Examining the net worth of renters and homeowners: Most Americans stash their wealth in home equity. Many housing markets affordable, just not the area you are looking at.

The nation is undergoing a radical transformation where renting is currently outpacing homeownership. The reasons are complex including the multi-year investor orgy into single family homes. Since the crisis hit 7,000,000+ homes have been lost due to the long and drawn out process of foreclosure. No need to worry since investors picked up a solid portion of the slack here. Americans are notoriously bad savers and addicted to debt. For most, housing is a forced savings account. This is why when net worth data is pushed out we find that homeowners clearly outperform renters. It is important however to keep in mind most of the net worth is tied up in equity. That is, you will need to tap your home somehow to get the money flowing out. This is how we end up with dumpster diving baby boomers scrounging the local Whole Foods for goodies while living in a million dollar crap shack. The hipster kids don’t seem to mind since they are now living with mom and dad, unable to afford the high rents in places like California. Yet housing overall does end up being a big forced savings account and that is why the net worth figures between homeowners and renters are not even close. If anything, it adds more evidence to the feudal landlord nation we are witnessing.

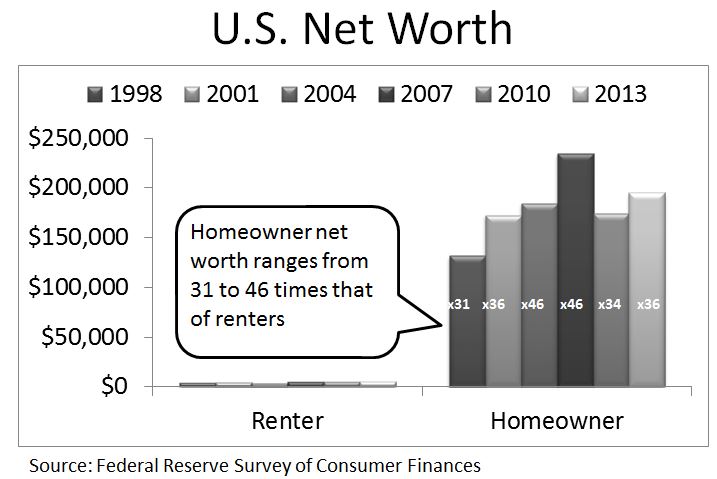

Net worth – homeowners and renters

One of the more in depth surveys done on net worth comes from the Federal Reserve. The data is comprehensive and shows a clear win for homeowners on the net worth front. In fact, as a nation, renters are one paycheck away from eating Kibbles ‘n Bits. Yet this doesn’t paint a very clear picture for say a place like San Francisco where the majority of households rent but you have tons of high paid tech workers.

First, let us examine the data:

Source: Federal Reserve, NAR

I found this chart while browsing the NAR website. It looks like a clear cut case of buying over renting. For most of the nation, I would argue that this is true. People are simply poor savers especially in our hyper consumer driven economy. A home forces many into a hedge against inflation. I think it is important to look at the data closely as well:

“(NAR) Data shows that median homeowners had nearly $200,000 in net worth or 36 times that of the median renter who had just over $5,000. The median value of owners’ homes was $170,000.â€

You get that? In essence, the bulk of net worth of homeowners is tied up with their home. This doesn’t really help in retirement when you need a stream of income from somewhere. If you own a rental, then yes, you have an investment throwing off cash. But if you live in a crap shack you are actually spending money without cash coming in. You still need to pay for maintenance, taxes, and insurance.

What this chart shows more than anything is that housing has been a useful forced savings account for many Americans. With investors crowding out regular buyers, you lose the one vehicle where Americans have consistently been able to build wealth. In other words, welcome to renter nation and the USA of Feudal Landlords.

With this data out there, does that mean you should spend $700,000 for a tiny drywall paradise? No. Keep in mind that the median home price in the US is $222,900. Most of the country is affordable with low interest rates. But in many areas, buying a home is not a clear decision especially given current price tags. You have opportunity costs to factor into your decision and people in places like San Francisco, L.A., or Orange County have other motivating factors: investing difference of owning and renting, affordability, and availability of properties.

I think when people see charts like the above, it almost seems like a resounding case of buying over renting. While this logic is clear cut for the nation as a whole, this doesn’t apply to manic markets. You have to run the numbers much more carefully. This also assumes you are unable to find alternative investments that can outperform real estate which overall tends to track the inflation rate. For the public however, the stock market is viewed as an exhilarating casino while real estate is really easy to understand and perceived as riskless (ask those 7,000,000 foreclosed households how riskless it really is). That is why you can have the “Dad used to be a truck driver but now flipped his way to millions†type shows. It doesn’t take a genius to understand. You don’t hear about people flipping their way into a job at Google or rehabbing a space shuttle. But everyone can “get†that if you put granite in your kitchen you can sell for more! Add a bathroom? More money! Recessed lighting? Cash in your pocket!

