California Housing: 1 out of every 192 Homes in Trouble. Top Ranking State in the United States.

The foreclosures numbers for the month of June did not give us any hint of a second half recovery. The lunacy of some of the politicians out there is simply baffling. Apparently the current recession is now all in our heads:

“(CNN) Obama was responding to comments from Phil Gramm, a former Texas senator and a co-chair of McCain’s presidential campaign who told the Washington Times that America has “become a nation of whiners” and the country is in the midst of a “mental recession.”

We have sort of become a nation of whiners. You just hear this constant whining, complaining about a loss of competitiveness, America in decline,” he said. “You’ve heard of mental depression; this is a mental recession.”

Maybe Fannie Mae and Freddie Mac falling through a sinkhole is just in our imagination. The 35% housing median price decline in California is a figment of our imagination. Let us click our heels twice and we’ll be fine. This is the same genius that repealed the Glass-Steagall Act with his Gramm-Leach-Bliley Act in 1999. The problem with keeping up pretenses is pathetic and simply ingenious. How can someone say this is a mental recession? What in the world is that anyways? This is the same delusional Horatio Alger mantra of pulling yourself from your bootstraps; but that only works when you have a government looking out for you and not selling out your country to the highest bidder (by the way, you can now call the Chrysler building the Abu Dhabi building). This isn’t a free market. This is a free market for those with $5 million+ in a Wall Street investment bank. Why didn’t Phil tell Bear Stearns to suck it up and deal with their “mental recession” – instead, if you are a middle class American you need to suck up the fall in the dollar, the declining housing market, and higher fuel prices.

California has the highest foreclosure rate in the entire country. Of course we would have the highest number simply because of our size but now, we have the highest percentage with 1 out of every 192 homes being in some sort of distress. Here are the raw numbers as provided by RealtyTrac:

Notice of Defaults: 37,989

NTS: 10,053

REO: 20,624

1/every x HH in trouble: 192

Percent increase from 2007: 76.97%

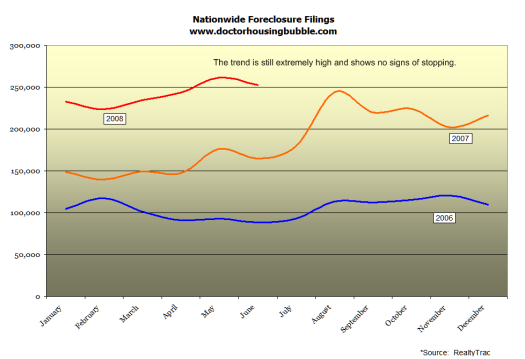

Now if you want to see how these numbers look for the nation, take a look at this graph:

The nationwide trend is still high and we are looking at having our worst year in terms of foreclosures. And just wait until the $300 billion Pay Option ARMs in California recast hitting in full force during the 2nd half.

Even Ken Lewis, CEO of Bank of America is pessimistic on California which is rather “shocking” given they just bought uber mortgage stunt dummy Countrywide who had nearly 40 to 50 percent of their mortgage portfolio in the state. Here is what Ken Lewis had to say:

“(LA Times) But he added that Wall Street clearly didn’t believe him on those issues, given how far Bank of America’s stock has fallen in recent months. It fell $1.48 to $22.06 on Wednesday, and is down 46% year to date.

As for the housing market, Lewis said Bank of America’s latest forecast called for a further 15% decline in home prices nationwide, with the decline going into at least the first quarter of next year.

In the case of California, Florida and other markets that had the biggest booms, a further 20% decline is more realistic, he said.”

So you just bought a lender with nearly half their portfolio in the state you are predicting to go down by an additional 20%? Smart move. No wonder why Bank of America stock is being punished:

You need to remember that much of that REO count isn’t in the MLS. For some reason it seems like lenders are artificially keeping these things off their books to make their 1st half earnings look stronger. From a few sources and agents I have heard that lenders are simply not putting some listings into the MLS. Let us look at the current Southern California market:

Current Inventory: 140,867

Distressed MLS Number: 21,286 (15%)

May 2008 Sales: 16,917

But what about that 20,624 number? The massive disruption here is that inventory numbers have been steadily decreasing and those 20,000+ REOs simply do not appear in that overall MLS inventory number. What a freaking shocker. You may get a few replacing the current sales but the numbers do not jive. I would venture to say that come this fall, there is going to be this massive correction that is going to overwhelm the system.

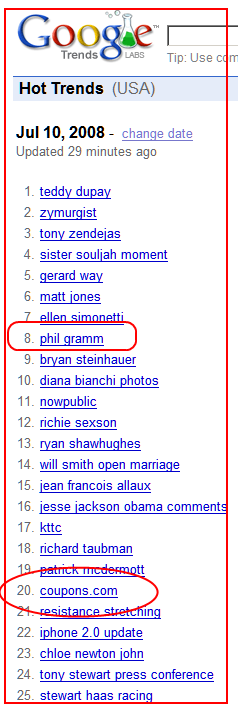

Recently I’ve also noticed that the e-mails about people wanting to buy have gone silent. During the first 3 months of the year, every day I would get an e-mail about “is this the bottom” or “I think it is a good time to buy right now.” Those e-mails are no longer coming. Now I get more e-mails asking about wealth preservation and protecting your current assets. Want to see what people are starting to search for:

I also took a quick glance for the last 10 days and did not see coupons in any of the top 100 trends. Maybe people are feeling the pinch? I wonder if they are searching for virtual coupons to be used in their make believe recession?

