Three reasons why you should be happy about renting in California: Glut of rental housing, mobility, and hedge against future price drops.

Last week I was talking with a colleague about how disappointed he was that prices in Pasadena have not corrected since the California real estate market drove off the depreciation cliff (they have by the way). To this I responded that the 91101 zip code in the city has a median price of $172,000. Of course, this isn’t the area that he is even considering. Yet many people are realizing that prices in some markets are resistant to price drops. For example, the median Southern California home price is now up to $305,000, an increase of 22.5% from last year. What gives? Well if you look at the data carefully, those once $500,000 homes are now moving at $400,000 or even less. So prices have fallen yet the current volume is reflecting higher priced homes (plus investors are pulling back from the Inland Empire from their manic buying of last year). In fact, Riverside and San Bernardino saw year over year sale decreases while the more expensive markets like San Diego and Orange County saw double digit jumps. This overall jump is basically the year long artificial stimulus party coming to its expected conclusion. Yet the market is still saturated with toxic mortgages and overpriced homes. There really isn’t any better time to be a renter in California.

Glut of rental housing

It is useful to go through one example to highlight this. A reader sent over this home in Sierra Madre that is listed for sale:

Let us look at the stats on the place:

2 beds, 1 bath

1,064 square feet

Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $450,000

The place looks like it was recently remodeled and looks nice for a starter home. But all we need to do is look a few blocks down and we find a bigger rental for the following:

2 beds, 1 bath

1,100 square feet

Monthly rent:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,795

In fact, if we plot this out on a map these places are right in the same neighborhood:

In the above situation, the obvious answer is to rent. You get to live in the same neighborhood while hedging your bets until all the toxic mortgages filter out of the California system. There is absolutely no rush to buy in today’s market. Mortgage rates have only one way to go and that is up. Even the FHA has recently added more guidelines for premiums because of the amount of defaults occurring. I can only see this getting tighter as time moves forward. The economy in the state has shown no sign of recovery so to expect that somehow wage growth will push prices higher is unwarranted. The only reason to buy right now in many areas is merely based on emotions. The fundamental economic metrics do not justify prices in many areas of California.

I’ve thought about the psychology of many that are sitting on the fence and are perched to jump in right now. They buy the argument that right now is the time to buy with all these incentives to purchase and rates destined to go up. But keep in mind, if rates go up, that future buyer you will sell to will only have access to mortgages that he or she can afford (unless you plan on staying 30 years in the place you buy). So if rates go up to say 9 percent for 30 year fixed rates, they may no longer be able to afford the home you bought with a 5.25 percent mortgage. It helps if we run the numbers. Let us assume you buy the above home with a 10 percent down payment:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $45,000

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $2,704 (with a 5.25% 30 year fixed mortgage)

Let assume you live there happy for five years but need a bigger place but mortgage rates are now up to 9 percent which is the 40 year historical average. What would the numbers look like for this future buyer? Let us assume you sell for the breakeven price:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $45,000

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $3,726 (with a 9% 30 year fixed mortgage}

Even if you sold at a breakeven point, this future buyer has a net housing payment that is higher by 37 percent. The good news after 5 years is that you have paid down the principal balance from $405,000 to $373,000. This is a total of $32,000. Good job right? But you are forgetting that renting the bigger similar place around the block will cost you roughly $900 less per month.

$2,704 (PITI) – $1,795 (rental) = $909 per month

5 years is equal to 60 monthly payments:

60 x $909 Â Â Â Â Â Â Â Â Â Â Â Â =Â Â Â Â Â Â Â Â Â Â Â Â $54,540

So even stashing the money away would make more sense here. In these markets, the rental rates are telling us a very significant disequilibrium is occurring between sales price and rental rates. These markets have a large number of Alt-A and option ARM products that will cause problems deep into 2012. There is no reason to jump into these markets.

But what if the landlord wants to up the rent? You move out. The market is saturated with properties. Even those areas that are “prime†like Downtown L.A. are seeing falling rents:

“DOWNTOWN LOS ANGELES – A study recently released by the USC Lusk Center for Real Estate had harsh tones for landlords, with a prediction that rents for Los Angeles County apartments would decline by an average of 3.5% this year.

A group of Downtown Los Angeles building owners don’t think they will take a hit.

