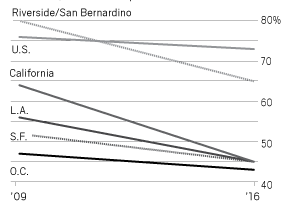

The growing underclass of the Orange County Bubble:Â You need to earn an hourly wage of $28 to afford a basic one-bedroom apartment but 68 percent of OC jobs pay less than that amount.

You have to love the Orange County bubble. It is fitting that Disneyland is in Anaheim and actually has some of the poorest households in the entire county. You have a world of Princesses and fantasy and right in the same city you have topless dancing fulfilling a fantasy of a different sort. You have cities like Irvine where most of the new homes are selling to investors or foreign buyers. It is an interesting county. Yet a new report continues to show that California is no place for the middle class. The report also found that Millennials are leaving the area while Taco Tuesday baby boomers and older folks are the only cohort actually expected to grow in proportion relative to other age groups over the next 25 years. It is also no surprise that plastic surgery and expensive leased cars dominate the crowded streets. Unlike L.A. County that understands that there is a large struggling class of people Orange County seems to be in a fog when it comes to the deeper realities.

The growing underclass of Orange County

So let us look at some challenging trends:

“(OC Register) — To afford a median-priced, one-bedroom rental unit, an hourly wage of $27.62 is needed. Yet 68 percent of Orange County jobs pay below that.

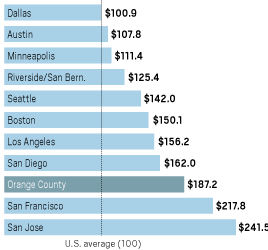

— Orange County’s cost of living is almost double the U.S. average (87% higher). Housing costs are 356% higher than the national average.

— Residents 65 and older are the only group projected to grow proportionate to other age groups in the next 25 years.

— 48 percent of children are not developmentally ready for kindergarten

–Nearly 60,000 households are on waiting lists for government rental assistance.

Michael Ruane, an affordable housing executive who was the county’s project director on its first indicators report 17 years ago, said the data show “there are two Orange Counties.â€

“What’s striking is the enormous variation. You have poverty in a prosperous region. You have a knowledge economy with high wages, and a tourism economy with lower wages.â€

First, let us examine costs for housing and income:

When people are spending half of their income on rent, there is little left over to save. Plus, you need to earn roughly $28 an hour for a basic rental but many jobs in OC don’t pay that (think of working at Disneyland for example).

Housing cost are 356% higher than the national average, which makes it tough for people to save to buy a home:

Fewer and fewer people that live here can buy so they don’t. You have old school Taco Tuesday baby boomers going gray and fragile in their homes while new buyers are dual-income professionals, investors, or foreign cash buyers. Those Taco Tuesday baby boomers are the broke folks in their hood while the new buyers are cruising around in Teslas and BMWs. So as the report finds, oldies are going to stay in their homes and are also welcoming back their economically struggling adult children back.

The fact that nearly half of kids are not ready for kindergarten is troubling. This is the future. If they are not being adequately prepared, are they going to be able to buy that $700,000 crap shack when it is their turn?

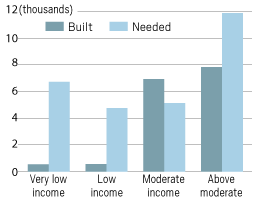

And finally, the vast majority of the new building is focusing on higher income housing:

So is it any surprise that you have a larger number of people just treading water in OC? But of course, don’t let that burst your perception of the OC.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

381 Responses to “The growing underclass of the Orange County Bubble:Â You need to earn an hourly wage of $28 to afford a basic one-bedroom apartment but 68 percent of OC jobs pay less than that amount.”

Orange County is lost already- too many illegals packed like sardines into cramped apartments, Chinese nationals hiding their money in real estate, and leftist moonbats voting for regressive policies that destroy the quality of life in CA just for the sake of politically correct virtue signalling.

Endless immigration and birthright citizenship is turning CA bluer every day, yet because of geography, weather, and existing industry/infrastructure, CA has been succeeding overall in spite of all these factors… but it won’t last forever; eventually the leftist morons of CA will realize their “everyone can come to CA, and we’ll pay for it!” stance was a mistake but by then it will be too late… SAD!

CA has always been a grifter’s paradise. OC is ground zero of grifters. You know a grifter based on fashionable looks, leased luxury cars, Equinox memberships, attending (insert evangelical church) to troll for “new investors” over coffee and donuts, etc., all precariously perching on a mountain of debt. Every 10 years the debt earthquake happens, and many of them get shaken out, to places like Denver and Phoenix, with a fresh batch of young grifters coming in from all over. It’s the circle of life.

The leftists are to blame for Orange County? It’s been Republican-dominated for decades. What on earth are you talking about?

Republicans in CA, especially in the big cities on the coast had zero power for a very long time.

Try again!

Democratic voters outnumber Republicans in Orange County’s three largest cities including Irvine. In the 2016 presidential election, Clinton beat Donald Trump by nearly five percentage points, or 39,000 votes, in the county.

http://www.ocregister.com/2016/02/19/irvine-is-latest-orange-county-city-to-tilt-democratic/

http://www.latimes.com/nation/politics/trailguide/la-na-election-aftermath-updates-trail-orange-county-turns-1478716018-htmlstory.html

“It’s been Republican-dominated for decades. What on earth are you talking about?”

If we were in 1995, you’d be correct. In case you haven’t noticed California of 2017 is nothing like it was 20 years ago.

The 48% of children not ready for Kindergarten are the Mexican immigrants that are of the servant class, as the English Overlords in India use to refer to the locals. Yes, to maintain our style of living, we need the servant class. California is great in this regards.

I knew that cat would come flying out of the bag in one of the first comments.

Now, you sound as non-PC as Trump. You are going to hurt the sensibilities of snow flakes.

I hear about around Monterey County and other ag areas you have public schools that are essentially baby sitting immigrant kids and don’t provide any education. Likely because they need labor that is not too educated but will remain here to serve the farmers.

yes, legal immigrants want too much money. It is preferable for many reasons to employ the undocumented. My friends in Marin County do this, but of course, we are all register Democrat and donate money to the party. Hypocrisy in the pursuit of money has never been a problem with us.

Homerun,

I grew up in Monterey & San Benito and do not feel this is the case. Could the teachers & schools be better? Sure! But it takes more than schooling to raise a child. The reality is that these children’s parents are usually never around and don’t give a shit about their children. They say they come here for a better life for their children but that is hardly the case. They come here for themselves.

@ Don Ciccio

Well I have heard from friends who live in the Salinas area that literally their mother in law quit because the other teachers claimed the person was making the other teachers look bad if one was making an effort to teach some of the immigrant children. Also some these children have social issue, which it made it difficult to even bother helping them. Although some teachers maybe more adaptable with these children than others. Just seems a bit suspicious from what I have heard.

Homerun – I am specifically from Salinas. Your story seems true. I just don’t think it is extremely widespread. The worst high school in Salinas is Alisal High. This issue might be more widespread at that specific high school.

The 52% that are “READY” get the pleasure to be injected with a COMMON CORE so that they end up no better off than the other 48%. You see Equality of OUTCOMES works!!!!!

If you only have a small down payment, you can only buy when private mortgage investors are confident in the value of the collateral behind the mortgage, which is your home. So, now is your chance. If you miss and wait till the recession hits, you have a difficult time getting in without a large down payment since mortgage investors will shy away from buying debt with falling home prices meaning falling collateral. In cheaper markets where GSE financing works, you can buy with a small down in a recession But, in higher priced markets, GSE financing is not available, and you borrow from a private lender, so you will have difficulties. The bottom line is if you buy in a high priced market with a small down payment, you have to take a chance and buy high because that is your only way into the market.

“… and you borrow from a private lender, so you will have difficulties. The bottom line is if you buy in a high priced market with a small down payment, you have to take a chance and buy high because that is your only way into the market.”

Maybe if you type it enough times, it will come true.

It is true. I was a private label, conventional, whole loan, CMBS, and CMO mortgage trader. That is how I know.

