Where the income is lacking – Calabasas median home price falls from $1.39 million to $877,000 in one year. A city where nearly 80 percent own yet incomes are unable to support bubble prices.

It should be rather obvious that many communities in California are still in mega-bubbles. Old habits are hard to change and we have a large group of people force fed on the bubble decade real estate religion that somehow, their niche market is blessed with certain inalienable rights that give it an advantage. With this advantage they are entitled to a high price even if the global economy is crumbling like stale bread. A large part of this is simply because of the lack of mathematical analysis conducted in these markets and wishful Hollywood twinkle in the eye inspired thinking. It should be obvious that homes are overpriced in many markets like Santa Monica or Culver City. The large shadow inventory and slowly declining prices is simply a symptom of this reality. The challenge in dispelling these myths is that you have a deeply entrenched belief in a system and these things rarely go away easily (i.e., people believed the world was flat even when evidence came out because you have to understand the evidence before you can accept it). So today I wanted to dig up a city where the bulk of properties are owner-occupied and carry mortgages. The city we will look at today is Calabasas.

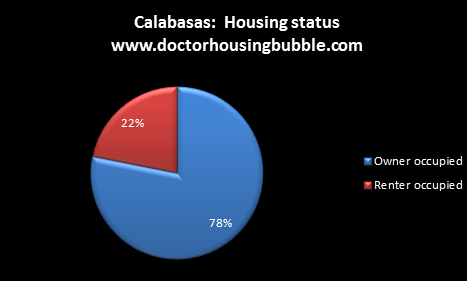

Calabasas – Where 78 percent of housing is owner occupied

The problem when stating the obvious that much of Los Angeles County is in a bubble, we usually get the retort that most people rent so we can’t use median household income metrics to derive a ratio. On the surface this is true since 51.4 percent of units in Los Angeles County are renter occupied. And it should also be obvious that renters for the most part will have lower incomes because it is skewed by people that are barely getting by or are unable to purchase a home. In the last decade, this was papered over with Alt-A, option ARMs, and subprime loan products so falling incomes had little to do with qualifying for a mortgage. So when we look at county income data, we are simply getting a snapshot in time. Obviously the income to home price ratio held in the 1950s, 1960s, and so forth so we can use these as simple guides. Yet some folks just want to believe in fairytales. Sure, incomes of those who own are typically higher but enough to justify current prices? Absolutely not. Since the Census doesn’t break out owner occupied income versus non-owner occupied income the next best step is to find a Census zip code where most households own.

Calabasas is the quintessential SoCal bubble city. Household incomes are solid yet nowhere close to justifying current prices. Over 78 percent of housing units in the city are owner occupied and 22 percent rent (to be precise, 21.9 percent). So the data for this city goes against the typical renter dominated areas of Los Angeles County.

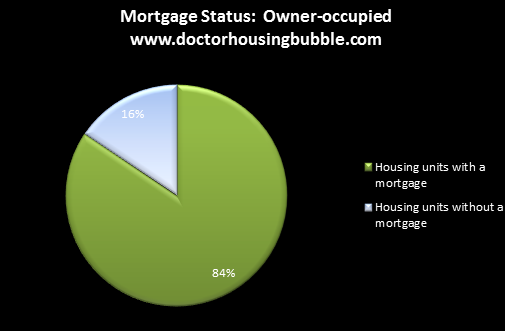

Next, we should refute the argument that most people that live in these homes have their mortgages paid off:

Of those who own a home, which is close to 80 percent, we have 84 percent of households carrying a mortgage. We have solid data on this market so we can really parse into the meat of the argument here. So it is rather apparent that most did not pay all cash as some would like to believe. It is very likely that the 16 percent that have no mortgage moved in pre-bubble days. No need to speculate, we can pull that data:

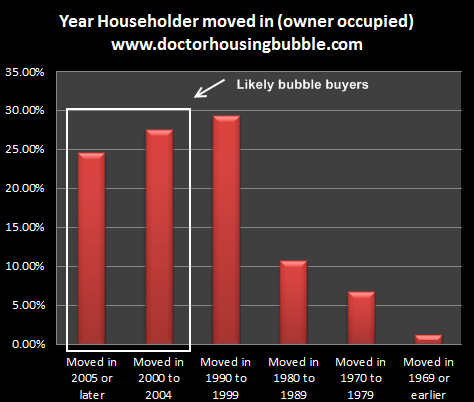

Over 50 percent of current owner occupied units in Calabasas were purchased during the bubble decade. The Census data goes out to late 2009 so this is a solid indicator of where things stand. And how many bought in 2010 and 2011 thinking that a bottom had already been set? And for those who think you have folks coming in with a large down payment think again:

Homes with a mortgage median housing costs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,001.00

So far, we have gathered a solid amount of information on the housing situation in Calabasas. What is the current median price for the city?