Homeownership makes sense in many regards. But to make it seem like a no brainer purchase is absurd in many markets. Think about the tech worker at a startup in San Francisco looking at a $1 million starter junk home. Will that company be around in 10 years? 20 years? 30 years? That household will be carrying an insanely high nut for a long-time even with a giant down payment. Many people simply shack up with others and split the rent. Are you willing to co-sign and split a home purchase? With a spouse, yes. Then people forget that homes have an aphrodisiac quality that seems to beget kids. Kids are incredibly expensive. People seem to forget that there will be additional hidden costs to buying a home beyond the PITI. The net worth data simply reiterates how leveraged we are when it comes to real estate. There is so much lobbying in terms of buying that people fail to save adequately in other investment vehicles.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

98 Responses to “Examining the net worth of renters and homeowners: Most Americans stash their wealth in home equity. Many housing markets affordable, just not the area you are looking at.”

Welcome to our instant gratification society.

Those of us who save, plan ahead, and sacrifice for the future get to pay for all this once Joe Loanowner discovers that his “riskless” $1mm+ crapshack is unaffordable and squats for 3-4 years waiting for the bank to foreclose, effectively living rent free.

Quite a system, eh?

Here’s an article in the September 12 LA Times called, “Housing Price Cuts Point to a Shift in the Southland Market” —

http://www.latimes.com/business/realestate/la-fi-home-prices-20140912-story.html

Well, the banks are taking 5 to 10 years to complete the foreclosures whether someone is living in them or not. So why not live in them? The banks are the ones that are not completing the paperwork. Even after they have physically taken back the house they are failing to file the proper documentation to match their physical actions. One has to ask why?

Mortgage applications are at a 20 year low. Cash buyers have pulled back significantly. This leads to:

“the slowest August in four years and down 18.5 percent from August 2013.”

http://www.ocregister.com/articles/percent-634654-san-bernardino.html

Housing bulls, repeat after me. “But prices are still up YoY. Prices are still up YoY!”

Cling to that, ’cause it’s all you have left. 😉

“…But prices are still up YoY. Prices are still up YoY!…â€

There will always be a few true believers who will still drink the Kool-Aid despite everyone around them are dropping dead on the ground.

My sense is the line to the Kool-Aid bucket is now getting rather short.

I have been saying homes are higher on YoY for quite some time. And I am a money conservative and libertarian, I don’t believe in the .GOV and the banking cartel. But what I believe in is that our economy, as well as the markets (housing, stocks, bonds), are completely rigged. That’s the point. In the ponzy economy and crony capitalize environment you cannot expect the real price discovery to take place. Can this ponzy go on forever? No! Will the housing tank this year? I don’t think so either… As much as I want the game over for this corrupt system, unfortunately, it didn’t run out of steam… just yet. So… housing NOT to tank hard in 2014, I wish it did, though.

In some Long Beach areas, I have seen lower asking prices over the past 2 weeks. Real Estate is local, but if this is happening in other areas, the ‘TANKING” has probably begun.

Nice work by the DOM-Inator! Housing IS Tanking Hard in 2014!!

It is not, at lease on the East Side (King County, WA)

Ah the good Doctor helping us serfs understand the implications of purchasing a home.

Household formation and debt levels coupled with our tax policies and inflation are an event horizon we have already passed. I endeavor to provide a better life for my kids and futher his kingdom. TPTB have a finite ability to keep the bread and circuses going.

It is amazing to watch the computer age mutilated into the last breath of a hyper consumer ponzi. I pray we will see a cognitive revolution when our souls collectively dis-ease from conuming more then we produce.

Hello Doc

Concidentally LAT has posted a ‘rent or own’ calculator for the SoCal area.

Here is the link

http://graphics.latimes.com/rent-or-buy-los-angeles/

“Affordability is calculated based on the industry rule of thumb of 30% of gross household income (though you can choose to spend less or more). Ownership calculations do not include mortgage interest tax deductions. In each ZIP Code, calculations are based on the median price for re-sold single-family homes in the second quarter of 2014 and the median rent for a two-bedroom unit in the last 12 months.

*Monthly home cost is calculated based on mortgage payments, property taxes, maintenance, insurance and other expenses.”

Of course, you will see that ‘cheaper to own’ regions are far from LA.

But can you imagine how much money those crap shack owners can spend into the economy? Just use you house as a limitless ATM…

To start with I do not think this is a good comparison. It is like saying that 20 year olds do not have near the earnings power of a 45 year old. The comparison also only values the savings of the renters I imagine. Having been a landlord for many years, tenants tend to put money into other things such as jewelry and cars. While I am by no means trying to say that they have anywhere near the net worth, the net worth of owners could be fleeting.