Then you should also know that different lenders have different requirements and standards. The standards may change a little with the market, but not enough to prevent a top tier borrower from getting financing.

Let’s take a hypothetical (but realistic and very common) potential borrower. $150k combined income, no debt, all six FICOs ranging from 770-820, ten years working in the same career. They have 20% to put down on a property that will result in a 37% back end.

You’re actually telling me they won’t be able to find a lender to approve them in a down market? That’s BS and you know it, so at this point I guess you’re more concerned with sticking to your story than being right.

Being top tier isn’t difficult or rare, and finding a lender is like shooting fish in a barrel for them in ANY market.

jt specifically said “small downpayment.” Your example used 20% down which is definitely not considered a small down. The buyer in your example should have no problem getting financing. Change that 20% to 5% are everything changes.

Yeah I chose to ignore that, because he changed his argument. In multiple prior threads he just made the blanket statement that it was difficult for anyone to get a loan in a recession. Then he amended that with “on the coast”, and now “small down payment”.

Yes, I imagine it would be difficult to get a jumbo loan with 5% down on a $3m Manhattan Beach property.

Jt,

so basically: Buy high with a small down payment and buy now or you wont get into the market!

Brilliant, you sound like Warren Buffet!

/sarcasm off

It is not BS. When an investor decides the mortgage securities they hold over-exposes them to house price volatility, which is the case with private lenders ( i.e. non GSE paper ), they stop buying. It does not matter what your individual numbers are. They want no more non-GSE pools, so you get no mortgage. They may still buy GSE paper since they get protection, but the limits on those loans are below what it takes to purchase a decent property in LA/OC.

“but the limits on those loans are below what it takes to purchase a decent property in LA/OC.”

Jt, you assume the prices in RE stay the same as they are today. In a RE collapse, that is not the case; prices will much lower. Therefore, those limits will not be a problem.

Your funny, private lenders are not buying anything right now, risk is too great and rates are too low. Why compete against the artificial low rates via the fed. The bankrupt govt. entities are still buying 80% of loans though they are in receivership. In fact, they should have been wound down by now. It tells me the smoke and mirrors economy and hyped RE market is just that

CD wrote: Your funny, private lenders are not buying anything right now, risk is too great and rates are too low. Why compete against the artificial low rates via the fed. The bankrupt govt. entities are still buying 80% of loans though they are in receivership. In fact, they should have been wound down by now. It tells me the smoke and mirrors economy and hyped RE market is just that

Very true! We just bought a house. We got a loan from NBKC Bank, 30 days later, they sold our loan to Wells Fargo and got a letter from each stating as much.

Then about two weeks later, we get a letter from Fannie Mae stating that Wells Fargo sold our loan to them, but Wells Fargo will still be our loan servicer.

So after all was said and done, our mortgage is now owned by the government!

L.A. will be hosting the Olympics in 2028. Housing to skyrocket in 2026 and tank in 2029.

So we wait 12 years to buy? Many of us will be dead by then, including some of the Millennials posting here. Just the odds. People die at every age.

I’ve no desire to wait 12 years for a nice house. Better to overpay now, if you can afford it.

that was a joke…

The opening ceremony will have cholos driving into the arena in low riders. Followed by the march of the baby mamas, with a synchronized dance that includes strollers going in various formations. The release of doves will be replaced with chickens standing on discarded couches.

“The release of doves will be replaced with chickens..”

These will be free-range chickens, and the eggs have more Omega 3’s (much healthier)

Classic. I suppose they will also feature no gender specific bathrooms – just open pits to be more “inclusive”.

The “Drive-By” will be introduced as a new summer event in the future LA Olympics.

The concession stands will accept SNAP and EBT.

There will be “Preferred Seating” for illegals and low-income spectators.

Due to diversity laws any event without minority representation will be cancelled.

Next to the Olympic Village in the parking lot there will be a Tent City with it’s own “Homeless Olympics” featuring timed shopping cart races.

Damn Jed, you’re on fire!

Cant wait to see the “indeterminate gender” greco-roman wrestling and competitors with hijabs.

Oh I forgot that Caitlyn Jenner will light the Olympic torch during the opening ceremonies and then receive a gold medal “just because”.

I think that RE prices in LA are going to be influenced negatively far more than Olympics by the dead and illegals voting in LA:

https://mishtalk.com/2017/08/05/california-has-11-counties-with-more-registered-voters-than-voting-age-citizens-registered-voters-144-of-egilibility/amp/

Ha! Since housing historically has been in 7 year cycles, it will crash starting this year, bottom out in 2021 and reach a new peak in 2026. Buy in 2021 and enjoy the Olympics but sell by 2028.

I heard they hired this guy.

https://www.youtube.com/watch?v=zW5gklIKcDg

QUOTE:

This is the complete NWO, satanic tunnel opening ceremony at the Gotthard tunnel in Switzerland. The ceremony took place in two parts. There is a short clip of dignitaries and elites spliced in between the two ritualistic ceremonies.

The first part of the ceremony took place in a train house before the elites were loaded onto the train and sent through the Gotthard tunnel. The second part of the ceremony took place after the trip though the tunnel.

Quote: “Those Taco Tuesday baby boomers are the broke folks in their hood while the new buyers are cruising around in Teslas and BMWs.”

That is just dumb. My renters drive big priced vehicles while they pay me north of $4,000 per month. One has an AMG MBZ. In the meantime, I drive a 5 year old Toyota and a 6 year old Honda Pilot. If you have money, you are best to keep it hidden by driving vanilla vehicles.

JT, this is another point where we think alike. Or maybe it was this mindset which helped us succeed at the RE game!!!!…

I just have a truck and a Subaru Outback although I can afford a Lamborghini. I like my money to work hard for me. For me it is more important to have free time and travel. On top of that, I don’t care to impress anybody.

I agree. But, even more than that. Driving a big price tag car just advertises your wealth, and criminals take notice. You are better off sliding by in a older normal car.

Buying a new luxury car is pretty much the stupidest financial decision one can make. It’s funny how people oooh and ahh when they see someone in a brand new $70K car. I look at them and think “what a fucking idiot”.

It’s not that terrible, you just have to keep and maintain it instead of swapping every two years and taking the hit over and over – I bought one of those and love it but it’s now almost 8 years old so the shiny has been almost fully amortized. (Bought the prior one new & shiny too, now in year 17 at 225k.)

Jim at Law, are your vehicles Lexus? BMW and Mercedes are money pits.

Each to their own I guess. The real smart play if you truly want a fancy name plate is to buy an off lease one that’s 2-3 years old. The initial depreciation hit is paid by someone else, you still have a relatively new, low mile car under warranty that can impress people just as much as the newest and shiniest. People who are impressed by a BMW or Mercedes don’t know the difference between a 2015 or a 2017, they just see the badge and go ooooooohhhhh ahhhhhhhhh, that person must be important. LOL

You can buy a fully loaded, lightly used, certified pre-owned Ford Fusion for 10-12k. Great looking car! I don’t understand why anyone would pay more than 30k for a vehicle… It better s*** my d*** while I’m driving if I’m paying more than that!

One Audi that was 60k in 2010 and one Ford that was 40k in 2001. Both new and beautiful when I bought them, the Audi still looks terrific, the Ford could use new paint but she has served me well for almost two decades and I will keep her until she drops or I do.

That is very accurate, especially for young people who have the following choice:

a. Spend 40K on a new car.

b. Keep your old beater and use that 40K to get into a socal property.

Going with Option a could be the biggest financial mistake of your life!

Just heard the announcement, Los Angeles agrees to host the 2028 Olympics. How awesome is that having the world’s greatest sporting event in our backyard! Can’t wait!

