As Housing Prices Peak Zero Down Mortgages are Back: No Down Payment Loans Available up to $1.25 Million.

The attention span of people is slightly above that of a cat thanks to social media platforms that rewire the brain for instant gratification, including on the financial front (think of all of the meme stocks and Robinhood). All the cheerleading that is happening for real estate is largely socialism for real estate. That is, a Fed that is pumping easy money artificially into the market to inflate prices for those that already own. So not a shocker that 2.3 million California “young adults” are living at home and many are waiting until their Taco Tuesday baby boomer parents take a dirt nap from one to many street tacos until they can inherit the home. Don’t believe this? Go read some forums and you will be surprised what this distorted market is doing to people. But don’t worry! Help is on the way. As housing prices reach a peak, our good old friend, the no down payment loan is showing up to the party with a bit more alcohol and financial meth to keep things going.

Housing History Amnesia

I know 2007 to 2009 must seem like ancient history to some. 7+ million foreclosures (with only about 1.5 to 2 million foreclosures happening due to funky loans) and the majority of people that lost their homes last time happened to those with boring traditional 30-year fixed rate mortgages. Because when you lose a job, it doesn’t really matter what kind of mortgage you have if you can’t pay the monthly nut. Today, we still have millions in forbearance and other millions of renters on moratoriums. All of this seems slated to end in the fall.

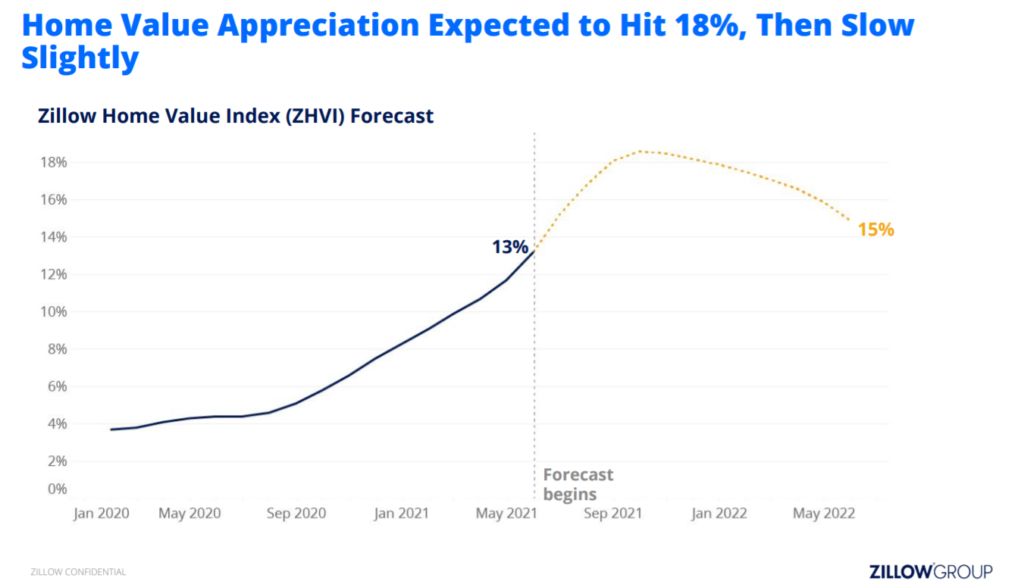

Housing is so hot that it is forecast to get hotter (because you know, momentum):

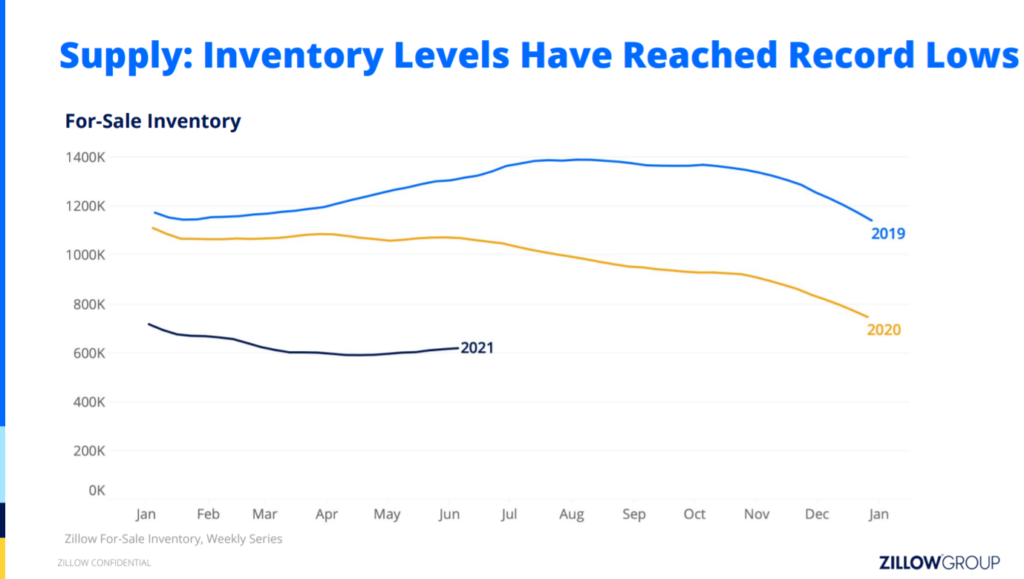

So we are still likely to see higher home prices because of this:

Wait, doesn’t economics tell us that rising demand and prices would add more supply? Yes, in a truly capitalist market. But housing humpers don’t want to admit that real estate in the US is one giant socialistic operation between banks and the Fed (and this is strictly from a non-political definition). How so? First, the market is artificially depressed – forbearances and moratoriums for example. You also have the Fed with an unlimited debt printer so interest rates are incredibly low. Then all of the tax breaks given to homeownership. So with all of that, builders are building much more rental housing because they know Millennials are deep in debt and unlikely to buy in numbers like their baby boomer parents. Also, builders do have a memory of 2007 to 2009 unlike most housing cheerleaders.

So this leads us all to zero down mortgages baby!

“(OC Register) Now, even first-time buyers without a down payment can get in on the action. That means no skin in the game — just like the good old Great Mortgage Meltdown days.

No down-payment loans are available for up to $1.25 million so long as the primary wage earner has at least a 700 middle FICO credit score.

Should you not show enough income from your day job or your self-employment income to qualify, you can document your income with bank statements, averaging the most recent 24 months of personal bank statement deposits.”

That is correct. Instead of looking at things deeper for the causes, we are trying to juice this party even more. It is worth noting that lenders are competing for the razor thin inventory sales so guess what? Now that zero down is back in the market other creative instruments are only a short duration away.

And you are seeing booms and busts again. Bitcoin hit close to $65,000 this year – it is now down to $33,000. This isn’t some meme play here. This is an asset class valued at $626 billion (was over $1 trillion). Or to frame it differently, Bitcoin at its peak was valued at the total auto debt market of the US.

So going back to housing, zero down is back. Lenders are getting more creative because capital is cheap. But what happens when all of the Fed juice starts slowing down in fall? This time is different of course. In one year, the median home price in LA (with a major homelessness crisis) will be $1 million because you know, this time is truly different!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

204 Responses to “As Housing Prices Peak Zero Down Mortgages are Back: No Down Payment Loans Available up to $1.25 Million.”

Enjoy the decline

One can only hope…

People probably don’t realize that you have to pay PMI (which means potentially hundreds more a month just for “insurance”) and that your monthly mortgage payment will be much higher.

I don’t know WTF is happening in the U.S. anymore. What I do know is that it all benefits the wealthy. God forbid the middle class need any housing or assistance.

Whaaaaaat? Seriously, what the eff are you talking about? Have you been under a rock for the past year and a half?

In CA a family of 4 making up to $94K a year is getting 18 month of rent forgiven. Just like that. Newsom waved a magic wand and all is forgiven. The middle class also got trillions in ‘Rona bucks. Have you forgotten about all the stimulus checks already? Plus extended unemployment benefits, moratorium on interest for student loans, new child tax credits. The list is endless.

Now since I am an evil rich (white) male, I got none of that. No stimulus check, no unemployment, no child tax credit. Nada. I’m too “rich” for any of that. I do however get the privilige of paying for it all through taxes.

And then people like you are still not happy. You still whine about rich people. You should be on your knees thanking me right now.

@ Mr. Landlord: “evil rich (white) male, I got none of that. No stimulus check, no unemployment, no child tax credit. Nada. I’m too “rich” for any of that. I do however get the privilege of paying for it all through taxes.”

