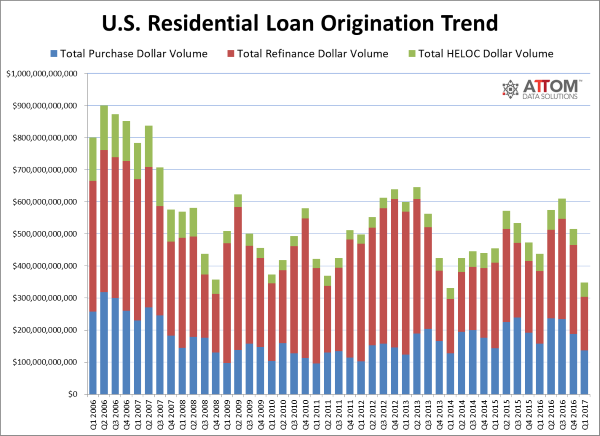

Who needs a loan to buy a home? Loan originations are down to a three year low.

The housing market is running on opioid induced euphoria and the tentacles of mania are deep into every large metro area. You would think given all this unchecked optimism that mortgage originations would be near a record level since you would assume people are out buying in mass. Yet that is not the case. What is happening is people are fighting over the scraps with low inventory and are bidding prices up on crap shacks to ridiculous levels. And there is data to back this up which is important because people are living in an alternative reality. Loan origination volume hit a three year low this year. What? How is that possible when all the cheerleaders are out in the streets preaching the good gospel of buying real estate? Well the reality is that a good portion of the market is still driven by investors.

If you need a loan, you can’t afford prime property

You can go on many forums and people are doing mathematical and budget gymnastics all so they can afford a crappy starter home. Some of these homes are in bad areas but who cares? Everything will eventually gentrify, housing makes you more attractive, and 30-year mortgages are awesome. At least that is the logic and people are buying in stretching their budgets like spandex.

Loan origination figures show a rather dull market:

Isn’t the market blistering hot? On the price side, yes. You have people fighting over scraps. And you should keep in mind that the economy has been on a massive bull run since March of 2009 (over 8 years now). Some people have forgotten what it is to live in a correction. I even see people on credit forums saying:

“So I lost my house to foreclosure 7 years ago. But now that is off my record and I’m ready to buy again. Is this a good plan?â€

Yes. A great plan. Perfect timing too. Go out and buy that crap shack. There are some hard rules you should adhere to:

-Do not spend more than one-third of your monthly income on housing costs

-You should be ready to stay put for 10 years in the house

-You need to save for retirement outside of housing

-If you can’t afford 20 percent down you probably shouldn’t be buying

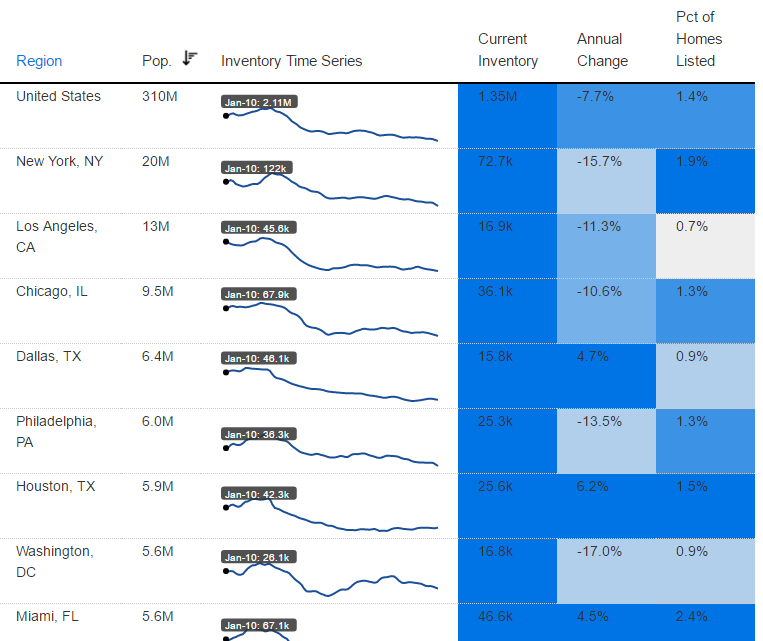

Inventory still remains very tight. Just look at the below:

Nationally inventory is down 7.7 percent year-over-year. For Los Angeles, it is down 11.3 percent. And this is down from already record low levels. There is simply too few crap shacks available to buy. So that bodes well for prices right? Well that assumes the economy keeps chugging along and optimism runs supreme. But that is the telling thing because many are somewhat negative on the economy (that was a large driver for the election even though stocks and real estate were back near peak levels). Yet this is the perception.

We are setup for a boom and bust cycle here. That is the nature of our current economy. People want to redline the car and wait until the engine blows. You just need to do your own analysis here. I go to open houses often and people are out to lunch. They usually are in the house humping stage (aka adding people) and most are being driven around by emotions versus logic. So how can you argue data with that?

What we do know is the homeownership rate is down, there is a renting revolution, and loan origination data shows a different world.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

195 Responses to “Who needs a loan to buy a home? Loan originations are down to a three year low.”

I saw the first deal in a decade today offering cash back to the buyer, openly and brazenly on the Zillow advertisement. This was an overpriced rehab in Sacramento that was purchased for 70k less only 6 months ago. All it takes is one or two “comp bombs” for this thing to trigger.

In the Westside of LA, you almost need all cash to compete. That means banks are not getting that 20/% down/80% finance mortgage business.

Signs of a recession?? While stocks have had nice increases, large industries supporting GDP growth are weak. House sales down, car sales down while dealership inventories exploding. Restaurant traffic declining, grocery & traditional retail sales hemorrhaging and Amazon’s absolute dollar growth isn’t anywhere close to cover the gap in declining retail sales. Global shipping down. hmmm…

Nothing to see here, folks. This time, things are truly different.

When (not if) reality hits the US economy, the unfolding of the imaginary animal spirits will be breathtaking. I own a mortgage and I still wouldn’t advise anyone to jump into this steaming market morass. This is NOT the time to buy.

It’s going to be super ugly. We kicked the can from the last recession (should have been a depression) and the chickens will roost. With all the trends in automation and machine learning, jobs will be wiped out and there is no “next thing” for people to move into.

Structural unemployment and serfdom for the masses.

Check, please!

The economy appears to be teetering:

The first thing I would recommend to hopefully save the economy or reduce the recession damage is stop using cloud services. Every client you send to the cloud a local service job or jobs are lost along with other services around it.

Stop the eb5 program or make sure who ever is buying these properties are actually recruiting local jobs. Not just Visa jobs. Hey it’s Trumps plan right?

You hear housing always leads a recovery? Really. I thought non housing jobs lead a recovery?

Well, the whole country is in LaLa land. Economic fundamentals no longer matter. If the stock and housing prices are going up, everything is Awesome.

Honest question, I was reading through the last few entries and comments…

Why all the hate for Realtors on this site? Just wondering…

If anyone actually has a question for a Realtor, I am happy to give an honest answer from that perspective as opposed to maybe an assumption of what people are thinking. Anyway hope to have a productive discourse.

Bryan, I can answer your question based on my long experience with RE agents over decades. Most people don’t understand what RE agents do and how they work. Also about 80% of RE agents bring a bad reputation to the profession – willingly or unwillingly. That is the reason for misconceptions.

I believe that about 20% of them are worth their money and some more (especially top 5%). The truth of the matter is that is very hard to find an agent who is truthful, respects the fiduciary responsibility, is very knowledgable and enthusiastic about his/her job, has experience, etc…all in one. You might find some traits in one and some in another, but is very hard to find them all in one. I found few like that over the years – they were goldmines for me.

