Going Broke on $200,000 a Year: Step by Step Process of Going Down with a High Salary.

You may have noticed that gas prices have gone up recently. I’m just taking a wild guess that you’ve heard of this. For those of us in commuting urban areas we are all too familiar with fuel prices. Gas prices always go up during this time of the year right before the summer driving season. The only difference this time is prices are going up at unprecedented speed and this time, high energy prices might be here for sometime. Most would think that during economic downturns such as the one we are in, you would expect to see falling prices running in line with falling demand or people simply adjusting to a different lifestyle. This isn’t the case. Housing prices are tanking but you need to remember they were up in the heavens and made no fundamental sense – prices are now only coming down to reality. Yet other cost of living items are going up and going up fast. If you are planning on sending your kids to the top public institution here in California, the University of California you can except to pay more this upcoming year:

“Despite angry protests from students that led to 16 arrests at UCLA, California’s two public universities took actions Wednesday to charge higher fees for education in the fall.

The trustees of the Cal State University system voted to raise annual undergraduate student fees 10%, or $276. A key committee of the University of California regents approved a 7.4%, or $490, raise per year for undergraduates that is expected to be endorsed by the full Board of Regents today.”

Most of the higher paying jobs in our country such as those in the engineering field require you to have a bachelor’s degree. This isn’t like a high school grad going off to become a mortgage broker and pulling in six-figures just by stuffing people into toxic mortgage products that are now showing their after-effects on our economy. That industry is taking its last few gasps. What happened in the travel industry will happen in housing. Websites like Zillow and Redfin make it fool proof in finding a home and not going with the traditional 6 percent commission. In fact, Zillow now offers an anonymous mortgage quote marketplace were you can remain completely anonymous and let lenders compete for your service. This isn’t like other mortgage online shops where they take all your information and sell it out to marketers; here you have the opportunity to say “I make $150,000, my credit score is 740, and I’m looking for a $500,000 loan. What can you do for me?” Why would you go back to paying for a service that brings so little? And this coming from someone that was in the industry.

You can also use Google Maps with many widgets to find excellent schools, view neighborhoods, and you have a much better sense of what you are looking for. You can pay a real estate attorney a flat fee to review loan docs and the contract, pay an appraiser and title company to review the transaction, throw it in escrow and you are done. Clearly anyone that thinks the days of high YSPs is going to come back is delusional. And why is that? Let me show you a hypothetical case of a colleague that was in the industry that was pulling in $200,000 a year during the good times. On paper and visually he was rich but in reality he was a walking debt zombie. He is flat broke now. Actually, a homeless person is richer since they have zero net worth where he actually had a negative net worth and had to declare bankruptcy. You’ll see why in a few seconds.

In regards to salary, car, and other payments I have a pretty good idea how much he was pulling in since he would gladly show me and tell me. The other items I will fill in (food, etc) based on his typical behavior.

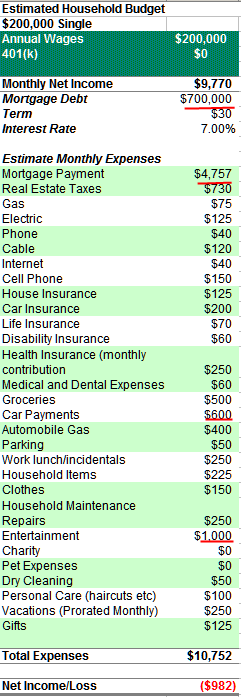

Going Broke on $200,000

First a little information on this guy. I’m sure many of you know one or two of these kinds of people. Generally a good guy but absolutely no idea on how to become wealthy. Whenever I would mention macroeconomic policies he would simply glaze over; he was in for the thrill of making fast money and living a fast life. He had what would seem to be everything. A nice BMW which was leased, he ended up drinking his own Kool-Aid and purchasing a place out in the OC for $700,000 zero down of course on a 2/28 mortgage, and was going out all the time charging everything up. You also need to remember that with a high income and especially being on commission, you are taxed to the max. $200,000 dwindles quickly even before you see your paycheck. So let us now look at the reconstructed budget:

Anyone not from the OC really cannot relate to this so let us go into this a bit further. There is a hidden society of people that seem to fit to a tee the new idea of the brand new rich. That is, these folks seem to unconsciously realize that being rich means driving a luxury foreign car, eating out at certain restaurants, and spending a lot of money on trendy clothes. Your budget can be radically depleted and there are plenty of shopping centers all the willing to take your money (hi Fashion Island!). On the outside, he would seem to be living large but knowing his budget, I knew this guy had zero in any retirement accounts and all of it was going out as quickly as it came in.

