Real Homes of Genius: Anaheim Half-Off Sale! Down 40 Percent in Less Than Two Years.

Considering all the fireworks last week with the global market meltdown, the Fed dropping rates in an emergency session, and the government sending money to everyone (told you it would happen) not much came of it in the end. After all the shenanigans, where did the week end?

DOW Jones: Up 47 points or .39%

NASDAQ: Down 20 points or .88%

S&P 500: Up 5 points or .41%

So all that work and panicking and the market moved sideways for the week. Except we now have the Fed adding fuel to the flame and the government getting ready to fire up the printing presses. This will cause inflation. Printing money out of nowhere is inflationary by definition. We will still have sector deflation in financials and housing but it is very possible with this $150 billion stimulus package that we will see consumer side inflation. Incredibly, many companies that announced abysmal earnings or future potential did amazingly well last week:

Ambac Financial: Up 84% for the week

Bank of America: Up 6.9% for the week

Lennar Corporation: Up 22% for the week

Mind you that we have one insurer, a bank, and a builder all shooting up during the week.One is on the verge of bankruptcy, one announced dismal earnings, and the builder announced a $1.25 billion quarterly loss. And these are the sectors that rallied. So when you dig deep into your soul to see which companies the Fed cut really helped, you need not look any further than the stock market.USA plutocracy where corporate welfare is the way of life and downside risk is hedged on the backs of the lower to middle class. That is 80 percent of the entire population. If you thought this week was packed with excitement just wait until next week:

| Date |

Source |

Event |

|

1/28 |

Census |

New Home Sales |

|

1/29 |

Conf. Board and |

Consumer Confidence |

|

1/29 |

Countrywide |

4th quarter earnings; yearly report |

|

1/30 |

The Fed |

FOMC Policy Statement |

|

2/1 |

BLS |

Unemployment Rate |

So get ready for a whole lot of action on the markets. The week will give us insight into the sentiment of the American consumer and how well employment is holding up. It will also give us an idea of how things are going at Countrywide. If numbers are low with new home sales and Countrywide reveals something unusual expect the Fed to cut rates like a maniac. Frankly, I wouldn’t be surprised at anything at this point since looking at who did well last week, this is starting to look like a financial and housing sector bailout except those on main street will not get to benefit. I’m amazed at how many in the housing industry, the rank and file think raising caps is somehow going to rejuvenate this housing market. It is not. We have a decade long overhang that will take years to filter out. However, your industry leaders are making out like bandits while giving you the impression that this will be the silver bullet that will revive the market and happy days will be back once again. For those that need any further evidence, let us go into the trenches. Today we salute you

Real Homes of Genius

Today’s home takes us to a bank owned property in

This home is a 3 bedroom 1 bath home on 1,300 square feet of housing goodness. It was built in the 1950s but so what, this is

11/08/2007: $586,046

09/21/2006: $665,500

08/31/2005: $610,000

Fool me once, shame on you. Fool me twice, shame on me. Full me three times, shame on Bernanke? Many of you not familiar with this area are saying, “so what, this is

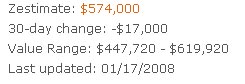

That’s a picture of

I love that value range. A $170,000+ range. Bwahaha! “Hey Joe, I love this computer. How much will you sell it to me for?†Followed by, “well Johnny, I have it priced in a value range of $500 to $5,000.†Myth and bubble legend, meet reality. And guess what the economic data for the area shows us?:

Average Household Income: $55,000

Median Rent for Similar Home: $1,825

Let us run the numbers for the person that bought the home at $665,500:

PITI: $4,689 (Jumbo rate of 6.5% and 5% downpayment)

Now you are telling me that if you can rent a similar home for $1,825, that you are willing to pay $4,689 a month? Forget all the tax advantages because that comes after the fact, you still have to pay out of your monthly nut $4,689. An average household in this immediate area can’t even afford this if they put 100% of their income to their home! You can’t even purchase Top Ramen at these levels. Even the current price will stretch the income of families in this area.

