California Home Prices on a Roller Coaster: Monthly Payment for a California House: $1,410 in 2012 and $5,210 in 2024.

It’s been nearly a year since we last posted and we missed you all, and the California housing market has been anything but dull. The landscape has shifted significantly, influenced by a confluence of economic pressures, demographic trends, and policy decisions. As we delve into the current state of California real estate, we’ll examine key factors driving these changes and provide a detailed analysis supported by recent data and trends.

The State of the Market

Inventory and Pricing

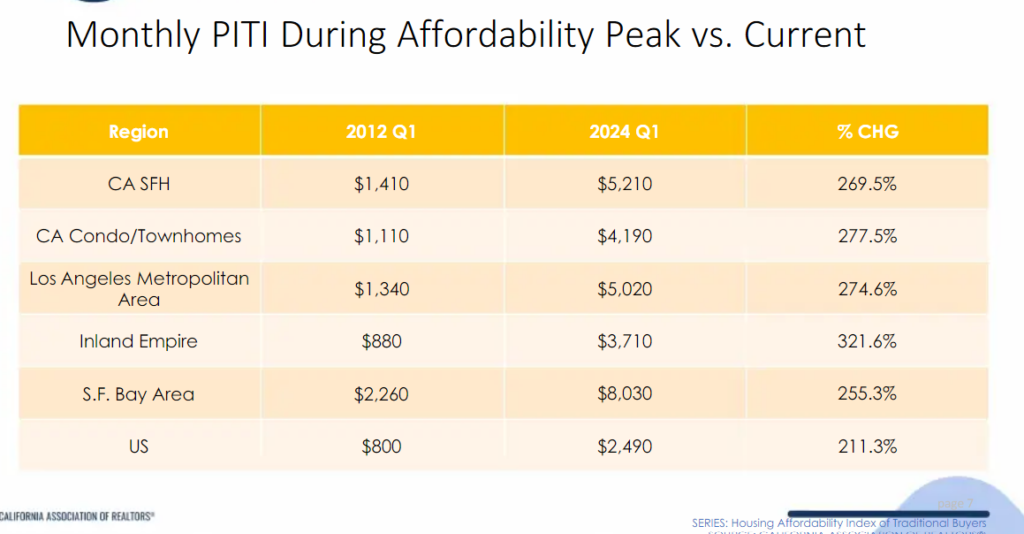

The California real estate market is in unaffordable territory last seen right before the Great Recession. Rising mortgage rates, driven by the Federal Reserve’s aggressive rate hikes, have cooled some buyers but not by much. The result? Higher prices driven by stretching out the monthly payments like a balloon. Take a look at this:

The standard monthly payment for a California home is now at $5,210 a month, up from $1,410 back in 2012. But certainly, incomes have kept pace over these past 12 years, right? Not exactly:

Median Household Income CA

2012: $58,328

2023: $85,300

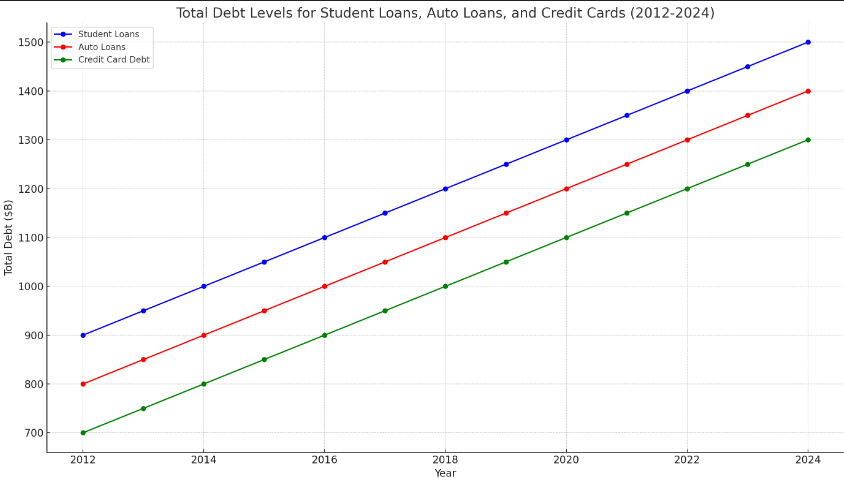

During this period, the monthly payment is up 269.5% yet household income is up 46%. So how is this even possible? First, 2012 was the bottom of the crash and affordability was strong at that point. Now, people are maxing out debt on all fronts (student loans, auto debt, credit card debt, and mortgage debt). Signs are flashing red as everything is up:

