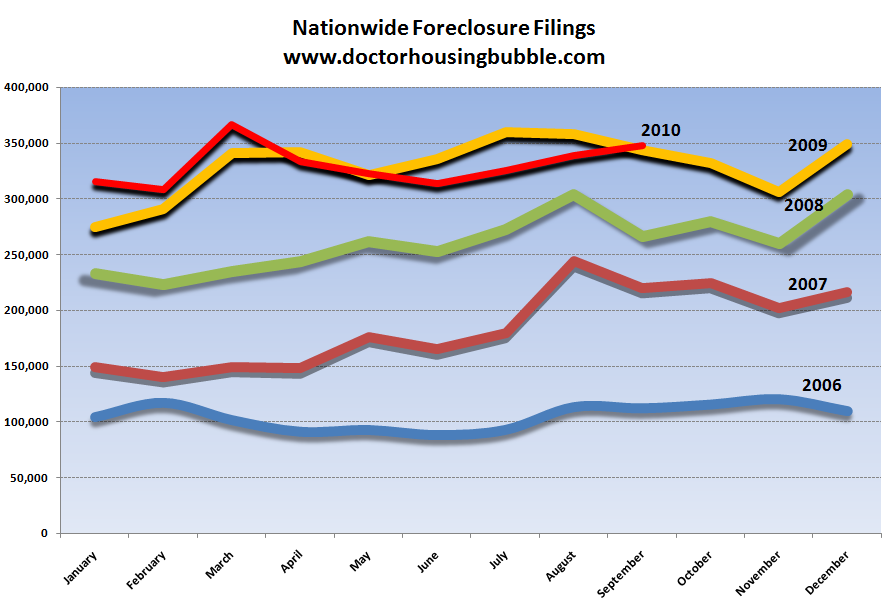

Who will buy the homes of tomorrow? 2010 highest average monthly foreclosure filings on record. 330,000 average monthly foreclosure filings in the United States. Student loans and stagnant job growth will create anemic prospects for housing.

Foreclosure is the ultimate sign of housing distress and is probably the best indicator of a healthy or distressed real estate market. 2010 has averaged a monthly rate of 330,000 foreclosure filings and this is higher than the 329,000 average of 2009 which was already a tough year.  The housing market is facing drawn out years of challenges both in financial terms but also in the legal system. The amount of shoddy mortgages has infected the entire housing market and has created a nationwide contagion soiling the prospects of real estate moving forward. Many investors are jumping in buying homes thinking this is a typical business cycle recession but it is not. Many cities are dramatically shape shifting. To put the current foreclosure filing rate in perspective, in 2006 nationwide we averaged a monthly foreclosure filing rate of 104,000.

Looking at the latest foreclosure filing data shows very little change in housing market issues:

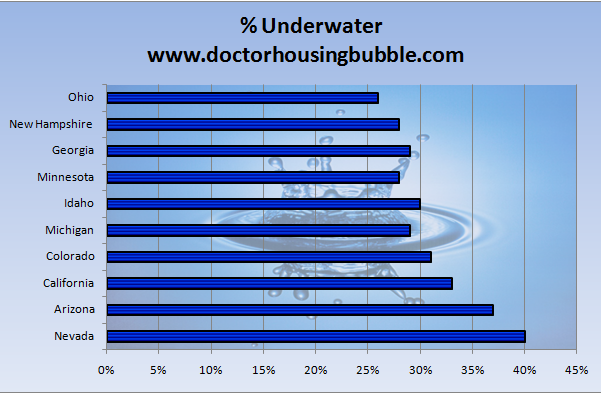

If we parse the data even further, we realize that the bulk of the issues stem from states like Nevada, Florida, California, and Arizona. In fact, for Q3 of 2010 these four states made up 46 percent of all foreclosure filings. Much of this has to do with the fact that these states also had the most pronounced housing bubbles. There is little hope for shaving off bank losses if prices do not recover. Prices cannot recover without the real economy growing and providing stronger and healthier wages for Americans. First, let us look at the percent of underwater mortgages by state:

I wanted to include a few unlikely states here to show that even areas that seen to be immune from the housing bubble like Idaho or Minnesota have a large percent of mortgage holders underwater. Of course the degree of being underwater is important. There is a big difference from being say underwater by 5 percent in New Hampshire versus being underwater by 40 percent in Nevada. The above chart just shows the percent of outstanding mortgages that carry a bigger balance than what the home would fetch in today’s slow housing market. Troubled mortgages are really at the center of this crisis but even regular 30 year fixed mortgages are facing issues ahead.

As we’ve argued for years, without a healthy employment market the Fed can do whatever it likes but housing prices will not move up. And the employment market looks anemic at best:

Source: Economist’s View

According to the above chart, we are still three years away from getting back to the employment levels before the recession hit. Of course, our economy needs to add roughly 100,000 to 150,000 jobs per month just to keep pace with population growth. So even a month where zero jobs are lost on paper can actually increase the unemployment rate. How? Well you have a large number of graduates from high school, 2-year schools, and 4-year colleges entering the workforce. These groups have been hit hard and many now carry incredible burdens of student loan debt that will hamper their ability to buy a home in the future. This is a new phenomenon. Student loan debt isn’t new but the degree of student loan debt is. The same thing happened with the housing market. Mortgage debt isn’t necessarily the issue but the amount of leverage and toxic loans was.

