The stubborn resistance of shadow inventory – six states make up over half of all shadow inventory. 3,000,000 distressed properties sold since January of 2009.

There is an interesting trend that continues to be a hallmark of the shadow inventory. It has barely moved since January of 2009. While overall visible MLS housing inventory peaked in 2007 it has been continuously falling since that time. Yet the shadow inventory remains inflated in spite of 3,000,000+ distressed properties being sold since January of 2009. Now why is that? This is something that we will get into later in the article. A handful of states, six to be exact, make up half of the current shadow inventory. Since current sales are dominated by lower priced homes you are seeing most of the housing action occurring in the distressed side of the inventory equation. However as the housing market flails forward, there is a backroom acknowledgment that until the shadow inventory clears out, there will be no healthy housing market.

Those that can are holding back but for what?

Aside from a smaller segment of the market, most people that are losing their homes are losing them involuntarily due to economic hardship. Those that can hold back are pulling inventory off the market for brighter days:

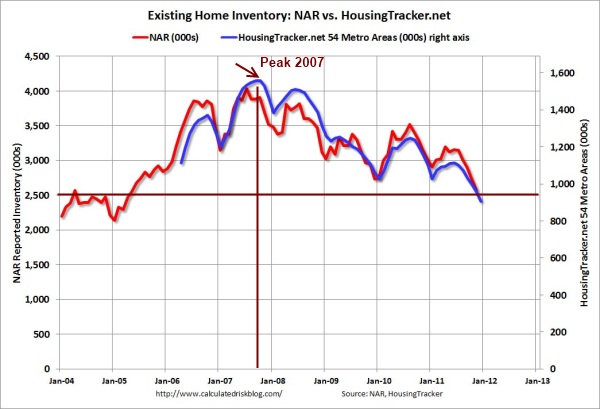

The above chart comes from the Calculated Risk Blog and highlights inventory from two different sources. The trend overall is very clear. Total visible housing inventory peaked in 2007 and has fallen steadily since that time. Now you would think that because of this movement prices would have stabilized but to the contrary. A large volume of sales has occurred with distressed properties since that time. The market is largely being driven by shadow inventory which slowly migrates into the visible inventory space.Â

3 million distressed homes have sold since January of 2009 and these sell for a discount:

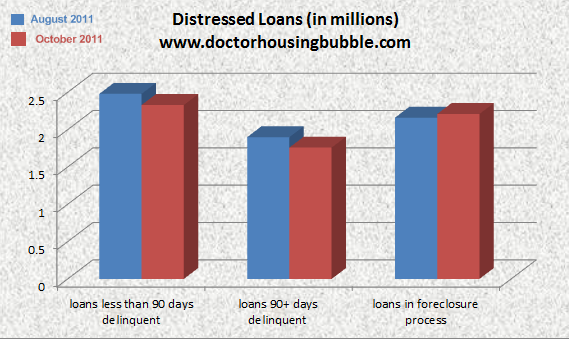

Yet shadow inventory remains stubbornly high because more distressed housing is coming onto the books at banks as the economy continues to waddle along. This is why behind the scenes the shadow inventory figures are still extremely high:

It depends how you measure the above. For some, a loan needs to be seriously delinquent and not showing up on the MLS. However this misses roughly 2,000,000 loans that are 30+ days late only itching to enter that seriously delinquent category. Cure rates are abysmal so it is likely a large number of these will enter the foreclosure process. In other words there is going to be major pricing pressure to the downside so it should be no surprise that the latest Case-Shiller data shows a new post-bubble low for home prices.

It should also come as no surprise that last year was a banner year for all cash home purchases. A report by Hanley Wood Market Intelligence showed that in 2011 38 percent of home buyers bought homes with all cash despite record low rates. Of course this is being driven by investors looking for bargains in many markets but also the broken balance sheets of many potential home buyers who are opting to rent. Low rates can only do so much and this is another gamble that is being subsidized.

Don’t think that low rates on the 30 year fixed rate mortgage are all good especially when the Fed is artificially holding rates low and mispricing risk:

“(Businessweek) This system simultaneously drives down mortgage rates on guaranteed loans and permits lenders to back them with minimal capital. This encourages banks and other deposit-taking institutions to hold more mortgage securities than would normally be justifiable, a recipe for both bubbles and bailouts.

