San Francisco and tech driven housing mania: The median home in San Francisco reaches a new high of $1.5 million.

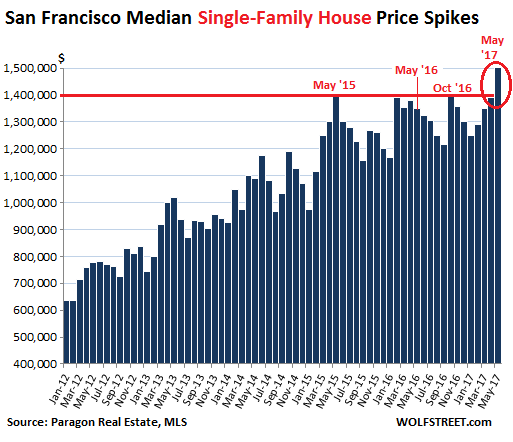

San Francisco real estate is deep into a tech driven mania. Home prices in the Bay Area are comically out of reach for most families and people are getting squeezed out like ketchup in a disposable packet. What seemed like a new peak was once again surpassed. The housing market is running on massive fumes and delusions run rampant. The justifications for current prices run abound. Yet the truth of it all is that we are deep into a manic phase of the market. The current median price for a home in San Francisco is now $1.5 million. This is for your standard crap shack flavored box. People are still buying even though volume has trended lower but just look at the current price range. A lot of this is being fueled by wildly high tech valuations and people believing that prices will never adjust. In other words, a bubble.

Tech driven mania in San Francisco

Home prices are up nearly $300,000 in one year simply because San Francisco is going through a housing mania. Tech valuations are off the charts and there seems to be this belief that prices will never come down. The consensus seems to think that buying real estate at any given point is a smart move. They simply cannot foresee a correction in the cards. What is interesting is that some think that since people didn’t buy in the last dip why would they buy this time? So therefore you should buy today. The problem with that line of reasoning is that it doesn’t focus on the most important economic item for most people – the actual jobs they hold.

So take a look at current prices in San Francisco:

This is how a mania looks like in the form of home prices. People seem to think just because we don’t have NINJA loans or no-doc products that somehow no bubble can ever occur again. Have you been to Las Vegas? People routinely put actual cash on the table and lose it. This isn’t a shock. Just because you use cash or have a sizable down payment doesn’t mean a correction can’t happen.

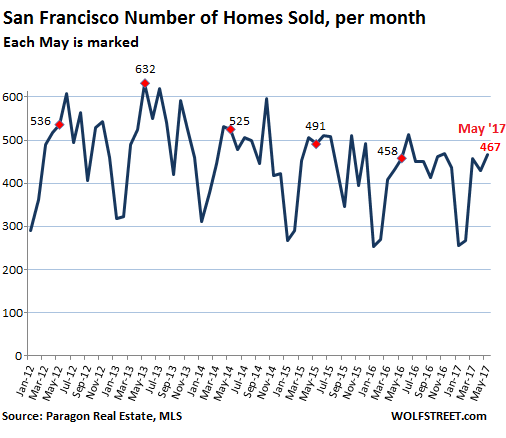

You already see sales volume trending slightly lower:

There is something going on and it doesn’t seem all that clear. But what is clear is that sales volume is moving slightly lower. Prices are in another dimension. The stock market is also in record territory and you have big deals being made like Amazon buying Whole Paycheck Foods. We all know that when corrections hit valuations do get adjusted.

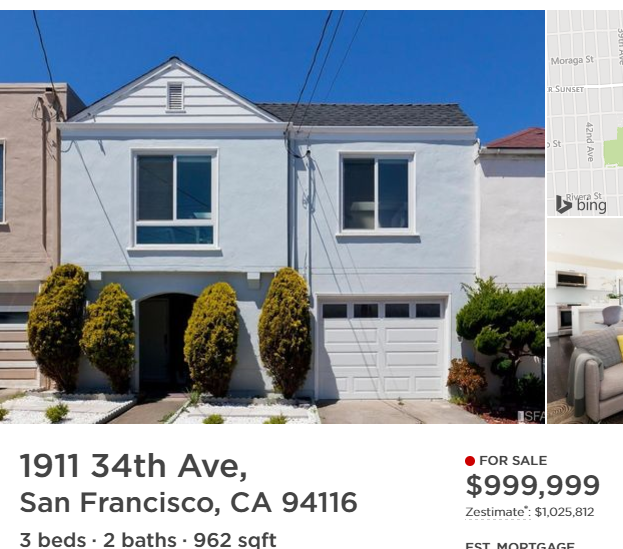

So what can you buy for $1 million in San Francisco?

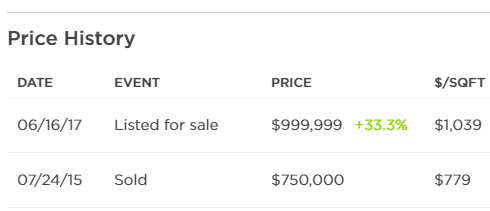

You don’t even get 1,000 square feet for $1 million. Someone is already trying to cash in here:

It sold for $750,000 in 2015 and here we are two years later and somehow the place is now worth $250,000 more. Totally makes sense.

So you have to wonder how long this Bull Run can go. We’ve been in a very strong bull market since 2009. Eight years of moving up for stocks and real estate is a long time especially at the speed of how things are going. When crap shacks are going for $1 million you have to wonder where do we go from here.

San Francisco is in another world when it comes to real estate and the justifications being given remind me of tech bubble 1.0. Will tech go away? Of course not. But many companies will and with that tons of high paying jobs. I wonder what happens after that?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

193 Responses to “San Francisco and tech driven housing mania: The median home in San Francisco reaches a new high of $1.5 million.”

Real Bay Area!!! F yeah!

Home of Genius: https://www.redfin.com/CA/Los-Angeles/3959-Dwiggins-St-90063/home/6956721

AND it’s also a Redfin “Hot Home!”

Yeah, it’s only $237,000. But it’s in City Terrace (listing says Boyle Heights). And 578 sq ft — with 3 bedrooms, 2 bathrooms.

How they managed to squeeze a 3/5 into 578 sq ft, I don’t know.

Tear down…value is in the land? Not too far is away in City Terrace (aka Boyle Heights) is this 3bd/2ba updated home with view of downtown LA for $585k. Crime in the area isn’t too bad…

https://www.redfin.com/CA/Los-Angeles/4229-Milburn-Dr-90063/home/6955581

City Terrace was a distinct neighborhood back when I was young. We had relatives who lived there. It’s south of El Sereno and east of Boyle Heights and Lincoln Heights. We used to go south on Eastern Ave through El Sereno to get there. Cal State LA is right next to it. The area is so cut up by freeways now ( I 10 and 710) that it hardly has any continuity at all.

Mexico

Yes, but after a 5% correction in the next recession prices will continue their climb for the next 20 years when the median will be one billion….only the entry level houses, like the one one in the picture will be priced at 999 million. After the bidding war, it will sell at 1.3 billion. Yes, I know that salaries will continue their climb to $250,000/yr with rent at $20,000/mo. However, if you buy below rental parity, in another 10 years you will get there.

What do you think JT, did I miss anything???….

Yeah, you forgot how you can leverage yourself into a multi-million coastal property for the low price of a penny. But don’t worry, your generation of buyers will still be the least leveraged in history.

Yes, that all makes sense. By then, we should all be earning 100 million dollar salaries and US $100 bills will be using for toilet paper.

Some companies are looking for greener pastures, with lower property prices, lower taxes, and more reasonably priced housing for their employees. Denver, Portland, and Austin seem to be luring many CA expats. At what point does almost any other city look like a better place to business?

Maybe we’ll continue to have a steady migration of people out of high priced CA and no meaningful correction takes place. Get out while the getting is good?

Should I be worried when my Uber driver give me real estate investing advice? He’s thinking about buying a second property in Nevada wherever Tesla is opening a plant and maybe apple or google is going to have offices. Already has a place in Sacramento he says that’s gone up in value.