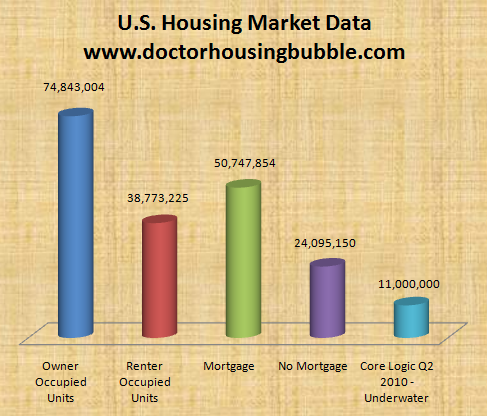

Now let us examine the overall housing market:

“74 million owner occupied housing units exist in the U.S. Of those homes, over 50 million have mortgages. Of those 50 million loans, over 11 million are underwater. As things stand today, there are roughly 2 million active foreclosures. Another 5 million Americans have stopped paying their mortgage.”

So the pipeline is rather full for the next few years with distressed properties. The only way this doesn’t end badly is if home prices increase. But who will buy these homes thus pushing prices up? Your young professional couple, likely college graduates is now mired in debt. Not all but certainly many given the average student loan debt is now pushing $25,000 or the price of a new car. The only avenue to a so-called middle class lifestyle requires a college degree. That is now a prerequisite. Ironically, the housing bubble might have been the last time you have a giant non-college population of people as real estate agents, mortgage brokers, and others associated with the financial industry making good income without a degree. The recent job growth has occurred in education and healthcare industries that require college and a certain level of training. Hospitality has also grown but these are typically lower paying jobs.

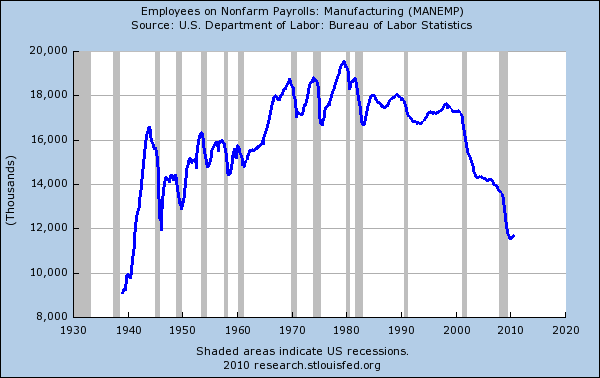

So do we have enough Americans with stable salaries and good jobs to soak up the excess housing units? I just don’t see it as of now. Roughly 1 out of 4 Americans has a four year college degree. If we had a big manufacturing base that paid well, then this industry would provide an avenue for a new line of Americans to keep housing prices up. But this is how that sector looks:

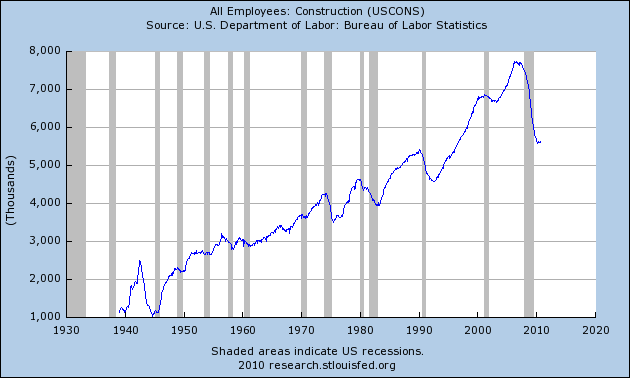

So it isn’t going to come from this sector. What about construction?

And this is where the lag in employment exists. These typically blue collar industries are simply flailing in this market. The manufacturing sector has contracted since the 1970s. But construction was a big player from 2000 to 2007 with the housing bubble. Now what? We are left with college educated professionals but many are deep in debt already. Are they looking to buy an expensive home? Probably not and the data seems to suggest that many are having trouble paying their homes today. I just don’t see the manic desire to buy homes like in 2005 where lines and waiting lists existed for crappy condos built in Southern California. All that was a tulip like mania that is unlikely to happen for a few decades until another generation of Americans forgets the lessons of the past when they touched the toxic mortgage stove.

Who will buy the housing of tomorrow? Hard to say but at current prices many are reluctant or unable to do so. After all, the median household income for an American family is $50,000 according to the Census data. California has a median household income of $67,000 yet the current median home price in the state is $265,000. The only way home prices stay at these levels is if incomes quickly pick up and the employment market turns a corner. Unfortunately we haven’t seen that happen which suggest home prices will continue to edge lower.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “Who will buy the homes of tomorrow? 2010 highest average monthly foreclosure filings on record. 330,000 average monthly foreclosure filings in the United States. Student loans and stagnant job growth will create anemic prospects for housing.”

It looks like from the Manufacturing chart, that the peak was 1979 and the Powers That Be then decided to pull the plug on The USA and went looking for an “empty suit” that would go along with them.

