks 10x better than any other citizen of any other “red†state.

And remember the solidarity payments California makes to support the other (red) states. If we can have those back, thank you and we could all drive Bentleys to work.

Sammy: Can you concisely define “solidarity payments” and state exactly how much (in dollars) California pays to “red states”? Thank you.

Sammy: And remember the solidarity payments California makes to support the other (red) states.

No such thing as “solidarity payments.”

But if there were, I’d rather make “solidarity payments” to my fellow Americans (in whatever state), than to illegal alien criminals (in whatever state).

As far as taxation, you get what you pay for. In CA, there is cleaner air, cleaner beaches, more bike paths, parks than any other state. Most people prefer not to live in a Republican slum state while being poisoned daily.

the above only applies to the rich, for the poor, our parks are filled with homeless drug addicts, gangs, drugs, not safe to take children, crime, shootings, etc. public parks are essentially homeless/drug society living quarters.

I think Sammy means that the great Democrat state of CA sends far more in to the US government in Federal taxes than it gets back.

CA is not a leech state like most Red States that leech off of CA’s Federal tax payments.

Just look it up on Google.

In other words, Democrats generate far more income than any Republican states so they pay more in Federal taxes.

Just like I said about the Great Republican Kansas experiment. Democrat States grow the economy and generate Federal Income far more than Republican States

I think Sammy means that the great Democrat state of CA sends far more in to the US government in Federal taxes than it gets back.

EVERY state sends more to the federal government than it gets back.

This is because much of the taxes are spent on federal employees in Washington, or sent to foreign nations or NGOs, or to overseas military bases, or overseas intelligence operations, etc.

What, you thought 100% of tax money sent to Washington comes back to the states?

And the other states are not “leeching” off of California taxpayers. Many (most?) Californians don’t pay ANY federal taxes. And the super rich in California would not be super rich without access to the other 49 states’ consumers.

Bob,

This is the nice CA environment you tout so much:

http://theeconomiccollapseblog.com/archives/california-is-being-overrun-by-rodents-and-in-this-case-we-arent-talking-about-the-politicians

Bob love your replies to Flyover it would be great if he kept on flying to Texas and stays , flyover you must be among the super intelligent ( a legend in your own mind) as you insult everyone else and their capability and obviously not smart enough to know the difference between both parties is subtle at best their basically clones and I can clearly remember Ronald Reagen giving amnesty to 3 million illegals in 1986 a Republican president ,right ! I keep track of 2 markets where I have lived in the past and may return .

Texas gulf coast and N. SLO county In Ca at this point I see both markets in decline though the Texas market is showing larger markdowns ,the SLO is showing almost 80% consistent markdowns and the RE market at least in Texas and Ca. is in decline and I believe will fall much further but this is from someone who is lived outside the US for 10yrs.,2011 -2012 was the temporary bottom the next bottom will be in the next 3-5 yrs.

and similar to 2008-2012 drop likely 50-70%.

Two of the worst presidents in history Bush and Obama one created a bubble in RE with no effort to stop the ongoing corruption in the RE industry and the other bailed out all the banks , wall steet etc. and created one huge financial bubble with real rates near O% and now we have the worst president in all history the orange idiot ,who if has his way would bring about negative interest rates.

His history is one of piling on debt and defaulting (bankrupt 6x) and not paying taxes ,he claimed 1 billion$ in tax losses for a 10 yr period 20 + yrs. ago .

So flyover Republican or democrat there is little difference big government is always a problem and yes Ca. has its problems but is more accountable than any other state about the environment and liberal or conservatives wake up their equally good qualities in both but again I am not super intelligent like flyover just likely hell of lot more experience in and with life !!

Richard S., it does not have anything to do with my intelligence, but observations. Texas is almost blue and Austin and the other big cities in Texas are completely blue. I don’t like Texas because of the high property taxes and most of it humid weather.

I did not vote for Bush and I did not vote for Trump. I agree with you that Bush and Obama were the same – globalists. I agree than more than half of GOP politicians are republicans in name only (RINOs). While I don’t like any on the left (all globalists/communists) I like some on the right (i.e. Ron Paul). Over all, I don’t like most of the politicians. I like that Hillary lost and I like that Trump brought the issue of illegal immigration to the top of media conversation.

I hope that clarifies my views.

Richard S has inspired me to continue.

So, when Bob is confronted about CA, he deflects to TX. Ok; that means you admitted that what I said are facts.

Really??? You sound like Fox News. I only mentioned that on item 5 with regard to beaches. Never trust a Republican to offer an honest rebuttal.

You can’t hide the largest poor population behind billionaires. In feudalism you also had lots of equivalent billionaires today, but that was not progress – it was a sick society. CA looks more and more like a feudalist society of few super rich and all equally poor. If you praise the CA politicians for that, then you admit how sick are the liberals who campaign on redistribution.

So CA has created the most wealth in the US and you are against this? It also supports the most Ag in the US which has the most low paid workers in the country. Do you want food wherever you are holed up? CA provides it under its great Democrat leadership.

CA is the only state I know that is working to raise minimum wage and solve the extreme wealth disparity seen in Republican states. The Great Republican Kansas disaster experiment made the Koch Brothers wealthy. Everyone else fled.

You also praise the liberal politicians for environment and the air is full of smog (yellowish greyish color) the streets of the big cities full of homeless and feces (thousand and hundred of thousands) with all the health consequences of such a “clean†environment.

And the Republicans have a solution for the Homeless? What is it???? All I hear is crickets.

CA is the only state I know of trying to deal with this. The Republicans are just loading buses of homeless out of town. This looks like how FDR got elected in 1930. Given enough voters who are homeless or soon to be homeless due to Republican policies in the US, Bernie or some socialist will be elected in 2020. Republicans have no solutions to this. Democrats have solutions.

You blame poverty on illegals but the CA social democrats support and invite them in their sanctuary state and cities. Trump offered them help via ICE and walls but democrats refuse that. They like to see that mass poverty because it reminds them of the good old days of feudalism where they are noble and the rest are servants.

Extreme Capitalism is what the US is becoming. Just like the final rounds of Monopoly. A few .1%ers own most of the wealth in the US. The rest are homeless and out of the game. Fortunately, a bit of socialism will solve this problem just like it did when FDR was elected. Vote Democrat to Make America Great Again.

