Squandering Ourselves into Economic Prosperity: Lessons from the Great Depression: Part XXII. The Infection of Consumerism and Living Fake Lives.

The story of Jdimytai Damour, the Wal-Mart temporary employee who was trampled to death is a sickening verdict on the consumerism disease plaguing this nation. The worker was trampled to death as rabid shoppers broke down the door at 5:00am in New York. Other Wal-Mart employees tried to help Mr. Damour but the crowd kept rushing in like salmon swimming upstream to spawn. Shoppers simply stepped over his body and witnesses even said that some people continued shopping even after the incident was announced! An innocent man was killed simply because people couldn’t be civil or patient enough to purchase a VCR?

In Desert Hot Springs, two people were killed when they had a shootout in a Toys R Us store:

“(LA Times) Joan Barrick, 40, of Desert Hot Springs said she was buying a Barbie Jeep for her daughter when two women started brawling. As the women swung at each other, the men they were with also started arguing.

The younger of the two lifted up his shirt and flashed his handgun, pulling the grip from his baggy pants pocket. The other man yanked out his own handgun and started chasing him down the aisle and firing, witnesses said.

Barrick hid behind a stack of DVDs and recited the Lord’s Prayer. “If I’m going to die, I need to make peace,” she said. “A lot of people were crying. I was crying. We were all very, very scared.”

What a sad state of affairs. In early reports, it looks like people somehow defied the laws of financial logic and are spending in droves. Of course, it is much too early to gather figures but the fact that we are even discussing “brisk and strong” sales is astounding. People are rushing out to buy Guitar Hero and Grand Theft Auto to indoctrinate a generation in mindless drivel. Think of Grand Theft Auto. You play the role of a criminal who car jacks innocent bystanders and shoots police while talking with prostitutes for fun. Is this what we are spending our money on? And Guitar Hero gives people the chance to play a fake guitar and pretend to be a rock star. Just what we need, another generation of self indulgent egomaniacs.

What ever happened to learning to play a real guitar? We have a large number of our population who are living fake lives. Just look at what TV shows are popular. All these reality shows have large audiences because people are so bored with their own lives that they need to watch the drama of others to feel alive. And the lives of those on reality TV aren’t even real! How twisted is that? We can lament about these societal issues but look at this fake economy we have built over the last decade. A society pretending to be richer than it really is by mortgaging our own future with debt. Then we expect that the next generation who is in a trance in front of Grand Theft Auto is going to be equipped to deal with this epic calamity? Time for parents and the younger generation to prioritize. The only thing we have trained millions is to get ready for a Mad Max world which given our economic mess isn’t so far fetched. Heck, we have tons of shiny brand new off road vehicles that are simply sitting on lots.

Nothing highlights our lack of preparation more than the big 3 automakers going down in flames. Sure, we can argue that it was because of this credit crisis or because of legacy costs but the reality is they were outperformed by foreign competitors. People voted with their wallets. The big 3 bet on large expensive gas guzzling urban tanks and lost big. Now, they are teetering on the verge of extinction like the Tyrannosaurs rex. If the credit crisis was at fault, why aren’t Toyota and Honda on the verge of bankruptcy?

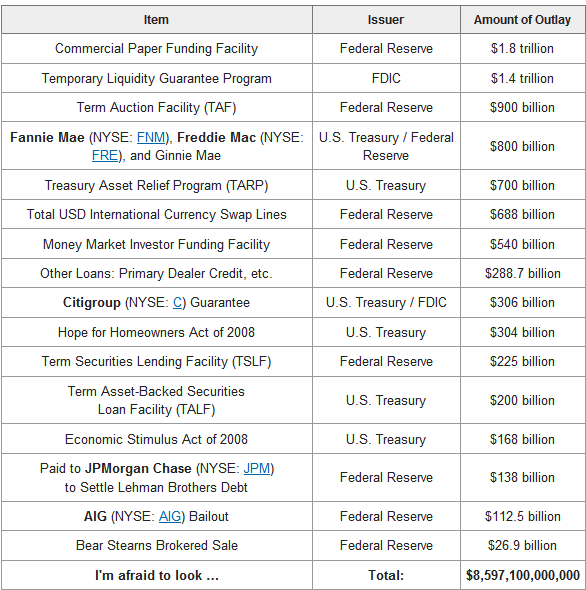

We are at a major crossroads here. As a society, it is time we refocus our energy on the sciences and engineering and stop thinking about how many ways we can put granite countertops in every kitchen of America. If we are serious about staying competitive, we need to invest money in these areas. Initially NASA was seen as a big waste but I think most Americans would rather see money invested in NASA instead of WaMu. Yet the sad thing is even with all these pathetic bailouts, all the money is going to financial companies which are at the heart of the matter. Take a look at the money already set aside for this mess:

*Source:Â Motley Fool

So far the government has spent $2 trillion of this amount and we can rest assured more of it will be used up since it is already committed.

