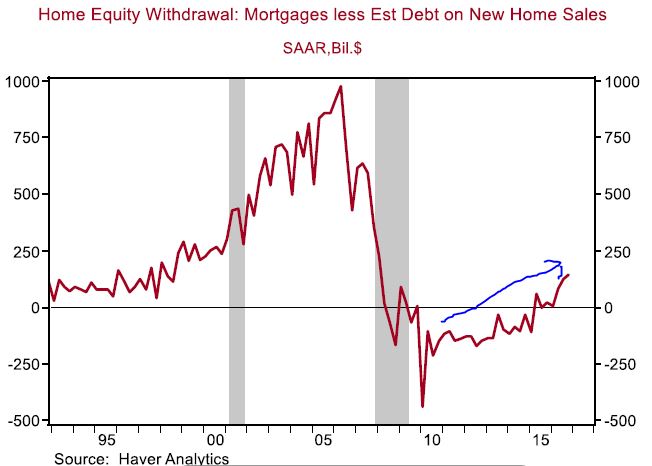

Treating homes like ATMs is back in fashion: Home Equity Withdrawals rising at fastest pace since Great Recession.

I love getting tips from Uber drivers especially when it comes to buying real estate. We are now back at that level where real estate can do no wrong, the house humpers are confusing luck with investment acumen, and of course the sheep dive in head first at the most frothy time. It is clear that we are in a mania and hot money is flowing everywhere. Credit card offers are soaring and lending is booming across all areas: credit cards, auto loans, student debt, and housing. With housing, we are now seeing one of our favorite past-time events in treating a home like an ATM. Home equity withdrawals are now moving up in a direction that is not exactly positive if you believe in actually keeping your equity locked in instead of cementing your belief in the bubble and adding more debt. You do need to pay those loans back by the way which many tend to forget. Home equity withdrawals are simply one of the final steps in the delusional mania.

The housing ATM is back

Real estate is blistering hot. It is fully disconnected from incomes or any sane measure of valuation. The only thing beer belly house lusters can say is that “well comps are selling for this so therefore the market has spoken!â€Â Cult chasers were also buying tulip bulbs, beanie babies, and itching to get a piece of Bernie Madoff’s investment sauce. Now the hot thing of the day is buying a crap shack at all cost even if it means you are living on rice and beans to pay the mortgage.

The Fed knows we are close to having a turning point. Just look at how many times interest rates have been changed in various decades:

Hah! The Fed knows we are s-c-r-e-w-e-d. The Fed needs to “try†to keep rates low but the market can become unglued at any moment. After all, everything seems stable in our current economy and political system [/s]. I can’t help to think that we are aiming for a Black Swan type event shortly that simply is off the radar. By definition, these events are unforeseen and yet if you look at history they are replete with them. We know they will happen. To think otherwise is to be naïve and to ignore history and avoid the basic tenets of scientific inquiry. Markets by definition are operated by herd mentalities. The herd is running rampant.

Using your home as an ATM is dumb. Yet here we go:

Home equity withdrawals are now getting back in fashion. People are already leveraged up to their eyeballs in other forms of debt (see later in article). So what if they don’t have a NINJA loan. What happens when there is a correction and the next recession hits? Just look at the balance sheets of many tech companies based in California. They are ridiculous. And these companies employ hundreds of thousands of high paid tech workers. Many of these workers are keeping the bubble afloat in places like San Francisco. Does it matter that you put 20 percent down on a $1 million crap shack but lose your job? Many of these tech companies have balance sheets that are not performing.

So the stock market is hot, the housing market is hot, and now the mania is making people think that using your home like an ATM is smart. It is not. This is simply “cheap†debt that is secured to an inflated asset. You need to pay this back. All debt requires a payment. And yet the issue in the last crisis wasn’t liquidity but solvency. The notion was that if you only fixed a couple of things, all would be well. But no, people made absurd bets on inflated valuations and it all came crashing down. People over paid on a grand scale and it imploded.

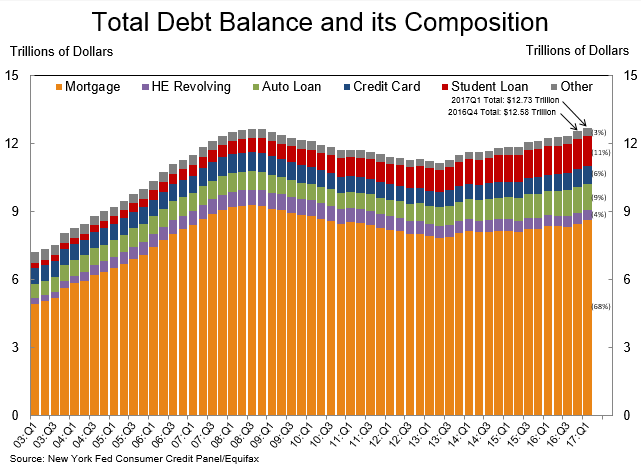

And make no mistake, there is a lot of debt out there:

Total debt is now at a record. And you know what is even more nuts? We have more debt in items that are more volatile than housing:

-$1.4 trillion in student debt

-$1.1 trillion in auto debt

-$1 trillion in credit card debt

People are in debt up to their eyeballs and many Taco Tuesday baby boomers are unprepared for retirement especially with their Millennial kids now moving back home. Time to tap that home equity to pay off those college loans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

173 Responses to “Treating homes like ATMs is back in fashion: Home Equity Withdrawals rising at fastest pace since Great Recession.”

Housing To Tank Hard Soon!

Housing market will not tank. Sorry to say that. I know we cannot afford. But it is the new normal.

Don’t mind Jim. We love him around here. He is but a ‘metaphor’ for those anxiously waiting on the sidelines for a fair and just price correction. As if,… besides, he’s been wrong since 2012. Lol.

Heck, why are you doing on a house bubble blog? Go out there and enjoy your equity gain. If you don’t already own, then run to the nearest realtor.

@Jed and that folk below him. I am here because it is not your business. Even though I don’t own any house but I also admit housing price will not tank. You are not millionaire but you have to accept the truth. You cannot afford it! The truth that you cannot afford it does not mean the price will go down for you. I want the housing tank, everyone here wants it. Everyone wants a Ferrari doesn’t mean everyone can afford. This is reality. Your wishful thinking and fancy illusion cannot change anything in reality.

@Adam

This blog is a discussion about the current bubble. So why do you even take it seriously if you don’t believe that one exists?

And if you do take the blog seriously, lay out your reasons why high prices is the new normal as a contrast to what I have argued is another unsustainable market.

“@Jed and that folk below him. I am here because it is not your business.”

…Huh?

@Prince of Heck

How does it stay flat for the current housing price? The price will just go up. Do you know how many cash buyers from China come here or remotely transfer money to buy those houses? My coworker’s family was once in the realtor section and they saw Chinese buyers pay 110-120% of the asking price with cash. Chinese buyers will keep buying and buying. The more houses they have, the more houses they can afford.

Just because prices SHOULD go down does not mean they will.

With easy credit people are going to spend everything they have and more. The movie, “The Big Short” is correct we are living in a completely fraudulent system.

Yes housing will not tank. I don’t own any but I would rather not be having those wishful thinking.

Adam, housing will crash hard. Just a matter of patience. Prices will be 50-70% off from today’s market, easily. Why buy now and screw yourself?

“Taco Tuesday baby boomers” makes me laugh every time

The IMF just cut growth estimate for US because of #fakepresident and anti-Christ policies:

http://www.marketwatch.com/story/imf-says-us-economic-outlook-uncertain-casts-doubt-on-trump-administrations-gdp-projections-2017-06-27

A few minutes ago, McConnell threw in the towel on Healthcare as no one in their right mind will touch Medicaid or inhumanely take medical care from 22M people.

http://www.marketwatch.com/story/wall-street-stocks-on-track-to-slip-hurt-again-by-a-drop-for-techs-2017-06-27

This is not going to end well. Not to worry though, all is well Comrades says Russian bootlicker orange Cheeto.

