The twin bubbles of housing and higher education – housing bubble expanded from 1997 to 2007 and imploded. Since 2000 tuition costs have been soaring but graduate pay has been falling. What happens when you price out a generation looking for starter homes?

One of the many problems facing the housing market is the lack of qualified first time home buyers. Household formation for the purposes of buying a first home typically occurs in the 25 to 34 age group. Yet this recession has hollowed out the middle class and we have found out that millions in this age category simply moved back home or don’t qualify to buy even with historically low interest rates. Typically this group would be renting and saving for their starter home. However with a poor economy for young professionals this step is being stunted. A big part of the market is being driven by lower cost distressed properties being purchased by investors. The young professional household is facing challenging times ahead especially with so many coming out with tens of thousands of dollars in student loan debt. The old fogey remembers the days of hundred dollar annual tuition and working part-time to pull through college with no debt but with many public quality universities now routinely charging $15,000 or more a year, it will be hard to cover your costs by working at Wal-Mart part-time (especially when you are competing with millions for those part-time spots). One aspect largely missed in the press is the connection between incredible levels of college debt and the impact this will have on the starter home market.

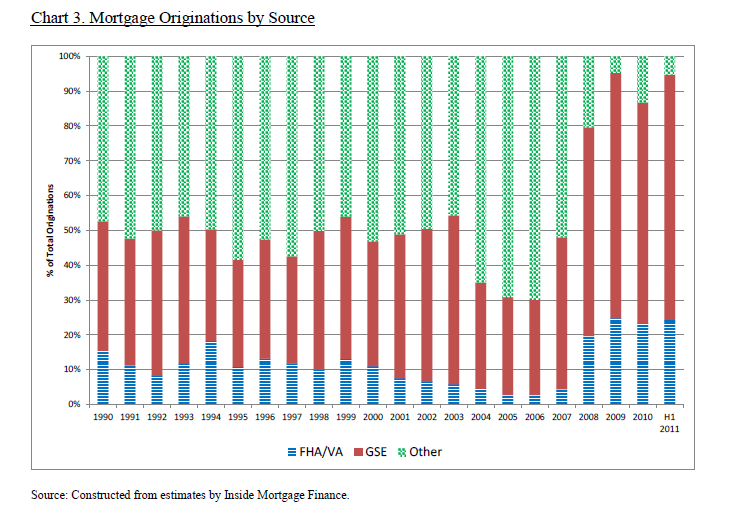

First the scariest graph on mortgage debt once again

I had mistakenly assumed that most people already realized that the government was pretty much the entire mortgage market:

As it turns out, most people think because they refinanced at Bank of America or receive their monthly statement from Chase that they somehow own the mortgage. This is not true. The government with the ultimate banker in the Federal Reserve has pretty much turned into the mortgage market since the crisis hit. Bank balance sheets are a mess and banks are willing to lend to qualified buyers with sizeable incomes and a good down payment. Suddenly banks are tight with their funds but more than willing to roll out taxpayer dollars. But look at the above chart and you will realize what banks are realizing. The entire U.S. financial system is being supported by the government. In other words, investment banks and the too big to fail are largely wards of the state only alive because of taxpayer bailouts.

Yet look closer at the graph. Notice that blue line? Those are those low down 3.5 percent FHA insured loans. Even in the non-bubble year of 1995 FHA made up roughly 10 percent of the entire mortgage originations for that year. This year it is well over 20+ percent. Current default rates are not good on these documented loans because of the poor economy. In essence banks are like a Hollywood set for the public pretending like they have money and making loans but in reality are nothing more than a shell that is empty.

This brings us to our next issue with student debt.

Mortgaging education and housing

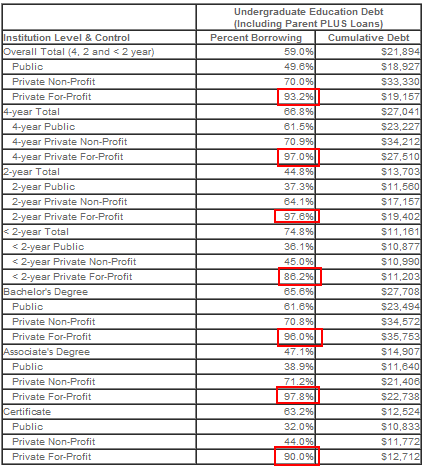

If the above chart on mortgage debt was startling this below chart should give you the chills:

Source:Â NY Times

The student debt market is now much larger than the credit card debt market in the United States and the trend is making a clear move to $1 trillion. Now this wouldn’t be such an issue if graduates were earning a nice ROI on their investment. More and more evidence is showing that with over 4,000 colleges in the U.S. some degrees are simply not worth it. In fact, it is like purchasing a Real Home of Genius except you have absolutely no ability to walk away. You bought a shack at the peak and now have to pay for all the debt associated with the place.

It is ironic that large segments of the education pipeline are looking like the exotic mortgage financing sector during the boom days of the bubble. Just look at borrowing rate of those going to for-profit institutions:

Source:Â FinAid.org

Over 90 percent of those going to for-profit colleges borrow! This is like the 100 percent financing brought on by the toxic mortgages. It is actually worse because some will actually use a credit card to finance that last 5 or 10 percent making it a truly nothing down move. The amount of debt is sizeable. For those getting a 4-year degree at a for-profit the average cumulative debt is $27,510. Assume this person is looking to buy a $100,000 home. Their ability to borrow is already impaired unlike previous generations of graduates who came out with either no debt or very little debt.

In spite of the costs, just like the housing bubble, as long as easy accessible debt is available more and more people will enroll if they perceive some added benefit. After all, any education is good right?

Higher education is definitely in a bubble. One of the ways that a bubble was spotted in housing was when home prices went right into the stratosphere yet household incomes went stagnant. What pushed demand was the false delusion that real estate would always go up simply because it had in the past and debt was accessible. It disconnected from market fundamentals. This can only go on until it bursts. In housing the bubble ran for a good 10 years (from 1997 to 2007 and picking up steam at the end). In higher education we are already one decade in as well. A reader sent this troubling chart:

Source:Â Businessweek

What you are looking at is basically real college graduate pay going down by roughly 10 percent for the last decade while the real cost of going to college soared by 20 percent during this same period. In other words this is a bubble. Of course timelines for predicting bubble pops are unpredictable by definition since they are driven more by psychology, greed, and mania instead of fundamentals.

Given the blue collar job market disappearing it is true that many of those graduates are merely looking at ways of becoming more competitive to enter into the middle class. Since home ownership seems to be such a cornerstone of that dream, many will dive into massive debt pursuing a college degree even from an institution that is essentially a step above a paper mill. This is the problem when you hollow out your workforce. You start having an unstable economy. Bubbles pop up everywhere as long as the financial system is able to pilfer the pockets of the taxpayers.

Access to college was another stable part of the American Dream for the last few decades. Affordable community colleges that had a direct pipeline to public universities with low prices for many stood strong. That system is quickly being changed and tuition is soaring. Now that some have gotten this deal, they seem to be saying tough luck to future generations and pay me a peak price on my inflated home! Yet the irony is that the system is self-reinforcing since to be competitive younger professionals are pushed into college debt just so they can pay higher prices for housing. Yet because of the college debt they carry they are able to borrow less for a home purchase. Ultimately we have debt piled upon debt and we seem to be pricing out a generation of those starter households that are the prime candidates for first time home purchases. One thing is certain and that is higher education is in a bubble and when it pops the implications on housing will be hard to predict.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “The twin bubbles of housing and higher education – housing bubble expanded from 1997 to 2007 and imploded. Since 2000 tuition costs have been soaring but graduate pay has been falling. What happens when you price out a generation looking for starter homes?”