Rather than diversifying risk, these government policies promote a concentration of risk. A single national event, specifically an abrupt increase in interest rates, would adversely affect prices for this entire asset class. Banks may attempt to hedge this risk, but hedging gains and losses can be uneven, particularly in the case of volatile markets or when many participants are forced to sell at the same time. For example, Fannie and Freddie have had a combined $17 billion in hedging-related losses during the first three quarters of 2011.â€

Shadow inventory will continue to be a big drag on the market deep into 2012. And what were the six big states for shadow inventory?

-California

-Florida

-Illinois

-New York

-Texas

-New Jersey

This shouldn’t come as a big surprise. Don’t be fooled by what is being displayed on the surface. Things are still fragile for our economy and 2012 is likely to prove a circus of a year in politics. In other words the soil is fertile for pandering, boneheaded economic policies, and promising the world nicely gift wrapped.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “The stubborn resistance of shadow inventory – six states make up over half of all shadow inventory. 3,000,000 distressed properties sold since January of 2009.”

It’s only going to get worse.

http://money.cnn.com/2011/12/28/real_estate/foreclosure/index.htm

You’ve got folks living in their homes for up to three years without making a payment. What happens when these people are finally kicked out and the homes come onto the market?

They should have saved up enough money to buy an old trailer and live in a trailer park for the rest of their natural lives.

Hey! Notice that 5 of those 6 states have beaches and the 5th starts with Ill. Good way to remember them.

Do we want the question or the answer on this continued chaosp and who has either??

Not true. If 5 have beaches then so does the 6th if it starts with Ill. It’s my understanding that it’s near neighbor has the longest coastline in the US. That would be Michigan. That’s what they told me when I was a kid and we lived there in a summer home. Michigan being Michigan though the house next door was vacant even in the fifties.

Let the pandering rage on. Allowing mark-to-myth accounting is probably the biggest gift many mortgage owners still have. If the Euro keeps falling, another QE mayb be in the offing. But nothing will help real estate prices until the shadow is cleared-up from the market.

According to some news sources things aren’t so bad. This mornings lead story was:

Data show momentum building in economy

WASHINGTON (Reuters) – New claims for jobless benefits rose last week but the underlying trend pointed to an improving labor market, while regional factory data showed the economy gaining momentum as the year ended.

Lots of craziness gong on to try to get someone re-elected. Today’s story plays down much of what is written here by the Dr. We have a long way to go before the overall situation shows any real improvement.

According to BLS, the number of civilans employed is at 1982 levels!! According to Shadow Stats, inflation ran about 10% this year. This is based on inflation calculator actually used by USA pre-Clinton. Meanwhile, we have the most massive austerity occuring in the world right here in USA and that is greatly under reported by our mainstream media. Wages and benefits and retirements cut. Weekly layoffs in the 400,000 range.

This is what we got for bailing out the Banks for making bad bets in late 2008. Thanks Bush and Obama and our two-party dictatorship Congress.

What is retirement?

Shadow inventory has been and will be the gorilla in the room for real estate. The government has done a great job masking the real market with its bag of tricks over the last 5 years. With the foreclosure pipeline once again open after the robo-signing debacle, more homes will now be liquidated by the banks. At the current sales rate, we have about 5 years of shadow inventory to clear. That could result in another 10-20 percent in home prices.

http://Www.santamonicameltdownthe90402.blogspot.com

All real estate is local (or at least, regional). In this case, it is possible different forces are at work in each market and even submarket, from job losses to automation to falling wages to more part time work. Banks often dispose of property without listing it, so do individuals, and the amount of that no-realtor sales volume varies greatly in different markets and price bands. The answers then, are found in personal interviewing of prominent busy brokers and title officers in the states you list. Journalists dig for the story by conducting these interviews and then compiling what they hear and changing the questions as they learn. The story in Skokie, Illinois, is quite different than the real estate story in Stockton, although usually similar factors will be in play in varying but highly significant amounts. The banks through the Fed, felt the answer to all such problems is one solution, record low interest; when that failed, they ramped up their other great tool to stampede people into purchase debt, that is inflation; when that stumbled, they saw to it certificates of deposit yield functionally zero, so the only investment left to thwart inflation destruction of cash, is…that home the bank wants off their books. The banks are now promising even lower yields on bank deposits, and even lower home mortgage rates, repeating the same exercise until it works, one can suppose. The actual known solutions of creating jobs and better wages and more people with jobs instead of less, and more employment security, well, not their business.

