Commercial real estate boom: Commercial real estate values up nearly 100 percent since 2010. Is this a bubble?

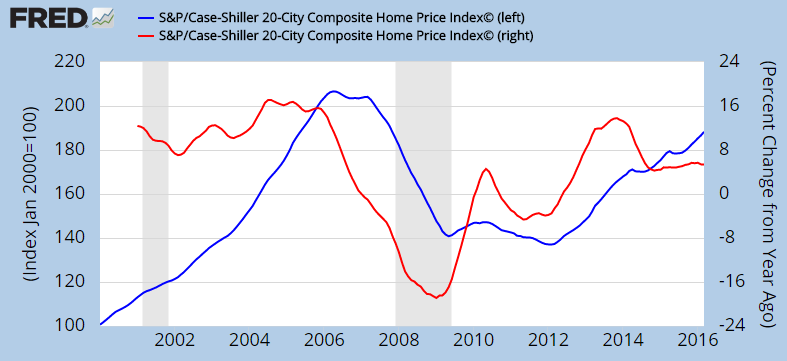

There seems to be a heavy rush into everything real estate. This is to be expected in a low interest rate environment where the market is encouraging dramatic credit borrowing. According to the Case Shiller Index US real estate values are up 28 percent since 2010. That is a solid increase especially when income growth has been anemic to non-existent for many household groups. The housing market tends to garner most of the attention because that is what the lemmings in the media enjoy digesting (plus you make good money selling ad space for refrigerators, stoves, and all the other crap you fill your house with). Yet the commercial real estate market rarely gets any sort of attention. It is hard to believe that based on a couple of commercial real estate trackers, commercial real estate is even more inflated than residential housing. In a widely tracked index, according to the Moody’s/REAL CPPI index commercial real estate values are up by close to 100 percent only since 2010.

The boom in Commercial Real Estate

The commercial real estate market is interesting because it is a good view into business perception on the economy. These aren’t typical house humping enthusiasts chasing after crap shacks. These are business people trying to turn a profit. You open up a small business and want to make sure you have enough revenue to cover your lease and to make a profit once all expenses are factored in. Also, builders here go more by what the overall economy is doing rather than catering to individual consumers which is the single family home market. Yet many times like in the last bubble, they obviously miss turning points in the economy.

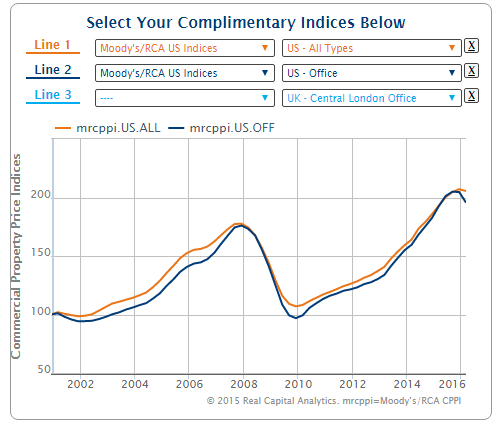

Let us look at the chart:

We can all agree that there was a significant bubble leading up to the 2007/2008 summit in prices here. The chart above clearly indicates that. Prices collapsed and hit a bottom in 2010 in the commercial real estate market. But since then, prices have not only gone straight up they have surpassed the previous peak by a sizable number. The index has zoomed up by nearly 100 percent since 2010 while the Case Shiller Index tracking single family homes has gone up 28 percent (which is significant given paltry income gains).

Sam Zell who knows a thing or two about real estate, had this to say:

“We have distorted markets. Maybe we have bubbles.†Then, on second thought, he said, “I don’t even know what a bubble is, so I wouldn’t want to be the definer of it. But I think that we have too much intervention and not enough market movement in interest rates – and in other assets.â€

“You know what the problem is? The problem is I think the Fed should have raised interest rates two years ago, and therefore today would be able to make a much more rational decision as to what to do. The problem is that they’ve so deferred reality for so long that I think they have a serious credibility problem if they don’t raise rates.â€

Yes Sam, this is a bubble especially in commercial real estate. It is a bubble because the Fed needs to manipulate rates as much as possible to keep prices where they are (in other words, you need artificial support to keep this game going). Just because no-income/no-doc loans are not used in mass, doesn’t mean that 3% down mortgages are any less dangerous. And in commercial real estate, the game is radically different. The price movement in commercial real estate looks dramatic when compared to residential housing:

It looks like commercial real estate is in a deep bubble here. But as Sam Zell mentions, there has been a distortion in the market because of cheap capital and the belief that this is a “forever†thing. Millennials can’t buy because they are at home living with mom and dad or their incomes are too weak even for a rental. Taco Tuesday Jimmy Buffet baby boomers would like to sell and get their hands on some juicy equity but where will they go? Plus, many have their offspring living back at home in their rooms playing on their Nintendo and Snapchatting about their Uber experience.

