The double-edged sword of low interest rates – In the last five years the drop in interest rates has made a $500,000 mortgage carry monthly costs of a $350,000 mortgage back in 2007.

I recall talking with someone about purchasing a home near the peak of the bubble. The funny thing about bubbles is that like a game of musical chairs, you rarely believe you will be the last one standing with no chair. Professionals in the housing industry understand how important emotions are in purchasing a property. This person eventually bought even after having a solid and thorough analysis of the market at what would be close to a peak. Underlying it all was this sense of urgency to purchase because of a fear of missing out on lost appreciation. This year I’ve noticed this same psychology playing out in Southern California. Even in say 2006 when prices were looking frothy, if you bought you had a window in 2007 to exit with a nutty price. Today appreciation is going to be capped for a few reasons and we are entering another pool of uncharted waters.

Go ahead and buy but don’t call it an investment

As Robert Shiller carefully highlighted in his research housing typically tracks the overall rate of inflation. Not exactly a stellar investment but so what if you only plan on using it as a place to live. Even back in 2006 I would have people try to rationalize their purchase and they would ultimately ask, “should I buy?â€Â Buying a home is a very personal decision and likely the biggest purchase you will ever make. But if you do not plan on being a landlord, you should not examine your primary home as some sort of investment. The market today has some new interesting factors in play.

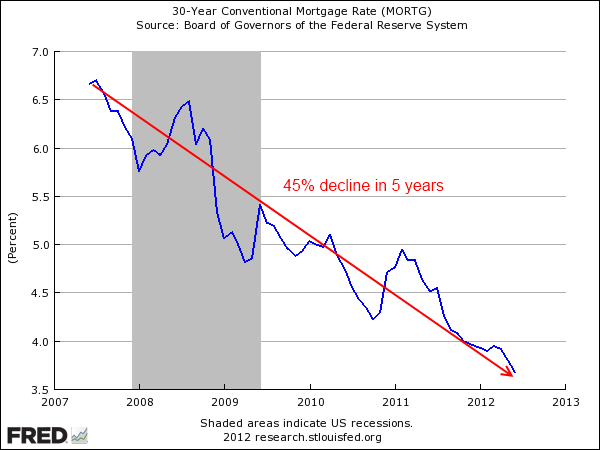

First, these low rates are an anomaly and the drop is astounding even if we only go back five years:

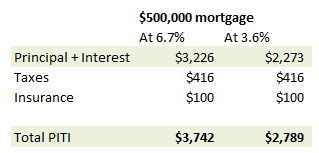

The typical 30-year fixed rate mortgage has fallen into the 3.6 percent range. Compare that to 6.7 percent only five years ago. How big of a difference does this make? Take a look at a scenario for a $500,000 mortgage:

The difference is a payment of $3,700 and $2,700. That is a massive difference. To put this into a more direct perspective, a $500,000 mortgage at 3.68 percent would have a similar PI as a $350,000 mortgage at 6.7 percent. These low rates in other words have pushed purchasing power so high, that the increase in a place like Southern California has caused leverage to jump by $150,000. That is enormous. This is nearly the median price of a US home.

More importantly however is that this low rate environment is being caused by weak economics and declining household income. That is actually the bigger economic story. It would be one thing if overall household incomes were increasing and the economy was actually becoming healthier organically. Yet that is not the case. Here in California we have many years of major budget deficits and a big tax vote coming up this November. Underemployment is near 20 percent so these items will add pressure to housing prices rising.

Yet the big cap on appreciation is the low interest rate. As noted above, the 3.6 percent mortgage rate has given an underlying boost of $150,000 when looking at a $500,000 mortgage. Since many are apt at pointing out lease equivalents, are you willing to pay $150,000 more in face value just so you can have a comparable place that you would rent? This is fine actually. Yet many should be aware that they are going to be locked in for well over a decade if a scenario like Japan plays out. I believe a Japan like scenario is the best case given our current economic situation. Look at Europe to see what happens when interest rates suddenly spike. At this juncture, the current housing market wouldn’t even handle the rates last seen five years ago.

Nationwide a bottom is being found but we are talking about a median home price of $180,000. So run the numbers for someone buying an $180,000 home with 10 percent down:

$162,000 mortgage

@6.7% PIÂ Â Â Â Â Â Â Â Â Â Â Â = Â Â Â Â Â Â Â Â Â Â Â $1,045

@3.6% PIÂ Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â $736

This is a big boost for your typical US household pulling in $50,000 a year so it should be no surprise that nationwide prices are going up. In essence, the PI portion of the housing payment has fallen by 30 percent in conjunction with the actual face value falling over 30 percent since the peak.

