Southern California housing and the lost decade in prices – Inland Empire median home prices now officially back to 2001 price levels. Orange County median price down 5 percent on an annual basis.

The full 2010 housing data for Southern California sales are in and the results are surprising only to those who think mega billion dollar deficits and high unemployment are good for the economy. You could have gone to sleep on January 1 of 2010 and waking up today you would have not missed one dollar of price appreciation in housing. In fact most counties are now showing year-over-year declines as expected. Two counties in the Inland Empire have now entered into a lost decade of nominal home prices. What we should remember is all of this occurred with the backdrop of unprecedented Federal Reserve intervention and subsidies flung at the housing market. Purchasing a home is already subsidized with every government subsidy yet the pot became even sweeter with additional gimmicks, yet this was not enough to cause a turn around. What is occurring is a reversion to more historical measures and the answer to this should not be surprising to anyone that understands housing in a broader context.

The lost decade of the Inland Empire and soon to be SoCal

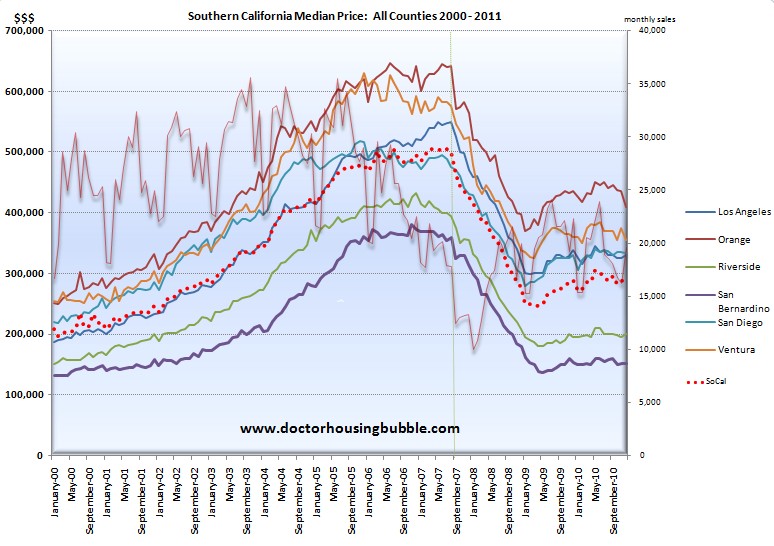

As the results trickled in for Southern California we now have two counties that have nominally returned to their 2001 price levels. The median price for both Riverside and San Bernardino counties are now back to levels last seen in 2001. The Inland Empire had one of the biggest booms in terms of construction and many families migrated out of Los Angeles and Orange Counties for a piece of a bigger American Dream. At the time, a $300,000 Inland Empire home might seem like a much better deal than say a $600,000 Orange County home. In retrospect when bubbles are raging all prices seem logical even if the underlying economy is weak. The figures did not seem weak because the Inland Empire economy heavily relied on construction and finance to expand their workforce. The housing collapse served as a double whammy.

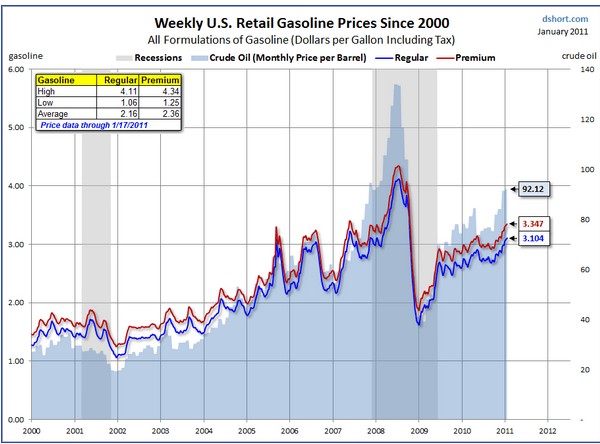

Since many people commute from these counties, oil prices cause major disruptions in these markets. Incomes are lower so any increase in fuel is going to put an added strain on already lower monthly budgets. The first oil spike was the catalyst that pushed this market over board. However oil prices have crept back up:

You can see the spike of 2008 above but gas prices are now double what they were from 2001. So think about that for a second. Overall incomes for the Inland Empire have gone nowhere since 2001 yet home prices are the same and gas prices are double. Where are these people getting more money to buy homes? Even at these levels home prices are inflated in the most heavily corrected region of Southern California.

Both Riverside and San Bernardino have unemployment rates of approximately 14 percent which makes their underemployment rate closer to 26 or 27 percent. At this level of unemployment even a $150,000 or $200,000 home does not coincide with family incomes or employment possibilities.