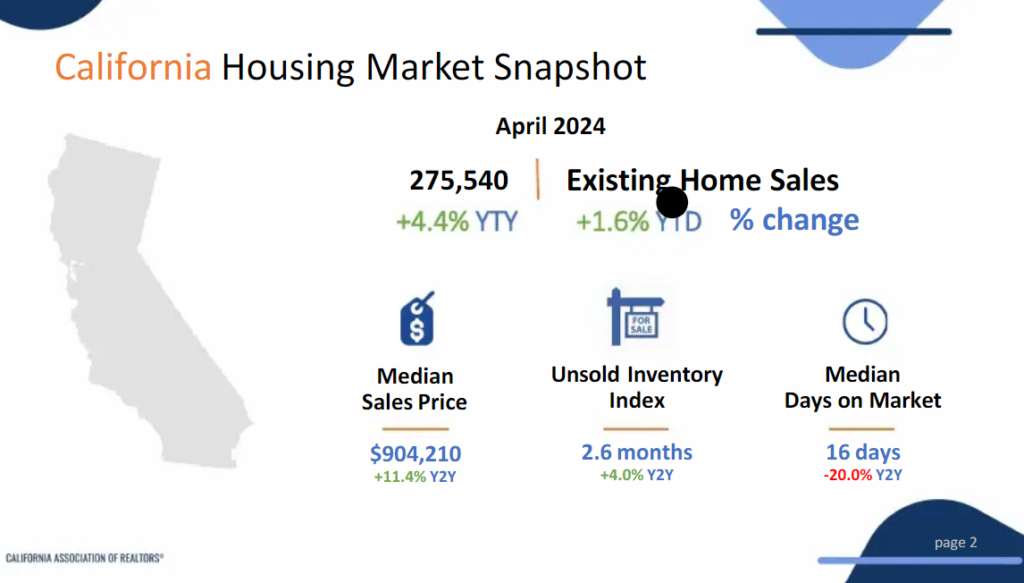

The typical home in California is now over $900,000 yet the typical household income is $85,300 (a typical family will need at least $200,000 in annual income to afford a home – in other words, your typical California family cannot afford a typical home). So sales volume is very low and people are maxing out their monthly payment. It is musical chairs territory. “Hey, should have bought and now I have six-figures in equity!” You do not have that equity until you sell which requires another person believing in this narrative. A bit of mania is in the market now but even with that, the numbers just do not work for what people earn.