This is great, nothing will change(no change to health insurance situation, no change to mortgage and property tax deductions, no change to cheap money), party on and on forever.

Gibbler, you still did not answer me why are you an Obama bootlicker – #”real” president and “pro”-Christ. After all, I did not know that muslims are “pro” – Christ. I know, it is painful, but get over it; we are getting close to a year after elections and you are still butt hurt.

It looks like you drunk so much from “fake news” CNN, that even CNN changed the narrative, but you are still stuck in Russian collusion fantasy:

Today, CNN fired (“resign”) 3 employees who were publishing those “TRUTH†news. Why? Because they were publishing fake news for “ratingsâ€. This news is not from Zerogedge, but from CNN.

http://money.cnn.com/2017/06/26/media/cnn-announcement-retracted-article/index.html

CNN was lying for so long that even the CNN executives got “disturbed†by the level of “fake news†coming out from them. Maybe the bottom line was affected by the lost of credibility with the public. They had to do something dramatic to stop the slow dying of their outlet. Bad credibility is not good for ratings. Bad ratings are bad for bottom line. They might care about their ideology and agenda, but if that kills you, then you better take the bitter pill.

Conclusion? It pays to take your news from different outlets and use your critical thinking for the course of action. Don’t swallow everything you read just because it makes you feel good. Cross check and again cross check. After all, you are the only one to lose or to gain.

Your #”real” president Hillary “pro” Christ, has lost; get over it. It’s getting old. It took CNN 8 months but even they got sick of their lies and decided to move on. It’s your turn now.

The CNN employees made a mistake, admitted it and they resigned. That is what professionals do. Fox News and whatever sites you are getting your false information from are the real fake news. Your racism, ignorance, and hatred does not make you correct, it just makes you look like a mean spirited fool.

Trump is a joke and should be treated as such. It is a shame that you have been tricked and lied to, but like most people in an abusive relationship, you are so invested in this fraud of a man that you can’t admit that you were conned by the biggest liar and cheat to ever steal the Presidency.

You, sir, are everything that is wrong with America. Stop getting your news from Fox and Facebook. You have bought into propaganda. It just makes you look like a fool.

Condo Owner, you are not a player, you don’t have a house. How do you like that Condo board jerking you every which way and abusing you? I know of horror stories about the evil Condo boards. Condos are the last to go up in price and the first to fall down, nothing like a spread, single family house on a good amount of land, and a real lawn with trees.

Could you please be more specific? What did I say that is racist? Or bigot?

Just spewing the same terms used by CNN does not make you correct or smart. CNN is a propaganda network same as Pravda. Personally I wished that Ben Carson, a black person, would be president instead of Trump. Does that make me racist? I care less about % of melanin in the skin. What I care about is character. Trump is president, I have to live with him.

How did Trump “steal” the presidency? I saw Hilary stealing the presidency from Berney, cheating outright. That was proven. I never heard of any illegals voting for Trump and I never heard of dead people voting for Trump. I heard those illegals and dead people voting for Hillary. One of her operatives was caught and convicted already.

Facebook? I never had an account. Fox news? Another globalist network. Who was beating the drums of war more than anyone else (for Iraq, Syria and now Russia)? CNN

Like I said before – I did not vote for Trump but I am glad Hillary lost and Obama is no longer in power. I am sick and tired of communists and globalists (aspiring communists for the whole world). Trump is saying the right things but I am afraid he is also a puppet of the globalists, the same like Hilary, Bernie, McCain, Romney, Bush and Obama.

The person who bought into propaganda is you. I think for myself.

Hey CondoOwner what did flyover write that was racism? I missed that part.

Personally for me the only thing getting old this cycle is the term “Fake News”. Generally all the big news agencies including Fox and CNN do report at their core real world events with generally true facts. The place where they can all get into trouble is with their narrow focus on only certain stories. The layer on top of that is the narrative they try to weave real facts into. The only truth you can glean from investigative reporting are the cold boring facts of real world events. The narrative and punditry to goes around them should always be taken with a grain of salt.

For me at least Trump is a uniquely shitty person to be the POTUS. He is erratic, petty and self-absorbed. Not someone I want making decisions or representing the public face of our country. But I can’t expect the Republican base to be unhappy that he is a shitty person, given that he is mostly just ramming stock Republican policy down everyone’s throat without any real ideological agenda other than making his base love him, come to his rallies or patronize his families businesses.

CondoOwner, The CNN employees made a mistake,

They did not make a “mistake.” They intentionally violated their own journalistic standards. They reported a story for which they had only one, unverified source, whereas their own standards required verification from other sources.

This thread is becoming another off topic ramble now. Time to change subjects. This is a housing blog. End the racist political $#@!& comments.

Homerun, I told that Gibbler guy to stop with this nonsense. He starts every thread with the same – “cheeto” antichrist -…

If you did not notice, it is him exposing his juvenile thinking on every post. On top of that he gets cheerleaders for his “smart” comments. Those cheerleaders don’t find him a fool because they think the same way as he does.

If I would like to hear his propaganda, I would go to CNN or other MSM. Since I am sick and tired of that, I am here on this blog to find that propaganda still.

According to the article, the IMF laid no blame on anybody for the weak economic forecast. The weakness was already baked in due to the long term structural problems that past administration’s ignored. In other words, the economy is hitting it’s credit limits for this cycle.

Ultimately its the collapse of the Bretton Woods agreement and the worlds reserve currency reaching its logical end state after being decoupled from gold for so long. All other countries followed our lead and the result is the destruction of not just valuation, but of cultures and the work ethic.

Gribbler, I’m sure the FED policies of raising rates and QT in a declining economy do not have anything to do with economic contraction. Servicing another 10 Trillion in debt, accumulated in the last 8 years, do not have anything to do with funds available for spending on main street.

Could you enlighten us specifically which Trump ENACTED policies are responsible for the economic contraction? I know that he was TRYING to spend some money on the infrastructure but the party of “NO” (democrats) opposed that. They opposed because the bankers who put Obama and the rest of the democrats in power want to have their additional 10 Trillion in debt serviced. If the money go for infrastructure, there is nothing left for interest for that “debt” created out of thin air.

Do you actually believe the dumb shit you say? So all of our problems are because Trump has been in office for six months, and has nothing to do with the last eight years of liberal policies?

Before the 2012 election, Obama surreptitiously tells the Russians that he would have more ‘flexibility’ after the election.

After the election: Obama gives Russia Syria, the Crimea and about half of the Ukraine, and fixes up Russia’s pall Iran with a sweet deal.

But Trump is the one in the Russians pocket? SMH

In order to better understand the Russian collusion it’s important that we understand exactly how Putin made this young man break the law. Until we understand how Putin is doing these things, we can’t stop him. We’ll have to nuke him from orbit. It’s the only way to be sure.

http://www.zerohedge.com/news/2017-06-27/young-virginia-democrat-gets-prison-time-registering-dead-people-vote-hillary

Again, Trump was right that dead people voted for Hillary.

Your message gets lost with the juvenile cheeto comment every time. If you have something constructive to say, people will listen, but childish name calling reeks of desperation.

Mr Turkey….. Your idol, Obummer, has created a garbage health care plan which has failed! The repubs are trying to fix it and the rest of us don’t want single payer. You and your fellow lib-tards can pay for those that don’t want to work of the 22M. The markets are more optimistic on Trump than Obummer, the difference is you lib-tards are trying to side track the administration with the hot air russia stories so that he can’t implement his policies.

Nearly every poll taken of the general population, not just left or right, shows that over 50% of Americans want single payer.

