Real Homes of Genius: Culver City Housing Bubble. Housing Shadow Inventory in Action. Countrywide Bank Owned home versus Duplex on Same Block. Foreclosure Holiday.

The shadow inventory issue will be an important factor in how California home prices move in 2010. It isn’t a question of shadow inventory existing since that has already been established but how banks are going to proceed with leaking out the inventory to the market. One spigot used in 2009 revolved around the HAMP loan modifications but as we are finding out, much of these last minute deals simply delayed the inevitable since only a handful of trial modifications became permanent. Yet banks realize the razor edge they are walking on. Should the real inventory make its way onto the market local area comps will be depressed and prices will fall once again. And keep in mind prices haven’t been surging up. We have placed duct tape on the massive crack in the shadow inventory dam and homes are starting to leak out.

Here in California shadow inventory is massive. It is likely that we have the same amount of inventory in the shadows as we do in the actual public MLS. The way home values are derived come from recent local area sales. Bank owned homes sell for much less so banks are holding off inventory trying to allow the artificial supply to juice prices so they can release inventory onto the market later creating a mini bubble. The only reason banks can even do this is because of the crony banking laws and the fact that they have trillions in taxpayer bailout money. The irony of course is that it is a win-win for banks. They can hold off and sell homes at an inflated price with taxpayer money to taxpayers thus taking them for a ride twice. At a certain point you wonder if the public will keep on taking this since lower priced homes will make more sense in this climate with high unemployment and lower wages.

The good news is the shadow inventory issue has gone mainstream:

Source:Â L.A. Times

“A supply of 1.7 million homes headed for sale because of foreclosure or delinquency looms over the nation’s housing market, which could dampen progress toward recovery should the Obama administration fail in its efforts to aid struggling homeowners, researchers said.â€

It is also hard to see what lurks in the shadows when banks have effectively issued a foreclosure holiday:

“Some lenders have declared limited foreclosure moratoriums this year to give troubled borrowers time to catch up on their payments or work out other solutions. Those announcements continued Thursday: Mortgage titans Fannie Mae and Freddie Mac said they would suspend foreclosure evictions from Saturday to Jan. 3, and Citigroup Inc. said it would suspend some foreclosures and evictions from today to Jan. 17.â€

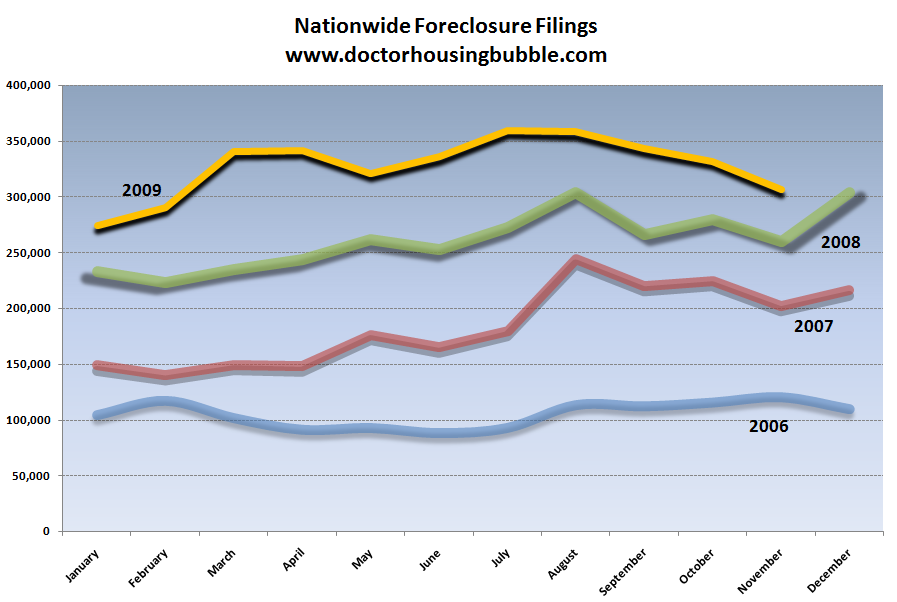

That is certainly a nice holiday gesture by Fannie Mae and Freddie Mac but what does pausing the foreclosure process do for someone with no job? And isn’t that really the problem here? If incomes and our economy were healthy not many would be concerned about housing prices. The problem is how we’ve dealt with this crisis. Everything centered on housing because that is where crony Wall Street had placed its massive bets. We had equity injections into banks. Then we nationalized Fannie Mae and Freddie Mac. When that didn’t work, we started with moratoriums. Basically this was the “allow the scab to dry†fix to the housing market. That still didn’t stunt the tsunami of foreclosures. Then banks straight out allowed people to stay in their homes without them making payments. The government then stepped in and issued the HAMP initiative. With this, the government basically decided to give people option ARM lite loans for their problems. And people are still stunned why foreclosures are near their peak:

9 consecutive months with foreclosure filings over 300,000. Yet somehow the market is healthy. Well with moratoriums and banks not moving on non-payers of course everything looks good. This is like credit card companies only reporting data on those paying their bills.

Yet the underlying problem still hasn’t been fixed. That is, millions of Americans still can’t afford their mortgage payments. The growing backlog of shadow inventory is merely a reflection of this problem. Even so-called prime cities don’t appear so prime when you cut into their data. Today we salute you Culver City with our Real Homes of Genius Award.

Culver City Duplex versus Shadow on Same Block

The interesting thing about shadow inventory is your neighbor might be gearing up for a strategic default and you have no way of knowing it. You probably don’t care but what you should care about is what a foreclosure sale will do to your own property values. If there were only a handful of distress sales it wouldn’t factor too much in a large city. But have a distress inventory the size of the MLS and then you have problems.

The above home is a duplex for sale in Culver City. The property has been listed on the MLS for 270+ days. This two unit property has two bedrooms and one bath and another one bedroom and one bath unit. Let us look at the pricing history on this place:

Price Reduced: 06/03/09 — $695,000 to $650,000

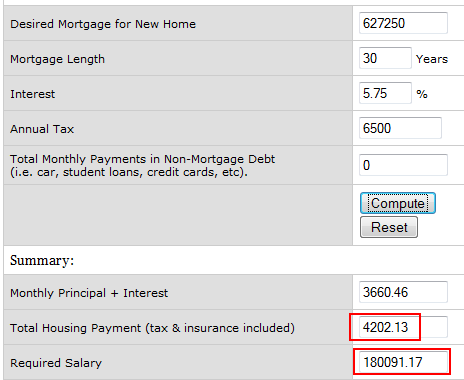

Now for someone buying this place, you would need to approach it as an investor. Let us assume that you wanted to live in one of those units and rent the other. Let us first run the numbers on your FHA insured loan:

3.5% down payment:Â Â Â Â $22,750

This above chart is so incredibly important. Just because you can technically afford a mortgage doesn’t mean you should get it. To buy this duplex someone will need to have a gross income of $180,000 and a down payment of $22,000. But that is only the first step. FHA insured will work if you occupy one of the units. Do you think someone making nearly $200,000 wants to live in a 2 bedroom duplex? Nothing wrong with that of course but you are spending $650,000 here. In some states you get a helicopter launching pad for that price.

Some obsess with the monthly payment number. Okay. Let us look at that as well. Your monthly outlay comes to $4,200. Assuming you live in one of the units, how much do you think you can get for the other unit? Do you think that you can justify a $4,200 a month outlay here? That works out to $2,100 per unit (give or take for the bigger unit). Yet this is the kind of amateur logic that is used when valuing real estate. What if you have a vacancy? What if the roof needs repairing? What about upkeep issues? Your costs keep on increasing. It is nice to simply run the numbers and assume you will have a full rent check each month but anyone who owns rental property understands this is merely a hopeful dream. Reality is much different.

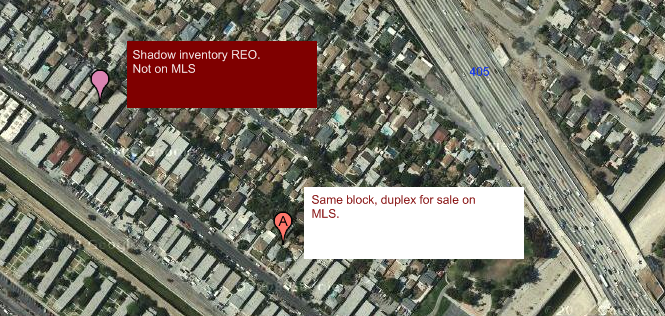

So this duplex is on the market for sale for all to see. But what you don’t see on the same block is part of the shadow inventory:

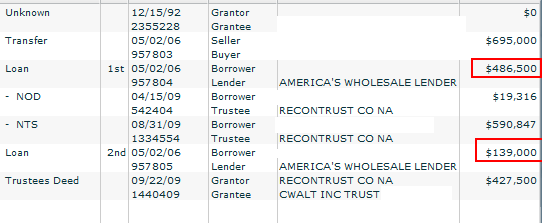

The duplex is listed as “A†on the map above. Oh, and after a bit of investigation we find out that the property is next to the freeway. At least you have easy access. The shadow inventory bank owned home is a 3 bedroom and 2 baths home. It is listed at 1,169 square feet. This home has an interesting history:

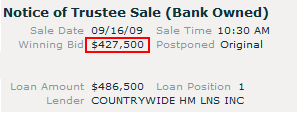

At foreclosure this home had $625,500 in loans. The home fell back on payments and ended up being foreclosed. What price did the bank take it back?

The initial loan amounts were $625,500 but the bank took it back for $427,500. That is a 31 percent drop. But you know what? Does a falling tree in the forest make a sound? Apparently not because this price adjustment isn’t factored into the current median price data.

Culver City (90230):Â Â Â Â Â Â Â Â Median Price ($530,000) y-o-y drop of 9.3%

Culver City (90232):Â Â Â Â Â Â Â Â Median Price ($715,000) y-o-y drop of 4.5%

Now don’t you think that if this home was on the market the above data would be different? The home was taken back by the bank in September. So it has been a few months. Why isn’t it back on the market? Because banks are using your taxpayer dollars to create an artificial market and trickle inventory back into the city. This is a lose-lose for taxpayers. How? Prices are artificially kept in a bubble while banks keep sucking money like financial vampires on taxpayer money so they don’t write down loans that they made at the peak of the market. Make no mistake, this is their fault. And if you think about it, they are the only entity not suffering. Everyone else suffers above. Why?

-The previous owner got his punishment by losing his home to foreclosure and bad credit.

-The taxpayer gets taken for a ride because they now are funding the banks little experiment of keeping inventory off the market. Prices artificially go up so a new buyer pays more because of his own bailout!

-The bank wins because they can keep sucking money from the taxpayer while allowing inventory to trickle out into the market one by one and buffer their write-downs.

This model is clearly unsupportable. Starting next year, a new commission will be looking into the causes of this financial meltdown. The fact that they are starting the approach in the past tense is completely wrong. The crisis is still going on. Banks are largely responsible for this mess. This form of corporation run government is troubling. Clearly people can see the sham that is going on with shadow inventory. This is a complete robbery of the American people. Think of the case above. If the REO home were to sell at the market rate prices would depress for the block. Is this so bad? Doesn’t that mean that a future home buyer would have to take on less debt to buy a home? Plus, local area incomes do not support current prices.

The phony numbers will keep coming out but 2010 will be a critical year. Do people demand transparency in shadow numbers or even the Fed balance sheet or do they turn a blind eye and allow our entire financial system to be run as if it were a Bernie Madoff fund?

Today we Salute you Culver City with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

20 Responses to “Real Homes of Genius: Culver City Housing Bubble. Housing Shadow Inventory in Action. Countrywide Bank Owned home versus Duplex on Same Block. Foreclosure Holiday.”

Sounds like it’s pitchfork and torch time! Where should we go Doc? Who’s door should get the battering ram?

The duplex in Culver City looks to be worth less than $300K to me.

If Wal-Mart buys 2,000,000 homes in CA, do all their property taxes remain at the level they purchased at under Prop. 13? If so, there’s yet another problem where investors make out hand over fist and contributes to the problem of why renting is considerably cheaper than buying in CA.

The whole system is a Casino and Wall St., banksters, and corrupt politicians make the rules.

I have a GREAT idea! Let’s all fight and call each other names because banana republicans are better then DEFAcrats! In the meantime, they both sell us out to line their pockets.

I have mixed feelings about starting the “pitchfork and torch” routine. On one side I want the gov’t to come down hard on the banks to abide by free market practices. But I feel that if we complain to older brother too much, Obama will simply bailout all the homes underwater which will do nothing for lowering prices. (A bunch of people will get to keep their homes who don’t deserve to.) The market will still correct itself because wages aren’t going up any time soon, but it’ll take a lot longer.