I was noticing bidding wars picking up again this year in Southern California. Banks leaking out shadow inventory have created an artificially low supply of inventory in which low interest rates have created a boost in leverage. Let us examine what is going on in the market right now by looking at three pending sales in Pasadena in various price categories:

Pending sale number 1

1433 El Sereno Ave Pasadena, CA 91103

3 bedroom, 1 bathroom, 1 partial bath, 1,034 square feet, Single FamilyÂ

List price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $230,000

Sold for $435,000 in 2006

Pending sale number 2

550 East Elizabeth Street Pasadena, CA 91104

3 bedroom, 2 bathroom, 1,643 square feet, Single FamilyÂ

List price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $435,000

Sold for $803,000 in 2006

Pending sale number 3

1646 Sierra Madre Villa Pasadena, CA 91107

3 bedroom, 2 bathroom, 1 partial bath, 2,951 square feet, Single FamilyÂ

List price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $999,000

Sold for $1,190,000 in 2005

Good deals?

When you do your analysis do not forget opportunity cost. If you put down $200,000 as a down payment that is money that could be invested elsewhere. Presumably if you are buying a million dollar home you understand a little bit regarding opportunity cost. It should be clear that low interest rates are likely to keep a lid on any sustainable appreciation moving forward short of household incomes actually improving (this would be very positive). And any investor is not going to treat a home like number two or three as a lease equivalent option. Why? First, you have vacancies and even one month of it being empty to transition renters will eat $5,000 to $6,000 of carrying costs. In addition, California is not a landlord friendly state. Say you get a tenant you need to kick out because they stop paying. You still have to pay the bills. There are many other items we can discuss and property investors understand this very well. You do not treat your primary residence as an investment.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

83 Responses to “The double-edged sword of low interest rates – In the last five years the drop in interest rates has made a $500,000 mortgage carry monthly costs of a $350,000 mortgage back in 2007.”

I have heard that once the full investigation into the libor scandal is complete, that mortgage interest rates will be forced up to where they should really be. If this its true, then I would expect to see a dramatic drop in home prices as most people can barely afford their monthly mortgage payment add it is.

Spot on…it is hard to argue that the banks have their footmon the throat of the housing market. For years the national association of realtors lobby group has kept the banks out of real estate, they couldn’t get approval to buy and sell real Edgar and give loans at the same time…but now look what these bankstas have done!

They can move the market with inventory control, and interest rate control. This is bad news for an industry that was truly one of our legs in a four legged stool along with construction, services, and manufacturing. Hard to argue real estate was truly a free market…now controlled by banks, and our lame government regulations created by legislators on the dole. It is all pretty disgusting to say the least!

If true the FED would just change Operation Twist to Operation Twist with a dash of Libor to compensate!

I heard from Captain Obvious that once the full investigation is done, nothing will materially change whatsoever. A few underlings will be hoisted on the gallows but all in all, no crime will be found to have been committed by anyone in charge.

Buy the rumor sell the news.

Well it seems to me it was banksters doing what the government basically would have done if it could have anyway. So you can say it’s particularly evil because it’s banksters (I have no love of them), but it really seems the policy everyone wants anyway: extremely manipulated interest rates and who cares if someone holding cash or on a fixed income takes it in the shorts.

The “other edge” of the double-edged, interest rate sword is your homeowner’s insurance premium. Hasn’t anyone noticed that these are going through the proverbial roof? Not that surprising when one considers that the insurance companies are now getting next to nothing in interest on their fixed income inverstments (T-bills/notes/bonds). So (suprise!, suprise!) they are making up the difference by jacking up premiums at double-digit annual rates.

As I have noted before, “What the ZIRP giveth with one hand, it taketh with the other”.

I must say that I seem to come from a different perspective than the majority of people who post comments on this blog. I am a finance guy that is interested in the economics of the housing bubble. I do not read this blog or the many books on this topic to find out if it is a good time to buy. I look at the housing market minus the emotional foggy lenses.

