Zillow is Off by a Small Amount. Try $250,000 off with Proof!

I have found how Zillow prices their homes. Please, this is definitely confidential information so I hope that we can keep this between us bloggers. I have found their head algorithm engineers and took a snap shot of their insanely accurate “Zestimate†figures. Here is the clandestine photo that I took of their uncanny picking abilities:

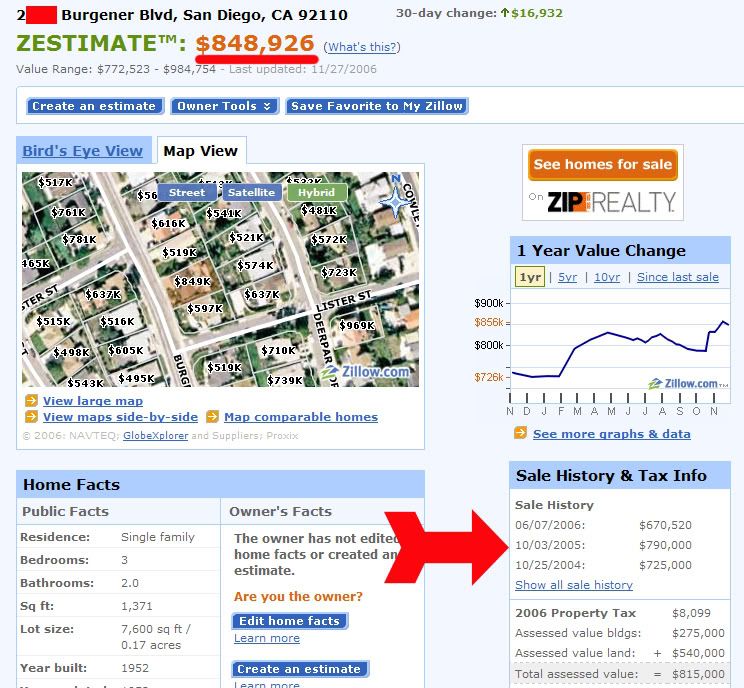

In all seriousness, let me show you an example of how off they really are. Below is a Zestimate of a home in San Diego county:

Zestimate: $848,926

Sale History

06/07/2006: $670,520

10/03/2005: $790,000

10/25/2004: $725,000

Currently this home is REO and is listed at $614,000. So Zillow is off by exactly $234,926! Are you kidding me? I wish I would have gotten away in graduate school with approximation like this. Can you imagine if you worked as a teller at a bank and you told your manager “yeah, I’m only off today by $15,992.32.†Your manager would smile and probably report you to the authorities once you stepped out of the building. This is only one case example of how distorted the current housing market is. When banks start getting more and more properties as REOs such as this one we will begin to see how shady the mortgage lending and housing construct has become. There needs to be some purging that happens in the next few years.

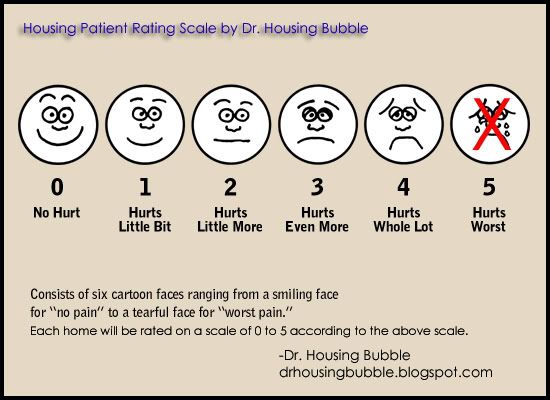

This home on the Dr. HousingBubble scale rates as:

What overpriced homes have you come across?

Subscribe to feed

Subscribe to feed

11 Responses to “Zillow is Off by a Small Amount. Try $250,000 off with Proof!”

DR.,

SOCALAPPRAISER here. I can’t figure out how the blogger idenitity thing works so I just go as anonoymous. Zillow simply uses county tax records for most of their info. If I appraise 25 houses 18-22 of them will typically be significantly different from what county tax records say. Larger living area sq footage, BR count, BTH count, etc… the list goes on and on. More important however is the “external obsolescence” factors they do not account for ie. next to a gas station, fronting a freeway, etc. Good appraisers have never feared these online valuation models because 75% of the time they are not even close. Wait to see what happens to the stock prices of all the banks / mortgagors that used online appraisal method to get deals done when the 07/08 foreclosure / devaluation wave hits. From our side of the business it could not happen to nicer (HA!) people.

