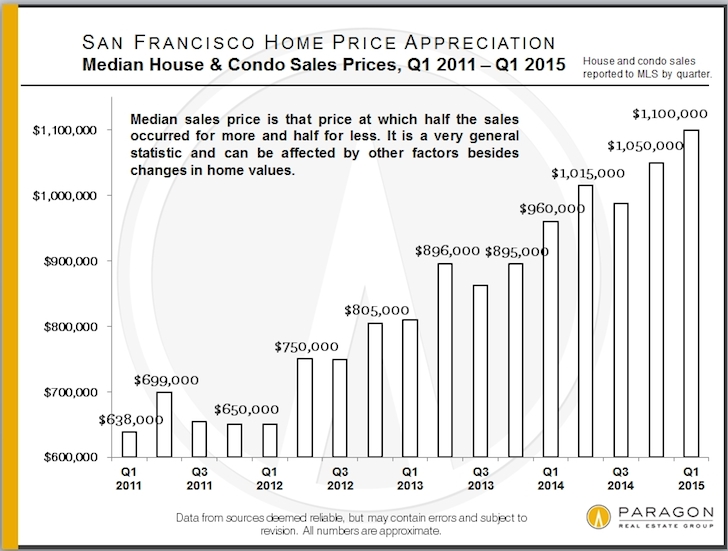

The massive jump in home prices in San Francisco: Median home and condo sales prices now top $1.1 million up from $638,000 back in Q1 of 2011.

What constitutes a bubble? It is always difficult to call a bubble while you are living deep in one. For housing, a good metric was looking at local area incomes and what those in the immediate area were able to afford. But in a place like San Francisco where foreign demand is incredibly high, a high percentage of demand is coming from abroad, in particular from China. You also have big investors jumping in. Sure, if you want to qualify for a mortgage you will have to demonstrate sufficient income to purchase a home but what if you come in with cash? While the LA/OC area is the most unaffordable real estate market in the nation based on local area incomes, the San Francisco market is the most insane based on market prices of homes. Home values in San Francisco are up a stunning 72 percent from Q1 2011. Incomes don’t even remotely come close to keeping up with this. In fact, people in the San Francisco market are having a very tough time making their rents, let alone trying to chase after million dollar crap shacks. San Francisco makes SoCal look relatively mundane when it comes to real estate.

The unstoppable run up

Tech and San Francisco go hand and hand. The heart of the Silicon Valley and tech companies are here to stay. But many smaller companies being funded with private equity actually go around the public funding model. From many sources in the tech know, there does seem to be some frothy behavior going on with the private equity funding of start-ups. It does seem to be more of a black box than in the last tech boom and bust when the public got in and got slammed. It is ironic that housing is following a similar pattern. The first housing bubble allowed the public to play and the result was more than 7,000,000+ foreclosures since the bubble burst. The latest run has been largely fueled by large investors and foreign money. All the public has to show is 10,000,000 new rental households and 1 million fewer actual homeowners over the last decade. The margin players have better incomes but still need to leverage up (this is why volume has been so low but with tiny inventory, prices have moved up).

It is interesting to see that home prices in San Francisco are going hand and hand with the NASDAQ:

The median home and condo sale price in San Francisco is now a whopping $1.1 million. This is up 72 percent from the $638,000 figure back in Q1 of 2011. Do incomes justify this run? Absolutely not but with low inventory and investors/foreign money coming in prices can go up as long as a buyer is present. But with flippers in the game, many are looking for a quick in and out. This is definitely a sign of bubble like behavior.

But take a look at how the NASDAQ has done over this same period as the housing chart above:

The NASDAQ is up 80 percent from Q1 2011. Coincidence? Probably not. We’ve had a very solid run in the stock market starting in 2009. It is hard to tell what will occur when the next correction hits. But in reality, how many people can actually compete for a $1.1 million crap shack in San Francisco? I’ve had many e-mails from high income tech folks talking about sky high rents and having to shack up with roommates. They are certainly not looking to buy.

Want to see what $1.1 million buys you?

4369 21st St, San Francisco, CA 94114

2 beds, 1 bath, 1,106 square feet

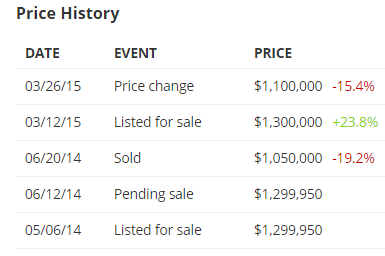

Sure looks like a millionaire home. Take a look at the price history:

So this place was listed for $1.3 million on March 12 and two weeks later it was dropped to $1.1 million. What happened in two weeks were $200,000 in “value†evaporated? Sure sounds like steady pricing moves here.

