The Four Horsemen of the Economic Apocalypse: Lessons from the Great Depression: Part XX. Housing Distress, Stock Market Tanking, Commodities Collapsing, and Unemployment Surging.

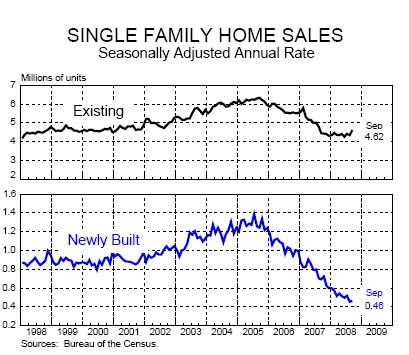

The market on Monday opened sharply lower only to quickly rebound on the early morning new home sales numbers. This was short lived because after you dig through the journalistic rhetoric you will find that this was the lowest September since 1981. It was hard to spin the report. This includes what should be the end of the strong summer selling season yet the data was simply not there. This in light of major price declines which gave home sales a modest monthly boost. At the end of the day, the market was down yet again sending the S & P 500 to 848 or a whopping 45+% drop from its peak only 1 year ago. These are epic numbers. Wicked swings on the up and downside are not good. This is massive volatility spurred by economic uncertainty.

If the technical definition of a recession is not met even in light of the entire economic calamity, then we clearly need to retool our measuring tape. We are facing eerily similar circumstances from the Great Depression. I will examine the four horsemen of the economic apocalypse in this article. Many people assume that the Great Depression originated in the United States, which it did not. Many also think the 1929 stock market crash was the source of the Great Depression when it was merely the most obvious symptom of a long-term and slowly growing global problem. In fact, other global markets had already been declining even years before. Charles Kindleberger in The World in Depression 1929 – 1939 (a must read) does an excellent surgical economic and historical dissection of the world economy at the time:

“To the extent that the depression was ushered in by the stock market crash, it was the crash in New York that was of consequence. Canadian prices went higher from 1926 and declined further from their peaks, compared to New York. They were the tail of the dog. European security markets had for the most part turned down earlier: Germany as far back as 1927, the United Kingdom in mid-1928, France in February 1929. The Vienna stock market, which had led the parade in the crisis of 1873, was quiet, waiting for 1931. The action was in New York. It had its effect worldwide, but not through tightly parallel movements in security prices.”

No doubt the spectacular collapse of the stock market in October must have been a stunning blow to many but it was merely reflecting difficulties across the globe in many areas.

In the 1920s Florida saw a massive real estate speculative boom and bust. It makes for a fascinating read since it chronicles a large part of the psychology we saw during this bubble. Much of swagger is gone from real estate pitchmen.

The 4 major issues we are seeing that reflect much of what occurred during the 1920s are: (1) Major housing distress, (2) Global stock markets crashing, (3) Commodities collapsing, and (4) Unemployment surging.

This is part XX in our Great Depression series:

14. Bank Failures.

16. Items That Sold in the Credit Bubble.

17. The All Hat and No Cattle Nation

18. Charity for Financial Deviants.

19. The Silent Economic Depression

Issue Number #1 – Housing Distress

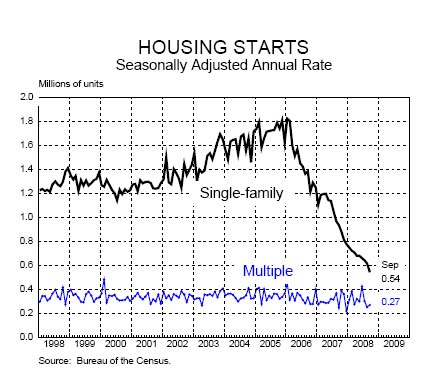

The above chart should be a dramatic demonstration of what has happened to the United States housing market. It has simply come to a screeching halt. A large number of relatively well paying jobs in construction, machinery, and financing of this growth all depended on housing starts growing for the foreseeable future. Even if we are to look at current housing sales trends the numbers still reflect a serious problem:

What you will notice is that lower priced resale homes had a slight jump while newly built homes which have more to do with construction growth and employment have fallen off a cliff. But a more important point to note on both charts above is that you’ll notice peaks in late 2005 and early 2006. This was nearly 2 years earlier than the August 2007 credit meltdown. Keep in mind, the stock market didn’t reach peaks until October of 2007. Once these leading indicators started trending lower it was only a matter of time that the economy came with it. Why wouldn’t it? So much of the newly created industries since 2000 completely depended on the finance, real estate, and the insurance economy (FIRE).

