The rush to buy: Dropping contingencies on offers, thinking equity went up in last month, and stated income loans.

Stated income loans? No contingencies on offers? My equity just went up 10 percent in the last month? These are some of the current conditions in the California housing market. A couple of contacts in the industry have been mentioning that some of their prospective buyers were outbid by others that were coming in with no contingencies on their offers. In a previous article we discussed how people in Orange County were now trying to include PowerPoint presentations to win over a seller. It is understandable to make an argument based on low interest rates and looking at various opportunity cost scenarios but now you are having people rushing to buy because they are worried they are going to miss out on gains. The stated income loans appear to require a decent down payment but they are now back. Jumbo loans now make up a good portion of the market as well.

Will supply increase in 2013?

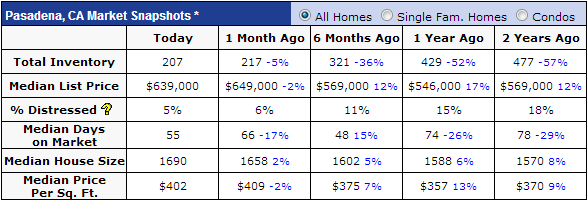

The dramatic drop in supply is truly the housing story of 2012. For example, take a look at Pasadena:

Inventory has fallen by 57 percent from two years ago. During this time list prices have gone up by 12 percent. Those looking to buy today will need to compete with flippers, investors, and foreign buyers. The median list price in Pasadena is now $639,000. What you do see is irrational behavior in the sense of removing contingencies or placing bids way over the list price trying to outguess other potential buyers. It almost makes you wonder if California’s housing will be in a perpetual boom and bust?

Flipping is also helping to push comps up in certain areas. The churn in certain markets is causing prices to inflate courtesy of flippers. How so? Flippers typically buy properties at lower market rates and rehab them to sell quickly. This has been the recent trend and select markets are seeing inventory decline and prices increase. Flippers add more expensive inventory to the local market because of additions to the property.

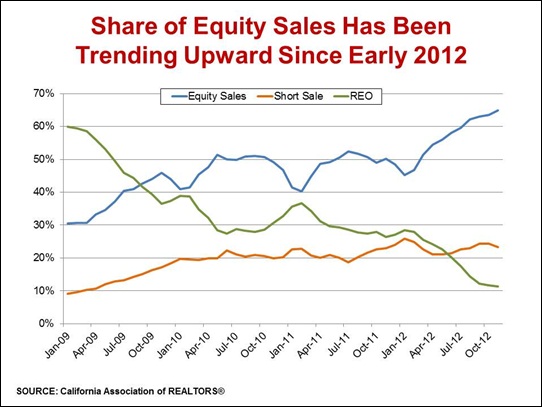

Distressed property sales are also declining significantly in the market:

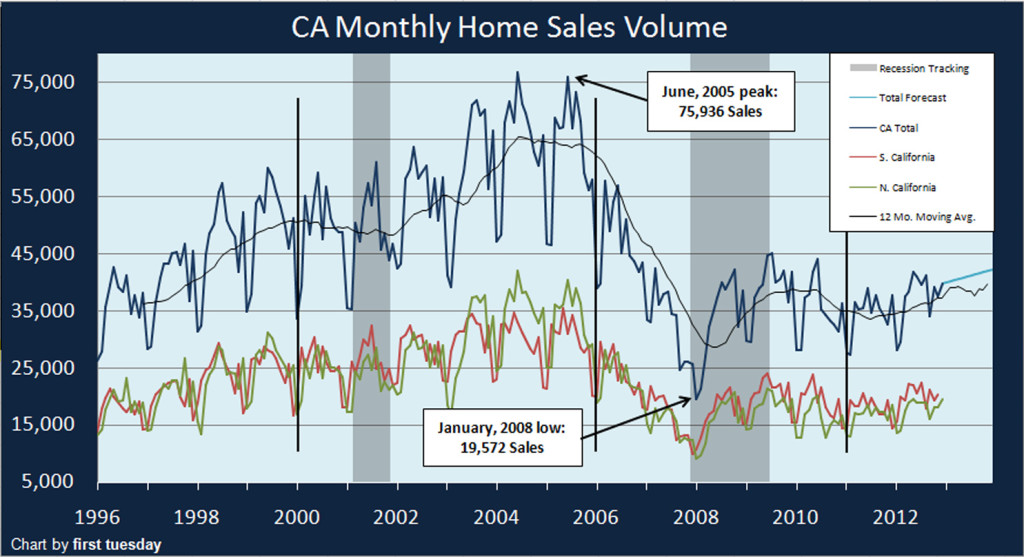

Equity sales now make up over 60 percent of all California homes sold whereas it was 30 percent back in 2009. Sales volume is up but nothing dramatic:

What you have is fierce competition for the little amount of properties out in the market. Regular families all have the same access to those low down payment FHA insured loans or if you have a down payment, you have access to low rate conventional mortgages. Yet that may not be enough when you have all cash investors swooping in to pick up properties.