And the Inland Empire isn’t the only area facing a lost decade:

Median price – December 2010

Orange County                ($410,000 – first seen on June 2003)

Los Angeles County       ($330,000 – first seen on September 2003)

Southern California       ($290,000 – first seen on February 2003)

Orange County is down over 5 percent on a year-over-year basis and Los Angeles County is down 2.7 percent. As we have been saying each county will reach a nominal year over year decline sometime in 2011 and at some point will have a nominal lost decade. The only question is how deep will the correction be? Are we going to see another say 5 percent decline or a more severe 15 percent decline in the year? Much of it will depend on the Federal Reserve and their ability to artificially keep the 30 year mortgage rate down.  Bill Gross stated that he believes without Fannie Mae and Freddie Mac and their implicit government guarantee that the 30 year fixed rate mortgage would see a rate 3 to 4 percent higher (i.e., 8 to 9 percent). In other words the market would collapse without massive government intervention.

FHA insured loans continue to fuel home buying in SoCal. 1 out of 3 loans is backed by the FHA. The fact that the typical mortgage payment committed to by recent buyers is $1,200 a month you realize that many people are stretching out whatever income they have to get into homes. Sales have collapsed on an annual basis but the desire to jump in is still there even if the income isn’t.

People keep asking about a bottom. When I hear this question asked I’m assuming they are asking about a nominal bottom. Keep in mind that even moving sideways is losing money because inflation and a declining US dollar keep eroding your purchasing power as each year moves on. Last year the dollar declined and inflation as low as it was, did show up. Keep in mind that the inflation figures are short-term distorted because so much weighting is placed on housing. This is the biggest factor in the CPI so it hides the cost of fuel prices jumping, or healthcare premiums jumping up, or the fact that taxes are now higher. These are all added costs to a household on a monthly basis. The only thing that has gotten cheaper is home prices but they are still inflated in many parts of California. Why? Because incomes are either moving sideways or are going lower. The California budget will bring additional cuts (more lost wages) or/and higher taxes (less disposable income). In the end it is hard to put a date on an actual bottom but you can rest assured that every single county in Southern California will have a nominal lost decade in prices before any bottom is even in sight.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

63 Responses to “Southern California housing and the lost decade in prices – Inland Empire median home prices now officially back to 2001 price levels. Orange County median price down 5 percent on an annual basis.”

Please don’t flame – I’m an avid reader of your blog and very appreciative of all the amazing analysis you’ve done on the housing market.

I’m a first-time buyer at the lower end of the market (around 200K) looking at north San Diego County (San Marcos, Escondido, Oceanside, etc.) While it sounds like there may be more price corrections in the near future with resets and foreclosures throughout 2011, I was wondering if you or any commenters might have an opinion on whether the low end market that I’m looking at will undergo significant drops this year. I guess like many people I’m afraid of seeing the low end prices stabilize while rates creep up and was wondering whether you think this is a likelihood.

Thanks for any insight

in my opinion, if rates go up, prices will go down. Everyone is focused on their monthly payment, and if the rates go up so will the monthly payment. However, when this happens there will be less people who will be able to afford the new higher monthly payment, and thus less sales. At that point sellers will have to lower their price to be able to meet what people can afford to pay monthly.

Please also consider that, as that happens, minimum down payment requirements will likely also rise. Depending in how it comes together, the actual price drop that should develop in response to rising rates will likely be less than one might expect looking at mortgage payment calculations alone. (it may be helpful to look at mortgage activities from the 70’s and into the early 80’s to gauge a sense of what we might be in for)

rates go up = prices go down. Unless you really love the house….wait. You can buy it later for less if it is for sale. Stop looking at houses as an investment and decide that you want a place to live at a price you can pay. Most of us can’t live in two houses. Leave that to the flippers.

As you indicate, keep an eye on the price of gasoline, it will be the death of housing. What do you think a four or five hundred dollar a month gasoline bill does to the average wage earner? And, if there are three cars in the family?

True, but only if it’s SUSTAINED. The brief spike in summer 2008–due solely to speculators like G-Sachs & that ilk–thankfully didn’t last long enough cause a macro-shift.

I’m not clear how much of current spike is speculation, vs. dollar decline, vs. ChiCom hoarding, vs…? Somehow doubt that world demand is enough to build support/floor at $110/bbl… but you are correct, it’s a HEADWIND TO HOUSING, especially outlying SFRs.

A combination of dollar decline, and forcing ethanol upon us. You notice your mileage has worsened? Fuel is taxed per gallon, so govt grabs more, as you burn more due to the puposely weakend power provided by the “watered-down” gasoline we are stuck with. There are also other detrimental consequences to ethanol, in that it is ruining my fuel systems in my vehicle attacking the rubber components and corrding the metal ones. Other consequences are higher corn price, and reduced food supply. No worries though, that only affects the poor starving undeveloped countries.

Speculators, speculators speculators….they are always to blame!

The fact is speculators are part of world financial, commodity markets, always have been always will be. But speculators come into the market as a result of some macro economic issues that most people don’t think about too much.

Mainly, in this day and age, money, capital can be created with a stroke of a pen. That capital is used to rapidly expand world markets, faster than is good for well functioning world markets.

