Real Homes of Genius: The Five Figure Zip Codes are Growing. A $62,000 Median Home Price in Southern California?

If I would have told you even a year ago that we would be seeing the Southern California median home price at $285,000 many of you would have laughed and rightfully so. Yet we now know this will be the worst recession since World War II, 10 major indicators now tell us this. Even the most ardent and loyal bubble believers probably had a hard time envisioning a correction like the one we are experiencing. I know. I was one of them. As I look back at some of my articles, it wasn’t that I didn’t see a steep correction occurring but the current velocity of the decline has taken my breath away like reaching the apex of a rollercoaster only to freefall.

So what pushed California over the edge in 2008? After all, many of the factors hitting the market today were present in 2007. Why this year? It is hard to put your finger on simply one cause for this correction. I’ll give you a few that really accelerated the decline:

(a)Â Toxic mortgages like option ARMs took away the leverage borrowers once had.

(b)Â California tipped into a more deep recession than the overall national economy.

(c)Â The bubble simply collapsed on its own weight.

(d)Â Mortgage resets and price declines provided no exit for over leveraged borrowers.

(e) Consumer psychology shifted. With fears of the economy and more people having their religious bubble moment, the urgent desire to buy is now gone.

(f)Â Stockpiles of foreclosed and REO homes.

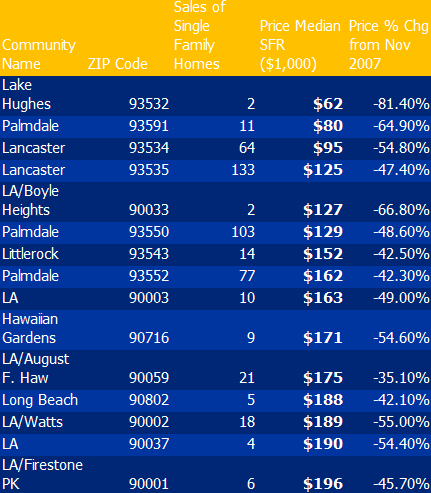

These combined with the awful global news combined to make a perfect storm. As people are focusing on more macro issues, I decided to do a quick check in Los Angeles county to see what is happening in specific niche markets. Would you believe it that 3 zip codes now have prices in the five-figure range? Or what about 15 zip codes with prices under $200,000? Let us first take a look at the list:

81 percent decline! Okay, this is a small obscure area way off in the mountains with approximately 3,000 people but seeing a 81 percent decline is stunning. But look at Palmdale and Lancaster. These areas have been absolutely hammered. Many of the home sales in these areas were to commuters looking for the pleasure of homeownership during the bubble heyday yet many of these buyers never had the ability to purchase in metro L.A. or surrounding cities. Many brave souls decided to sacrifice a mind-numbing commute for the ability of owning a home. I look at these price declines and it only makes me reflect at the power of mania in epic bubbles. Logic is thrown out the window.

I still believe that we won’t see a housing bottom until 2011 although given the current speed and velocity of the price correction, we may actually see trough prices in 2010 yet they will carry over into 2011. I’m baffled by people putting a bottom on 2010 thinking it will somehow bounce like a basketball after it reaches that price. It won’t. I think we’ll be looking at prices moving sideways essentially like Japan given that we are emulating virtually every policy move they did which led up to their lost decade(s).

You may argue that many of these areas are unique. Yet in the list we also have a zip code in Long Beach, a few in Los Angeles, and Hawaiian Gardens. For anyone that truly understands Los Angeles, the difference in one or two numbers in a zip code is a world of a difference.

Los Angeles County is the most populated county in the state with nearly 10,000,000 people. In this giant metropolis we have 88 cities and 270 zip codes. Cities like Los Angeles and Long Beach have multiple zip codes given their geographic size and large populations. Another interesting data point that I found looking at the 270 zip codes is this startling fact:

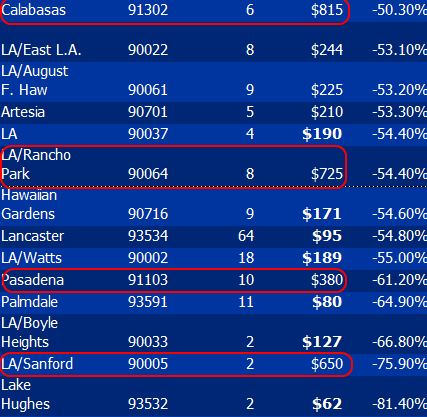

15 zip codes have now witnessed 50+% declines

Many more zip codes have already breached the 50 percent decline from their peak but on a year over basis, are down 40 percent. You may be thinking that this is only hitting more lower priced areas. That is not the case. This bubble is an equal opportunity price destroyer:

How appropriate that Calabasas, home to uber-toxic-mortgage poster child Countrywide is now seeing a 50 percent decline. Let us now look at 3 homes in the five-figure zip codes to see what we can get when we go bottom fishing. Today we salute you five-figure priced homes in L.A. County with our Real Homes of Genius Award.

