The Southern California housing spring that never was. Median price for a Southern California home falls by 8 percent year-over-year. Sales collapse by 17 percent pointing to future problems.

The spring bounce never arrived to the national housing market and certainly did not pay a visit to Southern California. Home values across the nation are experiencing a strong double-dip courtesy of a continually weak economy. As the layers of financial bailouts are peeled back like an onion we realize that housing values were extremely inflated and incomes never justified prices. The mania was purely psychological and given the mini bounce in 2010, even an epic housing collapse wasn’t enough to deter more people from jumping back into the frying pan. It was amazing how many people were telling me about the “deals†they were landing last summer. It was as if they were on the Antiques Roadshow and were told they had magically found an ancient coin in their mattress. Simplicity is rarely examined but the fact is nationwide incomes and incomes here in California never justified housing prices (in many areas of California bubble still persist). This is obvious. Yet the banks are now wedded to inflated book values and the machine can no longer convince larger groups of people to buy. Southern California had no spring bounce and here we are entering the summer selling season.

The spring that never showed up

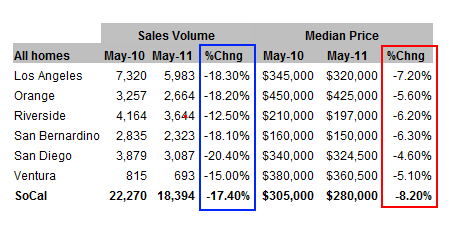

Source:Â DataQuick

Historically spring is a good season for home sales in Southern California. Home sales volume usually goes up 5.7 percent on average from April to May (this data going back to 1988). The chart above tells us a very different story. Home sales collapsed by 17 percent on a year-over-year basis and fell from April. California has many issues needing attention including a large budget deficit that seems to be swept under a rug for the moment. The crashing in home sales volume is largely brought on by:

-The mini mania that hit in 2010 with tax credits and fence sitters jumping back into the market

-The continued weakness of the underlying economy

The California underemployment rate is still near 23 percent. What is even more troubling is the new jobs added in the state since the economy crashed are coming in lower paying sectors. This is why I asked the following question; how many McDonald’s jobs does it take to purchase a home in California? The current sales figures tell us that more and more people are waking up to the fact that maybe going into massive debt isn’t such a good idea when it comes to buying a home. Either this is happening or people simply don’t have the money to support current prices.

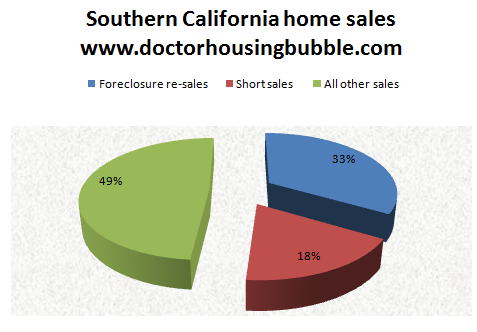

Majority of sales still coming from distressed properties

Prying deeper into the data we realize that the shadow inventory is going to cause serious future pain. The fact that every single county in SoCal is now witnessing solid year-over-year declines in median home prices reflects this adjustment. 33 percent of all homes sold last month came from foreclosure re-sales. Another 18 percent came from short sales. Over half the market in SoCal home sales is coming from distressed properties.

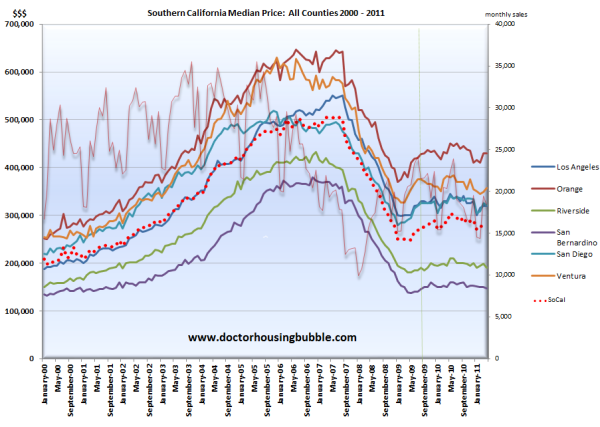

If you look at SoCal sales and prices the double-dip is clear:

What is even more disturbing is that a third of home sales are being financed with insanely low down payment FHA insured loans. As many of you are aware, all that is needed is 3.5 percent down and you can qualify for these government insured loans that are one step above NINJA loans. Just because you can show some income does not mean you can actually afford a home. The default amount in FHA insured loans of course is growing but what else do you expect? I now see some people argue that FHA is fine and not to worry. Forget the fact that FHA has stepped in to keep the market going recently and problems don’t hit until years later (does anyone remember option ARMs for example?).

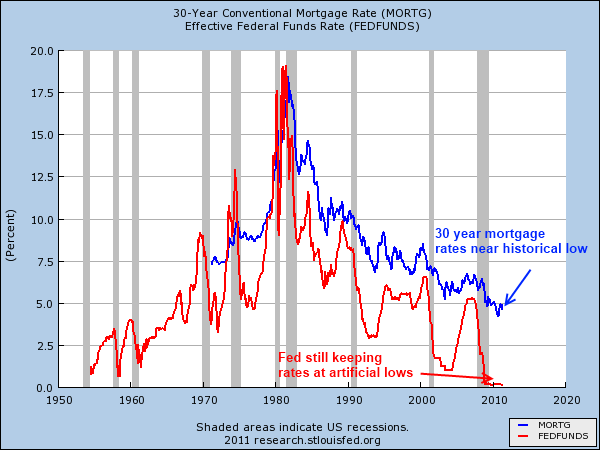

On top of all of this 30 year fixed mortgage rates are near historical lows:

The perfect storm is brewing. To stem the housing correction the Fed bailed out the banks in an incredibly irresponsible manner. The price tag is in the trillions of dollars here. The too big to fail banks are the biggest winners in the post-bubble world. The gimmicks to prop up the housing market weren’t to help the American homeowner but to pretend that bank balance sheets were really worth the fictional fantasy valuations that were made during the bubble (much of these valuations still rest on the accounting delusions of the banks). None of this has stopped home prices from collapsing further because ultimately a homeowner needs to pay the mortgage. Sure, you can have 675,000 people not paying their mortgage for over 2 years with no foreclosure being finalized but that can’t be good for business. It might bring profits to the banks but the taxpayer is paying the bill in more ways than one.

