More Housing Inventory is Coming: 850,000 Borrowers Will Exit Forbearance Between August and October.

Who would have thought that a first in a generation pandemic would actually be a good thing for housing values? While the economy is facing new challenges including major supply chain issues (just look at the shipping costs for containers from Asia to the US) you start to realize that there has been a massive amount of money injected into the economy. While many people are getting stimulus checks, trillions of dollars have gone into the hands of the corporate welfare machine (usually benefitting those that are hardcore free market types). Also, in many high-cost metro areas you still have money flowing in from investors and in parts of California you still have foreign money coming in, largely from Asia buying homes with no contingency requirements and fast close promises. So no surprise that even for a professional working couple buying a home right now with limited inventory is problematic. However, much of this is because of a stunted market with inventory. As a new report highlights, inventory is set to increase by 15% over the next few months because of people exiting forbearance periods.

New Inventory is Coming

There will be more housing inventory hitting the market soon. As home prices are up and most are no longer in negative equity situations, some will decide to sell into this hot market. Obviously not paying your mortgage for 12, 14, 16, or even 18 months is a nice bonus that party is coming to an end. This research found that most are not going to bring their mortgage current. Assume someone took a forbearance and their monthly mortgage cost was $2,000 per month, some may be behind by up to $36,000 when the forbearance period ends. Okay, well what if you can’t make it current? You can defer the payments to the end of the mortgage but you still owe that and many got used to not even paying the regular monthly payment. So a sizable portion will be selling. How many?

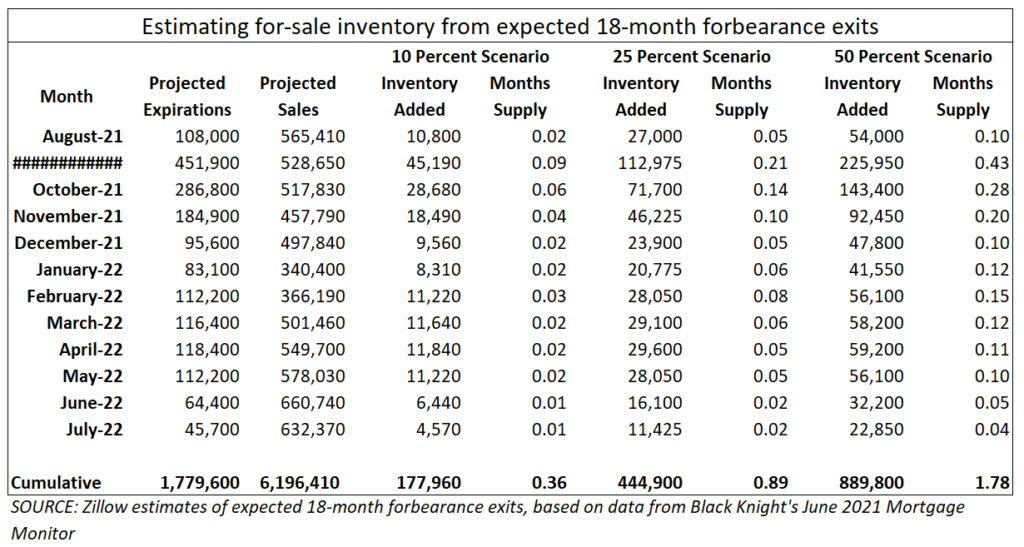

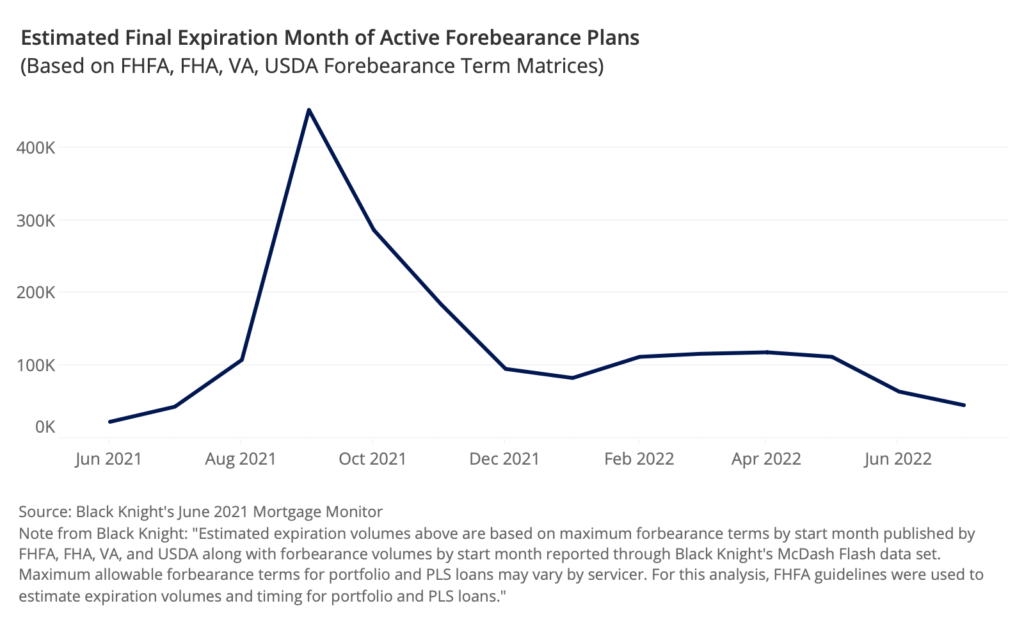

The research finds that roughly 850,000 homes will hit the market for sale within the next few months. Current prices are too attractive in many locations. This should be happening within the next few months:

The big months will be September and October. While rent moratoriums have been extended, mortgage forbearance has not been extended. In many places, including high priced California, you will have many people enticed to sell their $1 million crap shack. The big question is will it slow things down?

The market has been hot because people are fighting for scraps with inventory. There has been such a stunting of the normal market right now. Think of these major economic supports for housing:

-Mortgage forbearance

-Rent moratoriums

-Big investors buying places up

-Artificially low rates

All of this amounts to welfare for housing, investors, and homeowners. The argument here isn’t whether this is “good” or “bad” but it is telling when you have free market capitalist (many owning homes) who cry like little toddlers about socialist policies in other areas when they are getting some of the largest socialism ever known in history.

So we are going to see more inventory entering the market in the next few months while many “pause” like programs will be expiring. At some point you need to the pay the bills and you simply cannot kick the can down the road any further.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

206 Responses to “More Housing Inventory is Coming: 850,000 Borrowers Will Exit Forbearance Between August and October.”

Inventory here in San Diego is definitely increasing and I’m starting to see many price decreases which were unheard of just a few months back. We are definitely hitting a peak.

Small business…the driver of all employment growth…is literally being locked out by the entirety of the US Federal Government.

Biden is presiding over *AT LEAST* a 40% unemployment rate in the USA at the moment. *AND THE DEMOCRATS ARE SAYING LIAR LOANS ARE THE ANSWER?*

good luck with that

Plus inflation

Plus taxes

Plus taxes on top of taxes

Who the hell is buying anything in the USA at the moment?

*WHERE THE FUCK IS THE COLLATERAL FOR ANY OF THIS GOD DAMN DEBT?*

Am not a real estate cheerleader nor a hopeful bear waiting for the next GFC to buy discounted assets but the number that popped out from the article was 1.78 months of supply for the 50% scenario… do others think 2 months of supply is sufficient to reset a housing market that is still structurally undersupplied?

It’s probably not a crazy view that some type of economic deleveraing resulting in many more forced sellers and uncertain buyers and/or rate spike deflating (the affordability boom due to low rates is needed for some on the sidelines to get their actual buying opportunity.

https://www.noradarealestate.com/blog/los-angeles-real-estate-market/

”

The median home price of the Los Angeles metropolitan region rose to $725,000, a gain of 0% from April and 35.5% higher as compared to May 2020. On the supply side, the number of active listings is down. Months Supply of Inventory for the Los Angeles Metro Area is now 1.9 months. Months Supply of Inventory (MSI) is a calculation that quantifies the relationship between supply and demand in a housing market.

Generally, a balanced market will lie somewhere between four and six months of supply. Inventory is calculated monthly by taking a count of the number of active listings and pending sales on the last day of the month. If an inventory is rising, there is less pressure for home prices to increase. With 1.6 months of supply left, it is well short of what economists say is needed for a balanced market. Hence, the Los Angeles housing market will continue to see upward pressure on home prices in 2021.