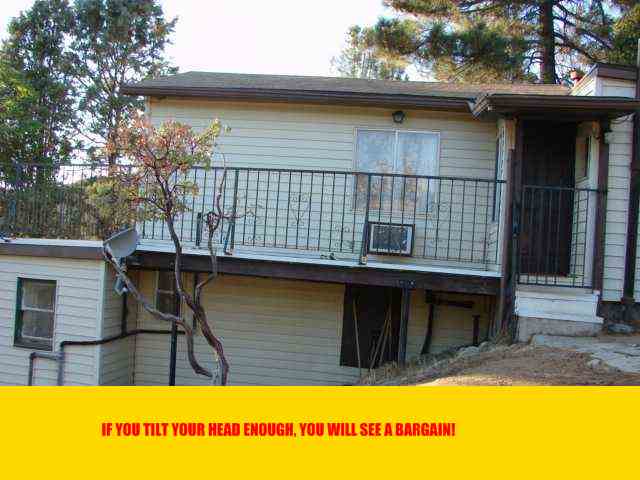

Lake Hughes – The bubble will find you even in the mountains

L.A. County has some random zip codes and areas that many people wouldn’t suspect as part of the county. Lake Hughes is one of those. Located up in the Angeles National Forest, this is a very different world from the concrete jungle that is Los Angeles. This is a very small community and how prices got to where they did is beyond me. How far is Lake Hughes from L.A.?

67 miles in L.A. traffic is like 300 miles anywhere else in the country. You might as well purchase a helicopter to commute. I doubt you’d be community from here anyways. The above home is currently a foreclosure with 1 bedroom on 964 square foot of land. The current asking price is $97,500. Yes, five-figure homes in L.A. County are here and we’re only at the end of 2008.

Palmdale – Party like its 1996Â Â Â

The Lake Hughes property is more of an anomaly but here we get into our more bread and butter Real Homes of Genius.  This home is a 3 bedroom and 2 baths home sitting on a rather large 1,595 square feet. It has a gigantic lot size of 22,000 square feet. I thought they weren’t making anymore land in L.A. County?

This home can be all yours for the wonderful price of $39,900. That’s right. For the price of a new car you can call this place, home. Now before you go running off to buy this place let us dig up some sales history here:

09/30/2008: $101,530 *

01/06/1997: $71,000

06/24/1996: $40,000

Party like its 1996! We’ve rolled back prices to the bottom of the previous Southern California housing bubble! Looks like the bank took this place back in September of 2008 when someone decided to jump on the mortgage equity withdrawal train. Party is over folks.

Lancaster – Nothing says happy holidays like boards on the window

Before you start feeling sorry for these homes, you need to dig into the details and you’ll realize people were digging into their homes like ATM machines. This Lancaster home has 3 beds and 2 baths and is situated on 1,572 square feet. Big homes for bargain prices. The current list price of $61,750 may seem cheap, but I found a dozen more in this area in the $40 and $50 thousand range. Prices now matter and people are paying close attention.

I love how the ad tells us this is a “contractors special” since the windows are boarded up and the grass is yellow like the blistering Lancaster sun in the summer. If you run the numbers, this place is selling for $39 a square foot! At the peak you were lucky to find faux granite countertop for this price. I love how the ad also tells us this place is “centrally located” – centrally located to what is the logical follow-up question. Let us look at some price history:

Sale History

10/24/2008: $101,156

04/23/1997: $46,000

07/18/1996: $42,630

Someone got busy either refinancing or pulling equity out. Given the last price, I would think it was an equity withdrawal situation. If you look at many homes in Palmdale and Lancaster you’ll see a similar pattern. Some foreclosed homes will have a sale price of say $30,000 in 1999 then you’ll see a foreclosure noticed posted, the home is for sale at $40,000 yet the price at which the lender took it back was at $110,000.

With so much economic news being thrown around, it is easy to sometimes forget what caused the bubble. Look at these homes and you’ll completely understand why things are unfolding as they are. Today we salute you L.A. County five-figure homes with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

17 Responses to “Real Homes of Genius: The Five Figure Zip Codes are Growing. A $62,000 Median Home Price in Southern California?”