Enter The Gipper, a power napper who talked about People magazine articles with great leaders of the world and didn’t work more than 4 hours a day.

That guy will sign anything, they thought!

Yes, it’s true, he was already heavily brain damaged and probably didn’t even know what he was signing….

@Cambridge–There you go again, failing to sing the praises of the greatest populist of them all. “I’m from the government and I will fix all the problems, or at least make you feel good about becoming a nation in decline. I’ll tell you I’m lowering taxes, then raise the SS tax rate, the single-most destructive act to employ Americans in history, while I rail agains big government and taxes. But who needs facts when we can just live on rhetoric”

Isnt’ it more likely that some manufacturing base deserted the U.S. because of rampant inflation at the time? Reagan wasn’t sworn in until 1981 and didn’t have laws enacted instantaneously. You probably have to go to 1982 to have a year that you can truly credit or blame as you wish to Reagan.

As for inflation, well, FDR took the U.S. off the gold standard in 1933 but foreign countries could still turn in their dollars and ask for gold till 1971. Apparently this didn’t happen much, till the mid 60’s when the French, among others, noticed that Johnson was causing inflation by simultaneously trying to massively increase domestic expenditures while also paying for a huge war in Viet Nam. The French made more and more redemptions of dollars for gold till finally, under Nixon in 1971, the U.S. gov’t decided it couldn’t keep giving away its gold and took the dollar completely off the gold standard. Thus was born inflation.

So, the blame pie for inflation? I’m guessing you’d have a great big slice for Roosevelt. Another great big slice for Johnson. A goodly piece set aside for Nixon and only little pieces for Ford and Carter who probably didn’t handle the money supply as well as they could have but were kind of in uncharted waters by that point.

I tend to agree with this.

I agree with you, Cambridge, inasmuch as the outcomes are attached to Reagan. But let’s not overstate the creature’s accomplishments, which mainly involved being a corporate shill and B actor.

He was elected by and represented globalizing plutocrats. Christ, Dutch’s and Mommy’s best buddies in SoCal were the freakin’ ANNENBERGS.

http://www.amazon.com/Clothes-Have-No-Emperor-Chronicle/dp/0671673394/ref=sr_1_10?ie=UTF8&qid=1288376771&sr=8-10

The ’80s were a decade of moral and ethical vacuum. And it’s still playing out.

Ronnie may have been a B actor, but I think most will agree that he played the pivotal role in ending the Cold War by standing up the Soviets and eventually causing the Soviet Union to bankrupt itself as it tried to keep up with our rampant defense spending fueled by all of the above-mentioned monetary wheeling and dealing. And to get rid of the constant threat of nuclear assault is worth it in my opinion.

WP, you think that the threat of nuclear assault is a) gone?

The problem is that the debt is too large for most persons(govt, people, and etc.) Treasury Secretary Geithner has already decided to debase the currency to cheat the Chinese because they will not revalue their currency. Lowering the value of the dollar substantially, will increase our import prices that we will all pay, and increase inflation and the cost of everything, including houses. Wages will also go up, but the debt remains constant. The persons that own the debt will be sad. Politically, the federal government can not raise taxes and can’t cut programs, hence the ongoing deficit that the Fed. Reserve will finance by buying the government bonds and giving the federal government their Federal Reserve notes which results in more inflation. Remember Jimmy Carter? Now is the time for people to go and read about those days. Obama reminds me of Jimmy.

You can pretend Jimmy Carter caused inflation all day long but it won’t change the facts.

Remember WIN buttons? “Whip Inflation Now” coined by the Ford Admin. Remember the price controls that Nixon put in place but soon removed them because the price controls caused shortages?

Jimmy Carter, what did he do? It seems to me he appointed Paul Volker to the FED.

You know, Paul Volker, the guy Reagan and the Right celebrate for breaking the back of inflation by raising interest rates to a level that crushed inflation.

Of course changing history books is always an option since most are printed in Texas.

John CPA JD

Was just owned by Martin. Nice work Martin.

true…Jimmy was trying to be fiscally conservative. He still is…watch his interview on 60 minutes.com. The problem is that people didn’t like being fiscally conservative.

Carter cannot be blamed for the double-digit inflation that peaked on his watch, because inflation started growing in 1965 and snowballed for the next 15 years. To battle inflation, Carter appointed Paul Volcker as Chairman of the Federal Reserve Board, who defeated it by putting the nation through an intentional recession. Once the threat of inflation abated in late 1982, Volcker cut interest rates and flooded the economy with money, fueling an expansion that lasted seven years. Neither Carter nor Reagan had much to do with the economic events that occurred during their terms.

All those administrations were sufferring from lack of creativity. Now we just create bullshift formulas to say that inflation is near zero while gas is $4 a gallon and hamburger and friezz is $5. But instead of a $35 steak dinner we can substiture a $5 hamburger over and over, so see? there is no inflation.

Manhattan wants us to bicker over party rhetoric and watch football while they continue to loot the treasure and our 401k plans. The enemy isn’t the governement–it’s the Manhattan banksters.