What it boils down to there is not enough oil in the world for everyone in Asia to live the American lifestyle yet they are on a rapid rocket ride to that very end.

There is enough oil to run the world today, but “Speculators” see that in a short time, unlimited monetary creation will create shortages in everything from oil to food. What won’t be in short supply is things created by factories (raw materials for the items aside) factories that can be financed with the stroke of a pen.

So it is all quite simple, anything that is made in a factory is plentiful since there is endless money at zero percent to build factories. Finite raw materials are the only thing keeping the entire world, Asia and Africa from living the American life style.

This is a problem. Too much capacity (factories) limited raw materials and downward pressure on factory production due to too much capacity.

Something must give but on this journey to our financial doom, “Speculators” will bid the price of commodities up well in advance of the looming shortage. This is good.

Good because it will cause a solution, either from enticing more of the commodity to be produced or a collapse in what is an unsustainable situation which in all probability was brought on by the actions of wold central banks.

If you really need a Boogie Man, scratch the word “Speculator” and add “Federal Reserve”. The Fed and other central bankers created the flood of money the “Speculators” are using and all the problems that come with it. Don’t forget it.

It is like blaming the housing bubble on all the “speculators”. In my book Alan Greenspan is the culprit.

@Martin,

We are looking at unprecedented amounts of speculation in futures contracts using massive amounts of leverage and liquidity provided by the Fed. Bunch of hedge funds in a big position to manipulate things.

I understand the feeling by many about peak oil and obviously oil will run out and production will drop. However, there isn’t enough good ground data to tell where we are at. Further there is a lot of really stupid discussion on things like clay shale out there already, theorizing on the ultimate cost.

There are ways to curb excess speculations vs companies hedging bets on cost. Currently it is all excess speculation.

@Martin

There is only one thing that drives pricesof oil: demand for futures contracts. Supply has increased, demand has decreased–the price of contracts moves without regard. There is probably a correlation to the stock market, as when it gets near a top of sorts, speculators jump to something else, typically commodities–oil, gold. Peak oil is all about selling contracts to non-experts. Sure it will happen, but that is a long-term driver, not why it jumped $3 today and dropped 2$ the day before.

This have been no surprise to me. We moved from Simi Valley in 1999, and after owning for only 3 years, was happy to have made 60,000 to put down on a nice home here in the south on 4 acres. I talked to a realtor friend in 2004 and she told me if I had stayed in Simi, I could have made a half a million profit on my house…I thought, who is paying 700,000 for an 1800 square foot house on a 6600 sq ft lot, where is this money coming from… That is when I started paying attention to what was happening in California. Go back and listen to ads and commercials of banks pushing the public to either move up with your equity or buy into the equity… The value will always go up…Well here we are!! My guess is that prices will come down to 2000 prices and stay there for a long time…a very long time. The 1994 earthquake was what allowed us to finally get into the housing market to begin with, after renting for 9 years in Northridge. Good luck Californians, I’m glad I got away when I did:))

LOL, you’re not kidding about the ads…here’s one of the all time greatest from the peak years (the “Suzanne researched it” Century 21 ad). I especially love the comments

http://www.youtube.com/watch?v=Ubsd-tWYmZw

Well, we are overdue for another earthquake….

Its all about leverage whether in the equity markets,new car sales or real estate none of this has a good smell.

FWIW dept I have been checking 5 zip codes for new listings this year (Northern Calif) pretty much short sales and foreclosures property. The foreclosure properties seemed pricey at first but this week many are reducing prices considerably while others seem to endlessly go through the active to pending back to active all with price reduced. One came up yesterday in Santa Rosa a foreclosure flip purchased end of Nov for 390K and now with a full ikea remodel is listed at 579K! I asked the listing agent if they had permits she thought they did but wasn’t sure but they would be happy to disclose what was done….

That’s interesting… I live and rent in Santa Rosa….my complex is getting pretty close to empty. The rent for a nice-ish 2bedroom with dishwasher, washer/dryer, garage, parking spot, low crime area is $1,100/month.

I talked to two people loading their moving trucks up this weekend….moving into homes they bought. Santa Rosa is interesting…..there a lot of home on the MLS (plus Short Sale, NOD, etc) that are under 175k….which is getting pretty close to $1,100/month. Not sure if I ever seen rents go down, but could happen here.

Santa Rosa will drop like everywhere else…..but there will be very little if any appreciation. As DHB states, who can commute to the Bay 30-50 miles each way at $4/gallon gas?

Santa Rosa property values suffered from the tech bust and now State Farm is moving out. The big hope for employment was new home building on the West side and up towards Cloverdale but recession has put a big hold on that. What is interesting is how the political cast got the light rail approved hoping to push development along 101 up to and beyond Cloverdale but the recession has killed big parts of the funding so now they want to build out a smaller track mostly to San Rafael. The land owners still have the political power but trying to keep the housing bubble alive doesn’t look promising. Sounds like you could get a significant reduction in rent!!!!!!!!!!!!

