Rising home values in the face of stagnant incomes – Home prices are rising at a rate three times faster than the CPI. Lowest available inventory in over 30 years.

For the first time since September of 2010, nearly two years ago, has the Case Shiller 20 City Index realized a year-over-year gain. Does this signify a sustainable turning point for the market? At this point it is too hard to tell for a couple of reasons. The first has to do with the composition of homes being sold but also, at a more profound level, household income has fallen for well over a decade. Much of the sustained gains have come from astoundingly low interest rates offering buyers more leverage, low available inventory for sale, and a continuation of low down payment mortgages. You will notice that none of these reasons include household incomes rising to meet current prices. It really is unsustainable unless incomes can follow in conjunction. This year, according to the Case Shiller Index home values are now up 3.86 percent. Household incomes are not up. So what justifies this significant move? The CPI is up 1.3 percent so why are overall home values moving up at a rate 3 times higher than the overall index? You also see Millennials taking the brunt of the negative equity situation.

Young and underwater

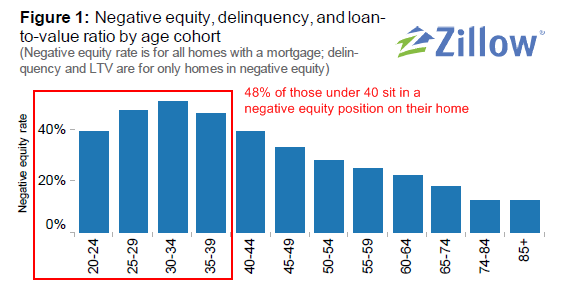

Zillow recently came out with data showing that a whopping 48% of homeowners under 40 are in a negative equity position. This rate would look even worse if we considered how many of these homeowners actually bought with say FHA insured 3.5 percent down loans and have a razor thin level of equity. The reality is, we have two groups in the US right now when it comes to housing. You have younger Americans confronting a very tough employment market and purchasing homes during the manic 2000s and you have many older Americans that bought pre-2000s and enjoyed the multi-decade long bull market of the US, including steady rising incomes and home values:

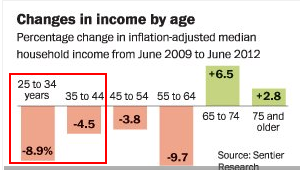

Income is absolutely important and as we discussed previously, younger Americans that are in a deeper underwater state also saw the biggest decline in their earnings potential:

Source:Â The Washington Post, Sentier Research

So how is it possible that home prices are rising so strongly in spite of weak income growth? First, there is an unusual mix of buying going on. You first have investors competing for a lower amount of distressed inventory. Take a market like Las Vegas were over 50 percent of all sales last month went to all cash buyers, a continuing multi-year trend except inventory is lower now. Cash buyers in Las Vegas are now paying 19 percent more for their summer 2012 purchases versus the purchases made in summer of 2011. For Phoenix 41 percent of buyers paid all cash last month. The vast majority are investors as noted by their absentee status. Nationwide investor buying is a big segment of the market and with falling distressed inventory and people chasing yield, prices have been pushed up as many investors are likely opting to purchase non-distressed homes that carry a higher price tag.

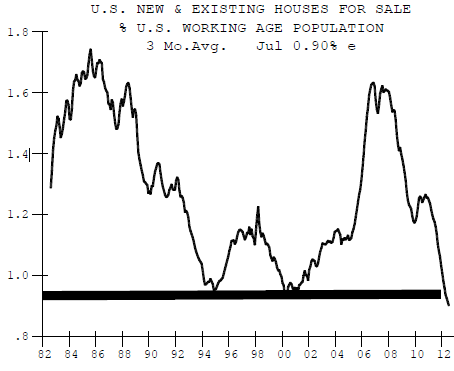

The other segment is coming from the low down payment FHA first time buyers. Rates are at incredibly low levels. Interest rates have fallen substantially in the last year. The 30 year fixed rate mortgage has fallen by 28 percent in the last year alone from an already very low level. So even with stalled out incomes, many Americans found that they could afford more house with the same or even lower household income. With slim pickings for inventory, many bid prices up. Think inventory isn’t low? Take a look at this:

Source: ISI Group

Inventory is at a 30 year low and probably even lower if we had data going further back. Yet as we noted earlier, half of those under 40 are underwater. We discussed that there might be a bounce and slog market as we move along since rising prices will bring more people to the table to unload properties. Banks are methodically dumping distressed real estate.