Room and board is the crazy part of all this. I don’t think you can live within 5 miles of any college or university in the world without paying crazy rents and high food costs. Used to be landlords and merchants would charge students what they could afford. Not anymore.

We’re probably of a very similar opinion and working in different directions toward the same conclusion, but I disagree with the “not anymore.” Market prices for things like food and housing are set by what people are willing to pay. Specifically to housing, what an individual is willing to pay is usually — at least in California — very close to the maximum they are able to pay. In the immediate moment, they are able to afford it.

In the long term, they are crushed by debt and prices skyrocket until they the propellant runs out and moon party crashes back down to earth. And that’s the real problem: short-sighted, near term immediate payoffs from ultimately-destined-to-fail, pie-in-the-sky policy. It’s the same bug that bit the mortgage industry and the stock market and the tech industry, etc. The credit crunch in 2008 was very similar in composition to the margin calls 80 years prior (to the month, even). The main difference is that food lines have been replaced by EBT cards and we’re expected to pretend it’s all different this time.

History’s warnings have not been heeded. And now we have communists marching around “occupying” major economic centers and threatening business leaders, economic growth entirely dependent on the smoke and mirrors of federal give-away programs, falsifications in every jobs report and inflation stat, and the birth of conditions almost guaranteed to bring about, at best, a decade or two of pure stagnation. It all happened before. And now it is doomed to repeat.

All must be good so long as Pizza Hut takes EBT.

The protesters are NOT communists. They are agitating for a return to the more balanced regulatory environment of the “New Deal” – – make no mistake, the middle class was a direct result of the New Deal, Unions and WWII. Our country blossomed in the 50’s, 60’s thanks to the confluence of fairness brought about by FDR/Unions and the war. Asking the wealthiest 1% (or 10%) to pay higher taxes is fair. Heck, I’d just like them to pay at the same rate I pay! This word: COMMUNIST has become a joke along with NAZI because they keep getting thrown out as insults. COMMUNISTS, want to take control of industry, not tax it. Personally, I think we should aim for (inflation adjusted) tax rates as they were under the Republican president Eisenhower (top rate was 90%)

The people protesting are not communist (inspite of what you have heard on Fox News). Nor are they killing anyone (inspite of what you heard Glen Beck say).

stick to the facts,jack.

Communists? What, another extreme right wing-o wack job? People are suffering. The Bought and paid for Congress, Whitehouse and Supreme Court are lackys for the theiving rich. Why, it’s the best governement that money can buy! Time to put a stop to that.

Actually, I don’t watch much TV news. I have no idea what either the left or right pundits has been saying about the protestors. My inference of commie principles has come from videos and stories friends have posted on facebook (which, fwiw, have almost entirely been in favor of the protest agenda) and by reading the rants and demands on occupywallst.org. It’s pretty much straight from the lion’s mouth. The agenda is one almost entire built on class envy.

Please note, as well, I am not defending those who are being protested against. I have a history of comments here and other sites lamenting the widespread incompetence among the leadership of both government and many industry heads. The mess we’re in is a direct result of the abandonment of the proper tenets of risk assessment. That is, short term gain was put ahead of long term viability, and this was promoted on a systemic level. This was not just dangerous and improper. It was corrupt and morally affronting.

When you have members of the protests claiming that their demands are things like the annullment of ALL debts, or a minimum wage of $20/hour, or “free” health care, or $20/hour equivalent pay for those on unemployment insurance, there’s really no two ways to take it. The goal seems to be the destruction of the wheels of capitalism in our society. In one video, John Lewis was shouted down and denied the opportunity to speak to a crowd in Atlanta. Throughout, their justification was somethign to the effect of “all voices are equally important; no voice is more important than others.” Their stated goal of creating an open channel of dialogue was a farce. Their own voices were enforced as more important than his due to the fact that he is a senator (and despite the fact that he is a highly regarded civil rights leader). He was shouted down in anticipation of an expected dissenting opinion. To claim that this movement is in anyway democratic or in anyway not anti-money/anti-capitalist is to practice doublethink to such a high degree that absolutely no good can possibly come of it. Critical to well-functioning democracy is an even-minded assessment of facts. Implicit to doublethink is a complete refusal of intellectual integrity and logically sound reasoning. It is the formula that has brought about the most dangerous and murderous regimes throughout history, and it is not welcome on my front porch.

Banks set the price of real estate, not the buyer or seller. That is why we are where we are.

dangermike, it’s even more complicated that that. It’s not so much “what people are willing to pay” as what levels of debt people have been willing to go into, to maintain the standard of living to which they aspired/became accustomed/were trained to lust after.

Look, it’s perfectly possible for someone to live at home, attend whatever college is nearby, while working–for free if necessary–to build professional credentials. And to REFUSE to go into debt. That’s going to position young people better for real life–life as most of us will have to live it–than the nonsense that Ed Biz PR and admissions departments pump out. And I know that, from 30 years in that industry.

But for too long the Ed Biz did what the RealTorz did–they had mass demographic profit-skimming models. They convinced everyone that THEIR special little genius could get a class-war leg up over all the other kids if they borrowed six figures’ worth to go to Hahvahd or Madison or Berkeley or Grinnell or whatever.

With so many parents choosing that, of COURSE the rents, etc., were run up sky high in Cambridge, Madison, Berkeley, Grinnell, etc. Greed is what makes The Invisible Hand so goddamn grabby.

This too has been a bubble phenomenon since the 1970s, when higher education embarked on the financialized and effectively franchise based model of schooling.

I am constantly advising kids–as I have all my life–not to sweat the bachelor’s degree. It has been so devalued in the Magical Inflating Degree game. It’s now a basic credential of access to other things. Kids who are able to think about this realistically will also manage to milk the college experience for learning that will be valuable later in their lives, but as my own teacher used to say, none of that would even begin to make sense till we were in our 30s or 40s (pre-Socratic and Stoic philosophy, for instance, or Spenser’s Mutabilitie Cantos, or the jokes in the Old Testament, or the Anabasis).

Kids who go into college clueless about things like how debt works, how work works, how real life works–of course they’re going to be raw meat for the Ed Biz. Just as the clueless and greedy were devoured in big gulps by the housing industry!

Our goal should be as DHB’s is–to issue caveats to people who’ve had their heads turned by the Bubble Industry, which has gone from one sector to another, inflating expectations beyond any possibility of achieving them, and turning real economies into fields of dead tulips.

I am constantly advising parents against endangering or destroying their own middle or working class survival, with the dream that if they just rent their kid a seat at a highfalutin undergrad program, everything else will take care of itself. It has never worked that way, except in dreams, and maybe by accident for a minority of people. How many people are now bewailing their fall in class and consumption status, because they thought their B.A. in social work, and their first job out of college, was going to be “enough to start a family on”?

The numbers have not supported this SINCE THE 1970s!!!! It’s all been a shell game since then.

The major social narratives for middle class success have for too long been co-opted by the corporate and institutional mass media. Now suddenly the pretense cannot possibly continue, and everyone is so shocked…

…to learn what we in the Rust Belt learned 40 years ago. And others learned before us.