So after banks ripped off the taxpayer, the shadow inventory grew like a New York skyscraper. In 2010 tax breaks and selective leaking of market inventory created a slight bounce but as we all know, this was simply a sucker’s rally. Since one third of buyers have been buying home with FHA insured loans over the last two years in SoCal, each one of those households is now in a negative equity position. The biggest factor in predicting future foreclosure is negative equity and here we are putting people into homes with almost no down payment. The market is down over 8 percent in price. There goes that 3.5 percent down payment.

Given the political climate and the absolute waste of money in taxpayer credits, what other options are left in the crony financial system’s hat? Mortgage rates can’t possibly go any lower. If down payments go under 3.5 percent you might as well bring back NINJA loans. Selective inventory? If banks held any more distressed properties on their balance sheet they would capsize. This is why home prices now continue to move lower. Four years is a long time to screw with artificial floors and delusions but now reality has to set in. The problem of course is that the cost of saving the too big to fail is leaking out all over into the general economy.

It is amazing that the banks and the government proclaiming that they want to increase affordable housing actually increase the price by intervening. For example, low mortgage rates not only create artificial price systems but also increase the actual sticker price of a home. Throw in loans like FHA insured products and then saving for a down payment is unnecessary. This was a key factor in causing the bubble. Why not have people save 10 percent or more for a down payment for a loan? Isn’t it prudent to actually see if someone is capable of saving cash before making the biggest purchase of their life?

We have downplayed the significance of buying a home. It is amazing how many people are willing to sign off on a $500,000 mortgage simply because they buy into the housing propaganda. Would they be signing so quickly if they had to put 10 percent down and realized that home prices might go stagnant for a decade? Probably not and with a lost decade in home prices I think many people are finally waking up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “The Southern California housing spring that never was. Median price for a Southern California home falls by 8 percent year-over-year. Sales collapse by 17 percent pointing to future problems.”

Great post, Dr. Two observations I’d like to hear the chorus chime in on. First, while Dr. HB correctly lays the blame for the bubble with the TBTF banks (and secondarily with their Fed and Govt enablers), I think the general public is taking another path. I read a lot of the commentary on last week’s CNN story about “squatting” homeowners, and it was downright depressing. People who thought until recently that their home values were secure are waking up to the fact that they are underwater themselves, and they are blaming not the banks, but their defaulting neighbors.

To me, this is like blaming a cancer patient for not getting better after years of care by quack doctors. Quack doctors who nevertheless sent a massive bill to the taxpayer which needs to be paid sooner or later.

My second observation is that, while their apportionment of blame is wrong-headed, it is a good sign that so many homeowners finally “get it.” The problem for the long-term health of the market is that the newly awaken segment is only awake because they are mired in the muck. The potential buyers still do not “get it.” They are lambs to the slaughter. In my area, it is clear that they are still overpaying, which means if the economy in Chicago doesn’t turn around soon (and how can it?) they too will be in big trouble.

Looking at the “Big Picture” and the grass roots levels leads to the same dismal conclusion. We are screwed.

Dr. Housing Bubble, I am a follower of your highly informative blog. I live on the East Coast and work in NYC. I pay my property taxes directly to my municipality away from my loan servicer (Wells Fargo). From what I understand, the loan servicer will step in and pay any property taxes that are unpaid after some time. I haven’t read any material related to this factor and it’s impact on the banks and or loan servicers. I assume they do so to keep any third party tax liens out of the equation. Can you add some color to this for us? Not only do the banks/ls have to be concerned about the mortgage payments not being made, but also the property taxes correct?

In the event that a homeowner stops making payments, the bank will take over the property taxes so they dont lose the property. If the bank didnt pay the taxes, then the state, county, or city has the right to take over the property and auction it off. In that situation, the bank would lose out which is why its in their best interest to continue making the tax payments even though they are losing out on the mortgage payments.

Okay. Doesn’t a declared double dip mean the second dip on the chart dips to the same point or lower than the first dip?

The short answer is yes.

We are currently on our way down. The bottom is obviously unknown, but that would be the location of the next dip.

We could just as easily stay flat or bob up and down for years to come…

Double dip isn’t guaranteed…

The aggregate YOY dollar change for the region is actually much worse overall, a stunning 23% FALL from 7 billion dollars in May 2010 to 5.4 billion dollars in May 2011. Taken together, cumulative real estate closings in 2011 will be at least 10 billion dollars LESS in 2011 than in 2010 or an aggregate loss of 800 million dollars in commissions and fees, representing a loss of approximately 9000 jobs to the local economy in the FIRE industries alone.

Thank you Good Dr. would you be so kind to speak to the ramifications of this decision.

Appeals Court Clarifies MERS Role in Foreclosures

The ubiquitous Mortgage Electronic Registration Systems, nominal holder of millions of mortgages, does not have the right to foreclose on a mortgage in default or assign that right to anyone else if it does not hold the underlying promissory note, the Appellate Division, Second Department, ruled Friday. “This Court is mindful of the impact that this decision may have on the mortgage industry in New York, and perhaps the nation,” Justice John M. Leventhal wrote for a unanimous panel in Bank of New York v. Silverberg, 17464/08. “Nonetheless, the law must not yield to expediency and the convenience of lending institutions. Proper procedures must be followed to ensure the reliability of the chain of ownership, to secure the dependable transfer of property, and to assure the enforcement of the rules that govern real property.” The opinion noted that MERS is involved in about 60 percent of the mortgages originated in the United States.

From the ruling…

(Emphasis added by 4F)

Decided on June 7, 2011

SUPREME COURT OF THE STATE OF NEW YORK

APPELLATE DIVISION: SECOND JUDICIAL DEPARTMENT

ANITA R. FLORIO, J.P.

THOMAS A. DICKERSON

JOHN M. LEVENTHAL

ARIEL E. BELEN, JJ.

2010-00131

(Index No. 17464-08)

[*1]Bank of New York, etc., respondent,

v

Stephen Silverberg, et al., appellants, et al., defendants.

I am an owner since 2002 and when I conduct a title search MERS is all over my deed circa 2004-2005 ultimately granting the infamous Recon trust who eventually sold my mortgage to FHA. Does this New York decision play in the future of CA RE.

Nemo dat quod non habit

My dilemma, please give feedback. I’ve been renting in a trendy neighborhood since nov. I’ve found a one bed condo this week at prob. 185k negotiated, it will put me at a monthly that is in line with rent for comp. Units, although at 20 percent down I’ve put 18 k into the deal plus closing cost, do I keep renting or do I make this first small move to not be paying rent indefinitely? Total m,t + hoa=1250, ave rent for my area?