What is concerning overall is the price rise has come from artificial factors. The low interest rates are already having hidden leakage costs in other sectors of the economy. You also condition the market to low down payment loans that are defaulting in mass in spite of rising home values. And of course the low inventory pushes prices higher given access to more leverage via lower interest rates and also investors competing for a smaller pool of properties in a tight market. It would be one thing if household incomes were moving up in tandem with home values. But even this year, home values measured by the Case Shiller are moving at a clip 3 times higher than that of the overall inflation rate.

Household income absolutely matters and has been a good metric to use for multiple decades. Only recently have we seen such artificial stimulus in the market where it has the ability to push home values up in spite of slow income growth (i.e., Alt-A or lower quality loans during the mania, low down payment FHA loans and massive levels of investor buying in the current market). The interesting point of rising home values is that it will likely drag out some of the underwater inventory and thus add more supply to the market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

68 Responses to “Rising home values in the face of stagnant incomes – Home prices are rising at a rate three times faster than the CPI. Lowest available inventory in over 30 years.”

Does income really matter in a world with funny money? The current market has been manufactured by a continuation of easy/cheap money along with inventory “management”. There has been neither real growth in demand (income + population growth) nor real decline in supply (housing stock) yet prices are increasing. Does this sound familiar?

It does in that when there’s NO money, it ain’t funny.

You don’t need money when there is free credit/debt!

I agree. The market where I live is dominated by speculators and flippers. Most of them don’t seem to have real income from work, definitely not the kind counted as “income” in national statistics. They add no value, only drive up costs.

These parasites have expanded their niche and should be taxed out of existence if we ever want housing to meet needs of consumers again.

Dave, we too live in a neighborhood of flippers, they have drove prices up. Waiting for a new law that buyers cannot sell properties for at least a year, that should stop all the useless flippers. Perhaps they should go get a real job that makes a difference, instead of being greedy.

notbuyingjustyetb, there is no constituency for your proposed law. Neighbors of flipped homes love flippers. FHA feeds the flipper customers, who love to see shining granite and Home Depot cabinets.

Seriously, though, flipping isn’t all that easy, especially in a flat to down market. If there weren’t a market for the post-flip, they’d be out of business.

Regarding “infestors” (aka flippers)

Here’s our experience in Ventura County. We go to the auctions (we’re a cash & close), and the flippers aren’t getting deep discounts on the nicer bigger stuff anymore (think 1600+ sq ft) because the loan balances are too high, and the beneficiaries are bidding against them after the final flipper is left standing. I am seeing MLS+ prices. It’s surreal!

With the 2-3 month around on some flips, at this point in time, the flips are a better deal. At least the lipstick on the pig is done. We are in escrow on a FIXER (not just cosmetic) and oh man, we’re going to be doing everything. It’s our final home, and it will be our “flavor”. It is a one-story w/ a pool, walk to stores and parks. That’s why we are willing to sink an absurd amount of dough in it.

Investors generally make homes unaffordable and are parasites, I agree 100%. They call themselves “capitalists” at the auctions. Do they add value, employee Americans, etc…? Hell no. What inflated egos.

Everyone- have a great day.

BTW, this is a retail, not an auction home we are buying. Most auction homes we’re interested in are being postponed or cancelled. The auctions are drying up. Anything worth buying has such a high opening bid, they are going out REO.

If you look at the figure, it strikes you as really terrible (underwater). But the figure failed to say how many younger people actually bought houses. Young people mostly are renters, and they tend to enjoy their young life more, and they have student loans to pay too. I don’t believe young people are much of driver for the housing market. also, Is there any possibility that we have really low inventory that we have not built much at all in the past 7 years? Some of the neighborhoods I looked at frequently have almost been completely turned over (ie, the houses on the block have been all sold once for discount in the last 5 years).

I wonder what effect if any the expiration of the Mortgage forgiveness act will have?

Mortgage Forgiveness Act

The 2007 Mortgage Forgiveness Debt Act provides temporary tax relief through 2012 for homeowners that short sell a primary residence or lose a home thorough foreclosure. This act eliminates the normal tax liability associated with these transactions. To qualify, the total amount of written off debt cannot exceed $2 million dollars and the property must have been your primary residence.

My guess is that they will extend the tax break along with the zero percent interest rate, the 3.5% $729,000 conforming loans, the $1,000,000,000 annual budget deficits, QE1…QEn, the mortgage interest deduction, inventory management, etc. Hey, they may even bring back the first time tax credit! This is truly a house of cards and things are going to be unpleasant if they can’t find a bigger bubble soon…

Whoops! I forgot the all mighty suspension of mark to market accounting….

