The Paradox of Spendthrifts – Government Offering 0 Percent on I Savings Bonds and Creating Incentives to Spend. Punishing the Prudent and Savers. $115 Trillion in total U.S. Debt.

It is fascinating to witness policies enacted that punish the prudent and those who have been financially responsible. I have been a fan of I Savings Bonds from the U.S. Treasury since they came out in 1998. For those of you who do not know what an I Savings Bond is, it is a saving vehicle composed of a fixed rate and a rate that is indexed to the CPI. They are marketed as low-risk and liquid savings products. The lowest return you will ever receive on I Savings Bonds is 0 percent. This would only occur if the CPI rate turned negative. For the first time in 11 years, the I Savings Bond rate is 0 percent.

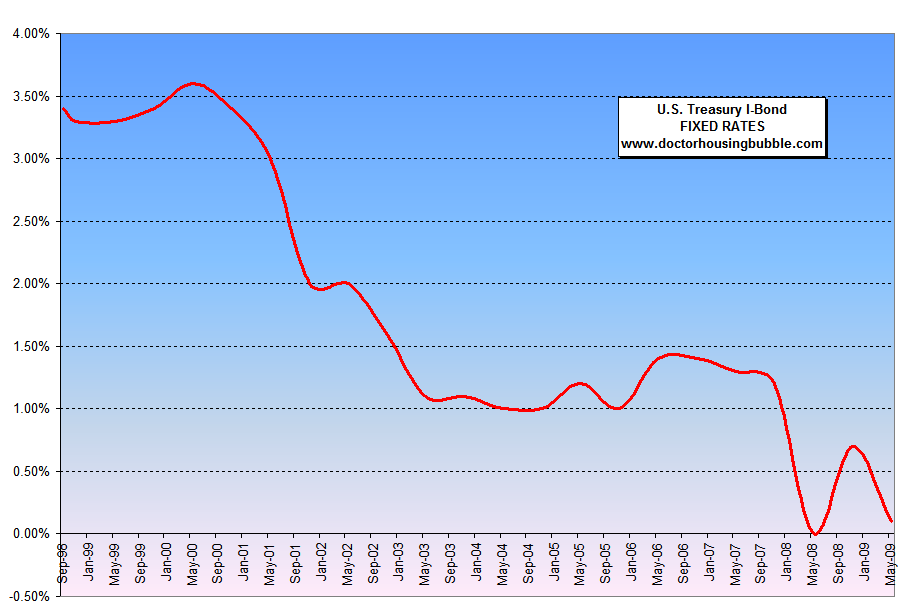

I want to focus on the I Bond because this product highlights many problems that we are currently experiencing in our economy. First, let us look at the fixed rate component of the product:

The only time the fixed rate part of this product has trended upward was in the late part of the 1990s when the technology bubble was raging. But after 2000, the fixed rate component of this product has followed a strong trend to zero. The rate did hit zero in May of 2008. Currently the fixed rate stands at 0.10%.

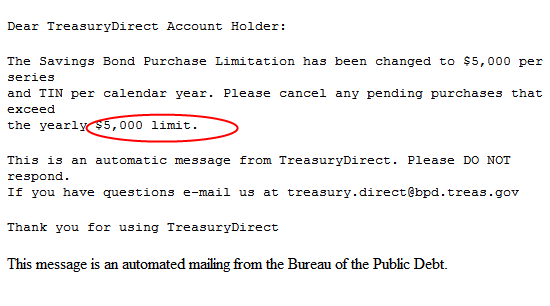

If the zero percent fixed rate isn’t enough to keep you away, the limit on how much of this product you can buy in a calendar year was also dropped in May of 2008 (it used to be $30,000):

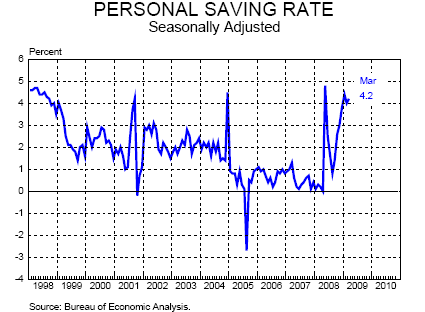

Now this should all be further evidence that the U.S. Treasury and Federal Reserve want to punish savers and force Americans back onto the consumption machine. An unintended consequence of financial crashes like this one is people start finding a desire to save. Many don’t follow things this closely but the U.S. Treasury and Federal Reserve knew people were going to start gravitating to more secure and low-risk saving vehicles. So to create very little options for Americans, they have pushed interest rates to absolutely pathetic levels while many Americans search for secure investments away from the Wall Street casino:

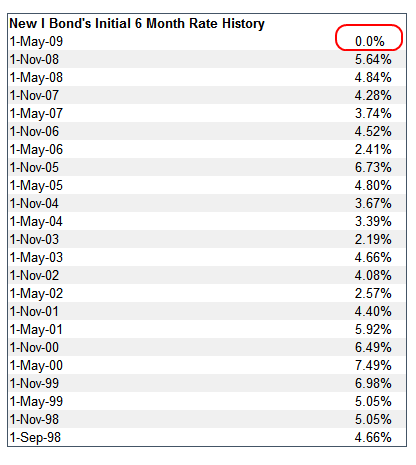

So with this new found desire to save, what rate would you get with I Savings Bonds?

Bwahahaha! You might as well stuff your money into your mattress. The government is now offering you 0 percent for purchasing I Savings Bonds. Now of course, this is largely due to the negative CPI rate but you would get a lot of buyers if you offered a more lucrative fixed rate that would adjust in the next semi-annual rate adjustment. Yet this would encourage saving money, which if you have read any over the counter finance book, is actually good for you! But the Wall Street crony machine only wants you to pump money into stocks via your 401k to fund the global debt casino. That is why when we look at actual indicators on Main Street we realize the recent 31% rally is nothing more than a reflection of pit bosses on Wall Street trading with one another. Insiders are selling a lot more than buying.

So now, if you simply want a safe and secure investment like an I Savings Bond you are going to get zero percent for locking up your money for six months. This is the biggest “do not save, and go out and spend” sign you can ever create.

This is a philosophical problem with our current economy. The current economy is so driven by consumption that even prudent measures of savings will punish the system. No government official would ever come out and admit this but for the most part, these actions and what has been occurring over the past decade show contempt to the American public. Not one of my successful friends or colleagues (Republican or Democrat) has ever become financially independent by spending more than they earn. You would think something as painfully obvious as spending within your means would resonate with many but it has not. That is why the credit crunch is hitting Main Street so hard.

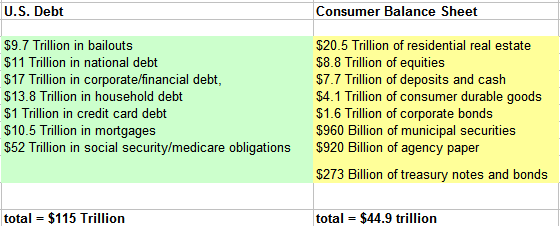

You want to see how ridiculous this has become? Take a look at this:

Source:Â Zero Hedge

I’ve put together the above chart in a clean format to show the insane amounts of debt floating in the system. If you look at the U.S. debt side, you will see that we have some $115 trillion in debt/obligations through various bailouts, national, corporate, and consumer debt. On the consumer balance sheet, you still see that residential real estate by far is still the biggest asset of most Americans. Another 10 percent decline in real estate which is very likely would wipe out another $2 trillion in wealth.

The above chart is a site to behold. It is also apparent that we will never ever pay off that debt.

Even in previous wars, we would encourage the population to buy bonds to support the cause:

Now, we just expect to finance all this debt and external expenses with no cost to citizens? Where is this money coming from? The point is that the money is not even here and at a certain point, this Ponzi scheme of an economy is going to put Bernard Madoff to shame. We have already seen glimmers of this unfortunately with the March market lows. The bailouts are only a sign that we are willing to put our entire future at risk to keep the debt pushers up on the taxpayer’s dime. If we are going to argue that we need debt, then let us create a national Good Bank and lend money out directly. People would argue that logistically this won’t work but if we look at the current bailout funds, most of the money isn’t making it to the hands of consumers anyway. I think we can somehow manage to create a decent bank with $10 trillion.