The more of this stuff I read about, the more my attitudes harden. I have no sympathy for the banks or the plutocrats who rarely feel the consequences of their failures, but it looks like massive suffering is the only reasonable solution, and it must come in the form of inescapable debt burdens which impress on many people that leverage is a nasty, venomous, slithering threat to their well-being.

I used to think that the impossibility of student-loan forgiveness was wrong – just a welfare program for banks who wrote student loans – but now I think that it may be what saves us. There is not enough fear of debt, and crushing, 30-year-long payoff burdens for overpriced degrees will force people warn their children off of debt, shut down many universities with marble administration buildings and jacuzzis in the dorm bathrooms, and refocus citizens on leverage as a tool instead of a way of life.

Many people who were children during the depression were scared to death of even mortgages, let alone auto, home equity, and credit-card debt. We must traumatize our population so severely that, at the mere mention of debt, they will sweat with dark and visceral fear.

“I have no sympathy for the banks or the plutocrats who rarely feel the consequences of their failures, but it looks like massive suffering is the only reasonable solution, and it must come in the form of inescapable debt burdens which impress on many people that leverage is a nasty, venomous, slithering threat to their well-being.”

This is bad logic. You say you have no compassion on the banksters, yet turn it around and want the PEOPLE to bear the burden (which we are through the Bailout). In addition you want inescapable debt burdens on the PEOPLE. This will not bode well for those who cannot add wealth to the population and turns people into commodities who are only useful if they can work…or in your eyes…”add” to society. Best of luck to the sick, elderly, and those whom are simple. Make a mistake, get de-frauded? Oh well, no debt escape.

“I used to think that the impossibility of student-loan forgiveness was wrong – just a welfare program for banks who wrote student loans – but now I think that it may be what saves us.”

Are you insane? Really, are you insane? Education is what can SAVE this country, but it’s not going to happen when education is a pure capitalistic tool in order to make other people wealthy. The majority of people attending higher education is to better themselves, and this in turn makes the country stronger. Lack of good, FREE education in this country is more of a threat than terrorism.

”

We must traumatize our population so severely that, at the mere mention of debt, they will sweat with dark and visceral fear.”

You have some serious issues, I hope you never enter public office, and better yet, never sire another human being.

“cabron” – urban dictionary definition = dick, bastard in spanish

Your chosen name for posting suits your views well.

Swiller skipped first grade math class, and thinks I should subsidize his Escalade payments.

Hey, I am a Baby Boomer female who has a “dark, visceral fear” of debt… and it’s not as though I ever ran up so much. My largest car loan was for $6000 in the early 80s, and I have about $11K in cc debt run up because I was so cashed-strapped from paying off an error at work that ran a $23K inventory loss ( I am in the securities industry and have S24 and S27 licenses, among others, so I have to PAY), that I was expected to pay back inside of five years.

Let me tell you it never frakkin’ fails…. .if I run up even the smallest bit of CC debt, no matter how solid I am at the time, SOMETHING will transpire to make it a mountain to climb… .such as a 40% reduction in pay and hours.

We Americans grew very spoiled and complacent during the Post WW2 era- a time when most people could count on jobs that were at least solid and reliable, if not particularly lucrative, and could bank on staying on them until they retired. That started to come to an end in the 80s, but we could not wrap our heads around the fact that we Boomers would not have the automatic job security with ever-increasing incomes and opportunities, and automatic COLA raises, that our “Great Generation” parents had in the 50s and 60s.

The human is a complex being and is slow to adopt to utterly new modes of thinking and being with the speed necessary to adapt to an economy that changed as rapidly as did that of the U.S. in 1980 to the present. I have, in my life, witnessed the deaths and births of many industries, and the deaths of companies and whole industries that were hot in the 80s. I have also witnessed more financial “bubbles”- food commodities, metals, real estate in the early 80s, the tech stocks, and the recent bubbles, that most people of previous generations ever saw in three lifetimes. Also more scams- ARMS, oil and gas deals, limited partnerships, penny stocks. managed money.. then I thought could ever exist as a kid, and I noticed that the further we departed from what made this country rich and powerful to begin with, which was our pre-eminence in technology and in manufacturing and commerce- the more scams and bubbles were generated, and the more debt people piled on.

The net result of 30 years of denial regarding the true source of real wealth, and the creation of a false economy based on financialization and debt, has been to strip every generation from the Boomers on down of everything they bled to earn. Most of those of my generation have NOTHING to retire on. They trusted Enron, they trusted WorldCom, and they trusted the debt-fueled “growth” paradigm that was foisted on them by our elites and their bought political tools.

God knows what we will fall for next.

Laura, I truly feel we are indeed entering a vast void where all of our valents are artificial and we don’t realize that the entire national engine has been replaced by an arithmatic Ponzi scheme. We either embrace the virtual economy or risk sudden collapse. The die is cast, the road has been chosen. There is no turning back. These debts will never be repaid.

“The net result of 30 years of denial regarding the true source of real wealth, and the creation of a false economy based on financialization and debt, has been to strip every generation from the Boomers on down of everything they bled to earn.”