For those in other high priced metro areas, you can always take solace that San Francisco is in another dimension.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

94 Responses to “The massive jump in home prices in San Francisco: Median home and condo sales prices now top $1.1 million up from $638,000 back in Q1 of 2011.”

What’s my real estate concerns if I’m soon changing genders?

Thanks in advance,

Bruce

Andy Bruce, From your name I can see you are planning to ‘cut back’ instead of ‘bulid out’ your real estate. There might be some tax benefit, please check with H.R. Block…

Depends on if it’s a demolition and new construction, or a remodel, or just lipstick on a pig.

It appears to be happening everywhere to a lesser extent, but still insane. I looked at an old home in Chino Hills, CA (still considered the IE) and I was astonished to find that home prices in the <3000 sq ft price range were almost $800k!! BLEW MY MIND

If you travel inland to California the median home prices in many cities are $250K or less. The median home price in Sacramento is around $240K.

It’s a tale of two cities in California: the uber ultra rich and the rest of California.

Meanwhile the Democrat Party continues to almost completely dominate California state government as it has for decades.

I’ve been monitoring the Sac area and rural surrounding areas for the last 18 months. The sheer number of former rentals on the market is evidence that everyone is trying to get out of their mortgages in a hurry. House prices are back up to the 2006/2007 but the number of actual buyers is paltry. It is like everyone drank the Kool-aid but no one has come down off the high yet. We’re waiting for November when all those landlords turned sellers wake up to realize the so-called “seller’s market” is all smoke and mirrors, and the quick sale they hoped to get turns out to be a 6 month long painful wait for a buyer. By that time, we should see a new round of panic sales and foreclosures or short sales. That should be interesting. I’m not dumb enough to jump into the pool now. Think I’ll wait for sanity to return into the market. It will make my advanced degree in Clinical Psychology work, for once!

Victor Davis Hanson writes about this sort of thing a lot. Here’s an example:

http://pjmedia.com/victordavishanson/versailles-in-california/?singlepage=true

Or:

http://pjmedia.com/victordavishanson/meet-the-richerals/?singlepage=true

Both a published Classicist and Historian, as well as being a farmer in the Central Valley, he’s worth following, esp. when it comes to the decline of the California Dream.

Just a thought.

VicB3

Sacramento owes it’s existence to big government–it’s filled with state workers, welfare recipients, lobbyists, and subsidized Section 8 housing. Sacramento is cheaper for a reason. Who’d want to live there? No thanks.

LOL if you think the Dems have been dominating CA politics for years. They were stonewalled on and off for decades and what little that was passed was usually milquetoast trash giveaways to in state industry and power players presented as development projects.

I’m surprised it’s only 1.1. And yes, I do understand the meaning of “median” …

Too true of the entire SF Bay Area. Housing costs as a percentage of income are unhealthy – but that won’t change unless there is a change in demand. Space is limited, jobs are plentiful, etc. The lack of space part of the equation isn’t going to change. The # of jobs may decrease at some point (certainly has in the past) but house prices are slow to follow.

I own in the inner sunset, I see the writing on the wall and will rent it out when I leave for water rights on the property. The dot bomb years come to mind, the crazy amount of high rise cranes whipping out SOMA and City condos prices between 1-5 million is ludicrous…

Heck it took me 1.5 hours to get 10 miles the other day since I have to drive thru the city…

The City is full of hopium, its around the time of maximum hopium where peoples dreams will be shattered by the long grind down…

Business credit availability is tightening, this is canary in coalmine, it’s back to 2009 levels…people buying today are going to know a world of negative equity hurt….

People have no patience…thus the banks use it with purpose..thus people will continue to be slaves to bankers

“The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented… Bankers own the earth. Take it away from them but leave them the power to create money, and, with a flick of a pen, they will create enough money to buy it back again… Take this great power away from them and all great fortunes like mine will disappear, for then this would be a better and happier world to live in… But, if you want to continue to be the slaves of bankers and pay the cost of your own slavery, then let bankers continue to create money and control credit.”

– Sir Josiah Stamp, president of the Bank of England and the second richest man in Britain in the 1920s,in an address at the University of Texas in 1927

I’m curious about the tightening of business credit. What’s the source of data behind this statement? From the outside looking in, it seems that the money is still flowing and easily available.