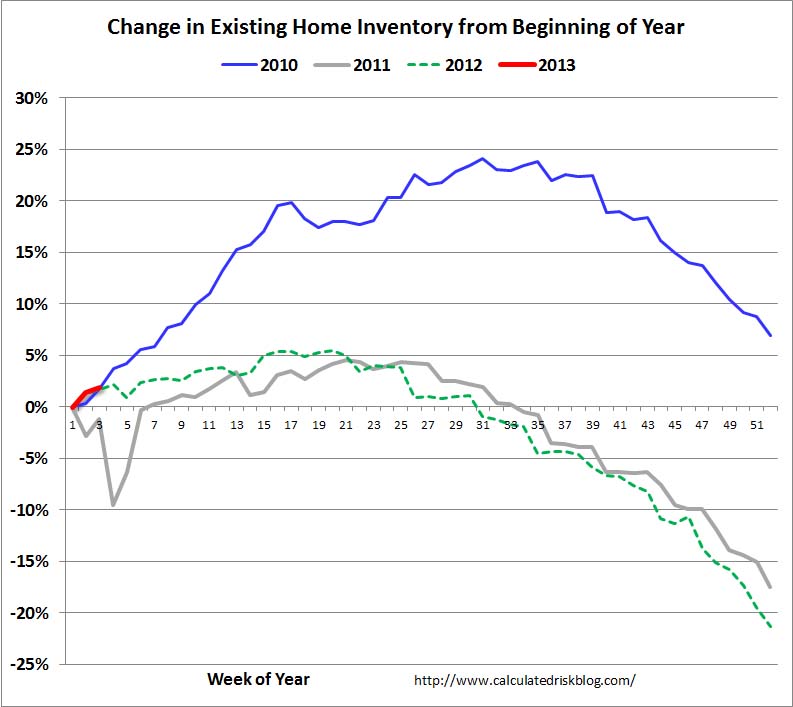

Nationwide inventory is slightly up for 2013 but it is way too early to tell where this will trend:

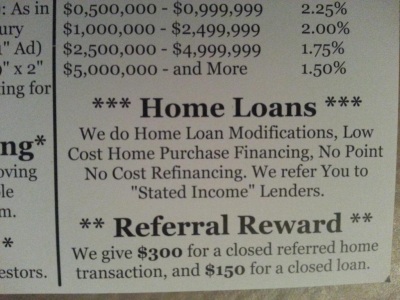

If you are looking to buy know what you can afford and have a steady budget in place. The same rules apply. I’m seeing irrational behavior where people are spending way beyond their budgets just to compete in the current market. Many will face competition from flippers, investors, and foreign money. I forgot where I saw this but it does appear that some lenders are doing stated income loans:

Most are keeping these in house with large down payments (30 percent). Then again, it has to start somewhere right?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “The rush to buy: Dropping contingencies on offers, thinking equity went up in last month, and stated income loans.”

Hi Doc. Pretty shocking those increases in home prices. Who woulda thunk back in 2010 that 2 years forward the YOY increase would be approx. 6% per year. I am getting the impression that SoCal could in fact be a series of continual booms and busts as you mention (or busts and booms depending on the start point:).

Booms and busts are what CA has always been about, dating back to 1849 and the gold rush days, but always the next boom goes to greater heights. Nothing ever repeats exactly, so just some changes at the edges this time. The next boom is already underway, the largest drop in CA unemployment in 25 years, budget forecast to be in surplus in 2014, Bakersfield is currently experiencing an oil boom and homes are booming in good locations already. And that CA is about 12% of the nation, the CA boom will lead the national econ recovery from its slowness, but the national recovery is solid albeit slow because of the health of major corporations and strong financial markets, especially since housing has already bottomed and housing is key to recession recoveries. Thankfully, there still enough fools who only see doom, because the nature of booms are that they climb a wall of worry. When these guys get positive will be time for wise investors to exit, but not yet.

“Thankfully, there [are] still enough fools who only see doom,…” So the guy who believes a forecasted budget surplus by next year is calling someone else a fool?

Joseph, the budget that Brown gave forecasted a surplus (by his own estimates) for this year – but no one will know what actually is going to occur until July 1st. Anything else is pure speculation, including your erroneous statement of “fact.” Also, your other blanket statement about a broad economic and housing recovery flies in the face of everything posted on this blog over the past year – please offer objective sources for proof of your macro budgetary and housing forecasts. BTW, calling anyone holding a contrary opinion from your own “a fool” is just asking for others to call you the same, since you’ve offered nothing in evidence of support for your statements.

Polly want a cracker?

> Who woulda thunk back in 2010 that 2 years forward the YOY increase would be approx. 6% per year.

Actually Credit Suisse, back in 2008. They prepared a chart showing likely delinquency rates due to subprime and predatory option ARM recasts. The chart predicted a nose dive in foreclosures in 2011 when these things timed out. As it turned out the robosigning scandals helped too. It seems likely that the housing recovery is the result of a reduction in shadow inventory coming to market, at least for now.

A recovery condition only exists when the patient’s health is improving. At this point the patient’s vitals are being stabilized by drugs.

I agree that there appears to be a reduction in the shadow inventory coming to market. My guess is that it’s being purposefully held back.

I was recently in a remote location watching a pair of hawks hunting an evening meal. They circled and swooped for quite a while, eventually I heard a sharp cry as one deep swoop proved successful; the hawks quickly flew away with their catch.

I wondered what the remote area would be like if the govt began dropping thousands of rodents daily, flooding the valley with prey to ensure the hawks wouldn’t starve. Would other hawks come, would hawks start spending more time fighting each other than hunting? Would some hawks become too obese to fly? Would a new predator arrive, start feasting on the grounded hawks? Random thoughts.

Hawks are territorial and defend their hunting ground.

The Proud American Bald Eagle on the other hand comes to mind. I have counted roughly 350 to 400 Eagles sitting on the fence around the landfill in King Cove Alaska. Sitting there waiting for the next load of trash. In the same town I saw the fabulous stellar sea lions feeding on the waste pipe from the cannery.

