The Sham of our Current Unemployment Rate Numbers: Lessons from the Great Depression: Part X. Data Mining.

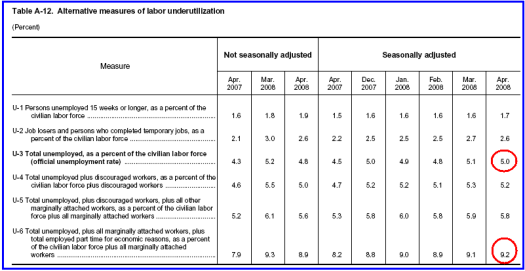

When you look at the current unemployment rate of 5 percent, you would think that our economy would be humming along. Yet the way that they calculate the official unemployment rate is such a joke, you are almost left guessing how many people are really out of work. Are you looking for work and simply can’t find a job and gave up? Consider yourself not counted in the numbers. Are you working part-time although you want full-time employment? Guess what? You are not counted either! It is patently absurd and frustrating to see what kind of gimmicks the government uses to massage the unemployment data.

Mish over at Global Economic Trend analysis on a monthly basis has to dig into the data to point out the stupidity of the unemployment numbers:

It is such an utter disturbance that people are quoting 5 percent as the unemployment rate when 9.2 percent of our population is either underemployed, working part-time, or flat out given up and not working. Also, what about all the people in finance, construction, lending, or any fields associated to the credit bubble that are now receiving a lot less simply because they are commissioned based or depend on their being easy credit? These people are still hanging on by a thread with a massively reduced income yet they are still counted as fully employed. That is the issue with our current unemployment rate. So if our current rate is closer to 10 percent, wouldn’t that change the perception of our current economy?

This is part X in our continuing Great Depression series:

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

6. Crash! The Housing Market Free Fall and Client #10 Contagion.

7. Winston Smith and the Bailouts in Oceania: Lessons from the Great Depression Part VII.

8. Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear

9. A Bubble That Broke the World

It may help to take a look at the unemployment rate during the Great Depression:

*Soucre: Gold Ocean

“The Great Depression began in 1929 when the entire world suffered an enormous drop in output and an unprecedented rise in unemployment. World economic output continued to decline until 1932 when it clinked bottom at 50% of its 1929 level. Unemployment soared, in the United States it peaked at 24.9% in 1933. It remained above 20% for two more years, reluctantly declining to 14.3% by 1937. It then leapt back to 19% before its long-term decline. Since most households had only one income earner the equivalent modern unemployment rates would likely be much higher. Real economic output (real GDP) fell by 29% from 1929 to 1933 and the US stock market lost 89.5% of its value.”

The chart above is disturbing. Yet you also need to remember that the job losses came fast and furious during this time. If you were unemployed, you were unemployed. In today’s market, anyone can get a minimum wage job with our so-called service industry yet struggle along as a walking zombie. What happens when you go from a $100,000 a year real estate career to earning $9 an hour in a service sector job? If you dig into the previous jobs report from the BLS you’ll notice that the larger increase of jobs is in service oriented jobs that pay less than the other important sectors such as finance and manufacturing. Either way, the sham of the current job report is that it covers up the true reality of the situation.

You may also be shocked to hear that California now has the nation’s third-highest unemployment rate only behind Michigan and Alaska:

“(LA Times) Although April’s unemployment rate was unchanged from March, it represented a full percentage point increase above April 2007. Almost 200,000 more people were out of work than last year, giving the state the third-highest unemployment rate in the nation, behind Michigan and Alaska.

California lost 800 nonfarm jobs in April from the previous month. But seasonally adjusted numbers for the month were up slightly — 0.2% — over a year earlier, according to the Employment Development Department.”

The Great Depression also hit hard throughout the country on farmland that was mortgaged and many local banks going into default.  But we had a backup plan then. We were a lender as a nation! Now we are a massive debtor. We also witnessed deflation during the Great Depression which we are already seeing asset deflation with real estate:

“Another unusual aspect of the Great Depression was deflation. Prices fell 25%, 30%, 30%, and 40% in the UK, Germany, the US, and France respectively from 1929 to 1933. These were the four largest economies in the world at that time.

To put the severity of the depression in modern perspective, consider the following. Real US GDP went down 4.4% in the five years that it declined since 1959, all added together! Unemployment has never exceeded 9.7% and we have not had one year of deflation. Maybe you’re thinking, “what’s wrong with a little price deflation?” Depending on how much and how unexpected, deflation can be a devastating economic event. Imagine wages falling by 30% and the value of debts simultaneously increasing by that much.

