American housing too expensive and the multi-income trap will not save the housing market. Banks have laundered their bad bets through the Federal Reserve and GSEs while working and middle class income has eroded.

The banks have an effective way of laundering money. First, they proclaim that they are turning a “profit†with TARP funds but fail to mention the trillions of dollars of leverage they garner through the Federal Reserve. The cost is indirect through inflation and the debasing of the U.S. dollar. Next, Fannie Mae and Freddie Mac just announced that they might cost U.S. taxpayers $368 billion. Maybe I learned finance incorrectly, but a $368 billion loss is not a profit in my book. Fannie Mae and Freddie Mac don’t make loans directly to the public but allow banks, the same robo-signing variety, to issue loans on their behalf. These losses are merely a reflection of their horrible lending practices and a sophisticated method of laundering money into the economy by debasing the value of the U.S. dollar. That is why today, when people ask me what is at the root of the housing problem I tell them that home prices are simply too expensive because incomes are weak.

The reason people bit into the toxic mortgage apple was because they were falling behind on household income and felt they needed to use financially destructive products that allowed them to have too much leverage for their actual household balance sheet. It is a matter of what you can safely payback.  If banks and individuals were allowed to fail for these bad bets, so be it. The end results aren’t even that bad; millions will now need to rent and we will have fewer bank solicitations in the mail). Yet the majority of prudent Americans are financing this casino and housing mess. How about loan modifications for the vast majority that do pay their mortgages on time or tax breaks for renters that do pay their bills on time? With new Census data leaking out it is obvious that multiple income households and deep debt have masked how far we are from finding a balance in the economy.

Two incomes not enough for middle class life

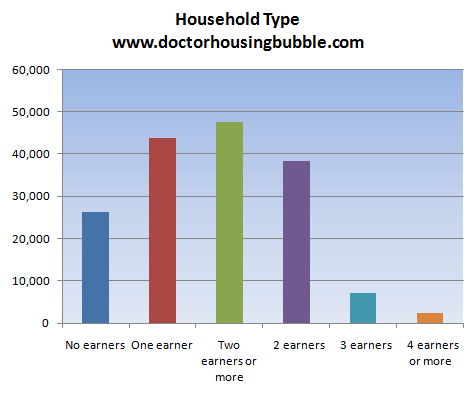

Source: Census, thousands

I was digging through the new Census data and broke out households by earners. Ultimately people have to pay for their mortgage and other bills with an income. Presumably this income comes from a job (no-doc loans provided a way to avoid this tiny issues when purchasing a home). But even now the biggest group that we have is households with two earners. This is definitely a reversal from previous times in our history. Yet it has gotten progressively more difficult to have a middle class lifestyle in the U.S. I think housing is the ultimate symbol of the American Dream. This isn’t to say that this is good but this has been a heavily ingrained belief for the last couple of generations. I think the generation that grew up in the Great Depression might have something to say about housing being a fantastic investment but that population is largely not with us. The collective psychology has purged those terrible memories but we are recreating our own today.

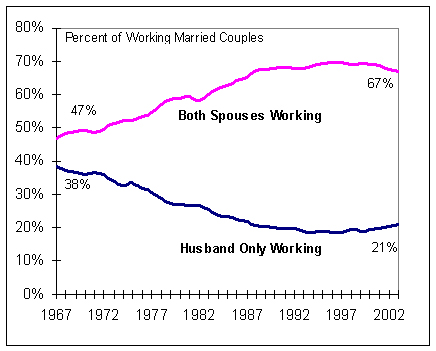

Much of the costs of middle class life have been buffered by women entering the workforce:

Source:Â Tax Foundation

In 1967 47 percent of working married couples had both spouses working. In 2003 that number is up to 67 percent. This number is now lower because the data above only goes out to 2003 before the depths of our current recession. So you have two incomes now flowing into one household but individually, these incomes are lower on a per capita inflation adjusted basis. Did people actually become wealthier over this time? The numbers seem to suggest a different trajectory.

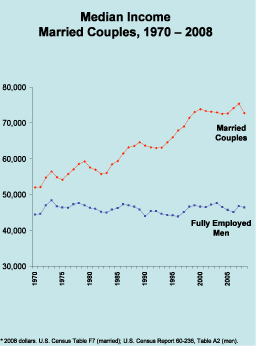

Wages stagnant for individual workers

It should be no surprise that two incomes are better than one. But if we separate it out for the individual worker incomes have been stagnant. And recently, even married couples have seen their incomes falter as many households are seeing one spouse without work and trying to adjust to a one income household. A one income household in 1970 might have provided for a middle class lifestyle but today that is largely becoming a distant dream.

The current median home price in the U.S. is $178,600. The median household income is $50,000. Overall, housing prices are too expensive based on the income of U.S. households. Take a look at this data:

1970

Median U.S. home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $17,000

Median household income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $9,300

2009

Median U.S. home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $178,600

Median household income:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $50,200

Even today, with the majority of households having two incomes home prices eat up more of a household’s income than back in 1970. The only reason the Federal Reserve is pushing interest rates lower is because this is the only way they can hide the shrinking buying power of the American middle class. Just look at the data above. In 1970 it took about 2 years of an annual household income to buy a home while today it takes over 3. Even on face value, buying a home is too expensive overall for the nation (let us not even dig into specific cities in California that are largely in housing bubbles even today).

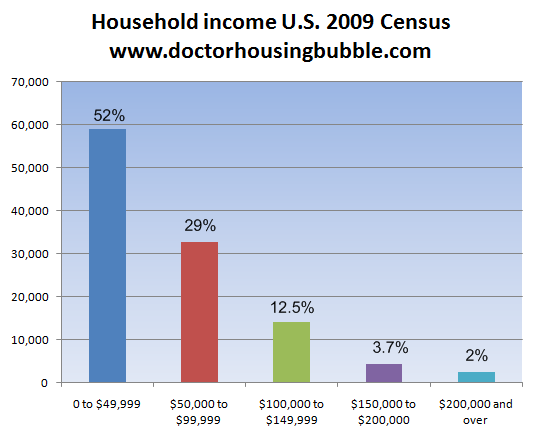

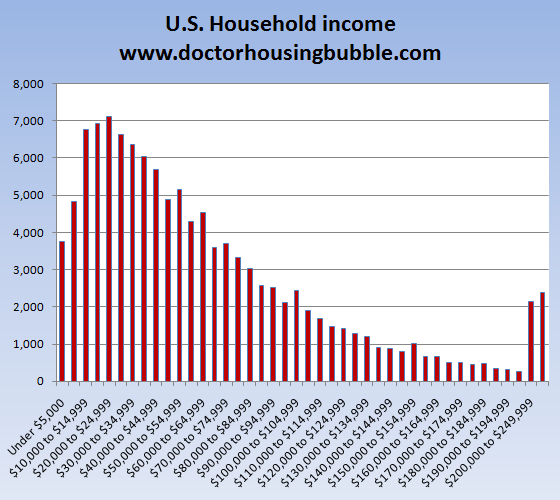

Income distribution shows a shrinking middle class

Source:Â Census

The ugly secret that the media wants to ignore is the erosion of buying power for the middle class. Take a look at the above chart. Even at the median home price of $178,600 over half of the households in the U.S. are ruled out from being potential buyers. No household making $49,999 or less can afford a median priced home. Even the next group of those earning $50,000 to $99,999 will have a stretch depending on where they buy and on which side of range they fall on. We can break the data out further:

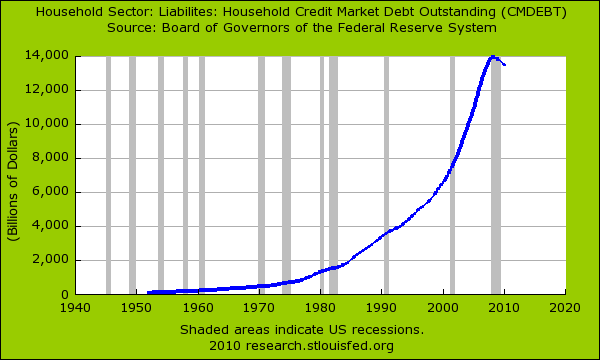

Even more troubling is the number of households that live on $25,000 or less each year. It is important for this group to have affordable rents. So why are we pursuing policies that purposely keep home prices inflated? It is no surprise that all this middle class living has been accomplished merely by going into massive amounts of debt:

Our economy since the 1970s has started making up for the stagnation of buying power by supplementing purchasing power with debt. Now, we have students routinely leaving school with $50,000 to $100,000 in student loan debt. This was virtually unheard of in the past. Will this group be able to buy a home? Or what about all the people with incredible amounts of credit card debt? Never has the U.S. had so many people encumbered with so much debt. When you purchase with debt you are promising future income for current consumption. With the housing bubble, we have committed 5 to 10 years of future income to current home prices. Yet the economy did not grow and wages certainly did not. So now, a correction must occur and is occurring. All these stop gap measures are simply covering up what no politician wants to admit. Many banks must fail because they were on the wrong side of the bet. Instead, we are allowing banks to launder their mistakes to taxpayers through Fannie Mae, Freddie Mac, the FHA, the Federal Reserve, and other gimmicks that allow banks to siphon off more capital from the actual real economy to pay for their multi-decade embezzlement. This is a zero-sum game here and banks are raiding the public’s wallet.