The ultimate sign of pain is foreclosures. These numbers are not encouraging:

September 2008:

Properties with Foreclosure filings:Â Â Â 265,968Â

This was a 12% drop from the previous month but keeps us at a record shattering pace that will see 3 million foreclosure filings in 2008. Some of this drop can also be attributed to new legislation issued in California forcing lenders to delay the foreclosure process. This will only kick the can down the street a few more months.

Prices are still coming down hard. The median California home is now down 41+% from the peak reached last year. Overall housing is not healthy and an economy so dependent on this one industry will have problems.

Issue Number #2 – Stock Market Crashing

Global markets are suffering and this is hitting across every market. What was propping up the emerging markets and many foreign markets was the notion of decoupling. The idea with decoupling is somehow the world was large enough to withstand an economic recession in the United States without missing a beat in growing. Not only is this notion wrong it is being proven utterly without merit. Japan on Monday hit a 26 year low. Iceland goes bankrupt. Trillions of dollars, your dollars are injected into the system to nationalize banks. We are a world couple whether we want to be or not. The global financial system is too interdependent.

The issue at hand is going to test economic philosophies. Many monetarists from the Freidman School believe problems like the one we are currently living through can be solved purely through monetary policy as discussed by Kindleberger:

“Monetarists, such as Milton Friedman, think that the depression of 1929 was no accident. They find the origin in the United States rather than in Europe or the periphery; in monetary rather than real factors; in policy rather than in the nature of institutions or in the tasks required of them; in a national economy rather than in the operations of the international system. Within the limits of U.S. monetary policy, moreover, which excludes the villain of many another analysis – structural dislocation in Europe after the First World War or the failure of the United States to act like a creditor nation, particularly the imposition of the Smoot-Hawley Tariff Act of June of 1930 – they rule out stock market speculation and the delay in passing the Glass-Steagall Act of 1932, which overcame a domestic shortage of monetary gold by allowing the Federal Reserve System to substitute government securities instead of gold for the lacking eligible paper needed as backing for the central bank’s liabilities…

…But Freidman’s explanation of the 1929 worldwide Great Depression is national, monetary, and related to a policy decision. It is unicausal. In my judgment it is wrong. Recently, starting with Allan Meltzer, monetarists have been admitting one international aspect to their analysis: the Smoot-Hawley Act. The concession is slight, however, and the analysis remains almost wholly dependent on the quantity theory of money.”

Current Fed Chairmen Ben Bernanke comes from the monetarist school of thought. In fact, much of his often quoted “helicopter” analogy of dropping money from above comes from this idea. He is a student of the Great Depression and I imagine if he is a true monetarist would adhere to this idea. He is having a chance to put his theory to work and clearly, it is failing. It fails to address the systemic problems infecting the global markets. It also has little impact in commodities collapsing as they currently are. In addition, flooding the system with money would require solvency on borrowers which does not exist. That is why I lean a bit more to the neo-Keynesian model of economics in that at present, if we are to inject money into the economy it should be into to strategic job creation for a larger portion of the population. Many will argue that this is interfering with the market but what the Fed and U.S. Treasury are doing is intervention. We simply have differing philosophies of how to use the funding. I think having one dogmatic philosophy is also dangerous since it misses the scope of the entire situation. Even recently, Ben Bernanke mentioned it may be a good idea for more stimulus checks, a clearly Keynesian point.

Honestly, I am not for stimulus checks. This amounts to a quick jolt into the economy which is quickly sucked dry. I would rather see the funding go to strategic development of new industries and sustainable jobs. Where will this money come from? The same place the $700 billion in easy money for corrupt crony capitalistic banks came from. At least in this move, the larger public will benefit instead of a few corrupt Wall Street banks and lenders who led us into the abyss in the first place.

Issue Number #3 – Commodities Collapsing

Commodities are collapsing across the board. The above chart of oil should give you a major idea of what is happening in the market via demand destruction. When you go from a peak of $147 to $62 within a few months, you can safely say that the market has collapsed.