BTW,

You really should read Steinbeck’s “Grapes of Wrath”. That describes America today.

Socialist FDR was elected shortly after.

Third World Country

https://www.nationalreview.com/2019/06/california-third-world-state-corruption-crime-infrastructure/

and yet Newscum still blames Trump for everything. Check out his twitter feeds-the comments/responses from people though are very hilarious!

Speaking of foreigners and real estate…

Minneapolis (home of Ilhan Omar) has done what SB50 would have done in CA. No more single family neighborhoods anywhere in the city will be allowed. Any property can have an apartment built on it. And the kicker on top of it is the city has set aside $50M to build “low income” housing. Which essentially means that every single property owner in the city could potentially have a Section 8 building next to them.

I’d pay good money to see the reaction of upper middle class white women who vote Democrat (cuz Trump said a bad word once) find out who the new neighbors will be. These women talk about diversity all day long, but live in high end exclusively white neighborhoods. Not for long…..LOL!

That is so true. It’s great how some of these well to do libs preach diversity until they are forced to deal with it on a personal basis. Their leafy suburban neighborhoods and top notch schools are anything but diverse. Upsetting the status quo sure as hell would scare a lot of them to death. How about setting up a homeless shelter or undocumented immigrant shelter in their neighborhood…not gonna happen!

Don’t say anything against these CA democrats because you might trigger Bob and his sensitivities. He thinks that the way the democrats lead CA is best thing ever.

There’s a word for that now: https://www.urbandictionary.com/define.php?term=NIMBYcrat

The Democrats are the anti white party. They will do anything they can to destroy whites. Not only they prohibit them (especially males) from all government jobs, but also from the universities in the highest demand (you may have 4.0 GPA, max test scores, hundreds of volunteer hours and the best of references – no interview). Now they want to “diversify” all white neighborhoods to crash the values of their homes for which they worked their whole lives. They think we don’t have enough diversity. They will continue to “diversify” the US till all cities look very homogenous like those in Africa and Mexico and all whites will live under the same conditions (only with public transportation, of course). Then they will fly to New Zealand or other private islands and leave us to solve the mess they have created. Of course, if we state the truth, we are “racists” or “deplorables”.

I can’t wait for Bob to have a housing section 8 next to his house so he can enjoy the blessings of his democrat politicians. People should be able to eat the fruit of what they sow.

You mean the Pedo Marxist Jews that use their third world pets as shock troops to destroy civilized society. They sit on the school boards mandating trans perverts have free rein, they sit on planning commissions that mandate third world squalor and limited use of private cars. Don’t believe me? Check your local area, guaranteed the cancer has taken hold.

Now you started it, Flyover.

This blog is becoming ZeroHedge.

I thought you were a Libertarian? Do you really want Section 8 housing on one side of your house and massive strip mining on the other? That is a Libertarian dream! Unlimited property rights.

That is not a local Democrat government stance. Democrats believe in zoning. Republicans and Libertarians believe in unlimited property rights.

Oregon and Minneaplois, both run by Democrats almost exclusively have banned SFH zoning. CA is about to with SB50. Republicans are non-existent in CA govt.

Bob’s conclusion: It’s Republicans who want to get rid of zoning laws.

LOL. Never change Bob.

Bob, I am not a true libertarian. There are lots of things libertarians support and I don’t. I am a constitutional conservative with libertarian leanings. The closest politician to my views would be Ron Paul.

I believe in zonings. I believe in property rights, but not to the detriment of the neighbors. I am not a philosopher; I am a very practical person and I like to see common sense. I believe that the big government (especially when they have an evil agenda), can be more destructive than the libertarians, even if the libertarians have some good points in what they say.

The policy of importation in millions from third world countries, the policy of allowing tens of millions of illegals in this country (via sanctuary cities and states) is very destructive to US and especially the middle class. Trump speaks against it (common sense) and the democrats supports this illegal immigration (verbally and in practice). The fact that white males (except those well connected at the top) are discriminated in all prestigious universities and all government jobs is a FACT. It does not have anything to do with ZeroHedge; I felt it countless of times in day to day living and my son, too. The conservatives believe that admission in jobs and universities must be merit based (no discrimination based on percent melanin in your skin) – you work hard, you deserve it. The Chinese are not whites, but they work hard and have a higher percentage than whites in universities with no added points and no help. That means that there is no discrimination in universities (like the democrats claim) against blacks or hispanics – just against whites (I am talking about those places in high demand like medicine or dentistry or Ivy League).

Flyover, this is not entirely true.

“That means that there is no discrimination in universities (like the democrats claim) against blacks or hispanics – just against whites (I am talking about those places in high demand like medicine or dentistry or Ivy League).”

According to you, the Democrats are discriminating against just whites. That is not true. If you believe your argument, there is discrimination against, Whites, Asians, Indians, Muslims, Pakistani’s Israeli’s……… None of these have any special scholarships into universities.

My point is that the scholarships and aid are going to the poor. It may be that African Americans and Hispanics have a higher poor population trying to attend college. Why is that? It was only 40 years ago when a white person could not date or marry a Hispanic or African American in some states without being jailed. It was only 50 years ago when the same could not go the same restaurant or bathrooms. I was alive during these times. I may be old but it was not ancient history. It all happened during our current generation.

Yeah, affluent liberal shills love to inflict diversity on the general population, but panic if they have to deal with it first hand. For the ones that aren’t politicians, it’s rather perplexing why they would support the liberal agenda.

As a resident of a MInneapolis suburb, I can confirm that this is happening and was very contentious issue. Even worse, the city council is currently considering passing an ordinance that would prevent landlords from denying applicants with a any criminal history or evicitions more than a few years old, or those who have no/bad credit history. “everyone deserves a chance” mentality at its best. Now the SJW women you reference above will be able to live next to Section 8 filled with tenants who have stalking/assault convictions and there is nothing the landlords can do about it. FYI, this is why I live in a suburb. Could never live in MPLS proper. Absolutely nuts government.

I love you…..

I’m in favor of adopting something like Vancouver did with a tax on vacant properties. You want to park your criminal money in American real estate? Fine. But you need to pay us a vig. Even if it means real estate values drop a little, I’d rather have that than foreigners controlling such a yuuge chunk of housing. Hell, a foreigners can’t even buy property in Mexico within 50 kms of the coast. Yet any Mexican (or Chinese) can buy beachfront homes up and down California. As usual we (Americans) are the doormat of the world.