Sorry to run on. I’ve been busy with harvest, been doing a lot of thinking, been talking to a lot of people. Yall can charge me Standard Therapy Rate for reading this. ;^D

rose

Communists? Mike, you would make a cat laugh. Show me one communist in the United States. People really are desperate to assign guilt to anyone at all, but really, communists?

“Used to be landlords and merchants would charge students what they could afford. Not anymore.” 🙄

STOP, yer killin’ me over here with ye olde Marxist financial naivete’… did you perhaps learn that at a 4th-rate “university”?

Seriously, it implies that landlords and merchants obtain their products from trees growing in the wild… no massive cash outlays… no interest payments… no opportunity costs… no insurance… no maintenance… no workman’s comp… no TAXES… oh yeah, I can’t BELIEVE the nerve of those scummy shopkeepers, charging a profit on their wares… obviously a conspiracy to AVOID BANKRUPTCY… 🙄

Yeah, LAer, it’s crazy. In Michigan, Ann Arbor and Ypsilanti are right next to each other. Both are college towns, but Ann Arbor has the prestigious University of Michigan, while Ypsilanti has the one half as large (and more blue collarish) Eastern Michigan U. Five miles apart, and it costs 40% or 50% more to buy or rent in one than the other.

Not really hard to figure out. When you have one of the 20 or 25th largest universities in the country, with hundreds of millions of dollars floating around, you’ll get these secondary bubbles, even if they are located in the economic calamity known as Michigan.

These bubbles aren’t sustainable. College tuition is paid from many sources, including stock market portfolios and the equity one’s parents have in homes, businesses, etc. We’re riding on fumes. Doesn’t take a genius to figure out why Bernanke is so desperate to keep the stock market levitated.

Standards have changed. My parents, while in college, lived in a one room hut in the woods with no phone and a propane stove, yet they could drive to a major capitol city in 45 minutes, so it wasn’t like they were in North Dakota. My dad hunted ducks and deer and they picked mussels and caught fish for food, he gave the landlord venison instead of cash for rent 🙂 They lived like this because this is what they could afford. People have changed, but the students have changed as well as the landlords. Now students take out enormous loans and then moan about debt.

I was in grad school recently and I recall the Chinese students, from China, who would live 8 or 9 people to a two-bedroom grad apartment. A Chinese student could finish a 4yr PhD and save $40k to take back to China. Grads are only paid $20k, sometimes less, and then we had to pay rent, food, transport.

Reductio ad absurdum.

If these were Chinese from China, the Chinese government was footing the bill.

First off LAer, KUDOS on the solid insights and career advice re: ACCD below, and I respect you as someone with a finger on the pulse of So-Cal.

Second, not to hack on you on as an alleged Marxist, but really, this INFLATION of college costs, courtesy of Duh Best Federal Gov’t Lobbyists Can Buy, has been going on for DECADES, i.e. well before the recent Housing Bubble immortalized by this blog. And you think that kind of SUSTAINED inflation is NOT going to INFECT housing around the bloated hot-money epicenters (formerly) known as “universities”? Impossible NOT to.

Consider what happens to both property valuations and tax RATES in such a maelstrom, once the local gov’t tax vultures catch on–increased police and fire resources is a common gambit–and more NON-serious students in “fluffy” majors (and on longer timelines, i.e. “6-year party plan”) GUARANTEES the amp’d up fire and police stats.

Consider that virtually every uni has INcreased enrollement because of the hot money, often EXPANDING the borders of their campuses, and bulldozing near-in housing (i.e. REDUCING SUPPLY) in the process. SEEN IT… and so have you.

Consider what happens when a surviving near-in prop then changes hands–can you say price SPIKE? That MUST be passed through in RENTS. No sane private entity can provide any goods, even shelter, at a LOSS. (Only Duh Gov can do that, by making it YOUR collective loss.)

And don’t even get me going on how “in my day” all dorms, and virtually all near-in private rentals, were BARE CINDER BLOCK walls, and downscale/rote/basic in every other regard too… TODAY, textured drywall, ceiling fans, central air, fancy PRIVATE bathrooms(!), on-site POOLS(!), DISHWASHERS(!), etc. God forbid anyone ignore such details and actually STUDY… Ordinary and Partial Differential Equations, anyone?

That’s Federal (i.e. YOUR) “hot” money, at work, my friend. INFECTING everything… nada to do with landlord and merchant “conspiracies”… we just pass it along… no crony subsidies on the front lines. In short, it’s a lagging, or “tail-end” price increase, i.e. an effect, NOT a cause.

Outstanding analysis, pointing out indirectly that first, the mortgage market is an utter government-guaranteed fake bubble; second, that the additional factor not mentioned is the feeling of “no job security” which keeps people from buying homes and remain as renters. Clearly, lots of new smaller size apartments with shorter leases is going to result over the next ten years; something like half of all apartments or more are rented to one occupant, I believe. Also, debt pressure causes many divorces among the younger especially (debt and marriage don’t mix well with many personalities), and certainly causes smaller families or no children at all, which will have huge ramifications. These factors are cumulative, so that knowing if you buy a home and one person loses a job and they are in jeopardy or will pressure their marital status, all adds up to keep home ownership of the new-buyer class or even marriage prospects, grossly reduced. It then becomes a societal norm, while home ownership is now the norm, and that too has massive impact.

Like many things IF we survive the current mess AND drop the belief that things will return to as they were, then a much better situation will result. Adjustment is painful but often beneficial. Less debt, smaller families happier lives.

Dr. Bubble is ringing an alarm that goes unheard. I work with several recent MIT grads who have to tripple up in their rentals because of crushig expenses and the student loan monkey on their back. If the cream of the crop can’t make ends meet, then who can? Certainly not those who are studing from home in their PJ’s!

You don’t hear many politicians discussing this 300lb elephant. This is one hell of a social and national corrosive situation we are facing.

GLTA

I have a friend who wants to attend ACCD here in Pasadena. She lives at her mother-in-law’s house rent free, but she would be graduating with about $200K in student loan debt! I hope I can knock some sense into her head….

@Rhiannon

Sorry for posting so many things about this, but I feel I must respond because I know a lot about ACCD and your friend’s desired career path. ACCD is a non-accredited trade school, and IMO that means ripoff. Many of their profs will teach at other local colleges as well, just tell your friend to take the cheapest course with those same professors at a JC or state college.

Being non-accredited means they don’t offer a full palate of classes and therefore their classes don’t transfer to any other institution. This is bad. Paying 200K for this is even worse.

They only teach art and design. If your friend wants a sustainable career, she needs to think not only about the artistic side, but complements as well. Graphic design mixed with some computer programming skills will get you hired as a web designer/developer. Or design major + cognitive science minor = user interaction designer. These skills will get her a job in this market. Fine arts in painting will not. These classes are available at most state colleges of which there are 3 in the LA area alone. Your friend needs to focus on skills, not fame of school. I have designer friends who went to JC’s, Iowa State, arts magnet high schools or self taught, all making good money. It ain’t about the school’s name, it’s all about skills.

Rhiannon, that girl is the poster child of this education bubble talk. No one spoke to me about the reality of money when I was in college, and luckily I only ran up 20k. Get her to read up, and to realize what this can do to her life. You be the one who educates her. Kids are stupid and they really want that nice sweatshirt in the student store that says USC on it or whatever. There are smarter ways to get that sweatshirt if she really wants it.

