Land of the grown adults living at home: 5 reasons why California will continue to have millions of Millennials living at home.

California has millions of young adults living at home with parents because they are unable to venture out into an expensive rental or a dilapidated crap shack costing close to $1 million. It is interesting to see many articles written by baby boomers sporting beer guts and how Millennials are “destroying†many industries like chain restaurants (i.e., TGIFs, Buffalo Wild Wings, etc) or retail stores (i.e., Sears, K-Mart, etc), or are simply not buying homes. Of course Millennials have different habits. And getting stuck with an absurd 30-year mortgage on a dump is not a big aspiration for many. They are more into health and wellness, life experiences, and many are delaying marriage. So why do they need a home? The data is backing all of this up of course contrary to the house humpers that continue to sing the praises of $1 million crap shacks. California is in a major rental revolution. And Millennials will continue to live at home in mass for a few reasons.

Reason #1 – Demographics

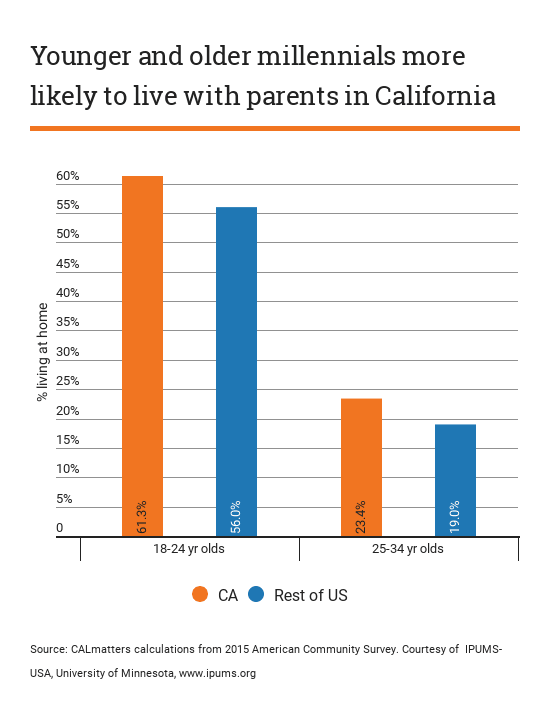

If you are a Millennial in California you are more likely to live at home. This is simply how things are playing out. Take a look at this chart:

There are millions of young adults living at home because rent is too expensive or they simply cannot venture out to buy a home. And many city revitalization efforts are targeting adding more apartments instead of houses. Just look at Los Angeles.

Reason #2 – Failed Savings for Down payments    Â

When rents are incredibly high it is hard to stash away money for a down payment. For example, the typical house in Orange County is getting close to $700,000. So a standard 20 percent down payment is going to be $140,000. Now a $700,000 home is nothing spectacular in many cities thanks to the crap shack mentality.

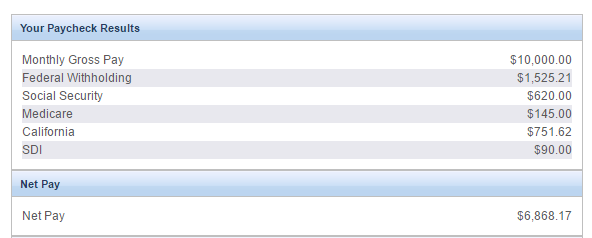

Now let say a family is pulling in $120,000 a year. This would put the family in the top 25 percent of California households:

To save $140,000 over 5 years they would need to save $28,000 per year (roughly $2,333 per month). In other words, they need to save roughly one-third of their net income per month just for a standard 20 percent down payment – over 5 years. And a typical rental apartment in many nice areas will go for $2,000 to $2,500 or a rental home will be $2,500 to $3,000. After that, there isn’t much for retirement savings, food, and other bills.

Basically this is a one asset class strategy and you are aiming for a crap shack.

Reason #3 – Buying Power is Already Maxed Out

We’ve been in a low interest rate environment for well over a decade. Rates can only go up. So every little ounce that can be milked out of the market has already been done. Also, you are competing with all cash buyers and older home owners that may have equity and sell out. Yet many are not selling out because taxes would get reassessed and many of these older baby boomer owners can’t afford anything higher without shopping at the 99 Cents Store but living in a million dollar home.

In other words, sales volume is likely to stay low.

Reason #4 – Millennials are Different

Millennials don’t have the same desire of buying a home and pumping out 3 or 4 kids like older generations. Ironically many are now living back at home in their late 20s, 30s, and even 40s. They also enter into an economy that is hyper-competitive, with little company loyalty, and many will have multiple jobs with various companies over their career. Long gone are the days when vast numbers of people enter into good paying jobs and were able to chase the American Dream. In fact, this current political season shows how out of touch those with wealth are from the rest of America.

Millennials also value financial flexibility and many came of age during the last housing crisis and witnessed firsthand the nonsense their parents went under. Many parents were rocked to their core when housing values crashed for the first time nationally in our modern history. And what about the kids that lived in those 7,000,000+ completed foreclosures that happened in the last decade? You think they are eager to buy?

Reason #5 – Lower Home turnover

As it turns out, many current home owners are just reaching break even. Since many thought their homes were piggybanks they are now left having to delay retirement since guess what? You can’t live off the equity until you sell! You can live in a $1 million crap shack but you still need to pay taxes, insurance, and upkeep. How do you access that $1 million? By selling. But many want to live like millionaires without unlocking that equity. So here we are. A stalemate. And guess what? Many of those adult kids are living at home.

Builders in California are smart. They are targeting multi-family units over single family homes. In some areas they are building out condos because if the market takes a turn, they can simply turn them into rentals since there is big demand for that.

The idea that Millennials were going to save the market is off base. Prices are high but for reasons that go against a healthy housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

320 Responses to “Land of the grown adults living at home: 5 reasons why California will continue to have millions of Millennials living at home.”

U.S. household debt reached a record high in the first three months of this year, topping the previous peak reached in 2008, when the financial crisis plunged the economy into a deep recession.

Americans have stepped up borrowing over the past three years, yet the nature of what Americans owe has changed since the Great Recession. Student and auto loans make up a larger proportion of household debt, while mortgages — the epicenter of the financial crisis — and credit card debt remain below pre-recession levels. Those changes suggest households are still cautious about taking on debt to fuel day-to-day consumption.

Our household is getting a lot credit card offers again. i guess easy street credit is upon us again.,ugh

It is because the equity in the homes is back. Now they can borrow again. Plain and simple.

When will this madness stop?

In San Fernando Valley areas of Stuio City, Sherman Oaks, Valley Village, Encino, etc. the prices have leveled off, but not really falling. When will it start Q2 2018? We’ve been waiting for an opportunity, but the time never comes. And what if the time comes, and the Fed does QE 4? Another 5-7 years of waiting?

Analyzer,

No one knows when (or if) the market will fall. I believe the goal is for prices to stabilize and return to a normal rate of appreciation. People are hoping for a severe price correction but I don’t think you’ll see one. The 2008 recession was possibly a once-in-lifetime occurrence. Since the bottom of the market, many homes were purchased by cash buyers, investors, and other people with “skin in the game” who are less likely to walk away from there homes this time. From an investment standpoint, rents have gone up so much the past few years compared to the last recession that I don’t see investors dumping their homes in droves.

If you look at how fast the population is increasing and the lack of available land along with pent up demand, I don’t see a huge price correction. If you want to try and time the market, best of luck.

If there is a moderate correction, I expect investors / foreigners with suitcases of cash to buy up properties if they go on sale. People expecting 50% price correction in LA are living in La-La land.

That 50% correction in parts of CA happened 8 years ago. So never say never. There are similarities in why the prices then and now go up despite locals not being able to afford the mortgages.

I was looking at a small, older house in my neighborhood for sale this week and saw it sold for ~800k less just 4 years ago. I love seeing sales history. If the economy softens, do I want to take even PART of the haircut that would involve if I had to sell??? It’s a cute but 1 bath house and I’d only moderately want to live in for 1.8mil list price? No room for a pool. 🙁 There have been crazy spikes in prices over the past 4 years here in the Bay Area. No reason they can’t go down if “investors” decide their money needs to be used elsewhere.