”

https://fred.stlouisfed.org/series/MSACSR

Doesn’t the idea that 4-6 months inventory constitutes a balanced market come from the days when things moved slower. People didn’t carry around smartphones back in a day and everyone was using paper signatures to sign contracts. When I look at Redfin charts, it looks like 15 weeks of supply is a balanced market that keeps prices flat for most of the year.

Mark Hanson, who made the mistake of remaining overly bearish on the housing market for too long, is actually bullish on housing in his most recent blog post.

While I don’t think it takes much inventory to cause prices to fall, I do think it takes a sustained increase in supply. So if Kevin Paffrath becomes governor of California and fulfills his promise of building 5 or 10 times as many homes each year in California, that’s a sustained supply increase. It seems to me that a one-time forbearance bump will just stall the market for a while.

I never heard of Kevin Paffrath. I’m voting for Larry Elder. He promises to end this Covid nonsense. No mask mandates, no vaccine mandates, no vaccine passports. Freedom of health choice.

Def. voting for Kevin Paffrath!

https://www.businessinsider.com/youtuber-leads-poll-to-replace-california-governor-gavin-newsom-2021-8

He’s the guy!

Joe, I agree Paffrath is the guy to vote for to replace Newsom, but PredictIt shows that Elder has twice the chance of winning compared to Paffrath, suggesting he is way ahead in most polls.

Zerohedge recently posted several articles talking about replacements for Newsom and none of them mentioned Paffrath. I make comments on Paffrath and I get downvoted, while everyone else gets upvoted.

We want people in government who are smart when handling money. Paffrath is the only one I’d trust based on his track record. He is very talented in multiple ways.

I’m voting for Newsome. Yeah, he made some mistakes but he’s the only sane choice. Science and data for the win!

Nobody sane votes for newsom.

Larry elder or Kevin paffrath are the best options!

Newsom represents everything that’s wrong with California.

TDS is alive and well. Trump lives rent free in so many people’s minds. Gavin Newsome is an utter failure at so many levels. But Trump, Trump, Trump…

The Big Guy isn’t doing any better. Everything he has touched has turned to fecal matter. But Trump, Trump, Trump…

See a pattern?

His name is Newsom (not newsome). Some say newscu*

There isn’t much good to say about him. Sadly recall is the only option here.

Yeah, pass on the YouTuber for Governor, I’d say. His video after his obvious margin call should’ve shot that down. Do you rly need a leader who thinks it’s wise to borrow money for more hype equities?

@E

Meet Kevin (Kevin paffrath) made millions through real estate and YouTube in a short amount of time. No doubt he’s a smart guy.

What do we know about newsom? He locked everything down but restaurants opened for his covid indoor parties (no masks). Oh, and California is a mess in all aspects. Newsom is known for “do as I say, not as I do”. Anything else he accomplished?

newsom is fine. not great but better than a set of clowns on the ballots. Did you really think recall would go through? Now he is almost guaranteed next term.

BTW I really applaud him for eating at the restaurant after putting everyone at home. This is a great way to get a peaceful dinner without crowds and lines. Plus some feed for the haters.

covid is a short term tragedy. Yes people died, but it will go away and will be a blip on a historical timeline.

As long as there are interest rates well below inflation, people cashing in investments that may have peaked (e.g. Bitcoin, stocks), huge Government spending projects financed with printing, and acceleration of inflation, there will be interest in buying Real Estate. Government projects often pay money into the pockets of system gamers who then need a safe place to park the money. A lot of the forbearance is also gaming the system. It is driven by Government intervention in the market, and I see no end in sight of that. I would see a slowdown of Real Estate sales without a deceleration of inflation and continued Government spending without increased taxes as a screaming BUY!

“As long as there are interest rates well below inflation, people cashing in investments that may have peaked (e.g. Bitcoin, stocks).”

Bitcoin and stocks haven’t peaked. Far from it. Inflation and money printing will push both asset classes up much further. Plus, where else do you invest your money in besides RE, stocks and crypto?

In the ’70s, California RE beat the snot out of stocks as an inflation hedge. Of course there were high interest rates back then instead of the current financial repression. And crypto hadn’t been invented so there was gold. It went way up but crashed in the Reagan years.

I read an article from an investment newsletter company which said that Warren Buffet, Stanley Druckenmiller, Bill Ackman and Paul Tudor-Jones, all billionaire investors, are all worried about inflation now. I checked it against independent sources, and it is true. Plus Larry Summers, a Clinton/Obama economics big-shot also is warning about inflation now.

So the real question is will this be a runaway inflation that causes real asset prices to skyrocket in fiat currency value (and therefore making this an inflation hedge), or is it a prelude to a deflationary crash, the Mother of all stock market crashes, with similar drops in real asset prices as the currency deflates.

If you keep holding dollar denominated instruments, it could be a hedge against the MOASMC, but if we instead get an inflationary spiral with a currency reset, you could lose nearly all of the value of your dollar holdings.

Either way, the biggest winners will be the Billionaires. They have enough assets to afford losing their cash and other dollar-denominated holdings.

As the economy booms under Biden, this it completely expected.

Extremely too much demand as people are flying and partying again is not unexpected.

Let’s see if supply can catch up.

The only thing “booming” is the inflation. If real CPI would be used (like during Carter years) and subtracted from nominal GDP, the real GDP would be negative – that means economic contraction. Printing money doesn’t make anyone wealthy, except the bankers, the president and their cronies. The vast majority of people, with or without money, take it in the chin.

The capitalist system and free market would respond but the fascist system created by democrats favors only the super big corporations who can afford to lobby the president and his democrat Congress.

LOL. Imagine thinking hyperinflation = booming economy. I guess Zimbabwe had the best economy ever when inflation was running at 1000% a day or whatever it was. Bob, is the best poster here. Comedy gold!! Thanks for the laugh, friend.

the economy was booming 2017-2020. 3% unemployment, 3% inflation, 3% mortgages. Unheard of before. Median income adjusted for inflation hit an all time high in 2020. Then China unleashed the plague on the world…..

As the economy booms under Biden, this it completely expected.

Extremely too much demand as people are flying and partying again is not unexpected.

Let’s see if Capitalist supply can catch up.

SIABB,

Are you OK? The two posts of Aug 16 are way below your standards. Grammatical errors aside, it just doesn’t make sense. Spending government cash as fast as you can isn’t a booming economy. It’s like a prelude to Weimar Germany or maybe (hopefully) to the ’70s here in the US. I wonder if this is a fake Bob trying to make you look bad?

“Are you OK? ”

Sorry for the multiple posts.

Thanks for asking, JoeR. I had posted from my phone since I am out having fun now and spending money that I couldn’t spend before. ie eating out, flying on airplanes, going to packed concerts. I need to watch my spending again.

I think supply is catching up with the increased demand that caused temporary inflation. Lumber is already falling. The supply chain is catching up.

The economy is booming. It is booming compared to 1 year ago when we were all stuck at home.

It remains to be seen where prices will stabilize. I suspect they will be higher than 2019.

I don’t see people stockpiling assets like they did under the Weimar Republic. People are out having a good time. Finally.

https://www.cnn.com/2021/08/12/economy/july-inflation-producer-prices/index.html

August 23, 2021

“Producer price inflation, which measures the prices US producers receive for their goods and services, rose 7.8% over the 12 months ended in July. That was more than economists had expected and marked a new record high since the Bureau of Labor Statistics first began calculating the index in November 2010.”

7.8% inflation over the past year. It’s only the highest recorded level ever. But don’t worry, Bob says the economy is booming and there is no inflation. HA HA HA. This dude probably thinks Afghanistan is going grrrrrreat too.

It is basic supply and demand. I learned this in high school. Mr Landlord should Google it.

As restrictions are lifted, airports are packed with travellors spending money, highways are packed with vacationers, and concerts have resumed with $200+ tickets.

People are spending more money than any time in history after being pent up for months under the previous administration. Demand is enormous.

Supply is starting to recover. Mr Landlord should look up lumber prices.

I call this a booming economy

Mr Landlord,

If the price of rental cars, toilet paper, beanie babies, or tulips increase 1000% temporarily, this is not inflation.

If the price of lumber drops 80%, this is not deflation.

Demand is high, supply is low on items that are being counted. This does not mean inflation or deflation in the long term.

It will be interesting to see where this all settles out when supply recovers.

In the meantime, everyone is out flying, driving, and partying in this booming economy creating huge demand. Nothing like what happened in Weimar Germany.

Vaccine passports in California. Who wants to live in this commie state.