You’ll also notice that people aren’t too focused on oil anymore. Remember a few months ago when most were clamoring about oil being the number one issue? Well this was simply a distraction from the number 1 issue which is the entire economy is being bombarded from multiple fronts and oil was simply part of the multi-faceted problem. If oil was the main problem, then this current price should be sending stock markets soaring. In fact, the opposite is happening. Take a look at a couple of other charts:

Â

Â

This is demand destruction on multiple fronts. What the Fed and the U.S. Treasury are trying to do is avoid deflation at all costs even if it means sacrificing the dollar. Chances are the Fed will lower rates again which is not good for the dollar. Incredibly, the only advancing item in the last few weeks is the U.S. Dollar:

I would imagine this quick run up is massive deleveraging of those who made large bets on the decoupling theory and need a safe place to stay for the moment. In the end, when you have 60+% of the world reserve currency you still carry a bit of weight around.

A couple of things. Commodity prices sharply declined during the Great Depression as well. They started their decline before the stock market crash. Much of the decline was due to demand destruction. This may pose even a bigger threat to exporting countries. Look at what happened to Russia for example when oil collapsed this year. They had to shut down their market a few times.

Issue Number #4 – Unemployment Surging

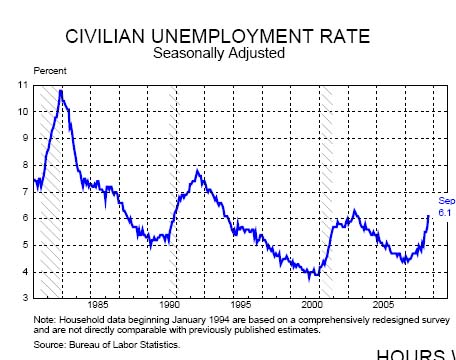

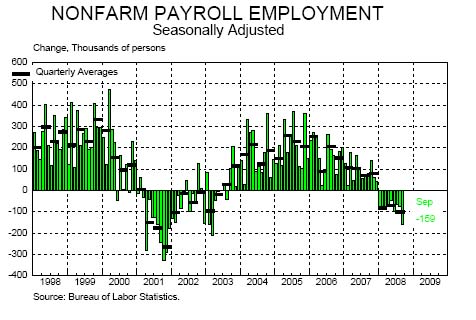

Unemployment is growing at a feverish pace although the above chart will not show it. The true current unemployment rate is more like 11% which also includes part-time workers looking for full-time work and those who have given up looking for work altogether. As a frame of reference, unemployment in early 1929 was 3.1% with slightly below 2 million people unemployed from the work force. In 1930 the number went to slightly above 4 million. 1931 saw the number increase to 8 million. By 1932 the number was at 12 million. In 3 years, the unemployment numbers went up by 10 million people. This was a staggering number even by today’s standards.

This year alone not one job has been added in the aggregate. Last month we saw 159,000 jobs lost:

We are teetering here. It wouldn’t take much to push this over the edge. Already we are seeing massive layoffs across many industries. Yahoo!, Bear Stearns, WaMu, eBay, and other companies are cutting back. The government which employs a large number of people is also cutting back. The few industries that are hiring are simply not big enough to absorb the glut of workers.

This crisis has now spread into every area of our global system. It is important at this point that policies that are taken do not usher in another Great Depression. If we are to fling money at the problem, we should at least ensure that the money is spent on behalf of improving the overall status of the economy and not simply maintaining a failed banking system. We clearly need to rethink things before we launch anymore money into these industries. Calling for price supports is absurd. This was tried in the past and failed. It sounds good but is a gimmick. What we need is a comprehensive new vision of what we expect out of our economy. Blowing one bubble after another feeding on speculation and greed simply breeds a market psychology of greed and instability which in the end, the middle class (should it continue existing) usually has to bailout. Is this really how we want our system functioning?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

19 Responses to “The Four Horsemen of the Economic Apocalypse: Lessons from the Great Depression: Part XX. Housing Distress, Stock Market Tanking, Commodities Collapsing, and Unemployment Surging.”

Nice charts and some interesting data. I tend to agree – not that I think monetarist theory is completely wrong – but like most things there is not one simple answer. Its like Amazon when in 1999 it was at 400$ a share (it eventually fell to 4$ a share). All the credit in the world could not prop it up – it simply was not worth that price – it only got that high due to human EMOTION. The same is true of our housing market, which you have so ably documented. Credit is not income, debt is not wealth. Bernanke’s solution of more credit to alleviate a problem caused by too much credit is misguided. But it is understandable – nobody likes pain, but we’re gonna get it.