On the Yukon River heard a tale from an elderly Upic how all the grandfathers and grandmothers left the wilderness and the old ways to live closer to the Yukon River trading post. You could find work and get coin for whiskey that was sold at the trading post.

After the USA bought Alaska, the congress sent some bureaucrats up the Yukon on a steamer to asses the indian situation. The party landed at Mountain Village on the Yukon and saw a slum of roughly 600 alcoholics living around a trading post “whiskey shack”. This the agents proclaimed to be a “traditional native village.” Now that there is some real confusion and cultural misunderstanding .

Now I imagine camp was pretty swell for the first trappers and traders up the Yukon. Young men and women applying themselves to a wilderness. Seeking fortune or just finding a place. After the first efforts comes a little more commerce. Then after a while the whole place just seems to go to shit.

What I need is another continent, more wilderness to settle. There is no glory hangin’ with eagles on the fence waiting for the next trash truck.

+1, thank you for your insightful and thoughtful post.

This is a dual market, similiar to Gov. Browns fantasy budget and Obamas “recovery”.

On the surface, all looks fine. No inventory, low interest rates, cheaper to buy than to rent in many areas (East of the 605 anyway).

But the foundation is a house of cards, supported by fiat currency and a crumbling foundation that is the value of the dollar, skyrocketing debt, etc. A lot of people are the textbook “2 paychecks from BK”.

We’ve decided to pull the trigger in March, hopefully there are a few more homes on the marlet in our zip code then. Right now, with $20k down on a $250k home, we’re looking in the area of $1500/mo PITI with PMI. Renting in the same area is $1500 to $1800, with no tax breaks.

Will this pay off in the long run? Will I stay employed? Time will tell…

Nice to see someone young with a family getting into a house. Best of luck to you

Thank you.

Full disclosure – I commute. A lot. And the job situation is questionable, but these days what isn’t? I’ve been sidelined for 7 years and am jumping off the fence!

I would go in on a $250k home if it were near me. But working west of the 405 and north of LAX pretty much screws me over. I’d rather be renting at $1,500 and saving an equal amount in cash I have because otherwise I’d have to risk buying a crappy old 2-bed condo at $400k OR spend 3 hours a day in the car – my time is certainly worth something. Unless I got married, in which case with dual income MAYBE my spouse and I could do about $650k. But even then, that would buy a dump in this part of LA.

I’m in the same boat except that I already have a family. I would rather rent and have a short commute and see my family than buy a long distance away and have to endure a ghastly commute. As for the $650k shoe boxes around these parts, no thanks. My apartment literally has more square footage than these so called ‘houses’.

Good for you Papa. If you can buy cheaper than renting, then it truly is a no brainer. You can lock in an ultra cheap monthly payment for the next 30 years. I highly doubt rent will stay the same over that time period. In fact, renters are getting bent over the barrel in a big way (from my personal experience). Uncle Barrack and Uncle Ben will have your back if you are an “owner”…I don’t think this will change anytime soon! Good luck out there.

PapaToBe

Go for it. Your quality of life will soar, you’ll have real roots, and a plae to call home. We are the happiest we’ve been in a decade. We’re in the poor house, but at least it is ours, and no HOA or LL.

I am sooo happy for you. Best of luck in your search. I see an engineered housing market for years to come. I am licensed (ommercialside/understand residential) and I would say buy through Redfin for the rebate (if your area isn’t a full rebate, at least you’ll get something back).

I don’t do those drugs anymore. The 1% rule is clearly in the dumpster in this town. You cannot collect $6390 in rent for a $639,000 home. Laugh at them. Will the price somehow skyrocket to make appreciation worthwhile? I’m am amazed at the lunacy. For 639,000 in Las Vegas or Atlanta a person could get about 7 properties that are in much better condition with cash flow to retire. I sold in 2010 Eagle Rock for over 500 square foot and bought elsewhere for 42 a square. I rent in Burbank when I need to be there for 45 a square foot and I get a pool and a gym( don’t use the gym tho). But the location is great and at 45 a square foot? Love that.

This is the reason houses less than $300k sell so well. Than can be rented out for 1%. Houses higher are not as popular sales.

Killerjane, vito, the 1% figure comes from the days when interest rates were at 8%, in that case it was right to expect a 12.5% return on rental income to offset all the expenses and vacancy rates etc.

But nowadays, many people with money are happy about a 5-6% gross return on rental investments, which translates to 3-4% net. Despite all of its risks, rental properties are quite a safe investment compared to what else is out there.

The dramatic drop in supply is truly the housing story of 2012. <<<<<<<

There is another key housing story in 2012. Rents are up significantly. The house I track in 92127 (in San Diego North County), price dropped from $640K in 2005 to $505K now, but rent rose from about $1900/mo to about $2900/mo. With interest rates now about half what they were in 2005, the rent is quite significant compared to what CD rates are now.

Not my rents. You’re going to need more than a singular example to make this case.

Bernanke is still trying to trick Americans back into debts: still time to borrow; we’ll make loans like candy for you. We need to unwind debt and Bernanke is spending billions, trillions to sucker more Americans into loans for overpriced housing. If housing was fairly priced Bernanke would not be spending billions to make housing look attractive. Why is Bernanke spending so much to try to convince everyone housing is attractive? If housing is really attractive, houses would be selling themselves and the Fed would not have to be discounting loans by spending more and more US tax money to save the banks, the housing sector, and the Real Estate crooks.

Housing prices will go much lower. In America, in Spain, in France, in Ireland, in England, in China….

Historical housing gains averag 1-2% per year. We had a gain of 200-300% in four years in some parts of America. Do you think housing is not overpriced? Why is Bernanke keeping interest rates at Zero? Because housing is overpriced. And he is desperate to keep it overpriced.