Everyone with long experience in RE will tell you the same thing. Due to word of mouth advertising, those good agents make 80% of the money. Making money in RE, like in any profession is a long term game. I live in a town of about 60,000 and hundreds of agents. I will probably work with only 3 of them. The rest, I would send them home. Some are stupid, some dishonest, some inexperienced, some are there just to leave home and say that they do something. You can be laughing to hear that one offer I made was sitting on the listing agent’s desk for 3 weeks without ever being presented to the seller. My agent had to go in person to the seller to present the offer. On a counteroffer of 1/3 of a page there were 5 major mistakes – that listing agent was also the broker for that office. Some agents are nice people who lack knowledge and experience.

I would say this is pretty true; however, I would like to add that the job doesn’t just begin when an agent has an escrow and that it is far more demanding than all of you assume.

Think about it; commission ONLY with a large up front investment of time and money.

Buyers agents (typically) do not get buyers under a contract to show property. So, imagine showing a buyer every weekend for 8 straight weekends 5-10 houses per weekend and then you get a text message saying they are going with their sister-in-law who just got her license. Don’t think this happens? I see it EVERYDAY.

Cancelled appointments, flaky buyers, unrealistic buyers, unrealistic sellers, etc…

What a lot of you don’t realize is that it can take 6 mos to years before a BUYER or SELLER pull the trigger on a transaction and (assuming it’s with you b/c they could jump ship at anytime) you have had lots of follow up and energy and time invested into that prospect.

I think some of you have this image in your mind of a listing agent walking up to someone who wants to sell, getting the listing that day, sticking a for sale sign in the front yard and then counting the 6% commission. While in this market, that *may* occur occasionally; in reality it doesn’t, and the good agents work very hard for their commissions.

I am not a realtor; however, work in the same office with many of them and see it all day every day.

Just my .02

Just a few reasons as to the hate for realtors:

(1) Broker fees are ridiculous, particularly in a time when technology is disinter- mediating just about everyone. Fortunately, players like Redfin, and more recently HomeBay, will be driving broker fees down tremendously over the next decade.

(2) Brokers are, at the least, constitutionally incapable of holding any objective view on the market and are, at the worst, just downright dishonest about market fundamentals.

(3) Brokers engage in certain business practices, like double-ending a deal, that would simply not be tolerated in any other professional field. This really goes to the heart of the issue: greed.

(4) If you are a middleman — whether it be a stock jockey, car salesperson, realtor — that adds no value to the underlying product, don’t expect any love from the rest of the universe that views you as a profiteering vulture.

I hope that clears things up for you.

Now carry on ripping people’s faces off.

@ calling bs….so true.

What business would ethically allow an agent to represent BOTH SIDE OF THE DEAL?? Crazy. I think RE agents are not basically bad, but the system is screwed up. The MLS is the holy grail for eyeballs so you have to make a deal with the devil (enter the RE agent) to deal with them.

And btw, homes sell in record time now….so a 1m shitbox will get multiple offers and sell in a week. Don’t give me ‘I have fixed costs and marketing, etc…’ Thats bullshit today. Throw it up on the MLS, do a glossy (often full of hyperbole and misspellings ) one page set up to hand out the ONE broker open and ONE open house and you already have it sold with multiple offers in a week. This 6% commission structure has to change. Its robbery.

OK, here’s my question: will there ever be a better time to buy than now?

@ Bryan. Perhaps a good example of the hate for realtors is the slogan I saw a few weeks ago by a realtor. “It’s never been a better time to buy or sell”. Isn’t that statement inherently contradictory?

Another reason for the hate is during the run-up to the 2008 crash, realtors were running all over the place claiming: ‘buy now or be priced out forever’.

Bryan, isnt NOW the best time to buy? Just like last week, last year, the last few years? Anytime?

Why i hate realtards more than anything on this world…..mhm lets see:

They lie whenever they open their mouth

They are not on your side. In fact they are your worst enemy. They make more money when they sucker you into the most expensive, most overpriced home.

Negotiate? Hell no, rather making up shit why you need to buy now.

They actually profit if you cant make the payments and need to sell.

Fake appraisals. They collude with their lenders to only hire appraisers that appraise at full value. That way they dont have to negotiate and get more money.

They will make up every lie there is to get you to sign. Only if you sign will they make money.

In an environment where Americans are broke and cant afford to buy anymore, Realtards need to lie even more to survive financially.

Inflation lie, low inventory lie, housing will go up lie, its a great time to buy lie, appraised at full value lie, there a re multiple offers lie, buy now or be priced out forever lie, this time is different lie, housing will double in price next year lie, we are good honest realtards lie, i am here to help you lie……….and on and on it goes.

Anyone who can fog a mirror can get an RE license. This means that people who couldn’t make it as a fry cook are now writing contracts, frequently involving someone’s life savings.

The commission structure of real estate sales is wildly unfair, both to the sellers and to the vast majority of agents. The hardest working realtor in a small town makes about as much as a full time cashier, while an agent in an affluent area who happened to graduate high school with a lot of wealthy friends makes crazy amounts of money from referrals alone. I personally know both types, and the one from the affluent area could make a living from a few days work/year if he chose to. Unfortunately, the workload of buyer’s agents varies so greatly that coming up with a more fair system is difficult. That kind of service seems unnecessary in an online world, but the demand for it hasn’t gone away – so how do you compensate an agent who has spent the last year showing a hundred properties to a client, only to end up losing that client to a listing agent when he realizes that’s the only way he’ll get an offer accepted? Everything about the system is wrong.

Redfin and the like are not making much of a dent in traditional sales. At the very least, if commissions remain in place, there needs to be a dollar cap.

Honesty goes a long, long way, but most agents aren’t smart enough or knowledgeable enough to get that, and still claim it’s a “great time to buy” whether it is or not. One of the most successful brokers in north San Diego county, Jim Klinge, got that way because he tells it like it is, and that reputation brings him business.

“Anyone who can fog a mirror can get an RE license.” Speaking of which, I’m seeing a lot of friends and acquaintances getting there RE licenses in the recent months. The only other time in my life i remember this happening was about 10 years ago. hmmmmm

Thank you for confirming what I said. Any commission/payment is negotiable. There is no law about how much a seller should pay. However, no agent can do that unless the broker/firm allows it. For that reason, I always look for an agent/broker/owner. They can do whatever they like. Some properties are harder to sell and some easier, some are less expensive and some more expensive. Therefore, I offer a flat fee or 0.5% or 1% commission on the listing side. Based on the same criteria I offer 2, 2.5 or 3% to the buyer’s agent.

I always thought that the buyer’s agent has far more expenses and work and risk on the line. For that reason he should make more.

In conclusion, EVERYTHING is negotiable with the right agent/owner. If they have a broker above them, they can not do anything – they are just a cog in the wheel.

Realtors are necessary but they are way over paid for the actual work they perform for anything over 500,000 threshold. No way does a realtor deserve 5 or 6% on properties over 1/2 million. Its a good gig for sure! That profit comes directly from the homeowner which inflates the price for the buyer…such a scam! Realtors are there to sell on the way up and on the way down…good metrics! I recently sold my property and in no way did that realtor provide any service that warrants 60,000 commission! Wow, realtors have it good for pushing paper no doubt! Like i said, its a good gig!

Realtors are obsolete/unnecessary. Just get a lawyer to review and print out the papers. Lawyers charge by the hour. Less lies and less money spent.

Realtors are dishonest, overpaid and the entire system is BS. They cant get a real job so they try to rip people of by suckering them into overpriced crapshacks.

My view Realtors are licensed investors. Nothing more. However, they have access to all the nice real estate tools that essentially gives them an edge over other investors.

I agree that the commission seems like it should be weighted lower as you sell larger estates. $20 million dollar home and realtor will get 6% of this? Wow nice quick retirement money.

At the end of the day they are a necessary evil that helps the non investors figure out what they need.

The dislike of realtors is mostly tied to the insanity of the current housing market. Obviously realtors are in the sales business and looking to maximize conversions.

The remaining feelings are due to realtors often pressuring their clients to go beyond their means.

Cause it’s a nothing preditory job.

Before I explain why I dislike most realtors, let me first say that there are some really awesome ones out there, but they are very few and far between. The good ones bring real value to a transaction, but they are very much a minority.