What, I think you left off some zeros in that annual budget deficits. When you start talking trillions, billions are chump change. I think they add a billion to the debt every 8 or so hours. Like you said, we’ll see how long this insanity can keep going!

Whoops, you are right! I meant trillion dollar ($1,000,000,000,000) annual budget deficits. So many zeros!

1. Sub 1% savings/CD rates

2. Sub 4% 30 year interest rates

3. Rising rents in many metro areas

4. Many purchases by absentee buyers (investors)

5. Historically low levels of inventory despite YOY increases in home values

6. Historically low levels of building in the last 4 years and counting

Connect the dots:

– People with cash are looking for somewhere to park the money. The rate they can get from a bank isn’t cutting it.

– Cash is cheap for investors who have good credit. Refi’s allow homeowner’s to decrease monthly mortgage costs.

– Investors see rising rents and put money into housing, driving up prices. After a refi, homeowner’s are closer to rental parity and are more likely to stay put.

– As long as investors are getting a good ROI they won’t be selling anytime soon. Even if a homeowner is underwater, but the refi’d PITI is cheaper than they would pay for rent, why move?

“- As long as investors are getting a good ROI they won’t be selling anytime soon.”

My (unfounded) theory is that investors are going to increase the average inventory turnover time, adding upside pressure* on price, over the long haul:

-If a significant subset are getting positive monthly income on borrowed money, they don’t care if they’re underwater in the short to midterm.

-If a significant subset is, in fact, using borrowed money to fund their investments, then the longer they wait to sell, the better the equity and return.

-RE is not as liquid as APPL. They can’t just sell the next day, when they see a good value play pop up in equities. This gives them the mindset that that money is off the table for a long while.

*whether that pressure is significant or not, is another story

So, what you are really sayin is that it is a good time to buy? Now where have I heard that before????

It’s a good time to buy…………..compared to 2006. Imagine if ReMax started putting advertisements up saying ‘It’s a great time to buy’ and in the fine print below they had ‘*compared to 2006’.

My speculation isn’t a comprehensive analysis of all possible forcings or their magnitudes, let alone a call to action. It’s just an idea, concerning one of many forcings.

I sure as heck wouldn’t buy a $400k house out here. I’m from a small town on the east coast, and for $400k, you live like a 1%er back there. To a small-town east coaster, spending $400k on a house that’s just a boring 3 bed/2 bath with a small yard, is freaking crazy, (unless the whole mountain top comes with it).

However, the prices in my old neighborhood have been handsomely inversely coupled with the interest rates, these last 10 years, and I’m starting to be priced out of my old neighborhood with this 3% for 30 years crap.

Trying to “time” the market is too hard. The right time isn’t when C/S is at xxx.xx or unemployment is at x% or our federal deficit is at $xx trillion dollars.

IMO, the right time for most people is when..

1. You can commit to a property for 7+ years

2. PITI is less than equivalent rent for that property

3. You are confident in your ability to pay PITI long-term

4. Have 6+ months of savings

Wow!!!! What an epiphany!!! Housing can only go up from here! You are so right! Is it too late for me to get into this investment opportunity??? Sign me up!!!

That’s the spirit. Now go long Annaly Capitol Management (NLY), SPY, DIA and other S&P blue chip ETFs. Now’s a great time to get in on some Greek and Spanish bonds.

You do realize I’m kidding, don’t you?

The upward pressure I’m musing about in my other post is more than likely a small forcing compared to interest rate manipulation, the FHA cash machine, student loans decreasing RE demand, wages and employment, etc. The only time it would have a significant effect is if there was a local market dominated by investors (like 75% of the SFH market was investment properties), and the turnover rate was significantly higher than the primary/secondary residence rate.

I’m worried about my old, east coast neighborhood, because when interest rates do start to come back up, that will have a good downward pressure on the prices, unless employment and salaries offset that pressure…

We will have bigger problems than falling home prices if/when interest rates go up. Our country will need to default on the trillions of dollars of debt amassed in the past five years. Do you remember when we first hit one trillion in debt? It took our country over 200 years to amass our first trillion. Now we tack on a trillion a year! What is 7% of 14 trillion again?

The rate will not go up. Didn’t you get the memo? They told you zero rate will be at least to 2014. Now they are thinking open ended. There are piles of money waiting to find home. Bank reserves, corporate cash, all kinds of funds. It’s the people who will spend money do not have any. This can last long time.

