Real Homes of Genius – Culver City Home selling for $744,500 but Neighbor Home is Renting for $2,250. The Rent versus Buy Analysis and 40 Years of Mortgage Data.

California is in a split market. In some areas, buying a home makes economic sense and the numbers actually workout even with a conservative financial budget. But in other markets, you have people delusional about prices and thinking that somehow prices will remain high even though many areas are mired with foreclosures and toxic Alt-A and option ARM products. Yet somehow bubble prices will remain. We always hear that California home prices are more expensive than the overall U.S. market and are somehow expected to take this at face value.  They mention the sun. Arizona has sun. They mention the good weather. Florida has good weather. They talk about beach front property. South America has gorgeous beaches too. So there has to be other reasons. This current bust should tell you that in fact California prices can crash significantly. For example, the national median home price is now at $173,500. Two counties in Southern California in the Inland Empire, Riverside and San Bernardino, are near or below that mark. So in many cases, California homes are even cheaper than the national median price.

Yet in many other cities in the mid to upper tier markets prices are still with bubble valuations. People have a hard time visualizing what a bubble city looks like versus a more normal market so we’ll use an example today. Today we salute Culver City with our Real Home of Genius Award.

Culver City Rent or Buy Analysis

How do you know if a home is priced at a right level? We have various metrics that we can use including common sense which seems to run in short supply. That is how we spotted the epic California housing bubble years ago while the real estate denial cheerleading crew thought that prices would simply continue to go up. In these mid-tier markets underlying incomes do not support current prices. It really is that simple. What is happening in these markets is this; homes are building up in the shadow inventory since fewer homes are actually selling but defaults are still rising as many Californians are unable to make their payments. The above home is an excellent example in mid-tier Culver City. This home is a 3 bedroom and 2 baths home that was built in 1950. This is what many would consider a starter home.

The above home has been listed on the market for nearly 60 days. The last sale price on this home takes us way back in history:

11/02/1972: $27,500

Now what is the current sale price? The current sale price is $744,500 for a 3 bedroom in Culver City. The median sale price for this zip code in Culver City is $540,000 so I’m not sure exactly what pricing angle they are going for here. Now prices like this are common. These are the markets where people really think this price point is “fair†and what the cheerleading crew will try to tell you is the market value is what anyone is willing to pay. This to a certain extent is correct. Yet that doesn’t make financial sense in the long-run. It means another sucker is lining up to buy like many that took on Alt-A and option ARMs and now find themselves massively underwater. And those that think prices are without bubble valuations rarely use thorough analysis or market valuation methods because their analysis falls apart when you think of more macro issues. We’ll look at a rental right on this street to prove our point but also, interest rates:

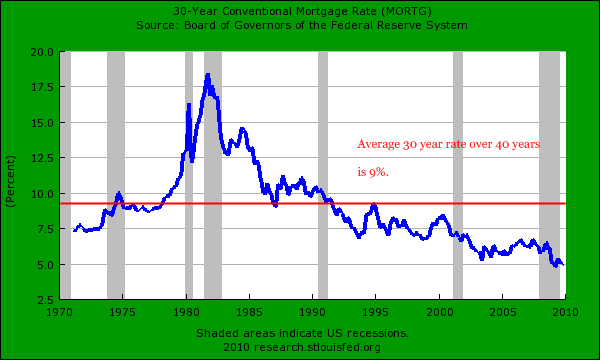

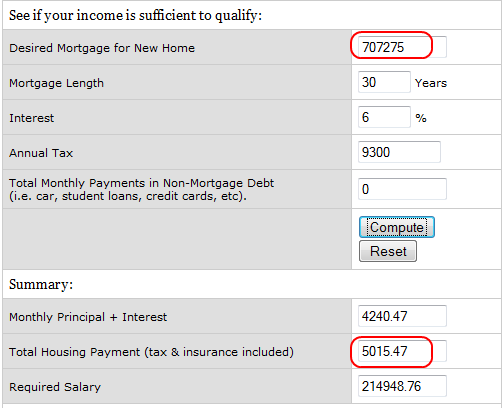

One flaw used in many current analyses is assuming the current mortgage rate is going to stay static. It will not. We are at historical lows. The average 30 year rate over 40 years of data is 9 percent. We are a long way from that. But let us assume you buy this above home with an FHA insured loan with a 5 percent down payment:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $37,225

