United States of Investment Properties – The role of property investors in the current housing market. Las Vegas reaches 6-year high on sales with nearly half of sales going to investors.

The number of investors purchasing properties in the US is historically high. It is an interesting phenomenon to see markets like those in Las Vegas being dominated by investors. It is difficult to predict what the long-term impacts will be from years of high volume sales going to investors. Many are purchasing to rent these places out unlike those in the boom that were looking for the fast flip and profit. Unlike a quick flip, being a long-term property investors takes a lot of work especially in a volatile economy. Vacancies, repairs, insurance, and taxes are just a few items that will always be part of the equation when you invest in rental estate. You wonder how many are buying today chasing a quick yield? What role does the investor have in the market today? What is the status of distressed properties in the US?

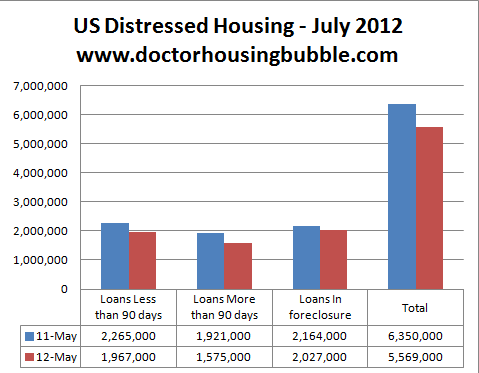

Distressed property data

The latest data shows that over 5.5 million properties are in the distressed pipeline:

Source:Â LPS

Compared to the 6.3 million last year, this is a significant improvement but shows that we are still a long way from having a normal market. Data highlights that distressed properties have been selling for more than 40 percent below their peak level prices. Given how many millions of people have lost homes through foreclosure in the last few years you have to wonder about the impact of these people being unable to purchase properties for a few years?

The one big multi-year trend in places like Nevada and Arizona is the massive proportion of investors buying up properties. In the early 2000s the bet was on real estate appreciation. The current big bet now is that rental yields in these markets will hold steady.

Las Vegas reaches 6-year high of sales with unique set of buyers

Las Vegas home sales reached a 6-year high:

Last month nearly half of all sales came from “absentee buyers†which means these are likely to be investment properties. The rate was 46 percent last year so this trend has been holding steady in Las Vegas. The median price was $122,000 which is a far cry from the $312,000 median price reached in November of 2006.

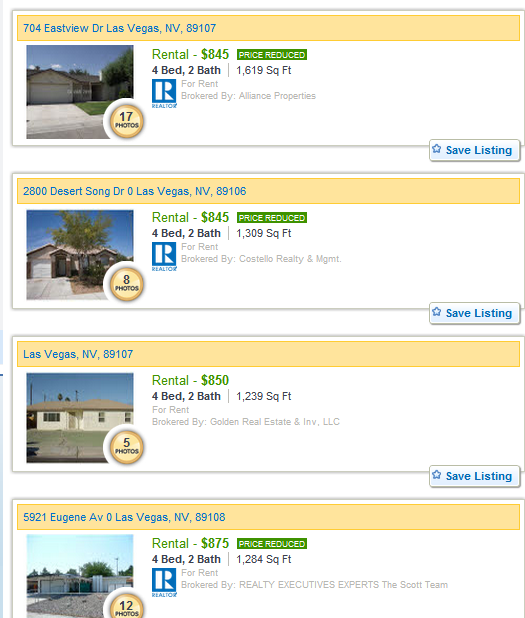

Most of these buyers are coming into the market with the same mindset. Many are likely looking to keep these as rentals. Some for the long-term others just long enough to sell for appreciation if it ever comes. A quick glance shows some 4,500+ active rental listings in Las Vegas. In a large region, you need to know your market and some are reducing prices to attract renters:

From analyzing various reports it looks like the region has a 10 percent vacancy rate. Being a landlord is no walk in the park and many of these people are buying without even being close to their properties to manage. Many will pay 8 to 10 percent simply in property management. Another 5 or 6 percent if they ever decide to sell. What are the implications of having so many investors buying up a large portion of your homes without living in the region? Will this be good or bad for the area? For now, this is the engine driving sales and we will soon find out.