A while ago RE shills and cheerleaders were telling us the Chinese are comingn. They are going to buy up all the houses. Better buy now before you are priced out. Now we are learning the Chinese are fleeing the market in droves. I said it many times before, RE shills were saying the exact same things about California in the 80’s about the Japanese.

Now, that inventory is increasing sharply and foreigners are fleeing the market it’s time to eject. Sell now or be stuck with an overpriced house for another decade.

The surge in Chinese investors in Canada and the US coincided exactly with the crackdown on corruption in China. Now that all the big players have been arrested or identified, the exodus is over.

The Chinese are not fleeing. They are buying less. LOL That is what ZH does. They manipulate the facts. The Chinese still spent $13 Billion. I would love to be in the an industry that has a $13 billion potential sales.

I bet there are at least 100 million Chinese that would buy a home in America if all they had to do was jump over a fence. The Chinese government is cracking down…it is not because they want to flee the U.S. market.

Exactly. Wait until the Chinese Pooh Bear Xi announced bring back that stolen money or your families get executed. That’s when the fun starts!

If this article is true, what about this?

Even cool, Bay Area housing market is still hot

The typical buyer in Santa Clara County needs $614,000 down to keep mortgage within budget

https://tinyurl.com/BayAreaHousingBubble

Good news and hopefully this continues. Americans are sick and tired of their communities being bought up by Chinese investors. I have lived in So Cal my whole life and cannot believe what they have done to cities like Chino Hills, Ca. Which of course is reflected in many other communities in our state. Keep up the good work President Trump!

I know someone who lives in a nice place in Eastvale, and the house behind them is owned by Chinese investors, and sometimes is empty and sometimes temporarily occupied.

Used to live in Walnut. Sold house for $1M to Chinese 3 years ago and got the heck out of there. Hated living there. Was chinatown.

the places that Chinese buy are few and far inbetween. The Chinese obviously LOVE San Gabriel Valley. It started decades ago in LA when the wealthy Chinese who built their fortunes in ChinaTown started moving out of DownTown LA to Monterey Park, San Gabriel, Rosemead, Covina, Arcadia, South Pasadena. Then they started buying in Hacienda Heights, Diamond Bar, etc. Here where I live on The Westside… hardly any Chinese. I bet there arent many Chinese in SouthBay or the Valley. But of course, LOTS in Irvine also.

Then why are new home prices in Irvine continuing to go up?? Who are they selling to? I walked into a new home community in Irvine and it was obvious they weren’t interested in talking to me because I wasn’t Chinese.

Going up?

Are you kidding?

I follow zip 92603,92604,92612,92625 closely.

With very few exceptions, for at least the past year, every MLS posted with a price change has been in the downward direction.

If you want to get some peace and quiet these days, go to an open house, cause nobody’s there.

Last year I posted the percent of foreign buyers in CA (~ 40000 out of ~250000) and less than half of those were Chinese (maybe ~40% as I recall). Chinese were the single largest group though. Data is just as the Dr says, with foreign purchases dropping since 2013. Little wonder. This isn’t Trump (2017 first year) but the lack of good buys and increased regulations on currency transfers (e.g. bitcoin). 2013 was the last year with good deals (my Daughter moved up to a bigger house that year).

Thank you for your interesting post. This issue has been getting a lot of coverage, but I really liked your graph showing the real drop off in foreign buyers. I assume that the 2019 was an estimate based on the first six months? I wonder if the Chinese anti-corruption crusade has also made the Chinese a little concerned about standing out by buying US property.

“Chinese anti-corruption crusade”

In a Communist country that has traded the Communist economic system for one more typically Fascist, corruption is what the government defines it to be. If the concentration of power and wealth in private hand starts to threaten the establishment’s control, all of a sudden there is corruption. Having a place to run to in an emergency makes it harder to control someone. Look at what is going on in Hong Kong with the Quisling government trying to institute extradition to the Mainland.

I went to a loooot of open houses this weekend. Saw a biker who was riding his bike through the neighborhood. He was the only visitor and he lives in the area, he’s not looking to sell or buy. Besides that I didn’t see anybody. Obviously, there were the realtors. Lol. All of these houses had multiple price drops already. Crash baby crash 🙂

The music has stopped as some posters said already.

What?!!?!??? Americans can’t afford to buy here anymore. Now foreigners stopped buying too????!????? Are there still crazies out there who don’t think this is going to be 2008 all over again?!?!???!!

In the news … San Fernando Home Prices hit record high, and inventory is dropping. So much for the Chinese story.

https://losangeles.cbslocal.com/2019/07/20/san-fernando-valley-home-prices-hit-all-time-high/

Don’t confuse perma bears with facts. They have a story to tell.

That must be fake news. Millie has went on record many times saying home prices are crashing and inventory is skyrocketing.

There will be no tanking in 2019, you can take that to the bank!

LOL desperation is setting in now among the REIC shills

If anything the desperation is on the perma bear side. Every week you guys come up with some new doomsday scenario. It’s a lot like the MSM and Trump. How many times has the MSM pronounced the end of Trump? LOL

OC Register columnist Lansner is continuing his series on the “housing shortage”. Headline: ” Housing shortage ranges from 2.5M … to zero ”

He says ” These shortfall guesstimates are very much ‘it depends on who you ask.’ ”

He references the McKinsey Global Institute report of 2016 based on 2014 data that is tied to Gov. N’s push for new housing.This report estimates that 3.5 million houses need to be built by 2025 to meet needs. And the report estimates that 1 million houses will be built in that time span. Yet a report from Freddie Mac stated that there is a nationwide housing shortage of 2.5 million for ALL 50 STATES! The McKinsey estimates were based on statistics for older population states NY & NJ, both older shrinking states. The Embarcadero Institute has used other state comparisons to come up with much lower figures.

In my opinion, population growth estimates can vary all over the place from shrinking to growing at the poor end of the economic spectrum due to a potential flood of

Mojados.