Umm, wouldn’t 20% down be more like $37k? Anyway, in this now-obvious-to-everyone DECLINING market, I’d say negotiate harder… assume–quite rightly–that condo will lose ANOTHER 12% in the next year… then negotiate even lower than THAT. If they refuse, do a sarcastic look over each shoulder, and say “Thanks, I’d better get out of the way of this long line of serious bidders, waiting to pounce on this rare deal…” LMAO! In 3 months, THEY will be calling YOU back.

Seriously, if it’s just another nothing-special box, in a stack of boxes, I’d keep renting. HOA fees are sunk money; they rarely go down. Don’t be seduced by the granite countertops, or the cute RE babe. ;’)

PS: Are you SURE you have a qualified mortgage lined up? If the bank doesn’t like the “deal”, that would be a huge red flag.

Oh yeah, in this buyer’s market, why would YOU pay closing costs? Sod that, esp. if unit is still held by the original builder/developer. (You didn’t say whether this is a new or used building… similar cautions used when buying a used car should be employed in either case.)

BEST strategy is to wait, and then push those closing costs back across the table AT THE CLOSING, and not mention them beforehand. Let them prove how “motivated” they really are! Yes, Mr. Hardball is my middle name, nyuk, nyuk, nyuk.

Totally unethical and illegal advice about closing costs. That’s why there is a “sales contract” where the buyer agree’s to pay the seller X dollars for the property. Violating that at the closing is like saying there was never any agreement legally on the sale of the property. This is a sure way to NOT get the property you want!

Closing costs are to be born by the buyer – that is they way it should be. You need to be responsible for your insurance, YOUR title insurance, and the fee’s associated as this is YOUR financial transaction, not the sellers! Again, Americans need to stop thinking and living by the creed of “ME ME ME” and realize they need to pay their own way. The way it should be viewed is “if I can’t afford closing costs and a downpayment, then I can’t afford the property to begin with.”

“Totally unethical and illegal advice about closing costs.”

I guess it WOULD be state-specific… and I guess things are still a bit 1920s “loosey-goosey” here in F-L-A (e.g. disclosure laws WEAK, non-binding) , BUT… EVERYTHING is negotiable, and yes, I’ve taken add’l 5-figures off at closing for problems found late in game, personal pique, etc… it’s all money, and money is FUNGIBLE… call it “commissions”, call it roof repair, it goes to the same bottom line. You know Duh Gov and Duh Bank is gonna get theirs, but the Realtor’s cut?… not so inviolable. ;’)

Not to mention it’s a CLOSING–a private affair in a lawyer’s office–NOT reporting for military duty, i.e. not compulsory. So if things really get sideways, buyer can always walk out, and forfeit only a comparatively small deposit… and not even that if the seller is out of bounds on something. Real-tards may tell you otherwise, make you feel that it “HAS TO” happen, you “HAVE TO” go through with it, that it’s an inevitable, unstoppable juggernaut… and the price is the price… but, verily I say unto thee, ’tis NOT so.

It can all evaporate right there at the non-closing closing. OOOOooh yeah.

Rudy:

Don’t forget you will have closing costs twice(should you ever sell), maintenance(which is 1-2% of the cost of a property…believe me, it is real), adn finally, you lose flexibility with ownership–suppose noone wants to buy when you are ready to sell. Lastly, you woill be buying a depreciating asset–kind-of like buying Xerox stock at $100, and selling it in 5 yrs for $80–why do that??

One bedroom condos are virtually impossible to sell down the road. Your only potential buyers are young, single people, with good credit- this is a VERY small pool of potential buyers. You will take a bath on this.

Keep renting. Save your money.

Remember that you when you purchase a Condo you are purchasing a house. You are buying into a group effort. You must check closely what you are getting into. Are there many empty units, are the grounds OK, any big assessments coming up, what about the immediate neighbors, and in a condo that is like in the next bedroom. My advice is never buy a Condo un less you have to like NY.

The one bedroom condo is a hard sell. Unless you are in New York or San Fran, or some very densely populated city I would stay away from the one bedroom. If you are dead set on buying, get a two bed. You’ll want the extra room one day.

Sincerely,

SoCal Foreclosed property flipper

I predict a big downturn in prices after this summer. This spring has been the precursor, this summer will be a home sales bloodbath. Homeowners, hopped up for so long on hopium, are going to see those lateral moves in prices (which were totally, definitely a sign that the market was rebounding!!) turn south, and realize that they can go on paying too much for a home or get their expectations in line with reality. Suddenly those sellers who feel they are doing buyers a favor by cutting .5% off of their asking price will begin to see that unless they want to be shackled to a money pit forever they best start knocking off 20-30%.

What I fear is that the administration will have it’s ear cocked toward those involved in RE and start shoveling out the cash or, god forbid, start reducing principal on underwater owners. These moves will only serve to extend the housing doldrums. Anyone who still has some cash to buy a house with us smart enough to understand that market manipulation can’t go on forever and that someone will eventually be left holding the overpriced property hot potato…but only after the vested interests have off-loaded their interests onto the unwitting.

Sit back, rent, and tell your wives they can live without the ability to change their wall colors for a few more years.

Hopped up on Hopium… that certainly coins it!

“Sit back, rent, and tell your wives they can live without the ability to change their wall colors for a few more years.”

The supposed inability to change interior paint colors in a rental–especially a SFR–is largely overblown. EVERYTHING is negotiable. With a large enough deposit, a savvy landlord will do the painting for you–WIN-WIN! Money is a GREAT way to gauge how important something is to each party. ;’)

Not to mention that, if you’ve been a good tenant for a respectable length of time, no savvy landlord is going to bollocks that up over paint. You may have to assure that proper masking and dropclothing will be done. e.g. I allow painting in my props, but won’t allow use of rollers; a 4″ wide brush is nearly as fast, esp. when you factor in messing around with pan, pouring, pan cleaning, etc. You get one speck-let of paint on MY circuit breakers, and YOU are paying for replacements.

Paint is fleeting, concrete is not… don’t mix up any of the latter, lol.

What? Let you’re wife paint her apartment. It’s paint. It’s easy to paint over. Wallpaper…bad and let’s face it, frumpy outdated idea.