I am amazed at comments containing statements like “median numbers are meaninglessâ€. Really? So, what these commenters are saying is that we should ignore the data that we have and focus on marketing slogans. “There is a lot of money out there†or “the rich Chinese investor are buying up all the houses†blah, blah, blah. I have even heard “supply and demand has nothing to do with this marketâ€. You have got to be kidding me. There really seems to be a desire to brush aside the math and focus on emotions. Short term that may work but in the long term decisions based solely on emotions usually do not end well. Case in point is that I work in Silly Clown valley and the majority of folks I work with were multi-millionaires at one time. Now they are worried about how much they spend on lunch.

I welcome all the greater fools who want to purchase a 30 year prison sentence of poverty and immobility. Dumb new money making bad investments is not new either. I remember the rich Japanese buying up various US “investments†and we thought they were taking over the world. How did that work out? The rich Chinese is just a remake of the old rich Japanese movie I saw in the eighties. I already know how that ends. A fool and his money will soon be parted…

In a controlled market the median is meaningless. The banks simply hold onto the lower cost housing thus the median rises. This gives the effect that prices are rising when they are not.

There is a difference between median sales and median values. The reality is that both are manufactured but what do you purpose that we use to evaluate the “market”? The real problem is that everyone is explaining away the numbers for one reason or the other. At the end of the day, there is almost always a double dip in a collapsing market. Look at a NASDAQ chart in 2000 through 2002 or at the Dow 1929 through 1935. I will take the numbers at face value and argue that this is a normal collapsing market. The attempt to control the collapse is only slowing the process in some areas.

” Look at a NASDAQ chart in 2000 through 2002 or at the Dow 1929 through 1935.” Good point What? I’ve spent time studying bear markets, and the run up preceding them. The run up in housing was unprecedented and with all the speculation and fraud involved, it’s very likely we will have a similar 1935 correction. “Extend and Pretend!”

I think perhaps your threshold for amazement is preternaturally low.

It’s just a plain vanilla observation that the supply side of the equation is being aggressively manipulated by the banks holding the notes on houses — particularly those with second liens. This skews the supply/demand curve and prevents anything like organic price discovery.

I guess if I used big words it would make me right… I agree that the housing market is being manipulated but the housing market has been manipulated for more than just the past 5 years. The banking system has been manipulated since its inception. So, do we now say that supply and demand have nothing to do with this market? “Vanilla” Econ 101 tells you that taxation affects supply and demand curves. Does this mean that if you tax a market supply and demand will no longer apply? I can wait for your “loquacious†response…

I never suggested “supply and demand had nothing to do with the market” — don’t attribute that to me. What I am suggesting is that the aggressive manipulation of both supply and demand in RRE goes well beyond the scope of any of the ‘usual’ fiscal/monetary policy tools, (extended ZIRP; attenuating foreclosures; amnesty for banks; accounting gimmickry, etc.). The result is manufactured disequilibrium and the obstruction of true price discovery.

Hopefully this was prosaic enough for you. I can understand how polysyllables might enrage.

Really? Read the following and tell me about unprecedented.

http://econintersect.com/wordpress/?p=12970

You mean to say that there was no manipulated market before?

“There really seems to be a desire to brush aside the math and focus on emotions.”

I’ve noticed over the years that there are a lot of people here that are really really angry about the California housing market. Some of this no doubt due to chronically overpriced homes compared to most places in the nation. Some of it is frustration at housing price that seem to inflate faster than you can save money. A lot of it is schadenfreude, no doubt.

I certainly have shared in some or all of these feelings, but after buying a house in 2010, I am no longer really interested in seeing other home owners suffer for their ill gotten gains. This by the way, is not an example of wearing another man’s shoes — I don’t hold a mortgage and am probably paying much higher property taxes than my neighbors, and don’t look at my house as an investment, instead a liability — but rather an example of the resolution of my long burning dissatisfaction at having to live like a grad student for quite a bit longer after getting my degree than I thought could ever happen.

I have a house. I can do what I want with it. If I want a better house, I could buy that instead, but I like my house. So, I am satisfied. What the other 50M nuts in the state do, I no longer care. I wasn’t upset with the nonsense that is the CA real estate market — and it is utter complete raving lunatic nonsense — I was dissatisfied with my inability and powerlessness to do what I thought I should be able to do.

It would not surprise me to learn that your last sentence is the quintessential definition of the really really angry feeling people have toward the CA real estate market.