Roddy 6667, the population want single payer as long as they are not that single payer.

Yes, the government can print more money faster and faster to cover the deficits and faster increases in their cost to operate and faster increases for the cost to operate the hospitals, but all that means is runaway inflation till it ends like Venezuela. I want single payer as long as I am not single person who pays for it. Inflation is the most regressive form of taxation. The poor and the middle class will be affected the most. That is the sad reality; I don’t like to lie to myself.

Maybe ending the imperial wars will give some funds for health? I am all for it. However, the end of the petrodollar sustained by massive military, could also cause massive inflation. What is the solution? I don’t know; maybe smaller government and more personal responsibility??!!!

Asking a person in the US if they would like a single payer system is kind of meaningless because that means different things to different people and their is no detail on a proposed single payer system.

Health is toxic policy because no matter what you try to do with it you are going to fuck some large block of the population over. Someone will always pay more, some one else will get worse coverage.

Any proposed policy will be too complex for the general population to understand as a whole so their collective opinion will be basically meaningless.

Single payer is a weasel worded phrase. It’s like referring to toilet paper as a stain remover. It’s socialized health care. Why don’t proponents term it what it really is? I’m actually on the fence with this subject but weasel tactics put me off.

Single Payer means the government, or a trust, or some other public entity pays existing health care providers (hospitals, doctors, etc) for you, usually by an increase in taxes in exchange for no health insurance or premiums or other out of pocket costs. Socialized medicine is when the government owns and operates the health care providers that provide care for the electorate. I hope that helps.

The Feds already started Quatitative Tightening. It wont be long now.

“quantitative tightening” almost sounds magical after so many years of hearing “easing”. Thanks for the optimism.

Depressing. I’m exactly the young family man you describe in taco Tuesday boomers. Saving for a home and retirement is painful. People think we are will off. We have to rent.

The market is going to tank on our retirement fund, I’m sure

How are middle income families making it here?

“How are middle income families making it here?” They don’t. Move to Texas like the rest.

Sure they do. Wifey and I are among the lowest earners in our particular circle of friends, and yet we easily afford our 4,100sf with a pool, in a city with VERY low crime and excellent schools. So it occasionally hits 100 degrees – it’s certainly better than the Texas soup you folks call a climate.

John D, and pray tell what hamlet do you reside in?

Temecula.

$400k in Temecula will get you a newer 2,000sf home in a very good neighborhood. Without risking much (FHA loan), that’s about $2,255/month PITI, which a $90k income can easily afford and qualify for. The equivalent would rent for $2,300. $90k is a single software developer or a couple making $21/hour each. That’s admin assistant or retail floor manager money, jobs that are plentiful in town (10-minute commute).

If a couple is in their 30’s and hasn’t saved up $20k, they have other problems to fix before they should consider buying a house.

John D, been to Temecula, Congressman Issa is a good man. Lot of wineries there. The 15 going south is a parking lot on the weekends. INS has their border station on top of the hill, before you go down to Fallbrook , Escondido, and other parts south.

Shitty wine though.

400k for temecula is waaaay overpriced. There are no jobs there that pay good money. Buy after the crash and snag it up for 150-200k. Much smarter move.

“400k for temecula is waaaay overpriced. There are no jobs there that pay good money. Buy after the crash and snag it up for 150-200k. Much smarter move.”

I didn’t say it was a smart move, I said it was affordable, which it is – with the kinds of jobs that are there.

I wouldn’t wait for 70% off except maybe in an inland slum, because it ain’t gonna happen anywhere worth living.

Getting out of CA is a start.

live in Temecula… and work in Kearny Mesa in SD County or Anaheim? The commutes from Temecula are brutal… I-15 south early in the morning is almost bumper to bumper. I had an office in Temecula and know it well going back to the Rancho California days… I paid to get out of my lease early.

“The commutes from Temecula are brutal”

I live in south Temecula and work in Carlsbad. It takes me 50 minutes at 5am, always full speed, an hour back home at 3pm. Not so bad. I actually have the option of working from home and choose not to. Until recently, my wife worked in La Jolla and her drive was similar at 9am. The drive from north Temecula is a different story.

I would never consider commuting to the OC from there, but maybe Riverside.

“How are middle income families making it here?”

They can’t make it in SoCal, but maybe they have a chance in flyover country – no guarantee. The FED policies made sure that only the Oligarchs can survive and the rest, who cares. They created the 2008 “crisis” and they then brought in the inequality source of easy money and QE to enrich themselves even more. Now since they have so much money and everything is in a bubble, they plan to crash again everything to make Trump look bad and buy again everything for pennies on the dollar.

If you did not notice, that is what they practiced since 1913 when they’ve got the power and created the IRS to enslave everyone. What they fight for now is worldwide enslavement via one world central bank and one currency – the ultimate TOTAL control. You don’t believe that all wars are to fight ISIS and Al Queda and bring “democracy” to the middle east?!!…. Or even worse, that we try to protect the Syrians from chemical weapons; like we protected the Iraqis. I hope you don’t fall for that CNN “fake news”. With the Iraq war, CNN was the main propagandist for the military complex.

I agree with you. We need to stop the empire building and get rid of the FED just creating money and lowering the value of the dollar.

I think the middle class should live in states where money goes farther than other states: https://files.taxfoundation.org/legacy/docs/%24100%20Map-state-01.png

As long as you don’t have all your eggs in one basket, and don’t sell in a panic, your retirement fund will be fine. Those who owned mostly blue chip and gilt-edged stocks and didn’t sell during the last recession are now far better off than they were before the crash.

Honestly, they are not making it. The only way is for both people to work in high paying jobs. Or work and live at home. The best shot people have is to move out of state.

Pay off all your debt and save 30% of your income. Cash will be king when the recession hits…

OC is like LA in that young people try to “make it” here – The ones that don’t succeed move out of state. The ones that do make it usually have family who finance the first home at 23 – 25 years of age. Use the equity to buy in at 30 – 32 and hop up the property ladder every 5 – 6 years.

Anecdotally, I see very VERY few self made millionaires in OC who made their money in OC coming from humble backgrounds.

Of course, you see this on TV, but I believe it is very hard to do this in reality. And I don’t mean the leased car, rented home, credit card maxed out “self made millionaires”.

You don’t know any Vietnamese nail salon owners? Always a white Mercedes in the parking lot. And all tax free income. Of course they work 100 hour weeks.

I wonder how many small business shops are just taking in money under the table. How may liquor stores, nail salons, garment shops, textile shops, pizza shops are under the radar and taking home at least $100K. Probably the majority of them.

In Denmark where I spend a lot of time working, it is a running joke that all the kebob shops and pizza shops are laundering money for their counterparts in Eastern Europe.

College degree and the ability to hustle… or an extreme ability to hustle

LA is in a clash of old world suburban to new wave urbanization. As long as the Skyscrapers keep coming up DTLA and Hollywood it will be alright in 20 years. I can’t comment for the rest of LA…

Overpriced condos with bums urinating outside.

Water and food must be brought in from hundreds of miles away for the millions living in urban LA. It’s not sustainable. With numerous active earthquake faults, urban LA is a disaster waiting to happen.

First many families are dual income. To middle incomes can add up to an workable income. Many young people buying houses with average incomes have help. The only people I know buying homes with a no family help have pretty well paying jobs. And even some of them use teachers perks, VA to get loans with minimum down payments to get past our nasty cost of entry.

Those same people, on a gamble, limp into the housing market and some are able use that first home as a spring board to trade up later. You don’t hear much about the people that get fucked, end up in a foreclosure who are then forced to rent or move.

Another possibility is living further outside the city. There are plenty of more affordable homes in San Diego say if you are willing to live further from the city center. Then all you need to do is swing the payments with a 3% down FHA loan. If two people can swing $80k a year they can probably buy a $300k 2-3 bedroom home an hours drive without traffic from the city limits.

