The Silent Economic Depression: Lessons from the Great Depression Part XIX: Revising the Economic Past.

As I stopped by my local grocery store to shop I happened to notice that for a weekend, the number of people was extraordinarily low. Recognizing the cashier I observed, “it really seems empty for a weekend.” Her comment sums up the new feeling that many have. “It feels like we are entering another like Great Depression you know?” Talk of the Great Depression now seems to be mixed in like pasta sauce into talks of the incredibly unpopular $700 billion bail out for Wall Street and irresponsible lenders. Not only has the economic Armageddon talk entered Washington D.C., they are threatening that should you fail to get onboard, your 401(k) will be held hostage.

I find it stunning and opportunistic that these same people who were cheerleading that all was well only a few months ago are suddenly coming hat in hand begging for the largest government welfare check in the history of this country. What is even more pathetic is how they are threatening the debt addicted American public that should this bill not pass, they will need to go cold turkey. No credit for you consumer hamster! Incredibly, in some polls Americans realize the consequences of no bail out but simply do not care. It is like a hamster that suddenly has an epiphany that going on the wheel doesn’t take him anywhere but only gets him exhausted. The prospect has scared the living daylights out of baby boomers who seem quick to jump on the bandwagon since they cannot stand to see any more Fannie Mae, Freddie Mac, A.I.G., WaMu, or Bear Stearns hurt their portfolios. In a way, the cognitive dissonance occurring is that heads you lose (Wall Street and lenders get a corrupt and golden parachute bail out) tails you lose (Wall Street gets its comeuppance but you have to see your portfolio take a major hit).

Yet I am proud to say that people are now taking to the streets and protesting:

*Click to watch video

Los Angeles

Wall Street

People don’t like being given an ultimatum especially when that includes bailing out the same folks who actually created the system which is currently collapsing. Wall Street created an addictive drug and pushed it on the American public. Now, they want to ensure the government gives them more money to funnel their debt crack on more Americans. I hate to tell you but people need to realize that not everyone in this country deserves to own a home. These are things that should be earned. Maybe we should take a lesson from history here:

Click to learn what many brokers and lenders failed to learn

Bwahaha! We flushed that model down the toilet! Character? Are you kidding? Mortgage brokers were giving out loans virtually over the internet and never met the person on the other side.

![]() “Shady Lending. This is Slime Ball speaking can I help you.”

“Shady Lending. This is Slime Ball speaking can I help you.”

![]() “Yes. I need a loan for $500,000.”

“Yes. I need a loan for $500,000.”

![]() “You got it! Where do you work?”

“You got it! Where do you work?”

![]() “And how much do you make a year?”

“And how much do you make a year?”

![]() “You make $200,000 working at K-Mart? I’ll go for that! Can you verify that income?”

“You make $200,000 working at K-Mart? I’ll go for that! Can you verify that income?”

![]() “Heck no! We’ll just go no-doc and we’ll have this loan out to you in a few days so you can buy whatever overvalued home your heart desires!”

“Heck no! We’ll just go no-doc and we’ll have this loan out to you in a few days so you can buy whatever overvalued home your heart desires!”

![]() “Indeed it is my precious friend.”

“Indeed it is my precious friend.”

Is that enough to judge someone’s character? Of course not. Let us move on to the next 2 items, capacity and capital. Bwahaha! Well it almost goes without saying that nearly all the sub-prime, Alt-A, and option ARM crap was given to people that didn’t have the capacity to buy a home with a 30-year fixed. And forget about capital. The definition of no money down means you come to the table with no capital whatsoever. There were cases where you left the table with capital! The system became perverted and putrefied like the sewage running down the San Gabriel River.

How can you go from no recession to the verge of another Great Depression in a few months? You can’t. This system was developing over a decade long bubble with zero regulation or enforcement and rampant greed. The majority of Americans who were prudent are rising up and saying no!  Brad Sherman, a Valley congressman is saying that he is receiving 300 to 2 phone calls against the bailout. People know that they are getting absolutely shafted in this deal and that is why there is so much wrangling going on in Washington D.C. right now.

