Bubble university. Student loan accounts now match up with the number of auto loan accounts in the U.S. Future American home buyers will be hampered by massive student loan obligations and growth of for-profit education.

Student loans will keep a lid on how high housing prices will recover once the economy does settle down. It is amazing to think that currently $1 trillion in student loans still need to be paid and the amount of student debt is only growing. The question of higher education worth always comes up during recessions. Yet the one thing that pundits miss, just like they missed with the housing bubble this last time around, is that we have an enormous market of subprime college players eating up a large portion of government backed loans. Of course these toxic outlets usually grab headlines once bubbles burst but you also have students going to top quality institutions that routinely charge $50,000 a year or more. This is similar to what was seen in the housing market. No one is disputing that a home in a nice area is valuable but to go into massive debt without really thinking about the underlying value is financially disastrous. Millions of Americans are in massive debt or are preparing to go into massive debt to pursue a college degree. How will this impact future home buyers as more and more people carry debt loads that amount to a pseudo-mortgage even before buying a home?

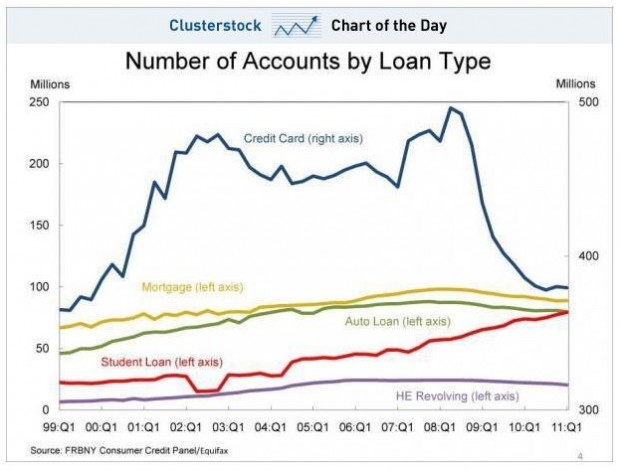

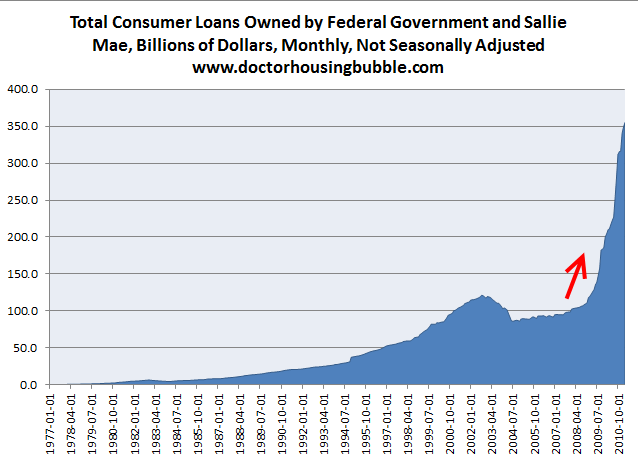

Only category of debt sizably growing is with student loans

The above chart examined data from the Federal Reserve and what is clearly displayed is the steady growth of student debt accounts. From the data in the chart, it now looks like there are as many student loan accounts as there are auto loan accounts. At this current rate it is likely that we will see more student loan accounts than actual active mortgages. Part of the massive growth in college attendance is coming from the for-profit institutions. Take a look at this stunning chart:

Source:Â The Chronicle of Higher Education

In 1997-98 for-profit institutions made up 3 percent of total undergraduate enrollment. In 2007-08 they made up 9 percent. What is more troubling is their oversized reliance on government backed loans to fund their enterprise. For example, for-profits eat up 21 percent of all Pell Grants when they only enroll 9 percent of students. These institutions also eat up 21 percent and 22 percent of subsidized and unsubsidized Stafford Loans. It would be one thing if these institutions were showing solid results in the real world but they are not. The only results appear in the profits of those running these institutions. Default rates are atrocious for these institutions. Career placement is a joke for the most part. Yet so much money is being funneled here because it is easy profits and the current environment is like a Wild West show. Just like in housing, the banks dictate government policy. Just look at some of these institutions:

While the stock market and economy went south over the last ten years, stocks for the for-profit colleges soared. Finding a parallel to the housing market, this is the subprime market of education and there are billions of dollars that are being made. The argument goes that many of these students need these schools, loans, and grants because they come from lower income areas. Sounds like a familiar argument. Sure, it is nice to get people into homes but how many of those people kept their houses once the bubble popped? Not many. The mortgage brokers never cared about the people they suckered in aside from the commission they were going to churn. Wall Street didn’t care since they were hedged to win no matter what including siphoning off taxpayer bailouts. These for-profit schools use large amounts of their budgets to target these areas and slam students into these government backed loans and who really cares if the person even gets a job later on or even learns anything. It is appalling because there is lack of oversight and no accountability. These schools only survive because of government backing. Hey, if they want to lend their own money then go for it. I doubt they would and the results pretty much sum up the story. At least when it comes to the for-profit sector of college, this is definitely one giant bubble.