Laura, you really nailed it. This is exactly what has happened in my lifetime and I’m furious about it to the point that I am ready to leave the country and start (well retire) somewhere else. However, part of me still wants to fix this issue, return the “finance industry” to its appropriate size and % of the economy. I know this cannot possible happen without revolutionary campaign finance reform (a nonstarter) and overturning several landmark supreme court decisions that gave corporations the same rights as human beings even while they have a million times the resources of human beings. The absurd inequities have typically resulted in revolutions, but now that media corporations can manipulate the reptile brains of the electorate, I don’t even expect that.

“But who will buy these homes thus pushing prices up?”

I’m an EE with a minor in computer science. This has been a lost decade for me. I simply cannot compete with someone who has more education and can live comfortably on $4.50 an hour. The employment implosion of the car industry took decades, but for EEs it took about five years. (And the second worst? Computer science.)

About ten years ago, I was thinking about starting a family. I crunched the numbers: if we saved every single cent of my girlfriend’s salary, we’d have enough money saved in 18 years to pay for the projected college education of one child. Child #2 would be SOOL. [shit out of luck]

Then I examined housing prices. Prices were rising so fast that it was becoming numerically impossible for us to save for a 10% down payment. “How could that possibly be sustainable?” I wondered. “If two college-educated wage earners can’t do it, who is expected to be able to buy a house?”

And if you think the laws for mortgages and credit cards are skewed to favor the banks, you ain’t seen nothin’ yet until the student loan racket falls apart. There’s now more student loan debt than credit card debt.

IMO, the whole damn house of cards coming down because the SOBs at the top got too greedy, stealing all of the wealth earned by the middle class from 1945 to 1970 and then some (thanks to easy credit that made up for falling wages). It’s not surprising that the middle class golden years occurred when there was 90% tax on the wealthy and the difference between the wealthy and everyone else was not so vast. Funny how everyone does better when everyone does better.

You are not an EE/CS. You don’t write or have the logic of an engineer or a computer scientist. You posting is both nonfactual and illogical, and the hypothetical situations and timelines you posit are nonsense. Not engineering-like at all. Your rant at the end of your posting is more evidence. You are a fraud.

OsMcBein,

I don’t see any evidence to support your claim that he is a fraud. Can you provide one example?

Hey, I don’t know what he does for a living, but, he sounds pretty smart to me. You, on the other hand, sir, are being rude.

McBain, I am a software developer with over 20 years of experience and I think his posting is completely logical. You should re-read his posting – I have no idea what part of it you didn’t understand, or thought made no sense. Educating a kid is hugely expensive, and so are down payments on three and four bedroom houses in California. You need to save an enormous amount of money for College, especially when factoring in future inflation.

McBain.

That’s a cartoon character played by Rainier Wolfcastle, right?

Your rant against the EE’s posting is the illogical one. He made perfect sense and your rant does not

OsMcBain, your situation is very similar to mine. And I had the same observations regarding housing and an overall sense of unsustainability of every aspect of our economy. My vote was cast ‘no confidence’, several years ago, and I followed the yellow brick road.

I’d have to agree with McBain here. How does an EE and his college educated GF not able to save a measly 10%?

and the rest of the post is just professional victim speech BS

Just look at the 1,2,3 and 5th paragraphs. The numbers the poster uses are all messed up and sloppy. Also, most engineers and cs’er’s know how to balance time, money, and other resources to meet goals. Nygenxer cannot or has not done so. True engineers and computer scientists cannot help but use accurate numbers, whether at work, at hobbies at home, when talking with friends or arguing about finances (at nygenexer is doing here). The examples in those paragraphs, and the rant is just nonsense. The poster is not an engineer. More to the point, the poster is a pretender.

Correction on my reply address: should have been nygenxer, not McBain.

Housing is going to GET SLAUGHTERED IN the next 5 years! SLAUGHTERED, BUTCHERED, ANNIHILATED. Who has the fricking jobs? WHO HAS THE JOBS?

Here’s an excellent video about the job situation in this country:

http://www.youtube.com/watch?v=CwpdGyIY2fQ&feature=player_embedded#!

Without a good job who can afford a house?

Without a good job, who can EVEN PUT FOOD ON THE TABLE? I work in healthcare. I have a decent job, but job and budget cuts are already happening. It’s going to get worse, so much worse. Charlie says we’re going into a depression:

http://www.shtfplan.com/headline-news/mcgrath-austerity-will-hit-america-like-an-eight-pound-sledgehammer_10272010

I have tried to be optimistic, but I cannot but think that Charlie is correct.

Back to housing – the government together with the banks have artificially propped up housing prices. THIS WILL FAIL. THIS WILL FAIL. For a look at what will happen to the housing market see this video for an idea: (1 min,50 sec video)

http://www.youtube.com/v/tbNKVmWj1K4

SMASHED, CREMATED, ANNIHILATED, DESTROYED, DEMOLISHED.

Thank God the recession is over. Maybe it just got so bad they realized’Recession’ was too nice a word for this. I think ‘Depression’ is insufficient. I only hope it is not worse than ‘Dark Ages’.

Jubilee would be good right about now. Everyone I know has student loan debt from the 90s. Those graduating now have even more. The only people I know who bought homes had wealthy parents who paid their down payment. They still are house poor and stuck in mortgages that are underwater.