The value of housing is no sure thing and could possibly go down. In an environment where the unemployment (real unemployment keeps rising, wages declining, and inflation taking more of the paycheck, it is unlikely that things will remain as they are now. What happens if rent controls come in to play or the hedge funds who have bought for pennies on the dollar are forced in to a rent war. What happens to housing values? We haven’t discussed interest rates.

WOW. That graph is exactly my situation. My wife and I had about $5k in savings (and $15k in checking). We purchased a house in October of 2012 (when most on this blog were saying prices were going to come down) We purchased a Fannie Mae foreclosure with 3% down, we were able to also add 3% to the mortgage for closing costs. I applied for 4 new CC and spent $30k to rehab the house. We sold it 18 months later. We now have over $200k in savings. (after paying capital gains)

I am happy we unlocked our equity:

https://www.redfin.com/CA/Los-Angeles/4546-Verdugo-Rd-90065/home/7177420

We now rent a small house one block away for $2300.

I will most likely buy again when prices come down a bit. what is a bit? for me a bit will be a smaller drop in price than the average person on this blog will need to think it is a good time to buy.

My ‘secret’ was luck. and ‘over paying for a house’ when people thought prices should not go up more.

Maybe my math is bad but with cap gains and realtor fees and rehab you’d be more like 160 – 170K?? Still an awesome return for 18 months.

Question is: how much time did you have to invest into it? Did you have a full time job at the time?

Wow, that is quite a profit. $30k for the rehab you’ve done in that house looks amazing (although I have no idea what it looked like before).

Here is a link of before and during pictures. I am very proud of myself. I did most of the work myself but had friends and family help with labor and I paid a few neighbors. I completely redid the main bathroom, refinished the hardwood floors, refinished and updated the kitchen (my friend who works at a prop house, took the cabinet doors and painted, and brought a spray gun to paint all the boxes), all new dual pane windows, new insulation, all new DWV, painted the house, added a stucco wall for the back patio with fountain and ventless gas fireplace, total landscaping, a lot more.

https://drive.google.com/folderview?id=0B4xM7993FJf6aWdDczZMVWZFUVk&usp=sharing

Yeah, indeed, why housing priced didn’t go further down? Oh… wait a minute, I forgot, was it 2012 when QE3 started and then turned to QE infinity? Indeed, who would’ve predicted that. Now, lets go back in time and say the FED didn’t do the QE1, QE2 and QE3, it didn’t keep the historically low interest rates for historically prolong period of time. We would’ve been in severe recession by now, I guess… Or, wouldn’t have seen the “recovery” at all…

2012 was the only year in the past decade I even considered buying anything. I looked at a few places and at the time I decided not to for stupid emotional reasons not related in any way to finances, and always kicked myself for it. Nice timing job…I’m a little jealous but glad it’s worked out for you…

Why didn’t you wait another 6 months? You would have avoided paying any taxes on the gain altogether. What some of you folks need to admit is that the system is rigged in favor of homeownership in this country. That can be good or bad policy, but that is another partial explanation for the chart.

@Dean What some of you folks need to admit is that the system is rigged in favor of homeownership in this country

What some of you folks need to admit is that the system is rigged in favor of DEBT in this country… here, i fixed it for you 🙂

I did not wait 6 more months because I can not successful time the top of the market. I believed that the mania would stop and the ‘minuses’ for the house would make it difficult to sell for a premium, i.e. main road, no central a/c, bus stop in front of house, etc.

Also, the gov’t knows best how to spend money, so they need the tax revenue 😉

Congrats to you! I’m not familiar enough with Fannie Mae or Freddie Mac loans. Are there strong rules against flipping for Fannie Mae/Freddie Mac or FHA loan holders?

“*Owner occupants are those buyers that will occupy the property as their principal residence within 60 days of closing and will maintain their occupancy for at least 1 year. Owner-occupant purchasers are required to sign an Owner Occupant Certification as a rider to the Real Estate Purchase Addendum. A buyer purchasing in the name of a trust, purchasing as a vacation/part-time residence, or purchasing so another person or relative can live in the property will typically be considered an investor and not eligible during First Look.”

Not shre if you reqlize , but you just admitted fraud by taking on a government backed mortgage intended for first time buyers. Fannie Mae Homepath is not intended for someone who has an investment property in Brooklyn already. I’m not saying you shouldnt have taken advantage because most wealth here in California started with fraud and loopholes. In reality you should have never been able to buy unless you had 20% down.

ouch. yikes. We were very transparent. All parties involved knew of the property we owned in Brooklyn. all our income was needed to be documented in order to qualify for the mortgage. All bank statements, past tax returns.

check the link for info.

https://www.homepath.com/incentives.html

You may be correct is the property is purchased the first 20 days or so, called “first look”.