Lansner cites the CA Dept. of Housing & Community Development estimates a shortfall of 1.1M not 2.5M! Lansner also scoffs at a building industry estimate of one new home for every 1.5 jobs created. Embarcadero asks “if that standard is true, what happens when California has its projected 19.4 million jobs in 2025? This ‘standard’ translates to a statewide need for 12.9 million homes. Well, the state already has 14 million residential units. So zero shortage.”

The ridiculous housing prices here (including rentals, so not just a speculative bubble) show there’s a huge shortage of housing. Basic supply and demand, dude.

Fair Economist: housing prices are clearly not contingent solely on overall supply and demand. In approximately 2009-2012, housing prices crashed, despite demand for housing being very similar to 2008. It’s not like there was some mass exodus of the general populace of the U.S. Therefore, it’s entirely feasible to have a housing crash independent of overall housing demand, especially considering that there are is a limited pool of buyers in an economic downturn.

The most annoying thing is when you have a listing but the sellers refuse to accept the market has shifted. Some are so delusional that they won’t even acknowledge comps. Fine, watch your neighbors sell and ride the market down…….everyone is an expert nowadays. I have 20+ years experience selling and buying real estate but people think they know it all because of some website article or commentary they read. This all reminds me a lot of the previous downturns. History doesnt necessarily repeat but it rhymes.

Negative YOY prices 🙂 bye bye bubble

https://wolfstreet.com/2019/07/18/housing-bubble-2-lost-its-mojo-in-the-san-francisco-bay-area-house-prices-drop-8/

But but but San Fernando Home Prices hit record high!!! Chinese love the San Fernando!!!

San Fernando data >>>> all other data. Lol

Most on Wall Street expect the Federal Reserve to cut the federal funds rate by 25 or 50 basis points on July 31. I say this is a dumb move as the FOMC continues “quantitative tightening.†(QT – draining liquidity from the market).

I say wait until the fourth quarter after QT ends. The Fed will drain $105 billion from the banking system in the third quarter.

Last week the Federal Reserve drained another $7 billion from the banking system. The balance sheet totaled $3.81 trillion on July 17, down $692 billion since the end of September 2017.

Fed Balance Sheet

Fed Balance Sheet FEDERAL RESERVE

Fed Chairman Jerome Powell has a goal to shrink the balance sheet to $3.5 trillion. When quantitative tightening ends at the end of September, he will likely be $200 billion shy of his goal.

The Federal Reserve should not be executing monetary policy with an eye on the stock market. Let the fundamentals and the technicals drive stocks higher or lower. Fed-Speak simply causes unnecessary market volatility.

The Federal Reserve is trying to increase inflation, which is a stupid mandate given the rising cost of living on Main Street, U.S.A.

Flyover,

You and I both agree on this. Trump does not agree.

The Federal Reserve should not be executing monetary policy with an eye on the stock market. Let the fundamentals and the technicals drive stocks higher or lower. Fed-Speak simply causes unnecessary market volatility.

It is like a good movie drama in slow motion. We’ll see if politics and Wall Street drive the Fed.

Next up…”California property values crater, residents blame Chinese investor’s exodus. We didn’t see it coming”.

Weak RE market in California points to recession

https://www.sacbee.com/news/business/article232996597.html

No it doesn’t. Don’t you even read the text?

Read it again, but read the text, not the misleading headline!

All data points you obtain on any RE related article show a recession is coming – fast. The real estate crash cannot be avoided. We see it every ten years after a highly inflated market run up.

I love these stats! “Inventory ‘skyrockets'” was the last one. Little known fact that the little increase in inventory still doesn’t do anything to the supply side of the market. Houses are still being bought and sold in little time. Now it’s “Chinese investors pulling back” never mind their impact on the housing market is so great that a 36% pullback (if true, I highly doubt it) does nothing for the sell side. They’re still buying in droves! And there’s no end in sight to it quite honestly. Look at Hong Kongs property bubble and tell me when that’s popping…not anytime soon! Our prices are a steal compared to theirs! The fact is that Chinese investors are DYING to dump their money into our market but limitations on investments are coming from their government not because they’ve lost faith in our market.

And since we’re talking about stats, consider this: foreclosures and delinquency are at an ALL TIME LOW! You can’t have a crash of everyone is paying their bills right? Now let’s see when this mystical crash will roll around that seems to magically happen every 10 years…

This guy new age seems to be in full denial. Now they tell you that skyrocketing inventory and fleeing foreign buyers have no impact to the market. Next they will tell you that negative YoY prices are only temporary. And the red hot selling season was delayed and will start in fall this year. There is no end to the bullshit they will tell you. It’s highly entertaining….this crash is going to hurt a ton of people.dont cry later and tell us we didn’t warn you…

Exactly right. You can’t have a true “crash” without an underlying problem such as delinquency uptick, credit crunch, mass layoffs, etc. The market may correct in an amount that reflects a realization of 2-3 years of irrational exuberance but so long as employment is humming and credit is damn near free, this won’t be more than 5-10 percent. Housing is a necessity, there will always be a demand at a given price point. People cannot substitute for a roof over their heads.

And? Corporate debt is at an all time high, especially in China. One shock to the system and you will see that delinquency rate shoot up like a rocket. Any wonder that the past 10 years have been aligned with central banks keeping interest rates artificially low? Look at the Japanese real estate market and you will understand the potential for 30 years of deflation.

give it 10 more years when all the “millenials” baby boomer parents die in the house they are renting and they are forced to actually support themselves, with their low wages, high rents, and student loan debt, a lot of people will not be paying their bills, most likely it will be the student loan as housing and cost of living come before a “bill” thus their credit will be ruined, with no purchasing power……..its really hard to tell whats going to happen in the future, but we all know that “something” definitely is going to happen and it doesnt look good, I dont see housing prices crashing and your average person buying a home…I see things getting worse, the people owning less, and the bankgsters owning more. God Bless America!

In 10 years millenuals’ parents will all be dead? Millenials are in their 20s and 30s, which means their parents are in their 40s, 50s and 60s. In 10 years these people will be in their 50s, 60s, 70s and very much alive.

LOL But nice try, I like the outside the box thinking by perma bears.