You won’t think it’s so effing awesome when you see the public bills for it, or experience the disruption. I can’t believe that people STILL think that these over-hyped events with their massive crowds and still more massive public costs for an event that is very short-lived and, worse, does not help local businesses at all outside the major hotel chains, are good for their city. A few businesses will clean up while the majority away from the game venues will lose traffic, and the jobs the event brings will mostly go to people who travel to take them. At best, the event is a wash, and it will end up costing Los Angeles billions of dollars more than advertised, just as it has nearly every other city that hosted it. As it is, we in the major cities have been bending over and picking up the soap, to put it delicately, for major sports team owners for over 50 years, soaking the taxpayers to pay for sports stadiums for giga-rich team owners.

Save Los Angeles- resist this event for the good of your city!

Laura, I don’t think you know what you are talking about. The selling point of LA is that the infrastructure is already there. Athens and Rio literally finished building stadiums and arenas a few weeks before the games started, not to mention their economies were horrific. The 84 LA Olympics was an economic success, this next go around won’t be any different.

Yes, traffic may be worse for a few weeks. That is a small price to pay to have the world’s spotlight on your city during that time. I vividly remember the 84 LA games, that was a high point for the city. Anybody who claims otherwise doesn’t know what they are talking about. I am excited and can’t wait.

Remember, this blog’s name is “How I learned to LOVE socal and forget about the housing bubble.” There is by far more hate here than love.

Lord Blankfein: Yes, traffic may be worse for a few weeks. That is a small price to pay to have the world’s spotlight on your city during that time.

Considering all the movies and TV shows that have been/are/will be shot in Los Angeles, plus the Oscars, Grammies, SAG Awards, and other awards and events, I’d say the world’s spotlight is already 24/7 on Los Angeles. The Olympics is at best an additional minor blip.

Lord Blankfein,

I think you are either a bit naive or own a construction company that is hoping for a lucrative contract with the City! The last Olympics was 1984. And despite some facilities being in place, I’m sure the planners will figure out how to spend $3 – $4 billion or more … Trouble is, there are a lot more problems today and it will be worse by 2028 at the rate California and the L.A. are are going! There are way more people, mass traffic congestion, rapidly declining infrastructure, a growing homeless problem, masses of poor, horrible public schools, gangs, serious mounting liabilities, and there might even be water restrictions for everyone but the Olympic pool by then! But, let’s pat ourselves on the back and show off our fine City!!!

You’re correct, studies with football have shown new stadiums only shift the money to the location of the new stadiums, usually at tax payer expense.

The 84 games were boycotted by the best athletes. The infrastructure was barely working in 84, what is new since then? Only by total focus on America were the games successful, this won’t happen again and the Olympics don’t carry the demand they did now that everything is divided for broadcast. You will not see a repeat of 84.

Sorry LB: you’re 792 years off. It’s 2820!

The greatest sporting event already happened when we won the Stanley Cup.

no, actually we just lost the worlds greatest sporting event ,,at choice of venue we placed it in the bahamas?? when S.F was already built for it? how dumb was that, besides the fact that there was literally no place for an audience unless you were uber-rich with a yacht to watch it from, which wasnt that great considering the light air ,,,yes land is cheaper in the bahamahs,, but S/F has a unique situation for the event ,plus great wind ,,,,no matter what country you come from the poor folks fish and sail to eat, sailing,and the “Americas Cup” is the greatest and oldest sporting trophy in the world

This is weird. I have been led to believe, by very smart liberals, that everyone on the coast makes $100K+, unlike those deplorable meth addicts living in trailers out in flyover land . Now you tell me only 68% of jobs in Orange County barely pay $50K a year? And this is in one of the wealthiest counties in the state no less.

LOL

You made the same meth remark in the previous thread. Why so obsessed with meth?

SOL, that is the stereotype created by media (MSM) about the people in red states – they are dumb and drug addicts (in a word “deplorables”) and those living in blue states are smart and beautiful. The conclusion for the basement dwellers, indoctrinated snow flakes was obvious – vote Democrats if want to be considered smart and beautiful.

Or so the MSM and Democrats hoped for….

Flyover,

Of course everyone in red states aren’t dumb hicks. But the drug epidemic sweeping the middle of the country (heroin) is real. You are out of touch with the youth if you believe otherwise.

States with the biggest increase in drug overdoses year over year:

Location Statistically Significant Percent Change from 2014-2015

Massachusetts Yes 35.3

New Hampshire Yes 30.9

Maine Yes 26.2

Connecticut Yes 25.6

Not quite “middle of the country”, is it?

https://www.cdc.gov/drugoverdose/data/statedeaths.html

SoCal,

It may be anecdotal, but my experience driving in SoCal (LA and Orange Counties) is that I see plenty of drug addicts and homeless. For the casual visitor, it looks like an epidemic and a third world country. When I am saying third world country, I think that I overestimate. I’ve been in most of Bolivia, the poorest country in So America, and I did not see so many homeless as I saw in SoCal. Homelessness, for the most part is due to drugs and the effects it has on the brain.

And I don’t even mention the smell of piss everywhere. With the exemption of some rich enclaves it looks pretty deplorable to me.

I don’t think that the red states have a corner in terms of economic despair. Like the doctor said, look at the millennials in SoCal (as blue as it can be) about hope for a decent standard of living in a decent area, especially if they have children. Thank the FED for their policies which caused this despair.

The opiod epidemic is where people are dying. That’s worst by far in Appalachia. “Flyover country” oversimplifies because some places considered “flyover” have low rates for the country (like the northern Plains) and some of the coastal areas have high rates (New England.) But California is doing comparatively well, although there’s certainly still too much opioid use here.

Cities in other states have apparently been caught recently literally busing their homeless to LA. Buying them tickets and loading them up.

But California is doing comparatively well?

Far more Californians die from drug poisoning each year than die in car accidents. More than twice as many Californians die of drug overdoses than are murdered.

http://www.sacbee.com/site-services/databases/article56168810.html

In 2014, California lost 4,521 of its residents to overdoses, the largest number of any state in America.

http://forterustreatment.com/california-treatment/opioid-statistics/

Yes, California is doing well on drug overdose rates compared to other states. It’s got the seventh lowest rate. Drug overdoses have become the leading cause of premature preventable death nationally, surpassing car accidents and guns in general (not just murders, which are a distinct minority of gun deaths). Comparisons to car and gun death rates aren’t particularly meaningful because CA is *also* good on both of those.

Which “smart liberals”? Reference please.

Well, this is why the Inland Empire exists, lower cost of living

you mean …like pomona? upland?

pomona crap 1 beds 1000, crap hi crime hoods, next to 10 fwy, let me rephrase what you said: this is why adelanto exists, lower cost of living….next to a supermax pen….but hey they might build a federal highway there and empty crap land is now for sale upwards of a million doelars! right now! get in while you fit in..

Scary thing is… This isnt just California with these figures. Its the whole world.say what you want I think its #lategamecapitalism

#lategamecapitalism

by no measure what so ever can what we have now be called capitalism. Failure is an integral part of capitalism and since banks/wallstreet are not allowed to fail……….

The sad state of hypocrisy! Don’t see any of those Laguna, Newport, or Corona Del Mar fine folks complaining about their housekeepers, gardeners, cooks, nannies, or bussing tables at those fine eating establishments. They seem to love the other side of the tracks … lots of cheap help! Kind of like watching those Hollywood Hills/Malibu celeb’s lecturing us on climate, equality, social justice, while they live behind walled estates, have their body guards, and all that help, and even have someone keep their daily schedule! I always chuckle at the perennial celeb who drive their Tesla or Toyota Prius, while they have a 10,000 square foot electricity eating estate and have to fly on their private jets! Just like the L.A. Olympics … think someone would eventually realize they have enough unfunded liabilities, degrading infrastructure, homeless, poor, horrible public schools, and would want to take care of those problems instead of spending on the Olympics …

It’s time for another bond issue to pay for the Olympics. A nice round figure, 2% sales tax increase. Enough glossy advertising about civic pride “showplace of the world” stuff, and bingo, the mind numbed zombies will approve it.

I was part of the protest against the Olympics here in Chicago, that helped kill our bid for the 2016 games, may the Gods be praised. At least we dodged THAT bullet. The citizens were all for the event at first, having bought the lie that the games would not cost the public a dime. Well, it did not take long for the word to get out that not only would the games put the city on the hook for unknown billions of $$ in the expense of building redundant infrastructure (like a special express train to O’Hare that is already well-served by the Blue LIne), but had already cost the city $100M, which was paid to a crony developer for the old Reese Medical property which was to be demolished to build the Olympic village.