As bad as housing is in the Inland Empire high gas costs could make it even worse because so many workers out there commute to LA or Orange County to work. they never created enough jobs in the IE to match all the housing, so workers spend a lot of time on the freeway.

About the cost analysis here… Here is the price for some MLS homes in Murrieta, CA.

28238 Ware St Murrieta. 4/3 2200sq ft, OK schools with only so many Mexicans dragging it down. About 70 miles to San Diego/OC (Irvine).

for 189,000$… plenty similar available

You can compare this to my current hood, Torrance, actually the crime infested Harbor gateway. Yo, shout out to the gang members that dumped a body in front of our elementary school.

1644 W 224th St Torrance, 1400 sq ft, 318,000$ price tag.

Or in Torrance proper….

17321 Wiltron Place Torrance CA, 1400 sq ft, only 389,000. This being Gardena adjacent and might not be Torrance schools. NoTo is the worst part of Torrance.

Then on to the halfway decent areas…

1418 Post Avenue, Torrance CA, Old Torrance….557,000$

I’m pretty sure that means prices are getting into decent territory in the IE compared to Beach areas. While you might get burned in the IE area at this point, it isn’t as bad as getting killed in the beach district.

An economy car is going to last 160,000 miles, costs about 14-22K. Will average 30mpg plus. Will easily last 4 years with 120 miles per day. 10k per year.

From Yahoo that is about 3100$ a month on a 447K mortgage.

Compared to 1100$ a month in the IE house.

Now if some traumatic life event happens like I lose my job. The commute cost goes to about zero for me and unemployment is about enough to cover the cost. Plus I have about 70K in savings since I didn’t blow my wad on the 100K 20% down.

The delta is about 1000$ a month more for the Torrance home. It is also a less tenable position if you have a life event like a layoff or bankruptcy. Additionally the amount you might end up eating in a sale is proportionally smaller in the IE house.

Not saying it is a great deal for the IE home here. Just pointing out that it is less out of this world cost wise. If you had 100K to put down and were betting on future holding/potential growth in value it is also an easy answer. My guess is the IE home should be under 125K. The house in Torrance… who knows… maybe in the 300K range. Bubble alive and well from percentage standpoint on both places.

DrHB is right. In my Bubble Zone (Miami-FtLaud-WPalmBch), only the stoo-pid money is biting at 2003 prices. The smart money (i.e. known REITs, hedge funds, local RE broker-gamer-scammers) is only closing deals at 1999 prices… or even less. Word up.

As far as a “bottom” goes, unlike stock markets, FX markets, and related super-LIQUID markets, when RE makes a bottom, it STAYS there, for a LONG time… no need to get a brain aneurysm trying to “time” the RE “bottom”… you’ll have PLENTY OF TIME to cherry pick because, in general, there will be no “bounce”. See 1989-1999 in most areas. (I mean sure, if you find a La Jolla gem with a desperate seller, and can swing it, hey…)

If you can’t wait, then keep plotting the trend lines, and keep making super “low ball” offers… which will turn out to be not so low, after all the Wall St. FICTION shakes out. Nothing more amusing than having someone who scoffed at your “low ball” offer, call you back weeks/months later, asking if you’re still interested, heh, heh, heh.

Trying to guess the bottom of the market is like trying to decide whether black or red is better in roulette. At the tables everyone has a theory on which color comes up more often, each theory more fantastical than the last. They’re all bunk. It’s out of your control, like the housing market. Numbers are never “due” just like a rise or fall is not “due” for housing.

Nobody knows what is going to happen in the housing market, because it’s too complicated. The “experts” can’t agree on anything about the future, and they can’t even agree on what the data tells us TODAY. Look in the OC Register any given day and an expert is claiming things are headed down or headed up.

Whether the houses in the area you want are over-priced may be up for debate, but incomes are not going to grow for the middle class. Salaries rise due to demand, and we’re increasingly competing in a global market – you need to work 10 times as hard as someone else to justify your salary. If you can’t, your job will be outsourced.

Who can commit to a 30 year mortgage when we have no idea if we’ll have a job in 2 years, much less 10 years? And if you switch jobs to remain competitive, who can say the new job will pay enough to cover your mortgage?

You sound like a real estate agent. There is nothing complicated with housing. The good doctor simply laid it out. With high gas prices, the state billions in debt, and huge government interventions that are failing, mostly 30 year fixed rate loans, housing will continue to go down. Go to http://www.housingtracker.net and see for yourself that asking prices in Los Angeles are significantly going down in the last several weeks.

@Matt – Nope. Not a real estate agent. Used to be a homeowner, sold to move and attend grad school, and I’m really glad I got out. At some point I will get back in, but I don’t know what’s going to happen in the market, and neither does anyone else.

I personally think that market fundamentals mean that housing prices should drop another 20% based upon trend lines, but our markets aren’t based upon fundamentals.