Happy Holidays to all! Great post Doc. It has now been two years since I began reading your blog. It has been truly amazing seeing all that you predicted come true in spades. I recommend you everywhere I go. I came across your site after wanting some information on house buying. You have taught me so much. Thanks! Haven’t bought yet BTW.

I grew up 90059 and I have to admit it was crazy seeing my parents duplex being appraised for $458,000 when I convinced my dad to refinance to a lower rate. My dad has rental income and his mortgage is about $1000 so he doesn’t care.

I just got back from Vegas and it was pretty empty. My wife and I stayed on the strip (Planet Hollywood) for $69/night with comp. meals, gaming chips, and a room with a view of the Bellagio/strip. Wife wanted to watch the phantom and the place was 2/3 empty. Shops were empty and those shopping were bag less. Wife also wanted to stop by some of the outlets on our way back and they were relatively empty it being two days before Christmas in all. From reading your blog and others I knew that Vegas had a bad economy and housing market but it was just sad seeing how bad things are for people there. Like you have mentioned Doc houses could cost $100,000 and rates %4 but if people don’t have jobs they cant buy, or at least not locals. To think that things can get that bad here is scary.

One last thing, I found a property on Redfin that looked tempting and went out to see it. To make a long story short I spoke to a Redfin agent and in our conversation she says and quote “banks have been waiting to get into the real estate market and this is a perfect time for them” I was speechless. She then says that one of the homes had 100+ offers at which point I just bluntly asked her “in your honest opinion how many of those offers would really close.” Do you think they would meet income requirements? etc. etc. I think the comment caught her off guard then she stumbled and said “well the home sold.” Didn’t really reflect well on Redfin IMO.

Interesting-

I just got a letter from the taxman today about an unsolicited property tax reassessment on my dad’s place- lowering the taxes $700 next year if I just send in $179 to pay for the processing- that’s like a 25% drop in property taxes in a year.

SOMEONE IS GONNA GET HOSED ‘cuz if the county’s doing this for many people there’s gonna be an UNIMAGINABLE constriction in county income and thus ability to pay for jobs and services.

And of course I feel I must point out that I mentioned here months ago pre-bailout that one of Mc Cain’s PRIMARY objectives in his hugely unpopular proposed program to artificially maintain property values must have been to avoid these huge downward reassessments and the huge changes they would necessitate.

This is why it’s unseemly for there to be so much schaudenfaude expressed so freely here lately this is a time to pray hard that some really awful things don’t happen to us and those we love.

Happy holidays everyone and esp. the Doctor-

“You may be thinking that this is only hitting more lower priced areas.”

No, I am not, and I wish you would quit saying that 🙂 Like Muhammed Ali used to say, pound the body and the head will fall. I would argue that California is especially vulnerable to a collapse at the upper end. Investments in almost everything have gone down 50% or more. Most hedge funds made their returns by astounding amounts of leverage. Many of these will go bankrupt, and investors will lose all PRINCIPAL as well as return (think of how many Madoff investors were WIPED out!). Many, many others will lose 60, 70, or 90%.

As you have pointed out numerous times, California is overly dependent on the FIRE economy. That will come back about the same time as…. O, lets see…NASDAQ 5000!!! (about 2054).

As technology expands (CGI computer generated imagery), the reason for Hollywood hegemony declines. The amount of entertainment content on the net is overwhelming (go to Atom films – all free – and many other sites for independent films). It wasn’t that long ago that “I Love Lucy” had a 90 share. Seinfeld was considered a highly rated show with 25%. CSI is the current ratings champ with 15%. All the entertainment industries are facing cutthroat competition. People have chorices!!! They don’t HAVE to consume what Hollywood serves.

The latest data says that 30% of mortgages in San Diego County are underwater.

http://www.voiceofsandiego.org/articles/2008/12/22/housing/847underwater122208.txt

I love the end of the article:

Fred Eckert, title rep at Chicago Title, tried to find the silver lining for the underwater statistic:

“On the plus side — 70 percent are still OK,” he said.

I think you mis-spelled PALMDIRT?