So it baffles me that Los Angeles would want to bid when almost every other city that has hosted this even in the past few decades, wishes it had not. Nearly every host ended up incurring costs far over budget- London went $12 B over budget and wishes it had never thought of hosting this boondoggle, and Atlanta, Rio, and other cities are stuck with rotting game venues that are useless for any other purpose- and massive bills to pay. Only Salt Lake City event, managed by Mitt Romney, was able to clear a profit. Worse, the games cause massive disruption and displacement of poor people everywhere they take place, and here in Chicago, would have displaced 10,000 residents of the poverty-stricken Washington Park area, pushing the residents into other neighborhoods and causing an even greater shortage of low-priced housing than is already the case. Los Angeles may be in better financial condition than woefully mismanaged Chicago, but not by much, for there is almost no major city in the U.S. that does not have massive pension obligations and debt overhang. And both Los Angeles and Chicago have quite enough going for them in the way of cultural and entertainment venues, architecture, beauty, and overall attraction, that the games will detract from them, while adding nothing, and damaging the quality of life for all residents of all classes. Please, Los Angeles, fight this event for the good of your city.

Laura: “So it baffles me that Los Angeles would want to bid when almost every other city that has hosted this even in the past few decades, wishes it had not.”

The people who brought the Olympics who LA will make out like bandits. Every one of the people involved has a brother in law somewhere who will get a $50M contract out of it. 99.5% of the city’s residents will wish the Olympics never came. But for that other 0.5%, it will be like winning the lottery.

Laura, you need to stop dodging bullets and give up on that corrupt bankrupt city of Chicago. Your inability to purchase another property in Chicago is a blessing in disguise. The universe is telling you to move to someplace like FLORIDA!

Opening Early 2018 – Single Family Homes from the LOW $200Ks. Cypress Falls at The Woodlands is the perfect place to call home. Discover low-maintenance home designs with open living spaces, and easy access to nearby beaches, golf, and cultural attractions. Located in The Woodlands in North Port, this 55+ active adult community features resort-style amenities and activities including resistance and resort pools, fitness center, tennis, and hobby clubs, so you’re sure to stay active year-round.

https://www.delwebb.com/homes/florida/sarasota/north-port/cypress-falls-at-the-woodlands-209208

Samantha, I just (finally) scored a BEAUTIFUL condominium here in Chicago, in a building I’ve hankered to live in for 30 years, in a neighborhood I love, and for the right price. Cash sale, quick close, and there is NOTHING in the shithole of Florida that can approach it in architecture or amenity for less than $900K.

I paid a tenth that much. My taxes are almost nothing because it is a large building. It is a historic masterpiece that is on the Architectural Foundation’s annual Open House tour almost every year.

Amazing the way you think that YOUR place is heaven, while mine is a dump. All you know about Chicago is likely what you hear on Fox News. News flash: most of this city is safe. The neighborhoods where 95% of the mayhem takes place are on the far south and far west sides of the city, which are a good 20 miles from my nabe on the far north side, as the bird flies. Longer if you have to drive or take transit. I absolutely LOVE Chicago, a city with peerless architecture, and top tier cultural institutions, entertainment venues, and beautiful parks & beaches. BTW, I live withing walking distance of the far north side beaches, which are calm and uncrowded; within 5 blocks of rail transit, and have 24/7 bus and rail withing a few blocks.

What does crappy Florida have but sinkholes, high insurance costs (my house insurance would cost at least 5X as much as here), and killer hot weather and sun that would kill me within two months? The only reason that it’s even possible to live and get a mortgage in that place is because Florida and other coastal states get steeply subsidized flood insurance. Jerk those subsidies, and ordinary home owners will not be able to afford the place on any terms.

Speak not of political corruption- Florida and its cities have been known for that for decades. And corruption is everywhere where there is a confluence of money and politicians.

Ummm I think LA came out pretty well in 1984 Olympics!

https://www.marketplace.org/2016/08/05/world/1984-when-los-angeles-actually-made-money-hosting-olympics

Laura, I don’t live in Florida and I’ve never been there. I don’t watch Fox news–we cut the cable cord long ago.

However, I’ve been to crappy Chicago many times because we have family who live there. My in-laws finally became fed up with Democrat corruption and insane taxation. They finally sold their northside bungalow and retired to Florida where they love it. We also have family who live in Libertyville which is on the north side of Chicago. They plan to leave Illinois and retire to South Carolina after their youngest finishes college.

Not only is the weather in Chicago awful and brutally cold, it has killer hot weather in the summer–literally. Ever summer there are news reports of people dying in those old brick buildings that you delusionally think are architectural masterpieces.

You claim that your property taxes are low (at least for now) but you are going to pay high taxes on everything else. Enjoy being a tax slave on your Democrat master’s bankrupt entitlement plantation!

Newport is a funny place. I work on my car, cut my lawn, work on my house, and all the other normal stuff in life. My Newport neighbors think something is wrong with me. And they really look down on my 5 year old vehicles.

Back in the 90s, when I graduated from college, lots of people in Newport lead normal lives. Over the years, most of them have cashed out and a new crop of unusually stuck up people have taken their place. My wife always tells me they make her feel uncomfortable. I don’t care.

I grew up in Santa Monica in the ‘North of Montana Ave’ neighborhood. Back in the 70’s then a good salaried blue collar worker could afford a home there. I have watched the neighborhood over the past couple decades for some reason attract movie stars and producers, I guess who want to avoid Brentwood, Beverly Hills, Bel Air and Palisades. And have watched the influx of $100K cars, and the original 3 bedroom homes be torn down for 3,000 – 4,000 sqft mansions. But the attitudes have changed also,,,, it is no longer a neighborhood where all these elite even greet each other as they walk down the street.

Preaching to the choir, but women are always more susceptible to social persuasion, peer pressure and ‘keeping up’ with the yup-yups (who are typically always in hundreds of thousands of dollars in compounding debt).

As a 30-year old entrepreneur who has never held a white (noose) I mean ‘collar’ job – or any job working for someone else, I have always driven old ass cars with well north of $500k in the bank (since I was 18 no less). I used to live in Montecito and everyone figured I must have been ‘down and out’ driving a 1990 mazda miata painted dayglo orange with purple roll bar. Yep, they just hated. To them, the t.v. and invisible social pressure says that the $90,000 G-wagon says that you’ve “MADE IT”. Nope, being free and being able to do whatever the hell you want all day and all night is the true measure of freedom.

They can take their HOAs, their cookie-cutter mcmansions with recockulous overpriced price tags to boot and shove them down their craws. I will lick their yuppie tears from their faces when they realize how colossally they have screwed themselves. Thankfully, as I know very well, the truly wealthy do NOT live in Santa Monica, Malibu, Newport Beach…the faux-riche live there. The truly wealthy live well out of sight of the public, where they don’t have to deal with the constant jealousy of the peasantry.

Hearst Castle?

Boomhakalaka.

When I was at OCC 20-ish years ago, I learned real quick to avoid the superficial, vapid, status obsessed, gold digging grifters from Newport. Still to this day, people that live in cities with “beach” in the name don’t get a whole lot of my time. Especially when it comes to dating. (Fwiw, the ones that grew up there weren’t usually as bad as the ones struggling to make ends meet in scummy apartments within shouting distance of Huntington Beach and Costa Mesa addresses.)

Attention all Southern California realtors! Please promptly pivot from low inventory, foreign buyer narrative to Olympics. Sincerely NAR and CAR.

Yes!! We finally have a new theme…. a year ago it was Buy now, millennials will go out and buy in droves. A few months ago it changed to buy now, we have trump now, he is a real estate guy! And now its, buy now, the Olympics are coming!!

Millie,

Did people actually use Trump as a reason to buy, because he’s a real estate guy? I think Trump as president is a good reason to buy because under him the economy is on fire. And will continue to be. But the fact he was in real estate means nothing as far as whether r/e is a good or bad investment.