Not saying you’re wrong in general as I’m not sure what massive, shiny new thing it would take to make that happen. I doubt the bay area would be willing to introduce laws limiting or deterring people’s acquisition of investment property. I know numerous colleagues, mostly older, who own several properties in the area for rental income. And some just leverage what they already own to buy more – keeps squeezing “poorer” buyers out of the market.

If you want to call my hesitancy in not buying said house and waiting for a better house or better price “timing the market” fine. But I’d call it not wanting to be a sucker, or bankrupt, or an idiot. If that mediocre 1200 sqft 1950s house can go up 800k in 4 years, imagine how it feels if it comes down just 400k in 2 years? And still no pool. Ah, but I could be underwater. See the pun? Maybe I’m just chicken.

“all cash buyers”

“skin in the game”

“lack of available land”

“pent up demand”

“buyers with suitcases of cash”

“high rents rationalize high prices”

All recycled catchphrases by RE cheerleaders to convey that “this time is truly different”.

SoCalGuy,

nobody is stopping you from buying now.

I on the other hand will wait for a 50-70% drop in prices. People like you think that what has worked during the last bubble will work this time again. What i mean is: Realtards, lenders, banksters profit from implementing fear like buy now or priced out forever BS. That worked last time with the boomer generations. Millennials on the other hand google everything. After a few mouse clicks you can read about this rigged market. The lies, the people who profit and how buying makes no sense if there is no rental parity.

So, you can tell us all day long, buy now, there is no price collapse…..it wont work and i bet you are not in the market to buy now….you just want millennials to pick up the slack and keep this mania going. Good luck!

“was possibly a once-in-lifetime occurrence”

the current RE bubble is the 3rd and quite possibly the 4th RE bubble I’ve witnessed in my lifetime.

“…All recycled catchphrases by RE cheerleaders to convey that “this time is truly different .”

Additionally, let’s not forget:

A) Everyone wants to live here.

B) The entire states of Michigan and Ohio are preparing a mass migration.

C) O.C. weather is always great.

D) There may be a bubble in ______, but not here.

E) California population is growing.

F) USA economy (based on RE market and equity-fueled

consumer spending) is strong. – 1,000 maids are

being hired in hotels each day.

G) They aren’t making any more land.

H) Housing had reach a new permanent plateau.

I) Prices are reflection of buyer’s demand.

J) You had to buy now or be priced out forever.

K) Prices will rise 20% for ever.

L) Foreign buyers will keep buying.

M) Low interest rates will stay low forever.

N) Renting is for losers.

O) Real estate NEVER goes down in value.

P). David Learah said………

I am pretty sure as long as residential homes are a commodity open to speculation both foreign and domestic we will continue to see a constant cycle of housing bubbles, Booms and crashes.

The current price trend may not crash or come down as 2008, but prices do not always go up. No investment asset has that property and if it did we would all be leveraged up to our eyeballs in property making a fortune.

@octal77,

You forgot a few things:

Supply and demand, no more buildable land, rental parity, skyrocketing rents, Prop 13 handcuffs, stock markets at all time highs, trader joes, progressive thinking, diversity, tacos, etc….

Anyone waiting for the housing prices to tank is kidding themselves. Don’t wait, buy now. Even if it drops, it will be back up in 10 years and you will be fine.

If the price drops, landlords will just begin to buy again like the last time. This game is rigged. But if you want in you have to pay. There are hedge/stock funds with cash that will pounce when the buy/rent multiplier is right. So yes, right now housing is a little high, but in 10 years it will seem cheap.

2008 won’t repeat in your lifetime. It will repeat in 2108 when everyone today is long done and it’s just a text book memory.

Sean, 2008 was not a one in a lifetime situation. 2008 was a minor correction. The Fed pumped quickly billions if not trillions in the market. Banksters were bailed out and interest rates lowered. The market was never allowed to really crash. Wait for the the next downturn….the fed has no more weapons. The next crash will be the biggie. If you dont believe it why dont you buy now?

“So yes, right now housing is a little high, but in 10 years it will seem cheap.”

As I said before, if current prices represent the through in the following decade, then housing will be the least of our problems. Concentrating an ever increasing amount of the country’s resources into the non-wealth producing FIRE sector is the death knell of the economy as we know it.

We started looking for a house in the spring of 2012. The general feeling on this blog then was, as Jim likes to say, going to tank.

we eventually bought a foreclosure in glassell park after searching for 5 or so months. the deal would not have happened without our Realtor, Courtney…also our next house would not have happened is it was not for courtney.

Anyway. We bought a fannie Mae forclosure for 3% down and received 3% towards closing costs.

https://www.redfin.com/CA/Los-Angeles/4546-Verdugo-Rd-90065/home/7177420

we turned down a few places that we thought were too expensive, all of them were fannie mae foreclosures with the same loan option.

check these out:

$300k in Feb. 2012

https://www.redfin.com/CA/Los-Angeles/3390-La-Clede-Ave-90039/home/7065258

$410k in March 2012

https://www.redfin.com/CA/Los-Angeles/3264-Garden-Ave-90039/home/7065883

$265k in Jan. 2012 (sold for $287k)

https://www.redfin.com/CA/Los-Angeles/5050-Almaden-Dr-90042/home/7081413

$350k was about the max I was willing to spend. making over $100k and I felt with was too much…..

basically after 18 months from when we bought our house on 4546 vergugo rd, seeing how high prices went up i decided we needed to see and sell fast because after the summer, prices were going to crash. I was so sure, I was willing to sell at what I thought was the top and pay capital gains in order to take my money off the table….

eventually the blog will be right. I am a landscaper and I am now seeing people pay $800k+ for a house in El Sereno.

https://www.redfin.com/CA/Los-Angeles/3271-Amethyst-St-90032/home/7000556

Anyway, housing prices to tank hard…not sure when or how hard.

i thought the prices were overpriced in 2012. I thought people were stupid for over bidding on houses in 2012, like the house on Almaden Dr. Can you believe some idiot bought it for $287k?!!!! I wonder if prices will go lower? if they do, what would that mean for the economy, my Roth IRA, my wife’s 401k, our regular investment portfolio, our gold/silver coins, and our jobs?

for now I am loving living in my new place paying $2200/month. 3bed, 2.5 bath in eagle rock, 2 car garage (up against the freeway)

Buy Low, sell high! only america can You turn a little more than $0 into $120k+ in less than 2 years.

My good friend in Berkeley did something similar, putting $15K down on a house in 2011 that would now make him over $500K (house is now worth over a million)…and he thinks it’ll go up forever, so he won’t sell.

Man, what I wouldn’t do to turn a $15k investment into a half a million profit in 6 years!

Had a boss that was sitting on some yuuge gains in the tech bubble of the late 90s. Wouldnt sell, didnt want to pay the taxes. Crash took care of that problem.

Part of what I realized from his and others’ stories is that if you are a true believer, you ride it up and ride it down and in the end arent affected too much. If you are a doubter, you dont make any money either. You have to be able to see when it gets ridiculous and GTFO. The current stock/housing bubble is beyond nuts so the aftermath should be interesting.

You don’t have to sell your home, get a home equity loan at three or four times your income. I am a loan broker as well as real estate and can set you up with that. Many older folks don’t sell due to taxes and sales expenses. Calif. taxes gains at 9.3% plus, and it is the Feds that capt gain, not Calif. Makes sense to sell if move out of state to AZ or NV. I advise the parents to kick their losers out or if they pay rent, tell them to shut up and follow the house rules. I don’t have that problem, thank God, I live on a boat. I work on the weekends, but come Monday, it is Tequila and the honeys. The Coast Guard told me no Tequila and piloting the boat, but that is a whole another story.

^^^ LOL!

I keep finding new listings which don’t seem to be as overpriced as older listings. Is it possible that home prices are already beginning to fall in Southern California even though June is traditionally one of the strongest sellers’ months of the year? If the real estate market is weakening in June, what does this foretell about home prices in the fall and winter?

Perhaps, realtors can sense that the market is weakening and are telling their sellers to be less greedy.

