5 reasons why falling home prices will be good for the economy – Higher homes values does not mean higher home equity, financial sector profits back up to 30 percent of all corporate profits, the mortgage debt equation.

A recent report shows that 11 million homeowners with a mortgage are underwater with a deep red line item on their household budget. Add into the mix those with less than 5 percent equity and we realize that 28 percent of all “homeowners†are either in a negative equity position or teetering close to it. States like California have negative equity rates of 33 percent thanks to the growth of highly questionable mortgage products. Yet California looks like a saint when compared to Nevada with an underwater rate of 68 percent! If we want to examine the core premise of the debate surrounding the bailouts, it is that higher home values by default are good for the economy. I would argue that having high home values as a mission is misguided if that is the only goal we are seeking (and that is basically what we have been doing for the last few years). In fact, the majority of Americans would benefit from lower home prices. A market with higher home values is only beneficial if incomes and the economy move along in synchronization. Popping the last few balloons of the housing bubble is a good thing for most. Let us examine five reasons why falling home prices will be a good thing for the economy moving forward.

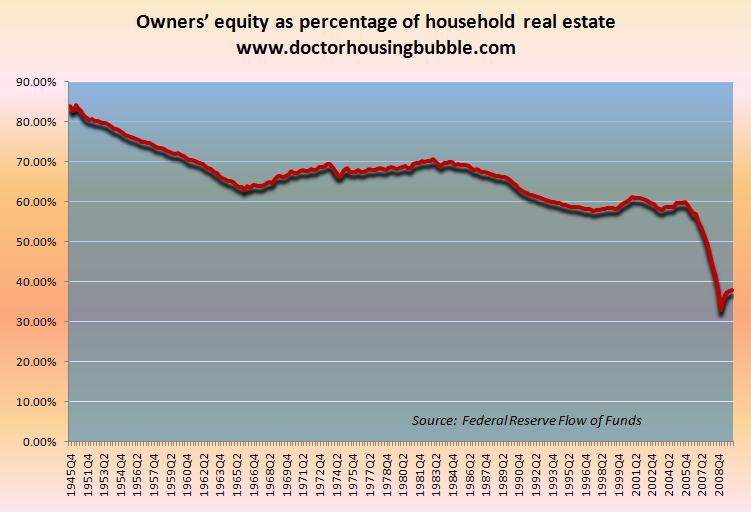

Reason #1 – As real estate values inflated actual owners’ equity plummeted

The above chart is of paramount importance in understanding the housing bubble. For fifty solid years, homeowners had at least 50 percent equity in their homes nationwide. It is fascinating that during the biggest jump in housing values that actual equity collapsed.  What happened? Low to nothing down toxic mortgages funneled by Wall Street and the invention of the home equity ATM. If we slice the above chart into a smaller timeframe and only look at the last decade, we see this insidious trend:

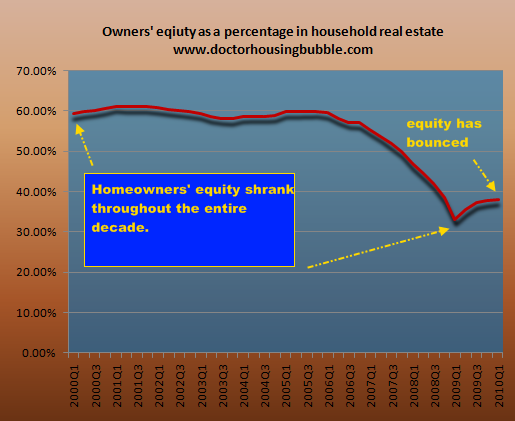

This chart pinpoints the last decade of growth for our economy. To sum up what happened, as the middle class struggled to gain any advantage in actual wages the home became the one-stop shop for consumer spending. Why save $500 a month when you can yank out that much money from your home equity and keep spending going? Of course the problem with this is that it is unsupportable and now the taxpayer is footing the bill. But as we will show later, the burden of the recession has fallen disproportionately on the shoulders of the working and middle class while banks have shielded themselves from the worst parts of the recession.

Why the recent increase in homeowners’ equity? This is good news right? Not exactly. The recent bump that you see is due to people losing their homes through foreclosure. For example, say a subprime borrower bought a home in an area with low incomes for $400,000. The home is now valued at $200,000. If the borrower is current, this is a drag of $200,000 on the equity chart. After foreclosure, a figure of zero actually helps the bigger mortgage pie. So expect this figure to increase in the short-term as foreclosures remain elevated.

Reason#2 – Real estate should not be the primary driver of the economy

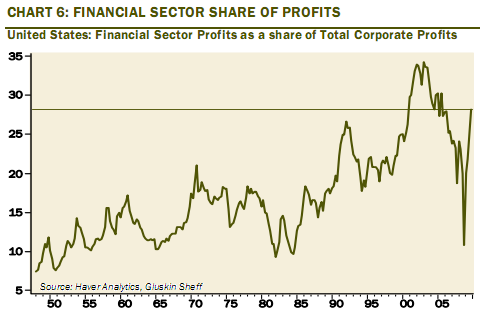

Financial sector profits are back to near record levels:

Source:Â Gluskin Sheff

It is interesting to note that back in the 1950s when Americans had their highest levels of owners’ equity, the financial sector was less than 10 percent of all total corporate profits. Today, it is back up reaching nearly 30 percent. Real estate and the financial sector is now a drag on the overall economy. Finance and capital allocation should be on creating and producing real value in the real economy. Today with no actual changes to Wall Street, we have days with flash crashes that erase trillions of dollars in wealth for most but actually make billions for a select handful of banks. The profit is now in speculating on the biggest casino on Earth. For the last decade, real estate was the hub of this speculation. Today, it is a matter of chasing the latest algorithm and trying to beat other hedge funds to the latest calculation that can rob wealth from the real economy.