Buying homes in California is a hot mess though given decades of shit policy making everything harder than it should be for the housing market to function as anything but a speculation nightmare. In this case you can squarely blame Democratic housing policies here but I don’t think the Dems have the market cornered on shitty state and city planning.

I mostly stick it out here for family and because I am payed well. I think there are many redeeming qualities to a city like San Diego but If I were to make an entirely cost based decision I would move away from California immediately. There are plenty of up and coming cities with better cost of living and good job markets. Minnesota, Colorado, and Texas spring to mind. But it really depends what kind of profession you are in.

Housing to the MOON BABY!

https://fred.stlouisfed.org/series/CSUSHPINSA

It’s a real estate bubble. We are above 2006 right now.

Yeah, really interesting…I wonder if this could happen (I added to it on the right):

http://imgur.com/7j0TQRU

double tops are not good in stocks…you have to consider homes like stocks now….they were gamed to go by the big boys and they will go down based on when they see best way to make a lot of money fast….

if you don’t think housing has been fixed then consider libor, oil, silver, gold and stocks….all have been proven to be fixed……

Astonishing markups:

This Venice house: https://www.redfin.com/CA/Los-Angeles/1016-Rose-Ave-90291/home/6744917

* Sold in 2012 for $650,000.

* Offered in 2017 for $1,495,000.

And over 100% markup in only 5 years.

This Santa Monica house: https://www.redfin.com/CA/Santa-Monica/2903-Delaware-Ave-90404/home/6764459

* Sold in 2016 for $775,000.

* Offered in 2017 for $1,499,000.

A nearly 100% markup in only 1 year.

Poor illenials (thats my new phrase for them – make sure to give me credit) will be like the gimp character from the move Pulp Fiction after all is said and done. Sorry kids, its your turn to wear the ball gag.

I remember my HELOC from 2005. I stupidly used the proceeds to improve the house. If I had any brains, I would have bought a boatload of gold, or a fleet of collectible cars. Good luck to everyone over the next couple years, we all will need it. Whether you’re a homeowner, a renter, or you live in your car…it will be tough sledding ahead.

What the banks should do is restrict what home equity withdrawals can be used for. If invested in additional real estate or financial assets, that is OK. If spent on vacations or to pay down credit cards, that should be stopped.

You can not restrict HELOC use because money are fungible.

Yellen bucks need to find a resting place. Or else the great recession would turn into a great depression.

You might as well prohibit HELOCs from being re-invested into 2nd or 3rd properties. Oh wait, that means that prices wouldn’t rise so exponentially.

Always remember this: “You’re not just looking for a house, you’re looking for a place for your life to happen.” Zillow

So why are you here? Go out there and keep an eye on your equity gain. If you dont have any, run to the nearest realtor.

Talking about easy credit… The “Pace” program gives people with equity in their homes and with NO…I mean NO credit at all money to fix up there home, new roof, windows, siding and air conditioning, no credit required if you can believe this, the loan gets tacked on to your property tax bill for a later date…Contractors are fleecing the sheeples left and right…

http://energycenter.org/policy/property-assessed-clean-energy-pace

Check out RenovateAmerica.com/pace while your at it.

Bay Area and OC housing market collapses 50%!!!!!!!!!!!!!!!!!!!!!!!!!!

And anyone making under $200k is still priced out, LOL!!! Haha.

Time to take over Baja and reclaim it for working and middle class Californians.

It’s already happening. Been to northern Baja lately?

Nearly half of Americans say their expenses are equal to or greater than their income

http://money.cnn.com/2017/06/27/pf/expenses/index.html

“People are spending a shockingly large amount of income on housing. These costs are going up while their wages stay the same.”

Housing to tank hard 🙂 Crash this economy!

That’s the dirty little secret. The majority is broke. Totally broke, like favela broke. And the Taco Tuesdays are running on fumes, and cheap margaritas.

You must be mistaken. The Yellen regime and the interest rate doves have been telling us that inflation has been negligible during the past 8+ years.

I just closed on a 3/4 of a million dollar crap shack with busted appliances, nonfunctional water heater and single pane windows missing screens. This is a sure sign of a market peak. My timing is impeccable.

Bubble Boy, I know what you mean. In the past, I have always managed to buy at the top and then had no money to buy at the bottom. This time I stopped looking at real estate once the signs of the bubble became obvious. It will be interesting to see if I made the correct decision this time. I have the money to buy but am waiting patiently for the bottom. My motto now is to invest as if I were going to live forever and wait for everyone else to panic.

and this just out:

LA and Calif Millenials have lowest homeowner ship. Not surprising

https://www.abodo.com/blog/millennial-homebuyers/

Still predominately a generation of renters, Millennials are seeing a slight surge in home purchases. According to The 2017 State of the Nation’s Housing report by the Joint Center for Housing Studies at Harvard, 1.4 million recent homebuyers were under age 35 in 2015. Still, the report also notes that this figure is well below pre-boom levels. The number of homeowners over age 55 jumped by 13 percentage points to 54%, between 2001 and 2015, while the share of homeowners under age 35 shrunk by 5 percentage points over the same period, to about 33%.

LA has been a city of renters for years. The Millennials fit right in.

LA has been 60-70% rental property for a long time.

Renting is the smartest decision one can do during a bubble. You wait for the buying opportunity….the ones that bought during the bubble are screwed. They will never catch up with how much the renter can save….factor in the loses during the crash…oh boy….financial suicide.

Hi guys, something odd happened the other day. I got an email from my realtor saying he expects a correction in the housing market later this year. Naturally, realtors are very bullish so I asked him what signs he sees that made him make this comment. I also said, I expect this market to have some legs until the next downturn happens. He has not replied….I am wondering if he was just baiting me to have a conversation or if others have similar experiences. I have trouble trusting realtors just from experience dealing with them…but what if even realtors doubt this market…..?! Has anyone had similar conversations with realtors?

Are you even listening to what you are asking? Realtors DO NOT HAVE YOUR INTERESTS AT HEART…EVER! They just need listings…inventory has completely dried up, 20 realtards fighting for 3 listings in the hood. Its ugly out there in that business.

He is a realtor so all he wants is collect a commission. Making you believe a correction is about to occur is a slick way of getting a listing for a sellers agent.

As a former Realtor, I can tell you that they lie about the market. To your face they will tell you that they expect the market to stay in an upward trend, but back at the office they are bemoaning the sagging sales prices and bad comps.

I wonder if I still have that bumper from 1986 that says “Now is a good time to buy a house”? They have parroted this saying every year, boom or bust, for decades.

I’m friends with a local realtor, he hit me up in the supermarket seeing if I wanted to buy, I gave him a rundown of all the factors why its a bubble and has already topped – red pilled him hard. Anyway, he didnt freak, he felt himself things didnt seem right and he’s been using the knowledge to help bump his clients to not wait for better prices down the road but to try and sell now – told me the other week its working.

Back in bubble 1.0 I told people the same thing and many knew in their gut that things didnt add up but they didnt do a lot of research to validate that nagging thought in the back of their minds. I heard so many stories from people telling me “I was wondering where people were getting all this money to buy 2nd homes and do remodeling and go on vacations”, plus all the building that went on, much of it substandard. Feels good to pull some souls out of the matrix.

I don’t see a problem with HELOCs, as long as the borrower can easily afford the payment. The problems occur when the borrower can’t easily afford it and goes in assuming that increasing home values are going to pay it off for them.

I don’t mind HELOCs either as I favor free market. What I do object is any type of bailout in response to such activities — either for owners or financial institutions.

While I can’t disagree with the housing mania that’s picking up again, it’s not quite as clear cut as you make it out to be. I needed to refi to get my ex off the loan……cash out refi was my best option since interest rate increases prevented me from doing an IRRRL. only took out 3k in order to make the loan work.

