Prime Pasadena zip code has a home selling for 41 percent off peak price – When flips go wrong. Los Angeles Case-Shiller negative year over year again.

The Case-Shiller Index once again showed a national decline in home prices. While much of the media was surprised by this there should be little shock given the poor state of our economy. Home prices continue to decline because we have 7 million distressed homes. This figure comes from current foreclosures and Americans who have missed at least one mortgage payment. How many people in California are living in mid-tier to prime neighborhoods rent free as the banks twiddle their thumbs and allow taxpayers to shoulder the bank bailouts? The fact that shadow inventory is leaking its way onto the market in many of these areas shows us that banks are starting to move on some of the inventory. Many banks probably thought 4 years would have been enough to get the housing bubble delusion in California going again but multi-billion dollar state deficits are starring us in the face for years to come. This may be the best time to get out while fence sitters are itching to burn their cash in the second phase of the housing correction. Today we look at a “partial remodel†in Pasadena that has come down in price significantly.

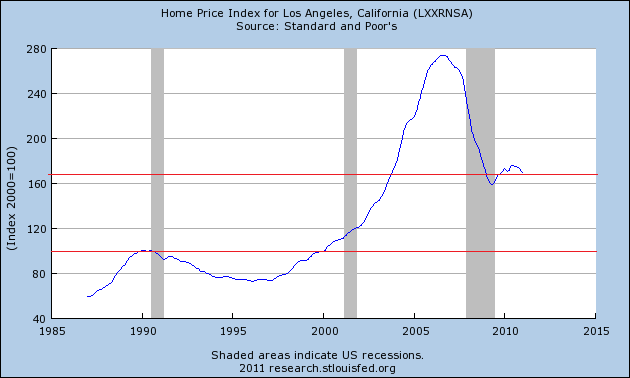

Case-Shiller Index trending lower

Nationwide home prices continue to move lower. In Los Angeles we are now steadily into phase two of the housing correction. This is the mid-tier to upper-tier correction that was bound to happen at some point. It is now in full swing. The shadow inventory is now moving online at a steady pace probably since banks want to exit during the spring and summer selling season. 2011 might be one of the better years to unload the large pipeline of toxic mortgages if you were a bank. The above chart doesn’t do justice to what has occurred over the last 12 months. Let us zoom in a bit:

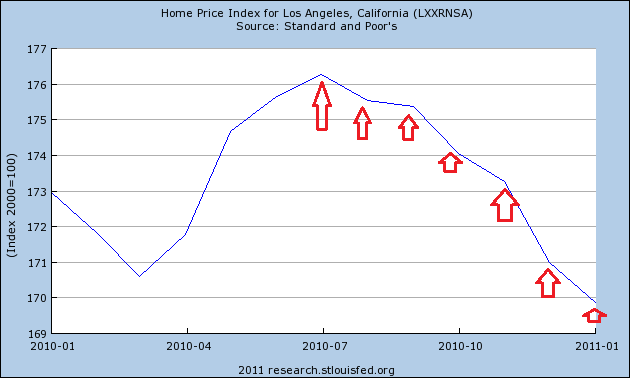

Zooming into the chart you can see what occurred over the last year. We had our spring and summer fence sitters buying into real estate propaganda thinking it was the “real†bottom. Tax credits and other gimmicks like the Federal Reserve keeping interest rates artificially low pulled people off the fence. All of that as you can see, has evaporated into thin air.   Los Angeles home prices according to the conservative Case-Shiller Index are now down year-over-year. We will have a lost decade when all is said in done by all measures (i.e., Case-Shiller, nominal, etc).