Today we salute you

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

14 Responses to “Real Homes of Genius: Anaheim Half-Off Sale! Down 40 Percent in Less Than Two Years.”

One point you always bring home Dr is its the income stupid it was always the income. I don’t live in a bubble area as bad as OC but Colorado prings has to many houses over 300k. I am in the top 10% of wage earners with a 90k a year salary and can’t buy much more than a starter home. All these idiots Realtors out here can say is rates are low and so is unemployment why won’t people buy? Well duh you can’t qualify for a 400k loan on a 50k salary anymore and you never should have been able to in the first place.

While I agree with you almost entirely, there is one point (that you have made before) on which I believe you are wrong: “Forget all the tax advantages because that comes after the fact, you still have to pay out of your monthly nut $4,689.” Assuming you have actual income (yes, I know that may not always be true), you can take advantage of the tax deduction each paycheck (or quarter). You don’t have to wait for a refund.

If you have a job, you have income tax withheld from your paycheck. If you know you have a tax deduction coming (interest and taxes) you can reduce your withholding and increase your take-home pay. If your income is not from a job, you have to file quarterly estimated tax, and can reduce that accordingly. The after-tax difference may still be bad, but the timing is not the issue.

–Kibitzer

$400,000 for that junk is still over-valued. It’s got another 15-25% correction to go before it’s all said and done.

I don’t think the stimulation money is going to generate significant inflation, but this panicked and irresponsible fed rate cutting virtually guarantees it.

Here’s an unpublicized tidbit I discovered a few days ago…as of January 1st, the treasury has dialed down the purchase limit on inflation-indexed I-series savings bonds from $30,000 a year to $5,000 a year. It’s been 30K since the bonds were first introduced in the mid 90s. Sure is peculiar timing, slamming the door on the only inflation-protected treasury instrument known by and/or readily available to common folks right as they begin to implement monetary policy guaranteed to produce significant inflation.

So in a few years when hairdressers are earning $100K in inflated dollars, those $400K houses will have buyers…assuming of course that foreign investors are insane enough to stay in the dollar investments needed to fund all those loans while they watch us inflate away our debts to them as well.

I have said it before, but I kinda get a warm fuzzy feeling from saying it again, so…

Morons! They are all huge frickin’ morons. You can pay 2.5 to 2.8 times your income on your house. And that is average over the long-term, which means that during the existing, deepening, and long-lasting (and extra crispy) Recession, you will see this affordability ratio slip close to 2 times income.

I need some Mogambo comments here but am too tired, so let’s just look at facts (more or less). Median income is $50k tops. 2.8 x 50 = $140k. 2.5 x $50k = $125k. And finally, at the bottom, 2 x $50k = $100k. And to think I needed a calculator for those!

Now, the Great American Consumer and the Facilitators from Hell (Wall Street, K Street, and Pennsylvania Avenue) ignored all that and instead confused can with should and debt with equity. The result is the biggest, nastiest, scariest BUBBLE in history. This one makes Tulips and Internet Stocks look like quarks and tachyons in comparison, tiny and fleeting.

The beauty of this catastrophe is that, despite the best wishes of this site and dozens like it, the worst possible outcome is a drop in prices. Yes, if the median price drops to $125k , then normal people can buy houses, save for college and retirement, and live happily ever after. Ignoring the fact that Americans simply no longer behave that way, we cannot even begin to contemplate the meltdown which a drop of that magnitude would cause.

House prices have officially dropped 1.8% year on year and provoked the so-called Sub-prime crisis. What happens when they drop 40%. We will go from $100 billion in write-offs to $3 TRILLION in write-offs.

Frankly, almost everyone who bought or refinanced a house, built houses, sold real estate, worked for a mortgage lender, bank, Congress, of the Fed over the past ten years should be taken out and shot. It won’t solve the crisis, but it would probably make the survivors feel much better, as well as definitively dropping the bottom out of the housing market.

This place is still 300% overvalued. It looks like a $175,000 home to me.