If you look at the above chart, we seemed to do well with bread and butter 30 year fixed rate mortgages. For the large part of 50 years we required people to put down 20 percent to purchase a home. That seemed to work and actually provided the biggest net worth boost to individual households and ushered in the largest middle class the world has ever seen. The latest gimmicks and mortgages seem to be only helping one tiny sector of the economy.

Any time you allow easy access to debt, expect to see massive inflation in prices. We have seen this with the auto industry, college tuition, and with of course housing. When you give people the ability to borrow whatever they like, many will do it. Some will argue that this is a question of personal responsibility. I agree. But the propaganda that banks won’t tell you is that they are gambling with taxpayer money. If banks wanted to lend someone $20,000 a year with no income so they can go to a paper mill institution, so be it if the money comes from their capital pool. But the money is largely taxpayer backed. They are funneling taxpayer backed loans into this market so care not if the loan defaults. The magicians of our time are the banks.

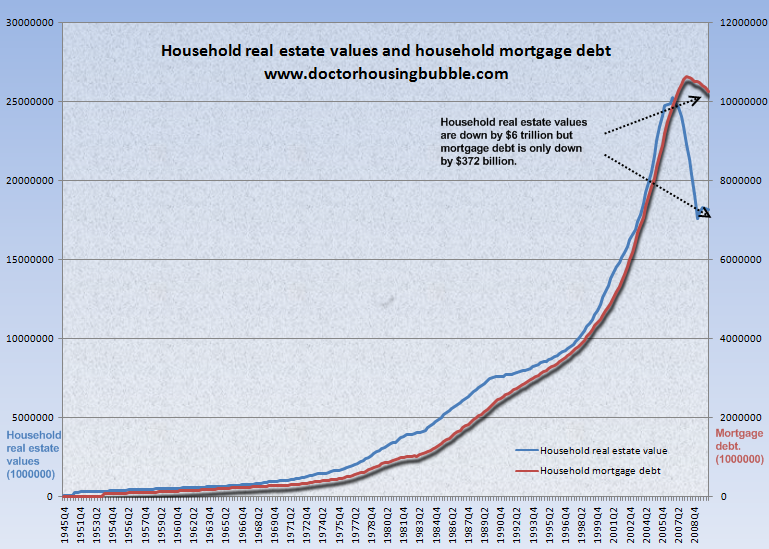

Reason #3 – The brunt of the recession has been shouldered by households

The above chart highlights the inequality in the bailouts. The biggest line item for household net worth is residential real estate values. Households in the U.S. have lost over $6 trillion in real estate values since the bubble popped. Interestingly enough, mortgage debt has only fallen by $372 billion. Banks are able to suspend reality and avoid using mark to market accounting so they can continue to gamble on Wall Street. Most typical American families have to contend with actual market values. The massive amount of toxic mortgages still out there is astounding yet banks continue to pretend that things are fine. What this does is stunts the actual clearing ability of the market. Japanese banks did this for decades and how did that turn out?

Home values are going down because Americans are now dealing with more normal market factors. We are now looking at incomes (at least at a more modest level) and as it turns out, the economy is not healthy. We are now looking at debt through a microscope and as it turns out, many households are maxed out. So lower home values are good for those looking to buy. The only way home values can remain high is if the government and Wall Street keep pretending that bubble values actually had some fundamental reason to be so high. Ironically agencies like the FHA which have a core mission to help fund affordable housing are actually the main tool in the market today keeping home prices inflated. I mean how can this agency say they stand for affordable housing when they are backing loans up to $729,250 in value?

Reason #4 – Not everyone benefits from a housing bubble

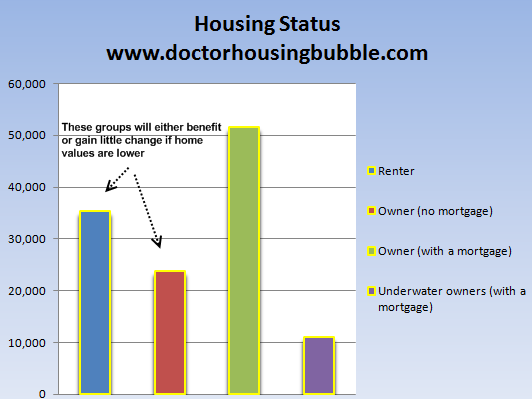

The brutal reality is that falling home values will actually help many out in the current market:

If you combine those who are renters and those who have zero mortgage debt, these two groups would make up the majority of households in the U.S. Renters will definitely benefit because they can purchase homes at a lower price without going into incredible amounts of debt. Instead of blowing a large part of their income on the mortgage, they can use freed up disposable income to actually spend in the real economy. Who wins when someone is funneling 50, 60, or even 70 percent of their income into a home?

Those who have paid off their house win either way. If home prices fall, they will get less for their home but at the same time, other home prices will fall so they can purchase a home at an adjusted level. Many of these people are not looking to move so either way it is a moot point. The only people that are obsessed with home values are those who are now real estate speculators.

