Will the stock market impact housing values? Taking a look at stock trends and current home values.

It is very telling to see how people are reacting to what has been a minor correction in the stock market. People have a hard time figuring out what they will do when things move down. We’ve had a great run in both stock values and real estate prices thanks to investors and hot money. This doesn’t do much for the cash strapped household that is now largely opting to rent. People do realize that renting is an option right? The crap shack peddlers seem to think that everyone is just itching to buy a $700,000 crap shack. Surveys of Millennials, the next group in line to buy houses in mass is largely reflecting a cooler attitude towards real estate. In most cases this attitude stems from the inability to afford a home. Keep in mind the homeownership rate has been trending lower for some time now and this is on the back of a raging bull market. What happens to housing if we have a correction in the stock market?

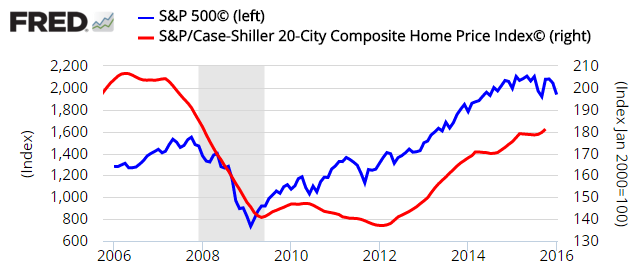

Stocks and real estate

If you look at headline economic figures things should be fantastic. First, the headline unemployment rate of 5 percent appears to be great. Then, you look at inflation figures and it seems like things are relatively low. Finally you look at stock and real estate values and they were on a tear up until last year in which they hit a wall (housing of course is poorly measured in the CPI figures but that is a separate story). This year stocks are off to a volatile start.

Contrary to what some will say, housing tends to follow the economy which tends to follow the stock market. In other words, real estate values do well if all other things are doing well. At least that seems to be the theory. Right now, the global one percent is doing well so it is no surprise that certain markets are doing exceptionally well despite local income metrics. But this argument is somewhat flawed when you look at hoods throughout California and see dramatic price increases. Something tells me Chinese investors are not pouring in bucket loads of cash into Compton or Pico Rivera for example yet home prices have seen a big uptrend in virtually all L.A. and OC cities. Heck, this applies to virtually every metro area around the country.

But let us take a look at this on a nationwide basis:

It is clear that some sort of correlation exists between stock values and real estate values. Stocks started their recent bull run in 2009. As you can see from the chart above, real estate values didn’t start moving up steadily until 2012. So there is a lag here. But what is interesting is the correction in stock values in 2008 matched up with real estate values. In fact, real estate values started trending lower before the market crash. Ultimately this chicken and egg argument matters little in the end result. At a certain point both will reflect a similar trend or what some would call a reversion to the mean. And right now we do seem to be seeing more volatility in markets: crashing oil, a strong US dollar, and a correction in stocks. Yet somehow, real estate should be immune and can only move up (except for when it crashes)?

The housing market is overvalued like stocks. It should be no surprise that the market is coming to this realization. By how much? Hard to say but there are few people that can shell out $1 million for a piece of crap stucco box. Sure, many Taco Tuesday baby boomers believe their home is “worth†whatever Zillow says it is worth and of course have a hard time envisioning anything less. This is a trick of psychology. But with real estate, prices are made at the margins. For example with low inventory, you might have a couple of homes for sale on a block. A few lower priced sales and all of a sudden all comps are impacted in the immediate area. The sword cuts both ways here when you use a tiny sample size on a largely illiquid asset class.

I have to rewind and talk about all the nonstop chatter of permanently high oil prices which ended dramatically in late 2014. Remember that? This wasn’t talk from some internet troll or drunk friend. These were predictions coming from supposedly credible analysts and experts. And then this happened:

Oil tanked and is now trading at $30 a barrel. The point being that inflection points are hard to spot. But what isn’t hard to spot is paying $700,000 for a piece of crap is going to give pause to many. Or if you are in San Francisco, paying $1 million for junk just so you can get some of that tasty tech induced action.   The market is definitely hitting a snag. A large portion of people have fully forgotten the last housing contraction. The options aren’t only to buy or leave the state. You can rent. Some younger folks are living at home. And of course in expensive areas the option has been to rent – in some cases by choice and in many other cases by economic necessity. And then of course you get the “well the all powerful Fed, government, fill in entity here will never let home values fall.â€Â Okay. So buy that crap shack. The reason there is still debate about this is that housing has turned into a speculative investment thanks to mega debt and large swaths of investors flooding the market. And when you have speculation you have booms and busts.

Housing values are not disconnected from the stock market or overall economy even though it seems tempting to believe that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

95 Responses to “Will the stock market impact housing values? Taking a look at stock trends and current home values.”

Looks like things are dropping all over, gas (petrol), stocks, etc.

Here we go again.

Right on. Oil was a huge clue given to use a year early. The rest is now falling into place. Bonds, Stocks, and Real Estate are the last to fall. But they will fall hard.

HOUSING TO TANK HARD NOW!

Are you happy now?

A little, but once the HARD steps up and it drops in half I will be much more happy

First the stock market, then jobs, then housing. Its going to be a big train wreck.