Does this mean we will see prices start falling, or will they continue to be propped up?

Housing will only go up. After the onetime 2008 crash, it’s been nothing but a good time to buy. Not buying has cost many of us our dreams of homeownership in SoCal. Forever priced out. I should have never listened to the internet.

Let me introduce you to Kentucky…..

Actually, most of the internet is always cheerleading a good time to buy. What you shouldn’t have listened to – this forum. It’s full of armchair economists who all missed NUMEROUS opportunities to buy a home and yet they still think they’ll get it right this year. And they might be, but how many years of their life did they miss out on by being wrong? At least a 15 years at this point, which is a LONG TIME to be wrong.

Federal court allows Biden’s new COVID-19 eviction moratorium to remain in place:

https://www.usatoday.com/story/news/politics/2021/08/13/federal-court-allows-bidens-new-covid-19-eviction-moratorium/5510062001/

A federal judge on Friday allowed the Biden administration’s eviction moratorium to remain in place, the latest development in what has been a protracted and politically charged fight with the housing industry amid the coronavirus pandemic. …

The ruling is a blow to the real estate industry, which argued that the moratorium has caused significant financial hardship and infringes on the rights of property owners.

Supporters say the moratorium is needed to ensure millions of Americans behind on their rent aren’t evicted as the pandemic has taken a serious turn because of the highly contagious delta variant. …

Yes, many tenants are living rent free. They have been for a year and a half.

And now the “delta variant” is an excuse to continue the eviction moratorium.

Im still waiting on the “shadow inventory” of 2012-14 to hit!

Jokes aside…

We had an inventory problem before the pandemic. Now its worse. Builders simply are not building enough homes . And they are building virtually no “starter homes” under $400k. I believe starter homes in cheaper metro areas will continue to rise aggressively, lots of demand, low income workers are now making $30 an hour starting pay, not the old $12 per hour, forever low rates, and builders cant build 1200sqft bungalows for $150k. Also rents are rising fast.

Another theory is low supply begets even lower supply, its a spiral down. Let me explain. you want to sell your home to move across town? you look at the market and your getting beat out by 10 offers on every listing. You say screw it and stay in your current home. So the market just lost a potential listing, lowering supply even more.

I believe the market will cool down as far as buyer activity, but prices will remain flat at worst.

This market has room to run, especially in the sub $300k starter home markets. Heck I could see starter homes doubling in next 5 years.

You’re right about starter homes. What I’m seeing is either high end stuff being built or apartments. Not much in between. As a developer that’s where the money is, at the extremes. 3/2 single family homes are no profitable anymore. The other thing is zoning that once allowed for SFH neighborhoods are going away thanks to the push by the hard left to destroy the American home. So if you have a new community where there are apartments, homes, townhomes, etc all thrown in together, who wants to live there? I sure don’t. I don’t want to pay top dollar for a home only to have Section 8 in the apartments next door.

So I will look for an older established neighborhood of only SFH homes. Those are the ones that get 20 offers now. Older established SFH communities are a thing of the past for new builds. But despite what the media tells you, that’s still where most people want to live. So those areas will continue appreciating no matter what the overall real estate market does. It’s classic supply and demand. The supply of those communities is fixed and demand will always keep growing over time. But a home that’s 15+ years old in a high end SFH only community and you will never lose money.

Blackrock and Mega Investment houses are buying up inventory and artificially support real estate market. It’s all centralized market economy manipulation by Govt. Trying to prevent a recession that could last 10 years.

The last insane RE price spike was fueled by the injection of trillions into the market by way of MBS and derivatives and associated loose lending. The current insane spike has been fueled by trillions being injected into the economy along with debt payment moratoriums. In both eras, consumer sentiment/emotions were the same – greed, fear of missing out, auction effect, ego, etc.

History may not repeat itself, but it sure does rhyme.

Perfect opportunity to buy.

if we see another YOY gain of 20%. Yes everything is on sale right now.

Come on Doctor! You know very well a) this will be extended forever just like the rent moratorium. And b) all the people who fell behind will be bailed out eventually. You think Biden wants 850K foreclosures on his hands leading up to the 2022 elections?

You guys are still stuck in a 1990s mentality. In AmeriKa 2.0 nobody ever has to pay for their mistakes. Only people who get punished are suckers who play by the rules and follow the law. You should know this by now.

“Only people who get punished are suckers who play by the rules and follow the law.”

So how exactly have YOU been punished?

I pay an ever increasing amount of tax so deadbeats can live well without having to work. At some point I will say eff it stop working and jump on the welfare train. If you can’t beat em join em.

“I pay an increasing amount of tax“

Sounds brutal! If I remember correctly you don’t even own property in California.

And aren’t you the one who disappeared for over a year when housing looked sick in SoCal and Millie was predicting his 75% crash? A fair-weather commenter you were at that time.

It’s cool. As long as no one confiscates any of your properties you should be fine.

Richie,

You make no sense as usual. Try being coherent for a change, I promise it will be good.

75% crash! ROFL…. I almost fell out of bed.

Maybe if there is an alien invasion or a zombie outbreak! Other than that you could be happy about a 5% reduction in home prices!

Cheers, M (millie)

@Mr Landlord: Have you considered just selling it all right now? Massive gains as of late.

BTW, Supreme Court just overturned the CDC eviction ban. Finally some people in our government did something that made sense. First time in 1.5 years!

Spot on Mr Landlord.

Beautiful to see Bitcoin breaking through 50k again. What an amazing asset. We can be so thankful to be alive during this epic Bitcoin bull run!

Buy before you are priced out forever!

I am seeing a lot more inventory and houses are sitting on the market with a few price reductions here and there. Would be nice to take a breather and plateau for a while. I need to get into our first rental property!

But….The best time to buy is now!! Too funny.

Close!

The best time to buy was yesterday. But today is the second best time.

Bob thinks inflation is no biggie and Biden’s economy is grrrrrreat!! LOL. In Realityville, inflation is running at a 30 year high and shows no sign of letting up.

https://www.cnbc.com/2021/08/27/key-inflation-gauge-rises-3point6percent-from-a-year-ago-to-tie-biggest-jump-since-the-early-1990s.html

Inflation is insanely high. Good for asset holders like us.

Just look at lumber prices.

https://www.nasdaq.com/market-activity/commodities/lbs

Like I said above. Supply and demand. The economy is booming on the demand side and the supply side is recovering like it should.

Inflation should be very short-lived. Except maybe China will play games with chip prices. It may take a little while for Biden to bring chip production back to the US.

Inflation is likely to be an issue while rates remain unusually low.

True, prices have risen dramatically in many places. But California was high to begin with. The median family cannot afford the median house – not by a long shot. And that’s problematic.

California will always be expensive, though. Regulation and weather. I don’t think prices will come done much in California for anything but higher interest rates (hard to imagine unless inflation goes totally bonkers) and/or significant building of starter homes (which isn’t happening).

Related to housing prices, this is still supply and demand. Low supply and high demand in the suburbs. Low demand and high supply in the cities.

My points are:

1) The exodus to the suburbs with work from home has driven up suburban home prices. Why pay $4000/month for a 2 bedroom city condo in SF when you can buy a 4X sized house in the suburbs? Why live in the city if you can telecommute? The supply of suburban homes for $4k/month is far lower than the amount of apartments being vacated in the city. 4K/month is a $950K mortgage at 30 year 3%. Supply is low in the burbs, demand is extremely high. I doubt many suburban homeowners are in forbearance when they could simply sell now and walk away with a huge profit.

2) Rents in large cities have fallen by 5% in the last year. The good Dr says 850K mortgages are in forbearance. How many of these are in the city where former landlords cannot make the mortgage due to lower rents or lack of tenants? Supply is high and demand is low.

As the the Dr says, as forbearance ends (the tide goes out), we will find out who has been swimming naked.

My prediction, is that either:

1) Companies will call employees back to the city and the suburban home prices will flatten and drop. This will likely be gradual. City prices and rents will gradually increase.

2) Or, loans will be foreclosed upon in the cities and there will be a slow crash in city condo prices as landlords must sell. That might be a good time to buy. Wait until Dec 2021 or in 2022.

My point is that this is not inflation. This is supply and demand driven by the pandemic and low interest rates.

New York Air Force veteran and her young daughter are living out of her car after being unable to evict tenants who refused to pay rent for almost a year under moratorium:

https://www.dailymail.co.uk/news/article-9934905/Veteran-living-car-unable-evict-tenants-moratorium.html

A landlord in upstate New York has been forced to live out of her car after the tenants of her three properties refused to pay rent for almost a year – while she is unable to evict them due to the state and federal moratoriums. …

I’ve cried many nights, like thinking, ‘Where’s my money?” she said.