It’s sad, but is my taxi driver right??? Or will that be a bubble too with everyone rushing to buy what they think will rise in value. It is speculation, after all.

@Slynnns I had a Lyft driver in Las Vegas telling me how it’s a great time to buy a home in Las Vegas. Homes are still cheap there, and and haven’t reached anywhere near their previous peak during the last boom. They’re getting a new NHL expansion team, and the Raiders are moving there, both of which are good for the city.

I priced out a few places, with my intention to rent it out and have it managed by a family member, and the total monthly cost for a home in a decent area is very close to rental parity, so short of a massive job-loss recession what do I have to lose?

While true that LV hasn’t reached its former peak, the cap rates on rentals no longer make sense there at this point in the cycle, you’re about three years too late.

If CA companies are fleeing and searching for cheaper places for their employees and lower taxes…Austin, Denver and Portland are bad choices. All these cities are not that cheap and have experienced quite the housing bubbles themselves. There are many other cheaper cities, unfortunately they don’t have the cool factor that Austin, Denver or Porkland have.

Cheaper cities are increasing their cool factor and can continue to do so.

Tech jobs found that doesn’t always work. Cisco opened an office in Denver and lured people from the Silicon Valley over there. Not even a year passed when the highly valued ones, quit and moved back. Cisco wound up having to pay those who remained even more money to stay and lost a lot of valuable employees to other tech companies back in CA.

For those who have the skills places like CA and NYC are it, they have to have a presence there to get the top talent.

Well, then, try Kansas City, suburban St. Louis, Iowa City, Iowa ( a very arty town), or Nashville, or Chicago, or Ann Arbor, or Madison, WI. Or name some other place with good educational institutions and cultural amenities.

We moved to Portland almost 3 years ago from Los Angeles, and the difference is night and day. Portland isn’t cheap, and it’s also in a bubble, but it’s noticeably cheaper to rent/buy than the major CA cities.

I’d say if you compare similar homes in similar neighborhoods, Portland homes are a solid 1/2 the price of LA homes, probably even less. $700K or so still gets you a beautiful, 3000 sq ft+ craftsman in the nicest parts of town with good schools (think: where doctors/lawyers live.) Our friends have a home that’s now a million dollar home here in Portland, and it’s like they live in one of the monsters in Toluca Lake.

p.s. don’t worry, we’re still waiting to buy even here in Portland. 🙂

All fantastic cities, Laura, with burgeoning tech industries. No need to lure anyone from the bay area, plenty of qualified talent already abound and moving in from other areas.

I just read a whole book on this. It’s “The New Urban Crisis” by Florida.

Basically coastal LA, SF, and NYC along with a few other places are “superstars”. To be able to live comfortably in these regions, you not only need to be a professional but a professional at the very top of your game.

But a company is comprised of various skills and pay levels, so yeah I don’t possibly see how companies can stay here. Maybe people like my neighbors who are wealthy and talented and often work from home.

That smells like NAR painted all over it.

I know of three old but large companies that have left and/or are in the process of leaving and have high paying jobs.

McKesson

Chevron

Charles Schwab

I know the counter argument is but look Twitter, Salesforce, Google, Facebook, and Apple have offices in SF. This will only last as long as the Nasdaq continues to move higher. Keep an eye on the job’s # for these companies, that would be a good leading indicator.

Not to mention Uber, Airbnb, Pinterest, Palantir, and Slack.

The wealth seems endless here.

Sam

Companies stay in CA because of the people. A lot of smart and creative types who can make a business a boat load of money from one idea.

Think about Snapchat, it was some lame little app that someone developed and now it is worth a lot of money to a lot of people…

What if they were an EMPLOYEE to some big company like google or facebook? Now one of those would own Snapchat because their employee created it on company time. Now those billions of dollars make a 6 figure salary look like pocket change.

CA is an environment for creativity and growth. Do you really see people in Texas or the Midwest are creating new things? Big things? No, they are just filling their trucks up with diesel and shoving their face full of BBQ. These are status quo humans. If a company wants to save money then yes, they will have to select employees from the “discount” rack.

Companies that stay in CA stay because the board members don’t want to travel and the CEOs can afford the cost of living so they don’t want to move their families. The companies that leave are more shrewd at making decisions on what’s best from a business perspective. More things are created outside of California than inside it, unless your only idea of things involve apps, taxes, and arrogance.

I agree. You would think that at some point the company’s stockholders would insist that the company move to a lower priced area — after all the company must be paying employees a premium to live in such a high priced city. That management stays there shows they do not have their shareholder’s best interest foremost.

I’d like to attend a dinner in Culver City tonight, but Sig Alert reports that traffic on the 10 is running at 7 miles an hour. OTOH, once I transfer to the 405, it’ll speed up to 11 miles an hour.

Truly, L.A. offers the greatest lifestyle of any city in the world.

Big part of why I bailed San Diego. So much to do, but the time it takes to get to anything made it not very appealing after a while, so you just hunker down in your part of the county and rarely venture too far away. Thats no way to live! I moved to a real county and put on way more miles because I can go to the mountains or a distant beach and I have very little traffic to deal with.

The other thing that I found funny was the guys paying big bucks on the sports cars – stuck in traffic next to me in my beater that cost 1/7 as much. Socked away cash and bought my freedom.

“..so you just hunker down in your part of the county and rarely venture too far away..”

Lol. I remember listening to a radio interview with Scott Baio several years ago. I think he lives in Encino. He has a strict three-mile radius he exists in. If it’s outside of his radius he just won’t go there. Probably doesn’t include his work, though.

“…Scott Baio … He has a strict three-mile radius he exists in. If it’s outside of his radius he just won’t go there.”

This is reality. Working from home and living on a nicely landscaped six line boulevard decked with shopping centers is critical for avoiding week day interstate insanity in California.

Imagine how much higher California home prices would be if traffic was a breeze?

My Mom was the same way … wouldn’t travel more than 5 – 6 miles due to the traffic. And, the only reason I’d live there, would be the beaches, but try to find a parking spot! Besides, unless you are a senior citizen like me, you wouldn’t know what a nice So. Cal. beach is … they disappeared a long time ago! When I had the chance to move back to L.A., I decided not to. I had already bought a place near one of the nicest lakes in the inland northwest with some of the cleanest water in the world, and love every minute of it. I also have a place in a Denver suburb and can now take light rail all the way to the airport or to a vibrant downtown that is packed with people on weekends. LAX is still a disaster and downtown L.A., well are the Mexican stores still there blaring their music? There is life outside the west coast!

Lurker on this blog. The sad thing is that we have many friends dual income professsionals that have recently bought on the peninsula. The rely on both income to sustain purchases of about 1.2 million for fixer-uppers. We look on incredulously because they barely afford these houses. If one or both loses their jobs, decides to have kids ( childcare here is at least 30k a year, more like 40k total), they’ll be underwater. We’re not really sure what to do other than wait and save.

We moved from San Francisco out to Fairfield off Green Valley (with a two year stop over in Dallas/Ft. Worth area). It’s beautiful out here and bought a 5 bedroom for $500,000 in a district with all 8 and 9 rated schools. 12 miles to Napa and luckily I work in the East Bay, but there is a ferry from Vallejo to downtown SF if I ever had to work there again.

We were paying $2000 a month childcare when our first son was born in SF. It just made sense for us to gtfo since he was sleeping in our walk in closet of our 1 bedroom Pac Heights apartment.

Now I dread having to go anywhere in SF or the Peninsula…it’s completely exhausting getting around.

Your not alone! I’m in the peninsula. The smart thing to do (in my opinion) save, save, save. This is a BUBBLE and can last longer than most of us think, but it is a BUBBLE. Anyone saying it isn’t, is lying to you. Debt is king right now, but cash is king in recessions. The fed is raising rates, in preparation for the next recession, which means you need to be aggressively saving.