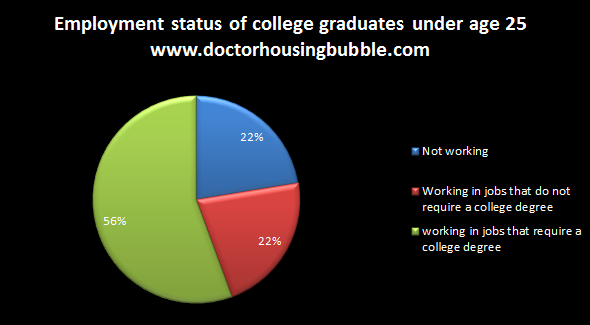

College employment for the class of 2010

Source:Â John J. Heldrich Center for Workforce Development at Rutgers University

The above chart looked at the placement data for the class of 2010. What is troubling is the large amount of students working in fields that really don’t utilize their degree. 22 percent are simply not working which is disturbing. But then you have another 22 percent that are working in jobs that really don’t require a college education. Keep in mind this is data looking at college graduates. You can imagine how dismal the data is for those without a college degree. As we now know, the prospects of earning good money in manufacturing are now becoming more limited. So an education in a specific field is necessary at least going to provide some skills beyond the basic. Fields like engineering, accounting, and healthcare seem to have solid prospects but require specialized and long-term training. No going overnight to a crash course and being able to become a mortgage broker making six-figures. Those days are done. So why would people go into debt for tens and even hundreds of thousands of dollars if the degree will not produce solid career results? It is one thing to have a basket weaving degree with no debt but another thing when you go into massive debt for it. I get the “knowledge†argument but nothing is stopping folks from going to their local library and reading the greatest books of all time (it also won’t cost you thousands of dollars).

Let me be absolutely clear. I really do believe in people getting a college education. I also believe that owning a home is a smart thing. But there are major caveats to both of these. First, you have to measure the worth and value versus how much debt you will take on. Both of the previous decisions can be problematic if people over pay. There is a mythology around both of these sectors. I call this the “priceless†mentality. For example, some people will say, “good schools, setting roots, and having a place to call our own is priceless†so they justify ridiculous loan amounts for this belief. The same applies to a college education. Many in the public get fooled thinking that all colleges are created the same. They are not. A degree from a top 100 institution is not the same as one from the other 3,000+ colleges out there. Bubbles create massive price dislocations and we are definitely in one when it comes to higher education.

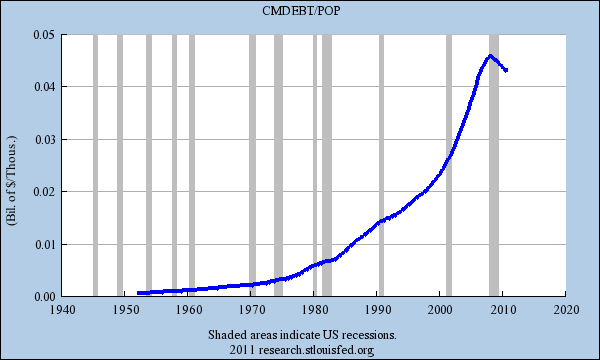

Student loan debt hamper future buying

I wanted to get a sense of how much debt has increased on a population adjusted level. The above chart is merely dividing total household debt by the U.S. population. As you can see, the amount per population unit has grown steadily up until this recession hit. Yet as we have shown previously the only sector seeing massive growth in terms of debt is with student loans:

The above chart simply looks at the Sallie Mae portion owned by the Federal government. I know some argued back in the early 1990s recession about the higher education bubble but there is no comparison in terms of debt size now and the for-profit system was merely a tiny player back then. $1 trillion is nearly 10 percent of our annual GDP! This is unprecedented. Show me another country where people take on student loans to the tune of 10 percent of their GDP.