From what I’ve gleaned from experts in various areas, here are a few points that support my view:

1) Most people expect to retire from equity in their home. Knowing that Baby Boomers are retiring now and will need their money, AND they’re a huge active voting bloc, I don’t think politicians can stay in office without protecting this group. The market should stay juiced.

2) Prop 13 protects legacy homeowners at the expense of the next generation. Every time we consider changing prop 13 tax protections on old houses, it gets shot down. This keeps people in houses they technically can’t afford and keeps the market juiced.

3) Jobs that were lost in the recession are not coming back. If jobs do come back, they’re paying less. Those who kept their jobs can expect wage compression or outright depression as they compete on a global market. This should lower the market.

4) Nobody can honestly know if they will have the same job in 30 years. Well, maybe doctors, but against popular belief, they aren’t the majority of people living in So Cal. Fewer people committing to 30 year mortgages should lower the market.

And on and on… It’s very complex and nobody knows what WILL happen. We only know what SHOULD happen.

1) Most people expect to retire from equity in their home. Knowing that Baby Boomers are retiring now and will need their money, AND they’re a huge active voting bloc, I don’t think politicians can stay in office without protecting this group. The market should stay juiced.

The 30 year mortgage rates are at record lows and house prices keep falling.

2) Prop 13 protects legacy homeowners at the expense of the next generation. Every time we consider changing prop 13 tax protections on old houses, it gets shot down. This keeps people in houses they technically can’t afford and keeps the market juiced.

Same answer to #1

3) Jobs that were lost in the recession are not coming back. If jobs do come back, they’re paying less. Those who kept their jobs can expect wage compression or outright depression as they compete on a global market. This should lower the market.

Exactly.

4) Nobody can honestly know if they will have the same job in 30 years. Well, maybe doctors, but against popular belief, they aren’t the majority of people living in So Cal. Fewer people committing to 30 year mortgages should lower the market

Exactly and also going to rent.

There is nothing complex about it. Government juicing temporarily halted the fall but those knive catchers are regretting their purchases.

@Matt

Perhaps. However, I think the Boomers have made a tactical error in making enemies of Generation X. In short we don’t care about the Boomer retirement party, have GenY beginning to mobilize under our direction. The divide between habs and have nots will divide the Boomer generation once the have nots realize they’ve been duped and will side with the younger generations out of practicality as well as spite. Juiced market and prop 13 be damned.

You all should pay attention to what our “overloards”, the bankers are saying. The bankers want to get out of the house owning business as soon as they can without taking unreasonable losses. It looks like that home prices will continue their slow slide. Also the state and local governments want to keep the prices from falling too fast, on account of the property tax revenue. There will be no fast or big decline. People should only buy a house if they like that lifestyle, not for an investment. You can do better in the stock market if you want to make money. I bought the S&P 500 at close to 1040 at the end of last June, and now it is close to 1300. The Fed is supporting the stock market(and a few other things, like the foreign banks).

If you’re single and don’t want to spend 1k a month for rent, I’ll bet there are more people than ever who are renting out a room in their house in order to make ends meet.

If I had to rent a place right now, being single, I would check this first. I’ll bet you could get into a nice room. in a nice house, with kitchen privileges and a private entrance, for less than 6 hundred bucks a month. And the family or person or family who took you in would probably be more than grateful for the extra income.

Excellent advice.

No, not excellent advice. If you can put up with people who dictate your lifestyle, sure, it *may* be a good decision. More often than not, I’ve heard horror stories from people sharing apartments and/or renting a room.

No thanks, I’d rather get a single or studio where I can engage in all manner of debauchery, er I mean act in any way I desire 🙂

Actually it is excellent advice. In fact, I hear more “horror stories” from homedebtors that just couldn’t fathom renting a room out to someone as they just had_to_have_their_own_place and god forbid they ever_have_to_make_any_concessions_or_change_their_glorious_lifestyle.

Perhaps that should be a prerequisite to any loan modification.

If the homedebtor *isn’t* renting a room out, then NO LOAN MODIFICATION.

EconE, it’s BAD advice, if you cannot afford the payment, default and get out. Loan mods only slow and burden the process. There are no…NONE, zippo loan mods that lower principal, so get the defaulters out, and let the prices stabalize.

You sound like you have never owned property with renters, *I* have, trust me, get a place you can afford, don’t rely on renters, and for God’s sake, don’;t allow the government to dictate that you would HAVE to live with someone.

EconE, you sound like a good conservative repugnantcan, willing to whine to the high heavens about government instrusion, unless it’s government to your liking.

Show me ze papaers.

Exactly what a friend of mine is doing in Michigan right now. They bought a house in 2007 (thought they were getting a good deal), two years later her husband decided that he didn’t feel like being married anymore. She’s in a college town, so she just started renting the basement (bedroom, bathroom, family room with cable) to a recent graduate. Looks like it will be enough to keep her and her two kids in the house till they finish high school in a few years.

