The drought of young California home buyers: Unaffordable housing reigns supreme as first time home buyers squeezed out of market. Of 7,000,000 completed foreclosures since 2005, 1 million occurred in California.

It is safe to say that the momentum of 2013 has fizzled out in the housing market. Sales are down and prices are reaching a plateau. Part of this has come from the slowdown of investors purchasing homes in the state. An interesting end of the year study by the California Association of Realtors (CAR) found that 82 percent of investors that bought in 2013 had the intention of turning the home into a rental. The other 18 percent were giving the old flipper lottery a try. This helps to explain why inventory continues to remain lowbecause in more typical markets, a person selling the home would usually also buy another home in the ragtime favorite trend of property laddering your way into a bigger home. In other words, two transactions with one move. Today, you have many investors buying foreclosures from banks with a one and done deal (buy the home from bank and then put it on the market for rent). Yet from contacts in the housing industry, the lack of first time home buyers is dramatic. In 2013 the argument was that pent up demand for young buyers was going to give housing another dramatic run higher. In reality, 2013 gave us a massive run from investors and with them slowly pulling back, the market is already entering into a tipping point. Flippers buy for appreciation so what happens when prices stagnant or turn lower which is typical in these boom and bust cycles? In reality, first time buyers are absent because they can’t afford to buy in California.     Â

First time buyers pushed out

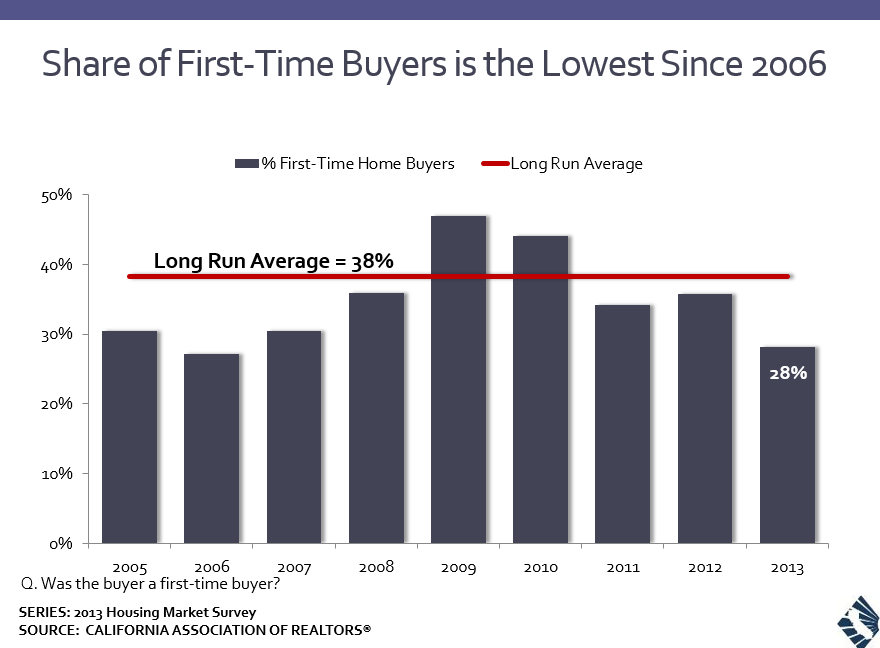

First time home buyers are largely missing from the game in the current housing market. First time buyers in California are at levels last seen in 2006 when the housing market was in full out mania. Of the 7,000,000 completed foreclosures since 2005 1,000,000 of those happened in California. But screw them and screw history right? This is about getting on this party bus right now before we have another 2013. The foreclosure number is especially high when you get the dogma that housing is always a sure bet. You have a large number of variables at play here and first time buyers in California are being smashed.

Take a look at the trend here:

The long run average is 38 percent and we are nowhere close to that. Why is this so low? Because first time buyers simply do not have the household income to compete with large pools of investor money.

Minimum income required to buy

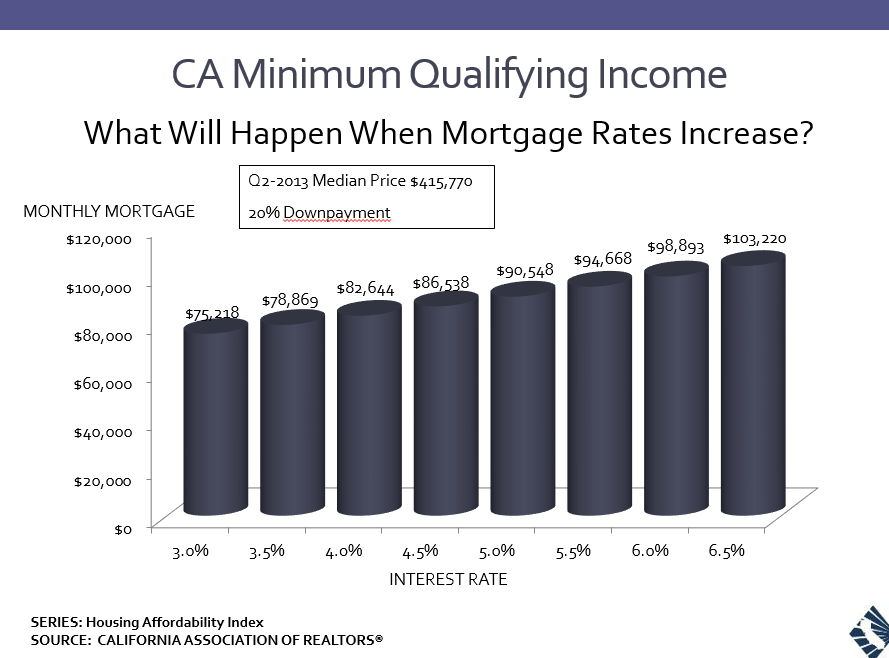

This data is from the annual CAR report so keep in mind this is from a group that is typically favorable to housing. Take a look at the numbers here in terms of being able to afford a home:

At an interest rate of 4.5 percent a household would need an income of $86,538 for the median priced home of $415,770. Since the report was published, the median price based on CAR data for California is now up to $457,160. Even if rates modestly move up to 6 percent, this household would suddenly need a $100,000 household income just for the median priced home in the entire state. Forget about the crap shacks in various areas around the state. You can get a great starter home in Compton or Inglewood. I’m sure young professionals are just itching to take the vanguard of gentrifying these cities. Instead of liquor stores you now have a Starbucks so don’t worry about that price tag.

More to the point, good luck finding a large pool of young buyers with $80,000+ for a down payment. For first time buyers, incomes absolutely matter and the CAR even realizes this.

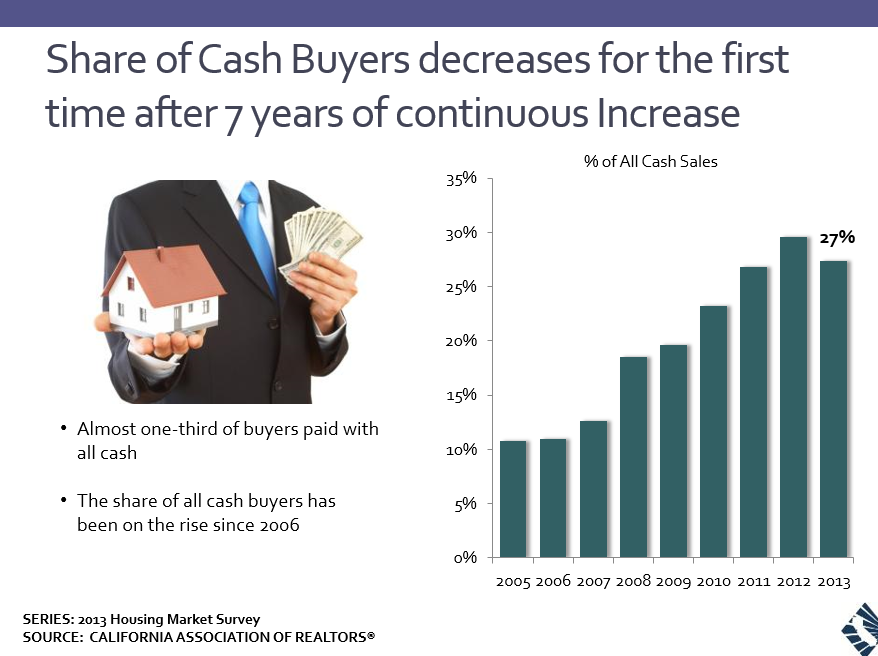

Investment buying with cash buyers

Of course the crowding out of first time buyers has come from investor buying:

You’ll notice that investor buying actually dropped a bit in 2013. It has dropped significantly in 2014. It is important to note that 82 percent of investors planned on turning their purchase into a rental. How many properties since 2008 have been pulled off the market for a decent amount of time? This is an interesting point to examine and absolutely helps to explain the low inventory hitting the market.