No trick, no conspiracy…….stimulating housing creates all kinds of jobs, housing being the most important sector of the economy to lead the slow recovery into a significant recovery. The growth will generate increased tax revenues to reduce the debt to an adequate degree along with some other appropriate things which are already in place for the future….plus, there will be some more when the economy heats up more.

Keep this one in the “Golden State”.

That way you can limit the damage and not dilute the IQ pool.

I think you’ve got a point, but the fly in the ointment may be the very low numbers of actual transactions. I’d like to see the refi numbers for the last 6 months as that will start to tell the story a little more clearly. Those that can get a 3.4% refi rate ought to be in a hurry to do so.

But, if inventory remains at these levels, the macro economic impact could be a pretty small version of the last bubble.

if we open our demand pull-inflation playbook, we can clearly see that the demand stimulas is minipulating the market. we have not yet unraveled the last quad trillion in bad debt used to faux stimulate the housing sector and thier off running another, GOV sponsored unpayable debt. no matter what you think, theis is just a house of cards stack on a house of cards.

OK fair enough, but answer this question – WHEN will this fall you talk about happen? I agree it “may”, but how many years? What if it’s 7 or 15 years away? Another $100k in rent during that time thrown away?

That’s a main reason I am buying this year, what’s to lose? It costs more to rent. Worst case scenario TSHTF and I lose the house I buy, but I’d be out that money renting anyway. Sounds like a win/win.

And one thing some people forget, or don’t think about, if home prices fall off the cliff that much, there will be MUCH more serious pain going on in the economy and our lives to worry about than home prices. Like soup lines.

Dude, you need an ass load of reality, fast. You keep looking into the past to find out the future. One day, you will look back and realize two things: 1) don’t do that, 2) you’ve wasted the bulk of your earnings because you don’t understand finance or exponential functions. 7 or 15 years? Not a chance.

The thing that keeps this Ponzi scheme going is CONFIDENCE; Confidence in the dollar. Look around you, the dollar has lost nearly 75% of it’s purchasing power since the mid 80’s. Look at the bi and tri lateral trade agreements world-wide now – they don’t involve the dollar. Once the US military cannot defend the petro-dollar, that will be the end.

Simply put, if investors desert the dollar and its exchange value falls, the price of the financial instruments that the Fed’s purchases are supporting will also fall, and interest rates will rise. The only way the Fed could support the dollar would be to raise interest rates. In that event, bond holders and households would be wiped out, and the interest charges on the government’s debt would explode.

People need to start holding assets that are nailed down, such as commodities and real property (that ACTUALLY produces real income, such as farm land, etc.) A house is NOT an asset. Repeat after me, a house is not an asset. It is a consumer durable. Housing is inversely proportional to interest rates. Rates can only rise in the future, thus housing prices will fall. It’s that simple.

Look at the total real income stream of owning (negative) vs. renting and the opportunity costs (0 or slightly positive at best). It’s about return of capital, not return on capital. Once you buy, you will loose 6% automatically due to transaction costs alone. Remember, there is leverage in buying, but NOT in renting. Rent prices will top soon; people do not have credit or the real cash flows for higher rents.

Wake up.

The collapse in home prices and rise in interest rates happens when the U.S. dollar is no longer the world’s reserve currency. So long as oil and many commodities are priced in U.S. dollars, the Federal Reserve is able to run the printing presses like madmen in an insane asylum.

Turkey is paying Iran for oil in gold. China and India are working on paying for oil using something other than the U.S. dollar. If Russia follows this trend to trade oil in something other than the U.S. dollar, then the collapse is much closer than most people realize. Perhaps 3 to 5 years out. Then again, Japan and most of western Europe is in even worse economic shape than the U.S. so maybe it won’t happen at all.

You win the comment of the day award Papa!

Variance, I’m as awake as they come. It’s you that’s still sleeping.

#1. I ran out in 2008 and bought gold, water filtration systems, food, all that crap. It’s nice to still have that, but the end of the world didn’t happen. Should have listened more to the people that have been alive for 80+ years like I am now. It’s all cycles. And there will be no “collapse”. They have a printing press. Period.

#2. You did nothing to sway my mathematics. It will cost me LESS, and at worst EQUAL, to buy than to rent right now. That equates a zero sum game, nothing to lose. Waht’s my current alternative, live for free on the street?

In fact, you are only strengthening my argument that if home prices and the $ collapse, we have much more to worry about than the home price. Like you said, “the military can’t defend our petro-dollar”. If that’s true, then who cares what the home price is??? Either way, until then, you HAVE to pay to live somewhere. Run to the hills all you want, fact is home prices are currently stable to rising, and our fascist leader over in Mordor On The Potomac has no plans to relinquish his control over that. In fact, that SOB is just getting started.

The trend is clearly to get away from the US$ as a reserve currency. The Chinese and the Russians don’t even hide this as their intention and actions. It all hinges on the petro-dollar as that accounts for life in the developed world. But the trend is to leave the US$. How long will it take? These things have a way of going on a lot longer than you think possible.

Do you even comprehend what you read? I’ll say it again, you need to stop looking into the past for the future. So what if has not happened in 2008. You need to STFU and do not do a thing until you understand exponential functions and finance. This current sit’ will last maybe 2-4 years tops.

Either you are a government basement ‘bot spamming the site with propaganda or you are incredibly dumb. Please reread what I have written and the guy below – he knows what’s up.