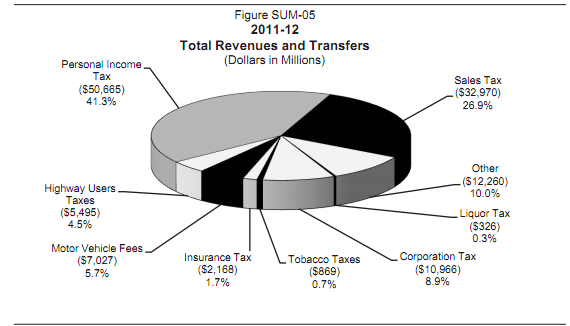

Why are home prices moving lower in California? First, the unemployment rate is above 12 percent and the underemployment rate is near 23 percent. Next, the new jobs coming online are in the lower paying service sectors for the most part. It is also the case that we have a $26 billion budget deficit and much of our state revenues come from personal income taxes:

Source:Â California Budget

Do the math here. Less work and smaller paychecks equals less revenue. Sales taxes take a hit in recessions because people spend less. During the bubble years people were loading up on three or four flat screens for the home and plowing them into the back of their newly purchased gas guzzling SUV. Sales taxes were flush. That has now contracted. So the state now has to cut and raise taxes. Unfortunately unlike the corrupt banking sector that virtually owns our one party government and the Fed, we the people of California do not have a printing press or a Quantitative Easing machine somewhere on Wilshire Blvd. States have to balance budgets each year. It is the case that we now owe the Federal government billions of dollars because of our deficit in the unemployment insurance fund. Money is going to be tight short of some deus ex machina stepping in to save the day. Apparently money does not grow on trees and debt does not equal wealth:

The housing market is still a drag on the state not because prices are falling but because prices are still too high! Too much money is being sunk into a product that really does little to advance our economy on a macro level. For decades housing was a rather boring and stable investment until Glass-Steagall was repealed and then it was off to the alphabet soup of casino products; ABS, MBS, CDOs, CDSs, HALF, HARP, HAMP, PPIP, and all those other loveable taxpayer handouts to Wall Street. Let us now focus on our city of the day, Pasadena.

When HGTV meets Pasadena

397 NORTH CATALINA AVENUE, Pasadena, CA 91106

Listed   12/21/10

Beds     5

Full Baths            2

Partial Baths      0

Property Type  SFR

Sq. Ft.  1,859

$/Sq. Ft.              $188

Lot Size 9,000 Sq. Ft.

Year Built            1905

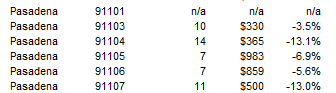

Here we have an interesting home in one of the better zip codes in Pasadena. Pasadena is a mid-tier market by most standards. It has yet to have any significant correction but now all zip codes are down on a year-over-year basis:

The median price for the 91106 zip code is $859,000 even factoring in the 5 percent fall from last February. This home has 5 bedrooms and 2 baths and the ad at least is upfront:

“Not for the faint of heart. Partially remodeled. Potential as an investment or a home. High density area near Metro and freeway.â€

They’re not kidding when they say it is near the freeway:

It looks like someone was going to do a “flip this house†Pasadena style when the funds ran out and the market went under:

“Who needs a sink when you can order takeout?â€

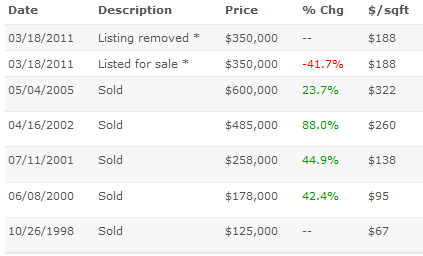

These are the kind of deals that will be hitting the market in the next few years. Take a look at the history here:

This place sold for $600,000 in 2005. The current list price is $350,000. A 41 percent price cut in a solid mid-tier zip code in Pasadena. There are now fewer and fewer places to hide. Is this a good deal at $350,000? You be the judge on that one but looking at this place it requires tens of thousands of dollars in repairs to make it livable or even rent ready so in the end, the move in cost is much higher.

Pasadena has 622 homes in the shadow inventory pipeline. Non-distressed MLS properties number at 540. Given the current sales rate we have 24 months of inventory. A normal market (if you just happen to have a memory that goes far back enough) usually has 6 months of inventory. Think about that when someone tells you we are at a bottom.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

43 Responses to “Prime Pasadena zip code has a home selling for 41 percent off peak price – When flips go wrong. Los Angeles Case-Shiller negative year over year again.”

