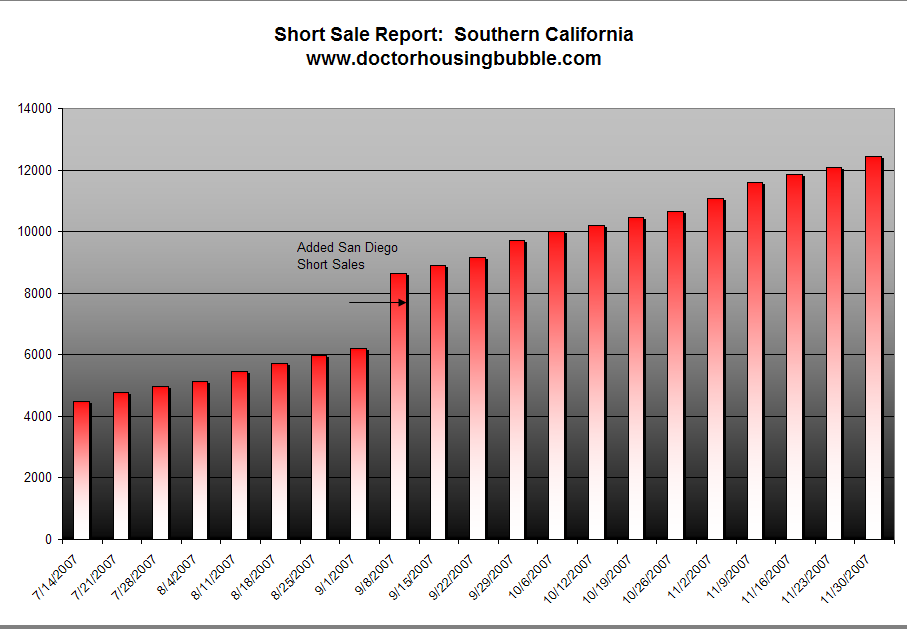

Short Sale Report Volume 3: Another Week and Another Record. SoCal Short Sales up over 12,000.

1. The Fed is practically elbowing us, wink wink, that a Fed rate cut is a foregone conclusion.

2. Oil Prices are trending lower.

But is this really enough good will to cause this mini rally? Are we really at a point where housing is going to correct? Clearly the government is going to try to bailout this market at any expense to tax payers. And make no doubt about it, this is corporate welfare for Wall Street. None of these plans are going to help the people facing foreclosure in any measurable way. We’ve talked about the plan of offering legislation that will support cram downs and I’ve heard rumors that this may be an avenue that is being actively pursued. This is the only solution that will force lenders to suck on their bile that they have dished out for the large part of this decade. But let us take a look at some of the bad news this week:

1. The US Commerce department announced that the price of new homes sales dropped to $217,800, a year over year drop of 13 percent. I wish I can offer you a personal reference on how bad of a drop this is but I wasn’t even born at the time we reached such significant drops in 1970.

2. The Case-Shiller Index showed a national decline of 4.5 percent.

3. Big retailers such as Sears showed dismal earnings showing that the American consumer is running low on high octane consumerism.

4. We have foreign entities taking up large positions in our top banks. The market tried to spin this as good news but is coming to its senses and seeing this for what it is, bottom fishing.

5. Freddie Mac announced a sale of $6 billion in preferred stock. This isn’t good news. It shows the company is running on low and needs liquidity.

6. Foreclosures continue to rise. RealtyTrac announced that foreclosures in October are up nearly double from last year seeing 224,251 foreclosure filings.

7. Short Sales hit another record here in

We can do a 12 days of Christmas list of all the negative news coming out but we’ll branch off and focus on the short sales here in

This week also seems to mark a somewhat psychological point in investing. The market seems to be getting immune to all the negative housing information. After all, we had literally one of the worst weeks in terms of market information for housing yet we are in a rally. The market in my opinion is in a dead cat bounce rally. How is this going to combat nearly $500 billion in toxic loan resets in 2008? Keep in mind that winter is the worst selling season and we are still in fall! Is the unusual rain today here in normally sunny