I feel you on that! Grew up in SF, now live in Oakland. Just saving every month, brown baggin’ it to work, camping in the summer. Watching the Tech and RE markets explode to dizzying new heights. The Bay’s economy since ’99 has known only 2 extreme states: Boom or Bust. Where this carousel of insanity will stop- who knows…?

Also Amazon is around $1,000 per share right now.

Warren Buffett says, “We don’t know who swims

naked until the tide goes out.” … good luck to all …

And Wall Street values Tesla as highly as Ford or GM while making a fraction of their revenues. Amazingly, cheerleaders still believe that investors have enough cash to support the price real estate, stocks, and tech unicorns at stratospheric levels.

Another one I don’t understand…. https://www.bloomberg.com/news/articles/2017-06-23/home-improvement-startup-houzz-closes-400-million-round

This is stupid and this company won’t be around in 3 more years. But that is about what is left in the bubble, IMO.

“Houzz Inc., a website for home design services and shopping, said it closed $400 million in funding from venture firms including Sequoia, GGV Capital and Iconiq Capital, the multi-family office which counts Mark Zuckerberg as a client.

Iconiq Capital led the funding round that nearly doubled the eight-year-old startup’s valuation to $4 billion, said two people familiar with the matter who asked not to be identified because Houzz is closely held.

Houzz sells more than nine million products on its website, which is frequented by home improvement hobbyists and professionals. The website also lets shoppers upload photos of their home to see how a piece of furniture or appliance would look within a space.”

@EastBayRenter

Another case of capital desperately searching for yield. If there ever was a strong case for the Fed to tighten quickly….

I’m sitting here in AZ well prepared. House sold, living in apartment watching the game play out. My question. In places like Colorado Springs, Reno, Wyoming, Montana. How much are they currently affected by contagion? If S.F., L.A., Denver, Seattle pop, would they feel much or are they still fairly priced ?

I hope you are enjoying that 120 degree heat all week in Phoenix.

Well, San Francisco certainly is bubbling, but I detect a slight weakening in asking and sold prices for condos and duplexes in westside L.A. neighborhoods. Is this the canary in the mine shaft for future lower prices? Perhaps the good Doctor could do some analysis for a future post.

But for a bit of history now: Back in late Fall 2011, previously bearish bloggers on the coasts — in New Jersey, Portland (OR), Seattle, San Diego, and the local Santa Monica Distress Monitor – announced publicly that they were purchasing residential property and then discontinued their blogs. Others like myself were either still traumatized by the Great Recession or expecting prices to drop even further (big mistake!).

It looks like the bloggers in 2011 were the “early bird that gets the worm,†buying just in time as 2012 began. The rest is now history as we’ve experienced an escalating run-up, the entry of the all-cash vultures (the 20 percent down that many had saved meant absolutely nothing at that point), and the ensuing Rental Armageddon the Doctor has so ably covered since 2012.Â

In moving forward and keeping current day San Francisco in mind, let’s remember what investor Warren Buffett has said: “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.† Those real estate bloggers back in 2011 may not have been that greedy but they followed in essence Buffett’s guidance. Best wishes to the Doctor as he chronicles the next impending downturn.

Those bloggers were dead nuts on regarding the Fall of 2011. Things were cheap and properties took a long time to sell, I saw many nice properties that sat there for months before being sold. And let’s not even talk rental parity. Not buying = Big Mistake!

Many people were still blinded by the Great Recession and didn’t know where the bottom was, prices might have gone down another 20 or 30%. However the numbers were hard to argue with. Prices may have only went down 25% in nice areas, but rates dropped from 5.5 to 3.5%. 2006 monthly nut of $4000 went down to $2500 in 2011. That’s all you needed to know!

I’m waiting for the big crash too. Tank this market HARD.

2011 was the height of bank and government intervention. As I’ve stated repeatedly I know a couple who lived 48 months without making a payment and the taxes were paid every year. They “finally” had to give up the house in late 2014.

had the government allowed capitalism to function a clearing price would have been achieved and this current run up most likely would not have occurred. Now most think (I see this verbiage all the time) that uncle sugar has their backs (like the stock market) and will never allow prices to fall to what incomes can support.

time will tell.

It’s now 2017. Can we get over 2011 already?

Again, The Lord is correct. 2011 was a good time to buy but houses took a long time to sell even when they were at a low price. I think the reasons are:

1) As you said, nobody knew whether it was the bottom.

2) Fear was running rampant.

a) The stock market dropped 30% and people had already lost 1/3 of their

retirement and life savings. There went the downpayment.

b) Many people lost their jobs so they had no income to qualify and no cash to buy

all-cash

c) If you want to benefit from the next downturn, don’t be in the 1 or 2 group

above.

IMHO the Feds had better be propping up the stock market. Since pensions are like dinosaurs, most of the entire Boomer and Gen-X retirement is tied up in stock market 401Ks. Can you imagine all of the Boomer and Gen-X retirement saving evaporating in a 70% stock market crash? If that happened, I think people would likely vote in Mao rather than starve. Even that wouldn’t help since all of the people that stole the money would have already fled the country.

The problem you still need to address is supply and demand. CA population keeps going UP. No affordable homes are being built. People got to live somewhere. Until CA sees an outflow of people without an offset of incoming, this isn’t going to get any better.

Add to this investors, who can buy into flats and homes and keep them empty till whatever suits them. This is what happens when you have insanely wealthy people. They don’t need to make their money work for them and they have no incentive to go out and make more and when they die their wealth will be split but that split will allow the cycle to continue on.

Interesting,

It’s wild that the market clears at current prices with multiple offers above asking price and down payments 20-100%.

Time will tell indeed.

@interesting

You just raw into a buzz saw of this blog’s resident RE cheerleaders. You are right about uncle sugar — it is alive and well. It is the primary factor behind the simultaneous bubbles — RE, stocks, tech, student debt, etc.

Once again, cheerleaders use economic fundamentals like demand and supply to rationalize high prices. But principles such as price to income ratios, limiting housing payments to 30% of monthly income, or pricing risk correctly are summarily dismissed. Those are indeed sugar high symptoms.

California population is not going up that much. Most is international immigration and birth rates. Both La and OC would have lost population the most 5 years if international immigration was cut in half. One reason that Trump may helped in the long term than the short term. OC only grew 20,000 people last year compared to 85,000 people in Maricopai Arizona.

I mean LA and OC would have lost population every year the past 5 years without international immigration.

Housing to tank hard!!

Housing to Tank Hard Soon!

Jim, it has started: http://www.marketwatch.com/story/another-part-of-the-real-estate-market-is-starting-to-crumble-2017-06-19

This is going to hit the fan on the anti-christ #fakepresident watch.

So, Gibbler, could you please enlighten us how the “anti-christ #fakepresident” has anything to do with this bubble developed in the last 8 years by Obama?!!???….

So, should the “anti-christ #fakepresident” pressure Yellen to lower or to increase the interest? Why?

Thanks for sharing. I also got an email from quicken loans promoting a new 1% downpayment mortgage! lol To all the people that say its different this time, because the loan quality is so much higher. Well I’ll give you 1% higher than it was in 08 lol.

Only thing fake is your wife’s love for you, shes doin the neighbor moron.

Gibbler, your Savior Obama, “pro-christ #”real”president”, did he have anything to do with this RE bubble inflated under his watch for eight years????!!!!….

@jim taylor

The 1% down program is not for everyone.

720 minimum fico

43% DTI max (including ALL other debts)

Income limits as well

Is this the time Jim i’m watching you since 2013 LOL

Tanking to house hard later!

I feel that San Francisco is one of the few cities in the United States that could get away with these prices since it is a tiny peninsula with no room to build and plenty of wealthy inhabitants and it is highly sought after worldwide. Don’t the laws of supply and demand still hold true in this case?

Economic fundamentals only count when prices go up.

Of course, somebody forgot to tell Japan prices should only go up since theirs is a tiny island with little room left.