SOCALAPPRAISER:

Thanks for the information. I actually like Zillow for the easy of finding previous sales prices. But as far as current market prices, I think they are off big time. If anything they are a lagging indicator showing you what COULD have been your price.

What are you seeing in the market right now? Are you seeing big price discounts? Are you seeing sellers accepting the fact that they will not get high prices or is the delusion still part of the market?

These are all very good points. Personally, I would much rather prefer to pay a very good real estate appraiser for a solid and well thought out price estimate, than to use a “monkey’s estimate” from a lagging indicator such as Zillow.

And it also seems to me that the pricing model in Zillow looks more like a set of ‘appraisals’ that are just trying to ‘hit the numbers’..

Today’s report on Boston has been released on both my blog and our new website. History has shown us that Boston is a great indicator of what will happen here in California.

thebubblebuster.com

or

Daily Home Price Analysis

DATA QUICK and ZILLOW may be source of “bloated” sales data.

In Shasta County, Ca found bank owned foreclosures being posted as “SALES”. Yes, people, that is correct! Just found bank owned foreclosures which are currently on the market being posted as November sales from Data Quick and also posted on Zillow.

The legal instrument by which a property is foreclosed in California is a “Trustees Deed”. Zillow & Data Quick are picking these lender owned properties from county data as SOLDS.

In November 2006 the Redding Record Searchlight showed 141 houses sold (data from Data Quick). So far, I found 11 of these so-called sales are actually foreclosures.

Please see if this is happening in your area.

anon:

Thanks for reading. In regards to Zillow many things are occurring that make it a “not so accurate†reflection of over-inflated markets. To be honest, Zillow is a great tool for areas that have normal appreciation; historically this means home prices adjust at or slightly above inflation rates. Now why is it good for these areas? Well Zillow gathers recent sales data from tax records, which takes 2 to 3 months to reflect since escrow and title recording take this long, and then does a brief analysis. Very crudely, they take recent sales in the area, divide sales price by square feet, and apply this to the property you are looking at.

This is excellent information if you are in a steady market because it will only be off by one or two percent of true market value. But keep in mind Zillow does not factor in cosmetic issues and major fix up issues which you know many homes need and have.

But why is it so off in areas in California and recently high appreciation areas? Well, take the example I gave in the article. Zillow has no way of knowing that the price recorded was based on an over inflated sell and the buyer has foreclosed. And this happened many times over in these areas so the Zillow formula takes recent comps and gives you a very high and inaccurate number. In many cases it is off by $100,000+ which to many including myself is significant.

Zillow will refine itself but in no way reflects the “true†market value of a home in high appreciation areas. It is a lagging indicator. We already know that many areas are showing zero to negative appreciation. Since Zillow records are off by a few months this will be reflected instantly. It is pretty much equivalent to looking outside of your window saying it will not rain only because the sun is currently shining and ignoring the brewing storm beyond the mountain.

San Marino, CA, house. Zillow estimates it at a little over $2 million with it “recent sold” for $271,000. That “sale” was a foreclosure.

I’ve seen this house when it was on the market last year. It started at $2.4 million, and ended as an expire at $1.95 million and didn’t sell at that price.

My wife and I offered $1.6 million but were turned down… and then the owner lost it to foreclosure!

It needs a complete renovation — kitchen, baths, everything.

Realistically, right now it’s worth no more than $1.5 million.

San Marino, CA, house. Zillow estimates it at a little over $2 million with it “recent sold” for $271,000. That “sale” was a foreclosure.

I’ve seen this house when it was on the market last year. It started at $2.4 million, and ended as an expire at $1.95 million and didn’t sell at that price.

My wife and I offered $1.6 million but were turned down… and then the owner lost it to foreclosure!

It needs a complete renovation — kitchen, baths, everything.

Realistically, right now it’s worth no more than $1.5 million.

Temple City House, CA home is asking $679,000. Zillow estimate is $673,000 but has wrong bedroom information. I am offering $640,000 but seller will not accept any less than $670,000. Any comments?

anon:

Typcial delusions of a seller in Housing Wonderland. Take 6 months of no shows and empty houses and slowly the reality will change.

The Temple will come down…

Dr. Housing

I can show you where they are off by MILLIONS.

compare these two…

336 S Hudson Ave. L.A. CA 90020

356 S Hudson Ave. L.A. CA 90020

You’ll laugh your ass off.

Leave a Reply