“Take it away from them but leave them the power to create money, and, with a flick of a pen, they will create enough money to buy it back again.”

This is why Bernie Sanders gets my vote. He’s been railing about this for 30 years! Hilary works for the banks, Sanders wants to break them up.

http://www.advisorperspectives.com/commentaries/20150401-dynamika-capital-l-l-c-recessionary-level-in-credit-conditions

Bernie Sanders? The old communist socialist who has spent most of his life as a pampered big government bureaucrat? Socialism is great for leftists at top and their cronies but everyone under else suffers. Socialism only works until they run out of other people’s money. Looked at all the failed socialist countries around the world like Cuba, Soviet Union, Venezuela, etc.

You’re conflating communist countries with socialist ones, i.e. England and France.

England with their bankrupt National Health Service that provides substandard care and delays access to treatment until patients die? France with their huge budget deficits and high unemployment? Socialism does not work.

I have been lurking this site for many years, now I have to say something. The bay area is really killing any sort of recovery we have had in this region. I mean rents are stupid high, home sales prices are the same. Even in Sacramento, 2 hour drive away, home prices and rents are rising as people discover its cheaper to commute. No justification for it since incomes have not risen the same. I saw the exact same thing in the 2000 tech bubble and in the 2008 housing bubble. Greed and what-ever-you-call-it sudo capitalism is ruining a decent economy. I cannot see this trend continuing. No way no how. The economy is now slowing to a crawl (some say cause of snow in east, yea sure), twitter stocks drop 20 %. I feel its the canary in the coal mine. Soon as one of these big tech companies stock crashes, look out. Could be soon, could be later, but it will happen and so will housing prices. And that usually follows with a mini recession which affects who??? The middle class and below of course. Everyone else will already have cashed out and left the card table. Gotta love sudo capitalism and global economy.

It’s pseudo

Nah, it’s pronounced Sussudio https://www.youtube.com/watch?v=r0qBaBb1Y-U

LOL

sudo is a Linux command line term

Not just Linux. AIX, Solaris, HP-UX, etc all have it.

(Twenty plus years professional experience in unix administration, here.)

Sudo. I thought it was a wrestler.

Mac as well, being that it is runs on BSD …

As for the Bay Area, the CBS news had a story on Chinese Ghost Houses in Palo Alto.

They interviewed neighbors, they say no cars, no kids, only a gardner once a week.

We have one in our neighborhood in Fremont, in 4 years, I have only seen a person once, old asian man. Check out the story;

http://sanfrancisco.cbslocal.com/2015/04/28/realtors-printing-brochures-for-silicon-valley-homes-in-mandarin-to-attract-chinese-buyers/

Anecdotally I know of a couple ghost homes owned by Chinese in SoCal. Everyone wants to live here so bad and the weather is so amazing that some of the buyers don’t actually live here.

Mostly corrupt local officials laundering money. Many quit school before the age of 15…

“They’re just happy to have parked their money in a relative safe haven that’s a good investment, and they’re not worried about losing $10,000 a month in rent,†DeLeon said”

This is SHEEPLE behavior. Save haven my butt. Realize the Chinese are also buying up properties in London, Europe and Australia at the same pace. Australia is in a definite property bubble and will burst before long. The US is the same for all the reasons cited on this blog.

Printing brochures in Mandarin and marketing to Chinese buyers is the new MO for an easy buck for Realtards. I watched an episode of “Selling New York” the other night, and they had priced these apartments so ridiculously high that American buyers said “no thanks” so they bought in Chinese agents to get on the phone and call China direct. They sold the apartments 🙂

I saw a few ghost houses in my neighborhood too. They were purchased within the past three years or so yet nobody lives in them. They’re well maintained during that time, and then they’re sold again.

I’ve heard the stories about the corrupt officials parking their bribery money here in SoCal real estate, but they’re just stories that despite being interesting almost seem too ridiculous to believe.

My buddy in China tells me that rich businessmen buy property to trade back and forth like cash. Businessman 1 owes Businessman 2 say 3 million yuan. He just gives him a condo in Sydney instead.

there is no future in America, my income hasn’t risen in decades all the while the stock market and home prices head to the moon.

what’s the fucking point? the best financial thing that could ever happen to my kids is a nice t-bone car crash, drivers side, that takes me out, they split a $1,000,000 ADD insurance policy.

my retirement plan at this point is to win the lottery

AND here’s a side note, just had a meet at the end of last year with my “financial adviser” (more like scammer) and put my retirement account in a fund designed for wealth preservation…it lost 4.4% the first quarter 2015, my fist loss EVER since I’ve been in .09% bond funds but have NEVER lost a dime until now…….what a fucking scam the whole financial system is!!! >:-{

I agree, the whole think is a racket. Regarding your financial advisor, you should probably be your own financial advisor. Low-fee index funds might be an option for you. Unless you truly know and trust your advisor, obviously there is a good chance he does what’s best for him and not necessarily what’s best for you.