Saving is a hard concept for many. People are now conditioned to expect zero down mortgages, multiple credit card offers, and zero down car loans. It was bound to end at some point. Our economy needs to rely on financial responsibility and an economy built on producing goods and services that the world wants and needs. The world has enough credit default swaps and derivatives. The message right now is to spend. Don’t follow that siren call. Start saving if you have not done so even if it means getting 1 or 2 percent in a savings account. Wall Street would want you to believe that you should put your money into the casino so it can be gambled away. Even with the recent bear market rally, many are still looking at portfolios that are down 40 percent only a few years before retirement. These are going to be lean economic times for many years.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

25 Responses to “The Paradox of Spendthrifts – Government Offering 0 Percent on I Savings Bonds and Creating Incentives to Spend. Punishing the Prudent and Savers. $115 Trillion in total U.S. Debt.”

The people running the show are greedy stupid scum. They don’t care about the populace and they don’t care about the long term health of the economy. We are owned by the FED and Wall St.

The banksters will continue to ream us until the Chinese find a way to dump their dollars, toppling dollar hegemony and sending us into the shitter.

The banksters already have a global currency setup at the Bank of International Settlements. It’s not the Amero; I forget what it’s called but it’s a tech term like “the international monetary unit.” It’s based on the value of the world’s current currencies.

If the dollar does collapse, then the moneychangers can just turn the switch and start over.

The system is very ugly and screwed up, but short of violent revolution, things are going to continue to be ugly and screwed up.

There is a new book, “The Narcissism Epidemic: Living in the age of Entitlement”

The authors discuss how people, especially younger people, feel they “deserve” the good life, even though they have done little or nothing to earn it.

Everyone gets a trophy to make them feel good. Zero down mortgages play into this mentality- why save, like your parents did, when you can have it “now”?

You can read an excellant book review of this- go to San Jose Mercury news and search for “”The toxic narcissism of generation me”,

by columist Ruben Navarette,(first published in the San Diego Union Tribune.)

The U.S. Debt side, does that include the stimulus debt or the projected budget deficit?

What about state and local municipality debt?

Great article, but I think you may have missed out those guarantees given out by the govt on almost everything-From mortgages, banks’ debts, etc etc, & now even auto warranties!!!

This is so sickening, wishful thinking by govt these guarantees are “much cheaper”, dead wrong! It encouraged moral hazard, akin to AIG selling tons of CDS thinking its free $ way back before 2006. Now that’s very very dangerous. What if just just a few top 5 banks blow up? US faced very high default risk!

Great article, Dr.

Robert, thanks for the book recommendation.

Another SERIOUS problem with I-Bonds is that they have all kinds of tax complications. And this matters A LOT unless you are saving them in a retirement account. But while saving for retirement is all well and good, most people also have other goals they are saving for besides retirement (a down payment on a house, a car, an emergency fund …). And I-Bonds are very unfriendly in these taxable accounts.

Robert Cramer: as for blaming young people for narcissism, ah give us a break. It’s not young people who have destroyed our economy. They aren’t the ones who have been in power for the last 30 years.

Doc wrote: “The current economy is so driven by consumption that even prudent measures of savings will punish the system.”

~

I’m with ya on this, DHB, and the solution.

~

People need to seek or build a different system. With even $100 billion we could get going a pretty good First National Bank of Us. A competing financial system something like the one Paul Grignon, Michael Hudson, and others have outlined.

~

But isn’t it true that many of us complaining about “the system” still secretly or overtly hope to benefit from it? Isn’t the dream of being the last man standing when all others have lost more powerful than the dream of creating something really worthwhile to help many?

~

rose

Rose,

No…I don’t believe that most intelligent people think that they can benefit from this system. Not at all. Anybody with half a brain can see that we have a horrible mess on our hands and that there is no way out.

Regarding my previous comments on I-Bonds and tax complications. I was confusing I-Bonds with TIPS. It is actually TIPS that have the tax complications. The tax complications of TIPS are such that I’d worry about being able to make my taxes if holding them in a taxable account. So the government does a great deal to DISCOURAGE people from buying TIPS via it’s tax policies. Another form of discouraging saving …..