California is protected by the large number of government employees, who will draw a salary even in the worst of times. (Starting salary for a fireman in Alameda, CA. is $96,000. a year.) This provides a solid base for appreciation over the next decade. People do not suddenly decide to sell if prices in the area are flat- they just hang on, paying the mortgage (You have to live somewhere.)

That is one of the major problemas. $96 grand for an entry level job. Gimme a break. The Wave of City and County Chapter 9 Bk actions will follow suit. The economics of $96 grand for an entry level job with out much post secondary education seems a bit odd. Also, I can’t help but think there’s ample opportunity for a little corrpution at those levels. I’ma a progressive but when I challenge the uppty fireman on my dog walk he whines and snivles about how it’s not his fault they forced him to take $200 grand last year including overtime because of “hiring freeze”. Can you spell V-O-T-E-R R-E-V-O-L-T ?

Oh you’ll be hugging him when those Alameda hills catch on fire and he saves your house. I would sure like to see the verification of 96K as the entry salary for a fireman. Sounds suspect to me.

See San Bernardino, Stockton, and Mammoth Lakes…

Umm, wait a minute. If the “solid base for home appreciation” is based on overcompensated state employees we are in REAL trouble. See Greece for an example of too many overcompensated employees on the government dole…this is where California is heading!

Do you think all those crazy=paying jobs are going to last when California is broke Bobby?

LA Fire has had a hiring freeze since 2009, they just announced a limited # of new postings. They got over 4,000 reply’s in less than a day. You actually have to hire them in order to get them to spend money.

Most cities in California are cutting back. Some cities in So Cal have plans to or already cut several jobs. Most cities are switching to on call contractors for previous in house jobs. Check any town out and see how many of these civil services jobs have been outsourced with contracts for as-needed services.

Out of any public employee, I would not pick on the fireman. They deserve every penny. Who else will run into a burning structure? Not a cop, I’ll tell you that.

But on that note, you’re correct all other employees are paid and benefited way to much.

Papa, they just don’t run into any burning building. That’s probably one of the myths the unions created If the situation is deemed too dangerous, they don’t go in. Period!

Papa, I believe the vast majority of calls firemen respond to involve medical emergencies; very few calls involve actually running into a fire. A cops job likely involves far more danger, if one wants to compare apples to oranges.

A close relative of mine is a long term resident of a pricey SoCal beach town. Many of her neighbors are retired fire or govt personnel; most live ocean close in very nice homes, many have income property. They receive generous govt pensions and will spend regardless of the economy. They are nice neighbors, but their world is different; they get a big guaranteed check and bennies whether the economy booms or busts. The only complaints she hears from these folks usually involve their grown kids who can’t find living wage jobs, move back home, and/or require long term financial support.

You have bought into the propaganda of selfless heroes charging into burning buildings. It’s a myth. These perfumed princes of the public sector are not our Dad’s firemen. They are union feather-bedders.

The injuries they play up invariably involve rural, volunteer firemen and part-time guys on the fire line at Cal Fire Service. [Your heroes despise these people/”scabs.]

The calls they respond to are overwhelmingly medical assistance calls. They are the problem. They encourage nonsense calls for service to pump up their stats. Fire them and hire Mexicans.

Becoming a fireman is joining a frat where you have to deal with shaitty situations 2-4% of the time while packs of retarded women (and some men) fantisize about being saved by you emotionally.

I’d give more cred to cops if they didn’t spend most of their time shaking down the citizens who pay their salaries with chickenshait rolling stop and front license plate tickets while 911 callers end up with little to no response to emergency situations.

UH Papa you might want to do a quick search on police officer saves before you slander the profession.

It’s not just that. So many factors twist California’s housing market into an overcrowded, overpriced perma-bubble:

*International and local speculators

*Shadow inventory – creating a false shortage

*Rent control and Prop 13 – keep property turnover articially low

In the case of Prop 13, elderly and retired Baby Boomers never downgrade to smaller residences because of the property tax hit. Oftentimes they are overwhelmed by the upkeep of their own residence and/or blissfully unaware of it’s worn-out interiors. When the house eventually goes on the market it’s dated and/or a wreck. That’s even if it goes to market before they die in it.

Meanwhile, you have poor immigrant families down the street with parents and children living in cramped one-bedroom apartments.

Not true. Age 55 or older can transfer the property tax amount to next purchase. See prop 60 and 90.