Things today have turned into a circus. How are banks turning profits when 26 million Americans are unemployed or underemployed, are seeing their incomes slashed, and are seeing their home values decline? Even multiple incomes can’t cover up this mess anymore. I’m not sure if the public overall really understands the complex laundering system setup by the banks and how they have sucked away productive capital out of the economy. This mess happened for a reason. This wasn’t an accident. How else did Wall Street hedge funds start placing bets on the housing market imploding starting back in 2006 when home prices were still at their peak? Some people clearly saw this happening and in many cases these were the same people putting together the mortgage backed securities that would later implode the banking system.

While banks announce wicked profits keep looking at the income data for actual working Americans. There is a direct connection here. Those losses of Fannie Mae and Freddie Mac originated from these same dubious banks and will be paid by the taxpayers. You don’t hear them bragging about TARP in this scenario.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

112 Responses to “American housing too expensive and the multi-income trap will not save the housing market. Banks have laundered their bad bets through the Federal Reserve and GSEs while working and middle class income has eroded.”

Someone making $49,999 a year cannot afford a $178,000 home? Interesting….

I heartily disagree with that observation and even further with the “50,000-99,999” range “barely” being able to afford a $178,000 home.

I’m not a homeownership cheerleader, but that statement is only fodder for “permabears”. High school level personal finance says that you can spend somewhere between 28-32% of your gross income on mortgage related housing expense (front end ratio). A $178K house in CA would have a tax burden of about $2,000 a year (give or take) or $166 a month. With 20% down (which no one who can’t scrape that together should even consider buying a home) that would leave a mortgage of @ $142,000. At 5% (which is high for today), your payment is $762. Add taxes and insurance and you’re in the $1,050-1,100 range… which is below the 28% front end ratio.

Not every kid graduates college with $100K in debt. That’s absurd. My two kids graduated without a dime of debt (and their UGMA accounts intact with sums in the low 5 figures). To say that all young adults are “buried” is a gross overstatement of fact. More gloom and doom. Certainly, there are fools that felt they needed to hock themselves up to their eyeballs for that degree from some pedigreed university – while majoring in underwater basketweaving – and now un or under employed. No one can protect a fool from themselves. Where were their parents?

I’ve come to terms with the reality that most people are not fit to handle debt. This applies to anyone in the past, present and future. However, if certain regulations are in place, perhaps they can. For instance, anyone who applies for a credit card or loan should have to go through schooling and earn a certificate for basic financial education before getting authorized for one. This will not minimize risk, but I’m sure it would lower it.

If you close your eyes then the problems don’t exist! Your children graduated debt free, therefore, all those with significant student debt are fools. Nevermind that schools cost tens of thousands of dollars a year, I close my eyes and it doesn’t exist! Its preposterous!

And of course, everyone earns 50k a year and its easy to afford a 178k house. See, here is the math. Its easy. No student loan debt, of course, 50k jobs are plentiful in those areas where housing costs only 178,000.

Of course, of course. You’re all just permabears. Everything is rosy and cheery!

Hahahahaha. It must be nice to see the world through rose colored glass even if it bears little resemblence what what is really happening in the trenches. You MUST be a boomer.

El — perhaps you find the narrative doesn’t comport with your personal experience, however, the charts and the census data are not anecdotal.

You’re projecting here. It sounds like you were a responsible parent with responsible kids, but don’t mistake your situation for the rule; is is very much the exception. Again, review the charts.

“High school level personal finance says that…”

That’s the problem with Americans today… they think they’ve already learned everything they need to know. The economics class they took in high school — taught by the football coach, who also happens to teach driver’s ed in the summers — is sufficient for them to understand all of the risks involved in buying real estate. The Doctor is right — 50K a year is not enough to take on a 178K mortgage. If a family makes 50K a year and has a 178K mortgage, that family is basically living paycheck to paycheck, and they would not be able to withstand a few months of unemployment.

When I graduated college, my starting salary as an entry level engineer was just over 60K. Initially, it seemed like a lot of money, but I quickly realized that it wasn’t very much at all. I can’t imagine how a couple can get by with kids and a mortgage with just 50K, even accounting for the various tax breaks afforded to married couples with children. Perhaps they can make it work if they tightly control the rest of their budget tightly. But I believe this “ownership at all costs” mentality is a grave mistake that is ultimately harmful to their children.

Besides, what can you buy in California for 180K? A run down house in a bad neighborhood? A tiny studio condominium? Or maybe a big house in an area crippled by high unemployment and lack of opportunities — somewhere in the Inland Empire or in the Central Valley perhaps? The fact that your kids graduated without debt is a great accomplishment, El Katz. I think you should be proud of that. Clearly you understand the danger of excessive debt. But please, reconsider your bullish position on real estate.

A tiny run down studio condominium in a bad neighborhood is at least 200k in LA.

Can anyone find anything under 200k? maybe in the dessert?

There are some condos in middling areas of LA County well under 200k. They aren’t new condos, but the complexes have high rates of foreclosure and they’re desperate to sell. The schools are OK in some of these areas. Not 10 on greatschools, but more like 6 to 8. So they’re OK.

Average student loan debt (undergrad) is now $24,000. http://thechoice.blogs.nytimes.com/2010/10/22/debt-3/?partner=rss&emc=rss

Congrats that your kids are debt free from their experience, but, as a rule, moat are leaving their school years with a debtload that is way too high, and pretty much impossible to discharge in one’s lifetime. Student loan debt, as a whole, has surpassed total credit card debt in this country – it’s well over 800 billion dollars. Now, you tell me how this young generation can even think of buying a house with that kind of obligation to deal with, and, of course, the worst job market in decades. Not everyone of the little geniuses got a job at Goldman this year.

Katz, I see your point, but forward looking, 28 to 32 % of gross might become an outdated percentage. Someone has to pay for this mess. The dollar is on par with TP right now. 0 to .25% interest will not last forever. We are looking at a new normal, which will likely be 15 to 18% gross for a mortgage. That’s my limits. I want to own my house, not allowing my house to own me. I hate debt. Drives me nuts. But I’ll live with a 15 to 18% mortgage to gross loan payment. My overall debt to income ratio is also in the the same range, meaning, I will not take on debt beyond a mortgage if I go into that level of risk. That’s just me, I’ve become a cash buyer of everything outside of the mortgage.

you are a fool. a “ratio” fool to be precise.!

before paying for the mortgage, you should live. here is break up and I am single:

bus/train: $300-$400

groceries: $300+

cell phone: $80+

car: $670 (ok, I could have saved a bit here)

insurance: $119 – $190 (NJ sucks; depending where you live)

gas: $200

rent: $1350 (1bhk)

utilities: about $250

this alone is adding up about $3300 and no funding for cigs and alcohals and entertainment and vacations and saving.

where do you have money for mortgage or for 20% down?

as I said you are a fool.. and don’t say that your crap housing is worth more than what you paid for. It is financed by people like us who support moronic govt with our spending and our taxes (that subsidizes your taxes).

So your kids are debt-free. You have done the right thing.

My problem is with your logic. Plenty of kids are not debt-free.

To further pursue your line of reasoning: Since you have not died in a car accident, nobody has died in a car accident.

Not every area has the CA tax rate. A $178K house in Western NY has a tax burden of about $7000.