Now that is what MSM, democrats and Bob call “White Privilege” – …the “Privilege” of paying taxes for all the “free” stuff.

Mr. Landlord, you are correct once again. The evil, rich, white privileged landlords are behind this scheme…WTF. And yet nothing is said about globalist pigs that gutted this country’s middle class for the past several decades. The people complaining the loudest are usually supporting the worst offenders. This is not going to stop anytime soon. The lunatics are emboldened more everyday. You may come home one day to find your house “occupied” for reparations purposes. Don’t think it can’t happen.

So the middle class is being demoted to the poor class. The poor are becoming homeless.

What do Mr Landlord and Flyover say? They say the same thing the King of Id said: “The peasants are revolting”. And then call on the police that they don’t want to pay for with taxes to haul those revolting peasants away.

Flyover should know better. He fled his home when the peasants actually revolted.

The key to a well-governed nation is not to let the arrogant allow the poor get poor enough to cause a revolution (In this country it would be by voting for AOC or Bernie). The rich and arrogant just don’t see it while the poor homeless are piling up in their manicured front lawns.

The US is failing at this.

TO MR Landlord. You clearly don’t know much. No one is getting their rent forgiven if they PAID it, like honest folks. They are only getting it reimbursed if they flat out didn’t pay it. You fleecers of the future always whine about how hard you got it, especially in CA where you legacy whiners are barely paying any real property taxes because you got grandfathered in. Righties are such snowflake whiners.

Now since I am an evil rich (white) male, I got none of that. No stimulus check, no unemployment, no child tax credit. Nada. I’m too “rich” for any of that. I do however get the privilige of paying for it all through taxes.

Thank you Mr Landlord. I received lots of money and I love your honesty. I wish people don’t complain like that and be grateful of what was given to them. I am CRAZY POOR ASIAN and here to thank people like Mr. Landlord who helped pay for all these money. I wish one I will become a CRAZY RICH ASIAN and will follow your foot step. By the way, I invested 70% of these FREE money into the Crypto market and already 5X my money, and I will continue to invest and hopefully one day it will go 50X, 100x or even 1000x the principal. THANK YOU TO ALL NOT EVIL WHITE MAN LIKE MR LANDLORD.

Lol

“ Or to frame it differently, Bitcoin at its peak was valued at the total auto debt market of the US”

We haven’t seen the peak yet. Local tops in bull markets don’t mean much. Wait until we hit 100k per bitcoin 🙂

As far as RE goes…..we hear every month the crash will come. Year after year. Meanwhile I refinanced my house that appreciates over 200k since q1 2020.

Either rent forever or buy assets that get pushed by the FED.

Thank you FED!

Millie, you are bringing a tear to my eye. Buying a primary residence in socal is an absolute no brainer if you can comfortably afford the payment and plan on owning for the long term. Or you can go down the crystal ball path and hope and pray for the big crash. As we have witnessed, the wait may be VERY long. Buying, enjoying your home and tuning out the noise is the way to go. This is no different than buying a stock index and letting it do it’s magic for several decades. Getting excited about the little ups and downs along the way is a waste of time.

Thank you Lord B! 🙂

I was a bear for too long but finally accepted the reality:

Timing the market doesn’t work.

The best time to buy was yesterday. The second best time to buy is today. Dips are noise. Buy and hold is the way to go as you said so many times!

Said differently: don’t fight the FED

@Lord Blankfein That was sweet. I feel like I’m watching a Hallmark movie.

Our little baby Millie is all grown up!

The Lord is absolutely correct.

Buy a house and a Bogle Index fund and you will retire comfortably sooner than you think without any further thoughts. Enjoy your house and enjoy your life and before you know it, you will be able to retire.

No need for expensive managed stock account since index funds have outperformed most managed accounts over history. We have seen it all before. Bogle wrote books about it. Apparently, no fund manager has a working crystal ball. I had the last one and it broke in the Northridge quake in 1994.

If you have time in retirement or while working, a rental seems to be a diversification of savings. A rental will require some time, money and headaches like any house. Buyer beware when purchasing. Look at the ROI and how much time and effort you have.

Thank the Lord!

Bob

Bob

Dated June 16, 2021: https://www.the-sun.com/money/3092295/americans-eviction-ban-ends-june-how-help/

“… 5.7 million Americans — nearly 14% of all renters nationwide — had fallen behind on their rent in April [2021].”

No need to sensationalize. The facts are sensational enough.

The good news is that taxpayers — I assume that includes M — will pay the rent for Californians who can’t: https://www.fool.com/the-ascent/personal-finance/articles/california-offers-to-pay-rent-for-people-who-have-missed-payments-due-to-covid-19/

In California, however, renters may be in line for relief. That’s because the state has pledged to pay off all unpaid rent that’s accumulated in the course of the pandemic.

Facts.

Just in case I haven’t mentioned it yet, I just refinanced and lowered my rate/payment on my massively appreciating house that I bought in SoCal in Q1 2020!

A renter faces ever increasing rents. As many landlords on this blog have stated, most renters pay their dues.

Be a homeowner and landlord and collect rent. Renting long term is financial suicide in places like California!

“Renting long term is financial suicide”

Bro, that’s my line! 🙂

State that financed the Bullet Train is going to pay back rent? With what money? Oh yeah, yours!

I assume California will also pay the rent for illegals … ehr, I mean, undocumented.

And because the rent will be paid in full, tenants’ credit scores will not be hurt.

Live rent free for a year and a half, emerge with perfect credit — Golden State indeed!

Probably. Drivers licenses for illegal immigrants. Check! Now stimmies for illegal immigrants. Check! Free rent for illegal immigrants next? They may as well just knock down the fence in San Diego. What’s the point of it anyhow?

Illegal immigration kills a country. And giving free stuff to illegals is just wrong. Give it to us. I could need more cash to buy my first rental investment.

The other issue is that illegals want minimum wage for yard work. Bummer, it would be nice to have illegals clean up your yard for $5 but they ask for at least minimum wage nowadays:(

M: illegals want minimum wage for yard work. Bummer, it would be nice to have illegals clean up your yard for $5 but they ask for at least minimum wage nowadays:(

Troll.

Sol, it’s called freedom of speech and capitalism. Sry you don’t like it.

M: Sol, it’s called freedom of speech and capitalism. Sry you don’t like it.

Lying once again. Typical troll.

I was merely criticizing you. You know, freedom of speech?

I guess when someone criticizes or disagrees with you, you imagine they’re attacking freedom of speech. When really, it’s the opposite — they’re practicing freedom of speech.

SOL is always so hostile (and makes up fantasy stories) and he seems to not allow people to have their own opinion if these opinions differ from his opinions. Sad that some people (like SOL) think they can shut down freedom of speech. Its not going to work SOL.

I’m not sure if zero down loans will have any effect in this market. My credit union (Navy Federal) has always had zero down loans (non-VA). Unlike the last bubble, this one is not fueled by low down payment subprime loans.

I’ve only paid attention to the homes that sold in my neighborhood. I think all have closed for over asking price. There are plenty of buyers with the standard 20% down that are getting beat out by cash buyers or those who have additional money to pay towards closing when their appraisal doesn’t support the selling price.

This is a seller’s market. No need to to accept offers from buyers with 100% loans when there are plenty of people with cash willing to pay above and beyond the fair market value of the home.

I totally agree, this is exactly what was going to say. I could put a sign in my front lawn and get multiple QUALITY offers within a week, why would I consider accepting an offer that would get withdrawn when the appraisal didn’t match the agreed price.

“Unlike the last bubble, this one is not fueled by low down payment subprime loans” lmao shows how much you know, or don’t know. SubPrime was NOT the cause of the last housing bubble bust, a mind is a terrible thing to waste https://www.youtube.com/watch?v=9UcnABDsGbo

Enjoy paying other peoples rent CA debt donkeys, I’m sitting on the sideline with cash ready to grab you over priced sinking ships, thank you. Nothing goes up for ever, this time it is different. lmao

With millions of ppe money in their hand the prices will continue to go up. Of course the middle class is fade away even more but the prices will continue to go up.

I’m a loan originator who has been at this long enough to have seen it all. I can tell you that the loan as described does not exist for primary residences. I’m familiar with the loan program in question. It doesn’t work as described. There’s a rule, codified by the Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act) that requires that all loans where the owner occupies the property meet “ability to repay” requirements. Therefore, bank statements, no matter how much money is flowing through them, would not qualify as to the ability to repay. Having said that, there are loans for NON-OWNER OCCUPANTS that are very flexible, but you would have to have a business purpose for the subject property. Moral of the story: don’t take financial or real estate investing advice from ill-informed jeernalists [journalists] who don’t know what they’re talking about.