“But isn’t it true that many of us complaining about “the system†still secretly or overtly hope to benefit from it? Isn’t the dream of being the last man standing when all others have lost more powerful than the dream of creating something really worthwhile to help many?”

no I don’t think so, compass rose. For one thing the sheer odds against being the last man standing make it ridiculous even on just that basis alone (although some of us are waiting for housing to bottom :D). Now one may play whatever money and skill sets and so on they might have however they think will serve them best in horrendous economic times, but really who wouldn’t have voted to avoid this joke economy entirely if only that option were presented.

Saving for retirement with 0 or 1% interest?

This can’t be done. In order to save for retirement you need to be getting some return on your money. If you only make 2% on your money, it will double every 36 years!

I would think that you need to get around 5-6% at a minimum to have any chance at being able to retire.

These super low interest rates are forcing retirees and people who depend on accumulated capital to either eat their seed corn OR take on much greater risk.

Low interest rates are great, but 0 or 1% rates are terrible!

Roberto

Most people are clueless to the amount of problems this country faces in the future. Let’s stop blaming our government, we, after all, are the ones who put them in power. Besides, it’s the other way around, the PEOPLE are the ones who should decide which way our govenment is supposed to be run, don’t expect them to lead us out of this mess.

VIDEO of Model Homes being demolished by CA Bank

http://vodpod.com/watch/1587821-one-way-to-solve-the-housing-crash?pod=misstrade&ref=housingcrisisnews.com

the story is that it is CA Guarantee bank demolishing 4 homes…b/c the city there was fining them everyday

Great article!! I do not think it is the young people that are destroying our country. Young people feel entitlement because we parents always provide it. Most things are cheap (China), so the system has made it easy for us to afford it for our kids, but this is not necessarly good. We need to teach reward for hard work only.

Dear Bank of the United States of Delusion and Trust,

We have recently conducted a stress test on your financials and have come to the conclusion that although you are hopelessly overleveraged, you are a sound institution and we commend you on ability to fleece your investors and wreck the economy all while raking in huge bonuses and declaring yourselves solvent. This is no small feat; in fact, we are going to encourage to do more of it by assisting you in every way possible. Should you have any questions, please don’t hesitate to call me on my personal cell phone number. Let’s do lunch! What’s another few dollars on the taxpayer (ha ha). Cordially,

Timothy Geithner

“Now You Have a Friend in the Treasury Business”

As reported by Reuters on May 5, 2009, Bernanke says, “U.S. recovery ahead, housing near bottom.†So what’s the worry? I just got a killer deal on a new 60†television, put 3% down on a $450,000 home in Oxnard, and picked up a new SUV with nothing down and no payments until 2010—all on a monthly salary of $3,000. Now if you don’t mind, I have to head down to Florida to meet with a guy who sells bridges at rock-bottom prices.

Robert writes “I would think that you need to get around 5-6% at a minimum to have any chance at being able to retire.’

<< Actually it would be more than that. Say you work for 45 years – age 21 to 66 . (Keep in mind that Soc Sec retirement eligibility for full beenfits is now 66 or will be in the next year or so.) Median household income is now around $48,000. Around 1964-67 it was about $7,856. (That’s right – only 4 digits in the ’60s household income. That means you would need an income that is 6.10 times more in dollars in 45 years than it is today.

<<>>

For example, if you have a $48,000 income today at age 21 and you estimate (based upon past inflation) that you will need a $292,800 income in 45 years at age 66 to maintain the same standard of living, you will have to have enough saved at the end of 45 years so it can produce $292,800. If after you retire, your ‘investments’ are earning 6% a year, that means in 45 years you will need to have $4,880,000 that you have saved up over those 45 years.

>>>

Since you will be saving over many years, some $$s will earn 45 years of interest and some 1 year of interest. To simplify it, lets assume that you will get 22 years of interest on 100% of the sums saved. Roughly, you would earn 132% in interest. 100% of savings + 132% interest on 100% of savings would be 232%. After doing the math, that means you have to save $3,793,000+ out of your median income of $48,000 (2009 $s) to $292,800 (estimated 2054 dollars.)