I think it is important to understand the magnitude of the mess we are in and to put it into a historical perspective. I started a series called Lessons from the Great Depression back on August 2nd of 2007, a few days prior to the peak of the stock market. In fact, our first article was looking at a personal letter from a lawyer from a small town recounting the destruction caused by the Great Depression. Here are some of the comments at the time:

“Yes, this is a housing bubble. We’ve survived housing crashes before and I see no reason why we couldn’t survive this one.

It’s fashionable to label every bubble crash as the next Depression. The Internet bubble was supposed to bring a depression, so was Black Friday in Oct 87, the OPEC problems before then.

Just b/c this is a bubble, doesn’t mean the country will go to “hell in a henbasket”. The U.S. will survive this like it survives everything else.”

The reason that this was being compared to the Great Depression was the global magnitude of the problem. The technology bubble as big as it was occurred primarily in a few nations. It impacted a large number of people but nothing in the scope of the current credit bubble. Here is another comment from someone who would benefit from a history lesson:

“Um, that “letter” is a fake. Anybody else catch that the author used the verb SKYROCKET???!!!! There were no skyrockets in 1933! Doh!!”

I found the letter in an old file and typed it up since it struck me how similar our current predicament was to that of the Great Depression. The skyrockets are referring to fireworks that of course were invented by the Chinese back in the freaking 12th century! But how would you know that if you sit in front of the tube playing Grand Theft Auto and enjoying Dancing with the Stars and never read a book? I’ve read numerous books covering the Great Depression and the similarities to our current predicament are all there. Here is a list of a few I highly recommend that cover the history and economics of the first half of the 1900s:

Since Yesterday:Â Frederick Lewis Allen

Only Yesterday:Â Frederick Lewis Allen

The Great Crash of 1929: Â John Kenneth Galbraith

Manias, Panics, and Crashes:Â Charles Kindleberger

The Big Change: Â Frederick Lewis Allen

The World in Depression 1929 – 1939: Â Charles Kindleberger

Some are more academic and some are quicker reads. Some focus on the economic aspects of the depression while others also look at the societal changes. All these books are highly recommended and provide excellent perspectives. You’d also learn a lot by simply reading old Harper’s Magazine articles during that time.

Today we are going to examine the years after the great crash. Ben Bernanke who is a self-appointed expert on the Great Depression is having his chance of testing his hypothesis of what went wrong during the Great Depression. As it turns out, he doesn’t have the answer either. Below I’ll type a few important paragraphs from Since Yesterday talking about this time in history and put a sock in the mouth of anyone claiming this is the bottom. We are nowhere close to a bottom.

This is part XXII in our Great Depression series:

16. Items That Sold in the Credit Bubble.

17. The All Hat and No Cattle Nation

18. Charity for Financial Deviants.

19. The Silent Economic Depression

20. The Four Horsemen of the Economic Apocalypse

21. The Big Change

Squandering Ourselves into Prosperity

“June, 1931:Â Twenty months after the Panic.

The department-store advertisements were beginning to display Eugenie hats, heralding a fashion enthusiastic but brief; Wiley Post and Harold Gatty were preparing for their flight round the world in the monoplane “Winnie Mae”; and newspaper readers were agog over the finding, on Long Beach near New York, of the dead body of a pretty girl with the singularity lyrical name of Starr Faithful.”

“For a long time past, as business slowed up in Europe, a sort of creeping paralysis had been afflicting European finance. Debts – national and private – which had once seemed bearable burdens had now become intolerably heavy; new financial credits were hardly being extended except to shore up the old ones; prices fell, anxiety spread, and the whole system slowed almost to a standstill. During the spring of 1931 the paralysis had become acute.”