“I don’t agree with this projection,†said developer Barry Shy, who owns six properties with more than 1,100 apartments in the Historic Core. “In my experience, new construction stopped a while back and we’re in a city where new people keep coming and the demand will still be there, but the supply is stopping.â€

Shy’s stance was similar to that of several other Downtown landlords, who said that despite a 9.9% decline in Downtown rental prices last year, this year they are likely to hold steady and could even increase.â€

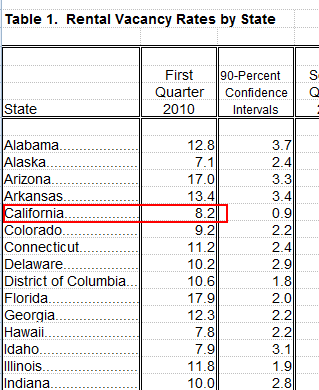

The current rental vacancy rate for California is 8.2 percent:

I wouldn’t worry too much about higher rents down the line. Plus, you have tons of failed condo conversions going back to apartments adding to more inventory. You also have the massive amount of distress inventory coming online so the rush to buy makes very little sense.

Mobility

I think many homeowners even at today’s adjusted prices are setting themselves up to be underwater in one or two years. As we know, FHA insured loans made up over 37 percent of Southern California purchases last month. From C.A.R. data we know the vast majority go in with the minimum 3.5 percent down payment. So even a modest drop of 5 percent will render these buyers underwater. In California one third of mortgages are underwater. That is, the owner has no mobility if he wanted to move today. Sure, he can strategically default at the cost of his overall credit but the renter in many cases is in a better position (certainly better than a third of California mortgage holders).

The fact that so many are buying homes today with little down payment products is troubling. If home prices drop even by 10 percent across the board, we are setting up another crisis in one or two years. If you really think about it, this is why a 20 percent down payment makes sense. A bank wouldn’t mind if you stop making your payments. Why? They’ll take the home with a built in 20 percent buffer. Assume 10 percent in fix up costs and sales commission and the bank actually makes money when they resell. But in today’s market, the buffer is razor thin even after the toxic mortgage escapades we went through. The government and Wall Street know the housing market is on thin ice. Here in California the unemployment and underemployment rate is over 23 percent. In this poor job market, it is actually useful to have mobility in housing if a new job comes along. Renting in this market makes complete sense. Pick a neighborhood you like and if home prices are too high, rent. In some areas like the Inland Empire you might find buying a home is in line with rental prices or a bit higher after you run the numbers. If that is the case, buy.

Hedge against future drops

I’ve noticed that some people psychologically are wedded to certain markets. “I can’t believe that Manhattan Beach still hasn’t corrected!â€Â I get some e-mails from people making $50,000 to $70,000 hoping for home prices in Beverly Hills to fall to “reasonable levels.â€Â Well even if say home prices drop from $2 million to $1 million, would you be able to buy that home? Probably not. So you have to be realistic about your own bottom line. If you like a neighborhood and home prices are too high then rent. So what? In California, we have as many homeowners with mortgages as we do renters (over 5 million for each group). So renting here isn’t uncommon. In fact, in today’s market it seems like the wisest thing you can do.

There is little reason to buy in some areas because:

-Home prices are highly unlikely to go up (if anything, they will go lower)

-A higher mortgage rate with a lower home price is better for you (easier to pay down and more options)

-Glut of inventory and distress properties (pipeline to keep prices low for a few years)

I see little reason to buy today. It seems like many are furious because the market they wanted to buy in simply has not corrected to their liking. Hey, in California we invented housing mania so some markets may stay irrational longer than you think. Just rent and be happy. If prices come down to more sensible levels then you can buy later. If not, just rent and enjoy being in the same area. Renting never made as much sense as it does today for some California markets.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

39 Responses to “Three reasons why you should be happy about renting in California: Glut of rental housing, mobility, and hedge against future price drops.”

Most people are impatient. They buy merchandise today, because they want it NOW, rather than wait 2 months for a sale. They DESERVE it because they work hard. They follow the lead of their brother , cousin, or spouses relatives, without evaluating what is right for their OWN situation.

The U.S. economy is in terrible shape. Many people have been out of work for a year, or longer. Massive cuts are coming to municipal budgets. Mortgage applications have fallen over a cliff.