Actually the FIRST market to crash is ALWAYS the junk bond market.

And, yep, it’s already crashed.

If you EVER wanted to spot the end of a bull market — junk bonds always breakdown first.

The only thing keeping them up is actual CASH.

For they must pay out every six months — real cash. Hope does not cut it.

The folks holding such notes are ALWAYS quicker out the door. Junk bonds are almost only ever held/ managed/ traded professionally.

Pension funds

Bond funds

Hedge funds

That’s about it.

The general public that wants ‘in’ does so by way of bond funds.

Why?

The commissions charged on small lot investors are absolutely brutal — and should you need to sell — you’re robbed blind.

Plainly we are in a MAJOR bear market — across all asset classes — RBS is correct.

Younger folks will have a zero future, unless they are well heeled. Ones close to retirement will have to keep working till they drop off the planet, unless they have other income because it may be a long time before market goes up.. We went into bonds several years before his retirement, when 9/11 hit we switched all into gov. bonds from the S&P index which was the 401k. retired in 2004. Our blue chip stocks are hit.

Margin loans (loans using investment portfolios as collateral) is what was driving real estate prices on the Westside, Culver City-Palms-Mar Vista-Cheviot Hills, portions of Torrance, portions of Pasadena, Westchester and El Segundo.

The threshold for margins calls on margin loans used in real estate is typically between 10% to 20%. Any further decline in the stock market is going to start kicking in these margin calls. Margin loans of 2011 to 2015 have the potential to be the sub-prime loans of 2002 to 2007.

The Royal Bank of Scotland (RBS) said to run to the door (sell everything and convert it to cash) to be the first one out before all the other lemmings. Apparently there is massive over capacity thanks to our friends in Communist(did you forget that?) China. Did anybody look at the prepper sites? Remember a stopped clock is right two times a day. Lock and load.

“Lock and load” has bugged me since Basic Training. Sure, it sounds cool, but you load, and then lock (the bolt). Just sayin’.

Time has erased the original meaning.

“Lock” = the gun, the weapon itself … NOT a portion of the gun.

“Lock” was used to describe ANYTHING of (complex — any moving parts) metal manufacture. This was at a time when very, very, few folks owned anything manufactured out of metal — much beyond forks and knives. You would not believe how expensive even a nail was.

Flintlock meant a flint-gun.

“Load” = ammunition, generally.

When the term originated all loads were (black) powder and shot.

So the term — the expression — caught on when it meant:

Weapon & Ammunition.

Now you can spread the tale.

I think you’re onto something there. The saying is just more archaic than I thought. I’m well acquainted with the various “locks” in history as guns have fascinated me since age ten or so. Thanks.

“It is clear that some sort of correlation exists between stock values and real estate values. Stocks started their recent bull run in 2009.”

Massive money printing by the Fed started in 2009. That’s what drove up the stock market.

The real estate market followed with a lag after banks started withholding foreclosures.

This is all a game played by the banks, for the banks benefit.

It wasn’t just the Fed’s massive money printing that drove up the stock market. Its rise coincided neatly with a congressional hearing in which a certain congressman Kanjorski (hope I spelled that right) threatened an official of the FASB, federal accounting standards board, if he didn’t essentially let corporations do whatever they wanted with their books. All of Wall Street said, “Oh. We can say anything we want in our books? Then we made profits. We made big profits!”

And it was off to the races.

Clearly since the Dollar rose if you look at the charts the market has had a lot over hang but sales and prices are still going.

However, like every cycle, when people loose their jobs, that creates fresh new distress inventory into the cycle.

The Housing bubble was unique since it was debt on debt leverage and on non capacity owning debt.

This cycle doesn’t have that issue hence why if you look at the demand curve it’s been very weak.

Once LEI ( Leading Economic Indicator) fall with higher unemployment claims then you have a real trend recession data set that will impact housing.

Still all a function of the economic cycle.

A lot of recessions calls in 2015 where wrong but were based on the thesis that in the last 50 years when industrial production fell 1% we were in a traditional jobs loss recession but a lot of the economic drama is happening over seas

Keep on Keeping it Real Dr. HB.

Just don’t watch to reactionary perma-bulls on CNBC. Everyday is a buying opportunity somewhere in the equity market!

“We”re well off the lows!”

“Money on the sidelines ready to work”

“Buying opportunity”

“Record highs”

“Goldilocks Economy”

“Savvy investors snapping up bargains”

“Panic buying”

“Stocks surged at the close”

“Fresh New Highs!”

“Stay the course!”

I wonder, does the C in CNBC stands for Comedy? I pity the anchors, must be hard to keep a straight face some days. I wonder if often they drive to work thinking, can I participate in this farce another day? The few times I watch CNBC it’s only for laughs, for me it’s like a new episodes of Seinfeld.

The only downfall of thinking that rent is a simple option over buying an overpriced house in SoCal (or NorCal) is that rents are ridiculous. Along with those ridiculous rent prices in LA is the fact that there is no federal guideline stipulating that rent can only be 40% of income like a mortgage app. So there are people who are forced to move only to find out there rent is going to increase 100-200% and end up spending 50% of pretax income on rent with no tax benefit.