In the great depression it would have been nice if the suffering had been so evenly distributed. Instead the deflation caused bankruptcies, which in turn led to, more bankruptcies! Millions of people and companies were wiped out completely. The lack of adequate social programs left people of all social strata depending on relatives and friends for charity. Spending became paralyzed with fear as the downturn was so unexpected, so severe, and the bad news just kept coming for years.

Many did not realize how severe the downturn was until 1932 or 1933 when the economy had technically hit bottom and even begun to chug forward. People’s resources were depleted by then and so were many of their friends’. So the human misery caused by the Depression really started in the mid-1930s.”

The problem inherent in today’s market is as follows:

First – Unemployment is understated by underemployment and shadow workers (those that have given up looking for work). It also does not reflect the loss of income in once high paying jobs.

Second – The FDIC although providing protection to depositors has created a sort of moral hazard. If you look on sites like Bankrate, you’ll notice that the highest savings rates normally come from the most capital impaired institutions. Many on the list will probably go bankrupt in 1 or 2 years. Now why would anyone invest their money in these institutions if they knew that their money wasn’t protected? If it weren’t for the FDIC, these lenders would be bankrupt and rightfully so; they have horrible and flawed business models and should be allowed to fail. Instead, they offer you a nice yield on a 6 month CD.

Third – Underemployment is just as bad as unemployment. In terms of economic data and spin, it is probably worse since it gives many a false sense of security. We are not at a 5 percent unemployment rate. It is simply an absurd number and even the fact that the CPI told us last month that energy prices dropped, I think that even the lay person now gets that there is something rotten in Denmark. If you look at the report, how can you consider someone working part-time but wanting full-time employment as part of the official unemployment number? The current number that should be quoted is the 9.2 percent number. As we’ve gone along, we’ve managed to allow the Ministry of Truth to massage out every kink out of the most important statistics of our economy.

Forth – Banks are being propped up on a crutch. There will be more bank failures. Think this is just hyperbole? Then why is the FDIC bringing out folks from retirement who lived through the S & L collapse to gear up for the next phase of the debt crisis?

“(MarketWatch) He’d built a new home by a lake in Texas, bought a boat and was working on his golf game. While taking on some part-time work, Holloway also traveled for months across the U.S. with his wife, from Seattle to Washington D.C., catching up with old friends and family.

That life of leisure abruptly changed about six weeks ago when Holloway got a phone call from his former employer, the Federal Deposit Insurance Corp., or FDIC, which regulates U.S. banks and insures deposits.

Holloway, a 30-year FDIC veteran, had worked extensively with failed lenders in Houston during the savings and loan crisis in the late 1980s and early 1990s, when thousands of thrifts collapsed.

Earlier this year, the FDIC began trying to lure roughly 25 retirees like Holloway back to prepare for an increase in bank failures. It’s also hiring about 75 new staff.

Holloway quickly went back to work. ANB Financial N.A., a bank in Bentonville, Ark. with $2.1 billion in assets and $1.8 billion in customer deposits, was failing and an expert like Holloway was needed to value the assets and find a stronger institution to take them on.”

No problem folks! Any comparison to the Great Depression is doom and gloom. Listen. I know that folks like to make light of this but the problem of complacency and mind numbing control from drones on the media is that people are now content to be under slavery to debt. Do you really own that car? Try missing a payment. Do you really own that $700,000 McMansion? Try missing your mortgage payment. The false guise of security is that consumer inflation is non-existent (hello $4 gas!), that unemployment is at 5 percent (you mean I can kick back at home and watch Montel and not be considered unemployed?), and finally assuming that things from the past cannot occur again.

Simply from looking at the data it looks like we are going to have our own lost decade like Japan. The data has gotten so out of whack, that you have rely on other measures like income to triangulated your assumptions. If we are simply to look at the CPI and employment numbers from the government we’d assume the economy is perfect like a bowl of warm porridge.

I’m not the only one that is waking up to this insanity:

“(Harper’s Magazine) If Washington’s harping on weapons of mass destruction was essential to buoy public support for the invasion of Iraq, the use of deceptive statistics has played its own vital role in convincing many Americans that the U.S. economy is stronger, fairer, more productive, more dominant, and richer with opportunity than it actually is.