You are throwing away today’s cash, which can be used to buy REAL assets, unlike a house. Tomorrow’s cash will be diluted even further. Renting a house is having a place to live too, but again you fail to understand finance – you need to understand REAL vs. NOMINAL returns. Housing is going up, but in nominal terms, not real terms. In real terms, it is declining at an accelerating rate. This rapid decline in real terms will accelerate in the future when interest rates rise as they have to.

JFC you are st00pid…there is NOTHING that can SOLVE the problem of exponential growth in a FINITE world, not printing or anything else. That you cannot recognize and/or accept this identifies you as a FOOL.

Give me a break. The United States is 20% of the world’s economy. Even if every other country on the planet abandoned the dollar as its “reserve currency” it’s not clear that would make any serious different at all, simply because no less than 1 out of every 5 units of buying or selling *must* be done in dollars, since it’s done right here. People talk as if the United States is Zimbabwe, and dependent on massive flows of foreign capital to prop things up. Not the case. Most US debt is bought by US citizens, or “bought” by the Feds printing dollars. Not a whole heck of lot is bought by foreigners anyway.

Nor is the US an export-driven economy, like the Germans or Japanese — we import more than we export, and what we export tends to be basic stuff like food anyway. The Germans are screwed if the PIIGS stop buying German industrial products (which is why they keep being willing to bail them out), and the Chinese are buggered if the US stops buying cheap electronics and shoes. But the only thing that would happen if the rest of the world stopped buying American stuff is that the price of corn and wheat would drop.

In CA I use the the words “I hate…” a lot. I love lots about CA but I don’t like the stress. Driving to do a simple errand can be a nightmare. Having to earn $6000 a month take home, just to pay the basics is no fun. The properties all need rehab and watch out if your water line/pipes to the street go bad! And most properties are due for that issue, my neighbors paid close to 20,000 for that one and another friend was charged close to 30,000. I just don’t see these half million dollar bungalows doubling in price anytime soon, but with the stuff they joke there, maybe they will?

$6000 per month??? Are you being facetious? Your debate is plausible but not necessarily realistic. It all depends on where you live in CA. Go east a bit, from anywhere, and it gets cheaper. There are millions that make do on far less than $6000 take home. They rent in coastal counties or commute inland, or in another group there are the people that are flat broke, which there are many of as well.

aahh, Papatobe, wait until you are Papabe and get back to us. Unless you have a family member helping you out with a large down payment $6000 a month gets you something average, small and in an okay neighbourhood for a family of 4 in OC. Renting, likewise, is not cheap unless you want to pile into a 2 bedroom apartment.

I don’t think it is too much to ask to have housing be a quarter of your monthly income. I can only imagine most people around here, like us, are spending much more than that. Renting, buying it’s all the same. You work in OC you live there. It’s preposterous that people who work here live outside of the area. It is bizarre to say you have to live hours away from your work place, if that is the next step.

Yeah, I think PapaToBe jumping the gun on the smack talking since he is about to jump into buying a home (finally). A little bit premature? Don’t count your eggs until they’re hatched you might see yourself back in that corner being bitter about not being able to buy a house.

Yeah, I think PapaToBe jumping the gun on the smack talking since he is about to jump into buying a home (finally). A little bit premature? Don’t count your eggs until they’re hatched you might see yourself back in that corner being bitter about not being able to buy a house.

I updated my name, just for you 🙂

I work in the South Bay and live in the I.E.

Everyday, 2 buses and dozens of vanpools pour in to my large place of employment with commuters from Riverside, MoVal, etc. Not everyone lives by where they work. Those that do, live in Hermosa, Hawthorne, or Culver City in tiny little dumps that are dated from the late 70’s or early 80’s. Landlords say they don’t have to update them because there is always a line of people waiting ot live by the beach. So I commute to a nicer domicile.

PapaToBe

Missed your post. What gender and the stats please?

How’s Ma? CONGRATS!

Killerjane…….All I can say to that is that long ago I began never ever having emotions like hate, envy, jealousy, etc…….it is possible……..the way I see CA is one can be any kind of person they want to be…..it’s all here in CA…..just find your niche.

Yet you call anyone who disagrees with your opinions a fool – hilarious, you’ve got a serious case of cognitive dissonance.

Congratulations Papa 🙂

I know I know. We have been back and forth for years trying to balance our location, jobs, family time, sanity. I personally can’t deal with the idea of having my kids in paid care for 11 to 12 hours a day just so we can buy a house. I don’t want my kids to grow up and one day we all look at each other and say ‘who the *u%k are you?’. I know this can happen because my parents were never around when I was a kid because they were always working.

Anyway, I think most of us here are struggling to get the balance we desire. At some point you have to jump in and try something out. You may be fine with your commute. Or not and you’ll change it. It is what it is. No one can predict the future. Good luck.

And @ Killerjane. I know what you mean. It all wears you down after a while. I went out the other evening with my son to pick up some Thai food and get some groceries and it took us nearly two freaking hours. That is not normal. Maybe I should just get the crappy Thai closer to my house. But then the food situation around here would get me down…

Many of you are noticing foreign buyers, especially those from China snapping homes.

Printing money destroys your currency which invites foriegners to come in and buy up all your assets. The purchasing power of the Dollar has gone down from $100=$100 in 1900 to $100 = $8.79 in 2013.

If you have a strong currency, you can buy foreign properties and assets.

People argue “If the Dollar has lost so much value, why is our standard of living so high?” A good question. A simple answer: our stadard of living is so high because we are spending our great-granchildren’s money to stay comfortable today. This is immoral. And stupid. The currency always shows the truth.

It’s important to understand what is going on today and what is our FED chief doing with endless QE. QE is designed to protects the banks and the bankers. This does not help the poor.