300 pounds? That’s a small elephant. Maybe 3,000 pounds?

Anecdote

In the previous jobless recession (2001-2003), many MIT grads had difficulty finding work. I know this because I know a few from that cohort. It ain’t a pretty picture when so-called sought after engineers from the best engineering/tech school in the entire f-ing world are having trouble finding a job.

I don’t know the MIT grads, but may be they had personality disorders or communication problems. Either way, they can relocate to China or India. Just because somebody has fancy degrees does not guarantee a person a good job.

Seriously? I have a friend who graduated in 2001 with a MBA degree from a state college along with just one computer related class, HTML, landed a 42k job and he only had one year work permit on F1 visa (student). After one year his salary went up to 60k something and now over 100k. I don’t think a fancy degree will land you a job. Attitude and personality plus some knowledge on the job will.

What will happen if students just can’t pay back their loans? Can they work out lower monthly payment plans? Everyone should have a right to an education, too bad the system is so screwed up.

They will have to become government slaves…err…employees, kiss the ring of the union bosses, and all will be forgiven.

But in the graphic design and product design fields?

WTF? Since when has joining a union resulted in student loan forgiveness?

Mike G,

My daughter is at Northern Arizona University studing physics and biology. She intends to become a high school teacher. If she gets a teaching job in Arizona her student loans will be forgiven.

Of course, in most states, one must become a teachers union member to teach, or at least pay union dues.

My niece had her $100k student loans forgiven by teaching in inner city New Orleans, at least until Katrina flooded them all out.

Note that both are government jobs.

If you cannot pay back your student loans, you will be hounded for the rest of your life, you will not be able to get a job in the profession you trained for, and your loan balance will continue to metastasize because every time you fail to pay, or pay late, you are assessed a “collection fee” that is 25% of the outstanding balance.

This is how a $25,000 balance becomes an $80,000 balance, or $200,000 balloons into $500K. Then, of course, the student can’t begin to pay it.

I am reading horrifying stories of what happens to unfortunate grads whose incomes don’t cover their payments. Go to http://www.studentloanjustice.org and read the stories, and make your young friend read them.

Do whatever you can to dissuade this young person from borrowing anything like this kind of money. If we had a decent government, total student debt would be capped at $20,000 for the student’s lifetime. Watch how fast college tuition crashes and how fast all the Sallie Mae enabled diploma mills and online schools fold up when that happens.

Thanks for the link! Even the cal state system is $$, seems like she’s going to be screwed no matter what 🙁 She’s just trying to make a better life for herself, and she is very creative and talented. She’s 33, Korean, and has been in the US for about 10 years. She’s married to one of my best friends who is having a hard time making ends meet as well. I know life isn’t fair and we can’t always follow our dreams, but I just don’t know what she should do. She’s very determined and hard working, so I imagine she’ll come up with something. And please guys, no stupid comments about becoming a sex worker 😉

@Rhiannon

Korean? LOFTLMAO.

In Korea itself, the students demonstrated cuz THEIR tuition was too high.

I also have personal experience with Koreans who were ill informed and enrolled such kind of school.

And, unfortunately, quite a few, being unable to pay the debt, chose the career you described at the end of your post.

My wife graduated from CSUN sprint 2010. Tuition was about $1800 when she graduated and they bumped up to $3100 the next fall semester. It took her about 8 months to find work and at $14/hr it’s not a career job.

I doubt that higher education is or should be a right!

How on earth can you say that? We need an educated population or we’ll turn into an even worse Idiocracy than we are now. Look at the Tea Party as an example of that.

Watch that language, or you WILL incur the wrath of the Marxist Smear Squads. You’ll be banished from PC society.

It’s all black or white, eh Mimo?

At this point MiMo is just stringing together buzzwords he heard from Rush Limbaugh.

You are right Mac. Most children do not go to college. Germany does just fine with out so much colleges. Trade schools are the way to go. In California, according to my gardener Pedro, who says why should our working class taxpayers be burdened down with paying for the college education of the upper middle class? I think that Pedro makes a good point. The state schools are subsidized which puts private colleges at a disadvantage. California should give vouchers so the student can pick which college to go to.

Look at the children who go to subsidized colleges. Most major in useless subjects and they can’t get a job in their major. College is just a big racket. (I know, I use to be the Professor.)

You don’t need an art degree to be an artist. You don’t need a writing degree to be a writer. You don’t need a music degree to be a musician. Here in California, you don’t even need a law degree if you want to become a lawyer. If you want a career in some kind of technical field, then yeah, a science or engineering degree might be requisite. If you have some specific field of study you’d like to enter, a graduate program may very well be the only way to collect the needed experience to build a career. But for most anything else, a degree counts for next to nothing. The social, practical, and problem solving skills important to a strong professional life are not (and I would argue they /cannot/ be) taught in any school.

Rhiannon has swallowed the hook, the line, the sinker, and I think even the fishing pole and part of an arm:

Rhiannon confuses “education” with “years of schooling.”

Everyone DOES have a right to an education, its called the public library, the internet, the school of hard knocks. Free stuff and sense of entitlement is what has corroded our culture.

Those things will be an alternative to formal education as soon as employers start regarding than as a way to get your feet in the door the same way formal education is. Clearly that is not the case now.

@Rhiannon

Graphic designers with skills in designing user interfaces can do quite well, things like websites, web apps, software products, etc. Product designers do well too, designing things like cell phones, food packaging, and on and on. Base pay’s around $35/hour with lots of opportunities globally. If you are artistic with some curiosity and drive to learn about how humans interact with their environment, you can do well. I know a lot of people in these fields. They have so many job offers it’s ridiculous.

Right. I definitely see graphic arts as a decent career path. Video game, film, and internet industry seem to be a great bet for the future. She’ll have work, but clearly does not need to pay 200k to get an education in it. Really getting into the industry is based on your portfolio of work. If I spent 6 months reading After Effects, Photoshop, or whatever technology you’re into, and coupled that with a sold understanding in design (cheap community college, or library), scored a couple of jobs (just do some stuff for free if necessary, which is cheaper than 200k), then you’re in the industry.

Great article on college tuition. I will be paying my children’s tuition in about five years (yes I am one of those parents that believes in funding my child’s education). When the tuition bubble pops it seems like this would be great (unlike the real estate bubble) since a degree will cost less. The degree is still worth the same (unlike the real esate ). Unfortunately, I don’t see a pop mechanism for tuition. Would tuition suddenly drop 50% because enrollment is down since students refuse to take on more debt? Has there been any evidence of a tuition bubble popping in other countries? Would institutions ever consider keeping tuition high and supplementing any short-fall in their budgets with their massive endowments?Should tuition be regulated?

Government basically did regulate this and send it stratospheric. Their guarantee of debt and broad availability combined with a complete lack of cost/benefit (payoff) analysis on the borrowers created a tuition spiral. They were also kind enough to make the debt bankruptcy remote so there is no getting out of it. Free markets do tend to work. When I look at the source of most bubbles, government is neck deep in underlying causes. I’m not a 100% free market person but government meddling has done more damage over time than anything else.

I literally almost lost it at the gym the other day. Someone had CNN tuned in and they were debating whether college was “worth it” with all kinds of hyperbole about Facebook, Apple, and Microsoft founders not needing college vs. college kids getting paid more on average. AT NO POINT did the “cost” vs. “benefit in expected salary increase” EVER come up. How can one debate the value of anything without knowing the costs and payoffs? What good are a few extreme outliers in proving a point about cost/benefit to the average person?