Commercial real estate is usually valued through a cold business perspective. That is, business owners will only enter into a lease if they think they can turn a profit. But with longer term leases, businesses also miss turning points and that is why commercial real estate can bust much quicker as well. If a business income dries up, you can forget about those lease checks coming in. If enough of this dries up, good luck servicing the debt even if you borrowed for rock bottom rates.

You’ll notice that when values crashed they crashed quick, but also recovered fast. If you look at the first chart, you’ll notice that office space valuations are shifting a bit. The economy and cheap credit needs to continue to keep this going.

Ultimately the price ramp up in commercial real estate is being driven by investor hunger and artificially low rates. But as we all know, that game can’t go on forever and the system is already facing strains. If you need any more proof that the status quo isn’t going to stay just look at this year’s election.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

98 Responses to “Commercial real estate boom: Commercial real estate values up nearly 100 percent since 2010. Is this a bubble?”

I think everyone reading this blog will agree that for a business to stay in business that business at some point turn a profit.

Overly amped up commercial real estate prices can only hurt new business formations.

Even existing businesses will have to cut somewhere. Me thinks it will be wages.

If wage growth is zero or goes negative how is are Taco Tuesday groupies going to pay the mortgage on their $800K crapshacks?.

I have been a long time fan of Sam Zell. God, what a genius. Sam’s term “deferred reality” really sums up the peyote chewing world we all live in right now. At least there is *someone* out there who still has some common sense.

Question for Sam Zell (who I am sure reads this blog). When is this LSD induced “deferred reality” going to end? I have thought it was going to end every year for the last 15 years. Guess I was wrong on that one! Help!

Housing TO Tank Hard Soon!

Go, Jim!

Hello Jim!

Jim, you owe me a lot of money!! I have been trusting your tank hard bull crap every year by not buying! Look at me now, my saving used to be able to a house, now it can only buy a bathroom in the same location!

Housing won’t tank in Flyover land. The home I bought in 1999 (4 bedroom 2400 sq ft built in 1995 or it is 3100 sq/ft if you include the finished basement) has appreciated on average 1.75% YOY which is less than inflation. So in 17 years it has appreciated a total of 37%. ($186k to $255k) My total repairs and maintenance over these 17 years is higher than my appreciation.

I also own a rental home that is still below peak 2007 prices. Heck..it is still below 2003 prices but rising.

Guess what….. unemployment is at 4.3%.

Somewhat jealous of the price appreciation in SoCal. But on the bright side property tax is only around $3500 /year (until all the state pensions implode…lol) and the HOA fee of $250/year pays for a well kept community pool and a nice playground park.

No bubble in this area.

“for a business to stay in business that business at some point turn a profit”

well maybe someone should tell amazon and Tesla that?

Exceptions that prove the rule. Plenty of existing unicorn companies awaiting the same fate as that of Pets.com, Webvan.com, eToys.com, etc.

Tesla might survive, but not as an independent entity.

You can only defy the Law Of Gravity for so long. Then we all know what happens.

The price of tulip bulbs went up and up. Until it didn’t.

Even they have to eventually turn a profit. Fortunately for them, they have the benefit of millions of investors pouring money into their ventures. However if they do not turn a profit eventually, even those investors will leave. For the common folks who run the overwhelming majority of businesses in this country, they do not have the benefit of horny investors looking for overnight wealth through stock appreciation. Thus Octal is 100% correct. Eventually they will have to turn a profit.

Whether it’s selling to customers or conning “venture capitalists” to keep dumping money in, as long as the money keeps coming in the door, it’s sustainable.

Frankly some of these companies are the biggest laugh since Bernie Madoff made off with so many rich fools’ money.

Didn’t Zell bankrupt the Tribune?

Sam Zell is a bubble blower himself. I lived in one of his residential buildings that was built as a condo so it had separate meters for all utilities. He charged us water and added a profit on the water, so he was making extra money on the utilities, aside from the exhorbitant rents. He also bought the LA Times newspaper and took out the local news. He is the epitomy of an opportunist, greedy and crooked. When he was in bankruptcy, he was allowed to buy more apartment buildings by the judge. He is the type of 1%’er that is a total creep!

You can preach “deferred reality” all you want. If you really want to be listened to, you better make some correct predictions on when to buy and when to sell. And so far, everybody has been dead wrong.

Looks like this guys knows how to play the game with his bankruptcy. A true 1%er at work!

The Wikipedia article on him does *not* make him out to be a knight in shining armor.