The truth is that most real estate agents have minimal competence or are just complete idiots. Just look at the MLS for proof: barely literate property descriptions or images so low quality it looks like a 2-year old did them. It’s not hard to get a real estate license, so it’s not surprising that the industry attracts low quality people looking for big commission payouts.

I work in the mortgage industry and occasionally have to work with real estate agents and I’ve found that many know little about the mortgage process (and sometimes very little about the home purchase process) and are greedy and pushy. They just care about getting the deal done so they can collect their commission. They often have huge chips on their shoulders and think they’re bigger experts on mortgage financing than a guy (me) who has been doing mortgages for more than a decade full time.

One guy comes to mind who typifies the average real estate agent, in my opinion. A number of years ago I was looking for investment property to purchase and ran across this agent who tried to hustle me into buying investment properties near the Salton Sea. Yes, you read that right. He said that was the next up and coming area and that values were going to go up. All that guy cared about was making a sale. He certainly wasn’t out to help me make a successful investment.

To all who responded. I appreciate the feedback. And despite some of the wording, it is good to know how people perceive the industry and those that work in it.

@ Flyover- I agree that most do not completely understand all that Realtors do…and some Realtors, as in the one that did not present your offer do not serve their clients or the industry well. Thanks

@ dan- Thanks for contributing that. It is often like people thinking sports and most fans see the game and think of only the game. But meanwhile there is a ton of time and effort that goes into practice or transactions that just do not take place, or end up lost. Like any industry or profession it is rarely as easy as it seems. And if it looks easy that person must be very good at what they do, in order for it to look as good as it did.

@ callingbs & GreenGroovyMom – Thanks for your thoughts. I agree the commissions structure should be more fair. And unfortunately it is that structure that leads to dishonesty. Not sure that anyone expects love for being a middle man, but the role of the Realtor, is that the seller has decided they want someone else to sell their home and are willing to pay that person a fee to do it so they do not have to deal with it themselves or directly deal with potential buyers. There is some level in value and separating parties I believe. Dual representation is not as simple as presented, but I can see why you disagree with it. Sellers are able to disallow their selling broker from representing a buyer in their transaction. The role of the Realtor is to guide someone who does not know what to do through the situation as an expert. That seems to be common in most professions that people pay rather than learn and do it themselves. The value in saving time and effort on rarely used knowledge. Like plumbing for me…

@ Prince of Heck and QE Abyss – The best time to buy is when the house is the absolute cheapest in terms of nominal dollars than it ever has been and ever will be again. The best time to buy often is not right now, it either has already happened or will happen in the future, especially in this market. But given that nobody knows when/if a better time to buy will present itself, each person needs to make that decision of whether they are in a good financial position to buy and hold on their own. That statement is a lie and can only be right one time and it probably isn’t when the Realtor is making that statement. That is unfortunate that Realtors were saying “buy now or be priced out forever.” That is also a lie. The market has cycles and will return to historical norms over time.

@ Sportsfreund – Sorry that you have that image of the industry. Clearly it is for a reason, but the best Realtors realize getting you the best price and terms while being a lower commission will result in more trust and therefore more transactions because of good valuable work. The only thing a Realtor should be offering is trust, transparency, and competency to their party, anything beyond that is going to result in the inability to follow through and thus the perception of a lie. If you believe a seller’s agent is lying in order to draw out better offers from potential buyers, even though I disagree with it I can see it happening, but that is because the seller has hired the agent to bring the best offers they can find. That is why having a buyer’s agent to discern that information is actually important because seller’s agents, even though they aren’t supposed to may lie, to get their client the most money.

@ John D – Part of why I got licensed is I agree with what you say. I have a master’s degree and a primary source of income aside from being a Realtor, so perhaps this allows me to operate with honesty as you say at the bottom of your response. Honesty and transparency go way farther than most give them credit for. People really just want to know what is going on and have options. Commissions are completely negotiable from the seller and what they choose to offer.

@ Flyover – exactly correct. Although I currently am not broker/owner, but that would be ideal for the reasons you mentioned.

@ Chrsitie 949 @ – I understand but truly Realtors are there to represent people’s interests, not buy or sell. Only the people in the buying or selling position should be making the decision to buy or sell. Realtors are selling representative service, not houses. The rate they are paid is negotiable, so the sellers are to blame for the payment, not the Realtor.

@ Millenial – I agree with the exception of the last line. Only buyers and sellers can make the choice to do something. If they are making decision based on scare tactics of dishonest people that is a shame, especially on the Realtor who should be providing information and options and letting people make their own decisions.

@ Homerun – agreed necessary evil. Unfortunately, because people are dishonest Realtors are needed to protect people in a transaction. That protection has a cost. If people were nice and honest, there would never be work.

@ oceanbreeze – A good Realtor will warn clients of the dangers of doing that and encourage buyers to look in a range of property values to find what suits them best.

@ Baba Booey – I disagree about it being a predatory job. The function is to serve people who are unable or unwilling to complete a particular exercise. It is not a hunter vs. prey situation. It is a how can I find someone who can benefit from my help so they can get what they want?

@ Joe – Very insightful, I have had a few of those encounters and unfortunately they are much more common than they should be. Thanks for your contribution.

Thanks everyone for sharing your experiences and thoughts. Believe it or not, the expressions made here actually help a lot to know of what the image is and why it exists. It also impresses upon the importance of transparency, options, honesty, and sharing information that has no component of pressure.

Loan originations are down because inventory is extremely tight.

So many of my agent referral partners cannot explain this inventory mystery.

Listings are down, so transactions are down therefore loan originations are down.

Bottom line, the market needs more supply.

Loan originations are down more likely because (borrowed) cash buyers are crowding out the mortgage-dependent buyers. In addition, more mortgage-dependent buyers are being priced out of even the lower tier properties.

Back in March, the NAR reported that pending home sales jumped in February from the previous month and was higher YOY. Yet, the low inventory meme had been circulated by the sell side well before then.

The mortgage dependent buyers are being priced out BECAUSE low inventory is squeezing prices higher.

I see it every day in the business. Listing agents have less listings and buyers agents have the same amount of buyers. Law of supply and demand right now is pushing prices up.

Less inventory = less pending sales = less transactions

All of this is not good for those waiting for the crash (like me) or even a correction. It’s quite frustrating.

@Dan

Read up on Logan Moh ta sha mi’s inventory analysis. Sales were higher in January when inventory was relatively lower. But inventory has been building up since then as demand has stagnated. To use my own anecdote, I keep seeing the same houses on the market for weeks in my neck of the woods. Redfin sends regular updates of price reductions and cancelled sales. How could that be with tight inventory?

Demand has been artificially propped by cheap and easy credit for investors and overall rate suppression. And yet, mortgage lending standards keep getting relaxed in a period of “low” inventory.

If you really want to own, check out other parts of the US. It’s cliche but that’s honestly the best strategy for 90% of people. Someday, housing here could be significantly more affordable but maybe it will be 20 years from now. Who knows? Too much of your life will be gone, and you only get one.

@oceanbreeze

That’s what I’m doing. Eventually one comes to realize the derogatory and dismissive snarks about flyover country and competitive comparisons is not only a self defense mechanism unhappy people in coastal areas come up with to attempt to justify their high stakes, but also another unattractive attribute to living here. There’s simply not enough good weather to make up for the soul crushing congestion and poor price to value ratio.

I heard an owner was going through a short sale and thinking this may try to get offered for a regular buyer to look at the lowball price. However, a realtor immediately bought it before it got listed. How the hell did the realtor smell this out in the first place before it got listed? That is where the typical buyer is never going to see these type of transactions on their radar. Likely the realtor already knows the contacts and maybe the lender or bank. However, I am curious what tool is a realtor using to find these properties? Is this database only available to realtors or could anyone subscribe to them?

Last night, a realtor had a Thursday night open house about 1/4 mile from my home. It was a fixer on a good street priced under two million. The home was swamped. This is getting so crazy. You have to wonder if we will be seeing eye popping price increases shortly. No inventory and massive demand spells big price increases … one wound think. I still think this all ends by 2020.