Keep in mind that during this time the U.S. was a creditor nation. Even though our Great Depression was horrific, revolutions and fundamental changes came about in Europe that turned their worlds upside down. Hitler slowly started to gain power in Germany and other economies started collapsing under unsupportable debt. The U.S. even right after the crash, still had not faced the worst of the depression. That was still to come and the market rallied many times even after the crash:Â

“He [President Hoover] called the newspaper men to the White House and read them a long statement which contained both his proposal for an international moratorium and the names of 21 senators and 18 representatives who had already approved it. The newspaper men grabbed their copies and rushed for the telephones.

When the news was flashed over the world a chorus of wild enthusiasm arose. The stock market in New York leaped, stock markets in Europe rallied, bankers praised Hoover, editorial writers cheered; the sedate London Economist came out with a panegyric entitled “The Break in the Clouds” which called the proposal “the gesture of a great man”; and millions of Americans who had felt, however vaguely, that the government ought to “do something” and who had blamed Hoover for his inactivity, joined in the applause. Little as they might know about the international financial situation (which had been getting nowhere near as much space in the press as the Starr Faithful mystery), this was action at last and they liked it. To the worried President’s surprise, he had made what seemed to be a ten-strike. It was the high moment of his Presidency.

Only the French demurred. Hoover sent his seventy-seven-year-old Secretary of the Treasury, Andrew Mellon, to reason with them, and exhausted the old man with constant consultations by transatlantic telephone. After a long delay – over two weeks – the French agreed to the plan with modifications, and the day appeared to have been saved.

But it was not saved at all.”

Now contrary to popular two-second sound clips, President Hoover was trying to resolve the crisis. He fundamentally believed in rugged individualism. This was collapsing because of global pressures and a multitude of factors. The crash of 1929 was only a symptom of a bigger world mess. Now don’t get me wrong, Hoover by all means wasn’t a good President but it is important to put the situation into context. President Coolidge was the bigger accomplice to Wall Street and history looks at him favorably because of the “Roaring 20s.” Will anyone look at this decade in economic awe? Hoover relied on the power base which was on Wall Street and this was quickly losing its halo of power. Plus, they were corrupt to the core just like Wall Street got during this past decade. The market had a brief rally. Yet fundamentally nothing had changed. Our current rally is a dead cat bounce. Nothing has fundamentally changed. In fact the core items of a solid economy are failing; production is down, unemployment is rising, prices are collapsing, and our debt is crushing us. Are these reasons for a rally?

“In the month of September, 1931, a total of 305 American banks closed; in October, a total of 522. Frightened capitalists were hoarding gold now, lest the United States too should go off the gold standard; safe-deposit boxes were being crammed full of coins, and many a mattress was stuffed with gold certificates.

American business was weakening faster than ever. In September the United States Steel Corporation – whose President, James A. Farrell, had hitherto steadfastly refused to cut the wage-rate – announced a ten-per-cent cut; other corporations followed; during that autumn, all over the United States, men were coming home from the office or the factory to tell their wives that the next pay check would be a little smaller, and that they must think up new economies. The ranks of the unemployed received new recruits; by the end of the year their numbers were in the neighborhood of ten millions.”

Let us take a look at the unemployment rate during this time:

Even in 1929, unemployment was at historical lows. In 1930, it had jumped but it was still below 10%. In 1931 the rate was now hovering around 15%. In 1932 and 1933 the rate had hit 25%. This is why pundits who keep pointing to 2005, 2006, or 2007 are so off base. Things can change so quickly. Look at the massive amount of layoffs coming down the pipeline. Citibank will layoff over 50,000 people in the next few months. JP Morgan will layoff 19,000 from the WaMu acquisitions. Take a look at the mass layoff announcements:

We are running at decade highs here. A mass layoff announcement is considered when a company has 50 initial claims for unemployment insurance (UI) filed against them during a 5-week period. This is a leading indicator that things will get worse especially since we are in the early stages of this recession. Paulson must have taken a page out of President Hoover’s bailout manual:

“Again Hoover acted, and again his action was financial. Something must be done to save the American banking system, and the bankers were not doing it; the spirit of the day was sauve qui peut. Hoover called fifteen of the overlords of the banking world to a secret evening meeting with him and his financial aides at Secretary Mellon’s apartment in Washington, and proposed to them that the strong banks of the country form a credit pool to help the weak ones. When it became clear that this would not suffice – for the strong banks were taking no chances and this pool, the National Credit Corporation, lent almost no money at all – Hoover recommended the formation of a big governmental credit agency, the Reconstruction Finance Corporation, with two billion dollars to lend to banks, railroads, insurance companies.