Anyone who can look at these facts, and still feel they should buy now-

Please take a deep breath, and repeat: “Let’s keep renting for a year, and see how this all turns out.”

No one ever regretted living below their income.

One other reason to rent: mobility. We live in Marin County (renters). My wife lost her job. She was finally able to find a great job, in San Jose. That commute would have been impossible ( 2 hours each way.) But, since we rent, we are moving down to that area, and it is a reasonable commute for us both.

If we had owned a house, she would have had to turn down that job, as nothing is selling in our area.

Looking for a job, if you own a house, is like running a foot race, with a bucket of sand in both hands.

I just rented a very nice, 2 bedroom, 2.5 bath with 1400 sq/ft condo in Sunnyvale for $1500 month. Very nice place: pool, carport, storage, fireplace, large patio, etc. Why in the hell would I buy in San Jose when you can get so much more for your money renting? The only houses in our price range are in dubious neighborhoods; and in good neighborhoods, chicken-shacks are still going for 500k. Oh, I’m on a gold course as well. We’re saving gobs of money to put toward a real place somewhere else. This also makes me mobile; if my job goes, I have cash in the bank, and can move anywhere on a months notice.

The buy-rent comparison argument is always compelling, so thank you for that.

But there are more wrinkles to the decision, aside from “look at the money you’re saving!”

I’m paying about $2600 per month for a nice SFH in OC (4 bed, 2.5) in a good neighborhood with good schools.

I would love to buy a nice house for my family (3 kids), but two things are disruptive to buying a home now.

Supply and Location.

Supply of good homes is very low in most parts of OC (though it’s increasing). Most homes priced affordably in OC are either:

1. Located within a few miles of the 405/5 freeway or the Irvine-SD train line. Not good.

2. Located in areas with poorly rated schools (yes, even the OC has some less- than-ideal elementary and intermediate schools). For example, I have eliminated homes in Capistrano Unified school district from consideration, so it’s Saddleback or Irvine Unified or bust, so the deck is stacked against me even more.

Decent, move-in ready homes near good schools in OC are $650K at least and often priced much higher. I can find fixer uppers in the $500K to $550K, which means I’m basically buying a $600K house again.

I have zero debt, but I’m not able to bank the difference in your example between $2600 in rent and the $3519 (PITI+HOA) I’d have based on $650K fixed at 5.25% with 28% down payment due to those pesky necessities called food, auto insurance, etc.

That would be nice to do, but what I’m saying is that there is another reality for families: It’s not affordable to buy a home right now unless you are an equity rich seller from 2005/2006 or you are using ridiculous FHA financing and will likely end up underwater on a $650K home in OC by 2011/2012 anyway. I think there are few people in CA with $200K ready for a down payment and next to zero debt. Even when you screw around with your federal and state withholding, it’s just not enough to make monthly outlays work.

I don’t understand how households in OC can designate 67%+ of their monthly net income to housing.

So this why I’m renting. I can’t be a homedebtor and still make the monthly budget work (yet).

I think part of this is social pressure. People were raised on the idea that home ownership was part of adulthood; now they don’t feel like real adults if they’re renting. I think a lot of people in my generation, particularly, got the idea that renting was for college students and the lower class.

Just beware, especially if you wish to rent a house, that your landlord might be underwater and may stop making mortgage payments. You could be evicted in case of a foreclosure. And just try to get an underwater landlord to make repairs. Renting may make financial sense, but it’s still not risk-free.

I really enjoy reading this website. In 2004, I bought a really nice three bedroom, 2 bath two year old house for $135,000 on 1/2 acre, then refinanced in 2006 on a 15 year fixed rate loan that I am paying off early. Yet I felt like a schmuck during the bubble years because the house seemed like it was far below the standard of what everyone was buying. I could have “afforded” a $700,000 house with the commonplace low interest teaser ARM loans of 2006. The proverbial illegal immigrant fruit pickers were buying $500,000 houses around here. Now this county has a 25 percent foreclosure rate and a 12 percent unemployment rate and those $500,000 houses can be bought in the low $300,000’s or high 200,000’s. The fruit pickers headed off for busier climes.