I’m not sure how many others are in a similar boat with interest rates rising, but it changes the information and you’re not discussing the whole picture.

The pending home sales dropped for the third consecutive month in the hottest time of the year for sales. In the West, it dropped even more. It is now at 2013 level. I am sure the interest rise and QT do not have anything to do with it. According to jt the interest will not affect sales.

http://www.zerohedge.com/news/2017-06-28/pending-home-sales-tumble-unchanged-june-2013

I said many months ago when JT did not see any impact from interest – wait for 6 months till you see the full impact of FED actions. It takes time from those actions to see the effect. Wait till the FED raises the interest again and increase the QT from 10 Billion/mo to 40 billion/mo.

Or is it the weather?!!!…

It’ll be more interesting when sales prices drop, not simply sales. As that article said, lower inventory and higher prices are likely to blame. Up here in Portland, it’s amazing how much more you could get for the money just six months ago, and inventory is down.

All that matters is recession. If we head into a recession, house prices go down, and in some zip codes, they could take a big hit. If we don’t hit a recession, then no problem. It is that simple.

Every recession has a different cause that no one sees ahead if time. So, good luck trying to guess when the next recession hits.

Your only strategy is to invest for the long term ( 15 to 25 years ). If you are lucky to have the financial ability to invest during a recession, then you do a little better. But, do’t get to fixated on recession timing. Life is too short.

For example, just 4 years ago, long after the real estate bottom, many said they were waiting for the next bust. In many beach cities, prices are up 50% to 75% for entry end homes over in last four years.

“In many beach cities, prices are up 50% to 75% for entry end homes over in last four years.”

Conclusion based on what JT is saying – buy now when prices are high by 50-75% (in 4 years).

My advice – buy when prices are 50-75% OFF.

It’s not just beach cities. I’ve seen listings in Sherman Oaks and the West Hiollywood area that were previously sold between 2011 and 2013 and just sold again for almost 100% more than the last purchase. The one in SO sold for $720k in 2013, $955k in 2015, and $1.32m in 2017, and it was already fully renovated before it sold in 2013.

I will say it once again. This is the greatest blog on the internet about California housing. Also, I love the graphs used. Very helpful. Keep it up!

Global debt was $199 Trillion in 2014, up 40% since 2007.

What could possibly go wrong ??

http://www.latimes.com/business/la-fi-investing-quarterly-debt-20160710-snap-story.html

Yellen bucks found its way into the stock market, tech unicorns, student lending, the auto market, etc. But housing cheerleaders would have us believe that the RE market was immune to the rampant cheap and easy credit.

Gibbler still watches CNN.

In San Diego, your net difference if you rent a $500k house and invest that $500k in midwest real estate, you come out way ahead vs. buying the $500k house. CAP rates are SO much better elsewhere, why waste all that $$ in a house in so cal when you could rent it for a comparatively low price?

A house I sold in the midwest for $600K in 2014 is still worth $600K…. so don’t forget that… CAP rates be damned.

I sold in 2014 and today the buyer wants $80k more for adding a 4′ retaining wall and a ceiling fan. And this if for FONTUCKY. He is asking for about half of my annual return. I hope the next buyer is ok with just half of this one. IN FONTUCKY. Did I mention that.

Maybe I don’t listen to the radio as much as I used to, but I heard Wesley Hoaglund on the radio yesterday with his “biggest no brainer in the history of mankind” pitch. He’s right, its an offer for people with no brains, but I’m just kidding, Wesley. The last time I heard him all over the airwaves was just prior to the last real estate crash. The rising valuations, the levels of public and private debt, and the declining quality of life in most of Southern California are on a collision course in my view. So I agree that what we are seeing is not sustainable.

“We live in an era of fraud in America. Not just in banking, but in government, education, religion, food, even baseball…” – The Big Short by Michael Lewis

The housing market and stock market will keep going up, as people spend freely when they have access to money. With the few regulations slapped on the financial industry after the last financial disaster removed – the next few years should be one hell of a ride.

Companies will offer more money as they will feel flush with money and Americans have proven multiple times that we will spend everything we have and more. “Half of Americans are spending their entire paycheck (or more)” http://money.cnn.com/2017/06/27/pf/expenses/index.html

The next financial crisis may very well take down the entire system.

yes, Skim/Scam is the new normal. From the Vet, workmen, CHP tix, bank fees, etc…

Next financial crisis we will have very little wiggle room with interest rates. So what else is there? I think we’re going to see a recession soon. It’ll be interesting.

Been looking at crap shacks on the westside for 6 months. Bid on some. Outbid. Did get one offer accepted but the inspection showed the place to be in such bad shape that I bailed. Disillusioned since. Really need to move since cluttered apartment living is getting to us, but the rational side of my brain just can’t do it. Can’t pay at least 1.2m+ (which is what it will be with the overbidding) for an 1200 sq. ft house (face it, that’s an apartment with a roof, basically) build in the 50s that will still need some work.

Some of these places are nice, I guess, fully upgraded and all that jazz, but even then the workmanship can be shoddy (nails sticking out of windows, uneven light switches, et al) that I wonder how much it’s just lipstick on a pig and he shack is still a crapshack underneath. And does nobody bother fixing all the cracks in their driveway anymore!?

Then there’s the pollution. L.A. seems unique in that there’s no many sources of pollution where houses are more *cough* affordable. Close to freeways, close to airports, bad air quality the further east you go. I’ve concluded that to get on with it here in L.A. you just have to ignore these factors.

an 1200 sq. ft house (face it, that’s an apartment with a roof, basically) build in the 50s that will still need some work.

I consider that a decent-sized house. People in the 1950s apparently thought so. Americans have become spoiled for McMansions.

I’ve lived in a 690 sq ft condo these past 30 years. I’d like something a little bigger, but probably couldn’t fill 1200 sq ft.

I grew up in a 2 BR ~1100 sq ft house that was definitely not a crap shack. The thing was a mid-century modern design with concrete block walls. My folks added on a wooden addition in the back yard so my older brother could be moved out of our bedroom; from 3 boys down to 2. I’ve seen big crappy houses built with chip board. Good things can come in small packages, and you can have an enormous pile of crap-shack.

Forgot to mention the chemical plant pollutions of El Segundo and Torrance.

Split the difference and rent a detached house.

I lived in socal (san diego, and a little in santa barbara) for 17 years, always within 15mins drive of the coast. Nonetheless, the noise and pollution are big factors – and not just air, but the water you drink/bathe in, as well as the ocean if you spend time in that which I did and do. My advice is to look for job opportunities either in rural cali, other states, or even other countries. Consider any opportunites a 1-2 year adventure and give it a shot. Its going to take probably 3-5 years for the next bottom in RE and you want to get out there and live life rather than wait cause you only have 1 trip on this merry go round.

Anyway, it took me 10 years after leaving Cali to really get my lung capacity to where I think it should be – the wim hof method of breathing did a lot, plus I live far, far away from so called civilization where for the most part the air is quite clean (although indoor is another story, thanks uncle scam!)

It’s hard for some people to believe but there is an entire world outside of California and not everyone is clamoring to be here.

It is human nature to repeat things over and over. An analogy that comes to mind is the driver who likes to text.

First they get comfortable with texting and driving, someone questions their driving techniques and they respond “i never got in an accident i will be fine, i am a safe driver.”

Driver is safe until something happens at an in-opportune time and a crash happens.

Driver says “I will never do that again.”

6 weeks later driver is back at it “This time is different, I just had to send a quick text.”

It is always a “quick text” it is always “I didn’t want to be priced out” “my kids need a yard” “It’s a long term investment and my job is stable” “my wife and I will be married forever.”