The monetarists completely ignore the other side of their equation: stickiness on the part of wages. As described at http://www.dougthorburn.com/newsletters/34-ThorburnFall08.pdf (my client newsletter) in different words, market-clearing prices include those of wages. If the price of everything else is falling in order to sell what is produced, the price of wages must fall as well. Hoover (and then FDR) did everything they could before the invention of the minimum wage to insure that the price of wages didn’t fall–guaranteeing un-sold labor (“unemployment”).

If you’ve got some apples for sale and they aren’t selling, what do you do? Yup–you reduce the price. With apologies to “humanists,” labor is no different. Yet in the ’30s jawboning and public works and unions (today, all of that plus minimum wage laws) do all they can to prevent the price of work from adjusting downward. This, along with an all-too-slow reallocation of labor and capital from real estate and finance into other sectors, may result in a massive increase in unemployment.

This article appeared in the NY Times October 25th.

Talking Business

So When Will Banks Give Loans?

By JOE NOCERA

“Chase recently received $25 billion in federal funding. What effect will that have on the business side and will it change our strategic lending policy?â€

It was Oct. 17, just four days after JPMorgan Chase’s chief executive, Jamie Dimon, agreed to take a $25 billion capital injection courtesy of the United States government, when a JPMorgan employee asked that question. It came toward the end of an employee-only conference call that had been largely devoted to meshing certain divisions of JPMorgan with its new acquisition, Washington Mutual.

Which, of course, it also got thanks to the federal government. Christmas came early at JPMorgan Chase.

The JPMorgan executive who was moderating the employee conference call didn’t hesitate to answer a question that was pretty politically sensitive given the events of the previous few weeks.

Given the way, that is, that Treasury Secretary Henry M. Paulson Jr. had decided to use the first installment of the $700 billion bailout money to recapitalize banks instead of buying up their toxic securities, which he had then sold to Congress and the American people as the best and fastest way to get the banks to start making loans again, and help prevent this recession from getting much, much worse.

In point of fact, the dirty little secret of the banking industry is that it has no intention of using the money to make new loans. But this executive was the first insider who’s been indiscreet enough to say it within earshot of a journalist.

(He didn’t mean to, of course, but I obtained the call-in number and listened to a recording.)

“Twenty-five billion dollars is obviously going to help the folks who are struggling more than Chase,†he began. “What we do think it will help us do is perhaps be a little bit more active on the acquisition side or opportunistic side for some banks who are still struggling. And I would not assume that we are done on the acquisition side just because of the Washington Mutual and Bear Stearns mergers. I think there are going to be some great opportunities for us to grow in this environment, and I think we have an opportunity to use that $25 billion in that way and obviously depending on whether recession turns into depression or what happens in the future, you know, we have that as a backstop.â€

Read that answer as many times as you want — you are not going to find a single word in there about making loans to help the American economy. On the contrary: at another point in the conference call, the same executive (who I’m not naming because he didn’t know I would be listening in) explained that “loan dollars are down significantly.†He added, “We would think that loan volume will continue to go down as we continue to tighten credit to fully reflect the high cost of pricing on the loan side.†In other words JPMorgan has no intention of turning on the lending spigot.

It is starting to appear as if one of Treasury’s key rationales for the recapitalization program — namely, that it will cause banks to start lending again — is a fig leaf, Treasury’s version of the weapons of mass destruction.

In fact, Treasury wants banks to acquire each other and is using its power to inject capital to force a new and wrenching round of bank consolidation. As Mark Landler reported in The New York Times earlier this week, “the government wants not only to stabilize the industry, but also to reshape it.†Now they tell us.

Indeed, Mr. Landler’s story noted that Treasury would even funnel some of the bailout money to help banks buy other banks. And, in an almost unnoticed move, it recently put in place a new tax break, worth billions to the banking industry, that has only one purpose: to encourage bank mergers. As a tax expert, Robert Willens, put it: “It couldn’t be clearer if they had taken out an ad.â€

Friday delivered the first piece of evidence that this is, indeed, the plan. PNC announced that it was purchasing National City, an acquisition that will be greatly aided by the new tax break, which will allow it to immediately deduct any losses on National City’s books.