Looking at Real Homes of Genius in the area serves more than showing absurd housing prices. What we get is the ability to peer into the massive disconnect of how flawed the housing system really is. We did have one good piece of news this week when government rate caps will stay at $417,000 for 2008. But we have systemic problems in this industry. For example, how is it possible that rating agencies are paid by the folks that get rated? There is clearly a major conflict of interest here. Also, the creation of a secondary mortgage market is a main contributor for what is going down. Wall Street has no idea what is going on in Detroit, Cleveland, Inglewood, Compton, the Inland Empire, or any other hard hit area since none of these people have been there! Think about it. These companies are using cowboy agents, renegade brokers, and bought off appraisers as their eyes and ears on the ground. Are you kidding me? Do you think they will give an accurate reflection of the price? The vast majority of these on the ground grunts were driven by one thing and that is to sell a home at any cost. Otherwise, no commission is cut. Are there good people in the industry? Of course. But the large number of bad apples are running the store. Before, with a local bank or lender you would have much more scrutiny and oversight since there money was on the line plus they knew the area from first hand knowledge. At this point now that horrific mortgages are being kicked back, no one really knows who the actual owner of some of these places are. Ironically this may be the first time the bank takes a look at what they own now that REOs are increasing.

It is an

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

13 Responses to “Short Sale Report Volume 3: Another Week and Another Record. SoCal Short Sales up over 12,000.”

There was a report by an unctuous man with a very soothing voice on local NM TV today about how we are not going to see a decline in housing prices locally since we didn’t see the big bubble they saw in other cities out west.

Alas, we have our homes of genius here, too, enormous McMansion style barns that were overbuilt to satisfy a speculator market. At the height of the insanity in late 2004 through early 2006, chartered flights were bringing chartered vanloads of happy investors in to snap up such new construction. Fully a third of new construction in this town, all at the high end of the market, was being snapped up by out of state investors. A quarter of all new construction here was being bought by Californians, alone. Because construction continued far ahead of demand and to satisfy the speculators, we now have a huge glut of housing, especially the type of housing that is out of the reach of ordinary working people who work for even decent wages by local standards, being dumped by these same speculators who not only failed to see profits because of the overbuilding, but who now face balloon mortgage payments if they don’t manage to dump it quickly.

Short sales will be us, in other words, for some time to come. Even areas like mine that didn’t see a bubble in housing prices are going to see deflation in housing values and an increase in foreclosures of speculators and people who suddenly find themselves in upsidedown mortgages alike for the next few years.

I don’t get the market. The market surges when there is a drop in rates. Then a week or two later the market drops because they are unhappy that the rate drop is increasing inflation, increasing the price of gas and devaluing the dollar. A little while later the market rallies again because there is supposed to be another drop in rates. A few weeks later will the market plummet again because of inflation and a worthless dollar?

Do these people only see what will happen in the next few hours and make all their decisions based on that? Maybe it’s day traders just grabbing cash based on the hourly headline?

I put in an offer on a short sale in Rancho Cucamonga about 3-4 weeks ago. It was a low offer, but since nothing is selling here, I thought it might be interesting to the lender to consider it. After two weeks of checking in with the listing agent, not a peep from the lender. Not a “no thank you” not a rejection and no counter offer at all. Strange.

Ok, so we moved on. We have money on a contract with one of the local builders up in the Rancho Etiwanda Estates. Prices have come down a LOT in the last year. Still we are talking about 700K. Nice lot, nice house, nice place, sick of renting. Despite the market being as it has been for months, this builder has learned/invested nothing into customer service. We are hung up on the kitchen sink. That’s right. They put in a different kitchen sink than was in the model. They say it’s the right one, but it isn’t. They put in small light fixtures in the master bath when they look stupid small for the size of the mirror. Smaller than in the model. Pretty much the rest of the property we are ok with.

I told them we would not put one more non-refundable dime down on this property and will walk away over the sink. I’ll keep you posted.

So, um, they don’t seem like they want to work with us, keep us happy, or at least be polite during the process.

As you can see, even with great credit, financing all lined up, etc, etc, it has been difficult for us to find someone genuinely interested in selling us their house.

My mind is boggled.

@warpster,

I think what you bring up is the next leg of the housing market to fall. Middle class neighborhoods that have the facade of holding up except are like a Hollywood set where the front looks just like the real thing except when you dig deeper, you realize it is only a front.