Have a great landlord. Rent on a “high end” neighborhood and have changed out wall colors/ flooring etc….. We decided this is where we will be until our last one graduates high school (3 more years) and have made our “rental” our home for now.

Maybe in three years it will make sense to buy a house….. maybe not…….

I appreciate you all concentrating on the last few words of my post, but they were intended to reflect a very strong trend I have observed for many years – man is happy renting, woman is outraged because she can’t manipulate her environment enough. Buying a whole house is unappealing for one reason or another, so they jump into the market with a co-op/condo. Result? They’re paying three times as much for the same space, with the only real difference being that they can paint the walls. This apparently isn’t just me, Slim and Dave_renter appear to face the same problems. I am also reminded of a ra-ra-ra article the NY Times put out in 2008 or 2009 about how strong, intelligent women were ignoring the pooh-poohing of their oafish, dim-witted husbands and still forcing RE deals through. Of course, there was the Countrywide(?) commercial back in the day with much the same attitude….

Advertisers know who to appeal to when they want people to go against their own best interests, and my experiences have born that notion out.

Cogent, spot-on, irrefutable post. When even the MSM cheerleaders are forced to admit a “Double Dip”, you know the “knee” of the down-curve is going to happen in 2011, not 2012… this is probably better for Obama & Co. anyway, i.e. even though there will be no “bounce”, the collapse news will be farther in past, come Nov. 2012.

I would appreciate insights on rental rate trends, and the factors and lag times involved.

Keep up the great work, Doc!

The time is coming when I expect that I will see a client that has been in his or her home for more than 5 years and hasn’t made a mortgage payment, in spite of receiving a notice of default back at the beginning. If that person has paid the taxes, I’m prepared to argue for “constructive dispossession,” that is, when the bank could have foreclosed and didn’t, there ought to be a point at which the law can treat the situation as if the foreclosure process went ahead, and then, say 6 months after that, consider that the homeowner is a tenant at sufferance. From that moment the limitations period would run, and after 5 years, the homeowner could claim title free and clear by way of adverse possession.

I would like to see the CA Legislature codify some kind of constructive repossession scheme that would encourage the banks to get on with clearing up the inventory, but as long as Juan Vargas is the chairman of the Assembly Banking Committee, I doubt it will happen.

Thanks for the update, as always, Dr HB. I completely agree with Clotario. I fully expect a much bigger price decline in July-Sep, as those who were hoping to sell into the “strong” Summer season quickly realize that they need to offer steep discounts if they truly want to sell. Sit back and watch the carnage from the sidelines – it’s going to be ugly. OR – you can lend a flipper a short-term hard money loan on a low enough loan to value (ie. below 60%) and make 15-25% annually while prices decline (I am doing this)!

One thing is clear – housing price deflation is with us and is here to stay for a LONG, LONG time (ie. YEARS).

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBI-Commercial-Real-Estate-Los-Angeles/

The real estate market is totally broken and sick in Southern California. There are too many back-door dealings between the banks and realtors and a small group of flippers. Unless the market is becoming normal, and the distressed properties get to the stronger hands, the bottom is far away.

The discussion that should be happening is who is going to take a haircut on housing? Someone has to pay to right the ship.

Current political wisdom seems to be that renters and first time buyers need to take one for the team, while we focus on supporting prices for the current owners. Banks are allowed to keep inflated values on their books, baby boomers are scared of losing their equity, and that leaves the young and the restless (renters) who don’t have the assets to play in the big leagues (as in, hire lobbyists).

If housing is allowed to settle to match incomes, we will have a LOT of angry baby boomers. Who, coincidentally, also run the banks and probably hold most seats in government.

I see the same thing. The more you abuse people in this pseudo-market the more long-term aversion you are seeding. The current renters and first-time buyers are the longer-term demand engines. Taking them to the shed is rough and you are killing a generation or more of support. The housing market will certainly never be like the 2002-2007 boom again but we may never even get what most people consider a normal market in their lifetimes. Scars and fear run deep in memory and housing is still inflated to dollar values that can really hurt all but very high income or wealthy families.

For me, I’ve been on the sidelines a long time thinking a bloodbath was coming since 2004ish. I’d like to buy but this is a ridiculously manipulated market and the sell side is horribly unrealistic/in denial for the most part. The reality here though is that my oldest son is 7 and in 10 years he’ll be off to college and that would start my downsizing phase. Maybe I just let this thing pass me by and rent. My wife is an issue but who knows. I have plenty of $, income, credit to buy but absorbing 6 digit losses is rough to recover from. I figure they wouldn’t be fighting this hard to hide it unless the risk was very real. No price discovery (let’s not even discuss uncertainty around taxes and energy costs) keeps me out unless I see a fabulous deal.

You told my story Slim. Just keep saving maybe we can buy our retirement house somewhere else for cash!

Concur. The political realities of the housing market make maintaining the status quo the most appealing of the various choices. Boomers are walking into retirement with decimated portfolios and paltry pensions. All they have is the equity in their overvalued houses. If Obama allows the rug to be pulled from under them the boomers will be back on the Washington Mall reliving their youths demanding the establishment’s blood. (that, of course, it was the Boomers’ voting choices to alter the social contract which was responsible for this state of affairs hardly needs to be discussed)

From their parents’ Greatest Generation to their Most Greatly Pandered To Generation…to my Bleak Future to Support Your Parents’ Generation.

Us renters are taking it pretty hard now….in the North Bay (Santa Rosa and surrounding) rents have taken off through the roof this spring…..you can’t find a place in a nice part of now that is a 2/1 apartment for less than $1300/month (I realize in LA that would be great) but in 2006 when I moved here I was seeing the same places for $750…meanwhile there are 200 plus homes in Sonoma county on the MLS that are priced under 200K…..

…..it’s not LA, but it starting to look like time to buy.

EtR-

It is a long discussion that the good Dr. has been actively feeding for several years. Taxpayers will be taking it the wrong way for Ben and Hank’s FIRE team until Rangnarök. Renters and first time buyers will be taking it for the irresponsible credit glee buyers and their enabling lenders until home prices reach a realistic multiple of homebuyer incomes.

Wow, I sure do love this blog.

My question for the good doctor and all other commentors is what will the right time to buy look like ? Almost every post is why not to buy or how much more shaddy behavior is happening behind the scenes.

Using Zillows local info tab I found that in LA the median household income was $36,687…and the Zillow house value median is at $374.900. Obviously no good can come out of that, but while looking at the data back to 2002 the median house was listed in LA at 276k…Something here still seems off. Assuming that household income did not incease how were people buying in 02 before the big boom?