The market is much worse than it appears but all the above numbers are all in your head. It turns out all we need to make this better is a shrink and two Prozac pills.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “California Housing: 1 out of every 192 Homes in Trouble. Top Ranking State in the United States.”

So 99.5% of California houses are doing okay? Sounds pretty good to me! Sorta like how 96% of the population is employed.

When the Power Goes Out and Other Lessons.

http://thegreatloanblog.blogspot.com

Keep up the great work Dr.! Daily read for me. Proud Sponsor as well.

Never were truer words spoken than your statement that “the free market is for those who have $5MM with a Wall St investment firm”.

There are no words printable that can convey what I felt when reading Sen Gramm’s statements. Gramm is very well-insulated from the consequences of the rampage of greed and fraud that he and his cohorts helped produce.

Gramm’s statements, and the certain bailout, point to the moral problem this country has now. We have a massive accountability problem, in that the people who are positioned to profit the most from the malfeasance and insanity of our banks are not the people who will have to pay for the damage. That falls to the hapless public, most of whom had no part in creating this mess. Those in charge don’t pay, while those who pay have nothing to say and no way to benefit.

The collatoral damage to the innocent is going to be massive. The mania drove prices past the point of affordability for sane borrowers, but now that they’re unwinding as reality asserts itself, the economy is unwinding, too, and now that we on the sidelines have affordable properties availabe, we might well not have the jobs and incomes necessary to get the advantage of the situation.

Great article, doc! I bet your next topic is going to be the continuing saga of Freddie and Fannie and their love stories with crap finances.

Those goons at realtor.com ruined all of my saved searches!

Please explain what is happening to Freddie and Fannie and explain why. Thank you. Your loyal readers, Bert & Ernie.

I was noticing that my saved searches at realtors.com are sort of … disarranged.

An acquaintance of mine is about to lose her home. She has to vacate the premises by Saturday.

She and her husband have moved the valuables to a self storage location. Basically, it is just them, a mattress, and a few changes of clothes in the place.

They’re planning on having a “Trash The House Party” on Friday night. Everyone who has been invited has been advised to bring a implement of destruction (hammer, baseball bat, cats paws, etc.) Drink and food will be provided by the hosts.

Everyone is invited to take out their frustrations on any portion of the interior of the home, excluding the windows and window coverings. Those have to remain intact as a courtesy to the neighbors. No fires are allowed.

Really nice behavior for a couple in their mid 40’s.

Sometimes I wonder about my mental health because of the people I know.

Thanks Doc for the straight talk express, oh sorry, wrong guy.

I am still digesting your article last week on the Great Depression where you quoted from Roosevelt’s acceptance speech in 1933 and how such blunt honesty about the problems the nation faces would be so 2008, NOT.

Well along comes Phil Gramm to set us straight. Let’s not forget about the part of his statement where he says that the US has never been in a better leadership position in the world (this could be the subject of its own discussion). I think he would have been committed to the crazy farm if he had made such a comment in 1933.

I will give him credit for pointing out that the psychology of our society has dramatically changed since 1933. But I believe it is because we have lost faith in our leadership, not because we have lost faith in ourselves.

If I have a moment of indecision on election day, please remind me of Mr. Gramm’s statement!

Yeah 99.5% of current homeowners are doing OK if by OK you mean they have not yet defaulted on their mortgage or are not anticipating having to sell their house ( or borrow against it). What we see, however, is how a tiny percentage of problem homes can tilt the economic scales and pitch the entire economy into a tailspin. In a population of 300 million people, only about 4 million will die in any given year but over 75 years 90% of the original 300 million will be! Such are cumulative processes. We are in a cumulative process with circular causation right now. As people default, housing prices fall, banks become capital starved, jobs are lost which causes the circle to widen and engulf others who were not affected by the first round of defaults. I imagine the government, amongst others,

with the data and resources have taken a stab at building an econometric model to see how big this could get but suffice to say today’s defaults were based on yesterday’s economy. If each 1% rise in unemployment causes 500,000 people with mortgages to lose their job and results in another 250,000 defaults in the next year you have one path to measure but not the only one. Energy, food, the evaporation of stock market wealth are all causing this thing to snowball.

Johnny 5:

I can’t imagine anyone coming to their party. I mean why do they think their friends actually share their frustrations? I mean maybe if their friends happen to be exclusively made up of people who are also losing their houses …

But better not invite any renters who have been priced out all along, or anyone who is struggling just to buy basics (homeownership is not a basic, gas to get to work might be), or any responsible homeowners who bust their buts to pay the mortgage, they might lack sympathy to put it mildly.