Are you just being facetious or were people really saying that?

It makes sense to think that with Trump RE would continue its upward climb with the economy.

Obamacare repeal/replace/reform whatever

Tax cuts

More easy credit policies

All of the above spur growth.

Although; both parties seem to be stifling his agenda so I think he’s somewhat neutered in this equation.

Of course nobody seriously believes that. The difference is Millenial is young enough to think he’s the one ‘outsmarting the system’.

We were all young once. Ah yes, the good ole days. Where you believe you have it all figured out.

Oh yes, people made this comment. Here on this blog. I wanna say it came from JT or NoTankInsight. They are usually good for comments like that but it would be too tedious to go back and find it. When I see a treasure comment like that I add it to my list.

Goudy,

“The difference is Millenial is young enough to think he’s the one ‘outsmarting the system’.”

Agree 100%. I believe I am winning by waiting for a housing crash. There is no doubt in my mind we will have another severe crash. Just a matter of time.

“We were all young once. Ah yes, the good ole days. Where you believe you have it all figured out.”

Unfortunately, the younger ones often believe the older ones when it comes to buying a home. I almost made that mistake. Many first time buyers believe that the older ones share their experience and wisdom with good intentions. That’s how many first time buyers get screwed big time. They don’t understand that the advice they are receiving is not helping them but the person giving the advice. I almost bought in 2014. That experience led me to finding this blog and other blogs like this which prevented me from buying. It opened my eyes about this rigged market that screws many and benefits only a few sleazy realtards and lenders. On the bright side, there are people like flyover and POH who are different.

“Obamacare repeal/replace/reform whatever

Tax cuts

More easy credit policies

All of the above spur growth.”

Tax cuts (or any form of supply side economics) have proven to be ineffectual drivers in the long term. The upper class won’t re-invest into the economy, and the lower classes need incomes to grow substantially before discretionary spending can pick up.

Easy credit policies when the economy is already over-satured with debt won’t do much. 8+ years of the same, and GDP growth can’t even reach 3%.

Real growth can only follow once bad debt has substantially removed from the system. And the latter entails a recession.

Sorry Mr. Landlord, The economy has been growing at less than 2%, why do you think rates are so low. The great unwind begins in fall.

the Bernanke Put is soon to end, the unwinding of balance sheet will cause some big hiccups in multiple markets and this BS fed grifted economy will finally be seen for what it is. A depression cloaked in 18 trillion dollars and 0% interest rates….

Many folks here could use some schooling on how the economy works..

I laugh at the phillips curve…The fed is thinking this is the 60’s……funny they are

cd,

Peeps like you have been talking about the great unwinding forever. The doom and gloom is always just around the corner. It’s always this fall, or this spring or this (fill in the blank).

I think I know a thing or two about how the economy works, given my degree was in finance and I picked up a thing or two working in finance for 10ish years. But maybe you know better since you read Zero Hedge. I dunno.

We had 2% growth because we had a fucking communist in the White House that you and your fellow Californians happily voted for. That nightmare is over Thank Allah! Did you happen to catch the fact last Q2 GDP grew by 2.6%? Probably not. ZH doesn’t bother with those stories. Did you happen to catch the fact the number of people on welfare is at a 10 year low? Did you happen to catch the fact that consumer confidence is at a 15 year high? No probably not. That goes against the “DOOM AND GLOOM FOREVER” mantra of the perma-bears.

“The upper class won’t re-invest into the economy,”

LOL. Unless people put money under their mattress they can do 1 of two things with their money

1. Spend it

2. Invest it (including just parking it in a money market account or CD)

Either 1 or 2 circulates the money back into the economy and is a stimulant.

Millennial,

Sounds like you are a single dude renting a room (not saying in a derogatory manger at all) and if bought in 2014, could be up 100k right now.

I guess if you’re single and in your 20s stacking cash and waiting could make sense. OTOH, you could buy and rent rooms to your buddies who will pay your mortgage for you while you pocket the tax benefits and any appreciation is gravy.

Unfortunately I no longer have time to burn with a 7yr old and 9 month old; the wife has been clamoring for years about buying and actually having a house with a yard instead of a condo with a patio. I have been a housing bear for years thinking the prices in 10-12 would continue their decline and dramatically underestimating the feds ability to save the market. My wife is pretty much always wrong when it comes to our finances (luckily I control the money), but, if I had listened to her 4-5 yrs ago I would probably have over 250k in equity today along with paying a lot less in taxes.

I do not see much inventory there’s low turnover with Boomers just sitting in their paid off houses and still strong organic and foreign cash demand therefore I see this sideways to up Market continuing.

“LOL. Unless people put money under their mattress they can do 1 of two things with their money

1. Spend it

2. Invest it (including just parking it in a money market account or CD)

Either 1 or 2 circulates the money back into the economy and is a stimulant.”

1. Their spending won’t make much of a difference. After all, the economy depends on mass consumption, not 1% consumption.

2. Corporations have been borrowed heavily at the lowest rate in modern history mostly to acquire other companies (job cuts), increase stock dividends, or to shore up stock prices. They have increasingly invested in automation and offshoring. Spending for domestic expansion has comparatively been weak.

“We had 2% growth because we had a communist in the White House that you and your fellow Californians happily voted for. That nightmare is over Thank Allah! Did you happen to catch the fact last Q2 GDP grew by 2.6%? Probably not.”

And? Did you know that quarterly GDP growth was greater than 2.6% at least 7 times under Obama? It’s annual GDP growth that we’re concerned with.

And Obama — Mr. privatize corporate profits but social corporate losses — is a communist?.

Dan,

“you could be up by 100k”

This is a common mistake by many people. It does not matter if you could be up by 100k, 200k, 300k. This so called “equity” does not equal savings in the bank. It’s just a book value that is tied to an overpriced house. Book value does not pay any bills. It has no meaning unless you sell (or take out home equity loans which means you are living above your means most likely)

What I do is cut out all emotions and stories and just look at the numbers. What is my cash outflow when I buy and what is the cost of renting the equivalent.

If I would have bought in 2014 my monthly payment would have been much higher than what the rent is considering taxes, tax savings, maintenance, PMI, P&I, insurance, transactions costs and HOA’s. What I monthly save by not buying goes into the bank (and more). I couldn’t care less how much this condo or house goes up in price during the bubble. People think the bubble makes them wealthy and that they are “up” but in reality they are locked in to an overpriced house. I can see them already, walking away from the overpriced house when the market crashes cause they cant bear that a millennial bought next door for half the price.

@Millenial

“Book value does not pay any bills. It has no meaning unless you sell”

This might be the dumbest thing I’ve ever heard on here. Any equity in a home is a direct offset to not paying rent otherwise. For every $100k that home values go up you can bet your ass rent is going up by enough to make up for it if not more. I have seen this firsthand in LA in the 10 years I’ve lived here.

If you had bought a home 30 years ago in California and have it paid off by now, you won’t have cash but you’ll have either:

1) A roof over your head and NO RENT PAYMENT

2) An asset that you can rent out and get cash from

“Book value does not pay any bills” … how on earth does that even make sense…

I take it if someone signed a deed over to you for a $1M property on the westside with the stipulation you can’t sell it for 10 years, you wouldn’t be too excited? After all it’s just book value…it’s useless! You might as well turn that offer down!

AA81

“Any equity in a home is a direct offset to not paying rent otherwise.”

I have not the slightest idea what you are trying to say here.

“For every $100k that home values go up you can bet your ass rent is going up by enough to make up for it if not more.”

Never heard that before. I know my rent has not gone up since I started renting.

“Book value does not pay any bills … how on earth does that even make sense…”

I want to try helping you but I am not sure what you struggle with.