As the winter of 1931-32 arrived and the run on the country’s gold continued, and it seemed as if the United States might presently be forced off the gold standard, Hoover issued a public appeal against hoarding and then proposed an alteration in the Federal Reserve requirements which – embodied in the Glass-Steagall Act – eased this situation. Again with the idea of improving credit conditions, he urged, and secured, the creation of a chain of home-loan discount banks, and the provision of additional capital for the Federal Land Banks. Steadily he fought against those measures which seemed to him iniquitous: he appeared before the American Legion and appealed to the members not to ask for the immediate cash payment of the rest of their Bonus money; he vetoed a bill for the distribution of direct Federal relief; and again and again he made clear his opposition to any proposals for inflation or for (in his own words) “squandering ourselves into prosperity.”

Still the Depression deepened.

Already the pressure of events had pushed the apostle of rugged individualism much further toward state socialism than any previous president had gone in time of peace. Hoover’s Reconstruction Finance Corporation had put the government deeply into business. But it was state socialism of a very limited and special sort. What was happening may perhaps be summed up in this way:-

Hoover had tried to keep hands off the economic machinery of the country, to permit a supposedly flexible system to make its own adjustments of supply and demand. At two points he had intervened, to be sure: he had tried to hold up the prices of wheat and cotton, unsuccessfully, and he had tried to hold up wage-rates, with partial and temporary success; but otherwise he had mainly stood aside to let prices and profits and wages follow their natural course. But no natural adjustment could be reached unless the burdens of debt could also be naturally reduced through bankruptcies. And in America, as in other parts of the world, the economic system had now become so complex and interdependent that the possible consequences of widespread bankruptcy to banks, the insurance companies, the great holding-company systems, and the multitudes of people dependent upon them – had become too appalling to contemplate.”

Just change a few names here and there and we are repeating history. Even with the RFC and the notion of crony capitalism made a cameo during this time. Now we call our junkyard the TARP. The world was connected at that time as well. I hear these talking head pundits acting as if during the Great Depression we were somehow savages and didn’t understand capitalism. As if credit default swaps are some form of evolution to the system? Please, the system if anything is more perverted today than it was bank then. And for executives coming to D.C. for cheese we got that going on back then as well:Â

“It is also almost useless to ask whether Hoover was acting with a tory heartlessness in permitting financial executives to come to Washington for a corporate dole whne men and women on the edge of starvation were denied a personal dole. What is certain is that at a time of such widespread suffering no democratic government could seem to be aiding the financiers and seem to be simultaneously disregarding the plight of its humbler citizens without losing the confidence of the public.”

“…people who had taken these fixed principles for granted, and had shown little interest in politics except for election time, began to try to educate themselves. For not even the comparatively prosperous could any longer deny that something momentous was happening.”

“The autumn of 1931 brought also an outburst of laughter. When old certainties topple, when old prophets are discredited, one can at least enjoy their downfall. By this time people had reached the point of laughing at Oh, Yeah, a small book in which were collected the glib prophecies made by bankers and statesmen at the onset of the Depression.”

A society who doesn’t remember history is condemned to repeat it. Our version of Oh, Yeah can be seen on satirical blogs and TV shows like the Colbert Report and the Daily Show. At a certain point, you have to laugh at how corrupt the system has gotten. We need to keep our spirits light because we have years of perp walks and trials that we will be going through. So much has already been squandered that when we dig deep into the books of failed institutions, we will be stunned. Maybe that is why the Federal Reserve doesn’t want to tell us about those $2 trillion in loans? But, isn’t that our money that is being squandered?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Squandering Ourselves into Economic Prosperity: Lessons from the Great Depression: Part XXII. The Infection of Consumerism and Living Fake Lives.”

doc – good article but a quick nitpick: The shooting was in Palm Desert, a suburb to Palm Springs about 100 miles east of LA. Palmdale is another miserable desert town 50 miles north of LA.

Hmm, video games are cheap entertainment, so I’d expect more of them to sell during the depression. There’s nothing wrong with Guitar Hero or Grand Theft Auto (incidentally, GTA last year’s game so it’s about $20.00 used), but even if there were all video games aren’t like that.

