Old School Venice: What does one million dollars buy you in a gentrified market? Riding it out in the Westside.

Venice has an interesting vibe for a California beach city. It certainly doesn’t carry the glamour of Malibu but you wouldn’t get that from looking at the price here. Venice is undergoing full speed gentrification. We are seeing shoeboxes selling for more than one million dollars. The lemmings are lining up to make purchases just when the market is reaching a short-term peak. In California we only know two speeds: boom and bust. We’ve had a nice boom recently. All you need to do is look at the history of what is going on and you will understand this is unsustainable. It seems with every gyration in market volatility, we go from yes an interest rate is going to happen to full on retreat. If you haven’t suspected, the Fed is running a confidence game at this point. Buyers are diving in with maximum leverage trying to get a piece of the housing action. Yet real estate is trailing the stock market and the market is losing some steam. Venice highlights all the craziness that is SoCal housing.

Venice housing

The pitch for housing values going up is the same one used in 2006 and 2007. That is, the population is high while new housing is simply not being built in certain cities. The argument makes some sort of sense until you realize prices cratered with these characteristics in place last time.

Let us take a look at one property in Venice:

1143 Harrison Ave,

Venice, CA 90291

2 beds, 2 baths, 805 square feet

The ad cuts right to the heart of the current market:

“BOM – Reduced immediately for quick sale. Buyer did not qualify,.. Perfect for fixer/investor type buyer. Super Prime R2 Lot w/ cute existing Duplex, by far the lowest priced in area. Excellent Location, West of Lincoln Blvd. Beautiful flat lot in a special setting. Walk to Abbott Kinney, Marina Del Rey, Beaches & Restaurants. Gated property has unlimited potential for new development. Surrounded by more expensive homes. The units are occupied by the owner and a tenant ***See Private Remarks*** Drive-by only. Call L/A for details.â€

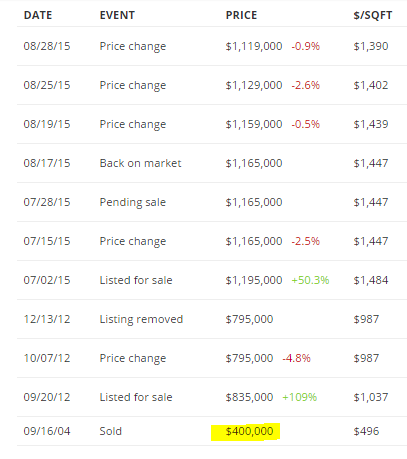

Why are they looking for a quick sale? What is nuttier here is that the home was a pending sale but that prospective buyer “did not qualify†and this is someone trying to buy a home for $1,165,000. Just look at the price history here for a trip down memory lane:

The place sold last in 2004 for $400,000. Not a bad price for a duplex in Venice. The current owner then listed it in 2012 for $835,000. A month later with no takers, they dropped the price to $795,000. They were eager to sell. 2 additional months later they pulled the listing and rode out the next three years. All of a sudden with people sniffing the crap shack glue, the owner decided to list this place at $1,195,000! A pending sale was locked in for $1,165,000 back in July. It was put back on the market for that listed price. A lemming almost bought at the peak. Now, we’ve seen some slow pricing action to the downside. As a rental investment property, this makes zero sense. This is probably why they are pitching the development perspective here.

But go back to the original buyer. They were more than willing to take $795,000 back in late 2012. Three years later, this 800 square foot duplex was close to fetching $1,165,000. The ad says this place is surrounded by expensive homes. Take a look:

And your view across the street:

Cars galore and you can smell the million dollar homes! People are pulling prices out of the sky hoping the mania continues a little bit longer to lure in that last sucker. As an investment property, this makes no sense. If someone is buying they are betting on continued appreciation and that is a big bet in this market. The speculation angle is all that is left.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

86 Responses to “Old School Venice: What does one million dollars buy you in a gentrified market? Riding it out in the Westside.”

I hear that sound a manual transmission car makes when it’s going up hill in too high a gear. I think this homeowner heard it too, but he put the car in an even higher gear.

The California RE vehicle is in the highest gear and the engine is redlining. Only so long before it overheats and blows up.

Excellent post. Couldn’t agree with you more. The comical part is that Houston Texas was beginning to resemble the California market until the shale oil “miracle” came unraveled. We have had plenty of lemmings buying into the Fed’s artificial asset inflation.

I was showing condos in downtown Houston last week. Sellers still holding out for ridiculous prices on luxury condos when you can rent a perfectly good place less than a mile away at half the the monthly cost.

Here in West Houston (directly tied to the Energy Corridor) new home sales are starting to get hammered. Why? because the prices are too damn high. New home sales in my area were off 35% YoY in August. Ouch!

http://aaronlayman.com/2015/09/katy-texas-west-houston-real-estate-market-august-2015/

That’s because the new energy area is Spring and The Woodlands.