Humans block out bad things from the past… its always “the good old days.” Not sure why that is but its simply human nature. Human nature will cause every housing crash until robots own us all and all our property.

Since there are no real consequences for non-payment of debt other than a slap on your credit score … yawn, who cares’, then America and American’s will continue to live and spend well beyond their means. If the government can do it, corporations can do it, why can’t I? Really, whats the worst that can happen … your home is foreclosed on, your car is repossessed, you make perpetual excuses about not paying what you owe, you have to deal with bill collectors, you never get a tax refund if you owe the government, the court garnishes your wages … it’s plenty hard to garnish your wages for anything but child support! Unless you were thrown into debtors prison and fed water and crackers, there isn’t much that is going to change!

At least we are still alive and it is a blessing

Meanwhile take more walk and watch less tv

Humans can live up to 120 years while

The business cycle can last up to 120 months

“So the stock market is hot, the housing market is hot, and now the mania is making people think that using your home like an ATM is smart. It is not. This is simply “cheap†debt that is secured to an inflated asset. You need to pay this back. All debt requires a payment. And yet the issue in the last crisis wasn’t liquidity but solvency. The notion was that if you only fixed a couple of things, all would be well. But no, people made absurd bets on inflated valuations and it all came crashing down. People over paid on a grand scale and it imploded.

And make no mistake, there is a lot of debt out there…”

From the debt graph the good Doctor published, I’d say that auto loans and student loans are the ones that have grown the fastest in percentage in the last 7 years. HE loans have shrunk a bit. This isn’t unexpected as younger people are taking on debt now, and they’re stuck with car loans and student loans. Makes it tough to get yet another loan on a house. I am seeing over-pricing, but not bubble mania, as the demand from people who need Ponzi financing to get into RE just isn’t there. (Remember.. first hedged, then speculative, then Ponzi!)

The OC Register RE section from Sunday had a dueling economist article by Jonathan Lansner, their RE columnist. Dr James Doti of Chapman U. is pretty much where I am with a potential bubble looming and no economic reason for prices to go up for more than a year or so, with an inevitable burst. Dr Mark Schniepp of the California Forecast firm (and formerly at UC Santa Barbara) sees a strong OC economy and supply constraints, so no bubble. (I’m paraphrasing someone else’s paraphrasing.)

Lansner defines a bubble as “where an asset’s value outstrips the underlying economic fundamentals behind ownership”. I don’t think that is the true definition of a bubble, as opposed to an over-valued asset. I like the one that I read in an article by Jared Dillian where a bubble is caused by a massive public preoccupation with an asset that is beyond rational. Wikipedia says “It could also be described as a situation in which asset prices appear to be based on implausible or inconsistent views about the future.”

I think that that type of bubble is not yet here, but could be ignited rather easily. Over-valued assets are common in the stock market without a bubble mania. This is how Warren Buffet has made money for years, patiently waiting for asset prices to drop (while he sits on a huge pile of cash).

Except that you missed the elephant in the room that is prevalent in the current and previous cycles: cheap and easy credit. The fact that Joe Public has been relatively shut out doesn’t make this cycle any more sustainable. This time, hedge funds, investors, rentiers, etc., were the primary beneficiaries of the easy money policies and were leading the charge to create unorthodox demand. With so many “all (borrowed) cash” deals, how could organic buyers compete? History is replete with investor-led bubbles. This time is no different.

If the current cycle, which has been going on for 8+ years, isn’t already a bubble, then it never will be.

Prince, the wildcard this time around is trying to guess what a small decline will do in a investor-led bubble. Will investors start selling at the first sign of a decline and cause a crash or will they decide to hold on to their properties during a decline because rents are so high. What have investors done in previous investor-led bubbles? Do you know of any examples?

It seems to me that Miami and Florida in general have many such investor-led bubbles in the past. In those cases, they did panic and sold property at any price.

I am well aware of the low interest rate environment, its just that I don’t see that as a big factor anymore as we are still in a situation where another deflationary event could be looming around the corner. So Joe Public in Joe R’s opinion isn’t falling in love with over-priced real estate.

I just a not hearing the mid-2000s real estate mania talk that accompanied the real housing bubble. Now, its a low inventory market in the “high rent” zone with high prices and a lot of low rent areas without a strong economic recovery to drive the market.

I think we are in basic agreement with each other, just that we don’t define “bubble” in the same way. And Dr Housing Bubble has helped draw attention to the negative possibilities in real estate which (along with other cautionary commentators) has kept people (or at least younger Americans) from getting too enthusiastic about real estate.

@Gary

Look at no further than the behavior of Wall Street for examples of investor-led bubbles. Prices go up until there are no more buyers — no more greater fools or potential buyers have hit their borrowing limits. Selling then outnumbers buying until everyone heads for the exits at the same time. Why wouldn’t those investors just hold on to their stocks and wait for prices to recover (and collect dividends during that time)? Many are most likely leveraged and face margin calls. Others need to be liquid enough to jump on the next potential investment to recoup their losses.

I see the same scenario with RE investors. The Fed is slowly draining liquidity out of the market, and home sales are hitting a wall. Prices will eventually follow. Flippers will certainly not be able to ride it out. Rentiers who bought high most likely won’t be to squeeze out more rental income as incomes continue to stagnant and more rental properties become available. The hedge funds that bought low have been unloading their inventory to retail investors and retail buyers during the past 2+ years. Eventually, sellers will dwarf buyers.

To get a true bubble all it would take right now is negative amortization, no documentation loans that took off in 2003-2004.

Then you would get a 50% run-up followed by a 30% crash wiping it clean over 5-8 years.

Inflation adjusted the crash would still be large versus nominal.

Gotta love the splitting hair logic used to rationalize the normalcy of an exhorbitantly overpriced and unsustainable market.

That would be helpful for a certain somebody’s re-election campaign.

I have my own definition of a bubble. A bubble is a situation when most people who borrowed, after paying all taxes and constantly increasing living expenses can not service the debt. At that point the bubble burst and the musical chairs song stops. Those who were not found sitting, lost.

Those who saved during the bubble will be like kids in a candy store and buy everything for pennies on the dollar. I’ve been there twice – such a good feeling!!!…:-)))

Common guys, from 1913, by now I thought everyone learned this game. By inflation and deflation, eventually the FED will acquire all the assets and the whole population will be enslaved. Nothing new. No, this time is no different. They have only one game practiced for hundreds of years since the cabal invented central banks.

What is a bubble? It is going to pop eventually? Sure…but does a bubble popping mean 10% reduction? 25%? Maybe…but how is all the pent up demand for inventory being calculated? All the house humpers on this blog will be scooping up the bargains!

Me thinks that won’t be happening….at least in a ‘desirable location’ close to good jobs i.e. entertainment and tech areas in L.A and S.F.

For those who keep on hoping for a shallow downturn, here’s a historical nugget from the king of subprime loans: “I’ve never seen a soft landing in 53 years”

We humans are psychologically controlled by fear and greed. When we see prices start to fall we hold back. Just normal behavior. We can’t predict the outcome as things head down. All we do is become complacent and as a result this snowballs into the crashes we see. So if everyone is idle on buying probably would see reductions across the board.

I wonder how all city/state governments will survive this time around if we see price drops of 40-50%? Will they defend housing assessments or will they agree to the owner’s wishes to lower their assessment?

A good article on the factors leading up to the next crash

https://realinvestmentadvice.com/yes-ms-yellen-there-will-be-another-financial-crisis/

excerpt…

Will there will be another “Financial Crisis†in our lifetimes?

Yes, it is virtually guaranteed.

The previous “crisis†wasn’t about just “an asset gone bad,†but rather the systemic shock caused by a “freeze†in the credit markets when Lehman Brothers filed for bankruptcy. Counterparties evaporated, banks froze lending and the credit market ceased to function.