…..and over 100 mill. people!!!!!…. According to rules of supply and demand the prices should have continue to go up to infinity. However, the prices were sliding down for decades. After all, gravity still works and man could not eliminate it just by faith in RE.

Try to buy a condo in Tokyo.

Then we can talk.

Prices were inflated in the whole Japan, not just Tokyo. They came down everywhere, including Tokyo.

Or Singapore

A 1 bedroom in Tokyo cost $1M USD.

It’s about 150,000 Yen per sq ft. (about $1300 per sq ft in Tokyo center)

It’s more expensive than SF or NY.

Best of luck.

According to these sources, average condo prices in Tokyo were nowhere near $1M.

https://resources.realestate.co.jp/buy/what-is-the-average-price-of-a-house-or-condo-in-tokyo/

http://japanpropertycentral.com/2015/10/central-tokyo-apartment-asking-prices-up-17/

$1M might have valid 20+ years ago or in the most expensive neighborhood.

The center 6 wards of Tokyo, which means you actually live in the city center like SF or NY is absolutely $1M for a 1 bed room.

Price per Square Feet to Buy Apartment in City Centre 146,870.04 ¥

https://www.numbeo.com/cost-of-living/in/Tokyo

In 2015 (which is the data you cite) it was closer to $800K for a 1BR.

Mortgage rates in Japan are of course only 1%.

What do you think would happen in CA with 1% interest rates.

Don’t think too hard on that LOL

“In Tokyo’s central six wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo and Shibuya) the average asking price was 72,770,000 Yen ($653K) ”

http://japanpropertycentral.com/2017/04/tokyo-apartment-asking-prices-in-march-2017/

Of course, you just happened to choose one of the most exclusive parts of Japan to distract us from the fact that prices in the country never recovered from their highs 20+ years ago.

What are you talking about Japan has been going up in price for almost a decade now and has never been cheap.

That’s the problem with the story line… Japan went from 100X too expensive to 20X too expensive.

Tokyo is not affordable by any stretch of the imagination.

That’s my point.

My point is that economic fundamentals cited by RE cheerleaders are nothing but a smokescreen to hide the real reason for modern day RE markets: government and central bank manipulation. RE appreciation has been driven by unorthodox demand in the current cycle (flippers, investors, money laundering, speculators) as it was in the previous cycle (unregulated lending to end users). The smokescreen is used to rationalize that no bubble, thus no real downside, exists.

After Japan’s last 2 bubbles burst during a span of 20+ years, prices returned to 1980s levels. Is their current cycle truly different?

They do until reality comes knocking in the form of an earthquake. Many have no clue what is in store. I’ll be interesting to see how that leaning tower handles a nice temblor.

I can see that exact tower from my office window as I write this. Joe Montana bought a condo in there for a “discounted” $20 Mil in return for some free promotion. Ugh, hope I’m not at work when the Big One hits!

Flyover, regarding the Supply vs Demand situation in Japan- just because it’s a horrendously overcrowded place does not mean there is “demand”. When your customer base is too broke to afford your product, means there might be desire. But desire only becomes demand when prices match the wallets of the buyers. So, in Japan, where the fabled job security and super-charged economy that supported it, have vanished, the prices had to drop substantially to create demand.

This lesson can be applied to anywhere, especially in overpriced U.S. markets. It explains why qualifiable demand is weak, and fence sitters shouldn’t be expected to jump in anytime soon.

Oh Yeah son!!! Let it fking tank hard.

We must be near peak. Nearly $1.9 million for El Segundo: https://www.redfin.com/CA/El-Segundo/519-Eucalyptus-Dr-90245/home/6645781#fsd

Yeah, it’s a beach city. But still, the house is only 7 blocks south of the LAX runway.

I have family who live 2 blocks south of the runway, and honestly the noise isn’t too bad. LAX and the FAA paid for their double windows (not just double-paned), and there are a lot fewer night flights than in years past. We always leave the windows open at night when visiting and don’t even notice it, probably because the runways are parallel to the city.

Calling it a beach city is a stretch, though. As you get closer to the coast, all you notice is the refinery.

The noise may be tolerable, but I bet the increased pollution they’re breathing in will lead to intolerable health issues down the road.

On top of all this, we have the illusion of declining debt to income ratios

https://realinvestmentadvice.com/the-illusion-of-declining-debt-to-income-ratios/

excerpt

In some states, when a couple enters into divorce, the court may award “alimony,†or spousal support, to one of the former spouses for the express purpose of limiting any unfair economic effects by providing a continuing income to the spouse. The purpose is to help that spouse continue the “standard of living†they had during the marriage.

The idea of “maintaining a standard of living,†has become a foundational bedrock in our society today. Americans, in general, have come to believe they are “entitled†to a certain type of house, car, and general lifestyle which includes NOT just the very basic necessities of living such as food, running water and electricity, but also the latest mobile phone, computer, and Internet connection. Really, what would be the point of living if you didn’t have access to Facebook every two minutes?

One of the charts that are often bantered about in the media is the increasing prosperity of the average American as witnessed by the following chart.

But, like most data extracted from the Federal Reserve, you have to dig behind the numbers to reveal the true story.

So let’s do that, shall we?

I like following the blog although I never comment since I don’t live in So Cal, but I do enjoy the insight and commentary. We are feeling the effects of the San Francisco housing mania in the Valley. Prices here are rising quickly and are becoming less-affordable (if you don’t want to be a slave to your mortgage payment). I’m assuming it’s because Bay Area folks can’t afford homes there, and see prices here as “cheap” compared to what they are in the Bay Area. Investors the same. So they come here and buy everything up which contributes to the supply issue and drive up prices. Unfortunately, those of us living in the Valley don’t make Bay area money and are getting priced out. I hate when people throw out their stats, but I’m single making 100K and feel like I can’t afford the simple single-story 3/3 with decent square footage, which is around $475k-$550K in a nice area in these parts (I know it sounds like peanuts compared to what you So Cal folks are paying so I’m not complaining). Maybe I’m just being cheap/unrealistic, but I’m not interested in half my paycheck going to a mortgage payment. That and I feel like things here are just simply overpriced. I guess I’ll be sitting on the sidelines for a while and continue saving until prices become more reasonable for the area. And as a side note, not all of us millennials are free-loaders off mom and dad btw 🙂

I recently cashed out of NorCal after buying in 2012 with a $700K cash gain.

I paid cash in 100% cash in San Diego.

Will the housing market eventually go down…. you bet… what will rents look like when the next recession hits?

That’s the question you all need to answer.

easy answer. rents trail income. Thats why we did not have any significant rent increases. Renting is much cheaper than buying unless there is a 50% drop in home prices. Then, i will probably buy a house.

My guesstimate for a 2BR in “desirable” areas of LA during the next recession is $4000 per month.

I say “desirable” in quotes because we all know nice parts of LA don’t exit LoL

“That’s why we didn’t have any significant rent increases…”

WTF. Rents have skyrocketed since the Great Recession ended. To claim otherwise is just plain false! I’m sure I’ll hear the old story of how your landlord loves you and gives you giant rent discounts relative to market rates…go buy a lottery ticket!

“Rents have skyrocketed since the Great Recession ended”

HAHAHAHA, what are you smoking? And most importantly, can I have some of that stuff??

Rents have for sure went up since 2012-13 but can we stop pretending that they still are?

http://realtybiznews.com/rents-are-falling-now-what/98742219/

If anything, I’d say mom and dads everywhere got lucky and ate the “cream” with the GI bill, pensions, first generation to get low rate mortgages after the war and when one income bought middle class life-style in a district with a good public education for the kids. That generation at the end of the silent generation and start of the boomers.

Your generation is left to fight over their dregs.

Thanks to everyone who has posted here. I have found most of the posts to be very informative and interesting. Shortly, we will all know if the bubble is popping right now, as most of us expect, and whether the investor class will add to the panic by joining the sellers or whether they will hold on–no matter what–and limit the decline to 25-30%,

It is more likely much or most of this price move is not a bubble. Instead, it is engineered inflation by the world’s central banks. They decided the world needed higher asset prices to bail us out of excessive debt and they enacted policy that did just that. This inflation will continue until either the central banks decide the inflation is over and they change course or till currency markets break. Stay tuned but do not fight the central banks. As long as the central banks decide more inflation is what the world needs, then just buy real estate.