As far as Mr. “Where were the parents” when students assume a large student loan debt, the parents are usually the ones who have trained the children from birth to believe they must go to college at any price. As a result, “any price” becomes the new tuition rate each fall semester. I love it when the smug “personal responsibility” types crouch so low as to blame 18 year-olds for a lifetime of conditioning. The university system is itself yet another bubble waiting to burst.

A $178K house in CA? Where exactly is that? In the desert?

You could probably find some rat infested REO in West Oakland for $178k. Your kids would have to join the local gang to keep from getting their throats cut on the way home from school.

As for student debt, my parents were not in a position to assist me when I went back to school at the age of 30. I left my job as a union foreman to go to engineering school and graduated with about $72,000 of debt. It has gotten me a new life, one with a future and much less uncertainty. I saw tuition increases of 15% every year but one of the five it took me to get my degree, that last year they “threw us a bone” an only raised it by 10%. University costs are out of control and I wholly agree with the previous poster that it is the new debt bubble. My situation is manageable, I have a great job with nothing but pay increases for the next 25 years, so $435 a month is not going to kill me. Many students are graduating with an excess of $100,000 in debt and going into jobs that pay very little in comparison, like social services, teaching, etc. Those are the kids who have really been taken for a ride and left with a very sad future.

Have a heart, not everyone has the options open to them that you kids did El Katz.

Yes in the desert. My folks got a 5 bedroom in the Antelope Valley for $177K earlier this year. Upper middle class neighborhood, the works. But unemployment in the AV is worse than most of LA County.

“Yes in the desert. My folks got a 5 bedroom in the Antelope Valley for $177K earlier this year. Upper middle class neighborhood, the works. But unemployment in the AV is worse than most of LA County.”

Upper middle class neighborhood, in the Antelope Valley? Or do you mean upper middle class neighborhood relative to the area.

You assume that someone who earns 49,999 somehow has managed to save up $35,000 for a 20% down payment. How many Americans do you think have accomplished that at that income level?

1. What can you buy in Ca. for $178K? You will get a much nicer rental house for the total cost you describe here. Plus, what no one ever seems to calculate, a house budget should facto in 1-3% per yr for maintenance!!

2. When you look at total taxes paid on the $50K income, and subtract out your housing costs, this leaves very little for “other”; savings, vacations, utilities, clothes, etc. $50K/yr. shoulc pay no more than $150K for a house.

178k gets you a dumpy house or a so-so condo, but it’s an ok deal. The rentals in the same neighborhoods are roughly the same cost as the mortgage on the house – sometimes higher. I live in one of those neighborhoods. The only downside is that you have to stick around with the house for it to pay off. The schools aren’t good.

It could work for some people, though. If you don’t have kids, or if you are highly educated and your personal level of education can shield your kids (if you have a dual Masters or dual PhD couple, their kids are likely to get advanced degrees).

“High school level personal finance” – someone please show me the high schools that are teaching kids about personal finance.

There is a reason why so many people are bad with money/debt. You take 12 years of science, and maybe 1 semester (if you are lucky) learning about personal finances.

True.

I attended one of the best public high schools in the country. No personal finance course. The only thing that came close was the 5th grade “Children’s Economy” project. That was great, but in 5th grade, you can’t really comprehend much nuance and it is too early to have much affect.

It’s probably safe to assume that the people that do best with managing debt are the people who’s parents taught them about money. Mine didn’t at all and I pretty much fooled myself into thinking that I didn’t need to concern myself about such things until my 30’s. Just as long as I could pay the bills, I was doing fine. I’d have a lot more money saved right now if I had paid attention to my finances early in life. Luckily, I have a high-paying job and easily got out from under the 60K in debt I incurred in college loans. Glad I chose a practical major.

I think many young people are just unaware. We do a great job teaching our kids that they should “dream big”, “reach for the stars”, and “you deserve the best”. As a culture, we are amazing at instilling confidence and desire to achieve. What we are horrible at is balancing that with an equal amount of pragmatism. Let’s face it, the former is exciting, the latter is boring.

el, what is your grass for smoking? In LA metro no city which gets close to say normal – wether, commute, ethnic mix, crime and schools houses start from 450K. Here we are talking cheapest crapshack, not the avarage house which is a match for the avarage income… Even in the getto where the incomes are lower than that 50K , houses start from 250K. On what planet you are living?

Hey El Katz, you want to tell me what part of California you’re buying that $178,000 house? That’s the nationwide average, not California. Sure, maybe in Stockton or Fresno, but Los Angeles, San Diego, or San Francisco/Oakland? Try $400,000.

El K-

Spending 28- 32 % of your GROSS income on housing is not good personal finance. It is buying the banking/housing industries BS hook/line/sinker to strap you with most debt they feel you can safely payback. Setting this standard with Gross Income is just absurd. Who lives off their Gross income? At 50k a year your after Tax- Net monthly income is somewhere in the $2000 range. So forget 28- 32%; your MUCH closer to 50% in reality. So now this your looking at a grand to pay the rest of your monthly living expenses. Ooooops !! Guess you shouldn’t believe everything your favorite real estate agent, mortgage broker, and personal finance website tells you. Good personal finance is about living debt free, not heaping it on.

True enough. But the places where most people can earn $50-99K don’t have houses or even condos that are only $178K. My county – the average 2 bedroom condo is still hovering more around $375-400 and that’s still too much to chew for me. If I moved to Florida, I could afford a house but I won’t be able to make a living wage.

Do you not have any friends? Or any relationships with others in this country.

Check the household income charts. I assume

Your obviously not of that income bracket nor

So you sound foolish speaking for them.

Spot on.

I would like to point out however that just because housing prices are out of whack with the past, it doesn’t necessarily mean that eventually it must return to the same ratio.

As our wages fail to keep up with cost of living our living standard must decrease and it will manifist its self in many ways, including higher home prices to wages.

That said I totally agree that many areas of ca. are still bubbly but I doubt they will ever return to the ratios of the 70’s or 80’s.

“Our economy since the 1970s has started making up for the stagnation of buying power by supplementing purchasing power with debt.”

No surprise considering the government authorized Fannie Mae / Freddie Mac to purchase private mortgages in 1970. There needs to be reform, but will the common people win the battle against a more cunning and resourceful foe?

Let’s talk about the home ATM for personal consumption.

We have all seen the HELOC abuse chronicled on both this site and the IHB.

Example: Think about a 100k household that bought a 300k home in the 1990s. Let’s assume that after all the usual payments/taxes that they have 20k a year for disposable income. Many (most?) of these people doubled their mortgage in a 5 year period from 2002-2007. An extra $300,000 or $60,000 per year was spent. Instead of spending $20,000 per year the “homeowner” spent an average of $80,000 per year. It appears that in 5 years, they pulled forward 15 years (at the $20k/year estimate) of spending. Now, they have to cut back to $20,000 again (if they still have jobs) which is essentially cutting their *disposable* income by 75%.

That’s gonna hurt for a long long time.

You are starting to not make any sense. I live in the suburban (San Gabriel Valley) and these properties out here are still selling fairly fast.

Some parts of the SGV are a really good deal. The schools are good or even very good, and the crime rates are low. Similar situations in the westside would cost in the 500K to 1M range. There are still sub-500k areas in the SGV like this. This is even after the “wealthy Chinese bubble” going on right now. I think the SGV has been overlooked while the westside grew. There’s always been prejudice against the SGV because the people here have been hicks, Mexicans, and Asians.

A $178,000 home is only barely affordable for someone making $49K a year.

Figuring on a down payment of 20% and 5% interest (and you are not likely to do any better than that, the lowest interest rate is hardly ever available), you will have payments of $764.43, BEFORE your house taxes, your utilities, your HOA, and repairs and maintenance. I’m figuring a condo with an HOA of $560 a month (includes heat), taxes of $300 a month ($3600 a year) and insurance of $50 a month. I won’t include electricity because it is negligible, about $25 a month in my case (even in summer). As I mentioned, HOA includes heat, so no gas bill.

The total payment is $1,674.43 a month. Out of my $4,083 paycheck, I will perhaps clear $3200. The payment will be half my take-home, and I must provide for food, transportation (cheap, thank God for public transit), clothing, HEALTH CARE, and SAVINGS with the rest.

Maybe the condo has a low HOA fee, but a large Chicago heat bill, about $200-400 a month; that is a big add-on to your housing cost.