There is an out for todays students, but I am afraid its not very pretty.

I was faced with same situation 35 years ago but on a much smaller scale.

I decided to take a job in my area of interest (software) that was non-ideal but would allow access to the current technology of the time.

I did a lot of extra work and essentially trained myself.

In other words, I got my employer to pay me for my “college”

Now 35 years later I am well established. Never have borrowed a cent for anything

in my life except for a home loan which I paid off in 7 years by investing in the stock market.

What are the downsides?

You *must* be really, really flexible. There is NO job security other than your finances.

I changed jobs about 1 a year during the earlier times to get more paid education.

I am single. I don’t think any wife would put up with my work schedule.

You have to scrimp and save to get $$ to invest to leverage yourself up with Real Estate

stocks and other investments so you can tell your employer to F-off. (I had to do that a few times to get what I wanted)

Was it all worth it? I think so. But that’s just me.

from Octal77: “I did a lot of extra work and essentially trained myself.”

You left off the leading 0! Hey, I did essentially the same thing. I had a business degree and worked as an accountant. I hated it so I switched when the first PCs were introduced. Back then the field did not require the level of specialization that it does today. It was a smaller segment of the work force. Plus, you did not have to compete with indentured servants from India. (H1-B is a farce.)

Today your chances of pulling this off are slim to none. Today’s kids are really really screwed. Look at the reason college costs are up so much. Look at the salaries and pensions for some of these professors and administrators. These are the real fat cats. On top of all this the stupid little kids will be on the hook for increased Social Security and Medicare benefits.

They want to tax the rich until there are no more rich. Then they will be slaves in a Marxist utopia.

Yes, it’s just you, and millions of other Baby Boomers who cleaned up on a series of bubbles…

…that you interpreted as your own superiority.

Or as Jim Hightower once put it, “He was born on third base, and goes through life thinking he hit a triple.”

With all due respect, of course.

I am just awaiting. There is too many houses and the baby boomers will inevitably downsize. So it is only matter ot time, when I will pick my dream house up very very cheap.

When I will do that – it will be for sanity of mind, rather than any economical benefit. It is much cheaper to rent, than own a house.

The education itself not profitable any longer, but yet the universities (same as banks) continue to drain our resources…

Boomers will not downsize if they are underwater.

You’re right. They will eventually be foreclosed on as they stop making payments knowing the housing market is not going to recover anytime soon.

The majority of them are going to die in the next 10-15 years. So they will be forced to downside to a grave size very soon.

Paid about $60 per semester for tuition and fees in the early 70’s at San Diego State. Still remember there was 100 people protesting when they raised the fees $10 per semester.

Tuition starting going up like crazy in 91. I graduated in 94 and many of my fellow classmates left school 80,000 dollars in debt. It’s closer to two generations priced out of home buying. I love that my hubby and I both work full time to afford a lower standard of living than my parents generation where only one adult worked. It’s the American dream right?

If your friends would of spent the college tuition on stock in Apple instead of going to school. Then settled into a nice job at say Wally’s World greeting shoppers. Today they would each be worth roughly $3,360,000 ! Each!

Welcome to the ’70s in the Rust Belt, gael!

No wonder all the public schools are pushing college prep for ALL high school students. Now that jobs are scarce, college is a way to keep off the unemployment line. Preying on the American Dream that has now become the American Financial Nightmare. Without jobs, people can’t buy houses. PERIOD. Put them further in debt, and the housing bust will only accelerate.

Even the beloved Westside which is besieged in denial, will find the financial nightmare reaching higher and higher up the levels of the real estate pyramid.

http://www.westsideremeltdown.blogspot.com

I graduated 10 years ago. I had no college debt basically because back then you could spend the first 2 years at a community college and transfer to a 4 year school, enter as a junior, and finish in another 2 years thus getting a 4 years degree for 50% less. Even so, the school I went to is now almost twice as much as it was back then and if I went today I would have debt.

I moved to the Bay Area in late 2000- right when the dot-com burst. It SUCKED. Rent was astronomical. Real estate was astronomical. Since dot-coms were boarding up their doors the chances of a recent grad getting a job when competing against 1000’s of recently laid-off experienced employees was next to nill. I shared a 2 BR apartment with 4 people. We all worked at minimum wage jobs with no hope for future prospects. None of us got jobs in our field until 2-3 years after graduating. But by then the housing bubble was in full swing and even after I had climbed the career ladder and was making close to 6-figures real estate was untouchable. So I’ve basically been through 2 bubbles-both of which have had major life-changing effects on my life.

I look at today’s recent grads and totally feel for them. They too are now graduating at an uncertain time. Perhaps a worse time than the period I went through.

Lastly, the first bit of this post mentioned investors buying up all the REOs. I find this infuriating. They’re basically helping to prevent prices from falling to levels that people should reasonably be able to afford. There’s no reason a starter home should cost 500k. The 250-300k these investors are paying should be what that level should start at- for everyone. Now with rent starting to creep up I’m glad we have saved a lot of cash because I swear if we have to pay more to live here we will pack bags and leave.

Compare California real estate to other areas in the country. It is still in a bubble.

Basically, I’ve got the same story. Graduated Spring 1999 to watch the bubble burst. I think Edvard, that we’re actually fairly lucky. We got into a crap market that taught us the fragility of work, and couldn’t buy into a bubble market. (Well we could have, but thankfully weren’t too stupid). If anything, we should all now be focused on patience.

Those of you who hit the job market at the Dot Flop have a lot in common with us Rust Belt punks, who came out of college during the oil embargo/recession eras of the ’70s and early ’80s.

So, no, edvard, no person is an island. We’re all affected by larger demographic and economic forces. Every last one of us. It’s just that some generations–like the Boomers–get to pretend otherwise. Well, for awhile.

pbamma is right–patience is called for. But that means something more than passive waiting.

For instance, the place to save money on college nowadays is to CLEP and AP test out of 1/3 of the credits. Any diligent, motivated person can do that. But it’s not the model of seat rental the Ed Biz sells (and provides debt for). A person can get a college degree for about the same amount as you did. It just takes a little more gumption and planning.

What will make the biggest difference is not young people whining about how bad they have it, or how Wall St. owes them something…but organizing to negotiate the terms of their educations with the Ed Biz.

And remember, edvard, when you take your California wages jackpot out of the state, and move to somewhere cheaper, you’re basically exporting California style class war and gentrification to that community. Don’t expect us all to love you for running up prices, supporting the local unaffordability bubble, and demanding a class status you purchased, but didn’t earn hereabouts.

The tuition bubble won’t pop, it’ll just plateau when rational people become indifferent between having a college degree and not having one.

http://en.wikipedia.org/wiki/Indifference_curve

So this will be the decision a prospective college student will have to make in the near future:

(1) Go to Harvard and acquire $800,000+ in student debt, and when you graduate, get a job paying $30,000 (with no job security); or

(2) Pick strawberries in the San Joaquin valley for below-minimum wage cash.

At some point choosing (1) will be financially equivalent to choosing (2). That is where the equilibrium is, and that is where we’re headed.

I think the worm is *slowly* starting to turn.

Some high schools are getting the message that college prep is not for everyone but rather trade school is a viable alternative. Thus, some high schools are teaching software and CAD design as well as “traditional” skills such as plumbing.