28 percent of households with a mortgage are either underwater or near negative equity. It is hard to call this group homeowners. For many, the only way out is for home values to surge. Yet many jumped in with low down payment mortgages so they have a big incentive to walk away. With a glut of rental housing, many would win simply by walking away, fixing their credit, and buying a home in a few years if they are able to meet stricter lending requirements (we can hope this plays out for the sake of our economy). If you think about it, the only big loser here is the banks holding the mortgages. Now you understand why the entire focus of the bailouts has been on banks. Strip the layers of the onion back and follow the stinking money.

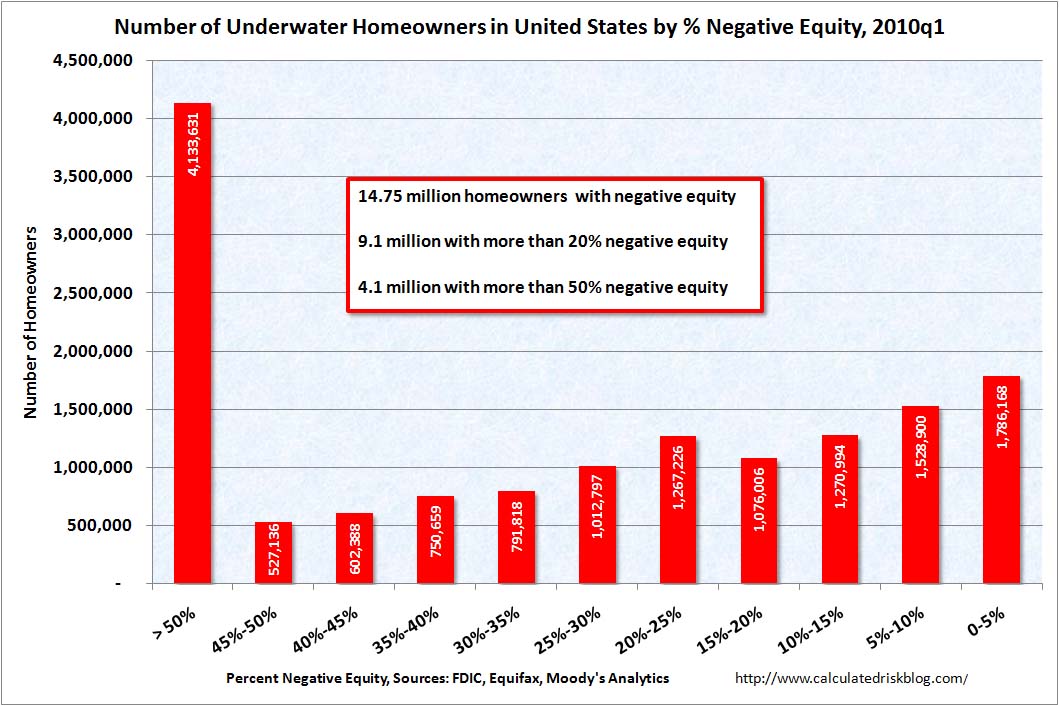

Reason #5 – Negative equity is a drag on the economy

Source:Â Calculated Risk

Many of those with negative equity are already walking away from their homes. They made a bet and lost. The only way banks can combat this behavior is ignoring missed housing payments and allowing people to stay in the homes while they keep mortgage debt on their balance sheets at inflated levels. But the longer this game of pretend goes on, the worse it is for the economy. Right now the vast majority, renters, those with paid off homes, and homeowners with equity who pay on time are watching this game between negative equity homeowners and Wall Street play out. Why should the majority be brought down because of the bad bets from these two groups? Realize the losses and move on. Otherwise, more and more taxpayer money from the other groups will be shifted to this area. That is not good.

In the last few weeks after I tossed out an estimate of nationwide home values falling by 25 percent, a handful of articles made the rounds predicting a similar figure. This was not some doom prediction for housing but will actually help the overall economy realize the losses and move on. In therapy, you have to accept a mistake to move on. At times, this realization will be painful but in the end it is better for you. Right now Wall Street is in complete denial and trying to pretend all is well. Their profits are up but all that is happening is a wealth transfer from taxpayers to this unproductive group. Lower real estate values will be better for the economy moving forward until wages catch up. If wages don’t catch up why should we insist on keeping prices inflated? Who really wins with higher home prices?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “5 reasons why falling home prices will be good for the economy – Higher homes values does not mean higher home equity, financial sector profits back up to 30 percent of all corporate profits, the mortgage debt equation.”

Three homes just sold in my South Pasadena neighborhood – – one for $800K, two for over $900K. Where the hell are people getting their money and when will this madness end? I live in an apt. by the way 😉

I have no idea where they get their money either.

It’s not absolutely impossible, but after their mortgage payment they have almost 0 disposable income. Or they’ll start renting out their rooms, garage or penthouse. LOL

Even “renting their bodies” to make the payments, LOL

I live in Northern California, within 10 miles of Facebook, Google, Oracle, Hotmail ,Ebay etc…, you get the picture, there is still a lot of money left with those in the computer field, there is still a lot of money coming in to California from Asia, especially China. I also see many cash offers on houses at the 800k level, however, I do not think it is a great idea, with the goverment and banks controlling inventory, some do not realize of huge shadow inventory and are buying homes. I think we are heading to a declining market for next 10 years with periodic dips to the bottom.