We had the luck of buying in 2010 and selling in July 2015 only to not be able to make the math work in the area we want to live in….so we rented. We struggled to find a decent house to rent (think wall heaters and painted shut windows in regards to SFH rentals) and we ended up in a nice condo paying more for rent than our previous mortgage.

So I sit here on the sidelines with a bunch of cash paying overpriced rent for a condo I do not like. I know and have already seen the market get soft and several of the local real estate agents are now fancying themselves as developers so I know the top is close.

I’ve been observing evidence of asking rents moving down and in some cases dipping below asking rents from one-two years prior. It can’t be explained away as seasonal since some examples have been vacant since Q1/Q2 of last year. This is on the popular west side of L.A.

The truth of the matter is that in these areas it is cheaper to rent on a monthly basis when comparing the lowest entry cost mortgage to rent, which is the closest relevant manner of comparison since entry cost to rent is a security deposit.

Rents can move two ways and the basis can be readjusted through renegotiation or moving to a different property. The price one pays for a house forms a permanent basis short of principal reduction.

The suggestion of 100-200% rent increases is pure hyperbole. The tax benefits conferred to mortgage holders is highly dependent on situation and with low rates/artificially capped property taxes in CA, net of the standard deduction it’s not a given advantage.

Painted shut windows? In the slums, I suppose or an extremely rare exception in any decent area. 50% pretax income spent on rent? Sounds like a budgeting problem.

The chart did’t go back far enough to see the correlation. Need to go back to 1995 which was the last bottom in real estate similar to 2012. I remembered the dot com crash of 2000. Stock crashed big time. They sold stock and rolled money over to real estate. Real estate price boomed big time from 2000-2006, double and triple in value. It happened in the past. Thus, you can have a bad year in stock and a great year in real estate. I think it’s possible for home prices to go up fast this year and surprise everyone. We don’t need to wait long. Should have confirmation by March this year.

It Starts: Tech Trouble Mucks up Silicon Valley Real Estate Party

http://wolfstreet.com/2016/01/03/it-starts-tech-trouble-mucks-up-silicon-valley-real-estate-party/

Are we seeing another tech bubble (and by extension, real estate) ready to burst in SV? It is starting to look ominous…

Will high flying real estate markets experience a correction, yes, and some stats indicate it has begun in some of So. Cal. and perhaps the Bay area as well. I still stick to the location, location, location, theory, and the notion buy the worst house in the best neighborhood … these location will correct also, but prices are likely to come back if the owner/investor has the patience and financial resources to wait it out. However, so much of this latest housing frenzy has been ‘crap shack’ homes selling for ridiculous prices per square foot in questionable neighborhoods. Unless those neighborhoods are in full gentrification mode, I think there will be a lot of financial pain for those investors/buyers! The jury is also still out for the Chinese. Their flying-high economy favored them purchasing American real estate, but with recent economic realities in China, that could change. The biggest potential problem in California, and the biggest unknown, is the socio-political culture of the State. Personally, it appears that the over-regulated and over-taxed structure is designed for the monied/privileged in California to feel-good, at the expense of a large majority of plain working or struggling folks, who could use a break on things even as simple as the price of gasoline, housing, etc.! Eventually, this imbalance will have to either be dealt with or it will catch up with the large cities in California and may have negative impacts on housing and even the desirability of the place!

Sorry, meant to say …that the over-regulated and over-taxed structure is designed for the monied/privileged in California to feel-good about their social and environmental conscious, at the expense of a large majority of plain working or struggling folks …

Cali is truly f*ked. Even though I moved almost a decade ago out of there (and as a native), it still pisses me off what has been done and what is on the horizon. You either are in the elite that screw everyone else over with no concerns, or you are in the elite but don’t realize the effects (and don’t understand much – like hollywood, or Silly valley folks not understanding anything outside of tech) or you’re basically like the gimp in pulp fiction. At some point the entire state may morph into a penal colony.

I guess they expect Asian money to buy this remotely. There is no yard and no privacy. The house sits on a triangle with heavy trafficked streets on either side. Crazy sign of an overheated market. This lot had an empty broken down house on it for years.

Website, http://www.houseofviews.com/home.html

Google street view, https://www.google.com/maps/@34.0695311,-118.3645986,3a,37.5y,70.06h,80.98t/data=!3m6!1e1!3m4!1sKKMtGgLduyik4S6FRMWbpg!2e0!7i13312!8i6656!6m1!1e1

This place is right by us. Drive by it everyday. They’ve taken forever building it. Think the delays will end up costing them.

Does it make any sense to you to build that type of house there? Or am I missing something? Notice on the website it’s all about the views BUT no street views. I’ve driven by that triangle many time and have thought it truly crappy place for a house. It’s like being on a small island with no beach and sharks swimming around it all day long. IMO

Wow. that is the worst website I have seen in about a decade

According to the site: “This Site is Designed to be Correctly Displayed on a Computer Screen. Many of the pics and the formatting are too wide to be displayed properly on your Smart Phone. At your earliest Opportunity, Please do yourself a Favor and Re-visit the Site at Home from the Comfort of your Widescreen Monitor, and There you will see the Displayed Results are Truly Night and Day. Enjoy and we look forward to Hearing From You.â€

Not sure what the deal is with the random capitalization of words.