Monthly PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,015

Needed Income to qualify:Â Â Â Â Â Â Â Â Â $214,000

Now something tells me that a person or couple making $214,000 a year is not going to buy this home (by the way, the median household income for Culver City is $82,000). Even if they did, are they willing to shell out $5,015 in a monthly nut for a 3 bedroom home in Culver City? And let us hypothetically say that things somehow change in the next five years forcing rates up. Let us now assume mortgage rates are back to their historical average. How do the numbers workout?

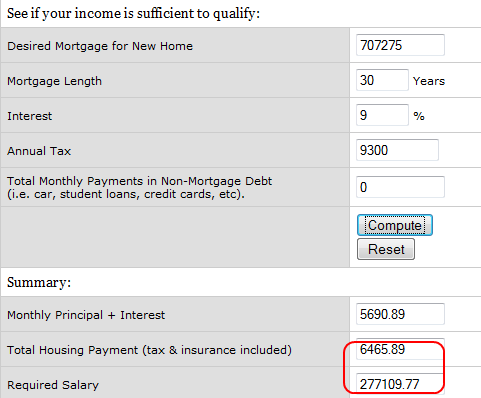

And here is where people miss the point. Say you want to sell the home in the future, say 5 to 7 years but rates are up to 9 percent. Now, to sell for the same price (no increase in home price) a prospective buyer will need an income of over $277,000 to buy this home! Their monthly payment shoots up to $6,400 just because rates went up by 3 percent. Of course, this part of the analysis is missed by those cheerleaders. These markets are littered with examples like this. Alt-A and option ARMs were tools used for people to buy homes like this during the peak with teaser rates. After all, over 93 percent of option ARM borrowers went with the minimum payment.

But you want more data right? Okay, let us look at a rental on this same exact street:

You can see the home we’ve been talking about highlighted above in red with the $744,500 listing price. I’ve circled the other home on the same street that is currently a rental in this market. The rental listing has the place at 2 bedrooms and 2 baths. Only a few houses away and 1 bedroom less. What is the monthly rental price? $2,250. You can rent two of these places for the price of the mortgage on the other place!

This is the kind of metrics that scream housing bubble. And keep in mind rental prices are more sensitive to monthly data because you are paying this amount out of your net income. No tax breaks, toxic mortgages, or any other gimmick. One simple rule when evaluating real estate is trying to figure out a home price based on rental income. One I use is the following:

$2,250 x 12 months x 10 = $270,000

Now this is a quick analysis that I use when viewing potential investment properties and trying to gather a starting price point (other factors will shift the price up or lower but not by much). So what we do is multiply the annual net rent income times ten to get a rough estimate of value. Now of course, the other home is a 3 bedroom but here we are being told that we shouldn’t expect much more than say $2,250 in rents for a 2 bedroom. Let us guess high and say we can rent the home for $2,750 because of the extra room:

$2,750 x 12 months x 10 = $330,000

$330,000 is a long way from $744,500. There are places in the Inland Empire where these numbers actually work on certain homes. I’m not sure if I would buy them as rentals given the local economies but if you live there and your income is secure, then buying might make sense. But not in Culver City. And keep in mind the California unemployment rate is up to 12.4 percent, a number unseen since the Great Depression. The actual underemployment rate is up to 22 percent and the California budget is in such a deep mess, that it is hard to see what will be done to remedy the shortfall.