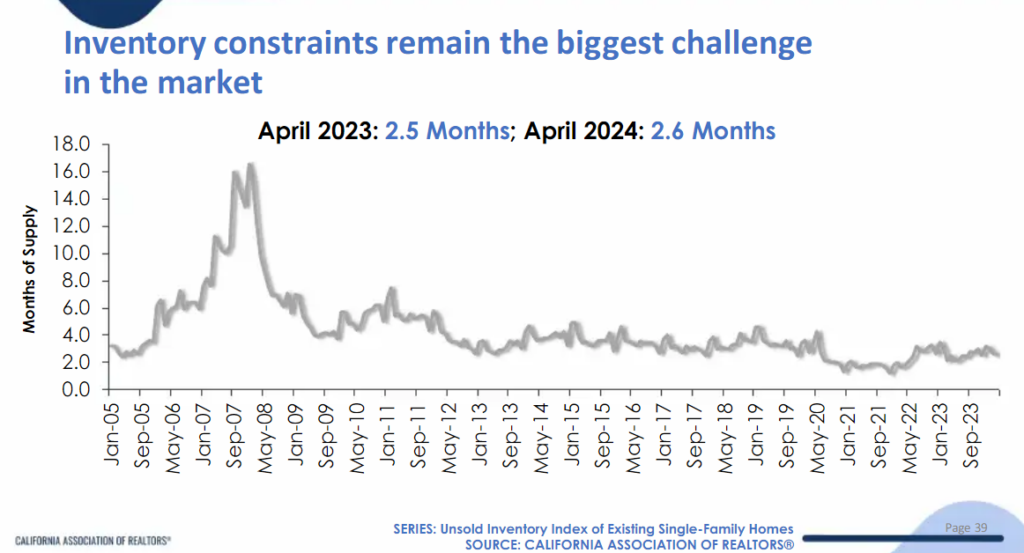

The story on the price front is one of low inventory levels:

You have people that bought and are staying put. So if you want to buy, you get the house obsessed crowd that is going to stretch to extreme levels only thinking that “now or never” is the motto to buy real estate. But the reality is, very few can afford homes and people are leveraging every piece to get in.

Just look at total debt levels:

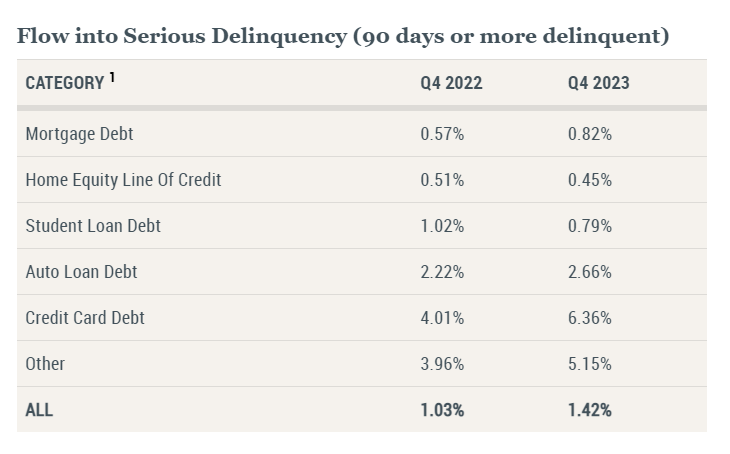

Student loan debt is above $1.5 trillion, auto debt above $1.4 trillion, and credit card debt above $1.3 trillion. In other words, people are maxing it out. And no surprise, problems started happening last year and continue today:

All of this to say, the debt needs to keep floating in to keep this party going. Nothing to see here folks!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “California Home Prices on a Roller Coaster: Monthly Payment for a California House: $1,410 in 2012 and $5,210 in 2024.”

Everyone makes the mistake of assuming that Californians are buying the houses that are selling now. I keep seeing houses go to wealthy recent arrivals from abroad. (Like the house next to my Daughter’s house). We are getting a new upper class with the local helots doomed to servitude.

Same deal next to my parents. Was there for a family reunion recently and these people complained about the kids being too loud. Oh no! Kids playing together outside! Dang, we used to blow things up in the front yard when I was a kid and nobody every complained. Maybe don’t buy a house in an American suburb next time, you morons!

Welcome back!!!

All of this is due to money printing to paper over massive deficits, war spending and close to a trillion per year the government has to pay in interest. War spending increases the GDP but the average person does not benefit from it. They just suffer the consequences of the money printing. Increasing the minimum wage does not help anyone; those at the bottom will suffer the most from the inflation it creates because they don’t have any asset to offset the inflation.

The fight against “fossil fuels” in the absence of any other RELIABLE energy source ruins the economy, but maybe that is the goal. Trying to cover up the implosion in the real economy via money printing does not fool anyone with their eyes open and understanding of the real economy. They will fool the sheep for the next election.

They will try to levitate this “economy” till the election time at a tremendous cost long term. After that, I believe they will leave all pieces to fall to the ground. What they do is totally unsustainable long term.