*Owner occupants are those buyers that will occupy the property as their principal residence within 60 days of closing and will maintain their occupancy for at least 1 year. Owner-occupant purchasers are required to sign an Owner Occupant Certification as a rider to the Real Estate Purchase Addendum. A buyer purchasing in the name of a trust, purchasing as a vacation/part-time residence, or purchasing so another person or relative can live in the property will typically be considered an investor and not eligible during First Look.

Andy: Pic # 5322… what the hell IS THAT STUFF???

It looks bad:)

It was old blown-in insulation. condensed and filthy from LA wind blowing in from the soffit vents for many years. Also bits of wood from the last time the roof was changed.

Wow, congrats! It certainly looks like you earned that ±$200k with all the work you did. The wife and I currently own a place (bought in ’09), and passed up buying several places in 2011 and 2012 for frivolous reasons (kicking ourselves now). So now we’re stuck waiting for the next downturn to buy again (current place will be a rental). Good for you that you followed through and made it happen!

I don’t want to detract too much from your accomplishment, but you’re lucky to have friends/family generous enough offer free/discounted labor. I usually decline from helping friends/family with such chores if they are solvent enough (or too cheap) to pay for labor themselves (not saying you necessarily fall into this category). Although if I would have helped a friend make ±$200k and I got nothing from it except maybe some free labor down the road from that friend, I’d be a little displeased. That, and I only get one life; I certainly don’t want to spend it laboring away for some cause that is of no benefit to me. That’s just me, though, and I realize everyone’s different. I’m fairly charitable in other regards; I just generally choose to only help people who really need it.

Yo Andy,

You are full of sh-t. You think you’re tough?

The math does not add up?

well…we also sold our condo in Brooklyn during that time and paid off the CCs. so now we have that invested money back, too.

http://www.zillow.com/homedetails/351-21st-St-APT-1F-Brooklyn-NY-11215/79719706_zpid/

Savings? When 30% of your earnings goes to mortgage and 25% to rent how do you save?

Your house saves it for you. Ask the home owners, how much of their net worth is actually liquid assets (bonds, stocks, cash, PMs) and how much is the actually “equity”. There you go, you don’t need to save if you got house, your house will do it for you!!!

“the equity in your house is your savings”?! What planet are you from?! How old are you 12? Does your mommy knows your on a adult blog?

You’re missing something. You have to account for the portion of your mortgage payment that is amortizing your loan. That is what people are calling “forced savings”.

“forced saving”? common? this a lame excuse to buy an overpriced “asset”. What people need in this country is a common sense, probably, try to understand what the banking cartels have done to the republic. “forced savings” sounds to like prohibiting 32 oz soda cans in order to reduce obesity rates, like it would prevent people from now buying two 24 oz cans…

What people really look for is an “asset” that will “grow in value” without them lifting a finger…

@KingLG wrote: “When 30% of your earnings goes to mortgage and 25% to rent how do you save?”

Not everyone overextends themselves.

I live in SoCal, walking distance to the beach. My rent is about 12% of my gross income. If I were to buy in my neighborhood, my PITI (principal-interest-taxes-insurance) would run 35% to 40% of my gross income.

In the non-bubble areas of the United States, rent since ZIRP (2008) is more expensive than home ownership. In most parts of the U.S., the monthly nut for buying is about 1/3 to 1/2 less than renting. SoCal, NorCal, Seattle, northern Virginia/Washington D.C., New York City, and Boston are the areas of the U.S. (real estate bubbles) where this relationship is inverted.

I am in the same situation. I can see the surf from my house while paying 10% of gross income to rent and it would be 30% – 40% to “own”. Remember the .gov takes about 40% (Fed about 30% and CA about 10%) and AMT takes all the mortgage interest deduction and just about any other deduction back. It would make absolutely no sense to “buy” in this environment. The job front in the bay area scares the SHEEITE out of me, so no 30 year commitment from me…

Oh… The “math” is live off of 30%, .gov takes 40% and save 30% of gross. So some of us lowly renter surf/serfs actually do save…

Great article doc, keep em coming. Like you mentioned, “most housing markets are affordable, just not the area you are looking.” It’s been like this for decades. Desirable pockets of CA have always held a premium versus the vast majority of other areas. Ditto, that housing to most Americans is viewed as forced savings. Americans are notorious bad savers, so paying $1000 of principal per month is a big accomplishment for most.

I still haven’t seen any 1M crapshack owning baby boomers dumpster diving. These people won the lottery. Housing went to the moon plus Prop 13 protection. They likely have a pension. They will collect a tidy sum of social security. And the stock market went up a factor of 20 in the last 40 years. I wouldn’t be shedding any tears for these people.

The net worth of owners in desirable parts of CA is astounding. That’s another reason we won’t see a housing collapse in these areas. These areas will simply weather any storm better than lesser areas. With that being said, come on over and join the club when the time is right.