It is designed to preserve the status quo, government by Wall Street.

Thank you for your wise words. 100% accurate. Problem is that you are speaking gobbeldy gook to most Americans. They have no idea how our monetary system work. What QE or Quantitative Easing is, or means. They do not understand where the money comes from or why it should even matter to them. They do not know what the questions are that they should even be asking, much less understand the answers. This is not their fault however. There has been no need to ask, or to ponder as the American economy has been very good to us. Until the last 30 years, that is. There is a reason wages have been flat or declining for the last 30 years and it isn’t some magical obscure reason like “it’s a the economic forces”. When you never create enough money in the money supply to pay back both the principle and the interest it is a mathematical impossibility to ever be out of debt. When there are not enough assets on the planet to back the outstanding debt you will inevitably have all the real wealth and assets that are securing the outstanding debt, transferred to those that perpetrated the system in their favor every time. Every time. Every time. It will be no different here. History repeats itself. The question is not if, only when. A world of debt slaves to the world central bank. The good news is it can all be magically rectified as well. Google Iceland- Forgives all fraudulent mortgage debt to see what they did just a year or so ago faced with the same situation as we have here in the US with equity stripping ponzi scheme that was perpetrated on Americans and the reason for the Lehman Bros., collapse that caused the great recession. Guess what, it was done purposefully. They knew exactly what they were doing! That’s why they hedged there bets with the credit default swaps! They caused it and profited off it. Anyway, back to why Americans’ eyes glaze over when it comes to financial speak. It is not taught in school. Why is it not taught in school? Perhaps Henry Ford said it best “It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” If this has inspired anyone to want to learn about this monetary atrocity a great source is a documentary called Money As Debt. It’s Money 101. Don’t worry it is not the BS about how to save money and pay credit cards, and how to budget!! lol No it’s actually about MONEY. One would think with the two most popular things, Love and money, there would be more info about what it is. There sure is a lot out there about love. Not many blockbuster banking movies and yet, the international bankers are the biggest war mongers, arms dealers, human traffickers, drug dealers etc. Sounds like a blockbuster to me! lol Nothing happens in this world unless a sale is being made. Money never just disappears like Corzine claimed, it is impossible, it can only transfer.

Hi Lynn,

What QE does is it destroys the Dollar, rewards the speculators who take out bad loans and punishes savers. I don’t see how this helps anyone but the rich and the banks who hold worthless loans (that the Fed buys out at full value and then holds while their value deteriorates in the ‘public portfolio’ — this portfolio will only profit as long as the Fed continues to corner the markets by spending trillions to keep interest rates from rising). This isn’t socialism. This is state capitalism, similar to Nazi Germany, where the corporations and the government were in bed together, both saving each others asses.

Of course, these policies continue to create the massive gap between the rich and the poor (call it socialism for the rich if you want to use the word ‘socialism’) — and then civil war and social breakdown become very real possibilities.

FED and Bernanke can try all gimmicks but nothing will work. The problem is….austerity is coming eventually to all, even if we spend trillions tryiing to delay it. Japan is coming to austerity too. QE, monetary tricks, delay the coming of AUSTERITY. Austerity is Winter — it is the inevitable UNWINDING of the Debt Bubble. Debt is karmic. It has to be unwound. The economy can’t grow until the dect is unwound. Debt fills up the glass. You can keep adding cheap water (money) to the glass — but them it overflows and you have the flood we now have. We need to dry out, as they say about alcoholics. We need to dry out, so we can plant the seed of economic growth again. We can’t plant the seed during the flood.

There will be no painless resolution of this. The Japanese have been practicing sophisticated denial since their Housing Bubble in 1989. Hiding their bad debts. Shifting toxic debts around, from corporations to the government, to keep capitalism afloat. But it doesn’t fix anything. The debts are cancers eating the system away. You have to cut the cancers out. You can’t keep spending today’s and tomorrow’s money to protect your perceptions that everything is ok.

To save the banks from loan catastrophe. Bernanke doesn’t give a damn about the millions of Americans he and Greenspan suckered into debt slavery through sucker loans and lower and lower rates.

Don’t you guys see what has been done to all of us?????

Any part of the economy that needs billions a week EMERGENCY TRANSFUSIONS is not working, it is dying, and the doctor wants to make it look good.

BILLION DOLLAR TRANSFUSIONS MEAN it is not working.

When no one is interested in housing and interest rates and in making profits by flipping house, we will be at the bottom, and ready to start an organic growth again.

What you see today is bunch of speculators trying to bring good and old go go days again.

Fierce competition for the few homes that are on sale? Lender’s allowing for more risk? Govt intervention at unsen levels? “investors” gobbling up inventory as soon as it hits the market?

Red flags are now showing up in abundance. There’s clearly an uptrend in the Southwest. The question is, and always is in a bubble, when will it end?

I thought Dodd Frank made no income or stated income loans illegal?

Dr. HB do you know any more about this and who is doing the loans?

Thanks

Yes, I too thought they’re supposed to be illegal, except in the case of refinancing of certain loans & farm/agriculture loans or something.

Or maybe there’s some other loopholes??

If there are, there’s no surprise that someone would find them, and exploit them, of course.

I found this:

http://www.housingwire.com/news/2012/06/15/rancho-financial-brings-back-stated-income-mortgages

But I don’t see how the law would allow for just, you know someone with a lot of money… Because those people got into trouble too before.

It certainly gives off the whiff of speculation.

And a lot of the stuff I’ve been seeing/hearing in the news lately about the housing market just smacks of an enthusiasm to return to the bubble heyday, rather than anything that sounds like a normal economic recovery.