Commercial Real Estate investing is a dangerous business in today’s market. Leasing can be perilous at best, and with business failures at over 90% and many within-in the first year, only the well healed who are looking for tax loses should ever get involved in a such a risky investment at this juncture?

As a multi-unit investor, I have for the past couple of years been looking at expanding into the commercial space. But the crap I see on the market, I can’t possibly fathom how you could make a profit at the asking prices. At best, people appear to be breaking even, hoping that the market continues to grow. This isn’t really investing, it is speculating, and eventually there is no greater fool to on-sell to.

“…At best, people appear to be breaking even, hoping that the market continues to grow…”

Especially when you consider that commercial is based on hard core math and cash flow, unlike residential which is largely driven by emotion and granite counter tops.

I would think that commercial real estate depends on the use! For example, brick and mortar retail seems to be at the mercy of Amazon and other internet sales, i.e., it is getting increasingly difficult to stay in business! Others, such as healthcare, seem to be booming and probably gobbling up commercial space, but one has to ask, is the entire healthcare industry sustainable given rapidly rising costs, ever tightening wallets, and government subsidies for Obamacare/Medicare/Medicaid, whose checks are backed with ‘funny money’! On the other-hand, anything related to technology seems to be unstoppable!

When I got into a large local art store and they don’t have the most basic stuff, when I go into a music store and a trumpet mouthpiece is $20 more than online, when I want to learn brush lettering and a lettering brush – if one can be found which it can’t locally – is $30 while online from Dick Blick or Jerry’s Artarama or a very underappreciated local California place, it’s $6 or so … I’ve been holding out so far but when I start buying off of Amazon I won’t shed a tear for the incompetent brick-and-mortar stores.

Up in my area we just lost a very large, good, used book store. The genius who owns it and ran it into the ground is now moving the whole thing to Gilroy, where I suspect there will be a huge liquidation sale in 6 months.

The brick and mortar store has to support the rent, taxes, insurance, utilities, etc of a retail establishment. Amazon only has warehouse expenses and minimum wage temp worker type employees, many of them on Social Security. Yes, it’s a lot cheaper, but I don’t know if it’s a good direction for society to move in.

Roddy I had a friend who had a motorcycle accessories shop. He sold a lot of oil and tires. You can bet he made sure to have oil and tires in stock. Also lots of gloves, boots, helmets. The more exotic stuff, not so much, and it was as much decoration as sales stock.

Seeing a store that lacks the basic stuff that’s going to be 80% of your sales tells me, the owner is just sitting back counting their money and waiting until they can sell the building, in the meantime, leave it in the hands of incompetents.

Playa Vista.

Investors of Playa Vista should be praying. Soon as agents starting coining the name “Silicon Beach” I knew were in for some trouble.

I first noticed the term “Silicon Beach” in the Santa Monica Daily Press. Many years ago, they reported that “Santa Monica, which is known as Silicon Beach, yada yada…” They even ran local tech stories with the opening SILICON BEACH, CA, as though that was where the story was filed.

No. Santa Monica was not “known” as Silicon Beach back when they started reporting it as such.

I suspect the Santa Monica Daily Press was trying to please its advertisers, working together with the Chamber of Commerce and City Council to make “known as Silicon Beach” a self-fulfilling prophecy.

The Press even ran a whiny comment several years later about how “the rest of the Westside” (i.e., Venice and Playa Vista) was calling itself Silicon Beach, “a term which initially referred to Santa Monica.”

Pretty pathetic, all the pimping that the Press did for its tech advertisers and realtors. And their snarky whine, as if Venice and Playa Vista were trying to steal Santa Monica’s exclusive reputation.

Santa Monica has an established entertainment and technology backing. Venice is a revolving door for small software startups, but the creative office spaces are too small for a company to grow within and are now too expensive. Google has outgrown their binoculars building in Venice for example.

Playa Vista commercial properties is a big question mark. The bet is people will work and live close, as this sits on the worst part of the 405 (no road improvements). Lease and ownership cost on par with Santa Monica. So they are betting high with this one and hoping the idea “Silicon Beach” will sell. Like everything with technology lately…sell the idea worry about the product later. The density of Playa Vista is ridiculous it is not desirable, I don’t understand who would want to live there….Again, sell the idea first don’t worry about the product, easy money.

I had dinner with a neighbor last week. He is a 40 year veteran as a commercial broker for one of the biggest firms in LA. We talk life and real estate a lot. He sold his home last year after 25 years and told me that one of the biggest owners of office space in America has started selling almost all their office space. I think they know what they’re doing. Also he clearly says “we are at the top of the market.” There may be a little more left but not much.