I do a fair amount of computer work for local real estate offices. Concur with your point on lots of properties not being in the local MLS. Several of the agents are monitoring/peddling Countrywide properties. Countrywide has a program called “Cash for Keys” that is worth investigation as is their apparent requirement that you pre-qual with Countrywide prior to submitting an offer on one their repos.

The number of agents has shrunk dramatically. Those who are remaining have no choice as this is their career; or, their’s is the second family income. Those who did not fill up the savings during the recent boom are in very bad shape. There is no market for their SUV or luxury car.

JS,

I, for one, did not attend. My wife and I bought a house just before the market went in that crazy upward spiral. No weird exotic mortgage for us. Just a straight 30 year fixed. Even so, we’re under water where we are. Our house is valued about $15K below what we paid for it. That is not a tremendous amount, so we’re doing the best to ride out the storm. That was after we saw the value of our home double in two years.

Even with a fixed mortgage as the cost of everything else goes up, the household budget is really tight.

I know several people who were going to attend. I haven’t heard the reports about last night’s “bash” yet, but if you’re interested I’ll post the report when I hear it.

There are many really angry people out there. They’ve watched their investments evaporate. 401Ks took a real hit in the DOT BOMB crisis, and never really recovered. Now the single largest investment has taken a real hit because of the greed of a few who are not going to be punished. They get to walk away with their ill gotten gains. Kind of like what happened at Tyco and Enron.

This coupled with food, and fuel prices taking off. The incessant drumbeat from both the Left and Right about who and what is to blame. The ever increasing level of regulation and scrutiny by our government and its entities (police, etc). Wars and rumors of wars. Here in California, an out of control Illegal Immigration situation that has forced hospitals to shut down. Demands that we pay for the welfare of illegals and their children and if we balk, that somehow we’re all racists . Our so called leaders in California and its larger cities demanding that we pay MORE taxes, when we’re all just struggling to make ends meet.

I could go on for pages.

But that is what is happening, and why. People are just really stressed out and pissed off.

Well said, Johnny 5.

Privatize the gains, and socialize the losses.

Each party blaming the other for the fiscal irresponsibility that both parties are responsible for.

Label anyone that is for legal immigration but against illegal immigration a racist.

My head is spinning……..

Any word on the “Trash the house party”? It sounds like they overextended themselves on a home they couldn’t afford, so now are being foreclosed upon, so will trash the house in protest? I wonder if they lied on their mortgage application……………….

I went to a foreclosed house yesterday. It was in a very nice neighborhood with the backyard adjacent to a golf course. Neighbor is thinking of buying it but the home has some ‘issues’ so he invited me to come take a look. While it wasn’t trashed in the Johnny5 ‘house party’ sense the former ‘owner’ removed fixtures to include chandeliers, appliances even the jacuzzi bath! As this house isn’t but a couple of years old I seriously doubt these were items purchased by the former owner. One would think the lender would initiate criminal and civil proceedings against such debtors. A few well publicized arrests of and judgements against people looting or trashing their former house might deter others.

Facts are great.The only problem is,truth is what ever you WANT to believe.Or are conditioned by others to believe.Black’s Law Dictionary says facts are not truths.

When your world crashes around you because of your decisions(based partly on what you were told to believe)what do you do?Have a “Trash your House”party?What is next?Trash your SUV ?

It will hurt to disconnect yourself fro the Matrix.

** Trash The House Party Update **

I spoke last evening with a friend, Jim, who attended. He had brought his kid’s softball bat with him in order to participate.

In short, nothing happened. Eighteen people showed up. Most didn’t bring any tools with them. When asked why, they said they were just there to offer moral support to the couple losing the home.

Everyone sat around on the floor and complained about what is going on in this country and the world.

The mattress and few other items were loaded up around midnight. Folks helped shut off the water at the meter, gas at the meter, and electrical at the main.

Every door and window in the place were left open as people departed.

Jim said he just felt sick as he drove away. He had a very hollow feeling that he couldn’t fill.

As to what happened to this couple, they were newly weds two years ago when the market was at its zenith. Both were employed and had good jobs. Everyone kept telling them to get a 30 year fixed, but the builder and the loan agent talked them into getting one of these zero down loans. They were told that they could use the “extra” money they had every month to landscape (pool) and buy new cars. They could then refinance, and then roll all of their debt into a mortgage payment. And it would be “tax deductable, too”.

They took the bait, and this is what happened. They feel betrayed by the people who were “helping” them. They’re “professionals”, right? They’re “licensed”, right? Why shouldn’t we listen to them?

Mr. Leamer disputes assertions that there is a housing shortage in California. He says his studies indicate that the housing problem is really income inequality. “We have workers who are essential to the economic well-being of the state who can hardly afford to live in decent dwellings, not to mention a pleasant little bungalow within an hour’s drive of work. San Jose’s solution to this problem has been to have its low-paid ($100,000 a year or less) service workers live in far away inland communities and commute long distances every day to work,” he says. “That worked when San Jose businesses could afford to pay premium wages to compensate their workers well enough that they would be willing to live this way. But this solution may not work for California as a whole, since we may price our work force out of the competition with other states.”

————————–

Stellathomas

California Alcohol Addiction Treatment

Leave a Reply