Based on the fact that housing is an abjectly shitty “investment,” and given the gospel preached here that a house is nothing more than a wooden box rotting away out in the weather as it irreversibly loses value, I decided to stay in my humble abode and remodel this year. I paid cash for all the materials and traded for the labor. My wife and I call it the “anti housing porn” house and remodel. Nothing in the remodel was done with the eye towards future resale “value.” Since the idea of “home equity” and “resale value” are colossal frauds whipped up by real estate scam artists, we remodeled to suit ourselves rather than some imaginary future buyer. For instance, against the advise of the real estate “professionals,” we tore out the master bath and replaced it with a closet. (I was told by a RE person that a house without a master bath “won’t sell.” I responded with “How many houses have YOU sold this year?” Dead silence. .

Now I look in envy at renters who could easily rent my house for $700 per month, but for the fact that this place will be paid off in six more years. Thank you for preaching reality good and straight

J Heat…..

Your right on point with that….I recently had to move from a home in which the LL had been pocketing the rent. I was told that my lease has nothing to do with her contract to pay the mortgage…..Also, she was the previous occupant, and she moved to be closer to the grand kids….long story short, I talked to some neighbors and was told that she had told them “I know its underwater and will get foreclosed, but I gonna rent it out anyways!!!”…..Well 7 months into 12 month lease the Realtors start showing up…I tell them piss-off, and no lockbox….Finally she terminates the lease with 1 month to go, to get me out so they can show the house….and she keeps my 2k deposit…..nonetheless, my small claims court date is set for July 14th.

look at cda, idaho, houses are 30% or more off in their value. there are no jobs. wall mart just added 300 jobs at $7.25 per hour, when it take $12 per hour to make it here. houses in cda aren’t selling because the houses in cal, have not sold, so those sellers can no longer move to no-job-for-u-idaho. rent is cheap here, but watch it, landlords are losings their homes. sometimes they can’t even rent a $450 PM apt, and for the lst time ever, I have seen apts advertising 2 free months rent free, if you sign on the dotted line. this is steve (not larry)

Hey Doc – what do you think of finestexpert.com? I’ve been seeing it touted on some forums lately, and am of two minds: on the one hand, it both automates and explains the cash flow of investing in a house. On the other hand, it seems to be linked to the data of realtytrac, which I’ve found to be notoriously unreliable (and limiting, since it tries to push a sign-up and we all know it’s a credit card scam).

And I DO live near CDA! And yes, housing “values” are in a dramatic free fall around here. Just in my neighborhood, both of my neighbors houses have been foreclosed. By August, my house will be the only one on either side that is occupied. The vacant lot across the street, which I am told was bought with a $300,000 liar loan construction loan in 2006, was abandoned when the buyer ran off with the $200,000 that was supposed to used to build a nice house …. smart people! But, now I have unrestricted river access over my own private vacant two acres. I wonder if that makes my place worth more …… NAAAHHHH. McMansions that were bought in 2006 and 2007 for $475,000 to $500,000 can be bought for $300,000 or less. A lot less. I have seen that with my own eyes. In CDA, since all the banks and mortgage brokers (the ones that somehow survived the brutal bloodletting of 2008) won’t make loans on these shitty “investments,” now there over 1,000 houses that were “sold” in the last couple of years wherein the seller is carrying the contract on a long-term escrow and that is just one of the escrow places in the county.

Surprisingly, this site is behind the curve of seller-provided long-term financing. I bet this new trend actually caused more sales, since now sellers are truly desperate, than the vaunted $8,000 tax credit.

Almost no one actually “buys” a house. They take out a 30 year debt in order to take title to a house. And probably the biggest debt they’ll ever have. The govt adds an incentive to taking on this debt by allowing the interest paid to be income tax deductible.

This is a highly leveraged, high dollar investment. The only question one should be asking is,”Is it appreciating in value?” If the answer is not a clear-cut ‘Yes”. This investment should not be made.

The stats show price declines in many parts of California as well as in the “prime areas” since the peak.

Some inland areas show up to 50% while in the Prime Areas the stats show maybe a 20 to 25% decline.

After spending the last 18 months trying to buy a house that was “in line” with the “stats” it is clear the stats are based upon a multitude of transactions by people with the right connections. Those with the “right connections” got the short sales for the great price, those with the “right connections” got the foreclosure for the great price and so on.

Unless you have “the right connections” you will not ever have the opportunity to buy a house in a “Prime Area” for 20 to 30% from the peak, more like 5 to 10%.