As things move forward with debt bubbles, you realize that there is only so much debt that can be taken on. This debt ceiling bread and circus was one of those. Now think about what just occurred; they were arguing about putting a cap on money they already spent! The U.S. government was trying to strategically default on their debt for a while. This is like buying a mansion on the ocean and then not wanting to meet your obligations. Whatever you think of the decision, this was money that was already spent. We need to be cautious because the student loan market is definitely in a bubble. Once Wall Street banks see a window for profit, they will exploit it and use the government as the insurance policy. Just like those who denied the housing bubble for years, you will have those equating all colleges as being worthy of getting government backed loans. They will argue that sure a degree is worth $50,000 a year in any field. I completely disagree. From one bubble to another. However as things stand today student loan debt sticks with you no matter what so no strategic defaults on student loans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “Bubble university. Student loan accounts now match up with the number of auto loan accounts in the U.S. Future American home buyers will be hampered by massive student loan obligations and growth of for-profit education.”

Students to feel pinch in debt deal

WASHINGTON (CNNMoney) — Some students will start owing more on their loans while they’re in school under a last-minute debt ceiling deal to keep the country out of default and reduce deficits by at least $2.1 trillion over a decade.

As part of the savings to trim the deficits, Congress would scrap a special kind of federal loan for graduate students. So-called subsidized student loans don’t charge students any interest on the principal of student loans until six months after students graduated.

Congress would also nix a special credit for all students who make 12 months of on-time loan payments.

The changes would take place July 1, 2012.

For taxpayers, the savings taken from the pockets of students will total $21.6 billion over the next ten years, according to the Congressional Budget Office.

For graduate students who qualify for the maximum amount of subsidized loans, it could tack several thousand dollars to the cost of going to school.

The money saved by the student loan cuts would help pay to keep Pell Grants, which so far are maintained at a maximum grant of $5,500 a year for some 8 million poor students.

“Full funding for Pell Grants is absolutely essential to fulfilling the president’s goal of the U.S. once again having the highest proportion of college graduates in the world by 2020,” said Pauline Abernathy, vice president of the Institute for College Access and Success.

Enterprise Rent-A-Car requires all of their employees to have a college degree. That 56% statistic is not an accurate reflection if you take all of the college students who majored in bogus degrees. I would estimate the real percentage being closer to 35% – 40%.

Like the housing problem, the student loan problem defies easy solution. The basic underlying problem is the we now operate in a global economy. The average person that is not educated is competing against uneducated workers in 3rd world countries, earning a few dollars a day.

Similarly, highly educated people are competing against similar people worldwide. Eventually, even highly technical jobs will be exported to India and China. What good is it to spend hundreds of thousands of dollars to earn a job skill that can be exported.

The only real hope for Americans will be to start their own businesses.

I agree. I have a degree in Math & Computer Science, plus years of work experience (I was an older student), and I cannot even get a job at Pizza Hut.

A lot of unemployed STEM workers blame H-1B visa holders, and it is true that many if not most employers would rather hire an H-1B than an American or even a green card holder. They think that if these visas were halted tomorrow, the problem would be fixed. However, what they are not considering is what you just brought up: offshoring. Even if new H-1B’s were halted and all current holders deported, American companies would NOT respond by hiring Americans. They would respond by picking up stakes and moving all operations to India or China.

TR–Good points. Unfortunately, the situation is even worse than that. You would think that after the 911 terrorist attack that W. Bush would have zipped up the border, tight as a drum, to help prevent terrorist plots. Uh, nope. The open border policy, demanded by crony capitalists, remains in effect.

Illegal immigration is lower now, but mainly due to the sluggish economy. When it eventually turns around, the crony boys will demand that the Border Patrol be weakened, under the guise of budget cuts or some other phony excuse.

As with subprime and Option ARM loans, with gains pocketed and losses socialized, the hiring of illegals is a major profit machine for the Crony Boys. They get all the benefit of cheap labor, but when they get sick or deliver babies, the taxpayer picks up the tab, since they don’t pay health insurance to illegals.

What’s sad about this is that this issue hits on the nerve of political bantering. Republicans don’t want to touch this issue because they want free enterprise and refuse to regulate hiring practices for business. Democrats, afraid of appearing harsh to immigrants and poverty stricken countries, won’t do anything either.

Great Post, your concise and well reasoned exposition and thoughts scare the living daylights out of me as to the future of the country (and the utter debt enslavement of those not born to enough family money). Today’s WSJ reports the same group in Spain, those Under 25 seeking work, are 48% unemployed. If you remove a large portion of the United States present group of misled/undereducated education-enrolled students from the schools by reducing endless government lending by any mechanism, fair, unfair, whatever, then what would that do to the 9.2% present unemployment rate? The government bubble funds a)school payrolls b) school building c) the multiplier effect on communities. I can’t even guess what cutting say, half the programs in some fashion, would do to the unemployment rate, want to guess?