Everyone knows someone and they know someone and who know’s what will happen. If you aren’t part of the Fed or inside Obama’s circle you don’t really know. In my job I still see tens of millions going into REITS and trying to chase a profit. My wife and I were about to put an offer on a home in Yorba Linda today but after watching a movie tonight, we feel like it needs to drop more or we will stay in our rental. It feels a lot better to stay in our rental than locking up a $2850 mortgage.

That’s correct, nobody has a crystal ball and can predict the future. Nobody could have predicted the wild ride we went on the last decade. Everybody agrees that things should have went much lower but the unprecedented intervention prevented it. The Fed, government, PTB did show their hand and everybody needs to learn from it. As I have said many times, base your home buying decisions on the facts that you know today because everything in the future is simply out of your control. If you are close to rental parity, you need to buy. To my knowledge, this strategy has never failed.

i pay $2,850 for a 2+2 condo rental on the 4th floor corner unit, in the heart of Playa Vista Phase 1… This is from an individual owner and it is not an apartment complex, but apparently the going rate is around $3100 I am told…

It’s absolutely insane, but I gave up on reason.

My wife and I have over $275K cash but no desire to buy here and overpay, the same place would cost me a monthly nut with HOA and tax of over $3500

I’m not so interested in the “friend who knows what will happen” – just on the information that the biggest owner of office space is selling out.

THAT’S interesting.

“The Fed, government, PTB did show their hand and everybody needs to learn from it.”

It has been the same hand as it always was and it has been shown many times before, including the times when it failed spectacularly. Just because some people caught on in 2008 doesn’t make this time fundamentally different.

I am sure your friend would be a wealth of advice, in past days. What your friend doesn’t know is what the FED will pull out of its rear next time to thwart a LONG past due market correction.

2009 began as a long past due correction but the QEs and the Blackstones and all of that leveraged money on the back of zero interest rates killed the correction in its infancy.

I think your friend is operating under the old adage ‘buy low, sell high’! It is also true that big money usually silently transitions out of markets before it becomes news and while they still have ‘chumps’ to sell to! I left So. Cal. housing market in 2014, and sold my investment property in the Denver area 2015. While prices are still going up, and perhaps I could have held on another couple of years, I’ rather have the safe gain, than play a potential game of roulette! Markets can turn very, very quickly!

Agreed, markets can change on a dime – to the downside. Inventory in San Diego County when I sold in 2004 was less than 5K iirc. Within 9 months or so it had more than tripled. Vegas, phoenix saw even greater increases in that time frame. Supply and demand, one needs to follow both sides of the equation to assess the market.

So many business unnecessarily buy their workplace. They have an area of expertise, their business. They should focus solely on that. Instead, they also go into the commercial real estate investment and management business, which is outside their area of expertise. Not only is their money spread too thin, but their time becomes involved in non-core activities. Formula for failure.

“..There are some things that a President Trump could do without any assent or cooperation from Congress or any other branch of government, while there are others like imposing tariffs that Trump could not do unilaterally. One thing that Trump could do absolutely without Congressional approval would be to deport 12 million illegal aliens. As to the feasibility of doing so, it could be accomplished quicker than many think. Current law gives an administration to deport any illegal alien.

Trump could use 100,000 military and law enforcement personnel to search every household in the USA. Assume that each soldier or police officer could knock-on or knock down the doors of 10 residences each day. It would take only about 150 days to search every residential unit in America, then round up and deport 12 million people.

Assume that those 12 million are now occupying about 3 million housing units. Thus, their deportation would leave 3 million vacancies. This would destroy the housing market. Home prices and rents would plummet. The departure of 12 million people would also devastate the commercial real estate market as well, especially retail. Trump’s camp is now suggesting that to get around the controversy surrounding his proposal to ban all Moslems from entering the country he could just stop issuing visas to everyone. That would destroy the hotel industry. The only real estate sector that might survive 12 million less people would be the extremely high end. This would be a continuation of the trend favoring the rich…”

http://seekingalpha.com/article/3975627

Illegals are clustered in certain neighborhoods.

If the police or military went into those neighborhoods, knocking on doors to find and deport the illegals, the streets would be filled with resistors, protestors, gangstas, and “human shields” composed of pregnant women and small children. It would get very ugly and bloody.

The violent anti-Trump protests are but a taste of what would happen if Trump tried to deport millions of illegals. Think Americans have the stomach for it, while the eyes of the world watch?

Not only that, but very poor areas tend to be within walking or biking distance of rich areas, because the rich folks have to have someplace nearby for their maids/gardeners/nannies to live that’s close by so their servants won’t be late to work.

I have a feeling Trump will not come close to even trying such a thing because his fellow rich are going to throw a hissy fit if they can’t have their cheap illegal workers.