Aaron.. you hit it right with the “Fed’s artificial asset inflation”

Many people are still buying homes in the houston area,but it’s the hoods close to downtown where people are buying.August home sales is 54 more homes than last year,which is pretty impressive since many people are losing their jobs in the oil industry.houston’s economy is very diverse,the medical center is the biggest faculty in the world and they are spending billions to make it bigger.there’s also other hospitals in other areas in Houston and it’s many surbubs that are expainding.since oil is down this is a great time to buy a home.some areas of town is very hot while others are not.in 2020 a million more people will move to houston.and since there isn’t much land close to downtown to build many homes it’s best to buy right now.im a young homeowner who bought close to downtown in late 2011,my mortgage is only $78,000 and homes smaller than mine that also have smaller lots going for the $300k’s.i bought in a down market and already house rich,even though it’s not 2011 you will get a better deal on a home rather waiting when oil go back up in a year or two.with all this ppopulation growth thats coming to houston,we all know homes close to downtown will start at a million dollars to get in.im already see homes under 1,900 SQFT going for a million or close to it,and many more will so buy now and save,like me.my mortgage is only $ 620.00 a month!and it’s a two story.

where’s the grammar police

I hear Houton gets HOT and HUMID.

I also hear that Houston has weak zoning laws, which helps keep house prices low.

@dj:

LOL! Sounds like you have some inventory to unload on a future lemming. Maybe you should write the next HAR press release.

@dj:

I should also point out that your supposed August sales increase is a lie. That’s a “statistically estimated” number on those press releases, as in a complete work of fiction. Local real estate board has been overestimating sales most of the year. July’s estimated sales numbers were just revised down about 4 percent.

Some real estate people said several months ago that houston economy would tank,but other people in the industry said it wouldn’t.seems like they were right,cnbc did a story about chinesse home buyers coming to houston,and this is only the beginning.since millions of people are going to arrive in houston in the future how many more people would be able to buy a house close to downtown?many people are leaving the burbs to be close in,and all the new high rises they are building is for the rich.downtown and the neighborhoods close to it are becoming playgrounds for the upper class and rich.poor and the middle class are being pushed out of these areas.

The July housing report of this year says home sales in Houston was 7,935,compared to last year total sales of 7,621.last year oil prices was high,but this year with low oil prices the home sales of this year is higher.even if they did lowerd the home sales report to just four percent,the sales is very impressive compared to last july’s report.the housing report of august 2015 is 8,147 in home sales compared to last year home sales of 7,637.houston’s economy is very diversed.

The healthcare industry is a net draw on the economy as is the industrial educational complex. The petro-chemical industry will eventually catch down to China’s over capacity and the slowing demand by the emerging markets. What happens when China puts capital controls in place? Maybe Texas will take in Mid East refugees.Texas is over leveraged imo.

Seeing similar things in nicer OC. Original, 1600 sq ft stuff has hit a ceiling of 800-900k, and doesn’t sell until several price drops later. Usually to be torn down or gutted. Higher end stuff is priced really high and sitting, price drops every month. No takers at 1.4 million…down to 1.2 million and still no takers. Every now and then one will sell…but not very often.

Never could I imagine crap shacks in Venice – and they ARE CRAP SHACKS going for over a mil. I attended architectrure school in Santa Monica (Olympic at Bundy) back in the early eighties and most of my fellow student types lived in Venice because it was a poor step child to the Marina and SM.

We used to refer to this place as the center of the ding bat apt. and the ding bat home – sticks and plaster – no insulation – rotting roofs and many questionable neighbors. And now….you can have a piece of this utopian nabe for over a mil. Sheesh!!!

the house is worth 100k. the land is worth 1 million

The land could be worth a million if you could build on it. The land produces nothing, and the city won’t let you turn the crap shack into a multi-unit. Only a select few lots actually have a view and are worth building a 3.5 story McMansion.

Paying for ‘hip’ or ‘chic’, a Venice shack, seems a California or Hampton’s thing, and is a status symbol along with the Mercedes/BMW sitting in the driveway! I sold a home in RPV with a nice view of the L.A. harbor/ocean in 2014 for a good sum of money, but when I look at these ‘crap shacks’ and how much they are selling for, I have to think these buyers have little sense, or belong to the group that has more money than brains! My cousin who lives north of S.F. is a retired carpenter. He used to describe the Silicon Valley moguls who would build homes in Sausalito … they’d spend millions only to dislike the result, tear it out and do over again spending a couple of more millions! Really, what is the average Joe doing to survive in a place like L.A., or are they? Or are the rest of those Angelino’s the ones who are driving up personal debt numbers again?

I remember in high school (1976,77) Venice and Venice canals were dangerous places – not only the barrio but the biker gangs as well. Venice canals were full of old car parts, trash, etc.