This middle class thing is an anomaly. For thousands of years before the industrial revolution you were either a peasant serf or you were part of the landowning ruling elite. Bonaparte started the civil service exam in France to get rid of useless brain dead aristocrats and East Asians ie Chinese Koreans and Japanese have had civil service exams for over a thousand years. Which explains their over emphasis on education at all costs

Too many people not enough resources. Ebola will kill off the useless eaters and we will go back to feudalism.

I believe over the past few years the younger generation have come to realize that cradle to grave jobs are very few and have reduced their expectations of working steady for the same company to retirement. They are apprehensive of taking on long term financial commitments especially in housing. In many cases renting is the only option for this generation in California, which has over 10% of the US residing here. They know the competition for high paying jobs are fierce and few, so I think in view of the situation they are doing the right thing by playing it by ear. They need their mobility to seek better employment, housing and educational opportunities, within or outside of California.

that chart is a classic example of sample bias and spurious correlation. a more interesting and insightful set of charts would break up that one chart into multiple charts by categories of per capita income (say prior 5 year average). When I write per capita, i mean take the total HH income and divide by # of family members.

Thus, you would get a chart comparing renter vs. home owner families with say $100-150k per capita income, $75-100, $50-75, $25-50, etc. Only then would you really see the impact of owning vs. renting on net worth. I’m guessing the gap will be much smaller in each category (though, granted, the distribution of the sample sizes will be skewed at the lower and higher per capita income groups)

Also, one could use the same groupings, renter vs. home owner, and show average per capita income as bar height. you will basically see the same chart.

I was thinking along the same lines…

As simple as I can put it: The more money one has, the more likely one is to afford, and then buy, a home. Visa vie, the more money one has, the more likely one is able to save.

This is the truth; the wholerestier truth, which the author seems to gloss over. The buying of a home is not the main contributor to a saver’s status. Having money is.

@rob_en, that is the problems with statistics.

Classic example: Bill Gates, 3 fast food workers, 5 middle class, and 1 upper middle class people are in a room.

What is the average (mean) net worth? about $6 billion dollars per person.

What is the average (median) net worth? less than $100K dollars per person.

Sample distribution does play a very big role. Even in SoCal, not all cities are the same. Income for residents of Beverly Hills (investments) is very different than Mar Vista/Palms/Culver City (salaries).

It makes sense to rent right now. Long term renters do not have the same net worth as long term homeowners. It is a forced savings plan that works for most people. Renting and saving equal to what homeowners save over time is not as likely. That’s why I say if renters are priced out but have cash,next downturn buy an entry level two bedroom condo in a high demand area. You will get more cash flow from owning a condo outright and collecting rent than leaving it in the bank. Wait to buy anything till after 2016 to see where the economy and housing is going.

Do, I guess, @Christie S agrees to housing to tank hard in 2016?

Renting is not much different than using credit cards, it makes you a slave to someone else with no accumulated equity. It may be necessary for some, or to live above your real means, but is a horrendous long-term behavior

I don’t think renting makes it me anymore slave to a landlord than a home owner to the bank. I am free to move any time, I don’t like my landlord, I can choose a different one, I don’t like my daily commute, I can choose to live closer to work… It is mobility and flexibility that you lack and it matters for me. And, I believe, you should not be “forced” to save through your house, it should be a discipline the one should develop. We are a high mid class earner family and we have very frugal lifestyle. I can save about 50% of I take home (after taxes, insurance, 401K, etc) and we have to pay for everything, we don’t receive any benefits from the government because we are too “rich”. And we have no debts! We buy everything with cash, if we don’t have cash for something, then we save and wait until we can buy it. It doesn’t mean we do not invest, we just do not invest into housing…

No. A mortgage is a credit card on steroids. Renting is more like living hand to mouth.

Everyone says they will be buying the dip in 2016/2017, which makes me think we will not have a serious crash until the next recession where jobs are lost across the board. You have the cash buyers saying they’ll buy again at 2012 prices, you have the long term savers saying they’ll buy if prices retreat to 2012 prices, you have the guy willing to put 3% down and get 4 CCs to renovate willing to buy the dip.

&&&&

We all know the last recession didn’t end for the 90%, so we need a real recession where the 10% have their jobs are risk: bankers, executives, tech workers, etc. in order for housing to come down. Otherwise, these same people we bid up housing on the margin in the desirable places.

“Everyone says they will be buying the dip in 2016/2017, ”

This concerns me as well, to be honest.

I console myself with the fact that when prices are falling, most folks wait for the bottom, and wait, and wait, then kick themselves when they “missed it”. When prices are falling, most folks become paralyzed.

Housing to tank hard in 2016/2017. Yes please! Would love add a beach close rental property to my portfolio.