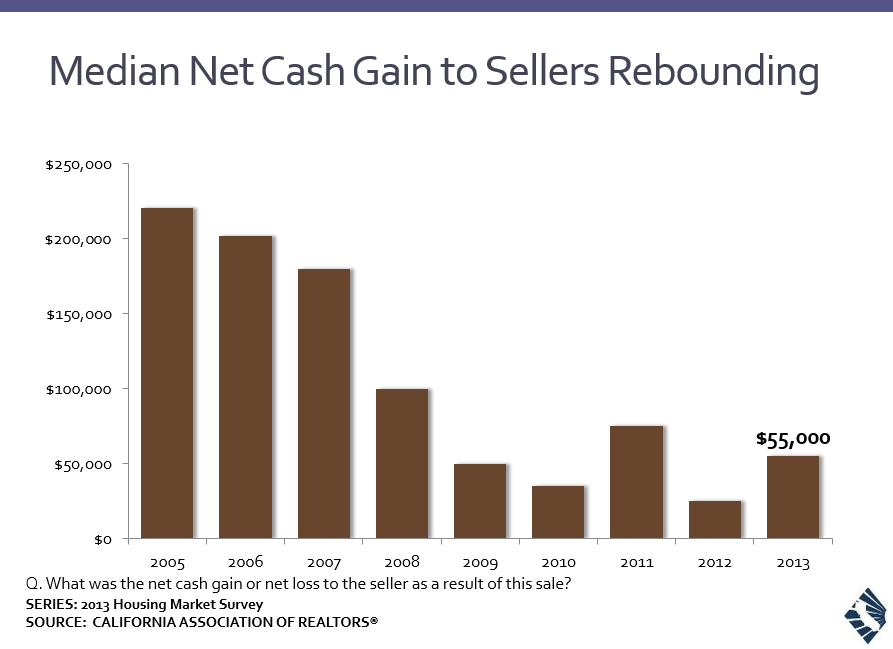

For those thinking that everyone that sells in California is making out with big bucks, take a look at the median net cash gain to the seller data:

Even in the very lustful 2013, the net cash gain to sellers in California was $55,000. Enough to buy you a basic foreign car outright.

Adults at home

So the young are not even players in this market. I would argue that many can’t even afford current rentals in more expensive areas. The data backs this up:

“(UCLA) For a variety of reasons — lack of a job, job loss, divorce, home foreclosure — more than 2.3 million adult children in California were living with their parents in 2011, 63 percent more than in pre-recession 2006. There were 433,000 older adults, age 65 and over, who housed approximately 589,000 of those adult children.

“A college degree is no guarantee of a job today, and an unprecedented number of families have been forced to return to a multi-generational household,” said Steven P. Wallace, associate director at the UCLA Center for Health Policy Research and a co-author of the study. “Until the economy provides the kinds of jobs that allow all adults to be self-sufficient, families will need help.”

AKA, incomes suck for many young workers in California, even those with college degrees. How are these adults going to afford those $700,000 pizza boxes when they can’t even afford a higher priced rental? The young buyer is getting smoked in California. So what many are left with is stretching their budgets to compete with these cash flush groups of hot money. 14 percent of SoCal buyers used ARMs in the last month of sales data. Compare this to 1.9 percent in May of 2009. Why? Because ARMs allow for higher leverage even when fixed rates are at near historical lows and the Fed continues to point at higher rates in the near future thanks to the end of tapering.

The mentality rarely changes and that is think for the short-term. Forget about retirement planning, just buy a home with the other lemmings and future income will come from somewhere. Maybe we’ll find some in the La Brea Tar Pits. And this also brings me to the point that 1,000,000 Californians flat out lost their home due to foreclosure since 2005! They bought at a high price and couldn’t sustain their payment. Heck, we still have some legacy owners deep in foreclosure still living in their property as banks continue to drag out the foreclosure process. This is also another reason why the median cash gain to sellers in 2013 was fairly low. Someone overpaid in the last bubble, held on, and is riding this game again so the gains are fairly low when you consider the current median price.

The psychology of the California home buyer and seller is fickle. In the last bubble, every justification was made for high prices. Today, we see similar justifications again but first time home buyers are being squeezed out. So then who will buy? Baby boomers with their golden sarcophagus? Probably not since many of them have their grown kids living at home. First time home buyers? Look at the stats. Not exactly promising especially when you look at incomes. Limitless foreign buyers? In some cities this will have an impact but for how long? It should be clear why there is a drought in first time buyers in California. Given the weak summer selling season, some folks missed the memo on housing being the safest and greatest investment in California. Don’t run the numbers, just buy. Those 1,000,000 households that lost their home don’t know as much as you do.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

182 Responses to “The drought of young California home buyers: Unaffordable housing reigns supreme as first time home buyers squeezed out of market. Of 7,000,000 completed foreclosures since 2005, 1 million occurred in California.”

So, we’re half way through “selling season”. Lets review:

The median asking price in Orange County has declined in 4 out of the past 5 weeks – http://www.deptofnumbers.com/asking-prices/california/orange-county/

Inventory in OC is up 55% YOY, yet sales are down 11% for the same time period – http://www.redfin.com/county/332/CA/Orange-County

1 in 3 homes listed have had a price cut, equaling last years high that was reached in October. The velocity of price cuts is accelerating rapidly – http://www.zillow.com/local-info/CA-Los-Angeles-Metro-home-value/r_394806/#metric=mt%3D6%26dt%3D1%26tp%3D5%26rt%3D6%26r%3D394806%252C12447%252C46298%252C16764%26el%3D0

Available inventory is back to 2012 levels and rising – https://ycharts.com/indicators/us_existing_home_inventory

Housing starts dropped sharply last month – http://www.nytimes.com/2014/07/18/upshot/housing-starts-fell-in-june-heres-why-thats-bad-news.html

Mortgage applications are down from last year, in spite of increased inventory – http://www.calculatedriskblog.com/2014/07/mba-mortgage-applications-increase-in_23.html

So, inventory is up, sales are down, price cuts are up, and mortgage applications are down.

Interest rates are expected to begin rising as the Fed ends QE in October. What happens next?

Dom lets review,

home team amasses over 600 yards,

QB sets new school record for TD passes, defense stellar for most of game.

But home town team losses in last second?

I could counter everything you posted with a really deep probe and I can assure you my stats are never involved with NY times, Red Fin, Zillow, calulatedrisk etc. in my research.

“So, inventory is up, sales are down, price cuts are up, and mortgage applications are down”? every cycle of Real State involves ups and downs, I can show you a horrific cycle back in early 90’s where houses were at 500k for the same junk as today, the predication then, homes will come down 50% and never return to that cycle. Those homes today sell for 1.8m.

Quick lesson for you and all, 2008-2010 was fraud Ville plain and simple, it had nothing to do with principles of buying and selling it was get free money from the bank, a big house you can walk away from etc.

Today’s market has no fraud just tighter lending, when the economy improves with new administration all will be back to buying and selling.

In the mean time this is just another cycle and buyer seller standoff, buyers can’t rent forever and their family needs a solid roof over head in the end buyers return and houses sell, it is American business no other place to invest in then America, buy a house be happy, shut off the news 5 out of 7 days a week.

“I could counter everything you posted”

Not likely. Feelings and anecdotes seem to be your weapons of choice. I posted hard data. Where is yours?

“A really deep probe. ”

LOL

You can counter everything he said….but you won’t…because you can’t.

Soooooo, now is a good time to buy! Right! Right! Right!!!

“when the economy improves with new administration all will be back to buying and selling.”

Might be the stupidest thing little r has ever said, and thats saying something.

robert: “buyers can’t rent forever…”

Buyers never rent, period. You’re not a buyer until you buy. Until then, you’re a renter. And many people can and do rent for a lifetime.

robert: “…and their family needs a solid roof over head…”

Renters already have solid roofs over their heads.

robert: “in the end buyers return and houses sell…”

Buyers buy IF they can afford a house, among other factors. But so long as houses are priced beyond their means, then buyers do not buy.

Your post sounds as though you think you’ve made some powerful arguments in favor of a rise in home sales, and home prices, but all you really did was make some baseless assertions.

“when the economy improves” Robert the economy improved…. for the uber rich. Everybody else not so much. There’s a little thing called “multiplying” effect though when you asses real estate prices from 09 to 2013. Why don’t you take a minute and read up on it. My words to you “inflation is a bitch”

Ah yes, the good ol’ this time is different argument.

Riddle me this – if the fraud has been cleared out and we’re now back to fundamentals, why not put all of the shadow inventory on the market and stop MBS purchases over at the FOMC?

Perhaps you could be so kind as to post your stats, as I’m told that Janet has her ear close to this board.

Another stupid, incongruous analogy from little r robert.

“I could counter everything you posted with a really deep probe”

No doubt you like deep probes, lil r robby. Keep your probes to yourself please though.

“I could counter anything you posted with a really deep probe”. I’ll thank you to keep that to yourself, you silly savage!

Little “r”obert, do we have to send you back to the children’s table, you predictable little shill?

Great post DOM. Inventory going up. Asking price has peaked/going down. Investors/cash buyers are starting to disappear. We’ve run out of steam already…and that’s with record low interest rates.

And, it is impossible to get a fixer on quiet street in Newport Heights or Cliffhaven. Every such property has multiple offers and prices are moving up very fast. It has reached the point where people are bidding on far less desirable properties under the flight path in Westcliff and Dover Shores.