Do-able for a single, childless person, but walking on the edge of a knife for a family.

I’m lucky, because I can buy a cheaper condo than that, and still get something small and nice in my city (Chicago). But forget about a SF house, or even a decent townhouse.

The old rule that prevailed before our leaders decided to make debt-and-gambling addicts out of us to line their own pockets and reduce us to beggery and serfdom, was that your housing expense should never be more than a quarter of your gross income. That was a good rule, but I know hardly anyone who adheres to it anymore. But it is the only way to be financially healthy and make room for emergencies and healthy savings.

good analysis, but I would also add 1-3% of the original cost of the home, as maintenance–people forget that.

In Calif we have become use to leverage and appreciation making up for the income gap both for homeowners and investors. Deflation in both commercial and residential

property will radically change this trend while their will be periods that reflect higher levels of activity in the coming years the long term term will mirror Japan.

Last night on Mythbusters, they tested the saying, “when the shit hits the fan”.

They were finally successful in showing that throwing simulated turds into a high-speed fan, did actually disperse the feces in all directions, and make one hell of a mess…

I’m not sure how exactly to draw the metaphorical comparison in this case, but it just got me to thinking…. Well, maybe this, the banks are the fan… and we are the….

On what are your doubts based? When there is no more money on the table, i.e. when the bid-ask spreads remains uncloseable, prices WILL drop–far. These myriad games by FED.GOD are only delaying the inevitable, a la Japan. Creating more .gov workers, propping up banks, Maiden Lanes I,II,III… XX, all just thin masks to fool those with their heads in the sand anyway.

In my bubbly zone (Miami-Ft. Laud), the latest NAR scam is to “sell” the house “officially” for $410K, but rebate $170K to the buyer “under the table”… keeps the comps at unrealistic levels… and keeps the fools fooled… at present, FBI seems preoccupied w/ bigger fish.

Martin — why do you doubt that prices will revert to the mean? This is basic economics; following any and all asset bubbles, prices correct to the mean. Do you believe that we can simply reflate the bubble or on delfate it a little and then patch it? Isn’t that like being only kind of pregnant?

The correction is protracted because of all of the measures devised by the Treasury/Fed to keep housing prices high. Geithner has made no bones about his intentions of keeping prices from falling. The thing is, the Treasury/Fed doesn’t have enough fingers to stop all the leaks, a major fissure being unemployment, among other things. All they have succeeded in doing is slowing the correction. Think about that: trillions spent to slow a correction…

:$178,000 home

I live in metro Boston, the starting homes are $400K+ in decent communities in and around the city. The median range is more $550K-$650K. In contrast, $178K is in the affordability zone for many office/white collar workers. That would be more rural Maine, rural New Hampshire, or an urban/slum-like neighborhood in eastern MA.

A downpayment, without PMI around here, is from $50K to $100K, depending upon the town/property. Personally, I’d rather have that kind of money in more liquid assets like cash, bonds, or precious metals. It’s easier to deal with a job loss with a few years of liquid *savings* for possible re-location expenses. The housing bubble, for many markets, isn’t over yet. The $178K is a straw man argument and is easily refutable.

I think much of CA real estate has had a price of 4 or 5 times annual income for many decades now. The median price in 1980 was about $175K and the income was not $50K.

Median price in 1980 was about $175,000…huh? In 1983 we purchased a new 3 bdrm/2ba condo in Yorba Linda for $92,000, instead of a new and larger single family home in Eastlake Village Yorba Linda which was priced at about $135,000 and considered unaffordable by us on our annual income of about $40,000.

+1 My parents did the exact same thing, ~$90 in 1979 for a 3 bed / 2 bath in West Yorba Linda. They were making a combined $28K/yr back then, and had a reasonable downpayment of ~13%. They are still living in that same house, it Zillows for$540K, yet they are now only making $118K/yr.

A common saying amongst the boomers in OC – “I could never afford to buy my house at today’s prices.” Well, neither can your children.

I think we need to get mortgage rates back up the 8% range and we will home falling like rocks. At that point it will pay to put money in the bank.

Also, we could have major inflation pressure with QE2 and the currency war with China. I don’t see these 4.5% rates that much longer.

The currency war is a bunch of propaganda. The US Dollar has considerably weakened equally across all world currencies and commodities these past several months. The US is trying to drag down the rest of the world without them but it won’t work. Rather, Europe is cutting budgets, China is raising interest rates, to save their economies.

:Currency wars

Currently China is the biggest owner of dollars, if they decide to dump them into market, no-one (and that means rest of the world combined) can buy them back. That means dollar ceases to exist as currency, it becomes Nigerian funny money.

That also means that you are playing with money that has any value because China wishes it so and there’s nothing US or anybody else can do about it now.

It seems to us (here in EU) that US isn’t even trying: Printing press is rolling on top speed year around.

Doctor;

I want to thank you for your excellent research and well written work. Your readers are civil and intelligent. I have learned a lot here.

Many pieces of this whole mortgage meltdown-fraud everywhere- and a complicit government too willing to cover it all up- have absolutely mystified me.

If any of your readers would like to see the best explanation of what happened- explained with precision and in fairly understandable terms, I invite you to watch the William K Black interview I have posted on my site. But I must warn you- there are some things you can not erase. Having watched this will place you in the minority of lunatics like myself- convinced that we have just witnessed the greatest heist in the history of the world without a single criminal prosecution to date.

http://thecivillibertarian.blogspot.com/

Multi Income trap??? Is the Doctor an Elizabeth Warren fan? haha.

All kidding aside, I urge everyone to view Elizabeth Warren’s lecture on the “two income trap”. It is probably the best analysis of the problems plaguing middle class American families today. Videos of her lectures are readily available online.

This is one of your best articles yet, Doc. One that gets to the heart of the problem — the erosion of the American middle class. A large portion of the middle class can no longer afford a middle class lifestyle. Instead, they finance a semblance of the middle class lifestyle through excessive debt.

The housing market will not recover until we confront the root of the problem. We need to rescue the American middle class.

60% of new college graduates have debt–an average of $22,700 for 2007 graduates, the College Board reports.

A person making $50K per year takes home LESS THAN $3K per month.

She must put aside at LEAST a few hundred dollars per month into her (stagnant) 401K before putting money into a down payment savings account. She must also pay her student loan, car payment, auto insurance , gas, auto registration AND (rapidly increasing) health insurance costs. She also has her basic household utilities, personal expenses and FOOD. Hmmmmm her money has already dwindled quite a bit.

More realistic that they can save 10% in a reasonable amount of time. So let’s say she decides to exchange her rent for a mortgage, taxes, insurance and home maintenance costs. Mortgage calculator says that a $178K home with 10% down will cost her about $1300 per month if you include taxes, insurance, PMI and maintenance.

That is a very tight squeeze if you are bringing home LESS than $3K per month.

Well yes but it’s also very easy to pay that much for a 1 bedroom rental in Los Angeles.

Well, the $1300 1BR rental is in a nicer neighborhood than the 178k house. The 178k house is in neighborhood where 1300 rents you a big 2br or tight 3br apartment, or a 1br house with a yard. So it’s worth buying if you need the space.

….and the month home ownership cost of $1300 per month is ONLY for folks with excellent credit. Other folks will be charged HIGH interest rates and thus can increase that monthly nut another couple hundred dollars.

The problem is flat out that home prices and rent prices are unaffordable for Americans who are recent grads, have children, etc. God forbid you’re divorced and paying child support and also trying to make ends meet, especially if you’re one of the souls who has lost a career and taken a significant pay cut in a new job.

New homes are being built that do not really suit the needs of Americans. Homes are being CHEAPLY built and sold for a PREMIUM. Look at the shoddy construction in the Tampa area where I live as an example.

We need to return to a housing market that is affordable. Home prices are too large a percentage of the average person’s income, largely driven by market greed, overvalued properties, etc. $1300 a month buys you a “there’s nothing special about this property” house that is cheaply made, basic, and on a tiny lot.

In my area, the folks who can afford new homes are either the VERY LUCKY folks who actually retired from the military before Congress could cut their careers early, or are military members who are given a sizeable housing allowance, or are dual income couples with well paying jobs. New home prices here recently jumped by $15,000, literally in 2 months’ time, and new homes are being built ALL OVER the area right now.