I was thinking the same thing, Responder. Vanguard Index Funds are about the safest thing going. If they’re good enough for Warren, they’re good enough for me.

My 401K is at 70% cash now and will go up to 80, 90 or even 100% cash in the next year or so.

I will also place GTC orders for quality companies like Google or Apple for 50-90% off of current valuations.

In the increasingly likely event of a GLOBAL crash caused by China, I will snap up good stocks at bargain basement prices.

You might want to consider some gold/silver. We are on a collision course to a currency crisis and that cash could be devalued as much as the stock market.

Twitter stock trading suspended — meager earnings released, Yelp crashed. Meager earnings. The monetization solution for every app and start up including Facebook? Sell advertising. Problem #1 – few people to buy products. Problem #2 — websites are so chock full of advertising as it is, I can barely stand to go on the web or mobile. Sites are way to heavy with ads now. Horrible user experience. Oh and don’t forget “Secret” the app that blew through 35MM in one year and announced today it is shutting down. See, the fundamentals don’t change – revenue is needed and these models have no way to drive revenue except advertising.

It’s gonna pop soon. I can feel it. Tech is a shell game. Moving money around. Pump and dump. The only reason it won’t pop is if these bastards have so perfected the game, they can keep conjuring new shells. They are sophisticated.

“I’ve visited places where there’s a huge amount of inequality, and the quality of life of the one percent isn’t that great. They live in gated communities, there’s an unpleasantness about the nature of their society.” – Joseph Stiglitz

http://www.salon.com/2015/04/29/we_have_a_distorted_economy_joseph_stiglitz_sounds_off_on_inequality_the_tpp_and_2016/

I hope you’re right!

http://www.businessinsider.com/linkedin-share-price-may-1-2015-5LinkedIn shares are getting decimated

GOLDMAN: Record financial engineering will goose stocks

“Goldman reminded its clients what this is all about: Buybacks tend to boost share prices. That too is a fundamental principle of financial engineering – getting share prices to rise while bad stuff is happening at the company. And as these shares rise, they will goose the entire market, the note added. Buy, buy, buy.

Read more: http://wolfstreet.com/2015/04/28/goldman-forecasts-banner-year-for-financial-engineering/#ixzz3YlBJ7wQb

usually best to bet opposite of what GS says…..they are setting up retail to get slaughtered…Sell in May will take place this year

Rising interest rates will reduce housing supply even further causing more price increases. People are locked into their low interest golden sarcophagus. Bad news, bears!

Yeah, you got that backwards. Rising rates would decrease demand and prices would drop.

Realistically though, I’m starting to believe that the Fed either won’t raise rates, or will do so at a token .25% per quarter for just a few quarters. They are painted into a corner and can’t do anything now. Every economically healthy (relatively speaking) country is reducing rates, there’s no way the Fed is going to raise rates and strengthen the dollar even further. Sorry, Brazil doesn’t count as an economically healthy country. My guess is that home prices will keep going up in this near ZIRP until we have a global disaster – China anyone?

Yeah, no I don’t. This is a supply/demand issue. Higher rates will keep owners locked in…who is going to want to part with their beloved 3.75% refi? And go where?

We’re at 2-3 months inventory. Sure, there’s multi-unit inventory coming on-stream, but not SFR, which is what most people want.

Higher rates will result in tighter inventory.

Lower rates and the bears are still screwed.

High prices remain regardless.

“Yeah, no I don’t. This is a supply/demand issue. Higher rates will keep owners locked in…who is going to want to part with their beloved 3.75% refi? And go where?

We’re at 2-3 months inventory. Sure, there’s multi-unit inventory coming on-stream, but not SFR, which is what most people want.

Higher rates will result in tighter inventory.

Lower rates and the bears are still screwed.

High prices remain regardless.”

There are a lot of assumptions behind that. To name a few… How many owners will there be with the ability to hold in place over enough time and levered to a significant enough of a degree to defeat price changes which are made on the margins? There is still significant shadow inventory in many areas that we don’t know how and when it will be put on the market. What motivations will there be for builders to crank out more SFH? Then there’s the demand side of the equation which wasn’t covered…

It could also be argued that with lower rates, more principal has been paid-in which makes taking a loss somewhat more palatable. Enough homeowners have to move over time, especially in the more mobilized world we have today, it’s either pay down the loss or do the accidental landlord thing.

