Casino finance – Wall Street lost $1 trillion in wealth before recovering most of it because of a missed keystroke? The cronyism and gambling of the banking financial sector.

Well that was an interesting ride. The U.S. stock markets fell a stunning 9 percent intraday before coming back up to end the day “only†being down by 347 points. The Dow at one point was almost down by 1,000 points. As I have mentioned for many years, Wall Street is now basically one giant casino to serve the purpose of the crony bankers. CNBC had an early report that the market bust was brought on by a trader that put in a “b†instead of an “m†and caused one hell of a crazy trade. If you believe that crap then you probably also believe that California’s 23 percent underemployment rate is also a sign of a healthy market. One tiny keyboard stroke caused a $1 trillion wealth decline before the markets pulled back? The entire stock market is one orchestrated casino and what probably happened is computer programs were triggered and started selling off since volume in the market has been low virtually throughout the entire one year rally.

This was the biggest intraday decline since 1987:

Even for buying a book online, I usually get two confirmation windows making me double check the order. You’re telling me those Bloomberg Terminals don’t have that? Yeah right. Some people will believe anything the crony banking system will feed to them. In reality people are realizing in Greece that many other countries have similar debt structures. Not as bad, but certainly detrimental to their future growth. Too much debt is not a good thing. Didn’t we learn that in the housing bubble? Apparently not.

In other news, Freddie Mac didn’t misplace that “b†and came out with a $6.7 billion loss for the first quarter:

“(Freddie Mac) Net worth deficit was $10.5 billion at March 31, 2010, driven primarily by a significant adverse impact due to the change in accounting principles. …

The Federal Housing Finance Agency (FHFA), as Conservator, will submit a request on the company’s behalf to Treasury for a draw of $10.6 billion under the Senior Preferred Stock Purchase Agreement (Purchase Agreement).â€

In other words, the big giant GSEs are now going back to the well for more money. Remember those days when we were told we were going to turn a profit on Fannie Mae and Freddie Mac. That at least served for a good laugh. The bankers gave us the worst of nationalization by passing on the junk from the banks but kept the actual societal benefit of nationalization by keeping the profits (have you noticed that Wall Street is still pumping out bonuses?).

Make no mistake, this is a direct battle against the working class and middle class of America. Some don’t want to acknowledge this because they enjoy the way the crony banking system is setup. Who has done the best since the bailouts?

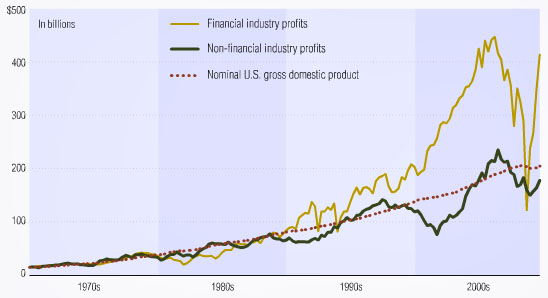

Source:Â Bloomberg

“It seems incredible that financials are now scaling their 2006/2007 heights again,†Reid wrote in a research note published yesterday. “The dramatic imbalances are re- occurring.â€

In July 2008, Reid said that U.S. banks had made “excess profits†of about $1.2 trillion in the previous decade, compared with how much they should have made based on economic growth, and that those excesses would be wiped out. Since then, U.S. financial firms have written down the value of their assets by about $1.15 trillion, according to Bloomberg data.â€

Remember those arguments about bonuses and how we “had†to give their executives big bonuses because they would lose some of that grand talent? After all, being unable to distinguish letters on the keyboard is certainly reason enough to offer someone a golden parachute. Most Americans just need to look at what is really going on. Housing values are still near their lows countrywide even in the face of unprecedented bailouts. We have put out over $12 trillion in bailouts and backstops to Wall Street. For this price, we could have paid off every single one of the 51+ million mortgages in the U.S. Talk about freeing up consumer spending! But the reality is, the money was never intended for you. It was intended for the gamblers on Wall Street and more importantly, the banking gamblers that actually make money on the failure of our real productive economy.