The problem couldn’t possibly be that it’s a sh*tty website, oh no. The problem is people’s phones (even though many people’s phones have resolutions equal or greater to a typical 1920×1080 computer monitor).

There has been a correlation between stock prices and the rental market here in Norcal. I have been watching intently due to the fact that I refuse to buy an overvalued home. Within the last two months rents have dropped about 50 dollars cheaper due to housing prices dropping thousands of dollars. The rental prices that peaked in November are finally starting to drop. Overpriced rentals have been sitting for 60 days and the brain dead agents are finally dropping prices to attract more interest. About time!

I did a rent price sanity check in the Castro area of S.F. back when Doc posted about it. The asking rent decreases were showing up in a very similar fashion to how they are down in L.A. So much for the meme that rents are headed for the moon.

The Treasury Dept. is finally trying to find out who is laundering money through high-end luxury real estate in the USA with all-cash bids.

http://www.zerohedge.com/news/2016-01-13/end-luxury-housing-boom-us-treasury-launches-crack-down-secret-buyers-luxury-real-es

I just heard about this on the radio. It’s a good sign. The US government can give info to the Chinese one, and work together to catch crooks. Maybe get INTERPOL involved too.

It’s impossible to “launder” money via all cash purchases of real property.

The funds had to be ALREADY laundered to effect the deal.

This confusing ‘project’ appears to be a tit-for-tat — as the only folks it could favor would be those deep thinkers running the show over in Beijing.

The players selling to such investors// speculators // what-ever can only come away much poorer by frustrating such trades.

IIRC one of the main gambits of this administration has been to eliminate privacy — especially financial privacy — on a global basis.

So Washington has really put the screws to Switzerland and all the rest.

I could see changes and adjustments in February. We should see price declines in March for rents and for housing… and some layoffs

It’s been bad for a while, but before it gets better it had to get worse. These passed 6 months have been the absolute peak. with China losing stock and currency values, plus the oil plunge to $30… there is no way the prices for rents and housing don’t go down. Wait till the companies start restructuring and forecasting go announce LAYOFFS.

Stay strong… This cycles never last forever… don’t trapped in desperation.

Look at this… if you don’t pay your rent for 2 months the police is quick to EVICT you. But if you buy with 0% down… the foreclosure process to kick you could be years specially in California..

http://www.nydailynews.com/news/crime/pa-girl-12-killed-dad-points-rifle-constable-article-1.2494633

I guess is better to buy overprice POS house… than rent… home owner protection will keep you in you house for at least 6 months or more.

Wimpy Police offices are to quick to draw fire…

In New York City, rent control/tenant protection laws allow tenants to stay rent-free in apartments for AT LEAST six month, sometimes longer. It’s common for tenants, during n eviction proceedings, to get many “continuances” from a court while they delay and drag on the legal process.

Hell when I lost everything in the crash I had to be out of my place in *3 days*.

Slightly off-topic from today’s post, but this article is so interesting I thought it would be worth a post.

The Treasury Dept is trying to find out who is laundering money through high-end luxury real estate in the USA with all-cash bids.

http://www.zerohedge.com/news/2016-01-13/end-luxury-housing-boom-us-treasury-launches-crack-down-secret-buyers-luxury-real-es

I have always wondered about this loophole.

Even though the article focuses on *very* high end real estate in New York and Florida, it would seem to me that the same principles would apply here in the O.C.

For many years, I have kept an pretty good eye on the real estate comings and goings in places like Turtle Rock, Shady and Corona Del Mar.

To me, their sure seems to be a lot of expensive empty houses.

Hardly scientific, and based on no data except my own observations, but nevertheless.

Question for those close to the real estate finance world:

Is there any reason, either legal or practical, that someone couldn’t literally show up at escrow with a cardboard box full of $100 bills?

Can anyone cite any reason why any escrow service would not accept actual cash money?

Wholly impractical at every level.

Though Carlton Sheets DID mention that he loved bringing briefcases full of cash to his deals… sometimes.

1) The escrow firm is required to notify the IRS.

2) Getting the bills out of your bank is a hassle — most bank branches will simply not do it. — You’ll have to go down town — or pay for armed delivery service.

You find these restrictions in the fine print — of every financial institution in this nation.

Bankers actually hate cash. It a PITA.

They love plastic — and digital money.

It’s IMPOSSIBLE to launder money by purchasing real property.

The funds needed to be laundered already to seal the deal.

Money is normally best laundered via fake bank loans or by rapid account transfers.

The Red Chinese permitted funds to two-step out of China via account transfers through Hong Kong.

With no muss nor fuss billions shot through that door.

THAT’S how it’s done.

Crazy real estate purchases really reflect the need to PARK the wealth — and to establish a bolt-hole for fleeing Red Chinese.

( Communists, of course. ONLY Party members have the clout and guile to shunt such huge funds out that police state. Signing on to the Party — in Red China — is obligatory if you expect to run a major enterprise. )

The funds are — invariably — corrupt. It’s the way of the world in ALL one-party-states.

The reason why the Chinese currency is soft — is because everyone on top is in a panic.

Orientals just don’t have ‘soft’ landings.