July 2011 data

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $877,000 Â Â Â Â Â Â Â Â Â Â Â Â (down 37 percent y-o-y)

Sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 16

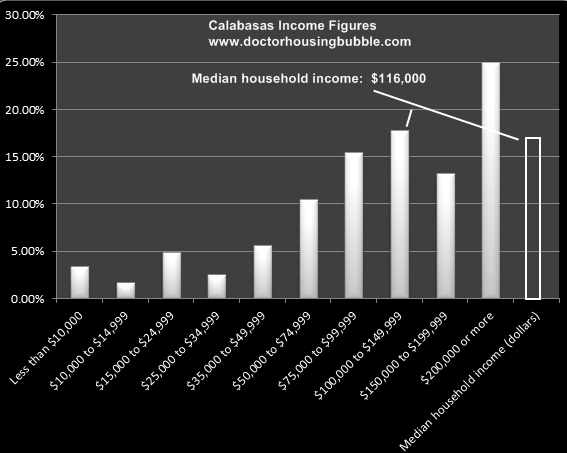

So the median home price at least compared to July 2010 home sales is down from $1.39 million. Why? Because even though incomes are solid, they still can’t support a home that costs $877,000 (the $1.39 million figure and higher past months are insane):

The median household income is $116,000 for Calabasas. Again, remember that nearly 80 percent of households own here so we are getting a much better perspective in terms of what can be afforded here. In my book, a drop from $1.39 million to $877,000 in one year is a nice correction but don’t let that get in the way of those hardcore believers that don’t believe in a housing bubble and think shadow inventory is simply a home or two in the bank balance sheet instead of 6,000,000+ distressed properties hiding off the market. Even for the $877,000 median priced home, you would need a household income well in excess of $200,000. Guess what? Only 25 percent of households in Calabasas make this and nearly 80 percent own! So those that bought in July of 2010 for $1.39 million were out to lunch big time. But again, why let facts get in the way right?

I wish we had more comprehensive data down to home owners and non-owners split out but this is rather compelling given the makeup of the city and the home ownership status. This is similar to the crap we saw going on with toxic lenders like New Century Financial and Countrywide yet people wanted to believe that “it was okay because it was only a handful of bad loans.â€Â No, it was pervasive and systematic robbery of the system. So the above data shows us that many cities including Calabasas are completely in housing bubbles even with a 37 percent y-o-y median price drop.

We showed a home in Bel-Air chasing the market down. Let us show you a home in Calabasas chasing the market down:

Listed   03/11/11

Beds     4

Full Baths            2

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,850

$/Sq. Ft.              $284

Lot Size 12,384 Sq. Ft.

Year Built            1965

I really enjoy the ad:

“Re-Appraised 05/11 and reduced $5,000 from previous listing!! POOL on hill with sloped property. Property needs work, updating, and lots of TLC. Fixer !!!!Property being sold subject 20 24 CFR 206.125 This is HUD information. Property is owned by Fannie Mae/HUD. No Repairs – As Is Only -No Home Path Financing or First Look – No Mediation or arbitration. All offers below the appraised value/list price will be countered to the appraised value/list price. Fannie Mae RMS HUD will accept no offers less than listing price. Property is private, prime cul-de-sac location with fantastic mountain views, 2 car garage, swimming pool. Neutral open layout, fireplace, large pool decking area with sliding doors from open living room. Home will need upgrades/repairs. Fantastic family location with great schools, close to freeway and shopping in Calabasas, Agoura, Woodland Hills, Warner Center.â€

Don’t try low balling with Fannie Mae folks. You even get a nice pool here:

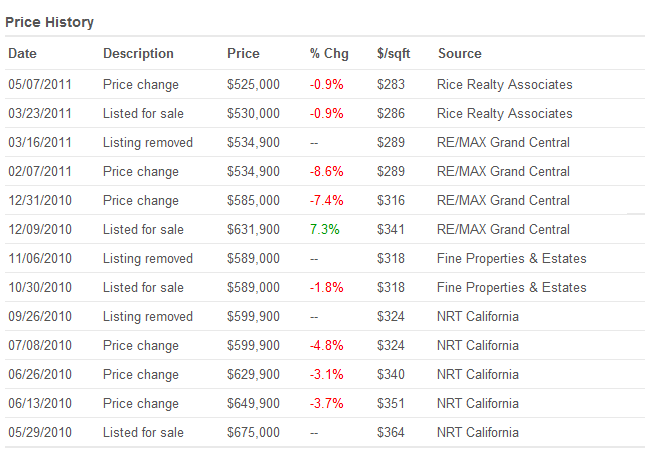

Now let us look at chasing the market down:

What I found interesting is the last tax assessment valued this place for $124,000! This is the backward nature of our property tax system. Could be a lot of refi action here but who really knows the full story. $675,000 in Calabasas would have seemed like a steal back in 2006 and 2007 to many but now we have a chase to the bottom. Now, you have to come up with some money and verify that income (even with record low mortgage rates the market isn’t moving so fast because people are finally getting it that the real estate world is not flat).

The point of all of this is not to deny that there are large pockets of money in California. Without a doubt, there are big bucks in the region but not a large enough critical mass as many speculate. Why speculate when the above data is available? Here is the psychological twist of course. Did the economy radically improve in the 2000s to justify this historical jump? No freaking way! In fact, the economy is much worse today with a 12 percent headline unemployment rate and a real underemployment rate of 23 percent. People would rather buy if the numbers made sense in most cases. No one disputes that but the problem shows up when we look at current income figures and home prices. Do you think if the median household income in Calabasas was $300,000 or $400,000 that the median price would have fallen from $1.39 million in July of 2010 to $877,000 in July of 2011? You have a small number of households with truly large incomes living next to a large number of overleveraged households that are living large paycheck to paycheck. Welcome to sunny Southern California!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “Where the income is lacking – Calabasas median home price falls from $1.39 million to $877,000 in one year. A city where nearly 80 percent own yet incomes are unable to support bubble prices.”

Everything’s bigger on the West Coast. Even our tiny 5.8 earthquake would barely make the news in LA.

It’s funny that so many people are religious, believe in aliens, Bigfoot, Loch Ness, and so many things that have no concrete evidence whatsoever, but can’t seem to grasp that there was a huge crime against humanity perpetrated here and that housing prices are being propped up by the mobsters in charge, even with all the evidence stacked so high you need a pole-vault to get over it.

It is truly a Crime Against Humanity… but don’t look for any warrants coming out of The Hague. OTOH, the creaking of the market distorting artifice is getting so loud that even some of the hypno-sheeple are snapping awake. The YoY and second derivative slopes are verifying that this almost-over summer selling season has been the worst in anyone’s memory, despite fairytale interest rates and non-stop NAR hyperbole.

It’s gasping… it’s weezing… it’s about to freeze up entirely… followed by the topple… well, OK, I guess the .gov employees can form a small “floor” of sorts, for perhaps another 18 months. 😡

They will not escape from justice. Their evil actions will come back to haunt them in the form of Karma. In the end they will face justice (not in the court room but via Karma).

Well, we hope… still, I’d like to be PRESENT when Karma catches up to The Scum of The Earth… I think that’s called schadenfreude… does that make me a “bad” person? ;’)

Crime against humanity. Now we’re striking the right tone. I also think it was a traitorous act and we should be looking at traitor-level punishment.

The difference between the Savings and Loan collapse and this “Ratings Collapse” where trash crashed your retirement party wearing a AAA suit is that this time around the crooks prepared for the ensuing collapse by occupying the offices of enforcement and shooing away those seeking justice backed-up by a KardASShian-obsessed media that would have to Google the term “investigative journalism” after being told it doesn’t have anything to do with getting the latest backstage dish on the famewhore of the day.

Like Capone-era Chicago, the gangsters had the cops on the payroll this time ’round. More than disgusting, it’s embarrassing to the reputation of our country that we haven’t collared them Mussolini-style or subjected them to a little electroshock therapy Rosenberg-style.

People are fools, a sucker is born every minute. Emotions defy logic. Sheep to a slaughter. The crime came afterward, with market intervention by govt to “save” the fools. If govt would have let market operate, it’d drop to where it should be, you’d walk from your $1M place, into the $200K place across the street, and all the banks would fail, and solvent banks would pop-up a week later. This could have all been over in about 10 days. Instead we have japan style slide into lower standard of living for the little guy.

