Real Homes of Genius: Today we Salute you Bell. 551 Square feet for $349,999. No Bubble Here.

The market has gone completely bipolar. A few weeks ago, the market was tanking and practically every day, we were hearing about one after another lending institution collapsing. Now, we are riding the stock market to prosperity once again thanks to the Federal Reserve and easy money (you can use these interchangeably). Even though we still hear about lending institutions tanking this is already baked into the market since data doesn’t matter anymore. This past week was full of pyrotechnic housing fireworks. Let us recap the week:

Fed drops funds rate to 4.75

Stock market soars like an eagle on methamphetamines

Dollar index falls below key support levels

Gold shining at 27 year highs

Oil prices keep chugging along

And guess what happened to the 10 year Treasury note?:

It actually went up! I’m not sure why so many in the housing industry think that the Fed has some kind of direct impact on the direction of long-term interest rates. Do you now get that they are simply bailing out Wall Street and hedge funds? Take a look at the stock market and you should get a clear idea who has gained the most benefit. They have a massive impact and influence on direction but this doesn’t always hold true. Fears of a falling dollar, inflation, and rocketing commodities had a larger impact on the direction of rates. And LIBOR rates that most adjustable rate mortgages track is still holding strong. We aren’t having a 30 year conventional fixed mortgage crises; we are having an exotic banana republic mortgage credit debacle. Thanks Ben for that .5 cut which does very little for 9+ percent subprime loans! Making lending standards more lax at this juncture may not get you into MENSA so let us take a look at a case example. Today we salute you Bell with our Real Home of Genius Award.

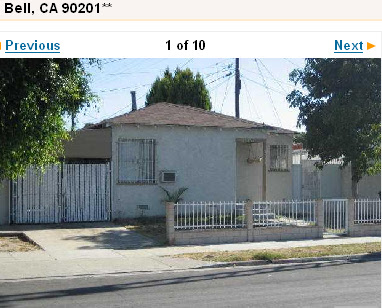

Today’s home is one of the smallest Real Homes of Genius ever featured coming in at an eye-popping 551 square feet. This 1 bedroom 1 bath home is the envy of the neighborhood. Who said you couldn’t have a white picket fence in Los Angeles County? This place can be your’s for only $349,999. Make sure you mention to your broker that you are looking for the Bernanke Special since it’ll save you $100 a month. What was this home initially listed for?

Price Reduced: 09/13/07 — $370,000 to $349,999

A $20,001 discount is not a bad incentive. I would not have looked any further if it was $20,000, but I’m a fan of one dollar bills with that great green portrait of Mr. Washington. In fact, I’m hearing that in a few years they’ll be collectibles since they’ll stop printing them and only dish out bills in denominations of $10 or more. I’m not buying a $100,000 boat but show me one at $99,999 and then we are talking. What does the sales history on this place tell us?

Sale History

10/26/2005: $299,500

12/30/1998: $78,100

06/29/1998: $95,970

Say what? 5 figures in Los Angeles County and within the past 10 years? This place had an 18 percent decline in 1998. This 18 percent decline amounted to $17,870. We already got that discount in a few weeks plus a few extra dollars; we’ll need those extra dollars for higher energy costs. Do you realize that this home went up by a multiple of 4 in 9 years according to the current sales price? Somehow I doubt incomes went up by this margin. Let us assume that they sell this home at the current price:

$349,999 – six percent commission of $20,999 = $329,000. A profit of nearly $30,000 if they stay in the home until the end of October and pay no capital gains tax on their profit. Again, this is assuming they sell it at their current price. Let us take a look at the neighborhood information:

Average/Household: $41,464

Median Rent Price: $900

So let us say that a hypothetical family in this area was to buy this place. Let us run their monthly budget:

PITI: $2,465 (5 percent down and 30 year fixed mortgage)

Monthly Net Income: $2,868 (filing as married with 2 exemptions)

So this family is left with $403 of disposable income each month. They are spending an unbelievable 85 percent of their income on housing. 401k? Forget it. Roth IRAs? If there is money after food. Do you see why this makes no sense? No investor would purchase this place since they would be negative cash-flowing by $1,565 a month. I know that here in California finding cash flowing properties is like finding a leprechaun. Even so, the number of investment properties bought in California has exploded over the past seven years. This was the flipping, mortgage-equity-withdrawal, and other people’s money (OPM) crowd. Apparently, this mantra is straight from the Fed because they have no respect for your American dollar and are using this OPM strategy. Too bad the other people are you and your family. Now that we are seeing depreciation in California, who do you think will buy these homes? Income ratios do not make sense so families in the immediate area are very unlikely to buy these places. Investors will not buy unless they want to feed an alligator property with no appreciation. Could it be that we have been living in a major Ponzi bubble here in Southern California and the game has now stopped? No amount of rate dropping will change the above facts.