They auger in — like the Tokyo leadership clique circa 1945.

It doesn’t matter who one might point to — no Oriental culture is without the requirement to “not lose face.”

This translates in to decision paralysis.

No better example of such being the Fukushima tsunami.

Even though the plant operators had been VAULTED eight feet into the air — thence to fall to Earth — the entire staff stood frozen at the controls. They knew for a certainty that a monster tsunami was headed straight for them. They were sited on the ‘tsunami coast.’

Yet, they didn’t do a thing — but watch the automated systems kicking in.

The proto-typical American would’ve would’ve operated without group consensus — and terminally shut down the 39.8 year old reactor — which was scheduled — for decades — to be shut down for all time a mere sixty-days away.

( The operators needed to vent the reactor down to zero pressure PDQ. The steam erupting from a boiling water reactor is virtually non-radioactive. (!)

( Yet, the operators kept the cork in that bottle.

( Yes, the single most troubled reactor was an economically dead asset — not worth a thin dime when the tsunami arrived. That observation should’ve taken five-seconds to figure out.

The same — super delayed — response has been witnessed during the epic bust of the Red Chinese stock market. They couldn’t have done anything worse than terrify the professionals — so they did so.

It’s a fair bet that when the dust settles, Red China will have passed through a civil war and a revolution.

I live near China Town in Oakland (yes there is one).

I’ve often wondered lately if all the Chinese/sushi/flower shops etc. That are pretty much empty all day and night. If these are simply fronts for someone in mainland China to launder money into the US.

Some of the nicer restaurants are filled or even have lines. Same for the meat markets. But there is at least a couple dozen places with no menu posted on the front door, and 1 or 2 employees milling around empty tables reading the newspaper. They get no business and have been open years and years…no change in ownership it appears…nothing. Yet there are dozens of the other small restaurants on the same block that go out of biz and re-open as something else.

Same with the foot reflexology places…WTF is that..for real.

These places are in downtown Oakland, walking distance between the 12th St BART station and Lake Merritt…prime real estate in a rapidly up and coming area. The rents can’t be cheap.

We walked by one on Tuesday night to go to place on 7th and Washington St. that is Korean BBQ…..I was telling my girlfriend about this and she agrees it’s crazy that they zero customers…EVER….so we’re gonna order take out sometime just to see if they will even make it.

I think you’re onto something East Bay. Chinese food place I notice always open, always empty. Other places come and go, tough business to be in. I’ve been in it once in past decade, nothing special but I’m not sure how they’re making ends meet, except for lunch time traffic, but yet they remain open until late at night, and this is a very small population.

Interesting about how Fukushima was mishandled. I have seen the “saving face” thing up close and its laughable. I have also seen “high picked” situations up close and you are right, typically with Americans, someone will see what’s going on, realize what needs doing, and lead. This is not necessarily the highest ranking person. Just someone who sizes up the situation and calls out “We gotta do this!” and then the rest, or enough of the rest, spring into action too.

I meant “HIGH PUCKER”.

Well, now, my comment didn’t even get posted so I’ll just leave you all to wonder what the fuck “HIGH PUCKER” is all about.

God I hate the modern internet.

Why did you post this twice, under two different handles?

It’s obvious that you and zigzag are the same person. Not only did you post the same link twice, but your wording is nearly identical in both posts:

zigzag: The Treasury Dept. is finally trying to find out who is laundering money through high-end luxury real estate in the USA with all-cash bids.

octal77: The Treasury Dept is trying to find out who is laundering money through high-end luxury real estate in the USA with all-cash bids.

Are you associated with the website?

Nice catch Son.

He posted under another handle because he is not Zigzag

Son of Landlord

No relation to zigzag.

Murphy at his finest:

Different handles.

Copied/pasted 1st couple of lines as a place holder in reply while I read the article and then forgot to delete. That’s what happens when your eating lunch, reading Dr. HBB and trying to get real work done at the office.

Great stuff as always Doc. Next few years are going to be interesting!!

http://www.marketwatch.com/story/feds-target-anonymous-all-cash-buyers-of-high-end-nyc-miami-real-estate-2016-01-13?dist=afterbell

Interesting, maybe this is the year the financial systems collapse!

The FED and the media were telling us that if the stock market goes up it doesn’t help only the super rich but everyone because of the wealth effect. People feel more optimistic and buy more houses. That means that now, with the stock market going down the housing market goes down. However, nobody in MSM is saying that???!!! How come? The trickle down goes only one way?

Don’t worry! The FED has the average US citizen back – that is to push him over the cliff.

Yesterday in a historic vote to audit the FED every american saw if their senators or representatives voted for their constituents or for the banking cabal. Coming this November, each one doesn’t have any excuse to vote for the same ones who voted against FED auditing. How they voted is public information.

1800-1826 area will end the sell off, it is just testing dip buyers right now….

very coordinated walk down by algos and bots….look at the VIX today, it would be flying if more fear…

but housing is still going to correct..stock market crash or not…..the balance of qualified buyers whom can buy homes based on real underwriting guidelines is now becoming one sided…to the low side

I’m repeating the argument made here many months ago:

0-care THROTTLES the growth of the money supply.

Hence, it’s insanely deflationary… across ALL asset classes.