The real story: Last night JT had too much to drink. Drinking does help with his pain. His sales numbers are way down….what can you do? Post propaganda on the internet and drink.

After the bottle was empty, he felt much better. In fact, he felt so good that he decided to go outside and get some people to buy a house. The sun was setting but for him it could not have been a brighter moment. People were outside! They even looked at him and even screamed! They all want to buy a house now he thought. And there it was….the open house with hundreds of buyers willing to pay over asking price. The tables finally turned and life is how it used to be. Everything is good now. He passed out.

The next morning JT wakes up and finds out what really happened last night. After drinking his brains out he walked outside mumbling about to buy now, buy now or be priced out forever. People started screaming because JT didnt wear any pants. More and more people came and escorted him back to his home. It turns out the open house was his own and these buyers were actually his neighbors deeply concerned about the state of his mind.

Buy now or be priced forever….Until 2020. But the correction will be a minor 15% after an additional 40% run up. I love it!

Prince of Heck, you sound like a true realtor. This is clearly the best time in history to buy California real estate, and prices can never drop more that 10-15% in the future. This is clearly the best of all possible worlds–one with never-ending real estate price appreciation regardless of average family’s income. Also, it is great to know that recessions have been permanently outlawed in California.

@Gary

Thanks for the compliment. I’m working to perfect my impression of a real estate cheerleader.

@jt,

I agree that this market likely has legs to run for a few more years. There is no inventory, rates are still super low, stock markets are at all time highs, foreigners and investors still flocking to CA RE. After that there will be a decline, then stagnation and then the cycle repeats itself and we’ll see higher highs.

At this point it doesn’t matter if the FED will use inflation or deflation, they will crash the system.

When that happens, they will have Trump exactly where they want him – a scapegoat.

Based on the evidence I have seen of the “establishment” or “deep state” try to take down POTUS, I would assume your comment has validity; however, then I would ask, what are they waiting for?

Better to do it NOW, before any of his policies can hurt said entities.

Dan, they want to make sure that none of the blame goes on the community organizer. They want to put the blame squarely on Trump’s shoulders for daring to upset their apple cart. He is too much of a wild card for them and with so many illegalities they did they are afraid for their safety.

@Flyover

My theory is that Trump will keep Yellen so she can be the fall guy. After all, she was appointed by Obama.

Avi, the problem is not with Yellen per se. Personally I don’t have any issue with her person or who appointed her.

The problem is with the system she represents. It is a very corrupt system of enslavement for more than 99% of the population. Personally, I believe that the POTUS and Congress have zero influence on the F ED and that actually it is the FE D controlling both the WH and Congress. I’m not speaking about theory but about reality. I want to make this clear before another blogger tries to copy and paste from the F ED website like it happened few weeks ago. I don’t need that. I know the “theory” of the FE D very well (I have an MBA and decades in finance).

I am talking about the reality of life here. It is the F ED choosing let’s say 3-4 candidates from their own tribe and then they need the “blessing” from the president to add legitimacy to their gig of anihilating the middle class (stealing and creating money out of nothing). Again I know the theory and the details, but I am trying to be brief to avoid confusion. In the end, it really means zero if Obama or Trump gives the blessing, it is still one guy/gal part of the system which gets there.

What do you think? Is it Trump controlling Goldman Sacks or the other way around?

“Give me power to control the creation of money and I care not who makes the laws”.

In my opinion, you will never see another middle class forming in US as long as you have the FE D in business. Too bad, JFK did not have time to suspend their business license. At the current prices, the middle class is only on the paper or few older guys who lived in a time before the F ED took all the power.

What you see today, really does not have anything to do with low inventory or Chinese – it has 100% to do with central (committee) banks policies. Today you have few guys (0.0001%) in charge of the money supply and their buddies in crime with the rest on the way to enslavement. I hate to call them “elites”, because there is no class or intelligence in what they do. They are just a cabal of thieves, using manipulations and force to steal. Middle class goes first the way of do-do, then the upper middle class and then the wealthy. The model and the direction are clear .

I will be looking for some type of misdirection when it happens. FED will probably look to a comment or anything just to create their master plan in my opinion.

Interesting point. The Fed has signaled that it is going to raise rates. Obviously, #fakepresident will be blamed. It would not surprise me if the Global Elite specifically hired the Russians to hack our election system so ensure that a dufus would win. This way, there would be an easy scapegoat and the masses wouldn’t revolt if the candidate was the least likable in history. #MAGA for the Global Elites!

Gibbler, what you say does not make too much sense. Why would the “elites” need the Russians, when they control all the agencies here????!!!!

The “Russian” meme is just from MSM for popular consumption. I would say that Hillary had far, far more information than Trump, straight from the source – White House. Or you think that Obama wanted Trump to win?!?

There are just such few properties to look at / bid on, that the demand is overwhelming the supply.

I dont doubt this, any property priced well has significant interest.

I could see buying something well located in the 700s this late in the cycle. But, two million dollar fixers … I would be nervous touching those this late in the up cycle.

Jt may be correct. You can hand-paint a real estate sign after drinking 2 bottles of wine and while stumbling to the curb, you will get 5 offers for your house?? I sold a house in Jan and it was a fixer. I set a price based on comps during the last month considering the condition of the house. We had a friend who had a RE agent friend who had an all cash foreign buyer who met our as-is, no contingency price. The RE agent still got 4.5% but I may have been better stumbling to the curb with Redfin. However, our RE agent had a buyer. Redfin did not. However, maybe Redfin had 50 buyers. I will never know.

Flyover, it’s ridiculous to claim that “good” realtors/brokers make 80% of the money in the profession. Perhaps good ones make 80% of the money from available referral business to ordinary people looking for a home, but even that’s probably a stretch. The realtors who do best are, like in every other field, the ones who are congenitally wealthy. Consider the brokers selected by major developers: they can travel from state to state, re-certify themselves, then sit in a construction office all day and print out the form paperwork for buyers of new properties, collect the commission, and never have to put out ads or chase business. These highest-compensated ones get to perform that function for commercial sales and leases, operating in an entirely different world than some thirtysomething white woman who loves “finding people a home.” Yet they are still, nominally, real estate agents or brokers.

Often they stay in a state/region, but not necessarily.

I know a broker-dude at a development who hardly ever needs to show up to work, even for appearances’ sake. The developer moved him into an upscale development with about 30 planned homes in the $5-8M range. Development takes about 3-5 years to sell all the lots. This broker’s job is to show up by appointment around once every few weeks to meet an upper-class couple who chooses their lot, tile preferences, et cetera, then fills out the standard paperwork and submits an “offer” (slight variations on fixed prices). When sale is done, broker earns his commission and it’s not even his job to call the foundation crew to start working.

The most ridiculous part of the deal for him is that he got to live in one of the furnished luxury models while he was “working” there for a few years. He could make six figures without having to dress up for work more than 15 hours a month. This dude was motivated, so he actually used his free time to travel the area and advertise to other high-end buyers and sellers, but he wouldn’t have had to do that. Could’ve just played Playstation most of the time and still made a great profit. Real go-getters can serve this function for large office complexes or mass housing, where it can dovetail with lease management, construction and maintenance selection, and other profitable sinecures.

If you don’t have prior or familial connections with a big developer(s) or an existing (retiring) broker(s) at that level, those jobs aren’t available. No applications, no advertising, can possibly gain them. Even dental, medical, legal, and accountancy cartels make token exceptions for someone with “good grades” getting a small percentage of the choicest appointments, but with realtors, I don’t know if anyone can distinguish themselves enough to suddenly become a big developer’s primary regional broker. Anyone seen that happen?

Money is still too cheap. Thus people don’t know what to do with it and many rich just plow it into RE as a storage. And the economy isn’t all that strong but it’s just a fiction made of paper and low rates.

At this stage of the game, the rich have or are cashing out. Mostly retail investors and buyers are jumping in late in the cycle.

Will be back under 4% on 30 year fixed after today for majority. 3.875. Free money essentially….God and the Fed hate renters….Shit. I need a drink.