I gave my little girl (who play Cello and Keyboards, incidentally) Jam Sessions, a guitar synthesizer for her DS that you use to play actual music (http://www.amazon.com/Jam-Sessions-Nintendo-DS/dp/B000MTF04U) and she loves it.

Compare games to DVDs, and it’s no contest. I forget what I spend on Jam Sessions, but at the moments it’s around $15.00. That game will entertain her forever, she’ll use it constantly when she doesn’t have access to the school’s cello or keyboards. (Priced them lately? Very expensive, we can’t afford them right now.) It will also help her improve her music skills. Even a great DVD, can’t compare. (Also, DVDs can be depraved or vapid just as much as games can be, obviously.)

Incidentally, I buy her books as well, so don’t think when I’m saying DVDs or games that’s all there is. (The last thing I gave her was a gift card so she could pick out her own books, but I also pick out books and give them to her.)

The kids are alright, and they have grim, unspeakably grim times ahead, so if they can have a little fun in their lives I don’t begrudge it to them.

“An innocent man was killed simply because people couldn’t be civil or patient enough to purchase a VCR?”

You’re seriously dating yourself here. VCRs are only slightly more popular than phonograph turntables as hot Christmas ticket items.

I don’t have enough time to read all your post, Doc, but I can comment on the first part.

The problem isn’t that folks are pretending to be rockstars or that they think they can kill prostitutes to get their money back. After all, some guy who listens to Eminem while driving down the freeway thinking he’s the baddest gangster around can still be civil at the table around his family. Hell, I’ve heard that the residents in Eminem’s gated community keep him in high regards as an upstanding member of the community.

No, the problem is apathy. To quote the movie Network: “We sit in the house, and slowly the world we are living in is getting smaller, and all we say is, ‘Please, at least leave us alone in our living rooms. Let me have my toaster and my TV and my steel-belted radials and I won’t say anything. Just leave us alone.'” And just like Network, the problem is that people aren’t getting angry about this situation and doing something about it.

They ignore it entirely and act like nothing’s happening. They pretend nothing is going on around them and try to keep the fantasy world they’re living in alive(And believe me, no one thinks they’re a rockstar when they play Guitar Hero). And when reality comes pounding on their doors, they’ll be caught with their pants down with a “how did this happen?” look on their face. They’re living in the past and forsaking their future and the worst part? They don’t even realize it.

They think the government will fix everything, but as the universally disliked bailout bill shows, the government doesn’t know how to handle this problem. So who does that leave to fix it? The very citizens who want nothing to do with it. So sad…So sad.

Thoroughly enjoyed your article Doc, another good one but the man didn’t get killed because shoppers were too impatient to purchase a VCR, they were probably after the cheap “Blue Ray” disk player. VCR’s are so 80’s

DDM: I teach mathematics at a socal community college where I have spent much of the semester (during break time) trying to get my students to become aware of “our” economic situation – bringing in articles, and websites for reference. From my observation, I agree that many people choose to be apathetic. In fact, the students show anger toward me when I try to discuss the realities of their generation (this is not anger toward the math they must learn since they seem to know based on the website reseach at “rate my professor” that I am one of there only hopes for understanding and passing a math class). I am truly sad for the shock that this generation will receive…

Doc, As always a very insightful article. I am in my early 30’s and I still use the term “VCR” in some of my math word problems – just to see if the students are reading the question!! Take Care, RL

so that’s how it happened at Toys R Us…humm.

The man trampled at Walmart really doesn’t surprise me, **** like that happens all the time and It not destined to change however.

Of course droves are going to come out and shop, times are hard and people want deals. Reminds me why I don’t go shopping on those days, everything is “last seasons make and model” and I’m too lazy to stand in line for hours over afew bottles of lotion, a shirt and mechanical goods. I’d rather pay more for the comfort of timely service and decent choice.

Or maybe I should make good and set my new years goal on learning to make my own clothing. Shopping is TOOO expensive.

By the way doc, no one would bust down the door and stampede for a VCR!!!! A DVD and Blue ray disc but NEVER a VCR. Believe me on that……

Another great post Doc… I’m with ya doc… seems like the Black Friday shoppers are scared and “whistling in the graveyard.” The song is over; time to pay the piper (yet these folks won’t understand until it is announced between blue-light specials or their card is declined). Most interesting to me: you mentioned on comments from readers missing the LARGER point and then comments immediately were filled with people trying to nitpick your column. It’s almost like they don’t read it. Oh, yeah… I especially appreciate the commenter that began his entry with “I didn’t have time to read the whole thing…” yet he had time to post one of the longest comments! That is willful ignorance.