Mr Landlord I may have been off on the “10 years” but the rest of the stuff still will come into play, and millennials will be paying their rents and living expenses before their student loan debt. Oldest age Millennials were born in 82, meaning their parents are in their late 60’s, 10 years would put them in their late 70’s….so perhaps 15 years would be more of a correct statement as that would put them in their mid 80’s and average age lifespan in the US is 84 years. 10 years vs 15 years is not a big difference, so I really wasnt that far off. Nice try at trying to down play it though Mr Landlord, lol. Man I know see what Mili is talking about regarding whatever nonsense RE shills or whatever yap about.

Better sell now and get out before you have to sell at a loss. Mark my words.

And I will quietly go about my buying the worst house on the block, repairing the holes that Millie’s companions have punched in the walls, new paint-flooring-and all the rest to make that house a desirable rental unit for Millie and his friends. I learned long ago that ” Positive Cash Flow ” is a wonderful thing. Think long term . I will buy the older home, not the home’s of today that are built with spit and bubble gum. My homes are the one’s that are used to exert peer pressure on the neighbor’s to maintain their properties. And Yes, I do treat the management of these properties as a JOB ! Life is Good .

Great job picapoi! Accept my post as a confirmation that you are doing great. Please keep buying overpriced crapshacks in the neighborhood (worst house) and renovate them. More rental units means more supply means rents are stable. Unfortunately I can only rent one cheap apartment at a time and my landlord already gives me a gift (never increased my rent). What you are doing is a win win. Somebody got to do it and you think you are smart by doing it….it couldnt be better!

….Cash flow positive (rofl). Sure! Whatever numbers you put on your little spreadsheet will make it cash flow positive! Maybe one day you look up the hill and see me jumping in my pool while you clean out the crapshack down on the low-income street. Difference will be…..I understood opportunity costs and bought houses at the bottom of the cycle while you bought crapshacks at the peak….I will smile and you will say but but but but long term I will be cash flow positive!

Picapoi,

Amen! Positive cash flow is what it’s all about. Appreciation is a nice bonus, but it’s never a consideration for me. The perma bears never seem to understand that.

We bought in the poor part of the South Bay in 2012. Our house payment was $800/month less than renting. Even if prices go down 80%, we still come out ahead over renting.

Looking at our small town of 30000 people, there are 30 houses for sale, most in escrow. I walk in our neighborhood a lot and for sale signs last about a month or so. Only house I know that lasted longer was $50k over priced.

The space race has made the north part of the South Bay a hiring Mecca.

Well, well well. If the WSJ is saying it…things might be toast sooner than we think. Better get on board with those “Zuck bucks”….

https://www.wsj.com/articles/u-s-existing-home-sales-decreased-1-7-in-june-11563890555

There are so many new names on this blog with their comments!

Compared to other blogs out there, I think this is in general, a kinder and gentler blog.

I think that is great!

Well, as long as they are not all aliases for Mr Landlord and Our Millennial.

I can’t speak for Millie, but I have never posted here under any other name.

HEARTACHE for the perma bears. June new home sales up 7%.

Womp Womp

Housing Bubble 2.0 All Ready Started, But You Know This As You’ve Seen It All Before.

“Largest Correction Since The Great Recession”: U.S. Home-Buying By Foreigners Sees Record Plunge

https://www.zerohedge.com/news/2019-07-22/largest-correction-great-recession-us-home-buying-foreigners-sees-record-plunge

Our perma bulls never read data or articles. Just headlines and then they immediately deny the facts.

This is a beautiful article describing the crash

“Purchases of U.S. homes by foreigners has dropped by 50% over the last two years, according to the Wall Street Journal. The figures come as a blow to top end real estate markets in places like Miami and New York.

Less than $78 billion in U.S. residential real estate was purchased in the year ended March 2019, which marks a 36% decline from the $121 billion in the previous 12 month period.

The pullback is resulting in price cuts in many coastal cities and causing new condos to sit empty. â€

JamesJim,

We have seen this all before from 1990-2000 when housing prices remained flat for a decade while inflation ate away at the real value of the housing prices.

Over a decade, the real value of housing prices were flat, while the inflationary adjusted value of housing prices dropped 50%.

I’m old. I’ve seen a lot before.

Bob,

You are correct, house prices in the 1990s were largely flat for a decade.

The interesting thing was that mortgage rates were in the 10% to 15% range in the 1980s.

And dropped to 7% in the 1990s.

been a while since i posted here. great site of course. San Diego, Houston, Denver, Orlando and I’m sure more than few others are not in free fall. We’ll see how aggressive the US Fed will be shortly…obviously the more aggressive the better.

California shows price reductions left and right. All you need to do is set up a Zillow or Redfin search. You will get bombarded with daily price reductions. Experts see a bottom of 50-70% below peak prices. This is in line with what we expect to see during the normal ten year boom and bust cycles. Right now we see skyrocketing inventory, declining prices, declining sales. They are building everywhere. We already see stable to declining rents which is another indication. Interest rates continue to go down and hasn’t brought back buyers interest. We will probably see 1-2% interest rates for a 30year mortgage along with a sharp crash in prices. That will be the time to buy. Now is the time to get the fuck out of housing – fast. Rent in the meantime. Renting is such a bargain compared to highly overpriced house prices. You don’t want to be caught during the bust and lose all your equity. Dont repeat the mistakes previous generations have made.

Housing bubble just got bigger! On a national basis, medium home prices in the 2nd quarter increased 6.4% Y/Y and 10.0% over the 1st quarter medium prices. The crash certainly hasn’t started on a national basis, and bargain home prices are getting further and further away in the future. All of those on this board may die of old age before home prices drop significantly.

Insane how pending sales keep crashing despite lower interest rates.

The crash is coming fast

https://www.marketwatch.com/amp/story/guid/CA54B182-AD4B-11E9-9DE8-AFC97186E038

Only in your wet dreams.

It really is like a dream come true. I am bombarded with price drops daily by Zillow and Redfin. Everything the RE cheerleaders have been telling us was wrong. The exact opposite is happening. The 50-70% crash is coming in a hurry.

In the same Marketwatch article: : The median selling price in June rose 4.3% to $285,700 from a year earlier. Prices have risen in every month for more than seven years, keeping lots of people from jumping in.

Read: lack of inventory plus healthy demand equals higher prices. Good try though Milli.