I guess people don’t want a real economic recovery if they can go back to the bubble? Lots of people made lots of money during the bubble, so it’s not really a stretch to suspect that.

“And a lot of the stuff I’ve been seeing/hearing in the news lately about the housing market just smacks of an enthusiasm to return to the bubble heyday, rather than anything that sounds like a normal economic recovery.”

I’ve drawn the exact same conclusion.

Thanks. Good article.

What they are doing is similar to how things started before: thorough appraisals, large down payments, excellent credit and lots of liquid assets. the investor gets a loan that is a lot less risky than it appears and they get paid a decent yield. Once others see how well it works they copy cats enter the market and competition leads to loose underwriting. For me this is the first significant sign that housing may have bottomed. Still job growth doesn’t support much appreciation from here and if we didn’t have a controlled inventory (there seems to be collusion between the big banks and maybe the government to release inventory very slowly-with no mark to market accounting for banks they have this option) I think prices would still be dropping.

@ Steve

Yes, the more I think about that article (that I linked to) and this here (the story upon which we comment)… the more it does sound like the beginning of the previous.

However, I don’t think it takes really big loosening of standards to make trouble at this point.

Even the very very very wealthy can get into trouble if they leverage out beyond the oort cloud. ha ha

Think mini bunches of David Siegels.

ha ha

There’s a lot to play into it.

Also, I suspect that trying to look at the markets for anything, and expecting them to behave even without interference, is probably a big gamble.

Seems like no matter what rules the market should behave by, other things always play into it and kluge up everything, making it very difficult to call bottoms or predict what people will do.

I don’t know if it’s a flaw in economic theories. Or if it’s just that people are so darn psychologically motivated, even when not knowing it.

There was a story my spouse was listening to today about studies they did measuring people’s responses to machines/computers given human-like behaviour. And even when the people didn’t realize it, they were treating computers in social ways. ha ha

That’s an eye opener. People behave in ways & they don’t even know it, when it doesn’t make sense… it’s not deliberate. It just happens.

You can’t expect anyone to be rational or do things in any kind of order, even in mundane situations, let alone when they’re under “the fever” of speculation.

Steve,

Stated income loans are not technically illegal under Dodd-Frank. What Dodd-Frank did was create a class of mortgages called “qualified mortgages” which banks were allowed to sell without retaining any partial ownership. Those “qualified” loans cannot be stated income loans. Stated income loans are still permitted for “non-qualified” loans but they are subject to other regulations and banks must retain at least 5% ownership of those loans.

Thank you for that clarification.

I’d like to understand this better.

Also, I wonder if the 5% is enough to keep lenders from getting so excited they lose their heads.

I’m not sure 100% could be effective given the right circumstances. Just look at what AIG did during the bubble.

One (small) positive thing I’m seeing. Even in these times of limited inventory overpriced properties are still sitting for a good long while. In the corner of eastern Ventura County on which I concentrate, move-up homes (~2500 sq ft, 3 car garage, etc.) had been selling for $700-900K at the bubble peak in 2007 and had dropped down to the 450-550 range during what now appears to be the bottom of 2009-2011. A couple of “ambitious” owners have put homes on the market in the last couple of months in the 650 range… and they’ve just sat.

During the mania of the last bubble the market would have accepted these kind of $100K YOY increases without batting an eye. Watching these properties sit for months gives me some hope that buyers still possess at least a shred of common sense.

Virtual disappearance of the move-up buyer a-la 2000-2007 accounts for part of this phenomenon.

I’ve seen this as well. A friend is trying to sell a house near San Francisco in an area where $1M is a pretty common price. He’s been asking $1.15M and has gotten two offers of $1M for it in about the last 3 months. So although houses are selling pretty quickly, this price range seems much more cautious that the under $500K range.

Do you think that this is as one would expect it to be? Or is this surprising?

I would think that it would be expected. But maybe not?

@papa. What are the costs of a commute…think about it. Moreover, Taxes, insurance mafia at about 20,000 year combined, upkeep, lawn, I am not gonna live on ramen noodles dude. Don’t get me started!

Well, first of all we take home upwards of $4500 per month, so ramen noodles are not in our pantry, thankfully. Second, I don’t believe in spending more that 3X my income on housing. I’m conservative and don’t believe in financial funny-business.

My best option is to commute to the I.E. and I am in a vanpool. Some of it is subsudized by my company, the rest is paid pre-tax through wage works. So I only pay $170 per month out of my pocket, and get to use the carpool lane. I am rarely on the road more than an hour, or 1 1/2 hours on Friday. That’s not a bad tradeoff for quieter suburban living vs. being crammed in L.A. or the Southbay.

Finally, I am not even from SoCal, and besides my wife and the family we created, we have no roots here. If I’m employed, I’m in L.A. and if I’mot, we will move. My wife is down with that, and it’s as simple as that. We have friends in Phoenix, so moving there is an option we have discussed. Also going back to the Midwest is an option, the economy is very good right now in my home town and many places are hiring.

It took me a few years to really anazyze my life and formulate a plan to get comfortable. but once I did it’s been so much better. It’s all about finding what’s comfortable for you and making it happen. I see so many people try to keep up an image, or keep up with the Jonses, etc…and they seem to be miserable. Why do they live a lie? I don’t know. I don’t care. I do me and what’s best for me, and it doesn’t “have to” include SoCal or owning property in SoCal. Right now that looks like an option and I am also equally excited about trying new cities in the future, if taht’s what my employment situation brings.

40 hours a month in traffic for the best case scenario to leverage up to a decent house vs a marginal shack with a short commute.