He bought a place zero down in the OC for $700,000 on a pathetic 2/28 mortgage. It was okay during the first 2 years but once his rate reset that is when all hell broke loose and his lack of financial knowledge became apparent. The rate on the budget is the adjusted rate when it reset and the mortgage payment reflects that. You’ll also notice the $600 for the BMW lease which of course also carriers higher fuel costs since it recommended 91 octane and also had higher insurance premiums since he was a younger guy. Insurance companies do not like young single guys in fast foreign cars. He would eat out all the time and blew money on lunches practically 2 or 3 times a week. Lunches went from $7 from your Jack in the Box quick lunch to $50 at a sit down restaurant with drinks and tips.

Once his rate reset, it didn’t take long for him to realize things were going to go down fast. Keep in mind this is the peak income from the good times. He also got smacked down once the mortgage market here in the OC went into the abyss. So you have 2 things hitting you squarely in the face:

1. First, your job is dependent on real estate selling and moving fast and with it shutting down and wholesaling collapsing, he was left with half his income in one year.

2. The rate on his home was a time bomb. For two years the balance did nothing except sit. Once the rate reset you had a lower income and a ridiculously higher housing payment. Plus your home was valued at $100,000 less than what you paid for.

It was game over pretty quickly. Even if he stayed earning $200,000 a year he was running budget deficits. He tried living off credit cards for sometime but he had to throw in the towel. There was no way he was going to sell the house even remotely at that price and his income only kept decreasing as the months went by. When all was said and done, this guy was left with nothing and a bankruptcy.

I would have a little more sympathy for him until he told me, “it will get better. This is only a temporary drop.” I felt like telling him, “no it won’t amigo and I would show you my site and point you to a few hundred essays showing why your industry was a once in a lifetime boom but that wouldn’t change your attitude.” Things will never go back to how they were. Get used to high energy costs. And when people made $200,000+ a year for many years and have nothing to show for it, you know why this bubble had to burst. Now the new GSE bills are requiring brokers to have criminal background checks and also licensing. It was fun while it lasted.

Looks like colleges are going to get that 10 percent more since many are going to need to go back and retool their knowledge base.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

27 Responses to “Going Broke on $200,000 a Year: Step by Step Process of Going Down with a High Salary.”

I call it “Fascist Island”

“he ended up drinking his own Kool-Aid”

This is what screwed so many of the lenders and realtors that were making huge money during the boom. If they would have forgone the high life and saved as much as they could they could have been set and not have to worry about money for a long time.

I think you maybe judging your acquaintance too harshly and not giving him the credit he maybe due. OK, he’s not a financial wizard but pulling in $200,000 a year indicates he has some abilities. Sounds to me like is a personable guy who can close deals. That is a valuable talent, often more valuable than any college degree. He is just in need of a new bubble to apply his skills too. Fortunately a new one maybe forming as I write.To see where one need only keep an eye on the bubble master himself Al Gore, father of the internet. You may recall how the man who flunked out of Divinity School parlayed his name, his conceit and his ambtion into seats on the boards of Kleiner Perkins and Google. By introducing a $5/month Gore tax on every landline telephone in America Gore replaced the blackboard in American classrooms with the laptop. Billions poured into Intel, Apple, fibre optic cable makers. The billionaires of Silicon Valley were grateful and this funding help fuel the dot.com boom. If the educational benefits to American schoolchildren have been marginal not so the profit margins of those companies able to cash in on the revenue the Gore tax generated. Now what is Al Gore championing. Why carbon offsets, carbon trading and solar power. Of course to prepare the way to sell something no one would ordinarily buy you need to convince them it is required and if you can’t convince them it is required you have to mandate they buy it anyway. You make a propaganda film and have it shown to every schoolchild in America if not the western world. You use modern technology to document imperceptible changes in temperature or ppm of atmospheric gases to stampede the public to believe the sky is falling. Then you craft new laws and subsidies to create your new bubble. Welcome to the Green

Economy. I saw in the San Francisco Chronicle so great is the demand for home

solar and wind power installations that a shortage of installers has developed. My guess is that the successful Real Estate Sales Agent can parlay his rolodex

and cell phone directory into a new career putting solar arrays and windmills on people’s homes. If you think oil and gas stocks have soared, you ain’t seen nothing till you persuse the rise in solar stocks and, unlike the oil companies , they aren’t really making money… yet. But as we saw in the dot.com boom profitability is not required to juice a stock mere promise will suffice. And those carbon offsets that Gore not only promotes but actually has an ownership interest in. Why just the thing for a smooth talking salesman to offer to a guilt laden movie star about to get on their Cessna Citation. Your trip to the Cannes Film Festival is not an exercise in conspicous consumption it is an ecologically responsible journey at the frontiers of psuedo science.