She added: ‘I don’t understand how they can give my private property to somebody to live for free. I bought that property. I fixed it up with my blood, sweat and tears.’

‘I invested in these properties, never thinking I wouldn’t have a place to live. I just want my house. That’s it. I just want my house,’ LaCasse said. …

Her house is currently occupied by a tenant that hasn’t paid rent for over a year.

LaCasse’s situation represents the current state for many landlords across the country, as the U.S. Treasury Department has noted that almost 90 percent of rental assistance funds have not been distributed.

New York has only doled out about 8 percent of the $2.6 billion federally allotted for the rental assistance to landlords, CBS News noted. …

‘Ten percent of all landlords collected less than half of their yearly rent in 2020, with smaller landlords (1-5 units) most likely to have tenants deeply behind on rental payments,’ the study concluded.

The study found that the percentage of landlords granting rental extensions to tenants increased from 15 percent in 2019 to 48 percent in 2020.

The percentage of landlords who forgave back rent owed by tenants increased from just 3 percent to 21 percent. …

My take on the Fed meeting in Wyoming this past week is the same as it has been. Fed is all talk and no bite. Their strategy however has changed a bit. They are acknowledging the elephant in the room on inflation. And it looks as though Powell is encouraging a few of his conservative Fed Chiefs to go out and talk to the media about a taper that needs to happen now.

Powell’s real plan is to continue asset purchases to the tune of 120 billion monthly. But he wants to take the attention off of those purchases and put the attention on a taper that hasn’t happened yet. They realize that inflation is just as dangerous to spiral due to psychological factors as it is from the numbers side. Therefore if they attack the psychological side of inflation by talking about tapering, the attention will shift away from what they are actually doing and go towards what they might do. And that’s how they are hoping they can successfully inject another $500 billion of monetary methadone into the system the rest of 2021 while gaslighting the public. Attention and talk track around tapering for the rest of the year, while their actions are completely different.

Now let’s say it is Q1 of 2022 and they are finally backed into a corner. More people/news outlets calling their bluff, inflation still high, etc. Then at that point we might see a 10b or 20b reduction monthly over a 6-8 month taper. So I think the Fed is still looking at the next 12 months as a chance to pump in another trillion of methadone into the system while talking about and then possibly tapering. (I’m still not convinced the taper happens). And then any talk of an interest rate hike is absolute joke to me. I barely see a taper happening let alone a rate hike.

All assets to the moon by the midterms. Dow above 40k, Bitcoin above 100k, Gold 2.5k, housing flat or another 10% bump. How can the asset classes not appreciate with artificially low rates, 1 trillion more pumped in by the Fed, and you know the Dems will come together and get about $4 trillion printed for infrastructure in hopes that will help with the midterms. That infrastructure money will not come all at once but it will be a psychologically positive thing for the markets and assets.

All assets to the moon by the midterms. Dow above 40k, Bitcoin above 100k, …

Is Bitcoin an asset? From what I’ve read, many people still can’t decide on what Bitcoin actually is.

Those that are smart and educated know that Bitcoin is the best performing asset. Obviously, a landlord needs renters to be wealthy. An investor needs Exit liquidity (dumb money) to sell high and Bitcoin needs people who missed the train. Imagine everyone would be smart and had invested in bitcoin….the price per precious coin would already be worth several million of dollars. As of now, Bitcoin is still affordable and cheap. Thanks to the not-smart people 🙂

It’s a failed currency now known as an extremely volatile “store of value”. In other words, a slot machine.

Obviously, you haven’t been educated yet.

If you put $1 into Bitcoin 10 years ago and purchased 1 full coin, you would now sit on a value of 50k.

If you left $1 in the bank, you still had $1. However, ten years later that $1 buys you less. It lost purchasing power. That’s called inflation. You see inflation in housing (rent and home prices) – as an example.

Bitcoin solves this problem. You can’t ever print more bitcoin 🙂

I can summarize it more succinctly.

Powell: Who cares about the bottom 50%!

Since 2019, 24 houses have sold in the greater neighborhood I live in. In 2021, all that sold went for ~$700K or more except for one absolutely thrashed house on the worst street (a flipper’s delight). Now there are only 2 houses for sale in the boundary. By my count, there are about 175 houses in the boundary. Both are going for more than $800K.

Someone I heard about moved out of state and rented his house out for a year until the price had risen enough to afford to buy something nice where he had moved to. If he had waited a year, he probably would’ve had $100K+ more, but there may be price increases wherever he went to thanks to inflation. Maybe in real money, last Summer was the peak.

Jonathan Lansner of the OC Register had a column today with the title “Who Pays for California’s Affordable Housing?”. His conclusion?:

“The bottom line? There is no affordable housing without financial pain. Property values must fall.”

In my opinion, that is a BS conclusion. It is not like California is in some unique position with rising property costs:

https://www.barchart.com/economy/housing

The link shows property price charts and tables for the US by state. California isn’t even the highest for average value. There are 4 out of 51 jurisdictions with higher prices than us. Several states have faster rising prices than we do. The charts are based on data from almost 5 months ago, and I see no slowing in that period. The problem of rising prices is everywhere, and that is because the charts are using the US dollar as their gauge instead of an inflation adjusted currency.

I did some digging into the numbers in the table I posted. I calculated the percent price increase for a dozen states between 2020 and 2021. I’m going to list them by region. Since I’m most interested in the West, the list is heavily weighted in that direction.

West: AZ = 9.2, CA= 4.7, ID=13.8, NV=6.3

South: LA=2.5, TX = 4.5, WV = 3.3

Midwest: IL =2.7, ND = 2.2

Northeast: MD=5.6, ME=8.6, NY=5.4

The three big winners in the price increase rate are all states with lower prices and “Country” living near bigger states with restless populations. Texas and California are actually quite similar in their rates. States with natural resource economies are lagging and states with big government spending are in the middle. Some states are just hopeless (IL).

Anyone wanting to complete the set of 51, be my guest. I’m outta here!

State data is kinda pointless. California and Texas each have 5 or 6 mini-states within it. Even in IL, Chicago and everything outside of Chicago are two different worlds.

Not pointless. Of course all real estate is local; but my point was that California is not unique. Housing prices are up all over the US.

Are you sure? Because Idaho shot up 31% YOY according to Redfin (and Boise 34%). California up only 4.7%? No way. That would be almost normal. Redfin shows 19.9% for CA and 17.4% for Texas.

https://www.redfin.com/state/Idaho/housing-market

It’s interesting to consider that in terms of dollars that’s something like $140K for CA but only $50K for TX even though 19% and 17% look awfully close. The HCOL areas are going exponential. The mean trend line is so far below the median sale price in California at this point. Not a bad time to sell if you’re going to evacuate to Texas. 😉

This database was from the end of March 2020 to one year later. And the data was for entire states, not particular hot markets. I just reported what I read. This type of data would be a more conservative picture than Redfin. My point still stands that real estate is up nationally, not just in California or other “trend setting” states. I’d say a move to Texas is an option for a lot of Californians, but not for me right now.

Ladies and gentlemen, you are now witnessing the beginning of the end.

New York State plans to extend eviction moratorium to January 15, 2022. (Getting close to two years of free rent.)

Landlords threaten to sue.

https://nypost.com/2021/08/30/ny-landlords-threaten-to-sue-if-eviction-moratorium-extends/

The lawless liberal NY governor does not care about SCOTUS ruling that eviction moratorium is unconstitutional. Law does not mean anything to the thieves. Who cares about contact law and private property rights when the country is ruled by thugs?!…These two are the bedrock of the capitalist and free market system. We are now an official banana republic, thanks to the democrat thugs. If a republican president would have ignored the Supreme Court ruling, the MSM would call him a fascist and would would scream impeachment 24/7. If the democrats are doing it, it is OK.

If inflation is running rampant on everything, they call it transitory – I guess, if you die, everything is transitory. Meanwhile, GM closed all plants in US – that will surely make the astronomical car prices “transitory”.

A realtor friend (very nice guy) told me the market is turning. And someone on YouTube said the market will crash soon? Debating if I should sell our house, live in a trailer and buy bitcoin?

“And someone on YouTube said the market will crash soon? Debating if I should sell our house, live in a trailer and buy bitcoin?”