If Trump wins the next election… he’s gonna get screwed so hard. The Trump name will be associated with the largest crash/depression in history. Look how Covid almost destroyed his legacy of prosperity. You will know with certainty the next crash will be in 2026-2027 just before 2028 election.

Welcome back, finally another post after a long hiatus. Sadly the market has gone even more insane since then. Guess there’s no hope out there and maybe this time is different….fundamentals don’t matter anymore and this is the new norm..

I think the other bubble is overlooked. Incomes haven’t risen enough from 2012 but the stock market is a bubble that is likely bigger.

Bitcoin: Up 2000X since 2012.

NVDA: Up 300X since 2012.

QQQ (a NASDAQ index fund): Up 8X since 2012.

If I was a smart and brave techie back in 2012 like M (I think he was in diapers then) and invested 100K in this current equities bubble, I’d be set to buy a house.

If I went all in with Bitcoin back then, I’d likely be a billionaire and I could buy 50 of any houses I wanted. Houses would seem so cheap.

If I was cautious and invested 100K in NVDA, I’d have a measly 30M so I could buy at least 10 houses.

If I was very conservative and invested in QQQ, I’d only have 800K so I could buy one house.

What are the morals of this story?

1) The equity bubble must pop to pop for the housing bubble to pop.

2) Given the wage increases showing a 1.5X increase, working for a living is for suckers.

3) Be born rich with a trust fund in equities.

Don’t worry, in 2008 both popped. However, after losing half their wealth and seeing housing prices drop 10% per year, everyone was too chicken to buy by 2012.

THIS! This is the only explanation for why housing is nuts. I wasn’t ballsy enough and only got like 20-30% returns per year on my 401k. But anyone that put $5k-10k in NVDA, TSLA or a dozen other tech funds made a killing. I have friends who’ve been out of work in the entertainment industry who own three homes…. Yep they put like $10k in NVDA in 2009 and held it. They survived off that multi million dollar NVDA return and now rent out one of their properties for additional income with 2% mortgages. They are sitting on $4 million if they are still holding NVDA. But my guess is they sold and have a cool million they are living off of. This is very common in big cities. Half the population are idle wealthy that work when their net worth drops below a certain amount. It explains the disparity in local incomes and home prices.

I always have a few additional thoughts after I post.

2012 was the best time to buy. Housing prices had cratered to 2002 lows and the stock market was just starting to recover. Wages and employment were starting to increase after 4 years of layoffs, foreclosures, and van living.

It was actually cheaper to buy a house than to rent in 2012 (refer to Wolf Richter’s excellent chart of Case Shiller home prices vs Owners Equivalent of Rent). People were still afraid after losing 10% per year on their houses for 4 years and watching their co-workers foreclose. The good Dr had many postings from people predicting further losses during that time (“Housing to Tank Hard Soon”). Fear was the predominant emotion.

By 2014, the stock market had recovered, and people were seeing their house value start to increase again. The Fed was still busy slowly lowering rates which made it more attractive to buy which started to blow up this current housing and stock bubble. The Fed kept lowering rates past 2017 which was the year price levels exceeded the peak of the last bubble in 2006.

I continue to read this excellent blog and watch Wolf’s chart for when Case Shiller home prices and Owners Equivalent Of Rent intersect again like they did in 2012.

No matter the fear level or how much blood is in the streets, that will be the time to buy again. If house prices fall 20% and rents increase 20%, then it will intersect again (or some combination of this to equal 40%)

Good luck and I hope I have the cash and income to jump in at this point.

If the Fed lowers rates, the housing bubble will continue to inflate and inflation will worsen. It seems like FOMO is still the driver of this bubble and making it cheaper, will just start crazy bidding wars again (for everything). It is much cheaper to rent than to buy now. People need to realize this and unemotionally wait.

“if I did this” and “if I did that”… “i’d be…” That’s meaningless. It can be said about anything. No crystal balls.