Unless you have the right connections you will not be able to buy in Riverside for 50% off from the peak.

Yeah, there are the Dumps out there that have been trashed that will prove me wrong but for the most part the bubble for the average Joe is in full force in California.

The good news is inventory is rapidly increasing and there has been a significant change in what I can get for 550K in the last 4 months.

I’ve waited for EIGHT years so far to buy a house in Orange County. I had 20% to put down all along but I simply REFUSED to compete against government-subsidized DEADBEATS & FRAUDSTERS using my REAL money. I refused to windup getting into the inevitable bidding war against people like my next door neighbor for example (btw, I’m currently renting a 3bd/2bth house for $1500.00 in Anaheim) who bought his home at the peak of the market for $570.000 on his landscaping job wages. Currently these same homes are selling for about $290K IF they sell at all, that is.

Apparently my neighbor’s plan was to build multiple divisions inside his house & garage in order to subsequently rent-out every nook & cranny available. At one point there were about 15 cars in connection to his property and people were CONSTANTLY coming & going at all hours. Up to then this had been a quiet residential street. Now there are at least 3 other homes with overcrowding and too many cars. Back to my deadbeat neighbor, a recent public records search indicates that he hasn’t hasn’t paid his property taxes since 12/06. Current PT debt with penalties: $30K. I bet he hasn’t paid his mortgage either for an equal period of time. Yet watch ME or any other renter try to skip a payment or two to see how long it would take to get the boot? I’m thinking two weeks, one month tops. Nice huh?

Such distortions created by the massive mortgage fraud and out-of-control government-subsidized lending has ruined MANY once-pristine OC neighborhoods, by allowing riff-raff who could otherwise have NEVER afforded to move in. I may be a renter, but my lawn is manicured and neat. The douchebag ‘owner’ next door has 3 cars parked on his lawn along with several used diapers and an assorted collection of broken toys and spare car parts. Code enforcement and the cops can do very little when the ‘homeowner’ knows he’s going to have to walk away sooner or later anyway. They simply laugh-off any fines or liens they get.

That’s why, as soon as home prices drop back to an affordable level, I’m going to buy a house at the same place where my job went about 2 years ago: OVERSEAS!

we’re renting and our LL is now in default. we’ve suspected this for a few months as she asked us to lie and say she is renting us rooms to do a loan mod. we said no. she then talked about short selling. said something about us buying the house, not going to happen unless it goes for 50k.

our lease is up this month. we don’t want to move. LL has our deposit $.

we’d like to negotiate to lower rent.

any advice?

Martin, I have noticed that inventory in the area I track (Redondo Beach) has also increased in the last few months…and places are not selling. A year ago, anything decent would be gone in the first week. Now I am seeing similar properties sit for 2 months or longer. This is good news for people who are patiently waiting to buy. I think most of the buyers were brought forward with all the home buyer credit BS. And it is getting clearer by the day that the economy is NOT recovering as projected. I think many people on the fence are still leery about buying now with all the uncertainty and prices still being too high. I am hoping that prices will be forced to drop with more and more inventory being added and all the gimmicks expiring for good. One can only hope!

Doc: Nice example.

I didn’t quite understand the “To this I responded that the 91101 zip code in the city has a median price of $172,000.” statement. Is it supposed to be sarcastic or factual? What I’m I missing? I see that a house sold for $172,000 in April ’10. I searched that zip code in redfin (http://www.redfin.com/search#search_location=91101), the avg house for sale is $800k+ (there aren’t to many for sale) and the avg price of the houses sold for the past year is 600k+.

Thanks!

Doc, the other thing you have to mention in your article is that when interest rates go up, price of the house will go down. I think I read $10K for every % point in the mortgage rate. So if the rate is around 4.5% now, a 9% rate will lower the price of the house by $45,000. Equity is wiped out in this scenario, which means that moving to a larger house for the family in question will not likely happen because they won’t have the downpayment needed.

I doubt that mortgage rates will ever get back to the historical norms at least in the US. Interest rates in Japan never went above 1% after their bubble. Our bubble is much worse. Fed and TPTB will keep rates low for decades until the banks can paper over their losses. Their will be no inflation, except in the things we need like food, energy and housing, and no need to raise interest rates. Housing prices usually only come down when interest rates rise. In the scenario we find ourselves in now, housing prices are dropping while interest rates have dropped or remained stagnant.