What are we all looking for as a sign? Sure there is more fall to come, but when would someone edjucated and able to see the signs know that now is a good time to buy? Are we waiting for 150k median in LA. Would that be reasonable with a 36k median HHI ? Is that realistic ? If we are all preparing for the absolute worst what will that look like in your eyes and then would you buy ?

1996 prices sound about right

In 1996

I think at $375k purchase price, 20% down, 7% loan interest rate, 30 yrs, $2000/mo payment, you had to have $100k a year household income.

At 5% loan rate, 30 yrs, the monthly payment would be 1500/mo or so and you have to be making about $80k a year household income.

What does a good time to buy look like, indeed! I’d say it’s time to buy when the numbers work without having to believe in real estate fairies. Anyone can price any property – what you can produce on/from the land (fruit, vegetables, rental income, living space to enable you to earn an income, etc) compared with what it would cost to rent it from someone else. Throw in there the [ridiculous] mortgage interest deduction and realistic (i.e., historical) rates of appreciation. Bonus points for established neighborhoods, down a few for frontier neighborhoods.

But, where we are now is a bit of a historical and economic juncture. The economy is being propped up, the middle class is being squeezed, and what tomorrow’s ‘normal’ will be is anyone’s guess. My feeling is that prices have to go through another good correction before one will be able to tell which way the future winds will blow. One way or another don’t think that a reversion to the historical trends (much less the trends of the 2000’s) will occur anytime soon.

Short answer – if it makes sense, it makes sense. If you have to depend on anything but a 3% appreciation rate to make the deal worthwhile, you should reconsider.

What you really mean to ask is when do people believe buyers will reach their maximum bargining strength based on market conditions? Anytime is the right time to buy if you are getting a great deal. Let say your household income is $37,000 and you go around in this market making $100,000 offers on houses that you want. You get rejection after rejection, after rejection, and then someone agrees to your price. No matter what the market conditions are, now is the right time to buy. Of course, we are assuming you’re not a complete idiot and did a little research before deciding to offer that $100K.

Personally, I look at 1997 prices with some adjustment taking into account real vs. nominal dollars, and reasonable appreciation, and a few more things. Am I wrong? Am I right? It doesn’t matter as long as it is logical. And, it is certainly not any more wrong or right than using comps. If a seller doesn’t like it that’s fine, reject the offer, watch your house go down in value. I’m sure if you have no mortgage, you don’t care either. If you’re underwater, good luck treading. And, if you are a bank, pray the government keeps handing you money and letting you slide on accounting.

Just a point of interest, bubbles tend to have prices drop below the start point, but massive government intervention may change things, but don’t be greedy. First time homebuyers should, look at their finances and pick where they think the bubble started, pick their price and stick with it.

My sentiments exactly, though I’m a bit more generous than you – in that I take the 1999 price (or earlier) and add 3% compound interest per annum.

I have nothing against paying a modest amount of appreciation, especially if they’ve kept the place up or done improvements.

But I”m not paying someone’s fantasy price, nor am I responsible for funding their pension.

Trying to time the bottom is nearly impossible. Buffett can’t do it, I know I can’t. The advice you have gotten from the other bloggers is sound. I would only add that financially it is better to wait until you feel really comfortable that the market has corrected. If you miss the first bit of appreciation as the market swings back to normalcy, no biggee. The bigger problem for any investor is the loss of 10-20% by jumping too early. Getting back in the market slightly late might mean 10% less gain. To me that beats a 10-20% loss, any day.

Even if prices fall within a reasonable range in the next few years, will you honestly be able to look at your situation and say “Yep, my job is secure for the next 30 years and I know I can find a similar one without moving if necessary? Hand me a contract!”

Can you even say that your job is secure for the next 10 years? 5 years?

I’m questioning the whole concept of 30 year mortgages in a new age where job security is a myth. And if we move to 15 year mortgages, prices better fall further to compensate for higher monthly payments.

What conditions will make you feel secure that your job will remain viable for the next 30 years in your area?

Eric, you hit it on the head again. My wife and I are lawyers in New York with cash to spare and I would personally love to buy something with rentals so in ten years we are making income off the place, but – do we have a reasonable assurance of having ten years of well-paying work? Not really!

Also, in NYC, our real estate market hasn’t taken much of a hit because the finance people have kept up their fat salaries and ever-inflating bonuses (another reason I loathe the endless series of bailouts). Will this state of affairs last?

We looked at a place down the block from where we rent now. Three large apartments plus basement and backyard. It was put on the market for $1.76mil, now $1.6, but still up from $600k-odd in 2004 (probably renovated, but do we want to pay the owners a renovation fee of $333k per apartment??). But, we could live in one, rent the others out for $2500+ each, in a few years of inflation the deal starts to make sense. But, there are a lot of ‘maybes’ in the deal – the Macro economy for one, our personal economy second. We’ll keep our eyes open for better deals.

The latest LA County median household income is $54,375.

Something gave you a median income of $36! LOL! Well it sure wasn’t the US Census which has ‘the’ most acurate data on income.

Hint: DO NOT rely upon Zillow for income data – or really much of anything that needs to be precise as it makes off-the-wall guesstimates..

LA county median household income is $54828.

LA city it is $48720

That means a mortgage of around $164,000 – $146,000 would be the most the typical household could carry (and assuming they have only neglibile student loans, car payments, credit card etc)

let’s just hope the politicians stay out of the way this time and let the market do what it’s suppose to do – in this case, drop.

You can already sense the dispair slowly sinking in to the SoCal economy. I know everyone’s been saying for years that the market will capitulate in “a few months” and you never know what tricks the gov/bank cartel has up its sleeve, but this data is astounding. The dual market of distressed vs. non-distressed homes will eventually merge into one nasty sell-off. I’ve been watching a 3/2 with an old kitchen sit on the market for months now – trying to get $800k. That’s the non-distressed market and what buyer with enough cash to buy an $800k home would even consider that? Meanwhile right across the street from that almost $1 million house there’s a boarded up abandoned “home.” People are getting laid off and not finding work, the days of carelessly buying whatever you want are becoming a thing of the past. This ain’t gonna be pretty.

I love the god forbid reduce principle. So if someone is living in a house with a loan with a 450k mortgage, they could easily afford a 350k mortgage(their income dropped) and the house is worth 175k. What makes more sense… reducing the principle to something they can afford or letting them foreclose?