Ah yes. Tulip heaven.

Hey DFresh – there’s a few inflection points for you. Get ready for the landslide.

Dom: Are you just cherry picking numbers to support your statement that “inventory is up, sales are down, price cuts are up, and mortgage applications are down”

Are we going to use YoY. LA or OC, or the just the last 5 weeks? Because if you’re cherry-picking, you can spin anything you want.

Asking prices are up YoY and M/M in LA.

Inventory is up and sales are down, but that was also the case in 2012 and it wasn’t an indicator of a housing crash.

Mortgage applications are as low as 2012, but does that mean it’s a precursor to a housing crash?

Housing starts are disappointing because it’s bad for the economy, but as the article you linked to says … “economists think the United States needs to build something on the order of 1.5 million new housing units a year to keep up with a growing population and older homes falling into disrepair”

MB – take your pick. Nationally, in CA, and in LA and OC “inventory is up, sales are down, price cuts are up, and mortgage applications are down†compared to last year.

Use the links provided above if you don’t believe these statements.

The last time the median ask went down from June to July, prices continued to drop for the next 6 months in a row, and THAT was with interest rates dropping like a rock.

http://www.deptofnumbers.com/asking-prices/us/

http://mortgage-x.com/images/graph/r_30_15_arm.gif

I didn’t see anything in what Dom wrote that mentions a “crash.”

LA median asking prices are up 6.2% YoY according to your link.

LA inventory is up 18% YoY, but 2013 had historically low inventory. With all the additional homes there’s still less than 4 months of supply, less than normal.

Of course the number that matters most to buyers/sellers, prices are still up 8% YoY

…. ALL RIGHT, ALL RIGHT …. TWO FOR ONE SALE ..

.. More defaults, More foreclosures ……. . Finally …More Realty …

YOU MUST HAVE INCOME TO OWN PROPERTY ( A VERY SIMPLE EQUATION )

Nice work by the Dom-Inator

Housing To Tank Hard in 2014!!!!@

Housing to go up 30% in 2014…

Housing to stay flat in 2014.

Housing will be dictated by hot fed money and wage growth…so since both are eroding, housing fix is getting close to the end…

The fed has proven it can fix any financial instrument.. Now, one thing they can’t fix is water…your house is worth zero without any of that….

“Now, one thing they can’t fix is water…”

The Fed is working on printing water via synthetic water instruments…

If you read and followed the advice in the comments of this blog you would never buy a house. Apparently it is never a good time to buy a house because prices are overvalued. Even in 2011 comments told us that prices were going to fall further.

It is bit like getting investment advice from Zerohedge: you never invest in anything because it is overvalued. They never said oops about the S+P gaining a record – that dead cat bounced into orbit.

When can i buy? Will house prices be halved by 2016? 2020? 2030?

BB – we sold last year and will be buying the dip. Put your money where you mouth is, right? 😉

bb, the prices didn’t fall further because of the two reasons. First, the FED started the money printing (QE) and was buying the defaulted mortgages, the second reason is shadow inventory. I personally know two families who lived in their homes for more than two years before they were foreclosed on, so, artificially controlled supply put a flour under the collapsing housing market. If it didn’t happen, the prices would’ve gone down another 20-30%. We did not have the real price discovery in 2009-2011. Keep also in mind the historically low interest rates…

Prices??? Prices may never be halved in another hundred years. But VALUES…well, there’s the rub. When your dollar’s value/purchasing power is effectively halved within 5-10 years…

@bb wrote: “If you read and followed the advice in the comments of this blog you would never buy a house….”

That is because this is a blog about Southern California homes.

If you live anywhere in the U.S. except SoCal, the Bay Area, Hawaii, Seattle, New York City, Chicago and Washington D.C./northern Virginia, homes are (SHOCK!) affordable and within the grasp of even those who work at McDonald’s or Wal*Mart.

In most of the U.S. (except the locales listed above), when factoring in the current mortgage rate of around 4.5%, the monthly nut (PITI – principal, interest, taxes, insurance) for the typical home buyer is frequently 1/2 the rent in that area. So, in many parts of the U.S. it is cheaper to buy than it is to rent.

@bb, Boston should be included in the locales where home prices are bubblicious and largely unaffordable to many if not most of the residents.

Funniest comment of the forum, houses are affordable to walmart workers any where but in California

so untrue a cave man gets it….

The fed fixed the market, plain and simple…when the central valley has no water your homes on the coast will drop faster than a Mavericks wave…

@cd, you’ve been in California too long.

Federal minimum wage $7.25. Assuming a 4.5% interest rate, that means a minimum wage worker can afford a mortgage of up to about $80,000.00

Here’s a list of houses that a minimum wage worker can buy: (nothing in the bubble list of above). The monthly nut on these are well below $325 per month, i.e. less than what some in California pay for gasoline for their Escalade SUV.

Jacksonville, FL $35K

http://www.realtor.com/realestateandhomes-detail/3518-Gilmore-St_Jacksonville_FL_32205_M62653-16782

Dallas, TX $45K

http://www.realtor.com/realestateandhomes-detail/1711-Riverway-Bend-Cir_Dallas_TX_75217_M71147-00602

Charleston, SC $55K

http://www.realtor.com/realestateandhomes-detail/2667-Lawrence-St_North-Charleston_SC_29405_M62643-04670

Kansas City, KS $65K

http://www.realtor.com/realestateandhomes-detail/1027-S-79th-Ter_Kansas-City_KS_66111_M74931-82653

Atlanta, GA $50K

http://www.realtor.com/realestateandhomes-detail/1128-Cahaba-Dr-Sw_Atlanta_GA_30311_M52836-77256

Minneapolis, MN $65K

http://www.realtor.com/realestateandhomes-detail/2947-Penn-Ave-N_Minneapolis_MN_55411_M89360-91731

Nashville, TN $65K

http://www.realtor.com/realestateandhomes-detail/1326-Bellshire-Terrace-Dr_Nashville_TN_37207_M77943-46100

Memphis, TN $78K

http://www.realtor.com/realestateandhomes-detail/6778-Rockingham-Rd_Memphis_TN_38141_M77426-58789

Tulsa, OK $42K

http://www.realtor.com/realestateandhomes-detail/4720-S-Santa-Fe-Ave_Tulsa_OK_74107_M79015-77826

Indianapolis, IN $42K

http://www.realtor.com/realestateandhomes-detail/4741-W-Caven-St_Indianapolis_IN_46241_M32634-24485

Columbus, OH $50K

http://www.realtor.com/realestateandhomes-detail/450-Redmond-Rd_Columbus_OH_43228_M40922-79486

Ernest,

your right, I have been here too long, I live in the City, have a home that supposedly is worth more than I would pay for it and then have to deal with the San Francisco mafia or city government. Those examples are still going to be tough to qualify for on that income you state. Their living on debt with credit challenges keeping them mostly in the high 7-10% range….I don’t think they can do it based off PTI, DTI, LTV….

I just spent a few days looking around out there (San Luis Obispo County mostly) because the last New England winter nearly killed me. You people have lost the fundamentals big time. I have plenty of money so I’d be a cash buyer nearly anywhere out there. Fuggetaboutit! Between the prices, the quakes, the rattlesnakes, the drought, the real estate bubble and the “Stepford State” surface only smiles, the weather just isn’t worth the move. Many are leaving.

Big Government — Jerry’s kids — are part of the equation, too.

These prices exact a surge in tax collections — which have to be paid straight off.

The result is a persistent and rising drain out of the cash flow available for residential real estate.

Bringing in impoverished aliens provides no succor to real estate values.

%%%

The bizarre nature of some flips is extreme. Many flipped properties were, and are, totally unsuitable for flipping. They’re too old, too small,… clapped out, they are.

Which makes putting in granite counter tops counter productive.

Houses all across Compton and Inglewood are in need of total demolition.

Yet we have the greatest fools flying around the ‘hood… slapping lipstick on these sties.

We should expect to see flipper implosions all across LA over the next twelve months.

$$$

Residential real estate tracks high paying employment.

0-care has shut that trend off. The Medical-Pharma-Insurance Cartel is draining all of the wealth that would’ve been spent on home living. It’s a sector with essentially no production efficiencies to be had.

The liberal Democrat vision has taken Big Government into a policy corner.

As Venezuela shows, you really can break a national economy. It’s a doable thing.

0-care places the maximum financial burden on EXACTLY that fraction of the population that constitutes first time home buyers.

This harsh trend has much, much further to go.

Even the stats quoted above have not yet been adjusted to the new 0-care tax bumps.

The affordability metric has taken a quantum leap into the abyss.

Venezuela, there we go…

0-care = zero care.

Ha. Nice ideological tell, Blert.

What was that you were saying, again?

Blert, you are correct in regard to O-care and its effect on housing 100%. Those that contradict you are blind in terms of economics and don’t have enough logic to connect 2 points.

The effect of o-care on housing will be more visible in the coming years. What we see today is just the beginning of the end. The politicians who brought that curse on US are either extremely evil or extreme idiots. My personal opinion is the former.

I want on that party bus now! Let’s drive down to the La Brea Tar Pits and pull out some income! Hilarious post, Dr. HB.