This is part XIX in our Great Depression series:

14. Bank Failures.

16. Items That Sold in the Credit Bubble.

17. The All Hat and No Cattle Nation

18. Charity for Financial Deviants.

Tent Cities

Just because you don’t see poverty in your immediate area doesn’t mean that things are fine and dandy. People who lost their home or simply cannot find affordable housing are now migrating to tent cities in certain areas of the country:

Tent city

These designated areas are exploding with new residents and only reflect a decline in the overall economic climate. Now you tell me how the $700 billion bail out is going to help these folks? The way they are marketing it is through fear that if you don’t get on board, you may end up with no job and you will lose your credit and sanity. How many Americans are one paycheck away from being out on the street? This notion of the Horatio Alger myth is finally breaking. The idea if you work hard enough life will reward you. What the current corruption on Wall Street is telling us is that if you screw enough people over, the government will be there to reward you whether you succeed or fail. You simply cannot reward such behavior. The new strategy from the banking syndicate is fear mongering and trying to get you to be so scared, that you will be willing to sign off on nearly $1 trillion! Being lied to by our government? I’ve never heard of such a thing.

Bank Failures

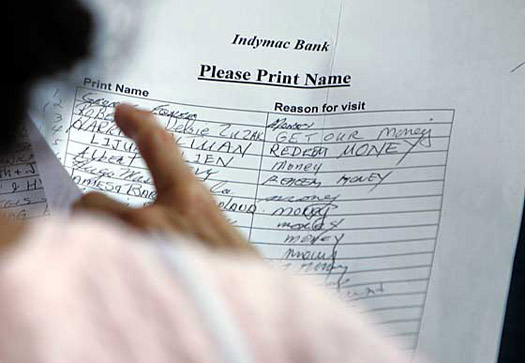

How quickly people forget that only a few months ago IndyMac Bank which failed spectacularly created bank runs and long lines of people simply trying to get their money:

*Source: OC Register Eugene Garcia

This of course didn’t simply happen over night but because IndyMac Bank participated in the toxic mortgage orgy and set itself up for failure. Year after year even after warnings and caution was being voiced in the community, these institutions kept on going with their mania and ignored any financial prudence. They screwed people over and karma got them back:

WaMu which essentially is similar to IndyMac except 10 times bigger recently failed. The biggest S & L failure in the history of the United States. I’m not sure if people think we are closer to a bottom but clearly many think that we have a long way to go. Over the past few weeks, $16+ billion was taken out of WaMu forcing the FDIC to take action. These are not signs that people feel confident in their financial system. Why should they? The financial system did not look at character, capacity, or capital. Now they expect the public to have character, capacity, and capital to bail out these bandits? Guess what? People do not want a bail out. Many are thinking that a hit on their 401(k) may be more manageble than being out of a job in a few years.

History Lessons

As much as some think they understand the Great Depression, they are proving through their actions that they are willing to sacrifice the middle class for their sacred Wall Street religion. Let us see what occurred during the Great Depression:

“To understand what has happened it is necessary to look at the problem in perspective. In the first place all facts are relative. We cannot understand the menace of the mortgage situation unless we consider the cost of carrying our present mortgage burden in relation to our changed national income. In 1929 the national income for the United States was 85 billions of dollars. By the year 1932 this figure had fallen to 36 billions. The most conservative figure for mortgages that I can find shows that in the year 1929 the combined total of urban and rural mortgages in the United States amounted to at least 46 billions of dollars. It is difficult to determine how much this figure has changed between 1929 and 1932. The first effect of the calling of outstanding loans was to increased the amount of money borrowed against real estate. It is safe to say, however, that any general increase in the total of mortgage loans has since been erased by the calling in of outstanding mortgages and the constant demand for the reduction of principal. I, therefore, assume that the total present mortgage indebtedness is about 43 billions of dollars.”

Many may not be aware that much of the larger problems from the Great Depression came from mortgages and housing. Yes, the stock market crash set off the fuse which would lead to a decade long calamity but Main Street USA did not feel the bitter repercussion until a few years later. You would think that we can learn from the past but clearly we cannot:

“But the prosperity of the nation depends upon its ability to make economic use of what is capable of producing; that is, it must either consume what it produces or sell it abroad. If because of fixed contracts, real estate levies too large a tool on the national income, the amount of income available for the consumption of commodities contracts also. As a result we have industrial stagnation, followed eventually by hunger and suffering.

Production cannot be generally resumed until credits are liberated to restore the purchasing power of the people. Credits cannot be liberated for the purchase of commodities, in appreciable quantity, so long as current funds are being drained off for the liquidation of capital obligations. Increased lending for refinancing purposes will only make matters worse, because on the one hand it draws off additional funds which might otherwise have gone into compensating producers, while at the same time it reestablishes debt burdens which we acknowledge we are unable to carry.”