Nancy,

You are right . You describe my mother’s situation to a tee. We fully expect to remove her cold body from the dated house she has lived in since 1973. Her prop 13 taxes are low- less than I will spend on textbooks this year for my daughter in college. The house will be ready for the D-9 treatment ( as in Catepillar) when she’s gone.

Matt forgot that only applies if you stay in the same county. If you go to another one, that county has to specifically allow the transfer. Some do, but if things get worse for them, money wise, they will rescind that transfer credit offer soon enough.

Are you talking about poor immigrant families that receive “unearned” free education and healthcare that the elderly have paid for their whole life and the taxes paid for “poor” immigrants from othercountries ie”leeches and parasites” to pay their expenses , while the elderly and and retired boomer’s own children are told by the government freak narcissistic educators, not too have children or maybe one or two reducing our paying tax base further.

Stick your criticism of citizens who have worked, lived modestly and saved their whole life. Why do you mock that they don’t spend borrowed money on granite counter tops that you, a broke fool, are accustomed to.

quitclaim is an ingrate that speaks of parent in the most degrading way, for shame.

I am not retired nor a retired baby boomer.

Parents better watch their backs with creeps like this for children.

You are talking out of yer arse. 90% of your post is speculative rambling with narry a shred of logic or evidence.

Stop believing the typical FAUX news garbage.

This is from my own observation. Must be nice to have bought a house decades ago. You won the lottery!

Regardless of whether you are for or against Prop 13, you cannot deny that the discrepancy between that and all other taxes has had a significant affect on the real estate climate today.

It is absolutely true housing only tracks inflation over the long run. The million dollar question is, which inflation statistic do we use? The original metric from the the 70’s or the newer one from the early 90s or the latest one developed in the early 2000s? The latest and current metric shows inflation at 1 or 2%, the one from the 70’s more like 5%.

Everything that is real and cannot be massed produced in China seems to track the original inflation metric from the 70s, like health care, housing and commodities in general.

Building a house use to be done with union labor and the country functioned just fine and houses were affordable. Given that today houses are mostly constructed using unskilled labor and lots of illegals, and the use of cheaper materials (including fixtures made in China), houses should be even cheaper (after inflation) than they were years ago, but they are not. I know that houses are much bigger these days but when you go by square footage the argument still holds up.

I agree prices are out of line in the bubble markets but I also think inflation is higher than the government states. http://www.shadowstats.com/

It only tracks it in a healthy economy. This what we have now…is not a healthy economy.

“You do not treat your primary residence as an investment.”

BUT YOU SHOULD! It’s your money and when you sign up at the bank, they are your landlord and you will pay double the purchase price so if you can’t rent it for your costs, run buyer run, fast!

The house is a depreciating asset. The land is not. I would consider a SFR consumption rather than an investment the same way I consider a car consumption not an investment…

A car is a means of conveyance. It is overhead — just like rent or food or fuel.

The car is a depreciating asset. The building is a depreciating asset. Both could be considered “overhead” or fix direct expense depending on the use. None the less, what does that have to do with the economic statement that shelter is consumption as is transportation, food, clothing, etc.?

A car could be considered an investment in that it ensures ready transportation to stuff like jobs. Let’s bicker back and forth about this though for several days. That’ll be cool!

How did that work out in Vallejo, CA; Stockton, CA; Sn Bernardino, CA?

“When you do your analysis do not forget opportunity cost. If you put down $200,000 as a down payment that is money that could be invested elsewhere.”

OK, but who is making any decent returns in the market these days given current interest rates? We have paid our investor guy a percentage to break even over the past 3 years, and my MBA sister says to get out of the market until Europe settles down. Might as well plunk my savings back into a house, for the reasons stated in this article but also as a hedge against long-term inflation (which I believe is currently under-reported and will be led by energy prices and climate-related food shortages).

In july 2009, gold was $900. Today it is $1600.

Gold is a bubble destined to burst also!

Gold hasn’t gotten to the bubble phase of this run yet. When it does its price will be truly astounding. Right now it’s merely pricey. When it breaches 2300 the bubble starts.

Here in Oakland, the number of active listings of SFRs has been dropping almost continuously since last year, and is down to 369 (per Redfin, as of July 23). For June, inventory was down 52.5 percent and median sale price was up 39 percent vs June 2011, and I suspect the numbers will be similar for July (except inventory will be down by an even greater percentage).