We would be so much better off if we take the pain now and let supply and demand dictacte prices instead of artificial interest rates and controlled inventory.

My sister and her husband both are public employees, working for the city. Each makes over $150,000, per year.

Since they do not have to save for retirement,(taken care of by the taxpayer),or pay for medical insurance(fully paid by the taxpayer)

they just dropped $1,200,000. on a house.

That is where the money is coming from!

What city is that? I don’t know any public employees that make that much, and I work in a capital with tons of state employees. Your example fuels the hatred for public employees, even though the financial crisis was caused by lack of regulation of the private sector and capitalism without boundaries.

That said I think the real estate market is not done dropping. We don’t have good new jobs that help people in the middle class. The middle class is squeezed out. It really does not matter if you own or rent imo. I see everyone barely making it. With increase in health insurance premiums, dental costs, college costs, most people cannot afford much of anything.

Where I live rents are not coming down. They have been pretty much in the same range for a while. I think it depends if you live in an area where there was a lot of speculation. Like AZ, Vegas, Parts of CA. So many houses were built that it makes sense that it will have a huge impact on the whole local economy.

Anyways, let me know about what these guys are doing for the government. I would be curious. I know nurses and lawyers that work for the state. They make a split of that .

Most people I know are teachers and they are barely making it, things aren’t so good for lots of us out here.

“Lack of regulation” and “capitalism without boundaries”?

This crisis would not have happened without:

1) Urban planners restricting sprawl and driving up the price of scarce “zoned” land.

2) The Community Reinvestment Act

3) Fannie Mae and Freddie Mac

4) Non-recourse mortgage laws that allow mortgagors to walk away from a reverse-equity home.

Note what DrHousingBubble is saying; the FHA is now underwriting loans on stupidly over-valued homes. Is this the free market?

There were actually housing price bubbles in almost ALL OECD nations simultaneously. The only thing that stops them all collapsing as rapidly as the US’s one, is that none of these other countries have non-recourse mortgage laws. It is this highly pro-cyclical regulation that allowed a property price collapse that took Wall Street’s analysts by surprise.

Lastly, any region that did not have urban planning that restricted new development, also did NOT have a housing price bubble. This is true of many areas in the USA and Canada. Unfortunately for first home buyers everywhere else, urban planners have used global warming as an excuse to make houses unaffordable.

Are you kidding me? Check out this website providing public employee salary information in Nevada:

http://transparentnevada.com/salaries/

I’ve seen similar websites for many other states, not to mention the salary and benefits to federal employees.

Because what Los Angeles needs is more sprawl (it’s not like you haven’t already got pretty much continuous sprawl from L.A. all the way down to San Diego), never mind that the inland empire and even the high desserts miles away from anything DID have a bubble.

Christina, I’m in the mortgage biz here in Socal and right now I’m doing a refi for a Firefighter and a Police Officer both making about 144K per year, so yes, public employees are making that much in certain positions. I know, I’ve seen the W2’s.

Thats fine, but who is going to buy their old home? We have a real problem with household formations because hardly any people graduating from college are able to find jobs. If they don’t find jobs how will they pay their student loans let alone a mortgage?

Rick, are you kidding me!? People with salaries of 150K are minor distraction to the main income distribution statistic. (As in the time of the French revolution there was labor aristocracy, which got the tick end altogether with Maria-Antoinette, and those were not representative for the poor condition of the general populace and didn’t turn the course of the revolution by the way…) How many are they to show some effect on the demands side? And if you story is true where the heck those people we till now in the real estate cycle? They were renting till now, and just now they decided to pour into the market? When they had salaries of 120K, 5 years back I guess, where we they, patient renters? Just don’t tell me they didn’t have salaries like this 5 years ago, because you don’t get those from 3 year working in the city of… Or maybe your people were single and just got married at their 50-ties and viola – new buyers. By any stretch of imagination those guys must be in their 50-ties and with the reasonable assumption of 10 years gov/state/city jobs so they naturally must have already purchased their home ( and paid in full) not even in 2003-2008 bubble but , they must did so in 1990-ties. If my assumption turn out to be wrong for your particular case then your couple is absolutely insignificant statistical noise…. Do you understand where I am going? For the future of the RE market shown in numbers statistically what matter is the general population stance. One statistical variable is function of another, not of the noise in the system or its exotic deviations … And the main picture shows the potential buyers now are struggling ( even if they may be working gov job) young couples with 2 children very often only one salary. What you are talking about? Are you serious, like grown-ups to grow- ups?

“Those who have paid off their house win either way. ”

Not always.

Let’s say my house would sell (net after agent rakeoff) for $700K.

Let’s say that I want to buy a scraper for $200K and build a new, smaller house than my current one.

At $700K, I sell and buy and build and have $140K in my pocket. Assuming $360K to build.

If prices go up by 10%, then I am 50K to the good when I sell. I sell for $770K and buy for $220K and spend $396K to build the new house. Leaving $154K.

If prices go down by 10%, then I am fucked. Now, I only have $90K left over.

The problem is that BUILDING costs won’t fall (and will most likely go up) when RE prices fall.

So, for those of us who:

1. want to downsize

2. want to build a new house tailored to our requirements

inflation is good and deflation is bad.

I don’t think anyone could fully understand your logic.