Take a look at the satirical film “A day without a Mexican” which gives an insight to what life would be like if â…“ of the population of CA went back to Mexico. Not a great movie, but the premise could become reality.

https://en.wikipedia.org/wiki/A_Day_Without_a_Mexican

Umm, the violence is coming from the left and it shows how much they are afraid of this being done. Funny that FDR did the same thing. America takes in more immigrants per year then most of the world combined. Right now their needs to be a stronger border, there are evil people whom would love to come here and bomb the shit out of malls and tell you about it on youtube. Why not use the same immigration laws of applicants country of origin? good luck becoming an American citizen.

500K of the 20 million illegal aliens are working in the fields…There are plenty of high school, college and poor people to cut lawns, wash cars etc.

I don’t enjoy sticking my head in the sand, hard to make money, get laid and enjoy life. Reality is current immigration laws if enforced would suffice. The govt. is not doing there job. Obama is much to blame for this, he literally invited them up here by signing and bringing amnesty up without congressional approval.

Republicans and democrats same shit, 2 different piles, the big difference one earns their pile, the others are like remora’s attached to a whale..free meals and transportation…

Commercial warehouses are in short supply in Denver and the rest of Colorado due to the legalization of pot. Meanwhile, pot is being attributed to the run up of housing in Denver because profits from pot are being plowed into real estate. Since many banks won’t lend to the marijuana industry, many entrepreneurs are moving to the state to start their own “extralegal†marijuana-growing operations, buying up homes in cash and driving the prices up.

http://www.denverpost.com/2014/03/10/pot-growing-warehouses-in-short-supply-as-demand-for-legal-weed-surges/

I suspect Trump would grant amnesty in exchange for cutting off the remittances. The big beautiful wall is financial.

Because a poorer Mexico would benefit the U.S. in so many ways…..

That’s actually possible. The remittances go through money order places, all that has to happen is to have them refuse on penalty of some punishment. Of course we’ll end up with smugglers smuggling cash across the border, but those can be caught. It’ll make it a lot harder for someone who’s here illegally and is sending money out of the country.

You can’t stop people from sending money back to Mexico. Businesses would pop up all over the world that would accept payment and forward it to Mexico for a very small fee. For example, a bank in Spain would issue debit cards to Mexicans in America. They would be available over the Internet and at local vendors in all the barrios. You put cash on the card, and it goes from the bank in Spain to Mexico. The bank takes 1/2 of a percent. It’s a totally automated cash cow.

You would have to stop all money from leaving the US.

A poorer Mexico as a potential knock-on effect wouldn’t be the point.

“You would have to stop all money from leaving the US.”

Not all of it has to be stopped, just enough of it to put the squeeze on the destination government to bring them around.

If this happen first time home buyer and local American will be very happy jobs and houses will go to deserving hard working American people I’m not particularly happy with the current status of immigration in this country.

USA can help those people in a different way but don’t help them at the expense of American people’s tax payment

For once US must think of his own people specially the growing numbers of homeless American people, it’s a shame that the greatest country in the world has more homeless people than Singapore and other Asian country wake up lazy and dumb politicians go trump do it clean this nice country of illegals and crime drugs gang will decline too

I’ve talked to quite a few homeless/marginal people here in California and while not all, most seem to come from a high-tech background. There’s also a lot of untreated mental illness.

Of course it’s very profitable for the “poverty pimps”. How they work is, they’ll collect money from the government from local up to the federal level, plus a good poverty pimp operation is also getting a building to work out of for free, tax-exempt status, and also getting donations out of which they can “skim” the best stuff to sell for profit. Common figures are for the average poverty pimp organization to take in say $50k per homeless person, spend maybe $5k on them, and keep the rest. It’s not a bad racket, actually.

I predict within ten years government buildings in California will fly three flags; an American flag, A California flag and a Mexico flag.

You already see the Mexican flag here and there, like on Cinco de Mayo. Or in front of stores that sell Mexican goods, occasionally.

We’re in a two-tiered society. The ruling class speaks English and the gardeners, cooks, etc speak Spanish. Every restaurant, I don’t care what kind of food, has a bunch of Mexicans in the kitchen, washing the dishes etc even if not cooking (a sushi restaurant is *not* going to have Mexicans making the sushi).

Steve Sailor of iSteve dot com talks about this – the US is merely coming more to resemble the rest of the Americas except Canada, where the ruling class is lighter-skinned and the working class is darker. Yes, we have a lot of pale-skinned working class people here, but they’ll become submerged into the darker-skinned masses, marrying as they do for compatibility and fondness, rather than for the preservation of caste.