Are you alright cheddar man? Please make sure you take your pills. If you struggle in today’s environment I am deeply concerned what will happen when the market tanks by 50-70%? Maybe it’s time for you to turn off the internet and go for a walk. Nothing will stop the upcoming housing crash. Reality hurts.

There is a limit to how much a lenders are willing to expose themselves to. Otherwise, the previous credit bubbles would have lasted far longer than they did. Already, commercial real estate lending is falling because banks are becoming aware to the increased risks (too much multi-family inventory and flattening rents).

Big layoffs right now at tons of companies in America. Thousands and thousands losing good paying jobs and still 90 million out of work. So who is able to buy except for banks and foreigners?

CA Senate just passed the Single Payer Healthcare Plan that would cost around 4B. Who do you think is going to pay for this? You can’t tax the poor because they don’t have any jobs. The rich will flee to establish residency somewhere else. It’s the California Middle Class again baby!

RL, you are correct. The middle class is being taxed out of existence by the California liberal politicians. They think that money grows on palm trees and that ever need, real or imagined, has to be met by the government.They have forced me to change my party affiliation from Democrat to Republican but one changed voter will make no difference. The number of poor–who vote for the handouts–is growing faster than the middle class who have to pay for them.

I may be forced to leave the state, but were should I go? Where is the place that is cheaper yet has California’s climate and cultural activities? Could I stand AZ and NV’s heat?

There is no other place in the US exactly like here. On the other hand, coastal CA is slowly turning into a NORC (naturally occurring retirement community). At some point it will be mostly old people here, and the cool stuff you like will be gone although the weather and beaches will remain.

All I can say is good luck everyone. Being assraped in the sand has its downsides.

its 400 B.

Eliminate Prop 13 and you find the money. Then you can see the mother of all inventory increases!!!…

Does CA still have a middle class? Most likely they will tap the wealthy again since they want to be here regardless of the price.

@ RL…that Calif. healthcare bill won’t fly. Even Gov. Moonbeam can’t justify the math to fund that boondoggle. He already said it wouldn’t pass as Calif. can’t afford it.

Middle class buyers have been priced out the market in California. Prices will continue to appear go up for at least another year since the only homes left are priced over $750,000, but what is really happening is PRICE COMPRESSION. The difference in prices between small 2 and 3 bedroom homes and large 4 and 5 bedroom homes will continue to shrink until there are no buyers who can afford either. That point is probably a year away in 2018.

Manias do not end kindly so a real estate crash will eventually come. The bottom will likely occur in 2020.

130 housing bills in the CA congress now. Sacramento will take over housing in the state although it’s not clear how long that will take. 5 years? 10 years? Not clear. Our politicians don’t like it when companies like Toyota remove millions or more in tax revenue just because of housing.

In 2005 people sold their homes and upgraded thinking the market would continue going up. Win win. They lost. Now, nobody is giving up their home and upgrading. Most are now just above water (and have refinanced equity out). Nowhere for them to go and their much smarter.

Moreover, investors snapped up everything post 2010. If a house comes on the market now, investors dive on it with cash and pay retail. Those looking for a personal residence can’t compete unless they offer way above asking in order to beat investors. Driving prices up. If they give up, hungry investors with no place to park cash will still keep the market at retail.

Investors buy as rentals. They know that if there is a crash, tomorrows renters will pay today’s mortgage. Meaning, no risk for them. They are right. The more renters are priced out the more they will (have to) pay higher rent.

In short, investors will never give up their rentals and homeowners will never sell their current homes. AND, foreign investors looking for a place to park money are coming in droves and increasing. More competition and less inventory driving prices high, high, high. Demand will stay high forever and global scenario/fundamentals make this a reality This is the new global reality.

That said, when families give up and only investors are competing for RE, it may flatten a bit and stabilize (10 years). The only thing that will change the outcome is a revolution by renters revolting at high rents and no place to live. This really is an investor driven market and economy. Again, if you have a renter to pay the mortgage, you can over pay for RE. Investors know this. This isn’t speculation. In fact, they encourage rising RE values that keep people from owning.

There is another storm brewing. With 130 housing bills going through the CA congress, Sacramento is going to take control of housing. Who knows what that will mean but big changes are likely. Moonbeam and Co. get pissed when companies bail the state taking millions of potential tax revenue they can spend (waste) on pet projects.

So much wording for “this time is different”!…

The renters can revolt against Prop 13. The poor want the state to pay for their medical insurance. Where will Moonbeam get 400 Bil.???? Make the renters happy by eliminating Prop 13. Shoot 2 birds with one stone. What will happen to inventory at that point????

I’ll give you the pleasure to answer:-)))

As the politicians need more and more $$$$ prop 13 may indeed get whacked.

I think that the Prop 13 limits on commercial real estate will go first. There are still enough older voters who own homes and younger voters who own condos to keep Prop 13 for residential real estate, plus low priced owner occupied houses in California’s flyover country (e.g. Bakersfield, Redding, Fresno, Needles, etc.). This disaster to the economy that raising commercial real estate taxes would unleash might just penetrate the brains of the California political establishment. Then again, they may all be brain dead already.

Maybe. But come any credit collapse (daisy chain of defaults) the big players that are leveraged out will need to sell in bulk upsetting this entire model. This credit collapse will also spike unemployment which will lead to further defaults. Rents can only go so high until disposable income evaporates creating the recipe for a recession (if not a depression). In that scenario wages will begin their race to the bottom…etc. etc. 10 years seems like a long time in this topsy turvy world.

Exactly! Things seem rosy until a contagion causes the money to dry up.

Sad to say, I’m finding everything you say here to be true, here in Chicago as well as L.A. It’s the same everywhere, though prices are not so bloated as in L.A. or the East Coast. I just had yet ANOTHER offer blown off by a condo investor who decided to put her place, which needed a great deal of work and was inhabited by a slob tenant, up for rent again rather than accept my offer.

There’s almost nothing for sale here except in the highest price ranges where I cannot go. I’m a cash buyer competing with people who are using 3% down FNMA and FHA loans, but I do not want to take on a mortgage at retirement age.

This is the worst and most rigged housing market I have witnessed in my lifetime. I hope it collapses for the sake of young buyers, and for those who wish to be frugal to make their retirement savings last. But our policy makers care for more for the financial oligarchs and large speculators,sadly.

A huge problem is the ****** foreign buyers who buy up housing in our cities which already have a critical housing shortage. With filthy dirty money to boot. We need to wake up and BAN any buyer who is not a US citizen.

Yes but the prince quotes a blog starting there is plenty of inventory.

#fakepresident family were just in China pumping up the “free citizenship if you invest/buy their property”. Sadly, neither Dems nor Repubs are going to stop the foreign buyers. American middle class is paying the price.

“Yes but the prince quotes a blog starting there is plenty of inventory.”

The blog uses figures and charts from the NAR to make its point. You must like it when the NAR narrative when it fits your agenda.

Laura said that “There’s almost nothing for sale here except in the highest price ranges where I cannot go”

In that I agreed (and you probably did too because you misread it). The bubble has pushed prices of existing and new homes drastically out of the price range of ordinary buyers.

Poor Gibbler, still butthurt about the election. Will somebody please remind her that this is not a politics blog?

Yes, we all know that real estate and politics are intertwined, but the childish bitching and moaning is past its sell by date.

Good grief, Laura is whining about the “rigged” housing market in Chicago again? When is she going to get off the DemocRAT’s Chicago plantation where crime and taxes are crazy high and DemocRAT plantation masters rig everything?

Why doesn’t Laura move to a state like Florida which has no state income tax and other taxes are generally much lower?

Housing costs are MUCH lower. For example, Toll Brother’s is selling new 2 bedroom 2 bath townhomes with garages for $238K in the master planned community of Nocatee which is located between Jacksonville and St. Augustine.

https://www.tollbrothers.com/luxury-homes-for-sale/Florida/Coastal-Oaks-at-Nocatee-Carriage-Collection

To Samantha: Why on Earth would I want to move to Florida, where the summer heat would kill me by the end of June?