Some fail to make the connection that when you incentivize bad behavior it will go unchecked. Just look at the option ARMs and Alt-A loans. This is the perfect example. Useless toxic waste mortgages that were pushed by mortgage brokers because they got massive commissions instead of putting people into traditional mortgages. These folks claim that they were doing their job but these same people wouldn’t have lent these borrowers one cent of their own money. They didn’t care because it was ultimately the taxpayer that was going to pay the bill. If you default in a year, what do they care? Wall Street had a bigger fool and funneled this stuff into pension funds and other investors globally. Hey, who cares if some poor Norwegian now owns a mortgage bond for a house in Atlanta that is now occupied by raccoons and feral cats?

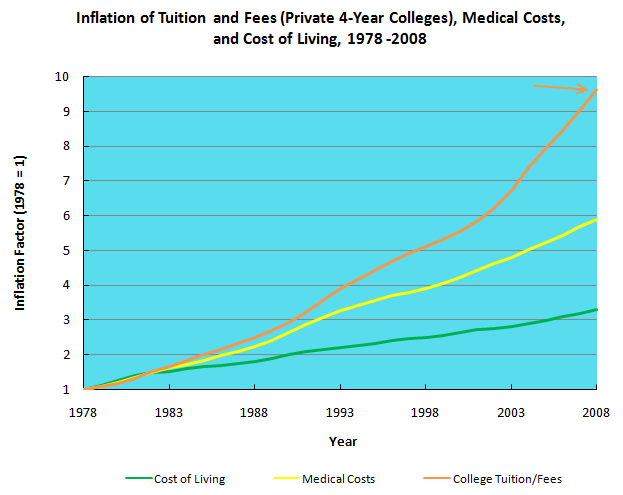

When it all went bust, the bill came to you, the average and prudent American. By the way, this is where the majority fall. You have your crony criminal Wall Street bankers which represent a small portion of our population and on the other side you have the scammers in our population. Yet the majority of Americans are sensible and they understand that what is occurring is a direct front to the middle class. Think of everything that has gone up in your life; health care costs, education costs, food, and housing:

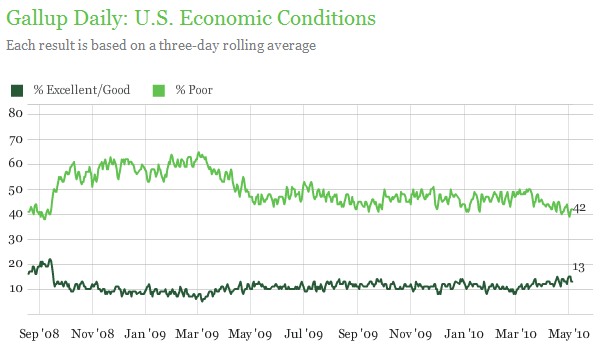

And wages have been stagnant for over a decade so the brunt has been felt by the majority. But not for Wall Street. And let us distinguish what we mean by Wall Street. We have companies like Google or Apple that actually produce a product and most Americans are fine with them earning whatever they can get. They aren’t asking for handouts or cheap government backed money. Then you have the investment banks that are betting and creating toxic mortgage products and things like CDOs that actually made things worse. How does this even help the market? I hear from “free market†Ayn Rand believers that actually think we’ve been living in a free market for decades. Really? Social Security? Medicare?  The U.S. Military? They preach these hollow mantras because in their mind, things work out for them. But when you look at surveys most Americans don’t believe this nonsense because they live in the actual economy:

Only 13 percent of Americans think economic conditions are good or excellent. Yet we have a small group that is operating in a different universe, and this is the same group that came on bended knee to bailout the banks back in September of 2008, and somehow forgot about their free market promise.

Anyone that has taken basic courses in psychology and human behavior understands these people have a severe case of cognitive dissonance. They are unable to see beyond their conviction that we are a free market when in fact, we are not in many large areas. We heavily subsidize housing (have since the Great Depression). We do this through tax breaks on mortgage interest deductions and cheap mortgages. This is targeted government policy (aka not a free market). Yet right now, we have the worst of both worlds since the government is basically operating as Wall Street’s lackey and raiding the taxpayer’s wallet. Has any real reform happened? Not at all and that is why we can actually have a 1,000 point drop in a day when someone didn’t close their Skype window correctly.