I have no personal problem with this; after growing up around Japanese (ruling class) and Pacific Islanders in Hawaii, let me just say right here that I love Mexicans. It’s a very kind, family-oriented culture and for every mean young Mexican hothead who sucker-punches a Trump supporter there are like 1000 who are really nice people.

Also I was explaining to the Mexican wife of my employer*, who pointed out to me that the immigrants are not all Mexican but come from all over South American too, that in the eyes of whites here, since they passed through Mexico, they’re all “Mexican” and nothing is going to change that. Sneak through Mexico in fear of Mexican soldiers, cops, and their own version of “la migra” to get into the US? Congratulations, you’ll now be called “Mexican” for the rest of your life!

*My employer makes a pretty good wage, and fancies himself middle-class, but he’s working-class as the say is long and won’t admit it to himself. His family consists of himself, two fully Mexican sons of his wife’s with a former husband, and one half-Mexican daughter with him and his wife, who will always fill in “Hispanic” in every official form ever.

Mulitfamily investor as well here. Rents are bubblicious. When jobs get hit rents will get clobbered, again. These BS proforma cap rates that people have been buying on will smoke them. I get brokers all day contacting me about my buildings and telling me about unrealistic proforma rents that are like $100 above what is realistic in the area.

Our bldg is doing fine, knock on wood. The dry cleaners have been in business since the ’80s, the catering business since the ’90s. All apartments are full. Our dad bought the bldg in 1963 and we held on to it.

Note to self: Buy building 53 years ago. Got it. Really, congrats on keeping it in the family etc.

I guess I could have told commercial RE is in full-on bubble because the guy I work for wanted to buy a building. “Commercial real estate, I’ve observed for years, is separate from residential real estate, the prices have no relation to each other” he said. This sentiment lasted only until I walked into a commercial RE office, told them what we wanted and our budget, and the agent really did do a thorough search, and of course we can’t afford a dog house here. That shut Mr. Unrealistically Optimistic Boss down right quick.

His latest thing is a circuit using a MEMS device, he’s convinced no one else has thought of it. 5 minutes on Google showed me that many people have been thinking about it for a couple of decades.

I think it’s boundless/brainless optimism like this that keeps the boondoggles going so long.

Um…okay?

I guess what I’m saying is, my employer is a quintessential Baby Boomer and has this boundless enthusiasm because he grew up in an age when boundless enthusiasm worked.

He honestly thinks he can buy a big building for $200k now, that he can come up with an idea and no one else has (the MEMs device idea is but one of many that 5 minutes on Google have shown to be old hat) that all he has to do is be enthusiastic and the money will come trooping to his door. This was actually not a bad way to go through life in the 1950s and 1960s, started to sour a bit in the 1970s and 1980s, during which he went off to England to keep the high-pay party going for a bit longer, but these days it’s a freakishly unsuitable way to look at life.

Gotcha. I’m a very cynical Boomer myself 😉

Hey all. have you seen just how much is going on in Downtown LA with regard to commercial real estate?

Check this out, hopefully the link will work if not, go to LADowntownNews.com then click on ‘development’.

There are over 100 residential and office projects going on now in Downtown LA.

In my mind these 100 investors, developers know something we dont… perhaps a burgeoning need for living and office space?

Did you know there are also over 10,000 residential units being built in DTLA and another 15,000 in the pipeline.

http://www.ladowntownnews.com/development/the-boom-continues-updates-on-downtown-projects/article_e40426a8-2293-11e6-9ce3-53e1fe72dd1e.html

Or it could be the typical indication of a bubble.

Yeah, remember all of the half-built and unoccupied new housing projects littering the Hollywood area after the last crash? I think we’ll see that again.

GH, something I remember (more than once throughout multiple cycles) is how quickly some new buildings convert to rentals when the purchase market falls just before or after their completion.

90% of downtown LA is gross and smells like piss. 10% is nice and that number is getting bigger. Just remember, you can’t move skid row and the largest concentration of homeless in the country.

They need to clean up dtla full of homeless and smell like piss and human feces. Most of the developer are in partnership with Chinese investors. somethings fishy here if all the apartments and condos rent are higher than buying a house who will rent all this apartments?

“Values” or just “prices”?

Think about it. There is inflation built into the equation, even if government statistics tell us there is no inflation going on – think about the prices you pay nowadays at the grocery store compared to one, two, six, ten years ago.

Ditto with real estate “prices”, not necessarily “higher values”.

What drove warehouse space prices through the roof was legalization of pot. I’m in a market to buy some warehouse space for my business, but with current prices I guess I will keep leasing, and will just look for land to buy and build.

Warehouse space prices went through the roof in every state after legalization: Colorado, Oregon, California, etc..