Forget about the bills in your wallet.

Most of the money in circulation exists as digital bits.

It gets called into existence when a mortgage is let.

Barry has un-FDR’d the economy.

So everything FDR put in to place is now headed reverse.

Even the punditry have YET to figure out how deflationary 0-care is.

To see how S L O W Wall Street can be — watch “The Big Short.”

Blert,

For the most part I agree with you. Regarding the effect of Ocare on the economy and money supply you are spot on – I agree 100%.

While you think they are idiots and can not understand cause and effect, I agree on that only in respect to the liberals who voted for it. In regard to the wall street who pushed for it, I don’t believe that they are idiots. The top heads there might be EVIL but not idiots. They are self serving reptilians.

I think they understood the consequences on the economy way before it was up for vote. I strongly believe they did it on purpose knowing full well the consequences. That would give them justification for a new QE.

Every time they crash the economy, the poor and the middle class lose wealth one way or another. Every time they do QE, the super rich (0.01%) get even richer. The consequences of each QE are always supported by the serfs. That is why I think they are not stupid, just evil.

I always said that they will not raise the rates, or if they will, it will be 0.25 and back to NIRP and/or QE. Based on the new developments, I still believe I was right.

I agree with both of you guys, too bad this site won’t let me post anything of any length. We need another FDR!

A drop in the Dow from 18,000 in October to 16,000 today; I wouldn’t call that a minor correction especially when the FANGS are pretty much the only reason it hasn’t dropped even more. When equities can be faked for a lot of reasons (and have been no doubt with seven years of ZIRP), I don’t know how anything having to do with stocks could provide an accurate or useful comparison. Maybe they do or maybe nowadays there’s no correlation with all the fakery. Would things that can’t be faked like commodities, energy, shipping rates be better indicators? Just askin’.

Renting isn’t such a desirable option. In 2013 I did the calculations and projections and decided renting was the way to go if I wanted to stay in Los Angeles anywhere West of the 405.

First house I rented, after 8 months the homeowner died and his kids sold the house, second house the owner just changed his mind the next year and decided to sell. Neither home was worth what it sold for. I ended up buying one I could afford, in a much less desirable but decent neighborhood.

I simply couldn’t bear the stress (and expense) of moving every year.

Buying here for investment may be stupid, but when you need a place to live and have no intention of leaving this city, the extra cost to buy is worth it for the peace of mind of knowing where you’re gonna live next year.

People say I was “stupid” to buy in 2015, but I can afford the mortgage (fixed) and I sleep way better now than for those past 2 years of wondering whether the rent would go up or I’d have to move. Hated renting. Plus neighbors treat you way nicer when you’re an owner. Just sharing my observation and experience.

Here, in the beginning of 2016, rents are trending down both west and east of the 405. Sleep need not be affected.

Rents go up and rents go down allowing the consumer to readjust as conditions on the ground change. The cost basis formed when one purchases a house will never go down, with the exception of principal reduction, an extremely unlikely possibility. The basis is forever carried forward. Timing matters.

Additionally, costs of buying are not fixed. Taxes, insurance, maintenance, repair, and replacement costs are subject to the same economy which informs the rent price level.

Unexpected move events come up for renters and homeowners alike. Ask the folks in Porter Ranch how that goes. Or perhaps the person who gets the neighbors from hell moving in next door. Those are just two examples of many.

It cuts both ways. The stress of worry over something such as foreclosure arguably has nothing on finding another rental, but we wouldn’t expect any experienced first time buyer of recent vintage to have much perspective on that.

All that has been done is the exchange of one risk set for another, so the aggregate potential for worry is relatively unchanged.

Well said, HC. Good critical thinking. If we would have 75% of the population with that type of critical thinking the politicians would have a hard time brainwashing the population. Most people just go based on emotions.

maybe we should be more concern about this.

http://allnewspipeline.com/Surprise_Surprise_Did_You_Know.php

Does this affect the credit unions as well? Yikes, now I am starting to get anxious…

do you believe in that stuff…FDIC is still in play….

be more worried about what the elitists are doing to the economy than some right wing stuff….

That’s OLD NEWS.

The key take away for Americans: the FDIC has their back.

Yet, the FDIC is rather like the old AIG and the ‘monolines’ bond insurers. (MBIC AMBAC et.al.

They don’t remotely have the assets to take systemic punishment.

&&&&&&&

Most modern money is nothing more, nothing less, than the debts of other Americans.

That’s what’s backing up the US dollar.

If you implode enough pocketbooks, then the backing for the national currency begins to shudder.

Something like this is seen — in Japan.

It’s (government) accounts have reach preposterous levels.

All politicians are SPENDING ADDICTS.

When the world transitioned to universal fiat currencies — it set the political class — and its cronies — free to loot the economy… GLOBALLY.

So we’re in that horrific situation where we’re all invested everywhere.

This also goes a LONG way towards explaining our bizarro foreign policy suite.

Barry Soetoro has got America for and against virtually every nation on the planet.

Hence, NO-ONE can figure out whether they are friend or foe.

A bitten hand is more tender than a kiss… so … stepwise … everyone has shifted over to hostility.

Everyone is waiting to see the end of Soetoro.