$150/month on clothes. I doubt it.

There is climate change going on, at the same time we are increasing CO2 and water vapor emissions. I saw a fascinating show on PBS how the decreased intensity of sunlight caused by the atmosphere being less clear has actually been masking how severe the climate change actually is.

Is it so bad to stop burning so much oil before it runs out? Doesn’t it make sense to use solar power to cool those forests of homes in Arizona? Doesn’t it make sense to build and sell that technology right here?

You know, the first doctor to wash his hands between patients was mocked, we used to use lead pipes and lead paint-if we end up being more efficient in our energy use, it’s a good thing.

I live in San Jose and the type of guy you describe lives here also…. in droves. The people in this industry (real estate) need a rude awakening and many are now getting it. Unfortunately, in our area things are not dropping quite as fast as in Southern California. I was perusing home prices today and things are still obscenely high here even though sales have slowed appreciably. Silicon Valley is the big draw. We have many people who work here and live in the Central Valley and make the commute from hell every day. I really can’t imagine what their gasoline bill looks like! This is done so they can afford their overpriced homes that are losing value as fast as the gas is going up; maybe faster. They are on the road 2 to 3 hours per day, five days a week. If one has to work in this area, why not rent something for a fraction of the cost? Its entirely possible. But, of course, they don’t get a piece of the “American Dream”; or is it the “American Nightmare”? I know many people who do this and complain of much less time to spend with their families. However, I think some may have marble countertops in their homes. Ain’t it wonderful? This mess is only going to get worse as the economy slows, the dollar loses value, RE prices drop, and energy costs go crazy. This is all self inflicted by everyone involved and American’s lack financial prudence. Let the games begin…..

PS: Just finished “Only Yesterday” by FLA, and it appears history is repeating itself. Great read. Also, looks like Mr. Ponzi of Florida real estate fame is alive and well.

$1,000 month for entertainment, please explain.

I’ve met many people like this in the financial industry here in Chicago. Neighborhoods like downtown and Lakeview are stuffed with people like this, and from time to time, you will see some newly-poor stockbroker or mortgage salesman sitting on his sofa on the sidewalk, along with the rest of the belongings that the deputy sheriffs have put (or thrown, they aren’t kind) on the sidewalk in front of some glossy high rise building.

In fact, this is the American Way; this is how most middle-class people in this country live anymore. We’ve kept the country running by running up bills and now we can’t begin to pay them. The residential implosion is nothing compared to the unwinding of commercial, of all those shopping malls and power centers within a mile of each other predicated on evermore manic consumer spending.

Good example, and I like the way you tell the story, but this is not a typical example, it’s only count a tiny tiny percentage of people around. $200,000/year salary, how many people can make it? 3%? 5% of the population? And how many are they have been rich for long time? I mean, many of them has bought house long before the bubble, and even bought house at 2003-2004, they are still in good position, right? So a new money, like to show off, bought a house at top of peak, it could be only 0.0005% of total population. (I don’t calculate the number, I just assume it’s small number here.)

Why “everyone” knows one or two this type of guy? It’s not because they are high abundant, it’s they are obvious, easy to remember. They are crying “hi, look at me, I am rich.” every day to everyone, and many people look at them with envy, so it’s impressive. There are way more people around, making same of less money, calculating their budget carefully, making smart financial choice, buying everything in Target, driving TOYOTA of Honda, living a low key life, we just ignore them.

Great article and having a high income myself I can relate to this story. It is amazing how fast $200,000 can go when you live in an expensive area and do not have your finances under control. This is one reason I started blogging – to become more financially savy.

Scott – wonderful stuff. Thanks. Global warming is the biggest hoax and scam every played on the people.

This example is like the others you have provided in that the guy could have handled all his other extravagant expenses if his housing weren’t so out of line. $3000 instead of $5000 puts him in the black on the higher salary. And he could cut back on the entertainment and car when the commissions got thinner. Hard to cut back on your mortgage when it’s underwater . . .

Whoa someone needs to lay off the kool-aid. Can someone find a designated driver for Scott?

Dr,

I know that eating out is expensive and this probably goes into the eating out category, but 1000 dollars for entertainment seems really high.

Data Quick: “The OC” broke half a million (going down). Home price this week is 490,000. A year ago 630,000

Nice blog. I hope your friend pulls his financial head out of his arse.

I had a friend I went to high school with who did something similar but he actually worked his way up. He had no college and went to work for a good company right out of school. Anyway made it all the way up to VP over maintainence at that job. He also was a body builder and danced on the side. Of course he met a headliner stripper 15 years younger and between them they pulled down 350k a year. I told him to be saving some because you never know. Anyway he hurt himself lifting weights got a staph infection during surgery. Lost his good job after being out for almost 6 months and 3 surgeries, couldn’t dance anymore because of the injury, and his cute young wife danced off with her new girlfriend. He now lives at home and sells RVs at least tries to sell them.