The corruption has tainted the very measures that most shape public perception of the economy-the monthly Consumer Price Index (CPI), which serves as the chief bellwether of inflation; the quarterly Gross Domestic Product (GDP), which tracks the U.S. economy’s overall growth; and the monthly unemployment figure, which for the general public is perhaps the most vivid indicator of economic health or infirmity. Not only do governments, businesses, and individuals use these yardsticks in their decision-making but minor revisions in the data can mean major changes in household circumstances-inflation measurements help determine interest rates, federal interest payments on the national debt, and cost-of-living increases for wages, pensions, and Social Security benefits. And, of course, our statistics have political consequences too. An administration is helped when it can mouth banalities about price levels being “anchored” as food and energy costs begin to soar.”

So the most relied upon measures for the health of the economy are completed screwed up. Like the entire ownership society myth that was pushed (and by the way homeownership is now back to 2002 levels, pre-dating the ownership society speech in 2003). The problem that is going on is we have a silent destruction of our treasured U.S. Dollar and our productive base is being dismantled piece by piece. People were placated since they felt somehow that pushing papers around and flipping houses was somehow going to keep us competitive with nations that are pumping out engineers and scientist on an incredible basis. Time to rethink our numbers and demand the truth be reflected but it would appear that most folks simply want access to a credit card, a television, and a burger in the hand. Time to get real and focus on improving the balance sheet of our country.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “The Sham of our Current Unemployment Rate Numbers: Lessons from the Great Depression: Part X. Data Mining.”

Doc- Again, great work. I hope you’re into meditation, since I think this oncoming storm is getting to you a bit. I believe your observations are correct. On an anecdotal basis, I am seeing many people (50+) with advanced degrees in engineering, MBA’s, high end sales execs, “wealthy” contractors, and other professionals, being laid off, downsized, etc. Most of them are now consultants, some doing okay, some not. But the safety net of medical insurance, 401k’s, et al, are gone. Further, I do know that many of these folks have re-fied many, many times- probably with variables, so that they could support their lifestyle, or buy investment homes. This is a very foreboding situation- they have no more time to make up losses, there are no defined benefit pensions in place and they may miss those critical years of traditionally highest pay to bolster what nest eggs they might have. You have ably pointed out many truths about what is going on- and it seems that the mainstream press is finally catching on. Certainly, the people I know, many who are not financially aware, intrinsically know that the government is finessing the numbers- if there has been massive deception vis a vis Iraq, goes the thinking, why would it be any different when it comes to the economy? Keep up the great work!

You make good points about the government stats being crap, but the same thing occurred during the Depression. Millions of farmers (my grandfather was one) would have been considered “employed,” but were suffering through crop failure after crop failure, generating almost no income. People who kept their jobs also had drastically reduced wages as well.

(1) “Unemployment soared, in the United States it peaked at 24.9% in 1933. It remained above 20% for two more years, reluctantly declining to 14.3% by 1937. It then leapt back to 19% before its long-term decline.”

******One has to be very careful in asserting precise statistics on unemployment during the 1930s for one simple reason – there was NO RECORDKEEPING about employment or unemployment during the 1930s. There was no Bureau of Labor Statistics gathering data, There was no Unemployment Compensation with people on its list. All claims about the unemployment rate during the 1930s is simple based upon ‘best guess’ estimates . Claiming that it was really and truly exactly “24.9%” is just flat silly since there were no records gathered or kept to definitively establish that it was 24.9% and not 20.9% or 28.9%. All historians agree that the unemployment rate soared – but no one can give an exact % and can only give an estimate.

(2) In considering the estimation of unemployment rates during the 1930s versus unemployment rates now, one adjustment MUST be made to get comparable data. In the 1930s there was NO Social Security Retirement, precious few pensions and 90% of the workers stayed in the workforce until they died as ‘retirement’ was something only the upper 10% or better could afford.

****Ergo, the estimates of unemployment during the 1930s include all who were in the workforce and that means 90% of those over age 65.

*** Social Security was not created as a ‘feel-good’ social policy. It was created as a means of getting the older workers out of the workforce so they would not be competing for jobs and doing so without leaving them to starve.

*****At the current time there are 45,000,000 people receiving Social Security Retirement or Disability. Around 40,000,000 are drawing retirement. Now add those 40,000,000 back into the current pool of jobseekers and you will have a lot closer to 31.4 (BLS ‘official) to 35.5 (Mish’s numbers.) If you assume that only 1/2 of the retirees would have to wwork without Social Security and/or be physically able to work, that is another 13.14% of the population back into the workforce – or 17.3 to 22.3% unemployed.

(3) Better calculation of the unemployment rate is at http://www.shadowstats.com/alternate_data. John Williams is an economist who does the economic calculations the way ther were done efore the Fed Gov’t got cute under Clinton and Bush. Williams started doing his own calculations of unemployment, GDP etc when he realized that the government’s ‘new and improved’ methods were producing unreliable data that lead him to give bad advice to his clients. His unemployment calculations for the 1st qtr 2008 shhow more like 13 -13.5% unemployment.