Fingers crossed.

In the meantime, the President lives IN a bubble — while his policies engender financial bubbles — everywhere.

Because the ENTIRE planet is fulcrumed atop the US dollar.

Yes, we’re still living in a uni-polar world.

Which the President is mightily trying to end.

In my opinion, we are headed for an inflationary recession. Prices on food and housing will rise and so will unemployment. This has happened before, in the early 1970s. It will happen again and everyone will be shocked when they watch food, rent, health care, education, and housing prices rise while people look for jobs. Happens all the time in third world countries.

Hasn’t that already happened for the most part? Unemployment may be arguable, but the pay and benefits have been significantly cut.

Almost feels like the same scenario. First it was stagflation in the 70’s and the prices went up while interest rates went up to what 18%? We seem to be starting that process now, but who knows if it will play out that way. It appears the next crash/recovery has a whole new set of issues behind it. The question is trying to figure what will it be this time. Last one was Credit crisis. This feels more like dollar/debt crisis.

Homerun,

You can not compare the current situation with the good old days of 70s. Back then US was a creditor, it had a large % of global GDP and strong industry/manufacturing. Most families (the nucleus of any society) were stable (there are always exceptions) helping to form a stable society. There were not such big inequality of income and wealth between the 0.01% and the rest. The population was more homogenious than today, which means more society cohesion. Back then the % debt of GDP was way smaller than today. The government liabilities were nowhere near what they are today. There were no derivatives in the financial sector and there are over 555 Trillions today.

These days, none of that is present. The risk today for a bigger depression than the first one is way greater. Same for financial or societal collapse.

inflation without wage growth equals no Housing growth….right now mirrors are propping the markets up…

better look into rail traffic, treasury deposit receipts and the whole bond spectrum dislocation…

Once the cheap oil works through the economy, they won’t be able to hide it anymore. My cable, water and electric bills are up 25 percent since 2009.

I stopped off at a McDonald’s today for an Egg mcmuffin for the first time in years, 4.19 before tax!

Great article! And it depends on whether The Fed enters the financial market to bail out stockholders … again! https://confoundedinterest.wordpress.com/2016/01/14/will-us-home-prices-fall-if-stock-market-continues-to-decline/

First the FED needs to bailout the oil industry. Just like they did the bankers, wall street, and Home Builders in 2009.

China just put a floor of $40 on oil. Not sure how that works but the refineries have to the state oil companies $40 a barrel.

The stock market was the only place to get a return. TINA. Now not so much. Cash is safe, for now. But offers a negative real return with inflation considered. That leaves housing, guns and food.

For a while it seemed share values and house prices were disconnected from the economy. Things may be slowly catching up. You still have a very naive home buying class that is so prevalent it is self-reinforcing the delusion. Couple that with FTBs who were not in the market during the crash so will have little recollection of what it was about. It’s a pity the Big Short focused so much on shorting the bust rather than the underlying causes.

Thank you, Doc, for the insightful post. Real estate goes hand in hand with the equity market. Now, there are banks that won’t accept small-cap stocks as collateral. Those banks who did so will suffer greatly in this current market because paper money are evaporating fast.

I can’t imagine any bank ever accepting small cap stocks as collateral, for they are not accepted as collateral for margin loans at brokerages, and brokerage firms holding them in their inventory must “haircut” their value 50% or more when calculating the firm’s net capital. I also believe that banks are not permitted to allow the full value of even listed, large cap stocks as collateral for a margin.

The Financial Crimes Enforcement Network (FinCEN) announced that it will temporarily require U.S. title insurance companies to identify the people behind companies used to pay for high-end residential properties in all-cash deals.

http://www.mansionglobal.com/articles/18195-high-end-home-buyers-will-find-it-harder-to-remain-hidden?link=TDheadline_2

Cost of renting in LA, LA, LAnd. the hits keep on coming:

Tenants may be required to pay up to 50% of landlords earthquake reinforcement costs.

http://laist.com/2016/01/14/landlords_now_allowed_to_increase_r.php

excerpt

“…The L.A. City Council voted to allow landlords pass on exactly one half of the costs associated with seismically retrofitting a potentially unsafe building to their tenants.

The decision came on Wednesday after a year of savage debates before the city between tenants unions and landlords. Tenants argue building owners should be responsible for their own property’s upkeep, including seismic retrofits. Landlords argue tenants should be liable because retrofitting is, well, expensive!…”

The increase to tenants rent is capped at $38 a month and may apply to 15,000 buildings in LA. I don’t think it’s a game changer by any means.

This is a total nothingburger… $38/mo the landlord will be allowed to pass along as an increase which only matters to the minority of rent-subsidized and rent control beneficiaries since everyone else is always subject to rent increases. There won’t be anything “required” about it since tenants can simply not re-up their lease and move to a non-affected property. It’s even less meaningful against the backdrop of asking rents trending down in L.A. by more than $38/mo.