Now if students can get the message that having an non-exportable skill is a good thing and if you spend what normally would be your college years saving and investing instead of getting deeper into college loan debt, we might be making some headway.

Downside of no college:

1) No Friday beer busts at the frat house.

2) No BMW to commute to class with.

3) Your roomate won’t be on the cover of PlayBoy.

U flogot:

4) Give Plofessa massage with happy ending for extla cledits

Not to criticize, but strawberry pickers in California make about $12.50/hour plus benefits.

~Misstrial

I sometimes drive by fields in the Central and Salinas Valleys where picking is going on.

I’m continually amazed at the cars parked by the fields, presumedly owned by the field hands – they’re better than my car! Really, not a rust bucket amongst them.

Those who go to harvard and can rack up a 800k loan payable are most likely those who can afford to pay it back easily thru trust fund.

Steve Jobs sent his illegit daughter to Harvard. He could easily afford it. I don’t worry about people who can go to that kind of school; they will be set for life, one way or another.

If by “that kind of school” you mean Ivy League universities…

…those are among the most generous in terms of providing needs-based funding to poor kids of promise, and of demonstrated skill and gumption.

In my experience (six years, Ph.D. program, Ivy), us poor kids had it even easier than the rich/trust fund kids in some ways. Rich kids know mommy and daddy are buying their way out of having to prove themselves. It leaves certain scars that us ghetto kids never had to carry. Our scars were different. But I never doubted my value or my path the way my rich grad school colleagues did. It was kind of laughable, really. When I doubted the meaning of life, it was always existential. When they did, it was frighteningly personal.

The unemployment rate for those who have a BA degree is 4%. Those who have a high school degree is 11%. Those who do not have a high school degree is 14-15%. What these numbers suggest is that you will have an easier time getting a job if you go to college. However, there is a bubble in the popularity of higher education as access to student loan debt is becoming more and more prevalent. Not to mention those who are currently graduating, realizing that there is no place for them to be employed, going back to graduate school (taking on massive debt), only to find out that the economy has no miraculously recovered. What will they do then? Because of this, I am predicting the higher education bubble bursting in 3-7 years. Eventually, a large group of undergrads will simultaneously realize they made a mistake by assuming the dean will hand them a job at graduation and the psychology will shift.

http://www.thecashflowisking.com

looking at the chart for number of college attendees by age group, it appears that we have about 15 million students–I guess that’s accurate. If 1/4 of those graduate that gives us about 4 million per year. That means we have to create 350,000 new jobs/yr–I don’t know how many retire per year, but it would be interesting to know how many jobs are needed to provide opportunity to the grads.

It’s fairly established that we need somewhere in the neighborhood of 90,000 jobs per MONTH (that’s over 1,000,000 per year) to keep up with workforce growth. See: http://www.cepr.net/index.php/blogs/beat-the-press/how-many-jobs-does-it-take-to-keep-pace-with-the-growth-of-the-labor-force

You’d also have to take into account young adults who don’t go to college and decide to join the workforce from the start. In terms of number, I heard something along the lines of 100K+ jobs per month to support not only students, but the general increase in population, and the decreasing velocity of people retiring in their 60’s.

Doctor, I’ve been reading your articles for quite a while now and always enjoy them. I was wondering if you’ve read “The Great Crash Ahead” by Harry S. Dent? I think you would really enjoy it and appreciate the data samples and statistics throughout the book. Keep up the great work.

The government has created the student loan/education bubble. Starting with Clinton in 1996 and culminating with Bush in 2005 student loans cannot be discharged via bankruptcy. The power of Sallie Mae, a former government org., lobbying. This, in my opinion, has destroyed any need for the lender to loan based on the credit worthiness of the student. They can just lend to anyone, knowing if default occurs the government will cover the loan, plus collection fees. A loan basically with no risk.

A recommended change:

Repeal the law prohibiting student loans from not being able to be discharged in bankruptcy and eliminate collection fees. In a real market past due loans collectors get a % of what they collect based on the amount outstanding/past due. To prevent students from going to college running up debt and immediately filing for bankruptcy after graduation to discharge their student loans, state that student loans cannot be discharged via bankruptcy until a minimum of 7 years after their graduation or last student loan. This would force lenders to research the creditworthiness of a student loan borrower or force the student loan borrower to get a co-sgnor. In turn a co-signor or uncreditworthy borrower would think of alternatives ways to finance college or “maybe” self appraise to see if they need, not want, to go to college to achieve their career goals.

In closing let the market dictate student loans not government. We have seen, with FAnnie and Freddie in housing and now the Dept. of Ed. in student loans, that government, while having “noble” goals, does not understand markets they enter and the unintended consequences of such programs create market chaos and uncertainty.

It wouldn’t work. Most students just aren’t credit worthy. No job, no income, no prop sect of one for many years. Sure some would co-sign — most like mom and dad — but then you can’t default without dragging them into the mud.

The whole approach is bankrupt. The right solution to over priced universities is not chapter 11, it is taking it to tuition prices. There are many things the government could do here. It could reduce grant overhead payments for institutions that charge more than $8k / year in tuition and fees. It could threaten to revoke their not for profit status if tuition is too high. It could limit federal tuition guarantees to non-profit institutions. The congress could start hauling university presidents into special hearings every week for a year.

“College” covers too much territory. The outcome for someone who trains in a hard technical skill (from accounting to engineering to medical to high tech) will be very different and mostly much better than it is for someone who majors in a field where you may have great knowledge but have no specific skills to offer, like economics or psychology; or worse, something like music, fine art, or literature, where your skills have no real market.

But even if you are attending medical school at a top school, you can easily ruin your life by accumulating debt in order to do it. A medical education, for example, costs about $250K, added to the cost of your undergrad degree. You can easily end up with a balance of $400,000 to pay. It is easy to see that even with an income of $200,000 a year or more, that this will be a massive debt to pay and will mean you won’t be able get the benefit of your paycheck, because a third of it will be committed to paying off debt that, if everything goes right, you won’t be able to pay off until you’re in your late 40s. The payments will be at least $2000 a month, subject to changes in interest rates, and you will have to make that payment in addition to your housing expense, your car, your medical insurance, your food, and whatever else you might have in mind to spend your money on. And we’re talking about a high-paying profession?

What about those who spent $80,000 to major in impractical, elitist bullshit that never was known to net a person a decent job? Please, people, if you can’t get a job out of it, it isn’t worth borrowing the money to do it. You are really better off just getting a job with the post office or the local transit agency, which is where you will end up anyway….. if you’re lucky.

In short, if you have to borrow heavily to fund your education, you will probably end up no better off financially than if you had settled for a much lesser occupation and had done a couple of years at the local CC and/or attended an inexpensive trade school instead. What is the use of sweating up to 8 years of college and delaying living like an adult if you are not only going to end up living the same lower-middle-class lifestyle you could have had being an admin assistant or police officer, but also have the knife of non-dischargeable debt owed to entities that have rights over you that no other debtor has, hanging over your head?

People contemplating borrowing more than a few thousand dollars for education need to do a careful risk/reward assessment before signing on the dotted line. You should do a lot of research into your chosen field and see if the likely monetary rewards are worth the heavy costs and risks of borrowing. Remember that college lenders can do things to you that were outlawed 45 years ago for any other type of debt. No other debtor is allowed to do things like harass you on the phone at any hour of day or night, call your place of business and defame you to your employer, charge “collection” fees that are 25% of the outstanding balance, take more than a certain percentage of your salary when garnishing your wages, and in general make your life unlivable. College loan debtors can and do. Oftentimes, they make it impossible for you to become employed in the profession you spent so much money to train for, meaning you can’t even get the job that would pay you enough to make the payments thanks to their efforts. Many college borrowers end up working “under the table” at extremely meniel, low-paying jobs, and living in trailers or “couch-surfing” at friends’ homes.