We also face the demographic pig in a python. Baby boomers reaching retirement age. Is it 10,000/day for the next 19 years? If their equity is reduced or gone in their house their need to downsize or economize on home expenses is not. Retirees don’t need 2000 plus sq.ft. homes to maintain. Many will want to relocate to lower cost of living areas of the country. California is not one of those low cost areas. While this may work to the advantage of Florida ( no income tax) I don’t see how it can benefit California.

Well, “No” because end-of-life realities:

http://www.boomerdeathcounter.com

~Misstrial

Thanks Misst…that was uplifting 🙂

babyboomers are expected to continue to work and put off retirement by 5-10years because they can not afford to retire with the downturn in stocks and housing. IT is the young people who will leave the state for the Promised Land of TEXAS. Saddle up.

Remember the employment situation is way worse than the 1990s. The state/nation is also facing the biggest deficit in decades. The stock market is being pumped up witht he Fed’s supply-but at some time they will have to fold. But really the banks that borrow the money from the Fed will probably just write off the losses and stand in line for another bailout. Lets see where it all ends.

Great Stuff Dr. B. One comment to make. The Inland Empire is what I call a Fractured Market. So much so, that Lenders need specialized market appraisers for each City. Of course, that isn’t possible, so no one in my opinion really knows what price to list a property for. Especially, banks and lenders. As long as naive uneducated, Buyers are willing to pay the price, Prices will remain inflated. Homes (Standard Sale), in my City, are @ 2004 levels. Last year, even REO’s sold for 95% of market value.

We are back to the basics. If you are buying a principal residence, you buy what you can afford in a neighborhood that you want to live in for many years. If you are an investor, you buy for long term cash flow commonly known as return on investment. Over many years, california averaged 6% growth per year. During the Bubble years, where properties appreciated 25-30% a year, a new investor mentality emerged. The investor that bought for appreciation and held short term. To invest like that in any market but a bubble, would be the kiss of death. We have to go back to the basics

How does this look for the highend job market in Southern California? More military cuts to come as well…

http://www.businessinsider.com/boeing-layoffs-orange-county-2011-1

@ Foolio

Suzanne researched it! Lol. I guess Suzanne was full of crap. Haha. That was a funny commercial.

@ Foolio

I love the part when the wife is replaying the voicemail message. Suzanne the realtor says, “This is a special house John.” Now, poor John is probably getting a divorce, paying child support, and his house is in foreclosure. Funny as hell. I love it.

So many realtors are so full of crap, it’s not even funny.

Wasn’t there a stat that there are as many realtors as houses on the MLS?

We are a long way from the bottom. It will be a slow, lingering decline for the next 2-3 years, minimum. What’s my evidence?

After recently losing my engineering job of 17 years, and having an interest in real estate, I took the test and got a RE license. I pretty much work exclusively contacting homeowners in default who may wish to pursue a short sale. I work in areas that had bubble prices in the range of $500K to $3M

I have yet to come across a single homeowner who is not in some form of workout with their lender. It’s not unusual to meet borrowers that have been in workout for over two years, after having been given 6 months before they were even contacted by the lender.

So after they run through the various loan mod delays, and maybe the nuclear option(i.e., bankruptcy), it could well be 5 years after an initial default that these properties come to market.

The net effect is the market is still being propped up and I don’t think all this tinkering with people’s loans will do more than slow the rate of decline in prices.

I think that’s EXACTLY what they want to acheive: SLOW the drop in prices.

Don’t forget that banks tooks hundreds of thousands of WORTHLESS mortgage loans, sliced & diced them into infinity, sprinkled them slightly with 1% AAA stock (just to get Moody’s & Fitch to give the ENTIRE BUNDLE a AAA) and then sold them on to ANOTHER bankster, who sliced & diced them even FURTHER, (rinse.lather & repeat 3 or 7 times more) until finally these DISEASED financial papers somehow found their way into the portfolios of unwary investors worldwide.

The U.S. government decided years ago to run a Ponzi-scheme economy of leveraged debt. The moment house prices return to levels based on actual income levels, the United States of America will COLLAPSE.

while i agree that may be the goal, i think there’s too much downward pressure to hang onto a steady decline. i think velocity will be higher within the next year and slowing down as prices lower. the relationship between time and home prices would look similar to an inverted bell curve, at least the first half of it. how housing will rebound will depend on the circumstances we face when the bottom comes.

Actually, rain is recycled water.

Slightly OT:

Do you live in Orange County, CA? If you do, bet you DIDN’T know that you’re drinking & bathing in SHYTWATER? That’s right, Orange County recycles its waste waters (including sewer) into drinking water. 9 out of every 10 people I ask around here ignore that fact.

Not where I live in north orange county.

Path Is Sought for States to Escape Debt Burdens

Policy makers are working behind the scenes to come up with a way to let states declare bankruptcy and get out from under crushing debts, including the pensions they have promised to retired public workers.