We may get 2012 nominal prices, but I highly doubt we will get 2012 interest rates in the low 3% range. I bet interest rates will be closer to 6% by then. Real prices likely won’t be much different than today.

As we witnessed a few years back, the pendulum swings very quickly between buyers and sellers markets. Fall of 2011 was likely the best time to buy. Prices were low, inventory was high and places sat on the market for months. We snapped off the bottom hard and less than a year later prices were slightly up and competition to buy a home was fierce. Anything priced within reason got multiple offers as soon as it hit the market.

Buying in a falling market is never easy. Nobody wants to buy and have 10 or 20% percent negative equity soon thereafter. Buy based on rental parity for your area…I’m sure this will bring out the rental parrots. 🙂 As the old saying goes, show me one example of buying at rental parity that didn’t work out in the end…

Baulk…

IF TRUE — THIS PROVES DOCS POINT – Seniors Forced Into Poverty As Education Department Demands Payment. People over 60 fastest growing debtor segment.

http://www.huffingtonpost.com/2014/09/11/seniors-education-department-student-debt_n_5807820.html

Wait a minute. These people are currently 60 and have defaulted student loans, they were in college ages ago! Students now are graduating with at least 5x as much debt if not more. Now I’m starting to see why everyone keeps talking about a student debt bubble. That’s damn scary…

a…Universities ( large schools) are like hospitals they charge like there is no tomorrow. With TV revenues and sponsors they pull in what amounts to boardroom profits.

They have these athletes most of which will never see a NBA court or NFI playing field believing the glory and injury is worth it?

The students get the shaft many have huge debt, this is why you send your child to college, to get in debt. Again Americans are so confused, so worried about every 30 days and where they will get the money to pay these bills, no wonder housing and going out to eat, mom and pops business, are going the way of the dinosaur.

tolucatom…This is true, seniors afraid to go to the mailbox and guess what, wait till Obama care folks get a bill for their subsidies if the courts don’t reverse the April decision.

Crazy, robert! It never occurred to me that all of these boomers living high on the hog weren’t paying their student loans off. 1.3 trillion in student loan debt. And it’s worse, far worse for young grads today — college costs are sky high compared to what the boomers had to pay. Who’s going to buy stuff? I saw an article which cautions Ivy League graduates not to expect to make too much money upon graduation. if an Ivy League education (and alumni network) doesn’t get one a great income — the rest are really in trouble.

Ok, lets inflate the housing and spend all that net worth into the failing economy, right? I have always thought economy was about being economy meaning you should be frugal and invest you money, not borrow yourself to the eyeballs and the future generations…

Underwriters are so crazy that folks with 800 credit scores and little to no debt still have a devil of a time trying to get a decent loan.

If you have any misstep in your background forget it people, that house you want to buy they won’t loan on it.

As for our friends the beloved appraisers, they are another story. Take the case of the 910k house that apply for a refi. The entire neighborhood sells for well over 950k to 1.3m. Exception, a short sale at 621k in April and a divorce couple who closed at 866k in July.

The report did nothing but reflect the poor performance of the development even though the closed homes of 955k, 998k, and 1015m the last 6 months didn’t have a affect on his summary?

To say the least the now over cautious lenders are also a major determent to a recovery, qualified buyers are getting rejected.

@robert, the reason people have a hard time getting loans is ZIRP. If the lender is going to flip the loan to Fannie Mae, Freddie Mac, or the Federal Reserve after close of escrow then the lender is following FF/FM/FR’s loan guidelines.

If a lender intends on holding the loan on their balance sheet, they will lose the shirt of their back if they get a down payment of less than 20%, and the interest rates are in the low 4% range.

In order to fund a loan and keep it on their balance sheet, interest rates below 5.5% are not financially viable for lenders. Only government backed (i.e. taxpayer backstopped) entities, i.e. Federal Reserve, Fannie Mae, Freddie Mac, FHA, VHA, can hold loans when interest rates are at the current levels.

If interest rates were to hit 7% there would be a huge line of lenders waiting to give away money to prospective homeowners. At the current 4% to 4.5% rates, the numbers do not work.

Ernst, I’m not sure that I believe any of this. Is this your opinion or a fact?

Just yesterday I locked in a 4.5% 30 yr fixed rate on a refi of one of my duplexes. I don’t live there so it falls into an investment category which means 70% max LTV and a hit of about .6-.7% over a SFR owner-occupied property. The bank says that they keep most all of their loans and I’m not sure that the government agencies would be interested in taking a mortgage on an investment property.

I’ve got a 5/1 ARM on my own home and that loan hasn’t been sold, I’m still paying the original bank.