Amazing attitude. “We’re offering a piece of crap house that needs a ton of work, but don’t you dare offer us what it’s really worth.”

That helpful attitude, coupled with the price history and larger market realities, is SURE to move this “steal of a deal” in a hurry! 🙄

Seriously though, it does APPEAR to be a primo lot–over 1/4 acre, killer views, etc.–salvageable house, etc… OTOH, I have only a tourist’s knowledge of LA area… is this Calabasas Highlands? Park Estates? or…? Doesn’t matter I guess, since no one who’s numerate is buying this beaten old nag until the price tag drops another 22% or more, eh?

PS: WHY has DrHB stopped including ACTUAL STREET ADDRESSES on these painted pigs? Does he not realize the sheer entertainment value of So-Cal RHoGs in Bubble Zone Uno, to those of us in Bubble Zone Dos, i.e. So-Fla? 😀

If it’s north of the 101, chances are it’s in a middle class tracty area rather than the “real” Calabasas, which is very upscale. I wouldn’t be surprised to find out that this house is virtually on top of the freeway, as some of those “Calabasas-adjacent” neighborhoods are.

Property is at 5849 Belbert Circle – Calabasas, CA 91302

Here is the Zillow link:

http://www.zillow.com/homedetails/5849-Belbert-Cir-Calabasas-CA-91302/19885273_zpid/

Seems like a good location, far enough from the freeway… looks like an early 60s house with mid-70s “disco-era” interior–NOT a plus… methinks the listing Realtard gonna have to soften the hardline BS… and soften the asking price.

… what is the FIRE DANGER in that locale?

(I should talk–just dodged a Category 4 artillery barrage called Hurricane Irene–can’t fend that off with a fire hose, lol.)

Fire is always a danger around here, Enzo, but it looks like the hills surrounding this area are balder than those south of the freeway, and less likely to be a problem. If it were me, I’d chance it on that account, and I say that having been through a very expensive “subsidence” event myself. But I wouldn’t buy that house for other reasons.

BTW, very easy to see from the Zestimate on Zillow (thanks for the link, JohnF!) that we’re still in a bubble around here. Not that Zillow is perfect, of course, but still….

Yep. Having lived in Pasadena all my life, I can tell you that there are lots of wealthy people here in the southland. Ever drive through SW Pasadena? Mansions galore. Most built by wealthy Easterners and Midwesterners back in the early 1900s as their Winter homes. I’m always curious who owns them now.

Calabasas is also home to many in the entertainment industry who wanted to get out of LA and the Valley yet still have a tolerable commute to Hollyweird.

Wow, that house actually looks tempting to me at the current list of 525K. Can’t touch anything like that on the westside for under a million.

Good luck… don’t forget you will have to spend several hundred thousand since it is a “fixer” and needs lots of tender loving care.

Well, I will say the pool looks updated, holds water, and is NOT algae-green… more updated than the front entrance and cracked asphalt driveway. The lack of more photos is a yellow/orange flag, but eventually the market will drag this down to a clearing price.

Might be choice enough lot to attract emotional foreign money… hard to say without street address or folio #. Apparently the drive to WeHo is “good” by La-la stds. A really motivated RealTard would hire a (widely available in LA) bikini model to lounge by the pool for Duh Sales Photos. RE Sales 101.

Calabasas is the home of Countrywide.

The chickenssssssssssss…. have come home to roost!

$1.39M to $877K is a scary drop, but to be expected after the previously insane bubble. There are pockets of the country that look like 3rd world countries that saw prices jumping during the “good” years, and are now hardly worth the value of a good bulldoze. It all comes down to employment…until we see labor markets markedly improve (and I’m not talking gov’t paying people to dig holes and fill them up) we can expect continued housing weakness. Increasingly volatile capital markets will probably also play havoc with home values soon enough…

Obama is working on a new ” plan ” to further extend and distort housing prices

http://www.nytimes.com/2011/08/25/business/economy/us-may-back-mortgage-refinancing-for-millions.html?pagewanted=2&_r=1&hp

This is a dream house compared to fixers in Burbank with a third less square feet, selling at the same price. Want to talk delusional???

I toured this house last year. It’s north of the 101. Roof needs work as does the pool.

Great… why is the ADDRESS a matter of national security? Can ANYONE post the ADDRESS of this cautionary tale? Even way over here in So-Fla, I think this would be worth monitoring.

Thanks in advance.