All I know is this. In may of 2009 Case Shiller (LA) hit 159.18. At the time, I told my friends and family that we were NOWHERE close to the bottom, citing, in large part the articles that you, Patrick, ZH and a few other blogs were posting that proved we were “nowhere close”

As it turns out, we in LA still havent busted below that May 2009 value 3 years later. Day after day, week after week, month after month, I have been mocked by friends and family as the data continues to show that May 2009 was indeed the bottom.

I so want to be vindicated for waiting this long. I dont want to eat crow anymore than you or anyone else does. Still, there comes a point where you need to throw in the towel, and for me, that time is getting short…

Never, NEVER make life decisions about something you read on the Internet. I have studied economics, I have read Dr. Housing Bubble, I have cross referenced his articles with other data and I came to my own conclusion, I take responsibility for my own decisions.

The outcome the Doctor has suggested and the outcome that I thought would occur is far far different than what has been occurring. But the question is why? In 2004 when I sold my house I had no clue the FED would go down a path that has essentially changed what the very meaning of money is. I had no clue the world markets would stand by and not only accept the implementation of Soviet style economics but actually cheer it on.

How this plays out now is purely a guess. I do know if I was buying with someone else’s money, like FHA, it is a win win whether prices rise or fall. Of course if prices rise you really hit the jackpot but you don’t do so bad if things go the wrong direction either. There is absolutely no risk to buy right now as long as you use someone else’s money. The hit to your credit should things go the wrong way is only a couple years, BIG DEAL! Especially when you can live free for years before they boot you out.

If things go south, everyones’ credit looks terrible.

Mortgage rates in May, 2009 were 4.75 to 5% APR. Look at where they are today. Sure, prices are about the same, but affordability has indeed moved to your favor with dramatically lower interest rates. It HAS been a smart move to wait.

I guess, but i refinanced last year after i bought in mid-2011.. and I plan on refinancing again in 2013 if rates drop to 3%…

You got bailed out by the Fed too, be thankful.

Every point lower regarding interest rates is about 10% more buying power. Did home prices go up 10% since last year? I’ll answer that for you. NO!

The ability to refinance helps even it out.

One of the big differences I see between 2009 and 2012 is that it’s become more of a seller’s market.

In 2009 it seemed like most everybody was scared to buy and the prevailing buyer’s mentality was how much % OFF list price should be offered. Low-balling was commonplace and expected. In 2012 cash-offers and bidding wars seem to be more common as the mentality has changed 180 degrees.

Wettie, take that Case Shiller index with a grain of salt. What were interest rates back in 2009? 4.5 to 5.0%. What are they today? 3.5%. Trust me, if we had 5% rates today, we would be at a new Case Shiller low. The Fed has figured that the only way out of this mess is that home prices CAN NOT go down; however, they will make your monthly payment less with ultra low interest rates.

I don’t know what area you live in or what price range you follow. The low end might be up from 2009, mid tier is probably very close and the high end is definitely down. Tell your friends to eff off! You should tell them that they should be very thankful that the criminal Fed and other PTB bailed their sorry asses out.

It has become apparent that the record low interest rates and hidden shadow inventory has caused house prices to climb again. However, the higher the prices climb, many underwater homeowners or landlords will then very likely put their properties on the market to break even or make profit. This will quickly put a ceiling on the climb of the house prices. The market will reach an equilibrium and then go back down again. Also these ultra low interest rates are destroying the Dollar worth and commodities and precious metals are/will skyrocket in price. This will translate to even higher food and fuel costs.

Like You, I believe what the good Dr. was saying was right on. We were seeing the reality play out before our very eyes. I’m alittle shocked too, how things are being played out. We are the honest folks, responsible, believe in truth. Todays world we have some athletes who go alittle further using performance enhancing drugs, is it fair to the other guy who plays by the rules, but isn’t the superstar, or doesn’t get that bigger contract. We have people who lied to get loans. Loans made of false income or no income accountability. Who bought or qualified when they were able to purchase and shouldn’t have.

I believe today we are dealing with great masters of manipulation. Like a person who could count cards as an example, playing poker, the average Joe might have alittle knowledge how to play, but this other person is a genius. These powers to be are the same way, so even if they lose a hand, they are just that much carefull next round. I also believe they are the puppet masters, able to pull the strings of our politicans and get what they want, and how they want it done.