Maybe the term book value confuses you? What this means is an unrealized gain or loss. This so called equity in your homes does not help you to pay for your cable TV or the water bill. It’s a value on paper. That value can vaporize easily when there is a correction/crash. Therefore, I disregard this argument when people say “you could be up by x amount”. Book value has no meaning to me. I am waiting for a crash and save money by waiting. I am basically getting paid for waiting. The buyer who pays much more per month for mortgage, interest, transactions costs, taxes, PMI, maintenance and insurance sees his house value going up during the bubble which gives him the feeling of getting wealthy…..until the crash. That’s when I come in and buy for half off. Therefore, the temporary “equity/book value” this buyer had, had no meaning. It was like a nice looking bubble that just burst.

As I said, most people make this mistake and don’t understand it. So you are not alone but I hope my explanation turned on the lights.

Good news Los Angeles!! First the Olympics now this. You guys are on a roll. LOL

“The big real estate news out of Los Angeles is that rapper-magnate Jay-Z and superstar wife Beyoncé are in escrow to buy a mansion for $90 million. Their pick of Westside neighborhoods after years of house-hunting? Bel-Air. We’ll be sure to let you know as soon as they have the keys to the newly built 30,000-square-foot home.

Ahh Mr. Landlord, Touch a nerve a bit I see. Finance guys like you with your keynesian background are a bit to locked into their theories and phony profits. Sorry Mr. Landlord, I don’t know of this zeroedge site, why would I use a contrarian viewpoint setup by bankers for my news. You seem to know it well. Again I apologize for owning a home in San Francisco valued much more than what it’s worth Mr. Landlord.

Your snap statement-do you take into effect that states have now went back to work requirements to get welfare. Thus the drop noted by your fine paper is almost entirely due to this.

I believe you read Zero Edge since you mention it most. 2.6% GPD is rubbish when you consider the fed and Bernanke put, subprime ABS paper push started by the govt. buy out of GMAC and turning into Ally.

Sorry Mr Landlord for your 10 years of finance that leads you down a rabbit hole of bullshit. You top of the cake of speculators whom were literally saved by the fed and govt. actions. You sit there and spit on your fellow man because of your luck…

your full of shit

Agreeing with cd. Our GDP doesn’t matter if the debt is so huge. It’s most likely much more than the 18 trillion they mention (just like fudging the unemployment numbers).

That’s like saying my salary grew by 3% this year and I just bought a car that’s gonna take more than 4% of my salary to pay the monthly payments, so I should be all excited? I am going to have less money because I spend more.

You forgot the weather. As in — it was a few degrees above 80 F too high to go out shopping during the busiest buying season in So Cal.

this weeks 15 yr fixed avg at 3%

3% interest. borrow $600K pay back $910K………..3%

Wrong, 3% for 15 years as stated: borrow 600k, pay back 746k.

If you spend $3K a month on rent, and assuming a 3% average increase every year, after 15 years you will have paid $540,000 in rent.

What it comes down to is

option a) spend $540K and have nothing to show for it in 15 years, other than fine memories of renting and having to move every year or two

option b) spend $910K and have a house fully paid for, in 15 years, a house that could easily be worth $1M, and most likely would be in such a long time horizon

Your choice.

Mr. Landlord,

Please stop making sense.

Not quite that cut and dray Mr.Landlord:

Your monthly payment on that 600,000 is 4100 a month + 500 month in property taxes = 4600. Now add on homeowner insurance+ maintenance,closing costs.

One problem is people can’t afford the jump in monthly cash outlay when they are stretched to thin. But even saying they could. It not a slam dunk, UNLESS you do nothing with the money you would have spent on the above. Kinda depends somewhat on your long term view of the stock market and what average rate of return you can get on invested money vs housing appreciation.

One of my favorite calculators to use…

http://michaelbluejay.com/house/rentvsbuy.html#mdt

Or if you invest the money in stocks while you rent. You will have more cash in your bank account than the house is worth

Maintenance costs will be offset by the tax savings, and then some. It’s a wash for the most part.

The point is renting for 15 years leaves you with nothing at the end of that 15 years. While paying a mortgage for 15 years leaves you with a fully paid house at the end.

Well Mr Landlord,

Only sheeple would buy at the top of the market. It happens everyday in the stock market.

Lemmings are easy to shear on a 10% down move, most have no stops, so how about we drive it down another 15%. They cave and sell. 25% less money than staying in cash…..

Buying RE at today’s prices is a decision best left for lemmings. There is an ass for every seat….have at it…

As I was walking the dog thru the neighborhood tonight in San Francisco, I noticed 1 and 2 million homes with few lights on, small yards unkept and a silent terror as these folks are stretched so thin that one 15% down move will wipe 40% out…

Fairytales are just that, expect rents to fall, the top is here….enjoy it while you can…

“The point is renting for 15 years leaves you with nothing at the end of that 15 years. While paying a mortgage for 15 years leaves you with a fully paid house at the end.”

What Jim T. said above. Some financial advisers even recommended holding off paying your mortgage off in favor of taking advantage of the greater rate of return from the stock market.

cd: As I was walking the dog thru the neighborhood tonight in San Francisco, I noticed 1 and 2 million homes with few lights on, small yards unkept and a silent terror …

Really? You noticed “a silent terror”?

What does “a silent terror” look like? I’ve never seen one before.

The only way renting is better than buying is if prices fall dramatically over the time span you are in the house. Over 15 years, r/e has not dropped post WW2. There are exceptions like Detroit where houses got for $1 these days. But that’s an extreme example. In California (and 98% of the country) there is no 15 year period in the past 75 years where r/e prices fell.

“Some financial advisers even recommended holding off paying your mortgage off in favor of taking advantage of the greater rate of return from the stock market.”

LOL. Do you know who most “financial advisors” are? They are people who took a 5 week course on how to be a financial advisor. It’s the same people who advised clients to buy pets.com stock. It’s the same people who are sure that annuities are good idea. It’s the same people who advise clients to buy tax free municipal bonds in their retirement accounts. There are few people more useless than realtors on this planet, financial advisor is one of them.

Not paying off a mortgage to gamble in the stock market is idiotic advice. Paying down debt, even low interest rate debt of today’s mortgage is the smartest thing anyone can do. There is nothing more liberating in the world than making that final mortgage payment.

POH,

So, don’t buy a house at the top but invest in a stock market at the top?

Aren’t both of those asset classes, which according to you have been artificially propped up with cheap credit? Seems you are contradicting yourself

“Some financial advisers even recommended holding off paying your mortgage off in favor of taking advantage of the greater rate of return from the stock market.”

I have heard similar advice. However, every financial adviser worth their salt should tell you that owning a primary residence in a decent part of town is likely the important piece of the puzzle. Being close to retirement and not having any equity in a property is a disaster in the making. Many people have 2.x and 3.x mortgage interest rates, getting a better return in the market lately has been a no brainer. Not true when rates were 7% plus.

Dan,

Yeah it’s weird how some people don’t see the correlation between stocks and housing. If one crashes, the other one will. The two always go hand in hand. So while I can see the logic of not buying and hoarding cash in anticipation of a r/e crash, it makes zero sense to rent and put all your money in stocks. At least with r/e if you foreclose you get to live rent free for a year or two. With stocks, they money is gone in an instant when the crash comes.

@Dan

Yes, you’re correct in surmising that I believe that both stocks and RE markets are in a bubble. But that’s the only thing you can brag about. I never encouraged buying into either ones at current sky high valuations.

“Yeah it’s weird how some people don’t see the correlation between stocks and housing.”

@landlord

Who are these “people” specifically? Btw, my response about financial advisors and retiring mortgage didn’t nest correctly and is down there near the bottom of he posts.

“Being close to retirement and not having any equity in a property is a disaster in the making. Many people have 2.x and 3.x mortgage interest rates, getting a better return in the market lately has been a no brainer. Not true when rates were 7% plus.”

Being close to retirement with little or no savings is also a disaster. Depending on your just equity to find your twilight years is not advisable. The strategy that I cited depends on personal risk tolerance as well.

Last sentences should have said:

Being close to retirement with little or no savings is also a disaster. Depending on just your equity to finance your twilight years is not advisable. The strategy that I cited depends on personal risk tolerance as well.

You think traffic in LA is bad now, just wait for the olympics.