WOW… just a few houses from the 210 Fwy and hemmed in by apartments. Add in Pasadena smog and the need to finish the remodel… well, on the plus side, the Pasadena Republican Club is a couple blocks away. That might be a selling point for some! I’d love to know if they get the 1998 price. Down the road, I’d love to know what happens. Perhaps you can do a follow up on this and some other properties you’ve highlighted.

$350,000 is way too much for that house. I’d say $150,000 to $180,000 would be a reasonable price if the house was in good condition, but I’m sure we wont see those kind of prices for years to come. Pasadena is still way overpriced.

Thanks for all your advise. I’ve been chasing reo’s and short sales for 2 1/2 years and your articles have kept me patient. I’m about to close on a reo in Gardena that sold for 520k in 2007 which I’m purchasing for 250k. My income has dropped 40 percent during this recession and rent was killing me. To live in a decent area of L.A. will cost you $1000 a month for a 1 bedroom apartment. Really difficult to live in L.A. if you make under 50k a year.

My advise for others in my boat is to be patient, look everyday on sites like Trulia and only deal with representing agents if your chasing short sales and reo’s. Also you need at least 20 percent down and factor in most reo’s need at least 10k to fix. Thanks again!!!

Also, there’s no way that was originally a 5BR house, so you’d have to scrutinize the dubious additions that have been made over the decades.

If I were to buy a house like that in a neighborhood like that, I would at least want it to have pre-war kitchen cabinets, etc. Those Home Depot cabinets do NOT go with that house. IMO, this house will be very difficult to sell for any reasonable price because the location is undesirable, and the house requires so much work before anyone can move in. Only an investor will buy it, and they are going to want a huge discount because the remodeling was not finished. Some of the sweetest real estate deals that people have ever gotten have been houses 80 years old or older where the owners started doing a high-end rehab, finished the extensive stuff (e.g. re-working the slate roof, new copper plumbing, new electrical) but then had health problems, money problems or got divorced before finishing. All the expensive work was done, the new owners got to pick out the finishing touches, and so few people are willing to buy a house that is not in livable condition that the new owners get an absolute steal. NEVER buy a fixer-upper without figuring out if you can afford to fix it, and if it is the right time in your life to deal with a fixer-upper. (If you have young children, or you might have to relocate due to your job, the timing is wrong.)

Buying a fixer-upper is a lot of work. We bought a semi fixer-upper (needed new floors and bathroom work, etc., but kitchen was ok) last Fall in Ventura County. Spent about $10k to get it livable. Five months later we still don’t have baseboards and need to paint the bathrooms. We did go in with open eyes so the costs were expected, but all the ‘little’ stuff takes time when you add on the other regularly needed maintenance, work, and quality time with young children. That being said, we still think we got a ‘fair’ price and we love having a decent backyard for the kids.

I realize this is a whole different can of worms, probably deserving its own blog, but have you considered examining what effect, if any, being in a “desirable” school district has on the price trends? I would imagine the deflation in Pasadena-adjacent neighborhoods like Arcadia and La Canada would be slower due to the perception of having “good” public schools, although I suppose this falls into the realm of qualitative data and is probably difficult to measure. Pasadena is mid-tier, but PUSD is not touted as a selling point.

Greg: I just saw an article that said that numerous school districts are going to an “all charter” system. When that happens, I think that there will be far fewer places where residential areas have vastly different prices based on school attendance boundaries. I would NOT pay a premium these days to be in a certain school district. I don’t think that the current school funding system will survive the collapse of state revenues, and I know too many people who overpaid to get into a certain neighborhood with “top” schools, and then were so unhappy with the “topnotch public school” that they took their children out and put them in private/parochial schools. They ended up with too much house, too much of a house payment, and private school tuition on top of it all.

Teachers union will NEVER allow that to happen. As lower paid, newer teachers are laid off, average teacher pay in Ca. will be over $70,000. next year.

Teachers are going to fight like wounded wombats to keep the system “as is”.