I wonder too, because of the political time, if interest rates did go up, what would of happened. How would it have made some of these investors not looking to by property to make money? I think it was a snowball effect to save people, “voters,” from more foreclosures and financial devastation it would of caused, making this nation look even worse at the hand of the banks and government action. Again, I’m for no party, look where both of these pieces of shit have gotten us. No jobs, wars, in debt, bleak future for our kids. I still believe there’s alot more shadow inventory, but like supply and demand, these masters know how to get the most for their scheming, and as we hear and see it’s working as they fiill their pockets by people lured by low interest rates,(which I can’t blame some people) and supposedly less inventory!!! Get it while it’s hot!!! You snooze You lose!!!

So no I don’t think we were wrong to think the bottom was going to be alittle deeper, or had come, especially in over priced areas like where I live in the O.C.

Also to be responsible. I’m looking at the 3 times ratio of income.

You are not alone, like the turtle and the hare the race isn’t over yet!! When unemployment gets down to the normal whatever that is, and interest rates don’t need to manipulate the market, housing will be able to stand for itself and we will see what true prices are than.

Is anyone surprised? We’ve all seen this movie where people are allowed to buy stuff with essentially no money down as long as they promise, cross their hearts and hope to die, they will make the monthly payment on time. As I recall, the ending wasn’t happy.

The more government monkeys around with anything (like FHA), the broker we all get. And the banks are clearly insolvent if they had not been allowed to mark-to-unicorn on impaired assets. That’s why there is so much mayhem in housing market stats….and all other assets as well.

True value discovery is impossible under these conditions. Everyone reading this site must know that by now.

Doctor, do you think we are in the bull trap in a typical bubble?

So a low down payment 400+k mortgage is going to have a Monthly PITI of roughly $2600.00 . That is an enormous amount of money for the majority of people.

My wife and I (plus child) are gross $160k+ and are able to live nicely, but not flamboyantly, with a $2200 monthly rent. Still saving for retirement, college, pating off student loan debt, etc…

If you saw the houses in los feliz, silver lake, hollywood, windsor square, larchmont area that you can buy for 400K in this crazy market, you have to assume that 1st time buyers are buying them hoping to upgrade in 5 years, real clunkers.

But what happens to these people when they realize that they are stuck with that clunker, I am sure they will walk away.

It is really crazy to watch this insanity repeat itself.

Your rent is the same as our mortgage… but we put about 10% down so our PITI is about the same as your rent. (we live in the westside of the valley.. not quite as desirable as the areas you listed.. but still good schools and plan on staying put for awhile).

We bought on my income alone… since no point in the wife working and paying a nanny $40K a year if she’s puling in $60K. Fingers crossed we’ll be pulling in a combined $200K-$250K+ by the time we have kids. That’s the goal..

Is sad that’s the kind of money you need to raise a semi-upper middle class family in Los Angeles. i was raised back east on a combined income of $50-60K and never wanted for a thing in my childhood.

Glad to hear I’m not the only one thinking this is nuts.

Here in Oakland, SFR inventory has been down at least 50 percent the past few months (vs the same months in 2011), median price is up 40 percent, per Redfin.

I’ve seen houses sell for 50 – 100k over asking price, even in very iffy neighborhoods.

It’s hard to find anything decent under 500k.

Meanwhile, only THREE PERCENT of the 1,164 REOs in Oakland are for sale (per searches of SFRs at realtytrac and Redfin, 8/27/12).

The prices aren’t as nuts as at the peak of the bubble, but they seem nuts to me nonetheless.

Another part of the problem, I think, is that many long-time LA residents have a distorted idea of how much housing ‘should’ cost. Never mind that the average income doesn’t support those prices. But, time and time again I’ve had people argue with me that the exorbitant prices (for rather crappy houses, at that) are somehow justified… mostly because that’s “just the way it is”. Until people are capable of realizing that

(A) your standard POS fixer isn’t worth 600k, and/or (B) that it’s a bad idea to spend 50% of your income just for living expenses… not a whole lot is going to change.

Sadly, I think we’re screwed.

Mr. Smith in LA – We live in Atwater Village and our rent is $2250 for a 2bed 2bed completely updated with central a/c. it is a duplex, we have no garage and one parking space in the driveway. Our landlord allowed me to upgrade the garden, we have raised vegetable beds, planted fruit trees, vines to cover the fence. We painted accent walls, and even have 3 chickens (that one we never asked our landlord for), and 2 cats.

Choosing to buy a house is mostly emotional and bidding higher than asking price is definitely emotional. After 7 months of looking and getting outbid, we finally big higher and we were accepted.