“First time buyer squeeze out”

Well I can maybe remember long time ago my wife and I said lets buy a house after one year of marriage. It was crazy CA, prices insane, Granada Hills CA 65k for 1200 sq ft Northridge for 95k, Chatsworth unattainable, off to Simi Valley home of the pass road and no shopping.

We took the chance of a lifetime but got a VA house for 26k, all relatives and friends said you are nuts no value, CA real estate will collapse especially in fringe neighborhoods. Got lucky yes, for two years it was tough but CA came back, the freeway was built, grocery stores came, the rest is history.

No different today, excerpt magnify by 10 because it is 2104 21st century, that 95k Northridge house is 950k, didn’t expect it to be any other way did you?

YES!!! I believe we will have a housing recovery if we just build more freeways and stores!!!

What, they can’t just be any kind of stores. They must be trendy bistros, hipster boutiques, and art galleries.

I read an L.A. Times article, of a few years back, saying that Eagle Rock’s gentrification had stalled. Proof of this was that so many trendy bistros, hipster boutiques, and art galleries had been opening. But now a few had closed.

Culver City also boasts of the many trendy bistros, hipster boutiques, and art galleries in its downtown area.

Pasadena too brags about its Old Town, with its trendy bistros, hipster boutiques, and art galleries. As does Silver Lake, and Los Feliz, and Venice, and even parts of Ventura Boulevard.

Apparently, there is an unquenchable thirst in L.A. for art galleries. It’s why so many rich Chinese and poor Mexicans come here. That, and for the bistros and boutiques.

What? Did you forget, we don’t build anything anymore…zero chance of GDP going up.

“What? Did you forget, we don’t build anything anymore…”

GDP = Goods AND SERVICES!!! You forgot hookers and cocaine…

“zero chance of GDP going up.”

You are correct but for the wrong reasons… Nice attempt…

But, I will stick with my nice even 10% GDP increase prediction for 2014 because I like nice even numbers…

What? You’re right…hookers get a bad wrap…they are working to save our country one man at a time…forget cocaine, pot is the new black, ring the register. See everyone feels better already! They don’t even care about GNP much less round numbers unless you can stick it in a pipe or elsewhere….

“They don’t even care about GNP much less round numbers unless you can stick it in a pipe or elsewhere….”

Wow, GNP huh? That’s an oldie. Your age is showing…

That’s a typo…GDP…nope not old at all….is 38 old? Yikes!

We stopped using Gross National Product (total goods and services produced by nationals regardless of location) in 1991 as a measure of economic health and moved to Gross Domestic Product (total goods and services produced by a nation regardless of nationality). 23 years ago you would have been 15. Not sure if you would have been a follower of economics in your mid teens but I was by my late teens so it is possible…

Gee, I don’t know.. have median incomes risen 10x to cope with that change?

Thank you for outing yourself as a Boomer, BTW. It all makes sense now.

shhhh. You will only confuse little r with nominal versus real…

Chris did you attend school? Avg wage was $2.65 hour today avg American makes about $24 hour almost 10 times, avg price of gas was 35c today more then 10 times at $4 what don’t you get about inflation?

The median income in 1973 was $9,226 ($48,557 adjusted for inflation). The median income in California is now $61,400 ($53,046 for the entire country).

Now… my dad has told me about how he was able to buy his first house that year for $25k while while making $7 an hour and my mom not working at the time. That house was less than two years worth of his income and less than three years worth of the median income that at the time. If you were to take the current median income and triple it ($184,200), you would not be able to buy that house today. Houses in that very same neighborhood are currently selling for $300k-$350k. It’s not a very nice area anymore so if you’re looking for a better neighborhood, plan on spending at least $400k to $500k in a neighboring city… if you can afford it.

Robert forgets were not in a wage growth 60’s environment, we have no manufacturing base which propelled housing higher. We are now like the UK, whom tought the US how to fix pricing and use houses as finance leverage tool to maintain a semi faux state of comfort for the upper class….

without water, california can go to Oklahoma very fast…. Housing will go down but if its so good why buy 25 billion more in MBS and not re-instate FASB 157-8….maybe I should not have to mark to market my holdings….great racket if you can be in it…

hopium loses strength when you least expect it

Ah yes. The tulips are blooming. Or as the Easter Islanders said ” What are you talking about we can’t run out of trees, they grow wildly.”

Many investors who bought a house, condo, apartment building with the intention of renting it out will find out that the reality is very different from fantasy. Rents are still a function of income for any given area. You can not just take a rental unit and ask more than what the market can bear. Plus trust me from experience, the best way to make money in the rental business (yes Virginia this is a business just like any other) is to rent below what everyone else charges so you can get more high quality tenants who will stay with you year after year. Trust me, low quality tenants and vacancy rates will kill your bottom line. Yes you can make money in the rental business but you better be smarter than the average bear and you have to take care of everything from showing the units to collecting rents to doing all of the minor repairs yourself. A lot of investors will find that this business isn’t easy and yes it does indeed take a lot out of you.

Sounds way too difficult to me. I think you should securitize that rental income stream and collect a fee. Now, that is what a real businessman would do!

“Rents are still a function of income for any given area. You can not just take a rental unit and ask more than what the market can bear.”

Wha? I thought high SoCal rents were being supported by a giant Red Chinese Buddha statue pouring liquid gold into the pails of the hopium-breathing house horny! You mean rent of $3,500/month for a 2/1 stucco postage stamp in CC is supported by time-tested economic principles? But, but, but, median incomes for CC are only $75/k!

Oh. Wait. I get it now. Median incomes is a crap indicator for prices for SFR’s (be it rental slave or mortgage slave) in gentrified and prime SoCal.

Whew.

http://losangeles.craigslist.org/wst/apa/4559713426.html

$3,500 for a Culver City stucco box for rent? How about $2,500:

http://www.zillow.com/homedetails/4351-Globe-Ave-Culver-City-CA-90230/20437580_zpid/

The Zestimate on this place is $769,000. Me thinks good old DFresh misses his lover Lord B. You’re doing God’s work with your unlimited rental parity reminders and your snark about incomes not mattering.

You sound like Lord B before he jumped the ship and bought a home. Sounds like you are minutes away from joining your close friend in the unlimited house horny land of SoCal. Where are you planning to buy DFresh?

@Jay, what we are witnessing is bifurcation in action. Similar events happened in 1974, 1980, 1990, 1999, and 2007.

I started renting a place walking distance to the beach last year. I pay around $1,400 a month. Buyers purchasing a similar place in my neighborhood are shelling out about $3,000 per month (mortgage+insurance+taxes+HOA dues).

Based on history, next part of the economic cycle for the year 2014: Recession.

Dearest Jay,

Lord B was amazing, but Blert is best. It’s his prophesy, after all, that this time IS different. I agree with him on that.

By the way, I don’t know if you’ve heard, but local median income is a crap indicator for assessing market rents and home prices. The actual market data backs that up.

As far as your own reasoning acumen, I’ll leave that to rest on your use of a Zestimate as supporting evidence.

Nice to have you around for a blip, Jay. Bye, bye birdy.

….. EVERYTHING IS A ” FUNCTION ” OF INCOME….. EVERYTHING ….

What we have today is a market intervention by several countries’ Central Banks (i.e.the Federal Reserve – US, Germany,Japan,U.K.,Canada, etc….. That is the real reason why the mess has been temporarily “swept under the rung” …

THIS IS ALL COSMETIC …

The Average Man on the Street .. is still suffering, enduring and hoping he won’t lose his paycheck.

I’m with yea! I purposely keep my rents (lease payments) as low as possible for that very reason. Some folks really appreciate my generosity. Others think I’m rich and take advantage of me. I’m not greedy, and very much appreciate a long term renter (lease payer) to having to go into the place and fix it up for the next tenant.

I agree with you 100%. Nothing about renting is easy not to mention some of the HOA rules you have to contend with. My background is large scale apartment communities. Pretty easy to manage with a full staff. When you manage just a few rentals it is a grind with all the random repairs that need to be made.

Not every area you can buy makes it a good rental, so you have to factor that in…condos in cheap markets like Vegas and Az don’t usually pencil out in the end because rents are low, incomes are low and it’s relatively easy to buy a starter home there.The cheapest entry level condo in a good area that is hard to buy a starter home throws off the most cash in my experience.

That is so true how do you know so much

I read the newspaper in for my hometown, which is in the middle of nowhere, CA. The last quarter’s rents in the area were the highest on record. We got everything last in my hometown – we’d just be hearing about stuff and it was already on it’s way out. Like for instance, when tech bust 1.0 happened, only then did our local leaders determine that we should get tech companies to our town, which was something everyone else was doing for 10 years prior. If rents are at their highest there, where incomes are like $9/hour part-time, then shit is totally gonna hit the fan soon.

With all due respect Doc, your posts are a clamor of hope that the death blow to home prices is finally here. I remember visiting this site first 4 years ago and the tone of comments from many posters were the same as they are today: “I’m going to get out the popcorn and sit back as house prices crash”…. ” don’t buy now, this is just the beginning of a massive unwind in house prices”…. “cant wait to buy a house in Santa Monica for $500K”…”if you buy now you will leaving a lot of money sitting on the table”… “the epic crash is coming in 2011″… “2012”…”2013″… “2014”…

Oddly enough when I have asked bloggers here to post what price will trigger them to buy a home here in LA,LA, LAnd, no one will actually say what they are waiting for.