“Lack of inventoryâ€

Rofl….i know, the RE cheerleaders wish for it. In reality though….inventory has been skyrocketing…is there a neighborhood near you where you don’t see houses for sale? Exactly….now, if we would have a shortage in housing why do these houses sit for 6-12month? Why do they have multiple open houses and price reductions? You can post your lies all day long it doesn’t change the facts. Market is turning quickly. Denial won’t help just makes it more fun for the rest of us.

If the Fed is poised to drop rates at the end of this month, and FAANG tech cos. are buying up So. Cal. commercial RE for office space, then RE here probably has the wind to its back.

Just open up the sails and enjoy the ride! UP,UP,UP.

Bull crap, rates have been going down and buyers demand is going down as well. We will never ever see higher rates again. Look at Japan/Europe.

I encourage everyone to follow Calculated Risk Blog, who nailed it with market timing last time.

https://www.calculatedriskblog.com/2019/07/new-home-sales-and-recessions.html

“Although new home sales were down towards the end of 2018, the decline wasn’t that large historically. As I noted last Fall, I wasn’t even on recession watch. Now new home sales are up slightly year-over-year, and 2019 will probably have the most sales since 2007. No worries.”

Millennial will be wasting time for years here.

He has already wasted 3 years and countless hours saying the same thing over and over again.

Lol

My net worth has been going straight up. RE shills who bought recently will be screwed as the market is turning fast. Soon we can buy 50-70% off!

calculatedrisk is the man. He has been following housing even before the 2008 crash. He knows his stuff.

In my neck of the woods, inventory is still very low and I know many people looking.

Also, the Chinese bought a lot of property but so did Wall Street. They then collateralize these loans into MBS with the Governments blessing. They have no risk in the game and are one of the reasons there is very little inventory for the 3 bd room starter houses. Wall Street bought as much of that market as they could.

I was in Portland recently. I was told that above $500k, there is a lot of inventory but it is impossible to find something under $500k and it gets snapped up in a heartbeat.

Three years of being wrong and counting is starting to get at Millennial. He hopes the mindlessly repeating the same mantra will make it come true. Maybe a pair of ruby slippers to click together would help as well. For someone who is making a killing in digital assets and living very comfortably in his “gift” of an apartment, it is curious why he spends such an inordinate amount of time on a blog that is, by definition, geared toward real estate owners. How long did it take Jim Taylor to give it up? Millennial might be trying that record.

That’s right, the last 3 years I have proven the RE shills wrong. They told us there is no inventory. Instead inventory is rising sharply. They told us prices won’t come down, instead we see price reduction left and right. I made a killing by investing and not buying RE at the peak. Now I just sit back and wait for a nice crash. You can’t lose by winning.

100% agree! Even if I buy during the next crash that doesn’t mean I am going away. Love the blog and enjoy making fun of the RE cheerleaders that have been wrong for so long now. During the crash they will all disappear until the market picks up again.

Milli, there are NO “sharp price reductions left and right” in any meaningful sense.

There are reductions in ASKING price. But houses are still selling for more than they did several years ago.

A reduction in asking price is not a crash.

If X buys a house for $1 million in 2015. Asks for $2 million in 2019. And sells for $1.5 million. That is a $500k reduction in asking — but it is not a crash.

Yes there are price reductions. Left and right. In California. Something we haven’t seen the last few years. Something, the RE shills told us won’t happen. A year ago they told us house prices will skyrocket. Nope. Price are down YoY in the Bay Area. Yep, the crash is on its way. Just be patient. You were one of those who denied that we have increasing inventory-a couple years ago. Now you don’t deny it anymore. It’s a slow adjustment to reality for some.

Hubby and I are living with my parents. There is enough space. We have been thinking of moving out but don’t see a reason. If market crashes and we can buy 40% off I think we would be fine with it.

You must be married to Millie. God help you.

That’s so pathetic. Seriously, living with your parents when married??? I get you do that for a month or two getting on your feet or if you move to a new city or whatever. But as a long term housing solution? That’s just sad plain and simple.

Living with your parents is bad enough. Living with your INLAWS? Christ almighty! I like my inlaws, they’re cool and we get along great. But I’d rather be homeless I think than live with them full time.

Your “hubby” is hating life, but being a milenial doesn’t have the balls to tell you.

When I married my wife, I made her a promise: we would never live with either of our parents. We’d sooner live in our RV. Pathetic is an understatement.

Reading all the post of married millenials living with their parents is pathetic. Old enough to do adult things such as get married and make babies but not quite adult enough to live by themselves. I would be embarrassed if I had adult kids do this, actually I would never allow it in the first place.

Guys, I think the disconnect is that the Married adults here live in California! Or in any other area with a high cost of living. In California it’s well respected and desired to live with your parents. It’s a fantastic way of saving during a housing bubble. Now, if you live in flyover country this is no longer true. House prices and rents are cheap in flyover country. No reason to live at home.

In flyover country I would not applaud any married adults for live with their parents. But for Californians it’s the best thing since sliced bread. Keep living at home. RE shills are actually jealous they can’t live for free at their parents.

Awesome Ashley! Please keep posting here! You are doing the exact right things to save money! Living with your parents is the single best thing you can do during an extreme housing bubble! Once the economy collapses you move out to a nice house at a decent price (50-70% off). I would move back with my parents or Inlaws in a heartbeat but then my commute to my tech job would be too long.

Smart gal! Doin da same. My chick and me livin with my folks is awesome. We live in a share and don’t care society. Why wouldn’t I share with them their big house? Back in the olden days homes were cheap. Supposed to pay over 2k for a mortgage, thanx-but-NO-thanx! I can share it for free, so why gonna change?? Asked my dad who just retired if I can share his car as well. We are working through this. I am half way to 40, don’t see any f’n reason to move out. Btw, chick works and I do too. 40h a week…. Gonna inherit all that good stuff!

My wife and I live with my parents. We are not planning on having kids so it won’t get too crowded. Living with my parents allows us to save money to retire early and take nice vacations in the meantime. Why go through all that extra stress just so you pay it all to the banks and seller? You got to make it a bit easier on yourself and get ahead by saving on rent and mortgage.