Home Path loan, 3% down AND ‘credits’ for all closing costs (3%?). higher rate but no MIP (means no 1.75%? MIP at closing)

Many trade off’s. 50% larger house, needs work but livable. 2 car garage, 100% larger lot. on busy street, can’t work to farmers market and/or restaurants/shops. no central a/c. better elementary school for me daughter.

We already own a condo in Brooklyn that loses money each month, a few hundred dollars. It is what we choose to do. We also spend a lot of money on eating out. it’s how we like to spend our money. We have no student loans, no car loans (2 newer model cars paid for) and credit card debt. we have never lived in a house longer than 2 years. On paper I would say it makes no sense to buy, but we are (assuming the closing happens)

3% down. Shoot me!

DHB, you compare the us housing market to Japan’s housing market a lot. I see the total similarities, but have you looked at Japans household income too? how does japan’s household income and US household income stack up? Japan property values have been declining for years, are their incomes declining too? or are the incomes increasing? Just curious

thanks again for a great article and analysis, keep up the good work

I’ve lived in Japan for 20 years, and even own (or mostly own) a home here. Declining property values have been accompanied by long-term deflation, largely due to the continued high value of the Yen.

Most Japanese salaried workers have their income divided into two forms: a base salary and a bonus. Bonuses have traditionally been large, amounting to a much as six months’ salary. When times get rough, the first thing to be slashed is the bonus. It may be cut to two months’ salary or even eliminated entirely. This creates an instant loss of income. When the college where I was a professor was hit by a combination of recession and declining teen-age population, our bonuses were cut dramatically; then the retirement age was lowered. Since salaries at the school were based on the salaries of government workers, changes in public salaries, such as cost-of-living adjustments, were also reflected in our salaries. Well, deflation means downward revision in base salary, which also downwardly revises bonuses, retirement bonus (final pay rate x years worked) and pension benefits. In addition, after I retired, teachers and staff were hit with another 10% reduction in salary when the prefectural government was caught in a financial pinch (partly as a result of declining tax revenues).

Short answer: for most Japanese, incomes have declined, often far faster than deflation.

@Not, thanks for your input. I would not be surprised if we follow Japan’s experience pretty closely. Although the US economy is not as productive as Japan’s, reserve currency status probably helps mitigate the difference.

Any charts on RENTS vs. Incomes…. I bet that’s out of whack also?

Home prices will fall at this point..when rents significantly start declining. This may happen in 2-3 years when all the new rentals being built hit the market.

This is most likely more of a dead cat bounce. No matter who wins the presidential election, the world economy is likely to go bust sometime in 2013. If Romney wins, expect the crash to be deeper and longer, as Republicans try to apply Austerian policies (think Greece). Even if Obama wins, if he still faces a Republican Congress, there will be economic gridlock.

Now there may be enough Bermudan and Caymanian drug, death squad, vulture capitalism and human trafficking money to buy up a fair percentage of California real estate, but continued economic distress will not lead to higher property prices.

Most likely scenario: continued low and perhaps lower prices, but the bulk of property snapped up pre-market by bundled rentier cartels.

So what you are saying is the govt runs the economy? Thanks, i didnt know that. A free market wouldnt have all these problems.

Straw man argument. “Free” markets aren’t. All governments make policies that affect economies. Austerians believe that starving government frees up capital that can then be invested to lift economies. The fact that this doesn’t work doesn’t deter them.

Corporations aren’t people, my friend. They have no conscience or sense of community. As a result, they need to have rules that will prevent them from dominating markets through coercion, bribery, fraud or generous gifts to lawmakers.

You will enjoy Somalia- a true free market-where might is right and there are no regulations.

It never got weird enough for me

We pulled the trigger…in escrow on a great house (built recently and huge.) Here is the caveat that the doctor is missing, at least in our case. We share a household with my still working 60yo mother. I am a stay at home mom until she retires (yes I have marketable skills). So we bought a huge house, 10% down, conventional loan. I think that just focusing on statistics and how much mortgage is “supposed” to be vs. incomes can be very misleading. Of course we can all move to the flyover zone where it’s more affordable but we don’t and we all know why…because CA still has alot to offer. I could of traded it all and had 50% equity in a house in CO but I didn’t because I don’t want to live there, I don’t want that Midwest life. Of course I will be thrilled if the new house goes up in value but even if it doesnt my quality of life is vastly improved compared to what I can rent for…and as a lifelong renter not having an a-hole landlord is priceless. If the S hits the fan, the bank man will take a lot longer to come knocking. Love Dr. Housing Bubble but there is just too much going on to use statistics to tell the future.