Price? Seems like “what price” in 2014 means what hit to your lifestyle are you willing to “pay” for the SoCal mortgage slavery dreams.

Besides, it’s considered impolite to bug Gram about her EKG report and latest dermo check-up when she’s putting a roof over your head and washing your jammies in exchange for opening up her Fancy Feast and clipping her toenails.

Patience, horny ones, you change enough bedpans and you’ll be rewarded with a seat at the probate officer’s table for a 70’s era 3/1 Culver City crap shack. Who knows, maybe you can rent out a room to your folks if Grams like you most!

There is no price that I would buy at in LA…

LA was over a long time ago for me…

You really need to change your handle. I think Lord Blankfein is available…

I was thinking RentalParity would be awesome.

Oh, how I miss rental parody…

I’m an upper tier Inland Empire shopper so I don’t know if I qualify, but here goes…

I’m not waiting for a price as much as market conditions that aren’t being manipulated at extreme, unsustainable levels. SoCal RE will always be manipulated, but the current level of .gov intervention was always unsustainable, thus so was this market and prices. I can’t say with certainty how much we’ll overshoot or undershoot the 2010 trough, but given where interest rates have to go and where wages are going I suspect an overshoot as 2010 payment parity negative wage deflation will be necessary for market equilibrium.

You need your own blog NihilistZerO. Everything you say makes perfect sense.

“Upper Tier Inland Empire”…if that’s not an oxymoron, I don’t know what is…

QE Abyss – I would buy at $400K for a 3+ bdr, one bath with a granny apartment depression era (or pre-depression) in a border neighborhood like St. Andrews square. Windsor Village. South of Wilshire in Mid Wilshire District doesn’t seem unreasonable for historical norms in los angleles, though that would be extreme for most parts of the country. My wife and I are gross 190K, with 10-20% down that would be a comfortable mortgage payement. It would have to be someplace that I like enough to stay in for years and years, not interested in jumping around upsizing.

A house is a place we sleep, eat, and relax so renting allows me to do the same, so I dont mind.

Looking historically at LA, and seeing the boom and bust cycles. I have to say looking at the present data for manipulated markets we are definetly in an inflated boom. A temporary out of sync tic in basic fundamentals does not make a new “normal”. The great depression lasted for 12 years. This crazy housing scheme has lasted for 14 (1997 may be ground zero, but 2000 was the acceleration point). If there hadn’t been extraordinary government intervention on the bakns behalf, we would have seen much further correction in 2008-2010.

” I would buy at $400K for a 3+ bdr, one bath with a granny apartment depression era (or pre-depression) in a border neighborhood like St. Andrews square. Windsor Village. South of Wilshire in Mid Wilshire District…”

Not saying this with judgement so please don’t take offense, but why in the fuck would you want a stamp house in LA proper anyway??? I could see a condo but in general your going to overpay for 5 feet of yard, all for the privilege of “ownership” in that cramped urban nightmare. I’ve lived in LA proper and could see doing it for sometime, especially considering your stated income, but why go 30 year on a shack when you can rent or at worst get a newer condo with some amenities?

Just curious. I’ve always said if I got offered a 6 figure job in LA I’d live like a pauper for four years while renting a room, put 75% plus down on a home in the IE and enjoy LA/OC amenities on weekends while enjoying the quieter, cheaper life during the work week. Most of the fun with almost none of the stress.

@ Mr Smith;

Myself, as a lifelong resident of LA – it sounds like you have done your research and what you are waiting for does sound rational. For those who really want to be closer to the beaches (assuming SM, Venice, WLA, Culver City, Beverlywood are too expensive) the eastern edges of 90034 and 90035 may hold potential and western edges of 90008 and 90016. In other words, the corridors between LaCienega, and Fairfax from Pico Blvd down to Kenneth Hahn State Park, etc. Perhaps some nice pocket areas between Fairfax and LaBrea as well North of 10fwy. If you are reasonably sure you n wife wont need to relocate in 5 or 10 years that may take away some of the burden of needing to sell in a downside cycle and losing money to follow your career.

As far as finding a ‘deal’ most of us will never have a backroom bank deal handed to us so the other level of ‘deal’ to be had may be along these lines: example; you look at 20 homes and 3 are too close to the freeway, and 2 only have a 1 car garage, and 3 have crappy remodels, and 4 dont have a fireplace (or dont have wooden floors, etc) etc. THEN 1 day you see a home that has the: 2 car garage, nice remodels, wooden floors, quiet street, fireplace… in other words it has nearly everything you are looking for. And priced reasonably. THAT will be the ‘deal’.

Insofar as WHEN to buy – the other experts on this site can tell you when to buy 🙂

Disclaimer; nowhere in the aforementioned does my reply say: ‘buy now or be priced out forever’; ‘this time it is different’; howzing to go up foreva’ …bla, bla, bla.

Lord Blankfein – you forgot rental parody…

Why buy in LA instead of rent or move?

I like to work on my classic car in a garage, I like to modify my dwelling, and I like to listen to loud musc, so that would be a nice reason to own a detached property if it met rental parity. My wife works downtown, I work project to project, presantly 5 miles away. But I am always commuting opposite the flow of traffic if I am out of LA.

I love living in the city, if I wasn’t in LA I would be downtown someplace. I am aging hipster foodie who actually enjoys the watching movies in the graveyard with all the other hollywood crazies. I like public transportationa nd i like taking taxis when i am going to be drinking.

So that is why I will give up on the McMansion or large tract house and live in a comfortable craftman bungalo. I prefer running predawn with the rats and prostitutes, instead of the coyotes.

If the Glass Steagall Act had not been overturned at the beginning of the 21st century we probably would not have been an in a credit crunch today. However, the dotcom crash would have taken it’s toll for a bit. However, that was about it.

Housing would have likely never seen the highs we see today. There would have not been any flipping on open parcels or crap shacks. Flip this house probably would have been very low key for the hobbyists. Developers would likely have not been building anywhere they could to get a quick sell.

I remember visiting this site first 4 years ago and the tone of comments from many posters were the same as they are today: “I’m going to get out the popcorn and sit back as house prices crashâ€â€¦.

… and then we had QE1, QE2, QE3 which turned out to be QE infinity, shadow inventories (millions foreclosures held by banks), historically low interest rates for historically prolonged period of time… I wonder why the prices didn’t fall further? Indeed, who could’ve predicted that US economy will be so messed up… we (or they) the people have lost any reality and understanding of economy fundamentals…

Great points. The commenters will not buy when prices are dropping because they ‘will drop further’. It is dumb.

I follow the boglehead philosophy: do not try to time the market. If you try to time the market you will fail.

The only time I have held back was the 2005-7 housing market, because the rent to house price ratio was way out of line. It made sense to rent during that period. At the moment it makes sense to buy in certain markets like San Diego. LA, OC and SF look expensive but apparently rents are really expensive in these places at the moment.

The commenters always use the median household income fallacy to support their position. Forgetting that median income is not a bell curve or normal distribution: there is long tail towards high median income and no one earns zero income. The median income also includes every household including retired people. It is also skewed because there are many more single people in households than in the 1970s-80s. You simply cannot compare median income in 1975 with 2014.

bb,

As you may have noticed, there’s been a subtle shift in verbiage. The mantra used to be “median incomes.” Now it’s just “incomes.”

Wait some time and someone with a recognizable rant but new handle will claim, “Nobody ever claimed here that median incomes were the most important indicator of home affordability in SoCal.”

“..will not buy when prices are dropping”

Price dropping from outrageous to ridiculous isn’t a signal to buy. That’s a dumb idea. It may happen prices never drops to affordable level but I’ll rent until that. But I do remember the crash in 1991-1993 where 40-50% of local prices went out of the window in an year. Then it was affordable to buy, for a while.

Things like affordability and sustainable overall economy and some honesty in the market has to come first, then suitable price.

I’m 35, wife is 37. We’ve got two kids, ages 4 and <1. We both have very good, stable jobs and gross between $150k and $200k annually. We should be homeowners, or be actively looking to become homeowners.

But we live with my retired Mother-in-Law, and have no intention of moving out anytime soon. Why?

Because it just makes sense. There's no way we can afford to buy in a decent school district, so we'd have to carry both a large mortgage for an overpriced house in a not-so-good neighborhood on top of shelling out for private school tuition. We'd also have to pony up $12-$1500 a month for child care for the younger one, plus after school care for the elder. We'd be paying property taxes on the inflated value of the home.

So we help with the mortgage, pay for all the groceries, utilities, and maintenance, and direct everything we would be spending on an excessively large mortgage towards savings, investments, retirement accounts, and private school for the kids. Plus Grandma gets to be around her grand-kids everyday.

I would never have thought that I'd be the type to live in a multigenerational household, but some small issues aside (manageable if you can all act like adults), it's pretty damn fantastic. This was supposed to be a temporary thing after job losses during the Great Recession, but we're certainly not going to be purchasing in SoCal anytime soon.