That house in Palmdale has a 22,000 sq ft lot? I think that ‘piece of fence’ is a place to tie up your horses! Yee haaw!!!

regarding the observation that 15 zip codes have dropped by 50% or more…

–

This is something that has to happen, and it is not the complete drop. For instance, down here in Orange County, the median house price exceeded $600,000. To finance that on a traditional 30 year mortgage with 20% down, the minimum income on a 5-6% mortgage is over $180,000/yr. The median income in orange county was around $60,000/yr at the time. That quite plainly indicates that proper valuation would be approximately one-third as much as the peak prices. To go the other way on the numbers, less than 1.5% of the county’s incomes were sufficient to support a traditional mortgage on half of the county’s housing units.

–

Now I’m not an economist or anything, and I’m not trying to blow my own horn here, but this is stuff I’ve been saying for at least 4-5 years now, and yet I still hear the talking heads on TV saying things to the effect “nobody could have seen this coming” or “we’re optimistic that prices will recover soon” or “there’s no telling just how low prices will fall.” All BS. A minimal understanding of finance could have predicted the mess, the only point prices need to “recover” to is affordability, and prices will continue to fall until they are met by a combination of income and credit that will allow people to purchase homes on an affordable basis. Period. It’s not rocket science.

Great write-up! The best thing that could happen to those houses would be a big bulldozer. The bankers are so smart, shrewd really, they acquired all that real estate and did it with taxpayer funds.

Changing zip codes by a couple numbers may mean worlds of difference, but that can happen even within a zip code. 90005 is a good example as this is one house listed…

http://www.redfin.com/CA/LOS-ANGELES/636-S-HUDSON-Ave-90005/home/7091104

Yet if you head east past Western it’s a whole different world within the same Zipcode.

Just north of 90005 is 90020…another east/west zip code.

In 90020, you have the Ahmanson Mansion for sale…

http://www.redfin.com/CA/LOS-ANGELES/401-S-HUDSON-Ave-90020/home/7091040

Beck’s (the singer) house…(I think he’ll lose some money on this one)

http://www.redfin.com/CA/LOS-ANGELES/Unknown-90020/home/16892586

and if you head east, you have houses like this one…

http://www.redfin.com/CA/Los-Angeles/500-S-Berendo-St-90020/unit-410/home/7089688/bankOwned-3108019

Worlds of difference within the same Zip Code. Medians are tricky deceptive numbers due to the sales mix even within a certain area or zip.

So what pushed California over the edge in 2008? After all, many of the factors hitting the market today were present in 2007. Why this year? It is hard to put your finger on simply one cause for this correction.

You forgot to add high gas prices to the list for most of 2008!

Another good post Doctor, thanks.

Thank you for the info.

Eventually, maybe this poor teacher will be able to afford a home.

Happy Holidays!

I love these posts, you just made my Christmas. I’m seeing areas like Torrance and Culver City starting to get killed. Looks like the main attraction is about to finally get underway.

I love these upbeat posts of Dr. HB. Let’s not forget it is not a crisis for everyone. It‘s a wonderful time. How about people like me waiting for this bubble for 5-6 years to become a history!? And what a history it makes. 😉

After the insane ride of 2008 we have all been numbed to a great degree. What would be surprising anymore? I think it is just a matter of scale, as these homes indicate. $53 trillion of debt is not a lot, if it is just virtual dollars–just write $53,000,000,000,000.00 –that was easy. The problem is that all the real dollars are becoming virtual, as well. It’s amazing to see the great rift that is forming with the massive inflationary plate undergoing subduction from the deflationary plate. By some measures the two might appear to cancel one another out, but energy is neither created nor destroyed–it just changes form. These pressures are building and will probably snap with the next major event. That could very well be the Alt-A/Opt-Arm avalanche of 2009-2011 as the Doc has so carefully presented in his thesis that last few years. Earthquake followed by tsunami is the natural course here. We’ve already got our boots on from wading through the BS all this time…

What’s going to happen in 2011 to magically drive up home prices?

Nothing.

In a few yearsm baby boomers start to die off and all those houses go onto the market. You can’t really see an end to this until 2018 or so…

2011? Forget it, unless you can provise a compelling reason…

Totally agree that 2009 is going to see prices continue to drop. At the pace things continue dropping, I think it’s unlikely prices will drop a lot in 2010.

I also totally agree that it will most likely take a while for things to start going up in any meaningful way — unless there’s some sort of artificial stimulus (which there sure could be).

When people ask me if it’s a good time to sell, I tell them, well, it’s a bad time to sell compared with a few years ago.

But is it a better time to sell than a year or two from now? Maybe so.

If prices continue the way they’re going, the answer is yes. If these trends continue, you’ll likely have to wait 4-5 years to see home values at where they are now.

But if you are going to sell, you need to be realistic. Cut your losses.

Leave a Reply