I have wondered that myself. We chose to move out of our home (loan amount 500k) and offer it for a short sale. Our asking price is starting at 317. We have a son with autism and didnt feel living in it while it was on the market would be good for him, so we moved out and put it on the market. Our servicer is Wells our loan is Mers and we never did find out who actually owned it. They wanted 41% of our income which was too much to continue to help our kids with college and provide adequate life insurance for our disabled one. We have an income of 125K still and probably would have accepted a loan at 400k. How does it make sense for them to foreclose or take the short sale offering? Is it just because they need to punish us? We were a fixed loan with 20% down. I honestly believe our only sin was stupidity for buying when we did.

Ann,

As someone who gave back her family house last year (deed-in-lieu) let me express my sincere sympathy for you. Moving out and renting was a very tough decision for us. But waiting indefinitely for someone to formulate a plan (which is unlikely to happen, because those with the power are feckless) is not a plan. The banks will not do a real mod. They won’t reduce the principal. You have to walk.

I can tell you that we survived the past year. Our kids are in a new school and happy. I hate my rental house, but at least it’s affordable. Our expenses are now in line with our income, for the first time since we bought our house in 04. It was our 2nd “move up” house. We put 25% down. Lost it all. I know what you mean when you say you feel stupid. But you were just honest. You didn’t know how many liars and cons were out there at the same time, putting nothing down. That won’t happen again.

Prepare for 2-3 years of renting. If you can, get a place you can be happy in for that length of time. Your credit may heal quickly (ours is back in the mid 700s) but the foreclosure on your credit check will scare potential landlords. And yes, that’s how short sales and DILs get reported on the credit score–foreclosure! Because we must all be painted with a broad brush and shamed into not taking action.

That said, this year our cash flow was good enough to send our kids to good camps for the first time EVER and put some money aside for college. People who are “saving” their houses are sacrificing a lot, and many families will suffer long-term. I applaud you for putting your kids first. Stay strong and good luck.

Ann, there is no sin in an above-board business transaction, just responsibility. It’s not that you bought your house at the wrong time, you took on too big of a mortgage ($500k) for your hh income ($125k). Of course, there are other entities responsible for your former home being “valued” at $500k in the first place.

There are two different avenues here for principal reduction. One, to which I was initially referring, is the bankruptcy court kind. There is something morally reprehensible and ridiculous about that concept: you decided to pay for something at an inflated price (PS – plenty of people knew better) but the court is going to step in and reduce that sales price because you can no longer afford it (or is it just that the price went down?). Purchasers made their bed and they have to sleep in it. And what price will the courts decide on? And what happens if prices go back up? It’s a terrible situation to be in, but moving on is the best thing.

But, you appear to be questioning the financial decisions of banks. Things aren’t that simple, and the bank really isn’t involved. There is an inherent tension when dealing with securitized mortgages – holders of the notes would support reducing payments to a sustainable level so they can maintain a cash flow from your mortgage. But because of the way securitization agreements work servicers have the financial incentive to move toward foreclosure…and servicers make the decisions.

But, again, is this because the purchaser can no longer afford the mortgage or because the value of the property has decreased? In the first case, it will neither be the first nor the last purchaser on credit who has lost the ability to pay for the underlying property. And, because we have thousands of years experience in dealing with this issue, we have developed the concept of repossession (i.e., foreclosure). If the property simply isn’t worth what it once was, again, not the first nor last time this has happened.

Wow. Houses prices are going down and down.

When will would be the right time to buy in South LA? Is it in 2012 or is it in 10 more years?

There is an interesting statistic in the median drop percentage – the overall drop for all of So. Cal. is -8.20%, while the drop for the individual counties does not go below -7.20%.

Anyone know whether an attorney can “Walk-Thru” the paper work on a Short Sale? I am being stone-walled by my own Agent and the Seller’s Agent, both work for the same realty company out of different offices. We have a time limit to get out of our current rental so it would simplify matters if we could force the lender to close by a specific date. What are our chances? Thanks Doc, this is still the best source for California Housing Info!

Any deal where you feel pressured is suspect. If you are on the wrong end of a foreclosure vs short sale negotiation, you may feel powerless. You are not. You always have options, as unpalatable as they might be.

I can’t say this strongly enough. Serious red flags if the people you are dealing with won’t allow your attorney to look at the papers.

Dump your agent if possible. See if bank’s/seller’s agent is allowed to double the commission and see if that gets the shlub motivated. Sorry, but a few bad experiences with RE agents and loan officers (and some short sale guys who are both) and I have little regard and less patience for the lot of the value leaching parasites. IMO most RE agents detract, rather than add, value from the home purchase and sale process. Should be an easy transaction FSBO to a direct purchase by buyer with proper financing, appraisal, title and escrow. Screw residential RE agents and their flashy jabber on the urgency to buy. They shill instant losses while yammering for the buyer to get it while its hot, yet these same turds can’t send you a decent set of comps in a reasonable time or carry on a negotiation that is in accordance with the buyer’s best interests.

Some bloke on CNBC early this am was yaking up the S&P going $105 EPS this quarter, new DOW highs during this cycle – sometime in the next year or two, and the icing on the cake – “HOUSING CAN”T GO ANY LOWER.” Between the perma-bull talking heads and the MSM nitwit Joe Kernan, I must be a sadist to get any morning financial news on CNBC. I can’t always get Bloomberg or the BBC, but they are slightly better.

Dear rental lurker, Bob Peston of the BBC has a good blog. Very Bank, Business, UK Budget focused.

http://www.bbc.co.uk/news/correspondents/robertpeston/

I’ve been astonished at how crummy the realtors are. In my area, listings for vacant lots only rarely include the lot dimensions. Instead, there is just a bare estimate of the square footage of the lot, or not even that. From what I can tell, most realtors, especially the female ones, will NOT get out of their car and walk across the lot to take a photo, even if there is a lake or creek view.

On listings of houses, it takes weeks or even months before the realtor finally posts ONE photo. Houses that have been for sale for over a year often do NOT have any interior photos at all. They don’t bother to take measurements of the room sizes, and they don’t mention which floor the master bedroom is on (critical to me — I have orthopedic problems). I saw a humdinger of a listing a few days ago, “too many features to list,” it said. So the realtor didn’t enumerate any of the features of the house. It really does make you wonder if they actually care whether the house sells or not. You would think that in this market, they would be knocking themselves out.