Add this:

Automation Insurance: Robots Are Replacing Middle Class Jobs

http://www.good.is/post/automation-insurance-robots-are-replacing-middle-class-jobs/

It’s true, jobs available today are one of two tiers: for the highly skilled and educated or in the service sector with nothing in between.

Gael,

just consider this for a moment:

There are virtually no jobs, in any industry or subset of industry, which could not be done better or cheaper by a good robot or computer program.

Think about it.

“There are virtually no jobs, in any industry or subset of industry, which could not be done better or cheaper by a good robot or computer program.”

There will always be those unless you have a robot/program which has the adaptibility and intelligence of a man. Nor better and definitely not cheaper: Adaptibility is extremely expensive.

Every robot/program is currently very far from situation where you can send one out and say ‘There’s a problem there, go and fix it’.

Until that happens, troubleshooters are irreplaceable. I predict that you or me don’t live long enough to see that happening, if ever.

Bulk production is another thing but it’s already running on automatons in most industries.

Except the jobs that require writing those programs

kaboom, you don’t spend much time around parents, farmers, electricians, plumbers, or sex workers, do you?

Also, there’s got to be millions and millions of us in our 50’s and 60’s who are college educated, vital and healthy, and youthful, but will never be hired regardless of our educations, simply because of our age. We are being seduced into being ‘entrepreneurs’ and starting our own businesses, as there is nothing else for us to do, but starting your own business is not as easy and lucrative as they make it seem. And when I drive by West Valley Occupational Center, the parking lot is always full. I wonder if it’s even worth it to go back to school at age 60, and hope to resurrect some kind of work/career.

Many renter occupied units have motgages too. How many are current? How many are underwater? How many are bought and paid for and turning out income free and clear? How many are being rented for less than the mortgage nut?

Let’s not forget two ongoing processes chugging along and probably accelerating in this depression that will bring us down even further – the advances in all sorts of technology that destroy jobs with their efficiencies, especially computers and the internet, and off-shoring of jobs. Every manager worth his salary is investigating how to lower his biggest cost, the cube dwellers and/or workers on the assembly line, if he wants to advance him/herself.

Migration and telecommuting will help offset that situation. We might (wil) all be forced to live frugally, and simply. How the heck do you think the cavemen did it? Another option I’m considering is moving (migrating) to Hawaii and have my family join the rolls of welfare recipients so I can surf more. The rich taxpayer will continue to foot the bill for that, right?

The gap between years for Nationwide Foreclosure filings chart is getting narrower. Isn’t that a positive sign? I feel we are bottoming out on low end of market. High end markets (above $800K) have long ways to fall.

Who will buy? a 4-letter word, “ASIA”.

Chinese will be the second language in west coast in no time.

What is this “Chinese” language you speak of? Do you mean Mandarin? Wu? Cantonese?

The problem with the “efficiencies” of automation is that they refer to “efficiency” as defined in a profit-machine model, not a human or sustainability one.

DHB said: “Many investors are jumping in buying homes thinking this is a typical business cycle recession but it is not.”

Boy, that sums it up. I STILL hear this lingo out of the majority of business reports/analyses I encounter. “Well, things have been down for X months, so obviously They’ll Start Going Up Any Day Now.” Remember: things always go up (â„¢).

It is amazing how on the Nationwide Foreclosure Filings chart, one can so easily see the effect of the foreclosure stalling public policies. But I say again: DHB, yer gonna hafta get a taller chart!

Doc’s including “nonbubble” states in the underwater chart is essential evidence of how weak the employment situation is. EVERYWHERE. It doesn’t matter whether a person or household exercised the maturity and prudence not to get swept up in the housing bubble. Doesn’t even matter if a state largely avoided all that. If a job goes away, or someone gets sick, or natural organic change of other sorts happens, then they can’t make their mortgage payment. THOSE are the people who should be benefitting from remedial programs.

Finally, the “private nonfarm payroll employment through various recessions” chart needs a footnote. A lot of the states that don’t appear in the top 15 of states experiencing massive underwaterness or foreclosure are farm-based states. The tsunami of economic hell went through them in the 1980s to 2000s, just as the Rust Belt tore through the Northeast in the 1960s and 1970s.

In the case of farms in those decades, corporatization/monetarization/Reaganomics destroyed the strong local/regional job bases of family farms, replacing them with mega corporations who used “efficiency” to mean “yield X thousand dollars per acre that we can skim and export to the global plutocracy.”

Future homeowners will be fine. Time will sort out the pricing. It’s the law of supply and demand. It will work. It would just be nice if it would work a little faster. One quick way would be for the bank to kick the dead beat “homeowners” who are not paying there mortgage out of the home and sell it to someone who can afford it. They that guy RENT while someone who can afford it OWN!

Instead we are propping up people who think they deserve a home – when they really should be renting. I don’t feel bad for a single homeowner that can’t afford his home due to poor financial planning – I am a renter because I could not afford the bubble prices. I am good a simple math so I waited. Those who bought and now can’t afford need kicked out into the street. Tough love. They will get over it in there apartment or living with there parents.

This sense of entitlement by the poor or house-poor is really aggravating.