Prices are still ridiculously high for bank owned properties on the west side of LA. Here’s a large one bedroom bank owned condo that’s just outside the Santa Monica border and right next to the freeway…asking price $411,900.

http://www.redfin.com/CA/Los-Angeles/2474-S-Centinela-Ave-90064/unit-2/home/6755028

Pending Short Sales have become the latest data tactic to hid distressed RE. One zip I follow currently has 40 active houses for sale and 44 pending sales with most being short sales moving through various bank channels. In Calif only 43 per cent of short sales make it to closing the rest move back and forth on the MLS as active then pending and finally they become foreclosures sold at auction. In order for a short sale to be pending the bank has to issue an approval that the potential buyers sign showing price and terms .The current system that recognizes non bank approved short sales as pending creates more worthless data points but generates a popular financial myth that housing is in a recovery phase.

Excellent post.

Could not agree with you more. MLS was forced by agents to add multi layers of contingency statuses and the definition of Pending is now completely up to the agent. Remember the good old days when a signed contract and opened escrow equaled a Pending Sale? Why can’t it be pending subject to 3rd party approcal? Agents do not mark a property Pending so that it can remain in the active catagory even with an excepted contract so they can continue to market to Zillow, Realtor.com, Trulia etc to drum up additonal business. So not only are the Pending numbers flawed but the Active inventory is also flawed on Short Sales. I think that your 43% success number is too high. I would hazard a guess that less than 30% are actually successful since many drop off the radar when the contract in MLS expires and no addtional reporting takes place when the property does not sell.

RE agents would be better off if the MLS only defined short sales as pending if they had a bank approval. The reason is that buyers have become educated to the process and now make offers on several properties and then wait until one finally makes it through the bank process. The reality is that existing contracts between underwater mortgage holders and potential buyers is basically worthless until the bank generates an approval.

OK.

I will give you the 6 states.

But, what I really care about is: how large is the shadow inventory in Colorado?

Visible inventory (aka MLS) for greater Denver has plunged (from 30K+ to 15K). http://www.deptofnumbers.com/asking-prices/colorado/denver/

So, why has this shadow not shown up?

And, how large is it?

Does it really exist?

Colorado’s sprawling market has never been a volatile mess like California. I spent my first 26 years of life there and the last 12 years of my life here in LA. I would be stoked if I could choose Downtown Denver, Boulder, Broomfield, Louisville, Thornton, or Brighton to find a $350K house that I could get to Denver to work in. ($350k in Brighton would be an insane home). It’s not quite that easy to do the same in Los Angeles (with traffic), and everything is still quite inflated.

Colorado must be getting back close to normal I would think.

Texas! It isn’t really in the six is it? I’ve seen nothing but “TEXAS missed the housing bubble blah blah blah” since the bubble popped. Austin in particular is the epicentre of the TX miracle. Nobody can get enough of Austin this or Austin that. The universal panacea is TX RE.

maybe texas is being spared this go around…………they got slammed worse than anywhere during the S&L scandal in the 80’s

Yeah, it’s different here! Texas real estate always goes up! etc.

Texas does not belong in the six. Texas is booming and never had a housing bubble thanks to our HELOC regulations and a vibrant economy. Houses are gaining in Central Texas and set to rise even further by 2012.

The first thing to remember is that foreclosures beget more foreclosures. The second thing to keep in mind is that the payment on a 30 year note on $500,000.00 with an interest rate of 3.75% is roughly $2,300.00. The payment on the same note with an interest rate of 9% is roughly $4,000.00. I am not convinced that our current 30 year 3.75% fix rate is sustainable over the long term. I believe that in the end we will find equilibrium regardless of all the economic/social engineering.