Candace, weren’t you looking in the South Bay? I don’t know of too many new, huge South Bay houses that are even remotely affordable. If you don’t mind asking, where did you buy?

Regarding flyover country, I consider many parts of LA/OC much worse than flyover country. Living beach adjacent definitely beats the Midwest, but comes with a hefty price!

You don’t need a crystal ball to know that time is running out for banks who delayed millions of foreclosures to keep their balance sheets with over valued real estate. Great for homeowners who are in default with no monthly payments other than maintenance of the property. This can’t last forever, a day of reckoning is coming, and will probably anticipate some more huge losses on their balance sheets and our economy, so don’t be shell shocked. TARP was a nice band aid for the banks only to cure a temporary problem.

First of all good luck on your new home, wish the best for You. I can see what Your saying but in the Dr.’s perspective the data would have to include three areas of income.

It sounds and it should workout great for You. Also I’m sure your mom will be a big help when You need a sitter, You won’t have to go to far, and being mom, trust is no problem, maybe granda ma just spoiling them!!!

The current economy has forced money that is setting to the side into the stock market or to purchase rental property. This is driving home prices up and the stock market up. Which one will retain it’s value in the future is yet to be seen. Where do you want your money…in housing that may have bottomed or the stock market which is hitting highs again???

I troll this and other RE sites but none of this offer any valuable information about how to make make some money in this market. Nothing but Debbie Downers. C’mon people someone has to be making money on RE. Bueller? Bueller?

I think housing is the best investment out there! You could make tons of money by over bidding other investors for rental properties! Being a landlord is a piece of cake! People gotta live somewhere! You could even flip rental properties to the rich Chinese that are coming over in droves with suitcases of money! There is really no way you could lose on a great investment like a single family house!!! NAR says that we are in a recovery so you should get in before you are forever priced out of the market!!!!

Doctor Housing Bubble. It is now official! The housing market is no longer in a bubble and is recovering! Yippie!!! Kool-Aid for everyone! We are now on the road to recovery! I think you need to change the name of your blog from “Doctor Housing Bubble†to “Doctor Housing Recoveryâ€. Maybe you can get NAR, FHA, Fannie Mae, Freddie Mac, etc. to sponsor your blog! Hey where is Countrywide when we need them? I am going to take all my cash and buy up investment properties before I get priced out!!! Hey, I should look into getting a real estate license. There are going to be a lot of opportunities now that we are recovering! I am so glad our government was able to get us out of this mess will little to no pain! I was a little scared that I would have to give up my Beamer/Bentley/Benz and lose all my LA pimpatude perpetration. Thank God my Granite and Marble are safe! Thank you Ben for saving us all!!! Now, let’s get back to the important things in life like how is Lindsey Lohan doing these days?

Hey What?, I too am astonished to see Doctor Housing Bubble’s take on this insane and completely manipulated market. Indeed, for the Doctor to even state “Does this signify a sustainable turning point for the market? At this point it is too hard to tell for a couple of reasons,” is absolutely astounding.

It seems the Doctor may be somking some good weed these days, or else he may have his head stuck up where the sun doesn’t shine. The economy is near a cliff, unemployment is way too high, interest rates are being artificially manipulated which is driving up home prices. Housing prices are still way too high in many areas. Prices may have risen some in the past year, but this manipulated market will come crashing down. And people who jump in the market and overpay for their homes, will get burned.

The graph showing housing inventory levels is astonishing. True record lows. So the market manipulation that TPTB have been practicing has finally acheived the bounce in prices they wanted. Wow. Who says you can’t buck the market?

Of course, the shadow inventory is still out there, but I guess the plan will be to trickle homes slowly into play, while keeping interest rates low (which also forces cash investors into the market), foreclosure times high, and bulk selling to the super-rich.

There’s plenty of reasons why it might not work, but betting against it seems risky. If I lived in the States now, which I don’t, I’d be sorelly tempted by one of those govt insured 3% down mortgages. After all, if the market turns the wrong way again, I could live rent free for a couple of years before handing back the keys. The money I’d lose on the deposit would be far lower than renting a place.

Heck, why not be ambitous, buy a much bigger place than I could afford, rent out a room, and if prices rise I’m onto a winner, if they fall I keep the renters cash for a deposit on a smaller place in a few years time?

Sure, i’m being a little sarcastic here, but the game is clearly rigged. Seriously, there’s millions of people who must be thinking along the same lines as me. Perhaps it’s time you well informed folks reading this blog started exploiting the un-free US housing market rather than commenting on it. Why should the bankers be the only ones to get away with screwing the system.