As part of the deal, it is also tapping the bailout fund for $7.7 billion, giving the government preferred stock in return. At least some of that $7.7 billion would have gone to NatCity if the government had deemed it worth saving. In other words, the government is giving PNC money that might otherwise have gone to NatCity as a reward for taking over NatCity.

I don’t know about you, but I’m starting to feel as if we’ve been sold a bill of goods.

•

The markets had another brutal day Friday. The Asian markets got crushed. Germany and England were down more than 5 percent. In the hours before the United States markets opened, all the signals suggested it was going to be the worst day yet in the crisis. The Dow dropped more than 400 points at the opening, but thankfully it never got any worse.

There are lots of reasons the markets remain unstable — fears of a global recession, companies offering poor profit projections for the rest of the year, and the continuing uncertainties brought on by the credit crisis. But another reason, I now believe, is that investors no longer trust Treasury. First it says it has to have $700 billion to buy back toxic mortgage-backed securities. Then, as Mr. Paulson divulged to The Times this week, it turns out that even before the bill passed the House, he told his staff to start drawing up a plan for capital injections. Fearing Congress’s reaction, he didn’t tell the Hill about his change of heart.

Now, he’s shifted gears again, and is directing Treasury to use the money to force bank acquisitions. Sneaking in the tax break isn’t exactly confidence-inspiring, either. (And let’s not even get into the less-than-credible, after-the-fact rationalizations for letting Lehman default, which stands as the single worst mistake the government has made in the crisis.)

On Thursday, at a hearing of the Senate Banking Committee, the chairman, Christopher J. Dodd, a Connecticut Democrat, pushed Neel Kashkari, the young Treasury official who is Mr. Paulson’s point man on the bailout plan, on the subject of banks’ continuing reluctance to make loans. How, Senator Dodd asked, was Treasury going to ensure that banks used their new government capital to make loans — “besides rhetorically begging them?â€

“We share your view,†Mr. Kashkari replied. “We want our banks to be lending in our communities.â€

Senator Dodd: “Are you insisting upon it?â€

Mr. Kashkari: “We are insisting upon it in all our actions.â€

But they are doing no such thing. Unlike the British government, which is mandating lending requirements in return for capital injections, our government seems afraid to do anything except plead. And those pleas, in this environment, are falling on deaf ears.

Yes, there are times when a troubled bank needs to be acquired by a stronger bank. Given that the federal government insures deposits, it has an abiding interest in seeing that such mergers take place as smoothly as possible. Nobody is saying those kinds of deals shouldn’t take place.

But Citigroup, at this point, probably falls into the category of troubled bank, and nobody seems to be arguing that it should be taken over. It is in the “too big to fail†category, and the government will ensure that it gets back on its feet, no matter how much money it takes. One reason Mr. Paulson forced all of the nine biggest banks to take government money was to mask the fact that some of them are much weaker than others.

We have long been a country that has treasured its diversity of banks; up until the 1980s, in fact, there were no national banks at all. If Treasury is using the bailout bill to turn the banking system into the oligopoly of giant national institutions, it is hard to see how that will help anybody. Except, of course, the giant banks that are declared the winners by Treasury.

JPMorgan is going to be one of the winners — and deservedly so.

Mr. Dimon managed the company so well during the housing bubble that it is saddled with very few of the problems that have crippled competitors like Citi. The government handed it Bear Stearns and Washington Mutual because it was strong enough to swallow both institutions without so much as a burp.

Of all the banking executives in that room with Mr. Paulson a few weeks ago, none needed the government’s money less than Mr. Dimon. A company spokesman told me, “We accepted the money for the good of the entire financial system.†He added that JP Morgan would use the money “to do good for customers and shareholders. We are disciplined to try to make loans that people can repay.â€

Nobody is saying it should make loans that people can’t repay. What I am saying is that Mr. Dimon took the $25 billion on the condition that his institution would start making loans. There are plenty of small and medium-size businesses that are choking because they have no access to capital — and are perfectly capable of repaying the money. How about a loan program for them, Mr. Dimon?

Late Thursday afternoon, I caught up with Senator Dodd, and asked him what he was going to do if the loan situation didn’t improve. “All I can tell you is that we are going to have the bankers up here, probably in another couple of weeks and we are going to have a very blunt conversation,†he replied.

He continued: “If it turns out that they are hoarding, you’ll have a revolution on your hands. People will be so livid and furious that their tax money is going to line their pockets instead of doing the right thing. There will be hell to pay.â€

Let’s hope so.