Too many unknowns exist.

Hopium burns bright like stars before they die…..

I hear the same things today that I heard in 2005-6….nothing will be different, yet the fall will be even more spectacular….stay away from debt and your free….my home is free and clear because debt sleeps with the devil…..I don’t think we would get along thus freedom is more important than the vanity of an indebted homeowner…

http://www.advisorperspectives.com/commentaries/20150401-dynamika-capital-l-l-c-recessionary-level-in-credit-conditions

cd: correct answer. Or as suggested on CNBC buy a new car on a 7 year loan and buy stawks with the money you “save” on low payments.

Conveniently forgetting you’re committing money you haven’t earned yet to seven years of payments on a depreciating consumable which will require maintenance, full coverage insurance, gap insurance [because you’ll be upside down for years with an 84 month loan], and repairs. While your stawks gain a mythical % a year. Arbitrage dontchaknow.

video.cnbc.com/gallery/?video=3000359186

Getting out of debt is liberating. Trying to play the game like the Wall Street insiders in a market pumped up by cheap money and stock buybacks is a recipe for disaster if you’re a

“retail” investor watching bubble cheerleaders on television.

Picture of a Chinese banana seller watching the stock market on his iPad over on Zero Hedge says it all.

I’d like to ask for some advice. I will be selling my in socal and getting back about 200-250k after closing. Even though I think the market is inflated now, I am not able to find rents that are reasonably priced. If I buy another place, at least I get to build some equity and also get some of the tax benefits of owning a home.

If I didn’t buy, where should I park my money so that I can buy again in the future? If the bubble is causing the stock market to be absurdly high, wouldn’t the stock market crash and the housing crash happen at the same time?

Just my 2 cents, I would consider CD laddering, since you want minimal risk at this time, some yield (even though its small (but remember your taking no risk)) and guessing you have a short term time frame before buying the next property.

that would lock you into lower rates….Why not just put it in a divi index fund….Cash works too…that way if market crashes you could pick up select divi paying symbols and be more fluid on change…

Let me start by saying that I am not a housing bear, in fact, I am about to close escrow on a house next week, but if I feel compelled to dispel you of this notion that buying a home is the only to “build equity” or that buying a home necessarily will allow you to “build equity”. I’m not sure where people got that in their heads, you don’t actually “build equity” when you buy a home until it appreciates. A lot of people I know bought homes in 2007 to “build equity”, they in fact, destroyed much of their equity. The other portion of equity that you think you’re building is paying down the principal amount of your loan, which is just forced savings. You can do that right now without a mortgage or interest payments. The mortgage interest deduction is an attractive subsidy, but it can’t make up for a poor financial decision, meaning, the primary reasons you should be buying a home are because there are psychic factors (family, stability, community) and financial ones (can you afford it). The subsidy helps, the forced savings help, speculation of future price increases is gravy, but none of these things should be the primary reason for buying a home.

Dean, the problem is MOST people are not disciplined enough to save money. A mortgage forces you to do this. If you don’t pay the mortgage you lose the house. The consequences of being a renter and not saving are not nearly as bad. I hope everybody on this blog who stayed out of the market for housing bubble 1 and didn’t get off the fence in the last few years is saving buckets of money.

“I hope everybody on this blog who stayed out of the market for housing bubble 1 and didn’t get off the fence in the last few years is saving buckets of money.”

I can imagine that those who are paying less in rent than an equivalent mortgage scenario are enjoying saving each month along with having the additional use of what would have been a down payment. That and the intangibles of renting probably make for a quite acceptable situation for many.

Siggy, I hope those people who are renting below the cost of owning are saving that extra money. Like I mentioned before, it is just too tempting for most not to enjoy that money right here, right now. Instant gratification is the American way. Sometime ago on this blog, I mentioned it is not uncommon in socal to save for a downpayment for at least a decade and then take on a 30 year mortgage commitment. I got plenty of jeers for suggesting that.

As usual, people who save and sacrifice will be rewarded in the long run. As we have witnessed, few can actually do this.

It’s obvious and nothing new that people have a hard time saving and succumb to “forced” methods of saving. What is in question is whether or not mortgaging real estate is an optimal approach. I contend it is not, primarily on the basis of risk and liquidity, regardless if the herd follows suit. It could also be said that one hopes those people who are mortgaging above the cost of renting are able to turn that equity into cash without loss should they someday expectedly need it.

the only thing i have going for me is my rent is about 1/3 the cost of buying so…….