Fixes for the 10 million underwater homeowners

Part of the command control housing market is based on programs to artificially keep inventory low. At last count some 10 million homeowners are underwater on their mortgages. A new program named the Homeownership Protection Program (HPP) seeks to help this underwater group:

“(DSNews) The use of eminent domain proposed in San Bernardino County and supported by the cities of Ontario and Fontana differs from more familiar applications in that it involves the forced purchase of homes from underwater borrowers at “fair†market value. This use of eminent domain was first presented by Robert C. Hockett, a Cornell University law professor.

Dubbed the Homeownership Protection Program (HPP), the solution considered proposes to have the local government purchase private label loans from current, underwater borrowers by using financing from Mortgage Resolution Partners. The program would have the original homeowner stay in his or her home, but with a new mortgage and a lower principal balance.

Mortgage Resolution Partners first approached San Bernardino County with the idea. In order to further consider the program, the Board of Supervisors in San Bernardino County approved a resolution to establish a Joint Powers Agreement (JPA) with Ontario and Fontana and other cities that decide to join.â€

This is definitely not a free market approach. The use of eminent domain is always a touchy subject and not many are buying this approach especially those with the most to lose:

“In the report, Amherst stated it believes that the intent of the program is to buy the targeted loans out of the trusts at 75-80 percent of automated valuation model (AVM) on the property.

A joint letter issued by 18 organizations, including Securities Industry and Financial Markets Association, Association of Mortgage Investors, and National Association of Home Builders, expressed strong opposition towards JPA’s consideration of the program.â€

It is odd that all these programs in place are trying to find a “true market†price when we have anything but a true market. You have bundled programs selling packages of properties to big time investors while banks selectively leak out certain properties. Whenever a program comes that seeks to “mark-to-market†and help homeowners institutions balk at the program yet are more than willing to take all the other programs that have subsidized the housing market for years.

You then have the Federal Reserve artificially pushing mortgage rates to record lows simply to keep prices inflated. What you have left is a market dominated by investors and many squeezing into homes with FHA insured loans. A normal market is one where the bulk of properties sold come from sellers willingly placing their property on the market and seeking out a buyer. Today’s market is driven by investors looking for the lowest price properties (typically distressed properties) and home buyers fighting for the few properties that hit the market. It is hard to predict how this will play out because never have we had such a controlled market for so long. From boom to bust to controlled housing market. The bottom line is the economy has to hold up to justify prices in many regions including rentals.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “United States of Investment Properties – The role of property investors in the current housing market. Las Vegas reaches 6-year high on sales with nearly half of sales going to investors.”

The investors are wrong!

Look at the opposition to the IE Eminent Domain approach. Lenders are basically threatening not to loan in the affected areas in the future if this approach is used to solve the problem. As the politicians and the makers of the “Golden Rule” (them that has the gold makes the rules) get most of everything they want from the politicians they support so munificently. Letting the market decide by pricing housing at the long long term multiple of median income to median home pricing will solve the problem, but this is an unlikely scenario. Everything else is a sham, Japan style kick the can down the road for the (not so hidden) taxpayer bailout implied by a market where almost every loan is a few percent down GSE and all losses are guaranteed by future generations of workers with the baby boomers who failed to save but still vote on their backs too.

“What are the implications of having so many investors buying up a large portion of your homes without living in the region? Will this be good or bad for the area?”

I think that the answer to these questions won’t be known for five to ten years. What we’re watching now is a new bubble, or, echo bubble, if you would, with a ton of money chasing yield in a zero percent world, and, of course, out of tradition and habit, residential RE is catching some of this cash flow. Know one is thinking this out, and the powers that be, banks and politicians, are happy to have this housing depression have money thrown at it from the private sector in any way possible, and they’ll take the short term gain. I just don’t get the logic, though. The landlords I know have all told me it’s hard work for the not so fantastic yield, and, if homes don’t appreciate as they (the “investors”) expect, well, where’s the profit? Personally, if I was going to get my hands dirty in that market, I’d buy a multi family – same roof, same land, same common facilities. A bunch of crappy older homes scattered about for miles? I don’t think so. Just imagine the fuel costs of driving around fixing up these homes.

Me, I’ll stick with dividend stocks. I don’t do plumbing at one in the morning, twenty miles away.

Great post!

I am shorting dividend stocks (bubble) and res (echo bubble) and commercial RE.

Best time in known history to short all of these.

I worked hard for twenty years and saved my money to buy a home. I watched ‘them’ driving up prices with money ‘borrowed’ from my pension fund. Money that will never be payed back, or if it is, it will be with devalued, funny money. I refused to buy property I knew I couldn’t afford. I had to forgo being a homeowner thanks to all the scams and blatant criminal activity. I am the only honest victim here.