This is the current big push. That is, the credit markets are frozen like a Klondike Bar and need some thawing to get going again. Yet spending is the exact reason we are in this mess. In fact, we are spending money on this bailout and we don’t even have the capital available to do so! Let us say the markets are unfrozen. Then what? People get back on the debt treadmill and spend again to another bubble? If you have good credit and some capital you will be able to get a loan today!  Don’t believe the damn propaganda that no one will lend to you. I went to a local credit union and they actually are still lending and in fact, are seeing a jump in business because they didn’t gamble their money on toxic crap mortgages.

Yet we should also look at how the Twentysomethings in this country are perceiving this market crisis. There is a good Newsweek article talking with two interns in their 20s and exploring the current crisis. Here are a few bits from the interview which is a quick and insightful read:

“Since I graduated from college, I’ve been pretty frugal, contributing to my savings account and my 401(k), and I keep an eye on those. I feel like if I keep doing that, I’m going to be OK. Do you think we should be worried?”

This is the first mistake that many do. Many people when they are young, follow the advice of some Wall Street game of telephone and “diversify” their funds. When you are young, they most likely put you into 80% stocks and 20% bonds. But what stocks are you in? Did they just put you into Fannie Mae and Freddie Mac? They may put you into international stocks but have you even taken a gander at the international markets and the myth of decoupling? In fact, people are pushing Treasury yields because people are flocking to safety. At one point in the last few days, some of the yields went slightly below zero! Why? People freaked out and simply want to protect their money forget about maintaining an interest rate. Let us look at some more from the article:

“Those are all things our generation is notoriously bad at, and buying things on credit (as I’m guilty of doing myself) is only going to make the crunch worse. When it comes to savings and all that, you’re a generational anomaly. After all, you once told me: “I have no problems with money.”

Exactly. I can’t tell you how many people I know that think they have no money problems because they are able to keep up with their car lease, credit card payments, and massive mortgage. Many of them have recently asked for advice and they are simply one paycheck away from declaring bankruptcy. How are they going to afford that $4,000 home payment? Car payments alone run up to $1,000 a month with insurance adding another $200 a month. Fuel is another $500. So only with the home and the car they are dishing out nearly $6,000 a month and this is no anomaly here in Southern California. Here is another fascinating insight:

“As for all the fluctuations in the market, like you said, we’re probably not the most knowledgeable financial advisers. But from what I’ve been hearing, I should just be playing the long-term game-not watching my 401(k) go up a little, and then down a little, but just keep contributing and not get too nervous. And since we’re in our 20s, insurance company meltdowns like AIG’s don’t seem to have much of a bearing on our lives. I definitely agree that our generation’s credit addiction is an issue-but as long as I steer clear of that, aren’t I setting myself up for a pretty solid future?”

Of course it has a bearing. Do you purchase insurance? Chances are premiums will go higher. When the market collapsed in 1929 it took 25 years before it came back again! Take a look at the chart:

The point is, simply throwing your money at the market is not enough. You have to do your own due diligence and really examine the balance sheet of certain companies and then invest accordingly. This idea that you have “time” is absurd. I rather spend a little more time, read a couple of prudent investing and history books and then invest. This is your retirement after all. But many boomers believed this get rich quick mentality and went aggressive in tech stocks in the 1990s and then jumped head first into real estate in the 2000s. Time to watch that 3 C’s movie above and understand what is at the core of any fundamental loan. People in their 20s simply do not have that much money in their 401(k) accounts to worry about the market. They are more concerned keeping their job. In addition, in no other time in history have young people come out with so much college loan debt.

Yet now we are being asked to throw $700 billion to bail out the irresponsible lenders on Wall Street while many Americans without the help of the mainstream media decided to seek out information and lived a prudent life. They did not lease luxury cars. They did not buy McMansions with granite countertops simply to dust off every single day since many are too busy to cook at home. Many had the artifacts of the “rich” yet lived a life of silent desperation. They had the items of the rich yet deep inside they felt, “why do I feel so close to the edge? I have everything a rich person should have.” Unfortunately we just had our own version of the Roaring 20s and everyone wanted to keep up with the Joneses including Wall Street.

The frustration of many is real. The majority of Americans don’t want a bail out. Yet those in D.C. are voting once again against the will of the people. Many of these politicians are the same folks professing to know very little about the economy! Then why are you so quick to dump $700 billion into a plan that is only going to help Wall Street and lenders that gambled? They ensured their own demise.