Below is recent commentary on Venice…being touted as a part of Silicon Beach. [It is not unusual to make $150K or more per year working in high tech, right? then double that for a husband and wife and you know why homes in Venice sell for so much…]

http://la.curbed.com/tags/silicon-beach

http://la.curbed.com/archives/2015/07/venice_cottage.php

http://goodtobebad.kinja.com/a-guide-to-l-a-s-surfer-friendly-startup-hub-silicon-1507916736

I understand that a certain segment make good incomes and can ‘afford’ this stuff, I just don’t understand the logic. Economists are already predicting the next recession will hit around the end of this decade. And, just read that California is one of those markets that could see a 20% drop in home values as interest rates rise. Add to that the insane competition of high tech, jobs here one day are gone overseas the next … I retired from the business and after the dot com crash, was able to hire the then $150k workers for $75k. Chances are, what goes up, must come back down …

Well – that was 40 years ago, and most parts of Venice are fairly well gentrified without any significant crime. Happening to Westchester now as well, with doctors buying at the northern end.

@JN, blame or credit the Federal Reserve for propping up the stock market.

In the affluent areas (the places most likely to have people with significant holdings in the stock market) home prices and the stock market have been tied together like Siamese Twins. Some of this is due to investors cashing out on stock options or getting stock grants. Many are in fact due to margin loans. When the stock markets were peaking a few months ago, many of these affluent households borrowed against their stock portfolios via margin loans. This is why in places where households with little to nothing in the stock markets have current home selling prices well below the peak prices of 2006 to 2007.

I will guesstimate that margin loans of 2013 to 2015 will be like the subprime loans (and home equity loans) of 2003 to 2006. A 30% decline in the stock market will result in a bloodbath in the margin loan market as well as the upscale real estate market since the two go hand-in-hand.

Nearly 25% of Manhattan Beach listings with price reductions. And this place is referred to as a litmus of prime desirability by some commenters. Apparently there are limits to what defines desirable and prime but then some try to make the case that ask doesn’t matter.

Figured what the hell and checked on reductions in a few other areas (using Redfin – available listings with reductions / total listings):

Culver City – 28%

Santa Monica – 26%

Redondo Beach – 33%

Torrance – 32%

Westchester – 27%

Venice – 25%

Pasadena – 32%

Arcadia – 38%

Thousand Oaks – 43%

North Hollywood – 30%

DTLA – 33%

Irvine – 45%

Valencia – 40%

Newport Beach – 39%

This stuff is flying of the shelves so fast that at best 1/4 of sellers resort to marking down the price tag. All that in a “low inventory” environment to boot.

You’re cherry picking the reductions. You’re ignoring homes going over asking.

This Santa Monica townhouse was listed at $1.125 million — and sold at $1,150 million: https://www.redfin.com/CA/Santa-Monica/1013-21st-St-90403/unit-B/home/6769428

Another Santa Monica townhouse listed at $588k — sold at $600k https://www.redfin.com/CA/Santa-Monica/1457-Centinela-Ave-90404/unit-5/home/8092257

Here’s a Woodland Hills house listed at $820k — sold at $910k https://www.redfin.com/CA/Woodland-Hills/4630-Deseret-Dr-91364/home/3549295

Another in Woodland Hills house listed at $699.9 – sold at $740k https://www.redfin.com/CA/Woodland-Hills/20944-De-Mina-St-91364/home/4173597

Sure, there are price reductions. And some listings are pulled without a sale. But other homes are being overbid. I don’t think anyone can say for sure whether the market will soon tank or not.

“You’re cherry picking the reductions.”

Nope, I’m using the numbers straight from Redfin.

“You’re ignoring homes going over asking.”

Absolutely. Redfin doesn’t have those numbers available as far as I’m aware.

“This Santa Monica townhouse was listed at $1.125 million — and sold at $1,150 million: https://www.redfin.com/CA/Santa-Monica/1013-21st-St-90403/unit-B/home/6769428

Another Santa Monica townhouse listed at $588k — sold at $600k https://www.redfin.com/CA/Santa-Monica/1457-Centinela-Ave-90404/unit-5/home/8092257

Here’s a Woodland Hills house listed at $820k — sold at $910k https://www.redfin.com/CA/Woodland-Hills/4630-Deseret-Dr-91364/home/3549295

Another in Woodland Hills house listed at $699.9 – sold at $740k https://www.redfin.com/CA/Woodland-Hills/20944-De-Mina-St-91364/home/4173597”

I’m fairly certain that’s cherry picking.

“And some listings are pulled without a sale.”

I’m presenting a snapshot of the data at a point in time, not over time, so pulled listings don’t really matter in this context.

“But other homes are being overbid.”

That’s true and if you can find those numbers feel free to present them. I’m not sure a particular amount of overbids necessarily mitigates the signal that the reductions are giving. Based on anecdotal observation I don’t think the overbid rate is anywhere near the reduction rate, but perhaps I’m wrong on that.