If you can hang on until the liquidity trap is set, you can buy from the “investard” at penny’s on the dollar. Be forewarned, you live on a lawless planet. They can maintain the reality distortion field a lot longer than you can stay alive.

Same here. I stopped working, fed up with long commutes, crap rentals for way to much rent and in fact working for reckless borrowers spending my money and stealing assets (houses) with it. I’m living like a nomad now, sometimes in a trailer at my parents place, other times renting a shack on the other side of the planet, wherever it’s summer. I’m not happy like this but it’s my choice as long as this financial madness is going. Unless several currencies go to zero I can keep doing this for a looong time.

I deal with a group of investors who buy non performing mortgage pools. They have created their own niche market and buy for 10 cents on the dollar of the unpaid balance. They then approach the homeowner and offer them a 50% principle reduction and reduced payment to stay in their homes. This is a free market solution but I guess it is just too simple for government bureaucrats.

That sounds like some good action. Throw-us a bone.

I do not see how you can call this a free market solution as it keeps the homeowners out if the competition to purchase at .10 cents on the dollar to keep the house they already were duped into putting up as collateral so the brokerages could rape the equity out if the Notes backed by over valued underlying assets the day the borrowers closed escrow.

Stop posting on the Internet while high.

This is the exact opposite of a free market solution – this looks more like a textbook example of crony capitalism

If only 30% of buyers are FHA that means 70% are not. FHA loans may be 3.5% down, but they are not easy to get. FHA underwriters go though everything of the borrower with a microscope (tax returns, bank statements, w-2’s, paystubs, DNA sample, etc….). So these people are REALLY qualifying for these loans and then some.

Also, you keep talking about the Fed holding down rates which is only the half of it. What is REALLY pushing down rates right now is the debt issues in Europe causing a money to flow into U.S. treasuries & pushing down the 10 year bond (which drives 30 yr fixed rates). If Europe wasn’t doing so bad, rates would still be low, but not even close to where they are now. So you keep harping on the Fed and that is not the whole story with the Fed.

RTC;

The ultimate controlling factor for low interest rates is Japan I.M.H.O.

52% of all of the tax revenue they manage to collect goes to pay interest on their debt. They just passed a law to increase taxes. If the increase causes avoidance or imports fall or the reactors don’t get turned back online or they have to pay more for natural gas, or if this or if that happens etc. etc. they are DEAD.

Japan’s Central Bank has to buy it’s own debt to keep the wheels turning, if the bond vigilantes go after Japan it would trigger a bond market panic. Capital from all over the entire planet would only have 1 place to hide. US bonds. That means that rates in the US have to stay low to keep Japan alive, If Japan debt market dies rates in the US will go to zero. If rates go up, say good night. Game Over last one to leave Earth turn off the lights.

“The Federal Reserve is propping up the entire U.S. economy by buying 61 percent of the government debt issued by the Treasury Department, a trend that cannot last, Lawrence Goodman, a former Treasury official and current president of the Center for Financial Stability, writes in a Wall Street Journal opinion article published Wednesday.”

http://www.moneynews.com/Headline/fed-debt-Treasury/2012/03/28/id/434106?s=al&promo_code=E8AA-1

You may wish to read up on “operation twist”, if you think the Fed is not in control of interest rates.

Read more: WSJ: Fed Buying 61 Percent of US Debt

According to this article, FHA is loosening its credit restrictions on loan apps, which in the past would have made 1 in 3 loan applications untenable. Any thoughts on what this could mean for the stability of low-downpayment loans or the quality of FHA applicants?

http://www.latimes.com/business/realestate/la-fi-harney-20120701,0,7521771.story

And why do you suppose the problems exist in the EU to begin with?

just an FYI, unless your loan is hard money or profoilio loan maybe 5% of the market, the rest are FHA, FHA mixed with various state programs, Fannie Mae, Freddie Mac, USDA, VA loans which require the same doucments that you listed..if FHA has no impact why did NAR fight tooth and nail to retain the high balance up to 729k FHA loan amounts for high cost areas……729k!!!!

I would not be surprised if the Banks are the real investors, by utilizing LLCs to quietly acquire distressed properties with a goal of renting homes which will provide some cash flow during these unpredictable economic times.