Wait a second…..are you suggesting the news media lied about something? That’s shocking!

This article is BS. The source used is OC Register and they have no source for this phantom 0 down program the entire narrative is based on. What bank? What mortgage company? What are the details? No source no story.

More RE fear mongering.

That is false. I’m also a lender and I write a lot of bank statement files. Bank statements do satisfy the ATR for primary residences provided the deposits are proven to come from their business which they are required to have owned for at least two years.

where the rubber meets the road in Santa Monica

I am co-owner of a home in the North of Montana area of Santa Monica. me and siblings inherited an 100 year old home, one of the few on the street that appeared to us to be a tear down. the house needs entirely new windows, plumbing, HVAC, windows, chimney, electrical.

The listing broker who has worked that area for 20 yrs insisted we make it move-in ready. stating that the housing market is so hot that it may get move in buyers as well as developers to bid, even needing major upgrades

Well, we did exactly as she asked, to get ir move in ready (new paint, new landscape, new appliances, etc just to get it ready for move-in without the upgrades mentioned above. ( no new elec, plumbing, HVAC, etc).

After the first open house, we had 14 offers. 2 developers with offers $300K under asking. We also have 12 offers at asking or over. including offers of $100K, $200K and $300K over asking.

Yes, move in buyers offering $400K to $700K over the flippers.

The highest offer was no inspections and 15 day escrow all cash.

We are in escrow!

Unbelieveable huh?

There is working income from wages on a W2 and also investment income that would show up on your tax returns and bank statements.

I’m sure M could quit his job and show only the 3X results of his 300K investment in bitcoin from a year ago.

Would a 600K investment income in bitcoin for 2020 qualify me for a house without a W2?

Nevermind, I could just cash out my bitcoin for the entire 900K and pay cash for most houses. It is obvious why cash sales are soaring.

As long as the party continues in equities and bitcoin, the housing party will continue.

it has never been that easy to become a millionaire. Crypto and tech stocks…..and of course buying quality RE.

Will it plateau at some point? sure. But the money printer is your friend….the FED wont let the ship sink. print baby print. Assets go up and up and up and up, plateau for a while and continue up and up and up.

There may be a point where the Fed is forced to raise interest rates in order stop out of control inflation, like in the Carter years. You could earn 17% on a CD in that time.

But I’m not sure Powell has the balls for it. I almost think he’d rather destroy the country than to make a gutsy decision and execute it.

Agreed, it’s never been easier to become a millionaire – thanks to all this Fed-induced inflation. Of course, it’s never meant less to be a millionaire either.

Maybe things will plateau for a prolonged period then go up again. Who knows. But, down is certainly a possibility. It always has been. Life is not so easy that up is the only direction.

Come to think of it, Bitcoin is plateauing right now… after tanking 50%. 😛

Bob,

It’s not that easy. You need to show 2 years of continuous income either W2 or investment income, in order for that income to be used for a mortgage. So a 1 time windfall won’t cut it since it is not continuous.

True. Unless you used your entire 900K windfall in equities or bitcoin to buy a house with cash or put more money down to qualify for a lower loan on an expensive house.

The amount of gains in equities and crypto is astounding. I believe it will continue to drive the housing market. Until it doesn’t .

These more aggressive loans are nothing more than an attempt to add to the already overcrowded pool of uneducated, exhuberent buyers in order to keep this frenzy going. Cheap, easy money for everyone!

Something doesn’t add up. Low supply, bidding wars, people flush with cash. And lenders feel a need for zero downpayment loans?

Whatever it takes to lure non-cash buyers into debt so the mortgage brokers can increase commissions. Think they care what happens after closing? Just predatory lending as usual.

Given the rates for these mortgages, I doubt there will be many takers.

I disagree but your confidence in the financial intelligence of the general public is admirable.

Yeah, it’s not like people didn’t fall head over heels for ARMs.

ARMs got a bad rap for some reason, but they’re a good product. I’ve purchased many homes using ARMs. Up until recently the rates on ARMS were significantly lower than fixed. I took 5 and 7 year ARMs knowing that in 5-7 years there was a very good chance I could refinance into a similar or lower rate. And the savings in interest for those 5-7 years more than made up for any refinancing costs. Also as a landlord my primary concern is cash flow, so getting a rate as low as possible is what I’m looking for.

For owner occupied it is also a good product. I have never understood the point of paying a higher rate to lock in a rate for 30 years. Who lives in a house for 30 years? Practically nobody. The average length of stay in a house is 7 years. For 1/2 the people, they will have moved by the time the ARM resets anyway.And this is especially true with first time buyers. If you’re 27 and buying an entry level house, the odds of you being there for 30 years is practically non existent. You will most likely move up in 3-5 years. So why not save on interest and get a 5 year ARM instead of locking in a 30 year that you will never use?

Yes, ARMs can be used effectively by financially savvy RE investors but in the hands of average Joes, not so much. Might be headed for another ARMageddon.

Even if you had purchased a house at the very top of the 2006/7 market, you’d be better off today than not buying. Prices are above where they were at the peak last time. Plus, a 15 year mortgage would be paid off or just about to be paid off. Renting on the other hand you’d have nothing and your rent would be at least double, if not triple what it was 15 years ago. And with inflation running at 10% today (don’t believe that 5.4% official number BS) it will double again in no time.

Renting long term is financial suicide.

Yes, it sure is but I wonder how many buyers in 2006/2007 wish they had rented just a little bit longer. Probably a number with many zeros in bubble markets like SoCal.

The Fed said no rate hikes until 2024 then recently walked that back to 2023. Actual inflation is around 10% and it’s only 2021. We’ll be Argentina at that pace, but the Fed obviously won’t let that happen. They’ll be more than willing to raise rates and put recent home buyers underwater for the next 10 years if it keeps the whole ship from sinking. Their homies at Black Rock are probably salivating at the possibility.

But what do I know. My crystal ball is as broken as anybody’s.

I was saying that even worst case scenario buying at the absolute peak would have been a better decision long term than not buying at all.

The government has printed $7T in the past year. Now they are talking about another $3.5T on green new deal nonsense “free” pre-K, “free” vacation pay, “free” college and a bunch of other vote buying graft, all funded with printed money. If interest rates rise, that $10T+ of new debt, in addition to the existing $20T will be unmanageable. That is why rates will never rise and 10% inflation is the new norm. We are Argentina already, most people just don’t realize it.

Hard assets like real estate is the way to hedge against that.

Mr. Landlord, you’re not joking about “free” college:

https://finance.yahoo.com/news/almost-nobody-is-repaying-their-student-loans-190151270.html

Almost nobody is repaying their student loans

In the 2020 CARES Act, Congress gave student-loan borrowers a temporary break from repaying their loans. President Trump extended that twice and President Biden once, with loan payments now set to resume Oct. 1, 2021.

Borrowers could have kept paying if they wanted to, but almost nobody did. As Tom Lee of the American Action Forum recently explained, the portion of borrowers repaying their student loans dropped from 46% at the beginning of 2020 to 1% today.

The portion of borrowers in forbearance rose from 10% to 57%. The rest include borrowers who are still in school, who have gotten deferments or who have defaulted. …

So I bought a 3 bed 2 bath in Redondo Beach for $800k in 2014 and just bought a new home. Should I keep it as a rental for an appreciation/inflation hedge or cash out for $1.4M or so?

What can you rent out the house for? What is your PITI? What is the balance on your mortgage?

I’m in a real good place. House is fully paid off, taxes $10k per year, insurance including earthquake $3k. Other costs tbd. Could rent for maybe $4,500.

Jim,

Assume a couple of thousand for maintenance, you will net somewhere in the $38-39K a year range. That’s a paltry 3% return on $1.4M. Look at it this way. If you didn’t own this house, would you pay $1.4M for it to rent it out for $4500 a month? No you wouldn’t. The higher end you get the worse the ROI gets because rents don’t go up linearly with the price of a home. A $500K home rents for $2500. A $1M home rents for $4000. A $2M home rents for $6000, etc. So the higher up you go the worse the ratio gets. The good money to be made for rental properties is the mid-level stuff. The extremes – both high and low – never pencil out well.

My advice is definitely sell it. If you still want to be own real estate with the money buy 2 or 3 $500K-ish properties and rent those out. The combined rent will be a lot more than $4500. In your area $500K will be a condo and there will be HOA fees, but I think even with that factored in you could do pretty well.