I think you’ve got to be crazy to sign up to pay $1300 a month–MINIMUM in my area–for new housing for 30 years. I see it as a recipe for disaster if you lose your job or circumstances change for some other reason.

Reading articles like these brings joy to my heart. The government needs to learn a valuable lesson about economics and the people need to fight when a government takes control of them and makes them believe that buying overpriced houses or paying high taxes is acceptable, therefore, an economic disaster like this is almost deserved. I have been complaining about this phenomenon since the start of the bubble in 2002-03 and when I told this to others they laughed at me and told me I was foolish, then shifted the conversation back to some reality TV gossip. Over the years, most of those individuals filed for bankruptcy when their investments caught up with them, which I got a laugh out of, especially the one with 3 kids who now has to live in a 1 bedroom apartment.

The point is, there are many of us here that haven’t bought houses and did the right thing and are not being rewarded for it. My allegence is to who pays my salary and who manages my affairs properly. The US government doesn’t do this, therefore I owe them nothing. The reign of the US empire is over and the death of our nation won’t be quick. Instead, it will be a long and drawn out suffering death and our inaction as citizens makes this terrible reality a well-deserved fate.

The 52% with household income under 50K do not have to pay income tax like the higher income earners. This group also demands more socialistic services from government(e.g. free school lunches that parents use to provide) which results in more government debt and taxes. The banks also get their government welfare. A Federal judge in California just ruled that the state can not cut the welfare that is in excess of the federal requirement without federal approval(do you think Obama will give approval?) It is the rest of us in the middle that carry the burden for these groups.

It seems we all benefit from a strong well financed Federal Government. I’m sure your clients making over $100K either work for the government or are employed by a company that receives large contracts from the feds. Without federal intervention of shoring up out banks and trying to stabilize our economy we would end up like Mexico. If the feds allowed Bank of America, Wells Fargo and others to close their doors, where would we cash our payroll checks, or worse yet, 401Ks, stock values lost for ever. As a small businessman myself, I understand financial sacrifices are painful, but once again grateful that my neighbors are receiving some government financial assistance which helps keep my doors open during these difficult times. My point is, we all must contribute financially to keep this country strong, I’m trying to do my part.

It is not those earners who make less than $50K who get these “socialistic benefits”.

The people who get these are people who are families with children who make less than $25K a year, or welfare recipients.

Single people who make from $20K to $50K a year get NO benefits at all, but pay for both the welfare given to the poor, and the Corporate Welfare given to the rich. They are too “rich” for the array of subsidies available for health care, college, and other services given to a select few of the poor, but too “poor” to afford these things without incurring crushing debt.

People tend to whine only about what they see, which is the admittedly over-the-top benefits given to the welfare underclass. What they DON’T see is the massive welfare for corporations, which includes most of our foreign wars (fought to make life safe for American corporations in slave-labor havens), our government efforts to secure trading privileges in foreign countries, and the countless billions of dollars thrown at large corporations- look around you, every Walmart, Target, Home Depot and other big box emporium you see, every two miles, most likely received a $5M local subsidy.

I’d like to see an economic landscape in which all the subsidies are revoked- the crop price supports, the tax abatements and TIF districts, the grants for college, the local subsidies for airport expansions, all housing “affordability” programs from FHA loans for $700K houses clear down to Section 8 rental subsidies, and of course the massive assistance for financial firms… and see how much prices fall for absolutely everything.

@LauraLouzader – You’re totally wrong. in LA County the median income is around 45k, and small families making up to 38k qualify for things like reduced price lunches, rent subsidies, and some other socialist benefits. The 38k to 50k (or even 60k) don’t qualify for the day-to-day, but do qualify for programs related to buying a house, going to college, insurance, and other things that are one-time or related to large expenses. plus they are sending their kids to public schools.

Above that, these occasional benefits decline, but you do qualify for lower-rate loans or zero-rate loans to buy a house.

Laura, you are right about Corporate welfare, but unfortunately, the rich folk run the place. Learn to be a team player and they will reward you. This is the system. You don’t get rewarded for speaking against investment bankers and Wall Street. You should enjoy reading the books “Bought and Paid For”, and “The Great American Stickup.”

Laura, I agree. Yours is one of the smartest posts I’ve read today.

Having kids changes the equation some, but PLENTY of people who don’t have kids earning under 50k are paying plenty in taxes. Have you ever looked at the tax charts, a single person with no kids and no deductions would have to earn under 10k to not pay taxes. Between 10-50k you can bet their income is taxed by the feds and the state. They’ll even reach the 2nd highest CA income tax bracket (around 10% state taxes), as that kicks in at only 40k something.

The 52% might actually need that welfare to survive in current economic situation, which banks made and thus don’t deserve anything. Essentially banks stole it from you and _that’s_ the real burden.

Also some perspective about the money: That 8 trillion banks got is $40 000 to every US citizen, kids included. I’d doubt that poor ones get even half of that money.

Of course you pay both but how about 2/3 of the burden taken away, the part banks got? I’m sure that would easen the burden a lot.

That’s money that goes only to those who are millionaires already and they don’t need it at all and have done absolutely nothing to deserve it.

Oh hogwash. Those with incomes under $50K most certainly DO pay income taxes. That single woman working at the grocery store makng $9 an hour will pay around 4.74% of her gross income in Federal Income taxes and 7.65% in Federal payroll taxes.. That is a total of 12.38% of her gross income that is going to Federal taxes.

There are multi-millionaires who keep their money intax free muni bonds and pay ZERO income tax.

BTW, all these posters seem to assume that the household income is ONE waage earner making that $50 -99K. In reality, here is who makes what:

50% of workers make LESS than $32,000 a year

75% of workers make LESS than $50,000 a year

88% of workers make LESS than $75,000 a year.

ONLY 6% of all workers make more than $100,000 a year.

Ergo the typcial household in that $50 -99K bracket (or pretty much any brakcet under $100K) will have 2 workers.

Doc – Normally love your work…but you need to get a more nuanced approach to home affordability….Simply showing income/home prices is not a good measure. You need to incorporate other factors (interest rates, % of income spent on housing, etc).

Home prices are still very bubbly in So. Cal but the true measure of that still comes from the multitude of rent vs. buy ratios.

In my Newport Beach neighborhood (Eastbluff), the three houses near me for sale are 1.4 to 1.8 million – -for 3-4 bedroom one-story houses on fairly small lots – -no view, etc. The people listing their houses at these prices must be on crack. If they can find a knife-catcher or two, well, shame on the knife-catchers. But otherwise, those prices are so far out of whack for even some home renter like me- – who is supposedly in the top 3.7 percent of wage earners acc’d to the graph above. The “American dream†of owning a house for many people, even people with high pay, is just that, a dream. First it was the rise in multiple incomes per household, then it was funny money loans (and they are still propping it up with 50 year loans – -ridiculous…that doesn’t make homes affordable, that makes DEBT affordable – but it is still way too much debt) – -so if you didn’t play the ARM game, you watched prices of homes escalate due to all those who did go for the ARM. Homes are so not affordable right now in most places. All I can say is that home ownership isn’t worth the cost right now. There are too many more interesting things to spend money on (charity, outings, vacations, good educations for the kids). I’m not simply a perma-bear, I’m out-to-lunch on buying a home until they are really affordable and in line with wages – my wages.

I’m in Newport Beach too, and in a similar situation. No way am I buying until things come back down to earth. It may be a year or two yet at this pace.

From what I understand, Newport Beach is one of the latest areas popular with Chinese investors to swoop in and make cash purchases. It might be a long while before that area becomes “sane” again.

I can imagine a scorched earth possibility where if China begins to dump their dollars, and float the yuan/$ exchange rate, they can buy up everything at a firesale. Tada, takeover without firing a single shot.

Buy Real Estate in September 2010, buy 2012 and after suckers

http://www.youtube.com/watch?v=QEbl4JWqe1E

El Katz,

It is not reasonable to expect a family making $49,999 a year to come with $35,600 for a down payment. How is one to save that amount of money with that salary? It would take 20 years to save that cash. Taking that into consideration, using your own statistics, no family can affort to buy under this scenario because they will never have the requisite 20% downpay. What you have done is go beyond the Dr. in terms of gloom…

GDP in 1970 was 1.04 trillion. Today it’s 14.62 trillion. This a true measurement of a country’s wealth, not median wages. Who knows what an actual wage is as taxpayers self report their income. $17,000 for a house nationally in 1970 times 14 equals $238,000 today. Stats can be used to prove anyone’s point.