That is a “very” interesting premise. I have wondered where all these so called “cash buyers” have been coming from.

Nor-Korean and russian counterfitters, I suspect.

As a real estate agent, I see a lot of cash sales. For Vegas and Phoenix, a lot of money is coming out of Canada whose market is still strong but is showing signs of a bubble. In 2005, I saw a lot of people, myself included, who said this market is crazy and cannot continue. They sold their properties with the goal of buying back after the correction. Not everyone fell for the bubble market as it was occuring.

If that’s the case the banks are even stupider that I’ve thought. Being a landlord is not real work, unlike borrowing from the FED at 0% and buying treasuries at 2%. Between state and city landlord tennant laws and property taxes and landlord duties and nusiance laws for vacant properties the banks will end up with 1000 white elephants spead out all over the place.

ack, I mean being a landlord *is* real work.

The key to buying investment properties is knowing your numbers and knowing your markets. Phoenix and Vegas will end up having a glut of rental properties and the rental price will go down. I deal with an in demand area and my investors are realizing ROI’s of 6 to 8 percent on single family homes and condos and that is being professionally managed. Stay with your own back yard and know your market. Don’t chase the crowds.

Absolutely right. I work with investors, we use hard money loans. Expensive, but if the numbers work, very profitable. And right now, the numbers are working.

I am curious about these “cash” offers. Until this year, we were able to make an offer as cash, using hard money. Now we have to label it ‘private money.’ How many of these cash offers are actually hard money offers?

With 4 bedroom homes going for $850, how does it “pencil”? If you have to repaint and recarpet a 4 bedroom house, there goes half a year’s rent. Do you have a better class of renter in Las Vegas than I’m accustomed to?

So “Mortgage Resolution Partners” teams up with the County of San Bernardino and uses the government’s power of eminent domain to force a short sale of the note encumbering the property to clear the property of the excess encumbrance. Apparently, they do this under the theory of community stabilization.

What they propose is that they finance the property for the occupant with a new private loan without the owner ever having to leave or go through foreclosure. They just get a new loan from a private lending group which would make sense because the investors could get a 6% -7% yield because the principal has been reduced so much that the borrower’s payment could still go down despite the fact that their interest rate is higher with the added benefit that a significantly larger share of the borrower’s monthly payment is now interest so the homeowner gets a bigger write-off even though their monthly payment is lower.

Using eminent domain to force a short pay is an interesting idea. I’m thinking the lender could still pursue the borrower for the short amount because the loan never went through the trustee sale process (California) which would terminate a lender’s right to deficiency and the homeowner instigated the eminent domain action himself since he probably had to sign something to initiate the government action. This does not leave the homeowner with clean hands. Essentially, he started it so why should he benefit?

What is also interesting is that you cannot get a cramdown in bankruptcy court whereby the excess debt over the value of your home can be cleaved off. So why should someone be able to use the eminent domain law to do what the bankruptcy court does not allow?

As noted in the article, I see a lot of industry opposition that will likely smash this idea. If they try to implement this there is no doubt they’ll end up in court and I think they will lose as this is not a legitimate use of the power of eminent domain – it’s contract interference.

“From boom to bust to a controlled housing market.” I have news for you, it has been controlled since 1999 when the Bankster lobbyists convinced their minions in Con-Gress to pass the Banking Modernization Act which Repealed Glass Steagall and then in 2005 passed the bankruptcy reform and consumer protections act which disallowed judges from lowering principle to CMV so people could save their homes! This was all orchestrated purposefully to steal what would have been the borrowers future equity! It has all been manipulated to steal fromAmericans and socialize the banks losses onto the tax payers backs! Why do you think they are instituting austerity all over the world? We have not had a free market for many many years.

This is exactly the root cause of the RE mess we’re in. Glass Steagall (or its equivalent) should be brought back and enforced.

This housing market is just a complete steaming pile of shit right now. This is not a normal market in any way, shape or form. I actually looked at an open house yesterday and the sales flyer said in bold words: PROPERTY SOLD AS IS, PROPERTY CONTAINS LOTS OF DEFERRED MAINTENANCE. You would think a place like this would be deeply discounted. Not even close. Realtor said he expected several offers after the showing. Are people really that stupid? Did we learn nothing from the bubble?

Oh Lord(y) can I relate.

You’re right about the market being a hot pile of waste.