Excellent!

Thank you for posting.

~Misstrial

I’m not sure what “impractical elitist bullshit” you’re referring to. For instance, creationists I’ve encountered would include any and all science in that designation. Left-wing types would consider it to include world history. Right-wing types I’ve known would lay that label on languages. Braniacs would apply the label to gym, and mental wusses to math.

One person’s shit is another person’s compost. I don’t disagree in the main that people shouldn’t be going into major debt for a bachelor’s in underwater basket weaving (indigenous lesbians of color track).

But what a person does with their degree–how useful it is–is determined in part by how they spend their energies before, during, and right after college.

I had a BA you’d probably call elitist bullshit–English major, dual minor (writing and science). It was from a fifth-rate college, too. That wasn’t what I got my free pass to grad school on. That came from what I was doing while learning all that human stuff–internships, volunteer work, white- and blue-collar wagework.

I have no doubt that /Hamlet/ taught me more about making sound decisions in times of doubt and crisis than anything else I ever was exposed to in school. Economics was no help; the “social” “sciences” were a joke; hard science often had little to say about the stuff I faced.

It was that thousand-year-old Danish story about the daddy-haunted rich kid who couldn’t make up his fucking mind that taught me a lot of what I subsequently applied as my roadmap for life. Obviously I didn’t need to go to college to read Saxo Grammaticus and Shakespeare. But access to my teacher certainly put it all in more realistic and relevant context for me than I could have achieved at such an early age on my own. This is what can be good about schooling. It’s too bad we don’t get back to those basics, which the Ed Biz has drowned in a tsunami of Greenspanomics.

IMO this portends for a future where a good portion of the economy is underground. And even black market, in some cases. If I was so heavily in debt and was making a pittance of a salary and a good portion of that had to go to pay off a horrendous student debt, I would be pissed, and I think that many will find ways to keep their money off the books, and for themselves (by not reporting it) and the only way to do that is to get paid ‘under the table.’ It’s no way to live a life, but it just may be necessary for some… in a bleak future….

I attend CSUN, every semester I get the following email:

“The fallout from devastating state budget cuts continued Tuesday when the California State University Board of Trustees approved an additional 12 percent tuition fee increase beginning this fall, on top of a 10 percent increase for fall 2011 that was already approved by the CSU Board of Trustees last November. (This second tuition fee increase was a last-resort response to an additional $150 million budget cut on top of the previously planned cut of $500 million to the CSU. The total $650 million budget cut imposed by the State Legislature on the CSU for 2011-12 brings funding down to 1998-99 levels.)”

Lost of international students in this campus and they pay a lot of money for tuition. Parking fees are too high, and let’s not talk about books and supplied. Where all this revenue go?

All the money goes to pay for the professors and administrators. I would guess that the professors make FAR LESS than the administrators. If you had kids and they want to go to college, make sure they undertake a degree in the hard sciences or engineering with a minor in business. It’s what our nation is going to need because over the last maybe 20 years, many people attended college for degrees that really do not fit in with the real world.

What is your tuition for a 12 unit class load?

In today’s real estate market and economy, it really makes no sense for most people in most parts of the country to buy a “starter home.” Where I live, house prices went down 8 to 14% last year, depending upon the precise area. Anybody who bought a starter home last year with an FHA, VA, etc., mortgage is already underwater. The only sensible thing to do in this environment is to rent until you have found a house that you want to live in for at least 20 years, and then buy the house as a “home” knowing that it will probably be worth less five years from now than what you paid for it.

But people in their 20s and 30s are NUTS to buy a house that they only plan to live in for a few years. It is too hard to sell a house these days, and the real estate commission comes right out of your hide, because the house won’t appreciate, it will be losing value.

If house prices continue to drop, a lot of people in the South and Midwest will find that they can simply save money and rent an apartment until the prices on houses in their preferred neighborhood drop down to what they can afford. The “starter home” concept took hold during a time of rapid house price inflation, when frugal, disciplined young couples could not save up a down payment as fast as house prices were rising. It made sense at that time for those couples to get a tiny house or condo with a VA loan, etc., and live there long enough to build enough equity to use the starter home as a stepping stone to a nicer place. This is no longer necessary, and it no longer works, as equity is generally lost with each passing year. It has been several years at least since I have heard ANYBODY talking about buying a condo, unless they were 55 plus.

This is why I chose DarkAges. This won’t be fixed in our lifetime, although there will be an ever-widening disparity of wealth and misapplication of resources, just like any hopelessly indebted third world nation.

There are a lot more bubbles than just housing and education. Ultimately there is a finite amount of Production/Capacity/Resources. Distorting the demand curve has been the greatest long-term disaster in a few generations. Get used to less.

Less.

Is more.

I recently received a bachelor’s degree in Math & Computer Science from a major university. I was an older student, in my late 30’s, so I had years of work experience behind me that did not involve restaurants and malls. I got a STEM degree because “everyone” told me that “hard technical degrees are worth money” and that there’s a “shortage” of STEM workers.

Despite my fancy degree, the ONLY job I have managed to obtain is low-level clerical work for $10.00/hour…TEMP. The reality is that majoring in a “hard science” is NO BETTER than majoring in theatre or dance. I simply cannot compete against offshoring, illegal unpaid (American) interns, and H-1B visa holders.

It’s not just me, and it’s not my “attitude,” my “unwillingness to work [my] way up” (I currently earn $10/hour…how much lower should I be willing to go?), or any other such nonsense. There are STEM graduates with YEARS of experience who can’t even get jobs at Pizza Hut. Go read the message boards on Dice.com sometime. The “Tech Market Conditions” board is especially enlightening.

I should have just majored in film.

Do you believe your age may have played a role in you not being considered for the positions you applied for? The reason I ask is because I’m thinking about certs i DBA, and I am in your age group. Thanks for any feedback you can provide.

I don’t think so. A lot depends on his specialties and skills. I am in my early 40s and my skill set is in Unix (Solaris/Linux) Systems Administration,engineering and architecture and I find plenty of work right now. How long that will last is anybody’s guess.

What DBA cert are you looking at? Get Oracle or don’t bother.

TR what was your area of interest while pursuing your degree and what skills do you have?

FTR: I don’t have a degree, six years of applied math, physics, comp sci and some econ.

I didn’t get the chance to develop an area of interest. I couldn’t afford to work unpaid internships–I had to actually do paying work outside tech to pay my bills–plus I didn’t qualify for any of them anyway. All of the ones I saw (and the ones I continue to see advertised) required years of experience, an extensive portfolio and complete fluency in at least a half-dozen different programming languages.

Other than a wealth of worthless theory that employers don’t care about, the ONLY “skills” I walked out of university with are a working knowledge of Java, MATLAB and C. That’s it. I learned a little bit of HTML, CSS, JavaScript and PHP on my own, but not enough to develop a website like the one we’re typing on right now. I also don’t know enough of those other languages to just start developing software.

I have perused thousands of job listings. I’ve never seen one that I was qualified for. Not even an “entry-level” position. I don’t have complete fluency in 12 different languages, plus a portfolio…and I cannot even imagine obtaining that fluency or building a portfolio on my own, sitting at home…these are the kinds of things that people used to do in a work environment.