Thank god I left that godforsaken place.

LA is only worth it if you are the type who is willing to put extraordinary effort towards your career. If you are more normal, LA could be a bad deal for you. LA has always been that way.

An estimated one in five Los Angeles County residents — nearly 2.2 million people — are receiving public assistance payments or benefits.

Welfare is a career choice for many in LA.

http://articles.latimes.com/2009/feb/22/local/me-welfare22

That’s my fear with Trump. He is actively working on cutting housing assistance and food stamps. There are already 100K+ living in homeless camps. What happens when Trump adds the 2.2M more unfortunate people above to these camps? Do these 2.3M people travel to DC or Mar Lago and set up camp in Trump’s front lawn to protest like they did under the Republican Hoover before FDR was elected with his social programs? Will Trump’s latest speech recommending to bash the protestor’s heads on car doors/roofs sway public opinion? CA cannot afford to feed and house these people without federal assistance. What will happen?

“What happens when Trump adds the 2.2M more unfortunate people above to these camps?”

See in it all before Bob,

Trump does not add anybody. Is it such a novel idea that people get responsible for their own actions? Why should I take the money required for my children’s education and give it to people who were free to take or refuse drugs??? They were free to choose; now let them live with the consequences of their own decisions. Why should I and my children be penalized for someone else poor choices? Why should my children finish college with a mountain of debt because the liberals want to spend the money on drug addicts?? Just to perpetuate a spiral of despair?

Before they decided to take drugs the first time, they should have thought about consequences. Our youth is indoctrinated in schools to do whatever they like and the taxpayers will pay for the consequences. Now they say they are entitled to everything, even a universal income. If that seems normal and fair to you, then my comments are in vain.

I am just quoting the OC Register and the good Dr from his article.

“To afford a median-priced, one-bedroom rental unit, an hourly wage of $27.62 is needed. Yet 68 percent of Orange County jobs pay below that.”

These are not lazy people. They are hardworking people who need housing assistance to avoid living in a tent.

What happens when Trump removes the housing assistance and food stamps from 68% of the people in OC?

Where do they set up their tent? My guess is we we see the Trumpvilles rise up on the White House lawn and at Mar Lago.

If Jerry Brown is smart, he’d give them all free bus tickets to Florida near Mar Lago or to DC before Trump cuts everyone else’s benefits. At least they will be close enough to do some good.

“What happens when Trump removes the housing assistance and food stamps from 68% of the people in OC?”

Seen it all Bob,

What will happen? Rents will be lower, consequently house prices will be more affordable (because of lower ROI for investors makes house investment less desirable), in short, those “hard working people” will afford the market rents and for those frugal, actually to buy a house.

Government interventions in anything (RE, cash for clunkers, student loans, Section 8, health care, etc) raises the prices for consumers dramatically, to the point that all those “benefiting” will be under a mountain of debt, always dependent on the government.

In a free market system (not the rigged market we have today) ALL the hard working people and with financial discipline can afford to pay in full not just a house, but multiple. Socialism ALWAYS enriches the ruling class and those connected (0.0001%) and makes everybody else EQUAL poor.

The new generation is in slavery (debt to their eye balls) before they even finish school. Sorry, but you can give me any argument you want and you will never convince me that Keynesian economics (the foundation of socialism) works. It works up to a point, by delaying the inevitable correction (kick the can down the road), and is followed by a major depression or a Venezuelan type of inflation. Basically you change a sinusoid graph (typical of normal business cycle) to an exponential graph (equivalent of inflation in 1000s %).

Only Congress can pass legislation that cuts funding for housing assistance and food stamps. Only Democrat dimwits who watch fake news on CNN or MSNBC think that Trump can unilaterally cut funding. If there are already 100K+ living in homeless camps as you claim, then most of them ended up homeless under the Obama regime and the the Democrats who completely control California. Maybe California’s Democrats should do more to stem California’s homeless crisis instead of offering more entitlements to illegal aliens? Maybe Democrat Gov. Jerry Moonbeam Brown should provide assistance to the homeless instead of spending billions of taxpayer dollars on his train to nowhere boondoggle?

“LA is only worth it if you are the type who is willing to put extraordinary effort towards your career. If you are more normal, LA could be a bad deal for you.”

**”LA has always been that way.”**

This is SOO not true!!!!

Flyover, you have a great point. If housing assistance goes away rents will likely fall. Back in the late 1920’s, housing prices fell but wages and jobs fell at an even greater rate. Different causes, I realize, but without a safety net, I fear there will be millions of homeless under Trump/

Samantha, “Only Congress can pass legislation that cuts funding for housing assistance and food stamps.” The Republican Controlled Congress had been completely blocking Obama with raising Food Stamps and Housing Assistance. Obama has been vetoing every bill related to cutting these programs. Now that we have a Republican President and a Republican Congress, we’ll see how fast they will bring on disaster like the last times in the 1920’s and in 2008. I’ve seen it before and only the ignorant ignore the past. Especially since it has happened twice. Fools.

Isn’t the real point that there are 2.2 million on assistance … that is not a sign of a vibrant economy and casts a long shadow on a housing market being driven by extremely low inventory only available to a few with money!

In 1984 everyone freaked out about the Olympic traffic. So they all left town and you could roller skate on the 10 Fwy. Carmageddon – same thing.

I went to those Olympics. We had tickets to the boxing. That’s the only thing I remember about it, except for gobs of people selling pins and memorabilia in front of the arena.

Dollar absolutely in the shitter lately. This continues and you can kiss any crash long long goodbye. Between way too low rates and low dollar this could get very ugly for the renter and prohibitive for the would B buyer.

Consumer prices rose by over 4% in 2007. The dollar always starts heading down at the tail end of bull markets as the printed money starts hitting the real economy, outside of the asset bubble.

As stated before, housing will be a secondary concern should the value of the dollar crash. Look at Venezuela for an extreme example.

For that to happen you’d have to have a better option that dollars. Where will you put the money? The pound? Not likely with Brexit uncertainties. Euro? Good luck with that the next time Greece or Italy or Spain needs a bailout (and it’s not a matter of it just when). The Yen? Whatever. The Yuan? LOL. Let’s see what else is there, oh yeah the really stable currencies of Brazil and India!!

LOL I love arm chair investors who weren’t smart enough to get a home when everyone else has, yet thinks they’re smart enough to know the future

“For that to happen you’d have to have a better option that dollars. Where will you put the money? The pound? Not likely with Brexit uncertainties. Euro? Good luck with that the next time Greece or Italy or Spain needs a bailout (and it’s not a matter of it just when). The Yen? Whatever. The Yuan? LOL. Let’s see what else is there, oh yeah the really stable currencies of Brazil and India!!”

Tell that to the Fed and government, which have been actively de-valuing the dollar for several decades. It has been their calling economic card to encourage exports and inflate asset values.

Bitcoin

Median household income in LA County: $55,900

Median income nationwide: $51,900

Median home price LA County: $550,000

Median price nationwide: $200,000

So LA makes $4k more a year, but pays $250K more in housing.

Tell me again how totes smart blue cities are, LOL

Errrrr…..$350K more.

After a 10-20 years of migration from liberal SoCal residents to Denver, it is now a city with awful traffic, smog, illegal alien gangs roaming the streets, and run 100% by Democrats. It’s the New LA, but with shittier weather.

And what is Denver’s plan to make housing “affordable”? Why stealing other people’s property and give it to poor people of course. This will be coming soon to a blue city near you….

http://www.thedenverchannel.com/news/local-news/mayor-announces-rent-buy-down-program

“While there are hundreds of apartments in Denver sitting vacant, finding an affordable place to live is tough. That’s why Denver’s Mayor Michael Hancock is proposing an innovative partnership to bridge the gap between how much those existing vacant homes cost and how much many people can actually afford.

In his address, Hancock announced a new pilot program, a partnership to open 400 existing, vacant apartments to low and moderate income Denver residents.”

It will be fun to see the 26 year old $100K+ tech worker in Apartment 501, meet his new neighbors…welfare recipients Laqueeisha and DeAndre moving in to 502.