I think prices are still going up at least in south SF Bay price listings. Venice area in SoCal looks like it might be similar. Inventory Low. They’re almost trying to break records it looks. Saw a sold price and it was 60k over the 800k asking on a really tiny small place on Friday. Disheartening but almost surreal at the same time. Truly hard to attach the asking price to the property I’m looking at. Crap shaks seem extinct. Did see one billed as an artists cottage. They even showed a community party invitation because everything else was ORIGINAL down to the asbestos linoleum floor tile and you were buying the culture of the neighborhood.

Seems worlds apart from what I saw online just a few years ago when I first started looking. Oh well.

Rents, on the other hand, are softening a bit. You have much greater rental unit choice and even some luxury units are starting to quietly offer free months rent. They were starting to get pet unfriendly (said my complex was “at capacity”) and now seem to be back to welcoming your pets like royalty to get you to sign a lease with them. Woohoo for renters.

Anecdotally, even my realtor up here in Portland let it slip that things seem to be slowing down, which surprised me.

I noticed that too

I noticed Portland is slowing as well. Supply seems up and more homes sitting longer.

California millennials remind me of whitetail deer. A small herd will typically live in an area 1/2 mile by 3 miles. This can go on for centuries. In a really bad winter, they will not go out of the area to search for food, not even over the first hill. They stay and starve.

California millennials could move to Raleigh-Durham, North Carolina and get a job in the Research Triangle and buy a house for $100,000, not a million. There are many parts of the country like this.

But no.

Entropy reigns.

@roddy6667

But then you’re stuck living in Raleigh-Durham with people who often confuse you with whitetail deer.

Isn’t that the truth!

The quality of life is very high in Raleigh-Durham and many would consider it better than living in a third world slum of LA in the Democrat’s communist state of California and it’s definitely better than living on the Democrat’s bankrupt entitlement plantation of Chicago with its horrendous weather, high taxes and high crime.

The median home price is 246K and the median rent is $1375 in Raleigh-Durham.

https://www.trulia.com/real_estate/Raleigh-North_Carolina/

I think people are confusing general millennials with young people who just like coastal cities and want to live in one.

Believe it or not some of us just grow up in larger cities and prefer a more bustling and less personal life style. Its not meant to disrespect alternate lifestyles. There are certainly Midwest cities that can offer a similar level of experience to LA without the overpriced housing or being in Cali.

And even growing up in California I too find the vast majority of LA unappealing. But don’t go overboard with the broad assumptions that all areas of LA are crime ridden, unsafe and filled with homeless people. LA has nice suburbs and desirable areas, which is part of why its overpriced. Overpriced sketchy areas are still generally safe, they just may be more heavily populated with immigrants and lower middle class. Prices skyrocket there for those who have a taste for taking the gentrification gamble… not my cup of tea but it appeals to some and may work out for some as well.

It is fair to pick on people that complain about prices in California though as though they are trapped. Its a choice to live here and their are other areas to pick from that offer similar life styles with a slightly lower price tag.

^^^ California is irreplaceable. I moved out a long time ago to Texas, and not a day goes by that I don’t miss the SoCal weather. As I get older the Texas Weather fronts “hurt” my body if you know what I mean. Joints, headaches etc. There really is no good answer for our kids. There are other nice parts of California that are not as expensive as SF or LA. Central coast/inland perhaps?

Yes, CA is full of very reasonable places. Only LA, OC, and SF are high. There are lots of great places that are not much higher than fly-over country. Look for places half way between San Diego and Irvine, there are good deals in that area with nice weather.

Katera, precious, have you ever been to Kerrville? The weather there is fine, plus we will even throw in Kinky Friedman.

There is no perfect place for weather. It’s fairly nice along the California coast but it can be damp and dreary with fog inversion layers. California’s inland valleys are usually scorching hot in the summer and often cold and foggy in the winter. Fresh water is a major concern for most of the state along with earthquakes.

If you have arthritis, a dry climate like Arizona might be the best solution.

Thank you, Samantha. The weather is overrated. Relatively pretty decent, but not perfect. The first couple months this year it rained a lot and there were bugs everywhere up until about a month or so ago. The past few months have been bone dry except for the freak rain we got on Thursday. Then there was the drought, which isn’t perfect. Now we are full on June gloom, also not perfect. It’s been rather cool the past couple of weeks and later this week it’s going to be hot anywhere not within two miles of the coast.

I moving to the Central Coast when I retire. CA is hard to leave for sure.

My millennial daughter and her husband just bought a 3 bd 2 ba 2300 sq ft house in Raleigh NC for $190K. No problem when both are nurses making $50K+ each. No problem even when only one is working. In coastal S.CA that would have been impossible and they would have been living with us for awhile. There are an amazingly high number of millennial CA transplants who have moved to this college town.

Or, millennials keep living in CA and enjoy rent free living at mom’s hotel. I think I can keep doing that forever. I save so much money I am thinking of working part time or retire early. Living rent free at mom’s is my American Dream. I just came back from a month long backpacking vacation overseas. This would never been possible if I had to pay for child care or an overpriced mortgage. That’s true freedom. If you are tied to a ton of debt you are not free…..you are a slave to the 1%.

The problem with Raleigh is you have to live in Raleigh. Cold winters (though not as bad as the NE) and horribly humid summers.

The other issue is the people. If you are young and live near the schools the kids are open minded enough. Otherwise, people become more ignorant as you venture out. It’s very clicky and everyone will want to know what “church” you attend. If you are Mr. And Mrs. White they might tolerate you. But as soon as you open your mouth and you don’t have their accent then you are an outcast.

That southern hospitality is a bunch of bullshit. Bunch of ignorant people playing in their private tennis clubs sipping on nasty sweet tea. They’re nice to your face and will take your money but they don’t want you there.

Southerners don’t like Yankees and hate liberal folk from the land of fruits and nuts. My sister married a native. She was never accepted and complains about it all the time.

There are nice people in the Deep South but not NC. You can find even cheaper homes but you have to live on Walmart wages.

But you can find cheap houses. Great.

I kid you not, my husband and I did try to move to Raleigh last year. We are older Millennials with two small children. Husband works in the entertainment industry, and most employers are clustered in California. There is only one company in NC he could work for, so if it ever went under or fired him we would have to sell the nice house and crawl back to CA most likely. Still, he did interview with them, but they realized he had no experience in the particular area they were looking for. Oh well. I tortured myself for a while by looking at Raleigh on Redfin.

We have other Millennial friends with kids who have bailed and fled CA for Arizona and Ohio. In our case we settled for moving from the Bay Area to Orange County–out of the fire and into the frying pan; every bit helps right? I don’t regret it, people are more friendly down here.

I’ve figured out over the last couple years that…I am the weird one in my circle of friends….

I penny pinch, I brown bag it to work, I avoid movie theaters, I avoid fads, I avoid eating out often, I avoid convenience stores which charge 300% markup on most items. I AM THE WEIRD MILLENNIAL!

I have zero debt and a net worth in the six figures. I’d like to get married and have kids but I don’t want my life broadcast by a SO on instagram or facebook. Plus every girl my age with a decent body has a tattoo. Ughhh I guess I’ll just keep picking up cougars in Manhattan Beach.

“Plus every girl my age with a decent body has a tattoo.”

Lol. When I grew up in the 50’s no woman would ever think of having a tattoo. And the only dudes who had them were those out of prison, or out of the Navy. And as far as not eating out, good for you. The best way to be/stay healthy is to cook your own meals.

Carnival workers too, Jed.

Your financial prudence will continue to provide benefits in all areas of your life.

DAZ… Carnival workers ARE just out of prison. Jed nailed it.

You sound like the male version of me. There’s nothing wrong with saving $$. I have an old phone bc I refuse to spend $600 -800 bucks. And I still drive my old college car, 99 saturn. So turret ate a few of us weird ones out there.

Cynthia,

I have been thinking about the price of smart phones and considering they are basically a super computer I think 600-800 is probably a reasonable value. That doesnt mean I agree that every average joe/jane should have one. I got lucky and bought the 6s @$200 just before ATT subsidies were stopped, I won’t be buying a new one anytime soon. I have taught myself to replace batteries and screens so I dont have to drop a mortgage payment on a cell phone. Similarly I grew up in a family that “changes their own oil” so I am able to save thousands doing my own repair work on cars unless it’s something major. Good on you for keeping that old dent resistant saturn on the road!