I would have been willing to go work as an entry-level programmer for $10/hour, but nobody is willing to hire someone without the fluency and portfolio.

And NO, I can’t “just move.” I have NO MONEY and all of my credit cards are in default. I can’t even afford to move to the next town, let alone hundreds or thousands of miles away.

I know I will never use this degree. Getting it was the biggest mistake of my life. I hate myself for doing this, and I always will. I will never forgive myself for doing this. I avoided the housing bubble…only to fall for this one.

I only hope that my story inspires someone else to NOT DO WHAT I DID. Unless you want to be a doctor or a nurse, forget college. Just go get a job. And for the love of god, DO NOT consider computer science unless you are a genius on the level of Mark Zuckerberg.

Agent Dent,

I was considering the SQL/Oracle program at UC Irvine Extension.

http://unex.uci.edu/certificates/it/database_mgmt/

Cost – About $6k

They also have a pure Oracle program, but it appears that is not for beginners.

Hey TR,

Don’t lose hope. I switched careers too and got my first unix sysadmin job at 40. Admittedly the economy was better then (mid 00s). Like AgentDent says, who knows how long it will last, but then I’ll do something else.

FTR: I have a PhD in a bioscience, and took some courses toward a MS in CS because I ran into a couple of managers who couldn’t believe I really wanted to work as a sysadmin. I got a job and didn’t finish the MS.

Can you leverage your previous experience in some way? E.g. people who have computer skills and accounting skills are much desired by accounting firms. See if you can impress people with your computer skills and move into a more computer-related job even if it is just helpdesk. Where I work now they hire the good people away from the helpdesk for higher-level jobs.

Also try hanging around user groups, you will likely meet people who are hiring and jobs will get posted to the mailing list, etc, at least that’s what I saw for perl and linux user groups.

Don’t give up tr. think outside the box for IT jobs in strange places… Like Starbucks, or retail, or manufacturing. Tech work is needed in almost all industries.

Oh please stop blaming on H1B. Do you know hiring a H1b is more complicated than just hiring a citizen or LPR? Do you know there’s a guideline by Dept of Labor of what title of work should be paid before they will issue a visa (and the price is determined by Dept of Labor by the statistics data gathered in the area)? Do you know the company who hires H1b has obligation to pay for any fees involved with it (attorney, fees charge by USCIS and DOL)? My company paid around 6k to obtain my H1b and 10k for my green card process excluded my salary. Do you know how difficult US government have prevent a company to hire a H1b worker? Even though most of you probably don’t agree but unless you’re one of the H1b you wouldn’t know.

I don’t know why you can only land a 10/hour TEMP job spartan117. I graduated in 2007 as an international student with only 1 year of OPT (legal working permit) and zero experience and I was able to land 2 jobs with $20/hours at that time. To be honest with you, most of the developers in my company, 5 out of 8, are on H1B. My supervisor was told by HR to stop hiring H1b because even the company is happy with the work we H1b workers provide, they have enough dealing with government and attorney and so they wanted to stop hiring any more H1B. So they put the ad on monster, dice, craigslist and etc. and interviewed few of candidates. After couple months, my boss gave up. They just cannot find a qualified one.

My company is hiring .NET developer, system admin, Sr. Hadoop developer for at least 2-4 months now and we haven’t found one yet. I really don’t understand why can’t you land a decent job when you posses so many advantages than we H1b workers. Maybe all you need is to sharpen your interview skills?

Rhiannon, here is another link to an informative article and even more illustrative comments upon it posted by student loan victims. Their stores will rip your heart out. Make sure your young friend reads every damn one before she signs herself into irrevocable, life-long student debt slavery:

http://www.peakoilblues.org/blog/?p=329

A few courses in basic financial literacy for students and their equally clueless parents would be helpful. A course teaching the Rule of 72 and the effects of compounding interest would be helpful by itself. Once you learn that simple little rule, you really develop a visceral hatred of debt as it hits you how you are robbing yourself of your future by paying a compounding premium for everything you buy on credit. Teaching people this rule at a tender age would spare millions of people much misery and help us become a much more resilient population better able to weather the massive economic contraction now underway.

Trouble is, the parents, who are Baby Boomers and Gen Xers, grew up in a society already addicted to credit, having been inducted by THEIR parents into dependence on car loans and revolving consumer credit.

wrong – I’m a boomer and I learned from my depression-era parents to never get into debt.

I’m skipping the starter home, going straight to the final retirement home payable in a all cash way. I have hopefully 10 more years of repaying student loan debt (right now its a $1K to $2K monthly payment so I can finish paying in that amount of time), and can’t even conceive right now of getting another loan ever. After living since the age of 17 with continous student loan debt and I’m now in my 30’s, I have learned the hard way the lesson that true freedom to live the life I truly want will not come until I’m debt free. I look forward to the day I no longer have to pay a student loan creditor.

Meanwhile, there is a massive bubble in India and China. I am sure they love free trade. We must be the dumbest country on earth- I mean who expects that w ewill reach ever lasting prosperity by shipping off all our jobs , all our industries and just buying stuff made elsewhere.

Looking on the flip side of the vast inflation of education expenses I see an opportunity. If there’s such high demand for higher education why not just start chartering lots of new universities? In this economy there’s both plenty of office space available and folks with PhDs and lots of time on their hands. The pool of potential new professors could include both younger/hungry PhDs with recent experience as TAs and the older layed off professionals with tons of experience. Jobs for folks that need them and increased competition to bring the cost of college down. What’s not to like?

Great business plan, but why mess with the golden goose. Make fat sums off easy student loan debt. Everyone is happy – the teachers, the administrators, you (the entrepreneur) and the student – until the bill comes due. When the jig is up, just close down, and you weren’t accredited anyway, so who cares. Takes your boatloads of cash and retire to the Cayman Islands.

It will all come to nought.

Harvard, Princeton, Georgetown, etc, will survive and will charge arms and legs to the kingdom come.

Just like the 19th century, when only upper class people went to college, going to college will once be the privileges of upper class only.

All these bs schools which were formerly teacher’s schools, seminaries, pastor’s schools, etc.etc. will just be left on the roadside to be M&A’ed and destroyed.

Relocate to SE Asia? I’m getting $ 900 net as high school teacher. A Sukiyaki soup at the school’s canteen is $ 0.35. Rent of a small house with 2 BR is $ 130. My small 100 cc motorcycle cost $ 400 (including new tires and a service). China is crying out for English teachers – wonna try this? It beats being unemployed at home!

The Doc’s analysis is deep and accurate. Keep up the good work, Doc!

Hope you like going hungry.

http://www.declineoftheempire.com/2010/11/chinas-dangerous-food-crisis.html

Oh yeah, and having DDT and melamine in your sukiyaki should lead to an absolutely delightful state of health in your old age.

http://www.foodsafetynews.com/2011/05/the-recipe-of-chinas-food-safety-crisis/

But what the heck, you have a cheap motorcycle now!

Great post as usual Dr.!

Del Mar Dreamin’

and the biggest ponzi scheme of all time

California Dreamin’ | Real Estate,Tulips and the Extraordinary Popular Delusions & the Madness of Crowds

here is the url:

http://caliscreaming.com/

Dr. HB, you might want to check this out…

Link: The Student Loan Racket

.

Leave a Reply