A brave new economy – California budget implications for real estate – 4 key metrics highlighting a very weak California economy.

Over the weekend it was announced that California’s large $9 billion budget deficit was no longer $9 billion but $16 billion. Whoops. Last week J.P. Morgan Chase, a darling of the Federal Reserve, reported a $2 billion trading loss on “synthetic derivatives†yet still had the audacity to state no further regulation was needed. Whoops.  What we have here is a system of phony numbers and massive speculation. This plays into the giant pool of shadow inventory sitting in bank balance sheets while trillions of dollars went to bailout these banks. Even accounting standards were frozen for these speculators. Instead of working to increase transparency and help the overall American taxpayer they instead are using the same leverage to gamble on global stock markets. The system is interconnected and that is why the California budget figures this weekend came as no surprise. What is surprising is the cheerleaders narrowly focused on real estate and pretending the economy around them is completely sound. Do they have ear plugs and blinders on as to what is really transpiring?

Employment

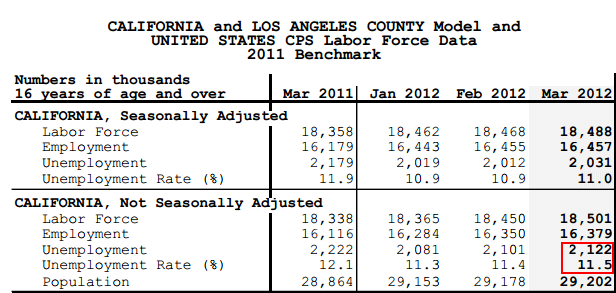

California’s unemployment rate is officially back to 11 percent but the underemployment rate is above 20 percent. If we look at “not seasonally adjusted†numbers the unemployment rate is 11.5 percent:

Over 2,000,000+ Californians are out of work. The participation rate continues to decline similar to trends across the country yet very few even address this. This is absolutely crucial especially when it comes to housing. Are all the retiring baby boomers going to be the next segment that will boost the housing market? The unemployment and underemployment figures are very important because as long as the employment situation is weak, there is little reason to expect higher home prices.

Unemployment Insurance

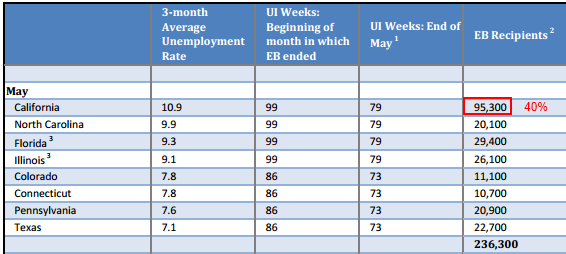

A report this weekend discusses how over 200,000+ people on unemployment insurance will lose their coverage this weekend:

Of those losing unemployment insurance coverage 40 percent will be here in California. I’m sure this is a big plus for the housing market. There is only so much fudging of numbers that can be done until people start realizing what a giant mess we are in. Besides this, we now have the government trying to obscure even more numbers to keep their crony financial friends protected.

Cutting off Census

I saw this posted last week and found it astonishing. Many in the non-mainstream financial press use the Census data to crunch numbers and bring a new perspective to what is happening in the market. I certainly use this data as I’m sure many of you do as well. Take a look at this:

“(Census) The Appropriations Bill eliminates the Economic Census, which measures the health of our economy. It terminates the American Community Survey, which produces the social and demographic information that monitors the impact of economic trends on communities throughout the country. It halts crucial development of ways to save money on the next decennial census.â€

This is mind boggling but plays into the statistics deception that is being pushed on the public. Similar to those trying to forewarn about the housing bubble bursting, the system is trying to hide data to keep the illusion moving forward. This is madness. Do people realize that good statistical measuring tools came about right after the Great Depression? You know why? So analysts, educators, and all citizens can dig in and keep the system honest. The fact that we spend billions of dollars building streets in other nations and can’t spend a few million to actually audit our own books is nothing more than a purposeful hiding of the obvious. Those that continue to act under the “business as usual†mindset are largely not open to seeing what is going on.