Glad today we lost $1 trillion but gained most of it back because someone was unable to use the keyboard correctly. Aren’t you glad your tax dollars are going to investment bankers for this kind of casino finance?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

23 Responses to “Casino finance – Wall Street lost $1 trillion in wealth before recovering most of it because of a missed keystroke? The cronyism and gambling of the banking financial sector.”

thanks for your job !

everybody should watch: money as debt !

the system by itself is a slavery

(excuse me for my english i’m french…)

Hey. Take at easy. Everybody can make a mistake. Didn’t you ever make a spelling mistake?

The stock market was crazy for about an hour. If you followed it second by second, you could have seen a 1% change within a 5 second period of time. The market just went up and down as much as 2% in less than 5 seconds. Yes, the Dow moved over 100 points within seconds.

Considering that you cannot get even 1% in one year on a money market, a change of 1% in a matter of seconds is just plain crazy.

I just heard on NBC that some of the major DOW components (including P&G) were going to “reverse” the transactions that happened during the 1,000 pt crash today. REALY? I give up. I didn’t buy a house that I couldn’t afford, therefore I have to pay rent month after month instead of living in a nice house for free until the man comes a knocking. Back in the beginning of 2009 I pulled my 401k and put it in cash because I kept hearing about a double dip – and let’s face it the market shot up too high too fast to not correct at some point right? So instead of it correcting as it should and get back to normalcy and then grow once the economy gets healthy, here I still sit on the sidelines while the gamblers get yet another free pass – UGH!

I was supposed to go to Vegas a few weeks ago but didn’t want to throw money away right now – maybe I would have been reimbursed for any of my losses at the tables? hmmmmmm…..

Still bitter after all these years.

There are going to be some extremely pissed off people who had stop loss orders on their stock positions and got taken out today. Can you imagine the liability we’re talking about if this indeed was trader/broker error? In the 10’s of billions.

when most people misuse their keyboards, it’s because their too busy spelling lose, with two o’s. Ie. “there were many loosers today”.

Hilarious to watch cnbc talking heads trying to make sense of it all.

Greece debt problems pale in comparison to the trillions of dollars of debt that must be refinanced and issued now and in the coming years in the USA. Greece represents about 3% of the Euro GDP and the media is flashing Greek debt troubles today across TV and internet screens! The USA propaganda machine is trying to ruin the Euro and have world investors flee to buy USA treasuries. The Federal Reserve stopped their purchase of treasuries recently and now the private world has to come in and buy all the refinanced/new USA debt at super low interest rates. So what happens..use the controlled media to slam the Euro and save the Dollar.

As the Dr. pointed out, this was no keyboard mistake. This was Goldman, JP Morgan, Deutche Bank leading the pack of bailed out (with your tax money) banking trading desks sending a message to the senate not to pass the audit the fed bill. Gee, it worked.

Just more proof that the stock market is nothing more than a casino. Yet, you are looked down upon if you don’t play the casino. It is almost expected that most Americans tie up a majority of their retirement nestegg in the market. I always hear: the market returns 8% per year historically, haha you are only getting 0.5% in that CD.

I have not been in the market the last decade and I think I’m still ahead. This market is nothing but fraud and manipulated to no end. The big guys will never lose money, the commoners can lose it all in the blink of an eye. No thanks, I like to do my gambling in Vegas. At least you get free drinks and you can always hook up with some loose women. I’ll take that anyday.

I don’t know of any software that allows me to enter numbers with alpha. This is all BS and I can’t believe CNBC and MSM keep repeating the same BS.

South Park nails it…..funny but true and sad.

http://wallstreetblips.dailyradar.com/video/bailout_clips_south_park_studios/

yeah…trading glitch my a$$. I’m not going to lie – I actually got excited when this drop happened because I have a bear market fund…meaning I make money when the market goes down. However, I only have that because I feel the market at 11k was COMPLETELY overvalued, and it was being manipulated the whole way up (not because I’m “anti-american” like some would say). I mean seriously, what is better about our economy now than 2 years ago? Nothing…if anything it should be worse, because the market looks to the future. 2 years ago, many lived under this fantasy expectation that this was a normal recession and we’d be in recovery by now. The current market should be pricing in all the foreclosures, continued unemployment, massive amounts of debt, and lack of non-govt spending. Instead, we have to listen to them exaggerate every “positive” piece of economic data. Not to mention the current positives are year-over-year growth figures…2009 was one of the worst years in our history, so comparing anything to that will look good.