Now, a harder guesstimating game: suppose you take the chart of United States numbers of student loans and a chart of total student debt incurred and outstanding, and try and project it out five years based on a)the huge numbers now in school b) the huge numbers that will enroll in the next five years (in excess of retirements of the college educated with jobs), what does that do a) for the loans and debts and b) jobless rate as the present group “hiding” in school graduates to the few well paying available jobs?

I have also read that the total student loan debt has surpassed the total credit card debt!

Degree requirement is more like a preference. A piece of paper is not what gets your work done. The individual and their experience does. Companies all went the way of making degrees a requirement because the government leaned on them. Leaning increases college entrance. Increase entrances increases government loans. Increased loans increases tuition and so the predicament continues. Department of Education is another blumber of of the government forcing its will on the people and instigating havoc.

Some future time, “I finished off my loans!!” an old man retiring at 85 shouts to his friend. Friend ask “so how does it feel to fully own your home?”. Old man replies, “home… no been paid that off. I just wrote my last student loan check.”

Here are some examples:

Link: My Degree Isn’t Worth the Debt!

From the story, Michelle Shipley is Fk’n hilarious. $140,000 in student loan debt, degree in political science and international development, working at a non-profit (not making much), and then racks up $7,000 in credit card debt. The American Way!!!

And as she says, “I had to pay for college on my own…”. Is taking on $140,000 in student loan debt “paying on your own”????

Everything is so far from logical that there’s no explaining to the youth anything, cuz they know more than ever. The only thing Mike Judge got wrong about Idiocracy is that that it will happen sometime in the future, because we are already there. But don’t worry–lot of ‘tards out there living kick-ass lives…

I don’t feel sorry for one second for these dumbass idiots borrowing too much to go to school. Been there, defied that. Housing, student loans, I’m so sick of everyone’s entitlement. All the douche bags need to pay back for their drunken adventures and not offload to taxpayers. Dumbshit homedebtors likewise.

I sort of agree that it is their own fault – but you have to admit that something isn’t right about the great United States of America being the only country where shit like this happens.

It really is a systemic problem where corporations (banks, for profit universities, etc) are being subsidized by government either directly or indirectly taking money from the poor and naive by promising them a prosperous future luring them into lifetime indebtedness.

Instead of putting their money into supporting loan products, the government should put that money directly into state colleges.

We’re also the only country that has such a huge level of narcissists and fat people. They have nobody to blame but themselves for that.

@dave

“gov’t…state colleges”

The problem there is the same as everything–the gov intervening is inflationary. You assume people will do the right thing–it should be obvious they won’t. Instead of making tuition more affordable they will spend the money and not do the right thing.

“It really is a systemic problem where corporations (banks, for profit universities, etc) are being subsidized by government either directly or indirectly taking money from the poor and naive by promising them a prosperous future luring them into lifetime indebtedness.”

Well said, this is exactly what is going on. By the way I believe education could be done way more cheaply. But the market for a good and affordable education barely even exists so long as this nonsense is going on (expensive and often low quality for profit colleges subsidized by the naive taking out government debt). So the best alternative actually in existence now is funding public colleges.

Yes to some degree they perhaps should not have chosen to go to an expensive college. But in that case we need to fully FUND THE PUBLIC COLLEGES. The state of CA just keeps cutting funding to public colleges, this will eventually destroy the only affordable higher education option in existence.

I agree that this is a huge, unsustainable bubble. I’m wondering what it might look like when it bursts…or what it will take to make that happen. Seems like as long as the government continues to back the loans and the borrowers can’t escape the debt, the madness will continue…meanwhile the impact of the bubble will be felt across every major sector of the economy. Even if somehow the for profit schools are forced out of business, it seems that the underfunded state schools can’t afford to reduce tuition in this economy anyway, and prices will stay high…

Many college students study things that have no application in the real world, unless you plan to teach at the college level.

If you are majoring in psychology, history, philosophy, social science you are wasting your money.

Head librarians, on the other hand, can make over $200,000. a year. And your job can not be exported.

If you have a kid in college, ask them what type of work they expect to do after 4 years. If you get a blank stare, it is time for a sit down “reality” talk.

No major is a waste of time. Why study something that doesn’t interest you just to make the big bucks? My friends and I all studied either art or art history. We went on to grad school. We are all gainfully employed and happy. Not wealthy monetarily, but happy!

Rhiannon, a particular major is indeed a waste of money if you must borrow more money than you can ever expect to be able to pay back on what you’re likely to earn in a particular field.

I was an art major, and I will say that it is a wonderful major if it is what you love, AND you do not have to borrow any portion of your school costs and do not have to worry about how you will make a living.

