Real Homes of Genius: South Gate home at $397,000 – Reduced from $475,000.

Today we salute South Gate for the Sunday Dr. Housing Bubble real homes of genius award. Yes, even though the above house is only 796 square feet and is 2 bedrooms and 1 bath, it is full of eager home buyer potential. So much potential that it has been on the market for 138 days. These folks have so much demand that they have reduced the price as follows:

Price Reduced: 09/22/06 — $475,000 to $463,000

Price Increased: 10/17/06 — $463,000 to $475,000

Price Reduced: 12/04/06 — $475,000 to $449,000

Price Reduced: 01/12/07 — $449,000 to $439,000

Price Reduced: 01/13/07 — $439,000 to $397,000

Too much demand in September that they bumped up the price for Christmas shoppin. However after that, a nice $78,000 drop in a few months. I’m sure they’ve dropped it as such for the addition of more bars to the front door. But surely Zillow is correct when they assess this home at $434,000 no? Well let us look at the irony of Zillow:

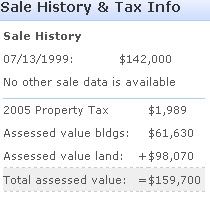

First, Zillow gives you a Zestimate of $434,000 and in the same page, you can pull up the previous sales data. The last time this home sold was in 1999 for a whopping $142,000. These aspiring Donald Trump moguls wanted to pocket $333,000 in 7 years!

Ah yes, we salute you South Gate for being a real warrior and genius of housing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

11 Responses to “Real Homes of Genius: South Gate home at $397,000 – Reduced from $475,000.”

I like posts like this. Where have I seen it before?

Marinite:

I haven’t seen too many post in more urban and what one would call rougher areas of L.A. County. I grew up in many cities around the LA and Orange County area. On some blogs I’ve seen people talk about Condos and newer homes in Orange County and also San Diego County but somehow the examples of Los Angeles are forgotten yet they also reflect what is going on.

As I discuss in one of my previous post I consider these homes benefiting from the halo effect™ of the housing bubble; that is they are in the vicinity of expensive cities in Los Angeles and that is their only claim to fame for being at these high prices. Why else? Is it because it is close to work? Is it good schools? Is it a good place to raise a family? I raise these questions only to point out that the main reason for speculation is vicinity to location. What does this mean? Well it means if you are close enough to greatness then somehow the Midas touch will rub off on you. Again, everyone in real estate realizes that location is pivotal in establishing a price. But doesn’t this imply that you have the benefit of good schools and a safe location? Not necessarily from what has occurred in Southern California. With the height of speculation they have eliminated the prerequisites of safe area and good schools only to leave prime location standing; and I would argue that it doesn’t really meet the definition of prime real estate and these areas will drop the most when the housing market deflates (which is already happening).

Keep in mind 10,000,000+ folks live in these Southern California metro areas. And not only that, in 2005 and 2006 25 percent of loan originations were in the sub-prime market and it only keeps growing. Guess which segment of the population these loan products are aimed at? Is there any reason to mistrust the MBA study that states that 1 out 5 of these sub-prime borrowers will default in the next two years?

Hit up areas like Stanton, Garden Grove, Huntington Park, and Lynwood and take a stroll into an open house. If you don’t want to see what is on the street then pick up your local L.A. Times or OC Register and you will see examples just like this. If you desire to take out a calculator and a napkin you’ll run some numbers and realize we are in a bubble.

My only guess is that many more folks will have examples like this in the months to come.

Hey Doc. Let the slaughter begin. By the second quarter this year there will be blood flowing everwhere as the idiots who paid 600,000 for a house worth 140,000 begin to die or commit suicide . All I can say is “What kind of a complete idiot were you to believe that any moron is willing to pay that for your cracker box ? ” Far from isolated the widespread panic should begin to set in soon. Burn baby, burn

Anon:

As all of us who have been following the housing bubble, I’m not sure we should underestimated the potential of housing. If I were to guess, it would be Q3 and Q4 since many will hold out to the last bastion of hope which is summer and then bite the reality bullet. In addition, the combination of loans resetting, inventory rising, and the new regulation being placed on loans will all combine for a perfect storm.

Doc, you should hire a guy to sing the “Real Homes of Genius” part and post it on the blog. Your award is amusing.

Chris:

Not a bad idea. Maybe we should cue the music and have something like…

â€Today, we salute you overpriced 700 square foot pink home. Yes, people say that $500,000 is too much and we agree; too much good stuff. The potential you have puts David Beckham to shame. When someone questions your worth you reply with a hardy voice, “I’m in California you douche bag†and then everything becomes crystal clear. Yes, we salute you overpriced 700 square foot pink home.â€

Dr.,

Another gem. One sidebar of this story is the amount of people from older areas (South Gate, Compton, Hawthorne, etc..) that sold during the boom and moved out to Fontucky, Riversippi, etc. I did quite a few of these transactions and the tendency was to take on more house and more debt than they were in in the house they sold. Drive thru parts of Moreno Valley some time. I was doing appraisals in 99, 2000 where people were still upside down from 90, 91. Not that I’m jaded but when bed sheets function as curtains its a dead giveaway what type of area you’re in. Remember all the new developments in Fontana, Rancho Cuca., etc. that advertised “NO HOA FEES”? As this market worsens get ready for the bed sheets on windows, brown lawns and the occasional Carolina blue paint job in these areas too.

Socalappraiser:

What you talk about is the allure of McMansions. Why worry about schools or good neighborhoods when you can fortress yourself in a 3,000 square foot castle? My feeling is that people went beyond the areas you mentioned and ventured out into Arizona and Nevada. When you talk about Moreno Valley you are absolutely correct; people left because they wanted “nicer†homes but you still need a good infrastructure in place to provide excellent future value.

You should post some of your anecdotal stories too since you have a in depth look at the field. However, as the air is coming out of the market it is becoming all to easy to spot these real homes of genius.

Dr. H

There are rumors floating around that if a house has a series of reduced price points. Then a sudden unexplained increase in price it’s a signal to mortgage fraudsters that this seller will be friendly to turning a blind eye if anything seems strange at close.

anon:

Fraud in the housing industry? I am shocked!

The Bonnie and Clyde of Real Estate

800 SF and 2BR/1BA sound like a post-WW2 tract house. Not all that bad, if you remember the place is probably showing its age. Which can be offset by the fact you should have a back yard over ten feet deep and no paying squeeze to the Kyle’s Moms in the HOA.

Depending on the neighborhood and lot size, I’d pay $100-200k for it, but nothing over that.

“Why worry about schools or good neighborhoods when you can fortress yourself in a 3,000 square foot castle?”

Just like Fidel Castro and Kim Jong-Il. They have to live in fortresses.

Leave a Reply