In times like this, I really attribute this to politics and our current term lengths. “Normal” recessions may be a year or 2, but this one is probably gonna be AT LEAST 5. If we all had realistic expectations of a recovery, it would make things much easier. That won’t happen because politicians have to show short term results so they can get re-elected….hence the stimulus and various other bailouts. Unfortunately, none of this crap is going to work. It may slightly cushion the fall, but hardly worth the amount of money being spent.

I know Im certainly not the first to make this comparison, but we are paralleling the Great Depression in so many ways right now. I recently watched a PBS documentary on the GD that was put together before our current crisis, and the similarities really are amazing. Back then, the market ran up because there was all this new access to credit (common people never had access to borrow money). The economy grew at unprecedented levels because of all this new money (current day: housing ATMs). In addition, people were borrowing money to invest. After about 8 years or so, the credit dried up because people were borrowing and living outside their means. there was a first initial crash, but then the crony wall streeters of the time pumped in sh*tloads of money to rebuild confidence in the market, and thus boosting stock prices (current day: gov’t money given to wall street, then pumped into the market). However, it couldn’t be sustained because the average person no longer wanted anything to do with the market and all the easy credit dried up. Then it crashed for real and stayed down. This all led to a massive war.

I think the market is going to follow history. Lets just hope we can avoid the war part.

While I agree this was no accident, or mistake, or computerized outcome of a keystroke error…

~

…this situation should evoke jokes involving the letters B and M in high finance.

~

DHB on the other hand is the platinum standard monogram for thinking about these issues:

~

“But the reality is, the money was never intended for you. It was intended for the gamblers on Wall Street and more importantly, the banking gamblers that actually make money on the failure of our real productive economy.”

~

Sadly and exactly correct.

~

As French noted, watch Money as Debt (Paul Grignon), both the first one and the new (2009) sequel, Promises Unleashed.

~

rose

Of course the whole fiat money system is also a massive gamble, just a slightly safer one than the wall street casino right now. Bottom line there is very little safety in a dishonest economic system (and yes even gold is a gamble, it has very little intrinsic worth, however at least they can’t print it at will.)

> Only 13 percent of Americans think economic conditions are good or excellent.

> Yet we have a small group that is operating in a different universe, and this is the

> same group that came on bended knee to bailout the banks back in September of > 2008, and somehow forgot about their free market promise.

I’m one of those in a parallel universe, but I don’t have anything to do with the financial sector. I just think we go through business cycles with periods of excessive euphoria, to be followed by all together too brief moments of sobriety. I’ve been rather cheered that the sobriety has lasted longer than normal, and given the antics in the stock market yesterday and today, looks to go on for a while to come!

We make good decisions when we’re collectively not drinking the Koolade. This country is best served by the generations that learned to be sober the hard way, particularly those that lived through the great depression and fought WWII. They build a lot of infrastructure that we still rely on today, crushed tyranny and made the world want to be like us.

I hope we use this time to do good works. Clean up finance and shed those parasites. Fix our energy policy so that it enriches us and the world around us, not our foes. Put in some infrastructure like universal broadband that we can build on in the future. (Working from home would be a game changer for many of us!)

Excellent post as usual. I agree that this was not a mistake. If it were that easy it would have happened already.

All of the electronic trading programs are keyed to follow each other down the rat hole.

The market is rigged. The best we can do is hope to catch a wave once in a while.

Aimlow Joe

http://www.aimlow.com

@Ft

Don’t be a party pooper. Let me get you a Koolaid.