We found a regular sale to look at. The listing office

let their buyers put in offers, and we have to wait for our turn (another brokerage) tomorrow. 3 offers on day one (dual agency), all above list.

We’ll offer above list, not by much, and we’re a cash & close.

We might have a shot. Appraisals are not working out for

the overbids lately. Many of the over bid homes are back in the MLS.

These enginerred low interest rates and low rigged inventory, along with

all thses buying is cheaper than rent (how much a month club) are bring

out stupid buyers, and us smart buyers are getting screwed.

Hooray for the bank appraisers having a stretch cap. Lord(y) I agree w/ you,

no lessons stuck!

Excuse my errors. I was up 17 1/2 hours.

We are also seeing a lot of houses go from pending back to sale. Appraisals are causing buyers to back out of the deal. A house that is pending at $600,000 in Culver City but appraised at $500,000 requires buyers to come up with a lot more cash to make the deal on top of the required down payment.

Many buyers need to do their homework and not offer more than the appraised value unless they have an extra $100,000 in cash to buy the property.

People, what is holding down US rates is interest rate swaps courtesy JP Mprgan and the Fed. See various articles by Rob Kirby who has been documenting this for years….

All I need to know is the demographic reality of the US. The 18 to 34 year old bracket has 80M people in it and most can’t afford homes at current prices because the employment is not there for them. Until that changes, things will only deteriorate.

Yep, it’s just as simple as that. Rental or non-rental are all based on that. Everything else is just an illusion.

Hear hear to that Ockhamesque bullseye.

Also, way too many in the age 18 to 34 bracket have little to no experience of work AND they were raised to believe that they were so Special, they need only turn up to get big rewards.

The Occupy meme has demonstrated how many people under 40 think that things like houses, college degrees, cars, a $60K salary, and consumer goods are entitlements, rather than something one works for. So this is not a demographic cadre that would benefit from the best jobs plan in the cosmos, coz that would require you show up and do something other than play video games or surf 4Chan or be told how they will save the world or take a degree in planting vegetables or weaving baskets.

The young folks I know who DO have a work ethic/sense of adult reality are either Nth generation US working class, of rural background, or new Americans, mostly from Asia and Eastern Europe. Also a good number of atheist born-again Christian young folks. They are forming multiple-person social units early. They are living frugally, working, saving, learning a lot of DIY skills…and they are way too smart to buy into the Boom Era view of things like housing and debt.

I’m a 30 something with a 6 figure income and career. I’m part of the Occupy movement. Your “greatest generation” drove deregulation, crony capitalism, and benefited from this bubble while you deferred maintenance on infrastructure, destroyed quality public education, and raised children who thought that these things were what they deserved. I suggest you look at the Occupy movement differently that you do. We just want to fix what your generation effed up.

I have a theory here. These investors are not all super smart people who know something you do not. They were raised in an era to trust the stock market and the bankers in New York. Now that we know we have been duped (called muppets by Goldman Sachs) and squeezed for every penny they could muster in fees and bonuses, we are reluctant to send our money to them.

We do not trust them to hold and grow our money. We do not understand the complex financial instruments they have created and we know that they have taken positions against their own customers to make the company money (and themselves more bonuses.)

We understand real estate. It may rise and fall in value again but we understand how the system works. Compared to the offices of JP Morgan, Goldman, Morgan Stanley, and Citibank- real estate is more trusted. It can be seen and touched.

The Facebook IPO proved again that Wall Street won and Joe Investor lost. The system has not changed much from 2008. My friends are paying cash for small homes to rent. They feel more safe.

Forgot to add: If anyone saw the 60 Minutes piece about company trading in and out of stock positions every few milliseconds by the smartest mathematicians in the country – you will agree with me. They have the fastest computers located very close to NY solely for the purpose of making pennies on every trade. The system is now for the very rich to dominate. I cannot compete in that realm.

Ha. I read recently that the high speed trading facilities are moving from just across the river in NJ to specific locations in Manhattan that are right next to the cables that enter and exit Manhattan. This will give them some absurd advantage in the timing of trades, something like a millisecond, over their rivals. That’s how crazy this new trading technology has become.

I agree, the FlashCrash was probably the deadliest event to the marketing of trading to the average schmoe in the past decade, deadlier than the crash of ’08, even. Just at the point when Mr and Mrs America was starting to get their toes wet again in the stock market, that happened, and poisoned the atmosphere for a very long time. Your theory that RE is “safer” is spot on, but, I fear many will be unhappy in five to ten years after all of that hard work for little gain. But, hey, makes me happy – I’d love to see a ton of houses come into the rental market. The more the merrier, and, cheaper.