THERE IS NO WAY YOU CAN BUY IN SOCAL AND HAVE IT BE CHEAPER THAN RENTING………at least in my area.

What area are you talking about?

Most areas in CA are at rental parity at current interest rates.

Maybe not a block off the beach in Manhattan Beach or on Nob Hill but those areas have never been at rental parity.

You mentioned your renting is 1/3 the cost of buying. You are obviously not comparing equivalent properties. This may be true for comparing a small apartment to a nice SFR. Now do a rent vs. buy for that same SFR and you will likely be very close to rental parity. Unless you are talking about niche multi million dollar properties, you can NOT rent for 1/3 the equivalent buying cost anywhere in socal.

“…build some equity and also get some of the tax benefits of owning a home.”

Don’t know where exactly you’d be looking to purchase but in the more expensive coastal areas of SoCal, a purchase is more expensive than renting on a comparable basis, so that would make the equity point moot in those areas.

Tax benefits are typically overrated as the real benefit is what itemizing would bring net of the standard deduction. In a low rate environment as we currently have, the amount of interest to deduct relative to the price of the home is generally less, making yet another reason why purchasing when mortgage money is cheap not quite the gift it may appear to be on its face. CA property taxes are low in relative burden to other typically high cost states, so that benefit also is not quite as sweet if you’re to buy back into CA because the difference is made up for in other taxes that don’t qualify for a federal subsidy.

The connection between the Stock Markets and high end housing is nothing new. I made a comment about this connection several months ago.

Housing above $800K is most likely financed with a combination of stock grants, stock options, cash, and maybe, just maybe but unlikely, a conforming conventional mortgage (i.e sub $400K loan).

Housing selling for below $500K is most likely FHA financing with 3.5% down payment.

There’s really no middle ground today.

As far as stocks are concerned, companies do not have to go public on NASDAQ, NYSE, London, Hong Kong, etc. for stocks to trade. Private stock trades of pre-IPO companies are normal. Many Facebook, and Twitter stocks were selling in private trades before they went public.

Remember the old slogan ‘drive until you can afford’ back in 2005? It is happening again. Beside all the same old factors that jack up housing price, this time around, the international demand of American land, due to devaluation of greenback and global inflation, is added to the magic formula.

“…the international speculation of American land…”

Fixed it for ya 🙂

As long as the inventory is tight and there are buyers willing to shell out ridiculous amounts of money … . But, the rapidly expanding exclusivity of home ownership is but another symptom of globalization and global competition. Only highly skilled workers, successful business owners, or the last bastions of union workers like Longshoreman and government workers can make it. Every one else is on the wrong side of supply and demand, is loosing financial ground accordingly and is becoming irrelevant. There is a reason foreigners, especially rich Asians, can bring suitcases of money to a real estate closing, and American’s can’t even come up with a downpayment for a mortgage.

I bought in SF in the first quarter of 2011. A very similar house down the street is now on the market for 70% more than I paid. Other houses on the street have hit the market since I moved in and they’ve all sold within days at over asking for all cash. A brand new house around the corner sold two years ago for an absurd amount of money and I’ve never seen a light on or the shades pulled down. It’s obvious no one ever moved in. I think the market is being driven by foreign money (which seems limitless) and tech money (which could be bubble driven).

I remember how the city emptied out after the 2000 tech bust. Suddenly it was possible to find parking – something I use as a key indicator. Now driving is impossible, forget about parking. If the tech market hits a snag a huge number of people will leave just like before. The newcomers aren’t invested in the city in any real way. They’re not supporting the arts as you might expect and haven’t become active in the community in any real way. It’s almost as though they know they’re going to move on so they don’t want to get involved. (Just my observation.)

Ron,

If you ask a car salesman if you need a car dont be suprised at the answer. This is a housing bubble blog so dont be suprised that my answer is rent. Regarding you money, short term cash or cash equivalent investments.

Look, we are in a perpetual boom and bust. The only way to get ahead is to try and time the market. Feels to me we are only 50% of the way to the top this time around. Do I use any data to back that up, of course not. But what good is data when income/rental/purchase ratios are meaningless. Get in low and sell high, leverage as much as possible and hopefully if you guess wrong it will be the bank taking a bath and not you.

Good Luck!