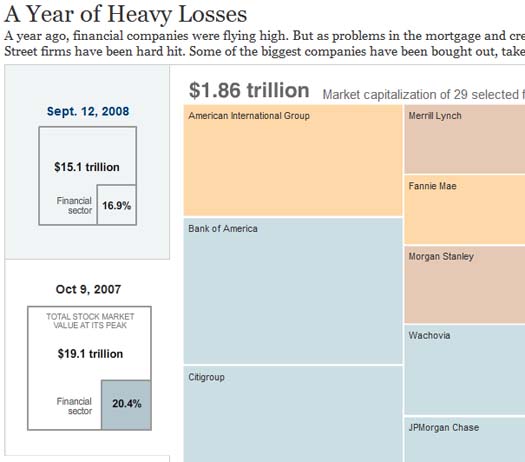

Since the peak of the bubble, residential real estate in the United States hit a peak of $24 trillion. According to the most recent Case-Shiller Index data, we are now down, 18.8% from the peak price point. What this means is this:

$24,000,000,000,000 x 18.8% = $4,512,000,000,000

What this means is that from the peak in July of 2006 $4.5 trillion in household equity has been destroyed. Add to that the over $4 trillion in stock market wealth that is now gone:

*Click to see excellent interactive chart

And you basically have approximately $9 trillion in wealth that has disappeared in 2 years! Keep in mind the GDP of the United States is about $13.7 trillion. In essence, when this thing is said and done we will have lost the equivalent of over one year of GDP.

Technically we are not in a recession. We just skipped over that and put ourselves at the edge of economic depression. Those same people that brought us here want more money to keep this system going? If you want to tell them how pleased you are with this system contact your representative in this election year:

They’ve had years to talk about the economy and now that the election is nearing in November they are responding to Main Street? Maybe someone else is feeling a silent desperation.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

30 Responses to “The Silent Economic Depression: Lessons from the Great Depression Part XIX: Revising the Economic Past.”

Some guy did his thesis on San Diego real estate between 1890-1990. He used 95% of classified newspaper real estate prices for 1890 till 1950 every 6 months. So there may have been higher and lower prices.

May 1929–$5,599

Jan 1934–$2,300

almost a 60% drop during the depression. Of course San Diego real estate never goes down in prices.

Sunday eyed for agreement on package but some Republicans hold out thttp://www.marketwatch.com/news/story/financial-rescue-plan-talks-resume/story.aspx?guid=%7B55C235E5-6249-435B-A11A-041E44804707%7D&print=true&dist=printMidSection

Bush sought to reach out to taxpayers in his Saturday radio address, saying he understands their frustrations. “You make sacrifices every day to meet your mortgage payments and keep up with your bills,” Bush told listeners. “When the government asks you to pay for mistakes on Wall Street, it does not seem fair. And I understand that,” Bush said. But he said it’s impossible to let every firm on Wall Street fail without American families’ finances being affected.

“The rescue effort we’re negotiating is not aimed at Wall Street – it is aimed at your street,” Bush said Saturday. “And there is now widespread agreement on the major principles.”

What a lie or nonsense a politician can make up!

Where can we see the Main Street in the original 3 page Paulson sketch? Now they claimed it is for the Main street. The last Monday, they said there was a general agreement on the plan. Last Thursday, it was very clear that there was a Big disagreement.

(Note: News said, Bush summoned lawmakers and the presidential candidates to the White House on Thursday to rally consensus behind his plan. Instead, the meeting revealed a deep split between Democrats and House Republicans.)

My local radio reported, a congress man said that “the plan is a fantastic idea when our government can buy cheap MBS assets and later sell them even cheaper to our people.” Is he treating us like a baby just born yesterday without any business experience? Exactly, who is going to be a victim of the plan?

My dear congressperson, let me ask you a question: Do we have any chance to get a bargain by paying 10 cents on a dollar to buy those troubled asset thru this Paulson plan? Am I asking too much? It really depends on which side of the table I am sitting on.

The things I know are that JP Morgan scoop up Bear Steam last Spring and now took over MaMu. Again, JP Morgan got huge profit potentials at deals which they paid 3 cents on a dollar. And something like Mr. Alan Fisherman, CEO of WaMu, may have $18 million in his 14 working days with WaMu. So far, please tell me what our average Joe has gotten? NOTHING! period.

This morning, both presidential candidates are claiming what they accomplished in the rescue negotiation talks. Obama said he spent on the phone everyday with Paulson, McCain claimed he did whatever he could. Well, tell the truth I have no idea what they have done, except lip service.