Of course, I'm the only one of my friends doing so, so take this anecdote for what it's worth (which is basically nil).

First-time home-buyers aren’t fleeing to Texas, they’re paying Grandma’s cable bill instead. How exactly does this portend @ Tank Hard?

living the dream, I’m not sure what you do for a living but have you considered moving out of the area? Are there more children who will eventually inherit the house? Perhaps the mother in law will sell to you? Long term I gotta thing you will be worse off, you can afford something. They call it a starter home for a reason.

QE is right on, 4 years ago people where told to NOT BUY<, why, I bought 4 homes in Lancaster to rent, each in 50k range, no worth mid 150k range I carry loan and resold to people who lost their 300k homes, bad credit fine, they flake I get it back, the home, yeah,,,,,, also vegas, I bought 3 townhomes in 2010 for 22-23k each ! ! ! resold 2 for 59 and 69k, yes I carry the loan, one in 8 percent range, why because rent was 780 and hoa etc, now she owns and she pays 20 bucks more a month to own and I never have to repair. 30 year high interest loan, single mom bad credit, 2 jobs, why not, my brother has a brain tumor so I have him live free in one. Anyhow 2009 was a deep bottom for antelope valley, 2010 was the bottom for vegas, I keep getting blessed finding the bottom. I get no advice I go with gut, I just sold 2 of my simi homes I bought in 2008, saw one that was 640 in 2006 , I paid 426 in 2009 and it went down to 350 in 2012 wow,, so this year in may I got out at 469. Also the other home 4 bed 2 bath 1630 sq feet, paid 308k in 2009 and resold 425 cash buyer. I have had horrible tenants, been doing this for 14 years since my 30s and I can say my worse tensnats have been in past 2 years. they don't pay, then it's 2 payments per month, it's horrible. When I carry a loan the people pay better but late also, so I collect late fees. Landlording is hard now more than in past 14 years. NO JOBS, and always 7 to 13 people end up moving in, yeah even in simi. Everyones on drugs. The quality of people and desperation has made landlording harder. Again I sell and ask for closing, I did ask for 4k down and no one could come up with it yet paid rent monthly for years no problem, so I decided if I leave the mortgage same as rent I will get paid, so I ask for 500 bucks down so I can do paperwork, deed, transfer tax etc… I have a unique system that works, Now I'm down from 14 rentals to 5 rentals, 8 notes, 2 I sold outright, good news is my 2009 purchases I put 30 percent down so selling returns 2x, equity. I am amazed last sep was hot selling and here we sit july and it's slow, we don't have inventory either. I was told in june I sold too low, coulda got 20 k more,, oh really, i'm never greedy, I just go with gut and see, it's slow,

west simi has 20 homes under 450k . that's low and one comes on every few weeks. IT's low crime, so for the GUY WHO MAKES up to 200k living with mother in law, MOVE !!!!!! simi and some nice safe towns with good school you can find a good home for 500k with 3 bedrooms and 2000 sq feet and mortgage 3k month with tax, i'm sure 36k out of your 200k won't hurt you and you can write off the interest. I live in thousand oaks and I'm 30 minutes from all of what los angeles offers except crime and traffic aren't ramped. I'd say look to buy around xmas, we are in a little bubble, but this site is about doom no matter what year, doom every year and it's not true, learn the market, I have my eye on a golf course in apple valley where mobile homes go for 30-50k and fairway views and you own the land, so no HOA,,,,,,, find the gems and you will do well. I buy cash only , and I've not bought since 2011, I'm geared up for round 2….a bit concerned that if we have this rich get richer and poor get poorer and it looks like the great depression of 1929 where the middle class was wiped out, I can say no debt and buy cash, at least a real asset owned free and clear has less demand and stress, if we go into the depression I can cut rent in half and survive, right…. if money sits in the bank I may lose it, it's going to take years to fix this mess the administration has gotten us in, and low rates, imagine the loss in buying power when rates inch up,,,, BUY WHEN BLOODS IN THE STREETS and also, don't be afraid of taking section 8,it pays on time guaranteed. QE IS RIGHT, it's not always doom, 2009 buys went up 300 percent for me, 2010 buys as well, each area rises and falls slightly different, CASH IS KING,,,,,,,,,,,,,,,, buy near nov and dec,,, up to as late as march 2015.

With all that money you got coming out your ears, maybe you could afford to take a couple of lessons and figure out how to space your paragraphs.

Baller is right, take an english course. As trading goes, take your profit because you never know what comes next. The antelope valley will be dead without water, so pray for rain or sell now at the top…anyone living up there has to auditioning for Breaking Bad…..that place is a poophole…

Sure, we’ve considered moving out of state. It’s a big decision, because we did it once already and it didn’t really work for my wife, who has a lot of close family here in SoCal. But now that the MIL is retired, it’s more workable because she could come visit us frequently than she could before she retired. My wife is also more on-board these days because of the kids.

And yeah, there might be cheaper homes in Simi, but my wife’s current job is in Pasadena, and mine is in the South Bay, so moving to Simi just isn’t an option for us. My commute is bad enough as it is without involving the 405.

It’s not for everyone, certainly, but it works for us. At least for now…

“It’s not for everyone, certainly, but it works for us. At least for now…”

If it was for more people we’d all be better off. Another advantage our Chinese competitors have over us is stronger family units. I live in Rowland Heights and there are a ton of multi-generational Asian households. They work together and often PAY OFF their houses then help the next generation buy. I may not like the foreign takeover of my old neighborhood but I at least appreciate that some of them are taking $ out of the banksters pockets by going mortgage free. I’m working on doing the same myself as I plan to have relatives in tow when I buy. Just waiting for those higher mortgage rates in 2015-16 that will bust the current bubble.

“In 2013 the argument was that pent up demand for young buyers was going to give housing another dramatic run higher. In reality, 2013 gave us a massive run from investors and with them slowly pulling back…”

This is why predictions are ridiculous. Everybody’s always wrong, every time. Or as Condoleeza Rice would say, “Who could have predicted….?”

…a smoking gun turning into a mushroom cloud.”

Aluminum tubes…

Nearly every post in this blog share the same themes:

Home prices are too high, rents are too high, wages are stagnant, majority young buyers can’t afford anything and are either forced to room with parents or friends.

THIS is the new normal. It’s common with other large metropolitan cities worldwide. Every city reaches a point where there is no longer enough land for tract housing. Infill building becomes the only new source of building, but that becomes more and more expensive as the land prices increase.

Los Angeles has been fortunate with vast amounts of buildable land until the 90s which helped keep housing prices (relatively) low. Until zoning gets relaxed and more high-rises can be built, I’m not sure what one can expect than high housing prices accompanied with high rents.

I’m not predicting that housing and rents will only go up, there will always be fluctuation, but the writing is on the wall, and one can simply look to prices/rents in other international cities to see how this is going to play out.

Remember, LA is still a relatively young city…

Ya right. My arguments of LA being among the elite international cities were shot down years ago by the “locals” on this board, who pine for Brady Bunch suburbia when the skies were browner but the people were whiter. There is no “brand” to LA! Its relative proximity to the paradigm-shifting emergence of Asia means nada. Hey! LA is a shithole, don’t you know!?! Boeing is leaving! That means nobody has jobs! The entertainment business isn’t really a business anyway! If it doesn’t have nuts and bolts it’s not real!! Foreigners don’t buy here! Oh, wait, maybe they do, but in small numbers. Oh, I guess they do in significant numbers but only in certain areas and that has no impact on overall demand. Yadayadayada.

All that matters is there are too few white people and too many brown (who cares about the fleeing blacks, I guess)!

Those ridiculous hipsters over-paying to live in slums to be part of a counter-culture? The beatniks, hippies, rockers, stoners and punkers back in the day were awesome or something.

“I’ve driven through Venice, and I’ve SEEN with my own eyes what looks to be a crack-house 5 blocks from the beach sitting right next to a mansion! And now that crack-house is up for sale and they want $700,000!!! What house horny hipster would pay that amount when they could follow Tex to the promised land!?!”

Check it…the bears on this board are white boomers who don’t live here anymore (by and large), and aren’t looking to buy here.

They don’t even subscribe to the theme of the blog “Love Southern California.”

I am not a baby boomer, I think los angeles is nasty and not worth anything near what is asking,I’d not live in manhattan NY either, but burbs are better. I mean riverside has not the best crowd, crime and crack, it’s cheaper there. I Live 3 miles from Brittney spears and we have many movie stars who escape here to get away from los angeles. young people with 300k limit can get a townhome here, that’s not bad, 1500 sq feet , awesome schools. many older people live out here but it’s quiet and safe, I’m on almost an acre yet live 2 miles from a big mall, it’s paradise ventura county, well conejo valley. I’d never move back to los angeles, I did live in Torrance for most of my life, nice beach town , near Redondo beach, however when your kids grow up and drive you don’t want Lawndale or Wilmington as your surrounding cities, look how close bad area is to manhattan beach, TOO CLOSE,,,,,,

britney spears lives in riverside? That’s news to me.

“This place is different.”

I think landlord/investor/broker lives in Simi Village.