Unlike cities, the states are barred from seeking protection in federal bankruptcy court. Any effort to change that status would have to clear high constitutional hurdles because the states are considered sovereign.

But proponents say some states are so burdened that the only feasible way out may be bankruptcy, giving Illinois, for example, the opportunity to do what General Motors did with the federal government’s aid.

Beyond their short-term budget gaps, some states have deep structural problems, like insolvent pension funds, that are diverting money from essential public services like education and health care. Some members of Congress fear that it is just a matter of time before a state seeks a bailout, say bankruptcy lawyers who have been consulted by Congressional aides.

Bankruptcy could permit a state to alter its contractual promises to retirees, which are often protected by state constitutions, and it could provide an alternative to a no-strings bailout. Along with retirees, however, investors in a state’s bonds could suffer, possibly ending up at the back of the line as unsecured creditors.

That makes me wonder if policy makers are busy working behind the scenes to come up with some scheme to prop up the market as we speak. How can anyone in his/her right mind want to commit hundreds of thousands of dollars to buy when nobody knows what the government/special interest groups/banks/consummer groups may come up with some policy to skew the market? Everyone should get their paws off and let the market fall wherever it should fall.

I have been in the market for a house but the current environment makes me pause and reconsider.

Agree – I’ve been watching/waiting for a while and some of the big unknowns give me real pause (boomer downsize and equity extraction demographics, gas pricing for suburban, middle class unable to keep up and repair neighborhoods, state/local taxes, general economic climate, mobile workforce, generally high pricing and taxes in desirable areas).

I don’t expect appreciation/investment potential, I just want a decent roof for the family but really I do not want to take a 20-30% hit. I make good money but pricing in most areas in America is still built up to where that kind of hit would seriously hurt. I have no interest in being part of that.

That makes sense. Since the market will be at best, unusually illiquid for the foreseeable future, how can anyone commit to 30 years of giant payments? Will your company and your skills be in demand 10 years from now? The public sector is likely to freeze and then contract in light of collapsing state and local budgets. Almost every state has committed to decades of bond payments, exponentially increasing health costs, pensions and sports stadiums. Interesting how we think some athlete is worth a zillion dollars but we need to go to China to get someone to make his shoes…Since we’re just printing money, why not give everyone a couple million?? What’s the difference between 15 trillion and 150 trillion? Neither will ever be repaid. Let the band play on.

i have been sitting back in my rental since we sold on home 7 months ago and have been reading about the projected price declines. I have watched people trying to hold onto the dream price but lately have seen things really start to change in new and old listings. I like this one in the Lakewood Village section of Long Beach that started at $630K in September and is now down to $425K.http://www.redfin.com/CA/Long-Beach/4740-Whitewood-Ave-90808/home/7559929 Also seeing 1,500 square feet plus homes being listed for less than $400K. Lucky I sold when I did and I will miss watching things from the sidelines if I ever do decide to buy.

The State is not in need of bankrupty legislation because the Governor is pushing the responsibilities down to the county and city who can go bankrupt. There is no need for Congressional legislation(it is a pipe dream anyway).

A little off topic but looking at maybe buying an investment property in the IE for around 200K all cash. Is there information available that shows what average asking rent is in certain areas and if so where? Also is there any info on demand or can it be gleaned somehow by looking at certain figures?

The excellent patrick.net offers such a service for $47/month… probably RealtyTrac and other big players cover those counties, at higher cost.

But basically, thumbnailing it, at $200k, ASSuming this prop is turnkey, ready-to-rent, *I* would need to be getting $1,525+/mo. in rent to make it a “going” concern. WALK the ‘hood in question, TALK to folks… hand out cold beers as necessary. ;’) Point 0 is, no need to pay the “asking” of 200k, esp. if CASH… don’t forget to plot the cost TO YOU of tying down that much capital… why not leverage it w/ a loan at today’s historically low rates?

If you/your family/firm has considerable home repair/remodeling talents, this can put you way ahead in buying the many “vengeance trashed” foreclosures.

There ARE positive cash-flow investment props out there, but just be aware that you’re a minnow, and the sharks have probably already passed over that property “for some reason”, esp. if it’s gone through the usual “Establishment” foreclosure/short-sale pipeline, or been “listed” in any official channel.

Best bet is to find the underwater folks on your own, by cruising the (mostly online) county records, and approach them on your own, IF the owner isn’t the occupant.

Also off topic but kind of connected:

Here it is ….

The new Governor of California, Jerry Brown, is jogging with his dog along a nature trail.

A coyote jumps out and attacks the Governor’s dog, then bites the Governor.

1. The Governor starts to intervene, but reflects upon the movie “Bambi” and then realizes he should stop, because the coyote is only doing what is natural.

2. He calls animal control. Animal Control captures the coyote and bills the State $200 testing it for diseases, and $500 for relocating it.

3. He calls a veterinarian. The vet collects the dead dog and bills the State $200 testing it for diseases, and disposal.