Deal or No deal? We don’t know yet. but the Paulson’s plan grows from it original 3 pages (09/18/08) into 42 page (Monday, 09/22) and went onto 102 pages (09/27). What I see and read leaves me an impression that those politicians are trying to make thing so complicated to hide their main intention to protect their Wall Street buddies, not the main street.

Our root is at the people, not those fat cats in Wall street. What I’d like to see most is for one of candidates to stand up and say “NO DEAL”? I wish they could be brave enough to look around and find the root voice out of the average Joe.

Stop buying any thing that is not mandatory

Take every cent out of the bank except what is needed to pay the bills, inflation is eating it faster than the interest a bank pays can replenish it and their fees make it even worse

grow your own food as much as possible use farmers markets, local resources as much as you can realize that big box stores are gutting your local economy and jobs

the only nonviolent way to beat the banksters and corporate thieves is to starve them

welcome to fascist amerika

Once again, you nail it! Everyone I know is just trying to “hang on” but that is not going to cut it. Now is a good time to keep expenses low… avoid debt. If possible, take action to lower your housing expenses NOW… this will pay off later. The economy is going to get worse, not matter what because the American consumer is toast. Here in OC, I know many 20/30-somethings that have (for the first time) been laid off. These young people don’t have anything set aside for a “rainy” day so delinquency on their debts is nearly immediate. Now that the “good” jobs have disappeared, they are being forced into work for lower pay… say 12-15/hr. Heck, if you have a car payment of 300/mo and make 12/hr… how are you going to live? In OC… renting a ROOM can cost $600/mo and so then you spending 1/3 to 1/2 of your (12/hr) wages on housing. How do you pay for health insurance? educational debt? Answer: you don’t. Looks like that Capital One credit card is going delinquent and NEVER getting paid. When things are so tight, You only pay for housing, food and transportation to get to/from your 12/hr job. Welcome to the new depression!

Another good article. Those of us living within our means here in the boofoo midwest are being punished to bail out the over-leveraged on the coasts.

Driving around rural Indiana last week I was struck by how run down things are, people are getting by thanks to easy money but when the economy collapses (a la 1982, which was very rough around here), then what ?

Where do you think the S&P will be at the end of the year ? By all rights it should be at 1000, but I’m betting on 1,213.01 – exactly where it is now – thanks to federal bailouts.

Maybe we should reward these scumbags by voting them ALL out of office this Nov! Afterwards we can try them for treason

Amen Jon!

Once I find out the names of the CA congresscritters who voted ‘aye’ for this fiasco,(and it will be public record) I’m crossing out their names on my ballot and writing in ‘none of the above’ come Nov 4th.

The house.gov site is down. go figure…

Good job Dr. H. Bubble. I wish you were wrong…

If this bailout passes what is the lessen to our children? You don’t matter much to Washington or Wall street. Unless you are born into a family with influence, you will carry the dead weight of the insiders & powerful, & there’s nothing you can do about it.

Get use to taking transit, because you won’t be able to aford car ownership.

There is a lot more to fear than fear itself. There are only two possiblities:

1) They didn’t know what was happening, but spoke with authority that they did know it was contained.

2) They did know, but intentionally decieved us.

Either way was a deception. Why should we believe them now? Do they finally understand what is happening? Do they know that it obviously the jig is up so no point in lying?

(I’d like to ring the neck of the dastard that said on CNBC after Bear Sterns “That’s it. It’s all over now” although I didn’t believe for one second what he said.)

It is a foregone conclusion that Obama will win the election (look it up, every incumbent party is blamed or rewarded for the state of the economy relative to the last election, whatever the merit of that). Ron Paul doesn’t seem like such a nut anymore does he? Looks like he was spot on.

Now would be a good time to become a landlord, Forget tents, I would suggest investing in shipping containers. Think of them as family dwellings.

For the single person, I would invest in refrigerator boxes. Not sure how much I could charge for rentals, however.

$9T? Phantom wealth?

see Carter, “what if the b.bommers can’t retire?” Ask yr managers

who wil buy stk. funds when boomers start to retire.