Sean, your not getting it. If you think these deadbeat homeowners control ANTHING, you need to wake up to reality. The government (yes, the ones YOU voted for), is bailing out the banksters. The banksters in turn, do not foreclose and kick people out because they are being compensated up to 85% of the losses. 12-24 months of “free” rent to the people living in the home (I won’t call them owners), and that huge unpaid portion is then covered by the gov.

Yes, the people living without paying need to be kicked out, but it’s not their fault. I know people personally that have MOVED OUT of their homes, and the banksters will still not foreclose. This also means the “deadbeat” owner is responsible for the property if anything really bad happens.

If really wish the sheeple would look farther than attacking their neighbors, but this divide and conquer through fear, has worked for the political structure until you have only two choices left, and both are corrupt and useless. Defacrats & repugnantcans.

People victimize the ones losing their homes because it’s an easy target, and bullies never pick on someone bigger than they are, hence the reason people don’t attack the banksters and government.

@Swiller – That’s a bunch of B.S. you say you know people who “Moved out” but are still responsible for the damage to their homes??!! Those are few and far between. Did you know they could do a quit claim on the property?!! Yes, they will be responsible for the loan but not the property. Most people I saw took advantage of the situation and paid their debt and some went on vacations.

If we want to succeed in life we need to quit letting ourselves be victims. Being a victim is a double edge sword. It makes us feel less guilty but it keeps us from changing or adapting to the situation because whenever something goes wrong we blame someone or something else. This puts us in a state of vulnerability where others promise us (like the government) that they will save us. We need to take responsibility of our own actions and when we do…we will succeed. Don’t let others suck into the blame game. Learn to adapt, have faith, live within your means, and take charge of your life.

‘Deadbeat’ owners are not the ones slowing down the process. The Fed’s manipulation of interest rates and the banks holding inventory are what’s slowing the process. You could kick a family out of a home, but the banks determine whether or not that home is released to the market.

Furthermore, low interest rates make incurring debt much cheaper, so people can now make ‘more affordable’ payments on bigger loans. You could potentially buy a 350K home in today’s market and pay the same monthly payment amounts as you would on a 280K home 10 years ago.

It’s gonna be a long time from now to the time when mid to upper tier homes become more affordable. Instead of waiting for that time, I’d rather focus on how to protect myself from all the bad policies that are making its way into the near future (obama plan anyone?)

I’m getting tired of explaining this but here goes. Most of the people buying homes in 2005/2006 were sold by banks on the logic that.

a) home prices always go up

b) your personal incomes will always go up.

Under that logic getting a home loan for whatever the max the bank would give even at an adjustable rate seems logical. The value of the house will go up allowing you to refinance at a lower fixed rate once your equity = 20% and in that timeframe your income would go up enough to make affording the payment comfortable. This was what perpetuated the bubble. Obviously it didn’t work out that way and hindsight is 20/20. It was actually loans to middle/upper middle class people along with the poor that have really blown up. Back to my original point

a) Home values are down substantially

b) Incomes are down substantially

This toxic mix has financially destroyed almost anyone who bought a home between 2004-2006. Making matters worse even though interest rates are lowest they have been in a generation no one who bought in bubble markets during these years can refinance because they owe so much more than the homes are worth. I don’t think it has a lot to do with entitlement or the poor, but more of poorly timing the market and a large mix of economic factors. I do agree with your point that the banks need to complete these foreclosures(or workout a deal, but that never happens) and take their losses so the healing process can begin for us all.

I agree, however the logic you noted was NOT ONLY the fault of the bank. Everyone is responsible for #1.

“Most of the people buying homes in 2005/2006 were sold by banks on the logic that.

a) home prices always go up

b) your personal incomes will always go up.”

All the time I have people trying to sell me something. (That’s our economy.) Telemarketers want to sell something daily. TV ads for cars are always on TV.

It’s up to the individual to determine if he/she can afford the home on their current income. Not the bank! (Qualify you can afford it, that math is up to you.) Just because someone says it’s safe to jump off the cliff do you do it? NO.

So those homeowners who purchased on those assumptions listed are financially “slow”. Note: I said financial “slow”, they may be smart in other areas, but not in finances. As a financially prudent person would not buy something they can’t afford for the next 5-10 years on there current salary.

If you think there is money to be made, then you are SPECULATING. If you are a speculator trying to make money on your home then you LOST. Time to eat the humble pie and go away. (Yes, it seems the bank is not making that easy, but that’s part of the game.)

Let’s get the financial slow our, and a NEW family into the home that CAN afford it. We need to reset this market ASAP. It is very UNFAIR to “adjust” for the people who bought, as it punishes those of us who waited. If they are going to pass out 100-300K to these homeowners, why not just give that to renters? Add that to our savings and we can buy the home. (Hence, why the only fair way it to kick the original buyers out – ruin there credit – and let the free market bid on the new home.)

I agree with DG, but would go one step further: books like the Big Short highlight how much insight Wall Street had to the failings of the system, and the impending collapse. The bastards of course took this information to find a different angle to make money. The upshot of this is that critical decision-making information about the true nature of the system was unavailable to millions of intelligent, hardworking people.