Sadly, Saving4TwentyPercent is right. Now that obama has been unmasked for what he really is (milquetoast, lying campaign promises, etc.) and his cabinet is full of the same crooks (with obama-issued “ethics waivers” no less) who engineered this mess (and continue to do so,) I’m afraid we’ll have to write off the next three years before having a chance for real reform. Of course, by then, it will likely be too late.

In addition to all the other problems with California real estate, you have to consider what happens if the wealthy and civilized citizens keep leaving at the same rate. Even a cheap house is not worth the bother if the bulk of the neighborhoods are populated with semi literate wards of the state prone to theft and violence. How much will the neighborhood change in five years?

It is probably better to rent a small apartment or condo in Newport Beach, etc. than to own a house in a marginal area. Stability has fled this state, in the financial, political, and quality of the people sense of the word. I believe we are in a death spiral and there is no going back to the “Iowa by the sea” days of the 1960’s. California is third world to the bone now.

You just made my Top 10 List of Real Estate Blogs. Congratulations & Merry Christmas.

Megan

http://megan-mcginnis.com/719/top-10-business-real-estate-blogs-on-technorati/

Well the beneficiary of the shadow inventory is clearly homeowners not in default. Since supply is artificially constrained, the demand curve is steeper and homes perceived value remains higher than they otherwise would.

The bigger question of course is what the long term consequences of the shadow inventory will be. It would seem that one aspect of the housing bubble and associated shadow inventory serve to make the US itself less globally competitive as home values and associate debt need to be serviced. In other words high home prices neccessitate high wages to service debt. Of course this debt and wages to support it serve to make the US less globally competitive.

Longer term given the changes to FASB re: mark to market time lines will with near certainty keep the shadow market in play. During the bubble times banks and homeowners nearly marked their assets up annually if not more often. However, now with the FASB mark to market accounting banks are allowed to value assets (homes) over 5 or more years. So if you are a bank, with REO property what is to stop you from taking this 650K culver city duplex and mark it up to 850K with a 5+ year ‘mark’? Nothing from what I can tell. And the up side if you are the bank is that you can record that difference as profit to the good old balance sheet. My suspicion is that we will see more of this in 2010. Banks making money as they mark assets up using their accounting practices over larger time lines.

For the country it seems likely we are in for something very similar to the Japanese stagflation of the 90s. The more scary thing as I see it is that the US itself doesn’t produce anything with exports accounting for only 10% or so of GDP. And given the wages paid in the US and the global market I don’t see that turning around any time soon. Which of course makes one wonder what if anything is going to spur demand to bring us out of recession. And if it is government stimulus, spend in the ways of the current economy is broken down how sustainable will that be. Scary stuff to be sure.

Well, we voted them in the office. Why don’t we happy with it. USA really need a new political party to replace those Republicans and Democrats. They are corrupt to the bone. What bother me is the crony bankers messed up the systems and they received millions in BONUS and billions in bailout. Our government keep giving them the money. Should them be HANGED (or executed as in China) instead? I am fed up with those Democrats & Republicans.

The area has a Culver City zip code but it is technically not in Culver City. The area is west of Culver City and is known as Del Rey, Los Angeles. It is predominantly lower income neighborhood with a demographic that is mostly Latino. The lots are very tiny, narrow streets, many apartments, a project, and graffiti all over.

In 2010 the continuing saga of falling apartment rents will foil the banks plans of stabilizing the housing median price by keeping inventory off the market.

The bars on the doors and windows of this duplex are very impressive in an inner-city sort of way. This looks like something I could buy in Detroit for $400.00. Based on what Matt says, my gunfighting skills would have to stay sharp if I moved into this one. $650K!! Wow!!

How much would this thing have to drop to actually reflect the income of the neighborhood’s residents? Is there any way this thing could work as an actual investment? Doesn’t look like it!

The banks can be foiled if people refuse to buy houses for a while, a year at best. The banks have to hold on to the houses, receiving no mortgage payments. They have to keep the houses up, to some extent. Let the yards go to weeds, and the paint peel, and they won’t sell them so easily. They will also drive down property values in the entire neighborhood, as who wants to buy even a nice house, if several houses on the street are rundown “shadow inventory” homes?