And wage inequality was nothing like it is today in 1970. This country still had a thriving ONE EARNER middle class. Manufacturing jobs were abundant, and paid well. Most of this GDP growth you speak of was in the financial industry, which has effectively drained the middle class, and therefore, our economy of it’s vigor, and concentrated the nation’s wealth in the upper 5%.

Your stat just proved that the growth in weath in this country over the last 40 years has not been shared with the middle class.

Makena–

So then, what is yours? That the average household income of today is in fact $238,000, or that the GDP of this country is skewed insofar as 70% of it is represented by consumption? Consider that GDP is not the same as gross national income (GNI), but is intended to be a measure of total national economic activity. The most recent GNI figure for the United States is $9,780,000,000,000.00, or $33,070.30 per person, not accounting for inequality of distribution. While I certainly agree that statistics may be used to prove anyone’s point, allow me to encourage you in your future posts to take the good Doctor’s lead and offer one buoyed by something other than groundless assumption.

I know I’m the contrarian of this blog but GDP growth is a national growth of all industries, not just one industry or socioeconomic group. To put on a pedestal the working middle class man of the 1960’s as a paragon, to me, is backward thinking. My relatives of yesteryear lived this way and it was a hard, tedious life…grinding away in some mill or lathe 10 hours a day.

And about the comment of $238,000 as a wage. Sorry for not being clear, but this number would indicate a median national house value when extrapolated from the 1970 GDP number.

Makena–

First, by your logic, the median household income of today should correspondingly be 14 times the prevailing median household income of 1970, or $130,200 (not $238,000, which I mistakenly included in my first post). Second, to suggest that the economic landscape of the US during the 1960s was one of hardship for the average person is to know nothing of this country’s economic history. Though the work may have been hard, more often than not it was rewarded with a living wage. Federal minimum wage is currently $7.25 per hour; had wages kept pace with inflation from 1970, that figure would be around $22.00. Not to be impolite, but I believe you may be confusing “contrarian” with “sophist”.

Pretty cluelesss Trying to compare walnuts to rocks type of comment.

The ‘average’ income when dividing GDP by households is a stupid number. It isi a ‘Bill Gates walks into a bar where there are 10 people with median household incomes and the “average” income of everyone in the bar is now……” kind of absurdity.

Exactly Ann. I never tried compare GDP to income. I initially pointed out that income is an imagined number since the taxpayer, in trying to pay as less tax as possible, will do anything to keep this number as low as possible. GDP is a real number. But socialist love high minimum wages and extreme government oversight. It is the belief that government is infinitely wise.

This is a good article that encompasses many problems facing the U.S. economy. Corrupt banks, toxic mortgage, the fact that 2 income families can’t afford what 1 income family could afford years ago, the growing student loan bubble, and credit card debt.

However, I think what is most important about this article is the statement about all of these situations being intentional. The economists that most irritate me are those that understand all of the outcomes but can not connect all of the dots and understand how simple creating booms and busts is.

It is simple high school economics and I believe that all major macro booms and busts are created by design, most effectively after the Gold Standard was abandoned.

“”””If banks and individuals were allowed to fail for these bad bets, so be it. The end results aren’t even that bad; millions will now need to rent and we will have fewer bank solicitations in the mail). “””””

dr housing bubble – great blog as usual but you are acting as if we get the debt to income ratios back to pre-bubble levels we are ‘ok’…..hahaha.

the problem isnt defaulting hime owners…the problem is the derivative products that will default when the mortgages blow up. we have one mortgage loan and thousands of CDO’s and CDS’s written against it….

we are all ‘dead men walking’…you just dont knw it yet. that $150k mortgage was turned into quadrillions of dollars of paper bets and when that unravels (and it is right now) we will have a depression like no other……………..

Good comment. There is almost no discussion of the derivatives and the Collateral Debt

Obligations. Will someone comment on these unaccountable, ethereal layers of unbacked

mortgages that have been sold as some form of debt instruments in pools? Are there 50 trillion of elusive mortgages floating in misty pools that may come unglued with investigation? How could the gov’t ever allow mortgages to be sold and resold and disconnected from the collateral, the house? Will these all crash? Where are they? Joe

It’s a bad situation for both renters and owners. Renters will continue to pay an inflated rent because the fake housing levels are holding up the rents as well. Still, renting is the lesser of two evils.

If you guys think that student loan debt is bad for graduates, think about student loan debts + credit card debts being taken out by the same people.

Southern California is different.

One fundamental the Doctor has never touched with is the presence of a large Asian group in the region.

They bring cash from across the pacific and buy houses, since to get a green card one needs a permanent US address.

As long as USA doesn’t stop immigration from Asia, Socal housing in Asian-dominated locales (like Monterey Park) will always be in boom.

When Dr Housing does a ‘home for genius’ in Monterey Park or San Gabriel Valley, I will believe him.

Despite immigration from asian countries, prices are still sliding in Monterey Park and San Gabriel valley. They’ve fallen close to 15%~20% off peak. I wouldn’t really call that a boom. At best, they’re holding off the downward trend better than other areas.

Besides, most asian immigrants don’t buy homes to establish residence. They borrow someone else’s address.

Nothing wrong with Asian’s bringing loads of money into the USA. Monterey Park, San Marino, Alhambra, Temple City, … will always be high for what you get. Asians want to live near each other so they pay a premium. But many live 2-3 families to a home and rent out the garage to another couple.

I would be curious what would happen if the SGV actually enforced the zoning laws? R1 = One residence. Not two families and 5 renters.

Other than San Marino which does enforce zoning, the rest of that area isn’t all that nice. Lawns in disrepair, vegetables growing in the front yard, tin foil for drapes in the windows, trash in the streets, and a lack of trees. There are pockets of nice areas but for the most part, the SGV is in need of a makeover.

It is a myth that many rich Asian bring cash to SVG to buy houses. The fact is, many rich Asians are rich because we outsourced our jobs to them. Bringing cash to buy houses in SVG means they will have to stop working in Asia and move here, or have family separated (e.g. hubby watches the factory there and wife bring kids here). They will need to stay working in Asia to stay rich. If they are only looking for investment opportunities, there are much bigger bubbles in Asian to latch onto then the deflating one in SVG.

Just a reminder about the foreclosure pipeline: http://www.housingwire.com/2010/10/22/jpmorgan-wells-fargo-and-bofa-each-hold-more-than-20-billion-in-foreclosures?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+housingwire/uOVI+(HousingWire)

PMorgan Chase (JPM: 37.70 0.00%), Wells Fargo Bank (WFC: 26.11 +0.31%) and Bank of America (BAC: 11.44 +0.70%) each reported more than $20 billion in single-family mortgages currently foreclosed or in the process of foreclosure as of midyear, according to Weiss Ratings.

In addition, for each dollar these banks held of mortgages in

foreclosure, they had additional exposure to more than $2 in mortgages that are 30 days or more past due.

“Although only some portion of the past-due loans will ultimately go into foreclosure, these figures tell us that the biggest players are not only in deep, but could sink even deeper into the mortgage mayhem,” said Martin D. Weiss, chairman of Weiss Ratings.

Among all U.S. banks, JPMorgan Chase has the largest volume of mortgages in foreclosure or foreclosed with $21.7 billion. It has $43.4 billion in mortgages past due.

Bank of America has a somewhat smaller volume of foreclosures ($20.3 billion), but it has a larger pipeline of past-due mortgages — $54.6 billion. Thus, overall, including all foreclosed and delinquent categories, Bank of America has the largest volume of bad mortgages among U.S. banks, with $74.9 billion, while Wells Fargo has the second largest with $68.6 billion.

The main issue is that the US is now, a finance based economy & thus, asset bubbles won’t end well. The nation has lost the will to do real research & development, a long time ago. That was the engine of growth throughout the post-war era, not financial services. And from the political side, tax cuts alone don’t generate new industries; real technology, however, does.

Starting in ‘88, the NSF put out articles on an impending shortage of scientists/engineers but strangely enough, big supercollider projects were cancelled, R&D labs (both public & private) started downsizing during the 90s, etc. Somewhere in this time period, offshoring to Asia began. By 2000, many newly minted stateside scientists/engineers were looking for business programming IT work in the IT sector (since the R&D shortage was a myth) and then of course, that bubble collapsed with Nasdaq 5K.