“I don’t think anyone can say for sure whether the market will soon tank or not.”

I don’t think that observing reduction rates above a certain amount proclaims a tank – however one defines it – although I think it’s a useful signal for the state of the marketplace. At the very least it proves the point that so-called desirable prime is only so much.

Hotel California: I’m fairly certain that’s cherry picking.

Well, DUH. Of course it is. I’m balancing your picks with mine.

My whole point was, you can point out prices cuts, but I can point out overbids. So one can’t say for sure there’s a tank coming.

“I’m balancing your picks with mine.”

“My whole point was, you can point out prices cuts, but I can point out overbids.”

That doesn’t make any sense. I haven’t posted any “picks”, I’ve posted a data set. I’ve put up the raw numbers and you’ve given a couple of examples which are not meaningfully comparative.

“So one can’t say for sure there’s a tank coming.”

I’ve never mentioned anything about a “tank”, I leave that to you and others.

HC is looking at reductions in the market as a whole. Just because it doesn’t include over asking doesn’t make it cherry picking.

Posting 4 places that you found over asking? That’s cherry picking.

But there is absolutely a trend in reductions right now. Because people aren’t buying? Maybe. Another likely cause is people listing right now have greed up to their eyeballs, thinking they can cash out to the stratosphere. Then the house sits for a couple months and reality sets in…and down come the prices.

I visited a relative recently who lives in a house on the beach in a “highly desirable” SoCal zip code. While standing on the balcony I was shocked to see three guys openly urinating on the wall of the house next door, in broad daylight. I yelled, bring a camera, thinking they would be shamed, move on. Nope, they seemed to pose, one actually smiled, excited at the prospect of being photographed.

For the next few hours heard lots of shouting, obscenities, etc. as hundreds of people streamed by. The next day the walkway alongside house was littered with trash, dog cr*p, etc. Horrendous parking. The sounds of trucks, a jackhammer, power saws began at 8am, was told it was a neighbors construction project, about every 6 months a house is torn down, built, or remodeled, expect noise 8am-6pm year round.

People do seem eager to pay millions to live in this “highly desirable” environment which seems to be getting more crowded and unbearable. Bless their hearts.

Drinks, not sure what highly desirable beach city you recently visited. It must have been one of the party zones (Hermosa, Newport pensinula, etc). The noise, drunkenness, rowdy behavior, lack of parking is commonplace there. The property values are also through the roof. There are plenty of highly desirable beach cities with a nice low key vibe. The noise from construction from all the McMansions may be annoying, but that is the sound of money. By bulldozing those old crap shacks and building new mansions, the surrounding property values only go up. That’s a small price to pay. I should start charging you guys every time I hear “highly desirable.” 🙂

WeDontMakeThoseDrinksNoMore: guys openly urinating … shouting, obscenities, hundreds of people streamed by. … littered with trash, dog cr*p. Horrendous parking. … sounds of trucks, a jackhammer, power saws began at 8am …

I see that every time I’m in Manhattan. Just a typical day in New York, New York — where the home prices make L.A. look cheap.

Expensive micro-sized apts and co-ops, and when you leave the building, you’re amid trash, jackhammers, and pissing bums. But many Manhattanites can’t imagine living anywhere else. As far as they’re concerned, NYC is the Center of the Universe.

“The property values are also through the roof.”

All that tells us is what we already know, but it’s not very substantive in refuting the idea that Drinks is putting forth.

“There are plenty of highly desirable beach cities with a nice low key vibe.”

Drinks wrote that the property was “on the beach.” There’s a distinction between that and “beach city.”

“The noise from construction from all the McMansions may be annoying, but that is the sound of money.”

This comes across as because someone is spending money the costs of an impacted standard of living are nullified and I think that’s a hard sell to most people.

“By bulldozing those old crap shacks and building new mansions, the surrounding property values only go up. That’s a small price to pay.”

Doesn’t this mostly benefit speculators selling at some point and cashing out the gains? Since we’re often led to believe that everyone wants to live in these places because of x, y, and z, wouldn’t we be more likely to consider the scenario of being a long-term if not forever owner occupant resident? In that case the costs don’t appear to be small. The taxes and local costs go up with the property values and so do the transaction costs if one is to sell and move to another property within the same locale. The only way to truly pocket a gain is to move away at some point to a different locale with a lower price level, but if someone is to do that then it refutes the idea that the original locale is desirable enough to stay put.

On the topic of Manhattan, per Redfin (last 90 days of data):

Median list price = 2.825 M

Sale to list ratio is a whopping 101%

Average number of offers =2.7

Call it what you will regarding price reductions (maybe it’s the slow selling season since school started). Based on the data I presented, highly desirable Manhattan Beach RE looks pretty healthy to me.