Someone on Youtube??? Did ZeroHedge publish the link?

Well, if this is a repeat of 2008, and you don’t have any way to pay the mortgage for 1-2 years if you lose your job, you should sell now and buy a nice new luxury trailer with all of the profits.

Or, you could wait and buy a cr*ppy rundown trailer just like they did in Nomadland after foreclosing because they had only invested in speculative investments and everything crashed in 2008. You could write a book on your experience for some income.

If history does not repeat itself, and this is not like 2008, then just hang on and watch your house value explode to the moon. Everything will continue to go up and up forever! Including Bitcoin.

Crazy glue did not fix my crystal ball. Any suggestions?

I have stocked up with cash and popcorn. I am waiting until the 850K loans come off mortgage forbearance and the 2.5M rentals come off forgiveness.

I did open a pack of popcorn to watch Nomadland over the long weekend.

I don’t recommend it. The book was much better with more details on the 2008 crash and why many of these people were living in old unreliable vans down by the river.

The movie insinuated that it was mostly by choice. The book said otherwise.

If your crystal ball says we will have a repeat of 2008, I’d sell your RE now and buy a luxurious RV before all you can afford is an old van after the crash. Glamping is more socially acceptable than vandwelling.

Not if I have anything to say about it. To the moon!

I can’t imagine how bad this would have been if I did not purchase a house in Q1 of 2020. I am currently looking at close to 300k equity gain!! Wow! If I would still be a renter, every monthly rent payment would be throwing money out the window. Instead, I pay myself (principal) and gain equity! Buying a home is a sure way to get wealthy!

M,

Buying a house at any time is a great move as long as you can afford the payments and have some reserve cash.

Even if a year from now you post that you are down 500K on your house, just enjoy it for another 10 years and history reliably says you will eventually be above water again.

Just don’t sell or foreclose at a loss. A few co-workers who did this in 2009, are very sorry. They even had a job that paid their house expenses. They panicked and sold/foreclosed at a loss and did not buy another house until too late. Don’t panic!

Also, don’t put all of your reserve eggs in one speculative basket. That was the basis for Nomadland.

I doubt there will be a significant correction in house prices. Imagine there is a 5-15% correction….smart investors like me would buy investment properties like there is no tomorrow!

Maybe 5-15% this time.

Or 40-50% like last time in 2008.

I posted this before, but this classic 2005 book is making a comeback. Read the comments.

https://www.amazon.com/Are-Missing-Real-Estate-Boom/dp/0385514344/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=&sr=

Does history repeat itself?

M: smart investors like me …

Back when you were predicting an “epic crash,” you were saying that “smart” people such as yourself were renting rather than buying.

Considering your “epic” mistake about the crash, how about you just state your current opinions in humble terms, and let others decide if you’re “smart”?

“The wise don’t make a show of their knowledge, but fools broadcast their foolishness.” — Proverbs 12:23

Hi SOL,

Thanks for the question. I agree, it’s obvious to see that my investments were smart:

Bought my house in Q1 2020 (close to 300k equity gain)

Dollar cost avg into stocks since many, many years. Up bigly

And dollar cost avg into crypto since many years: life changing money in my portfolio.

Obviously if someone’s winning (like me) you will have a hard time arguing against it 🙂

It’s okay to celebrate wins. Sure, everyone wants a trophy but in reality, the smart investors win. This is called capitalism.

Some like socialism and communism better because they think there is a free lunch for them. Good luck is all I can say to that!

SOL, i disagree…..you might be waiting a looooong time for an epic crash here….

Buying yesterday was the best time. The second best time is today. Just watch how my equity grew since 2020….smart!

M: i disagree…..you might be waiting a looooong time for an epic crash here….

You’re disagreeing with yourself.

As recently as January 2020, you were a self-proclaimed “real estate expert” predicting an “epic crash.” Loudly, smugly, and with unabashed arrogance.

Now you’re a self-proclaimed “real estate expert” predicting the opposite. Loudly, smugly, and with unabashed arrogance.

I can only agree here. I am a real estate expert! With my first house purchase I gained close to 300k equity since Q1 2020!

An advice I like to give first time home buyers is: the best time to buy was yesterday, the second best time is today!

M,

Ride that bubble !

The media and internet are full of content expressing that the market is

“turning”. LOL! LOL! Give me a break. Yeah, it’s turning all right from

frenetic to merely hot. Big deal. Prices are NOT dropping, just less multiple

offers. There’s some pickup in inventory, but not too much in So. Cali.. The

# of homes listed in Redondo Beach and Torrance are miniscule, especially

if you extract the obvious larger higher priced homes. Remember, internet

barkers spew out anything to get clicks. And that’s mainly negative news.

In this case, nonsense. If you really want to worry about a market turn then

at least wait to see if the Dems get their tax packages thru. Then as said in

the movie Tombstone, Hell’s coming.

Landlords Crushed by Eviction Bans Rush to Sell Properties, Stifling Rental Market:

https://www.nationalreview.com/news/landlords-crushed-by-eviction-bans-rush-to-sell-properties-stifling-rental-market/

As the article shows, the bolsheviks we have in WH and Congress, not only scrapped the Contract Law, private property rights, they are worse than the ones from Soviet Union. The ones in USSR took the properties but they forced the new tenants to pay for taxes, utilities and maintenance. The ones we have here in power took over private property rights but force the landlord to continue paying for taxes, maintenance and utilities.

These bolsheviks are the ones praised by Bob and he votes for them. Good thing I had nice properties with high caliber tenants who cared about their credit s

As the article shows, the bolsheviks we have in WH and Congress, not only scrapped the Contract Law, private property rights, they are worse than the ones from Soviet Union. The ones in USSR took the properties but they forced the new tenants to pay for taxes, utilities and maintenance. The ones we have here in power took over private property rights but force the landlord to continue paying for taxes, maintenance and utilities.

These bolsheviks are the ones praised by Bob and he votes for them. Good thing I had nice properties with high caliber tenants who cared about their credit score and took good care of properties!… For millions of landlords that was not the case.

Flyover: Good thing I had nice properties with high caliber tenants who cared about their credit score and took good care of properties!

California intends to pay 100% of the rent owed by tenants who didn’t pay “because of Covid.” So I assume those tenants’ credit scores will remain unharmed.

At least that landlords are also benefiting.

I keep hearing commercials on the radio urging tenants and landlord to apply for this program. “And you will not be asked about citizenship,” the radio assures us.

Under which political party who controlled both the Presidency and the Senate did eviction bans and mortgage forbearance begin?

I think Flyover is correct. People grew tired of them and voted them out.

Given that, I agree with the Supreme Court now that vaccines are available and effective, and job openings and the economy have reached new highs, that eviction bans and forbearance should only exist for very rare circumstances.

The main downside may be for M as 850,000 forbearance houses and up to 2.5M forbearance rentals suddenly appear on the market. He can tell us about the cheap new rental he purchased while understating the $500K he is underwater on the house he purchased in 2020.

I’m old enough to have experienced this ride twice in my life. Just close your eyes, don’t panic, and look for opportunities as they arise with the conservative cash on-hand. Never foreclose or sell at a loss.

I heard another radio commercial for that “free rent” program. It says that when the state pays your unpaid rent “It will not be considered earned income, and will not affect your eligibility for other entitlement programs.”

* Enhanced unemployment for a year and a half — earn more staying at home than while working.

* Free rent — the state will give you the money — but you don’t have to report it on your taxes.

* This “free rent” money will not be considered when assessing your eligibility for other government freebies.

* Citizenship is not an issue. Come one, come all!

And come they are! Pouring across the border, and flying in from Afghanistan. Come for the freebies. Stay to denounce our systematically “white supremacist” society.

Bob: Under which political party who controlled both the Presidency and the Senate did eviction bans and mortgage forbearance begin?

Maybe you’re unaware that many of the eviction bans and mortgage forbearances were state and local. Yes, local — my city of Santa Monica enacted them too.

And the strictest bans and forbearances — still in place today despite the U.S. Supreme Court — were enacted by Democratic controlled governments.

This is the best time to splurge and buy a nice luxury car. Everything else will be more or less flat; get into a nice wheels and enjoy the life for next 3 years on your lease. Revisit after that.

My Wife, who studies the area map around our house frequently and intensely, says that houses have started to move more slowly this last month. That is roughly the same area I mentioned in my post of 08-28-21 although her boundary is probably a bit larger to help give more data for trend analysis.

She thinks that the asking prices are causing problems with getting financing and there are fewer people who can make up the difference with cash.