Credit, not the stock market, is the “lifeblood†of the economy.

Of course, it is all good now because the Federal Reserve says so with Ms. Yellen placing a great amount of faith in the Federal Reserve’s own carefully constructing, and recently released results, of “bank stress tests.†Interestingly, EVERY bank passed with flying colors. In other words, the Millennial generation has now passed the baton of “Everybody Gets A Trophy†to the banking sector.

At an economic summit in Britain, Janet Yellen said the following:

“Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not [happen] in our lifetimes and I don’t believe it will.â€

(from Fox Business on-line)

She thinks that the changes to the banking system made after the crash make such events very unlikely. Well, it probably won’t be a sub-prime mortgage crisis, but how about a string of state government insolvencies? Or cranking up the printing presses to pay social security for all the boomers? One is deflationary, the other potentially inflationary. If state governments have been borrowing from banks, what happens if they start to default? How about this:

“June 26, 2017 – Puerto Rico has no cash and can’t borrow money anymore. So it is looking to sell itself off in parts.

The troubled U.S. territory is preparing to seek bids in coming months from private companies willing to operate or improve seaports, regional airports, water meters, student housing, traffic-fine collections, parking spaces and a passenger ferry, according to a government presentation reviewed by The Wall Street Journal.”

God was patiently waiting for Janet to make that comment (noted above). God wanted Janet to make that comment because he appreciates macabre irony. The pattern of the universe indicates that the pillars don’t buckle and fall to the ground until someone like Janet Yellen shakes her fist at fate with extreme confidence.

As a matter of fact, in hindsight, I think we will be able to say that the entire reason Janet was born was to make that statement. A statement that will be repeated with mocking derision until the end of time.

Its just another housing bubble. God has nothin to do with that. It’s just boom and bust cycle…normal for California.

I had started writing my comment before I read QE A’s link. Catalyst #3 is mostly what I’m discussing in my post. But the effect of massive state defaults wouldn’t just be in the area of pensions. Good post, QE A!

We are probably going to see changes at the top of the Federal Reserve in the coming year.

From ValueWalk website:

“Considered the top candidate to candidate to fill the role is Randal Quarles, a former Treasury official in the George W. Bush Administration. Quarles currently runs The Cynosure Group, a private investment firm supported by a network of large US-based family offices. During his time in the Bush Administration, Quarles was an advocate for increased regulation on Fannie Mae and Freddie Mac, and he had argued for reform of the US regulatory system.

Whoever is nominated to take the regulatory supervisory role will join a community banker on the board for the first time. This nomination is expected to go to the current Chairman and CEO of Old National Bancorp, Robert Jones, Bloomberg News first reported.

Rounding out the list of three expected Fed nominees is Marvin Goodfriend, a former economist at the Richmond Fed and current professor at Carnegie Mellon, who the New York Times first reported was under consideration.

Quarles is a hedge fund guy who worked in crisis management at the Treasury Department in both Bush presidencies. Robert G. Jones is the head of a regional bank in Evansville, IN. Marvin Goodfriend is a Carnegie-Mellon Economics professor. Goodfriend wrote “THE CASE FOR UNENCUMBERING INTEREST RATE POLICY AT THE ZERO BOUND” which makes the case for NEGATIVE interest rates.

A regional banker might be a good addition to the Fed, but the other two sound like bad ideas. This first one is crisis management as usual a la Bush. The second one is Mr Financial Repression on steroids. No wonder I was so unhappy about the choices we had in the last election.

Me no likey at all. Rather see someone in the mold of charles hugh smith or kyle bass, people who see through the facade of the plantation economy. Bankers just perpetuate it.

I would choose David Stockman.

Yeah, Stockman seems like a straight shooter.

Today is June 30, 2017. The year is half way over and there is NO tanking in sight. I personally don’t think we’ll see any meaningful correction for the rest of the decade. And from all previous down turns, it takes years to finally hit bottom. For the people on the fence, be patient and save, save, save. For those that can’t save, it’s likely in your best interest to move out of CA.

There is currently no tank in sight, it’s funny to read bloggers here post about how it’s imminent when it is so clearly no where in sight.

However, during the next recession you will absolutely see a housing correction.

The problem is this time around the homes are affordable to those who are buying them. That wasn’t the case for many from 2003-2007.

You will see the more typical recessionary drop as you saw in the 1990s and 1980s.

It’s all about inflation. The drop will be minimal but over 5-8 years when adjusted for inflation the drop is huge.

Or save and move out of CA and save even more as a result of moving. Plenty of people who can afford a crap shack in CA are also moving out in their best interest. There are also people who don’t need to save who are trying to time the CA market. You make it seem as if there are only two scenarios.

Just a little bit more patience. Crash is around the corner. Sure, some people have a drive through mentality but waiting for the buying opportunity can take a decade. Thats just ten years. And you will save 50-70%. A no brainer 🙂

When you wait a decade do you think you are saving 50-70% off of current prices??

Or do you think prices are the same?… or what exactly.

In a decade your rent in prime CA neighborhoods will be double.

Oh and one last thing…. you think a decade is “just around the corner”… LOL

If you wait a decade to buy, there is no way you will come out ahead when you factor in tax write-offs, principal payments, inflation, further appreciation, increased population, continued land scarcity, etc. The fact is that things are high right now, but not nearly as high as you think. Many parts of coastal California area undergoing a slows change where the original builders/owners are dying off or moving out and the next generation is either priced out, rents with 5 roommates or makes close to $200k or more in the tech economy. I’m far from the wealthiest millennial, but $750k fits well within my. Budget on a single income. Others are reacquainting themselves with Las Vegas and Phoenix.

As we all know, buying a house is a very emotional purchase. Few if any people can wait a decade for the perfect buying opportunity. Add in family pressure, spouse ultimatums, little Johnny and Sally need stability as in not bouncing around from rental to rental, etc.

I think we are in for a perfect storm in certain parts of socal. You have old money, new money, foreign money, investor money and people with little money who will do all they can do scoop up a piece of prime socal RE. But, it’s no different this time. You’ll have your 3/2 SFR in prime socal neighborhoods for 400K before you know it….

A decade is nothing. Ten years of waiting and saving hundreds of thousands of dollar is smart investing. People who rush into buying will never catch up especially when buying during a bubble. It’s just simple math. We are getting paid to wait and can probably buy in all cash when the next crash happens.

I really have to laugh at some of the comments! First, Trump didn’t cause this mess … it’s been building for some time! This is a result of our greed, both financial and material! We want so much, we’ve rationalized the ‘Made in China’ labels as good because we can buy more or afford something! Yet, we overlooked the consequences … the gutting of the middle class due to the loss of all those once good jobs building stuff! Worse, we’ve rationalized debt, personal and governmental, as a further means to accumulate material goods, to have things we really can’t afford! And it doesn’t stop there. We’ve taken on social cause after social cause, taken a soft attitude toward immigration, all because we have no concept of fiduciary responsibility … we are gong broke in the process, going further in debt in the process, and jeopardizing the very things you people yammer for … healthcare, Social Security, Medicare … there will be no money for any of this!!!! Though this is a housing blog, focusing on housing prices will blind most to the next crisis … housing will simply be a casualty, not the instigator!

JNS, you summarized it all by saying, “… there will be no money for any of this!!!!” The Fed and state governments are out of control. What is needed is less spending, less giveaways to both the poor and rich, less money for defense and less money trying to be the world’s police force. The national and world needs are infinite, but the U.S. budget in finite. We can’t live forever beyond our means with more and more credit. The Republicans need to find some backbone–the Democrats are beyond help!

You’re right. Housing won’t tank. An earthquake in soca won’t happen. Definitely no terrorist attacks. No hurricanes on the eastern seaboard. Trump really really won’t get us into a shooting war. Dear leader Kim in n. Korea won’t pull any shenanigans. In other words, everything is gonna be great. We are definitely not living in a trump bubble. Everything, the stock market, real estate is a can’t lose proposition. What Could go wrong?