Most people are not concerned about becoming “wealthy”- they know there is no hope of that. They only want to earn an income sufficient to support themselves and perhaps a couple of kids in a decent, safe neighborhood, and be able to cover the cost of a minimally decent lifestyle. Being burdened with several tens of thousands of dollars of school debt will seriously hamper you in your pursuit of all of these things. If you make, say, $50,000 a year, which is not a high income by anyone’s yardstick, and you have $40K worth of school debt, you will be hard put to it to keep a shacky roof over your head and keep a junk car running after servicing your debt.

And if you borrowed $100K or more? You will be a lifelong debt slave even at a high middle income of $80,000 or more. You will never save money or own a home or be able to have kids, and you will be a very bad marriage prospect

To be able to “follow your bliss” and “do what you love” are indulgences that no other population in the history of the world has ever had until the age of Fossil Fuels, which is almost over. We are about to discover what a rare privilege it is to choose an occupation just because you love it, and how anomalous is a society that can afford to offer such a high percentage of its population such a privilege. And it’s one of the first privileges we’ll lose on our way down the slope of depletion. Most people can’t afford it now, and they sure as hell can’t afford to risk terminal debt slavery to pursue something with little to no utility in a world of shrinking resources and mounting economic pressures.

Why didn’t you just study art and art history with a group of people for free? I doubt you needed the degree to get your current job.

Head librarians? I don’t think so. If Google and electronic devices sucking info from the cloud don’t make libraries obsolete soon, then the slow wave of municipal fiscal problems will. Have you noticed that libraries are one of the first things shuttered when a town nears bankruptcy?

Let’s not dumb down America anymore. History, as we all know, repeats itself, so everyone should be educated in the subject. Psychology? Can you say mass marketing? I could go on, but, as I said, we need less ignorant, stupid people out there.

I used to care deeply about public libraries, but that was before they were turned into air-conditioned daycare centers for the poor and downtrodden. The noise level is horrendous, and the old librarians who used to “shush” everybody have all retired.

My preferred reading material is English literature written before WWI. Now, it is all freely available for download on the internet, and public libraries never stocked a good selection to start with.

If you have internet and a Kindle, you really don’t get much out of the public library system. America is broke — the libraries can be trimmed down considerably, along with the police and fire departments.

I think psychology and social sciences have great potential applications in society. It’s too bad that people feel it needs to be monetized in order to make it worth the time, energy and money spent in acquiring sufficient knowledge.

Unfortunately this is the problem with a lot of people in our country. They believe college is trade school. It is not! It is a place to learn and find out how to research a topic and then analyze it. I think where everyone on the forum shares common ground is that paying too much for anything is a bad idea. Nobody should be going $140k into debt to pay for a degree.

You’re very wrong. Nobody goes to college to ‘think’ and ‘analyze’. The people who do well are the ones that can ‘memorize’ and ‘regurgitate’. Basically the better you are at conforming, the better you will do in college. Complete opposite of what you have proposed.

We shouldn’t be discouraging people from attending college and increasing their knowledge and ability to compete in the job market. Instead we should be looking for ways to make higher education more affordable. During the housing boom I would ofter hear pundits claim they were making housing more affordable by offering innovative loans. People don’t want affordable loans, they want an affordable house. Same applies for going to college. Kids don’t need more loans, they need more affordable schools, and more scholarship and grant opportunities for high achievers. The push to offer more loans in both housing and higher education is what was responsible for the skyrocketing prices of both.

Well said gael. Federally backed loans are the problem, not the solution.

Change the bankruptcy laws. Anyone lending money without collateral or certainty of ability for repayment deserves what he, (shouldn’t) get back.

Thanks for talking about this subject, DR.. This and the 70+ million Boomers going into the end game over the next twenty five years will be the two most important demographic forces that will drag down our economy for decades.

profound statement:

“I don’t feel sorry for one second for these dumbass idiots borrowing too much to go to school. Been there, defied that. Housing, student loans, I’m so sick of everyone’s entitlement. All the douche bags need to pay back for their drunken adventures and not offload to taxpayers. Dumbshit homedebtors likewise”

—HiThere gives us the patented response of those that absorb the mainstream media push of “personal responsibility” even in the face and obvious proof of a “rigged game”. Hopefully it’s clear by now, that indebtedness by young, middle aged, or the old does society absolutely no good whatsoever. It keeps us slaves to the system, period. It’s an easily attainted result though because corporations run a full gauntlet of propaganda to argue it’s normal, understandable, hell – even a GREAT thing. They convince us to use more plastic cards in order to hide the rapidity of our indebtedness (mastercard says profits are up 33% today) , the article above states how they are even pulling the very SMALL assistance like “delayed interest cost” on student loans, and come on now – let’s not even bring in the idea of “control fraud” in regards to the mortgage and housing debacle (google William K. Black for more on that HiThere, you really need to).