Thank you Mr. Landlord, that is my hunch too. My brother thinks I should keep it as an inflation play as it will appreciate faster than inflation. But looking at Shadowstats the real rate of inflation is more like 9%.

I’m not sure this house is going up $126k a year in value. Maybe. Thing is if we are really potentially on the edge of hyperinflation the fed is going to have to do the terrible and jack interest rates like Volker did to ~10% and then real estate may really crash. At least for buyers. But as Buffet says as long as you have a product in high demand, like a coastal property under a mile to the ocean in a great school district you’ll weather inflation ok.

So the only reason I’m considering holding on is that. What if we are on the precipice of Weimar style hyperinflation? Where else do I stick my cash?

Jim,

I can’t argue with the hedge on inflation thinking. And 3% guaranteed ROI isn’t the worst thing in the world either in an era of 0% interest rates. Ironically enough, if real estate does take a tumble, rents may increase. That’s what happened in the last crash. As millions of people started renting, rents increased while the price of homes decreased. This wasn’t across the board, but it did happen in a lot of places.

I don’t think you can lose either way given that your timing to buy was excellent and it is coastal property. Suppose inflation goes hyper and the Fed *has* to raise rates. That could have a significant impact on real estate but it’d be hard to imagine prices dropping below 2014 levels. Maybe ask yourself if you’re diversified enough right now and do you want to be responsible for a rental. Nobody knows what will happen next.

It all depends on your age. If you’re 55 or older seriously consider cashing out. If you’re younger, keep it as a rental and keep working hard.

Hi Jim,

It is good to be diversified in cash, equities, bonds, and housing.

Look at your investments now. Are you diversified?

The house may be worth 1.4M now during this time of irrational exuberant demand so it may be a good time to sell. However, longer term with inflation, a rental may be a better investment.

What will you do with the gains if you sell? Put it in overpriced equities? Put it in the bank at .01% interest?

Put it in Bitcoin? ha ha ha!

What is your investment balance now and try to balance your investments.

I think/hope Mr Landlord is asking what market you are targeting?

1) Is it a fully upgraded home in a market where professionals are making 150K+ per year? Rent it!

2) Is it a home “with potential” in the same market? Maybe rent or put in some improvements.

3) Is it a home in a neighborhood that is potentially gentrifying but the average income is much much lower than your expenses for the house? Sell!

We are going through the same exercise with apartment in an area with low average income. We will do OK in any case since we purchased it 10 years ago but trying to determine the correct price for the market and for the condition of the apartment. How much improvements do we need to attract renters for a maximum ROI who will not trash all of our improvements?

As I have said on this blog before, I will buy more rentals to diversify investments. This is recommended for everyone. When it makes sense as far as ROI.

I’m not a bull like M or Mr Landlord, but I am not a bear as far as owning rentals. It must make sense now or in my perceived future. Making sense now is difficult.

This is new to me so I have not Seen This Before.

Wells Fargo just cut personal lines of credit because they know the pandemic has hurt the economy so bad they can’t trust their own customers to pay back the money they may borrow on their credit lines.

With that said we know the 2008 fiasco that was caused because people grifted the system with the no money down loans. It’s too easy for all the scumbags to not grift the system when you can simply live high on the hog until the house of cards collapses. You won’t have lost anything seeing you would never had been able to afford that lifestyle on your McJob in the first place. Only thing now is you get to declare bankruptcy and keep the brand new car you could never afford along with having the government pay off the mortgage you could never afford. This economy and people behind it are pathetic.

“ This economy and people behind it are pathetic.”

What many miss here is that a certain group of people make an absolute killing while low paid workers fall further behind.

I just came back from Tahoe…..walking the dog daily gets you in lots of conversations:

Do you live here? Are you from the Bay Area? What area do you work in?

There is a common theme at the north west shore:

Tech money is pouring in and these high earners are buying second homes / vacation homes. I assume they are often not even investment properties, meaning you technically are not supposed to rent them out (Tahoe even has short term rental

Bans on the nv and Ca side). What I am saying is: if a couple from the Bay Area buys a second home in Tahoe they are loaded with cash. Homes that used to be in the 700’s are now 1.2-1.5M up there. And you don’t even rent them out??

Down here in SoCal, 1M + homes fly off the shelves with multiple offers.

To say that people behind this economy are pathetic is not painting the right picture.

Lots of people do really, really well and buy homes the avg joe can’t afford. The avg joe keeps falling further and further behind. This reality has been true for many years but gets worse every year it seems.

Agree with M here. The Fed’s decisions have increase the wealth gap a lot in just the last year. Asset holders win, especially the top 10% and most of all the 1%. The bottom 50% fall farther behind. The Fed is no friend of the lower middle class and poor but is quite a good friend to the affluent and BFF with the wealthy. It’s sad but true.

“Down here in SoCal, 1M + homes fly off the shelves with multiple offers.”

What is your definition of “fly off the shelves”? Because I’ve seen a number of 1mm+ homes sitting stagnant/stale on the market for the past month or so where I am (South OC). Maybe certain parts of SoCal and the more desirable 1mm homes are that way and perhaps more so during April/May but it doesn’t seem as much currently…

Millie,

You are right that the top has benefited from the ‘Rona panic.

But the low tier has as well. Expanded unemployment, stimmie checks every few months, just yesterday the “poor” started getting $300/mo per kid directly deposited to their bank account. Nobody making under $94K in California has to pay rent anymore. And now Biden is about to give them “free” pre-K, and “free” vacation pay. And we all know a massive student loan forgiveness is coming. The poor are making out like bandits these days.

What is your definition of “fly off the shelves”?

>> meaning they show pending a few days after hitting the market and sell

Above asking price.

Talking north county San Diego specifically.

Mr Landlord, I understand your argument on the handouts of rent control, stimulus checks, enhanced unemployment, etc. Def generous and unnecessary. But why is the PPP for businesses never in the discussion. Millions of small/medium/large business owners got a helicopter drop of cash in spring of 2020. Many of these businesses fudged the numbers on the payroll side to get an extra bump of cash. And then aggressively fudged on the forgiveness side when it came to payroll with the money. Many of these businesses were unaffected financially from Covid, hundred of thousand had a record year in revenue. Even some of the affected businesses such as restaurant owners made out very nicely and forgiveness requirements on the payroll was very loose and generous with timeline terms. The PPP was an enormous drop of cash and charity to business owners. It is a huge reason for inflated asset pricing and rise in consumer goods.

I agree. PPP was full of fraud. It was all fraud, PPP, unemployment, rent protection, mortgage protection. Millions of people scammed to get some of the money the govt was throwing out. If even 10% of people legitimately got money I’d be shocked.

I know of a contractor that used PPP to pay his employees on a large job. The job was remodeling the contractor’s house! Sign me up for that gooberment program.

JDM,

Exactly! The majority of the handouts went to corporations and businesses. Then they proceeded to lay off massive amount of employees while preserving stock prices and Executive bonuses. This is called Corporatism/Fascism.

Flyover loves it!

There is a thread on Bogleheads discussing how to get some of that PPE. It was shameless. Pretty disappointing to see because that crowd has some admirable qualities. Wisdom, discipline and all that. But shrewdness can sometimes take an ugly form. I have no doubt in my mind that PPE was designed primarily as mega-stimmie for the affluent.

PPP, I mean. PPE is Personal Protective Equipment. That was a thing at the time, too! LOL

Apparently, Mr Landlord hasn’t invested in a kid.

$300/year may pay for diapers for a few months.

I’ve seen historical price charts for So. Cal. RE and the pattern seems to be

that if a current peak drops into a valley that generally will never fall below

the the previous peak before starting its ascent again. And in the long run

those cyclic saw-tooth patterns always trend upward. If history is a guide,

you can’t loose in the long run. And presently, most economists are predicting

smooth RE sailing for the next several years given the demographics and

demand. That is, if Biden and the Dems don’t kill the economy with their

insane tax legislation. Which I don’t think they’ll ever get thru. So, at the

moment, I’m not too worried.

I agree with what you say about the long-term outlook. Long-term has always been good in this country of ours – at least in our lifetime. But it’s possible economists are not all feeling so rosy about things anymore. Inflation is freaking out more than expected and at some point people get sober, even insider types. Wolf Richter published an interesting article today about inflation spiraling in which he said this:

“There is now a lot of clamoring among economists and Wall Streeters that the Fed will wait too long, fall too far behind the curve, keep stimulating for too long despite rampant inflation, and thereby trigger an inflation spiral that would be hard to bring under control, and that these belated efforts to bring inflation under control when it’s totally out of control would wreck the economy and asset prices.”