Please realize that we all need MONEY. Credit is not money, and neither is the dollar! Please pick up a regular college level dictionary, such as Random House Collegiate dictionary. After having looked up the word money, you’ll find that it says gold and silver coins are money. When you cross reference paper money, you’ll find that it refers to bank notes. What, pray tell, is a bank note? It says that a bank note is a promissory note. Therefore the dollar is an IOU on which the government has defaulted. Please, go and exchange some Federal Reserve Notes for real money. Why do you think the U.S Mint is running low on silver and gold coins? Think about it, if gold and silver were not money, our Constitution would not say as much in Article I section 10. Look at the stats of the sales at the Mint web site. Who do you think is buying all of the gold and silver? The average person doesn’t even know that the dollar, and indeed all paper currency is NOT money. It is currency. Look it up, and do your own thinking, not relying on the media. There is currently the beginnings of a shortage in physical silver, so act fast while you can, b/c a depression is indeed coming and the dollar will collapse and return to its intrinsic value-zero! Therefore, take your assets, while you have them, and trade them for gold and silver. Don’t let anyone tell you otherwise, for the whole system is falling.

Move it!, time is of the essence.

Mr. Banana Republic,

You are correct about the silver shortgage. It’s very difficult to find in good quantities from brokers or even large bullion distributors. I’ve got some gold and I’m looking for minimum of 1000 silver eagles. There is too much risk out there, and I don’t trust any of these bankers, politicians, or wallstreet fatcats.

The USA should hire Roni Deutsch, declare BK and start over.

Sorry, China- we wrote off our debt!!

First of all, the $9T was phantom wealth or paper wealth. It did not ever exist in the first place. If I buy my house for $200K, and it increases in value to $300K, I do not make $100K until I sell it. Likewise, if it decreases, then I do not lose money until I sell it. Unfortunately, people accessed the phantom wealth in their houses and used it as an ATM.

Secondly, it did not take 25 years for the stock market to recover, it took less time. You are looking at stock prices only, and did not include dividends. I do agree with the gist of what you are trying to get across to your readers.

Third, I do believe something needs to be done to free up the credit markets. I opposed the original $700B bailout bill, and will likely oppose the $700B Frankenstein monster of a bill that came out this weekend. The problem is not one of liquidity (i.e. the credit markets freezing up), the problem is one of solvency and to a lesser extent, fear. Paulson used his bazooka to take over Freddie and Fannie, yet it solved nothing. Paulson now will get a bigger bazooka, and it will not solve anything as well. With the Option ARM mess coming down the road, will Paulson (or his successor) get a $1T dollar bazooka next???

Finally, I live a frugal life, have a stable job, and save more than I make. Such a life may be boring, but it helps to live it when the times are bad.

IRWIN KELLNER

Don’t call it a bailout. Or a depression

PORT WASHINGTON, N.Y. (MarketWatch) — We are nowhere near a depression, so let’s stop talking ourselves into one.

Remember also it was policy errors, not the stock market crash, that caused the Great Depression: ….

While I am at it, I would like to take issue with the almost ubiquitous use of the word “bailout” to describe the government’s rescue package. Folks, this is not a bailout of anyone, not Wall Street, not Main Street, and certainly not the so-called “fat cats.” It’s an infusion of liquidity, designed to unclog the financial markets. In doing so, it will benefit everyone, business and consumers alike….

package may not even cost $700 billion. For that matter, it may wind up costing nothing. It all depends on the price the government pays for these distressed assets and what it winds up selling them for.

**** ***

If Irwin is right to the point, we can’t agree enough to say: “It is not a bailout.” But what it really is?

Well, let’s forget a lie, threat or blackmail as Irwin suggested and believed as I do, just call it “an infusion of liquidity.”

Then, my next question is why we don’t direct $700 billion to the root, the people, and forget about giving it to the Wall Street mechine? That’s the most direct way to an “infusion of effective demand” to revitalize the economy.

So, in order for us to spend money, we really need ” any way shape or formality”? Without a checking account, Joe doesn’t know how to use money?

Give me a break!

Wow! Joe Can’t Spend Money? Only the Big Cats Can. http://activerain.com/blogsview/708940/Wow-Joe-Can-t

Who will be servicing the “bad debt” that the gov’t will be buying up? We all know how slow gov’t agencies work, therefore, if they are servicing, people can stop paying their mortgage and live in their home for say, 3-5 years before being foreclosed on. Damn, if that’s the case, I missed the boad.

Looks like they are going to ram this bill down our throats no matter how loudly we scream NO.

I dunno, Kim.

~

House just voted against it.

~

rose

Reading this particular article I sense more anger than reason. To educate is one thing, to vent is another, let’s not confuse them which I think this article does. I understand that after years of predicting this outcome our beloved

blogger feels a tad pissed off but simply saying let the chips fall where they

may will not help, on the contrary.

Whether we like it or not we are stuck with having to infuse liquidity in the system because not doing so will have consequences much worse than doing so.