>>>

In fact you would need even far more than that $8,800,000 as you would have to have additional income that can be re-invested to provide returns to keep up with inflation for 20 years or so in case you live to be 85. And in the past 20 years (1989-2009) that would have meant increasing your income by 87% or 4.36% every single year.

>>>

GFL (Good f—–g luck!)

You guys crack me up! Love it.

It surely is true we could start our own bank if only we didn’t have to use their currency – that’s the rub – because so long as they can print it at will and spread it far and wide, there isn’t much point in saving anything anyhow – low interest rate savings? In the face of the inflation headed our way? Hell, we need a BUBBLE of expansion just to keep up with their spending and printing! What good is even a 10% rate of return if you are battling these kidns of nujmbers coming out of their printing presses?

ha ha ha savings ha ha ha

DISHONEST ARTICLE: You compare “U.S. Debt Position” to “Consumer Balance Sheet.†This is an apples vs. oranges comparison. What is corporate commercial real estate valued at? What is agricultural land valued at? Where are the plants and equipment? Where are the timber and mineral assets? Known oil and natural gas reserves? Where is the (partially offsetting) future social security/medicare tax revenue? What is infrastructure valued at? Are technology, patents and intellectual property valued at zero? In short, you list most known corporate, individual and governmental debts but only list some of the assets. That’s misleading. You don’t need to mislead to assert that Americans are profligate. It’s true, but it’s not as bad as you claim.

@Rob

Yes it may not be a comprehensive balance sheet, but the debts are also understated. The point is well made, as it is just quantifying in a general way that the obvious prudence of saving and providing earnest money in any transaction has been trumped my the mentality of ‘I can have it right now’.

There may not be any way to wind down the general ponzi scheme, which is the world economy, but there must be a better method than the inverse-Robin-Hood scheme we are enduring now. The fact is, most of us are prepared to endure a declining standard of living. Even a virtual zero return on our money is better than an actual partial return of our money. I’ve accepted the new world odor. It stinks, but it is what it is. I’m saving. As long as we aren’t pushed into another world war, that may be the best we can hope for.

I can’t afford to lend the government money and get no return for my investment.

I wonder if government bonds of other countries would be a better return?

I disagree with the conclusion, that we should be saving $$. We should be putting spare cash into anything but cash-like vehicles. With all that debt, the dollar is doomed. It’s only a matter of time before inflation hits us hard. Buy durable items now. You’ll think you’re a genius later.

Excuse me… but what happens to INFLATION adjusted bonds when we go into a DEFLATION?

Zero percent seems pretty generous!

Rob–

No, it’s worse.

Dr HB, Kudos again for summarizing the shape we’re in. It’s amazing how business forces (Media, govt, banks) are tying their best to skew the data. A cold hard look at the facts though, dispells such a notion. All that’s happening is, taxpayers bailing out the banks for inexcusable behavior. It’s the same as enabling a bad child after they have done something wrong. But, perhaps your child is so rotten, you don’t feel as if you have much choice. Our economy is built on bubbles, and those in charge are fighting against any real change.

Lately, there’s been a small ground swell that economy and housing are reaching bottom, because things aren’t as bad. People forget these are consecutive numbers and not measured year over year. It’s like digging a deep hole deeper, just not as quickly. I guess losing just over 1/2 million jobs last month is a good thing. In regards to housing, the seasonal month to month numbers are being touted as good news. What about record foreclosures? And the denial that toxic ALt-A and Option ARMs aren’t in their neighborhood. The next blows to housing will be if the Banks release their REOs and the commercial real estate market comes to a screeching halt.

Here on the Westside of LA many are still delusional after recent 25% declines. We have yet to go through a 2nd summer selling season after the latest credit freeze. The pool of “qualified” buyers are getting smaller and smaller for still over-inflated Westside prices. I believe this summer tilts in favor of buyers, as sellers run out of time.

Even the Uber-rich are feeling it now. A $17,000,000 property just sold for a measly $11,000,000. 35% discount before it drops another 15%…

http://www.westsideremeltdown.blogspot.com

Dr. Housing Bubble:

Are you dead? Have the jack-booted government thugs thrown you in jail? Where are you? I’ve become addicted and need a fix!

Leave a Reply