Socialism is awesome, eh kids!!

Fuck you with your racists comments

Raycist! Raycist! squeal the loony Democrat dimwits who can’t refute the facts.

So far Samantha has used the word ‘dimwit’ in each of her many posts.

Ha! Project much?

And if you are a landlord, I’m sure the new folks will take perfect care of your unit and then be happy to leave and leave it in perfect condition when the dole runs out. Enjoy!

Denver Housing Authority Executive Director Ismael Guerrero said that since the program will be mainly city-funded (aka taxpayer funded), participants likely won’t have to meet all of the same qualifications as federal housing programs like Section 8?

Democrat insanity.

The real underclass being victimized here – or perhaps we should call them the under-underclass – is the explosion of the homeless here in OC. The camps are everywhere, and this is new – I didn’t see them even 4 years ago. The police clear them out but of course they just reform because the homeless don’t disappear. Some people love to stereotype them as ravening crack addicts but I volunteer at shelters and that’s just not so. Generally they’re people who’ve had some kind of problem and in a area where it takes more than minimum wage income just to have an apartment it doesn’t take much of a problem to kick somebody onto the streets.

The increase of large apartments is painted as a bad thing because it will reduce rents and thus returns for investors but that’s backwards because rents are far too high and need to come down. Unfortunately it will be decades before current construction will drop enough in price to help at the low end. But, it’s still better than nothing.

I have to disagree, I’ve done a lot of work with homeless and I work with those who come out of prison and in twenty years I can only think of two families that were homeless, the rest were criminals, ex-cons, drug users and the mentally ill.

Being homeless isn’t about losing a home, it’s about being in a position where when you have nowhere to go you also have no one to take you in. You have to burn a lot of bridges to to get to that point unless you’re unlucky like those two families I can think of.

Though I will admit i have no experience with homeless in the west coast, but lots of it in Chicago, NY, DC and Miami.

It may not be the same in other places, because CA real estate prices are special. Prices are nuts everywhere here except in remote exurbs which aren’t an option for the homeless. I’ve worked at two shelters. One was a shelter exclusively for single mother families – and it was always full with a long waiting list. The other was a new shelter for the general homeless, and literally almost half of them had serious medical issues.

It’s true that these people aren’t just those suffering hard times. They are incapable of functioning in any capacity due to stupidity bordering on mental illness or drug abuse. Anyone can get off the streets in a matter of hours. I work with rehab homes all the time. They take anyone in and get them on track. No matter how stupid or addicted. The only condition is sobriety and a willingness to learn.

The real truth is the world is changing and these people offer no value to society. More will be joining them as robotics advances. Many commenters on this blog included.

Most homeless have major mental and drug problems. There are many safety nets to get people off the streets, but most choose to be there.

A family who is down on their luck (unemployed, no money, no family help, etc) is completely different than the bum sitting on the bench near the liquor store.

Found this article a positive read; and, thought others might as well.

And here’s the link:

https://qz.com/903194/vancouver-house-prices-are-falling-as-it-gets-its-real-estate-bubble-under-control/

What a joke. This article celebrates govt intervention in the free market. Any time the govt tries to make something “affordable” thats something becomes more expensive.

Also for those of you thinking you will see 70% drops in prices, look at the chart in that article. Vancouver barely budged in the 2008-2009 crash. And by 2010 the entire decline was a memory. Had you bought something at the peak of the last bubble in Vancouver, today that property would be worth 50% more than what you paid for it.

The government and central bank certainly interfered to push prices up. However, it doesn’t have the courage to truly deflate its bubble by themselves. In the end, the decision might be out of their hands, even with rates still near historic lows.

@SoCalGuy just have to pipe in due to that ignorant heroin comment. I’ll bet more people in California are addicted to Oxycotin, which is a synthetic form of heroin an opioid, no different, it’s just prescribed, then anywhere else in the country. It’s very hypocritical to think those addicted to Oxycotin are any better than those using heroin it’s the same drug. Smh. It’s just hypocritical is all.

Lynn,

But you see, if you voted for Obama and Hillary, you drug addiction is much more acceptable than if you voted for evil Trump.

Ignorant? No, CA actually ranks pretty well in overall drug overdoses including opioids (including Oxy) per the CDC. My wife is from northern KY/Ohio. It’s so bad they are using refrigerator trucks for bodies because there’s no room in the morgues. Appalachia is exceptionally bad. West Virgina is out of control… TN also. Now it’s spread to the east coast.

CA is just full of potheads.

California is just full of potheads?

Then why is it that more Californians die from drug poisoning each year than die in car accidents and more than twice as many Californians die of drug overdoses than are murdered?

@Samantha,

https://www.cdc.gov/mmwr/volumes/65/wr/mm655051e1.htm

Scroll down and you’ll see a graph from the CDC which shows number of drug deaths per capita and you’ll notice CA is near the bottom of the list. This was until 2015. The number of deaths have skyrocketed just in the last year in the states which were near the top. My wife’s family is from these regions and it’s really sad. No jobs, dying cities, lots of poor, mainly white people killing themselves. Even here in CA, the vast majority of deaths are not in the Hispanic and black communities. Drug death among asians (even though we have a large population) barely registers. It’s not in their culture.

I’m not sure what the number of car accident deaths or murders have to do with anything. But according to the IIHS, CA is relatively safe state to drive when comparing number of miles driven per capita. I can only speculate it’s because people drive/can afford newer vehicles that are safer with newer technology. Also, we sit in a lot of bumper to bumper traffic.

The whites are popping oxy then moving onto heroin. The Mexicans smoke weed and drink Chelada. The Asian kids are popping Adderal so they can stay up all night and study to get into med school.

Looked and saw this link from the cdc. California is around 12/100k. Where Best Virginia is about 45/100k.

https://www.cdc.gov/mmwr/volumes/65/wr/mm655051e1.htm

My theory is three fold why California is low.

1. Immigrants tend not to abuse drugs.

2. Culturally California has long experience with drugs. Results in limited cultural based immunity against abuse.

3. Drug abusing ne’er-do-wells often leave the state.

Gibbon1: Immigrants tend not to abuse drugs.

They don’t? No drug abuse among the Mexican gangs? You know this, how?

Gibbon1: Culturally California has long experience with drugs. Results in limited cultural based immunity against abuse.

??? California has “limited cultural based immunity against abuse”? I don’t even know what you’re trying to say.

Gibbon1: Drug abusing ne’er-do-wells often leave the state.

They do? Again, you know this, how?

The CDC report you linked to refers to states with the most increases in drug and opioid-involved overdose deaths for the period of 2010–2015.

California already had high drug and opioid-involved overdose deaths. As the state with the greatest population in the country, the rate of overdoses per 100,000 residents is substantially higher than in other states.

Orange County drug, alcohol deaths have soared 82 percent, with accidental opioid overdoses the primary cause

http://www.ocregister.com/2017/04/25/orange-county-drug-alcohol-deaths-soar-82-percent-with-accidental-opioid-overdoses-the-primary-cause/

Samantha, read the links. California has a pretty low rate of drug deaths for the United States, even after the increase you cite. Actually, the article says the increase is for 2000-2014, and I think the national rates about tripled in that period, so the increase is (comparatively) good.

@son of a landlord – immigrants don’t abuse opioids much, because they don’t get prescribed them. Current opioid addictions overwhelmingly start with legal prescriptions – either direct, or for a friend or relative who leaves unused pills in the medicine cabinet. Doctors are far more like to prescribe opiates to white people – quite possibly because the doctors are racist and think the blacks and Hispanics will abuse the drugs which the whites are “good people” and will only use them properly. In reality, of course, the biology of opiate addiction is the same for all races. Ironically, for once, racism is *protecting* non-whites.

Fair economist,

The statistics can be deceiving for many reasons. One of them is this – the population of CA is large (aprox. 40 mil), the state is big, but most of the homeless population is concentrated on the coast (LA, SF, OC). In these places, relative to the area they occupy and population, the homeless population represent a high percentage and seem way higher that what shows on paper for the state as a whole.