Laura:

I have no idea where you saw this alleged article but the chances of that happening are in the low thousandths as in .000 especially here in California. Now the governor of Florida is fronting a proposal to do just that. Here is a link to the article: http://motherjones.com/politics/2010/12/rick-scott-florida-education-jeb-bush

Rick Scott’s School Plan for Scoundrels

Manny you are a troll/and or a scoundrel yourself. Please take your simpleton teacher bashing to a fux news forum where it will be welcomed by other uneducated types. See if you can catch the irony and the error in my above sentence.

Calculate what a good private school education costs for your kids. That should be the premium on the button. My folks bought in crappy neighborhood, but sent us 5 kids to parochial school with the $$ they saved not buying in “desireable” nehigborhood. We had the added benefit of learning “street-smarts” that our priviledged peers lacked. It also makes you more appreciative of what you have, and what you can and do achieve in life. There is no price on that. I chose different route for my kids, I instead live in primo area, am debt-slave, and send my kids to public school.

we did the same as your parents, and saved untold sums in doing so

I think school district still matters a lot…these all charter proposals will mean nothing unless those charter schools actually demonstrate that they can do better than the current public schools and I sure wouldn’t hold my breath. La Canada has much better schools than Arcadia (my opinion) and also has a ready made population of good jobs (JPL) though they are facing some cuts (and possibly major cuts if the Feds get serious about budget cutting everything except social security, medicare, defense & national security and tax breaks for homeowners.) On the other hand Arcadia and South Pas have good-ish schools and they have the advantage of a pipeline of wealth coming in from China. Take your pick…either way, it’s hard to predict.

There is no correlation between amount spent on education, and quality of schools.

Calif. has doubled the total amount spent on schools in the last decade.

Most of that money went for teacher raises. The bad teachers are still protected by the seniority system. Can’t get rid of bad teachers, unless they have sex with a student (on a desk, in school, at that).

People don’t generally factor in cost of ownership, let alone what has been happening to all the homes that are in a state of disrepair and getting worse as either; The squatter isn’t gonna fix the broken faucet leaking into the wall because he hasn’t made a payment in a year and knows he gonna go soon, or the poor sod is way over their head in payments yet scrapping by so they use a bucket to catch the leak from the roof praying for California to go back to a drought.

People need to put a few hundred dollars a month on top of the PITI just to cover basic repairs that will happen.

Burbank is filled with old houses in desperate need of basic repairs for sale in the half million dollar range. Must be really delusional to get into that mess. The chickens will come home to roost!

I’ve been touring a lot of the condo’s and townhomes in burbank. From my experience, the units that have fallen into the 300~450K range all have some need of repair. I wouldn’t buy some of those units even for 250K, let alone the 400K+ they were selling for. On the bright side, those 500K+ homes have already fallen into the 300K range. Only a matter of time before we see it crack into the 200’s.

Yes Ed, the 300,000 ones are totally dilapidated. Almost tear downs. But it’s still hard to imagine a condo or townhome going for the prices you’re seeing, and still needing work, not to mention the HOA on top of that mortgage. These places are also mostly surrounded by apartments north of Glenoaks in a very high traffic area with poor street parking. I rent a house for 2200/month, which needs about 50,000 in upgrades to be worth buying, and Zillow has it estimated at 479,000. Go figure.

Last time I looked at Condos in Burbank they were in that $300 – $450 K range. I stopped looking at real estate then. I think it was 03. They were essentially apartments that were worth in the $100 – 200 K range. I was of the opinion then and still am today that those were bubble prices.

do you think all the people leaving IE because of higher heating/cooling/gas prices will move closer to LA and rent, pushing rents up?

no they won’t be able to afford the rent in l.a. even at current prices

Only over the long term. As I mentioned before, gas prices are going to go down, as well as up. They should start going down next month, due to over speculation:

http://www.zerohedge.com/article/no-more-storage-cushing-wti-will-be-90-month

Long term, gas will be at $500 a barrel in 10 years, in real terms. You’ll see bigger ghettos in the cities. And the unsustainable spots will become ghost towns.

A couple notes on this topic: Pasadena has one of the worst school districts in the Southland, so there should be no premium for schools. If you have school-aged children, be informed before leaping. Additionally, the areas adjacent to the 210 freeway, be it north or south, is full of highly populated rentals and there are lots of illegal garage conversions. Although crime is not as prevalent as the Northwest portion of Pasadena, this area has gang issues, and property crimes are a regular occurrence. I applaud anyone who intends to buy in this area and show pride of ownership.