Nasdaq actually rents space in their data center at exorbitant rates to high frequency trading companies that want to place their servers right next to the Nasdaq servers, to shave microseconds off their data transfer latency in submitting orders. It’s insane.

They are also financing a new undersea cable that will be the shortest possible distance between London and New York. Trying to get a phemtosecond advantage.

THERE. Exactly.

First of all, life is not fair. Second, man “success†is supposed to be based on man’s adaptability. Well, adapt to the current reality or die.

I welcome these “investors†purchasing housing at prices I am unwilling to pay. This will most likely provide more rentals on the market which will put downward pressure on rents which will put downward pressure on property values.

I adapt to the current reality by renting. Those who don’t adapt will pay more for a house than it is worth and will be trapped in a 30 year nightmare. Nighty night…

=I welcome these “investors†purchasing housing at prices I am unwilling to pay. This will most likely provide more rentals on the market which will put downward pressure on rents which will put downward pressure on property values.=

There might be an upward pressure happening as well, if the turnover rate for investment properties is significantly slower than that for primary residences. If 50% of the market is investment properties, and investors are primarily wanting to hold them 2 or 3 times as long as a regular home buyer normally stays in their home, then that kills supply of regular, non-investment homes which drives their price up.

The questions then become: will there be a significant difference in turn over rates for the two species, and how big a bight will investors take out of the market?

I don’t care how long an “investor†holds an “investmentâ€. The point is that “investors†are most likely going to rent their “investment†property. This will increase the rental to renter ratio. This normally puts downward pressure on the price of rent. I am fine with “investors†holding “investments†that are not performing. The word will get out that these “investments†do not perform due to the ROI. A fool and his money will soon be parted…

Cash Offer above list went in today in So Ca. I like to call the pricing “bottoms up”, which means the minimum they’ll take. We have a little wiggle room for round two, but this home needs a lot of making it current. A fool can top us, we feel extorted at the price we offered. WE HATE this rigged market. 4th offer in 2 years. Not much to offer on. I’ll keep you posted. (reg sale-many, many offers.) FHA’s ,10%-20% shredded, then the rest of us.

Lender Appraiser hopefully will scare seller on financed buyers and more extortion.

Yes, Las Vegas is 50% investors paying with cash – Canadians are refinancing their homes to get the cash. Californians are borrowing from mom. None of them knows what being a landlord entails. None of them knows the calibre of LV tenants, deeper and darker than anything experienced in Cali or Canada.

None of these “investors” has a clue that 75% of condo complexes are occupied by tenants, and it’s growing. It’s just a matter of time, they won’t be sellable, except for cash. That’s when the complex goes Section 8. Down from $80,000 to $35,000 and no lender will touch it. The noise level goes up, the landscaping dies, cars parked all over the place.

These “investors” have, once again, shot themselves in the foot. Money down the drain.

Houses? You’re lucky if you can get a 2-year lease, most are one. Condos are 6 mo’s to a year. LV is a gaming town. Investors are, once again, getting gamed.

Somebody commented earlier, stay with what you know. The majority of these LV “investors” don’t even know there’s life beyond The Strip. Sad, just sad.

In case there’s any doubt that the interest rate game is rigged:

http://buzz.money.cnn.com/2012/07/04/barclays-libor-email/

The bankers always win…

The key to everything, is interest rates. Not how much shadow inventory, not how many underwater homeowners, but INTEREST RATES.

When I was a younger and bought my first car I was surprised that the vast majority of car buyers only cared about the payment. They didn’t care about the interest rate or the price itself, as long as they could afford the payment.

I for one, didn’t care about the payment, it was how much and at what interest rate, payments were the last thing on my mind.

Unfortunately, the same type of low information buyer is now in control of the housing market, it is all about the payment, price is of no consequence.

These people will be able to afford ever increasing prices as long as 30 year rates keep moving down. Sub 2% is guaranteed if the economy does not pick up.

Bravos “1 million dollar listing” will soon need to be changed to “10 million dollar listing” because if 30 year rates keep going down, the sky is the limit on prices.

Common sense and prudence could the downfall to those with brains.