Our society – the you and me – the people who aren’t in the “the big club” as George Carlin once comically quipped about – are being preyed on. (People in sales (revenue/profit generating) understand this). The answer in part, YES, is personal responsibility – it can ONLY HELP – it requires: the search for answers, the questioning of things, and if you can’t do the previous two things: at least stop believing what rings out of the ultimate propaganda machine ever created (and now in HiDef): your Television — (or rather, the 3-4 televisions in most peoples’ houses!)

BUT — we must admit that because this is the DESIRED EFFECT by those in the “big club” using corporations to execute the plan ( ie: profits at any cost to society) – we too – need a concerted collective effort to battle it:

We need more education MUCH EARLIER on in life in regards to what money really is – and admitting just what “financial responsibility” really means… We have 18-19 year olds in college will literally ZERO financial education given to them. It’s a PROBLEM in society, society has to PROVIDE an answer…

You’ve got people being lied to and hinged to mortgage grenades with the pin pulled — note: people want a house, not a mortgage – the mortgage is unfortunately the ONLY WAY people can afford a house. HiThere implies it’s too bad if those in control of allowing that transaction to occur: lie, cheat, steal, and withhold information: all outright fraud

Same goes for “college loans” in HiThere’s world too: an 18-19 yr old – walking down their college campus being rooked into credit cards (free t-shirt! free football!) AND even college loans (horrible financial tools in their current form, start with eliminating the interest, yup – every penny). The current compounding interest effect makes them truly not worth the paper certificate they’re supposed to pay for…Unfortunately, the college kids – don’t understand the ramifications – hell, most parents don’t either! It’s a problem in society, society has to provide an answer…

But the answer isn’t to scream “too bad, I knew! you should have figured it out too!” – the answer is, again, a concerted, collective push by us — the serfs — to not allow these monolithic business interests to herd us into the pen for a lifetime of fleecing (financially speaking) and admit to each other and our kin what’s really going on.

So my point isn’t so much that we’re being preyed on – or that people like HiThere want to parrot the mainstream corporate talking points of “personal responsibility (in any and all instances) – my point is why can’t people understand the answer, the only one, to improve these “financial effects on the average joe” is banding together with the rest of the people – calling BS on this complete RIGGED and ONE-SIDED BENEFIT GAME – and saying we’re not gonna take it anymore. And supporting everyone who bravely speaks such truths to power…

– junior college used to be completely free in southern california — universities were immensely cheaper

– credit cards were never as prevalent as they are now — ( there is a long concerted effort to do away with carrying paper money around for debts – remember, mastercard profits up 33% – proof in the news today)

– Corporations use government to pull out even the small “assistance” stops on loans – delayed interest, interest rate caps, etc…

People – there is definitely a war on – one side knows exactly what it wants and has been in full court press to get the effects of it for years and years ( profits at any cost to society). Now, the other side – us, the people, you and me —- are bombarded by corporate propaganda to keep us infighting, blaming each other, and in a state of “reacting” instead of “acting” to improve the financial war being raged against us…

Too hard to see ??? Really? come on now…. and yes, every mainstream politician is complete bought and paid for – and whether red or blue, conservative or liberal, democrat or republican — they are owned by the monied interest and ALWAYS work in unison for the big financial corporations that fuel them on the big issues: FINANCIAL POLICY.

(the hidden student loan cut out of delayed interest, ie: “subsidized loans” is an EXCELLENT example of this)

Personal responsibility? Awesome! I love the idea of it — Yes people, do whatever you can to educate yourself – but see the forest for the trees here – and admit that HELPING each other – by getting this financial fraud into the light – is a GOOD THING – and that we need more transparency and exposition so people can learn and acquire more personal responsibility like “HiThere” has attained… Actually, we really need to cut of the government policy that is serving as conduits to allow all of this…

Anybody willingly throwing society under the bus for all the effects of this financial terrorism has had their morals and mind captured by the monied interests ( most get PAID for it though – but many members of society have no problem eating their own with just continued corporate programming via their boobtube and favorite political heroes)

It’s 2011, it’s time to figure it out: It’s us ( the masses ) vs. the monied interests.

(as it has been ALL DOWN THE CENTURIES)

We can have all these things whenever we want them:

– FREE college

– FREE home

– FREE Mass Clean Green Transit

– and SAFE PROTECTION of Wealth to support our families and their offspring

oooh do I hear whispers of “socialism” ?? HA, the monied interests are already ahead of you – they’ve decided to accept that approach but “frankenstein” it a bit: You’re already learning to love their new twist on the model: socialize the costs, privatize the profits.