This is what I’ve been talking about lately. Long-term, people who bought homes in the last couple years will be okay if they can stay put and keep their employment (which was pretty hard for a lot of people last cycle in SoCal). If the Fed has to raise interest rates and dunk recent buyers under water for a few years to curb a total economic disaster then I think they will. They need to start tapering and talking about rising interest rates sooner than they expected.

A Delta COVID surge wouldn’t make the situation any easier. Strange what the charts in some states are showing the last couple weeks. And just look at the UK. My goodness, they’re even more vaccinated than we are and it’s quite a surprising spike.

Unintended consequence of rapid prices is when you sell, you are more likely to owe at least some of the capital gain tax (especially if single). If you bought for 700k 10 years ago, your home might be close to 1.7ml now, which is 500k above the exclusion limit.

I assume that not good for people using their homes as ATM’s.

In your scenario, capital gains will be 15% on $500K. The first $500K profit is excluded from taxation. Would you rather have $1M profit and owe $75K in taxes or have no gain and owe no taxes? Owing that $75K is a good problem to have in this scenario.

Eat the rich, starting with the landlords.

What wine goes well with landlord, white or red?

Seattle Times

July 16, 2021

“Between January and April, 23.8% of home sales in the Seattle area went to buyers paying all cash, according to an analysis of county property records by Redfin. The level of cash purchases is up slightly from about 22% in the same period last year and roughly 20% in 2019. Nationally, the share of all-cash home buys — 30% — hit a level last seen in 2014, when cash deals were soaring in the years following the housing crash, according to Redfin.”

From president Biden to our blog declared socialist, Bob who’ve seen all before:

President Joe Biden said while speaking from the White House on Thursday.

“Communism is a failed system—a universally failed system. And I don’t see socialism as a very useful substitute, but that’s another story,” Biden said during a joint press conference with German Chancellor Angela Merkel.”

While Biden said the right words, his actions speak louder than his words. Or, he might not be a communists but a national socialist who married the government with business to control freedom of speech!….

Biden, you, and I agree that Communism is a failed system.

Trump giving the majority of bailouts to corporations is Corporatism and Fascism.

Biden and I agree with this.

Do you agree that Trump failed?

Failed at what specifically?

He promised much, delivered little, but had some successes.

However, many of his promised policies were blocked or sabotaged by the Deep State, and even by the Kushners, from day one.

I am on track to see an increase of 250k in equity. Said differently, comps are selling around 250-300k above what I paid. I bought in Q1 2020 and the majority on this blog called it the worst decision because I am buying the peak. Lol

Lesson learned, do the opposite of what the majority of people think will happen.

M: the majority on this blog called it the worst decision because I am buying the peak.

Did they? Can you provide a list of names and links to the actual quotes?

I don’t recall a “majority” commenting one way or the other about your alleged home purchase (though a minority did doubt that you even bought a house).

Prove me wrong. Please provide names, quotes, and links to this alleged “majority” who decried your alleged home purchase.

Correct! It was the overwhelming majority of posters who cheered like there is no tomorrow. Millie bought so it must be the top!

Lol! Yeah, it will be fun to look at the comments. The majority was wrong! Lesson learned! Do the opposite of what the majority believes will happen! It paid off massively!

M: Correct!

Troll. I dispute your claim, yet you pretend I agreed with you.

M: It was the overwhelming majority of posters who cheered like there is no tomorrow. Millie bought so it must be the top!

And you repeat your earlier assertion, yet again fail to provide evidence. No names, no quotes, no links.

agreed. at least half of the people here have been posting for years. They all remember and new people can just go back to Q1 2020 articles and see the comments. soooo many people on this blog cheered when I announced my purchase! “Millie bought so it must be the peak” just one of many comments.

All wrong….not only did i not buy the peak….i am now sitting on 250k ish equity 🙂

That just proves how wrong the majority of people are!

And obviously you know all this 🙂 You just like to make up fake stories and spread incorrect statements.

M: agreed.

Why do you post “agreed” and then disagree?

Typical troll behavior.

M: You just like to make up fake stories and spread incorrect statements.

And still, you post no evidence to back up your claim.

When I accuse you of something, I post dates, quotes, links.

You just make accusations without evidence.

Correct. Buying a house in Q1 2020 was the best decision!

M: Correct. Buying a house in Q1 2020 was the best decision!

Once again, you say “correct” in response to nothing that was said.

Then re-post your boilerplate for the umpteenth time.

Troll.

Correct!

Renting long term is terrible. Unless you hate money.

M: Correct!

And yet again, you say “correct” in response to nothing that was said.

Followed by the usual out-of-context boilerplate.

Troll.

Confirmed!

Our equity increased almost 300k by now! While refinancing reduced our monthly payment (which is fixed for 30y.)! So awesome!

M: Confirmed! … blah, blah, blah

By replying to M, I realize I’m feeding a troll.

And I know one shouldn’t feed trolls.

But in drawing M out, I’m also exposing him as a troll.

Affirmative!

Not buying real estate in places like SoCal doesn’t make much sense.

Long term renting is like throwing money out the window. Why would you do that?

M: Affirmative! … blah, blah, blah …

Troll.

Thats spot on!

Buying Bitcoin is a must nowadays to diversify and hedge against inflation!

Anyone who brags as much as you is bound to be humbled somewhere down the line.

It’s karma. It’s the way nature works.

Good luck to you.

Don’t know how many of these other posters are for real but concur – young overconfident braggarts are destined to eat some humble pie. Self aware millennials with family and career don’t spend their time trying to impress / denigrate others on an internet forum. Luck, experience, knowledge… all play a role.

That said, long real estate has clearly been the right market call… my problem with this site is that championing a perma bear mindset to real estate as an asset class ignores too many important considerations including carry, relative value, type and level of leverage (very important), and taxes.

HeroShrew: Self aware millennials with family and career don’t spend their time trying to impress / denigrate others on an internet forum.

True.

I’ve said it before, M does not sound like a mature, thirty-something, married professional and homeowner. He sounds like an immature basement-dwelling brat.

Which is one of the reasons reasons I doubt his claims.

It used to be in this country that people applaud you for being successful due to the right financial decisions. But nowadays, communists and proponents of anti-free-speech just hate on you for being successful. Sad to see.

Luckily, there are still some that appreciate a good success story like mine!

M: But nowadays, communists and proponents of anti-free-speech just hate on you for being successful.

Once again, M claims that to disagree with him is to be “anti-free speech.”

Troll.

SOL,

Socialism doesnt work! Work hard and invest (Crypto, RE and Stocks).

Its that easy!

I hope it keeps going well for you. And me! Though, my house is only “making” $7,000 per month now. $10K was better.

This is all just very weird.

Must’ve been how people felt during the Carter years.

We all know the Fed won’t raise rates even if they talk about raising rates. They are all talk no bite. So rates on home purchases will average in that low 3% to low 4% range for the foreseeable future. That’s a very safe range for the housing market where nothing drastic should happen and deal flow will still be lower than average due to high cost/low inventory but deal flow will be consistent enough to not colapse the market.

But does there come a point where 2nd home buyers like these Tahoe tech money that M speaks of just kind of fades away due to unrealistic asking prices and property values? Or maybe the money dries up for more future buyers like this due to how expensive it costs to live.

And then combine that with a first time home buyer group that feels left behind and is not even going to try and over extend themselves into a home anymore.

Are these few points enough to at least slow this freight train of appreciation down? I believe it might be. Not gonna crash or even dip. But my outlook over the next 18 months is flat with no more appreciation.

The 1% always benefits from recessions. When they are positioned for the next recession to occur, the Fed will be given a green light to sink all markets. All that QE and stimilus money was destined to flow to the 1%. Bezos, Zuck and others have been quietly unloading.

https://markets.businessinsider.com/news/stocks/mark-zuckerberg-sold-billion-facebook-stock-2021-double-sales-2020-2021-4

Mitt Romney said recessions are a great time to buy stocks. He was running for President… during a recession. Oops.

What did the Fed say, no rate hikes until 2024? Then, they said not until 2023. It’s clear the last thing they want to do is raise rates. Crazy inflation doesn’t seem to trouble the Fed, though other nations’ central banks are beginning to flinch. Powell could probably win a game of chicken — or kill us all in a tremendous crash.

“But my outlook over the next 18 months is flat with no more appreciation.”

I wouldn’t be surprised. But nothing surprises any more.

I agree, Turtle.

Like any good control system there is overshoot and then a settling value. Even if home prices drop 10%, the settling value will keep most homeowners above water if it is a 10% drop.