Florida is NOT cheaper than Chicago. For one thing, condos are taxed pretty lightly in Chicago, as the property tax is a land use tax, and condos occupy far less land per unit than single family houses do. Florida, on the other hand, has many significant hidden costs, the foremost of which is insurance. I pay $600 yearly for insurance at the most for comprehensive condo insurance here, while a similar unit in Florida would cost at least $2000.

In any case, I prefer a cooler climate, a dense city with a wealth of cultural institutions and entertainment venues, reliable 24/7 public transit, and a walkable neighborhood with a lot of retail I can easily walk to and that delivers, with nice places to hang out and meet with friends.

Buyers are lurking everywhere with no end in sight.

3 friends of mine are brokers. one in WLA, one in Irvine and one in Del Mar. They all say the same thing – they all have buyers chomping at the bit to purchase a home. Get this – they said the buyers are a wide range of investors, foreigners, multigen families, even normal Americans from flyover land who have accumulated a lot of money and WANT to move to SoCal.

Tell them to look at San Francisco. I hear that inventory is building up there and prices are stagnating. It’s your friends’ clients’ chance to buy a piece of the West Coast.

What you see isn’t always what you get. Sometimes it takes people who relocate to SoCal a while to discover what they really got.

There’s an awful lot of ‘Quicken Loan’ tv commercials on right now. They’re pumping the last gasp of air into the balloon. I think this happened just before the last crash, as well.

Jed, I think Peter Fan is wrong. There a lot of signs that a real estate top is near. Even investors will stop buying eventually and start selling. Investors are always looking for a better place to park their money, and real estate will eventually lose its bloom. They will start selling more than they are buying at some point in the near future.

I’ve been preaching Quicken Loans to the RE cheerleaders here. But they’re more concerned with hypothesizing rather than acting on the potential price gains.

http://www.ocregister.com/2017/05/28/heres-a-big-warning-sign-for-orange-county-housing

The article suggests 50-50 chance OC prices will dip, up to 10% if his spreadsheet pattern plays out. Or, does it gain because of Trump’s proposed Tax Plan & repatriation of offshore money. Can it infuse the OC economy enough next year? Probably

I’m betting no dip in coastal OC, especially South OC. North OC’s old dilapidated cities will continue “gentrify” with more “new homes” causing the working poor to keep migrating to Rivertucky.

Rivertucky in Urban Dictionary means:

Riverside and San Bernadino Counties in Southern California. Additionally, it includes areas encompassing the 909 area code. Inhabitants comprise mostly of bros, bro hoes, alongside miscellaneous white and Hispanic trash. Asians are banded from living there.

Mortgages are low because people have been saving the past 7 years and have pockets full of cash. I mostly see all cash offers to win a home.

This is the new normal for a long while. Prices are not going down when you have 30 people putting in offers on one home.

If you didn’t buy in the last downturn, what makes you think you will buy in the next?

Homes will go up the next 5-10 years and then pull back. But when they pull back they will be more expensive than they are today.

Housing isn’t going to tank anytime soon.

…meanwhile the number of Sold and Pending sale has decreased in the busiest sale season of the year!!!!…..Hmmmm!!!!….

no supply, how can people buy what doesn’t exist?

Same old recommendation: follow your own advice and go out and buy as many properties as possible.

Dont miss out Sean! Go out and buy now!! Before it’s too late!

Sean101 is in self preservation mode. He wants you and other millennials to break your necks at current prices. He thinks that only people with money have intelligence. Since the millennials are already in bondage to the banks due to student loan bubble, he thinks there is no intelligence there.

Oh Doc I’m sure what the information that you bring forth is credible but I don’t believe it tells the whole story. A significant portion of the buyers in prime areas are foreign, specifically the Chinese and they have the cash and are financially savvy enough to keep their homes even in an unlikely downturn. So if people are willing to pay and have the ability to pay perceived inflated home prices, then there is no air in the “bubble” and thus there is no bubble, just a new standard in home prices. And to further back this theory up, China’s economy may be in a bubble so the need for the wealthy Chinese to invest in the US real estate market is more dire than ever and as long as the prices here are cheaper than desirable cities in China (Shanghai, Hong Kong, Beijing, etc), which they are, then the hard money will keep pouring in further driving prices up when coupled with the low inventory factor.

Which leads to the next point. When prices climb, it will be to tempting for builders so they will build, increasing inventory, getting the millennials on board and THEN you may have a bubble. We also live an ever-decreasing middle class society which is uncharted territory for modern USA. I hate to say it but maybe it is different this time around. Maybe we are entering a new age of haves and have-nots which will transcend to the real estate market.

In general I agree with your grim assessment of the situation and the destruction of the middle class.

HOWEVER foreign buyers does depend on immigration and their ability to purchase homes. Immigration can be restricted and in the age of Trump is likely. The eb5 visa program will enter more stringent requirements in the fall.

Also there’s no telling whether, like Canada, a movement will pick up to restrict foreign buyers. In Canada this took the form of an extra tax and a vacancy tax.

“Oh Doc I’m sure what the information that you bring forth is credible but I don’t believe it tells the whole story. A significant portion of the buyers in prime areas are foreign, specifically the Chinese and they have the cash and are financially savvy enough to keep their homes even in an unlikely downturn”

Yeah, right. Except that recent stories tell otherwise:

1. Chinese government is cracking down on capital flight.

2. The Chinese have borrowed a lot: 277% debt to GDP ratio.

3. The Chinese have borrowed fraudulently:

a. A Chinese national is being accused of borrowing $10M from a Chinese bank and fled with it to Canada.

b. Many Chinese companies have used the same piece of collateral to secure loans from multiple lenders.

4. The Chinese invest recklessly:

a. Their stock market plunged due to over-speculation last year.

b. Many newly built towns are practically uninhabited due to the lack of consumer demand. Hence, China is known for its many modern ghost towns.

c. Chinese buyers decided to walk away from off-plan apartment investments because they couldn’t secure enough funding (a.k.a. LOANS) due to reason 1) above.

Prince, for those who don’t believe you, here is the link to pictures and information collected by Reuters in China:

http://www.zerohedge.com/news/2017-06-02/pledged-assets-are-not-there-reuters-goes-china-discovers-ghost-collateral

@Flyover

I think Asian stereotypes, such as being intelligent and industrious, gives the false impression that their character is above reproach. As anecdotal evidence, a good portion of the casino clientele in California is Asian.

Has anyone looked at the percentate of forclosures vs actual homes for sale?

What is with this rows and rows of homes that look like taco bell with a 0. lot line, no sqft, closets or view? They look like section 8 but cost 1/3 more than a average home and are forclosed on all the time.

I was all ears until you wrote that these buyers are financially savvy. There’s no way for anybody to know that for sure. Maybe they are, but it’s anyone’s guess until the buyers are put to the test.

Hi. Have you read this article? (I know, consider the source…)

http://www.realtor.com/news/real-estate-news/home-prices-rising/

I am rooting for a correction. I know it’s terrible because a Recession hurts people and animals. As a dog lover, I hate to think about the pets turned into the Shelters and likely not making it out alive, which is what happened during the Recession when people lost their homes. However, prices in LA County are unrealistic.

p.s. I agree. I’ve had interactions with many Agents and believe that 80 to 90% of them are incompetent and lazy. Finding the really excellent ones that are “on it” is extremely difficult.

I even tried a Redfin agent and caught him in a lie. I still have the email with his lie. And he got promoted shortly after that to a bigger region in Glendale, CA.

“I am rooting for a correction. I know it’s terrible because a Recession hurts people and animals. As a dog lover, I hate to think about the pets turned into the Shelters and likely not making it out alive, which is what happened during the Recession when people lost their homes. However, prices in LA County are unrealistic.”

I don’t think it’s terrible because current conditions are not as advertised:

– Housing costs in overpriced regions can consume close to ~40% of incomes.