Is anyone shocked by this revelation? Now we know what the $700,000,000,000 was ment for, bank mergers & not to help Joe the plummer.

Nice post Sean. Let’s not forget that Dodd, Pelosi, Reid, et al are the keys players for why we are seeing all of this in the housing market. Loaning

money to folks via the CRA during Carter, then Clinton forcing banks to

loan to folks that could never repay is why we are at this juncture.

Govt is never the solution, it is always the problem. This will not be the

only bailout. There will be many more attempts to prop up the economy and

housing and all will fail. Taxpayers will revolt once the massess figure out

what a sham this is and will continue to be. Great post Doc. The end is near. Hang on everyone, it’s gonna be a wild ride.

PrevenTragedy has it right. We’ve screwed up labor prices so much in this country that it’s either a living-large wage or unemployment, nothing in between. But the monetarists DO know that, Friedman even wrote against the minimum wage for that very reason.

Still, Bernanke’s biggest mistake is that he’s fighting like it’s 1931. It ain’t. In 1931 the government had very little debt and could afford a little stimulus, today government debt is the problem and every attempt at governmetn stimulus is another nail in the coffin.

CRA did not bring about this downturn in the global economy nor bring about the problems in the housing market. Read: http://www.businessweek.com/investing/insights/blog/archives/2008/09/community_reinv.html

Funny how the week of 7-14 ushered in both the bear market rally in the dollar and a commodity collapse. I think something else is afoot. Some sort of treachery. I’m smelling a US debt default relatively soon. Realistically, it can’t ever be paid back, so might as well string it along for a while.

Good article. Go to whatdoesitmean.com for critical international news concerning the US. The economic crisis is part of a planned facist coup taking place. Here comes the north american union and rescue currency amero. All part of the march to the new world order. Notice to elite/illuminati, game’s up creeps. See you on Pentecost 2012, you know the place and purpose of the meeting. Regards from Enoch……………the remnant

an optimistic opinion:- problem-reaction-solution.

pretty simple really. but most are falling for it.

only people can create their credit.

what is going on is literally one giant shell game; problem is there is no peanut under any of the 3 shells that are being moved around.

the game involves only those who can add, subtract, multiply and divide the numbers 1 to 10.

any game needs players, but remember from whom the rules are made by.

anyone who has played the game ‘Monopoly’tm will recall that the banker participates but never loses ‘his’ position.

Now 99% of everyone today is in reality going around the ‘Monopoly’tm board.

One does not have to ‘buy’ Park Lane, the ‘electric company’, a ‘train station’, but one may fall upon a ‘chance’ and one will have to go by that ‘chance’; it may even mean ‘jail’ or ‘gaol’. The longer the players stay in the game circulating around the board, the greater the chance of foreclosure/ bankruptcy in the end.

The game decides whom, in the end, will have everything and all control; even hold more “notes” than the banker.when that is achieved the game is over and no one else can play. Then it is time to start the game a fresh or play another kind of game called ‘Chance’.

That is just how it is.

Before I knowed it, I was sayin’ out loud, ‘The hell with it! There ain’t no sin and there ain’t no virtue. There’s just stuff people do. It’s all part of the same thing.’ . . . . I says, ‘What’s this call, this sperit?’ An’ I says, ‘It’s love. I love people so much I’m fit to bust, sometimes.’ . . . . I figgered, ‘Why do we got to hang it on God or Jesus? Maybe,’ I figgered, ‘maybe it’s all men an’ all women we love; maybe that’s the Holy Sperit-the human sperit-the whole shebang. Maybe all men got one big soul ever’body’s a part of.’ Now I sat there thinkin’ it, an’ all of a suddent-I knew it. I knew it so deep down that it was true, and I still know it.

The Grapes of Wrath

Just give Obama the opportunity to declare carbon emissions to be a form of pollution (as he has promised) and wait to see the EPA call on the horsemen…

“…a few corrupt Wall Street banks and lenders who led us into the abyss in the first place.”

The first problem to address is the corruption.

No economic theory in the world will work as advertised until the criminals are put in prison and the mechanisms put in place by the criminals and used by the criminals to use the economy like it is a stolen debit card are deconstructed.

Who ensured that soaring leverage was made available?

Who loosened lending standards?

Who brought about the unregulated nature of the CDS market so it was a roaring bucket shop operation?