It should be obvious that prices are much too high in these market. Plus, people don’t even have the income to support these levels! A couple making $100,000 or $120,000 trying to buy this home is way out of their league. This isn’t stretching your budget but more like putting a financial albatross around your family budget. No matter how you slice it, the above home does not make sense. Yet this is real market data.

The MLS lists 93 homes for sale in Culver City. Yet the shadow inventory is much higher:

Notice of defaults:Â Â Â Â Â Â Â Â Â 79

Auctions scheduled:Â Â Â Â Â 90

Bank Owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 18

On the MLS only 2 foreclosures show up and 17 short sales show up (most of the short sales are condos). Yeah, this looks like a healthy market.

Today we salute you Culver City with our Real Home of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “Real Homes of Genius – Culver City Home selling for $744,500 but Neighbor Home is Renting for $2,250. The Rent versus Buy Analysis and 40 Years of Mortgage Data.”

Another great post as usual DHB!

$2250 to rent vs. $5000 to buy…and you aren’t even factoring in the falling rents in the area. 2 years ago you could hardly find a livable 2br apartment in the area for $2250. Now it’s like $1300-$1400. Seems like a whole lotta people moved back in with Mom and Dad. And with 12% unemployment that doesn’t seem to be going away anytime soon, I would expect rents to continue falling. All of the sudden landlords are willing to negotiate their prices and everything else, “You have a big dog?…No Problem!”

Perhaps you can do some research on the insecurity factor in different areas of LA. It is obviously much higher in Culver City than in the IE. I can’t really think of any other reason someone would over-pay so much for a place to keep dry and sleep at night.

Dear DHB:

(Thanks again for another wonderful post!) The monthly nut on your example should be actually be more because your Taxes & Insurance portion of the calculation (inadvertently, I believe) excluded the insurance portion (the example only shows PIT), thus making the required income even higher. This reinforces the housing bubble we are in even more so!

Burbank: Local foreclosure rates higher than state, nation

Regional foreclosure filings surged 63% in 2009, triple that of California and the nation, as more area homeowners struggled to make mortgage payments, according to a widely cited real estate report released Thursday.

The 3,325 foreclosure filings in Glendale, Burbank, La Crescenta, Montrose and La Cañada Flintridge were up from a total of 2,044 in 2008, according to data prepared for the Glendale News-Press by real estate tracking firm RealtyTrac.

I’ve been living in CC for a long time now as a renter. Now, our apartment is in default [nice landlord, NOT!].

I’d like to buy my home so that my family has more stability, but the bank wants approx. $100K more than what I’d pay. Denial isn’t just a river in Egypt!

Culver City has a bunch of pretty hard working, upwardly mobile 30-something couples/young families who bought in 2003-2007, and they refuse to face facts — they’ll have to sell for less than they paid. Until reality sets in, the shadow inventory in Culver City will continue to explode.

Some markets are now low enough where the price is less than building the house. Once you start to dip below replacement costs, you know you’re in somewhat safe territory. But it doesnt mean it cant go lower in price. Culver City is just one of many areas that are still going to experience an “adjustment” in the future.

Dear DHB, I admire your tenacity! You are one of the few soothsayers I follow. And you are quite the optimist! You see a bottom to all this. Personally, I think California is toast; and a harbinger of America. Want to own real estate? Go to Beijing or Hong Kong in a few years. But you better bring gold! Thanks to our President, congress, and their predecessors, the USD will soon be worthless.

Keep up the good work.

Thank you for illustrating that rent vs buying is still way out of whack and currently favors renting. I was looking on Craigslist recently and have seen several 3 bedrooms in Culver City for 2000-2200 so even with the extra room you can get a great deal! And a yard. 🙂 They do seem to go fast though…

The asking price of a house can be whatever the wishful seller wants it to be. It looks like they are asking for $200,000 more than the other houses on the same street. So what? Maybe they don’t really care about selling. It sounds like the asking price is like Zillow’s “make me move” price. It took millions of fools to cause this housing bubble. Maybe there is a greater fool lurking about waiting to snap up this wonderful home.