It’s possible that Britney Spears lives in Hidden Hills or Calabasas. Lots of celebs live there. That might be about 3 miles from Simi Village.

Or rather, I think Simi Valley.

LA was nice in the 70’s, little more smoggy but nice.

It’s now a rotting carcass that coyotes are now feasting on….

signed former LA local, happy to live in the water part of the state…good luck enjoying that place without water…..it will be hell

“This time is different.”

Real estate prices are ridiculous in California.

In California, real estate will go up 25% a year, every year, FOREVER!!!!!! (we’ll ignore that when adjusted for inflation, real incomes have gone down in SoCal by about 10% since 2007).

Yup those young whippersnappers are getting squished right out of the CA hosing market, need to pay off those student loans, $4 gasoline, obamacare & Itune accounts, wait till next year things will be even more challenging.

Zillow is not a real good source, trulia is worse it’s higher by 20 percent on average, do use the tools to see what nearby homes sold for, that’s the real reliable source. Realtor.com also. Do not use Zillow, it says townhomes in moorpark are worth 240 in a complex where last sales are 318k and nothing less than 280. it takes last sell and does the math by what the last home sold for and makes the price based on square foot. it’s a foggy estimate. Just like Kelly blue book puts a 98 Honda at 1300 bucks on a good day, on auto trader you won’t find one cheaper than 2k. something is worth what another will pay for it. SEE RECENT SOLDS FOR SOLID INFO…..

Great info regarding Zillow, Trulia, etc. Thanks!

The simple truth is that something is only worth what the market will bear.

That’s a seventh of all foreclosures over the period. However, California is a big state–one out of eight Americans lives in California. That’s a bit greater than the national average but not enormously so

I’m willing to bet there’s a much higher percentage of shadow inventory in CA relative to the nation, especially in SoCal. 1/7th of completed foreclosures just doesn’t tell the whole story.

Insanity. My family lived in Saugus (now Santa Clarita) back when it was full of horses, not people; husband and I met at UC, so we well know & lived the former golden California dream. We left as a couple in the 1980s when it was clear we couldn’t afford the real estate. Now we’ve raised two kids in a three-story 5B 3bath home on 3/4 acre (cost us $259K in 1998) in the best public school pyramid in Georgia; kids are going to UGA with the state paying their tuition (HOPE scholarship). Husband has a 20-minute commute. I got to be a stay-home mom because we left California. Best decision we ever made. We still take fab vacations to CA but you know what? We are glad to get home. Wake up & snap out of it, young California Dreamers–there is an entire other country out here!

Zabrina, you do realize the average Californian views Georgia as populated by backward, uneducated, racist rednecks.

SOL, your statement itself is rank stereotyping.

The reality is that people in SoCal don’t think of Georgia or Georgians whatsoever.

Guess that makes us “elitist.” Whateves.

As homework, go ahead and troll some Georgia real estate blog and see how many Californians are posting.

Landlord….”avg Califorinan” which means like America they are from somewhere less your statment of what they think of Gerogians is ludicrous at best.

absolutely we do. omg, I go to Indiana where family is and what a drag. California is where everyone wants to go, find a good area that fits your budget. Some of those small towns back east, mid west, etc,,, the people are so slow, everyone closes at 5 and no on answers the phone on the weekend and it’s not for most fast pace over thinking Californians. I couldn’t leave here for that slow paced life. I guess if you do it young it works, but red neck is right…………..NO THANKS<

landlordInvestorBroker where are you originally from? My guess is a large city in the north east. Did I get it right???

I went from GA to CA and am observing the opposite.

In ATL there are all-night businesses everywhere, go downtown and the night life is excellent. The gas there is 25% lower than CA.

In the mean time, EVERYTHING in the bay area closes before I’m done working. There’s nothing open when it’s needed, people are killed in “officer-involved shootings” in neighborhoods hovering in the 850’s. You don’t ever see grass.

I’m eyeing the tech sector in metro ATL, because I can’t afford jack out here while I could be a cash buyer there.

Ha ha, yes, I used to think that too!

@son of a landlord, I’ve traveled all over the U.S. and what the non-Californian thinks of California is that California is a financially bankrupt, badly mismanaged nanny state filled with jack-booted thugs masquerading as law enforcement, filled with a gay mafia that requires Californians to engage in homosexual sodomy while hating Christians and outlawing the celebration of Christmas. And that Californians are overtaxed, over regulated and over medicated.

And there are government officials all over California that are ready to strip away your civil liberties, engage in oppressive anti-business behavior just so these same government officials can collect their $100K per year pensions when they retire.

And also, California is the land of welfare recipients and illegal aliens living the lush life off of the backs of the tax payers of California.

Kudos for being happy with your choice. Happiness and contentment is where it’s at for many, but not all:

Surprisingly, people willingly give up happiness to live in major urban areas:

(http://www.sciencedaily.com/releases/2014/07/140722103917.htm).

“Our research indicates that people care about more than happiness alone, so other factors may encourage them to stay in a city despite their unhappiness,” says Gottlieb. “This means that researchers and policy-makers should not consider an increase in reported happiness as an overriding objective.”

At the same time, since this is a blog essentially for people looking to buy RE in SoCal, what you considered expensive in the 1980’s, relatively speaking, would be considered a bargain today. Suffice to say you’d be a lot wealthier today if you would have bought in SoCal versus Georgia.

Your anecdote, then, ironically proves the point that “expensive” is always the case in LA, and the inevitable rise is to higher levels is always the case.

Buy now or be priced out forever, as ridiculous as it sounds, has been the rule of thumb for SoCal for 40+ years.

How unhappy are you willing to be to live in SoCal? As we’re seeing by ngzsu and others, happiness itself can be rationalized and redefined.

You are right Z, if your young than move out of California. We could see what was happening in CA and sent our kids to college in Texas. They both stayed after graduating. My son just bought his first house, 20% down at the age of 25. His payment $1050/ month and that includes property taxes. We sold out and also moved out to TX in April. But we have owned land out here and always knew we were moving.

“…sent our kids to college in Texas.”

I certainly hope they went to college where they wanted and not where you “sent them”. 18 years old is a bit old for your parents to tell you where to attend school.

I’m unsure where you are in Texas, but I’ve been to Austin a couple of times in spring/summer, and the heat/humidity are not exactly pleasant. Austin is great, except for the weather in spring and summer.

According to zillow my house has dropped $40,000 since January from 400k to 360k. This is probably a really good thing as it will hopefully allow some younger buyers be able to afford to actually own. It may need to drop a little more though as the 30% increase we had in 2013 was unjustified.

DG…Please take what you want from this or any blog, but Zillow is by far the worse indicator of anything, it is just a place to see if the neighbor is valued more then you, which is ridiulous on face value of a property?

Chinese homebuyers are flocking to U.S.

http://money.cnn.com/2014/07/23/real_estate/chinese-home-buyers/index.html

“More than half of the $22 billion Chinese buyers spent on U.S. homes during the 12 months ended in March was spent in California, Washington and New York, according to the National Association of Realtors.”

Yesterdays news.

China is in trouble. http://time.com/98814/china-property-apartments-developers/

Dom, you obviously haven’t been getting your news from DHB because according to many here there never was a China influence on SoCal housing.

Just search for “gold plated Red Chinese” and catch-up with the rest of class.

DFresh – naw, the influx of Chinese money has been huge, and has been well documented. I read a report a few weeks ago that stated 80% of the RE transactions in Irvine over the past year were for Chinese buyers.

The news coming out of China lately is bad, and it sounds like the party is over. Perhaps their version of the Fed can implement some QE, Chinese style. 😉

There may be trouble in China, but we don’t know what effect it wil have. Will it mean less money available for buying Californian/Canadian/Australian RE, or will it mean more people desperate to get their money out of the PRC?

More smoke and mirrors from the cheerleaders. No one here has claimed that there was no influence from China on the local RE market. What has been disputed is the scope of said influence as it relates to the sustainability of the general price level.

@Dom, the Red Chinese are buying in Irvine, DTLA, and the San Gabriel Valley.

The Red Chinese with the hot money are not buying in SoCal areas that do not contain significant Asian populations.

One would think the Red Chinese with the hot money would be streaming in to Torrance and Gardena (areas with large Asian, i.e. Japanese and Korean populations) but the Red Chinese are not.

I live my life according to the teachings of NAR, CAR, etc…

Tired BS, please share your former handle so I can do some searching on some of your own older posts.

In the meantime, here are some oldies but goodies for you to chew on:

FTB

November 29, 2013 at 3:26 pm

Sorry-iphone issue. I was saying that in the US only about 7% of people n 17% of households make over 100k a year. The areas the chinese are buying are very expensive spots. I seriously doubt anywhere even close to 5% could afford those types of homes, especially because the chinese person would be purchasing their second home far from their first home. Also, many here seems to think the chinese want the US/cali real estate. Read a little more and you’ll see many actually are trying to go to singapore and then many others are trying to get into europe as many countries (portugal, greece, etc) are offering visas or pathways to citizenships like the US is. I couldnt tell you how many chinese will buy in the future in cali, but there are stats for 2012, etc that even the good doctor mentioned in previous articles with real numbers. I think we would all be better served to stick to hard facts and not rhetoric or false extrapolations of data.