If you somehow magically manages to sell your 700k house, don’t you think you can find a decent smaller house at around 500k? Or even better you can wait a year or 2 and re-buy your old house at 500k. just kidding…

Why do you HAVE to build one?

@Ben,

Don’t have to build. Have the itch to build.

Built our current house 23 years ago.

Want to downsize and want to build a new house in a more affordable neighborhood.

What you say may be so but……THERE IS NO DEFLATION IN THE CPI!

You cannot point to any time where the CPI has been negative more than one month in the last couple years! The CPI shows inflation. The very CPI that has been manipulated so many times over the years to understate true inflation. Using the pre Clinton era CPI index inflation is currently running around 3%.

There is no doubt that equity and real estate prices are down drastically from their peaks but that has NOTHING to do with deflation. The CPI has nothing to do with asset prices, housing in the CPI is reflected only in “owners equivalent rent”.

During the booming bubble Alan Greenspit and those in Washington enjoyed the “inflation of housing” without it affecting the CPI and reminded us constantly how it would be wrong to account for “housing inflation” in the CPI.

Now that the shoe is on the other foot, asset prices are declining, everyone wants to imply that deflation in housing is related to deflation in the CPI. You can’t have it both ways.

The reason the megaphone of deflation (when there isn’t any) is on high is they are brain washing everyone into thinking that with deflation here there is no need to worry about inflation from all the monetary expansion coming out of the FED.

In truth we have CPI inflation and massive printing which means massive inflation is in the years ahead, when, I don’t know but it is less than 10 and more likely less than 5.

When Gold and silver start setting new highs (significant ) like gold 1400 and silver 25.00 I will throw caution to the wind convert my cash to realestate. Higher metals will be the first sign that the massive inflation is less than 2 years away. By the way, when I say massive inflation I mean 7 to 15%.

Ten years of 7% inflation will reduce the real national debt to less than 20% of its current real value. That is just what Helicopter Ben and Washington want.

A house overvalued by 50%, 7% inflaiton will take care of that rather quickly too.

Currently I expect housing to still decline but I am on the watch for what is looming on the horizon.

Yes in ten years we might start seeing inflation in housing prices. But that will be after a roller coaster economy where:

People will start saving as opposed to speculating for retirement. This will send Real Estate prices lower.

Interest Rates will start rising which will send Real Estate prices lower.

House prices will fall in line with previous historical metrics in relation to household incomes and similar rents. It will be a long process that will have many, many peaks and troughs.

You seem like someone that is ready to jump in at the next peak and ride the roller coaster.

I would suggest waiting until prices stabilize in ten years or so. This is my plan.

I know what I am doing. I sold my house in mid 2004 and had put all my liquid assets into the precious metals markets in 2001 and 02.

I have no intention of buying anything at a “peak”

just wondering after reading your comments

when would you start buying real estate again?

when do you plan to sell your precious metal?

I just sold mine, was it too soon?

chanthy

“I just sold mine, was it too soon? – chanthy”

Yes, way way way too soon.

I wish I knew.

The Fed is in an epic battle to ignite inflation at a time of extraordinary deflationary pressures. Given the acts and the comments of the FED I have no doubt inflation will win.

Make no mistake, the FED has shown that it would work with the Government to do what is necessary to avoid deflation. Imagine the kooky things they have already done X 10!

That would mean metals eventually will be much much higher but in the meantime there could be a 50% drop for all I know but I am not counting on it.

As far as realestate I will not act until I see inflation winning. As I said, new highs in metals are a sign, a collapsing bond market is another. When this occurs I don’t know but I am on the watch for it.

Just my opinion.

There’s a lot of truth in that. In spite of builders going through hell the last few years, they don’t seem to realize it was a bubble and are still charging bubble price for their work and would rather sit than bid for less. Pricing is very elastic on the way up, but not on the way down. Supply and demand are distorted like crazy these days. So when the deflationary depression accelerates, the wheels are probably going to come off and this train screeches to a halt–not some smooth downtrend back to reasonable.

Either building prices will fall, or builders will go hungry. There’s a huge surplus of housing right now. The construction sector is really hurting in most areas.

People with paid-off mortgages on houses bought decades ago don’t necessarily win in a period of asset inflation, and actually lose if they want to just live in their houses.

My mother bought her house in suburban St. Louis 40 years ago, and she bought it to have a place she could pay for and live in for the rest of her life, and have her expenses fixed, with no worries about ever-escalating rents. Well, so much for that, because her taxes – the rent you pay your local taxing authority for the privilege of retaining ownership of what you bought and paid for- have ratcheted up in keeping with the housing inflation. Her taxes are now nearly $5,000 and her municipality is planning another tax hike. God forbid she should improve the place, which means effecting the repairs necessary to keep it from falling down on her- a repair-replace is always considered an “improvement” and causes a hike in the taxes.

House inflation benefits no one but property flippers, lenders, careless borrowers, and taxing authorities.

well said.

Property tax is a the real wild card at this time, IMO. Govt is strapped for money and it’s one place people cant run from or hide. I think they’ll try to raise it accross the country.