Great blog as always. The shadow inventory allows banks to control and time their losses and it also gives them total control of the housing market — a nice bonus. Considering that I feel as if I could sell all of the “shadow homes” in my area if they were made available, it is disappointing to know that inventory continues to be held back. There is so much demand in my area and buyers are forced to wait months for the house they want to appear (and then bid for it against other waiting buyers) or wait months on a short sale. We are all ready to hit bottom and move on – it has been a long hard 4 years – and releasing the shadow inventory is a key component. Until then we are all bracing for a potential tsunami of inventory that likely will not come (if the past informs us), but is still a possibility. What is guaranteed is that the market will continued to be controlled by the big banks until this is remedied… and this could go on for YEARS more.

At this rate it can go on for decades like the Japanese model…

or until after 2012 election cycle, after which shadow inventory should hit market 2013, I think…why? :

Bankers are very short sighted and want quick change inorder to: cancel existing stock options, write-off all losses, re-issue stock options, forget about the past, and make big bonuses and cash-in on newly issued stock options (diluting shareholder wealth) at very low strike prices (say $6/sh). When bank stocks recover and stock price exceeds (say $25) low strike prices of the new options, bankers cash-in ($25-$6=$19/option given as incentive to improve “stakeholder wealth”). Fast easy money. That’s my forecast on shadow invenory.

Used to be that CEO/CFO/Execs’ job was to maxamize “shareholder wealth” — get back to basics!

Agree. Hear this huge shadow inventory is out there yet it never makes it to listing. Trick after trick. No show shadow. Same overpriced crap month after month in Burbank. If I do see a for sale sign, someone is already moving in. This price gouging is the biggest rigged game since the bubble itself. Trulia lists tons of foreclosures that never hit the market. To hell with these people.

Endless money that can be pulled out of the Federal Reserves rear end is the reason for all of this crap that does not make any sense to anyone, not even to those who have lived long enough to “see it all”.

We are 40 some years past the date that Nixon took us off the Gold standard when Nixon and the others realized we could no longer afford our current standard of living unless we could just start printing “real money” .

The 40 year old experiment is holding together , so far, but the ramifications get more scary every passing decade.

In the 1990s printed money facilitated the Internet bubble, then in the 2000s the housing bubble and now a the scariest bubble of them all, the u.s. treasury bubble.

A nation that has 50 trillion dollars in on the books obligations and in addition has an ever increasing deficits in both fiscal and trade? And the world is willing to hand over their savings for 30 years at 3% interest to a nation that is broke and is printing like mad ?

Where this all goes I don’t pretend to know but it doesn’t look pretty.

Population by State 2010:

California: 37,253,956

Florida: 18,801,310

Illinois: 12,830,632

New York: 19,378,102

Texas: 25,145,561

New Jersey: 8,791,894

===============

total: 122,201,455

US Population 2010: 308,745,538

This “only six states” also represent 40% of the population. Now, representing half of shadow inventory instead of just 40% is probably noteworthy. However, it isn’t earth shattering, and may be more of a statement about the states that don’t have a lot of shadow inventory than those that do.

Very interesting point. I’ve been looking for an investment property (3 bedroom SFR) since 2006 mainly in Irvine, Fountain Valley, Westminster, Cypress and haven’t made a purchase because I don’t want to catch a falling knife. The prices have dropped from the peak but not as much as Riverside county cities like DHB has pointed out in other articles.

What I found interesting though is that the number of active listing in MLS has dropped by almost 50% in those cities compared to summer of 2010 and even summer of 2011. I’ve been keeping track of number of active properties every month for 3 bed, 2 bath, 2 garage SFRs. For example, # of active properties in Northwood Irvine was 82 in Sept 2010. In Dec 2011 there is only 29. Other markets I’m tracking show similar numbers.

Based on DHB articles and comments I see, I think I’ll sit tight and wait a little while before I jump in. It sure stinks to be earning less than 1% on my savings though. And sometimes wonder if I would be better off buying a SFR for around $400k all cash, rent it out and make 4% return and take advantage of tax deductions.

Well that is exactly what the Fed would like you and I to do. They want us to think our 500K is worthless.

If that property goes down 4% in value per year, your return is less than zero. Don’t forget liquidation costs too, not to mention calls to your cell phone at 10:00 pm about clogged drains.

Leave a Reply