90% of the realtors appear to be completely useless. Before you hire one, take a good hard look at the listings for other houses in your neighborhood, and consider using the realtor who actually makes an effort on putting out a good listing. The funniest thing is when they post photos and don’t make any effort to weed out photos that do more harm than good, such as photos of bathrooms that have been ripped out, overflowing closets, or kitchens that are so full of country-cozy baskets and knick knacks that the kitchen looks horrible, even though it is probably a decent enough kitchen.

What do you guys think about a house in Malibu that rents (relatively easily) for $5700 a month. But the house is on the market for $1.7 million. This is our house. My wife swears it is a reasonable value – and it is priced consistently with the neighborhood, but I have to say that I dont understand why it is “valued” so highly. Even if someone could finance the entire 1.7 million nut at 4.35% for 30 years (not even possible, of course), they would still be paying $10,000 per month when you factor in properly taxes. Who in there right mind would buy? I think the place is worth 1.25, max.

Bad news. A property should rent for about 1% a month of value. Your house is worth about $550,000.

For a RE investor, that is totally logical. The thing that drives down a malibu locale for me personnally, is the lack of surf in wintertime.

Jay,

There is this type of properties all around. Based on patrick.net’s calculation system (rent vs sale price), a good buyer price for your property should be 760K. But since Malibu is a highly sought area you can probably go up to 1140K and try your luck, so 1.25 is pretty close.

Jay, I’ve been renting in Malibu for 3 years while watching the market in Malibu and other beach communities closely. I can honestly say that Malibu is the craziest of all the markets I’m monitoring. It was also the market where the bubble appeared to have peaked later than anywhere else. Most Malibu properties on the market are priced above their 2004 sale prices (except for some way inland). Just like Santa Monica for example, I think that the correction in Malibu isn’t even in full swing yet. And you will stand no chance with your 1.25 offer. The problem is that you might lose your nice rental if someone comes along offering 1.5 or 1.6.

If you REALLY like the place and you can afford to lose a few hundred grand in the next 5 years (and if you have enough cash) then you should consider buying, but are you getting a deal? Definitely not. How much is a happy wife worth to you?

What I would do is keep renting and hope nobody bites at that price. If it does sell however then I would look for another rental in Malibu as it doesn’t seem to be too hard to find decent ones at 5-6k/mo.

Of course it is stressful being forced to move, but I personally find losing hundreds of thousands of dollars a lot more stressful…

What are the factors that produce the $5700 rent? If you determine that, you will find your answer.

Comparable value means about zero. cash flows matter.

For instance, if your landlord owns the place outright and the $5700 provides an income stream about net costs; it would be reasonable to assume they would accept a lower rent for the certainty of a great tenant. I would extend the lease out and pocket the $40K-$50K per year.

Let me clarify a bit on my post, above. I am the owner of this property, and we are renting it out for approx 5700 a month. That results in a net shortfall of about $1,00 a month for us based on our particular mortgage and property tax situation.

We are considering listing this property at the going rate of about $1.7 million. But I’m just baffled as to how it could be worth that much. One poster below thinks my house is worth $550,000 which is absurdly low, but I would expect that kind of estimate from a poster here. Now We know that a willing buyer would come along and pay 1.3 -1.5 mm. That is just “today’s market.” But my question is, why are poeople even paying that much right now, much less $1.7mm?

The only reaosn my wife and I can come up with is that the buyers of these homes are “rolling over” singificant equity from previous residential property (to the tune of 300K to 700K), and, in order to avoid taxes, need to purchase a comperable personal residnece to dump the money into to create one of those tax avoidance “exchanges.” This kind of activy must be the explanation of why one would chose to buy our house for the inflated 1.5mm-1.7mm asking price rather than jusr rent it for $5700 a month. That is the ONLY justification I can come up with for the current market price.

Does anyone have another, rational explaination (other than a mass delusion, which the Dr. advocates, and which I sort of believe)? I want to find some way to persuade my wife to sell it quickly before more value and equity is lost – but if the tax exchange argument will be keeping malibu permentantly aloft, I have less “ammo.” Thanks. Great board, by the way.

Clarification appreciated. You hit the nail on thte head, there IS no rational explanation. It is tough for us logical/technical thinkers to swallow that, but markets certainly have emotional elements to them, as humans are not always thinking. Some might not appreciate my brief sarcastic comments, such as the one above, but my intent is to get folks to think and read between the lines: Close proximity to a certain surf spot would seem illogical or silly to MOST folks, but to me it is paramount. Besides I don’t have too much time to be long-winded.

I’d review some of the doctor’s past articles on asking prices vs rents in various areas.

I would also recommend answering:

If $1.3-1.7 million is realistic $5700 per month rent sound extremely low. If that produces a $1100 per month deficit, you should be able to still charge a below market rent and make a couple grand per month.

What do the neighbors do? Are they smart and savvy? It only takes one knucklehead to buy the house. Likewise, can you get a renter in and become cash flow positive.

Why exactly do you own? What’s your opinion on, “the more stuff you own, the more the stuff owns you.” Is this a peace of mind problem.

to Pattsfaninpittsburg:

The reason I own the house is that my wife had it from before our marriage. I would never have purchased it. I’m telling you , the situation is baffling to me. Either the rents are way too low or the price is way too high. Unless there is some TAX REASON that the prices are so excessive in Malibu (and elsewhere, perhaps). I continue to wonder whether anyone has any insight into that (see my original post above) as a potential reason that, from at least a cash flow perspective, prices are so insanely high and out of adjustment with rental prices?

Jay

Sounds like it’s just best to get rid of it and pocket the money.

Sometimes it’s just best to do it and save the stress. If $1.7M is “resonable” list at $1.695M and exit. When I sold an inherited property in SC, it had an advantage over the other houses in the neighborhood. I used the guy who noticed the advantage and sold.

Could we have made more and waited? Maybe but why stress in life.

I am not an expert on real estate, but common sense tells me that buying a property at this time or the near future is not a wise choice. Property values will go down so more. Renting is not cheap, but does not carry any other responsiblities than monthly payments to the landlord and insurance. I have been through one depression, one devaluation and soon may be seeing another financial disaster coming. My advice: do not purchase any items which are not absolutely necessary for your daily needs. Keep your cash for a rainy day. If you have the cash down the road, you can buy houses which are valued at 50% now for at least another 20% off the current price.

Does anyone believe that the unemployment situation will be solved? Not in the short run. It may take years to recover this financial fiasco if ever.