As for foreclosure inventory, here are some numbers from realtytrac for SFRs in Oakland, as of July 28:

REOs: 1,692 (only 34 of which are on the market, per Redfin search, 7/30/12)

Preforeclosure: 1,129

Auction scheduled: 850

So the off-market inventory of foreclosures is over eight-times the number of active listings.

And this does not take into account the shadow inventory of defaulted loan-owners who the banks have not yet issued an NOD and are living payment-free.

I’m certainly seeing the effects of low interest rates and controlled inventory – mid-tier houses selling for 50k, 70k, and even 100k over list price.

At the same time, rents are presumably soaring.

I’m effectively being priced out of the market.

“Auction scheduled: 850”

As someone knee deep in these stats, the homemoaners are getting one of the following:

*postpone the aucttion- modification

*BK to postpone the auction. Not all stays on homes work.

*Cancel the NTS and all is well.They refi into another loan thanks to Uncle Sugar

Those auction stats take daily tracking. And don’t get me started on the arrogant flippers. Flippers make home unaffordable, and usually do a 1/2 arse job, imho.

Flippers are another topic entirely!

From my experience here in the East Bay (Oakland/Berkeley, etc), it seems that most fixers are bought up by real estate agents for flipping before they even hit the MLS.

They might show up for one day on the MLS, and the next day go to ‘pending.’ I’ve seen more than a few listings go straight from ‘delisted’ to ‘pending’. Maybe there are legitimate reasons for some of this, but I suspect many/most are suspicious transactions (i.e., illegal or at least in a very grey area).

And yes, the renovations are usually crappy. Most flippers seem to use the cheapest stuff from Home Depot, and then jack the house prices way, way up.

The sad and infuriating thing is that buyers still gobble these up.

So would it be surprising to see another 30% drop in prices if the interest rates go up to 6.7% as Dr. HB put up for discussion?

To increase his numbers…that would mean a million dollar house at current rates has the same monthly cost as a 700k house. So if rates do go up just 3%, will that million dollar house drop 300k?

If you earn money it’s an investment. If you overpay and don’t earn money on the house at the sale, then it’s not. I choose the former and it has been a great investment.

Define earn.

Thank you, Dr. Housingbubble for your graphic presentation of what has happened to mortgage rates in the last five years. This has been manipulated by the Fed in an attempt to maintain some semblance of price stability in the housing market. As you can plainly see, it has been a catastrophic failure. Housing price have fallen dramatically and continue to fall in spite of central planning. Imagine if interest rates were priced at their real market value? That would easily drop prices another 40%. Ironically, that is what should have occurred immediately and cleared out the market and we could have started over with a relatively short period of pain. The current plan is to drag this on until there is a complete and total collapse of the financial system. Take a look at the prices for food commodities, are they increasing at 3.5%? Our friends at the Fed have placed the entire world in a giant whipsaw of deflationary assets and wages coupled with hyper-inflationary food and soon to come energy costs. Get ready for the return to the dark ages or worse.

“If you put down $200,000 as a down payment that is money that could be invested elsewhere.” Elsewhere!!! Like Facebook IPO.

Rental homes is the new normal, which means positive cash flow for investors who buy right.

Sorry, but you’re following the herd on this one and the herd, as a rule, is never right.

Residential rentals are doing just fine.

Is this Bob Max?

So, is this the new NAR propaganda? And why are you tacking SM on to your handle? Are you a RE agent in SM?

Could this be you?

http://beverlyhillscacoc.weblinkconnect.com/Real-Estate/David-Cooper-Realtor

Busted!

So rental homes are going to be the new normal. Great, I hope the next few generations won’t mind the fact that their chances of “owning” a home will be slim an none. The history books will go something like this: “There was a great housing bubble in the oughts. When the dust from the aftermath cleared, investors bought up all the remaining houses. This is how our current renter society was formed.”

Bwahahahahahahaha! 🙂

Another awesome defrocking of yet another NRA – approved schlockmeister shill! They seem to be popping up everywhere these days, which we last saw during the years directly proceeding the crash. It’s like a real – life version of whack – a – mole.

Manny,

I love people that say housing should have dropped 80% back in 2006 and we would be better off now?! If you still even had a job, if we still even had a functioning banking system!

What would have kept 80% of the underwater homeowners from all mass squatting?! Were you renters going to go kick them out yourselves… Cause law enforcement would have been too busy handling the rioters.