I’m not saying you’re wrong (my personal anecdotes don’t carry any weight), just looking to learn more about how all of this works…

@Jeff How do you know when a banker is lying??? When his/her lips are moving!!! My favorite banker game is to ask about fdic insurance and how much can I be covered for in their bank. Go ahead and ask and see what they say and get back to me with your “personal anecdotes”…

Bankers lie and the sky is blue. Monsignor What, are you telling me that my loans are in fact of the government variety? Or perhaps you have some other point to make?

All I know is that it is no more difficult to get a loan now than it was 1 or 5 years ago. But then again I know my front and back end DTIs and credit scores and those numbers don’t exclude me.

What does FDIC insurance have to do with government backed mortgages? I haven’t a clue. Enlighten me.

@jeff, mortgages are typically chopped up and resold as 10 year bonds (aka mortgage backed securities). These compete with the 10 year U.S. treasury. Add 50 to 100 basis points to the current 10 year U.S. treasury yield, plus another 50 basis points for cost of operations, and this will give the the cost of holding a mortgage.

Recessions happen every 5 years. Please provide the name of the bank that is holding your mortgage. This bank will be a prime candidate for shorting.

Buyers continue to reject over priced houses, it is evident everyday, sales are at a standstill, RE agents continue to play the good guy, bad guy.

Good guy… they tell sellers, buyers will be back price high and wait.

Bad guy….They tell buyers houses are overpriced, but interest are on the climb so maybe you better buy now.

Buyers and Sellers are at a all-time what do I do. Sellers really don’t have a idea of how to market the property, sales are all over the place. In some locations as much as 300k more for the same house around the corner, the difference the buyer paid cash so no appraisal.

Buyers are so scared of 2007-2008, either they want a surety of profit in the future or a cheap loan to wait it out, which isn’t available to them.

Cash buyers throw the whole game out of whack, I suggest buyers and sellers invest in Tums and by all the stock in it?

Does the panic mode start to set in?

@robert, you’re right about agents playing good cop/bad cop. They sit the seller down and tell them the market is softening and they better hurry up and sell, sell, sell before they lose more money. Then they smile and tell the buyer that prices are going up, up, up, there’s nothing to worry about, it’s time to buy, buy, buy.

Agents talk out of both sides of their mouth, they’re incapable of being truthful.

“Lawyers talk out of both sides of their mouth, they’re incapable of being truthful.”

…Fixed your sentence.

@marco

Real estate agent/brokers are lying sacks of shee-ite and the only thing that can come out of a sack of shee-ite is shee-ite.

There, I fixed it for YOU…

@Whatever

that was a Hell of a Zinger! You sure are an amazing wit!

I see some houses “sitting” for over 6 months with NO price reductions… I wonder, who will blink first…

The ones that priced accordingly, still fly…

i sold my one brm condo at $170,000 in may 2014. i guess it was priced right

As a responsible saver, I am being penalized by the low rate of return on my money market account. I was doing well in 2006 when I was getting 5%. Now I’m getting a paltry 0.75% Bring back the higher interest rates and lower home prices!

The USA has become a nation of consumers, rather than savers. The misguided Einsteins in power would prefer we spend rather than save, and spend on CREDIT. Thing is, since we now consume instead of save and create, our spending is making other countries rich while the USA builds debt. Low interest rates are not a good thing in the long run. The typical American consumer would disagree, since their outlook is short term and centered around “me” ie: how much can I spend on credit?

As for me, I must be the only renter that is not piss-poor. I probably have a lot more net wealth than most of my “homeowner” neighbors, and most of my “wealth” is liquid. The only wealth my neighbors have is tied up in “equity” in their homes, and that is starting to disappear. Some of them pay double to carry their house every month, than I pay in rent.

I have no debt except $50 on a credit card to keep it open, I own my near=new car, no student loans, no mortgage. In fact I am in the middle of a Master’s program and my employer pays 80% of my tuition. Class by class I pay cash for the difference. I will graduate with zero debt, thank goodness.

I save 35% of my income, and I’m waiting for the next drop in real estate prices to come my way.

My point is, renters who are conservative with their money can build net wealth too.

great job cali girl….your doing it the right way…

Debtpushers are much worse than drugpushers….

Debt likes to sleep with the devil….that is not a great one night stand….

The guy across the street must be reading the tea leaves. He was the last one to buy on my street. He bought while the bubble was still deflating so he was losing money as he was moving in. Must be four years now(?) Well, he had a Broker’s Open House today. Big For Sale sign in front. First 4 Sale sign I have seen in this area in a couple years. Woodland Hills area. I haven’t found out how much he’s asking, or if he’s selling at a loss.

In the last 150 years, the longest time between the onset of two recessions is 10 years. We are 7 years out since the last recession started. Another words, the shoe is set to drop sooner, not later. So what will cause it:

A) A “classic” collapse of the current credit bubble stemming from low rates?