L.A., San Francisco, San Diego, Portland, are major port cities,, with lots of rail and freeways in and out ,,,,business will take quite a beating before leaving easy supply lines and shipping ,,,currently am in what would be a major port city except our rail was destroyed years ago leaving us with no easy supply lines as our only major freeway is mostly 35mph speed LIMIT (not kidding) our 2 major hwys are always closed for slides or construction over 50% of the time ,,,,before a business will move they consider logistics ,,raw material & workers in– finish product & workers out,,,,little town I grew up in could have been on the map except they would not give a 2 year tax incentive to Dreamworks studios ,,,looking back it was bad decision on their part ,,,sorry mexico calls

“Have you been to Las Vegas?” Truer words were never spoken about our current economic system. Keynes once disparaged Wall Street and unregulated high finance as a “Casino Capitalism”, looks like things are not that far off the mark.

Also, in terms of the tech industry: this is an industry that could conceivably be outsourced far faster and easier than say, the domestic auto industry. Why not send the majority of software engineering jobs to Hyderabad? No different than shipping a factory to China or Mexico. Keep the executive headquarters in the States and run the whole operation digitally. Remember these are all information products. San Jose is truly a one trick town and could, someday soon, become the “Detroit of the Future”… Just food for thought.

No kidding. In 1950, Detroit was the wealthiest city in the country on a per-capita basis. You have to be at least as old as I am to remember what a beautiful city that was, built mostly in the period 1910-30 and replete with stately high rise buildings and beautiful residential neighborhoods populated by prosperous blue-collar workers. People thought it would never end, but the seeds of destruction were planted for Detroit and all the other industrial behemoths of the Midwest and Northeast long before the 1967 race riots in Detroit. Even in the 60s, industrialists were not only looking to relocate to the non-union south, but to offshore. My mother worked for a metal-plating concern, and she and two male colleagues tried to form a metal plating company and have it taken public in 1966. No dice, the brokerage firms told them, that industry will be offshored by the 70s and there’s no way you can be competitive.

It only stands to reason that if something as physical as auto manufacturing and its supporting industries can be outsourced and offshored, so can something that exists only in cyberspace.

Here is an interesting one – land North of Montana Avenue.

This relatively decent home went on the market for $3.5M no buyers. Listing was lowered to $3M and sold within a week to developer. Total rebuild, now on the market for $5.4M.

the shocker is that 7500 sqft lots North of Montana Ave are now selling for $3M. My grandparents bought a house near this one for $16K in 1955. My family still owns it. One of the dumpiest homes on 16th Street and land value is $3M !!!

Manhattan beach sand section has tiny tiny lots around 3.000 sq ft. And, land value is north of 3 million. They were 300K 20 years ago. Same in Corona Del Mar, south of PCH. There, land is north of 3 million for a tiny lot. This has also gone up ten times in the last 20 years. Both locations are appreciating around 250K per year. Crazy stuff

Actually, this is jt … the Bo is a typo.

Blah, blah, blah, blah, blah, blah – blah!

Houses cost a lot of money.

In Bay Area, houses cost more than other areas.

People earning low salaries outside of Bay Area think prices too high.

For them, prices too high.

For inside Bay Area, prices affordable.

Prices drop when economy slows down.

Instead of $1,500,000 median price, 30% huge drop down to $1,000,000 median price.

People living in Bay Area with Bay Area jobs and salaries remaining, still afford to buy and buy.

People outside Bay Area sit and cry and point fingers and laugh in glee when in fact people outside remain locked out, tech workers and plenty of old world monied highest class upper tier persons all stay in San Francisco and use the drop as time to buy rentals.

Super wealthy old world money class already in Bay Area simply buy more and then sell later on when median back up to $2,000,000 later on ten years from now.

Rich get richer.

Poor get poorer.

Blah, blah, blah, blah, blah, blah – blah!

Same old story, BFD.

“Super wealthy old world money class already in Bay Area simply buy more and then sell later on when median back up to $2,000,000 later on ten years from now..”

That’s what I’ve been saying. There are simply “more people” (millions?) with deeper pockets than anyone here can wrap their heads around. Life didn’t just start in 2017. We’ve had hundred of years of history with old money, which never went away. The riches just go downstream to the heirs. Go buy a lottery ticket and win – if you want a home.

I feel the same way. There seems like an endless supply of money. Even BART Janitors have total compensation packages of $270,000!

Sam

Decline appears to be starting, but will investor join the sellers or ride out the decline?

What they decide to do will determine the magnitude of the decline.

San Francisco Mayor’s Office for Affordable Housing, units for sale BMR, Below Market Rate, with city assisted 2nd mortgages.

Must qualify to buy $925,000 Asking Price 3 BR, 1BA condo. City 2nd of $375,000 maximum. Income must be below 120% of Area Median Income.

$97,000 one person to $160,000 6 persons.

So there is affordable housing in San Francisco.

Six persons earning under $160,000 combined get $375,000 second mortgage from City, the balance is a regular mortgage and the HOA dues a extremely low for San Francisco of only $243, at least 1/3 of what HOA dues are anywhere else.

Current offer is at $995,200.

Buyers must be willing to exceed current offer price and be in a lottery to see who the lucky winner will be.

Affordable housing, SF style, City makes it possible, even at these high prices.

See link to SF Affordable Housing latest offering under City 2nd. City also has a separate link for BMR units, Below Market Rate, taxpayer subsidized.

http://sfmohcd.org/current-listings-city-second-program

A house costing $925,000 is “affordable” to someone making $97,000 a year? 10X the buyer’s income is “affordable”..REALLY??? By what metric? Even if you have cash in hand to buy that house, you need a couple of hundred thou a year to comfortably carry the taxes (at least $15,000), the maintenance, and your ordinary living needs, like cars, insurance, food, medical, and unforeseen emergencies. Never mind such luxuries as furniture, high-quality food, daycare for your kids, let alone private school or pre-school, or an occasional 2-day trip up to Crater Lake, or some other diversion.

Laura

You also just got to love the tag line “and be in a lottery to see who the lucky winner will be.”

Just like a deep south documentary I once saw that encouraged dancing with rattlesnakes to impress the elders.

Guess the definition of “lucky” has morphed at bit…

A few months ago I was looking at homes out in the Riverside area. Not speculating on the market, not trying to beat the system, just looking for a place to live because my landlord was driving me mad.

Due to rent control I pay relatively low rent compared to market so its pointless to move into a different apartment, that is why the idea of buying appealed to me in the first place.

I put in offers for a few places but luckily no one was interested. The whole time my realtor is telling me to go $15k above asking (i probably had the worst realtor). I am thinking… lady… this is Riverside, no one wants to live here, why would i spend more than asking? She had plenty of excuses but in the end of the day they were just excuses… Now she sends me emails “still interested in this house? They lowered the asking price.” I just decided to ghost her because she is such a bad realtor.

The market is 100% plateauing and it is summer so that’s not a good sign.

In 3 years if I’m lucky I will be doing what I love full time, if I’m not I will still be working in the Finance industry.

Either way, I should be doing well enough to get a condo.

I have some universal advice for EVERYONE. Always have a Plan B.

There will be a adjustment. Don’t miss out like all the Big Crash people did around 2010. If home prices drop 10-15% buy.

10%-15%?? That’s where the prices were a year or two ago in SoCal. This thing better drop more than that, or it’s barely a blip.

15% where I’m looking is 120 grand. I bought in 2010. Sold it recently. These hard tank guys missed out because they were waiting to buy a place in Newport for 200k. If you wait for a 40-50% drop off peak you’ll probably blow it.