The issue is the circumstances on the home buyers in the last 1-2 years.

Will they walk away like they did in 2007?

If they purchased with Bitcoin cash or stock equity gains – No

If they purchased on a 20% loan – No

If they purchased on a FHA 3% loan – Maybe

If they purchased on a VA no down loan – More likely

If they purchased on a loan the good Dr described above. – Extremely likely.

As you know, the total numbers are important. A sudden impulse input of new homes on the market will behave as a traditional control system and plummet prices until Capitalism (or artificial Fed lower rates) drive the housing market back up.

Personally, I have my popcorn and am sitting with cash enough to purchase a rental house if the crash happens. Otherwise, I am enjoying my primary work-from-home condition and reading this excellent blog (and reading Wolf Street). I avoid ZeroHedge and The Housing Bubble blog since they’ve been predicting the end of the world since the 1990’s. Most of their readers must be living in trailers in Baker without AC

The keys are:

1) Mortgage forgiveness. Will they stay or will they sell.

2) Rent forbearance – Will landlords decide to sell to remove the extreme hassle of renting to tenants who won’t pay.

3) Underwater personal home mortgages – How much skin do they have in the game? I’d sell before foreclosing.

4) Jobs and pay. – Will increased wages alleviate homeowners from selling?

I think the critical point is August (maybe, unless extended) after the government removes forbearance.

I will hold cash until 1-2 months after forbearance ends.

Well said, all of it. I’m in the same position right now: popcorn, a portion of cash and reading Wolf Street (some intelligent comments there).

Now tell me, what is this “Capitalism” you spoke of?

I had to add a corner case to this.

I saw a Reddit blog where a FOMO pandemic buyer moved 2-3 hours out of the city and purchased a home 6 months ago. According to the blog, their jobs are now calling them home to the city office 5 days per week. They don’t want to commute 3 hours to work so they want to sell.

They are finding out:

1) They can’t make a profit OR even break even after owning a home for 6 months (Sell price, Commissions, moving expenses, etc). Well, this is obvious for the reason that don’t expect any return for at least 10 years after purchasing.

They will have to sell at a loss. 🙁

How many of these type of people are out there? How many companies are calling their feral workers home?

This will also drive prices down in the burbs but may drive prices(or rents) back up in the cities.

Question: I own a co-op in Manhattan — rental prices dropped so I rented for lower than usual — now property values are starting to increase again — r/e friends say it is ‘BOOMING” — I’m trying to figure out if I should sell — I have no plans to return to NYC — I’m living in California where I would like to buy something at some point — my apt in NYC is on Central Park and is a nice size 1 bedroom — I’m still in the area of tax where I can sell it and it will not be considered an income property but that time is quickly going away — I’m concerned about waiting and then having to pay increased taxes on capital gains — any advice? I owe about $380 — can sell for $650-700

Richard,

I would sell the New York property and roll your equity into a home purchase in CA. And keep your purchase below $1 million unless you are sitting on a bunch more cash. I’m assuming you are not Bc you are renting. But if you have a downpayment for CA home then keep the NYC apartment and buy a home in CA immediately and stop renting.

no more bears left? Cant really count “realist”

It’s not hard to see them, M. And of course Realist counts. Why wouldn’t he? You do.

Agree with Tortuga, not all bears will post 20 times in a thread “40% crash coming soon!!” I suspect most register somewhere in the middle with a slight lean.

Bob: “This is called Corporatism/Fascism. Flyover loves it!”

It is exactly the opposite. I hate it while you cheer for it and those who practice it. When DNC gets welded at the hip with the social media giants from Silicon Valley to censor conservatives and free speech, you along with Biden and Pelosi cheer for it. I never saw Twitter or Facebook to censor anybody on the left. Why? Because of the fascism you complain of. If it is fascism or communism, they are both totalitarian forms of government which I detest. Like all the democrats you project on others what you practice or support.

Personally, I like freedom of speech, including crying “fire” in a theater. I also like everything else in the constitution, free markets, small government which doesn’t/can’t pick winners and losers, basically I like everything the democrats loath.

Awesome! Flyover and I agree with the same things.

When Trump tried to become a Fascist dictator by telling his VP that he had the Constitution authority to overthrow a US election, Flyover woke up and said “Seen it all before, Bob” was right all along and decided he wouldn’t vote for fascists like Trump anymore.

We both agree now, Flyover. You can stop your commenting.

Stocks setting more records this week. Amazing how trillions of stimulus dollars will do that huh? Oh what’s what? A gallon of milk is $5 and used cars cost more than new cars? Don’t worry. This inflation is temporary, that’s what Biden and his team keep telling me. If you believe that, I have some terrific oceanfront property for sale in Nevada. Call me.

The woke people will soon have another awakening when their price for kale increases noticeably and rent hikes come into effect.

https://www.nytimes.com/2021/07/22/business/economy/rising-rents-inflation.amp.html

It will be blamed on Trump of course.

Guys like myself and Mr. Landlord have been preaching on this subject for years. You NEED to own assets such as RE and stocks to protect yourself from inflation. Especially runaway inflation we are seeing now. I almost feel bad with the amount of money I am making in the stock market. This is the easiest money ever, even a blind man could have seen this from miles away. Renting and keeping cash in a savings account is a financial death sentence, especially in places like CA.

You are not kidding about runaway inflation. I was at the store yesterday. There is this bread we buy that has been $4.99 for as long as I can remember. Yesterday it was $5.79. 80 cents may not seem like much but percentage wise that is a 15% increase. And this was right after I bought gas for just under $4 a gallon.

Yet the MSM and Biden admin laughably keep telling us inflation is transitory and really not anything to worry about. Sadly a lot of sheep believe this bull**** and will be financially decimated in a couple of years.

The housing bubble is about to pop.

A U.S. appeals court ruled on Friday that the Centers for Disease Control and Prevention lacked authority for the national moratorium it imposed last year on most residential evictions to help curb the spread of the coronavirus.

The ruling by the 6th U.S. Circuit Court of Appeals in Cincinnati means judges in Tennessee, Kentucky, Ohio and Michigan are no longer bound by the moratorium, said Joshua Kahane, the lawyer who argued the case for a property manager.

https://www.thegatewaypundit.com/2021/07/federal-appeals-court-finds-cdcs-eviction-moratorium-unlawful/

I did a search of annual inflation rate for the US for last month. I got several different values which differed to one decimal place, but all of them rounded to 5% annual inflation. It reminds me of a story about the Venetian Navy. They had people watching for Turkish ships, and they got reports from them varying all over the place as to how many Turkish ships were heading their way. But ALL of the reports said the Turks were heading for them, so they mobilized the Venetian Navy immediately.

The rising house prices are partly a sinking dollar and partly people trying to put cash (and borrowed funds at rates well below inflation) into a good inflation hedge.

Side Note: further market “accommodation” of Covid-distorted realities, Cox, Comcast, and other major cable/internet providers, who forever allowed only ONE account per RESIDENTIAL address/site, have now created the “roommate” account mechanism, because the Millenial gamers, having moved back in with Ma and Pa, were blowing through the generous base data limits, and/or they don’t want to pay half of the parents’ set-top box habit, when they, the youngin’s, are streaming everything. Separate modems, separate bills… back to Year 13 of Fed Funny Money.

See replies from the usual suspects here, and postures that cannot be overlooked.

Here are 2 more facts of interest

1. The FED is dumping money like water. This can only go on for so long until some cries “the emeperor has no clothes, mommy”.

2. The “statements” about no money down on buying at over a million is an illusion. Yes the program does exist. Not exactly as it is presented here, but is available to a person(s) who have a 760 FICO score, cash reserves of say at least 12 to 18 months, and a job that shows a W2 of $171,485! 80% first TD payments at $3,373 with a piggyback 2nd TD payments at $1,288. Therefore $4,661+ prop tax at $1,041+Ins at $300= $6,002 PITI.Assuming no car loan or cc debt, that W2 would have to show at least $14,290 a month. Who out here reading these replies can show me a W2 for 2020 of $171,485? Self employed? Pound sand to get approved on that magic carpet 100% loan.

All this media hype just creates more drama and confusion in the lending arena and the possibility of a defaulted future when there is no skin in the game.

“Greed is good”. Great line for a movie. Well that is what the banks have conjured up now to keep swimming with the sharks, or is it the Jones’s?

Z

CNBC headline:

Housing boom is over as new home sales fall to pandemic low

Then you have to read a little to find this nugget:

The median price of a newly built home in June rose just 6% from June 2020.