ALL OF THIS AT THE TAXPAYER’S EXPENSE. THANK YOU TAXPAYERS AND HOWOWNER’S FOR KEEPING THE LOCAL AND STATE GOVT AFLOAT. DONT YOU THINK IT IS TIME TO PULL THE PLUG? WHY PAY FOR HIGH WAGE, GOVT UNION JOBS AND PLUM PENSIONS? THIS SHOULD GET YOU ANGRY, NOT THAT YOUR HOUSE IS WORTHLESS OR THAT YOU DONT HAVE A JOB. LOL

Live debt free: walk away from all your debt. Not an ethical decision but a business decision. Learn how to live a debt free live. No stress. Learn the value of cash and saving. Free yourself. The banks wont care anyway if you stop paying them. If you have to file bk, then do that but only as a last resort.

True-Our taxes went up 25% in one year while the actual market value of the home dropped. This is how economies die. Bleed us when we’re already down. Yet the state had millions to build university buildings to cash in on the student loan-shark scheme. This is not sustainable.

There’s roughly 58M mortgages in the US. 28% of that means that 16,240,000 mortgages are underwater. Right now about 8M mortgages are not being paid. Assuming this 8M is part of the 16,240,000, we have about 8M more mortgages that may slip into the “not being paid” catagory.

At a very conservative figure of $1000/month mortgage payment, this equates to roughly $8B/month not going into the mortgage payment system. That’s $96B/year not being paid…..how does this effect the system?

Another consideration along that is line is the taxes aren’t being paid, the condo fees, etc. What a snowball this is becoming.

Another point is the phsychologic damage done, just as in the previous depression, where the righteous are wiped out and many of the criminal prosper. Many are coming to terms with the fact that unfettered capitalism will not work without some ground rules and consequences for begger-thy-neighbor actions. Right now, crime pays so crime abounds.

This is silly.

The SEC did not do its job, contributing to our problems.

The Fed messed up horribly in setting interest rates way too low in the early 2000’s.

Fannie Mae and Freddie Mac became the backstops, the ultimate guarantees for banks to issue mortgages that were certain to end in foreclosure.

Congress was warned as early as 2004 that Fannie Mae was in big trouble but Congress, esp. Massachusetts’s own Mr. Frank resisted facing this truth.

And the community reinvestment act demanded the issuance of mortgages, whether this was wise or not to people living in areas that it was claimed had been redlined or denied credit previously.

When you put it all together, one must certainly concede that there were massive counterproductive government policies that contributed to the problem. To call the present situation “unfettered” capitalism is to utterly misrepresent things.

I hear you…but blaming it on the government is a cop out. Businesses are mandated to make profits and that’s fine. But they have gone way beyond making a profit to destroying the economy and millions of families, all the while contracting congressmen to do their bidding. I don’t have a clue where to start, but unless someone goes to jail for this, it’s just like the S&L Crisis–few went to jail, most kept the profits, we have I believe 8 more years on the bonds to pay for that mess, and here we are again only much bigger. And everyone says business is good, government bad, people foolish. This is a total failure in humanity.

Looking at your list, I’d say the problem isn’t that government was ineffective, it’s that it acting effectively to benefit a small group of well-connected businesses at the expense of everyone else.

I expect this to continue unless we find a way to get some of the money out of politics. Unfortunately we seem to be headed in the other direction; corporations are now allowed to buy off politicians directly, thanks to recent Supreme Court rulings.

Even the LA Times is getting in on the doom and gloom (i.e. the REALITY) of the RE market, particularly in LA/SoCal. No more NAR propaganda cheerleading from them, it seems.

Today’s paper’s business section came out with this fantastic report on the upper end of the market – million dollar plus foreclosures have tripled since 2008, quadrupled since 2007, and continue to grow with no signs of abating. As many of us projected based on previous history, particularly Dr. HB, the affluent are certainly not immune. Though it virtually always takes longer for such downturns to affect these upscale, affluent areas, they get their share of the pain eventually:

http://www.latimes.com/business/realestate/la-fi-l​uxury-foreclosures-20100829,0,7308058.story

Yes, prices in high end neighborhoods of the Westside are falling. Brentwood, Beverly Hills, Malibu, Bel Air, Santa Monica, Pacific Palisades, to name just a few. Short sales and REOs, beginning to pop up in every neighborhood. Banks realize prices will not return 2005 – 2007. Sit back and watch all the crying and screaming as you stash your cash.

http://www.westsideremeltdown.blogspot.com

Manhattan Transfer:

You almost had it right -but IMO you didn’t strike the hamemr cleanly.

Nothing inherently evil about unfetered “capitalism”.

Be careful when you start using generalities like that, as it feeds right into the tea-baggers, Glenn Beck, John Boehner, Sarah Palin, et al.

What I beleive you meant to convey, is unfetered, and therfore, unregulated BANKING and FINANCE.

The banking industry enjoys a uniquely differnt position and therfor, by extension, serves an entirely different purpoose in our caitalistic society.

It is the ONE industry, that if lef to run wild, can and WILL bring the economy to it’s knees.

Not to mention, the vastly unproductive resources that the banking and FIRE industry abscond with – but that it another entirely different philosophical argument.

Simply put, BANKING, and it’s ilk, have to be caged and controlled.

Or the beast will literally run wild and kill everything that stands.

More so, now that MIT Quants and comouters control the system.

Not really–It’s the Walrus and the Carpenter. There has to be a balance because people will not do the right thing merely based on the carrot–there has to be the stick too.

I’m an engineer, not an economist. When we build transistors, we have to regulate them because otherwise they will go out of control and be useless in a circuit. You pay for a lot of potential performance, but it has to work, period. We pulled Glass to juice the markets and did not consider the consequences. We need to build a sustainable civilization. Massive economic growth and exponential profits will not do that. I don’t know what it will take, but this isn’t it.