# # #

OutofCalifornia

December 4, 2013 at 11:30 am

San Marino is full of Asians because of rich Chinese moving in? Somehow I doubt it.

I grew up in Manhattan Beach but went to high school in Torrance, near Palos Verdes, and my school was packed with Asians. I don’t remember any of these people being fresh-off-the-boat Chinese, maybe some were, and I admit I didn’t ask questions of them, but it was probably very few, if any.

And where do you get the idea that the San Gabriel Valley is filling up with Chinese elite trying to park their money? The San Marino Valley had a large Asian population well before people began believing the hoax that China was some Unstoppable Superpower that is the Future of the World.

The idea that all these wealthy Chinese are going to prop up the grotesque housing bubble is just mania. Are you going to invest in bitcoins too? All signs of pure desperation. China is a communist country and the vast, vast majority of people there are poor, okay? As for the minority with money, there are other places that would suit them besides Los Angeles — Paris, London, French resort towns, New York, etc. So you have a small pool of buyers spread very thin. The Chinese are not going to prop up every bubble area worldwide any more than the “elite†are going to succeed with their ridiculous vampiric Ponzi scheme. All it is is people in power trying to stay in power and they are going to fail.

Sorry DFresh, Tired was anon in his prior life…

Good try though… Did you do your conversational mandarin homework? Can I copy yours?

Maybe it’s because you’re a relative newcomer, Anon/Tired BS:

NihilistZerO is also on record for snarking on the Chinese buy-side argument:

NihilistZerO

May 15, 2013 at 6:38 pm

“The only difference I can see now is that CA has about 15M more people and mortgage interest rates are at record lows with not many homes for sale.â€

Don’t forget the lords of Chinese slave labor settling in SoCal with their ill gotten loot

DFresh the Chinese Oligarch influx, while a factor in the current “market”, is not a panacea for a correction. If mortgage interest rates are at 6% and comps are being dragged down why would a ChiCom overpay? To save his ethnic brother’s comp??? I doubt it. This whole mess starts and ends with the FED just like Bubble 1.0. As soon as the monetary meth goes away completely next year prices WILL adjust.

“…***no*** influence from China on the local RE market. What has been disputed is the ***scope*** of said influence”

Try again. Show me where anyone on this blog has stated that the Chinese have no influence on the general price level.

And no, I’m not staking out new beachheads for anything. It’s called clearing the smoke you’re creating – of which you’re creating even more with this nonsense. I’ve held the same position since we first caught wind of the Chinese situation. And yes, I’m still waiting for the empirical evidence of the ***reasons*** why Chinese buying has increased. If you’re able to extrapolate – you are able to, aren’t you – you would understand that my demand of the attributes assumes said influence.

All, since you are using my living my life according to the teachings of CAR/NAR thread to discuss the “China” impact, I will chime in.

I am on record as stating that the “Rich Chinese” is a good headline but I still believe we will find that it is not much more. We never talk about the “Rich Canadians” who have purchased significantly more US property in the past five years.

The reason why we focus on the Chinese has to do with the fact that they are seen as an enemy to the US. Rich Chinese, Russian Mafia, Illegal Mexicans are just a diversion from the real criminals.

Financiers and Corporate Raiders are the actual culprits and we seem to love to listen to the bed time stories they tell us on the nightly news. Propaganda is alive and well to this day and we are no less influenced now than any other time in history.

I don’t buy the narrative today anymore than I did 5 years ago. And just because it is on the TV (internet now a days) doesn’t make it true. I have seen this movie before and I already know how it ends.

President buys $4 million dollar Palm Spring home? Guess he isn’t worried about CA real estate tanking?

I don’t want that SOB in our state, go back to Chicago where you where a humanitarian and stop all those shootings, why would Obama come here, hate that guy !

Investor broker….CA was the natural choice, it is so democratic now nobody has to campaign there. BTW, the President loves desert golf it is told, Michile preferred the shopping and lifestyle of Scottsdale, can you imagine Obama living in GoldWater country and running into Palin at Scottsdale Mall, Palm Springs it had to be?

I’m no fan of Obama, but if let Reagan (back) in, we should let Obama in. Reagan was the biggest disaster for the Middle class with his fake ‘trickle down theory’. The ultra-rich made out like bandits while everyone got the finger. What I hate is FAUX or FAKE news painting him as a so called hero. This is getting way off topic though. Neither party is in it for the people, but blindly hating Obama because FAUX said so is just idiotic.

Janum sounds like most libtard idiots in California that vote Democrat and try to blame a president from the last century for the mess this country is currently in. The biggest disaster for the Middle class has been Obama and the Democrats. Obama and Eric Holder did not send one banker to jail for the banking crisis. The ultra-rich bankers that put Obama into office got bailouts and have made out like bandits while the middle class got the finger. What I hate is liberal state run news painting Obama as a so called hero. Blindly praising Obama and hating Reagan because the liberal state run news media said so is just idiotic.

If indeed Obama buys in Rancho Mirage, it will do wonders for the prices there, which have lagged prices for similar properties in coastal CA by a huge margin.

Too bad. It’s nice to have a beautiful CA community to go to that hasn’t been overrun by big name celebrities and where an ordinary rich or semi-rich person can buy a fine home for less than $10M, and often less than $1M. Rancho Mirage prices are a very, very good deal for the money, because this desert area has been rather out of style for a long time. Too bad that that will change if the Obamas buy there and the area will once more become another overpriced celebrity roost.

Laura, what the hell are you talking about – Rancho Mirage, Palm Springs, Desert Springs and the “expensive” areas out there have been red hot since the moneyed (West) Hollywood gays started taking over and buying up vacation properties there over a decade ago. There is no parity with “similar” coastal properties because this area is 100+ miles from the ocean!!! There is no comparison to prime coastal property except for prime coastal property.

Craigslister, the prices in Palm Springs and Rancho Mirage look extremely reasonable to me, even when compared to prices in prime Chicago suburbs. Beautiful houses for no more than what a comparable property would fetch in less favorable climates. The houses in the $2-$3M range were pretty impressive, but there is a drop-dead beauty at number 3 Mozart Lane, languishing for months in the $8.5M range, that looks to me like it could easily get $25M along the coast.

I don’t expect the reasonable prices to last long if someone like Obama buys there.

why would the bammer worry since he has been on the wall street take with his buddy AG Holder since he was elected….get real, the house was given to him by wall street…

won’t matter when their is no water…or course his loss won’t be as bad as anyone else since it was paid for by corporate masters….

sheeple…they are everywhere…including DHB

New home sales tumble in June at fastest rate in nearly a year

http://www.cnbc.com/id/101863962

Up up and away?

Up is good right???

Well that is your own stupid fault for living where there isn’t any affordable housing in the first place! Duh!

Hey Tired BS, it’s been way too long between one of your prescient and on-the-mark “Chinese gold” comments.

# # #

NEW YORK (CNNMoney)

Chinese buyers are now the biggest international players in the U.S. housing market and some states are seeing billions of dollars in real estate deals as a result.

More than half of the $22 billion Chinese buyers spent on U.S. homes during the 12 months ended in March was spent in California, Washington and New York, according to the National Association of Realtors.

It will NEVER end!!! They will buy FOREVER!!! This time is DIFFERENT!!!

See you at our conversational mandarin class tonight at SMC! Is it my turn to drive or is it your turn?

What?

Fo-EV-ah!!

http://finance.yahoo.com/echarts?s=^GSPC+Interactive#symbol=^GSPC;range=my

You smell that? That gasoline smell? I love the smell of an exponential growth curve in the morning. It smells like an eminent crash…

You continue to prove my point. No one disputes the activity. The debate is about the potential outcome. You’re pointing at something and I’m looking just beyond it trying to make out what follows.

Again, buy now or be priced out forever because its different this time due to the newly landed Chinese loaded with buckets ‘o money.

Readers haven’t just awoken from some amnesiatic spell.

Your point for over a year was that Chinese demand wasn’t real. Your metaphor to prove your point was “Chinese dripping in gold.”

Remember yourself pounding the table demanding “actual numbers” to prove the Chinese buying? Of course you don’t.

Like many who find themselves on the losing end of an argument, you’ve pivoted recently to establish a new beachhead. Whatever, dude.

DFresh said: “Wha? I thought high SoCal rents were being supported by a giant Red Chinese Buddha statue pouring liquid gold into the pails of the hopium-breathing house horny! You mean rent of $3,500/month for a 2/1 stucco postage stamp in CC is supported by time-tested economic principles? But, but, but, median incomes for CC are only $75/k!”

And I gave you an example of a $2,500 rental in Culver City. $1,000 a month differential is a big deal but of course, you accuse others of cherry picking data and you do this all the time. You are sounding a lot more like your lover Lord B. Me thinks someone is itching to buy that home. So where you planning to buy DFresh?

“Your point for over a year was that Chinese demand wasn’t real.”

I have never claimed the demand wasn’t real. I have and continue to question the scope and the attributing factors.

“Your metaphor to prove your point was “Chinese dripping in gold.â€

Actually, it has been “buckets of money.”