The government can try to manipulate the real estate market on the short term, like they did with buyer incentive. However, the only thing that will help is jobs, well paid jobs. And, the government has been an absolute failure. Actually, they are reducing jobs on ALL governmental levels, the only real control they have. And, raising taxes at the same time. How about defense industry (Southern Cal.)? They are going to cut it to the bone, just like the space program. Try looking at house prices on http://www.zillow.com/ and type in Titusville or Cape Canaveral. You can buy a house for $40,000 in good condition five minutes to the beach. But you cannot rent it or find a job to pay for it yourself. Because the space program is dead…

Hello Jake. True that! I grew up in Westchester (West LA) and as a child I look back and am amazed at all the aviation/aero/space jobs there were in LA back then. More than half of my friends fathers at the time worked for TRW, Garret, Hughes aircraft, Northrop, AiResearch, McDonnel Douglas, Grumman, Boeing, AirSupply, Allied Signal, etc…. most of these now have been gobbled up by Boeing and others and moved out of LA.

This blog should state…. If you work in the film and tv industry in los angeles.. Or healthcare industry…. Buying is now safe. Hollywood is never leaving Los Angeles! And people always will get sick….

Any other industry in Los Angeles might not be safe in the long term….

Here you go, pool home, less than a cheap BMW. Less than $35 a foot, and five minutes to the beach. I realize this is not fabulous S. Cali. but a lot of people thought Florida was going to be Cali.

http://www.zillow.com/homedetails/260-Yumas-Dr-Titusville-FL-32796/43377725_zpid/#{scid=hdp-site-map-list-photos}

I’m still not convinced that FHA is such a bad thing. An FHA can get me into a place where my mortage, taxes, insurance will almost be the same as my rent, maybe only a few hundreds dollars more.

In a declining market, wouldn’t it be wise to lose 3.5 percent than a 10-20 percent downpayment?

And, on the other hand, if its a declining market, why are you considering buying at all? Especially if you’re working on the theory that you’re going to ‘lose’ your 10% deposit?

It amazes me – after almost 5 years of housing crash – that people still think that a house is an investment vehicle, rather than a place to live.

I AM looking for a place to live, a home. I wouldn’t mind losing 3.5 percent because I’ve lost ALL of my past money on rent. Atleast with a mortage, I’ll have the pleasure of owning one day. With this idea, I think an FHA works for me.

You lose all your money on rent! If renting is comparable to owning…. Buying is always better after 30 years…. You have an asset afterward! Rich people own property…. The poor rent over the long haul.

Dr., can you please estrapolate the relationship between the Case-Shiller Index and the Credit Suisse perfprmance schedule to what kind of projection we may get in 2011-13?

http://usawatchdog.com/wp-content/uploads/2010/06/CreditSuisse-reset-chart.jpg

http://www.cotohousingblog.com/wp-content/uploads/2010/03/CreditSuisseResetMarch09.jpg

Thanks

Doctor, I thought the banks make more money the longer they hold out and refuse to foreclose on at least some of the deadbeat loans.

My understanding was that the various bailout deals and Fanny/Freddy/FHA deals offered by the federal government will cover not only the banks’ principal losses, but interest losses as well.

If so, a deadbeat loan recast to a 9% interest rate is the equivalent of an investment of capital at 9% for as long as the banks can hold out and not foreclose.

How do so many “highly educated” and “accomplished” MSM pundits, analysts, journalists, etc. give so little weight to unemployment and the threat of a U.S. Treasury default? Collusion, misinformation, willful ignorance or just plain lack of understanding of macro-economic forces? Today CNBC’s Rick Santelli scoffed at the threat of a U.S. default and its effect on future bond yields. Huh?

Give this a read.

http://www.foxnews.com/politics/2011/06/15/housing-collapse-steeper-than-during-great-depression-analyst-says/

Housing in Cali will continue is downward slide.

I read an article in BloombergBusinessweek today regarding the down payment requirements (http://www.businessweek.com/magazine/content/11_25/b4233053223432.htm?chan=magazine+channel_top+stories). To stem speculation, govt should do what the Germans did (40% DP) for second houses and incorporate what the Australian government did for income taxes (graduated income taxes according to taxpayer age).

so many “highly educated†and “accomplished†MSM pundits, analysts, journalists

The large majority of which aren’t worth a bucket of warm spit. With few exceptions, they are little more than pretty storytellers hired for their looks or their blarney. Those that have any insight to begin with are hopelessly compromised by the pressures of keeping favor with their employer’s interests.

In some parts of Central Florida one can buy a house in a decent neighborhood for less than what one paid in 1980. Even the beachside properties are at the 1985-1990 levels. 70-80% off from the peak. Just give it a little bit more time guys.

Dear Dr., you forgot to mention the fact that one can buy a house (FHA financing) with a $100 down payment. No, it is not a joke.

Thank you, and keep up the good work!

Florida is a hot, humid, hurricane prone senior citizen cess pool. Name any good jobs based out of florida excluding military. Los Angeles has a powerful world renowned ever growing tv and film industry and celebrity tourism fueled cultural that isnt going to disappear. Housing in Los Angeles will never be as cheap as swamp land Florida.

My wife and I decided to buy about a month ago. We purchased a 2200 sq foot house in Chino, CA that we both believed had everything we were looking for: big kitchen, lots of space for kids, fancy swimming pool in the back, gated community, 3-car garage, etc. We bought it for about 60%-65% of what the place was valued at the height of the boom, and we got a great fixed interest rate as well.

Frankly, I don’t care if the property drops a bit further. Right now, I would say it’s hovering at 2003 prices. But other comps in the surrounding neighborhoods are actually selling for roughly the same price, so I can’t imagine there’s going to be too much a future plunge. At the same time, we didn’t buy this place as an investment. We wanted a house…to live in, and that we could decorate as we wanted to. There’s some fixing up to do (multiple potential projects) but ultimately I think we could be very happy there for the next 20-30 years. I think the mistake people make is to say, “Oh, this place looks good. I’ll buy into the market and flip it in 3-5 years.” That thinking just doesn’t work any more.

What if it doesn’t drop “just a bit further”, and goes down another 30% in 3 years? Your $300k home is now $200k, and you’ve sunk $50k in all the upgrades. Plus the property tax, insurance, and maintenance, and you’re well underwater compared to if you just continued to rent. And unless you are a small business owner, good luck commuting to Irvine/Los Angeles/Pasadena where the jobs are.

Leave a Reply