Cynthia and John, get a room, already. 😉

(also, reasonably good phones are only $200-$400. Get on a good MVNO and you can get one every year or so and still come out cheaper than the big 3’s contract rates with “subsidized” handsets)

John,

If you want to go all in on, my advice would be:

1. Get a vasectomy

2. Buy a multi family property and rent to young millennials, landlords will benefit greatly over time with the millenial generation. Home ownership will be controlled by a wealthy few over time similar to the rest of the world. The trend will accelerate because the millennials want no part of ownership.

3. Enjoy your life

Notankinsight,

“millennials want no part of ownership.”

Correct. Unless we get a 50-70% price collapse i am not getting off the couch to look at open houses. Renting saves millennials tons of money over time that can be invested in a smart way. Buying overpriced crapshacks is like burning your cash in a fire pit.

The best would be to stay with parents and enjoy rent free living. Unfortunately, my parents dont live next to my work place.

BTW, i know some co-workers who decided to buy in the inland empire….they hate their daily commute. You waste so much time by being stuck in traffic….much better to rent closer to work and save money on top of it. I enjoy a happy renters life, short commutes and therefore less stress. Its a no-brainer.

I thought I was the only one! I’m 29 and I’ve never been in any kind of debt – never even carried a credit card balance, which is kind of a miracle when you consider that I’m a renter in CA. Though I’m definitely not worth six figures (more like four) and I’m not sure how anyone gets there from here. Everyone says “go to school!” but I don’t want to spend that much money (even if it’s other people’s money), and I’m kind of skeptical of this whole way of thinking where we can preserve the American Dream by jamming everyone into the very tip of the jobs pyramid.

And yeah I totally get you on the girl problems. Is it me or does everyone seem to be stuck in the party phase forever now? And it seems like every girl I meet is either a psychology student or a single mom. That doesn’t seem normal.

School trains you to be dull. It kills creativity and stifles innovation. Unless you plan to have a career in a technical field that would require a degree, you’re better off just learning by hard knocks, finding something you can be better at than others, and doing it independently. If you want the breadth of a college education, Kahn University and Dr. Jordan Peterson (among others) have a plethora of valuable educational materials available for free.

The term is called “Extended Adolescence” and Matthew McConaughey made a movie about it called “Failure to Launch” which accurately describes most Millennials/Snowflakes

“every girl I met is either a psychology student or a single mother” Hey, I saw that episode of Crazy Ex-Girlfriend!

If you think a house is expensive just wait until you have a wife and kids. You are likely the richest now in health, happiness, and freedom than you will ever be.

Exactly why I moved out of the United States! My advice to you is to get portable job skills and get out. Once you meet some nice foreign girls you’ll never go back to dating American chicks. Trust me.

I’m no millennial (I’m 45) and I feel like you, a decade older. No debt here, either. When the first housing bubble was ramping up I was in my 30s and resigned myself to never owning, so I went to grad school instead. Years later, I’m done with school (worked my way through, no debt), doubled my income, and I still wouldn’t buy at these prices.

Speaking of tattoos – I’ve never married and you are right, it is nearly impossible to find someone without them now. I’m far from a prude, I’m a musician and toured in a band for years (hence why I had to go back to school to get a chance at a better job!) but I never got a tattoo. It is funny to me how having a tattoo went from being an anti-establishment thing when I was a kid to something that EVERYONE has now. It was just becoming mainstream when I was in a band, and the most “rock n’ roll” people I knew ended up being the ones who never got tattoos because they weren’t “joiners”. Now every 30-something single mom nowadays thinks she is Lemmy from Motorhead.

It’s like if people permanently adopted any previous fashion trend – picture if every woman who had a “Rachel” haircut in the 90s had to wear their hair that way forever. Or if you wore a polyester leisure suit in the 70s because it was in style, and then you had to wear one for the rest of your life. It is just fashion now, and will be out of style when all of these kids grow up and associate tattoos with their uncool parents.

Get into Med School, go into plastic surgery and open a removal clinic like Dr Tatoff. Being in a field outside of Obamacare is a great idea for an up and coming physician who wants good money for doing a public service.

Funny thing is the inks are quite toxic and tattoo removal breaks them up so they more readily pass into the bloodstream apparently. Doh!

And I hear you on the weirdness this culture has devolved to. Im 46, 7 figure net worth never married and most women (men too, but I dont care about them) are a mess. What has shocked me lately is how fat people are. All kinds of fd up, more tattoos than teeth, just a disaster. I’d swear there is something in the water to make all these people commit slow motion suicide.

John,

I’m with you man! I lived in Hermosa Beach for 3 years when I was in my mid twenties. I always felt like the south-bay was full of middle aged woman who never wanted just wanted to still party and never face growing up or had married young, gotten divorced and were now reliving the years they missed out on in their twenties. I would rarely find any chicks my age up there that had their shit together. I since moved to San Diego and the quality of younger professional women blows the South Bay out of the water. Live where you want to live and invest where the numbers make sense. I rent in Mission Beach but own rental properties out of state. It’s the best of both worlds. I get the benefit of equity gain/appreciation and don’t have some miserable commute just so I can own a house..

I am in my 40s and retired on my rental houses. I got married in my early 20s. Married a hard core catholic girl who goes to church every day. I was an out of control party animal. If I did not marry this girl, I am certain I would be dead. The best thing I ever did was getting married to a conservative girl. I recommend that to everyone.

Smart move JT. All people influence one each other – for good or for worse.

I did the same thing. Married in my 20s, still married decades later with the same conservative girl. That was the best move I made in my life. From there to saving and investing it was easy. I would not be semiretired today with lots of paid off RE investments without that marriage. That after raising 4 children and put them through college.

I know that what you and I did is not popular today, but it is still practical from many points of view – finances, health, and happiness.

Flyover, the most important choice in life is your spouse. Get that wrong and nothing else works out. Getting your real estate or career right is far less important in the grand scheme of life.

Haha John, we are one of the same! Except you have much more savings than me.

I live in Hollywood and these women will be all over you and then the next minute they’re gone. When women are younger they have artificially inflated egos. They don’t realize that eventually they will get too old to have kids, they will get wrinkles, those perky boobs will be gone, and then they will be clawing at any guy desperately. I am all about discounts haha.

I’m not gay but guys just seem to get better with age until we are senile like some of the posters on here….

This is madness:

https://www.openlistings.com/p/1415-allison-avenue-los-angeles-ca-90026

Payments on a $600,000 loan – $3,770 (not counting another $189,000 down)

Monthly rental on the two units – $2,390

And it’s rent controlled.

Houston, we have a problem.

Assuming you could eliminate the rent control it might make sense.

People don’t usually invest on hope.

The problem with millennials is that they’re true believers. As a Gen Xer I get to see the high points and low points of those on either side of me. Millennials are the true Trotskyites. They’re true believers in “social conscience,” clean eating, eco-friendly, etc.

The Boomers invented all of these things, birthed out of the hippie movement, right down to organic living and rock crystal deodorant (it doesn’t work). The boomers look at the millennials and say, “wow, I can’t believe they bought this sh*t, we were just talking out of our asses.” The vast majority of Boomers were only superficially communist, even in the 70’s. Their selfishness and self indulgence would never allow them to be real, actual communists (except professors).

So what you have is the millennials, these kids eating up all this “social justice” nonsense and the boomers turning around one day and are now having their empty words thrown back at them by true believers. It’s like making up a religion and then being overthrown by puritans of what you made up. And now the Boomers scream, “but it was all bullsh*t! A marketing gimmick!”

This is one of the best comments of all time. Thank you.

JR,

This is truly a brilliant comment.

As a fellow GenXer I wonder what happens when the true believers are in charge.

The millennials who visit this site are not part of the mass of true of believers.

The true believers wouldn’t even bother with a housing site, they don’t care about ownership in any form. All they want is their living wage and a fake art job in a top urban area.

Their kids will probably be the next great generation who has to put on their boot straps and pay for the mess.