Tonight’s shooting is two streets east of the showcased property

From the evening news……. Wednesday, March 30, 2011

PASADENA – One man was shot and wounded Wednesday night in a residential area of the city and police are searching for the gunman.

Pasadena police received calls about shots being fired in the area of Mar Vista Avenue near Villa Street about 8:50 p.m. Wednesday, according to police Lt. Thomas Delgado.

Officers arrived to find a 26-year-old male Latino suffering from a gunshot wound to the leg, Delgado said. The man was taken to the hospital for treatment.

Police received information that the gunman, described only as a male wearing a black hooded sweatshirt, was on foot.

Delgado said the shooting is under investigation and the motive is not yet known.

First, the picture of the fat woman, with the word elephant highlighted. Funny.

The banks would not look with favor on housing being valued at market because they would take a very big hit to the income statement and balance sheet. But postponing the day of reckoning can go on only so long and apparently it is getting close.

The State of California’s GDP is around 1,700billion, so a 25billion short fall is no big deal. To continue the current higher taxes is doable. Let’s stop all the whining about this. Buck up folks.

John, you’re not really a CPA, are you?

“The State of California’s GDP is around 1,700billion, so a 25billion short fall is no big deal.”

GDP is NOT tax revenue, so don’t give the appearance of such. CA’s revenue or net income is roughly $100 billion a year. It has a current DEBT of roughly $150 billion – with an annual deficit of $25 billion a year. So technically, the state is BROKE. GDP does NOT measure how much the state takes in. It is a measure of total business conducted within the state.

Try again.

The State, as Sovereign, has the power to tax the economy of the world’s 6th largest economy. There is no problem. Only the will to use the power of the Sovereign is lacking for now. A Federal Judge can order the state to have sufficient taxes to pay for services that the Federal Judge deems necessary, like in some other states. Do the math, to raise $25billion on a $1,700 billion economy is less than 2%.

A 2% tax on nominal GDP is roughly a 100% increase in effective state tax rates. You are insane. Doubling the state tax rate would kill the economy, and you would get much less than $25 billion as your $1.7 trillion economy plummets 20%. Even if you can raise state taxes by 100%, all you are doing is covering the annual deficit. You speak nothing to the $150 billion debt that still lingers. You are definitely a government employee – your sole goal is to paper over the mess, instead of dealing with the core problem of government spending.

You must be a CPA that works for the State who wants to retire at 52 with 80% of your pay. Better still, you must be one of those CPA’s who runs the actuarial assessments for CalPers because you can’t figure out the basics of accounting which boil down to this: The money that goes out can’t be more than the money that comes in.

Without fixing the huge state worker pension and benefit issue the government HAS NO CHANCE of becoming solvent, no matter how much you tax state residents.

Yes Ki, I do get a very large CalPers pension, amongst others. I can always move to the promised land of Texas(no income tax), if I so desire and leave all you nice folks to pay taxes to the Sovereign, as represented by the Democratic Party. I left State employment a few years ago at the high point before the place started to disintegrate. I got a letter from the former Governor praising me for my big contribution to the government. But that is another story. Soldier on!

You sound like a Koch brother troll spreading opinion in a drive to make it fact. Budgets consist of far more than pensions and benefits. Take your propaganda home and put it in a closet where it belongs. Then come back and join the rest of in the real world looking for and supporting real solutions that support people and not corporate interests.

I’m not a troll. I have worked in both private and non-profit HR for over 20 years and I have been through a Cal Pers actuarial assessment. wydeeyed, whenever you are confronted with the truth, you scream, “you must be a troll”.

I know what I am talking about, and I rarely make comments about schools and pensions on this blog. It’s funny that I was right on the money about the CPA – that he worked for the State and is receiving a fat pension WHILE working for another company. That’s what happens when you can retire with 80% of your pay at 52 years of age. I have a strong hunch that I am right about you, public school teacher.