This is the best example I’ve seen Dr. Keep up the good work. I hope these prices deflate as fast as possible so I can use my own savings to buy a house. Not someone else’s imaginary money. Yes, I maybe dumb for doing this way but at least it is my money and it will be my mistake.

Thank you doctor housing bubble. I am seeing homes like this all over the place.

Almost every house I see for sale in cities like Long Beach, Compton, Bellflower, Lakewood, Downey, Pico Rivera, Norwalk, Paramount, Moreno Valley, and Whittier has the same scenario as this house in Anaheim. We will not be seeing a bottom for a while. We have just begun the second wave of mortgage resets and all hell is starting to break loose in the economy. It’s just funny how Bernanke’s comments a couple of months ago were that he was confident that this housing problem will not affect the overall economy. He should fire his advisors. I can’t wait for Country Wide’s numbers to come out because last I remember Mozilo was insanely speaking about a positive 4th Quarter.

You shouldn’t qualify for a loan of more than $150K on $50K income.

Also, is that family, combined income, or individual income? If $50K is two earners, take that down to $125K, because you have two sets of working expenses, two cars (bought with loans, doubtless), and a couple of kids (or 3 or 4).

I predict that as all the kazillions of dollars worth of credit default swaps, options on swaps, floaters, and other derivative crap starts unwinding, remaining solvent lenders will return to the pre-1978 standard of 2.5 times your income, which will put some real brakes on housing price inflation. We should never have departed from that standard, especially when you consider that when it prevailed, we also carried far less credit card and car debt, and saved more money.

It is paramount that the American population begin saving again, but how will we do that in a climate of hyperinflation and super-low interest? The best way is to return to the lending standards that prevailed before the late seventies and the invention of the Collatoralized Mortgage Obligation, and all its various children.

A correction of only 30% will be nothing but a fanciful dream in a few years.

What happens when the 50-100K per year jobs also go away?

Go to realtor.com put in Flint, MI and search for homes UNDER $10,000

As of today there are 203 for sale and these are real homes for around $2K. NOT monthly rentals.

How many of the 700 square foot crap shacks that we see courtesy of the Dr. are just a couple years away from being sold for scrap value?

I dont know but I just have the sinking feeling that we are not going to become like Flint Michigan.

I could be totally wrong by the way, but it is a thought.

This Anaheim house reminds me of my old house in Westminster Ca. (Orange County) 13602 Palomar St ,92683. Ca.

Single family 3 beds 2.0 bath 1,254 sqft Lot 7,200 sqft Built in 1955

Below is Z’s hilarious estimates.

ZESTIMATE®: $537,500

$451,500 – $569,750 30-day change: -$40,000

This is the history : I bought it in 1997 and sold in 06

01/30/2006 $625,000 18.3%/yr

12/04/1997 $159,000 2.2%/yr

08/11/1993 $145,000 -2.5%/yr

01/04/1993 $147,250 —

I am now seeing homeowners listing their houses in this same neighborood for 400k and below and not selling. I have seen a house priced at 375K sit empty for about a year now… its one block away from my old house ! My wife and I went out looking at houses a month ago and actually made three low ball offers.

I looked in areas that were asking 700k a few years ago . The scary part was after a counter offer from each agent they all excepted our offers at 475K. We of course backed out . Does anyone know what a good lowball price per sq foot

would be for 92647 and 92683? What is a good base to start from? Thanks for this website Doc. I read it every night. David

The story about Stockton, CA on 60 Minutes Sunday night was certainly eye opening; especially when you see the map with all the dots showing the defaults/forelclosures…

http://www.cbsnews.com/sections/i_video/main500251.shtml?id=3756665n

BK

This is one of my favorite postings so far; well written. I’ve been reading for a while now, wondering when the time would be that things finally broke. I think it’s safe to say we’re past that point, and I’m definitely enjoying the show.

Things always come back to equilibrium, depite the pleas of those who will be afflicted.

Leave a Reply