Reading the comment about “true believers” is interesting. I am a millennial and i dont think it applies to me.

I dont believe/trust anybody in life. In general, people dont just give you good advice. They give you advice that looks like good intentions on the surface but in reality benefits the person giving the advice and not you. You cant believe banksters, your employer, realtards, insurance agents, sales people…or anybody in power. Just look at our clown president…A con artist who cheated his whole life is now president. Does that not tell you something? You cant even believe your boomer parents or boomer parents in law when it comes to buying houses. They cant handle thinking about the market going down causing book values to vaporize. So they tell you to buy now to keep the bubble going.

I also dont believe in social justice or crystal deodorants or this gluten free overpriced food. Are you a sheep or a wolf? Do you do your own research and be vigilant or are you driven by a drive-through-mentality wanting to have everything now. Those are the kind of questions i ask myself and act accordingly.

That’s definitely the big question there. The millennials on this site are not your average millennial. It will be interesting what they millennial generation becomes, how it morphs over time.

Now this Z generation is an interesting bunch. They remind me more of the Gen X crowd, mostly because they’re the kids of Gen X.

JR,

I feel bad that my kids will have to grow up in a millennial controlled world.

At some point I am certain the millennials will start a living wage, inflation is going to get out of control at some point under millennial rule.

Millenials don’t understand that all of their tech efficiencies simply create hyper inflation in the few necessities of life. Millenials end up spending near 100% of their salary on rent and food.

Millennials=true believers of what boomers invented???

One thing you cant do is generalize….I am a millennial and I am def. not what you describe. One of my millennials Co-worker just quit his job to pursue some online/day trading business. Apparently being a currency pirate pays much more than a high level job at a TECH COMPANY!!

Another quit a good paying job at the same tech company and took his family to south america to start a business at the beach. Another one quit a few months back and is still backpacking in Thailand. These are real life stories. I barely meet a millennial who wants to start a family, buy a house and be a debt slave. I often try to push buttons and ask why don’t you want to live the American Dream. The responses are one sided. They want no business in buying real estate. Smart people! They don’t repeat the mistakes of our former generation. Live independently, seek an adventure abroad while giving two shits about the American lifestyle/values! I like it. Its becoming embarrassing to be American…just look at that political shit show. I lost my devotion to support this economy and these shitty values. Maybe even lost my patriotism. I am a true UNBELIEVER.

Jordan 99, Do you think you’re the first generation to discover South America and Thailand? Do you know how many baby boomers just had to go to Machu Picchu at your age? Do you think pitching a tent in Peru and “dropping out” was invented by millennials? You’re following the same arc. Only believing it. The boomers didn’t go to Peru to pitch a tent, they went to screw each other and take drugs. The tent pitching was part of the process. Heck, even my Generation went to Prague and Amsterdam circa ’95 to screw each other and take drugs.

And do you know what the boomers did after they screwed each other in Peru? They came back here and opened a chain of Cost Plus World Markets that sold cheap Peruvian trinkets that were made by Chinese slaves. Wake up Jordan. You will have that tract home in Laguna Woods (no lagoon and no woods) one day.

Nice post JR. I wonder if it will sink in with anybody. As a rentier, I fully support these delusions (and high prices…)

JR wirt,

By reading your comments I def. believe your drug use history. Keep repeating your millennials are true believer nonsense. What’s more likely is that boomers will be remembered for creating the biggest debt burden in history. The mess has to be fixed by generations to come while boomers escape the responsibilities.

Interesting analysis.

I am technically a millennial and don’t trust anyone. I think the older millennials like me will have more influence. I remember a pre-cell phone world. Some label us the Oregon Trail generation.

GREAT comment! Statements like this are why I read this outstanding blog. Love the people who post here!

Brilliant.

Rejecting the “values” of my Boomer cohort has reaped all sorts of benefits in my life.

{ not “lifestyle”, please note }.

Al that double talk about being a “better generation” and rejecting materialism and we became our parents X10.

Thanks for all the great comments.

I’ve always felt that to really know the baby boomers you had to see them in their baroque era (the 1980’s). My God they were an ambitious crowd. Not the deer in the headlights, lamenting mortality while plastered on margaritas, Taco Tuesday boomers we see today. I had a jazzercising first wave soccer mom. I know these people. Right down to the track lighting and skylights. I will say for any downside to that generation, they did have the best music. No one can deny that the best thing about the boomers is their record catalogue.

It seems a significant amount of boomers believed the “buy now or be priced out forever” nonsense back in 2003-2008. Many lost their shirt. Fast forward a decade we are at the end of bubble 2.0 and they really expect millennials to believe them that “this time is different”. If millennials would buy what boomers are trying to sell them why are they not interested in buying homes? Aren’t boomers constantly telling us its the american dream, interest rates are low and buying always makes sense in the long run? Its obviously not working….ever heard that the younger generation is trying to avoid their parents mistakes? I am wondering if you got this backwards here with the true believer notion.

My concern for the generation that follows is that I see a bell shape curve being formed. Boomers are the beginning of the growth and Millennial’s maybe represent the peak. However, the generation that follows probably follow the degenerational group. Those that saw the past and missed it and now have really no motivation to innovate or get ahead. likely will stay at home until they see a need for a change or the family kicks them out.

Homerun,

you make it sound like staying home with your parents is a bad thing. I am in my early thirties and love staying with my parents. They love it to…we help each other. I would never rent an overpriced crapshack if i dont have to. Same for buying. If we get a beautiful crash / economic disaster i will go and start looking to buy

No I was not looking at it that way, but the prospects for a job/career for the next generation might not be so promising and the likelihood that we will have echo millennial’s living at home more often may become the norm for a majority of families. Question is at what age does a typical millennial plan to leave the nest?

If you are a landlord waiting on these millennials to keep their income stream flowing when do you call it quits? If millenials find less job prospects in the future, hud does not pay the bills like they used to or less foreign buying? It seems that landlords would be screwed if families did the logical thing to allow their young to hang out if they want to avoid rent. Obviously job prospects near them may not likely fit their location which is why this living arrangement may not work out for everyone. Of course the landlord will like this arrangement.

“I would never rent an overpriced crapshack if i dont have to. Same for buying. If we get a beautiful crash / economic disaster i will go and start looking to buy”

Statements like these give me some glimmer of hope that the elite .0001%’s plans to heap all the debt onto subsequent generations can be somewhat thwarted. We have seen corporations walk away from their obligations, financial institutions get bailed out while the rest gets thrown under the bus, and chief perpetrators of the last economic crisis get immunity. Millenials are only doing what’s best for themselves.

Boomers. Be careful what you wish for or you may get it!

Flipping mania has reached peak insanity. The same houses are being repeatedly flipped at high markups, without ANY work done.

A Santa Monica house: https://www.zillow.com/homes/for_sale/Santa-Monica-CA/20486564_zpid/26964_rid/globalrelevanceex_sort/34.056783,-118.433819,33.962155,-118.559647_rect/12_zm/

Sold in March 2017 at $2,100,000.

Offered in May 2017 at $2,650,000.

A $550,000 markup after only TWO months. With NO remodeling done. The photos are the SAME as during the March sale. I watched this house, and its paint, everything, are unchanged since the March sale.

Or consider this Woodland Hills house: https://www.redfin.com/CA/Los-Angeles/4326-Pampas-Rd-91364/home/4307610

Sold March 2016 at $755,000.

Sold again in November 2016 at $839,000.

Offered again in June 2017 at $929,000.

Again, NO real work done on it since the March sale. Maybe some new paint. The listing LIES. It says “updated” kitchen. I toured this house in Feb 2016, before its first sale. The kitchen is unchanged. I took photos and I still have them to prove it.

I suppose the realtor could say, well, it was “updated” several years ago. But the listing implies it was updated since the last flip. That’s what prospective buyers will assume.

People are buying houses, and reselling them within MONTHS, with NO work done on them.

Looks like it has some water damage in some weird places. R

This could be a realtor scam. I see it all the time in my area. A realtor will find someone to list a home what is clearly 25-50% too high for the area. They use this as a comp for a home that is 20% overvalued. This tricks Zillow and Redfin and the fake “worth calculator” will increase the value of the home calculation.