As to all the moratoria and low rates the banks are extending to the defaulted homeowners, that is not a long-term solution. What the banks want is a bunch of foolish and overeager people to step in and buy these houses from the struggling, overextended current “owners.” Keep the prices up, keep the market inventory down, and force would-be buyers to pay mid-bubble prices. But if people aren’t willing to do this, to fall for the scheme, prices have to come down further at some point. There is no way around it. In California, the median income in no way supports the cost of a median-priced home.

Don’t conduct your own bailout of the banks, by buying houses whose price is being artificially inflated with short-term silicone. If you buy more than you can afford now, it is very unlikely that there will be another government bailout. You’ll owe that money for decades.

Banks can artifically keep prices high for awhile by limiting inventory. But, the shadow inventory keeps getting bigger and bigger each day, and soon everyone will know about it. A few smart banks may open the floodgates before the others do and capitalize on high prices. Others may foolow as the reglatory noose starts tightening.

Throw in losses of GOOD jobs along with Strategic Defaults and the banks will be drowning in properties. It makes you wonder how upside down your neighbor is, and how it could affect your neighborhood. IMany Westsiders bought with toxic loans beginning in 2001-2002. Beware of your recent neighbors!

http://www.westsideremeltdown.blogspot.com

I wish everybody a Merry Christmas and a happy and prosperous New Year.

We have a home designer that works with us and she told us how so many of the McMansions she works in, the people are so budget contrained that they have no furniture at all on the top floor. The appearace is that they are well off, but the reality is they are just getting by. I’m sure much of CA is the same way, now that the drive-thru ATM in the kitchen is closed. Plus most cats and racoons no longer qualify for HELOC’s any more.

Still, Fed is on the highway to hell and there aren’t any good choices left. If it’s either re-bubble or WW-III. I’ll try the former. Too bad we didn’t build any pyramids or stuff so future civilizations can ponder over why we vanished.

flippers are still flipping, and making a flipping forturne.

http://www.youtube.com/watch?v=om10ZCFzDGg&feature=player_embedded

@ Kid Charlemagne – IRT your comment: “…Too bad we didn’t build any pyramids or stuff so future civilizations can ponder over why we vanished.”

Actually we have – landfills – containing all our “valued possessions” (typically from China via Walmart)…….Should provide plenty of “source material” for countless “studies” for future generations to ponder endlessly.

(excerpt from): http://econospeak.blogspot.com/2009/05/60-of-chinese-exports-to-us-are-from.html

…. [7] Kissinger Associates and Walmart folks know all about the true nature of US trade with China, after all. Walmart is China’s fifth-largest export market, ahead of Germany and Britain. [8] and is responsible for approximately 10 percent of the United States’ trade deficit with China. …..

But not to worry — as California can always work harder to raise the quantity of its No. 2 “value-added” “high-tech” export product to China up to “No. 1″……..(and lead the nation as well)…….!

CHART OF THE DAY: California’s No. 2 Export To China: Trash

http://www.businessinsider.com/chart-of-the-day-californias-exports-to-china-2009-11

In 5-10 years this area of Culver City will look like the ghetto that it is. I wouldn’t pay $60,000 for that duplex. This area is going to look like Detriot in 25-30 years. Get ready, people!

why does that moron think that slummish place is worth 300,000 when 45,000 is more like it….bit for the difference in tax going to pay for crony capitalism and bleed the common sap into poverty again?

“Paths to reform” don’t all involve pitchforks, torches, and voting.

~

The most powerful thing Americans can do to stop this mess is refuse to buy till prices come down.

~

But as we all know, many, perhaps most, are just in it for the best deal they can get for themselves while passing along the costs, or outright screwing, the other guy.

~

As for the CC duplex for $650K? Hell, call CCA–Corrections Corporation of America. The prison bars are already installed. Single storey would make surveillance gear installation a snap. Plus it’d take a helluva act of faith to view the numbers on this place as anything other than a boondoggle, and CCA constantly trumpets their “faith based” incarceration programs. CCA could afford the duplex, and turn it into a money engine. Plus that high-density pink establishment right next door might provide a supply of inma…er, residents. Win win. Right? RIGHT?

~

sigh

rose

Leave a Reply