That’s what I’m saying. Buying in 2010 and selling now was certainly a good move, but prices hadn’t only fallen 10% in 2010 when you bought. I’d say wait until 30%, at the least.

If prices drop 10-15% in total over 5 years … when you take into account inflation that is more like a 30% drop. Don’t forget inflation.

That’s what I’m saying. 30% real prices, but even more considering inflation. We’re well passed the point of only 10% ups and downs. It’ll be a jagged from here on out.

I would need prices to drop 70% before I could or would be willing to buy. That or my income has to triple.

I’m just bidding my time till the Grim guy shows up. There is no hope, there is no future in the United states for a lowly Mechanical engineer like me only pulling down $90K a year……and $90K a year is SHIT FUCKING MONEY IN 2017.

Interesting,

You can easily move 40 minutes to an hour away and buy an affordable house near basically any US city. That is the tradeoff.

Your other option is to marry a higher paid mechanical engineering wife. Don’t let the gender pay gap people know the truth.

Hang in there. I know a couple of public HS teachers who bought in 2011 in the Bay Area. They got a great deal and are now millionaires on paper. More importantly, they could buy a house that could afford on a teacher’s salary in 2011. Not now.

“I would need prices to drop 70% before”

Just wait another year or so. Collapse is around the corner. It will be nice!

Doesn’t work. I married a dentist, and the first thing she did is quit her job, have kids and stick me with the student loans. They figure out quickly once they got you.

I live in the city, the market is quirky, many older residents using home for bank and prop 13 with living trust handed to kids, whom might live in the house.

Many empty homes here that were bought with hot Chinese money. They sit, well kept with no one living in them as a hedge against china currency devaluation.

I’m seeing renters move out in greater numbers in my area. Think landlords are squeezing the lemon too tight and it will come back to bite….it will be the canary in coal mine here….

The City is really booming on hot money….Chinese and tech…..

Its not an organic boom. Just a mania based on debt. People think if you buy houses and cars you have wealth…..they dont see that this is all bought on loans. Wait until they lose their high paying job during next recession. It will all come crashing down so fast it will make your head spin.

Maybe, but isn’t it just as possible that the next stage of market manipulation to prevent true price discovery would also make our heads spin?

That’s like saying we will see an Alien arrival this year. It has never happened before. You can only push a bubble for so long. At the end the market forces are stronger than manipulation. Its basically like the law of physics.

Huh? Do you remember 2008 and the years that followed? Formerly unimaginable manipulation occurred under the guise of an emergency. It has happened before, very recently in fact.

Sum Ting Wong with these prices in SF!

Condos will be hardest hit. 60% price drop won’t shock me along the orange county coast. Condos being sold for 100k back in 2011 now being sold for 300k. Plus they have built an astounding amount of new inventory. I’ll be trying to snag a condo near the beach plus a small warehouse a bit inland.

In my woods there are condos that are selling for 1/10th of what they were at the peak of bubble 1.0. People bought in 2011/12 for 50% thinking they were getting a deal. Its weird, there are condos down the street that are back to bubble 1.0 prices (and they are junk, will definitely lose another 50% again) and new luxury ones going for over a million – but those have pretty big ocean views, not just a peak or garden views. Condos are weird, assessments can kill you but pricing seems to be all over the map so valuing them is hard imo.

Oh, and for the guys claiming rents rose in this bubble – not everywhere. Just had my rent raised by 5% after no raises the previous 7 years. Still way less than 10% of my income. Escape the madness of Cali and other blue places (asylums?) and you’ll be golden.

Wow.

In a stunning development involving Canada’s largest alternative lender which as recently as a month ago was facing virtually certain insolvency after a furious depositor run drained it of liquidity, overnight Home Capital Group announced that billionaire Warren Buffett’s Berkshire Hathaway will indirectly acquire C$400 million ($300 million) of the firm’s shares in a private placement through its Columbia Insurance unit, for about a 38.4% stake, and will aso provide a new C$2 billion ($1.50 billion) line of credit to its unit Home Trust Co, ending the Canadian lender’s strategic review process.

http://www.zerohedge.com/news/2017-06-22/buffett-stuns-market-after-berkshire-acquires-384-home-capital-group-provides-c2-bil

Lights out for Canada’s housing market. US is next.

Will Canadians be happy that part of their future debt will be owed to an American opportunist?

Buffet is getting ahead of the government bailout this time.

Well played.

Exactly!! Since a government pension fund already bailed out the mortgage lender he knows they Canadian government has his back.

What does Buffet have to gain aside from a PITA if the whole thing goes down? The Canadian government might bail out his exposure, but not necessarily at a premium.

Getting ahead of or there was a handshake with a wink by the gov implying this was a guarantee?

Most likely the latter

Here is a great investment. This is an up and coming area in eastside Costa Mesa. At this price, the home is a complete fixer. Something to keep you busy on the weekends. However, 21st street is not as busy as many of the other streets. This is a buy.

https://www.redfin.com/CA/Costa-Mesa/220-E-21st-St-92627/home/4598100

I would try that one in the high 700s.

when the market crashes (probably next year or so) this crap shack will sell for 250-275k. I would wait until then and dont buy now. You save money by waiting.

I would be willing to bet you $275K, you can’t even buy it for double that next year.

This house is probably worth only about $750,000 right now–at the top of the bubble! The current price is simply crazy. The home will probably drop below $500,000 within 3 years. Buying this house now amounts to committing financial suicide.

The fact that the seller is so greedy to even ask for $850,000 is another sign of a bubble top. Asking prices like this one are completely disconnected from reality.

I disagree. Look at these just blocks away. A 1 bd, 0.75 bath closed at 925K.

https://www.redfin.com/CA/Costa-Mesa/279-Flower-St-92627/home/3557141

Here is another. 1 bd, 1 bath, 700 sq. ft. that is pending. It had multiple offers … ask is more than 1M.

https://www.redfin.com/CA/Costa-Mesa/365-Costa-Mesa-St-92627/home/4603437

So, if you can get the 21st property below 800K, that is a deal.

A buy? You did notice the square footage?

It will never, ever reach 275k, but 600k I can see happening. Wouldn’t buy it even at that price.

I can build brand new in a better state with more land and keep it under 300K no problem. Coastal cali people are sooo dumb!

Well, it is gone. Must have gone for close to full price.

You know what, compared to LA and San Diego, San Francisco prices aren’t looking so crazy anymore. There is some pretty nice stuff with good schools for $1.1 to $1.6 million. Sure, that’s maybe 1 to 1.5x of Southern California, but incomes are easily 2x.

A former company of mine moved to SF, and salaries were about 15% higher. The positions which pay 2x are not the exact same ones as down here. They are of a caliber and type which does not exist here and require specialized skills.

I finally sold my investment property and can all but assure the collapse is coming. It is like a slow cancer, my original price list of $900k seemed like a bargain for the zip code since it appraised easily over 950k all was gold, I would make a $ 100-125k profit?

The problem, I couldn’t get qualified buyers, the bank always had a excuse not to loan unless 80% was put down. Cash buyers dried up after 8 months, they saw a blood letting and started the drum beat take 20% off list price or keep it another 8 months.

I did just that, kept it 7 months more and finally said uncle.

All said and done with property taxes, insurance, repairs, utilities, worry something will big will breakdown, I took my first loss ever over 40 years of buying and selling. I did break even on two properties Ca. and Denver in the 90’s.

My take, prices in most parts of the country are unattainable, taxes are going up and up, although Ca. is a special market it demands attention, all I can say is the biggest fall in CA. history is coming and this does not include a major earthquake.

I can only base this on my experience with banks who know it is coming, they want the public to take all the chances now, it won’t matter how much prices fall, most folks won’t have a job to buy anything let alone overpriced houses, it is already happening in the auto business, lease cars are being repo at a record rate.

Im in the no buy camp currently but the tank people seem to forget that it took nearly 5 years from peak to trough to bottom and thats with the government doing everything to hump housing. Thus the idea that you will get 30-40% off in a year is just silly.