I saw an interesting chart on another blog the other day showing the unemployment rate of people in the “family formation” years – late 20’s through early 30’s. The rates show unemployment of around 10%. This does not bode well for high housing prices as demand will be lessened by fewer family’s formed, fewer children being born.

I have lived all over CA and have seen over the last 12 years the naked greed of landlords and property owners. Everyone wanted to get rich, be the big man/woman. Let’s see what happens to them now.

+1

Doc: Nice example.

I didn’t quite understand the “To this I responded that the 91101 zip code in the city has a median price of $172,000.†statement. Is it supposed to be sarcastic or factual? What I’m I missing? I see that a house sold for $172,000 in April ‘10. I searched that zip code in redfin (http://www.redfin.com/search#search_location=91101), the avg house for sale is $800k+ (there aren’t to many for sale) and the avg price of the houses sold for the past year is 600k+.

Thanks!

+1

The Doc must be on something very potent if he thinks 91101 Downtown Pasadena median price is $172,000…I’d be buying up all such properties and renting them for $1.8k-$3k which is what rents go for in 91101.

Based on Actual Sales in the past 3 months (from Redfin), condos average $404k. There was one, exactly one, house sold for 172k on 4/2010, so you can’t call an non arms-length transaction the median. Of course there was only one house sold in 91101 in the last 3 months, this is DOWNTOWN PASADENA 91101. Why don’t you stick to 91105 or 91106 which are nice Pasadena zip codes with mostly homes…of course the Doc would find the one Condo sold in those zip codes and label that as “THE MEDIAN” to prove the point he might be trying to make on his rambling posts that day.

Housing has become a cartel run by the banks. They are limiting supply and squeezing every last dollar out of short-sale buyers. It’s dang near impossible to buy a house. I’ve made full cash offers that get no call back. That’s how they are keeping prices high.

If you are waiting for the government to raise interest rates, good luck. There is no political will to raise rates. Debtors love low rates and this country is nothing but debtors.

Don’t believe the government figures on inflation. The method of calculation keeps getting revised so it produces a low inflation figure. Think about it, does the government want high inflation numbers? Of course not because then entitlement payments like Social Security go up.

The government will keep throwing your tax money to keep prices stable under the inflation can erode away the housing debt. So it’s debt slavery or get killed by inflation. There are no good choices here.

@Van

So are you comfortable parking your cash in a Bank? I am in same situation I can not find a decent home. Someone talked about “Connections” and that is exactly the case. All the Bank owned and short sales are not for regular buyers.

I agree that Pasadena has held its value compared to most of the state. It’s a great place to live and the city is well run. If you come down to the Pasadena 91101 you would not find anything near your quote of 172K that you would want to live in. For that price it’s a fixer upper at best or maybe a studio condo. Also, this district of Pasadena is probably 95% or more condos/townhouses because it’s Old Pasadena where the city plan is for mixed use and walking/biking opposed to using cars. There are very few single family residences in that zip code.

@js

No, I’m not comfortable with all this cash just sitting in the bank earning 1% because I believe the government is understating the inflation rate. So although housing prices are still high, I am being “smoked out” by inflation and I am looking to buy. Look, you have to buy something, some tangible asset or inflation will kill you. Home prices are high, so is gold, so are stocks. Pick your poison. I agree with most of the stuff on websites such as this but it doesn’t address all the risk involved with just sitting on a pile of cash. I think if you can get a decent deal on a house then do it. You can’t pay your rent with 1% interest in a savings account and you can’t live in it either. Good luck with your housing search.

Mobility combined with low or no debt levels is the place to park oneself until economic trends are stable. Be kind to yourself!!!

Pasadena is over priced and over hyped area in Los Angeles, just close to downtown Los Angeles……Wow big deal….

I lived rent free for 5 month after the bank took over. The day the auction happened is the day I stopped paying rent. I wished I could do it again….