Assuming CPA status was earned at age 25, that makes minimum retirement age in state service at age 55, not 52, and that gets 60% of income for 30 years of pay. That is NOT 80%. Most people also pay 7% of salary to PERS. Some cities and counties or agencies pay the retirement ante outside of earnings….nearly all are public safety workers. Don’t begrudge any of them, they (almost all) earned it

“We believe it is reasonable to expect nearly 8 million foreclosures to enter the market over the next three years,” Meyer wrote. “This means we can expect a steady shift into rentals from foreclosures through 2013.”

Despite all the foreclosures, the homeownership rate remains at 66.5 percent. That is likely to fall to 63 percent over the next five years or so, said Richard D. Hastings, consumer strategist at Global Hunter Securities in Newport Beach, Calif.

“People are more conscious of the operating overhead of home ownership,” Hastings said. “It’s a very expensive thing to own and operate a house as people see their equity is not growing and overall mobility has decreased. There’s been a psychological shift in which homeowners have become much more focused on the burden over time of the operating expenses, and some of them are pretty severe.”

The above is from CNBC

In summary, prices should go down for the next 3 years. There is no rush to buy.

It seems like this house was built in 1905! [Source: Zillow].

350K for a 1905 house! looking at the pictures in “Zillow.com”, was the attic converted illegally or legally?

Nice size lot (9,016 square feet), but it is narrow and long.

I think that house is kind of an anomaly–the houses north of there are nice and that’s what makes it a good zip code. Those blocks south of Orange Grove and north of the 210 are definitely not prime. Until the latest housing bubble they were just plain sketchy…I think only a fool would pay that kind of money for a house there.

I know that area very well. The fact that that house sold for $600,000 in 2005 is a complete joke. The fact that it is on the market for $350,000 is a complete joke. The area is not in a very “good” area. Many people have a serious misconception of Pasadena. Many people don’t know about the major gang problems and crime problems in the city. I grew up there, so I know about them very well. The school district is terrible with lots of problems with gangs and other crime within the schools.

Going off the topic, I will say that there is a great carniceria around the corner from that house that has really good carne asada along with other meats.

$600,000 was the “I have no brain” price.

$350,000 is the “I have only half a brain” price.

This is an absolute rip off at this price ($350K). It needs mega bucks to fix it up. The house was builit in 1905. Let’s see…106 years old. I’d be willing to bet it needs a minimum of $100K just to make it liveable. Don’t let the new paint, 50 squares of tile, and $200 worth of cabinets in the kitchen fool you….this house is an DINOSAUR which is probably near extinction.

John CPA JD

Please don’t be confused by my post. It was not meant for you. It is Ki that comes across like he just popped in from a Glen Beck show. The software here does not track who the response is to very well.

John CPA JD and DR Housing Bubble, thanks always, I am learning everyday and thank to all other people who post as well!

91106 zip is prime Pasadena ONLY south of California Blvd (south of Cal Tech). As you go north in that zip code, it gets worse and worse and worse. The subject house in this post is in the most ghetto of that zip code–a small strip north of the 210.

I was lucky enough to have grown up in the 91105 zip, over by the Arroyo, such a great area.

The 2 bedroom, 2 bath aprtment 1,300 sq ft on the 31st floor in my apartment building in NYC was just listed for $2 million, the mainenance is $2,409 per month it is also for rent at $9,000 per month. This is about equial to the absolute high of the market in 2007. I live in an identical apartment on the 30th floor. The building is a condop (unique structure to NYC). I did not buy when the building went condop in 1991 and remain a rent-stabilized tennant, my rent is about $130 less than the monthly maintenance. If this apartment sells for the listing price, there will have been absolutely no net decline in prices for NYC apartments. As a condop there is no restrictions on financing however many coops in NYC require 40% down payments and some do not allow any financing at all. In mots cases the ccop board requires a buyer to have a liquid net worth equal to the value of the apartment.

Without even knowing which ‘hood you’re in, sounds like one of those sweetheart Manhattan deals that peeps hold onto ’til they die… and THAT is why New Yorkers pore over the obits, EVERY DANG DAY, LOL!

Leave a Reply