– Consumers are encouraged to borrow recklessly to buy items that they otherwise could not afford.

– Medical, food, education, and other basic necessities are artificially inflated by the Fed’s currency manipulation.

– Wage growth has lagged behind the growth of afore-mentioned expenses.

I would simply say that corrections are healthy. Sort of like getting sick is a correction from drinking too much alcohol, it’s a natural and necessary event that helps preserve the body for the long term. Maybe the reason why people in SoCal have such a hard time with it is that they don’t experience real weather seasonality. There’s a lot which could be said about the connection between the environment and state of mind.

The law of supply states that a higher price leads to a higher quantity supplied and that a lower price leads to a lower quantity supplied. As prices go up in homes, why does the supply not increase like economic law states?

A different pricing effect often occurs when buyers in a real estate market have few viable housing alternatives. Sometimes, locations, like Burbank, with very happy homeowners not wanting to sell can create a housing undersupply, leading to a ‘seller’s market.’ In other cases, a location is so popular that builders can’t keep up with demand and sellers command top dollar.

What you say it is true in a “free market”. What we have now in RE is not a “free market” but a “manipulated/rigged market”. Manipulations can not last forever. Eventually the gravity takes over. “Mark to fantasy” works only for a while. Eventually there are disastrous economic consequences.

Manipulations are possible only when you have a big government/socialism with the power to intefere. Still the millennials blame the current conditions on capitalism. They say that capitalism failed although you can not have capitalism without free markets. I don’t think anyone can say with the straight face that we have today, especially in RE, are free markets – they are manipulated to the max to make the rich richer and anihilate the middle class.

On the contrary. A higher quantity has been supplied — but just of the wrong type of product. The public clamors for properties affordable to the middle class. The builders respond by building luxury properties to cover the high costs of land acquisitions.

Once again, it’s amazing how fundamentals matter only when prices are rising. But economic fundamentals that go against the narrative don’t matter: price to income ratio, the economic cycle, too much corporate and personal debt.

Don’t want to sell because they’re satisfied or don’t want to sell because all the alternatives aren’t worth the added cost?

Bought one of my properties two years ago w/o an agent. Wow… that was TOO EASY!!! I’ll do it again… title company did the only legal stuff worth paying for and having two compete for my contract resulted in 1/2 price. Inspections are s joke, city permit records are electronic and free, city development office gave me access to all records just by claiming “buyer” etc etc. Seller sold at a reduced cost because she walked away w/ extra profit.

RE agents are basically worthless. They are the most overpriced people in the world. I hired one of the top agents in my area to sell my last home. He is absolutely nothing to sell my home–no advertising, no flyers, no open houses, etc. Why he was and still is one of the top selling agents beyond my comprehension.

You didn’t stipulate up front what your agent was to do? i.e. number and frequency of open homes, list of places home will be listed, etc.

Whose fault is that?

@Oceanbreeze I agree I think they need to limit the foreign buyer here in california. They are teh main reason the RE price here are over the moon.

Middle class american are priced out. These crazy folks who love Los Angeles are wasting their time here. Move out or be priced out.

Yes, we’ve reached insanity. A Chinese diplomat even made fun of the US for allowing it. She said: “You guys are so foolish allowing this to happen. In China it never would.”

The situation is horrid with people dumping millions on properties then at *best* coming in and not participating in the community much at all. More normally, the properties might sit empty which attracts crime and damages neighborhoods.

@oceanbreeze politicians here in california are dumb and fool. They are more concern about illegal immigrants here than the welfare of US citizen and tax payers legal citizen.

Why do I think this ends by 2020? Because, nearly every housing market across the country and many across the world are rising in tandem regardless of the local fundamentals. That smells like inflation. It would be healthier to see some markets rising, and others falling, but that is not what is happening. For such a pattern to continue, you would need to assume the worlds central banks will ignore this. I doubt this. Eventually, they will cool inflation off, and I doubt they will let this go for more than a few more years.

Global central bank-induced inflation through speculation.

I wonder with high home sales prices are states potentially asking for a little more time to fund their budgets?

Chinese hot money undeterred by Vancouver’s Foreigner tax. Wow

http://www.zerohedge.com/news/2017-06-03/biggest-real-estate-bubble-all-time-just-did-impossible

It wasn’t nearly strict enough. 15% is chump change for wealthy foreign buyers.

A tax would only be effective at 100% and even then not great.

The best solution is that to own property you must be a Canadian citizen, and you can only own one property in areas with a housing shortage.

Is it really so much to ask immigrants to rent while they are working on citizenship?

Or just maybe Garth Turner is onto something when he says the price mania is vastly a result of Canadians levering up. I wasn’t convinced of his position before, but now am beginning to doubt myself. Looking at the rest of the article and charts, it’s about the amount of mortgage debt Canadians have taken on, so maybe there’s something to it. And if there is something to it, maybe the same could be said about coastal U.S. markets.

Crap Shack is the best term to discribe what’s being sold over and over and falling out of escrow due to realistic guidelines. Agents are activly duping Home Buyers by holding open houses on properties that are allready sold, just because they can. I learned in Real Estate School, no one ever sells a home at a open house and that an open houses purpose is to advertise the agent. Why these sellers allow people to trapes through their home before it closes is they are selling crap and know it. I see so many code violations and the owners expect the buyer to pay for an inspection. They probably want a copy for their records too. Never seen so much cracked and over done cement jobs in my life on the same property’s with a bad roofs with water stains on the ceiling. Do they think everyone is stupid? Sac is just too far from the Bay Area and wages are just too low and with 1000 jpbs leaving shortly all you can see is pre-foreclosures. And if the propery is actually worth the money with no major improvments to do it is allready sold before it hits the net. Buyer beware, as there is no more flip the kitchen and pump the price 100k anymore. These selllers are trying to milk any potiential equity the home will ever have with some of the craziest sunken living room, uneven staircases and closet built for minalulist. All those sunrooms that are falling down being used for square footage? You don’t dare point this out or they will know you have a brain and escort you out. Sorry, I don’t want a crap shack and the employers in Sacramento think it is so cheap to live here that the wages make people go back to the Bay Area after loosing a few years at their career. I love Sacramento for what it is and have no visions of it being anything but what it is, a mish mash of urban redevelopment that had city planners with an IQ of less than 00.00. The light rail is a success if you live within walking distance and I hope they continue to evolve it. The downtown condo’s are only for the obserdly high paid Goverment employees and Doctor / Lawer types with their days numbered as they retire and are not being replaced. A real shortage of Service Profesionals has arrived and if you want to put your health in the hands of someone on a special visa, be my guest and no thank you as I have been there or faces with licenced prof. that don’t look old enough to drink. How can this underpaid group, employed by greedy corperations going to afford the homes as the average goes over 300k? Nothing left over to fix that bad roof, fence, concrete with the curb apeal of river rock? Pop : )

Yes, Sacto, still a cow town, according to some. Great Ag surrounds Cali’s capitol, so appropriate.