“Median list price = 2.825 M”

Not sure how this metric is very useful in the context of discussing reductions. The median list could be 10M or 50M or 100K with 25% of sellers reducing list. I suppose if one is to define the “health” of a marketplace as a function of its price level relative to others there’s some meaning in it.

“Sale to list ratio is a whopping 101%”

From Redfin: Sale-to-List Ratio. The final sale price (what a buyer pays for the home) divided by the last list price expressed as a percentage.

The problem with using last list is that it’s only telling the (final) part of the story when the seller found a buyer and came to an agreement. It’s not accounting for the part of the story when the seller wasn’t getting any bids.

“Average number of offers =2.7”

Same problem as above. If 25% of sellers bring down their lists from the starting point by a particular amount to reach pricing equilibrium, then it’s expected that bids will roll-in. It doesn’t tell us anything about what took place to get there. Never mind that averages are prone to skew.

HC, that’s a whole lot of words you got there.

I’ll keep this short and sweet. Manhattan Beach RE has gone up SIGNIFICANTLY since things bottomed out a few years ago. Look up your own facts, this can’t be refuted!

“HC, that’s a whole lot of words you got there.”

Yes, those are called details.

“Manhattan Beach RE has gone up SIGNIFICANTLY since things bottomed out a few years ago. Look up your own facts, this can’t be refuted!”

A lot of markets have gone up “significantly” since the last bottom and that’s not being disputed.

You can call them details if it makes you happy. I’ll call them opinions since they aren’t facts. And you know the old saying about opinions…

“You can call them details if it makes you happy.”

That’s what they are and my happiness isn’t riding on them.

“I’ll call them opinions since they aren’t facts.”

Redfin’s use of last ask is a fact. It is also factual to point out that there is information available for analysis beyond the three metrics which accompanied your opinion on the “health” of the MB market.

You mean to tell me that this 1925 duplex has 805 sq. ft of total living space. So there are two units totaling about 400 sq. ft each? It’s not even within walking distance of the beach and it’s pending for over one million dollars? Hell, you can’t even see the ocean from this crappy neighborhood. That’s ridiculous. This is some kind of joke.

Who cares about the beach when you can walk to world’s most congested Costco in less time than it takes to go two blocks in traffic on Lincoln!

You all come to Oxnard and I can get you a nice place for much less. It is true that the women here are not as good looking as Newport, but they are better than Porkland. The people that like to spend $1million for a Venice shack have their own white culture which I do not understand, but then again they do not understand Oxnard, the Newport Beach. It is Captain Morgan time now, see you later.

Hey Carlos

do tell us where is the desireable part of Oxnard / ocean front areas ? (Sincere question)

Isn’t Oxnard like 80% Hispanic and suffer from bad crime & gang violence? No thank you. If I want that I’ll just move to Mexico, it’s cheaper.

How did Oxnard get the prime beachfront property between Santa Barbara and Malibu? Thousand Oaks, the wealthiest city in Ventura county, is sweltering in the heat wave, and the folks in Oxnard are enjoying the beach. No one can predict the next area that may gentrify, but I enjoy living here, and if great things happen in the next 30 years, I would be OK with that.

Yes it is primarily Hispanic, non Chinese and Armenian. White yuppies are welcomed. The gang problem is no more than in Venice. Ever take a look at Venice High, or Mark Twain Jr. High? Two blocks from the strand, old speedway, in Venice, you have the gangs.

The harbor and beach front down from Ventura’s Seaward is nice. Unfortunately, it is out of your league. We want White yuppies with money .

I am going out with the good Captain(Morgan), shortly, along with my crew, after we get our tacos, so you little boats, get out the way of my Sea Ray Sundancer.

I will be showing property this weekend.

I’m so jealous of Carlos. He lives on a boat in Oxnard and eats tacos. He is truly living “The American Dream”.

Agreed Hunan, that is a really bad joke and someone almost went for the punch line. As other have mentioned, it feels like the market has hit a tipping point in my area. Properties are not selling like they were a year ago and price reductions are happening.

I just do not understand these prices. It would be nice if there was a 30%-50% pull back, but I will not fold my breath.

2014 was a horrible year for sales. I dont have exact numbers but the sales numbers in 2014 were one of the lowest or the lowest ive seen in decades. If sales are slower now than it was in 2014, then that is a problem…

Estimated losses as a result of the housing crash = US$4-6 trillion

Estimated cost of two wars without raising taxes = US$4-6 trillion

LOTS of people were able to hold on to their homes after the crises, so maybe all losses didn’t shake out to balance the books. This next bubble will be minor, oh maybe a cool $1 trillion to make it whole.

We also never hear about the competitive hedge residential real estate investors have over traditional home buyers – depreciation income!!! Not to mention other benefits of being a cash flow investor in a negative interest rate environment.