This is why I find it fascinating what is going down in Greece. People have been living in austerity for well over two years and now, for lack of a better word, are revolting. They realize the financial system has them by the scruff of their neck. They have nothing left to lose with a 25 percent unemployment rate. Here in the US, it seems like the folks in charge would rather keep the data obscure and feel that as long as you get your steady dose of iPhones, Dancing with the Stars, and double-lattes that things will just keep marching forward. By the way, we’ve been in recovery since the summer of 2009 so all this data must be imaginary right?

Budget Gap

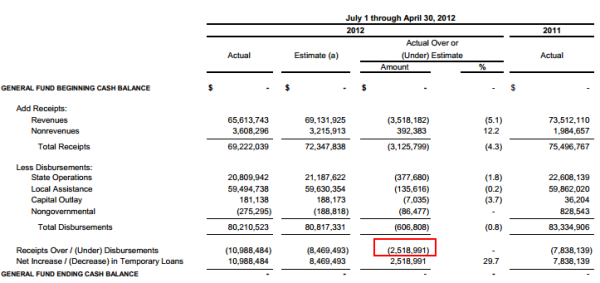

The budget gap announced this weekend was stunning but not surprising. Just look at the April revenue data:

Source:Â State Controller, CA

“SACRAMENTO – State Controller John Chiang today released his monthly report covering California’s cash balance, receipts and disbursements in April, showing monthly revenues came in $2.44 billion below (-20.2 percent) the latest projections contained in the Governor’s proposed 2012-13 Budget.â€

April is a big month for tax receipts and revenues came in $2.44 billion below expectations. The California budget is a mess. So we are now assured that we have two items that will hit in the next year:

-Tax increases

-Service cuts

Both of these are unlikely to boost real estate values. I hear arguments of people saying they are buying homes near prime schools and colleges like UCLA or UC Berkeley. These are public colleges with large support from the state! What do you think this does if prices keep on increasing and put students into deeper debt? These institutions were built with public funds and those funds are running dry. So what do they do? They raise fees. We have a lot of hidden benefits in California paid for by taxpayers and many in the state suffer from the “I want it all but don’t want to pay for it†mentality. Well the time is coming when choices will need to be made. Real estate is no sacred cow like some would think. Heck, even 30 percent of those that own their home in the state are underwater on their mortgages. Just looking at all of this in context makes you realize that some of those diving into the housing market today are suffering from cognitive dissonance when it comes to real estate. The low mortgage rates are a siren call to jump in but just look at the above metrics. What are we going to do, live in homes and trade them to one another continuously as our major source of economic growth? We tried that during the housing bubble and look how that turned out. Beyond artificially low interest rates, why in the world would housing values go up in the state given broader economic conditions?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “A brave new economy – California budget implications for real estate – 4 key metrics highlighting a very weak California economy.”

With JP Morgan having more than $50 TRILLION in bets in the derivatives market alone, this $2 billion loss represents only 0.025% of that amount – literally pocket change

We see MORE of the same bullshit that we see with many (most) U.S. state governments: cobble together a PHONY smoke-and-mirrors budget – where the numbers don’t even add up in the first place.

Then you ADD to that totally phony “revenue projections” claiming that the state will GROW its revenues to close the remainder of the budget gap.

…and then when the phony numbers are exposed as fraudulent, and the revenue-projections are exposed as fraudulent, we get the state government saying they were “surprised” by how events played out.

…and they do this EVERY YEAR in California.

Jeff,

You need to do a little work on finance. The money JPM lost was CASH. The wild numbers you are throwing around are leveraged at God knows what ratios. The loss is a big deal and it will grow. It is called a fractional reserve system. Just ask FM Global.