Living with my wife’s parents is amazing. We save $2000 in a month in rent, the fridge is ALWAYS full, and sometimes I take my father in laws car and don’t fill it with gas. In exchange for that I have to deal with some very minor discomforts. Occasionally there is a fight and we have to skip a few free family dinners. Also sometimes my father in law walks around the house in his underwear. I should also mention when I blast my music in my bedroom it sometimes feels like I’m a teenager all over again. But you know what?, we are going to inherit all of this in a very short 30 years !!! We have no ambition to accomplish anything for ourselves, and why should we? All we do is show off our travels and an occasional fancy meal on social media and live high off the hog of my in laws…. admittedly with those very minor discomforts. The other day my mother in law even tucked us in before bed. My wife sometimes asks for gas money and we really save.. but nothing beats the full pantry of food.

LOL at millenials. You guys are living with your parents to save money in order to buy $1200 phones and $20 avocado sandwiches and $9 coffee. Or you could have a $200 phone and make sandwiches and coffee at home – your own home.

This generation is so screwed up. Seriously messed up.

The good news is Gen Z seems to have corrected course and the millenial insanity was a weird one time fluke.

Actually, we never ask for gas money. Both of us work full time and make decent money. We consider ourselfs independent but chose to play this smart during the housing crisis. I have to admit, the in-laws in underwear is totally true. To be completely honest we all have seen each other in underwear. Oh well, its family and it’s not much different from seeing each other in bathing suits. Living with your in-laws is more like having roommates but you don’t pay for the cost of living. I think more people should give it a shot before being so opposed to it. It really has advantages that peers don’t have.

Lived with my parents for 4 years after graduating. Paid off student loans and invested the rest. Had enough of a downpayment to buy in 2015 for 800k despite the naysayers. House is now sitting at 1.2 mil according to Redfin and a similar house down the street just sold for 1.32 mil. If I had to rent during those 4 years, I probably would be in the same boat as my fellow millenials.

Pro Tip for the yuutes reading this: Major in something useful like business or engineering. That way when you graduate you don’t have to live with your parents. On the other hand majoring in SJW Studies, leads to living with your parents.

Toni Not A Buyer,

“the housing crisis”, what??? What housing crisis? It’s called renting. If you can’t afford rent you can’t afford to live here. It’s that simple.

Living with your in laws is like living with roomates? Living with roomates sucks, but your in laws?

Hey I totally get living with parents to save money when you just graduated from college. Even if that is painful when you really want your own freedom that can work out very well.

Living with your parents when you are married? Good lord man.

It certainly depends on the relationship with your parents or in-laws. After living with them for x number of years you may save up to 100k in cash. That’s totally worth it to us during these Bubble years. If this severe bubble ends, we will move out and buy our first home in California.

Don’t you hate those awkward moments when two headboards are thumping at the same time? So weird, right?!

It’s sometimes hard enough to live with your wife when you are married.

But to live with your wife and her parents? Good luck with that one.

Very smart to live with your parents or in-laws. Crash=you buy, no crash=save money while living for free with parents or in-laws. Wish I could do it but they live a bit too far from my tech job.

These comments are ridiculous. One day the people of the United States (yes it’s only you) will realize multi generational living is the rule in human civilization and your need to break your families apart is the exception. There is nothing wrong with children and parents living together their entire lives.

For obvious reasons there is nothing more that RE shills hate than millennials living with their parents.

RE shills top sales pitches are:

Prices can only go up – buy now or be priced out forever.

Rents are going up

We have no inventory and they are not building more land

Obviously, these are all blatant lies. However, some poor souls believe these lies and end up buying at the worst time (at the peak/now). The sales pitches don’t work on people who live for free with their parents. That’s why RE shills hate it so much.

The only way to combat people living with their parents is to make it look like it’s a bad thing. To me, that is very encouraging. I might move in with my in-laws just because it pisses RE shills off. 🙂 unfortunately, my commute would be longer AND my cheap apartment is a gift compared to buying. When the market crashes you will have rental parity again and buying makes more sense.

When my wife and I got married just after college in the mid-80’s we had a combined income of about $50K and our rental 2 bedroom apartment was $700/month or $8400/year. The apartment was “high priced” because it was only a 5 minute walk to the beach. It was about 17% of our combined income.

The same apartment is now renting for $3.5K/month or $42K/year. I guarantee you that a Millennial couple that just graduated from college is not making $350K/year.

If I was a Millennial today, I would be living at home also until this craziness goes away.

LOL at Millies living with their parents. Pathetic doesn’t even begin to describe it.

My first apartment out of college was $1600/mo, which at the time and place was not even that much relatively speaking. That same apartment – literally the same place in the same building – is $2600 today. The building got a nice renovation too, and the pool area was totally redone, looks a lot nicer than when I was there. In 20ish years the rent increased by 3% annually on average. Boo hoo!! Poor millenials, you’re so much worse off that previous generations!!!! LOL Give me a break.

Adjusted for inflation I’d be in the exact situation today were I just starting out as I was 20 years. Only difference is I wouldn’t be whining the way today’s 23 year olds whine.

It’s also why 20 years later I’m a millionaire and today’s 23 year olds will be broke and living with mom and dad when they’re 43.

“Living with your parents is bad enough.”

I can’t get my commission or rent checks if you do that….whos gonna pay for my leased BMW or Benz????

This $3 million Santa Monica townhouse has been sitting for 8 months: https://www.redfin.com/CA/Santa-Monica/1032-3rd-St-90403/unit-104/home/17229898

No price drops.

Why is it still listed for $3 million? Doesn’t the seller knows that it’s way overpriced?

Does the seller seriously expect to get this amount, or is there an ulterior motive in keeping this townhouse on the MLS at $3 million?

Some people are just dumb when it comes to this. I’m a car aficionado and always look around for interesting things to buy. There’s a car on Craigslist that has been for sale for at least a year. It’s a nice ride, but it’s listed at $15K above its true value. Nonetheless, the thing’s up time after time. Old listing expires, a new one is made. Not a 1 cent price drop. And I’m sure in that time a lot of people must have made offers at the true market value. But the seller has the “I KNOW WHAT I HAVE” mentality and won’t budge.

One example >>>> All data

https://www.mercurynews.com/2019/07/26/bay-area-home-prices-sales-tumble/

Looks like “Mr. landlord” brought high and now have negative cash flows….pity LOL

What a million dollars buys in Brentwood: https://www.redfin.com/CA/Los-Angeles/1120-S-Barrington-Ave-90049/home/6760840

A 1924 shotgun shack, 828 sq feet.