Some think 50-70% in a year for a truly ribsplitting LOL.

The housing market… especially the current one is like a cruise ship. It takes years to turn.

The biggest declines whenever the next recession hits will be inflation adjusted declines.

Even if prices were flat for 10 years that can be a 30-40% decline inflation adjusted.

cruise ship, just like the titanic. Ice berg ahead and no way to avoid the crash. 50-70% drop is conservative. Christmas for those who waited, nightmare for those who recently bought. That’s life.

Cheddar, while the total decline in home prices might take 4 or more years, 2/3’s of the decline will occur in the first 16-18 months. Just think back to the declines from the 1990 and 2007 tops. The initial half of the declines were very quick. It is really a myth that foreclosures caused those crashes. Over half of those declines occurred before the first foreclosures even hit the market.

It absolutely was due to homes that would have been foreclosed and sold short instead.

Last time there were not so many SFR REITs which could experience redemptions.

NoTalkin, you are wrong. The decline began because homes became unaffordable, then the recession made them even more unaffordable. People stopped making payments or decided to sell while the getting out was still possible. Soon there were no buyers because people were afraid to buy a declining asset. The last step was when homeowners simply stopped making payments because their homes were underwater. Foreclosures took years to appear and simply extended the longevity of the bottom, They had nothing to do with starting the decline or determining the depth of the decline. Greed turned to fear and fear lead to selling.

San Francisco housing market is bat shit even relative to the rest of California… still though big cities and hot job markeys will always have the highest prices. And tech companies keep offices there. They aren’t fleeing places like SD more companies in that sector are opening shop.

If a city is cheaper to live and finds a way to draw in lots of high paying jobs then it won’t be cheap for long. Hence why cities like Austin, Denver, and Portland are all getting more expensive. High paying jobs fuel housing speculation well beyond even what the jobs should be doing to the prices alone.

But almost non go to the level of san fran. Some serious though and policy needs to go into curbing speculation in that area. Maybe if we ever get a state government shake up here, because it’s pretty clear a Democratic majority isn’t interested in making and policy to help out.

I wonder why people don’t pool their funds with say friends, or workmates, or even by advertisements, and buy homes together. Pool their two to four incomes and live communally in a home they both purchase together. They can divide the home into two sections and each family inhabit that part of the house. I never would have thought that ‘tiny homes’ would take off, but they have, due to the circumstances of housing. Since extended families with several generations live together in other cultures, why is so hard to think that consenting, agreeable people couldn’t work together to attain what alone they could not. This could be the future of home buying, multiple families living in a single residential home. I guess it depends how desperate you are for a house to live in.

Communal living in the same home COULD work with young, single, childless people who know each other extremely well, have a strong basis for trust, and have a shared passion, such as music, or art, or the company they are founding together… …. but only for a while. Study the communes from the 60s and 70s to see about how well most of these arrangements worked out- not.

And it totally will not fly with most women, especially those who have children. Women tend to be extremely proprietary about their personal space, their families, their husbands, and their privacy. Either you don’t your co-dweller woman’s beady eyes on your own rather wobbly housekeeping, or you resent her squalor and her kids’ noise, or conversely, her fussbudgetry. You don’t want other people’s paws on your personal things and you hate their collections of teapots or whatever.

Condo living is quite communal enough for me, thank you very much.

This has been a trend for a while, but only before having children:

http://zillow.mediaroom.com/2017-02-08-More-Young-Unmarried-Couples-Buying-Homes-Together

After having children, the arrangement doesn’t work as well. At that point you are better off moving to a cheaper part of the US and having your own place, despite losing some benefits of being here.

Because, Hell is other people! – Sartre

Some of these houses are tiny to begin with (1200sqft for ~2 mill in south bay). So you have to ask, what are you gaining from purchasing rather than renting or finding a rent-controlled place? Equity? Only if you think it will gain in value and you don’t mind the maintenance efforts and costs/cost of selling/possible need to stay there for years to break even (capital tied up).

There are stories in the NYTimes of families or couples starting to do that in NY state in recent years you can read about. Legal structures in the bay area called TICs – tenancies in common already exists but look more like small condos. I wouldn’t touch them and require a lawyer to review prior to purchase – unless you enjoy risk!

I’ve actually considered this with a relative and spouse’s business acquaintance but as an investment property out of the area or country or as second home – we wouldn’t actually want to live together full time. No thank you. I already refer to the neighbors upstairs as “the unwelcome house guests” because I hear far too much of what they do.

I agree with Laura. I grew up near communes in S. Ca. My sister-in-law grew up on a commune in the late 60’s and 70’s. None of them exist today. Ideally, they are a utopia, but in practicality, someone always wants to be the boss, most think the division of labor is unfair. We are humans with human frailties and not robots.

And the one who wants to be the boss is never the one that gets stuck with 90% of the work.

It’s bad enough with many condo associations, especially small ones dominated by investors, in which it is close to impossible to maintain a functional Board with a clear line of authority and responsibility. But it’s one thing to put up with other owners when you’re merely trying to run the building and you never even see them, but quite another to have them in your own kitchen or bathroom, or occupying the living room sofa.

I can’t think of many worse nightmares.

Recession ahead. Oh wait its going to be a deep, long depression.

http://www.zerohedge.com/news/2017-06-24/why-next-recession-will-morph-decades-long-depressionary-event-or-worse

JUst like in Japen, US housing prices will decline for the next decade. Dont buy, wait.

Here is an excellent investment. This will double over the next 12ish years.

https://www.redfin.com/CA/Redondo-Beach/138-Via-Colusa-90277/home/7708666

i would wait until after the crash. You probably be able to snatch it up for half the price. Waiting pays big money. Its like getting a raise. Next ten years will be deflation territory for sure.

Redondo Beach only dropped 30% in the last crash. I wouldn’t hope for anything more than that.

Except, this bubble is much bigger than the last one. Bigger bubble, bigger crash. Its just logical.

Prices have farther to drop, yes, but that doesn’t mean the percentage will be different. Using Redondo Beach as an example, in the last bubble/crash $835k became $620k, current median of $970k could turn into $680k. Logic is looking at past bubbles – usually a price trough is not as low as the previous trough (i.e., the very long-term trend has been upward).

jt, don’t let the secret out.

The Avenue Streets and Riviera area of S. Redondo are still cheap compared to similar Manhattan and Hermosa properties. Get em while you still can!

Just saw this article over the weekend, every time I see something like this, I am open to entertain the idea that maybe these sky high prices will continue to go up and majority of us on this site are wrong on this. I know the current data is pointing to a bubble but when all the economist are saying no and SoCal house prices are heading higher and higher, even Chris Thornberg is saying the same thing, maybe this is really the new normal. Either way, if this is the new norm, I guess I miss the boat on this couple of years ago..oh well, at least I am not the only one in this truly disparaging market/future for non homeowners..

Sorry, forgot to include the link to the article in my last comment.

http://www.ocregister.com/2017/06/25/how-much-longer-can-home-prices-keep-going-up/

Perhaps you should expand your attention to other high-flyer markets, such as New York and San Francisco. Think that So Cal is any different?

“A Second, Even Bigger Foreclosure Reaches NYC Billionaires’ Row”

Another luxury condo at Manhattan’s One57 is scheduled for a foreclosure auction — the second time in a month that a property seizure is being sought at the Billionaires’ Row tower following a mortgage default. And it might be the biggest in New York City residential history.”

http://www.fa-mag.com/news/a-second–even-bigger-foreclosure-reaches-nyc-billionaires–row-33469.html

But but but….skin in the game….all cash purchase…tightest lending requirements ever.

According to some here, the prime markets are insulated from corrections. Or, maybe, the billionaire row is not prime enough for them ?!!!???…..