Unfortunately, as long as we have BHO, and the Dark Sith Lord, Larry Summers, with his pet dog, TimGeitner, we will get more of the same.

Futile efforts at propping up home prices = propping up banks.

BHO doesn’t really understand what he is dealing with here, and after all – why should he?

He is and will be a one trick pony – Universal Health Care.

It was the voting populace that tried to infer that he would be some master of economics and heal all the ills.

He has bounced from one issue to the next, never really stopping long enough to deal with the most critical one facing our country.

But he never really said he could – other than to promise to push an ill-fated $1Trillion “stimulus” program, which, in the name of compromise and inexperience, he was all too willing to whittle down to $800B to appease the Republicans and further dillute its effectiveness with their favorite tax cut programs.

He and his team are not cut out for the job that confronted them.

Not only that, even if they are, they are the Rubin 2nd team players, who will protect their lazzez faire philosophies and banker overlords at any cost.

They got rolled on their feeble attempt to re-regulate Wall Street, and he lsitened to his chosen two.

The one’s who knew better have resigned or wlil be shortly.

He’s a lightweight, and obviously outmatched.

He should have studied and revered either Roosevelt, or Jefferson, instead of Lincoln so much.

Material correction. Mark to Market accounting was suspending in 2009. The suspension of the M2M rule is what allows banks to extend and pretend.

Another depressing (aka accurate) post. When did we all vote to let the government cover bad bets made by individuals and what were supposed to be private enterprises? Too big to fail needs to be too big to exist. Forcing taxpayers to backstop the banks is a disaster and needs to be stopped before the country is in ruins.

We cannot let fiscal responsibility be a choice. Individual and corporate responsibility is something that must be enforced by letting bad decisions lead to failure.

“Too big to fail needs to be too big to exist.”

Well said, and a sentiment I’ve been sharing since the first time I heard the term. Isn’t this the purpose of the FTC and SEC and the antitrust laws they were incepted to enforce?

Too big to fail is the result of failures too big to keep ignoring.

For real estate markets to recover and come at the top will take at least 10 years minimum from now. An economy does go through high’s and low’s and leaves a major impact on housing markets, but that does not mean that it is dead, by no way. In fact one of my friend sold her house at a price she expected. So there are potential buyers although their numbers may have declined.

That’s encouraging. In some markets, where I live, house prices are actually increasing because the quality of the neighborhoods and the marketability of those homes. I’m talking mid-150’s to 170’s, family neighborhoods, brick ranches, in an excellent location. Cosmetics seem to be making an easier sale, simply because buyers don’t have the extra cash to fix up a place and they want ‘move in’. And I mean “move in” as in NOTHING needs done. New everything like just built, or they step onto the next place. Maybe your friend had realistic ideas about what her home would bring in the market. Kudo’s to her for making the sale!

Its depressing because we are still talking the same talk after nearly 2 years of nothing happening to resolve the problem. It will eventually implode, no doubt about it, and it will be unstoppable because there isn’t much left to throw at it now.

“The only thing that stops them all collapsing as rapidly as the US’s one, is that none of these other countries have non-recourse mortgage laws.”

Which only means that the lender is even worse off than in US: They’ve lost all they had _and_ they have huge debt forever on top of that. Many commit a suicide, I don’t wonder why.

In honest world the value of the house fully covers the mortgage and it’s banks risk if it doesn’t: Bank is the one lending money, they should know.

In crooked world (like here in EU in most countries) bank lends you money and if you can’t pay, sells your house (to itself, via middle man, in forced auction and cash payments only, ie. dirt cheap) and you _still owe the bank more than 70% of the loan. Stealing number one: Usually the selling price is 5-50% of the current value, just because of short announcement, typically days and requirement of cash payment (of course bank itself has a lot of cash).

While you pay the loan, the bank sells the house behind your back getting more than there was loan on it, thus getting paid twice for same house. That’s stealing number two and show how the professsionals do steal, fully legally. Of course, because the banks own lawmakers here too. Especially EU comission is famous of ‘directives to anyone who has money’ -policy, ie. blatant corruption.

Tuomas, that is scary. I hear Australia is recourse loans too-so you are on the hook for the balance. I think that is just weird, because of the double standards. here, bank of America just walked away from a 1.5 billion dollar mortgage- yes a billion. They had acquired it as part of an acquisition and after the bust, they just gave the keys back to the other bank and walked away .

If a bank can walk away from its huge mortgage and face no consequences-then why should a laid off factory worker be on the hook forever? After all the supreme court just ruled that a corporation was a person-so why not get all their benefits too? When a bank secures a loan against an asset(house/car/land/stock/jewellry)-then we should be on hook only for that asset. Every corporation is the same, they have so many different creditors-the secured creditor only gets what he is secured against and the unsecured creditor (for us credit card) may get nothing or if there is no money everybody may get cents on the dollar.

Not sure why we should hold the laid off factory worker with a wife and kids to a much higher standard than GM/Goldman/Continental etc… As an aside, from all indications, it look slike Australia is in a big bubble-well looking at pure fundamentals-so it would be interesting if they bust to watch the effects as I read they are a recourse country?