Did eye hear sumbunny say pocket change, I thought it waz Chump Change. Is us Chumps gonna have ta pay fer it er not,, agin? Heck this tyme ah aint gotta job so’s how’s Chumps gonna pay fer it?

If it was no big deal then why are so many executives being sacked and retiring early.

Manny,

It is worse than just losing cash, The big deal here is that the TBTF Banksters and their Gov lackies have 100% control over the rules of the games they play and they still manage to make a losing bet when they play against their own rules.

That is the big scary part of the whole story. They have a rigged market, they go entire fiscal quarters not losing one penny in trades.

Let me make it a little more clearer for Jeff.

THEY LOST MONEY IN A CASINO THEY RIGGED FOR THEMSELVES TO WIN AT ALL THE TIME.

This particular table game went sour on them, heads will roll.

No point in working if the government will pay your mortgage for you….

http://keepyourhomecalifornia.org/programs/uma.pdf

Provides mortgage assistance of $3000 per month for up to nine months.

OMG, you can get $3,000 a month in mortgage assistance in CA? Just because you “own” a house you can’t pay for?

What a vicious slap in the face to the working poor who are too “well off” to qualify for all the welfare benefits, but who must contrive to live on $10 an hour, keep a car running in a state dedicated to building evermore suburban sprawl, and perhaps pay on $40K or more worth of student loans because if you don’t pay THOSE, your creditors will literally strip you naked with collection fees, delinquent fees, and garnishments.

What an insult to people who pay $1000 a month market rent for some tiny loft or for an apt they share.

This goes way beyond minimum assistance to the truly unfortunate who would starve without the assistance. This is insane.

WTF is that?!!!! It is infuriating to be paying taxes in this country and state. When I moved here, I could not understand why everyone hated government so much. Now I get it. Policy makers are beyond compromised. Does gov’t here believe that it’s their job to decide who the winners and losers are? Where is the $#@!# meritocracy? Where is the personal responsibility? It’s not government’s role to reward people for making bad financial decisions. The lunacy is never ending.

It’s not really about bailing out the “homeowners”, it’s really and always has been all about the banks. That some “homeowners” get off with a steal in the meantime is just a side-effect. So yea a state that can’t fund the state colleges, that can’t fund the state parks, that barely funds assistance for those who truly need it, funds $3000 a month mortgage payments.

I….I have no words. This is the most infuriating thing I have read in the past few years. Actually, possibly ever. I am living responsibly with a $120k income in a loft that rents for $1,200…saving 13% pretax and 30% post tax, and these people are having their mortgage paid by my (ridiculously high since I don’t “own” a house) taxes. Unbelievable. The government is propping up the market, and keeping people like me OUT, by giving away money to deadbeat morons who bought at the peak with money they didn’t have, so that the values stay inflated. Maybe they see it as an investment because it preserves tax revenues???

This is more about keeping the status quo than bailing out the deadbeats. As someone already mentioned above, it is about bailing out the banks and in a way the Government itself.

By propping up prices, banks are saved and real estate values preserved and thus, tax revenue from the overpriced real estate is preserved.

All wicked, warped and evil thinking if you ask me, but it is what it is.

Just today Freeport Mcmoran sold off into new lows. Freeport is the worlds larges copper miner and has been looked at as a barometer of world growth for some time. Copper is a staple to the world economy and world growth is shrinking and the 5 trillion Federal Reserve/Federal Government induced bounce in the U.S. economy is coming to an end.

It looks like common sense may have the last word after all.

I used to do that! I quit 2 years ago and moved to Las Vegas. Now I am going to apply for disability. Guess what? You get to pay for that also. :):):)

C H U M P !

Sad but true – the “leaders” of CA and the US are afraid to do something more radical and practical: allow people to trade their deed for a rental. Dean Baker had a clever plan to turn the “owners” into “renters” — that is, they’d lose ownership, but could stay in their home as renters.