4. The Governor goes to hospital and spends $3,500 getting checked for diseases from the coyote, and on getting his bite wound bandaged.

5. The running trail gets shut down for 6 months, while Fish & Game conducts a $100,000 survey, to make sure the area is now free of dangerous animals.

6. The Governor spends $50,000 in state funds, implementing a “coyote awareness program” for residents of the area.

7. The State Legislature spends $2 million to study how to better treat rabies, and how to permanently eradicate the disease throughout the world.

8. The Governor’s security agent is fired for not stopping the attack. The State spends $150,000 to hire and train a new agent, with additional special training to include threats from animals.

9. PETA protests the coyote’s relocation, and files a $5 million suit against the State.

The Governor of Texas is jogging with his dog along a nature trail. A Coyote jumps out and attacks his dog.

1. The Governor shoots the coyote, with his State-issued pistol, and keeps jogging. The Governor has spent $0.50 on a .45 ACP hollow point cartridge.

2. The Buzzards eat the dead coyote.

And that, my friends, is why California is broke and Texas is not

That Texas has a $27 billion budget deficit in 2011? Did that hollow point cartridge cost $27 billion?

I love it how Texans are so holier than thou.

Kaz, you’re kidding, right?

The Kazes of this State are keeping the few realtors left employed.

Owning an “investment home” is identical to owning a small business, albeit a small business with extremely tight margins. Do you know how to run Quickbooks? Can you do your own taxes? Can you do home repair? Can you act as your own lawyer in an eviction proceeding? You’re asking about the initial price, but that’s just the first baby step in running the business.

Tell you what, if you have some cash to spare, do what people did before there were housing bubbles and stock market bubbles, in order of increasing risk: either put it in a floor safe, or spend it on self-education to give yourself a higher earning bracket, or if you’re in business for yourself already you can spend the money expanding your existing business, or perhaps find someone else in business wanting to expand and become their partner/investor.

Money from home appreciation? Forget it. FORGET IT. Look back 20 years and ask yourself what the heck just happened. I’ll tell you what happened: Interest rates were in the teens, just as two enormous emerging economies (China and India) began making lots of money selling the world cheap stuff and then needing to invest their cash. Where did they want to invest it? Not Russia, not Europe, not Indonesia, they wanted to put it here. They can here and bought loads and loads of US Treasury Bonds. That pushed the interest rates from the teens down to about 9% by 1999 and then down to 6% at present. As the rates fell, “affordability” increased, so prices rose. But then, like always happens, people noticed a trend line and began running ahead of the trend, causing the ‘bubble.” So now, we’re at essentially the bottom of the interest-rate scale. Prices are going to sit and sit and sit for as long as it takes for interest rates to climb back into the teens and then for the cycle to repeat due to some country wanting to invest here. That kind of dynamic is not on any king of repeating cycle; there is no magic 15 year or 25 year cycle at play. Will another interest rate plunge happen in our lifetimes? Maybe not.

So, live with it. Get rich the “old school” way, by expanding your own businesses, or investing in someone else’s dream. And stay away from that $200,000 duplex in Murrieta, unless you like home repair and eviction court.

You gotta love these guys:

Smedley Speaks:

“Could the Fed go broke?

The answer to this question was ‘Yes,’ but is now ‘No,’†said Raymond Stone, managing director at Stone & McCarthy in Princeton, New Jersey. “An accounting methodology change at the central bank will allow the Fed to incur losses, even substantial losses, without eroding its capital.â€

The change essentially allows the Fed to denote losses by the various regional reserve banks that make up the Fed system as a liability to the Treasury rather than a hit to its capital. It would then simply direct future profits from Fed operations toward that liability.

This enhances transparency by providing clearer, more frequent, snapshots of the central bank’s finances, analysts say. The bonus: the number can now turn negative without affecting the central bank’s underlying financial condition.

“Any future losses the Fed may incur will now show up as a negative liability as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible,†said Brian Smedley, a rates strategist at Bank of America-Merrill Lynch and a former New York Fed staffer.

“The timing of the change is not coincidental, as politicians and market participants alike have expressed concerns since the announcement (of a second round of asset buys) about the possibility of Fed ‘insolvency’ in a scenario where interest rates rise significantly,†Smedley and his colleague Priya Misra wrote in a research note.

Speaking of Dark Ages, which I feel we are entering, I read where the plague actually ushered in an era of rising wages in Europe. Perhaps those of us that survive a major calamity will be in great demand because those of us competing for positions will be far fewer. Super Volcano, Mega Tsunami, Asteroid, H1N1–there are any number of hopeful scenarios for rising wages, as long as you have post-apocalypse skills.

The entire world economic algorithm is unsustainable. It’s not just housing, the world is full of zombie banks suspended by zombie national treasuries. Most of us will live long enough to see the end-game of this giant Ponzi scheme play out. Make sure you have a chair when the music stops…

Leave a Reply