Bkeet, Yelp, LinkedIn, stocks are swooning for the same reason — no earnings. Secret closed after a year. LinkedIn was the darling along with FB. I’m in this digital industry. None of them are making money. Advertisers couldn’t tell you under oath if they get a positive ROI on their ads on facebook. Notice no blue chip companies advertise there . Just start ups. The whole tech deal is a mirage. It has been for years. Thing is there have been people who made a ton working within the mirage. If LinkedIn continues to crash it could affect all of the social media bullshit.

These are companies paying 21 yr. old programmers 159K out of college. Pay them selves 3MM a year. They are the main reason that WLA is unaffordable. Look at what Snapchat did to Venice . Snapchat hasn’t made a penny and never will. It wants to become a new feed. It’s demo will leave in droves.

How the hell did I type Bkeet when I meant Blert?

“Absolutely not but with low inventory and investors/foreign money coming in prices can go up as long as a buyer is present.”

I thought posters here had already roundly discredited the “scope” of influence of foreign buyers on prices and the supply/demand metric as meaningful in price discovery in real estate?!?

And Obama and Brown were supposed to drive USA and Cali into the economic ditch.

Still waiting for O-Care to bring down the entire economy as we know it.

Such fantastical thoughts!

As a pampered crony of the leftist Democrat elite, their Marxist policies don’t really affect people like you who live in a bubble. On the hand, the working middle class is struggling with fast rising medical insurance premiums, higher deductibles, and less access to medical care. Rental prices have soared. Food prices are crazy high. The cost of electricity have risen and water is being rationed.

@Derrick, if things are going so well then maybe you can explain plunging wages in Los Angeles?

http://www.latimes.com/opinion/op-ed/la-oe-governors-california-poverty-job-creation-20150106-story.html

“…the three fastest-growing job categories in the county — cashiers, retail salespeople and waiters/waitresses — pay an average of about $20,000 annually. This continues a disturbing trend that has seen inflation-adjusted median household income in L.A. County drop to $54,529 in 2013 from an equivalent of $61,544 in 1990…”

Ghost houses?

Sounds like a solution to the homeless problem.

In Mexico, squatters have rights and judges will grant them ownership of homes held vacant by absentee land owners.

Having similar laws here would curb the Chinese Communist land grab.

Oh I forgot, The Chinese Communist lobby in Washington wouldn’t allow that.

Somehow we forgot the American Soldiers who died fighting them in Korea and Vietnam.

Buffett says to buy when there is blood in the streets. I don’t understand why everyone is not piling into silver right now!!

They’re waiting for $12/oz

Yet home ownership rate is back to 29 year lows! Residential home sales are down 31% since 2006!

So who’s buying all these unaffordable homes?

Big investment firms bought thousands of homes and packaged them into rentals for investment vehicles. These homes will remain as rentals for a long time.

“These homes will remain as rentals for a long time.”

Is that just a guess or do you have a crystal ball?

The homes are in massive buy and hold investment vehicles for positive cash flow.

I don’t know how you would sell the actually houses.

“I don’t know how you would sell the actually houses.”

Probably the same way any other house is sold. Just because a house is held by this or that entity as part of this or that package, doesn’t mean it can’t be sold.

THIS TIME IT’S DIFFERENT

Went to Zillow to take a look. Actually quite a pretty little house in a what looks like a pretty neighbourhood. Nicely fixed up. Clean and light. Credit where credit is due and all that.

Contrarian view and all that: Could it be that by prices increasing in what was obviously once a working class area the quality of the neighbourhood is increased by the quality of the buyers? Gentrification and all that? The burglar bars come down and the paint stripper goes on, that sort of thing. And if rising prices cause that to happen, is it necessarily a bad thing.

Yeah, 1.1 Mil is insane for 1100 square feet, but is also serves to keep the Gang-Bangers and Section-8 people out of the mix. And given all the (fraudulent) joys of “Multiculturalism,” is that really a bad thing?

Just asking, and

Just a thought.

VicB3

@ViCB3: It’s one thing to have prices increase a bit which would price out Section 8, gang bangers, etc. However, it’s quite a different thing to have prices increase to the point that no one but a tiny segment of the population can afford to buy. A $1.1M house is probably something that only about 3-4% of the U.S. population can afford. So while that price increase and associated advantages to the neighborhood might be beneficial to a tiny population segment, it’s detrimental to everyone else making less than $250k+ or so per year.