So no worries, the only communism-fascism-socialism whatever you want to call it is going to be PRO-corporation/monied interests and CON-you/us/we…. We’re giving billions away to them every day….. but again, their propaganda machines have you thinking the biggest recipients are us —– but that’s the way they want it, you see, they have SO MUCH MORE fleecing to do to you and your future generations….

Remember: “It’s a BIG club…and YOU ain’t in it!” – George Carlin

A little too long – but good 🙂

True-The Manhattan syndicate has profited immensely from controlling everything we need and making the foolish think they need everything they want. And the prudent are pummeled too.

I don’t know if more people are actually going to college for short amounts of time, but our college graduation rate hasn’t really increased in 30-40 years from every chart I’ve seen. I completely fail to understand what is driving up the cost so much. It seems like the only thing driving the cost is the ability for students to borrow more money. The easy solution is to put lower limits on what can be borrowed and make schools find ways to teach more cost effectively. I can’t understand how UC Public schools that cost $500 a year in the 70s now costs $15,000 a year. I don’t think the quality of education has gotten any better so why has the cost outpaced inflation by so much?

DG – You hit the nail on the head! Just as with housing, the biggest thing driving up the cost of education is easy borrowing. Get rid of easy borrowing and watch college get a whole lot more affordable, and colleges that stubbornly remain expensive will go out of business. As for the UC Public Schools costing $15k/yr, that is just the fees charged the student. The CA taxpayer is subsidizing it, so the real cost is ?????

The cost to students for a UC education has increased from $500 (what I paid when I went) largely because the state has reduced its funding per student by 57% (inflation adjusted) since 1990. (And that was the figure before this year’s cut went from 500 billion to 650 billion.) The percentage of the UC budget provided by the state now averages about 13% per campus (it is lower on campuses with strong grant funding) down from the mid twenties back in the day. It is a misconception that taxpayers pay for all or even a majority of the costs of a UC education.

This year will be the first year in which the state will actually contribute less per student than the student pays in fees.

Back when I was in college, I spent most of my time and money on booze and women…the rest was just wasted.

Makes you wonder if part two of this education ripoff isn’t bubbling with the push for vouchers for private K-12 education. I’m not arguing that the public schools aren’t bad–they are, but having non-profits and education corporations dipping into the homeowners property tax to supposedly better educate your child is suspicious.

Oh, Boo Hoo. A large portion of the students were stupid and made wrong decisions to pick majors that do not have a job market. No problem, the debt ceiling bill that the President signed yesterday will severely reduce the amount of student loans going forward. Give a cheer for Obama. He is so wise to see that this was a fraud with all these for profit college rip offs. “WASHINGTON (CNNMoney) — Some students will start owing more on their loans while they’re in school under a last-minute debt ceiling deal. For taxpayers, the savings taken from the pockets of students will total $21.6 billion over the next ten years, according to the Congressional Budget Office.”

College became a joke sometime in the early 1970’s. They are now just paper mills. In california you have to get a license in your profession before you can start to put all that knowledge that you got in the Ivory Tower to work. Lots of folks believe that their paper on the wall is worth something, most of the time it doesn’t say much. The other Day I was talking to a UCLA grad with a 3.5 in Civil Engineering and he needed to pull out a calculator to calculate 21 times 7. (WTF??) No wonder why if you have half a brain cell you can live comfortably, as long as you understand economics:) This is what the Doctor knows and is teaching in real world examples. I have been supplementing my living from REIT’s for many years. All of economics is simple if you get it. Most will not, and the vast majority when they make enough income will want to buy a house because they have been marketing the hell out of home ownership for so long that people get confused between the accounting that makes something a liability or an asset. Many young people I talk to today I just encourage them to buy cars because they are not depreciating as fast as homes are in California and if you know how to buy a car then you actually have something that you can use. As far as buying Real Estate, stick to the fundamental’s rent to price ratio’s etc.. College look to get the degree cheap because people judge you by it, but make sure you actually improve your understanding.

Reminds me of seeing a commercial on tv from an art institute. It said something like “Do you like to doodle, and can’t concentrate in class because you’re always doodling?!”

Please, who hasn’t doodled in class?? That’s equivalent to that infamous 21th century mortgage commercial. I probably could have applied, shown the art institute my portfolio of stick figures, and they’ll tell me how talented i am just so they can get paid by the government.

Btw, If someone finds that commercial, please link it.

I found the videos for those commercials – there are actually many available from 1980-2008, here is one from 1990

ArtInstructionSchool-1990

A little research indicates this school seems geared towards augmenting your skills or advance a personal hobby. Even in comments complaining of the costs indicate it will set you back around two thousand dollars total, not even in the same league as the life-draining paper mill monsters this post is primarily about.