******Hmmm….now add those 20-40,000,000 million retirees back in to the labor pool and you can then make an analogy to the 1930s. Williams’ 13-15.5% + retirees of 20,000,000 (another 13.14% of the working population) – 40,000,000 (another 26.28% of the working population) means around 26 -39.78% unemployment.

Now seems like a particularly good time to learn to garden or raise chickens. Or maybe learn a trade. As in, “I will fix your broken radiator if you will give me a dozen eggs.”

What will happen to all of us white collar fools?

Learning to garden and raise chickens isn’t exactly going to work for most Angelino’s, remember 50% of the population rents. Yes, I know, tomato plants on the apartment balcony.

Barring total social breakdown people with traditional saving should do ok though (or even if the dollar tanks more, then hedge a bit with some savings in foreign currencies).

Gardening is a good idea to help yourself and your family. Learning a trade is always useful, however the best thing you can do is GET OUT OF DEBT. We saw this train wreck coming a while back and in 2003 started our debt snowball. We also sold everything we didn’t need and I took on an extra job. We cut up the 7 credit cards and got on a budget. It took about 4 years to become completely debt free including our home. When we started we had a combined income of $40k to $50k we ended up at about $65k, so we weren’t rich. We will NEVER finance anything again, if we can’t pay for it, we can’t afford it. We started stocking up on food last year, that includes long term dehydrated foods as well and took most of our money out of savings and bought gold and silver with it.

We Americans have been living beyond our means and have had an entitlement mentality for a couple of generations now. Our idea is “if I can afford the payments, I can buy it” or “I work hard, I deserve it”. That only leads to perpetual debt and a rude awakening. And for those holding out that the government can or should “do something” don’t hold your breath, they are the cause not the cure.

It is good to see that someone FINALLY brought up the fact that the jobs being offered in the service sector are at such a lower pay grade than the jobs that were lost. I lost my job after 22 years in the mortgage business and have gone back to school for my masters in public administration. I’m one of the uncounted unemployed now that my benefits have been depleted. Now that the cities are having to layoff due to lower tax collections and non-profits having to cut back due to lower donations, I may have to re-think my strategy when I graduate in a year.

trace the money

Wealth in not destroyed – but merely transfered.

So… where did all the billions of dollars disappear to ??

Somebody – nr 1 – sold their MacMansion for 1 million and the “buyer” took out a 100%

mortgage, that later defaults and gets sold by the Bank for 500.000$

BUT..where is the first million gone, that nr. 1 ran off to….

Did he ..retire… and put his million into a “wealth fund” that bought the very mortgage that has now defaulted……that was later “frozen”.

Now – no house and no million….haha – but got a job with…Fdic

Could some-one look into this – side of the moon

Mike.dk

Ive now some people who are underemployed, I know a few that are unemployed. But I do not know 1 in every 10 people I know to be that way.

Were are the soup lines?

Were is the crime?

Were is 10,000 resumes for every job posting?

Were is there mass migration?

I do enjoy your articles but John Williams is a little too tin foil hat for me. And mish sherdlock comes across as cheering on a second great depression.

Hey Dutch Trader. Is John Williams still a little too “tin foil hat” for you? Bet your rethinking that. You don’t know 1 in 10? Still? What world are you living in?

Mike: much of the wealth was destroyed. Much was spent on toys, tv’s, vacations, and other consumer items. Nominal wealth which is not put to productive uses is destroyed. The rest was flushed into the system and created the price inflation we are seeing. Most of the inflation was created where the money ended up: in China and the Middle East.

To quote “Die Hard” – “Welcome to the party, pal!”

The true employment picture has been *seriously* distorted since at least the end of the tech bubble in 2000/2001/2002.

Everyone should simply look at the “employment-to-population” ratios put out by the Bureau of Labor Statistics (www.bls.gov) every month.

You will find out that this ratio remains markedly lower for all sub-55 age cohorts – lower than even 7 or 8 *years* ago (how long the “employment recession” has really been going on).

Bottom line, the “employed to population” ratio is simply *much* harder to manipulate than the joke that is the “unemployment rate” – and therefore it is a much better metric for the true state of the labor markets.

Unlike the UE, the E2P rate takes into account 1) so-called “discouraged workers” who have allegedly given up looking for work, 2) new labor market entrants (HS and college grads), and 3) the long-term unemployed.