*JUST* 6%. Lol. Oh no houses are appreciating at JUST 6% a year, the housing crash has begun. Run for the hills. This is why I hate the MSM with a passion. It’s nothing but lies and manipulation.

A more accurate headline would be this: Home prices increase by 6% in June as sales of new homes slow down.

But that would be telling the truth. And the last thing the MSM wants is to confuse anyone with the truth.

PSA: Turtle has decided to stay in Texas forever.

I realized moving back to SoCal wouldn’t be worth it *even* if there’s a huge crash. We’d still be spending thousands more each month for a similar lifestyle. It’d not even be much cooler for summer since we were mainly looking at Temecula/Murrieta for it’s reasonable niceness to cost ratio. I want to retire early and mortgage-free living in Texas gives me a chance.

We’ve finally acclimated to the Texas summers after 10 years. Getting a boat has been a nice way to enjoy summer. The lake is so close you can see it from three doors down. Using some of that SoCal house cash for a pool would make things even better. And maybe a small Airstream trailer for twice-yearly visits to SD (and lakefront camping). That’d be more trips to the beach than most San Diegans make, right?

Good luck to y’all whether it’s the California dream or an exodus to one of the states on the rise. Not saying this is my last comment, because I’m addicted, but you never know. Maybe I’ll kick the Doctor Housing Bubble and Wolf Street habit. Bogleheads aren’t suppose to pay too much attention to the markets anyway. 😉

@Turtle – where in Texas are you, generally speaking ( if you don’t mind me asking?)? I have relatives in Austin, San Antonio and Houston so it has crossed my mind.

Or maybe we should just move to Baja once COVID is under control. My kids will become tri-lingual, learning Spanish and continuing with Mandarin via online learning or something… LOL

BTW: we just put an offer in on another place around the corner from us here in South OC and the sellers sat on it waiting for something better. We put an offer in at asking, since the price was already high and above all comps, and they asked for best and final, in which case we offered $15k higher. The place is in good shape but definitely not that updated/current.

Well, waiting worked out for them because some buyer from the Bay Area (San Ramon to be exact) put an offer in at just over $150k OVER the ask price and as a 1031 exchange, so not even their primary residence…wth and smh. Pisses me off so much. We’re looking to buy a primary that we will actually live in and this one would have been the perfect location for our kids as it’s still very close to their school. We were *very* close to getting our offer accepted as it sounded like every other offer was close to being competitive to ours and then these fools came in and screwed it all over. The Bay Area crowd is certainly ruining it for nearly everyone else in the areas they’re migrating to or purchasing properties in right now.

Turtle,

I agree! An early retirement is the incentive.

A lake with a boat is more incentive to stay than an hour drive to a beach.

Texas has no State taxes but uncapped property taxes. Watch out for this. My brother in Houston had his prop taxes over double in the last few years. Prop 13 in CA limits the increase to 2% per year. Of course, if you buy in CA now, 1% of !M is 10K which is only a little more than my brother pays now in TX. Depending on if you had planned on living large and having a boat and going to the beach in CA, your CA state taxes would have even made the difference worse..

The lucky bought a house in CA in the 1980’s for 200K and are locked in at a 2K property taxes and considered poor at 100K in retirement income. Crazy and unsustainable. We will all die soon and open the door to the next generation. Unless our kids inherit the property taxes on the house and sustain our Republican Prop 13 dynasty.

Keep on Bogling!

‘We’ve finally acclimated to the Texas summers after 10 years’ – LOL.

great little achievement you got for yourself, a boat, after 10 years. enjoy, tortuga

Woke judges have ruled that $300/week extra UI has to keep going in states that eliminated it. This means more labor shortage, which means higher wages paid to those who do want to work, which means more inflation. That inflation will translate to even higher home prices and rents.

Every time the government “solves” a problem that problem gets 2X as bad. I wonder who will be put on the $1M note? Biden? Kamala? Yellen?

Hey ML,

The big government folks actually want to get rid of $100 bills! here is an article from the big government’s own organ:

https://www.npr.org/sections/money/2020/09/15/912695985/should-we-kill-the-100-bill

They want to get rid of the $100 so they can institute NIRP, and force people with savings to keep their money in the bank. Back in the ’30s, they had circulating $1000 bills. That is over $21,000 according to the government’s own inflation calculator.

Hey ML,

Can ANYONE rent your apartments on $300/week?

Are you complaining these people are camping on your well-manicured lawn while complaining about taxes to fund the police to remove them?

I am just pointing out current reality.

Please explain.

Bob,

I don’t own apartments only SFHs. And no, $300/week won’t do it.

I have no idea what your point it. What does defunding the police has to do with unemployment. You’re more nonsencial than usual.

Speaking of defunding the police. Have you seen what’s happening in Seattle? They fired close to 1/2 the police force. Crime has skyrocketed to the point of several shootings in the city every weekend, which was unheard of in Seattle. And now the mayor is backtracking and saying yeah maybe we kinda, sorta need more police after all, LOL!!! Good luck finding anyone who wants to be a cop there other than . Only people who will sign up will be gang members who will be more than happy to run things in their hoods.

Seattle is about to out-Chicago Chicago in terms of crime. Ahh leftism…is there anything it can’t ruin?

California taxpayers must now provide “free” medical coverage for illegals over 50: https://www.sacbee.com/news/politics-government/capitol-alert/article253057708.html

Gov. Gavin Newsom during a visit to Fresno on Tuesday signed a law that gives public health care coverage to low-income, undocumented immigrants aged 50 and older.

Newsom made the announcement while signing Assembly Bill 133 during a visit to the Clinica Sierra Vista Elm Community Health Center in south Fresno, which serves a large number of undocumented workers.

The expansion comes after the state expanded Medi-Cal, the state’s version of Medicaid, to undocumented children in 2016 and young adults up to the age of 26 in 2020. …

How do you even know if an illegal is “low income”? They don’t file taxes, all their income is under the table. Rhetorical question of course, CA doesn’t care about pesky things like laws. It’s all vote buying.

So the American that makes $70K a year will be too “poor” to get free health care. But the illegal making $80K under the table will qualify. This is what CA keeps voting for.

Meant to add…

This is so obviously a vote buying scheme for the recall. Hey illegals, want free health care? Make sure to vote for me in the recall.

Oh I know I know, illegals don’t vote, lol. Because as we all know voter fraud doesn’t exist. And if you believe that, I have some lovely beachfront property for sale in Riverside. Give me a call.

ML, beachfront property in Riverside? I’ve got the perfect place for you: Lake Elsinore 😀

“voter fraud doesn’t exist.”

Ha. Voter fraud only exists in the minds of the Orange Man and his hypnotized Fanboys. There’s only one thing worse than a loser. A Sore loser!

Democrats and vote fraud? Oh, never!

From the liberal Washington Post:

https://www.washingtonpost.com/archive/entertainment/books/1990/03/04/the-mystery-of-ballot-box-13/70206359-8543-48e3-9ce2-f3c4fdf6da3d/

Remember, in 1948, Johnson was the liberal Democrat against a segregationist who condoned lynching.

Here’s an article about Daley’s Chicago:

https://historynewsnetwork.org/article/164338

This is also from a liberal source.

From the bible: Can the Ethiopian change his skin, or the leopard his spots? then may ye also do good, that are accustomed to do evil. Jeremiah 13:23

Does this mean we will now have a massive amount of 50+ illegals swimming the Rio Grande to come working for the grape growers who are hiring illegal immigrants massively without being prosecuted.

What? You don’t want cheap grapes?

If you care, and are not a corporatist/fascist like Flyover, we should go after all of these companies that are hiring illegal aliens. Extremely heavy fines and hiring police and DEA to enforce this is needed. Both Republicans and Democrats seem to not want this.

Of course that would affect EVERY Trump resort site. The hypocrisy is real.

Bob, you should go after your idols, President and VP, for trampling the rule of law with open borders and catch and release, busing millions of illegals all over the US instead of deporting them as the law requires. These lawless leaders are to blame, not Flyover for pointing in the right direction and stating the truth. Stating the truth does not make me a fascist. Supporting tyranny and the breaking of law and Constitution makes you a fascist. Like all liberals you project on others what you support.

The primary role of the government is to protect the borders. Once you release those millions of illegals in US, ONLY 3 things are possible: pay for all their living expenses through money printing, give them amnesty or let them work illegally. What is your choice? If you chose amnesty, how many tens of millions you think will be enough? At the same time the liberals complain about overpopulation and the need for population control. How do you control it? Bringing 3 millions per year???!!!…or more?