B) Finally someone figuring out China is doctoring its 7.5% annual GDP gain?

C) The overstretched American consumer? Subprime auto, credit cards, school loans?

D) The paradox of high bond and stock prices combined with low volumes ending?

E) The end of the petrodollar and the fear of hyperinflation?

F) Or something else?

The seeds of the next economic disaster have been sewn and their fruition will be sooner rather than later. It will not bode well for the housing market.

Let’s add so more possibilities to your list:

1.) Financial or political upheaval in foreign countries?

2.) End of US Dollar as a reserve currency?

3.) Meteor?

4.) The Big Wigs pick something out of their @$!% to cause a panic?

Either way something will eventually happen. Just don’t know in what order it may happen or my guesses are not even remotely close.

F) Barry-Care

I’m a physician. I doubt it will be Barry care. That will just create crappy health care. Health care too expensive with or without Barry care and plenty of other reasons for wage suppression, part time jobs, “contractors,” and wage suppression in general. Barry care is only a small part.

DFresh – I call flip flop!!!

The Global Economy Isn’t Very Healthy

http://tradingslugger.com/the-global-economy-isnt-very-healthy/

Bill McBride – Question #7 for 2014: What will happen with house prices in 2014?

Read more at http://www.calculatedriskblog.com/2013/12/question-7-for-2014-what-will-happen.html#Ao0WVIFtD71Ao4P2.99

Bill McBride thinks national home prices will be higher in 2014, but saw weakness in the Southwest. 2015 will be intersting.

TEXAS, anyone?

Big Tex…yes you guys have a ton of land and a ton of people now call Texas home. But if you ever been to Ca. (40 million and still counting) please don’t wish for more folks to move to your state, more isn’t better when it come to population?

http://investmentresearchdynamics.com/wp-content/uploads/2014/09/Untitled5.png

Don’t know how representative this story is of California’s future, but it indicates that this DROUGHT, if it becomes truly severe, might cause PRIME-PRIME areas to TANK HARD: http://www.telegraph.co.uk/news/worldnews/northamerica/usa/11094232/Super-rich-make-last-stand-against-California-drought.html

I live in small town outside raleigh nc. I retired early as body was failing after 25 years in corpora life. Sold home after kids went off to school and have been renting different places from friends att below market rates ever since. Many people i know are real estate poor and are happy to get break even cash flow on older paid off properties. Been about eight years now and there seems to be more properties left than ever. Things i have learned are most any place becomes home in a month or so, most neighbors are friendly even if poor, small rural towns seem to have a real estate stock that is aging but fed money flow has ensured that the fire stations, city government buildings and hospital are some of the best looking construction available.

Distressed property supply, and mortgages, and

monetary policy, are manipulated. Privatized.

It’s not a lib bureaucratic thing but

a corporatist privatized thing.

But that the property comp’s end up in

location/price boxes is a self-aligning of

prices per ability to pay, which otherwise

is arrived at through the business savvy

of the monopolist or the instructions

handed to the lobbyist.

Back from my weekend of house watching and I can report, buyers are staying away in droves. About now is when RE agents start the drum beat, “I can’t make a living, so I will sell cars, be a server, learn how to be a commodity broker, and hope the buyers return soon.”

My sister just return from LA. She says, can’t believe the traffic, and every place is packed, no parking at the mall.

Of course I thought she would say what a zoo instead, geez Robert Ca. must be the place to live, what excitement wish I could afford to live there why did you guys move away.

I just paused and she said are you there, yes I am, just wondering why my wife and I did move away I said to myself and then it hit me, I have 100 reason why, but my sister could never understand, you actually have to live there then you start your list of why.

Due to traffic, most people in L.A. live in their respective neighborhood bubbles. My bubble is Santa Monica.

There are lots of interesting events in Hollywood, the Valley, Downtown, Pasadena, that I only read about. I’d like to go see it, but I don’t, because of the brutal traffic.

People rhapsodize that SoCal has SO MUCH to offer. But what good is it, if you can’t get to it?

Son of a Landlord

You are so correct, I tell new transfers to the region in my company to take there time and choose their neighborhood wisely, as that is where they will spend the majority of there time.

My wife and I live where we live because we like the theatres, hollywood bowl, restauraunts, etc… that living closer to the central city offers. So we pay that premium price to live in a more modest place so we can be here. If we moved to Valencia into the big home we could afford, we would never be in our hood again because of traffic.

I have good friends who live in Playa Vista who might as well live in Chicago for how often I actually see them.

I look at LA the way I do Manhattan — a collection of villages. Even on an island 7 miles long and 1/2 a mile wide one tends to stay in the ‘hood. I’ve lived a long time in both. My current village is North Hollywood – Burbank.

Everybody needs to at least get NEUTRAL inflation by owning their primary residence.

Leave a Reply