I don’t *think* the housing market will really drop much unless employment does. Housing has defied all logic in my eyes. I thought the pandemic/lockdowns would have an effect. Wrong. Then I thought the doubling of interest rates would cause a drop. Not really. A terrible unemployment rate? I won’t be surprised if I’m wrong about housing dropping in that situation too.

Oh, also add “4) Inherit a bunch of money from relatives like M”. Most of us said he was doomed after buying at the onset of a pandemic, but that all worked out fantastic for our favorite permabear turned permabull.

I feel bullish lately, but who cares!

San Diego is about to join the $1,000,000 median home value club (congrats, owners). But San Diego’s median household income is $100,000K. That is woefully inadequate for buying a standard single family home.

In my big metro Texas ‘burb, our median home value has reached $400K which is still below the national median and the median household income is $115K. Now that is some good math! Welcome, California refugees, but please stop honking so much.

Texas real estate taxes are pretty high though. No prop 13 keeps prices reasonable. Taxes in that $400k Texas home can be higher than the average $2 million dollar home in CA if the owner is older.

Actually, the average property tax paid in Texas is lower than the average property tax paid in California. And when you’re retired, you can fill out a form to make it $0/year for the rest of your life. Texas has a cap too. It doesn’t screw the next generation like Prop 13, but it’s there. Well, actually Prop 13 doesn’t screw the next generation when they’re inheriting million dollar homes. What a scam.

California used to be great. Now it’s just great for visiting. if you know where to visit.

I was a regular on this site during the last downturn in 2006-2011. When I bought my home near end of 2011, everyone on this site was still so negative and made me feel miserable after closing. Now I’m sitting on a $1 million dollar home that’s half way to be paid off completely. This site has always been to negative to be trusted. Even when thing were turning around in 2012 over a decade ago the negativity made it impossible to visit. You will probably be right this time around again… but admit you are a permabear. Atleast calculated risk called a bottom correctly.

We helped our daughter buy a bigger house in 2013. She now has as much equity in her home as we do (and we are completely paid off). I was never a permabear, but I do think that Real Estate is not the only thing to own. I am currently contemplating selling some out of state rental real estate, but the tax consequences may cost me too much.

Housing prices go down in a down economy and up in an up economy. And the local situation is more important than the national for any given property. Plus the dollar isn’t a fixed commodity so you constantly have to inflation adjust all values. Especially with Biden and his minions in charge.

Yeah, the best time to buy a house is when you are able to pay for one you like, whether it’s “high” or “low”. Timing doesn’t matter because nobody knows what will happen next. The thing is to get in when you are able and not wait for some magical discount. Almost everyone who could buy but didn’t has been left behind with the people that could never afford anything.

Congratulations on being 100% debt free. And, for buying in 2012! Perfect.

It’s a little ironic that DHB has gone dormant during the most MASSIVE bubble in history – the current real estate bubble. $900k as the median home price in California -this is MAXIMUM INSANITY. Who can afford that? I know – this housing bubble has dragged on way too long, and has defied all laws of rationality and reason. It’s like a magician making an elephant levitate. The current housing market is insanity on steroids – there is nothing rational about it. Normally, higher unrest rates make home prices decline. This has not happened in the current market. Anyway, I’m glad the sleeping bear has a woken up – maybe in time to see the fireworks. The levitating elephant will soon fall to the ground. Don’t get caught under it.

Welcome back Dr. Housingbubble. It is crazy looking in the rearview mirror at what CA housing has done in the past 20 or so years. Buying in 2011/2012 was an absolute gift. A simple spreadsheet showed the monthly payment to own was cheaper than renting, the fog of war still blinded many people from buying. I was lucky enough to buy in 2012 and encouraged people to do so for many years on this blog based purely on the numbers. Would I buy today? No, not unless I had significant cash and/or proceeds from a prior sale. I honestly don’t think we will ever return to a normal housing market in places like socal, but time will tell.

Hey people!!!!!

Good mood and good luck to everyone!!!!!

Leave a Reply