I know that on this board, many people are renters. Here are some renting tips from a friend who is a rental agent and also from my experience.

If you want a rental apartment or house for a good price: 1. Find an owner who is not underwater, not under financial duress, etc… Find someone who is financially stable. Usually these people will rent for far below market value in exchange for piece of mind. They just want someone who has a good solid credit history and will pay their rent on time and take care of their apartment or home like a responsible person. Once you do that, ASK and NEGOTIATE your rental price. Tell the landlord how responsible you are with your finances. A lot of people think you just rent an apartment or a house and the money just pours in. Dear God they are sorely mistaken. Now more than ever, a lot of people stiff landlords and won’t think twice about it. So experienced landlords will be more than happy to rent below market value in exchange for peace of mind. 2. Besides your usual websites for finding rentals, do some actual leg work. Drive around. Some people won’t advertise online. There are several apartments in my neighborhood that are not advertised on any websites. They just have postings outside! 3. Contact people and tell them if they or someone else they know is renting an apartment? If you contact 50 people and they contact only 3 more people, and they know someone else, etc… then you will get a good reference and first digs on a rental.

I guess that is all I can offer. I am renting a one bedroom apartment in a nice safe part of Chicago for $670 per month. For three years, the landlord has not raised my rent and kept it the same. When I told my parents, brother, friends, etc… they just couldn’t believe it.

HAPPY negotiationg everyone! We are on the drivers seat.

Another good post Doctor!

However, I’ve got “boots on the ground” so to speak, and one factor I see happening that keeps prices inflated, is demand from long time renters. The westside is still highly desirable for a lot of folks, as long as the property is somewhat reasonably priced. I represent clients that want to live there badly and often have $200k to $400k for a downpayment. And these are buyers in the age 30 to 45 category. Usually a mix of savings, gifts from parents, or inheritances from rich relatives. They’ve got the cash and know where they want to spend it. Inflated prices don’t bother them at all. Even short sales that take forever to get approved, get multiple offers within days. It’s absolutely crazy! I haven’t ever seen so much cash chasing real estate. Investors included. It’s truly unbelievable. I think the last boom has changed real estate in California forever. So much money was made by so many people! Flipping is still happening big time, and good money is being made. I believe prices will continue to have a rocky ride, but at the moment, the buyers keep on coming anyway.

If anyone noticed, the 4th quarter GDP number was released at 5.7% growth. How is that possible?!? The stock market went down with the news today. Tax revenues are falling across California cities, unemployment has not improved, Christmas sales were down, and the economy is growing? There is such a massive coverup with the shadow inventory and lies about the GDP by the government/bank propaganda machine I can’t stand it. It is shocking to see people who believe their house is still worth $750K.

Dr,

What do you think the real reason for banks/lenders to hold onto all the distress property (the so called shadow inventory)? Places like the IE went through a the foreclosure with the sub prime process pretty quick and it does not appear that properties purposely held off the market (like what is happening now with Alt A and Option Arms). I am trying to figure out why so much shadow inventory exists? Wondering if it is all a legal issue? Other States seem to be unloading a lot of distress, but it does not appear CA is.

Keeping CA and NYC RE propped up is the mistake de jour. It guarantees continued misdirection of capital that might otherwise be used to creat productive assets and help the US avoid the final catastrophe which surely awaits us. The other “shoe” to drop will rather be an atomic bomb. Bye bye banks, bye bye “recovery”. Can you say Great Depression II?

Of the 90 auctions and 17 short sales, a large number of these will like not close — they will be rescheduled as buyers will likely not step up to the plate and close.

To Matt,

I think the reason the GDP went up is because people were spending borrowed (deficit, stimulus) money. The problem will come when the deficit money has to be payed back. It’s always great to spend borrowed money. It’s always bad to pay it back, with interest. I would not be surprised if we have another recession at a later date when the government runs out of tricks to artificially inflate the economy.