One layer of scamming that the politicians, and society overall, especially the RE business, is perpetuate the idea that home owners are better people than home renters. So they keep wanting to perpetuate the illusion instead of doing the obvious: recognize that “being housed” is the real goal, and that “ownership” is a social construct.

The solution to this foreclosure mess is to lose our illusions, and give people housing in exchange for their property rights. Likewise, demonstrate that, through laws, it’s possible that renters transition into owners.

Put briefly: wow is this outstanding post by DrHB on target, cogent, and comprehensive and to the point without flinching!! For what it is worth, if the state raises taxes on the “rich”, the truly rich get resentful and find even FURTHER ways to hide income (as they do wholesale to duck Federal and California taxes). If the state cuts spending by $5,000,000,000, then the economists tell us that will cut jobs somewhere…and added income taxes on those jobs…by about 75,000 people.

Of course, not passing the tax and (short term) leaving the marginal money with the “rich” does not add those jobs back in to California, exactly as drhb points out, the “rich” lately take their excess cash and tend to invest or hide overseas with it (as JP Morgan is doing and blew it) and as the rate of tax rises, the truly rich simply buy more Muni bonds (exempt income).

Well, keep in mind the Federal ANNUAL deficit is a trillion dollars and if they cut that spiralling deficit at all, that means less jobs somewhere, and California will lose the most jobs perhaps of any state. Result: the young people won’t rush to form households, keeping household formation lower or as it has been, trending sharply down.

Fantastic article, Dr. HB.

I read the report from the state. The plan is ‘Hope’.

.

California facing higher $16 billion shortfall

SACRAMENTO, Calif. (AP) — California’s budget deficit has swelled to a projected $16 billion — much larger than had been predicted just months ago — and will force severe cuts to schools and public safety if voters fail to approve tax increases in November, Gov. Jerry Brown said Saturday.

The Democratic governor said the shortfall grew from $9.2 billion in January in part because tax collections have not come in as high as expected and the economy isn’t growing as fast as hoped for. The deficit has also risen because lawsuits and federal requirements have blocked billions of dollars in state cuts.

This should be no surprise to anybody. Those assclowns passed a phony, fraudulent budget last year that would have made any magician proud with the numerous smoke and mirror illusions and “optimistic” projections. At this point, the only way to right the ship is to let it burn to the ground. Get the chainsaw sharpened and start cutting everything!

The state of CA is still one of the largest economies in the world. But it also has the most people on public assistance as well as one of the highest unemployment levels in the country. It looks like it is quickly devolving into a two tier state with a large percentage of perpetually poor people. I get the feeling that if it weren’t for govt jobs, CA would have almost no one in the middle class.

It just gets uglier and uglier, and the spin doctors have to work overtime to hide the mess. The stupid mayor of Los Angeles wants to raise the amount for parking fines again, already sky high. What a joke. And Jamie Dimon, don’t get me started. What an ass. That quadrillion in derivatives is going to bite Wall St. in the ass and the whole thing will come tumbling down. They should have listened to Brooksley Born. You can’t have a shadow banking system running through mega-trillions, when there is nothing to back them if they go sour. INSANITY. The a**holes at the top act as if they are untouchable royalty. They can do no wrong. Skim and cheat pensions funds, totally acceptable. Sell sh** paper to investors the world over, totally cool!

This will end in violence, most probably.

Time to dust off the guillotines…

The W Bush administration were maestro’s at using fear leverage to justify even murder. Tanks in the street if we don’t keep kicking the can. You get the idea. If you don’t allow us to keep stuffing our pockets, and if you try to interfere in things so complex (well, not really), you will have no chance at gaining wealth, your 401k will be worthless, you won’t retire, you won’t have ajob, and your children will have no future.

Bush is gone………. move on.

Bush, Obama, it’s all the same tactic. You and your children will be annihilated if we do not:

1.) invade a Middle Eastern country (mushroom cloud Condi)

2.) pretend that investment banks are really saving banks and give them access to the free money machine – zero interest rate loans.