I see this all the time – the game is rigged to go up.

And stop looking at the home quality – they are all mostly junk in CA. 90% of what you are paying for is land and location. Just rebuild the home, they are not that expensive.

Insanity, theres no other was to describe it.

The bubble is pure entertainment. laughable prices and laughable comments plus a lot of useful information/statistics like the ones you can find here on housing bubble. We are in a unique situation….we can experience bubble 2.0 live and the great collapse thats coming up. Get the popcorn ready.

Speaking of the young ones living at home…

How many avacado toast breakfasts does it take to buy a home?

http://www.bbc.com/capital/story/20170530-the-avocado-toast-index-how-many-breakfasts-to-buy-a-house?ocid=ww.social.link.facebook

I bought a home in this neighborhood in 2012 and new it would ‘take off’. The reason is it is the absolute closest to the beach neighborhood in all of LA but without the Beverlywood, or Culver City prices (or all the other high prices as you work your way West to the coast). and its 15min to the beach on Sat/Sun morning.

This home sold last year for $630K Now with 2 new bathrooms and a new kitchen $900K!

Someone will buy it, perhaps it will sell for $875K?

If you ARE in the market to purchase, consider Baldwin Vista. It is West of La Brea, East of Lacienega, South of Jefferson. Before you laugh at what you think is a crime ridden area, take a drive through. Most of the crime is not in the neighborhood, it is car theft and shoplifting at the stores on La Brea and La Cienega.

My husband and I drove through Baldwin Vista by accident a year and a half ago on our way from an open house in Beverlywood to an open house in Westchester… we have made offers on a few houses in the neighborhood since then, but were beat out by all cash or flippers, or people who are seriously overpaying each time. Now you only see things coming on the market there for 800k+, whereas last year you were seeing stuff in the high 600s-700s. So unfortunately the secret is out and we missed the boat on that neighborhood. Not going to pay over 800k for a house where you have to send your kids to Dorsey High.

Also, the “view” homes in Baldwin Vista are going for well over a mil now – we made an offer on one sweet little grandma house- in ok shape but small with no recent upgrades, needed a new roof, etc. 71 other people made offers and it ended up going for 1.2 mil (asking price was 799k). It did have a 180 degree view of LA but still. People in the neighborhood saw that and have been putting up their homes for sale with no pictures of the house in the MLS listing- just a photo of the view and a price of a million or more!

We have stopped looking with any motivation to buy… things are too nuts. Going to stick it out in the rental apartment in the nice neighborhood for the foreseeable future.

Millennial Mama. The same insanity is going on in the Bay Area.

We bid on a 2 & 1 condo 1033 sq. Ft. listed at 445K. We offered 488K

Seller countered at 492K which we accepted. Someone decided it was worth another 20K over that (512K) You are better off renting, no risks if you need to move.

You are smart. It’s not worth stretching yourself to the limit to buy in an area with marginal schools. Keep renting, and also maybe consider option #2: Bail California and buy a nice home in a good school district in another state.

The problem with that neighborhood is the closest retail and schools are in slummy areas.

@ avi. True but it is changing. Baldwin Vista is 1.5 miles from downtown Culver City. There is Trader Joes, Sprouts and Co-Op in Culver City now and a Whole Foods is going in at La Cienega and Jefferson next year (on the site of the old radio Towers).

Zillow only shows 8 homes for sale in Baldwin-Vista. Cheapest: $1.1M

https://www.zillow.com/homes/for_sale/Los-Angeles-CA/pmf,pf_pt/12447_rid/baldwin-vista_att/globalrelevanceex_sort/34.107682,-118.18594,33.91701,-118.493557_rect/11_zm/

HI Samantha. Wow I didnt realize my neighborhood got that expensive. But the homes that truly in Baldwin Vista do not have the million dollar views or price tags. They are North of Colesium, bounded by La Cienega, La Brea and South of Jefferson.

there are a few still under $1M, here is one.

https://www.redfin.com/CA/Los-Angeles/5612-Bowesfield-St-90016/home/6889831

Qe Abyss – that bowesfield house is a flip. We looked at it when it was first on the market back in September but it ended up going before we could get an offer in. It also needed A LOT of work before you could move in- which clearly the flippers have done (though who knows what invisible things were left unaddressed), and are going to see a 300k profit from it. Again- I love the neighborhood, but we won’t spend close to a million bucks for the privilege of a Audubon Middle or Dorsey High education for our kiddos.

At local housing prices, I’m surprised the difference between CA and the rest of the nation isn’t more. Where are all the people working in retail and food service living? You can’t afford any place on near-minimum wage around here.

They are illegal immigrants crammed into crowded conditions like 10 people to a 2 bedroom apartment. Ever wonder why we are a sanctuary state? Citizens aren’t willing to live in those conditions.

Or they are millennial’s living with their parents with really low or no rent. This is the only way people can live here working low wage jobs.

Reason #6 – They don’t want to buy high, and be left holding the bag when the market crashes again

Purely as an investment, houses looks like shit right now. Sure, prices have melted up the past five years. But, if you buy at this point in the cycle, you better have an exit strategy. What happens if you get laid off and you have to move to find another job? Can you charge enough rent to cover your mortgage payment? Maybe you can now, but what happens if incomes go down in the next recession? Also, if you’re buying now, you’re locking in an extremely high property tax bill. The RE game is all about leverage and timing. Maybe some renters and basement dwellers are smarter than we give them credit for.

We bought a Florida retirement home in 2011 for cash. It is worth about 30% more now than when we bought. We helped our younger millennial son buy a home in NE Pennsylvania in 2010. We loaned him some money and gave him some money to purchase the home. He moved and bought another home in his new city. His home is worth at least 10% more than what he paid for it. It may be foolish to buy a home in CA but in other places it is still worthwhile.

Our FL cost us about $150K for 2000 sq ft in 2011.

You saw the first signs of this current tech bubble popping on Friday with the Nasdaq down 200 intraday. When the tech bubble comes undone, the damage to CA real estate will be significant. For the computer crowd, they’d be better off living somewhere where they aren’t likely to marry someone exactly like them and have autistic kids. Autistic millennials will not be buying with cash. But they will be happy to hump the CA welfare system.

Sigh. 200 points. Wake me up when there’s a real crash.

Are you talking about SoCal or Silicon Valley? Tech bust might have some effect down here but not nearly as much as up north. Plus if you are a techie in LA you will most likely partner with a non-techie.

Some effect? “Silicon Beach” will certainly feel major effects of a tech collapse. It wasn’t that long ago that my friend was sharing an apartment steps away from the beach in Venice on an hourly wage.

I am almost a millennial and I plan to work until I die and I believe it is a blessing. Ironically, I feel that the Millenial Generation (born in 1980s and 1990s) are similar to the Silent Generation (born in 1920s and 1930s). Please enlighten me if you have something to say.

Mark, “plan to work until i die”?? thats sounds horrible….why?

Millennials will inherit all the wealth from boomers. There is no housing shortage. There is massive oversupply. The only reason why boomers are not selling is the cant even afford the house they are living in….prop13 keeps them alive. And millennials will profit from it since we inherit the houses and low property taxes!….The only thing you have to do is hoard your cash and wait. And if you can, live with your parents….save tons of money and enjoy the full fridge. Cant get much better than that!

Each generation has its own challenges and struggles. That is how we can grow. All these glooms and dooms are really depressing. I will try my best to live one day at a time.

Working until you die sounds depressing.

“these glooms and dooms are really depressing” Recessions/depressions/economic meltdowns/price collapse thats all good stuff. It lowers prices which is good for potential buyers! In an economy that we have right now, only the wealthy are making money. The little guy is being screwed. Downturns are part of the economic cycle. Its healing.

So Mark are you younger or older than a millennial? Why such ambiguity in your comments?

“And millennials will profit from it since we inherit the houses and low property taxes!”

Well, what’re you gonna do for those 30+ years while you’re waiting??? I’m in my mid 60’s and my mom is 92. I will inherit her house, but then again, I’m past my prime, but I’m not going any time soon, and neither are the boomers. So be prepared to hunker down for 30 years.