@Laura- That’s me: Never plan to buy a house, didn’t have kids…very happy here!

I’m actually helping someone apply to both Otis and Art Center for either product design or environmental design. She has no money, so it will be all loans and scholarships. I feel for her but it’s what she wants to do. That is where her strengths lie. Luckily, she doesn’t want kids. She’ll have to look at her loan payment as just another bill to pay every month for the rest of her life, practically. It’s either that or work at a crappy $8 an hour job.

I’ve been kicking my student loan down the road with forebearances and deferments for a good period of time due to bad job opportunities, due to the economy, due to wall street, due to the politician crooks who allowed these loans to be distributed through private banks who all made a percentage. I’m hoping I can kick it of the cliff into the burning volcano along with all the other bad debt, ie: foreclosed mortgages, credit card charge-offs, and whatever else people walked away from. I’m aware that student loans cannot be included in bankruptcies post 1978, but I’ve been hearing a little bit hear and there that they may allow this to happen again. Does anyone know more about this??? I’d love to hear what you have to say. Thank you.

Interesting. Â From where I’m sitting we’ve got our priorities all wrong. Â Looking at potential for compensation vs cost of education is pathetic. Â For starters look at Wall Street speculators making a lot of money. Â What are they contributing? Â Nothing. Â They are a drain on our work output.

Teachers, artists, historians, etc. are all more than capable of making a difference. Â The problem is our society is currently structured to make so many potential contributers unable to do so. Â The bottom line is we are all conditioned to focus on getting over on each other instead of contributing the output of our talents, skills, to make life better for everyone.

We should be making this affordable If not free. Â There is now almost no way to maintain the station you’ve been born into much less raise it. Â The military doesn’t facilitate this anymore either. Â

Fixing this sounds sage, ignoring and/or belittling those who try regardless of the financial consequences reeks of doom. Â

Buy gold. Â It’s got all kinds of upside left. Â Â Â Â

Just an update on a previous post. House I Burbank 3/1 900 sqft. Listed at 439k now listed at 479K. How does this happen?? WTF? Does the nonsense ever stop?

Dow 11,383.68

I guess the thing we have all been fearing is upon us. The house of cards may be falling in. Look for a boost from QE3. Heard some hot-shot today saying the problem is Europe and US Corps making record profits. Even smart guys just can’t seem to figure out our wealth is a function of our ability to create dollars–Ben craps out a few billion a day while we mock Greece for doing the same thing on a little-league scale.

Word to wise guys: We are broke and our standard of living will continue to drop for years to come. Manhattan has robbed the nation and just robbed another trillion or so from the rest of America this week with the Market collapse. Sure, buy a house right now: brilliant.

The House of Cards isn’t falling. The sell off today has been crystal clear for months. The Treasury has an absolute ton of debt to roll this month, and the only way to do that is to scare everyone into the safety of Treasuries.

I’ve been expecting this for a while, and took profits last month. I’m sitting quite pretty right now.

Look for a push for QE3 after Jackson Hole next week; though it could be as soon as this weekend. I’ll be looking at buying stocks and PMs after QE3 is announced. Make no mistake – the Fed has absolutely no options at this point but to do QE3 and pray for a miracle (which won’t come).

I am really getting depressed with the housing market. Yes prices fell, for awhile, but in the prime areas of San Diego we are still only 20% or so from peak pricing. Prices have now stabelized, from my perspective, and inventory is now dropping again.

With all the manipulation, I always felt the only thing that could wash this out is higher interest rates. Higher rates make it costly for banks to keep shadow inventory and higher rates mean less money for principal in a house payment, i.e. lower prices.

Now, we are heading back into recession and interest rates have nose dived in the last couple days. AND, most depressing of all, talk of a “quantitative easing #3” or “monetary printing like a bat out of hell #3”.

The reason QE3 is so depressing is that the FED is talking outright asset purchases this time. Asset purchases could and probably will include realestate.

Money ain’t what it used to be, it is only what the FED says it is.

If it cheers you up any, the effects of QE3 will be shorter lived than QE2. And if you noticed, the effects of QE2 have been pretty much of eliminated to date (very low GDP, and stock prices way down for the year).

Consider this a practice run as to what the real meltdown will be like.

Also consider what the the stock market correction is going to do to the clueless homebuyers who are close to buying a house. It might give even those suckers a second thought.

I also wondered why college education is so expensive. The first is easy credit. Who would not borrow to go to school? It is the path to a better life. Once easy credit is in place what is to stop greed?

Which leads to the second point. Please check out salaries for UC professors – it is a matter of public record. When your finger gets tired from clicking people who make 200k plus per year, you will then have that aha moment.

college loans.

Leave a Reply