3.) make taxpayers responsible for the losses of the investment banks.

4.) do away with Social Security and write off the 3 trillion dollar loan to the USG

5.) export jobs so we can remain “competitive.”

6.) Forget about war crimes and financial fraud and “just move forward.” (Obama)

The DHS under Pres Obozo just bought 450 million rounds of hollow point ammunition and he already has interment camps and approval for a private Army. Pres Obozo is the wicked witch of the west. I say forget about buying or selling real estate & start buying some guns and ammo because you are going to need them!!

Yup an I betts youse out back banging away on ur Travon Martin Target, jus in case, when ur not at the local bigots meeting, that is. Youse been listening to too mush ……………….Mush, Mush Limp Wan that is. Ma advice…..git a life.

Banana republic.

As this continues, the wealth gap will continue to widen. Basically, if you can afford to live on a hillside, you’re ok. Everyone else will continue to dwindle down poorer and poorer.

Better to live on a hill than down below. I have talked to various “gangbangers” and it is easier to shoot downhill.

Upp thar that gun dude goes agin, a spouting that NRA (National Racists Association) dribble Them thar NRA’s jus solve all thar problems with a gun.thas whut they dew. Trouble with a shooting down on on us rabble is ya might jes git a whoopie stcik a shoved up yo glory hole an sumbunny might jus git twitchy with the business end, if ya knows whut I mean

The “Bush Administration?” You’re delusional. The bailouts continued seamlessly as the great BO took over and have continued to this day. You aren’t clear about who is running the show.

When someone refuses to acknowledge the blindingly obvious, there are only three possibilities: 1) they are lying to themselves (in denial), 2) they are lying to me (simply a liar), or 3) they really believe what are saying (and are thus delusional). Case in point. Only question is which of the three?

p.s. As long as you are on the subject of the depression, a lot of people forget — though probably not the good doctor — that the depression did not start with the stock market crash in 1929. The economy was down for a few years, then recovered a bit, and then the feces really hit the oscilating device in 1932. Think of it as the eye of the hurricane. I have felt this started several years ago, that there was a very good chance that would again be the case with our current downturn: First the chaos, then apparent improvement, then it gets really medieval …

Great post, DoctorHB.

Debating Repubs/Dems/etc. are hilarious. Neither party cares about regular people, focus is implementing the financial/cultural agendas of wealthy contributors.

It will be interesting which high earning celebrities, business leaders, etc. begin exiting CA for more tax friendly states if big tax increases are passed…of course, the moves will be explained as “moving closer to family” or “getting back to my roots”…blah blah blah.

But again, everybody who reads this blog understands (insert sarcasm here) once one leaves CA, the US is a cultural wasteland…intolerable weather, most folks elsewhere are uneducated, racist; no arts programs, poor educational opportunities, nothing to do, no good restaurants…and the durable “I can’t leave CA, I was born here!” argument…

CA, quickly becoming a population of wealthy, upper class libs who consider paying high taxes a badge of honor, a surging population of working poor/welfare who will require ever increasing govt services, a middle class of working or retired govt personnel, and a class of trust fund babies, living in and/or earning income off of real estate purchased by their parents/grandparents decades ago…it’s tough for them to admit, but for many it’s the only reason they can afford to live in the CA ‘hoods they inhabit.

Drinks, I like your summation of California…that’s spot on. I had a conversation with one of my friend’s this weekend who happens to be a government worker. Guess what, he’s heading for greener pastures too (Colorado). Despite being born and raised here and having plenty of family here he finally figured out the deck is stacked against him. Unless parents are helping with a down payment for a house and day care for the grandkids, it’s not worth sticking around here!

I think you nailed it! I am still amazed how many sheeple are unaware how lobbiests now run our government at most every level.