When the current stock market rally, which should be a doozy, is near its end in March or April, I can already hear the jackasses on TV talking about how Bernanke and Paulson and even Obama saved the day and are freakin’ geniuses. Then the market will turn and we will have another wicked leg down and the layoffs will reach a feverish pitch. By next summer, the delusion that everything is going to be fine and that this is just another recession will start to fall apart for a critical mass of people in this country.

By next summer, good deals on assets will be ubiquitous, as a much smaller number of people will be debt free, have both a job and cash, and be willing to take the plunge on investing in anything beside necessities.

Comrade Housing Bubble,

~

Outstanding piece of work! It’s eerie how similar things are to the Great Depression. However, I would submit that this could potentially be worse for a couple of reasons. First, the US was a creditor nation at the time and printing money did not present the problems that it does now. Second, the US had plentiful natural resources (the US was the leading oil producer until the 1960s). Now, well, drill, baby, drill pretty much sums up our energy delusion.

~

As I’ve said before, we’ve witnessing the greatest bubble bursting ever known to mankind. Plan accordingly!

MGM musicals will make a big comeback. Something to help us forget the bad times.

To be fair, it isn’t that people don’t care…they simply don’t know what to do. Polls showed that 85% were against the bailout, and it went through anyway. So, that is proof positive that they don’t care what we think. They steal our money in broad daylight.

The mainstream media is very powerful. My buddy is an educated guy, and yet he tells me that “Robert Rubin is a smart guy.” Doesn’t matter that he drove Citi into the ground, the MSM says that he’s a smart guy, so he must be a smart guy.

I don’t care anymore. I wrote countless letters and emails against bailing out that den of thieves called Wall St., and obviously my efforts were in vain.

I think that many of those guys should be killed without due process.

MD,

You have hit on a point I think has not been adequately addressed and that is the effect of a credit bubble on the society it occures in.

The contemporary mores and values of this society merely reflect the debasement and cheapening of our money. Now as whacky as that sounds, hear me out. If you travel to a different country one without credit you see certain things, namely respect for the things we take for granted. These people realize, unlike us, that matierial things are precious and not to be squandered friviously, they require REAL resources that need to be produced. They are generally very conservative due to that point and come off as being more attached to the world then our current airhead pundits.

They have extensive social networks not set up by government because there are no resources for that, so they appear to be more “socially connected” with large extended familys, tribes etc. and make attempts to more socially engaged in contrast to our empty values of “solitary individualism” via government back stops. Without access to ready credit, the values of things which appear cheap to us are quite a challenge to get for them (No neg am mortgages for them!), and being matierially poor they appear to have a greater interest in society at large, ironically for the somewhat selfish reason that they may have to “call in some social markers” in the future which makes them want to be involved.

Our society represents every cautionary tale since Soddom and Gommora. Its a story of people disconnected from natural rythyms and consequences. It harbors foolish notions and gives them “sage status” (just take a college philosophy course to understand my meaning). It flagrantly juxtaposes right and wrong and shields the results using the illusion of credit to smooth out any bumps, causing confusion, disorientation and uncertainty of purpose.

In short, when the VALUE of our currency goes down in real terms, we can expect that our societies VALUES shouldn’t be far behind. I dont know if one happens before the other, but I think the change is incrementally small at first, then builds up steam culminating at some point to where we face the “abyss” then hopefully t we make the right decision to re-evaluate the mores and values of prior generations and evaluate whats really important versus what is so much fluff.

Tanta, of Calculated Risk, has passed away.

She was fierce, funny, true, brilliant, and snarky. For all who wish to read her work, go to that blog (DHB has a link) and click on “The Compleat Ubernerd” for some samples. I know DHB frequented that site, which was one of the first to catalog the catastrophe.

A sad day…

Because of your blog, I made some decent money shorting the stocking market. Thanks because I would need the money whenever I get lay off. Btw, no one buy VCR anymore.

I get the picture about the VCR!!! Will you all stop being so freakin concrete, the “VCR” was not the point of the story!!! jees, I can easily see how we got into this mess.

Thank you for another good post Doc. Your energy and clarity is indeed impressive.

Occdude32 is spot on.