If the generation now of childbearing age doesn’t have children who have a reasonable chance of growing up to be productive workers with skills that the Market wants, then you most certainly will have to work until you die to have any sort of bearable living. Unless we all become lotus-eaters fed by super robots who keep us for pets.

You should read Howe & Strauss’ book called The Fourth Turning. I’m in the middle of it now, and, although I’m not usually apocalyptic, the book’s comparison of generations and cycles is both compelling and frightening.

Strauss and Howe and the “fourth turning” is pseudo-scientific garbage. It has no more validity than astrology.

It is worse than astrology, actually – at least you can talk to women about astrology, which gives it some limited usefulness!

Great books!

Mark Aaron,

“Living one day at a time” is a great way to go nowhere in life. Living in denial of the future.

I wasn’t around in the ’60’s, but didn’the the hippies live at the same time as the squares? I’m a “square” trying to get rich and retire, while some my age are trying to be cool, spend too much, drive expensive cars that depreciate in value, and go on lots of vacations so they can waste time posting pictures on Facebook.

Two statements by the Good Dr I have to comment on:

“We’ve been in a low interest rate environment for well over a decade. Rates can only go up. ”

In the real world, maybe, but in the surreal world of now, with a couple of rate hikes under the belt, any big recession could trigger ZIRP all over again or maybe even NIRP!

“Many parents were rocked to their core when housing values crashed for the first time nationally in our modern history.”

Depends what you call modern. I’m a Baby Boomer. Both of my parents lived through the Depression as adults, and they were very conscious about how prices for everything crashed in the Depression. My Wife’s Father’s family lost a modest fortune in California Real Estate in the ’30s. He never completely got over it. I’ve seen articles about East Coast and Midwest Real Estate in the ’30s and it wasn’t any better. People’s money was often stuck in Savings and Loan institutions that they couldn’t get their money out of and passbooks were sold on an open market for less than face value; the amount you got depended on how solvent the institution was. S & Ls were invested in Real Estate.

If this isn’t the “crapshack” paragon, I don’t know what is. Yes, ladies and gentlemen, for $1.1 million, you get a view of a dreary wall of the 405. In the backyard, you have the pleasure of apartment renters peering down at you. No central heat or AC. 2 Bed, 1 Bath.

Unbelievable. All of the value is in the land.

https://www.redfin.com/CA/Los-Angeles/11230-Pickford-St-90064/home/6753928

I have a close relative in 90064, and have been told that it’s an extremely desirable area…. and have also been told that any tiny 2 bed 1 bath fixer-upper costs over $1M.

This is a rather cute little house that has some limited possibilities, but it is no architectural masterpiece, and it’s badly in need of a facelift and a rehab. The exterior of the house, and the grounds both look like hell. I’d balk at paying more than $200K, let alone $1M.

More like all of the price is in the land.

I’m a Gen-Xer, and I wouldn’t mind moving back “home.”

My rent for a 1 Bedroom is shooting up to $2000.00 per month.

Not everyone should buy a home right? I never did. Wow. Big mistake.

I feel like I’m a college student again. Scraping to pay the rent and enjoying Top Ramen at the end of the day.

I’ve read that the median for a 700 sq ft one bedroom in LA county is $2100. This is insanity.

Your not alone! I’m a Gen X too in the bay area. I think the best approach is to move back home (if you can) and save as much as possible, build a massive war chest of savings, then buy when the opportunity presents itself.

Sadly, moving “home” is not an option.

But I agree, if you can do it, stay there for 5 years until you have $80,000 saved up!

How much $ is that ?

So if you don’t own a home and don’t have enough for a downpayment, as a Gen Xer, what were you spending all of your money on?

2k for a one bedroom? I would never pay that much rent for a one bedroom. I rent from a private homeowner who bought during the last downturn. The old lady rents the 2 bedroom condo for a bargain. I will stay here until she dies or the market crashes 🙂

Millenial,

I have been living here for 10 years paying 1200 per month. Landlord sold the place. You never know when your good luck will run out!

Luck? Finding a cheap place to live has little to do with luck….its putting effort in to find it. Sometimes you have to get out of your way and search long. Never rent from a professional managed place or a company.

You are wise, millennial. Sorry to have crossed you. Your temper is short.

Correct. It took a long time to find this place. Owned by a family for 3 generations. That’s why the rent was cheap. Time to look again…. just as you say.

Peace and well wishes.

Another Gen X here. After the peak of the first bubble, I was like Millennial – convinced prices were going to drop 60%+. Needless to say, they didn’t (not in the area we wanted), but luckily my nesting wife put her foot down in 2009 and we got in on the way back up.

I’ve since learned never to underestimate the government’s desire and ability to reinflate the market. It doesn’t matter that prices NEED to correct a certain amount, they may very well not. So even if prices have only dropped 25-30% (especially on the coast), if you see the median leveling off and the number of offers climbing, time to consider buying.

There you go. You are confirming what i am saying. Its all about timing.

“my nesting wife put her foot down in 2009”

You buy after the crash…..not in the middle or the end of the bubble peak…come on now, its not that hard to understand. Buy low sell high.

“There you go. You are confirming what i am saying.”

Not exactly. You’re waiting for a percentage drop that may not happen in your lifetime, which is exactly what I stopped doing, and it paid off.

nope, we are doing the same. You bought after the crash which is exactly what i will do. Dont get confused with a percentage drop. That is a given.

For most Americans buying a home is one of the worst financial decisions you could possibly make. Investors are purchasing homes, making quick fixes and then selling the overpriced crapshack a short time later. Also, foreign investors are looking to buy property because if the property is deemed “investment” property then they can get fast tracked citizenship.

Once the Boomers start downsizing or dying off – the housing market is probably going to go into an all out freefall. Gen X and Y were hurt big time by the 2008 financial crisis and will be very reluctant to buy into the homeowner investment b.s. and Millennials see what happened to those who bought homes – so they aren’t looking to step into that beartrap.

Super easy credit is going to mask the real problems for a while but at some point the game of musical chairs will end.

Spot on Anna Mouse!

I agree that the end of the Boomer generation will have a negative effect on many local real estate markets. I disagree that foreign money will stop coming into US real estate. Unless we get a Venezuela style Marxist government, foreign money will find its way here. I can see no shortage of kleptocracies out there. Connected individuals will certainly continue to try to get money to safe havens. So the more desirable the area is to the rich and infamous, the better it will do in the Götterdämmerung of the Boomers.

I’ve done well with real estate myself, but not all that much better than with other sources of retirement investing. As they say, diversification is the key to investing success. People who use a house as their sole retirement nest egg in this market are plumb loco.

“For most Americans buying a home is one of the worst financial decisions you could possibly make.”

The word “most” in this context is wildly inaccurate. “Most” of America has elevated prices, but is not in a bubble. You can buy a beautiful 2,500+ sf home in Orlando for $300k, in a school district with a junior high (the most difficult age group) that’s rated a 10 on Great Schools. That’s below rent parity, in a public school district that rivals the best private schools in southern California, with salaries that are far more in line with housing costs.

I agree with your post. I wanted to discuss predictions of the future in my post rather than present issues. I think you have to look at returns from buying a house in the particular market you are buying in. As your post points out, there are good markets to buy in if you are planning to stay for a few years. Look at all your assets and liabilities, and look at all investment options and come up with a plan that doesn’t depend on all circumstances lining up in your favor.

Everyone knows I am the biggest real estate bull, but only very long term. Like 15 – 20 years holding. But, I am shocked on how far prices have risen in east side costa mesa south of 20th street. There are two options. Either, we are seeing just craziness, or we are seeing the start of very big inflation. Very risky. If you buy now in a quality location, you will either see a huge gain, or a substantial loss. One or the other. Unlikely you will see price stability. I am stepping back and watching the show. However, renting is a tough spot because you will either win or lose big as a renter.