They still bring up the shop worn debate about social issues like gay marriage, etc….while the uber wealthy take more and more of the economic pie from the masses. Talk about a successful tactic. Distraction is the tactic of the clever adversary.

I work for a rich woman in SoCal. She pays about $10,000 a month to rent an apartment in assisted living/independent living. While I make $10 an hour (and I consider myself lucky) working over 60 hours a week, she keeps telling me to go to college (USC) and to work 16 hours a day/7 days a week in order to afford it. Meanwhile, she has so much money from purchasing property decades ago, and will be giving her business to her children. They will each inherit over a million dollars and several overpriced apartment complexes. And yet, here I am, not understanding how someone can have that much money and instead of feeling fortunate, complain about how their granddaughter bought her “cheap cheese” or how she scored a “dirty” used microwave for $20 bucks (which is working perfectly.) I originally come from a poor area in the North East, and so far all of the people I have met here who have money just continue to think these high home prices are just pocket change and have no realistic idea as to how someone making $8 an hour and working 100 hours a week could POSSIBLY be struggling. And I have also met so many poor people who insist paying 3/4 of their income for rent is normal and they must remain in this state because it’s sunny (even though they work so much they don’t ever get to enjoy it).

@CeeCee,

I cone from a lower middle class background. My Dad never atended high school, for example, and worked his whole life in a factory. My parents stressed education, and made my brother and I attend college, the first in our large, extended family. I left college in debt, with very little cash, no car, and moved clear across country to California, without knowing anyone there and with no job. I am now middle aged, a millionaire, and enjoy the challenge of figuring things out, including continuing to get ahead.

I had to let go, and throw myself at the world, and take my lumps. Visualize a better life, work hard and smart, and be honest with yourself, which I find is the hardest things to do, frankly.

spot on ceecee..this is the problem in a nutshell…i’m 65 and figure i’ll be dust before america’s housing

You should realize that many of the elite Hollywood or Silicon Valley types have already moved, at least on paper. They set up a home in a low to no tax state and pretend they spend more than 180 days a year there.

Look at billionaire Ted Turner. He has all his business offices in Atlanta GA, but he has a little home in Florida and (does not) pay taxes there. Similar things are going on in California.

Thanks for the data Dr. HB. Your research is one of the few places where people can find the facts. It’s too bad most don’t take the time to read and inform themselves. Once the shit really hits the fan they will, and it will be their own fault.

In regards to real estate, Westside Condos are now getting slammed. One of your favorite areas, Culver City is getting hit hard with discounts up to 50%. West Hollywood has declined up to 60%. It’s beginning as banks begin to release a few more properties. With the condo market now starting to clear, that will eliminate the move-up buyer into entry level houses, which are still overpriced by 20-30%.

Keep up the good work, as the pig works it’s way through the python.

http://www.westsideremeltdown.blogspot.com

Given statistics, cycles, math…whatever poison you pick, you will find events tend to last around 15 years. The Great Depression was appx. 1929-1944. The Internet boom/bubble was 1986-2001. Homes went up from 1996-2006, and on and on and on. Things always start out slow…remember BBS boards with your 8088 IBM? By the time they catch on they are in full swing.

This junk we are in started going down in 2006. This is logically and mathematically the eye of the storm. There is no reason to believe there won’t be another recession in 2013 to put the icing on the cake…keep going down until a disastrous bottom in 2016 that will eventually emerge around 2020. Thus completing a cycle close to 15 years.

It’s not that hard to figure out why. Each generation learns different, by 2020 there will be adults that were kids that learned from all this. Also, no matter how bad an economy is, people still move, retire, and pass on, etc…thus opening up jobs all part of a natural cycle. Nothing more than common sense.

If you have an interest in generational cycles, look up the book “The Fourth Turning” written about 15 years ago, you might enjoy.

The bullet-train we voted for will save us, just be patient and hope!!

Given the current state of CA’s fiscal mess should I postponing buying a house?