Ummm, yeah — someone mixed up billions with millions. I work for a large financial institution in their investment area, and my boss and I both almost spit out our coffee when that rumor crossed the wire. It is simply impossible. All trades are entered with NUMBERS. As far as a transcription error, the order of magnitude between a millions and billions is simply too great (who has the capital or margin line for a multi-billion $ trade to go through all at once without any order verification?). We found the timing of the error to be very interesting since the Senate was debating on whether to codify TBTF language in the financial overhaul bill. Not to get all conspiracy, black helicopter on you, but it felt like we were watching a modern day version of Atlas Shrugged. I doubt Blankfein and company take public humiliation lightly. These are not humble, humane, live and let live people. They could make life very uncomfortable for our politicians if the US markets crashed for a third time in 10 years. Billions, millions, my butt. Try more like a De Niro in Taxi Driver moment, where the titans of finance basically looked back at our federal goverment and said “you talking to me?”

> If you believe that crap then you probably also believe that California’s 23 percent underemployment rate is also a sign of a healthy market.

This is the key – employment. Even though UE rates look to have stabilized, it’s really just the effect of unemployed people dropping off the UE rolls. It’s smoke and mirrors designed so the U3 UE # never goes above 10% regardless of how many people are actually out of work.

Housing prices may be down 40-50% from peak, but income has gone down even more, in some cases by 100%. I just don’t see how asset prices can be this high, I just don’t. Housing in major cities and suburbs of those cities is still out of control. In smaller town, there is just no employment base left to support a household. Throw in outsourcing, huge productivity gains, and international wage arbitrage and you have the word that no one wants to say – deflation. And that big 1000 pt drop on the DOW, it wasn’t a trading mistake, it was the market doing its job. Most MSM commentators are really pushing that there was some sort of trading mistake or manipulation so they can fit it in with their “economy is improving” narrative. Economy might have bounced back a little from last year but the new structure of the US economy will be one of deflation, low growth and high unemployment. We’ll be like Europe but without all the fun summer festivals, nude beaches and nice, free plazas to hang out in. Instead, we’ll have our normal US crazy drug criminals, serial killers, bad parenting, government scam artists and self-esteem issues assuaged by materialism, but this time we’ll be broke too.

It would be interesting to see the graph that shows industry profit growth, also created for other industries, such as health care for example. If shown for the major industries in the economy, it would illustrate where exactly the wealth increased (and decreased) over the past 40 years.

One other comment. That same graph shown on this page:

http://pragcap.com/the-trilliong-dollar-reversion

has the vertical axis indexed to 1970=100. This makes it easier to evaluate the relative growth. It shows that financial profits have grown at about twice the pace of the overall economy since 2010. Interesting discussion there whether this is good or bad for the country.

LAer: I agree that many people have reduced income. But you are not taking into account that 35% of the workforce are government workers. Except for a few furlough days, which affect only about 3% of workers, their income has not gone down.

In Alameda, CA. the teachers are complaining because they got “only” a 4% raise this year, not the usual cost of living raise, AND a 4 % raise. This will be fixed by a parcel tax of around $1,000. per house, which will allow normal raises to go through, and pensions to increased, again.

Everyone who spit their coffee out when they hear Thursday’s unprecedented break in the stock market are correct, the “fat finger” error is impossible to occur. Systems to enter orders have confirmation boxes, quantity and price limits hard-coded in the trading front-end to prevent this type of error. Besides you can’t get off a $16 billion order in any market, especially the e-minis.

CNBC showed how f’**ing clueless they are by repeating this rumor multiple times through the afternoon and evening. There are a big break in 2 currencies just before the stock market break, the yen an pound sold off and then the equities followed soon after. . .

“They” couldn’t use the USD 12++ Trillion bailouts to pay back the mortgages because that would destroy bank “assets” AKA The Debt.

The bailouts are there to *protect* those assets, keep the the debt growing in fact, and support the spending by the very wealthy – “Consumer Spending” is irrelevant in an economy where the top 1-3% controls 80% of the economy; The top 1-3% IS The Economy therefore they must get their bonuses in spite of their dire performance, to boost “consumer spending”!

What an amazing loss of American spending power. This is a truly deflationary force, which has affected millions of americans. We’ve seen it time and time again as we track the Sell My Home listing data with ever decreasing home listing prices. It’s astonishing to see if you go to sites like Zillow and such. Thank you for helping to clarify the magnitude of this economic force that is the housing market.

Leave a Reply to Blogger Bob