NO SHELTER Lyrics by Rage against the Machine ring through…

“They make you think that buying is rebelling!” & “Trade in ya history for a VCR” & l “Chained to the dream they got ya searchin for”

http://www.ratm.net/lyrics/nos.html

Mucho love,

Sorry, sorry everyone. I think I just posted a reply to this message that was supposed to be for DHB’s 11/28 one, on market technicals.

~

rose

Today they finally acknowledged that we’ve been in a recession for 12 months, although anyone with an IQ > 65 already knew it. Fortunately most of us have fattenned up and we’re ready to hibernate through the Kontradieff Winter. Dow plunged 680 points and the debate is Blu-Ray vs VCR. WTF? Folks, this stuff is real and it is really happening. We are in trouble. The beast is not contained and no amount of backstopping and stimulous will make a dent. All of the salient crises of the last 30 years: bank failures, stock crashes, dollar crash, unemployment, foreclosures, hedge-fund implosions, municipal debt reneged on, 3rd-world debt unserviceable, entitlements unfunded, terrorism?, pestillence, war, famine, death…it’s all coming ashore with the surge of the perfect storm and we all better get to high ground. Read up and learn what you need to know. Better to prepare for the storm and be missed, than be trampled in a Walmart shopping promotion…or worse.

“Don’t think it won’t happen just because it hasn’t happened yet.” J. Browne

Excellent comment Occ, it really is a paradigm shift that has to happen–not just print more money and extend more debt. I’m sure that our collective intelligence is diminishing continually as in ‘Idiocracy’. That is one of the most telling results of the Depression, that we all depend on one another and we better look out for one another.

Has anyone noticed that whenever they dump some bail out money into the banks the market rallies for a couple of days only to suck up the money when selling like crazy and bringing it down again?

Are we giving the investors an extension to make up their losses?

Why do I get the feeling that the rich are using their power to make sure that they don’t lose any money…

Like today… so what else is new that we are in a recession? Everybody knows that we have been in one for almost a year. Why would an official announcement bring the stock market to it’s knees? This isn’t news – just confirmation of old news.

What an excuse to sell off and cash in on the last weeks upturn.

All financed by the tax payer bailout money.

To those commenting on the apathy… What do you expect people to do? The hand has already been dealt… Most people never knew they were playing. Now that everyone is aware of the card game they were in… They have to play their cards. No one can change what is about to happen. Really, I would rather not understand what is going on. Ignorance is bliss while it last.

Instead, I pretend around my family and friends everything is going to be okay. I even lie when they ask how bad is it going to get. Why tell my dad that his masonry business he built is going to go under? Why tell him that he will lose his house in the process? Having this knowledge now will not prevent the outcome. I figure why hit them with reality when it is going to hit them anyway. Give them a few more months to live the dream. It will end.

So the apathy… I understand. It will only be temporary.

Above all I understand why the college students don’t want to hear it. So many of them have been legal voting age for what? The latest presidential election only? But the damage has already been done long before that. They have been sold down the river by older generations in a way that should make them angry enough to start hanging politicians from the flag poles. But since they can’t actually do that, what are they supposed to do? Learn their math, get an education and try not to think about how even that eduction may not buy them any economic well being because their elders mortgaged their future with an option ARM mortgage.

So, what do we do? I’ve been reading your articles for weeks and I’m certainly convinced the problem is real, but what is the solution? Maybe some articles I missed have already addressed that, but I think it needs to be a focus in most articles. The millions of volunteers who helped elect Obama proved that this country isn’t entirely apathetic. It’s human nature to ignore problems when we see no solution, to not vote when both parties seem corrupt, but when given leadership and hope, millions stood up and showed far less apathy. I’ve been watching it happen slowly in regards to climate change, and we need to get to work on these problems of debt and corruption as early as possible to lessen the consequences, even if only a little. There is one major difference between 1929 and now and it is the speed and low cost of electronic communication. The mass media is powerful, but individual blogs like this are growing in power and I think they are the only hope of starting to fix this mess. Don’t just tell us the sky is falling, tell us how to prop it up.

Hey Doc just wanted to chime in and say how great your blog is. I’ve been reading every post religiously for the last few months.

There is no excuse for what happened last black Friday. Human life is worth more than $3 off your favorite overpriced copy of Batman 3.