Our economy is weak, imbalanced and distorted by the machinations of the government. The only thing is that we are queen among the pigs. Very few economies around the world have much strength right now. I read International Living and they are hawking deals in Latin America, Europe and Asia right now explaining that their economies are so weak our “strong dollar” gets you a hell of a deal. Trouble is “a hell of a deal” in the face of future weakening or drops is no deal and their economies are very weak – never mind the Greek and Argentinian economies. Where in the blazes do you put money today? I don’t see much of a return in mattress stuffing and gold…..

International Living is a crock of you-know-what. Please don’t seriously consider any “investment opportunity” in their publication sphere, as they have a huge profit stake in any development or deal they promote overseas. In general, I’d note whatever countries they’re promoting as the “latest inevstment or retirement haven” and run the other way.

Uh, OK. I don’t think I suggested buying anything from any listing they had. I read it for an informational overview of various foreign countries. I wanted a dialogue on where people think is a best place to grow portfolios – not see if I can get someone to bag on the investment opportunities offered by a publication. Do you have any stats to back this up? Who do you prefer? Where is the best place to RE invest right now? in your opinion? It seems that Brazil and Argentina are weak and a bargain, but Argentina may not have hit bottom. Spain maybe? Or just here. At least you can drive to your properties – but the taxes and regulations are really getting much worse here.

Getting back to the LA end of things I just saw this article that reads like a parody of all the LA hipsterism that is constantly reviled around here. I’m just posting the link to see if our gracious host’s head explodes while reading it.

http://www.nytimes.com/2015/05/03/style/los-angeles-and-its-booming-creative-class-lures-new-yorkers.html?action=click&pgtype=Homepage&version=Moth-Visible&module=inside-nyt-region®ion=inside-nyt-region&WT.nav=inside-nyt-region&_r=0

That hipster-ism.. it’s all over UK now too – below some insight from other forums.

_____

Tweaked Real Estate listing description: “Having lived here for 20 years, I have finally decided to leave the area, my heart filled with sadness. All good things come to an end, and it is time for me to move on. These are difficult times, and the area is now better suited to youngsters with their deadly serious beards and satchels. I am just glad that there has been such a large influx of well-to-do entrepreneurs and media gurus, that I can now sell my house for a million dollars.”

_____

I thought we had reached peak beard in the middle of last year?! A fashion journalist told me so, so it must be true. Love the idea that the hipster beard is a HPI phenomenon – young men stuck in an eternal childhood living at home with their parents and with no hope of owning their own home, of course they are going to try to enhance their sense of masculinity through superficial appearance, it’s obvious when you think about it.

Just been researching Hotel Occupancy – sometimes a ‘tell’ for slowing economy – for San Francisco… still looks hot hot hot (for now), on most recent data.

That led me to some recent changes/rules that have been passed for Santa Monica vs short-term rentals.

http://www.latimes.com/business/realestate/la-fi-santa-monica-council-votes-to-rein-in-shortterm-rentals-20150428-story.html

http://www.smmirror.com/articles/News/Vacationers-Sent-Packing-As-City-Bans-Short-Term-Rental-Listings/43211

Perpetual rise in home prices = economic stimulus plan 9.0?

Consider this. If Person A buys a home right now for $500K, after two years of the same punch we’ve been drinking, that house is now worth $600K. Person A lists the house for sale and Person B shows up with 3% down ($18K) and with the gracious and infinitely inexhaustible funding provided by BANK 123AtoZ24/7 Person B gets the funding he needs to close the deal. Person A walks away with a cool $100K which he uses a hefty 10% on cocaine, hookers and in-app purchases further stimulating the economy and all of its shadows.

This can happen again and again … until it can’t? Until some other force outside of the controllable parameters of BANK123AtoZ24/7?

Just a thought.

I think a meteor collision might put things in perspective.

@TheGoldenFlower, you just described how Ponzi schemes work. Charles Ponzi and Bernie Madoff would be proud of you.

@TheGoldenFlower, it gets even better. Every time the house is sold and reassesed, taxing agencies (ie property tax) get a larger cut. Ditto for homeowners insurance providers beacause suddenly the house is “worth” more and will presumably cost more to replace, etc. Even your gardner gets in on the act, since suddenly he is servicing a “rich” neighborhood and can charge more.

Bubble economy definition:

an unstable expanding economy; in particular, a period of heightened prosperity characterized by rapid expansion due to artificially adjusted interest rates.

We are living in the most obvious bubble in the history of the US. Unsustainable economy with zero wage growth and record low interest rates over the past 8 years. Funny thing about a bubble is larger it gets the harder it is to see until it pops. We are now at the point of complete blindness.

Leave a Reply