The question is what are the terms of this liquidity infusion. We don’t want to

write a blank check and we should take our time to get the details and the

terms right to make sure the tax payers are protected as best as possible (which simply means loosing one hand rather than both hands and feet) given the situation.

Ya, I get it. The future has a better chance of being crappy if it passes. But Americans said I’d rather do the right thing even thou it’s going to hurt. I got hurt today financially, but I feel proud to be a American today. Bush, welcome to the jungle Mother F”ka

It was a bad bill, it deserved what it got. First there was the whole rushing through a bill (it must pass yesterday!!!) thing. No, there is almost always time to THINK and deliberate and debate first. And then there was the fact that house members were asked to pass the bill before even reading it!

Then there was the whole entirely unconstitutional giving the Treasury unlimited powers thing. That was corrected somewhat in the revised version but not nearly enough. Then there was the fact that the bill is not targeted toward homeowners but rather toward the holders of the bad paper. An obvious transfer of more wealth to the rich, the end result of which would be even more concentration of wealth and power in the hands of the rich. As unsympathetic a bunch as people who got mortgages they could not afford may be, bailing out wall street is even worse. And there was the fact that the 700B figure was just pulled from someones @#(@. Then there was the fact that it would increase the deficit will no real means to pay for this (at least if they raised taxes that would be one thing). Honestly, how much deficit can we run until it’s lights out for the dollar?

Many an economist, even of the hardcore pessimist camp, thought this bill was a disaster. Can we at least have real economists rather than wall street darlings draft our bills? They may still be horrible, but at least it wouldn’t be such a naked conflict of interest.

http://tinyurl.com/4nokgz

Well, here’s a Modest Proposal for you, Paul.

~

For how long now have Americans been told that we can’t afford universal health care? The tab for that? Figures I’ve seen say $75-100 billion a year.

~

For how long have Americans been told we can’t afford to repair our crumbling infrastructure, have a CCC for energy efficiency and innovation, improve schools, rebuild US productive capacity, wean ourselves from the FIRE economy, bolster local economies, engineer climate change adaptation, develop local and sustainable food systems, and provide care for our elders and support for those supporting elders?

~

Here are the figures Byron Dorgan used late last week:

~

– $29 billion: JP Morgan Chase for Bear Stearns–

– $300 billion: Fed Loans to Wall Street Firms

– $300 billion: Federal Housing Administration

– $200 billion: Fannie and Freddie

– $87 billion: JP Morgan Chase for Lehman Financing

– $85 billion: AIG

– $50 billion: Prop up Money Market Funds

~

(Source: http://mailman.lbo-talk.org/pipermail/lbo-talk/Week-of-Mon-20080922/015527.html )

~

Above totals $1,051 billion ($1.05 trillion).

~

To put this into perspective, the M2 money supply in August was $7,716 billion ($7.716 trillion). (Source: http://www.federalreserve.gov/releases/h6/current/ )

~

Even without the current bailout, if you divide the already accomplished bailouts ($1,051 billion) by the M2 supply ($7,716 billion), you get .1362, or 13.62 percent.

~

That’s a pretty clever tax without representation, isn’t it? $136.20 of every $10,000 you have in M2 assets (checking, savings, CDs, money market accounts), transferred to Wall Street. Without a vote. Taxation. Without. Representation.

~

Lay atop this the Taxation With Representation plan du jour, the Bazooka Hank TARP (more like a tar pit), and the numbers become $1,751 billion/$7,716 billion, .2269, or 22.7 percent, for $227.69 out of every $10,000. Hey, 22/7 is pi! The Illuminati strike again!

~

As Nouriel Roubini and hundreds of other sane economists are pointing out, this is NOT going to “save the economy,” it’s only going to make it harder for prudent Americans to rally their resources to survive and rebuild AND it will reward the moral hazard of the banking and financial industry.

~

http://www.mercurynews.com/news/ci_10533487?source=rss

http://online.wsj.com/article/SB122237192928276077.html

http://faculty.chicagogsb.edu/john.cochrane/research/Papers/mortgage_protest.htm

~

Prudent Americans are supposed to step forward and be the bank of last resort of the most reckless generation of financiers since ancient Rome. And they can’t effing explain what they’re going to do with the money! Gimme gimme gimme. Here’s the pinstriped tincup, cough it up America.

~

You bet that’s anger. And I’ll tell you what else, Paul. I’ve devoted my entire LIFE to sustainable economics, to building local business and economies, to people-centered real assets. I had loads of chances in grad school to go to work for the FIRE and media industries, and more down the line. I turned them all down. You know why?