All 3 groups are intentionally ignored by the standard defintion of the UE.

Result – *millions* fewer under-55 workers are currently employed than would have been employed now if employment rates were anything like they were 10 or 15 years ago.

I asked an acquaintance who works at BLS about the unemployment numbers, and here’s what he said:

“When BLS measures unemployment, they do it according to generally recognized international concepts of what unemployment is. It is not a measure of economic hardship, which is what the blogger seems to want it to be. People who want better paying jobs or people who want full-time jobs when they only have part-time jobs may not be happy with their situation and it may cause them economic hardship, but you can’t say that they are unemployed. The unemployment rate is just one measure of economic hard times, but, generally speaking, when it is on the rise, things are getting better and when it is falling, things are getting worse. See the Frequently Asked Questions page for more about the unemployment rate: http://www.bls.gov/cps/cps_faq.htm.”

1. People that graduate from high school or college, etc that never had a job are not counted in unemployment stats, and they cannot get unemployment payment since they did not work. How many of these are out there? What are their prospects for work?

2. We are a highly urbanized and technologically dependent society. Yet we have exported much of our manufacturing capacity, unlike the great depression. When the war (that was clearly materializing but ignored by many) hit, at least we had the engineers, machinists,and machine tools to get us moving out of depression and into war materiel production by 1940. We lack much of that now.

3. America was still about 40% rural/small farm/small town in the 1930’s. While many of these people struggled or had to give up farming, many were able to eke it out. We are now a commercial agribusiness country, making stuff in huge quantity for processing into pre-prepared food, non foods, or for mass export. Good luck to us.

So right! Debt will rear its ugly head at the worst possible moment. If you do not relinquish its hold you will lose EVERYTHING! to quote Cinderella man, “It all stopped being mine.” thats how it works. When you are in debt you don’t own anything, you are then living in somebody else’s house. People need to live within THEIR means! Not their neighbors who just got the cool new car. People have this strange notion that to be equal to someone you have the same or better stuff. Its not true. By the way this is a 14 year old kid talking to you about “big people stuff”, trust me your kids don’t want you to hide stuff from them. It makes them wonder whether you are always honest with them. They will love you no matter how hard times are, even if it dosent fell that way. They know you love them, so just tell them. They are smarter than you think. I’ll go finish my summer assignment now.

I have to agree with AnnScott. I’ve been having this same discussion for about three weeks now. During the Great Depression, we didn’t have Social Security, nor did we have Welfare. I don’t know if those receiving welfare are included in these numbers, but if not….they should be. There are too many programs out there that allow the numbers to be distorted. We’ve been in a recession for two years and are quickly heading for a depression. The volume of people seeking employment is overwhelming. I’ve been doing some recruitment consulting since I got laid off four months ago and the amount of people apply for these positions is huge.

And yes, Jes….I did garden this year. I canned over 100 quarts of green beans, 40 pints of pickles, 20 quarts of spagetti sauce, 27 quarts of tomatoes and froze both squash and peas. (My corn bombed.) This was my job after I got laid off. My husband is also going deer hunting for the first time in years. And, I planted fruit trees this year (we just moved to a new state) it will take a couple of years to produce, but it will take more to recover from this mess.

I also got rid of my credit cards 15 years ago when I went through divorce. I bought two homes with other credit history (orthodontia, utilities)….We aren’t rich and my kids are having to adjust…but their resilient.

I just hope my husband keeps his job…..:)

Yea wealth is destroyed because when you buy toys, tvs, vacations and other consumer items the people that take your money for these items put it in a furnace this furnace burns the money this generates heat and causes alot of the global warming we have been seeing recently

I never knew what to think about it until this year. I was completely in the dark as to how to process the unemployment situation… until I read your article. It really fits in with so many other things I’ve been noticing lately about the economy.

However, I believe it’s not all the government’s fault. At the heart of it all is lust for wealth. It just so happened that we recently had a President who came from a BIG money background. Generally, I would say that the CEOs of these major banks and such have been showing their clownish-yet-evil natures perfectly lately in the midst of our recent crises. They, and types just like them, have been corroding the layers of this country away for a lot longer than most people realize — you’re gonna have to go A LOT further back than the Great Depression to find the root of it.

Anyway, I’m glad I stumbled upon this article. I’ll definitely be keeping an eye out in the future!

To: “dutchtrader”

A man is in a room with five doors. He opens four doors and sees a cute puppy behind each door. He tells all that there are cute puppies behind all doors in life. The only problem is that behind the fifth door is a MAN EATING LION. So much for our personal experiences being the only way of the world.

Leave a Reply