Today we salute you Bell with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “Real Homes of Genius: Today we Salute you Bell. 551 Square feet for $349,999. No Bubble Here.”

I am not sure now what drove the housing prices. It is been almost 7 years that run have been on,but I have failed to notice appreciable decline in home values. Houses are still selling but at slow pace may be.I am sure banks and lenders been very tight who they lend money to.What I have not grasped is the,where is money still pouring from in housing. Look around in any listing available, you will see homes for sale and it still reads 700,000 plus for any decent home.

Who are these buyers who have lot of money to pay for the homes they are buying, and what kind of work they do? Is it documented income after paying IRS taxes or it is not. How they have come out with so much money we need to run a blog for that.

Will ya

@ andre

The folks buying now are the last batch of bag holders. Remember that most people get ZERO news and have no idea regarding the credit bubble.

Many of them will lose their jobs shortly.. Clueless at home = Clueless at work.

@ Dr H.

I’m actually glad that Big Ben is changing rates. Every time we see rates change and we see that it has made ZERO difference in the bottom line of the average maxed out family, the US population loses a little more faith / trust in the Fed.

Eventually folks will realize that the Fed now has ZERO control over anything more than a few weeks out, and even that control is slipping away every day.

It’ll be interesting when the credit cards start to dry up and when cars are advertised by their price, not a payment.

Right now used car loans seem to be running around 7.25%… 15% should bring the prices down a wee bit.

The rest of the world is only lending us enough money to keep us on life support until they figure out what to do with the trillions in worthless dollars. Big Ben is just giving the banks a little more time to find a bunker.

I agee that a study should be done on the buyers that are buying houses now. I have been looking for two years now. I am seriously wondering if they really know what is going on with the real estate market or are they clueless?

I just checked out a brand new home in North Fontana that has been reduced 100000USD!I bet it will come down even more!

How much money do you really need to make to afford a house that is 500000USD. Most people have no clue and those are the people buying now!

Tom in Rancho!

I’m not convinced this is easy money or a bailout. 4.75% sure gets the attention of a rational borrower, and investors are fast becoming much more rational. The 0.5% cut itself certainly won’t cause hyperinflation.

The real action was at the discount window and with lending regulations. The Fed floated very short-term loans to keep the salvageable mortgage lenders running for a few months. The ones that manage to stay in business will be good for the economy, and the near-death education they are getting is a priceless asset to the American people. The others will fail, but hopefully the illusion of government support will last long enough that Congress won’t run an expensive bail-out. Bernanke is new enough that we can at least hope that this is his master plan.

Contrast that with the debacle in the UK. Prime Minister Gordon Brown guaranteed zero losses to the people who underwrite risky mortgage lenders. This cannot end well.

@ WONDERING BUYER-

Where abouts in N.Fontana were you buying/looking? Were you looking into a new home from a builder?

I looked at a few new homes from Centex, Young Homes, and KB. This was back in December of last year. You are right they have all taken a dive in price.

Have you looked at homes off 15 @ Limonite? Something similar is happening there.

I feel your pain with all of this.

Using a standard inflation rate of 3% this house isn’t worth much more than $100k (I think that’s still too high for this POS). Given the choice I think I would move as far away as possible for this Idiocracy.

Love these posts. Thankfully there is someone sane left out there. I was really beginning to wonder. Loved the methamphetamine remark too. Is there any other explanation for all this? Makes you wonder.

I do feel sorry for all those duped by this mystical r.e. market. Watch this Rocky; Eenie meenie, chili beanie, I can make your equity disappear. Along with your life, your car, your boat, your snowmobile, your retirement, your bank account, your sanity…

Sad…very sad.

I talked to a real estate broker from the Bay Area last night at a party. I asked him about the real estate market and how sales were going. He said it was the worst ever. Lots of foreclosures and people do not have money to buy anything. He caters to the Asian community and they pool their money to get their foot in the front door. Even with the rates going down, very few can qualify. He thinks it will take a couple years for things to start moving again. He also said the mortgage companies aren’t dealing right now on foreclosures but is expecting that to change in a few months.

You ask where the money comes from? It is all credit, literally funny money. The time to finally pay the piper is rapidly approaching, and rolling the huge credit bill from one venue to another will no longer be an option. It is going to be very, very ugly.

You should bring your skills to the East Coast. Everyone talks about the NYC market being immune, but looking at some of these new developments, you wonder how many bankers are there to afford this stuff.

I am talking fringe NYC. So-called up and coming areas like Harlem and Long Island City have new developments with condos starting at 500k! This is already on top of condos in the heart of Manhattan going up over the next 2 years. I am a banker and cant afford this stuff!