Unfortunately, I am one of them… a house purchase with 20% down in 2005, and now I’m 40% underwater and in a neighborhood surrounded by distressed properties. I didn’t use my house as a bank or speculate, I just did what responsible homeowners did. But the system has destroyed my financial life which in turn will have consequences for my families life for years. And we did nothing wrong.

Idaho was *not* nonbubble. The action was in Boise because HP and Micron were there, and it’s close to Cali and southern Oregon.

There were little mini-bubbles all over the place. You think the same flip/specuvesting fads in Florida weren’t tried by wannabes in Montana or Kansas? The Realtor-builder-HGTV buzz got around fast. You know, cable TV, Internets and stuff.

Yeah, I agree that it wasn’t the fault of the home buyers at all…I think that most of them were swindled and had no idea of what they were getting into. But you can BET that the real estate agents, the mortgage brokers, and the Wall St. banksters knew EXACTLY what the fuck was going on.

Sadly, the bastards at the top get bonuses, the home “owner” gets kicked to the curb, and the rest of us pay for the shenanigans via our tax dollars and inflation.

i still think that if people really understood what those creeps at the top have done, there would actually be bloodshed.

Everyone is given a simple 1 page document called “Truth in Lending” that states exactly what you’re getting into. Everyone needs to take responsibility for what happened from the Banks on down. Banks were forced to make loans to people of lower income or be tagged as “racist” and they had to advertise those loans to everyone. They should have pushed back against that more but we need to realize that we are all at fault. Most people I saw took advantage of the situation while not paying their mortgage and paid their other debts and some went on vacations.

If we want to succeed in life we need to quit letting ourselves be victims. Being a victim is a double edge sword. It makes us feel less guilty but it keeps us from changing or adapting to the situation because whenever something goes wrong we blame someone or something else. This puts us in a state of vulnerability where others promise us (like the government) that they will save us. We need to take responsibility of our own actions and when we do…we will succeed. Don’t let others suck into the blame game. Learn to adapt, have faith, live within your means, and take charge of your life.

So besides waiting for jobs to become available and unemployment having a substantial increase, a solution would be to have housing values drop, right?! If so, how can that happen?

Calasian…….Asians from Asian will not come to Cali or other state to buy the properties any more………they will hold the cash or exchange into gold……. Also, don’t get me wrong Calasian, I am not a Asian and I only hang out with Asians…but Asian language will not be the 2nd language……Spanish is and will dominate many parts of US cities……

Oh DG…I LOVE your posting 🙂 Thanks!

The States Take on Foreclosures

Fortunately, there is no end to imaginary money, so total collapse can probably be kicked down the road a few more years–we’ve been running on empty since 1971, so who know how long we can keep up the charade. The obvious problem is that it crowds out real money and we’re all going broke. The only thing keeping US afloat is money going out to pensioners, welfare, socialist security, medicare, frannie-mayhem, unemployment, food stamps (what would food prices be without all-time high recipients?), government employees at all levels (such as standing armies, global), government contracts, government bailouts, bank carry on treasuries, interest on US debt paid to wealthy, FDIC. Oh yeah, tiny contribution from actual private sector productivity, especially insurance, pharmacueticals and entertainment…the founding fathers would be so proud.

We are still seeing multiple offers on homes here in Southwest Riverside County on homes listed below $300,000. Many comparable prices have gone up and every time there is a low ball short sale listing listed, they get many multiple offers. Consumers are still biting, especially in the Inland Empire and Temecula in particular. I have cash buyers who keep insisting on offering thousands less than asking price and cannot get a home. These buyers think that the market will crash and they will have their day, but it’s not happening yet!

Jane – Tarzan Here. You are right – the market “crash” has not happened yet, at least not “the Big One,” as Fred Sanford used to say. It has been more like a slow crash, but THE BIG CRASH IS COMING.

As you say there are multiple offers on homes less than $300,000. Why? Because people think $300,000 dollars is cheap compared to the “bubble days” pricing. That is one of the long lingering effects of a financial asset (housing) bubble: people lose sight of what the asset in question is really worth. “$300 K? That’s cheap,” people think. NO IT’S NOT CHEAP. NO IT’S NOT CHEAP. Take Tarzan’s word Jane – THE BIG REAL ESTATE CRASH IS COMING.”

If we want to succeed in life we need to quit letting ourselves be victims. Being a victim is a double edge sword. It makes us feel less guilty but it keeps us from changing or adapting to the situation because whenever something goes wrong we blame someone or something else. This puts us in a state of vulnerability where others promise us (like the government) that they will save us.

Be leery of those who like to blame others for their problems, they tend to be losers and are miserable. They are looking for company. There are others who want to use this vulnerability to make you dependent and to control you.

We need to take responsibility of our own actions and when we do…we will succeed. We need to learn to adapt to the unpredictable changing weather of our economy. Don’t let others suck you into the blame game. Learn to adapt, have faith, live within your means, and take charge of your life. True fortunes are made the way you build a wall… one stone at a time. They are lost by get rich schemes, greed, or being unrealistic. It is true that you cannot have freedom without responsibility. This means you and me not someone or anything else.

Leave a Reply