L.A. is a different world. It, and other prime international destinations will forever be cuckoo. Keep wishing for a 2007-08 crash. It’s nothing like 2004-2007, but keep correlating this bull market with that one. Nobody’s hoping for prices to decrease more than me (and I’m a home owner) but wishing for an era that will never come back is to delude yourself and to waste precious time one can be using to be productive and figure out how to walk around the brick wall rather than to continually smashing your head against it, hoping it will come tumbling down.

Never is often proven wrong

So your argument is that this time is not similar to last time, hence prices can’t come down? Good job FresnoResident. No offense but Fresno is the armpit of California. If you believed your own argument you would sell in your area and put that money into hot Bay Area real estate or L.A. real estate. Something tells me you are going to stay in the armpit of California.

Oh get off your high horse. As someone who has lived in several different parts of CA, there is no question in my mind that Fresno is no more of an armpit than LA and for that matter in many respects even better than LA and most of the urban/ suburban parts of SoCal. I own a beautiful old house in a neighborhood with great neighbors and close to Yosemite and Kings Canyon. I have no mortgage and can actually save for retirement. The people are generally friendly and not all stressed out and road raging. When I want the coast and big city culture, all I have to do is drive over to it. And I don’t have to sit in traffic. Yes we have smog and gangs, but so does overbloated polluted spawling ugly SoCal. Overall, Fresno is just a better place to live than SoCal, at a fraction of the price.

As for the comment about prices, they are going to come down again. Maybe the tone of your reply to the other Fresno commenter is due to the fact that you might have invested in SoCal property in recent years? If so, are you getting nervous? Are you worried Jay?

“Overall, Fresno is just a better place to live than SoCal, at a fraction of the price.”

Uh, no. Hey, armpits are a necessity for the human body but are you saying Fresno is actually a better place than L.A.? But that is your opinion.

FresnoResident keeps cheering L.A. while living in the armpit. If he really believed what he was saying he would buy in L.A.

Fresno’s only redeeming qualities are it’s COL (relative to California; there are many other cities in flyover with comparable COL that are BETTER places to live) and Oct-April weather. The air sucks, its summers are miserable, lots of poverty and non-english speaking poor, terrible job market, high crime rate (the affluent, desirable neighborhoods are no longer that inexpensive).

L.A., the places worth living, are just not even a feasible dream to entertain. I would probably be the working homeless in L.A. Outside of weather, California is overrated. Given the COL, the desirable non-congested towns (e.g. sonoma county) become undesirable. If you can handle to the cold and humidity, many other cities, large and small, have such a higher quality of life than Cali. As a kid I used to think living in coastal weather towns was important to me. Then I grew up.

For those wishing and hoping for a huge correction like from 2009 to 2012, keep dreaming. The Fed, federal government and banks own all of the marbles. If we do get significant price decreases then they will intervene. Just like they did with the last bust; remember the housing tax rebate, banks limiting the number of properties they foreclose on, etc.

No one is serious about limiting house prices from going up or even allowing the free market to function. But they will intervent at the drop of a hat if prices crash.

If it doesn’t go the way you proclaim, will you come back here and tell us it was God’s will?

You’re implication that ‘they’ do not make $s on an implosion is wrong.

We heard your prayers already. The economic trinity will save all of real estate with magic pixie dust.

Housing price will drop. Many properties are sitting on the market for years. Sellers are delusional. They are waiting for suckers with more money than brains to come and rescue them. All it takes is for the Fed to raise interest rates 1%-3% and let’s see who are the real losers. If the real estate market is so healthy, why are we afraid of raising interest rates? That is because we still have investors out there borrowing cheap money and hoping to cash out in less than 3 years. It’s not happening. We have losers and winners.

http://www.globalresearch.ca/the-2015-global-housing-market-crash-property-prices-plummet-worldwide/5474123

Get real! The Fed is never going to raise interest rates. Everyone is just playing a game of “let’s pretend”. The Federal government’s debt is 19 trillion and they will never stop until we see hyperinflation. That is the only feasible way out for our overly indebted government.

I never said that the Fed will raise interest rates for sure. That was sarcasm for those who think that the economy is going well. Many unemployed folks are not even included in these so-called statistics. These people are homeless living on the streets. Many full-time working folks are living inside their cars. If the Fed does decide to raise rates next week, it would be very insignificant. The Fed’s main job is to protect Wall Street investors. Trickle down economics does not work. That’s why there are income inequalities and the wage gap is getting wider. The rich get richer and the poor have more kids. That holds true everywhere you go. Different settings, same old craps.

Most of those lots in Venice are tiny and they build right up to edge leaving no garage. Good luck parking on the street when you have someone camped out in an RV in front of your house as shown in the picture. Not to mention, homeless people deficating in the alley behind your house. Abbot Kinney Blvd may be chic now, but it is still Venice with gangs, crack dealers and lots of homeless looking for a place to sleep.