I think the NYC market is headed to 1990 era collapse in many parts…largely based on analysis similar to your’s. The investment proposal is dead in these areas, and people cant afford to live in them themselves and pay the mortgage ==> value must go down.

Andre:

I agree with the previous posters and with DrHB: the homebuyers you are seeing at this late stage of the game are largely remnants of uninformed bagholders, funny-money mortgage owners, and as DrHB stated, there will always people who buy since they sold their home in areas that do not have the volatility of low-middle class areas.

One thing though: watch for a higher than normal divorce rate amongst these buyers that you are posting of should something go terribly wrong (like a precipitous drop in property value). Things will go OK in the marriage as long as there are no negative repercussions to conduct.

HOWEVER, once big money is lost, “For Sale” property is chasing the market down, and/or retirement funds evaporate, then you will see the wives divorced by the husbands as a last-ditch attempt to save themselves from financial destruction. its just a matter of “when.”

~Misstrial

@ misstrial

Did you see Doc’s post of Ben Stein’s column from a few weeks back? It was the wife saying she’d divorce the husband… search the blog and you’ll find the link. Very funny.

Doc- Some bitter kool-aid this morning?

I tend to doubt the political muscle exists to prosecute the industry for the misdeeds perpetrated. Who’s going to go after Mozilo for being the largest (by volume) purveyor of neg-am ARM’s and sub-prime toxic waste in California? Didn’t Countrywide just move their HQ to Dubai so the executives can escape prosecution? Oh, wait, that was Halliburton.

As an aside, on Minyanville, a columnist opined last week that borrowers shoulder much – most – of the blame.

http://www.minyanville.com/articles/bank-loans-housing+reforms-arms/index/a/14146

Exit said…@ misstrial

“Did you see Doc’s post of Ben Stein’s column from a few weeks back? It was the wife saying she’d divorce the husband… search the blog and you’ll find the link. Very funny.”

No haven’t seen it but I will do a search & read it through. In my limited experience, recently its been the males initiating the dissolution petitions in cases involving financials. Should this become a trend, middle-aged women are really in for it. They will never wish they “just had to have” that house.

~Misstrial

DrHB:

Thank you for your excellent post.

It is going to be interesting to see not just the financial changes brought about by this bubble, but also the social changes.

We are in uncharted waters, indeed.

~Misstrial

@misstrial,

So many factors contribute to a divorce, including financial difficulties. Other factors included are age of 1st marriage, level of education, family social class, and the stability (both mental and physical) of both partners. Then you have folks that have unrealistic expectations (i.e., I expect a 2 month Europe vacation every month but also to have financial stability) and you wonder why the divorce rate is so high. Nevada has the highest divorce rates in the Country. In addition, financial demands from work and a changing economy require couples to be flexible.

Ironically, as the economy goes into tougher times and couples need to unify even closer to build economies of scale, many start to become rigid and fail to adapt to changing circumstances. I had a friend that worked in the tech industry during the boom and got married during this time. He had an extravagant wedding and splendid honeymoon. Shortly after, his company downsized and laid him off. He still worked in the industry but financially it placed enormous strain on his marriage and issues of expectations always kept creeping up.

It would require an entire post on the economics of divorce but it is an important thing to note. Especially since many folks that divorce normally have to sell their home if they live in a community property state if they bought together or lived in the place and saw a large equity jump; many of these states are in bubbles. Many times these people can’t stand to live with each other anymore and become very motivated sellers. Right now is not the time to fight but of course the clock keeps ticking and folks will marry and divorce as usual. Hard times will put people to the test.

@exit,

I doubt any party will try to rock the boat this close to the primaries. And yes, Countrywide I believe is now hiring in India. Maybe they are trying to break into the India housing market? Even in May of this year – yes, only 4 months ago – Countrywide was announcing plans for a 50 year mortgage and expansion in their subprime division. The kool-aid is being served up on the rocks.

@andre,

Some areas will always sell at a premium, bubble or no bubble. In lower to middle class neighborhoods there is already a significant market adjustment. You can see this in the actual price per square feet of selling homes. In addition, sales numbers have fallen off a cliff so those homes that do sell are typically nicer homes in prime areas of cities.

@steve,

Even though the Fed publicly states they are watching for inflation, I think the underlying policy decisions that they are taking demonstrate that they are ten times more fearful about deflation. Remember the last time the Fed uttered the word “deflation?†The market started to go down fast and hard.

@wondering buyer,

It is hard to say Tom. Believe it or not, there are still exotic mortgages being pumped into the market. Are they to the extent of two years ago? No. But we are still seeing these Johnny come lately folks buying homes. Sales have dropped off significantly. People were still buying certain tech companies even on the way down. A rational explanation may not be forth coming.