The last 4 houses I wanted to buy got over 10 offers each within 48 hours. Frustrating times.

Brown’s budget shows temporary tax increase revenue of $5.5 billion with a corresponding increase in K-12 education to be used to pay for teacher’s pensions.

If you are a teacher or related to one, by all means vote for the tax increase(sales tax and income tax).

California is a failed state. Accept it. My cousins went back to Mexico where the economy is much stronger than the stagnant California economy. California is no longer the promised land. It is a sinking ship.

What amazes me is how many people thought California ever WAS the promised land.

Even the most cursory look at the state’s history shows that the entire thing has been from the get-go a combination of scam, con game, pyramid scheme, and boom-bust orgiastic tulipmania.

The real question is: when will the financial typhoon sweep over the entire world, and will it be in the form of hyperinflation of the fiat currencies, or a deflationary storm?

Because, there are few places to safely store your wealth/savings. Few asset classes to use for “safe keeping”.

I think the first storm clouds will takwe the form of Greece leaving the EU….with Spain close behind.

You see, ONLY Iceland as bucked the trend of accepting banker occupation of government, took their lumps, and now have a clear economy, transparent and growing slowly, steadily.

I see no clear way out for California without massive adjustments. There were afew that sqw through Jarvis’ scam….that legacy has cost California tax revenues how much since implemented?

Up here in NoCal, the inner East Bay (Oakland, Berkeley, and adjacent cities) are nuts. Per Redfin, inventory of houses for sale in Oakland is down 46 percent compared to April 2011; in Alameda county as a whole, inventory was down 55 percent.

Oakland’s shadow inventory, by my count a couple of weeks ago, was about 2.75 times the number of active listings, and presumably there are many more people in default who haven’t received notices yet and therefore aren’t yet counted.

So far, May seems worse than April, judging by the paucity of listings in the daily emails I get from Redfin.

While prices at the low end of the market have deflated a lot from bubble insanity, mid-tier houses don’t seem to have deflated nearly as much.

And of course in Silicon Valley and San Francisco, another tech bubble is driving up real estate prices into the stratosphere.

So CA may be in a fiscal mess, but even here in Oakland – where the government is also a mess – it’s almost impossible to find a half-decent 3br house in a half-decent neighborhood for under 500 – 600k.

Nobody talks about offshoring anymore. We lost tens of millions of high paying jobs. When a factory closes, so does it supplliers, sub-contractors, restaurants, small businesses-the entire eco system is burnt to the ground.

The same with technology and business jobs that are offshored-entrie departments. It used to be tech jobs were offshored to India. Now I am coming across some places, where they are offshoring to Phillipines and Mexico-apparantely they are much cheaper than the Indians.

I think, we have to look at the merits of proctetionism. Or let our country become a third world nation to compete. This modern world of free trade has only been in existance for a few decades -countries have always pursued trade policies that benefited them-not bankrupted them. Come to think of it, trade exists for one reason-profit and if we as a country are not profiting from free trade, then time to move on-else if our people can’t take it naymore, then it will be worse than Europe-we have lots more guns.

Both parties are useless. One wants to outlaw abortion, gays, climate change and wants school children to learn about “intelligent design” in science class-not philosophy. The other is clueless and stands like a deer in headlights-but still is ruled by the corporations. If this isn’t fascism, I don’t know what is.

The people who benefit from making specific trade agreements are not the people who do the actual front line work. That is why they can throw the wage earners under the bus. Higher profit margins directly benefit the business owner, not the worker class. I don’t see this policy changing until the business class finds they are having a hard time competing with other business class folks overseas. Short answer, until it hits them in the pocketbook, it will not be an issue.

if you didn’t make your money in the last 20 years in california,then just get the phuck out.to many people with not enough work brings the standard of living down for everyone.

Well, Doc, I think ya nailed it.

The whole economy is now a whoopsie cushion.

Leave a Reply to compass rose