But what do you expect for a million bucks in “Silicon Beach”?

http://www.westsideremeltdown.blogspot.com

I rent in West LA, in a reasonably nice area. A homeless guy just “moved in” to the alley by my place. That’s where he sh@ts. He also like to smear sh@t on the neighbors wall occasionally. Cops periodically drive the alley, but do nothing.

This is the result of a single homeless person. I can’t imaging owning in Venice, especially with the tent city off Rose. I like the old craftsman houses, but I’ve seen too many “residents” in the alleys to ever consider buying, paying taxes, etc. Gross.

Not about SoCal, but you dudes have gotta see this!

Vancouver, Crack Shack or Mansion?

http://www.crackshackormansion.com/

Asset inflation is a worldwide phenomena. When it blows, it will be the mother of all busts.

I remember hanging out in Venice in the mid nineties and a real estate agent begging my friend and I to look at a huge 4 bedroom craftsman a short block from the beach/boardwalk. The price was exactly one million. We were guppies back then, but I was surprised that no one was inside on a Saturday afternoon. I remember thinking what a tough job he had …. trying to sell a million dollar house in Venice!

The mid-90s was the nadir of LA’s Aerospace Bust/Rodney King Riots/Northridge Quake real estate depression. A house going for a cool million back then anywhere in town would go for at least $3-4 million these days. With the glamorization of Venice over the intervening decades that craftsman house by the beach is probably “worth” significantly more than that now.

IN san diego, I am seeing the price reductions becoming more n more common which was not the case 6 months back

the market has definitely softened. Definitely not a good time to buy here

Petaluma isn’t San Francisco, but it’s been pretty strong with Marin County folks moving out this way (and buying for investment too), nice old homes and 100K population relatively bucolic living. For $500k you can get a decent home only 15 miles to San Rafael, 30 miles to the GG Bridge, and drive through farmland to beaches less than 30 minutes away too.

I’m holding my breath prices stay firm, but dollar for dollar, I think it’s still viable to buy at these prices up here.

I’ll also say that I know real estate in OC very well, check out the pricing and inventory activity in Corona Del Mar.

Interest rates people!!!!!!

It is hilarious reading all these posts that are totally irrelevant. Recessions are a part of the economic cycle, however in the past the fed could manipulate rates to keeping the economy moving forward. Iranian oil, realization of the total lack of relevance or income potential of social media, Apple unable to come up with anything new, and a whole generation saddled with subprime student debt, auto debt, and CC debt they have no means of paying back, and people living 10 to 20 years longer than anyone ever expected means we have a HUGE correction coming. 2008-2015 has just been the eye of the storm. We are now approaching the other side of the storm and God help anyone who has participated in this totally bogus and artificial economy created by central banks all over the globe. If we would have just left the economy find its natural rhythm and all the banks and insurance companies that took on insane amounts of risks go belly up, yes it would have been painful for some in 08 we would be coming out of it healthier than ever. Instead we kept the economy going on steroids and other drugs and now the pain is going to be exponentially worse. My prediction is a 50% haircut across the board on all asset classes. Adios Starbucks. We’ll see how comfortable people are paying $5 for an average cup of coffee when they realize just how bad our economy really is. Hasn’t anyone noticed that all the vacant commercial real estate has been occupied by banks. Did it occur to anyone that they did this because had they not there would still be millions of vacant sqft of retail space available. I have literally seen banks have four branches within a mile of each other. Sometimes on the same street. 4k sqft retail spaces with 4 employees and just ridiculous amts of unused space but if the banks didn’t take the space it would still be sitting vacant and therefore just feeding into the psychology that there is a lot of vacant space available.

OC Inventory still going up up up!

http://i.imgur.com/GoUCkYU.png

Yup, flippers and investors hold on to their “million dollar properties wannabe” until they go broke and foreclosed. I have seen so many of these already in OC and in West LA. Instead of absorbing the investment lost by lowering the price, they are holding on to their “million dollar” crapshacks all the way until the end. Most of these groups of investors/flippers comprise of hairdressers, cooks, nurses, real estate appraisers, retirees, and unemployed folks who called themselves “entrepreneurs.” They continue to recruit suckers to invest with them. I went to a couple of these meetings with a friend just for fun and free food. I could not help but to laugh at how desperate these vultures are. People are living in a bubble. If flipping real estate for money is easy as it sounds, then everyone is a millionaire then. We do not need to work for a living. Just pour our money into real estate. Flippers continue to make money as long as suckers are continue to buy from them. And most of these suckers are investors themselves especially those newbies.

Does anyone want to buy this house? It has been on the market off and on for over a decade now: https://www.redfin.com/CA/Newport-Coast/5-Wayside-92657/home/5928301

Hmmm, what’s wrong with this picture? Eventually it will sell at 2 mil but not now baby.