So_Fla HVHZ-rated roofs are more expensive than yours, so I’m guessing even a complete tear-off, w/ up to 20% rotted sheathing replacement, on 1850 sq ft. should come in under… $15k?? I’m perhaps being naive about access, hilly lots, local mafia/roofing rackets, seismic codes, etc… in short, it’s something you could use to knock off $22k, not $50k.

@Jay – dude, careful when it says fixer upper. That’s real estate lies for “needs total renovation”. Looks like a nice place though. It is nice to see prices coming down to reasonable levels. BUT WATCH OUT. I had friends who bought nicer places during the main part of the bubble at lower prices and closer in to central LA. Still overvalued by 100K+ IMO.

In THIS buyer’s market, the phrase “fixer upper” immediately knocks out all normal arms-length (i.e. mortgaged) buyers, esp. if a female is involved in the decision. This leaves the hardcore cash/REIT buyers who KNOW what it takes to flip this for a profit… and those cold calculators ain’t biting.

I love 60’s style houses that haven’t been messed with. This is a nice home in a nice area. I would just do the repairs and leave it original. Like a 65′ Chevy Malibu.

I agree… Love the MId-MOds… hence my handle.

The front doors are period/style correct, but the carriage light, garage door, and other items were clueless choices, and too downscale for such a primo prop… perhaps a symptom of over-extended owners?

The garage entrance being perpendicular to the front elevation is a big plus, but something I’d expect in this price range. Again, more pics needed.

Still, a YEAR (probably more) on the market is a wake-up call. WWDLD? (What would David Lereah do? LMAO!!) 😀

Here Dude-

http://www.trulia.com/property/3013795460-5849-Belbert-Cir-Calabasas-CA-91302

I could live in it as is. Why plow money into it? Ride your bike to the beach.

What! You mean to tell me that Cheesecake Factory employees cant buy this house at there current salaries, even though they work a short distance away? LOL

Bubble cities in West Los Angeles are about to take a serious hit. Owners (Debtors) who get behind the market, will get crushed. Cities with large % of mortgage holders will ultimately suffer the worst. Just like last time during the early 90’s. History repeats itself., nothing new. Hopefully it will be sooner than later, otherwise we won’t see any price increases until 2017-2018.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

How about cash buyers? I know someone who bought a little house in Venice just up from the boardwalk (one of the walk-through streets). He paid just over $1M. Cash!

Forgot to add that he bought it this Spring…

Ahhh. You’ve discovered the secret on how to make an easy, cool $500,000 in Real Estate. Start with $1 Million. 🙂

Just think what he could’ve done had he put it into gold at $1,400 an oz.

The last two sentences really sum it up nicely:

“You have a small number of households with truly large incomes living next to a large number of overleveraged households that are living large paycheck to paycheck. Welcome to sunny Southern California!”

Calabasas does have some truly stunning homes – mansions on magnificent lots…

…but I never understood how EVERY home in the area could be so incredibly overpriced, nor who the heck could afford all these average properties at premium prices.

Now I understand. Many of these “owners” CAN’T, in fact, afford their overpriced properties.

A 37% decline in one year??

It’s a start.

Renting in Tarzana

P.S. BTW, the daily work commute from Calabasas to the Basin would be hellish at ANY price.

My crystal ball says: it won’t sell until it drops to $460,000. Which may happen as soon as the next QE is publicly announced (have a funny feeling it is happening now…but they ain’t tellin’).

Be fun to have a poll now Doc…”pick-a-price poll” and when it sells, the one closest to the price gets big free attaboy or….girl….

Imagine the con artists running Fannie Mae dictating what the selling price will be….more delusional than I thought.

Soon, it won’t be worth 100 one ounce gold coins….seriously. Think hard about that…

$525K seems reasonable for Calabasas, people attempting to move in would need to be making $175K not that difficult for two income family…. But, this home is ugly! Needs major renovation and updating maybe $150K before you even move in, so you’re right back at $675K.

Why do people still insist the housing bubble was the fault of the lender? ANyone ever hear of personal responsibility? Maybe do the math and read the contract?

I was given the sales pitch of pay “X” dollars, with a strange mortgage and sell the house in five years before the mortgage resets, use this money to buy your next house. It was all Bull. I can’t believe people think they were ripped off when the data was right in their hands. Sorry, I’m not buying that anyone was “harmed”, but they commited financial suicide. I’ll bet that if a similar offer was present to the individuals “harmed”, they would’nt do it again? This was a big educational experience.