I would argue that if the Fed took over the zombie banks, paid FDIC deposits by printing money, removed the management, shareholders and bond holders would lose everything, AIG (which was taken over) would pay insured bond losses by printing money we would not be in any worse shape. I understand the concept of soft landing but this is beyond soft landing. This has become an effort to continue the bubble which by definition is unsustainable.

There is no bubble in 90% of the US housing market. The Dr. has even affirmed this. Prices are in line with incomes in 90% of the U.S.

I think there is room for a 10% bubble in this country in major coastal cities for eternity. Or busts and booms to continue for infinity in these areas.

I thought that the government should have followed Volcker’s plan during the S & L crisis, but of course on a much larger scale. The enduring shame of it is that the very same man sat about three blocks down from the WH during the deliberations this time, but no one bothered to use this valuable resource – as I had feared all along, his appointment was merely window dressing. I have yet to see an interview with the man about all these machinations – no doubt he’d be an interesting outlet to hear from right now.

“not be in any worse shape?” .. being the key word. Either way.. nearly 70% of the population losing equity of 80% in their primary residence is gonna truly destroy an economy. So far we’ve rolled back to 1999-2003 real estate prices across most of the united states. That worked because the stock market has recovered somewhat… If the stock market were still down at 6000 things would be much more hopeless right now.

Those that bought in 2004-2007 that couldn’t afford the mortgage for any reason have folded their hands. There are a large group of 2004-2007 buyers that are doing well financially and can afford their mortgage, but another 20% drop is gonna make them throw in the towel and strategically default.

The government knows this.. and it would lead to a repeat of march 2009 stock market crash if they let it happen.

NotaSucker,

The real problem is that the home values will go down the full amount either way. One way is to have you lose 30% nominal value and the other 30% via devaluation of currency. The other way is to lose 60% nominal value and at the end you are in exactly the same circumstance. The point you might have missed is that we still have the same management and the same regulation that got us here. Nothing has changed. I would prefer we convict the criminals remove profit from the profiteers and reset the system which will enable a possibility of economic growth. There is no real opportunity for growth under the current broken market. As I have said over and over, the economy is slacking because of the artificially propped up market. The overheated housing market was fine when people could supplement their stagnant income by extracting income from their house. The problem is that we still have the same stagnant income of the 1990’s with the balloon prices of the 2000’s. Housing costs are crowding out other spending. Add a good amount of currency devaluation and goods and services bid on the world market become more expensive further crowding out other expenses. Finally, selling existing housing to each other has little impact on GDP unlike new goods and service…

NotASucker…

I am not convince that we are anywhere near equilibrium when I look at a 100 year housing chart adjusted for inflation…

http://observationsandnotes.blogspot.com/2011/07/housing-prices-inflation-since-1900.html

@Not a sucker

Since Obama became President the national debt has increased over 5 trillion dollars. To pay off ALL the underwater mortgages in America would cost about half, 2.5 trillion dollars. Without going into detail, but you can read up on it, most of that debt went to finance the banks and bail them out by interest rate spreads on government bonds while borrowing from the Fed for practically nothing. Not because of the mortgage debt but because of derivatives, CDSs. The American taxpayer has signed on to bail out the one percent at their own expense. This will go on for decades and it is much worse than Japan because there was/is more leverage in the banking system. It would have been much better to have wiped out the elite that gambled with house taxpayer money. Keep believing the propaganda, if you wish.

Don’t forget that when there are no constraints on “supply†via the conversion of rural land to urban, the price of housing is still dictated by the lowest prices that developers in free competition with each other, can bring housing to the market.

Low interest rates under these conditions, represent an increase in discretionary income in the local economy; rather than facilitating increases in house prices, they facilitate lower mortgage costs for houses that remain stable in price regardless.

This is why those cities that had no house price bubble in the first place are doing doubly well now.

@Phil from NZ

“Low interest rates under these conditions, represent an increase in discretionary income in the local economy; rather than facilitating increases in house prices, they facilitate lower mortgage costs for houses that remain stable in price regardless.”