I love the listing: Adorable storybook home with tons of Charm and white picket fence to top it off. … a cute backyard for those warm summer nights. … Can this house get any more adorable?

A “storybook home.” I guess that’s realtor talk for tiny house.

The “shotgun shack” doesn’t look that awful to be honest. I could see that working if you were a bachelor (and did some repainting). I’m from OC, so I have no idea how nice that area is, though. I will agree that the price is ridiculous.

I know that part of Brentwood. Horrible location, because Barrington Ave from Sunset to Wilshire has horrible traffic. At night the sound of cars speeding by. at rush hour, a parking lot outside your front door. But after all is said and done, it will sell to some trust fund baby who wants to live in SpentWood.

That’s a house? I thought it was a She Shed.

Here is a NOLA shotgun house at the northern edge of the French Quarter. Smaller lot, same approx size house on market over a year at $565K.

https://www.realtor.com/realestateandhomes-detail/1312-Dauphine-St_New-Orleans_LA_70116_M87758-74286?view=qv

Here’s a double barrel shotgun 3 blocks from the St Louis Cathedral 40 days on the mkt for 749K. Almost 1800 sq ft (2 units) on 2800 sq ft lot.

https://www.realtor.com/realestateandhomes-detail/809-Dauphine-St_New-Orleans_LA_70116_M79817-06787?view=qv

Would you say shotguns give you more BANG for the buck in NOLA?

Now, this I do NOT understand and never will. These New Orleans shotgun double houses were built for poorer factory workers, dock workers, and other working-class types, and New Orleans has a murder rate comparable to Baltimore, St Louis or Detroit, all cities that make Chicago- and Los Angeles- seems like low-crime paradises compared. The surrounding neighborhood is not particularly desirable, and neither are the local schools. The weather is the worst- unbelievably hot and humid from March through November.

I mean, I can see why a tiny house in Brentwood, California, cost $800,000. Brentwood is one of the most desirable places in the Los Angeles area, a wealthy west-side area with low crime and beautiful scenery, in a place with the best climate in the country. And it doesn’t cost anymore than a small, 145- year-old “fire cottage” in Chicago’s hyper-expensive Near North Side.

But New Orleans? I just do not get it.

Laura L:

These examples are in the French Quarter. That is the part of NOLA that doesn’t flood. It has the old buildings, the clubs and fancy restaurants and the country’s most interesting street party (if you’re into that sort of thing). More like West Hollywood than Brentwood, but pricey by NOLA standards.

Subprime 2.0 is back. No credit, no problem! Buy a house!

https://www.zerohedge.com/news/2019-07-24/subprime-20-mortgages-now-available-borrowers-without-credit-scores

No credit score is not the same as a low credit score. No credit score means you do not use credit. Is this really a bad thing? If you have no use for loans or credit cards does that make you less likely to pay your mortgage or more likely?

The RE shills last hope is rate cuts. That’s confirmarion that the market gets weaker and weaker and the only way to keep it alive is to drastically reduce rates. I could see the market gaining steem if they cut out 2%. I would consider buying if the market tanks and mortgage rates are in the 1% range. 🙂

Remember buy low and let the dummies buy high. History always rhymes.

Millie, the housing bubble just got bigger in June! On a national basis, medium home prices in the 2nd quarter increased 6.4% Y/Y and 10.0% over the 1st quarter medium prices. The crash certainly hasn’t started on a nationwide basis, and those bargain home prices are getting further and further away in the future. All of those on this board may die of old age before home prices drop 20-40%.

How can home prices be rising the fastest rate in 4 years if there is a crash going on? Apparently, lower 30-year loan rates and a loosening of lending standards are working.

Gary, that’s fake news for California. In the Bay Area for instance YoY prices are negative. To think that we die of old age before we see a 20% correction is one of the dumbest things I have ever read on this blog. It totally makes the list next to buy now or be priced out forever.

Don’t confuse Milie with facts. He has a narrative to push.

Using a national stat does not prove that millenial is wrong about rising inventory and falling prices.

RE is local, and the coastal CA market does not move in sync to flyover country

I think both of you are right because the new tax deduction limits were designed to hurt markets where million dollar houses are concentrated. Combine that with the drop in chinese buyers in CA, and RE refugees fleeing to other states raising prices there. You both are right about your particular markets

SBSparky is spot on

Hi Millie ; sorry to leave you hanging…I refinanced one of my ” CRAP SHACKS ” yesterday after providing a copy of a 2 year lease to the mortgage company. Yes , I painted the exterior a color of the tenant’s choice ( within reason ) and even after moving into a 10 year loan at a lower interest rate , I got a YUUUUGE increase in the

” Positive Cash Flow ” and the tenant will pay off the loan for me in a decade instead

of 28 years. A free and clear title on one of my homes is more valuable than a price reduction that you are expecting. Remember Millie , Rinse-Lather-repeat. Life is good.

Cute! He painted one of his crapshacks! Keep up the great work, somebody got to deal with the crapshacks! We have a lot of them! You are mistaken with one thing though….buying low is ALWAYS better than buying high. During the bubble you want to invest in a smart way and don’t tie your cash to overpriced crapshacks that you can’t sell during the bust. The next crash will be epic. Don’t lose your shirt while I get the beautiful house for half off.

There is nothing more RE cheerleaders hate more than a declining market. It’s obvious their only response during that desperation is anger. There is nothing else they can do. Myself and others were right, nothing goes up forever: Every bubble pops at some point. The music always stops when the last sucker bought high. The RE shills keep reading the same data but instead of having an open mind, they tell themselves THIS TIME IS DIFFERENT.

It’s going to end in tears for many who purchased at the peak of the market….. just like every time

Immigration of legal or illegal labor is a given for all of us as our agriculture system requires it regardless of cost. However, reading on how this is really a one generation job for most of these people I can only expect automation to fill that gap. Ag work is hard on the body especially if you were to do this all summer long and bending over to pick/move the crops.

Ag is the pillar that allows for us to do other things such as tech, real estate, racing, etc… You take that away I can guarantee that society will look a bit different or perhaps we would switch to an automated system faster than we could imagine.

That day is coming.

“Immigration of legal or illegal labor is a given for all of us as our agriculture system requires”