Now, it’s the year 2010, a lot of damage was already done and people are suddenly asking themselves… what happened? and decide that it’s the govt’s fault when it’s been poor business practices (esp in finance), lack of R&D focus and planning and the USA core business destructive policies of global labor arbitrage all in effect.

If we had many of these discussions back in the 90s or early 00s, then I might have believed that something could be done but now, it’s too late. Once core research is in the Pacific Rim, the real wealth will move there. That’s just the way it is; you can’t stop half the world’s population esp once they’re motivated and trying to beat what was formerly an American stateside mainstay ,,, Bell Labs, Xerox, DuPont, GE, etc. And speaking of GE, today, it’s mainly a financial company. Imagine, Edison’s former company, called *General Electric*, isn’t making its bread/butter from electronics but from trading bonds.

“The nation has lost the will to do real research & development, a long time ago.”

Not will, but the long term economic perspective necessary to do so. Why do you think economists use _quarters_ in their predictions?

Because that’s about the longest timespan they can understand. Combine that to greediness, where _every quarter_ must provide not only profit but _more_ profit than the previous quarter and you get economic shortsightness in cosmic scale.

Compare that to China where _short term_ economic plan unit is 5 _years_ and long term unit 100 years or in perpetuity. That’s a policy which leads totally different decisions than 3 months perspective. Even then when the goal is the same: Maximize profits.

No research will ever pay back when your time scale is quarter of an year, so you don’t do it, it’s just an expense. Same thing manufacturing anything or trading with manufactured goods, _way too slow_. So you don’t do that either.

So the company ends up day trading stock in Wall Street: That’s something that provides profits _now_, immediately and not somewhere in next 10 years. Just like GE.

Essentially economists (and definitely everyone in financial sector) are big children who don’t have concept of time at all, everything is just _now_ and the profits must be had _now_. Anything beyond tomorrow doesn’t exist and “next year” is utterly incomprehensible. Stealing today is the norm because tomorrow (with the consequences) doesn’t exist.

They should be given power about economy excatly as much as little children: Very, very little.

Somehow these greedy bastards have bribed their way to owning it all. And they succeed as well as infants do: not at all. It’s just “Mine, mine,mine, mine!” all the way.

Most of these people are individuals who would have been shot in China for “crimes against the state” and their property confiscated to the state.

That’s justice I like: You steal billions, you get shot and your property taken away.

Won’t happen in US, though, there you have courts and no justice. Courts are designed for just one purpose: To make lawyers rich. They fulfill that purpose very well, but no justice is done in there, unless accidentally.

“Essentially economists (and definitely everyone in financial sector) are big children who don’t have concept of time at all, everything is just _now_ and the profits must be had _now_. Anything beyond tomorrow doesn’t exist and “next year†is utterly incomprehensible. Stealing today is the norm because tomorrow (with the consequences) doesn’t exist.”

Well, back in the early days of Wall St, there were the Jesse Livermores and William Ganns who consistently beat the market and used leverage wisely. The idea was that in every generation, there would be this elite core of traders who could make a fortune, regardless of whether or not the market was trending or in a sideways channel. Thus, I don’t think the culture of elite speculators is a new phenomena.

What’s new, however, is the sheer volume of them. Realize, today there are some ~10K hedge fund but in reality, there really can’t be more than 500-1K elite traders per generation and thus, there should be a soft limit of 1-1.5K hedge funds. This isn’t happening. Instead, everyone seems to be a great speculator and can match the Livermores and Soros in applying leverage et al. This is the present day Leviathan and needs to be toned down, if we want capital to be re-directed to real R&D.

“No research will ever pay back when your time scale is quarter of an year, so you don’t do it, it’s just an expense”

This will end w/ the US becoming a banana republic & I’m going state that it’s too late for change.

Here’s why … from Sputnik to Voyager, an entire generation of Americans were raised on the notion that science/engineering work was ‘good for society’ and a stable source of income, leading to a middle class existence. The ‘good for society’ angle is what got folks to want to study 6-12 hrs/day, otherwise, many of these persons would have tried to become doctors or patent attorneys.

Today, the best and brightest opt for careers in medicine, management consulting, finance, and law. Even MIT has been placing roughly ~40% of its graduates into consulting or financial types of firms during the 2000s. And that’s MIT, the Massachusetts Institute of Technology, America’s leading tech school, not Dartmouth, the classic banker’s Ivy.

The reason why I bring this up is that it takes a generation to build a critical mass of expertise in various technologies. It’s not just that someone reads a book on circuit analysis and then starts a new industry. Fine, perhaps one Nikola Tesla could pull it off but he’s a once in a century type of phenomena. For the rest of the top graduates, there needs to be a cadre of experienced professionals, sharing industry know-how. Starting a decade ago, that mass has been dwindling and building high frequency trading platforms has become the rage for tech graduates. What this will do is, in effect, allow R&D critical mass to grow in Asia, while the US focuses entirely upon arbitrage situations to make a living. No one will put in long hours of study, just to be in the lower classes. The difference in salaries between let’s say a stateside licensed Pharmacist vs that of a person with a masters degree in Biochemistry is $110K vs $35K (a.k.a go-nowhere lab assistant role).

Thus, we’re in a financial type of economy and the net result will be a loss of the tech laden concentration, which led to the golden age of the 50s, 60s, & 70s, where the only place to do *real* science work was America. Instead, anyone interested in tech will be looking at Singapore, Beijing, Bangalore, or Seoul, in the years ahead.

To add to your comment I recently read an article on a retired executive of Intel who lamented not just the loss of R&D but infrastructure as in manufacturing capacity as American companies including his own invested billions into building that infrastructure in the far East. His assessment? It is now to late to get it back. It may well be dark days indeed ahead for this country.

“I recently read an article on a retired executive of Intel who lamented not just the loss of R&D but infrastructure as in manufacturing capacity as American companies including his own invested billions into building that infrastructure in the far East.”

That was Andy Grove’s article; I read it as well.

In a way, it was like calling the kettle black because Groves initiated a lot of the offshoring, during his tenure at Intel. Now, he’s having a mea culpa experience and some residual guilt of leading his fellow tech executives down the path of national demise.

Well, I’m glad he did it now, in 2010, then during his death bed like former defense secretary, Robert McNamara, who shared his regrets about the Vietnam, thirty years after the fact. At least Grove’s now has a clean conscience & may be able to make some waves in the press before it’s curtain call for America’s tech sectors.

Anybody else here get a kick out of reading the NYTimes articles on homedebtors?

I love the recent “refinancing” article for “frugal” people!

Their subjects Kathy and Mike Bernreuter AKA Kathleen Bernreuter and Michael Downing are held up as examples of prudent people. However, per the article…

“Kathy and Mike Bernreuter have been working on the refinance of their home in Northbrook, Ill., since May. The property taxes in their escrow account were improperly credited, a small mistake that nevertheless threatened to put the mortgage in default. They had to get a home equity loan on their former apartment, which they could not sell, and apply the funds to their house. “

Ponzi financing at it’s best. Rob Peter to pay Paul.

Here’s the “apartment” that these frugal folks own (and couldn’t sell)

Purchased in 2004…

http://www.zillow.com/homedetails/360-E-Randolph-St-APT-1408-Chicago-IL-60601/2141862532_zpid/

And the home that they bought in 2008….

http://www.zillow.com/homedetails/1315-Wildwood-Ln-Northbrook-IL-60062/3337674_zpid/

LOL!

This is the end game. There are no other options. All of the natural logarithms will follow their ultimate course. No matter how much luggage you throw out of the plane, the engines aren’t turning and the ground is in view, and there is no soft landing to be had. Mark to market is reality, and eventually all banks will have to jettison non-performing loans, REO and paper. Fed will swallow another half trillion shortly. Is that all of it? As Doc points out, Freddy and Fannie are still making this stuff. You think it’s stopped? No, it hasn’t. That’s not it.

We’re losing the war on many fronts, the little dutch boy hasn’t enough fingers and such to plug all the holes. Demographics, government entitlement (you too, Penatagon). With zero return, how many pension funds will fail in the next few years?

Tell me how it all works out–somebody–just make something up if you have to. I can’t even do that.