Here’s a Home of Genius: https://www.redfin.com/CA/Los-Angeles/1619-S-Bundy-Dr-90025/home/6755925

Located in West L.A.’s Sawtelle district — 660 sq ft for only $849,000.

A true “diamond in the rough” as the listing describes it.

That is a terrible part of South Bundy drive also, nonstop speeding cars when there is no traffic and during rush hour, like a parking lot. Many of these main arteries running North and South between the ocean and 405 are like this.

Ever been on Walgrove Street (Mar Vista) during rush hour…?

Back to the Bay Area insanity, I am a renter, 6 years now. Going Boo-Hoo, I wish I bought in 2008-20011. I tried to, but I could only qualify for 350K, and kept getting outbid.

Looking at what is out there now, in the least expensive area of the east bay, Hayward.

Most crap shacks are around $500K, 1950’s flat top staged flips in areas that you would not want to live in anyway. Too many people on the streets in the wee hours of the morning, ampped up on crank, Street gang graffiti on fences, So I rent. secretly hoping that the economy will tank, but even if it does, too many rich investors with connections will scoop up any low priced properties. Too many people in the Bay Area needing a roof over their head.

This House Owns you: congratulations, you get it. If the big crash happens, cash and connected will get all the “deals.” They will be more than happy to rent to you or anybody else for Bay Area market rate rent. I would personally never rent in that area unless I had a high percentage of striking it rich. For the average person, the deck is stacked much too far against them.

“And you know the old saying about opinions…” – Lord Blankfein

“…hoping that the economy will tank, but even if it does, too many rich investors with connections will scoop up any low priced properties.â€

In the event of a tank, that might be true regarding the really good deals. But just like in the last crash, you can likely get a deal if you try. I stupidly passed up a number of places in 2011-2012 that I could have easily and realistically bought. From my experience, it’s pretty simple, really:

1) Don’t have a realtor- just let the seller’s agent double-end the deal. For an average-joe buyer (like me), I haven’t found that realtors offer any added value. Using the seller’s agent also eliminates the potential for collusion between that agent and your (the buyer’s) agent.

2) Make your best offer, which may have to be a decent amount above asking (but sometimes just offering the asking price might be sufficient). 20% down and a pre-approval letter should be sufficient to be taken seriously.

As in the last crash, just because you can’t get the same deal as a well-connected or cash buyer, doesn’t mean that you can’t get a deal. Some of the places that I passed up in 2011-2012 have increased in value by as much as about 50%.

Check this ridiculous listing: https://www.redfin.com/CA/Los-Angeles/347-N-Crescent-Heights-Blvd-90048/home/7095438

Ugh, I drive this stretch of Crescent Heights every day in my commute. Good luck to anybody living on this street if they ever plan to pull out of their own driveway. Non stop rush hour style traffic seven days a week. Must be soothing listening to that all day, literally 20 feet from your front door. Also the restaurants on nearby Beverly Blvd use your block for all their valet parking. You’re not even paying for the land–just the location.

When the next economic down turn arrives buying a house in los Angeles will be more expensive compared to the downturn of 2008-2012,since home values have skyrocketed.just like buying a house in the downturn in late 2000,80`s or 90`s would of been cheaper.the september housing report in houston is 7,454 houses sold,last september it was 7,407.many people who are losing their jobs in oil are going to the petro-chemical industry that industry is booming,they are spending billions of dollars on construction.they need engineers,etc.the saudi’s thought they could take out all of the u.s. oil companies,they were wrong.both sides have taken hits,but the u.s. companies are winning.

Never underestimate the stupidity of people in large number’s, Glad to see Doctorhousing bubble alive and well. Basic business math will tell you if an asset is over/underpriced. Currently the prices of real estate don’t match the intrinsic value. Up here in Santa Barbara I am seeing prices at the lowest in 12 years, but it still is overpriced. I have real estate investments but the rule of thumb is that you got to get your rent to cover your mortgage plus a little for repair and taxes. Working underwater is for fools and underwater welder’s and only one of those makes any money underwater. If the fed got out of manipulating the housing market maybe it would autocorrect, but a lot of pain would be felt by a multitude of people.

“Currently the prices of real estate don’t match the intrinsic value.”

What do you mean by this? Intrinsic value, as in you’ve determined through fundamental analysis of some sort that this is the case?

Well he did do that. Intrinsic value is the same as saying “You go right ahead, I’ll pass”

Imagine the troll war that would have occurred during the Tulip Bulb madness.

Intrinsic value is set by those that have “no dog in that fight” so to speak.

There is no intrinsic value in building islands in the U.A.E. nor replica cities in China.

Humans do lots of silly things with other peoples money, you always end up asking why?

When you come across the confluence of 3 major rivers and don’t see any type of human settlement, then you ask why not? When you see Pittsburgh and see what they did, then you say Why did you fark it up?

Leave a Reply