Who ignored infractions of regulatory rules such as naked shorting and failure to deliver?

Don’t say “Wall Street” or “the politicians”.

Who were the “cheerleaders” that brainwashed the purposely dumbed-down populace with phrases like “ownership society” and ideas like “housing prices never go down nationally”?

There are specific individuals who made sure this crash would happen.

Although congress critters as a whole merely introduce/sponsor/vote on the legislation that paved the way.

There are specific congress critters used as “go to guys”. The Congressional Record will provide the evidence of who they are.

Lawyers for banking interests were directed by key individuals to write the legislation.

Lobbyists for banking interests were directed by key individuals to bring it to specific congress critters for introduction.

Key banking individuals use the corp/gov revolving door to gain access to the Treasury and Fed…either themselves or someone they control.

Although it’s been quite a while since GATT and NAFTA, the resulting hollow economy in the US was the ONLY major result. That was the intention. That led to susceptibility of the economy to the later actions of ratcheting up leverage, loosening lending standards, spreading debt risk like a cancer with derivatives, etc. The results we see are the only way it all could have gone.

It doesn’t take a PhD economist to see the obvious. Of course, inability to handle the truth will lead one to finding lame excuses in order to not face the truth. After all, what good is a degree if it doesn’t apply to the current truth? In order to justify that degree economists will come up with excuses.

Excuse #1? They must be incompetent.

Excuse #2? They just used the wrong economic theory.

The criminals are at the controls. As long as they stay there, nothing will work the way “theory” says it should….any theory.

Some are now looking past the Great Depression to the American Revolution. We are in unchartered waters, as the financial system here and around the globe is teetering. 1000 point swings on the DOW are becoming more commonplace. C’mon, something has to be brewing. Real estate is way overvalued still, as the world reasses all of the overspeculation. If you look at the RATE of decline in the stock market, we have already exceeded the Great Depression.

Oh, but it couldn’t happen here, because my neighborhood is different…

http://www.westsideremeltdown.blogspot.com

We tried emptying out “sick” wages. What we got was WalMart and Pico Rivera RHGs. It wasn’t unionized American workers who let somebody sign on the dotted line for $425,000/11 times median community income for crapshacks, profiting both from toxic sales and from reselling the toxic debt to be traded as derivatives.

~

It was banks. It was speculators. It was the high finance class, that gets richly paid to skim the cream off of others’ productive work, and who think that playing accumulation games with Monopoly money is the apotheosis of economics and civilization, while fair wages for real work are anathema. It was the people who quote Ayn Rand. Not Tom Joad or Gene Debs.

~

People were observing the bubble-features of this mess back in 2003, 2004, 2005, 2006…it was only through acts of willed, expensive-doctrine ignorance that it was ignored in favor of trying to squeeze the last penny out of anything that could be made to look like a teat. Doc, that’s how I began reading your old blog, looking for people who weren’t drinking the Moo Juice.

~

One of my big issues was the talk of “decoupling” coming out of the mouths of the same people who were cobbling together the global FrankenEconomy, against which no one was supposed to utter a peep of dissent because it was so Globally Unified In Progress. (So it was gonna Nationally Decouple In Regress? No, it was always intended that a small class of global plutocrats call the shots and take everybody’s jewelry, then get the lifeboats when the Titanic noses downward. This election year I’m spozeda be all happy becaues the billionaires running the game are, apparently, Democrat-leaning?)

~

I want to comment on Doc’s points about monetarists, and Bernanke’s BlingCopter. We already know that money is debt, that banks create new money out of debt, and that the only thing backing our fiat currency is the debtor’s agreement to pay the debt back. The debtor agrees to go into society and find enough money there to send to the banks, money that originated with other banks creating other debt.

~

I have no idea how this can work logically–to me it’s like a snake that eats its own tail turning into a hydra that eats all ours. But anyway…this debtor-agreement to repay was formerly a firm backing. Now that’s questionable as foreclosure becomes a mass movement…encouraged by the banks who encouraged the loans/minted the funny-money. I mean, the now game in town is financiers LITERALLY betting on who is going to fail first. The fiat currency backed by belief is now backed by statistical probabilities of crashing and burning.