Seems like the choice between a turd sandwich and a giant douche.

One more thing, the schools are so underfunded, they are a joke! Give me a break, property tax doubled and tripled over the last decade. Why is the state claiming broke? Answer that Dr. HB? That is the billion dollar question. In Eagle Rock parents were asked t our elementary school did we want a nurse or a librarian? We moved. 2010. It sucks.

Eagle Rock? LAUSD? Duh.

The schools are NOT underfunded in…

Burbank

Pasadena

San Marino

Rosemead

Glendora

San Dimas

La Verne

Claremont

Upland

Chino Hills

Rancho Cucamonga

Cerritos

Santa Monica

El Segundo

Redondo

Hermosa

Torrance

Manhattan

Seal Beach

Woodland Hills

Calabasas

Thousand Oaks

And a lot of others, I’m sure

Papa

We just moved out of Thousand Oaks. A lot of the K-6 schools are invaded and are now ESL schools. More sec 8 then it was 10 yrs ago. Parts of Westlake Village are flooded w/ illegals as well. Crazy!

> Give me a break, property tax doubled and tripled over the last decade.

Property taxes for NEWLY PURCHASED HOMES went up over that time. Everyone else’s taxes went down. (They increase at a rate below inflation.) In addition, California’s tax system is very progressive, so the bulk of the non-property-tax dollars come from the very wealthy. The problem with the very wealthy is they generally don’t work steady jobs for steady pay. When the stock market goes down, they lose money that year and pay no tax. When the stock market goes up, they have a windfall and pay more tax that year (if they sell). The yo-yo nature of the 1%’s finances is why the state goes through boom and bust with the business cycle, or slightly behind. (Tax receipts are delayed.)

If you want to fix the problem, repeal prop 13, institute a flatter tax system and raise sales taxes. This, of course is anti-progressive, but I don’t think you can have a stable financing system based on very progressive income taxes.

First year-over-year gain in median RE prices since 2007 and there are cries of a new bubble? The real bubble right now is the interest rate bubble; for 30 years now we’ve seen year-over-year relative decline in mortgage rates versus inflation rates (trend line, not actual). We’ve totally lost sight of how incredible 3% mortgages sound.

People are afraid to list because they think that prices will continue to go up(especially when inflation hits) and that we are at the bottom of the market. If a person sells now, they will have trouble buying a replacement home(rents are going up as well), so they stay put. The government should force the banks to release the hugh amount of inventory that they control. This housing market is crazy and people are scared to move.

Fannie To Allow Walkaways by On-Time Borrowers: Mortgages

Fannie Mae (FNMA) and Freddie Mac will let some borrowers who kept up payments as their homes lost value erase their debts by giving up the properties, helping Americans escape underwater loans while adding to losses at the mortgage giants bailed out with $190 billion of taxpayer money.

Non-delinquent borrowers with illness, job changes or other reasons they need to move will become eligible in March to apply for a so-called deed-in-lieu transaction that erases the shortfall between a property’s value and the size of its mortgage.

http://www.bloomberg.com/news/2013-01-28/fannie-adds-bailout-for-underwaters-walkaways-mortgages.html

Better hurry up and file that disability claim!

“People are afraid to list because they think that prices will continue to go up(especially when inflation hits) and that we are at the bottom of the market.”

I’m guilty of this train of thought. However, we’ve decided to list one of our properties. The printing of trillions of dollars/inflation is a real fear, but seems it’s time, not be too greedy, which regretfully we’ve done in the past. Impossible to time the market…been there, done that. Just make peace with a decision, move on.

What we have, is ostensibly a recovery, but in actuality, its just a steady drop to the bottom. Again we have folks believing “it can’t happen to me/here”, but it will. I can’t say exactly when but sometime in the near future I believe, as it wouldn’t take much (global instability) to bring the house of cards down…

Doesn’t this just scream “buy me for half a million”?

http://www.zillow.com/homedetails/796-Caudill-St-San-Luis-Obispo-CA-93401/15389987_zpid/

‘Discerning buyers will really enjoy the train whistles at 12am, 3am, and 5am, as the train whizzes by, just a block over’. Looks like the house is surrounded by industrial and commercial property, so if the train doesn’t wake you up, then the fleet of commercial vehicles and shoppers in the area will surely fill in the gap. ‘Must love ear plugs and automobile pollution’.

Taxes assessed at 18K, the last tax payment being 180 bucks for the year. Obviously this is a 0.5M dollar property. It’s been a 0.5M dollar property for 6 years of no one wanting to buy it. I’ll give them 8K for it and hope to get 12K from the commercial property owners nebulous to the venture.

Yep terrible neighborhood. SLO has not recovered economically in relation to how little housing prices have fallen since the peak. A friend is a manager at a SLO high tech company and they all just went through substantial salary cuts. Salaries in SLO are already so low in relation to housing prices – who can possibly afford to buy there?

That about sums it up. And I don’t know who can afford to buy in SLO. I sure can’t and it’s frustrating. It’s way, way overpriced. It is not La Jolla or Beverly Hills, especially not in incomes.

If I could find work in SLO, I’d go back in a heartbeat. If you know the area, you understand the half mil. Price tag for a tear-down.

I’m personally going balls out on this one!

@sadie…your kidding, right? It screams “run forest run” run fast.

Yes, I’m kidding. I’d be afraid to even step foot on the porch.

Wow. Deja-vu back to ten years ago.

http://www.pardeehomes.com/homeward-bound

Now, with a twist.

http://www.pardeehomes.com/smart-move-advantage

Leave a Reply