We had the same situation. I can tell you that you can take advantage of the situation. There is no mode to investors and this house is going into foreclosure for sure. If you know the auction date (like we did with ForeclosureRadar) you tell the landlord that you hold rent for that month and use the deposit for the days until the auction date. If she manage to postponed the auction date (happened to us twice) pay rent for the month until the next date. When the house is sold ask the landlord for the remaining deposit minus the days of the month prior to the auction but be prepare for not receiving it. The bank rep, will be in your door very in a couple of days after the sale. Do not accept the cash for keys offer, it is not worth it. Just sit tight until the last minute that can take up to 5 month rent free. If you have some balls and fight eviction it can linger even more. Big saving here!

js,

No need to park your money in a bank. Invest it (NOT in buying a house). There is a ton of money to be made on alternative investments right now that can be highly collateralized, as this mess has resulted in the massive deleveraging of business and individuals. It’s almost impossible to get credit and this presents a very nice opportunity for those with cash to a beyond nice return.

You can thank the greedy bankers and politicians for the growing gap between the rich and the poor for presenting people with cash with the opportunity to make great returns while most suffer. The rich continue to get richer and the poor are left with a joke scenario. The avg household income, without being adjusted for inflation, as is actually about -6% from 2000 to 2010. I can only imagine what this country will look like in 20 yrs. There will be no middle class at all (literally), as opposed to the barely remaining middle class of today. And that’s thanks to greed and politicians having money stuffed in their pockets behind the scenes. What else could possible explain the lack of Financial Reform YEARS later. What a joke.

I feel horrible for the majority of the country. I’m one of the fortunate ones (not that I’m that wealthy) who has enough cash to be comfortable and to find really nice alternative investments right now. And I have been renting through this whole ordeal because I knew there was a ridiculous disconnect, which means that was able to invest the rent-or-buy spread on my money and accumulate more wealth. The whole system just shouldn’t be like this – it’s just not right. Until we wipe out lobbyists we will continue to have this corruption. And unfortunately I just don’t see it going away anytime soon.

Good luck to everyone. And, whatever you do, DO NOT buy until 2013-2014 in California in the mid and upper priced areas, which is when the Alt and Option-ARM mess will be mostly behind us. Anything that you read that says otherwise is either paid for by someone with an agenda (NAR) or a media writer who is commenting on one month’s worth of data without taking into account seasonality, shadow inventory, etc. Poor Americans that read the media – it’s such a joke.

‘Alternative: Investments? Elaborate please. About the only alternative investment I can think of now that can make any real returns in loan sharking. Are you a heavy who is good with kneecaps?

@Van – It seems that having money is your problem. I am completely broke and don’t have to worry about any of these things – buying a house, investing in equities. Enjoy the little things, be thankful you have a little nest egg even if it is at a paltry 1% interest rate.

@JR – You hit it right on the head. Greed knows no bounds. The little people get squashed time and time again. I do think using 2000 as a base year for looking at household wealth is a little biased though. Early 2000 was the height of tech bubble so incomes were skewed high. But yes, incomes have been declining while debt has been increasing. People just arent’ gunshy about taking on more and more debt. I think the standards of living in the US from early 90’s through 2008 or so were an anomaly. I can remember back when I was a little kid in the 80’s and hardly anyone had any money. Luxury cars were for really rich people, only professionals and successful business people lived in houses bigger than a 50’s era 3/2. I think we will still have a middle class but it won’t look like the middle class of the 90’s-2000’s.

JR,

What do you mean by alternative investments? Are you talking derivatives? Most people don’t know anything about investing in complex securities. You think putting money in something you know nothing about is a good idea? There’s nothing out there right now that makes a decent return without a lot of risk. That’s why interest rates are so low. There’s a ton of liquidity out there looking for a decent return.

CAE is correct. Until that last payment is complete everyone is a renter. Only difference between renter and title holder is the possibility of selling the difference on loan remaining against the equity accrued. Well guess what folks, equity game is over. House should not be considered investments. It would be considered sustenance. Shoes, socks, bikes, cars, computers. All are needed these days. Each of which “may” be used to increase income without you doing any actual work with them, but just like this list, a house should not be used for investment.

People simply will not get it through their thick heads. All they see is dollar signs. And this innate flaw in mankind where an object this is big and expensive must be, no is demanded to be, a futures commodity is what keeps the spiral of crisis flowing across the earth.

Figure out what kind of mortgage your regular rent would cover. If you’re paying $1500 a month, you can get a loan for $220,000. Does that cover the house at a short sale? Maybe even if it doesn’t, it looks like a really simple sale. It’s all paperwork.