~

This is why the bailouts don’t, as some have suggested, hand out the trillion dollars in equal shares to each American. Money is debt, and only through more debt can we have more money. So Bazooka Hank and Ben want to give already existing/created money to banks, to fuel the creation of more debt, i.e. money. Like Doc, I think the trillion should go toward a new sustainable economy. Or at least we should put a black box in an Iowa field and say, “OK gang, this is where our money is now coming from. Fairies did it.” Anything other than what’s happening.

~

For as Sean’s posting notes, the banks are NOT going to be loaning that money out. Why should they? ***IT’S NOT HOW THEY WORK.*** Banks don’t make loans from money they have, they make loans out of thin air, based on this manipulatable thing: mass belief.

~

THE PAULSON PLAN RELIES ON PEOPLE–and New York Times reporters– MISUNDERSTANDING WHAT MONEY IS AND WHERE IT COMES FROM. It always did. This plan is what it was intended to be: wealth concentration, aka, robbery.

~

Manipulatable mass belief backs fiat currency. Belief that it’s important to go into debt to buy things you’ll never afford on YOUR salary (health care, housing, education, food) because those things will actually make your life better someday/somehow. Our entire monetary system rests on the willingness of people to speculate on that powerful formula: things and experiences equal happiness.

~

Sometimes there is a correlation between the thing and the better life, but we all got into trouble believing that having certain things EQUALED the better life, and the more stuff you had, the better your life was, even (especially) if the stuff was bought on debt. Which meant you could devote yourself to accruing things, rather than working for them. Especially since people with a lot of money and degrees would argue that your wages were too high, even though you haven’t been able to afford much of anything since the ’70s. So live in your house for a year, and flip it for far more than your local median income, and buy yourself a jacuzzi–what the hell, you’ll never get ANYTHING working for a living.

~

Doc, I argue this reflects a kind of rationality. Not the kind I like, but understandable. It’s hard for individuals and households to argue against that, especially when the things that really make a better life–dignified meaningful employment, health, community–are taken away from them in the rush to auction everything off to the highest bidder.

~

Sorry for all the capital letters. Shift key’s getting a workout these days.

~

rose

Cumpas rose, are you reading my mind again?

Hi Doctor,

used to be you were one of the few preaching the fall of the empire. Have to admit, with the mainstream media finally “getting it” I visit your site less often.

>

America moves closer and closer to the left. National healthcare, to nationalized banks (with buddies and girls too!). A living minimum wage. All nice stuff…. yes indeedee, I like it!

>

Too bad we don’t have the guts to pay for it. Instead put our kids in hock to the Chinese and Arabs.

Wages aren’t the only sticky thing in adjusting downward. Houses of course are sticky, but heck RENTS are sticky even. Have you ever signed a year lease? Rents are sticky until there is turnover (old renters moving out, new renters moving in) come to think of it it operates in much the same way jobs do! Anything you buy a year or more at a time is sticky (think insurance also).

So I don’t get the argument that only wages are sticky. But I do get why no one wants to take a pay cut when none of their living expenses are declining with the exception of gasoline!!! Really, when have you actually saw something that constitutes a cost of living GO DOWN in price? Houses that are still out of the price range of the vast majority of people, don’t really count for much.

I guess the whole sticky wages thing is Keynes. Well yea, but he was talking about the Great Depression where we had 1) unions keeping wages much more sticky than lack of job market turnover will (as I said lack of market turnover is no more sticky than lack of renter turnover for instance) 2) REAL DEFLATION. I’m very doubtful we have any resembling real deflation now. We do have crashing asset prices. In the Great Depression the cost of living actually went down (which didn’t help much if you were unemployed but ….)

A few economists and social scientists, with a hundred subjects to interview, could probably find out what jobs are vanishing quickly, and find out some possible ways to put these people back to work, even temporarily, using their skills to benefit us. A carpenter could do some time as a handyperson, and tax money could be used to have them fix old folks’ homes. There are things like roof-repair loan programs — use that as a prequal to hire a subsidized crew. There are probably a lot of decent ideas out there, that could cushion the effects of this recession.

We don’t even need to “give” them the money – you can loan it to them at zero interest, but with monthly payments after a while.

Here are three statistics as food or thought:

Unemployment will exceed that of the Great Depression > 26%.

S&P Dividend Yield will exceed that in the Great Depression >16 %

The dollar is the world reserve currency because of 10 Carrier Battle Groups. No other country has even one. We control the oceans and thus the world’s single common key economic ingredient: oil.

That’s just the way it is.

Leave a Reply