As I read this blog I think everyone relies way to much on “AVERAGES”. It’s not how SoCal Housing works. It has always been expensive to live here and it always will be expensive to live here. Most of you complaining that homes are too expensive for you likely won’t ever be able to afford a home in SoCal. That’s your reality and the sooner you deal with it – the sooner you can get on with your life or move.

In a nutshell:

About 50% of the people in LA rent. That 50% bring down the average income.

The other 50% are in a much higher income bracket than the “Average” America. I know many people who have a family income of 150-200K+. Most people in a technical field in SoCal (Managers, IT Professionals, Sales, Banking, etc.) all make in the low 100’s. And almost all have a significant other earning almost as much. With that said an income of $150K is easy. And those are the home buyers who are shopping today. Yes, they may be the “top 5%” of income earners in the USA. And there are plenty of them shopping for homes.

Yes, they all know renting is cheaper! But they don’t care. As most rentals in CA are sub par. No laundry, little parking, loud, dirty, etc. So they spend extra money on a home. These are the same people driving a 100K Porsche SUV. (Yes, their car is 10% of there home price.)

I would like homes to come down in price too, but I realize that they will never be priced for the “Average” buyer in SoCal. Average priced homes are in Las Vegas. SoCal homes are priced for the top income earners who can afford them.

Yes, we did have a bubble – it’s over. A pull back happened. But to think we are going to prices that “Average” buyers can afford is wishful thinking.

You capitalist pig!! Haha, dude you’re right on. I have a N.Y. Times paper from my mother’s birth (1939) and apartment rentals in Manhattan were going for thousands. It is what it is. Desirable area, lofty price.

My family was from Manhattan also.

Rents way back when were annual rents.

My parents bought a 3 BR + Maids at 322 Central Park West for $24,000 in 1966

Same floorplan is now nearly 3MM and has been listed forever.

It’s a bubble there too.

http://www.elliman.com/listing/for-sale/manhattan/upper-west-side/322-central-park-west/iuxtkkv

How the heck old are you Sean? Because Southern California has not always been “expensive” There was a time that developers lured people here from the east with the promise of cheap homes and cheap land. Read a little history. And while you are at it I suggest you read some census data on what the income demographics are. Not that many people earn low to mid low six figures let alone significantly above that. Your comments are hogwash. I suspect you are obfuscating. 100,000 dollar cars and million dollar homes on $150,000.00 a year? Uh will you sell me some of that Arizona swampland?

You seemed to miss the entire point of the post. I was to focus less on averages and focus on who the buyers are. I know the history and the times you are talking about were after WW2. Since then we have over developed in an unplanned way. Do you have any examples in the past 20 years?

And I really don’t care what people drive, but if you look around there is a lot of rich people here.

Sean,

You haven’t been doing your homework. Without Fannie and Freddie, there aren’t enough suckers to keep these still bubble prices going with 20% down. Cal hasn’t settled down and will need a bailout shortly. Sam will demand austerity from the Golden state that is still in delusional denial. On the surface there are still a lot of folks with ways, but they will only have the means for a season, and the first snows have already fallen. Cal needs to gather some more nuts, ’cause it’s a long, cold Kontrdief winter coming in.

One solution will be the multi-income household. Like the old Soviet system, grandparents in the basement with their SS, in-laws with their unemployment checks, cousins with their welfare checks, 9 foster kids…people will find a way to survive–no doubt.

Thanks for chiming in though. I appreaciate a glimmer of hope. I’d rather you be right than me.

It may drop a little more, but I doubt 20%. We are near the bottom. And when unemployment begins to fall in a few years housing will stabilize and pop up. Trust me, there will be new tricks and a new bunch of suckers. The world and So. Cal are not coming to an end as we know it. I know everyone loves stats, but you have to account for human nature. Everyone here needs me to point them to facts about income, but they don’t trust that I talk with many people daily that have that income looking for a home. By the time its in print its old news and there is something fine said for good old fashion Americans. We will find a way! So I don’t see the return of the 250K home in Beverly Hills to match the local income. If it happens great! I’ll buy 4 or 5.

Sean–

Your claim would certainly be more credible were you to include tangible statistical data beyond “I know many people who have a family income of [$150,000 – $200,000]”, and “most people in a technical field in [Southern California] … all make in the low 100′s”. What constitutes “many” and “most”? If in fact you want to be taken seriously, please make more of an effort to provide statistics that bear out your argument, rather than following an obvious insult with generalities that support little more than my belief in your ignorance.

It’s not about the stats. I know many people who make that amount and I am not special. My point is that income does not tell the entire story. So. Cal is full of rich people with cash in hand. Just like nyc. It’s not all about getting the book out about averages, because those incomes leave out that the family sends there kids 20k month in a trust fund. Of that they moves to So. Cal when they sold the family business for 10MM. I was offering another reason on why prices won’t ever be average. But you keep waiting for average here and you will always be a rentor

Sean–

Actually, I am not a renter, have little interest in the mean, median or average, but do demand of those who make claims contrary to fact more than a simple, “I know this guy whose sister’s husband’s brother’s friend heard from the owner of a dachshund that her boss lives off of a million dollar a year trust funded by his late uncle’s mattress.” Your argument as it stands is at best speculation; observation based upon such a flimsy, amorphous sample qualifies as little else. So, before you decide to crash another party, consider that true authority is borne of fact, not vague assumption.

It’s not speculation. I work as manager for IT. I probably work with around 200-300 people per year and I am familiar with what I pay for the resources. My job is one of 100’s in SoCal and people in my position often network and share information. On topic is always housing since it’s always in the news so we have a good idea of who rents and who doesn’t.

My numbers stand and they are accurate. You are the one who made an assumption that I heard it second hand. I know of many people moving to the area or relocating that earn 200K+. Those are the people who are often looking for homes. The people I hire in at under 100K are usually renters and they can relocate easier. It’s just an observation that I was offering to explain why prices are high. Not to crash your personal party and allow you use your extended vocabulary.

As for the trust funds. I often ask point blank to my friends that live in 2MM+ dollar homes how they afford them. The theme is that they inherited money (parents/trust fund) or have a successful side business. This is on a sample of about 10 people. Not a large sample but it’s easy to see a common theme as NONE of them said “We work two middle income jobs.”

Hope this helps. I was trying to help by offering an alternative way to view the housing prices. Call it speculation, but if you notice there are not a lot of homes over 2MM defaulting. That’s because the owners have the means to buy them.

“Your argument as it stands is at best speculation; observation based upon such a flimsy, amorphous sample qualifies as little else.” How about we live in a 15 trillion dollar annual economy. Nothing flimsy or amorphous about that.

I like to use big words too, but you just sound silly.

Sean–

Thank you for the clarification; that you have amended your argument to include both anecdotal and numeral data beyond “many” and “most” undoubtedly makes for a happier reader, and certainly one less prone to assumption.

Makena–

If you think that sounds silly, I am convinced you would find irresistible one of my many interminable guest lectures at UC Santa Barbara, to say nothing of the dizzying prolixity that would eventually come to define my thesis!

Allow me to conclude this seesaw of debate with two unrelated though important statistic that seam almost universally neglected by the blogging public: The Second Edition of the Oxford English Dictionary contains full entries for 171,476 words in current use, and 47,156 more noted as obsolete. Furthermore, never has information necessary to bear or disprove our conclusions been so immediately accessible. Why should we choose to abandon for even a second such luxury to provide mediocrity a foothold in our conversations?

While renting is definitely a huge percentage of greater Los Angeles residents (and much of SoCal in general, with the exception of the boonies), your circles are clearly unusual. You must work on the wealthy west side, because that’s the only zone where that kind of pay is relatively common. The east side (SGV, and most points south, with the exception of Pasadena and San Marino) is definitely not making that. Aside from the coastal towns and Rancho Palos Verdes, the South Bay is only marginally higher-paid than the east side. Many inner city areas are industrial ghettos (like Bell, which has been in the news lately), where incomes are far lower than even these relatively-affluent areas.

I know many people in the greater Los Angeles area (I grew up there) and only know a handful of individuals with six-figure incomes. The majority (one exception) fall into the following categories: Renters with roommates, long-term section 8 renters, living with their parents (including educated young couples), purchased their home at least 30 years ago, or inherited their home (almost invariably purchased before 1975, but most before 1960).