SOL, it is good you used quotation marks for the word “free”, because NOTHING is free in this world. Only in the mind of a liberal something is free. Everyone pays for it, especially the middle class. Somebody else has to work for a service or to produce something. Even if no “visible” taxes are paid, the inflation created by the money printing is the most REGRESSIVE forms of taxation. Mr Landlord already explained the effects of it for those who can not connect two dots together.

I’m pretty sure Bob is just a really good troll. Nobody can be that uninformed about the world. And because of that I will stop responding to him.

I must have hit a sore point with Mr Landlord if he won’t talk to me anymore.

He must be hiring illegal aliens to clean his rentals for below minimum wage.

Just like with Trump Resorts. The hypocrisy is real.

Please don’t respond and I will keep bringing up these points.

The truth hurts.

Here’s comes the housing and rental bubble pop –

https://patch.com/california/moorpark/time-bomb-ticking-see-rental-arrears-ventura-county

I walked by the “Lipstick on a Pig” house I mentioned a few posts ago, and the signs are all down. It closed about 2 weeks ago. More than $800K for 4Br3 Ba >1700 sq ft and ~1/6 acre. The lawn in the parking area is dead, and all of the rest is un-mowed. No sprinklers in the parking, and some in the front yard aren’t working. Two women at the front door were speaking Spanish to each other. They looked like either tenants or a cleaning crew. Compact car in the driveway. Maybe it’s going to be a rental, or maybe a big rehab is coming soon. I can keep an eye on it.

Bob: “So the middle class is being demoted to the poor class. The poor are becoming homeless. What do Mr Landlord and Flyover say? ”

What I am saying is “stop printing money” (counterfeiting) and importing millions of the poorest through open borders. When you print trillions every year you don’t help the middle class and the poor; it is exactly the opposite – middle class becomes poor and the poor gets in the street. The extra millions you bring creates a housing shortage with the same effect on the middle class and the poor.

What the government creates through these actions is exactly the opposite of helping the poor; they obliterate them through the created inflation which is a tax – the most REGRESSIVE forms of taxation. If you understand basic economics (which I am sure you do but pretend you don’t) you know that what I am saying is the absolute truth.

Flyover,

You have excellent points. Inflation is a tax on the middle class and poor.

However, you forgot (intentionally?) that due to the same supply demand that is causing price inflation, wages are also rising to balance inflation. This is both due to rising minimum wage and extreme demand for workers. Corporatists and fascists don’t ever think about rising wages. It hurts too much.

It will balance out at some point thanks to Biden. To what? We shall see.

No, Bob. The wages don’t balance out not even with the bogus published CPI. Wage increase is far, far lower than CPI. Now, if you look at what the average middle class and poor person buys, the inflation is more than 15% and increasing; that is far greater than the wage increase. In my past life, the communists said the same thing – yes, prices are increasing but wages are increasing, too. It got to the point where the average wage per day would buy a loaf of bread.

Again, I don’t doubt your intelligence, I doubt your honesty. You know very well that what I am saying is true, but pretend you don’t see and bring the bogus word “balance”. Every worker out there even without a class in ECON 101, can see in real life what I am saying. This can not continue forever; when it crashes, the workers will be even worse off. I din’t say “if it crashes”, I said “when”. It is a given that it will, we just don’t know when the FED will take the punch bowl.

Flyover,

I think you are saying that if Democrats raise minimum wage and Social Security to track inflation, then the effect of inflation from Fed Corporatist money pumping will be alleviated.

Good idea! Vote Democrat and this will happen.

Unless it turns into hyperinflation, then the Fed will have to stop the money pumping.

More evidence of that “transitory” inflation the left/MSM and Biden keep telling us about….

There’s a gas station I pass buy often that used to have $4 car washes with the purchase of 8 or more gallons of gas. That $4 has now been increased to $7. No biggie, just a 75% increase. But don’t worry, this is “transitory”, I’m sure it will be back to $4 very soon, right? LOL.

Leftists who claim to care about the little guy are destroying the little guy through runaway inflation which is the most corrosive aspect of an economy for the lower classes. Evil rich white guys like me will be fine since my assets will appreciate and keep up with the near hyper inflation we are experiencing. But the poor, who work menial jobs, rent and have no hard assets…..they are taking it in the shorts.

Sure inflation is double digits, but no more mean tweets. So everything is A-OK!

Yes, many tenants are living for free.

Yet another landlord’s sad story: https://www.msn.com/en-us/video/newsweather/ny-landlords-income-dreams-gone-due-to-eviction-ban/vi-AAMOkQD

Columnist Lazerson for the OC Register is backing off a prediction he made two months ago; he predicted a 3.5% 30 yr fixed by the end of the year. The current average is 2.8%. He said that the Fed is continuing to buy $40B in mortgages every month, and there is no sign of an inclination to slow down. Furthermore, the 15 yr has hit a record low. So Lazerson says he’s eating crow over his prediction.

I think the Fed believes that the inflation we are seeing is transitory, and it will take a major acceleration of inflation to change their minds. The one thing that is limiting this market is retail lender’s jitters on appraisals. This forces buyers to put down more cash, and keeps the most marginal house hunters out. The people I know who have bought recently all had inherited money to sink into the houses. Not enough to buy for cash, but enough for a downpayment.

Oh, I forgot the one guy who sold a big hunk of Bitcoin at the top, and also got help from still living family. (Not M!)

No politician will appoint a Fed Chief or ask the Fed to raise interest rates at this point.

Even when the economy was booming, our previous President forced the Fed to lower rates.

I think it is more important to look at the borrowing and the economy.

It was completely irresponsible for the previous President to set record yearly deficits while boasting the economy was the best in US history.

Our current President isn’t doing any better. Yet. However, we don’t hear irrational egotistical boasting about the economy. That makes me think there is an adult now in charge and we have hope.

When it comes to “Paying the Piper” the payment to the flautist will be extreme.

Trump was a registered Democrat for a while and was a buddy of the Clintons. His monetary policy is abut what you’d expect from a Real Estate speculator. But most “moderate” Republicans have that policy, too. I can’t think of a Democrat who doesn’t go along with this policy. The major figures in opposition to this are Rand and Ron Paul who ran as Republicans.

Bob: “Even when the economy was booming, our previous President forced the Fed to lower rates.” …right when CNN was telling me how bad the economy was for the past 4 years!….CNN does not agree with you.

“That makes me think there is an adult now in charge and we have hope.” Unfortunately, the “adult” we have now is so old that he clearly has dementia. Even the liberals see that. You don’t have to be a doctor – it is visible for all to see.

I heard another president who was selling “hope and change”. He never delivered the hope and we’ve got left only with the “change”….for the worse.

We might have an “adult in charge,” but it isn’t Biden. Someone else is calling the shots.

Some have speculated that his chief of staff, Ron Klain, is the real acting president. I think it’s more of a consortium of people. But Biden is not “the decider.” He can barely decide what to put on his oatmeal.

Almost every time I go on Zillow my house shows an increased value. That’s fun! Getting richer by doing nothing. I want more houses!

Inflation is running high in this country. The fed pumps your asset and stock prices up.

Man, someone should have told me years ago how easy it is to get rich in this country…..but stocks and Real Estate. Sit back and get wealthy.

M: Man, someone should have told me years ago how easy it is to get rich in this country …

Troll.

Millie, guys like myself, Mr. Landlord and jt were preaching that for years. The only way out of this mess is printing money which leads to inflation. Stocks and RE all benefit fabulously from that. You are well aware of the draw of socal RE in nice areas, couple that with CA being short of millions of units and you see the end result with prices going up. You got into the door with your first home, that is always the hardest. When the time is right, you can carefully scoop up your next property. If you can pick up an additional property every 10 years or so, you will retire a wealthy man.

Very encouraging Lord B!

Thanks! I can’t wait to get into my first rental.

Looking at a 1b condo right now for 300k. Zillow says it rents for 1700. Have to do more research on it.

Hi was looking for fixer upper I can flip for around 300k in the newboat beach area

Thank you

Tom Vu!! How’s it going man, still hanging out with the models on your yacht?

Haha, I almost spit out my coffee. I remember that guy from back in the day. Get rich quick. The models on the yacht were a nice touch.

Usually getting rich is a long term proposition that takes decades. it’s not overly complicated, but few want to put in the work, sacrifice and savings to do it.

M,

Zillow is fairly reliable for any non-trashed tract house in major metro areas. It is very unreliable for one-off houses, especially in small towns and rural areas.

When in doubt, jack up the rent

Invitation Homes increasing the rental rates on their portfolio of 80,000 homes.