Be careful for what you wish for. I assume you are in NZ and, if you are, you are very fortunate indeed. However, here in California pension funds MUST have a return of around 6% or some as high as 8% growth to maintain their viability. With interest rates at around 2.5%, how in the world will the pension funds avoid collapse? Oh, put all the money in the stock market, which has been flat for over a decade. Where is the growth in assets prices going to come from over the next 20 years when millions of public workers retire on their fat pensions? There is only one other choice and that is to tax the poor suckers who still have a job.

And another thing about the 500k low interest home vs. the 350K normal interest home is that it’s a heck of a lot harder to prepay down your loan with the 500k house for a given yearly income: Say you set aside an extra 10k per year to prepay your loan down. Over 10 years you’ve paid 100k in prepayments. That’s only 20% of the 500k home’s original price vs. 28.5% of the 350K home’s price. If you put down 200k up front the your left with 300k vs. 150k. 10 years of prepayments yields 200k (ok, minus amortization) left over, vs. only 50k (minus amortization). I’ll take the higher rate, please.

I haven’t been in CA long enough to know, but i bet the real deals come right after a major earthquake.

Where, I’m from, in a small capital city on the east coast, they avoided most of the bubble during the good ol’ days, seeing as how most folk there don’t have the capacity to leverage up in the higher extremes. There’s no bubble in the 10 year Zillow trend line for my city. Well there was no bubble. Now, due to these interest rates going down, down, down on the chart above, there is a happy positive trend for a poor state. Also, I see in my college town that trend has gone from 143k average to 202k from 2002 to present, which is about a 3.5% per year rise. It’s almost as if everything is normal there….. Normal, until that interest rate starts popping back into the 4’s then 5’s.

Also, where I’m from, those shacks pictured above are can be had for about 50 to 80k, 100 to 150k, and 150 to 200k respectively. Anyone with a six figure salary lives like a god, there.

I’ve been here 10 years and can say the dynamics are very different from the east coast, sans maybe NYC. I don’t know why, but in the Midwest and out East, people tend to NOT want to spend a lot on housing, as doing that leaves more $ for other stuff. In CA, it’s like a status symbol or something. True there is a “weather premium” which also comes from stricter building codes and use of land, but I still think it’s overrated on many fronts. The weather isn’t worth ‘that much’.

My observation has been the same. As a general rule I think that people in SoCal are often more careless with money and more concerned with the perception of status than folks in most other parts of the country. That’s not to say that being risk adverse always pays off or that there aren’t snobs elsewhere.

We are all focused on the now… instead of looking at the past for the chance of history repeating. There is a good chance that mortgage rates continue to fall… they could fall by an additional 50% from the current price.

It seems to be a winning shell game for banks– refi the middle class and rich every 12 months and chage them $1200 each time to do it. Banks need income channels and the economy needs to supplement higher costs for food and energy.

Saving $300 on principle and interest is great, but not when you spend $290 more on gas and food… but that is the new reality to most. If you have cheap house payment you are all good– we can always not eat and drive, right?

If we are in the footsteps of Japan we are headed for sluggish price appreciation and even lower rates… Any rise in rates will crush the market, and the Feds know that.

You clearly do not understand mortgages. Banks have been sending 90% percent of all mortgages to Freddie and Fannie for decades..that does not get them off the hook though. Have you ever heard of buyback provisions? If a loan goes bad, the first people that Fannie and Freddie go after is the lender. If any issues are discovered with the loan when it was made, then the lender has to buy back the loan. This provision is one reason that underwriting standards are so tough..lenders (especially small ones) are terrified of making mistakes. Sending the loan to Freddie and Fannie only frees up more capital to make more mortgages…nothing else.

So those claiming that letting the system collapse wouldn’t freeze up all the banks.. because the government insures them is nonsense. They are all interdependent. If house prices fall .. it kills the banks and the government… so that is why things are propped up.

Then we will follow Japan’s model…

you know darn well buy backs are, if enforced, maybe 1% from fannie and freddie. the reason of higher standards in loan is because just about every home loan in th last 10 years was fraud. income and assets, valuation, down to respa viloations and who th hell was thr acting agents… hell just look today,even if you have a perfect borrower the 90 day appraisal valuation system is neck deep in BS. meaning the assets that secures the deed/note is not correctly valued. case in point, i know of a home valued at 185k in OCt 2011, 6 months later it is valued at 265k. who is the banking knuclehead that will accept the value of that asset. the bank will only accept if FHA, Formor GSE’s, VA, USDA is willing to bank roll thier risk with tax dollars. FUBAR…

Leave a Reply