@daniel newby,

Absolutely. Anyone who thinks that this action will help those with subprime mortgages or the buyer and seller on the street is not looking at the data. These policy moves are intended to help the financial services sector stay afloat a few more months. This was Bernanke’s first move. He has researched and studied the Great Depression and believes the Fed did not do enough to stop it. In this light, his decision to cut rates isn’t that shocking but it also tells us how he perceives the future of the credit markets. He could have easily lowered rates by .25 but his policy actions tell us a lot more. The Fed even with their previous liquidity injections is not taking a hands off approach here. They are very much involved in this current market.

@fz6,

What is the word on the street in Fontana?

@peter68,

This home had a double-digit drop in a steady market. We are going to see incredible amounts of mortgage fraud especially in lower-income areas. This will go from a financial issue alone and spread into deeper societal implications. How do you go after brokers that clearly committed fraud? Do they have any responsibility? What if they are charged with forging documents? What of the buyers? Or Agents? What about Wall Street? I am sure we will see countless cases like this emerge in the next few years. As this thing grows so will the public outrage forcing policy makers to do something more drastic.

@scott,

You know you are in a bubble when you look at every piece of economics and nothing really justifies the sky high price. Then you hear the industry leaders telling you that housing will go up because each previous year saw price gains. They were right but economically their argument had no basis in fundamentals.

@jaye,

Hard to believe but the Bay Area has just as big of a bubble as here in SoCal. California as a whole is in one gigantic housing bubble. Lower to middle class areas are being hit first and hardest such as Fresno, Modesto, and the Inland Empire.

@nl,

We can always offer multi-generational loans and drop rates to zero like the Japanese did in their housing bubble. We haven’t seen the end of funny money.

@qre,

New York City is another ball game. Instead of the sprawling Southern California land, you have a very confined space and different perceptions of what is prime property. Here in LA, a prime home away from the beach is a McMansion while in New York, it may be a loft in uptown. From looking at the numbers, it doesn’t seem like any large metro area will remain immune from this declining market.

@All,

California is once again ahead of the curve:

“The current GSE conforming loan limit for lenders willing to originate conforming mortgage loans for median-priced homes in California is $417,000; however, according to the California Association of Realtors, the median price of a single family residence in July was $586,030. Again, this disparity makes these products practically irrelevant in California,†Gov. Schwarzenegger writes in the letter to Congress.

Raise the limits, baby.

GSE Loan Limit Exceptions: Are They Really Fair?

I’ve posted on other blogs about how this Blog, LA Land and Kate in the Valley maybe saved my ass big time.

I posted on my blog about how I was in the market to buy a new house.

Up until that date – I was full-on making offers and everything; I was your typical, dumb-ass, knife-catching, would-be first-time buyer.

Fast forward to last Saturday: I go to a cook-out at a friend’s, and she introduces me to HER friend because she knew I had strong feelings about the housing market. This girl was far from an uninformed idiot: she recently finished a graduate program at one of the country’s premier Journalism schools, got a job in LA (at NPR’s Marketplace, no less) and was curious about buying and the market with all the confusing stuff in the news.

We talked for over an hour and I can tell you, Andre, people ARE NOT HEARING THE NEWS about the dangers of buying in this market.

At the most, they hear – due to the credit crunch, it’s a buyer’s market. Or perhaps until the sub-prime shakeout, you should wait awhile.

Yet, in the other ear, there is still the constant drumbeat of “if you like it, buy it!â€, or “only buy what you can afford!†or “Interest rates are still low!â€

No one is saying “houses are overpriced†except these fringe bloggers like Dr.HB. You can’t even say it on this blog with out trolls flaming the comment boards with prolonged econ 101 hack-job discussions on what “home value†actually means.

All that to say: we are a long ways away from REALISTIC home pricing is being set.

I wnated to take a quick second to thank you. We are planning a move to Florida for work reasons in Fall of 08 and I started searching for Houses–for planning purposes. I even entertained the idea of getting in at the current prices and renting it out. (I know – I laugh out loud at the thought now) Anyway, we decided to put our house on the market up here in Maine now – and rent until we move. The one thing I have taken away from your sight is the importance of price and market.

I basically looked at the 30+ homes for sale similar to mine and priced it 30th. We sold in 20 days – and will be out on Nov. 1. We got a fair price – much more than we paid back in 1999, and will be renting a nice three level –in the city with everything but electric included for about 1000 less per month than it costs to maintain the McMansion we had.

Life is good. AS for the Florida deal—we will be happy renters, I have seen 700K+ homes for rent for under 2K in Naples. I get the math now–thanks, Dr. HB

In my neck of the woods (in Colorado) one would be paying mostly for the dirt and not for the 551 sq ft, at that price.

The assumption would be that you could tear down the old building, build a new one with straight zoning that is much larger, and that the lots price plus the construction costs would produce a reasonable price per square foot.

Leave a Reply