My Wife, who studies the area map around our house frequently and intensely, says that houses have started to move more slowly this last month. That is roughly the same area I mentioned in my post of 08-28-21 although her boundary is probably a bit larger to help give more data for trend analysis.

She thinks that the asking prices are causing problems with getting financing and there are fewer people who can make up the difference with cash.

My Wife, who studies the area map around our house frequently and intensely, says that houses have started to move more slowly this last month. That is roughly the same area I mentioned in my post of 08-28-21 although her boundary is probably a bit larger to help give more data for trend analysis.

She thinks that the asking prices are causing problems with getting financing and there are fewer people who can make up the difference with cash.

Bob, I give you credit for that – about the one who initiated the eviction moratorium. I give Trump an A on foreign affairs, an A+ on the economy for the first 3 years and an F- for the last year. He should not have trampled on Contract Law and private property rights – the bedrock of American prosperity. It does not mater who does what, if it is wrong it is wrong (D or R). I don’t agree with the Emergency Declaration and trampling of personal and property rights and freedoms protected by the Constitution, regardless of who does them. Can you admit as much when Democrats are in the wrong?!…

That being said, there is no reason for any democrat to continue in an F- economy, especially after the SCOTUS stated the obvious in their ruling.

The free rent money is just incredible. The state of California and many others are so desperate to find renters to give this stimulus. Anyone with a pulse who is a renter is eligible. This program and the PPP are huge helicopter drops of cash. This rental assistance program is a big bandage on a bad gunshot wound. It will certainly help the bleeding in the short term term by helping to prevent maybe 80% of the short term evictions. But in 12-18 months when most of this rental assistance is exhausted what is going to happen to the next batch of rental deficiencies at that time? Rent prices are 20% higher on average than it was 18 months ago and the unemployment and stimulus programs are over other than the child tax credit welfare program. I gotta think we will still be facing millions of evictions around the country 12 months from now from new renters who fall behind and renters who get this stimulus and then fall behind again a year from now.

I gotta think we will still be facing millions of evictions around the country 12 months from now …

Then there will be no evictions. Whenever a problem (e.g, evictions, unemployment, inflation, war casualties, crime, public debt, etc.) reaches Critical Mass such that the system can no longer absorb the problem, then the normal rules no longer apply.

The system will keep applying ever more extreme remedies until nothing works. Whereupon crisis ensues. Evictions will not happen. Debt will not be repaid. Soldiers desert en masse. Crisis ensues.

Right now our problems are only economic, not military. But who knows, if the Deep State is dumb enough to enter into wars with Iran, Russia, or China.

We are already at war with the countries you mentioned, just not in a conventional sense- it’s economic, disinformation, and cyber-war. War with superpowers in the nuclear age is a no-go and a virtual stalemate but proxy wars like Afghanistan and Syria get the green light. There are so many conflicts going on in the world right now that I’ve lost count. The question is which are the most profitable and serve our interests.

I am a merely a cog in the wheel but made a shit ton of money just in the last few months due to the current situation in Afghanistan. Once the Taliban somewhat stabilize things and we release their funds (to turn around and pay us), it will be a gold mine just like Iraq. This time I’m older, wiser, and will be part of the cash grab at the front line. There will be no shortage of disillusioned soldiers wanting to join the team.

Just keep printing money and pay the rent for them? We have done it for a couple of years, why not do it for the next 30-60years?

this is the dumbest comment I have ever seen you make. Comments like this make you lose all credibility.

Andrew Yang did run for President in 2020 with the proposal for Universal Basic Income (UBI). He proposed 1K per person per month.

That would cover part of rent. For 2 couples in a 3 bedroom SFH, 4K/month would cover most, if not all, rent.

Yang lost.

says who? Never read anything from you before!

I hope you get enough money together to buy your first home (condo). We are happy to assist with experienced comments!

svs,

I think M is being facetious. However, there’s a 50:50 chance what he’s saying WILL come true given the current administration’s penchant for dumb mistakes and pandering to the Left. Instead of rent control, just pay it for people. Eventually, the government will dictate how much rent they will pay, and rental property values will crater in real money.

I’ve been reading this blog for over 7 years and have comment before. I’m not sure why that would matter though. My comments are just aa important as yours. I have a home in CA and plenty of money to buy another with a hefty down payment. You gatekeeping proves my point that you lack logical thought process.

Cute! Svs9000

My Cardano crypto coins (ADA) were bought with an average cost of 10 cents. One ADA trades for over $2.4 now and I have way over 100k coins 🙂 if you pull a performance like that you can talk with the big boys 🙂 by the way, this all happened within a year 🙂

Guys pls consider 30 for 30

https://news.bitcoin.com/30for30-bitcoin-solidarity-with-el-salvador-trend-tries-to-convince-people-to-buy-30-in-btc-tomorrow/

The First Nation has declared Bitcoin as legal tender! Let’s celebrate with buying some bitcoin!!

Funny thing is that I’ve been highly invested in crypto – but not cash investment, I mine HEAVILY and have been for awhile. YET, hearing M give any advice makes me want to move in the opposite direction and sell all of the crypto I’ve been holding onto. When all the sheep and low iq drones start cheering the same thing, I think it’s time to look at moving in a different direction.

“Funny thing is that I’ve been highly invested in crypto”

Music to my ears!! The amounts I have staked with Cardano are astronomical. On paper I am already a crypto millionaire but I believe this was just a mid cycle correction and we have seen nothing yet! Don’t let a good bubble go to waste!

M: On paper I am already a crypto millionaire

So now you’re a millionaire?

Two years ago you were renting in a cheap area, and sneaking into your neighboring building’s pool.

Last year a sudden “inheritance” and you (allegedly) bought your first home.

Now you’re a millionaire.

How soon before you expect your first billion?

@sonofalandlord – agreed. the only reason he feels that he has relevance here is that he became a homeowner but only because he needed someone in his family to die in order for him to achieve that. Most of us do it on our own, so if he is misguided enough to believe that his “investment” advice carries any weight, it makes for a good laugh.

Yep, that is 100% correct. I have been dollar cost avg and hodling in crypto since years.

I know several millennials who have done that and are crypto millionaires. Crypto is making people crypto millionaires daily. It’s the buying opportunity in a lifetime. Best thing since sliced bread!

Just take Cardano for instance. The founder Charles Hoskinson is the co-founder of ethereum. He took his time to build a gen 3 cryptocurrency. He isn’t concerned about short term get-rich schemes. He build a crypto that is very promising. It traded for 0.03-0.12 cents for a long time during the last bear cycle. I loaded up. Now it’s over $2!! And I don’t think the cycle is done. I will be taking profits when it hits $10 🙂

That alone is a huge junk if my crypto millionaire portfolio. Plus my portfolio in Bitcoin, ETh and other currencies. Not to invest in crypto is the most foolish move and you will regret that.

Always remember: bull markets can make you money, bear market make you rich!

And you have to have foresight….I invested in Cardano when nobody talked about it (except smart money). Now it’s the top 3 crypto and just released smart contracts 🙂 🙂 🙂 $$$$$$

Foobar,

That’s accurate. I sat on a large downpayment for years and was bearishly waiting for a small dip in the market. I would have liked a 50% crash of course even more.

Well, then I got a large inheritance. And after a year, when I got the payout, I sat on way too much cash. I was forced to buy real estate. I just couldn’t justify not to buy any longer. That was during covid. Q1 2020. I bought. People cheered. The top is in!!!! The peak is in!!! The crash will happen. Fast forward and it was one of the beat decisions ever! I made out like bandits and all those haters are quiet now 🙂 I sit on 300k equity gain 🙂 muhahabahahaha

Headline: Crypto BLACK TUESDAY: $400B is wiped from ALL digital currencies as El Salvador adopts Bitcoin as legal tender: Rollout is immediately hit with technical difficulties (but not at McDonald’s!)

https://www.dailymail.co.uk/news/article-9966561/Early-stumble-El-Salvador-starts-Bitcoin-currency.html

It was a dark day on Tuesday for traders of cryptocurrency as every major digital coin suffered double-digit losses that wiped out some $400billion in market value – with Bitcoin falling the hardest even as it was adopted as legal tender by El Salvador.

Bitcoin fell 11 percent on Tuesday after El Salvador became the first country to adopt the cryptocurrency as legal tender …

That is correct. This was another beautiful way to get a discount on Bitcoin. As you mentioned, Bitcoin is the best performing asset and any discounts are appreciated!

Buy now before you are priced out forever!