Taxed to the “max?” His rate must have been 33%… That’s laughable by the standards of westernized countries and lower than I pay as a self-employed person making a fraction of 200k. Cry me a river over 33%. His tax rate could have been 0% or even -10%, he’d still have blown it all as soon as he got his hands on it. At least his local school system got some of it and some good came out of a little of it. Since he essentially smoked his share, society would have been better off if taxes had left him with less to waste. He didn’t even get taxed enough to cover his own economic clean-up with bankruptcy costs, I bet.

Guys like this make me think the cyclic nature of the economy serves a positive purpose by flushing these actors out of the system. It’s like an economic outward bound experience.

@Scott,

Out of curiousity, can you do a similar deconstruction of Cheney and Halliburton? Or are the only evil geniuses democrats?

Anyone with $200,000 of income who gives nothing to others through charity deserves no charity from others, or from the public. Single guy, fast money, fast life, fast car, $700,000 house for himself. It’s his values that got him where he is today. Loan brokers made used car salesmen paragons of virtue and integrity by comparison. “Generally a good guy” other than dishonest, selfish, and short-sighted I suppose.

C’mon! $150 is just one Burberry shirt from Nordstrom!

$1200/yr to insure a young driver on a leased Beem sounds low as well.

And Scott: there is no way the “green economy” will replace the housing bubble.

Not in any way that earns $200K/yr for glorified order takers.

Sorry, but the folks making $200K during the housing bubble were not “deal closers.”

The big money players were the quant guys at hedge funds, and even they aren’t pulling down what they once were — if they still have jobs.

I know the personality type you describe here – a friend of mine became a Hollywood agent and was living the high life for a while. Heck, one year his bonus was larger than my entire near 6-figure salary. He was over $50k in debt from living it up, driving the leased BMW, etc etc. And that was with expensing a ludicrous amount of entertainment. He finally got his act together when he met his future wife and decided that massive indebtedness was not going to impress her.

Emmi? 33% tax bracket? How you figure? Well, yes IF the only taxes you count are federal income taxes he’s in the 33% bracket and yes that rate used to be higher on top earners but other taxes used to be lower (and of course that kind of money also used to buy a LOT more, now it makes you able to afford a house in southern CA, whoop de do).

–

But really add 10% CA state taxes on top of that 33%. Add FICA and medicare and SDI (although lucky him he’s in the bracket where some of these taper off). I figure if my 25% federal tax bracket with all the other taxes means I’m paying 44% of my marginal income in taxes, that he’s probably paying equal or a bit more, and on most of his income. And he’s single with no kids – so not a lot of deductions there other than the house. My point is taxation is high. But even so taxes are absolutely NOT at all the reason for his downfall. Not with that kind of NET income. It’s the voluntary spending, including being a homeowner.

How the hell did the discussion wander off into Left/Right “Global Warming Hoax” talk? Isn’t this a housing blog? Anyways, I work with young people like the example… they are not rare and the recession will teach them a lesson. It’s the same lesson people my age learned in the late 1980’s/early 1990’s… what goes up, must come down… do your best to be prepared. This guy will survive. He may never make that kind of money again, but he will survive.

>Add FICA and medicare and SDI (although lucky him he’s in the bracket where some of these taper off). I figure if my 25% federal tax bracket with all the other taxes means I’m paying 44% of my marginal income in taxes, that he’s probably paying equal or a bit more, and on most of his income.

He’s only paying 1/4 the social security I am (I pay double as self-employed and he pays half because he’s way way over the cutoff where he gets to stop paying). He doesn’t pay income tax on his health benefits (and neither does his company, btw) but I do (on insurance purchased as individual). My marginal tax rate was 50%. He’s in the system and gets a pile of nice benes for that, so now he gets to deal with the downside of having to make his own way. Some of us do that every day, so we don’t have much sympathy especially when the claim of “I was taxed to death” crops up.

But that aside, this rabid anti-tax thing is getting terribly old. I don’t have any kids, so I don’t have to try to explain to my grandkids why we partied irresponsibly for decades instead of having the balls to pay down the national debt. Some people seem to treat it as a badge of honor that we’re screwing over the next three generations of Americans. I personally do not. Everyone should be paying their fair share, especially people who are going to cost the system more than their fair share when they take a fall.

Figure in the cost of DVDs, hobbies, travel (vacation related), gambling, and other pursuits of the rich and famous, and you can easily spend $1000/month.

Leave a Reply