Yes Australia is recourse and I fear it will be devastating when the Australian housing bubble loses significant air. Right now, Sydney and Melbourne (as well as many smaller cities) are running cost of housing:income ratios of at least 7x, Sydney tops 8.

So far, it seems the bulk of the populace is not overly concerned. There are some notable economists (see Steven Keen “Debtwatch”) who have been sounding warnings for several years now but most people seem neutral to euphoric about housing prices.

In Australia, they have street auctions to sell houses and sellers are still getting offers 25% above initial asking bid in prime locations near city centers. Volume of sales is decreasing and time on market is creeping up but, so far, there is little sign of true distress.

I have two acquaintances that are each in the middle of purchasing their third Australian property, one they live in and two now for investment. I mildly asked if they were concerned at all about the prices being inflated right now. They gave me all of the usual justifications for why the Australian market is different. I tried to gently warn one friend that I thought I had seen the same housing movie before in California (lots of people seriously over-leveraged, young people priced out of the market, manic interest in types of granites and sink fixtures.) They countered with why Australia is different – including very resource rich, lots of foreign investment (especially from Asia), fairly loose immigration policies, and a “shortage of housing,” etc. Perhaps they are right, so I dropped it. They are going through with the purchase, and I wish them well.

You can rent a high end property on a long term lease for 1/3 or less of the cost of the note (for example, rent for a 3-4 million dollar property can be as low as 6000 AUD/mo.) Of course, this is seen as alright because their government really pulled out the stops to get people to speculate… in Australia you can deduct up to 40% of your rental losses from your taxes. Something called “negative gearing.” Talk about something to goose prices up!

Anyway, there is still euphoria in the Australian housing market. There are signs of strain and the situation seems unsustainable but the dam seems to be holding for now. Canada is in a similar situation.

My head tells me that the Australian and Canadian housing markets are significant bubbles that will deflate sometime, somehow. The cost:income ratio is just too high.

I hope I am wrong because I know that there are millions of wonderful Australians and Canadians out there, including several who are my friends, and I certainly don’t wish on them the pain that the US is facing right now.

Check the new home sales statistics released last week…..Not a single NEWLY built home was sold in the enitre United States in June or July that was priced in excess of $750,000. So, apparently, in almost every area, there ain’t that much dinero to go around. Look for further price erosion as stingy banks and tightened underwriting requirements “disqualify” more and more willing buyers. The old adage that you have to “prove you don’t need the money” before getting a mortgage loan approval is firmly in place.

Prices going down is good for me. I have no mortgage. When I sell my house for cheap, I can also buy a corresponding cheap house in Claremont(good by Burbank). I have also been saving cash every year too. As prices go down, my gain on my current house also goes down . This is all good. Don’t be so down on this idea. Welcome and greet the continuation of the prices coming down.

True deflation is really not good for anyone, particularly during a concurrent period of currency destruction. We’re getting burned from both ends. Fed is paddling as fast as they can but we are starting to spin around the maelstrom.

what ever happened to a home being somewhere to live and actually being interested in investing in the neighborhood in questions. If you can afford the payment who cares is your underwater.

or am I just nieve.

Actually, I think you are correct. And I am suspecting that while we are facing this economic crisis and it has many negative aspects, positive ones might come out of it.

I live in a working class/modest neighborhood. A lot of my neighbors have been here forever. I know almost everyone on the block and around the street where I live. We have block parties, and we watch each other’s houses when we are gone. We trade plants, and give each other apples or other things we have harvested.

My kids know where to go when there is a problem. This is a neighborhood built in the early seventies.

I noticed that a lot of the new mcmansions have no character, no community feel, and everyone seems to be living for themselves. I have friends that live in neighborhoods like that. Again, I think this crisis will bring people closer together. I remember buying my little house twelve years ago and not once thinking about financial gain, or trading up. We just wanted a little home in a nice school district, and a yard for my son. I never even thought about getting rich on my house.

Many people who own their homes w/o mortgage did so by saving up for a huge downpayment, buying less than they ‘qualified for’ (in realtorspeak) and then paying down the mortgage as quickly as possible, making double payements, etc.

Others sold a more expensive house and downsized to a less expensive one and paid cash.

Many immigrant families pool resources to buy a house in case or nearly in cash, in lower price areas.

For all these people, being prudent will be punished by the government ‘bailing out’ mortgagees by lowering their princple (something that is being discussed seriously in many quarters). No only could they have had a nicer house in a nicer area, they could have taxpayers pay for it in part.

Meanwhile, people who have been prudently saving up their money to buy a property outright, or with a 50% downpayment will be screwed again by forever chasing the housing bubble upward if prices are not allowed to fall naturally.

Retirees who would like to take money out of non-performing investments and buy a rental home to supplement their retirement income will also lose out if prices are not allowed to fall naturally.

If prices fall, lots of people will come in to the market and spur economic recovery. Not everyone blew all their money homes above their means, then rode the bubble up sucking every every bit of equity out to buy a nicer standard of living along the way.

Many, many people lived frugally, saved their money could fuel a modest recovery if allowed to invest their savings in lower priced real estate. These people are not going to buy at fake bubble prices.

A shortage of available properties was one of the key factors that supported the housing market during 2009, with the mis-match between supply and demand pushing prices up.

The sicknesses of the property market are excess liquidity, low real interest rates and the lack of investment alternatives. These structural problems are causing constant worry of a bubble and unless they are resolved, everything else is just a band-aid.

Leave a Reply