You are of course correct. The problem is that we all make mistakes. We all can fall victim to a good story. We all can fall for a story that we want to hear.

The people hawking those loans were carefully schooled on how to sell them. You and I may not have gone for such a loan, but many were taken in. I also know that I am not immune to a swindle. They just haven’t hit me with the right story yet.

I am not arguing with you. I too believe that the greater fault lies with the debtor. They had a responsibility to read the contract and think about what it meant. They signed the contract. They promised on their honor to pay the money back. They broke that promise, and now you and I get to bail them out. Not at all fair.

http://www.redfin.com/CA/Calabasas/5849-Belbert-Cir-91302/home/3330231

Well to understand why no one is prosecuting the Bankers for the financial mess they created in the Real Estate market you need to review theses two videos:

Part 1: http://www.youtube.com/watch?v=cNXyBIPAJqQ

Part 2: http://www.youtube.com/watch?v=i4PE1gZn7s4

For the last two years I have seen Professor William Black talk about how the Bankers need to be charged and jailed for the crimes they committed, I have a problem with now after seeing this information. Since the FDIC basically invented this crap, I guess he wasn’t aware of what they were doing with the toxic loans that the RTC packaged up and sold. Notice how the FDIC brags about being the leaders in recovering the most monies from the junk they sold….. Thanks RTC….

As much as I hate to admit it, the whole housing bubble has reset many people’s opinion of normal pricing. 500K just 10 years ago was a TON of money. Today, most people kind of shrug at a fixer priced at 500K and are not shocked by it. The Gen Yers don’t know any different since bubble pricing has been part of their entire adult life. With this psychology, unwinding this bubble will take much longer than most people on this site expect…and we’re seeing it with premium areas ever so slightly decling.

I love 60s style ranchers too. Barring any major structural issues, this house would be a cool place to bring back to its past glory. I think it could be done for much less than 150K IF you are handy and do some of the work yourself.

Totally agree!!! We used to think for 500K you would live in a nice beach home. Now you get a dump in the valley! The reality hits when you close, the property drops 10% right away, and you have to replace the roof. Then your spouse loses their job and you can’t make the mortgage even with your 125K job. Uh ohhh.

That’s a very cogent insight on how Duh Bubble has created a new/skewed “normal”, and how generational shift gives a psyops persistence to Duh Norm, and resistance to a return to a historical mean based on fundamentals. Kudos.

This of course ties in, cynically, with the NAR propaganda, aka “Susan researched this”. 😡

Also dittoes on being handy, and returning these MidMods to their past glory, incl. some upscale Saarinen/Eames/Mies/Neutra style furnishings, and some intelligent terracing and retaining walls for steeper parts of the lot.

It wasn’t difficult to find the place using Google.

Realtor advert:

http://www.trulia.com/property/3013795460-5849-Belbert-Cir-Calabasas-CA-91302

Address: 5849 Belbert Circle, Calabasas CA 91302

Hey Doc on the tax assessor you can thank Prop 13. The assessment is for the prior owner who played it forward for years. Never trust the tax assessor, Zillow, or anyone else for that matter on assessed value it means absolutely NADA.

Someone explain to me how this place is better than the 90’s house I just bought in a gated community in Chino for $125K less. Commute to Downtown is almost the same, possibly less for me (and I can take Metrolink), property taxes are substantially lower because I’m a mile over the SB County line, and if you want to talk heat/smog, I don’t see how Calabasas has any advantage over the east San Gabriel Valley.

Yet this place is $525,000 for a fixer. People are delusional if they think they’ll actually get that much. I wouldn’t pay $350 for this dump.

Well, as someone mentioned above, you could ride your bike to da beach from Calabasas, whereas from your zip it looks like a long road trip, with extra gas cans strapped to the rear bumper… I kid…

Also, being a 90s house the build quality is… dubious, and the style is probably… you know… (*blush*) Styrofoam-enabled faux-Med.

We won’t go into why the community feels the need to be gated.

JCC, for you the Chino house is great, but there is a big difference between Chino vs. Calabasas, after all the Jenner’s have a house in Calab not Chino.

Ummm…it’s in Chino?

1. Didn’t Calabasas start with much higher prices that other parts of LA before the bubble started?

2. Regarding how much you have to make to afford a home, what about for those people in Calabasas that have large amounts of money to put down on a home? Is it possible that even though people’s incomes do not support these home prices, people who move here might have larger amounts to put down on deposit to make them be able to afford those home?

Leave a Reply