There will be commercial buildings available soon. People don’t have money to shop like they use too.

From Time magazine online: a short list of stores closing

Wet Seal: 500-plus

Office Depot: 400

Barnes & Noble: 223 (through 2017)

Walgreens: 200

Children’s Place: 200 (through 2017)

Aeropostale: 175

Walmart: 154

Finish Line: 150

American Eagle: 150 (through 2017)

Sports Authority: 140

Sears/Kmart: 128

Chico’s: 120 (through 2017)

Pier One: 100 (through 2017)

Sports Chalet: 48

Macy’s: 40

Gap/Gap Kids: 35

Target: 13

J.C. Penney: 7

If you need big box real estate look for the old Haggen market or Albertsons stores. We have one in Redondo Beach that’s been an eye sore for almost a year now.

This is bad new imagine how many will be jobless. I bet they will sell the land to highest bidder and greedy investor.

Why this is not a national news, are the fee hiding something that we don’t know regarding the economy of this country.

Anyway I feel bad for this.

More likely the places will sit empty for years. We finally got a Sports Authority in my berg about 2 years ago, now its closing down. In the same mall is a Kmart (dying) and a Pier One (Dead) plus a number of vacancies that have lasted years. Retail is dying on the vine in a lot of places that aren’t near the DC/Wall Street trough and thats because the customers wealth is evaporating – hoovered up by health care, education and housing mafias all enabled and abetted by Uncle Sugar.

They get bought up by large investment companies and then they sit empty. What I want to know is how much counterfeit money is coming out of China? By way of N. Korea maybe? It just seems so overvalued to change RE values all over the world.

Smithy – The only one of those I go to is Target, only because they’re the best place around my area to buy rubbing alcohol, foot powder, Ziploc bags, Scotch tape, stuff like that. Their supermarket area is Meh, but they’re pretty decent for basic clothing items like underwear too. They do well in my area (San Jose, CA) because there’s no Wal-Mart nearby. Most people live and shop within a relatively small radius, that can be covered by walking, riding a bike, or taking the bus. So our Target seems to be doing fine. As for the rest of those, there’s nothing there you can’t get at Ross or garage sales.

Try the dollar stores–you can get almost everything at dollar stores now including food and the prices are much cheaper than Target. Besides if you are a woman, you don’t have to expect to see a man in the women’s restroom like you might see at Target.

Siesmic – you get what you pay for, and the wife of my boss is all about dollar store and discount shit and that’s what she tends to get for her money; shit. For instance, I do may laundry at their place once a week and they were out of dryer sheets, well, of course there’s cat hair everywhere and without the anti-static action of a dryer sheet, the dryer can’t pry all the cat hair off of clothes and I ended up with with hairy clothes. Yuck! So, I decided I’ll just buy some dryer sheets and got a big package of Bounce ones at Safeway, for $4 or $5. No big deal. Well, when I brought them over, she’d gotten more of her cheapo ones, and I worked the math and figured out that my name-brand ones worked out to be cheaper. Tons of things work this way.

i see for sale sign after for sale sign, prices jacked to high and not very many sell in a timely manner..the reason the prices are jacked is the counties are to greedy and want the tax dollars..

Freewil that’s right counties are so greedy and always run out of money because of all the benefits they give to illegal immigrants in this countries. The higher the price the higher re tax, but the taxes its not going to low cost housing and building houses. It goes directly to feed and pay for the medical cost of all illegal immigrants.

My friend is doing it right. He bought a commercial bldg. in LA, near Skid Row, for $465K in 1999. He said he will sell the bldg. before the end of the year for 4.2M, (which he was offered) then buy acreage in Austin.

I think he is selling the commercial bldg, at exactly the right time, but I told him to hold off on buying his land in Texas till after the election and wait till the bubble pops. He’s got the money so he doesn’t want to wait. At 62, he feels that time is short and not to wait for bubble-pop.

Jed I think your friend make a good decision to seek it now than wait for the market correction Austin Texas is a good lad to invest in re now Texas is in the up swing in re value

Your friend may want to rethink Austin, Texas. If there was ever a frothy RE market in Texas, it is Austin. I think Austin has had double digit RE gains for over a decade, is that a sign of a bubble? No surprise to anyone that many of the buyers there are from out of state (lots of Californians). I’m sure your friend is well aware of this. Just something to consider…

Congrats to your friend for buying right, and selling right, but he should sit tight and wait for things to tank. Places outside California are starting to charge California prices for sale or for rent, that are unjustified – it’s just frothy bubbles.