Funny, how you predict great things for Bitcoin because of El Salvador.

While I simultaneously (unknown to you) post an article showing that after El Salvador’s move, crypto tanked.

Proving your predictions wrong.

Agreed! A nation (the first) has declared Bitcoin as legal tender! That’s huge!

And you are correct, Bitcoin is up over 300% in the past 12month!

https://www.marketwatch.com/investing/cryptocurrency/btcusd

No wonder smart people call Bitcoin the best thing since sliced bread!

No way are you a thirtysomething, married professional with homeowner responsibilities.

Confirmed.

Married, tech job, first time home owner, crypto investor and stock investor.

https://m.youtube.com/watch?v=F531lACwf-M

^ this video does a good job summarizing why the housing bears may be wrong: very constrained supply, demographic driven rising demand. Add to that extremely low lending rates and it’s hard to see a crash bar some black swan global financial / geopolitical crisis.

Excellent video.

Him and Logan Mohtashami have nailed it. – no crash due to same factors as in this video.

The problem is that there’s a nice video for every view.

Pandemic and FOMO induced house prices are furthest from the trend line than ever. Not good.

Nobody seems to consider the trend lines before they buy.

You can’t know what will happen but at least find out what your chances are!

Newsom recall election less than a week away and how convenient that Golden State stimulus check #2 is getting sent out this week as we speak.

If the Democrats in Washington get $2.5 trillion in social infrastructure and welfare programs + the additional $1 trillion in physical infrastructure that should certainly help indirectly to keep the housing market propped up and even continued modest price appreciation over the next 3-5 years.

The Democrats hopeful outlook for housing is probably flat/modest appreciation for home owners. And flat or modest rental prices. Low rates (30 year at 4% or better) will get this hopeful outlook done. There will be enough free money floating around where loans will be written under 4% and people will be making money to justify a little bit of a premium price. I see absolutely nothing other than a tsunami or inventory coming on that will change this. And I just don’t see the government letting they tsunami even form. Small bump maybe in inventory but nothing they will derail this artificially inflated market that will not even really show signs of slowing up much thru 2022.

My Wife follows housing sales prices in an area a bit larger than the one I discussed in my post of August 28. She says that recently, properties aren’t selling like they were, and that asking prices are very high.So the length of time on the market is starting to creep up. Maybe people don’t have enough cash now to pay the difference between what lenders will shell out and what the seller wants to get. Lending institutions can pick very finicky appraisers. I’ve talked to both types of appraisers and I know they exist; those who shill for sellers and those who keep financial risk down for the lenders.

Bob thinks there’s no inflation, LOL. I think Bob has to be a troll, no way someone can be this far out of touch with reality. I mean come on Bob, do you never buy groceries? Do you never buy gas? Do you live in a 1 room cabin somewhere and never interact with society?

WSJ

Sept 13, 2021

New York Fed Survey Shows Inflation Expectations at Record Highs in August

https://www.wsj.com/articles/new-york-fed-survey-shows-inflation-expectations-at-record-highs-in-august-11631545200

___

Axios

Sept 13, 2021

Producer prices are still moving up as inflation concerns linger

https://www.axios.com/producer-prices-inflation-still-moving-up-79d21c53-731d-453d-b0db-e18d107c46cf.html

Yeah, if no inflation then why is the Social Security cost of living adjustment going to be the biggest in almost 40 years? We’re entering the Jimmy Carter years if the Fed doesn’t stop messing around with interest rates. My shopping is up almost $500/mo for the usual.

From Jason Hartmann

The Effect of Lockdowns and The Craziest Market We’ve Seen

The Grapes of Wrath 2020 continues.

Joe McCall and Jason Hartman discuss the effect of lockdowns and the craziest market they’ve seen.

Cities had increased crime and civil unrest. Work from home will continue and these high-cost areas will have less tax revenue collected. The suburbs will continue to receive these folks. However, the lack of housing options, especially entry-level affordable housing, means prices will continue to go up. Basic economics gives a good story as to how supply and demand will play a role in housing prices.

Is this the craziest market you’ve seen?

The craziest thing I ever saw was new homes in Riverside County advertised in a billboard “from the $190’s” during the Great Recession.

I wouldn’t be surprised to see that kind of thing again because this 2020 – 2021 craziness is at least as unbelievable as 2006 – 2007. The can has been kicked WAY down the road.

I play the long game but not an eternal-always-gonna-be-good-every-year optimist like a certain frequenter on these comments that we refer to with a single letter. Reality is a thing.

Money has been “redefined” since 2006.

He used to be the biggest bear till an alleged inheritance. Since then, he changed into the biggest bull. Us, older, we know that reality is somewhere between the two extremes.

Biggest bull? Naah, I am bullish on RE long term. In places like SoCal you must own property or you commit financial suicide by renting long term (learned that phrase from Mr Landlord).

Also, facts are facts: low supply, low interest rates + money printing = RE asset inflation

M: A nation (the first) has declared Bitcoin as legal tender! That’s huge!

Headline: BTC price tanks 12% on El Salvador Bitcoin debut

https://www.crypto-news-flash.com/btc-price-tanks-12-on-el-salvador-bitcoin-debut-here-are-the-key-reasons/

Buy the dips! Dips are buying opportunity. Smart investors buy bitcoin dips…..bitcoin is up over 300% this year. Don’t miss out. Buy now!

LOL

Saying “buy the dips” is like saying “sell the peaks”. You’re almost like those dudes who sell newsletters, claiming to know things nobody else can. #KeepHyping

Correct. Buy low sell high. What I have been doing so far is dollar cost avg in crypto and stocks for years. On paper I am a millionaire. I do have a strategy to cash out as well.

Always buy the dips in stocks and crypto. Riches are made when there is blood on the street.

“While many people are getting stimulus checks, trillions of dollars have gone into the hands of the corporate welfare machine (usually benefitting those that are hardcore free market types).” (From this post by the Dr.)

Dr HB,

What are you defining as “corporate welfare” and who are you calling “free market types”? Are the big money center banks like JP Morgan Chase “free market types”? Are green energy scammers like Solyndra free marketeers? From what I can gather, most of the money in the stimulus bill goes to fund bailouts of overextended municipalities and their high wage employees. “Prevailing wage” provisions make any construction related stimulus decidedly non-free market. (It’s hard to find articles by anyone critical of “prevailing wage” in an internet search; try it!)

Could you do a breakdown in your next article showing the flow of federal stimulus money into free market coffers, naming names and giving amounts, please?

While native Britons struggle to afford houses, the British government is buying houses for Afghan refugees:

https://www.msn.com/en-gb/news/uknews/councils-will-be-given-grants-to-buy-family-homes-to-house-refugees/ar-AANFBdO

Councils are set to get grants from the government to rent or buy large homes for thousands of Afghan refugees.

The average size of the families coming to the UK is thought to be seven, but at least one family is believed to be made up of 12 people. …

Although the details are unclear, the suggestion of grants to buy homes could spark resentment in local communities, with many Britons struggling to afford such properties. …

Many people in the West can’t afford to buy houses — but are taxed for buy houses (and pay for college) for Third World refugees.

And if taxpayers complain, the Neocons and Neoliberals will heap scorn on them, and say, “Why can’t you losers be like those refugees? Look at them! They came here with nothing, and they already own houses!”

Refugees who, in a few years, will be denouncing the “white privilege” of their benefactors, and the “whiteness” of all the historical statues and paintings in their towns, and the “whiteness” of the faces on TV, etc.

That is no different than what happens in US under Biden and Newsome and Bob is OK with that. He think that is normal and if you complain, you are a “raceeest”. If he would not agree, he would not vote for these globalists who implement the same policy in all countries of EU, US, AUS and NZ.

There is very little motivation for sellers to sell now, especially in prime areas:

1) Transactional costs are very high. Highly likely gain > 500k, thus portion has to be taxed and that amount sent to tax cannot be applied to next home. (Lost equity). Selling/buying costs.

2) Covid and significantly less relocations; thus homeowners are moving less. Also, mentally people are very grateful to own a home during pandemic and those who don’t are more desperate.

3) Interest rates are very low + high demand; incremental cost to pay additional 100k-200k are fairly low (350-700/month) compared to waiting around and waiting for more price hikes.

4) California tax rate is locked. Changing home now is likely to double one’s tax liability

5) Dumbest thing one can do is selling your home and rent waiting for a crash. More people understand/realize this now.

Surge

Makes a lot of sense for those bailing out to one of the more advantageous states. I won’t run down the list of advantages. Everybody probably know them by now.