Unfortunately, our culture is in many ways firmly rooted in overspending and consumption, and is addicted to the drug of credit. Pathological consumption permeates all layers of societal class, especially those without savings, and has been acerbated by corporate advertising and easy credit. Surely everyone is aware of the inherent greed of man’s nature, but these external forces can sometimes drive us to dangerous waters, such as seen at Walmart.

The only way to wean our society off of the aforementioned drug of overconsumption is–pardon me for being blunt–to smack the users upside the head like a dog that craps on the carpet, cut off the spigot of credit, and return to a saving-based financial society. People need to learn the value of a dollar, but its hard when the government doesn’t understand the dollar’s value to begin with.

Anyways, keep reporting things straight up. I’m sick of all the ego pandering and defensive posturing from our daily media regarding this bubble and our economic crisis.

I think we should all start praying now, you can you do it online nowadays at i-devotion.com

Doc…I only recently discovered your blog and have spent an inordinate amount of time on it this morning reading your posts and the comments left by your readership. You have validated my personal opinions regarding where we have been heading as a country and society and I believe that we are truly at a crossroads in American history. I wrote letters, made phone calls, and recruited others to do the same and yes, they still passed the legislation to bail out the financial industries anyway and keep throwing more money at the problem. I am terrified and appalled.

I think we have been heading down this road far longer than the last ten years and hope and pray that families and friends start rejoining and looking out for each other. We’ve become individualist and capitalist pigs (yours truly included) and are all going to suffer momentous changes to our lives no matter what financial bracket we fit into. Perhaps at some point the pendulum of moral and social values will begin to swing the other way, but I am fearful of how long that will take and how much further our values and morals will decline before we rise up and say enough is enough and accept our own hand and responsibility in our countries current situation. Our society is in denial and this is a problem that is systemic and multidimensional.

One of your readers asked you to articulate your thoughts on a solution…

I would say the very fundamental origin of a solution is for each and every person to evaluate their moral, social and financial existence and accept responsibility for their contribution to the problem and stop placing blame. Our society has lost sight of personal accountability in the choices that we make every day and we are our own worst enemies.

Keep on telling people the way things really are…we are nowhere near the bottom yet, so grab a hold of something rock-solid and hang on for dear life because individually we will begin getting back to the basics of food, clothing and shelter and everything else material will become superfluous and insignificant.

1923 Nation (N.Y.) 22 Aug. 181 The supply runs short and prices go skyrocketing.

What to do?

Congress isn’t listening so instead of trying to yell louder perhaps people should try to get out of US dollars. This has two effects:

A. you will have something if the dollar crashes (or even just inflates).

B. this will apply some amount of force downward on the dollar which

congress has no way to avoid other than stopping the dollar printing.

The other countries seem to be in similar shape, so the target needs to

be something else, perhaps gold/silver?

the begining of this post remind me scenes from the movie “night of the living dead”, in the mall.

i’m going to watch DVD of “mr. smith goes to washington” of frank capra, and maybe meet john doe, that were made in the spirit of the great depression. the first scene of john doe with the squandering of the name of the newspaper, can be applied now. a remake of those 3 movies could be good investment…

Fixing the economy is a piece of cake.

During the Great Depression,

Germany addressed and solved this problem,

and while the rest of the world was catering to

bankers, investment firms, and big unions

and sliding deeper and deeper into the Depression,

within two years Germany went from the poorest Western Nation,

to the most dynamic and productive economy on the planet.

They did this by eliminating the bankers and money hoarders from the loop,

and by providing entrepreneurs who had good business plans

with the capital they needed to create jobs, products and services.

In the process Germany generated large tax revenues

and they were able to build many roads, public housing projects

public buildings and parks. (And of course a powerful, modern military machine.)

What Germany did was to issue bonds that paid

a higher rate of interest than folks could get from banks.

This eliminated the bankers and money hoarders from the loop.

( Rather than giving bankers and investment firms billions

of dollars, Germany gave the masses a safe place to put their savings,

and a good return on their savings.)

Germany then gave low interest loans to entrepreneurs

that had good ideas and good, solid business plans.

The following quote is from Heinz A. Heinz’s

“Germany’s Hitler”

“The German Government offered to meet 40 per cent

of the cost to everyone who built a house or who proposed

to carry out reparations and improvements . The result

of this step is scarcely to be believed . The building

trade, hitherto at a very low ebb, looked up and went

ahead surprisingly . And consequently so have all the

allied industries . Factories are at work day and night.”

Leave a Reply