@all,

Did anyone see the information coming out about the Bush administration meeting with top lenders and banks? It has to be the one of the most idiotic proposals to bail out large lenders. They want to freeze rates on get this, people that cannot afford the rate adjustment! Bwahaha! All while the Fed is adjusting its own rates. So what they are admitting to, is that these people bought homes that they clearly couldn’t afford. This sounds all warm and fuzzy but why in the world would any future lenders give out adjustable mortgages again? You think lending is tight now, just wait until the government steps in and tries to regulate rates.

Dear. Dr.

Thank you again for another great post! You comment upon alot of what I have been thinking about this past week. I have a question. Is this truly the way Capitalism is supposed to work? I thought Capitalism was sort of a survival of the fittest type of system. Clearly, the no doc, subprime, ridiculous financial products that the banks were marketing did not work. Therefore, why not let nature take it’s course and let the chips fall. So that better bank loans and scrutiny can happen. All of this bailout, interest rate cutting crap is just getting in the way of letting some good come out of this financial mess.

@ Brian B: Amen! The back and forth is quite confusing and all the more frustrating. In the meantime, you and I are becoming the REAL bagholders as we amass a giant heap of dollars that are worth no more than the Charmin we wipe our arses with.

Well all I can say is these are the same idiots that brought you.

Iraq

Katrina

Super SIV

Now hope floats to the surface home bail out.

Chances of working somewhere between Bush’s IQ and his shoe size, both of which are single digit numbers.

We did have one good piece of news this week when government rate caps will stay at $417,000 for 2008.( Your quote)

I’m trying to find out how this is good news.

If are confroming limit was raised to oh lets say Guam 652,500( I can not figure out how they are a high cost number, but that is a whole different issue)

You know how much more business you and I would be able to write.

I look at this factor as the #1 reason it should be raised, because you and I, could help more people get out foreclosure, and get rid of most short sales.

Hi Thanks for this. I can believe short sales doubling…but people are still “waiting for spring” to list their houses. Handwriting is on the wall. These forced sales are going to drive prices down further. Appraisals that were done even a month or so ago become worthless.

Thanks, I blogged about this at http://www.HomeSaleRelief.com and I thank you for your excellent blog

regards

–Richard

I suggest that all homedebtors that take the tax payers bail out go to this site

Subtle Confessions and confess

their sin of taking our money to pay for your greed. How do you sleep at night!?

I am looking to buy a vacation/retirement house in Denver/Colorado Springs (not an investment!!!), and was looking at this market because supposedly there is no bubble there. What I found is that if you look at the rents vs prices, and incomes vs prices, it’s as bublicious a place as any. People hold on to prices as if Bible prescribed them; properties sitting on the market for 6 months or more; when I mention to seller thar reduction in price is in order, they get really insulted! One seller said they will ‘kill a baby seal’ if they don’t sell, and they will throw in a Hawaii vacation (or something) to the seller. But when I said that reducing the price might work, the seller sent me a polite email saying ‘I really don’t know what are you talking about’. People will stick to their unrealistic prices to the bitter end, that’s what I learned. After the ‘bitter end’ (whatever it be), pricess will go down much lower than they shot up during bubble period (pure panic psychology).

From my experience, I would say that buying now is a fatal financial mistake. People think that 400K in California is a good price. It’s not. 200K probably is, and will be. If you want to be saddled with 200K in debt for thin air in return, go for it.

People don’t understand how much money 200K is, that is, IF you are the one who have to pay for it, not the runaway price appreciation. That’s the problem. Hundreds of thousands of dollars are talked about as if a person can go to the bathrom and sh*t that kind of money and hand it over. Try it, it doesn’t work when your salary (as it is on average) is all you have.

Good luck to all, I will go back to Denver/Colorado Springs again next year, and see if the madness has subsided.

Lloyd

Maybe if we offered bucket houses like Countrywide a choice between a 30 fixed around 6% or cramdowns?

I office next to a person that handles REO’s (foreclosures), so I have an opportunity to listen in on what goes on all day at a bank. This individual is hard as nails and always in a bad mood!!!!. Yells as realtors and doesn’t really give a darn. Regularly rejects low ball bids and insists the appraisal indicates a higher price. I just bring this up to point out not all banks are capitulating, yet.

Leave a Reply