I’m someone who has been waiting since 2003 to buy a home. My family was poor and never owned a home. We moved constantly when I was a kid. I hav been in graduate/professional school nearly every year since I finished high school until 2003 when I turned 34 years old. I have rented places that were suboptimal waiting for this housing bubble to disappear. It has been 7 years now, I’ve saved up my money for a 25% downpayment on a 500K+ house yet it’s STILL not a good time to buy!

Hell yes I am getting impatient and I’m tired of living somewhere I can’t just nest in and make my own. I’m tired of buying cheap furniture and selling or buying new pieces because I have to move yet again. I’m sick of moving because the landlord wants to sell or take over the unit. I’m tired of arguing with a landlord to fix something that s/he doesn’t want to fix or change.

I want to own my own house someday (sorry if that makes me a greedy, impatient jerk), and I resent my parent’s generation for making it so that the only way to get a house at a fair price is to wait 10-15 years into my prime earning years, or to inherit one.

I don’t know where you live, but if you’re ready just buy a home. You have the down payment and if you get a fixed rate mortgage, go for it. If you listen to all the naysayers on this board, you will never get a home. I have heard the same thing about real estate for 30 years at various times……..the market ebbs and flows and you can’t time the housing market any better than you can time the stock market. If I would have listened to all the stuff over the 30 year I still wouldn’t have property. I grew up in the bay area and people were always saying that it was too expensive. Talk to folks my age in their late 40s or early 50s and they will tell you the same thing. Buying your first place is a little scary, but you’ll be glad you did in the long run. Just don’t buy places to flip it or turn it or whatever the word of the year is. Live in it, enjoy it, raise a family it, pay it off as fast as you can, then get the next one. Just don’t get greedy and get in over your head. After a few of these you’ll start keeping them and using them as income property. You’ll look back and be glad you did. I have posted here before that I have never lost money on California realestate (bay area, north bay area and metro socal).

People have always thought their homes were overpriced. My first home in a quiet east bay city was less than 100K and I thought that was overpriced, it was a bargain years later when I sold it for several times what I bought it for. My parents bought 1 acre in Sonoma County, near the city of Sonoma with 2 small homes on it for 38K in 1978 and they thought they it was overpriced, my friends in the Hollywood Hills down the street from Ellen Degeneris (she sinced moved) paid less than 100K in the 1970s and they thought they paid too much. I bought a nice piece of acrage property with a home on it in the early 80s for less 100K and I thought I paid too much for that at the time. Again, it was a bargain as the years passed by. I am yet to meet someone that thought they didn’t pay too much for a home. My parents first home in a middle class neighborhood in the mid 60s was 6K and they wondered how they would make the payments with 3 kids and only one parent working. Same thing happed in the mid 70s when they bought a home in an upper class neighorhood in the east bay area and they thought the same thing. Talk to anyone over 40 or 50 and they will tell you the same stories.

I keep waiting for the NODs to show up. My landlord is underwater on the two condos he owns in this building and even tried to talk me into buying the one I’m renting, but no thanks. If I stay another year he’ll cut the rent $50/mo (well whoopdedoo) but refuses to renovate the bathroom where the tiles are falling off the wall. Gotta decide by the end of the month if I’m staying here.

Considering the town he offered a good price but buying a condo is even dumber than buying a house now.

I think you missed something on the scenario:

“$2,704 (PITI) – $1,795 (rental) = $909 per month”.

I thought the rule of thumb was that you can take add about 1/3 to your current rent because you get it back in mortgage interest deduction each year. So that would net about $300 per month, post tax, vs. your $909 per month pre tax.

$300 x 60 = $18,000

So savings on house of $32,000 exceeds post tax value of $18,000, showing net of $14,000 represented in principal. The rest holds up, such as home value not holding up when interest rates go up. I do not see interests rates going to 9% though yet. In the short to med run, we are in a deflationary/low inflation environment. Longer term we should see inflation, but the “bad” inflation related to currency and public debt servicing.

This writer must be a renter who doesnt understand that house doubles in value about every 10 yrs on average in CA, you have see how much rent you will be renting the same house 10, 20, even 30 years later when i have my house paid off. I remenber my dad was paying $525 to rent an apt about 15 yrs ago, the same apt now rents for about $1600.

Good luck renting, I am trying to buy 1 more one now.

Leave a Reply