They can’t go much lower. If interest rates go negative, nobody would lend and everyone would want to borrow. For example, of the Fed decides to lend money to banks at -1% under the hope banks would relend to you at +1%, what would happen is that the banks would borrow as much money as they could, keep it risk free and lend none of it out to anyone, except maybe to buy treasuries. Thus, banks wont lend unless there is a cost to them for holding the money. This sets a floor on the prime rate.

Since the banks will always need to charge a spread between the cost at which they get the money and the cost at which they lend it to you, to cover default risk, consumer interst rates can’t drop much below that spread. So, there is anothe floor here too, probably at 2-3%.

Rates really can’t go lower than they already are, unless the government decides to loan directly to consumers with no middle banks in between. This would put the banks out of the business, which sound great to me! However, I can’t see congress going for it.

I used to blog on this site back in 2007-2008. We sold our home near the peak of the market in early 2007, rented for almost 2 years, and bought our new home, at a huge discount in the end of 2008. We missed the biggest portion of the downfall by at least 90% thanks in large part to the knowledge obtained from reading this site daily.

If you have the down payment, long term real estate investing is a screaming deal right now! It’s the best it has been since the 1960’s. The old rule was location-location-location. That’s still true but you have to be specific. The key in California is schools-schools-schools. California is broke. The schools are a disaster and people in good communities with bad high schools, are desperate to get out. (Especially L.A. Schools!) Private Schools in the L.A. area are out of room with ever increasing class sizes. That means private schools can charge what they want…and they are doing just that. If a neighborhood is has an excellent Elementary – Middle School, and High School you have a the trifecta. Families are willing to add an additional 20 minutes to their commute to save $1500 or more on schools. If you do the math you are really paying a lot of money for that short commute. Private school is like paying an extra mortgage.

Interest rates have created a situation in these communities where the rents are very high, and the mortgage is very low. We just acquired another home, that we rent out in Westlake Village that has a $400 positive cash flow after mortgage, property tax, HOAs and insurance. Non-owner occupied rates are as low as 4.5 % on a 30 year fix. Even if rents go down by 33% I will still cover my mortgage payment. I don’t see any signs that they will. There is a shortage of rentals in the area. We had 3 applicants in the first 2 days with credit scores above 750. The calls continued to come in all week long with potential applicants.

The bottom line is this: I only paid 20% for the property at today’s prices. Somebody else is going to buy the other 80% for me. When I retire it will be paid off and produce an income relative to the future cost of living changes at the time. Show me ANY other investment that is as good as that. Mutual Funds? Stocks? Maybe, but how do you know which one to pick?

If you have been saving for a down payment, it’s a great time to buy. As long as you don’t plan to sell anytime in the next 15 years, and you remember the three most important words in California Real Estate. Schools-Schools-Schools. Then you have to look at owner occupy rates and vacancy rates for the area.

The old capitalization rate standards have to be changed to reflect current fixed interest rates as well. Interest rates are ridiculously low, and if you find the right neighborhood, you should be able to cover the payments for the length of the loan. Then enjoy a much more comfortable retirement.

Now add maintenance costs and watch your cashflow get cut in half. Do you realize that most homes are going to cost over $200 per month (avg) to maintain over the life of the investment?

Mr. Landlord,

How do you figure $200.00 per month? What are the primary expenses in this figure? Are you a section 8 landlord?

Thanks,

Brian

“Â The current big bet now is that rental yields in these markets will hold steady.”

Sure, but consider the reason why they get away with this. It is much more difficult to get a loan now. Cash buyers can buy “low” now without fear from domestic debt-reliant competition. They win if rents go up. They also win if the credit markets loosen up, driving prices up. Some may consider it a win if they just don’t lose money. Suppose you lived in Greece….

Now it can all still go horribly wrong for them, and probably will. I suspect their margins will be eroded by repairs, property management companies who realize they can raise their fees or fail to maintain the property, and other unforeseen costs.

I live in Long Island, NY, and the prices have slowly but steadily declined over the past 5 years, but like Cali, still way overvalued. In addition, our taxes are the highest in the country, and still reflect the peak bubble home values. Whenever I’ve seen a property that has what I consider to be a fair price, I call up the realtor to find out there are already 15-20 offers on it. Odds are, a builder is going to knock the house down and put a brand new house there.

The good news is that at least now I can find some listings with prices I consider fair, even if I’ve got no shot at them. Even 2 years ago I couldnt find any. I give it another 3-5 years out here before we are back to “normal”

Leave a Reply