It wasn’t coastal enough…

Contrary to wide spread belief that 2008 was a once in a life time event, the BIS (the central bank of central banks) says that the next global financial crisis will hit with a vengeance. The CNBC expects 40% correction.

http://www.telegraph.co.uk/business/2017/06/25/next-global-financial-crisis-hit-vengeance-warns-bis/

http://www.cnbc.com/2017/06/24/stocks-to-plummet-40-percent-or-more-warns-marc-dr-doom-faber.html

Those who think that RE is insulated from what happens to stocks and banks are in for rude awakening. Nothing structurally changed since 2008. A band aid is just that, a band aid; the rot just continued to metastasize underneath. It is now 10 TRILLIONS in debt worse than it was in 2008 (double) and 3.5 Trillions worse in central bank increase in balance sheet. Every individual and business is in debt to their eyeballs. That is the inconvenient truth. Just by looking the other way, it is not going to change the reality.

Faber has been repeating this line every year for the past 5 yrs

Faber’s timing is bad. But do you want to be the last one standing in the game of high-leverage musical chairs?

Well, this time the BIS agrees with him. They ARE the money creators. Every single time when credit expansion drops relative to GDP you have recession or depression. No exception. Period. Look at historical charts. This number is published by BIS not Faber. BIS is THE BANK, not Faber. The only reason I put CNBC article (written by Faber) is because it is liberal MSM. In the past I’ve been accused for using Zerohedge and some discredited the message based on the messenger. This time the MSM supports the BIS narrative.

Credit expansion means increase in money supply and credit contraction means decrease in money supply. Now the credit collapsed by 6% from last year. Historically, that means recession in the best case scenario. It can be depression, too; depends on how it unfolds and how the FED reacts. In 1929 they raised the rates in economic contraction. This time they do the same. The ONLY reasons the GDP is positive (barely) are:

1. Obamacare (big unknown as to its fate because it was designed to fail).

2. Fake CPI. Based on the way they used to calculate the CPI, the GDP is negative even including Obamacare. Maybe that is the reason nobody wants to touch it and expose the real economy for what it is. I don’t think that any honest person believes the CPI numbers for everything that matters to the average person (education, health care, housing costs); yes, the fuel went down a bit, but that is less than 10% savings comparative with the increase in everything else.

I think folks need to understand that Zeroedge is just that……I believe its a doom site ran by GS and JPMorgan just so they can keep making cash off the volatility players thinking the next black swan is here….

Zeroedge has lost every one whom follows their meme a lot of money over last 5 years….

Well, this time, the MSM agrees with Zerohedge. See my CNBC and Telegraph articles above. Don’t kill the messenger for the message.

CD, Zerohedge provides information NOT financial advise. You should know that by now. You have to be well informed from the whole spectrum of publications from the left to the right and reach your own conclusions. ALL publications have bias, one way or another. Each one pursues their own agenda. For that reason, you can not rely only one one to find the truth. At the same time you don’t have billions to investigate on your own. Be smart, not indoctrinated.

CD, tell us who was publishing “fake news”, Zerohedge or the MSM CNN? Zerohedge was stating for months now that Trump/Russia collusion was fake news. CNN was presenting that as fact – TRUTH.

Today, CNN fired 3 employees who were publishing those “TRUTH” news. Why? Because they were publishing fake news for “ratings”. This news is not from Zerogedge, but from CNN.

http://money.cnn.com/2017/06/26/media/cnn-announcement-retracted-article/index.html

CNN was lying for so long that even the CNN executives got “disturbed” by the level of “fake news” coming out from them. Maybe the bottom line was affected by the lost of credibility with the public. They had to do some dramatic to stop the slow dying of their outlet. Bad credibility is not good for ratings. Bad ratings are bad for bottom line. They might care about their ideology and agenda, but if that kills you, then you better take the bitter pill.

Conclusion? It pays to take your news from different outlets and use your critical thinking for the course of action. Don’t swallow everything you read just because it makes you feel good. Cross check and again cross check. After all, you are the only one to lose or to gain.

Hi Esteemed Bloogers,

i need some advise.

Bought close to Culver for 900K in 2015 with 20% down, now Zillow says 1.3M.

Suppose for a sec i believe it (houses close by seem to be gone within 2 weeks).

OK, i sell it and buy alike crup in West Adams for 600K. Then i owe NOTHING.

If market drops 50%, i am still 100K ahead. If it keeps going up, West Adams does seem to attract some professionals, and with North USC village…

Anybody sees any downsign?

S, we have been assured by the many bears that housing will tank HARD soon. Some predict prices will crash up to 70%. If you truly believe that, sell your house today and buy as many ultra short REIT funds as you can.

If you can easily afford your monthly payment and you like your house, why not just stay put. You already have 400K equity from appreciation and are benefiting from Prop 13. Sounds like a no brainer to me.

Thats right….sell as fast as you can and rent…Crash is coming fast

Depends on how well you’d like living in the ghetto.

No, it’s not tech. Techies are being gentrified out of the city. They are leaving. It’s the Chinese, among others, who are buying up all the RE in the city. We need a Vancouver style 15% property tax increase on foreign buyers.

I did look at a property yesterday. It is in a beach city and the reason I looked at it is I heard the owners want to sell since they have an offer on a move up property. Such a scenario can be attractive so I rushed over with a blank offer in hand. I threw a number on it and the sellers agent said no way. She said they would take a second to drain the equity then make it a rental property forever if they could not get their target prices. I walked away. This is the changing face of the real estate market. Because of rapidly rising rents, many are frequently changing primary residences to rentals instead of selling. This is one dynamic to the shortage of inventory for sale which leads to higher prices.

Thank you for confirming that the so called “cash” offers are in fact based on other types of loans (in this case HELOC). I knew that, because I did it many times in the past. The transaction is reported as “cash”, but the cash was borrowed on a different property. It doesn’t matter how rich people are, they still borrow. That is how money are created – via borrowing. Now credit creation vs. GDP collapsed 6%. That is money supply contraction.

We’ll see what happens when everyone will try to sell to cover their debts!!!! Where will the buyers come from when banks will try to just survive??!!!…When the music stops, you better have a chair!….Enjoy it while the music lasts!!!…

Where’s the evidence that rents are still rapidly rising? According to most sources rents have already peaked in bubbly areas and at best increases have slowed way down in Los Angeles. Maybe your definition of rapidly is very different than everyone else.

@jt…same thing happened to me. I bought a new home, put my old home on the market and did not get my price. So I rented it out and now I pay BOTH mortgages with the rental income from the old house. Kinda a no brainer in beach cities. Why sell if you don’t have to?

In 2014, I did that w/ my primary residence of 9 years.

It wasn’t a fun experience renting out the house. So in 2017, I decided to sell it.

The only good thing is that prices rose about 25% – 30% in this time frame.

Houses are still moving quickly. House around the corner from me (in Simi Valley) was purchased for 500K in 2010 and just sold for 686K and was on market for 18 days. I think asking price was 679K.

I wonder how many people have been reading this blog from the early days and how many of them realized that the market had tanked to lows in 08-09 and how many jumped in and bought?

Guys, I’m am really happy I discovered this site, and I’m SO IMPRESSED by the amount of dialogue here! I haven’t seen this many comments in a while on the topic.

Is there a bio background on the author? I’d love to get to know you guys more. I’m based in SF and have been long SF real estate since 2003, but finally sold one of my properties in June 2017 to simplify life and de-leverage.

Thanks,

Sam

SF real estate didn’t fall much after the .com, only about 10%. So if there’s a tech Crash Part 2, r/e won’t necessarily follow.

Real economy was when diversification meant something. e.g. RE and PM was unaffected by DOT COM bubble. In today’s engineered economy, everything is linked, across asset classes and geographies! All asset classes go up in unision or they all go down depending on global co-ordinated moves by the banking cartel.

When the next crisis hits what will the banking cartel do to increase their stranglehold on the peasants?

1. negative interest rates (confiscation) Prediction: 10%-20% valuation drops

2. 0% interest rates (again) Prediction: 30%-50% valuation drops

3. do nothing Prediction: 70%+ valuation drops & martial law. Banks end up owning virtually everything!

Leave a Reply