~

Because I saw this day coming. There are tens of millions of people in this nation who know what to do to get through this crisis, but in such a rushed, top-down procedure, which is more like a stickup than a financial bill, who has a say?

~

And this is only the latest of a series of holdups. They want $700 billion. So what happens when the next several rounds of toxic mortgage resets happen…in 2009, in 2010, in 2011? These will surely lead to more defaults, more foreclosures, more vacant housing, lower housing prices (which, I’m sorry, has got to happen otherwise we’re going to FOREVER price out of housing everybody younger and poorer than Randy Newman).

~

Tellya what, Paul. If Paulson/Bernanke/Bush/Pelosi and President Cheney come out and say, “We want to commit $1 trillion to a First People’s National Emergency Bank of Thomas Paine, run by people for people, to bail out individual farmers and small businessmen who can’t get credit from the finance industry”–baby, I’ll be right there with my bankbook.

~

I don’t have a lot of money by Paulson standards. He cashed out of Goldman Sachs to the tune of $700 billion, which may be why he likes that number, since the Treasury admits they pulled it out of their downspouts:

~

http://www.forbes.com/home/2008/09/23/bailout-paulson-congress-biz-beltway-cx_jz_bw_0923bailout.html

~

But I’d hand over my hard earned–not speculatively stolen–savings to invest in real people with real ideas for how to get this nation off its Bong o’ Debt, and into the new renaissance.

~

Sorry to run on so long, but you asked for a plan. I suppose the above would just about fit on a napkin, huh?

~

Now let’s go from here. Let’s not succumb to the fear-and-terror tactics of the media and DC. Undoing stupidity and greed is always painful. Doing it fast only compounds it.

~

rose

Thanks Rose, that was well spoken. I think Paul needed a little better understanding why people are angry. We need things to build a better America and keep being told it’s to expensive but we can pour it down a drain for bailouts.

I’d rather rip the bandaid off quick instead of suffering a “lost decade”. We live within our means and would like the government to do so also.

Here’s the roll call

http://www.nytimes.com/ref/washington/ROLLCALL.html?currentChamber=house

I received an e-mail with a bunch of signatures attached. The e-mail is asking for everyone to participate in a nationwide general strike on Friday, October 3, and to sign it and forward it to your legislators.

I did. I’m not going to work on Friday, and I am not buying a damn thing either.

I’m sick of this crap.

No taxation without representation, and these a***oles in Washington haven’t represented us, the American public, in a very long time. I’m not paying more taxes so someone else can walk away debt free.

I for one got a pay option ARM even while I qualified for a fixed rate because I mistakenly believed that my mortgage broker had a fiduciary duty to steer me into the best loan product for me. I believe MANY people have made and are making the same mistake.

And Arnold just vetoed a law which would have established a fiduciary duty on the part of mortgage brokers in California.

I never have had a problem making my payments so at least I’m not making minimums or interest-onlies.

I believe that the reverse mortgage was established just so that all the seniors who fought WW2 won’t get utterly raked over the coals by the dynamics of the bubble. Although I strongly expect many to outlive the resources those reverse mortgages have provided.

Perhaps there is a silver lining…even behind this grotesquely convoluted bailout/rescue attempt by Congress, Paulson er al.

The United States has a unique history of development with a focus on hard work, honesty and opportunity for those who are determined and willing to subscribe to behaviors that are honorable. In recent years, this has been masked by greed and a new ammoral behavior that favours the fast and easy buck, at all costs.

Now that the Emperor has been shown to have few clothes, the old america, the grass roots america is recharging its governance with a second sober look at those founding principles.

I am proud of those members of Congress who have had the fortitude to separate the chaff from the grain and seen this bailout for what it is- a betrayal of american ideals in every way. I have been proud to add my one voice to the groundswell of opinion that desires a return to fair play and freedom.

And, I am Canadian as an aside.

Good post, this is very good information. Things were bad, real bad in the 20s and 30s and history does have a way to repeat itself. There’s a book just out that identifies an individual that sacrificed everything to support the laboring class in Louisiana and across America during the Great Depression. He took on the Roosevelt administration and fought the Banckhead act and called for the removal of Hugh Johnson as the head of the NRA. When he finally dismembered Governor Leche’s former Long organization he became to controversal for Roosevlet. Read more about the man at http://www.thomastfieldsjr.com or Google “I Called Him Grand Dad”. Names such as Long, Roosevelt, Farley and Lech are found throughout the writing.

Leave a Reply