For instance, I kind of know someone in New Orleans, and have been “watching” the place for a few years. They’re asking California level rates for rooms there, and real estate in any place there where you won’t get killed is reaching California levels too. It’s just not justified. New Orleans was dying and had lost tons of population until it became the “hip” place to go and party. Aside from its being a port, that’s all it has going for it; tourism. The crime rate is sky-high, jobs are low-paying, and it’s hot most of the time and full of bugs. And floods periodically.

The time to buy is when nobody wants to buy.

Might want to indicate a raft will be needed for any potential flooding in the future.

Purchased my 4-Plex for $750k. Zillow “zestimate” has it at over 1 million.

Should I list it for sale? Only bought it a month ago. lol

Too bad Zillow has that stupid SOLD FOR $750k on the damn listing.

Home-equity line delinquencies jump:

http://www.marketwatch.com/story/a-decade-after-the-bubble-home-equity-lines-show-signs-of-strain-2016-06-06

From the article:

HELOCs come with 10-year grace periods, so 2015 marked 10 years after the frothiest borrowings. In March, delinquencies were up 87% compared to a year ago among 2005 second lien HELOCs – those that stand behind a mortgage on the property – data provider Black Knight said Monday.

HELOCs taken out in 2005, 2006, and 2007 make up 52% of all active lines of credit, suggesting delinquencies could remain elevated for some time, Black Knight said.

There are about 850,000 2005 home equity lines, and 1.25 million each for 2006 and 2007, totaling about $192 billion in all.

Thanks for the post. This probably will not have any impact as the 192 billion is about 1.6% of all the tota market value of all homes.

“The problems in the subprime market seems likely to be contained” — Bernanke, 2007

I like John Hussman’s approach to the question of what will happen over the next few years, whether it’s real estate, stocks, or anything else. He doesn’t try to pinpoint the next market decline, he looks at probabilities of any significant return over an investing time horizon. The higher the price you pay today, the less likely you’ll generate a significant return over the next five to ten years or so. Most (or all) of the profits have already been realized by the people that sold the investment to YOU.

It’s possible that commercial real estate could continue to go up from here, but over a reasonable hold time, what’s the likelihood you’ll generate any significant return? Based on today’s prices and rents, it seems low, so it probably would make sense to sell any commercial investments and not buy any more until prices settle to a level where you’re likely to generate a good return again.

This is how I feel about the single family homes in supposedly gentrifying areas of Los Angeles. You are supposed to get a deal for moving to one, but people trip all over themselves and pay Silverlake prices in Highland Park and other areas. The sellers collect all the future gain as if the area didn’t have a long way to go. It’s just full faith that it will get there, however if the economy tanks those buyers are now stuck in hood.

Can I ask someone what the effect of min. wage increasing to $15/hr in the next five years will do to the booming rental market? Isn’t the main driving force behind the min. wage increase due to rising housing costs, namely rent? So it must have a profound effect on the rental market. That fact can’t possibly be ignored by developers so what do y’all think?

Doc: Great article. But don’t forget The Fed’s role!! https://anthonybsanders.wordpress.com/2016/06/07/is-commercial-real-estate-in-a-bubble-yes-for-apartments-and-office-cbd/

I have heard some new apartments complexes in Washington state don’t have to pay taxes for 10 years. Nice deal for some investors.

This Pasadena Flip Gone Bad to Worse that I’ve been watching — the one with the new, bizarrely small “swimming pool” — has gotten Still Worse: https://www.redfin.com/CA/Pasadena/2175-Loma-Vista-St-91104/home/7202612

Bought last year for $840,000

Extensively remodeled.

Now offered at $829,000

Crushing it!

My wife likes the home from the inside but the pool is soo stupid. What a waste of a pool/jacuzzi. We would be willing to make a play at this house around 600k but of course they aren’t crazy to drop it around that more reasonable price. I hate that gates in the backyard, no privacy. Now that I think about it more, this home is worth around 500k which makes it about 290 per sqfoot because schools are garbage and the backyard is a waste with no privacy, no attached garage as well.

More like expensively remodeled.

I got outbid by a $100 K on a house. They want me to counter offer, I said, no thanks!

RL good decision that’s ridiculous man 100k but there is still dumb buyer out there

1929 was the last true real estate collapse in the USA. It took 40 years to recover from it.

I must say we”ve had three busts since 81-82…1993, 2001 and 2008…all with even bigger booms that followed. But interest rates were at 18% in 1981…now they are about 3%. If equity prices collapse this housing bubble will make 1929 look like a firrecracker compared to a hydrogen bomb.

You folks have no idea what a real and sustained bust in fact even is…let alone what the collapse of the money itself means.

You’ll be lucky to sell your house for an ounce of gold if North America collapses in a hyper inflation.

Leave a Reply