Why are so many of these homes in Rancho falling out of escrow due to lending guidelines? Agents are activly duping Home Buyers by holding open houses on properties that are allready in contract, just because they can. I learned in Real Estate School, no one ever sells a home at a open house and that an open houses purpose is to advertise the agent. Why these sellers allow people to trapes through their home before it closes is they are selling crap and know it. I see so many code violations and the owners expect the buyer to pay for an inspection. They probably want a copy for their records too. Never seen so much cracked and over done cement jobs in my life on the same property’s with a bad roofs with water stains on the ceiling. Do they think everyone is stupid? Sac is just too far from the Bay Area and wages are just too low and with 1000 jpbs leaving shortly all you can see is pre-foreclosures. And if the propery is actually worth the money with no major improvments to do it is allready sold before it hits the net. Buyer beware, as there is no more flip the kitchen and pump the price 100k anymore. These selllers are trying to milk any potiential equity the home will ever have with some of the craziest sunken living room, uneven staircases and closet built for minalulist. All those sunrooms that are falling down being used for square footage? You don’t dare point this out or they will know you have a brain and escort you out. Sorry, I don’t want a crap shack and the employers in Sacramento think it is so cheap to live here that the wages make people go back to the Bay Area after loosing a few years at their career. I love Sacramento for what it is and have no visions of it being anything but what it is, a mish mash of urban redevelopment that had city planners with an IQ of less than 00.00. The light rail is a success if you live within walking distance and I hope they continue to evolve it. The downtown condo’s are only for the obserdly high paid Goverment employees and Doctor / Lawer types with their days numbered as they retire and are not being replaced. A real shortage of Service Profesionals has arrived and if you want to put your health in the hands of someone on a special visa, be my guest and no thank you as I have been there or faces with licenced prof. that don’t look old enough to drink. How can this underpaid group, employed by greedy corperations going to afford the homes as the average goes over 300k? Nothing left over to fix that bad roof, fence, concrete with the curb apeal of river rock? Pop : )

If you ask me, prices are starting there decent down now. I have been tracking the Laguna Niguel market closely and have seen lots of price drops in the last couple of months. The other day, I was in an open house…… “the brokers open”, and the house for sale was owned by the agent that was selling it. All of the agents from the area pretty much knew each other so one of them decided to ask the owner/agent why she was selling her house. Her response… “I’m trying to catch the top of the market as it looks like prices are headed down”. At that time a few agents in the room quickly commented that they agreed and she was smart to do so! You would never hear an agent tell the average buyer that prices are headed down, they are topped out, etc…..but since they were all just agents in the room (besides me and I was actually in the next room) they figured it was safe to be honest.

Another interesting thing is that I get zillow market updates for both Cerritos and Laguna Niguel. The market outlook updates which I just got in my email yesterday put both markets as “cold, buyers market”. The last update I had from them was “chilly”. I think that was 2 months ago. Their prediction for Laguna Niguel was a .01 price drop, and for Cerritos was a .01 price increase. Now we all know that zillow is nowhere near perfect but the fact that I have been watching them lower there market expectations over the past few months does say something as there predictions are always chasing what is really happening. They market will be tanking before they see it.

Are you JT’s realistic, down to earth twin brother?

J-Dub, you may be seeing a new reality. It does appear that prices are starting to fall in Southern California. All the new listings, I have seen, appear to be more reasonably priced than the older listings. All of a sudden sellers seem to be less greedy and more motivated to sell. The change in attitudes has really surprised me.

One thing we can be certain of is that home prices do not go sideways at mania market tops. Once homes stop going up, they immediately start declining sharply.

Hope so, would love to move to Laguna, be not at these prices. I’ll need to see a 20% drop, im all cash but im not taking on a mortgage at my age of 50+

No one can call a short term top or a bottom until after it passes. I have been fortunate that I have bought a lot of properties. Once I got the absolute bottom. All the others where purchased while prices were moving up. I kept my fingers crossed and got lucky every time in that prices continued to move higher. The only reliable indicator is that after a long uptrend ( 7 or more years ), prices usually stop rising or drop … every time the drop is caused by a recession and every recession has a different cause that no one saw ahead of time. In my opinion, the smartest strategy is don’t worry about the top. Instead, worry about getting the right location such that when the drop happens you can survive it without too much damage. Anyone who calls the top or the bottom before it is clear is a fool. That is nothing more than a guessing game. Look at all the people who called late 2013 a top … huge mistake.

Crash is around the corner….buy now and be screwed forever

Buy now and be screwed forever? Na. Most likely you will be screwed for 4 or 5 years. Then, you will be whole again. But, you will also be screwed in the stock market. And, if you wait till prices are falling, you need a huge down because banks get too nervous to write jumbos. So, you still can’t get in.

Just facts. Buyers who bought during the last peak are still under water. You will never get ahead of someone who had patience. Buying an asset that depreciates is like throwing your money into a bonfire. The smart ones wait for a buying opportunity, the ones who belief realtards screw themselves and never recover (financially).

Milly, most decent areas have values higher than 2007. The ones who are down made poor choices when buying in 2007. No doubt there are some dumb people out there.

Millennial. That’s funny you say that those who bought at the last peak are still underwater. Because everyone here keeps saying that we’re in this massive bubble because values have surpassed the last bubble.

But those two are contradictory. If we’ve surpassed the last bubble values that means people aren’t underwater who bought last time around at the high.

If people who bought in the 2006ish highs are still underwater then…doesn’t that mean things could go even higher from here until they get to 2006 levels?

Or…”it’s different this time…”

Its no surprise that realtards and RE cheerleaders do not like facts and logic. Only if you find a dummy who buys into the fear of “buy now or be priced out forever” BS will you be able to trick people into buying overpriced crapshacks. The choice one has to make is wait for the crash and buy 50-70% off of today’s prices or screw yourself financially and sign up for a massively overpriced crapshack during bubble 2.0. Simple.

millennial

Facts and logic are good. So which fact do you think is true below:

A) nominal prices have reached previous bubble levels

B) inflation adjusted prices have reached previous bubble levels

C) nominal prices have NOT reached previous bubble levels

D) inflation adjusted prices have NOT reached previous bubble levels

If someone is underwater from the last bubble I would guess C)…do you agree? In fact to be underwater after 10 years of payments…that’s the only way I see it happening. Do you disagree?

AA,

you must have been living under a rock the last decade?

just google it….I’ll do it for you….here are just a few out of thousands of reports/websites stating how homeowners are still under water.

http://www.cnbc.com/2016/04/04/how-are-millions-still-underwater-as-home-prices-rise.html

http://www.dsnews.com/daily-dose/03-07-2017/negative-equity-decreasing-many-homeowners-still-underwater

http://www.sandiegouniontribune.com/business/real-estate/sdut-zillow-negative-equity-underwater-homes-mortgage-2014may22-htmlstory.html

http://www.huffingtonpost.com/jorge-newbery/top-ten-metros-where-the_b_10615608.html

If you buy during a bubble (like now) you never catch up with someone who waited. You seem to have a problem with this statement: There are still many, many people under water with their mortgage even after 10 years paying for the overpriced house they got suckered into. On the other hand we are nearing the peak of the current bubble. Yes, in some locations the prices have not reached the previous bubble. There is no law that says a bubble has to reach its previous bubble price level. In a bubble prices make no sense. There is no rationality behind it. A bubble simply means prices are disconnected from fundamentals. Look at median household incomes and look at what drives prices artificially up. This is not a market, its a rigged game. A dummy who believed in “buy now or priced out forever” and bought a condo at 400k in 2005/2006 sees the same condo being sold for 250k right now. However, the median household income is about 50k in this area. So the median single family house price should be around 3 to 4 times what the median household income is: about 150-200k. Therefore, this crapshack condo should cost maybe about 120k or less. This is a real time example. Sorry to tell you but housing has a looong way of going down from here. If you think otherwise….please go ahead an buy now! you have the green light from me.

Millennial,

So you didn’t answer the question…which situation do you think we’re in, out of A B C or D? Let’s narrow it down to, say, all of Southern California?

Pick whatever you want. The answer is it does not matter. Comparing prices from the last bubble to this bubble makes no sense because none of these prices are backed up by true value. Its speculation, a mania, insanity. I am not sure how else to explain it to you. As i explained above, you are asking the wrong question. Buying a home is about timing and fundamentals. Right now is the time to wait because the market is heavily overpriced. Just do a rent vs buy analysis and you will easily see how renting saves you a ton of money because there is no rental parity. In case you make money by selling real estate its useless to explain it to you: “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!” Upton Sinclair

My mom’s friend has been house hunting for about 2 years. She’s a FL retiree who wanted to find something in OC…and not like, Laguna Beach or Irvine but more in the reasonable areas like Fullerton/Brea.

This lady found a duplex listed at $760k. She ended up buying it for $800k with zero contingencies and all in cash. She’s a retiree. I believe she was a nurse in her working life so, not like a crazy CEO or anything.

The lady is Asian so I’m sure everyone thought she was just some crazy Chinese money launderer. Nope! Just a super frugal boomer who took all her money to OC.