West Adams named: LA’s Neighborhood of the Year.

http://la.curbed.com/archives/2016/01/los_angeles_west_adams_neighborhood_guide.php

Makes me wonder if the author of this article has spent any real time in West Adams. I owned property there up until very recently and will say that it is not a place you want to be after dark. In fact I don’t think it’s a place you want to be during most daylight hours either. There are some nice craftsman homes in West Adams, but generally the whole area is neglected, dirty, gang-infested, and overall is ghetto and gross. I lost count of how many times I saw some wackjob walking into oncoming traffic on Adams in their pajamas in the middle of the day. Or homeless people lying on the curb with their junk out at the local gas station. I feel sorry for anyone paying 500K+ to live in this environment.

Inglewood won last year. LOL

I have a friend who lives in that neighborhood and each rare occasion I end up visiting there is always some ghetto BS to deal with. Last time a couple months back, there were dudes on pocket bikes running up on sidewalks and in through traffic creating a mini mayhem. No craftsman house is worth dealing with that sort of stuff for who knows how many years. By the time it may truly change over to a decent neighborhood, you’ve been through the ringer and a new phase in life is signaling time to move on anyway.

IIRC, aren’t most if not all of the neighborhoods in the running for curbed’s contest ghetto or ghettoish?

It never ceases to amaze me how certain trend followers get such a hard on over the idea of these crappy areas transforming thanks to the increasing presence of more people like them.

I’ve actually seen those pocket-bike boys on more then one occasion. No helmets, wearing shorts and wife-beaters driving super loud little illegal motorbikes on the streets amongst traffic. I actually came inches from hitting one once when they jumped off a curb on Adam and into the street. The local police could care less. I actually had to call the police after someone vandalized a property I owned in Went Adams. The police actually told me they were too busy to come out and take a report, and said if I still wanted them to come out I should call back tomorrow and maybe they could send someone by. I remember a few years ago when I was chatting with some cops at the Ralph’s between Pico & Venice near San Vicente. The police actually told me then that anyone living in West Adams should own a safe and a gun.

Hotel, that last line “It never ceases to amaze…”: pure poetry.

http://www.cnbc.com/2016/01/15/a-recession-worse-than-2008-is-coming-commentary.html

According to the author, the huge debt bubble that underpinned both the stock and real estate markets is going come undone in a huge way soon…

Also from the article:

“Therefore, despite record low mortgage rates, first-time homebuyers can no longer afford to make the down payment. And without first-time home buyers, existing home owners can’t move up.”

Housing will go down in price EVERYWHERE. Rent will go down as soon as the 1st round of layoff start. Yahoo, will start with 10% of workforce. a lot of internet jobs will go poof.

Silicon Beach and Silicon Valley are not safe either.

I expect down numbers by this June.

The downward movement in asking rent has already begun in L.A. and there is a very small subset of examples where contracted rent appears lower than it was one-two years prior. Looks like the party is just getting started, or ended.

http://www.cnbc.com/2016/01/15/not-just-oil-and-china-tech-is-falling-apart.html

More and more bad news 🙁

The millennial generation will only benefit from a major crash or correction for two reasons:

1. Most don’t really own anything other than debt.

2. Things will become cheaper/affordable.

3. With no jobs it will be free healthcare for everyone!

When Cruz becomes President, he will get on his high horse and drive those New Yorker values out of town. Get along little doggies.

It wasn’t too long ago that we had clowns on CNBatGuano telling us how “unambiguously good” falling oil prices were for the U.S. consumer. The shills in DC are telling us that if you are going to talk about facts and statistics then you must be “peddling fiction” because the U.S. economy is not declining. It’s just your imagination. LOL!

After watching the ‘Big Short’ it should be painfully obvious to anyone with eyes, ears and a brain that we have learned absolutely nothing in the last 7 years other than how to let crooks and liars take control of our economic policy and banking system. I have been talking about the next shoe to drop here in Houston for several months. The drop in oil prices was just the first signal that end-user demand is cratering and the “recovery” was nothing but the Fed’s work of fiction. When that paper wealth in the stock market begins to evaporate, as it already appears to be doing, real estate prices will fall again. Here in the Bayou City, it is already happening.

http://aaronlayman.com/2016/01/mortgage-rates-drop-as-recovery-drowns-in-the-sea-of-central-bank-market-manipulations/

Wasn’t low yield from bonds, or stocks or whatever what drove blackstone, et al. to buy up real estate in bulk and use it as an investment? Why wouldn’t a falling stock market, drive people to sell stocks and hide their money in real estate (which would of course drive up real estate prices)?

It’s still really easy to get a mortgage and it will stay that way. So the only thing that will affect house buying/flipping is a recession and job losses, both of which are happening now. Foreign buyers such as the Chinese are still int he market as well.

I need advice, our rent is recasting, meaning it will go up $300 and we will have to eat it, basically cut back on food. Family of 5. Here is the the challenge, should we buy a home to “insulate us from rising rents”? We are in Northern ca, fairly far north so it’s not the bay area, employment is steady but the purchase will put us on a wire, but we need to do something before prices continue to rise and rates go up…..that’s what the RE’s are saying, but are they correct, What would you all do? 3% down, pay less upfront, hope the house goes up and refinance out of the PMI someday? Wait it out, or “risk it out”? I really need some SMART advice, because I have one shot. Wait or just throw it all down and secure a home at this price? Thanks

This really caught my attention when I read the article…..

And then this happened:

crude oil

Leave a Reply