Paul, I think 99% of Americans are fully aware of the housing scam you described. Americans are very poor at math and finance, but they are way above average at getting something for nothing. This must be some engrained behavior or a class they teach at school. As I always say…it doesn’t pay to be responsible in this country.

You could have bought a mansion back in 05 with nothing down. Defaulted and probably lived free for a few years in your mansion. Rent a place for a few years and be back in the game again with a 3.5% FHA loan. If things head south again, you’ll get free housing for a few years. What a great system. Somebody needs to write a book on this.

Sure Your Lordship, I know everyone in the States is aware of the scam, and i’m not implying anything else.

I’m just astonished that the bankers and govt have actually succeeded in getting sales inventory so low as the graph in the article illustrates. It’s truly mindblowing that they’ve managed to manipulate the market so successfully, given the levels of shadow inventory.

And finally, here in the UK we can’t just walk away from mortgages by giving back the keys, and there’s no 3.5% govt backed thing, ( plus we didn’t build too many houses in the first place), but if we did, there’d be a lot more people jumping on the bandwagon and trying a risk free bet than I can see in the US.

I’m suprised there aren’t more people trying it on is what i’m saying I guess.

My wife and I bought a short sale, it closed in early May this year. We payed cash $250k. Zillow now puts the “Zestiment” at $309,472. My realtor swears I could get $350k.

I know I got A good deal otherwise I wouldn’t have bought it. I also got a good deal because I paid cash! If I wasn’t going to get a good discount for paying cash I wouldn’t have bought it. In other words I demanded a discount for my cash purchase, and I got it.

We were renting a property 6 blocks from where we bought, The rental got sold at a trustee sale a few days before we closed, the investor payed $280k for 1600sqft. with a pool on a 6000sqft. lot. We got 1674sqft. a bigger newer pool and over a half an acre. mostly flat. plus the house is in much better condition. It just shows me that investors at trustee sales are not necessarily getting the best deals. The investors also had to pay us $5,000. cash for keys just to get us out. Plus the investors had to buy everything sight unseen!

Guy’s all I am telling you is that there are deals out there, be patient (I have been watching and waiting since 2005). Don’t buy until the inventory starts to build. There is going to be another dip, start looking in November, don’t offer until December and January (the heard shops in May- July). Go to the short sales the deals are better, and demand a discount for your cash.

Congratulations on your purchase. There are deals to be had; however, with the supply/demand imbalance those deals are far and few between. Any seller with a double digit IQ knows this. If a house is priced according it will get lots of attention and buyers will have less leverage getting a better deal.

I agree that waiting for more inventory is the only way to go. Unless you find your dream house right now, waiting to see what transpires in the next few months is probably in every buyer’s best interest.

Greg:

You are my hero. You echo what I have been thinking. I am planning to start looking in the next month, build my strategy for pulling the trigger this winter. I have cash close to the amount you paid. In the meantime this current market has me nervous; the lack of inventory, the bidding, watching a property that was listed in the mid 200s come back on the market with the granite counters and an asking of $399k and all of the press on rising prices. So it’s good to hear a story of what I am planning for my purchase.

Lord and Wydeeyed, Thanks for the compliment. I appreciated it.

Lord you’re 1000 percent correct the powers have stacked the cards against buyers who demand affordability. but as you acknowledged Lord there are deals to be had.

One thing that I noticed early this year nobody knew what direction the market was going to go. all spring and summer 2011 I made my low ball cash offers on properties that couldn’t go FHA. The prices were already pretty good. My offers were usually atleast 50K to $100k off of list price, I got no takers. My realitor made the offers and tried, but knew it wouldn’t go anywhere. In my area prices in 2011 dropped 10% – 20% YOY, and most realitors sold very little. In January 2012 I called my realitor and told her about a couple of properties I wanted to see, this time her attitude had totally changed about low ball offering, In January she was all for it. Not knowing what direction the market would bring this year and not wanting another year of nothing, her attitude changed a lot, she even encouraged the low ball offers.

I made my offer on the house in January, The list price was $315k I offered $240k and both realitors grabed the offer on the short sale. I got lucky that there were a couple of really distressed and damaged homes that were recent sales and we were able to use them as comps. that really worked in our favor.

This January realitors might be coming off of the recent high of the improved market, but the winds of change might be different. Inventory rising, lack of buyers in January. We will just have to see what direction inventory and demand is going to take.

Greg in L.A I love ya ….you the man….you so smooth I should put ya to work !!!

Leave a Reply