Eastside CM is taking off because the City is promoting it as “Costa Mesa Cool”, “the Action Sports Capital”, “Live, Work, Play,” “Playful City”, and it’s crown jewel: “City of the Arts”. The business license fees max out at only $200/year!!! So, it’s remarkably cheap to start a business. It has plenty of dilapidated rental duplexes & R-2 homes sitting on valuable land less than 2miles to Newport Beach with it cool ocean breezes! Also, many Newport Beach owners help their grown kids move closer to them. Prices are half of what a Newps address fetches. Three freeways make it easy to go anywhere in OC, and hipster shops and top-rated chefs have been opening restaurants like crazy. CM is redeveloping.

FYI: The City has a 65-35% rental ratio which the City Council is correcting with a mandated development requirement of “townhome or SFR only” ordinance via the “Westside Plans” so now the Huntington Beach close Westside is the new up-coming neighborhood to buy into now. Check out the Freedom Home prices b/w Victoria & 19th St.

Few bargains in Eastside CM. Prices begin at around $600K for a 2 bd/2 batha town-home built in the 1970’s.

https://www.redfin.com/neighborhood/113910/CA/Costa-Mesa/Eastside-Costa-Mesa/filter/sort=lo-price

A big problem is that rents have also gone up big time, meaning that if you wait if out you won’t be able to save as much…. so bailing the state seems wisest.

My rent has not increased in many years. I think its a myth that rents are rising…rents usually go with income….Americans have not gotten a significant raise in a decade. Rents cant go anywhere.

Correct oceanbreeze.

When we moved back to the “Bay Area” (really Solano county) last year, it was either pay $2500 a month for a decent apartment or $3000 a month for a decent house for my family of four, or bite the bullet and plunk down that savings for a house where my PITM would be about $2500. We opted to purchase even though I know full well it could be at the top. I made sure we bought in a nice school district and the house I chose does have an in-law unit that we rent out that helps out with monthly bills.

I would have been sick spending that much on rent a month, so here I am, hoping for the best but expecting a correction.

Our neighbors apparently bought for about the same price we did back in 2008, so back to pre-recession levels in this neck of the woods.

Millenial,

Rents have absolutely increased (dramatically) in my area Orange County. Not a myth; i see it every day as I have been looking at either buying or renting.

@Millenial

Unfortunately they have indeed gone up big time. If you have been at your place for a while and not looking, and your landlord has not raised then that is very good. I know some people looking now, and it is just pitiful what you get.

@Calexan

Sounds like you made an informed and well thought out decision.

If you haven’t gotten a rent increase in the past 6 or 7 years, consider yourself very lucky. I like tracking rent prices in the old complex I moved out from in 2012. Rents for a 1 bedroom were around $1750 in 2012. Today they are pushing close to $2300. Another tactic is putting wood floors and cheapo granite into apartments, now it is a luxury apartment and you can pay an extra 20%.

Here is an old latimes link from 25 years ago. Back then, average OC rent was $790.

Better yet is this quote from the article:

“People’s salaries have not increased at the rate house payments have increased.”

People were saying that back when a luxury beach home was available for 400K. Fools.

http://articles.latimes.com/1992-05-11/business/fi-1315_1_housing-units

I have seen apartment complexes in our area that used to be owned by local landlords. However, that changed when we hear other large property corporations acquire these properties and essentially create a monopoly. All of a sudden the new rents went over 60% in about two years! As for the renters that stayed they got increases but I hear the renters now have to share some of the costs of the water, trash bills on top of the standard rent fee that normally was covered with the rent. What a joke that is and I almost feel it is bit deceiving to charge other fees on top of your rent.

“If you haven’t gotten a rent increase in the past 6 or 7 years, consider yourself very lucky.”

Has little to do with luck. My landlord keeps telling me how i am one of her best renters. I am guessing most people pay late or not enough or are just a pain. Americans are broke. There is no more parking on the streets because people rent and have to sub-rent a room to a stranger to survive.

No pay increases means landlord have a hard time collecting rent or charging more. Its just reality. I know RE cheerleaders wish the story would be different but that’s life.

Wait for the next job-loss recessions and its lights out for the housing market.

“My landlord keeps telling me how i am one of her best renters.”

Dude, I was the best renter there was. Paid early every month, never complained about anything, was courteous, quiet, etc. Every year there was an envelope taped to my door with a rent increase letter. It was all about supply and demand, if I didn’t want to pay the increase there was a line of prospective tenants who would have. Giving people a break for being good tenants is a good idea; however, being a landlord is not a charity business. Market rate rents or very close to it!

rising rents….

i rent a room in my house (private studio) $1575, last year we rented it for $1350

http://www.latimes.com/business/realestate/la-fi-rents-rise-again-in-20150402-story.html

I am not familiar with this site, but did a quick google search for rents in LA.

https://www.rentjungle.com/average-rent-in-los-angeles-rent-trends/

January 2011 = $1585

May 2017 = $2503

Starting to see some major price reductions; rather quickly (in the area I am looking).

Softening coming or has already arrived?

Yes, has already arrived. There is only one way for housing….and thats downhill….we will experience a massive crash soon.

I put in an offer (site unseen) on a 800k property only b/c my wife was bugging me about it. I don’t think I inteded to follow through if accepted, but, threw out 790k.

They immediately countered at full ask and FASTER/SHORTER contingency periods than normal. Come to find out they had already accepted an offer and I was the back up and since they had already fallen out of escrow once they wanted an aggressive timeline.

Well; I obviously passed and the agent called me 2 days later saying the accepted offer never delivered their escrow deposit and are now out too. LOL.

Cocky sellers and no buyers now.

Blood is rushing to my mid-section in anticipation

Mind telling us which area? Don’t leave us hanging.

Ladera Ranch

Agent keeps calling me to tell me to meet 1/2 way at 795k; and I keep telling her that the 790k was almost too generous in my opinion.

Even though the property was turnkey in a great area; the downstairs was too tight and the floorplan is the problem.

Also; I hate cocky sellers and will not give them my money.

Dan, if you lowball a seller, make sure your offer contract allows you a “final walk through” before closing. You don’t want the seller trashing the place (e.g., removing light fixtures or such) to “make up” for the lower price or to “get back” at you for the lower price.

@son

Always. That’s a given

http://www.theonion.com/article/man-kitchen-cant-remember-what-he-got-married-boug-56225

The Onion is classic Millennial humor.

Millennial humor? I’d probably say Gen X.

The Treasury report recommends fostering an environment conducive to increasing the availability of credit with a particular focus on residential mortgages, leverage loans and small business loans. Key highlights:

â—¦Repeal or revise the resi mortgage risk retention rules;

â—¦Encourage banks to rely on a robust set of metrics instead of a simply 6x leverage metric when making leveraged loans;

â—¦Consider reassessing regulations concerning CRE lending to promote additional flexibility for situations where a loan has strong collateral

This is good news for buyers.

Why expand (loosen) credit if supply was too tight to meet insatiable demand? Unless of course, demand was never as strong as claimed.

Currently the banks primarily just look at income, 3x or 4x regardless if you put 40% down. Under the proposal, if you put a large down, they will loan more times income, since a large down, 40% will more than cover a market down turn. Some people are cash rich, but the income is lower, so they can not afford to sell their home to buy another home for the same amount. Don’t forget the income tax on the sell of your current home.

@Lord Blankfein

Yeah it’s just that. If you haven’t gotten a fat rent increase consider yourself lucky. Where do you think the increase in homelessness came from? Rent got jacked, family ended up in a tent on the street.

I have feeling that we’re in store for mini ghost towns inside American cities. An over-abundance of overpriced apartments for which there is little or no organic demand for. Just like an over-abundance of overpriced houses that drives down organic demand.

Or we could see a lot of those apartment developments convert to condo as has happened many times in the past.

@Avi1985

Still would an overpriced condo for which there is little or no demand in today’s economy.

Rents are not going up because there is an affordability problem. People who are paid well are being laid off left and right. These jobs are going overseas. At our company we lay off each year and even transfer entire manufacturing sites to South America and Eastern Europe. There is nobody in the world who can stop Globalism. Ah wait, Trump will fix it: “I alone can fix it”. LOL

You can not stop globalization but you can stop massive illegal immigration in this country. There is no need for so many immigrants when the economy can not generate enough jobs here due to globalization. The sanctuary cities and sanctuary states don’t help with the drain of taxes from the middle class either. So, Trump has some valid points.