I was doing some work recently and overheard a meeting of mortgage insurance agents at a conference. The speakers were all cheerleading with the incredible compenstation to be made with these products. It occurred to me that this is another driver in the bubble. If someone actually had a brain, or at least a couple of acorns, and put 20% down, they wouldn’t need to pay mortgage insurance. The only person I know ignorant enough to fall for a predatory mortgage (much less common in the east, but they made some penetration here) told me how much his insurance is and it is absurd. One more group of vampire squids on the face of humanity.

Know your enemy–it’s the only chance we have.

PS–I’m sure Geithner is telling the truth about GS-AIG. It’s the Goldman Rule:

Do unto others, again and again.

Comment by Socal Realtor

January 29th, 2010 at 10:15 pm

“Inflated prices don’t bother them at all. Even short sales that take forever to get approved, get multiple offers within days. It’s absolutely crazy! I haven’t ever seen so much cash chasing real estate. Investors included. It’s truly unbelievable. I think the last boom has changed real estate in California forever. So much money was made by so many people! ”

Too true SoCal Realtor. I have a couple of friends back East who bought a beach house in the Hamptons for an investment and have rented it out as a loss for the past two years. They try to justify it to themselves by saying they get a good tax write-off at the end of the year…I guess they are hoping the market will come back and prices will go up so much that it will cover their years of losses…And I’m sure there are many homeowner/landlords that can afford to take a hit like this every year and don’t want to come to terms with selling at a loss. Bad business in my opinion, but hey maybe Obama Nation will cause hyper-inflation and all of us renters won’t be able to afford rent and we’ll have to sleep in the park! It is possible we could “priced-out of the market forever!” I just don’t see that happening with the mass currency destruction that is happening with every foreclosure across the state…looks like deflation to me…definitely in housing prices. And all the trust funds in the world can’t prop up this market long-term.

This weeks Barron’s lists California as the 10th riskiest “sovereign debt” in the world, on the same list as Dubai, Greece, etc. The credit default swaps impute a risk of default on California bonds of approx 25%. If this should happen, besides the general mayhem and imploding real estate values, what effect would there be on Proposition 13 taxes?

@MJL: Lovely chart on that subject can be found at zerohedge:

Seriously… Which Default Are You More Worried About?

http://www.zerohedge.com/article/seriously-which-default-are-you-more-worried-about

Enjoy!

I think there is a ton of shadow inventory in the IE still. Prices are already below replacement costs, but a ton of homes are going to continue hitting the market here for the next several years. A lot of the LA/OC markets are still insanely inflated and I would think have to come down further. Either that or incomes are going to have to skyrocket to make those homes affordable for the people that live there.

Mark

Can you say Great Depression II?

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Should not that read Great Depression II.2.0?

DG,

Completely agree with you about the amount of shadow inventory in IE. I live in the Temecula-Murrieta area and just going by what I see, the number of people leaving homes far exceeds the number of homes coming on the market. My old street had 25 homes on it. Since they were built (2005-2006), around half of those people have walked away. Only 6 of the homes have come back on the market, including one yesterday which is listed for $220k, $250k less than the purchase price in late 2006. This will sell pretty quickly unless prospective buyers realize that 20% of the homes on the street are vacant and the taxes on this home are ~ $6k/year or ~ 2.7%.

On a side note, I hate that the govt is doing everything possible to prop up prices but it does make me glad I walked when I did…by the time prices actaully bottom, my credit and savings will be at the point where buying would be a viable option, although I can’t imagine wanting to. It would actually be kind of funny to buy the home listed at $220k as it is next door to my old house but nearly $300k cheaper. I wonder what the neighbors would think about that? Pissed or jealous? Probably both. Interestingly, I wonder how many of those neighbors are wondering if they can buy the house and move a few doors down to save a couple hundred thousand. All of them, though I doubt they would admit it.