But yeah, if you’ve just gotta be in California, then it makes no sense to sell your $800K square of mediocrity and gamble as a renter for the opportunity to snag a home you actually love in a few years. It’s still going to cost twice as much or be half as good as what you can get out of state.

Enjoy the weather! It’s all California’s got left these days (for coastal residents, anyway). 😉

Very little advantage in other states; and it is fairly subjective.

Everyones circumstances are different. But combination of market forces and policies make California both expensive and fairly attractive to live in. Prices simply are and indicator of this phenomen

Turtle,

That’s right….best weather in the world + beautiful beaches + high paying tech jobs + beautiful scenery (Tahoe, eastern sierras, Yosemite….)

See, Turtle, you are focusing on negatives (using words like mediocrity).

Mediocrity is not objective. Objective is the price of something. Either you take it or leave.

If moving to a different state works for someone, this is great. But nobody cares.

From Ballotpedia:

“Proposition 19 changed the rules for tax assessment transfers. In California, eligible homeowners could transfer their tax assessments to a different home of the same or lesser market value, which allows them to move without paying higher taxes. Homeowners who were eligible for tax assessment transfers are persons over 55 years old, persons with severe disabilities, and victims of natural disasters and hazardous waste contamination.”

S:

You say “California tax rate is locked. Changing home now is likely to double one’s tax liability.”

True unless you are over 55, disabled or got burned out/poisoned out. A lot of people looking to move out are over 55. And there have been a lot of people burned out recently who may want to get away from the fire zones. Now you can do this anywhere in California.

True but only tiny percentage of population impacted by the fires.

If you are over 55 less motivation to move now because of huge tax liabiloty if selling massively appreciated home (lost equity). Plus homes are typically paid off.

I’m not so sure people over 55 are selling in CA unless it’s because they’re dead. Or, following their adult children out of state. Probably not enough to make a difference in supply though.

Surge,

I agree with all of your statements for a primary home. (Except Joe R’s point with Prop 19 allowing homeowners over 55 to transfer their prop taxes to a new home. This may force more sales as homeowners downsize to a cheaper CA location inland and cash in some equity while keeping the same 1980’s property taxes. However, personally, if I was retired with no mortgage and 1980’s taxes with a home close to the beach, I wouldn’t sell to move inland unless I had cash-out refi’d to the max with a massive mortgage payment.).

I have been seeing more activity on blogs reqarding your statement #1 from people who own rentals. They are looking to cash in on some or all of their rental properties and keep their primary house.

“1) Transactional costs are very high. Highly likely gain > 500k, thus portion has to be taxed and that amount sent to tax cannot be applied to next home. (Lost equity). Selling/buying costs.”

Prices are very high and rental owners are looking to diversify and cash out some of their properties while keeping their primary house. This seems to be due to:

1) Having a difficult time collecting rent during the pandemic

2) Having poor tenants with high overhead/repair costs. Repair people either unavailable of very costly unless they DYI.

3) Rental restrictions and fees (AirBnb bans, Rent Control)

4) A peak in house prices incentivizing some to cash out and re-balance their investments. Maybe to have more cash for any possible future crash.

5) Large Capital Gains (> $1M) which would likely put them in Biden’s high cap gain tax rates if they wait to sell next year.

I think rental property owners and some Prop 19 eligible see this as a great opportunity to sell.

I agree with you completely on all of your points for a primary home. Trying to sell and rent while attempting to time the market didn’t work for anyone I knew during the GFC in 2008. The exception would be if they want to relocate out of CA to a much cheaper home.

Good point, I should have clarified that this is for primary homeowners.

Investment properties are obviously a business and there are different motivations to buy/sell.

Smart!!! Tesla, El Salvador, cathie wood and now Kevin O’Leary invest in Bitcoin (list is too long to mention all smart bitcoin investors here).

https://www.cnbc.com/2021/09/14/kevin-oleary-says-he-wants-to-more-than-double-crypto-holdings-to-7percent.html?utm_content=Crypto&utm_medium=Social&utm_source=Facebook&fbclid=IwAR2GFny0dHNcduaZry_AT4XlnL8enF49wkPY89QJxOCcSjJvz0ezovDQbIQ#Echobox=1631636980

It’s going mainstream. PayPal, Robinhood, webull, Venmo apps are offering crypto purchase options.

So much demand and so little supply of BTC and ETH. Hold on tight. The crypto rocket is about to launch to the moon and beyond.

if the distance to the moon is measured in US Dollars, then you’re right. Here’s something I found on the internet:

In a lengthy interview many years afterwards with Pearl Buck, Erna von Pustau, whose father was a small Hamburg businessman who ran a fishmarket, made the same point: ‘We used to say “The dollar is going up again”, while in reality the dollar remained stable but our mark was falling. But, you see, we could hardly say our mark was falling since in figures it was constantly going up -and so were the prices — and this was much more visible than the realisation that the value of our money was going down … It all seemed just madness, and it made the people mad.’

Ummm, there is an unlimited supply of ETH (Ethereum). And demand seems to be steady at the moment. And yes, I own plenty of crypto.

Let’s see, Bitcoin at 43 today. It’s been some time now since it hit 60 and you said everybody should buy because to the moon and the back and all that. But keep on cheerleading because there is a chance that crypto will make you super duper rich. Just don’t convince yourself that you actually you know what will happen. Nobody knows what will happen, not with housing and not with crypto either.

It sounds like you play the long game and that is always good. Hold your assets, whatever they are, for a good long time and things tend to work out. It’s those dudes always buying and selling, thinking they can time the markets to get rich quick that tend to come out behind. I may pickup a little crypto simply to be more diversified if it falls below 30. I’m probably too much in cash at the moment although you’ll never catch me without a good stash of dry power.

Yes on the long game. Have been accumulating for years now. Buy a bit more on the dips. Easy to get rich that way. Just laugh off the fud. If BTC holds above the 20w moving avg than we have clear skies. If it doesn’t hold, well, we will have another capitulation and shake out of weak hands. Just means the cycle last longer and I get richer. Patience is key to generating generational wealth.

El Salvador can do it because it’s official currency is USD. Government is fully hedged against fluctuations in BTC, because everything is still tied to USD.

Also, what will happen is that just about everyone will get access to ~$30 USD in bitcoin (notice that everything is still quoted related to BTC). Significant amount of population would not know how to value or what to do with this small cash fall-out which is measured in some alien currency. Some smart guys will buy it out at a huge discount from large chunk of general population.

Crypto is a trend asset. Yes, it did generate tons of paper gains, but it has almost zero utility in the real world.

In next liquidity crunch, crypto will be the first asset to be sold off to convert to cash to meet debt obligations (loans, mortgages). Crypto can still be considered a “discretionary” investment. While they have increased significantly in value, nobody can decouple them from USD (or how many houses/cars one can convert crypto into). So, the moment it is between selling your house, your apple stock or your crypto, my guess the latter would go absolutely first.

Of course no liquidity crunch, no issue, we can accumulate assets forever. But I wonder how much of cheap debt has been taken to buy homes (which is OK) or Crypto (which is high risk).

Evergrande (China) will likely to be bailed out but not before ruffing some feathers in western markets.

LA Times article “U.S. housing market cools: Existing home sales fell in August, price growth slows”. However, most data driven So. Cal. You Tubers are saying just the opposite. Especially in LA Co, they aren’t seeing much of a cooling at all, if anything.

If inventory is still scarce even with all the Dem’s destructive tax increase rhetoric and

nutty proposals, then supply isn’t going to increase much in the near future. And rates don’t seem to moving much until sometime next year.

The Bear-o-Rama ride is still shut down.

a friend of mine is a broker in LA.

He listed a fixer upper in Encino about 2 months ago.

It had 24 offers the first week.

No NINJA loans

interest rates under 3%

First yr grads in many studies making $100K per year

multi gen living in 1 home

equity among avg US homeowner very high

The Bear O Rame ride might not open for another year

What are people making a measly 100k doing bidding on houses they can’t afford. Lol something smells fishy

Prices for RE are cooling a bit. No crash in sight since inventory and rates are historic low.

I must buy a rental investment. Maybe once I cash out of crypto I buy a few rentals? Should I buy SFH’s or condo? Or multi fam? Should I buy in California or out of state?

I go back and forth but so far all my investments have paid off massively. I don’t think you can go wrong buying rentals as long as they are in a good location and you can easily float vacancies? Always keep some cash for a rainy day 🙂