You’re right. We’re living in the Obama bubble that was facilitated by his cronies at the Federal Reserve with their ridiculously low interest rates of the last eight years and grotesque money printing.

For the last 10 years FED popping up US economy just by printing cheap money. These money come to the market, specially to IT sector, because this is very easy to make “intellectual property” from nothing, add it to the company value and then sold it on the market. You can see all these startups which makes no money (at least do not pay any dividends) but have $$$$$ values. Some of these money came to the real estate market and bubbled it everywhere when IT business exists. And everybody are happy now, market goes up just because of expectation of the future return. More money come – Ponzi scheme works!

But sooner or later investors decide to take money back from the market and this will be the end of the story.

Very insightful interview of a former Fed economist who criticized the current Fed for issuing the massive liquidity to fuel record business debt amidst the weakest economic recovery. QE was meant to do nothing but prop up asset prices to create a “wealth effect” — financial engineering on steroids. He further notes that we are late in the credit cycle as credit is tightening — guess what that leads to?

http://www.businessinsider.com/the-fed-has-undermined-the-economys-growth-2017-6

BINGO, and that’s when the market tanks hard.

In 2008 – 2012, a bunch of people got duped and sold their real estate for cheap or they gave it back to the bank. What a mistake. They got suckered by the fake news media pumping the housing crash. The media did this because they new the bigger the housing crash the better for Democrats. Next recession this will not work again. People will not fall for the fake news housing crash again. All the stupid people already walked away and are renters for life. Next recession will see normal price declines and the deals will not be what they were when the dumb people threw their real estate away.

Disagree. People believed realtards and other boomers who thought that prices only go up and cant correct. That was the stupidity. People thought that a house can appreciate. They dont even understand that a house is just a depreciating box. Sure, the land appreciates a little bit over time (2-3% per year). Whenever housing bubble start people think buying a house is a way to make money. In reality they get suckered into an overpriced box that loses value over time (crashes, maintenance etc.) We see what happened in Japan. Housing has been declining for decades… same will happen here.

The issue is that boomers were not educated enough to understand boom and bust cycles, economic cycles and that a house itself depreciates. Millennials learned from these mistakes and are not repeating them. Smart. However, when the next crash happens (i am thinking next year) prices will go down 50-70%. Millennials should buy then since the prices will be more aligned with real value.

Do you really think prices will go down 50%+ in 2018? If so, can you highlight several reasons WHY?

If prices go down 50%, I think there’s a good chance you might not have a job.

Millennial, FYI, housing in Japan has been appreciating for nearly a decade now.

Oh and one last thing, you can’t afford to live in Japan. California is more affordable, ta-ta.

Tank in sight,

you must be a realtor 🙂

Realtor hate the Japan story because it does not fit their sales pitch “they are not building more land”. On this tiny island of Japan house prices have crashed and are far down. Just facts…..

Any housing price index chart of Japan you look at shows declining prices for decades. 80% down since bubble peak. In our lifetime house prices in Japan will not “recover”….BTW i don’t like the word recovery in this context. You recover from an illness….rising house prices are not a good thing. Bubble prices itself are the decease. Deflation is a good thing. We need a crash and a declining housing market just like in Japan. That will be the solution! Crash this market!

So your point is – it happens because of the fake news? Not because the people lost job and have no money to pay loans? Just because of FNN?

BTW, do you know that more then 50% of US population spend all paycheck and most of them spend more than they got?

No one was duped. It was simply being caught swimming naked. The truth is a bunch of people could no longer afford to service their real estate debt and got out from under it by selling or defaulting. Your insinuation of those who walked being renters for life is what’s fake news. Tons of people in that category have already bought back in and are continuing to do so while many who strategically defaulted are still hanging on. It’s easy for you or any other random douchebag with an opinion to predict what hasn’t happened yet but at least be honest about what has already happened.

Here is Santa MOnica, I have seen the influx of New Yorkers buying properties….

After talking to some of them on the dog walking circuit, heres what they are saying…NY is over. They are sick of the filth, the weather and the overcrowding and sky high pricing for anything for takeout meals to sitting in traffic in an Uber…so So. Calif real estate, lowish property taxes and the high wages in creative fields actually makes sense to them.

Lets see how they feel after battling the freeways for a while…but they are flush with cash from their Brooklyn brownstones and they are giddy.

Santa Monica prices are nuts. I have a relative who lives there, and she also thinks prices are nuts. Anyone who buys there will regret it. All of LA and Orange Co. are overpriced–esp. beach related property.

If you think about it, it makes perfectly rational sense people are extracting inflated home equity to spend on life. It’s like when a publicly traded company surges in price and uses their inflated equity to buy cheaper companies that are accretive to earnings. A win!

And if there is a crash, not as big of a deal b/c they got something out of it.

Britain ‘is on the brink of the worst house price collapse since 1990s’: Experts predict property costs could plunge by FORTY PER CENT

Read more: http://www.dailymail.co.uk/news/article-4657812/Britain-brink-housing-price-collapse.html#ixzz4lsSSdx9T

It looks like as soon as the central banks are reversing the easy money policy, everything is reversing to the mean and what people can buy with their wages. It is a global economy and everything was awashed in trillion of dollars of debt. Since this debt can not be supported at infinity with new debt, when the easy money policy reverses, run for the exists.

Britain is just a glimpse of what is going to soon happen in US.

I’m sure millions of Britons are praying and lighting candles every week in hope of a 40% drop in house prices there. All but upper-income Britons have been hopelessly priced out of the market for a decade or more, and even council housing, if one can get it, consumes an outsized portion of the typical middle income paycheck. A massive housing correction will be the best thing that has happened for most citizens in over 20 years.

Although I am not a gold bug, below is an article strictly about RE in London, one of the most prime of the prime RE markets in the world. The run up was caused by easy money and the collapse is caused by the reversing of the easy money policy. This is a global issue and is not related to London RE market alone.

Is the NY, SF and LA prime markets immune to this reverse in easy money policy???!!!!…..After all, London RE is as prime as it can be.

http://www.goldcore.com/us/gold-blog/london-property-bubble-brexit/

Again, please skip the comments about gold since I NEVER advocated gold buying and is not related to the article. That killing of messenger instead of the message is getting old.

he home prices in Riverside have more than doubled since 2009-2012 crash while homes in Oregon have appreciated somewhat less–about 60%. My Mission Viejo home depreciated less than either Oregon or Riverside during the great real estate crash (because it is located close to major employment centers), but it also has appreciated a lot less since then–about 40% at the most.

Investors would have made the most money by buying homes that depreciated the most during the crash–areas away from the major employment areas (like Riverside), very overpriced areas near the beach (like Dana Point and Huntington Beach) and areas which consisted of rundown homes, esp. in high crime areas of Los Angeles Those on this site who recommend buying homes in the rundown areas of LA or near the beach are probably wrong. The very high prices of beach area homes can only be supported by speculation just like the rundown areas of LA.

patience is the key to investing….does anyone have it? Mostly No!

5% of stock traders make it, 95% lose all or most of their money….

housing is not much different. Does anyone see mark to market FASB 157 reinstated?

Isn’t the economy working well, since Yellen says no more financial crisis in our lifetime why can’t we bring back mark to market accounting principles that were abandoned in the downturn?

why? I know but do you? It’s because 18 trillion dollars in central banker free money has only produced 1-2% GDP……

keep on smoking hopium, myself, I live and own in bubble #1, do I think my house is overpriced, yes….will it find reality, yes, if you lived in Cali all your life you should understand cycles….they happen, enjoy the boom…..bust coming around the corner…

You are spot on CD!!

Leave a Reply