I agree with the general points made in this article and I am quite bearish on house prices in CA, but I see two flaws in the article:

It would be a more valid comparison to compare the rental vs. just the interest portion of the mortgage (as this better compares the rent of the house vs. the ‘rent’ of the money to buy the house); this removes consideration of the asset the homeowner owns at the end of the 30 years, vs. the renter who will not have an asset.

Also, I’m not sure how annual rental x 10 approximates any house value; surely it should be a much larger figure. If anything it would be rental x 30 + some future value of the home asset. If I could simply stay put in my current rental for ten years and then own the place outright, what a deal…I practically have been doing that anyways, and I’ve no asset to show at the end of the ten years. Am I missing something?

I haven’t even read the post yet. But the title is where I am right now. I rent for $2200 on a $730,000 Townhouse.

I am in the same situation. I live on the Peninsula in the bay area. Townhouses in my neighbor are priced around $700k, but no one is buying. But I rent for $2200. Its been like this for the past 2 years… ….watch when the prices fall. Hard.

This is quite humorous.

Basically who wants us to believe this basically “sh**box” of a house is worth $700K is your representatives to congress… people such as Nancy and Barb and Henry, etc. They made millions (now offshored in hard currencies [they hope]) from the subprime mortgage companies by misrepresenting themselves to Californians by making you fine folks think they were working for you.

They weren’t.

This trash house (and I live near Boston where are really horrible 1950s style never updated cape of 1.5 baths and 1,100 sq ft is still selling for $400K) is only worth its rental value (same as here)… capped at 9% (Patrick will allow 6%) that is around $300K

In 1992 I rented a house in Santa Clara, for $1800/mo. So by the x120 rule it should have been worth. $216k. Houses like it sold for $360k. (and interest rates were higher then too). Sounds like renting was a better deal, huh, and anyone who bought would lose their shorts.

Those houses peaked around $1m and sell for about $800k now. Rent is around $3000. The rent/price ratio is higher now (was 200, now 266), but interest rates are lower too.

For sure, renting is better in the short term, particular considering realtor fees. But if you plan to stay for 10 years or more, buying can still work out. Certainly I wish I had the means to buy that house back in 1992.

John McCabe brings up valid points. You can’t compare the entire mortgage vs. the rent. You have to compare the interest less the income tax savings plus maint and insurance costs against the cost to rent.

When you do this, home prices start to make more sense. Let’s assume that this house ultimately sells for $720k, it means that it makes more sense to keep renting at $2,750 UNLESS you can live there for longer than 3 years. Of course, this assumes that home prices will keep up with inflation (3% per year) which may not be the case. But even then, it just lengthens the time horizon for how long you have to live in a house before buying makes more sense than renting.

The x10 formula would put my Newport Coast, stunning ocean, catalina island, edge of hillside, city lights, canyon view 3700 sq ft, large lot jaw dropper home (that’s the reaction I get) at around 1.2M which is around $500k cheaper than the 2001 price. That would be quite amazing since the land alone would be nearly that and the cost of rebuilding the home is 1M+.

Comment by SiO2

“For sure, renting is better in the short term, particular considering realtor fees. But if you plan to stay for 10 years or more, buying can still work out. Certainly I wish I had the means to buy that house back in 1992.

Depends on when/where you buy. Just pull up some listings on Redfin and look at the historical sale prices. Plenty of examples on there of people who bought at a peak and waited 10-20 years just to sell it for what they bought it for…or less. You can hope for inflation to dig you out, but it doesn’t seem like inflation is happening anytime soon with 12% unemployment, record national and state budget deficits and massive and accelerating currency destruction taking place due to foreclosures…then again, who knows? Maybe Big Ben and the boys from the Fed can pull us out. Seems like a lot of risk to me as it has for the last several years. There are definitely some people out there making money, but there are some sharks making money in Vegas too.

Leave a Reply